Evaluating the Evolution of Investment Risks in Belt and Road Energy Projects: A Case Study of Belarus’ M5 Thermal Power Station

Abstract

Significant energy initiatives within the context of the “Belt and Road” are characterized by substantial financial transactions, intricate technological complexities, and prolonged construction timelines. Furthermore, the array of risk factors involved is diverse and continuously in flux. To identify pivotal risk indicators in investment projects, we employ the ISM-MICMAC (interpretive structural modeling-matriced impacts corise-multiplication appliance classement) method. We integrate the Leaky Noisy-OR gate model and dynamic Bayesian network (DBN) to formulate a dynamic model depicting the evolution of investment risk. This model enables us to trace the path of risk evolution at various temporal nodes through forward and backward reasoning. In a practical application of our methodology, we conduct an empirical analysis focusing on the M5 thermal power station in Belarus. The study findings reveal the establishment of a multidimensional and all-encompassing index system. We identify primary factors contributing to project risk, notably including political instability and policy alterations. Additionally, we unveil the intricate interplay among risk factors within major energy projects and highlight specific risks at pivotal junctures in their development. Through the creation of a dynamic risk evolution model and the subsequent analysis of risk evolution paths, our work offers a foundational framework for conducting risk assessments and understanding the evolution of investments in energy projects within the Belt and Road initiative (BRI). The study’s findings have important policy implications for improving the management of risks associated with BRI major energy projects, including enhancing government macroeconomic policies, strengthening industry associations, and optimizing enterprise risk management.

1. Introduction

In recent years, the global energy landscape has been undergoing unprecedented changes, with surges in economic growth and energy demand, frequent extreme weather events, and uncertainties in international political and economic dynamics combining to form a complex challenge to energy supply [1]. Against this background, strengthening cooperation in the energy sector has become a key path for countries to balance their energy supply [2]. As one of the world’s largest energy producers and consumers, China actively advocates and practices international cooperation in energy [3]. In 2013, China put forward the Belt and Road initiative (BRI), which aims to promote the smooth flow of trade, capital, and people-to-people communication through strengthening infrastructure construction in countries along the route, thereby promoting inclusive growth in the global economy, with more than 40% of investments in energy projects in countries that are building the Belt and Road together [4]. These BRI major energy projects play a crucial role in providing energy services to the populations of BRI countries. They differ from ordinary projects in their substantial transaction volumes, complex technical nature, and protracted lifecycles, thereby exerting a significant impact on the economy, society, and the environment [5]. These characteristics give rise to investment risks, which pose a significant challenge to energy projects and evolve in tandem with technological advancements [6].

The Belt and Road regions primarily host energy resources in the Middle East, Central Asia, Russia, and other areas. While these regions are rich in resources, they also face multiple challenges: overdependence on a single industry for their economic structure, high risks associated with complex and volatile political environments, limitations in financial technology support, lagging modernization of the energy industry, and increasing uncertainty and risk in the international energy investment environment. Against this backdrop, it is particularly urgent and important to analyze and identify the core disruptive factors facing energy market projects and their dynamic trajectories. This clarification will enhance the cooperative benefits of overseas energy investment projects and bolster regional energy security. The empirical findings reveal that political stability, the rule of law, regulatory quality, and corruption control are statistically significant factors that influence renewable energy investments in BRI countries [7].

Existing research exhibits several limitations. First, a preponderance of qualitative methods is employed, with a dearth of quantitative approaches for analyzing risks associated with overseas investments [8, 9]. Second, the majority of studies adopt a macroperspective, with fewer investigations into microlevel risks associated with specific projects [10, 11]. By comparing the current study with previous studies in the field, this paper innovatively adopts ISM-MICMAC (interpretive structural modeling-matriced impacts corise-multiplication appliance classement) to provide a new way to study the risk factors of energy projects. The application of ISM-MICMAC model analyzes the risk factors from the qualitative point of view and displays the logical relationship between the factors directly through the form of ISM model.

This study makes significant contributions in three main areas: first, by combining the ISM approach with the matrix influence factor classification (MICMAC) approach, this study establishes an effective framework for influencing factor hierarchies and attributes. The framework extracts a series of comprehensive risk factors, including system quality, cultural differences, market opportunities, energy demand, corporate capabilities, and overseas operations, which provide a basis for overall risk assessment and prediction of the project. Second, this study reveals the dynamic evolution path of risk through different stages of a project, deepening our understanding of the nature of investment risk and facilitating the practical application of risk management. Finally, with the help of dynamic Bayesian network (DBN) structure, the dependence on data is reduced, and the error in the estimation of the probability of risk nodes is reduced through the use of Leaky Noisy-OR gate model, which improves the accuracy of risk assessment.

The subsequent sections of this paper are organized as follows: Section 2 provides a summary of existing literature and refines the scope of the research. Section 3 outlines the research methodology employed in this study. Section 4 constructs the risk evolution model for major energy project investments. Section 5 conducts an empirical study using the M5 thermal power station in Belarus as a case example. Section 6 delves into the discussion of empirical analysis results. Finally, Section 7 offers a summary of the article’s conclusions and furnishes pertinent policy recommendations based on the results of the discussion.

2. Review of Previous Studies

2.1. Risk Factors of BRI Major Energy Projects

The assessment of risks in energy projects heavily relies on the identification of specific risk indicators. Uncertainties are always involved in projects, and most on-site assessments rely on qualitative data to determine the level of risk to which workers are exposed. Furthermore, the majority of legal documents for projects are inadequate for risk analysis [12]. This is exemplified by the variations in outcomes when different criteria are employed to rank energy sources in Istanbul, Turkey [13, 14]. Consequently, the accuracy of criteria selection in risk assessment plays a pivotal role in ensuring the reliability of results [15]. Comprehensive and accurate investment risk assessment is the key link to ensure the scientific and rational investment decision-making through in-depth analyses of internal and external risk factors, especially to strengthen the detailed assessment of internal investment costs and technological maturity [16]. This includes a theoretical analysis of the support measures provided by states for energy projects. A logistic model is utilized to enable experts to assess the internal and external factors influencing energy projects in Russia [17]. External factors encompass institutional quality, cultural divergence, market opportunities, and energy demand, while internal factors encompass enterprise capabilities and overseas experience.

In addition, foreign direct investment (FDI), trade openness, GDPPC, and R&D expenditures stimulate technological innovation in BRICS countries [18]. Certain countries grapple with high political risks and frequent changes in government [19]. In numerous developing BRI nations, recurrent political instability poses an additional hurdle and risk for proposed projects [20]. Institutional quality tends to foster outward foreign direct investment (OFDI) in a general sense, while cultural divergence tends to inhibit it. Notably, the inhibitory impact of cultural differences surpasses the promoting effect of institutional disparities, underscoring the greater significance of cultural divergence [21]. To resolve conflicts stemming from cultural disparities, multinational corporations must enhance cohesion among employes with diverse cultural backgrounds [22].

Furthermore, the limited market base in BRI countries can pose a substantial obstacle for investors [23]. Chinese enterprises encounter significant economic risks when investing in countries along the BRI, particularly in economically fragile Central and South Asian countries with a higher risk of loan defaults and lower foreign credit ratings [10, 24]. In terms of energy demand, some BRI countries possess abundant or high-potential natural resources, which augments the potential for bilateral resource development [25]. Internalization theory indicates a positive correlation between Chinese enterprises and the natural resource potential of host countries [26]. Empirical analysis using dehierarchical samples and ordinary least squares (OLSs) methods supports a positive relationship between China’s OFDI and the natural resources of host countries [27]. Additionally, the application of the space gravity model highlights the importance of Chinese enterprises considering investments in the energy resources of host countries [28].

Many countries have withdrawn or abandoned their BRI projects due to intrafirm risks such as corporate capabilities and overseas experience, as exemplified by Malaysia’s decision to cancel major energy projects [29]. Risk factors collected from existing literature and expert assessments reveal that cross-border investments confront both internal risks, including technical and organizational challenges, and external risks across social, political, economic, and legal dimensions [30]. Major energy projects entail substantial investments and intricate technologies, introducing uncertainty into decision-making processes and implementation phases [31]. Various scholars have employed diverse methodologies to examine different risk categories associated with China’s outbound investments, with a focus on risk identification and assessment of specific projects [32]. These methods include the fuzzy comprehensive evaluation model [2], technique for order preference by similarity to ideal solution [24, 33], linguistic distribution assessment, and evidential reasoning methods [31]. A novel project risk assessment model, based on probabilistic fuzzy research concepts and the Mamdani probability fuzzy system, has been developed [34]. Key indicators for the operation of major projects encompass net present value and cost factors, used to calculate the project’s risk level [35]. However, most scholars advocate enhancing investment efficiency through the control of primary risks associated with BRI major projects, with limited research focusing on the dynamic relationship of risk factors and the analysis of risk transmission mechanisms in BRI projects.

2.2. BRI Major Project Investment Risk

Scholars have extensively explored the evolution of investment risks in BRI major projects, delving into the internal interdependencies of these risks using various methodologies, including the cloud model, system dynamics model, neural network method, Bayesian network (BN), Copular, among others. Additionally, the supply chain network model, with suppliers, manufacturers, and banks as central entities, has been employed to dissect risk transmission pathways [36]. Dynamic Bayesian analysis of project risk contagion pathways has demonstrated the operability of probability models in risk analysis, particularly in identifying risks that could culminate in major project failures, such as stakeholder and information contagion [37]. The findings show that FDI increases economic growth but harms the environmental sustainability of BRICS countries. Moreover, we have seen that energy use is directly proportional to economic growth and CO2 emissions. This confirms that energy use is one of the factors that harms the environmental quality in BRICS economies. Likewise, economic growth increases CO2 emissions [18]. In the realm of BRI major project investment risk prediction, scholars primarily rely on methods like linear discriminant analysis to formulate risk prediction models and provide recommendations for risk mitigation [38]. The use of complex network-based risk prediction models allows for the calculation of effective risk transmission thresholds. These models compare the transmission rates of nodes within the network to generate valuable risk prediction information. Sensitivity analysis is employed to forecast changing trends in factors such as product selling prices and construction investments (Study on Risk Level and Utility in Multi-objective Decision-making about the Risk, 2007). However, when selecting investment risk prediction methods, it is important to consider their practical applicability. Linear discriminant analysis, for instance, demands extensive data acquisition. On the other hand, methods like fuzzy analytic hierarchy processes and artificial neural networks can be challenging due to difficulties in determining data weights, complex calculations, and the resource-intensive nature of these approaches, making them less suitable for timely investment risk prediction. The methods and gaps are shown in Table 1.

| Authors | Year | Methods | Gaps |

|---|---|---|---|

| Jonathan | 1994 | Subjective empowerment | Vulnerability to subjective factors |

| Gatti et al. | 2006 | Subjective empowerment | Lack of objectivity |

| Helwege | 2010 | Subjective empowerment | |

| Ghimire and Kim | 2018 | Subjective empowerment | |

| Duan et al. | 2018 | Objective empowerment | Poor versatility |

2.3. Literature Gaps and Contributions of the Study

Previous studies on investment risk in major energy projects have used a variety of methodologies and have delved into risk factors at multiple levels. However, there are still some notable challenges that need to be further addressed. First, when dealing with foreign investment risk analyses, there is an imbalance in the application of qualitative and quantitative methods in existing studies, which needs to be complemented by more robust quantitative analyses. Second, most studies focus on project-specific risk identification, assessment, and control, while insufficient attention has been paid to the dynamic evolution of investment risk throughout the project life cycle. Finally, although there has been some progress in the study of risk transmission, it has mainly focused on financial risks, while the understanding of other types of comprehensive risks still needs to be improved. This study effectively categorizes the influencing factors and defines the risk factors in detail by integrating two quantitative methods, the ISM and the matrix influencing factor classification (MICMAC). In addition, the study utilizes causal reasoning to illustrate the dynamic evolutionary path of risk through the various phases of a project. Meanwhile, by combining the DBN structure with the Leaky Noisy-OR gate model, it improves the accuracy of the risk node probability estimation and alleviates the dependence on large-scale datasets. These contributions address research gaps and offer a sophisticated framework for comprehending and managing investment risks in major energy projects within the BRI context.

3. Material and Methods

3.1. ISM-MICMAC

ISM is grounded in the interpretative model method. It is used to establish relationships among variables within a complex system by hierarchically defining them. ISM serves the purpose of visualizing interactions among elements in a system, including elements such as disorder, driving factors, and influence factors [39]. ISM has the capability to simplify multifaceted and interconnected factors into a more structured hierarchy, making it suitable for analyzing systems with intricate relationships, numerous elements, and a fuzzy structure. This modeling approach has been successfully applied in various fields, including supply chain management [40, 41], electronic government affairs [42], and production environments [43].

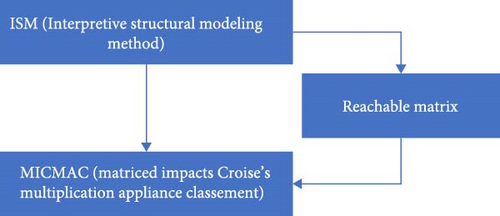

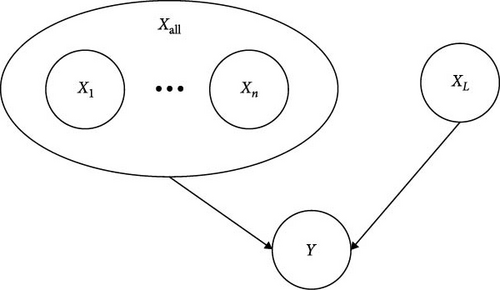

By comparing them with the existing field methods, this paper better combines ISM and MICMAC methods. In a straight look, it seems like some of the factors are dependent on some of the other, single or multiple factors. Remaining factors look independent. But via consultation with expert in this sector and thorough literature, it had been found out that every factor has relation with most of the other factors. This relationship is explored in this study. In ISM method, 0 and 1 are used to show the association between the two factors. However, there is possibility to explore this association in deeper with by using MICMAC technique [44], as shown in Figure 1.

In order to assess the relevance of the different factors, the ISM technique relies primarily on the results of expert insights and group discussions. This process was then further complemented and refined by MICMAC analyses aimed at clarifying the influence and interdependence of the factors [45]. The MICMAC analysis categorizes factors based on their driving force and dependence values, classifying them into spontaneous linkage, reliance, linkage, and independent quadrants [46]. This methodology identifies key factors that drive various types of systems [47]. In this study, dependence values and driving force values are derived from risk factors. Factors in the independent quadrant exhibit characteristics of high driving force and low dependence, indicating that they have a significant impact on other factors while being less influenced by themselves. The specific operational steps are as follows:

Step 3: Decompose the reachability matrix into reachability set, antecedent set and highest set. Reachability set, antecedent set, superlative definition, and representation are shown in Table 2.

| Class | Definition | Representation |

|---|---|---|

| Reachable set | Factor Si can reach a set of other factors | The set of elements corresponding to all columns of matrix element 1 in row Si of a reachable matrix |

| Antecedent set | The set of factors that can reach the factor Si | The set of elements corresponding to rows of all matrix elements 1 in column Si of an reachable matrix |

| Highest set | The set of factors that can reach the factor Si | The set of factors that can reach factor Si |

Step 4: Divide the levels and build the structural model. The reachability matrix is used as the criterion to divide the levels, and the definition of the highest set is used to determine the factors of the level. The corresponding elements and columns in the reachability matrix were removed. Similarly, Ln is used for the determination of factors at different levels. According to the reachability matrix and the interlevel division relationship, the relationship between the factors at each level is determined. The structural model is established.

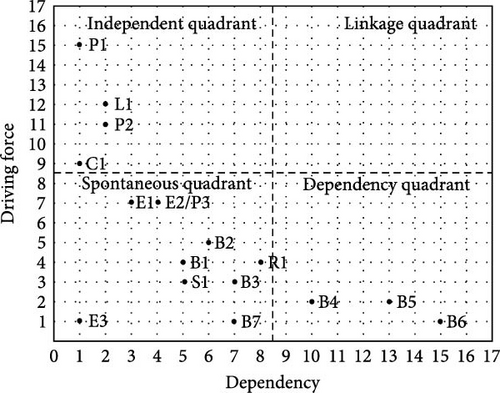

Step 5: Dependency and driver mapping, based on each factor’s drivers Di and degree of dependence Rj conduct MICMAC analysis, and classify the investment risks affecting major energy projects along the BRI into four categories. The investment risk of BRI major energy projects can be divided into four categories: spontaneous factors, independent factors, dependent factors, and linkage factors. Spontaneous factors are dominant and linkage factors are less influential.

3.2. DBN

BNs, often referred to as BN, are graphical models used for modeling random relationships among a set of variables [48]. BNs find applications in various fields such as sociology, economics, biology, and engineering [49, 50]. The construction of a BN involves making several assumptions, where each hypothesis is decomposed into a set of random variables. These variables can assume values from a finite set of states that are mutually exclusive and collectively exhaustive [51]. The dependency of one variable on another is represented by a directed edge or link in the network, and the relationships between variables are depicted through a family relationship, connecting parent nodes to child nodes.

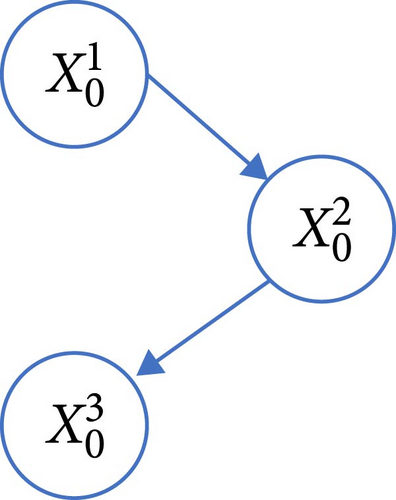

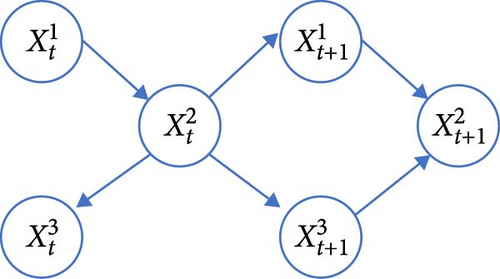

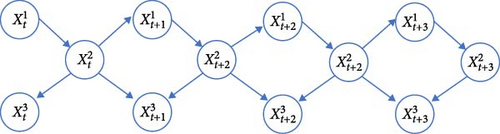

In situations involving dynamic and constantly evolving projects, it becomes necessary to employ tools that can account for changes within the system, such as DBN. DBN incorporates more advanced mechanisms that enable it to simulate changes over time and accurately characterize performance fluctuations. The DBN comprises multiple static BNs, often referred to as time slices, as illustrated in Figure 2. In this study, we adopt DBN to construct an investment risk evolution model for major energy projects in the context of the BRI. The model systematically reveals the evolution path of investment risk of these projects through forward and backward reasoning techniques, which provides strong support for in-depth analyses of the interaction mechanisms affecting investment risk.

3.3. Leaky Noisy-OR Gate Extension Model

The Leaky Noisy-OR gate model is a valuable tool used to analyze the dynamic evolution of risk within a DBN. This model reveals the internal relationship between variable X and the outcome variable Y, where both types of variables can assume values of 1 for true and 0 for false. Moreover, the model adheres to two fundamental conditions. First, it stipulates that the variables X, which serve as parent nodes of variable Y, are independent of each other. Second, it asserts that whenever any variable X is set to false (0), it triggers the occurrence of the outcome variable Y. This Leaky Noisy-OR gate model is instrumental in capturing and modeling the intricate dependencies and interactions between variables X and Y in the context of risk evolution within a DBN [52–54]. If any variable X is false, the result variable Y will occur, and the predetermines probability of (Xi = 1, Y = 1) is .

Considering the influence of other unknown factors on node Y in the model, the Leaky Noisy-or Gate extended model is obtained by introducing the concept of omission error into the model. In this model, the uncertain influence factors are fuzed into one factor, which is denoted as Xl. Next, the values of Pi and Pl are solved according to the Leaky Noisy-OR gate model. Suppose Y consists of two parents: XL and Xall. The model is shown in Figure 3.

The analysis of dynamic risk evolution using a DBN can be separated into two key processes: forward reasoning and reverse reasoning. Forward inference involves inputting known risk factors into the DBN to determine the path through which these risk factors propagate. For instance, when at time T = 3, a risk factor P1 occurs, inputting the value P (P1 (T = 3) = True) = 1 helps in calculating the probability of the investment risk node at T = 4. This process is repeated for different time points, and by comparing the probabilities across these time points, we identify the node where the probability change is most significant. This iterative approach allows us to establish the path of risk evolution. Conversely, when project risks manifest at specific time nodes, the outcomes are fed into the DBN. By observing how the probabilities of investment risk factors change at different time nodes, we can then trace back and determine the path of risk transmission through reverse reasoning. This comprehensive approach provides insights into how risk factors evolve within the DBN framework.

4. Framework of Investment Risk Factors Identification and Evolution Analysis

4.1. BRI Major Energy Projects Investment Risk Factors

To comprehensively identify the investment risk factors associated with BRI major energy projects, a more detailed set of risk indicators is obtained by following the guidance of the strategic triangle paradigm theory. The enterprise risk management framework (COSO-ERM), initially published by the COSO Committee in 2004 and subsequently revised in 2017, is widely acknowledged as the most effective framework for guiding risk management practices. COSO-ERM assesses both internal and external factors in alignment with an organization’s established strategic objectives and performance goals.

- 1.

Literature analysis: The first step involves a comprehensive review of literature related to the overseas investment risk of major projects, systematically identifying the risk factors specific to energy project investments in countries along the BRI.

- 2.

Data collection: Data collection is conducted using platforms such as China—the Global—Investment—Tracker, Google, and others to gather information on major BRI energy projects. High-frequency risk indicators are statistically analyzed from this collected data.

- 3.

Expert input: After the initial screening of the risk indicators, we collated information related to the project, including project descriptions, literature studies, news reports, etc. Distributing this collected information to various experts in the relevant fields of the energy sector and conducting interviews will help the group of experts to evaluate the project objectively and increase the reliability of the results. In order to ensure the objectivity and authenticity of our experts’ opinions, we have taken the deliberate measure of strictly anonymizing all their recommendations. This initiative aims to create a communication environment that is free from external pressures and potential bias, thus encouraging experts to speak freely and share their professional insights and honest thoughts without reservation. Their insights and expertise are used to optimize and refine the risk indicator system. Drawing inspiration from the COSO Committee’s classification approach, risk factors are categorized into internal and external risks [55].

The specific list of risk factors is presented in Table 3, providing a structured and comprehensive framework for assessing investment risks in the context of BRI major energy projects.

Risks sources |

Level indicators of risk | Secondary wind risk index |

Causes of risk |

|---|---|---|---|

| External risks | Institutional quality | Political instability | International institutions and regimes are often unstable, and the current government often disagrees with foreign cooperative relations, including the contracts signed by the previous government [56] |

| Policy changes | Maintain the healthy development of China’s economy, change the original policies such as opening up to the outside world, and prohibit foreign companies from investing in certain industries or fields in China [57] | ||

| Imperfect legislation | Some developing countries have imperfect and unclear laws and regulations for enterprises from other countries to invest in domestic infrastructure. Chinese enterprises may face a situation where they cannot rely on them when investing in these countries [2] | ||

| Legal information is asymmetric | Chinese enterprises are not familiar with and understand the legal system of the host country, or the law enforcement agencies of the host country adopt different knowledge laws and antimonopoly reviews, which may induce relevant risks [2] | ||

| International relations | If one of the two trading parties is regarded as an actual or potential hostile country by a third country, there is a risk of interference by a third country [24] | ||

| Business environment | A strong guarantee to mitigate the impact of policy uncertainty can effectively reduce the negative impact of “foreignness disadvantage” on investment in cross-border M&A [58] | ||

| Intellectual property risk | Investment risk is caused by legal penalties imposed on overseas investment enterprises for failing to comply with the relevant IP protection laws of the host country [10] | ||

| Law enforcement | In the process of law enforcement, the law enforcement agencies of the host country may adopt differential treatment due to different countries, and conduct unfair law enforcement or even antimonopoly reviews on Chinese enterprises [58] | ||

| Land issues | Major energy projects generally involve land acquisition and migration issues, which may inevitably lead to the risk of delay in completion time and overexpenditure of total investment [10] | ||

| Geopolitical | Competing for economic interests and strategic dominance of BRI countries and regions will interfere with China’s construction of the Belt and Road [11] | ||

| Cultural distance | Risk of culture | Cultural risk refers to the unstable factors that may restrict and hinder the construction and operation of overseas power grid projects, such as religious beliefs, ethnic groups, values, language, and cultural risks of the host country [10] | |

| Religious taboos | Religious belief is an unstable factor that may restrict and hinder project construction and operation [56] | ||

| National race | National race could restrict and hinder the project construction and operation of instability factors [59] | ||

| Social security | Social security unrest, robbery, and kidnaping in the host country will cause risks and property or personal losses to Chinese enterprises abroad and their employes [24] | ||

| Terrorism | The Global Terrorism Index 2018 shows that a significant proportion of BRI countries and regions are deeply involved in terrorism [58] | ||

| Public opinion risk | False reports on “Chinese M&A” or “Chinese-style expansion” can easily cause negative effects on the investment returns of power grid enterprises [60] | ||

| Market opportunities | Natural disasters | Including earthquakes, floods, debris flow, landslides, etc. Once natural disasters occur, they will cause devastating damage to engineering projects [60] | |

| Medical risk | Poor health conditions and low medical standards in the host country bring risks to the life and health safety of project staff [23]. Epidemic outbreaks pose a significant risk to supply chain and logistics. These risks are characterized by long-term disruptions that can have ripple effects, making them challenging to predict [61] | ||

| Environmental pollution | Chinese enterprises’ overseas investment is often hindered by natural resources and ecological environmental issues [10, 62]. Concern for the environment among individuals, stakeholders, and governments has steadily increased [63] | ||

| Other infrastructure | The infrastructure status of the host country is also an indispensable and important guarantee for investors in the process of construction and operation [10] | ||

| Economic system | Different systematic criteria are proposed for the contents, forms, and channels of Chinese overseas investment enterprises’ survival and development in the country [24] | ||

| Energy demand | Cycle | It includes four stages: introduction period, growth period, maturity period, and decline period. Changes in any of these environments will directly affect the industry selection of overseas investment enterprises and their specific investment and operation decisions [60] | |

| Exchange rate changes | It will affect the construction, operation cost, and debt structure of the project [24] | ||

| Interest rate changes | During the construction and operation of a project, the fluctuation of interest rates will lead to the loss of project revenue [64] | ||

| Energy market prices | As the main source of revenue for major energy projects, it is directly related to the benefits of the projects [10] | ||

| Inflation | Inflation is caused by changes in the macroeconomic policies of the host country, which causes the currency to depreciate, thus making it impossible for investors to recover on schedule [24, 58] | ||

| Internal risk | Capability of enterprise | Technology risk | Project in the process of production of the production technology has a high professional requirement, produce technology standard matching risk, trade risk [10, 65] |

| Competition risk | Due to the lack of unique technological and geographical advantages, it is difficult for enterprises to grasp market changes [65] | ||

| Managing risk | Chinese employes may not adapt to foreign working environments, and the employment of local employes may lead to lower work efficiency due to differences in working habits [66] | ||

| Marketing capability risk | Overseas investment enterprises do not have to match the host country’s social organization form of investment risk, as a result of sales strategy [67] | ||

| Social responsibility | Corporate social responsibility standards are one of the means for host countries to restrict the entry of foreign capital and have become the main form of international investment protection [10] | ||

| Financial risk | Mainly includes financing, capital operation risk, and accounting risk differences [60] | ||

| Energy output | Energy output is the main source of revenue for energy projects, which is directly related to the benefits of energy projects [60] | ||

| Industrialization risk | It refers to the risk caused by the failure of the new products designed by overseas investment enterprises to form industrial production and sales in the host country market, which will lead to the reduction of investment efficiency | ||

| Market size risk | It refers to the risk caused by an unstable growth rate and weak growth potential due to the failure of products and services of overseas investment enterprises to form a scale effect in the host country [10] | ||

| Overseas experience | Tax issues | The differences in tax policies and systems of various countries make it difficult for enterprises to manage taxes, and the application of preferential tax policies for overseas projects and reasonable tax avoidance planning schemes are difficult to achieve [35] | |

| Resource risk | There is a lack of local energy information records, or there is a risk of inaccurate data statistics. Energy distribution is uneven due to the limitation of regional resource endowment and the influence of technology and the economy [65] | ||

| Transport risk | Materials and equipment are mostly overweight, oversized, or irregular components, which have high requirements for the carrying capacity and size of transport vehicles. Some equipment, materials, and construction equipment are of high value and will have a large loss in the event of accidents [23] | ||

| Material risk | Due to different varieties and origins, the prices of materials are different. To ensure the quality of the project, the construction units purchase engineering equipment and engineering materials that are generally higher than the lowest price in the market, resulting in price risks [10] | ||

| Corporate goodwill | The investment risk is caused by the industry evaluation level, image recognition degree, credit status, and other factors of overseas investment enterprises or the world status of the home country | ||

| Market forecast risk | Investment risks are caused by enterprises’ lack of ability to evaluate and predict the changing trend of the overseas investment market [60] | ||

| Product value risk | The supply of products and services for overseas investment enterprises cannot meet the host country’s investment risk, as a result of the changing market demand [66] | ||

| Lack of talent | The lack of specialized talents with international vision and strategic management ability makes Chinese enterprises in the investment process not the related theory and practice for effective fusion [68] | ||

| Lack of project experience | When making transnational investment decisions, enterprises are often influenced by their own experience, they can realize the optimization of their overseas investment cognition system through the absorption and diffusion of internal knowledge [66] | ||

- Abbreviation: BRI, Belt and Road initiative.

In the comprehensive analysis of major energy projects considering both internal and external investment risk factors, a pivotal influencing factor is the investment risk associated with significant projects under the BRI. To establish a structured framework for evaluating investment risk, the following specific methods are employed. First, the identified risk factors are compiled into a comprehensive list, with each risk index categorized into one of five levels: low risk, moderate-low risk, medium risk, moderate–high risk, and high risk. These levels are denoted by numerical ranges such as [0, 1], [1, 2], [2, 3], [3, 4], and [4, 5], respectively, where higher numerical values indicate more elevated risk levels.

Second, enrich project analyses and improve objectivity by collating relevant information about the project, making experts aware of the risk elements in the questionnaire, and encouraging them to provide any missing risk elements and insights. Subsequently, the collected questionnaire data are meticulously processed, including the calculation of weighted averages for each risk index. Only those risk factors scoring higher than three are retained as significant contributors to the overall risk assessment.

In order to ensure the scientific validity and effectiveness of the data from this questionnaire, we have refined the selection and categorization of the construction of the expert pool. Specifically, the expert pool was subdivided into three unique and complementary groups, aiming to comprehensively cover different areas of professional knowledge and practical experience. These include academic experts who come from well-known universities and colleges at home and abroad and are senior scholars in the field of risk management education, providing valuable academic support and profound theoretical analyses for this survey; industry experts, who have accumulated a great deal of experience in overseeing the management of overseas energy projects, which helps us to better understand the challenges and opportunities of the actual project operations; and research experts, who, as professionals in design institutes, have long been focusing on the management of overseas energy projects, which helps us better understand the challenges and opportunities of actual project operations; and research experts, professionals from design institutes, who have focused on the design and construction of overseas energy projects for a long time and have at least 6 years of relevant work experience, their professional and technical backgrounds and practical work experience bring unique technical perspectives and in-depth case analyses to the survey. In total, 50 questionnaires were distributed, yielding 42 valid responses. Additional information about the participating experts, including their qualifications and expertise relevant to this analysis, is provided in Table 4.

| Classification | Secondary classification | Number of people | Proportion (%) | Primary classification | Secondary classification | Number of people | Proportion (%) |

|---|---|---|---|---|---|---|---|

| Gender | Male | 27 | 64.28 | The title | Junior | 10 | 23.81 |

| Female | 15 | 35.72 | Intermediate | 13 | 30.95 | ||

| Age | 30–45 | 10 | 23.81 | Advanced | 19 | 45.24 | |

| 45–60 | 19 | 45.24 | Education | Specialized subject | 6 | 14.29 | |

| >60 | 13 | 30.95 | Undergraduate degree | 17 | 40.47 | ||

| Area of work | The risk management of colleges and universities | 9 | 21.44 | A graduate student | 19 | 45.24 | |

| Energy project management | 23 | 54.75 | — | — | — | — | |

| Design institute project researcher | 10 | 23.81 | — | — | — | — |

Based on the data presented in Table 5, it is evident that the assessment scores for risk elements 1–24 all surpass the threshold of 3. This signifies that particular attention should be directed toward these risk elements in the context of risk prediction. Conversely, risk factors numbered 25–50 exhibit assessment scores below 3, indicating a relatively lower probability associated with these risk factors. Consequently, these factors may be more amenable to risk mitigation measures. As a result, in the realm of risk prediction, there may be a temporary exemption from considering these specific risk factors, given their comparatively lower impact or likelihood.

| Serial number | Risk factors | Score | Serial number | Risk factors | Score |

|---|---|---|---|---|---|

| 1 | Political unrest | 4.76 | 24 | Market price | 3.05 |

| 2 | Imperfect legislation | 4.68 | 25 | The economic system | 2.85 |

| 3 | Cultural risk | 4.64 | 26 | Bill of quantities uncertain | 2.76 |

| 4 | Energy production | 4.62 | 27 | International relations | 2.75 |

| 5 | Exchange rate changes | 4.44 | 28 | The environmental pollution | 2.47 |

| 6 | Doing business | 4.19 | 29 | Supplier risk | 2.39 |

| 7 | Technical risk | 4.18 | 30 | The lack of talents | 2.29 |

| 8 | Legal information asymmetry | 4.13 | 31 | Cycle | 2.22 |

| 9 | Financial risk | 4.09 | 32 | The size of the market risk | 1.82 |

| 10 | Managing risk | 4.08 | 33 | Risk of public opinion | 1.78 |

| 11 | Policy changes | 4.04 | 34 | Law enforcement situation | 1.71 |

| 12 | Interest rate changes | 4.02 | 35 | Labor risk | 1.64 |

| 13 | Material risk | 3.98 | 36 | Terrorism | 1.62 |

| 14 | Transport risk | 3.98 | 37 | Geopolitics | 1.54 |

| 15 | Social responsibility | 3.86 | 38 | Ethnic group | 1.42 |

| 16 | Natural disasters | 3.79 | 39 | Inflation | 1.38 |

| 17 | Medical risk | 3.64 | 40 | The enterprise goodwill | 1.34 |

| 18 | Resource risk | 3.51 | 41 | The protection of intellectual property rights | 1.2 |

| 19 | Tax risk | 3.48 | 42 | Lack of experience in project | 1.08 |

| 20 | Other Infrastructure | 3.34 | 43 | The industrialization of risk | 0.93 |

| 21 | Land issues | 3.22 | 44 | Religious taboos | 0.77 |

| 22 | Social security | 3.13 | 45 | Market forecast risk | 0.56 |

| 23 | Competing risks | 3.09 | — | — | — |

- Abbreviation: BRI, Belt and Road initiative.

4.2. Major Energy Projects Investment Risk Matrix

Based on the investment risk factors of BRI major energy projects, considering the current research on the overseas investment risk of major energy projects. Most of them identify the risk sources from a single perspective and lack the analysis of the dynamic risk factors. The construction stage of BRI major energy projects is divided into three stages: financing design, investment and construction, and project operation [69]. Therefore, we divide the investment in major energy projects into three stages: procurement, construction, and equipment commissioning. The risk indicators in the investment and construction process of BRI major energy projects are divided into five investment processes: financing design T1, material procurement T2, equipment construction T3, commissioning equipment T4, and project operation T5. Each stage is a time node T. For each time node, risk factors are classified into two categories, internal and external, to construct the investment risk matrix of BRI major energy projects, taking into account the risk characteristics of major energy projects.

In the context of assessing the investment risk factors associated with BRI major energy projects, it is noteworthy that most existing research has tended to identify risk sources from a singular perspective, often lacking a comprehensive analysis of dynamic risk factors. To address this limitation and enhance the understanding of risk dynamics, it is essential to consider the multistage nature of BRI major energy projects.

The construction stages of these projects can be effectively divided into three key phases: financing and design, investment and construction, and project operation [69]. Consequently, the investment aspect of major energy projects can similarly be categorized into three stages: procurement, construction, and equipment commissioning. Within these investment stages, risk indicators are further classified into five distinct investment processes, represented as time nodes (T1, T2, T3, T4, and T5). Each of these time nodes corresponds to a specific stage in the project’s lifecycle.

To construct a comprehensive investment risk matrix for BRI major energy projects, the risk factors are categorized into two fundamental groups: internal and external factors. This approach allows for a thorough consideration of the unique risk characteristics associated with major energy projects, ensuring a holistic assessment of investment risks throughout the project’s various stages.

By combining literature, project information, and the above expert opinion, a summary of getting “in” along the major energy projects investment risk matrix (Table 6).

Construction of the process |

Tender design (T = 1) | Procurement of materials (T = 2) | Equipment construction (T = 3) | Equipment debugging (T = 4) | Project operation (T = 5) |

|---|---|---|---|---|---|

| External risk | Political instability (P1) | Political instability (P1) | Political instability (P1) | Political instability (P1) | Political instability (P1) |

| Policy changes (P2) | Policy change (P2) | Policy change (P2) | Policy changes (P2) | Policy change (P2) | |

| Imperfect legislation (L1) | Imperfect legislation (L1) | Imperfect legislation (L1) | Imperfect legislation (L1) | Imperfect legislation (L1) | |

| Cultural risk (C1) | Legal information asymmetry (L2) | Asymmetry of legal information (L2) |

|

|

|

| Exchange rate changes (E1) | Cultural risk (C1) | Cultural risk (C1) | Cultural risk (C1) | Cultural risk (C1) | |

| Interest rate changes (E2) | Natural disasters (R2) | Natural disasters (R2) | Natural disasters (R2) | Natural disasters (R2) | |

| Market price (E4) | Medical risk (R3) | Medical risk (R3) | Medical risk (R3) | Medical risk (R3) | |

| Land problem (P3) | Exchange rate movements (E1) | Exchange rate changes (E1) | Exchange rate changes (E1) | Exchange rate movements (E1) | |

| Social security (R1) | Interest rate changes (E2) | Changes in interest rates (E2) | Changes in interest rates (E2) | Interest rate changes (E2) | |

| Other infrastructure (S1) | Ease of doing business (E3) | Ease of doing business (E3) | Ease of doing business (E3) | Market price (E4) | |

| Land issues (P3) | Land issues (P3) | Land issues (P3) | Social security (R1) | ||

| Social security (R1) | Social security (R1) | Social security (R1) | Other infrastructure (S1) | ||

| Other infrastructure (S1) | Other infrastructure (S1) | Other infrastructure (S1) | — | ||

| Internal risks | Technical risk (B1) | Technical risk (B1) | Technical risk (B1) | Technical risk (B1) | Competitive risk (B2) |

| Competitive risk (B2) | Risk management (B3) | Risk management (B3) | Managing risk (B3) | Risk management (B3) | |

| Managing risk (B3) | Social responsibility (B4) | Social responsibility (B4) | Social responsibility (B4) | Financial risk (B6) | |

| Social responsibility (B4) | Taxes (B5) | Tax issues (B5) | Tax issues (B5) | Resource risk (B7) | |

| Financing risk (B5) | Financial risk (B6) | Financial risk (B6) | Financial risk (B6) | Energy production (B9) | |

| Financial risk (B6) | Resource risk (B7) | Resource risk (B7) | Resource risk (B7) | — | |

| Resource risk (B7) | Transport risk (B8) | Transportation risk (B8) | Transport risk (B8) | — | |

| Material risk (B10) | Material risk (B10) | Material risk (B10) | — | ||

- Abbreviation: BRI, Belt and Road initiative.

Different from previous studies, the index system established in this study cannot only reflect the indicators of various categories and stages but also reflect the changes in risk factors of BRI major energy projects in different stages. The BRI major energy projects have different construction stages of risk changes mainly embodied in the design of financing, investment, construction, and project operation three stages have different risk factors. The risk index is unchanged in investment in the construction phase, but there are obvious changes in the probability of the risk factors.

4.3. Full-Cycle Investment Risk Structure of Major Energy Projects

To assess the correlation among investment risks in major energy projects, a feasible method involves utilizing the ISM approach, as proposed in [70]. In this method, a structural model is constructed, and a two-part Delphi expert consultation questionnaire is distributed to an expert database. The first part of the questionnaire collects information about the experts’ personal backgrounds, including details such as their work experience, education, and professional history. The second part of the questionnaire focuses on assessing the complex relationships between various risk elements in major energy project investments. As risk elements are numerous and interact with each other in the field of energy project investment, an accurate assessment of their correlation is crucial for making scientific decisions. To this end, we have designed a series of questions designed to guide our experts in analyzing the interconnections between the risk elements and to provide valuable expertise in the risk assessment of projects.

In assessing the reliability of the consulting experts, two key factors, namely, the degree of motivation and the degree of authority of the experts, were taken into account. In the first round of questionnaire survey, 40 experts were successfully contacted and 39 completed questionnaires were returned, representing a high recovery rate of 97.5%. In the second round, despite the more in-depth and complex evaluation tasks, we still received 37 valid questionnaires, with a high recovery rate of 92.5%.

In addition, we used a scientific method to assess the level of authority of the experts. Specifically, we calculated the degree of authority (Cr) of each expert through the formula Cr = (Ca+Cs)/2 based on two criteria, namely, the selection of the expert (Ca) and the familiarity of the expert with the indicator under discussion (Cs). This value is between 0 and 1. The higher the value of Cr, the higher the degree of authority of the expert, and the reference value of his/her opinion in the risk assessment is also increased accordingly.

After computation, it was determined that Ca = 0.92 and Cs = 0.90 in this study. Therefore, the degree of authority of the expert is Cr = (0.92 + 0.90)/2 = 0.91, which is greater than 0.70. This signifies that the expert possesses a high degree of authority in the subject matter under consideration, bolstering the credibility of their opinions and assessments.

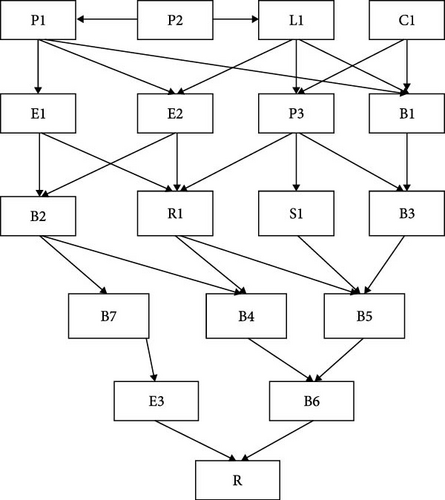

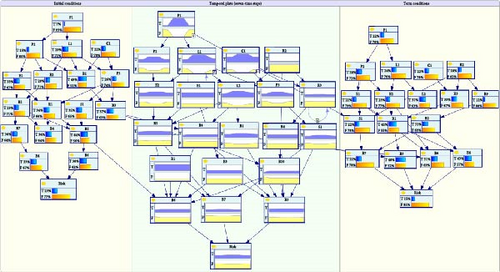

From Equations (4) to (6), the reachable matrix D performs interlevel decomposition to determine the reachable set R(Si), antecedent set Q(Si), and the highest set T(Si). The highest set is defined as the set of influencing factors of levels 1–5. The highest set is defined to determine the set of influencing factors from levels 1 to 5, which are L1 = [E3, B6], L2 = [B4, B5, B7], L3 = [R1, S1, B2, B3], L4 = [E1, E2, P3, B1], L5 = [P1, P2, L1, C1]. According to the influencing factors and reachable matrix relationship of each level, the investment risk structure model of BRI major energy projects is established, and finally, a six-level hierarchical structure is obtained, and the target level is the investment risk factor R of BRI major energy projects, which is shown in Figure 4.

The ISM methodology, when combined with MICMAC analysis, allows for the calculation of driving forces and dependence degrees concerning investment risk on project risk. This analysis provides valuable insights into how investment risk factors impact projects. In Figure 5, we observe that certain influencing factors fall within the spontaneous factor set, encompassing elements such as E1, E2, E3, B1, B2, B3, B7, S1, and P3. These spontaneous influencing factors exhibit relatively low driving force and dependence values, suggesting a weak correlation with the system. These factors, to some extent, operate independently of the system.

Conversely, the independent factor set of risk factors includes P1, P2, L1, and C1. These factors possess a strong driving force but weak dependence, signifying their dominance within the system. They play a pivotal role in influencing the system’s behavior and outcomes. Lastly, the risk factors placed within the dependence quadrant encompass B4, B5, and B6. These factors rely on the risk changes of other projects and have a limited influence on other risk factors. They exhibit a weaker impact on the system compared to the independent factors. In summary, the MICMAC analysis provides a comprehensive understanding of how different investment risk factors relate to project risks, revealing their driving forces, degrees of dependence, and overall impact on the system.

4.4. Topology Model of Investment Risk

We identified the risk factors of BRI major energy projects in the whole cycle, and through expert decision-making and relevant information, we determined the interaction between two risks at the same time node and finally obtained the risk structure model of major energy projects (structure model). To transform into a DBN structure, the risk factors are divided into parent nodes and child nodes. The causality of the risk factors is given by expert group decision-making and existing literature. Empirical research has proved that policy risk, which plays a dominant role in the early stage of investment, will gradually weaken with the progress of the project, leading to a simultaneous decrease in technology risk, which together contribute to the gradual rise of market risk as the main uncertainty factor affecting investment decisions [53]. In order to reduce the bias and limitations that a single expert may bring, we assemble a team of experts with different backgrounds, areas of expertise, and experience to provide a more comprehensive, multifaceted assessment. Matrix aij is used to determine the influence relationship between the current time node and the next time node, aij(T − T + 1) (T denotes a time node), thus obtaining the topology of DBN.

First, a fuzzy BN was established through fuzzy set theory to effectively deal with the network node ambiguity problem. The triangular fuzzy number was optimized by considering that the various risks were only not occurring (false) and occurring (true), with = (a1, b1) and. The “⊕” operation of = (a2, b2) is expressed as ⊕ = (a1 +a2, b1 +b2). According to the IPCC’s classification of risk level, the risk judgment opinions of 40 experts on the root node of the BN are calculated with the same weight as in Table 7.

| Natural language variables | Natural language variable triangular fuzzy number | Natural language variables | Natural language variables triangular fuzzy numbers |

|---|---|---|---|

| Very low (VL) | (0, 0, 0.1) | On the high side (FH) | (0.5, 0.7, 0.9) |

| Low (L) | (0.1, 0, 0.3) | Height (H) | (0.7, 0.9, 1.0) |

| On the low side (FL) | (0.1, 0.3, 0.5) | Very high (VH) | (0.9, 1.0, 1.0) |

| Medium (M) | (0.3, 0.5, 0.7) | — | — |

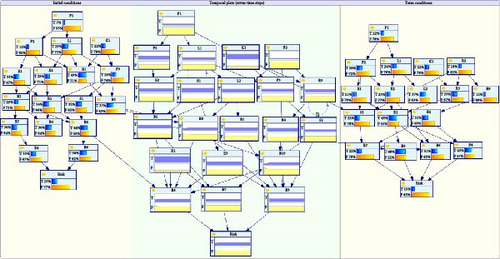

Second, to mitigate the influence of human factors on empirical results, we introduced the Leaky Noisy-or Gate extended model to calculate the CPT table of the BN for investment risk. This approach helps ensure a more objective and data-driven assessment. Considering the project’s multiphase structure, which includes financing, investment, construction, and project operation risks, we construct a major DBN for project investment risk assessment. The entire project lifecycle is divided into nine-time nodes, encompassing both the financing design and project operation phases.

Furthermore, within the project investment and construction phase, we elaborate on three distinct stages: material procurement, construction, and equipment debugging. Material procurement corresponds to time nodes 0 and 1, while construction is spread across time nodes 2, 3, and 4. Equipment debugging is represented by time nodes 5 and 6.

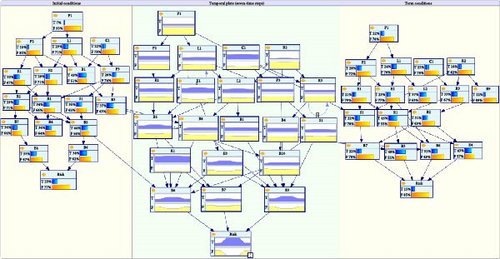

By carefully structuring these time nodes and phases, we establish the DBN topology model for assessing investment risk in major energy projects along the BRI. This model, illustrated in Figure 6, allows for a comprehensive and dynamic evaluation of investment risk throughout the project’s various stages.

5. Case Study

5.1. Brief Description of the M5 Thermal Power Station Project in Belarus

We have selected a representative case for analysis, focusing on the M5 Thermal Power Plant in Belarus. This project, financed through a commercial loan from the China Development Bank and overseen by Northeast Power Company, holds significant importance as it represents the largest cooperative endeavor between the two countries since the establishment of diplomatic relations. The winning company bears substantial responsibility for its successful completion. Furthermore, the project encompasses various phases, including design, procurement, construction, and project operation, allowing for a dynamic analysis of project risks.

The Belarus M5 Thermal Power Plant EPC Project, situated in Friendship Town, Minsk Region, presents a complex risk structure. Distinct risk factors are encountered across the three phases of financing and design, investment and construction, and project operation. While the risk indicators remain constant during the investment and construction stage, the probability of these risk factors experiences notable variations.

The established set of indicators not only accounts for the different categories and stages but also captures changes stemming from risk factors at various project stages. To gather expert insights on the fuzzy multistate BN root nodes P1, P2, L1, and C1 concerning investment risk in BRI major energy projects, we conducted interviews with 10 experts possessing extensive knowledge of overseas major energy projects. Prior to the interviews, the interview questions were designed by drawing on domestic and international literature and collating information related to the sending project to ensure the objectivity of the questionnaire. Their opinions on the status of risk levels were collected, organized, and presented in Table 8, providing valuable input for the analysis.

| Root nodes | Risk, etc., grade status |

Expert 1 | Expert 2 | Expert 3 | Expert 4 |

Expert 5 | Expert 6 | Expert 7 | Expert 8 | Expert 9 | Expert 10 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| P1 | 0 | VL | L | VL | L | FL | VL | VL | L | L | VL |

| 1 | FH | M | H | FH | H | H | FH | VH | H | H | |

| P2 | 0 | VL | VL | L | VL | L | VL | VL | VL | L | VL |

| 1 | VH | H | VH | VH | H | H | VH | H | H | VH | |

| L1 | 0 | FL | L | L | M | FL | L | L | L | M | FL |

| 1 | FL | H | H | M | M | M | FH | M | FL | M | |

| C1 | 0 | L | VL | FL | L | FL | FL | L | FL | L | FL |

| 1 | M | FH | M | H | FH | H | M | FH | FH | H | |

- Note: FH, on the high side; FL, on the low side.

- Abbreviations: H, high; L, low; M, medium, VH, very high; VL, very low.

Let each expert weight value be the same, the prior probability of the root node P (P1) = (0.15, 0.85), P (P2) = (0.07, 0.93), P (L1) = (0.29, 0.71), P (C1) = (0.22, 0.78) is computed from Equations (13) and (14). Similarly, the CPT distributions of the other nodes can be calculated. According to the expert opinion, we get P (E1 = 1|P2 = 1) = 0.5, P (E1 = 1|P2 = 0) = 0.3, and according to Equation (11), the connecting probability of the policy change of P2 is calculated to be 0.29. Leak’s probability is 0.2, and according to Equation (12), we get the CPT of the exchange rate change of E3. The results are shown in Table 9.

| Parent node | ∅ | P2 |

|---|---|---|

| P (E1 = 1) | 0.200 | 0.429 |

| P (E1 = 0) | 0.800 | 0.571 |

By analogy P (T = 1|E3 = 1) = 0.75, P (T = 1|E3 = 0) = 0.62, and P (T = 1|B6 = 1) = 0.6, P (T = 1|B6 = 0) = 0.55. The connection probability of the E3 market environment and B6 financial risk is calculated as 0.27 and 0.11, the results of the CPT of the impact of risk of the T energy project are shown in Table 10.

| Parent node | ∅ | E3 | B6 | E3B6 |

|---|---|---|---|---|

| P (T = 1) | 0.100 | 0.343 | 0.199 | 0.415 |

| P (T = 0) | 0.900 | 0.657 | 0.801 | 0.585 |

The CPTs of some nodes are calculated. The probability values of all investment risk nodes are obtained by further analysis combined with the above results, and then the DBN models of investment risk of major energy projects are obtained. The results are shown in Figure 7.

5.2. DBN-Based Forward Inference

In constructing our BN, we have structured it in a way that satisfies the conditions for the application of the Noisy-OR gate model. However, we acknowledge that there may be some factors that have not been accounted for in the model, leading to incomplete assessments. To address this limitation, we introduce the Leaky Noisy-OR gate model, an extension of the Noisy-OR gate model, to refine the CPTs of each network node.

During the application and analysis process, it is important to recognize that the factors contributing to the occurrence of certain outcomes (represented by Y) may include unknown elements beyond the defined set X. To address the uncertainty associated with these unknown factors, we incorporate the Leaky Noisy-OR gate model into our framework. This extended model allows us to build a DBN for investment risk, taking into account evidential inputs. This is illustrated in Figure 8. Considering technological, marketability, environmental, economic, and social factors, when market risk, cultural risk, policy risk, and investment climate risk occur, these risks propagate rapidly to nodes associated with transport risk, financial risk, social security, material risk, management risk, and resource risk [54, 71]. Ultimately, these risks have an impact on the overall project risk.

This dynamic risk transfer phenomenon is rooted in the inherently multidimensional nature of large-scale energy projects, which encompasses financing, the global placement of the material supply chain, and all aspects of the day-to-day operations of the project. This is coupled with the fact that the core stakeholders of the project span national boundaries, including bidders, tenders, and supervisors, who are inevitably exposed to a confluence of external risks, such as policy fluctuations, rapid market changes, and cultural differences. These risks rapidly accumulate or delay their outbreak within the company through a complex transmission mechanism, which in turn triggers the escalation of overall project risks. This comprehensive model allows us to capture and analyze the intricate interplay of risk factors and their effects on major energy projects.

5.3. Reverse Reasoning Based on DBN

During the construction of the M5 thermal power plant project in Belarus, should any issues arise at time nodes T = 2, 3, or 4, resulting in project difficulties, we can analyze the investment risk DBN network with posterior probabilities. This analysis is achieved by setting the project risk (R) at T = 2, 3, and 4 to a value of 1, signifying that project risk has materialized at these time nodes. The results are shown in Table 11. By examining the probability changes in a stepwise, forward reasoning fashion, we observe varying degrees of increase in the probability of the risk nodes. The evolution path of investment risk for the M5 thermal power plant project in Belarus is as follows:

| Moment | 0 | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|---|

| Market risk | 0.372 | 0.372 | 0.530 | 0.531 | 0.530 | 0.372 | 0.372 |

| Land issues | 0.338 | 0.341 | 0.360 | 0.362 | 0.343 | 0.343 | 0.342 |

These paths depict the sequential progression of risk factors and their influence on investment risk as the project unfolds.

Additionally, it is important to note that Belarus has a high dependence on its foreign economy, with imports and exports accounting for more than 120% of its GDP. Recent political conflicts between Europe, the United States, and Russia, along with fluctuations in oil prices, have placed Belarus in an economic crisis. This crisis is characterized by high inflation rates, reaching as high as 18.1%, and soaring prices.

The close economic ties between Belarus and Russia have amplified the impact of Russia’s economic situation on Belarus. In the context of the M5 thermal power plant project, this economic instability in Belarus can lead to challenges, including the need to secure means of production, building materials, and equipment well in advance to avoid potential supply shortages. These challenges can result in higher construction costs, increased management and financial risks for the project, and a heightened risk when collaborating with local Belarusian enterprises. These economic and geopolitical factors must be carefully considered in project risk assessment and management.

In addition to risk evolution occurring within the risk network at a single time point, there is also risk evolution happening at different time nodes. Figure 9 illustrates that market risk (P [E1]) and land issues (P [P3]) both reach their maximum values at T = 3. Policy risk, exchange rate risk, and cultural risk all peak at T = 2. Market risk is influenced by policy risk and exchange rate risk in the preceding time point, while land issues are affected by cultural risk in the preceding moment, with changes beginning at T = 2 and peaking at T = 3. Therefore, between T = 2 and T = 3, there is a risk evolution network that includes P2 → E1 → E3 → B3/B6 → R and L1 → P3 → S1 → B7 → R.

This dynamic risk evolution can be attributed to Belarus being in a period of transition from a planned economy to a market economy. During this transition, various policies, systems, and regulations are not yet fully developed and require improvement. For instance, Belarus imposes restrictions on the number of foreign workers and the nature of their work, necessitating permits for employment, which can lead to labor shortages. Additionally, Belarus faces challenges related to a shortage of skilled local workers, which, in turn, affects the project’s progress and increases project risks. These economic and regulatory factors play a significant role in the evolving risk landscape.

6. Discussion

This study reveals that key risk factors in the accident cause system are distributed across multiple levels. This emphasizes the importance of considering various levels of factors in the risk management of major energy projects, rather than solely focusing on direct causes. The analysis and discussion of the results can be summarized as follows:

Investment risk factors of leading projects: By utilizing the ISM-MICMAC method, we identified risk indicators with strong driving forces and weak dependencies. These indicators, including political instability, policy changes, imperfect legislation, and cultural risks, play a leading role in influencing project risk. The DBN model was employed to construct a dynamic evolution model for enterprise investment risk across the entire project lifecycle. Through forward reasoning within the DBN model, we observed how these risk indicators interacted and triggered an increase in project risk over time. It was found that risks tended to interact with each other, indicating the complexity of risk dynamics. In addition, the evolution of the external geopolitical landscape, such as the continuation of the Russian–Ukrainian conflict and the restructuring of international cooperation mechanisms, has added an additional element of uncertainty to the projects under the BRI framework.

Multiple evolutionary paths at a single moment: The risk evolution analysis model was applied to a case study of the M5 thermal power plant in Belarus. This analysis revealed various risk evolution paths occurring at a single moment due to factors like exchange rate changes, interest rate changes, taxation issues, social security concerns, management risks, financial risks, imperfect legislation, asymmetric legal information, technological risk, transportation risk, and cultural risk. These paths illustrate the interdependencies and complexities within the Belarusian development context, where external shocks can quickly lead to internal risks, subsequently increasing project investment risk. Managers should focus on external shocks during the investment process to prevent them from creating risks to the project.

Multiple evolution paths at different moments: By analyzing quantitative probability changes, we identified risk evolution paths at different time nodes. Of particular concern is the fact that during the critical period of transition from a planned to a market economy in Belarus, a complex set of factors—including frequent changes in the policy environment, high volatility in the exchange rate market, rapid and dynamic changes in the market environment, a still-undeveloped legislative framework, challenges in the allocation of land resources, and potential risks to access to resources—have had a profound impact on the trajectory of risk evolution in Belarus. These factors—including frequent changes in the policy environment, volatility in the exchange rate market, rapid and dynamic changes in the market environment, an undeveloped legislative framework, challenges in the allocation of land resources, and potential risks in access to resources—have had a profound impact on the trajectory of risk in Belarus. These risk trajectories, as verified by rigorous research, are highly consistent with the challenges and dilemmas encountered in the construction of thermal power plants in Belarus. This emphasizes the importance of assessing and mitigating risk from multiple perspectives, with managers not focusing on one risk transfer pathway, but rather preventing risk from expanding along other pathways.

7. Conclusion, Policy Implications, and Limitations

7.1. Conclusion

This study has developed a comprehensive risk evolution model for major energy projects within the BRI. The research aimed to provide insights into the dynamic nature of investment risks associated with these projects. The risk evolution model was established by categorizing risk factors into different phases of project development: financing design, investment construction, and project operation. Using the ISM-MICMAC model, four key factors were identified as central drivers of project risk. These factors include political instability, policy changes, imperfect legislation, and cultural risks. They should design market-based environmental regulation policies, emphasize on environmental taxes, expand renewable energy development, and environment-related innovations. Such strategies are key to limiting CO2 emissions and gain environmental sustainability [72].

In order to deeply analyze the complex interaction mechanism among risk factors, this study adopts the forward inference method in DBN model. This approach integrated the Leaky Noisy-OR gate model to mitigate the impact of risk probability estimation errors. The analysis revealed how risk factors interacted, leading to increased project investment risk. Notably, after policy changes, legislative imperfections, and cultural risks occurred, these risks rapidly propagated to other nodes, such as transport risk, financial risk, social security risk, material risk, management risk, and resource risk, ultimately influencing overall project risk.

Furthermore, the study identified dynamic evolution paths of investment risk at both the same time node and different time nodes using reverse inference. The results of the study show that investment risk exhibits diverse evolutionary paths at different points in time, presenting a high degree of dynamism and complexity. For instance, market risk and land issues reached their peak during equipment construction, while policy risk, exchange rate risk, and cultural risk peaked during material procurement. These findings highlight the interconnected nature of investment risks and underscore the importance of considering their interdependencies.

Overall, this study offers valuable insights into risk management for BRI major energy projects, emphasizing the need for a comprehensive approach that considers risk factors at different stages of project development. The application of advanced modeling techniques, such as the Leaky Noisy-OR Gate model and DBN, enhances the accuracy of risk assessments and helps project stakeholders make informed decisions.

7.2. Policy Implications

The study’s findings have important policy implications for improving the management of risks associated with BRI major energy projects. Here are the key policy recommendations:

- •

Governments should refine macroeconomic policies to provide guidance and create an optimized service system. Political instability, policy changes, imperfect legislation, and cultural risks were identified as having significant impacts on BRI energy projects. Governments can mitigate these risks by:

- •

Strengthening support for BRI energy enterprises in host countries through legal and policy mechanisms.

- •

Negotiating and signing multilateral investment protection treaties to safeguard the rights and interests of enterprises.

- •

Increasing financial support and encouraging commercial banks to provide credit support for overseas investment.

- •

Developing financial products that can transfer project investment risks.

- •

Optimizing information and consulting services to offer technical support for overseas enterprises.

- •

Industry associations should play a pivotal role in facilitating communication between enterprises, governments, and international industry organizations. They can act as intermediaries to foster negotiations on behalf of enterprises, protecting their international business interests.

- •

Industry associations should expand their services by utilizing technology to build multiparty communication platforms and enhance service methods. This will ensure that they can effectively mediate and provide valuable services to member enterprises.

- •

Enterprises embarking on overseas investments should adopt effective risk management mechanisms. Key steps include:

- •

Addressing system risks and industry-specific risks by engaging in detailed agreements with host governments. These agreements should cover foreign exchange, labor, taxation, and other critical aspects.

- •

Enhancing internationalization and localization efforts to better understand local policy trends, the attitudes of foreign investors, market barriers, and competition dynamics.

- •

Continuously monitoring investment risk factors in the host country and utilizing collected information for risk prediction.

- •

Strengthening the talent pool by recruiting professionals with investment experience, particularly individuals familiar with the host country’s culture.

These policy recommendations aim to promote the successful execution of BRI major energy projects by addressing and mitigating key risk factors. By improving the policy framework, enhancing industry associations’ role, and optimizing risk management mechanisms, governments and enterprises can work together to navigate the complexities of international energy investments more effectively.

7.3. Limitations

This study has several limitations. First, it relies on expert opinions and data, which could introduce subjectivity and bias into the findings. The accuracy of risk assessments is contingent on the quality of available data and expert input. Second, the use of complex models like the Leaky Noisy-OR gate and DBN necessitates precise historical data and model calibration, which can be difficult to obtain. Third, the study’s concentration on specific risk factors and case studies may restrict its applicability to other BRI energy projects. Lastly, while policy implications have been explored, their execution may encounter challenges stemming from political, economic, and regulatory factors. These limitations emphasize the ongoing need for research to enhance risk assessment models and address the intricacies of investment risks in BRI energy projects. In future research on investment risk dynamics, incorporating trigger mechanisms can enhance risk forecasting and management. These triggers identify events or conditions that initiate or amplify risks, allowing for proactive risk mitigation. Additionally, trigger-based scenario analysis aids in understanding how different events affect risk evolution. Real-time monitoring of triggers helps organizations respond effectively to changing risk dynamics. Insights from trigger analysis inform targeted risk management strategies and policies. This approach provides a comprehensive understanding of risk evolution, improving decision-making in dynamic projects.

Ethics Statement

Compliance with ethical standards as this article does not contain any studies with human participants or animals performed by any of the authors.

Conflicts of Interest

The authors declare no conflicts of interest.

Author Contributions

Yao Xiao: investigation, data curation, software, visualization, writing. Anxia Wan: project administration, funding acquisition, resources. Yue Li: original draft, formal analysis. Ehsan Elahi: review and editing. Benhong Peng: supervision, methodology, conceptualization, validation. The authors made the equal contribution and agree to participate in publishing of this paper.

Funding