Paving the Way for Low-Carbon Shipping Fuels in Long-Haul Trade Routes

Abstract

In 2023, the International Maritime Organization strengthened its ambition, aiming at net-zero greenhouse gas (GHG) emissions by 2050. This goal depends on the replacement of oil-derived fuels by alternative fuels and motorizations that bring the risk of technological lock-in and increasing global trade costs. The establishment of low-carbon (LC) trade routes (LCRs) is a way to mitigate such risks for the first movers. However, while a dozen LCRs are being considered, few scientific studies have focused on designing and evaluating them, particularly for the trade from emerging economies. We propose a methodology for assessing the economic feasibility, GHG emissions, and policy design of candidate LCRs. We employ it on a shipping route dedicated to the transportation of iron ore, a major dry bulk cargo. Findings show that the use of biomethanol can reduce by 37% the lifecycle GHG emissions of the route. They indicate an increase of 8%–25% in operational costs. This corresponds to 330 and 450 USD/tCO2e. The success of this strategy depends on the engagement of private and public actors promoted by policies and international agreements, which can be fostered by the existing involvement of the Brazilian and Chinese governments in the companies and harbors of the assessed route.

1. Introduction

The shipping sector accounts for around 3% of global carbon dioxide (CO2) emissions, with nearly 70% of them coming from the international transportation of cargoes [1]. In 2018, the International Maritime Organization, a United Nations (UN) agency responsible for the environmental regulation of the sector, established a preliminary greenhouse gas (GHG) strategy whose main objective was to reduce international shipping GHG emissions by at least 50% by 2050 (compared to 2008) [2]. In mid-2023, the IMO revised its GHG ambition, aiming at reaching net-zero international shipping emissions by 2050 [3]. This 2050 target includes interim milestones: by 2030, reduce carbon intensity by at least 40%; by 2030, reduce total annual GHG emissions by at least 20%; and by 2040, reduce total annual GHG emissions by at least 70% [3].

While constructive measures (e.g., efficient design and lightweight materials [4, 5]) and operational measures (e.g., slow steaming [6–9]) can significantly contribute to lower the energy intensity of ships, achieving deep decarbonization of the sector requires the large-scale deployment of renewable-based fuels, which play the important role of decoupling energy demand from fossil CO2 emissions [1, 10–12].

Unlike the energy transitions to coal and oil in the 19th and 20th centuries, the emerging shift in the maritime sector is not motivated by technical-economic gains but by a pressing socio-environmental need [13–15]. Consequently, candidate renewable-based fuels are diverse both in terms of production pathways and final energy carriers. For instance, bunker and diesel-like fuels can be produced from oilseed crops [16, 17], used cooking oils [18], agricultural and forestry residues [19], alcohols [17], or even through a combination of captured CO2 and green hydrogen [20, 21]. Due to their chemical similarities to conventional maritime fuels, such as heavy fuel oil (HFO) and marine diesel oil (MDO), these renewable-based fuels can be seen as nearly or fully drop-in fuels. This means that their application to the existing fleet does not require major changes in powertrain technology, which implies that these fuels can be used in conventional compression ignition engines by using minor adaptions [22–24].

On the other hand, low-cetane energy carriers such as ammonia, alcohols, and gases are not suited to combustion in conventional maritime engines, requiring, therefore, the development of innovative motorizations [23, 25, 26]. The need for new energy conversion technologies contrasts with the long lifespan of merchant vessels, typically ranging between 25 and 40 years [27–29]. Furthermore, the existing merchant fleet is relatively new. Although the average vessel age is around 21.9 years, in terms of capacity, the global fleet has an average age of only 11.5 years. This reflects the fact that old vessels are concentrated in smaller categories, especially general cargo ships [29]. For this reason, there is a need for addressing strategies directed to the use of drop-in fuels or retrofitting existing ships for the use of non-drop-in fuels.

The use of alternative fuels with significantly higher costs than those conventional fuels can impact freight prices and influence cargo trade dynamics, especially in lower-margin segments, such as agricultural products [19]. Meanwhile, the IMO’s revised ambition aims to have at least 5% of the maritime sector’s energy demand met by zero or near-zero emission fuels by 2030 [30]. This target comes in the context of a sector where nearly 100% of energy demand is currently supplied by fossil fuels [31], which also highlights the significant challenge until 2030.

To address the challenges associated with the transition in maritime transportation, a novel approach gaining momentum in the industry involves establishing dedicated low-carbon (LC) trade routes connecting key port networks. These routes exclusively use low or zero-emission fuels and rely on collaboration between industry stakeholders and governments committed to investing in decarbonization strategies for maritime trade along a specified route, helping to mitigate uncertainties and risks in the transition of the sector [32, 33]. Given the substantial contribution of bulk commodities to seaborne trade, which accounted for nearly 56% of total transport work of international shipping in 2022 [34], implementing such routes represents a tangible and impactful step toward significant decarbonization in the shipping industry, effectively aligning with the industry’s commitment to reach net zero as soon as possible. In 2022, a few agreements aiming at the establishment of LC shipping routes were disclosed. These agreements covered varied container and dry bulk routes [35–37]. At the 26th Conference of the Parties (COP26), a goal was set to establish at least six LC routes by 2025 [38].

However, some of the most carbon-intensive maritime routes connect major harbors from emerging countries, particularly for the freight of mineral or food commodities [39]. These emerging countries heavily rely on these trades and must find ways to deal with the more stringent GHG emissions targets from IMO. Therefore, this work aims to present a methodology for conducting economic and GHG assessments in the context of establishing such LC corridors. The proposed framework is designed to be relevant across diverse shipping sectors, especially those with clearly defined stakeholders. As a case study, the iron ore route between Brazil and China, both emerging countries, is analyzed. By using the route for the case study, the aim is to evaluate emission reduction strategies, considering alternative fuel availability, maritime energy demand, associated costs, GHG emissions, and the existing institutional framework. Given the agricultural prominence of both Brazil and China, coupled with the potential for biomass residues, biomethanol is selected as the fuel to be tested in the corridor. The biofuel is practical due to its ease of handling, storage, and compatibility with some dual-fuel engines, allowing retrofit [40, 41], reinforcing the fuel as a suitable option among non-drop-in energy carriers, which are the focus of the proposed methodology.

The selected route was analyzed by Getting to Zero Coalition in 2021, which highlighted that the establishment of LC fuels along this route could significantly reduce emissions despite the high costs [33]. However, considering that the iron ore producer is actively investing in research and measures to lower emissions on this route [42], Brazil’s expertise and potential in biofuel production [43], and the identification of the main origin port of iron ore in Brazil as a potential hub for biofuel bunkering [44], this route was chosen as the case study. Reducing emissions on this route aligns with IMO targets and addresses a gap in the literature—as of the authors’ knowledge; no studies have been conducted on establishing an LC corridor for this specific route.

This paper is structured as follows: Section 2 presents a review of the literature, Section 3 shows the methodology, Section 4 summarizes results and discussions, and Section 5 contains final remarks focusing on policy recommendations.

2. Literature Review

While LC maritime routes are already being discussed and implemented, such as the route between the ports of Rotterdam and Singapore [45], the scientific community has yet to make significant efforts to analyze these routes. Few scientific studies have been published focusing on designing and evaluating LC maritime routes. For instance, Wang et al. [46] evaluated a green corridor based on green ammonia produced by wind or solar power electricity, focusing on identifying locations for producing and bunkering this fuel. However, these authors did not assess the design of a green corridor, which should include not only the definition of production sites and harbors but also the identification of stakeholders and specific routes to serve as a niche market for the corridor. Ismail et al. [47] evaluated the challenges faced by ports to implement LC trade routes (LCRs) by interviewing professionals working at various ports interested in decarbonization. They identified that the main barriers are lack of stakeholder investment and collaboration, low technological maturity and availability of alternative fuels, high investment costs, and limited government involvement. The authors also proposed a methodology detailing the steps for ports to establish LCRs. Song et al. [48] and Jeong et al. [49] reviewed the current debate and implementation of green shipping corridors in the world, aiming at setting up global agendas. These are timely studies that justify the type of analysis proposed by us, but did not aim at proposing and applying a methodology for designing the concept of a green corridor. Particularly, the review of Jeong et al. [49] emphasized that most of the proposed or under-implementation corridors are located in Organization for Economic Co-operation and Development (OECD) countries or have a route that connects an OECD harbor to another harbor, being it in an OECD country or not—for example, a route between Los Angeles and Shanghai—Prevljak [50]. In this context, Jesus et al. [51] conducted an analysis that is a counterpoint of the aforementioned literature, as it focuses on a route between ports in emerging countries at both origin and destination: Lagos, Nigeria, and Shanghai, China. The authors did an economic analysis of the route using different fuels and concluded that hydrogen would be the most cost-effective option.

As per the technical literature, this issue is even more critical since the reports mainly focus on routes concentrated in ports of OECD countries [32, 33, 52]. According to Getting to Zero Coalition [53], 62 routes were under study or implementation in 2024, yet mostly in ports of Europe, Asia, and North America. Among these, 17 routes involve industry-led initiatives, 14 involve port authorities, 13 include governments, and 18 are driven by public–private partnerships. Methanol is identified as the main energy carrier for 17 routes, while ammonia and electricity are considered for 15 routes each, methane (CH4) (gas) for 9, hydrogen for 8, and second-generation biofuels are considered for 4. Most of these corridors have yet to define a specific vessel type, although Ro–Ro vessels or ferries, container ships, bulk carriers, and tankers are designated for 21, 15, 8, and 4 corridors, respectively.

The evaluation of routes has also been explored in other studies. Maersk Mc-Kinney Møller Center (MMMC) [54, 55] developed a feasibility methodology that covers since the evaluation of the route to its implementation. The reports outline a structured step framework for both the prefeasibility and feasibility of a specific route. These steps include analyzing the availability and supply chain of potential alternative fuels, assessing port infrastructure, reviewing trade routes and vessels, examining policy, regulations, and stakeholder engagement, identifying decarbonization pathways, and consolidating and maintaining the route.

To provide context for the case study, it is essential to first outlook the framework of international trade. Global seaborne trade, which averages ~12 Gt/yr [56], encompasses a wide range of products. While the general cargo market has seen substantial growth, especially in containerized trade, a significant portion of international shipping still involves bulk commodities, categorized into dry and liquid bulk markets. The dry bulk sector, prominently featuring coal, grain, and iron ore, plays an essential role in efficiently transporting large quantities of homogenous, low-value-added goods. Iron ore, a fundamental component in traditional steel production, and the scope of the case study holds particular importance, accounting for over 12% of global seaborne trade by mass [57].

Brazil, the world’s second-largest producer of iron ore, supplies approximately half of its exports to China, reaching around 244 Mt in 2021 [58, 59].1 Future projections for the iron ore trade suggest potential growth driven by increased infrastructure demands for renewable energy or, at least, the maintenance of current levels. These forecasts also indicate that Brazil and Australia are expected to continue as the leading global exporters of iron ore in 2050 [10, 60–64]. As a parallel example, the Brazil–China soybean trade route, associated with a major CO2 emission trade route, was analyzed by Carvalho et al. [19] by evaluating the potential for reducing GHG emissions by substituting conventional fuel with biofuels. The study demonstrated that, depending on the energy production pathway, Brazil could meet the demand for biofuels from that shipping route by 2050, offering an initial glimpse into the feasibility of fuel replacement. However, assessing the broader implementation of LC corridors requires consideration of factors such as the engagement of industry actors and the existing regulatory framework.

3. Methodology

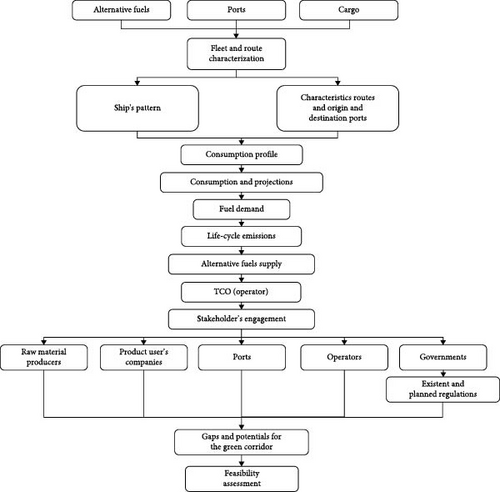

The methodological procedure applied by this study was adapted from [54] (Figure 1).

Detailed information on the data used for the LCA, the assumptions made for fuel availability, and stakeholder strategies associated with GHG emissions can be found in the Supporting Information (Tables S1–S6).

The first step is the primary focus for route selection, which helps to address the scope, the strategies, and the stakeholders involved in the decarbonization process. We have defined three main groups of primary focus: product-based, port-based, and alternative fuel-based. Product-based routes prioritize the decarbonization of ports and ships of a specific product that has usually high volumes of trade and/or high added value. An example of possible shipping routes focusing on products would be the route of Australian iron ore that is exported to China, Japan, and Korea [33]. Port-based routes are centered on specific ports that could be more prone for the establishment of alternative fuel bunkering, especially due to their high volume of trade or importance to the regional economy. The route between the ports of Rotterdam and Singapore is an example of major hubs that could be a prime candidate for decarbonized routes [33]. Alternative fuel-based routes could be prioritized due to the feasibility of developing the required infrastructure. The route between Australia and the Silk Alliance countries—including Southeast Asia, China, India, and the Arabian Peninsula—is an example of the route with the potential to become an alternative fuel corridor. This is supported by ongoing and projected efforts to promote the adoption of alternative fuels such as methanol and ammonia [53]. With the primary focus established, the subsequent steps presented in Figure 1 will be detailed in the following sections.

For the case study, the first step consisted of characterizing the shipping route in which the LC corridor will be implemented and the fleet associated with the route. Subsequently, the consumption profile was identified, and demand projections were made for the following years. After the demand projections, the life cycle GHG emissions were calculated to estimate emissions avoided by fuel replacement. Later, the alternative fuel supply and the total cost of ownership (TCO) were estimated. Then, the study assessed the stakeholders’ engagement, aiming to also derive policy implications. The last step evaluated the gaps and potential for establishing the LC shipping corridor and its feasibility.

3.1. Characterization of the Route and Fleet

To characterize the route, it is essential to identify the fleet profile. First, information on the characteristics of typical ships should be collected to estimate the key data, such as typical size, operational behavior, fuel tanks, engine outputs, operational power, and cargo capacity. These data are inputs to calculate average trip duration and fuel consumption. The next step is the collection of route and port data, gathering data such as the type of cargo transported in the route and the volume, distance, duration per trip, intermediate ports, and the capacity of departure and destination ports.

Therefore, for the case study, a survey of the fleet that traveled the selected route in 2021 was made [65], and a sample of 10% of the ships identified, prioritizing the vessels that carried more cargo in the year, was selected to be analyzed (Table 1).

The data collected in [65] are organized by vessel, identified through the ship’s IMO number. The origin (Brazilian) and destination (Chinese) ports that presented the highest cargo handling between 2010 and 2021 on this route were also identified. For each year in the historical series, the available information includes docking dates at both ports, the product transported, and the cargo movements recorded for each voyage. Therefore, by using the ship’s IMO number, it was possible to track recent port calls of the selected ships on [66]. Additionally, the average number of trips for each ship per year on the route was verified. Subsequently, the characteristic routes of the ship`s sampling were defined based on the recent history of port calls [66]. As Table 1 shows, data of each ship was collected by matching the IMO number of ships to its respective classification society. For instance, the ship called “Pacific Prosperity,” which was responsible for transporting more than 1.5 million tons of iron ore from Brazil to China in 2021, has the IMO number 9807059, and searching on the classification societies database, it was found that this ship’s classification society is CCS. Therefore, using the CCS Vessel Register [67], it was possible to find the deadweight tonnage (dwt), construction year, speed, and information regarding main and auxiliary engines. The route distance was calculated using Google Maps [71].

3.2. Consumption, Projections, and Fuel Demand

With the consumption factor per cargo transported and the historical profile of transported cargoes on the route in terms of volume, the route’s fuel demand can be estimated by multiplying the total cargo transported by the consumption factor. As per the time series of projections, a time step of 5 years, starting on 2025 until 2050, could be used, following the example of Getting to Zero Coalition [54], which also aligns with IMO target for net-zero GHG shipping, as mentioned before. To evaluate fuel demand for projections, it is necessary to input the projected cargo volume for the route or use available transported cargo projections from the literature.

In the case of the selected route, the database of iron ore transport demand of the Brazil–China route was taken from [65]. Subsequently, the projection of demand for the years 2025, 2030, 2035, 2040, 2045, and 2050 was developed based on the percentage of demand changes, in relation to 20203 (Table 2), from [76].

| Iron ore demand projections | Increase % in relation to 2020 |

|---|---|

| 2020 | — |

| 2025 | 24.3 |

| 2030 | 22.5 |

| 2035 | 18.9 |

| 2040 | 15.2 |

| 2045 | 14.8 |

| 2050 | 10.7 |

However, as addressed by Müller-Casseres et al. [10], the demand for maritime trade can vary depending on the different pathways of future trends in economic growth, human development, population growth, lifestyle, government decisions, natural resources stocks, and technology development. To cover the uncertainty intrinsic to the baseline development, a sensitivity analysis was applied considering a 25% deviation, upwards and downwards, on the demand projection. The sensitivity analysis was employed from 2030 onward.4

From the projection of demand for iron ore transportation, the annual demand for bunker (HFO) and methanol was calculated, using the specific consumption of [1], as well as efficiency gains over time [75]. The pilot fuel consumption, when using methanol in a dual engine, was estimated based on [77], being 3% of the total volume of fuel used in combustion.

3.3. Alternative Fuels Supply

The viability of replacing conventional fuel with LC fuels for the entire fleet is directly dependent on the available feedstock in the region and the potential for producing and supplying the required amount of fuel. Therefore, it is necessary to evaluate the potential production chain of alternative fuels in both regions and in regions near intermediate ports, with a particular focus on production viability. The analysis can also include assessing the feasibility of logistics, technological readiness, and the infrastructure changes required to support the adoption of the selected alternative fuel. Similar to the conventional fuel, alternative fuel demand can be estimated by using the physicochemical characteristics of the fuel in the method applied in Section 3.2 for the time series analyzed.

For the case study, the following production routes were identified: production of biomethanol via the biogas route [78] (Route 1) or through the gasification of lignocellulosic biomass [79] (Route 2). Although the analyzes were carried out based on biomethanol, the potential supply of electricity-based methanol (e-methanol)—produced from obtaining hydrogen via electrolysis with the use of renewable electricity source, along with obtaining CO2 via air capture or biomass combustion exhaust [80] (Route 3)—was also mapped. The objective was to verify the possibility of introducing renewable methanol as an alternative for a new stage of decarbonization of the selected route in the future.

The production potential of biomethanol and renewable methanol for Brazil and China, through the aforementioned routes, was assessed through data available in the literature. Information on the availability of feedstock for methanol production for each of the three routes in Brazil and China, as well as the technological maturity of the routes in each country, are presented in the Supporting Information (Table S5).

3.4. Life Cycle GHG Emissions

To assess the potential of emissions reduction by replacing a conventional fuel for an LC fuel on a specific shipping route, it is necessary to calculate the emissions of the fleet for each of the fuels, considering their entire life cycle—from the production of the fuel to its final use in the ships, commonly referred to as well-to-wake. Therefore, the product phases that should be considered, following the Guidelines on Life Cycle GHG of IMO [81], are cultivation, extraction, acquisition, or recovery of the raw material; preprocessing or initial transformation of the raw material at the extraction region; transportation of the raw material to the conversion site; conversion to the final product; transportation and storage of the fuel in ports; combustion or conversion of fuel into energy for the ship propulsion or other uses. Since the primary focus of this study is to assess the viability of the route, the lifecycle emissions can be sourced from existing literature that addresses the product phases highlighted before. Phases such as final disposal of products or recycling, which are considered in studies like [82], were not the focus of this methodology. The specificities of fuel production and the ports along the selected route should be considered since the production chain in each region has its own unique characteristics. Emissions should be measured considering the main GHG—CO2, CH4, and nitrous oxide (N2O), considering the annual demand of fuels as the measure for the whole time series computed. To quantify the emissions, it is recommended to use the global warming potential metrics for a time horizon of 100 years, established by IPCC [83], which were applied in the literature used in the case study.

For the case study, the CO2 equivalent emissions related to the bunker (HFO) for the whole lifecycle were based on the emission factors (gCOe/MJ) available in [84] and, for biomethanol based on emission factors (gCOe/MJ) from [85]. Thus, the average carbon intensity of the ships (kg CO2eq/t) and the total emissions (CO2eq) for 2020 and 2021 were quantified, as well as projected for subsequent years (2025 to 2050, in 5-year intervals).

As in the case of biomethanol, Szklo [85] presented CO2 equivalent emission factors by region of Brazil; considering the feedstock available and the potential of each location, a weighted average was calculated according to the different production potentials of each region. The pilot fuel emissions were incorporated in the calculation of biomethanol emissions. For biomethanol, the route based on biogas was considered, and the emissions offset due to the absorption of CO2 from the atmosphere during biomass growth were accounted for in the well-to-tank (WTT) phase. Finally, the avoided emissions on the Brazil–China route, due to the replacement of fossil fuel by biomethanol, were calculated based on the total emissions of the two fuels.

3.5. TCO

Five TCO scenarios were designed (Table 3) based on the year of 2030 and a bulk carrier with a capacity of ~400,000 dwt. The cost of ship acquisition was determined based on the base CAPEX values for very large bulk carriers provided in the TCO calculation tool of MMMC [88]. Notably, the acquisition cost is the same across all scenarios as it is based on the values provided by the MMMC tool. The cost of engines and storage was taken from Taljegard et al. [89], while the cost of HFO for the base year of the analysis was taken from [84]. The projected prices for 2030 and 2050 of HFO were based on Lloyd’s Register and UMAS [90], as well as the cost related to the loss of cargo space due to the use of a fuel with lower energy density. Methanol fuel prices, as well as infrastructure, maintenance, and retrofit for dual-fuel engines, were based on Korberg et al. [86].

| Name | Description |

|---|---|

| R0 | Conventional ship + retrofit in year 0 |

| R15 | Conventional ship + retrofit in year 15 |

| NPV | Conventional ship + retrofit year decision based on a cap adding 10% to the NPV of the operation with HFO. Led to the retrofit ranging between the years “17” and “20” |

| New | New ship already powered by methanol |

| Conv | Conventional ship (HFO) |

- •

Scenario 1: a ship initially built to use HFO as fuel, retrofitted in year “0,” to use methanol as fuel, also including engine and onboard infrastructure modifications.

- •

Scenario 2: a ship originally powered by HFO, with the retrofit performed in year “15,” half of the ship’s lifespan. This scenario excludes methanol-related costs in the first half of the lifespan.

- •

Scenario 3: similar to scenario 1, however the retrofit timing was determined based on limiting the NPV increase to 10% compared to the TCO of an operation with only HFO as a fuel during the whole lifespan. Sensitivity analysis done on iron ore demand suggested that the retrofit would occur between year “17” and “20,” after which methanol-related costs would be applied.

- •

Scenario 4: acquisition of a new ship designed for the use of methanol. This scenario added costs for dual-fuel engines and adopted storage tanks, as mentioned before. Costs of biomethanol, maintenance, and cargo space loss remained consistent with earlier scenarios.

- •

Scenario 5: operation of a conventional ship using HFO.

For each scenario, two variations of analysis were carried out. For the first variation, the fleet size remained constant in relation to 2021, with changes in the average number of trips per year per ship to meet the increased demand for cargo transport in 2030. As for the second variation of scenarios, the average number of trips per year remained constant, but the fleet size was changed to meet the demand of 2030.

Engine power, average annual trips per ship, and fuel consumption data were taken from the ANTAQ data analysis referenced earlier. For all scenarios, the equivalent annual cost and the average cost per trip, which includes an entire trip leaving and returning to Brazil, were calculated.

3.6. Stakeholder Engagement

To enable the introduction of an LC fuel on a shipping route, it is essential to have stakeholders committed to invest in decarbonization strategies for maritime trade and a favorable regulatory framework. The development of these routes relies on effective stakeholder engagement. To address each stakeholder role, it is essential to identify interest groups related to the production of products that are both transported and used for alternative fuels, port authorities, shipping operators, and government agencies. This approach enables a deeper analysis of stakeholder’s cooperation potential, making it easier to address opportunities for collaboration between parties and pinpoint gaps that need to be directed.

In the case of the studied route, according to [33], the main stakeholders involved in the process of decarbonizing iron ore shipping routes are the iron ore companies, ports, ship operators that cover the route, steel producers, and governments. Therefore, with the goal of characterizing these stakeholders and focusing on the engagement of these organizations with climate issues and decarbonization targets, information for the case study was collected from the two largest agents in each group (Table 4) by accessing their annual and sustainability reports, as well as data available on their websites. The characterization of government engagement was based on published reports, applicable legislation, and nationally determined contributions (NDCs) of each country.

| Group | Agent 1 | Agent 2 | Reference for defining the agents |

|---|---|---|---|

| Cargo Owner | Vale S.A. | Anglo American | [91] |

| Steel Producers | China Baowu Group | Ansteel Group | [92] |

| Ship Operators | Hong Kong Ming Wah Shpg Co Ltd. | H-Line Shipping Co Ltd.6 | [65] and classification societies website—Table 1 |

| Ports | Qingdao7 | Terminal Ponta da Madeira8 | [65] |

| Governments | Brazil | China | — |

The analysis of each stakeholder associated to the Brazil–China route is presented on the Supporting Information (Table S6).

4. Results

4.1. Energy Demand

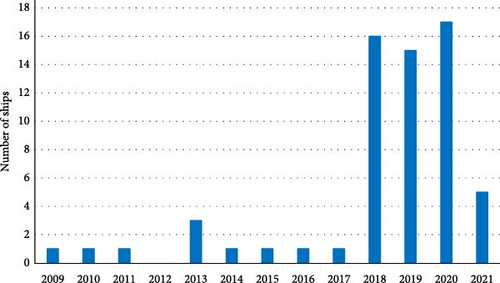

The selected route is traveled by large ships leaving Brazil, mostly from the Terminal Ponta da Madeira—São Luís, carrying iron ore toward China, where most part arrives at the port of Qingdao—Shandong province. Iron ore ships sail around 22,200 km to China, ~349 days, where they disembark their cargo (iron ore) and then sail around 23,100 km (~35 days) to return to Brazil. In 2021, 628 ships traveled this route, carrying iron ore, making, on average, 2.9 trips (considering round trips) in the year. The ships that travel the Brazil–China route are large, with more than 200,000 dwt. Among the analyzed vessels, 56% were Capesize (+200,000 dwt), and 44% were Valemax (around 400,000 dwt). The amount of cargo carried in 2021 on this route was almost 244 million metric-tons. Regarding the year of construction of the ships, among the analyzed vessels, the majority (27%) has been manufactured in 2020, followed by the year 2018 (25%) and 2019 (24%) (Figure 2). The average age of the analyzed fleet was 3.8 years.

The iron ore demand reference scenario indicated that the transport of this product should grow until 2030, when it will reach a plateau, and subsequently, there should be a reduction in the demand. However, even in 2050, the demand for iron ore transport on the Brazil–China route is still forecasted at around 270 million metric-tons per year, on the “Base” projection (Table 5).

| Iron ore demand | |||

|---|---|---|---|

| Year | Base (Mt) | 25%+ (Mt) | 25%− (Mt) |

| 2020 | 244 | 244 | 244 |

| 2025 | 303 | 303 | 303 |

| 2030 | 299 | 373 | 224 |

| 2035 | 290 | 362 | 217 |

| 2040 | 281 | 351 | 211 |

| 2045 | 280 | 350 | 210 |

| 2050 | 270 | 338 | 203 |

- Note: Author’s elaboration, based on [76] and in the sensitivity analysis applied from 2030 on.

Based on the demand for iron ore trade, the annual consumption of bunker (HFO), biomethanol, and pilot fuel was estimated (Table 6).

| Year | Base | 25%+ | 25%− | |||

|---|---|---|---|---|---|---|

| HFO | Methanol | HFO | Methanol | HFO | Methanol | |

| 2020 | 3.6 | 14.2 | 3.6 | 14.2 | 3.6 | 14.2 |

| 2025 | 4.4 | 17.4 | 4.4 | 17.4 | 4.4 | 17.4 |

| 2030 | 4.3 | 16.8 | 5.3 | 20.9 | 3.2 | 12.5 |

| 2035 | 4.0 | 15.6 | 5.0 | 19.5 | 3.0 | 11.7 |

| 2040 | 3.7 | 14.5 | 4.6 | 18.1 | 2.8 | 10.9 |

| 2045 | 3.5 | 13.5 | 4.3 | 16.9 | 2.6 | 10.1 |

| 2050 | 3.1 | 11.9 | 3.8 | 14.9 | 2.3 | 9.0 |

- Note: Author’s elaboration.

4.2. GHG Emissions

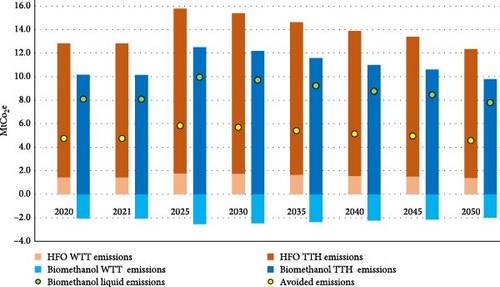

The evolution of CO2e emissions from the Brazil–China route, using both fuels, is presented in Figure 3.10 Emissions are separated by phases: WTT and from tank to hull (TTH). Negative emissions correspond to the absorption of CO2 from the atmosphere during biomass growth, accounted for in the WTT phase.

The emissions intensity (kgCO2e/t) of the route, considering both fuels, is presented in Table 7. It is possible to note that, by using biomethanol based on the biogas route, the net zero goal is not reached in 2050. However, a solution to decrease even more this emission intensity is by capturing the CO2 produced along with the CH4, on the bio-digestion phase, and incorporating it on the biomethanol production. But a deep discussion of how to ensure that the 2050 net zero goal is reached, by both LC fuels and energy and operational measures, is out of the scope of this work.

| Year | Base | 25%+ | 25%− | |||

|---|---|---|---|---|---|---|

| HFO | Biomethanol | HFO | Biomethanol | HFO | Biomethanol | |

| 2021 | 52.5 | 33.1 | 52.5 | 33.1 | 52.5 | 33.1 |

| 2025 | 52.0 | 32.8 | 52.0 | 32.8 | 52.0 | 32.8 |

| 2030 | 51.5 | 32.5 | 64.1 | 40.4 | 38.5 | 24.3 |

| 2035 | 50.4 | 31.8 | 62.9 | 39.7 | 37.7 | 23.8 |

| 2040 | 49.4 | 31.1 | 61.6 | 38.9 | 37.0 | 23.3 |

| 2045 | 47.8 | 30.1 | 59.7 | 37.6 | 35.8 | 22.6 |

| 2050 | 45.7 | 28.8 | 57.1 | 36.0 | 34.3 | 21.6 |

- Note: Author’s elaboration.

4.3. TCO

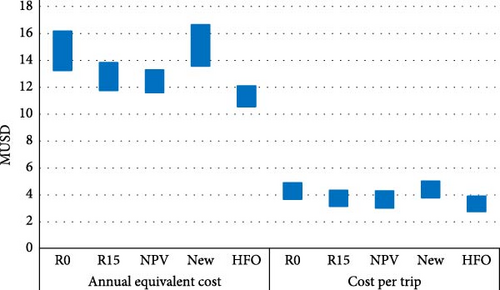

Figure 4 presents the range of results for the five different scenarios in annual equivalent cost and in cost per trip. The range presented in both figures covers the variation from the lowest to the highest values found for each scenario, considering the 25% deviation on iron-ore demand projections, as well as the two different variants applied for the TCO’s.

Hence, the additional costs involving the operation with biomethanol ranged from 8% to 25%, if compared to the costs of the operations using HFO. The scenarios R15 and NPV unveiled that retrofit can be an option for current fleets, which still have operational time ahead, involving a lower extra cost but also a smaller reduction in GHG emissions.

5. Discussion

The results showed that in 2050 it is expected a transport demand of around 270 million metric-tons of iron ore (ranging between 203 and 338 Mt) in the Brazil–China route. Thus, the projection of HFO consumption by ships operating on this route in 2030 (“Base” projections) is 4.3 million metric-tons and biomethanol 16.8 million metric-tons (plus 0.55 million metric-tons of diesel as pilot fuel). Brazil and China are major agricultural producers, having, therefore, the potential to produce fuels from biomass. Considering the production route via biogas, Szklo [85] estimated a total production potential for Brazil of 0.95 EJ/year, which is equivalent to about 92 million metric-tons per year. The analyzed studies identified that the regions of Brazil with the greatest potential for energy production from biomass are the Midwest and South of the country. Nonetheless, a bottleneck for the biogas route development in Brazil is that the upgrade process is not yet very developed in the country.

With regard to the lignocellulosic biomass route, the high capital investment required to afford the equipment for the process units, in addition to the level of technological maturity that has not yet been fully developed, are obstacles to the implementation of the route. The territorial dispersion of the feedstock can also be a hurdle for the production of biomethanol in Brazil [17] since it should increase the cost of the final product due to the need to invest in logistics for long-distance transportation, hindering the viability of scale production.

Similarly, the agricultural production in China has a very dispersed territorial distribution. Although agriculture is the largest sector of the Chinese economy, China’s food security strategy prohibits the use of feedstocks such as corn, wheat, rapeseed, and soybeans on the production of biofuels. These are possible obstacles to the production of biofuels in the country. On the other hand, biofuels produced from agricultural residues, such as biomethanol, may attract more attention. Regarding the lignocellulosic biomass production route, as in China, the coal-to-liquids (CtLs) technology is already widely used and shares processes with the biomass-to-liquid (BtL) route; the expertise from this well-established industry can favor the growth of this route. However, additional challenges may arise from the process of syngas cleaning, derived from biomass gasification, which is more complex than in CtL [93]. Due to the greater domain of the technology, China would have advantages over Brazil. Notwithstanding, this opportunity could be used to develop a technology transfer strategy from China to Brazil, considering the sharing of the route, the idea of the LC shipping corridor, and the scientific expertise in the engineering field in Brazil.

In reference to GHG emissions from the Brazil–China route, in 2021, around 11.4 million metric-tons of CO2e were emitted from the combustion of the HFO used by ships. By incorporating emissions from the entire life cycle of the fuel, the value increases to 12.8 Mt of CO2e (WTH). The results showed that, without replacing fuels, in 2030, the amount of emissions should be 15.4 Mt of CO2e (WTH), and in 2050, around 12.3 Mt of CO2e (WTH) (“Base” projections). In 2021, the average emission intensity of the route was 52.5 kgCO2e/t and the projections (“Base”) showed that in 2030, it should be around 51.5 kgCO2eq/t, and in 2050, 45.7 kgCO2e/t. In order of magnitude, the values corroborate the results of [33], which found a value of 48 kgCO2e/t and 10.5 Mt of CO2e for the same route, only considering TTH emissions. The noninclusion of WTT emissions explains the lower emissions when compared to the results of this study.

Replacing the HFO with biomethanol would bring about a 37% reduction in CO2e emissions for the entire fuel life cycle (WTH). In 2030, if the fleet is powered by biomethanol, WTH emissions would be around 9.7 Mt of CO2e (0.46 Mt of CO2e would result from the use of diesel as a pilot fuel), and the emission intensity would be 32.5 kgCO2e/t (“Base” projections). This would match the IMO target for 2030 in terms of CO2 emission reductions. By 2050, total WTH emissions would be ~7.8 Mt of CO2e (0.37 Mt of CO2e from pilot diesel), and the emission intensity of 28.8 kgCO2e/t. This replacement of fuels, on the Brazil–China route, has the potential to reduce the route’s emissions by ~5.7 and 4.6 Mt of CO2e, in 2030 and 2050, respectively.

However, following the start of the implementation of the LC corridor with biomethanol as fuel, there is the possibility of in the future moving to electricity-based methanol (e-methanol) when the production technology is more mature. This could increase the potential of emissions reductions in the route, depending on the electricity source used by the electrolysis plant. Both Brazil and China aim to increase the share of renewable energy in their electricity grid and develop the technology for producing hydrogen via water electrolysis, which could possibly meet a future production of renewable methanol for the corridor. Offshore wind production at nearby ports could be a possible option in this case.

For the TCO, estimations showed that the scenarios R15 and NPV can be an option for current fleets, which still have working life ahead, involving a lower extra cost. This is due to the fact that, during the period prior to the retrofit, the operator would only have costs related to the acquisition of the vessel and conventional fuel. However, both scenarios result in lower emissions reductions. Yet, as a large part of the fleet dedicated to this route is new, in the implementation of an LC corridor, the retrofit of part of the vessels will be inevitable. The values for operating a ship with biomethanol, in terms of Equivalent Annual Cost, ranged between 11.6 USD million and 13.3 USD million for the NPV scenario and 13.6 USD million and 16.6 USD million for the NEW scenario. The Cost per Trip ranged between 3.0 and 4.3 USD million and 3.8 and 5.0 USD million for the same scenarios.

The results of [33] indicated a TCO of 23 million USD/year for an operation with e-methanol on the Australia–Japan iron ore route in 2030. However, the study incorporated the value related to fuel production in the annualized costs, in addition to using e-methanol, which is more expensive than biomethanol. Korberg et al. [86] found the value of 11.3 million euros per year (about 12 million USD/year) for the TCO of a bulk ship, powered by biomethanol, covering long distances, in 2030. Likewise, Maersk MMC [94] also found 12 million USD/year as a result of a TCO for a bulk ship, powered by biomethanol, in 2030, corroborating the results found here. The same study indicates that, among ship segments, bulk vessels had a substantially lower TCO when compared to containers and tankers, which, in a biomethanol operation, had a TCO in 2030 of 38 and 19 million USD/year, respectively. Therefore, according to Maersk MMC [94], this segment would have the potential to lead the sector’s energy transition. On the other hand, the bulk segment transports products with a lower profit margin when compared to containers. Therefore, this smaller margin can be an obstacle in the decarbonization of these ships.

The CO2e price required to equate the TCO using biomethanol as fuel to an operation with HFO would range from 330 to 450 USD/tCO2e (Table 8). Carvalho et al. [17] unveiled that in order to maritime biofuel prices equal the maritime diesel (MGO) prices, the CO2 value would need to range between 68 and 516 USD/tCO2, depending on the biofuel, its route, and production site, corroborating in its highest boundary with the values found in this study. Rochedo et al. [95] collected data from the literature of carbon prices consistent with the trajectories for meeting the Paris Agreement—“below 2°C.” The average result was 370 USD/tCO2 in 2050. Even if the carbon price initially does not reach this high figure, the adoption of a carbon market would reduce the existing cost gap and increase the feasibility of the operations with biomethanol.

| Scenario | Range (USD/tCO2e) |

|---|---|

| R0 | 370–390 |

| R15 | 330–350 |

| NPV | 350–360 |

| NEW | 420–450 |

The assessment of the stakeholder’s engagement showed that the mining companies are the most engaged agents in commitments to reduce emissions from the maritime transport of their products. The analyzed steelmakers did not present projects or targets directed to the maritime transport of imported products; however, both presented targets for the decarbonization of their steel production. As the companies that import iron ore are not responsible for the product freight, it is expected that they do not have strategies to decarbonize the maritime transportation of their imports. Conversely, without an increase in the final product price, a rise in freight costs, resulting from the use of an alternative fuel more expensive than the conventional fuel, can affect the profitability of these companies. However, the increase in freight costs will not necessarily be incorporated into the final product. Depending on the model adopted, the increase in freight costs can be afforded by the ship operator, by the iron ore producer, or even shared among the agents of the chain.

For ship operators, no targets were found for decarbonizing the fleets or using alternative fuels. Although the companies invest in energy efficiency and voyage optimization technologies, no information was found about the use of alternative fuels in the fleet. It was observed that the operators work with long-term contracts with iron ore companies. Long-term contracts between cargo and ship owners, covering the use of a certain alternative fuel, or even mechanisms that allow the division of costs between the different stakeholders, can be a way to reduce the risks of the pioneers, enabling the first movement to be taken.

When it comes to the ports, no information was found of initiatives to decarbonize the operations of the Ponta da Madeira Terminal. However, as this terminal is owned by Vale, it is expected that reducing emissions from the port’s operation is part of the company’s decarbonization goals. The Port of Qingdao, in turn, established the goal of becoming a leader in green technology through the development of initiatives for energy conservation, consumption reduction, and smart buildings. One of the initiatives is the construction of a hydrogen refueling station.

Finally, the Government of Brazil has as one of the goals of its NDC promoting the production of biofuels for the transport sector, with emphasis on the RenovaBio program, an important driver for the increase of biofuels production in the country [96]. Although Brazil has ambitions related to increasing the production of biofuels, no targets were found for the maritime transport sector. One of China’s NDC targets is to increase the share of non-fossil fuels in primary energy consumption by around 25% [97]. In addition, according to the Chinese NDC, the country actively integrates the discussions with the IMO regarding the reduction of GHG emissions in the shipping sector. However, as for Brazil, no targets were found aimed at decarbonizing the country’s maritime sector.

Although the results have shown that there is a considerable extra cost associated with the fuel replacement, it is expected that the commodities transportation costs would increase to deal with the ambition established by the IMO. The commodities exported by Brazil are mostly products with low added value, transported over long distances, using residual fuel from petroleum refineries in two-stroke engines. This configuration has a low fuel cost, and an alternative fuel (and associated ship retrofit) would hardly be financially competitive, bringing a great challenge to the replacement of fuels.

However, LC corridors or routes are a way to generate scale for alternative fuels, motorization, and logistics, as well as a learning curve path for the stakeholders. Given its scale, this LC corridor can be a way of facing this challenge through an agreement between agents, addressing the Scope 3 emissions from mining and steel companies, and simultaneously the Scope 1 emissions from the ship operators. They can also preserve the operation of terminals, as supply hubs, stimulate national actions to reduce emissions, as well as generate a market niche for dual methanol engines, thus reducing its cost.

At a national level, it is important to note that discussions around this corridor should involve the development of a strategy to guarantee the competitiveness of Brazilian iron ore in the world market, given the relative disadvantage in the distance of the Brazil–China routes, when comparing the country’s exports with the ore exported by its biggest competitor, Australia. This fact also puts the Brazil–China route at a disadvantage in relation to the Australia–East Asia route when considering the IMO target established through absolute GHG emissions.

The implementation of the proposed corridor should then rely on long-term contracts in which the excess cost would be subdivided between companies. It should also involve public policy stimulus in a scenario in which the role of governments should be explored, as well as the large iron ore and steel companies, in supporting and enabling an LC route of this size. Interestingly enough, this can be fostered in the case of the assessed green corridor of this study by the already existing role of the Brazilian state as a shareholder of the mining company [98] and through its public financing bank, BNDES, which channels funds for infrastructure development and can help to develop the country’s harbor to become a multifuel hub. In the case of China, the assessment unveiled that the steel and iron producer China Baowu Group is owned by the Chinese Government, which occupies the first place in the ranking of world producers in terms of scale and profitability [92]. This company is already investing in initiatives to reduce the GHG emissions involved in their production chain [99]. Therefore, although no specific strategy related to the maritime transport of the feedstock acquired by China Baowu Group was found, this aspect could be explored in a spurring agreement between the Brazilian and Chinese governments. In addition, the Qingdao Port International is also developing measures to serve as a hub to the Chinese energy transition strategy with the goal of becoming a leader in green and smart technology. The company already works in continuous collaboration with Vale [100]. Therefore, a strategic agreement between Brazil and China could be developed, involving, for example, the possibility of financing the green route strategy. Interestingly enough, the New Development Bank, also known as the Bank of Brics, located in China, has the clean energy as one of its focus areas, with the aim of “mobilizing resources for infrastructure and sustainable development projects in BRICS…” [101]. The proposed route is an emblematic project for it. Finally, a route of this size could also generate a mass production of dual methanol engines, whose current commercial application is still small [102].13 Therefore, the implementation of this LC route would have the potential to generate a niche market for this product, reducing the cost of this engine and tending to get closer to a conventional engine in the future.

6. Conclusion and Policy Implications

The implementation of an LC corridor in the Brazil–China iron ore route would demand around 16.8 million metric-tons of biomethanol in 2030 and 11.9 million metric-tons in 2050, if all vessels from the route were converted to use biomethanol. The study indicated that both Brazil and China have sufficient feedstock supply for producing the selected fuel. The replacement of HFO for biomethanol in the entire fleet could reduce the lifecycle GHG emissions of the route by ~5.7 and 4.6 of CO2e, in 2030 and 2050, respectively. This represents a reduction of around 37%. To increase the potential of emissions reductions in the route, the LC corridor could be implemented in phases, starting with biomethanol but moving to electricity-based methanol (e-methanol) later when the technology is available in scale and cost.

Scenarios involving the use of biomethanol had additional costs between 8% and 15% when compared to conventional operations with HFO. This corresponds to a carbon price ranging between 330 e 450 USD/tCO2eq in 2030, depending on the scenario. Therefore, the feasibility of this LC corridor would depend on the engagement of the stakeholders involved in the decision-making proccess to deal with the increase in costs due to the fuel replacement and enable the technology necessary to support this transition. The support and strategies of the governments are also essential to spur investments in the production of alternative technology.

When assessing the biomethanol supply capacity, this study did not consider eventual demands for biomethanol from other sectors of the economy. Furthermore, the methanol supply assessed in this work considered only the production route based on biogas. When it comes to fleet characterization, the assessment was based on previous statistics only. Studies covering future fleet feature variations are encouraged to refine this analysis. It is also worth mentioning that there is a need for more studies on the demand for iron ore as the medium to long-term scenarios are quite uncertain.

Future studies could develop a more detailed study of bulk vessels engaged in the Brazil–China iron ore route, performing, for example, a more accurate consumption estimate or even considering the possibility of refueling ports over the course of the route. More accurate estimates could also be the focus of studies that emphasize GHG evaluation based on LCA. Finally, the methodology used in this study could also be used to assess other fuel alternatives (e.g., ammonia and lignocellulosic fuels), bulk shipping markets (e.g., oil, grains), and geographical routes.

One key policy implication of this study is the necessity for both the Brazilian and Chinese governments to ensure the supply of LC biomethanol by fostering the production of biomethanol and, at a later stage, e-methanol. In Brazil, a more immediate solution could involve tapping into the expanding biogas market. In addition, it is also essential that the governments create policies to boost the engagement between stakeholders, seeking to reduce the information asymmetry and to enable agreements between the actors.

Conflicts of Interest

The authors declare no conflicts of interest.

Funding

Financial support has been provided by Khalifa University of Science and Technology through the RICH Center (Project RC2-2019-007).

Acknowledgments

We thank the Brazilian agency CNPq and Coordination for the Improvement of Higher Education Personnel Foundation (CAPES) for its support to the early stages of this study. We also thank the RICH Center of Khalifa University of Science and Technology for the funding.

Endnotes

Supporting Information

Additional supporting information can be found online in the Supporting Information section.

Open Research

Data Availability Statement

Additional data supporting the results can be found in the Supporting Information files, submitted along with the manuscript.

- 1248 Mt in 2020, 244 Mt in 2021, 237 Mt in 2022, and 260 Mt in 2023.

- 2A more detailed estimation, involving analysis of variables as drag components and geometry of the vessel (as addressed by Fan et al. [103]; Guo et al. [104]; Karagiannidis and Themelis [105]; Wang et al. [106]), is out of the scope of this study.

- 3Note that after a slight reduction in the demand in 2021 and 2022 due to the pandemic, in 2023, iron ore demand more than recovered (248 Mt in 2020, 244 Mt in 2021, 237 Mt in 2022, and 260 Mt in 2023—Trade Map, 2024). The prospects for the short term also corroborate this finding [107, 108].

- 4It is out of the scope of this paper, a detailed analysis of the driven factors behind the Chinese iron demand. The idea of the sensitivity analyses done was just to cover a wide range of likely scenarios.

- 5Special Settlement and Custody System (SELIC), which is the benchmark interest rate of the Brazilian economy and serves as a key reference for other interest rates, such as those for loans and financial investments. The SELIC rate is used by the Brazilian Central Bank to manage inflation effectively.

- 6The second operator with the biggest number of vessels in the sample was Polaris Shipping Co.; however, due to a lack of data available, the third biggest was analyzed.

- 770% of the iron ore exported by Brazil (2010−2021) was sent to Qingdao port.

- 844.5% of the iron ore exported to China (2010−2021) left the country via TPDM.

- 9Average speed—14.8 knots. 1 knot = 1852 km/h.

- 10The figure presents the emissions following the “Base” scenario projections, as the avoided emissions fraction does not change among scenarios. The emissions projection considering the sensitivity analysis is available in the Supporting Information (Tables S2 and S3).

- 11R0—retrofit in year 0; R15—retrofit in year 15; NPV—retrofit year decision based on a cap adding 10% to the NPV of the operation with HFO; New—new ship already powered by methanol; HFO—conventional ship.

- 12R0—retrofit in year 0; R15—retrofit in year 15; NPV—retrofit year decision based on a cap adding 10% to the NPV of the operation with HFO; New—new ship already powered by methanol.

- 13As of June 2024, 584 vessels in the global fleet were using LNG (522), LPG (31), and methanol (31) as fuel [109].