Estimation of Threshold Effect of Kenyan Shilling Exchange Rate on Rwandan Economy: A Semiparametric Model Approach

Abstract

The exchange rate is an important variable in international trade which is used as a parameter to determine a country’s international competitiveness and indicates the position of the country’s economy. A change in the exchange rate of the Kenya shilling has an impact on Rwanda’s economy. To study this variation, some researchers use linear regression models which do not allow them to assess the threshold of the kenya exchange rate around which the channels through which a fall or increase in economic growth could be determined. The use of linear models is also a modeling limitation, as it imposes a predetermined form on the functions linking exogenous variables to dependent variables. To correct these two aspects, we have proposed a semiparametric threshold model to measure the threshold effects of changes in the exchange rate of the Kenya shilling on the Rwandan economy. This paper examines the threshold effect of the Kenyan shilling exchange rate on the Rwandan economy using yearly data from 1996 to 2018. Using a semiparametric model, the results of the imports, exports, and GDP threshold models revealed that the Kenyan shilling exchange rate is 7.78, 7.52, and 7.39 Rwanda’s value, respectively, and has a significant positive effect on the Rwandan economic growth, which gives credence to the relevance of threshold level. Thus, paying adequate attention to the maximum of the threshold values estimated by the Kenyan shilling exchange rate would lead to a better growth rate of the Rwandan economy. An increase of the value of Kenyan shilling by one Rwandan franc leads to a more rapid increase of the Rwandan economy through GDP, exports and imports when the value of the kellian shiling exceeds these thresholds. Based on these findings, the National Bank of Rwanda should ensure that the Rwandan Franc does not appreciate above its equilibrium level, which can lead to a loss of competitiveness.

1. Introduction

International trade is one of the factors which cause different countries to grow at different rates and achieve different levels of wealth [1]. In the context of the Eastern African Community (EAC) and the Common Market for Eastern and Southern Africa (COMESA), Rwanda and Kenya share a close economic relationship. As members of these regional alliances and participants in the EU-East African Community Economic Partnership Agreement (EPA), both countries engage in extensive trade activities [2, 3].

Rwanda, with its strategic position in the Great Lakes region, has emerged as an important trading partner, particularly for Kenya. Over the years, both Rwanda and Kenya have implemented measures to bolster their respective economies.

In the 2000s, both countries experienced remarkable economic growth, leading to increase per capita incomes [4]. Notably, trade services has been a prominent feature in both economies, with their services sectors witnessing growth and enhanced competitiveness [2, 3]. However, Rwanda’s economy outperformed the region, achieving the highest growth rate, from 6.2% in 2017 to 8.6% in 2018 while Kenya grew from 4.9% in 2017 to 6.3% in 2018, while Kenya’s growth rate rose from 4.9% in 2017 to 6.3% during the same period [3, 5].

Despite global economic uncertainty, Rwanda’s economy has demonstrated remarkable stability. In 2018, Rwanda’s total trade amounted to $1090.34 million, registering a 9.16% increase from the previous year.

Exports accounted for $169.91 million, imports totaled $841.92 million, and re-exports were valued at $78.5 million [3]. Furthermore, Rwanda’s export to other African countries reached $735 million, while its intra-African import amounted to $448 million. Key trading partners within Africa included Uganda, Kenya, Tanzania, and South-Africa [6]. With gross domestic product (GDP) per capita of $784, Rwanda’s economic development has been propelled by industrial, infrastructure, and agriculture, forestry, fishing, manufacturing, energy, tourism, and financial services (World Development Indicators).

Bilateral trade between Rwanda and Kenya is growing. The weight of Rwanda’s exports to Kenya in total exports from Rwanda increases from 1.54% in 2021 to 8.01% in 2022. In addition, the weight of imports from Kenya into Rwanda’s total imports will increase from 7.52% in 2021 to 8.01% in 2022. This change in the large share of trade between Rwanda and Kenya could impact the Rwandan economy following a depreciation or appreciation of the Kenyan shilling. This study proposes a methodology to measure the threshold effects of these exchange rate variations, contributing to more accurate economic assessments and policy recommendations.

Numerous studies have examined the impact of exchange rate fluctuations on various economic indicators, including trade, investment, capital markets, inflation, and employment in both developing and developed countries ([7–12]). However, the relationship between exchange rates and economic variables is often nonlinear, and traditional linear models may fail to capture this complexity. A change in the exchange rate of the kenya shilling has an impact on Rwanda’s economy. To study this variation, some researchers use linear regression models which do not allow them to assess the threshold of the kenya exchange rate around which the channels through which a fall or increase in economic growth could be determined. The use of linear models is also a modeling limitation, as it imposes a predetermined form on the functions linking exogenous variables to dependent variables. To correct these two aspects, we have proposed a semiparametric threshold model to measure the threshold effects of changes in the exchange rate of the Kenya shilling on the Rwandan economy.

In this study, we aim to estimate the threshold effect of the Kenyan shilling exchange rate on the Rwandan economy by employing semiparametric models. The semiparametric model was chosen due to its ability to handle nonlinear relationships without requiring the functional form to be predefined, unlike parametric models. This flexibility allows for more accurate modeling of the threshold effects where exchange rate changes might significantly influence economic variables such as GDP, exports, and imports. In contrast, parametric models assume a linear relationship that may not capture the complex dynamics between these variables. Therefore, employing a semiparametric modeling framework allows for great flexibility in taking into account the complex dynamics and potential threshold effects of the exchange rate on Rwanda’s economy. To achieve this objective, we employ advanced econometric techniques, including threshold regression models. These techniques allow us to robustly estimate the threshold effect and assess its significance. By utilizing a comprehensive data set covering relevant economic variables from both Kenya and Rwanda, we aim to provide a comprehensive analysis of the threshold effect of the Kenyan shilling exchange rate on the Rwandan economy.

The findings of this study are expected to contribute to a better understanding of the intricate relationship between exchange rates and economic performance in the East African region. By employing a semiparametric model approach, we enhance the existing literature by providing a nuanced analysis of the threshold effect and its implications. This research is aimed at informing policy makers, economists, and market participants, facilitating evidence-based decision making and fostering regional economic cooperation.

The rest of the paper is structured as follows. Section 2 presents the empirical literature review. Section 3 introduces the proposed methodology. Section 4 explores the data applications. Finally, Section 5 summarizes the findings.

2. Literature Review

Many researchers and economic policy makers have studied the relationship between economic growth and trade. Econometric models have been established by many researchers. However, quite a number of works done by several researchers on threshold effects have been revised and it was found that only a few researchers used the threshold models while others used the statistical approaches. According to many works in the literature, exchange rate is another variable that is supposed to affect the level of the country’s economy. The study by [13] worked on the thresholds in the process of international financial integration. The study used thresholds, conditions, and a parametric approach to identify the relationship between variables such as financial depth and institutional quality. The findings highlighted that satisfying threshold conditions can lead to improved cost benefits trade-offs from financial openness can improve when the threshold conditions are satisfied. [14] employed a threshold regression model to study the impact of real exchange rate volatility on bilateral exports between the US and its Top 13 trading partners. The panel threshold regression estimates revealed a positive and statistically significant effect of real exchange rate volatility on bilateral exports. In another study, [15] explored the effectiveness of exchange rate fluctuations on imports and exports. They found that exchange rate appreciation reduces exports, while devaluation improves imports, with both demonstrating threshold effects.

Examining the impact of exchange rate movements on economic growth, [16] used annual data for 14 Central and Eastern European (CEE) countries. The fixed effect estimation for panel data indicated a significant negative effect on real economic growth. Caporale focused on the prospects for a Monetary Union in the East Africa Community (EAC). They proposed a fractionally integrated or I(d) model and used primary data from four East African countries. The analysis suggested that a monetary union based on exchange rate between Tanzanian shillings, Rwandan francs, Burundian francs, and Ugandan shillings could be feasible, particularly considering the exclusion of the Kenyan shilling due to its high rate. [17] examined the relationship between financial intermediation and economic growth using a semiparametric model. Their study employed an additive instrumental variable (IV)-augmented partially linear regression (PLR) model with panel data from 66 countries. The findings emphasized the importance of the definition and measurement of financial intermediary development in determining its effect on economic growth.

Turning specifically to Rwanda, [18] estimated an inflation threshold at 12.7% using annual data from 1968 to 2010.

[19] conducted a study on the factors affecting Rwanda’s trade using a gravity model and found that Rwanda’s GDP, trading partners’ GDP, population growth, and real exchange rate had positive and significant effects on its trade. Previous literature has examined various aspects of the relationship between economic variables, including trade, exchange rate, and economic growth. However, there is a need for further exploration of the threshold effect of the Kenyan shilling exchange rate on the Rwandan economy

In the field of solving complex differential equation, there have been significant advancements in applying intelligent computing techiques. For instance, the design of neuroswarming heuristic solver for multipantograph singular delay differential equations [20] demonstrating the effectiveness of combining the networks and swarm intelligence to tackle complex mathematical problems. Similarly, a neuroswarming intelligent heuristic has been proposed for solving second nonlinear Lane–Emden multipantograph delay differential systems [21] showcasing the application of intelligent algorithms in dealing with intricate dynamical systems. Furthermore, the novel design of the Gudermannian function as a neural network has shown promise in solving singular nonlinear delayed, prediction, and pantograph differential models [22]. This innovative approach expands the repertoire of neural networks in handling a wide range of complex differential equations.

Similarly, an intelligent computing technique has been developed for solving singular multipantograph delay differential equations [23], highlighting the potential of intelligent algorithms in addressing challenging mathematical models. The advancements in computing techniques also extend to perturbed delay differential equations. A hybrid computing approach has been proposed for designing the novel second-order singular perturbed delay differential Lane–Emden model [24], illustrating the effectiveness of combining different computational methods to tackle complex mathematical models. The application of heuristic algorithms in this context provides valuable insights into the behavior of complex dynamical systems. Moreover, the use of a neuro swarm procedure has been investigated to solve the novel second-order perturbed delay Lane–Emden model arising in astrophysics [25]. This approach combines swarm intelligence with neural networks to address complex astrophysical phenomena.

These related works demonstrate the application of intelligent computing techniques, including neural networks and swarm intelligence, in solving various types of complex differential equations. They provide valuable insights and methodologies that can be relevant to the development of the proposed semiparametric model for estimating the threshold effect of the Kenyan shilling exchange rate on the Rwandan economy. Thus, the previous works contribute to the existing body of knowledge by showcasing the effectiveness of intelligent computing techniques in solving complex differential equations. Future researchers can build upon these advancements by exploring the application of these techniques in estimating the threshold effect of the Kenyan shilling exchange rate on the Rwandan economy. Additionally, incorporating additional variables, conducting comparative analysis, and refining methodological approaches can further enhance the understanding of threshold effects and their implications for economic policies and decision-making.

3. Methodological Tools

To study the variation of kenya shilling value, some researchers use linear regression models which do not allow them to assess the threshold of the kenya exchange rate around which the channels through which a fall or increase in economic growth could be determined. The use of linear models is also a modeling limitation, as it imposes a predetermined form on the functions linking exogenous variables to dependent variables. To correct these two aspects, we have proposed a semiparametric threshold model to measure the threshold effects of changes in the exchange rate of the Kenya shilling on the Rwandan economy. Let X be a ℝd-random variable, Z be a ℝ−random variable such that X and Z are independent random variables, Y be a ℝ random variable, ϵ(1) and ϵ(2) two white noise independent random variables, f1 and f2 are two functions defined on ℝd into ℝ, α1 and α2 are scalars.

In order to construct some estimators of f1(·), f2(·), α1, α2 and the threshold s, (Z1, X1, Y1), ⋯, (Zn, Xn, Yn) are assumed to be independent and identically distributed random variables with the same law as (Z, X, Y).

In the following section, we propose a nonparametric estimator of f1 and f2 based on [26, 27] approach. We will use the multivariate kernel which gives some sufficient conditions for the convergence of nonparametric estimators [28]. The estimators of α1, α2 and the threshold are obtained by optimizing the sum of residual squares in each case {Z ⩽ s} and {s < Z}.

3.1. Nonparametric Regression Estimators

- A1.

K is a Holder continuous, that is,

- A2.

The functions ϕj and marginal density hj are the Holder continuous.

- A3.

The conditional moments of Y given X = x are bounded in the sense that there are positive constants C1, C2, ⋯ so that for i = 1, 2, ⋯

- A4.

The marginal density g of X is bounded from below on the support of w.

- A5.

The marginal density g of X is compactly supported.

The bandwidth-selection rule may also be thought in terms of choosing h to make an effective predictor of Yi. In the following, we introduce the asymptotic properties of the nonparametric regression estimator defined by Relation (11).

Theorem 1. If (A1), (A2), and (A5) hold, then the estimators of ϕj are consistent for all ∈{1, 2} .

Theorem 2. Under the conditions (A1)–(A5), the bandwidth-selection rule, “choose to minimize CV(h),” is asymptotically optimal with respect to the ASE defined by ([ase]).

The multivariate kernel function satisfies the condition (A1). With this kernel, the kernel estimator is strongly consistent (see [28]).

We obtained the following result:

Theorem 3. If the kernel K is the multivariate kernel, then the estimators

Proof 1. We remind that

Using the Theorem 1, we have

Moreover,

The random variables ZiI(Zi ≤ s) are independant and identically distributed and then by the strong law of large numbers states,

Similarly,

Then, using ([f1]), we have

Similarly, we show that

This proves that the multivariate kernel and the estimators and of f1 and f2 are consistent.

3.2. Estimation of αj

3.3. Threshold Estimator

In the remainder of this paper, we will explain the threshold effect of the Kenyan shillings on the Rwandan economy. Specifically, we will determine the thresholds of the Kenyan shillings from which the Rwandan economy is impacted. Our results will be based on the trade between Rwanda and Kenya and indicators that characterize the Rwandan economy.

4. Data Application

The source of data is the Rwanda National Institute of Statistics (NISR) (https://www.statistics.gov.rw) and the World Bank Development Indicators’ database (https://www.worldbank.org). The data used covers the period starting from 1996 to 2018. The sample and the period of this study are informed by the availability of data. The dependent variables that we have used in this study are the real GDP (thousands USD), exports (in thousands USD), and imports (thousands USD) between Rwanda and Kenya.

Table 1 shows the summary statistics in terms of the mean, minimum, and maximum of the variables used in this study. Average of Rwanda exports to Kenya in the period under consideration was $103,200, and it ranged between $23,200 and $179,000. The exchange rate of Kenyan shillings against Rwandan francs averaged about 6.884, and it ranged between 4.748 and 8.577. The mean of Rwanda’s real GDP was 4.865 × 106, and its minimum was 1.382 × 106, whereas its maximum corresponds to 9.640 × 106. Rwanda imports from Kenya average was $99,130. It ranged between $26,960 and $175,720. Kenya real GDP averaged 38.02 × 106, the minimum Kenya’s real GDP within the period was 12.05 × 106, while the maximum was 92.20 × 106. Populations of Rwanda and Kenya average, respectively, were 9,360,416 and 39,227,087. Minimum populations of Rwanda and Kenya within the period were, respectively, 6,013,112 and 28,589,456, while the maximum was 12,301,969 for Rwanda and 51,392,570 for Kenya.

| Variables | Mean | Minimum | Maximum |

|---|---|---|---|

| Export Rwanda (thousands USD) | 103.4 | 23.2 | 179.0 |

| Exchange rate of Kenyan shilling to Rwandan franc | 6.884 | 4.748 | 8.577 |

| Real GDP(Rwanda) in thousands USD | 4.865 × 106 | 1.382 × 106 | 9.640 × 106 |

| Import Rwanda (thousands USD) | 99.13 | 26.96 | 175.72 |

| Real GDP (Kenya) in thousands USD | 38.02 × 106 | 12.05 × 106 | 92.20 × 106 |

| Export Kenya (thousands USD) | 40.78 | 2.80 | 145.00 |

| CPI Rwanda | 84.60 | 38.72 | 146.63 |

| CPI Kenya | 86.43 | 27.56 | 180.51 |

| Import Kenya (thousands USD) | 5.02768 | 0.03035 | 16.28545 |

| Population of Rwanda | 9360416 | 6013112 | 12301969 |

| Population of Kenya | 39227087 | 28589456 | 51392570 |

- Note: Source: authors and data sources.

This paper used the Pearson correlation coefficient in evaluating whether there exists a significant relationship between the dependent and independent variables. The Pearson correlation coefficient between all variables as well as their p values are presented in Table 2. The calculated correlation coefficients are very high and close to unity. This could indicate a strong dependence of variables. A strong correlation does not always mean that the dependent variables can be explained by the explanatory variables because there may be isolated points that would influence the specification of the model. For this reason, we model in this paper the dependent variables (export, import, and GDP) by a semiparametric model defined by (2), which is a more advanced and efficient model.

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) |

|---|---|---|---|---|---|---|---|---|---|---|

| (1) GDP Rwanda | 1 | |||||||||

| (2) Export Rwanda | 0.797*** (0.000) | 1 | ||||||||

| (3) Import Rwanda | 0.792***(0.000) | 0.772***(0.000) | 1 | |||||||

| (4) GDP Kenya | 0.798***(0.000) | 0.779***(0.000) | 0.790***(0.000) | 1 | ||||||

| (5) Export Kenya | 0.745 *** (0.000) | 0.690*** (0.000) | 0.761*** (0.000) | 0.734*** (0.000) | 1 | |||||

| (6) CPI Rwanda | 0.752*** (0.000) | 0.691*** (0.000) | 0.754*** (0.000) | 0.745*** (0.000) | 0.777*** (0.000) | 1 | ||||

| (7) CPI Kenya | 0.784*** (0.000) | 0.736*** (0.000) | 0.782*** (0.000) | 0.779*** (0.000) | 0.777*** (0.000) | 0.790*** (0.000) | 1 | |||

| (8) Import Kenya | 0.748*** (0.000) | 0.692*** (0.000) | 0.760*** (0.000) | 0.735*** (0.000) | 0.791*** (0.000) | 0.769*** (0.000) | 0.775*** (0.000) | 1 | ||

| (9) Pop. Rwanda | 0.683*** (0.000) | 0.635*** (0.000) | 0.699*** (0.000) | 0.672*** (0.000) | 0.647*** (0.000) | 0.728*** (0.000) | 0.719*** (0.000) | 0.718*** (0.000) | 1 | |

| (10) Pop. Kenya | 0.688*** (0.000) | 0.603*** (0.000) | 0.682*** (0.000) | 0.660*** (0.000) | 0.736*** (0.000) | 0.763*** (0.000) | 0.732*** (0.000) | 0.717*** (0.000) | 0.783*** (0.000) | 1 |

- Note: Source: authors.

- ***p < 0.1, p < 0.05, p < 0.01.

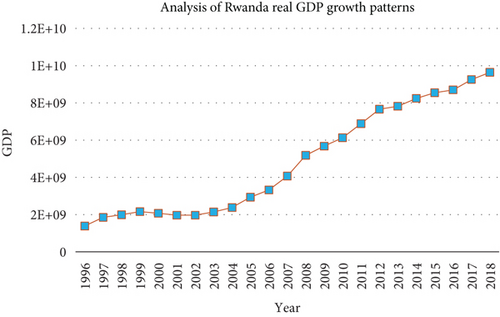

4.1. Analysis of Rwanda Real GDP Growth Patterns

Figure 1 shows that there was a positive GDP growth trend from 1996 to 2018 and indicates that Rwanda GDP has been decreased from 1999 to 2002 and is growing slowly from 2002 to 2005, but from 2005, it increases quickly which means the Rwanda production increased and competed in international markets. In terms of economic transformation, this trend shows that Rwanda is making progress on developing the services industry. Figure 1 also shows an increasingly movement over time in the economy which may lead to higher income opportunities for the population over time.

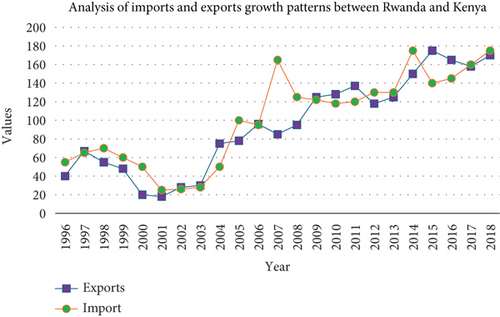

4.2. Analysis of Import and Export Growth Patterns Between Rwanda and Kenya

Exports are assumed to be a function of the real exchange rate and foreign income, while imports, disaggregated into consumer and intermediate imports, are related to real domestic output and the real exchange rate [30]. Examining the trends for both exports and imports between Rwanda and Kenya, it is evident that the pattern shows a similar trend, although there exist some variations as illustrated in Figure 2. For instance, between 1998 and 2000, both imports and exports have been decreased. From 2002 to 2005, imports are less than exports; this indicates that the country has a trade surplus, Rwanda’s service imports increased sharply through 2005, and 2007 was marked by a fall in imports. For the period from 2005 to 2006, the imports curve is above the exports curve; this is an indication of country’s trade deficit and this also happens in the period 2007 to 2010. From 2014 to 2017, the exports exceed the imports; in this case, the trade balance is said to be positive. In terms of economic transformation, the increase in capital imports within composition of imports reflects a drive to acquire the investment goods needed to transform the economy rather than being dominated by consumption goods, and also, Rwanda needs to do more in diversifying its export concentration. If a domestic currency depreciates it stimulates county’s exports and makes imports more expensive, therefore, if the Kenya shilling depreciates, it will be good for Rwanda.

5. Analysis and Discussion

Based on the model results, to estimate the threshold effect of Kenyan shillings on the variables (exports, imports, and GDP), the model defined by Equation (2) is used. On the methodological aspect, especially the estimators of α1 and α2, these two are obtained by running, respectively, the estimators αˆ1 and αˆ2 (see Expressions (21) and (22). Similarly, the threshold estimated is obtained by running the expression of equation (24). We proceed to estimate the threshold values, using semiparametric model approach; a sequence of threshold of GPD, export, and imports on Rwanda’s economy found the following results for the case of Rwanda.

5.1. Threshold Exports Model Results

The above results revealed that if the exchange rate of Kenyan shillings is less than 7.52 Rwandan francs, this is interpreted by the fact that an increase in one Rwandan francs of Kenya shilling exchange rate will impact the increase of Rwanda exports by 35.98 Rwandan francs; otherwise, an increase of one Rwandan francs of Kenyan shillings will influence positively the rises of Rwanda exports with 36.61 Rwandan francs.

5.2. Threshold Import Model Results

Based on the above results, if the Kenyan shilling exchange rate is less than 7.78 Rwandan franc, an increase of one Rwandan franc percent of Kenyan shillings will increase the imports by $32,080. Furthermore, when the exchange is higher than 7.78 Rwandan francs, an increase of one Rwandan franc percent of Kenyan shillings will influence positively the rises of Rwandan imports from Kenya by $57,700.

5.3. Threshold GDP Model Results

From the above GDP threshold model results, Kenyan shilling exchange rate increases by 1% and will lead to a $1,549,640,977 value rise in the GDP when the exchange is less than 7.389 Rwandan franc, while a 1% rise in Kenyan shilling exchange rate will lead to an increase in GDP about $1,985,090,795 when the exchange is greater than 7.389 Rwandan francs. In other words, an increase in exchange rate results in GDP growth. [31] argued that a positive coefficient of the GDP means that the increase in GDP is due to an increase in the production of imports substituted goods.

Table 3 illustrates the threshold model empirical results of the GDP, Import and Export equation, respectively. It reveals that when the exchange rate of Kenyan shillings is greater than 7.78 (maximum of the threshold values estimated), this would lead to a better growth rate of the Rwandan economy. We found that the coefficient of GDP, imports, and exports have a positive impact on Rwanda’s economy. A 1% increase in Kenya’s shilling exchange rate will lead to an increase in Rwanda exports by 36.61% approximately, a 1% increase in Kenya shilling exchange rate will impact to an increase in real GDP by approximately 19.42%. and a 1% increase in Kenya shilling exchange rate will lead to an increase in Rwanda imports by 57.70%. This positive threshold effect of the Kenyan shilling exchange rate on Rwandan economy was consistent with the conducted empirical study.

| Equations | Threshold variable estimator |

|---|---|

| GDP equation | 7.38 |

| Import equation | 7.78 |

| Export equation | 7.52 |

- Note: Source: authors.

6. Conclusion and Policy Implications

This study examined the threshold effect of the Kenyan shilling exchange rate on the Rwandan economy using a semiparametric model. By estimating the thresholds for key economic indicators (GDP, exports, and imports), the study found significant threshold values of 7.78 (imports), 7.52 (exports), and 7.39 (GDP). These thresholds reveal the exchange rate levels at which the impact on Rwanda’s economy becomes most pronounced, showing that an increase in the Kenyan shilling’s exchange rate above these levels positively affects Rwanda’s economic growth. The findings emphasize that managing the exchange rate within these threshold levels could improve Rwanda’s economic performance, suggesting that policy interventions by the National Bank of Rwanda could help maintain trade competitiveness. The study contributes to the existing literature on exchange rate economics by providing a more flexible, nonlinear approach to modeling, which captures the complexities of exchange rate impacts more accurately than traditional linear models. The findings suggest that maintaining the Kenyan shilling exchange rate within certain thresholds could positively affect Rwanda’s trade and economic performance. Policymakers, particularly at the National Bank of Rwanda, should focus on preventing the Rwandan franc from appreciating above its equilibrium level to avoid losses in trade competitiveness. Managing exchange rates around the identified thresholds could lead to sustained economic growth through improvements in exports and GDP. Future research could extend this study by exploring more frequent data (e.g., quarterly or monthly) to capture short-term fluctuations, and by applying more robust econometric techniques to further validate the results. Moreover, exploring additional economic variables and conducting comparative analyses across other East African economies could enhance understanding and inform broader regional policies.

Conflicts of Interest

The authors declare no conflicts of interest.

Funding

The authors thank the German Academic Exchange Service (DAAD) for a scholarship under the program Postdoctoral Fellowships in Sub-Saharan Africa 2021.

Acknowledgments

The authors wish to acknowledge the German Academic Exchange Service (DAAD) for a scholarship under the program Postdoctoral Fellowships in Sub-Saharan Africa 2021.

Open Research

Data Availability Statement

The source of data is the Rwanda National Institute of Statistics (NISR) and the World Bank Development Indicators database (https://www.statistics.gov.rw/ and https://www.worldbank.org).