Business Behavior, Energy Transition, and Sustainability: A Case From Transnational Corporations

Abstract

In the context of the escalating climate crisis, a thorough examination of the impact of multinational corporations’ (MNCs) business behavior (organizational behavior management [OBM]) on environmental sustainability (environmentally sustainable development [ESD]) is of critical theoretical and practical significance for reducing carbon emissions and achieving sustainable environmental development. This study examines a sample of 218 countries over the period from 1998 to 2022, employing a range of empirical methodologies to analyze the impact of MNCs’ business behavior on environmental sustainability. The empirical findings are that: (1) there are complex effects between OBM and ESD. On the one hand, OBM has a negative impact on ESD, and on the other hand, OBM can positively impact ESD by promoting sustainable energy transition. (2) The degree of country regulation, government stability (GVS), and carbon footprint management (CFM) emerge as crucial factors in mitigating the adverse effects of OBM on ESD. (3) The moment quartile regression (MM-QR) results indicate that OBM is statistically significant for ESD in the lower and middle quartiles. Additionally, CFM exhibits greater significance for countries with lower levels of OBM, while GVS assumes heightened importance in nations characterized by greater OBM. It is worth noting that national regulations that are too strict or too lax are not conducive to environmental sustainability. Based on this, this study puts forward some policy suggestions to promote ESD, which has certain reference significance for global environmental sustainable development.

1. Introduction

The significant global concern for nations worldwide in recent decades has been the exponential rise in greenhouse gas emissions, specifically carbon dioxide (CO2). This increasing pattern has a negative impact on environmental sustainability and is not conducive to economic advancement [1, 2]. In order to effectively tackle the pressing issue of global climate change, the United Nations has implemented a series of measures to mitigate the adverse effects of global warming by curbing carbon emissions. The establishment of the 1992 UNFCCC aimed to foster international cooperation in tackling the issue of climate change. In addition, the United Nations proposed 17 sustainable development goals in 2015, which include taking urgent action to address climate change and its impacts. In the context of economic globalization, countries have demonstrated strong interconnections. Emerging economies and developed countries derive mutual benefits from one another through diverse forms of economic exchange, encompassing trade in goods, trade in services, and foreign direct investment (FDI). Numerous transnational corporations (TNCs) have strategically established subsidiaries in foreign nations, thus playing a pivotal role as catalysts for technological advancement and economic development in the host countries. However, TNCs can also have negative impacts on host countries, mainly in the form of environmental pollution resulting from FDI [3, 4]. The pollution halo hypothesis and the pollution haven hypothesis are the two primary theories that aim to explain the influence. The pollution halo hypothesis suggests that the adoption of environmental regulatory policies at the national level can effectively reduce environmental pollution caused by the activities of multinational corporations (MNCs) in their host countries [5]. The pollution haven hypothesis explains the phenomenon of MNCs with high pollution levels moving their industrial operations to countries or regions with less strict environmental regulations [6–10].

In reality, MNCs demonstrate a tendency to allocate a larger proportion of their investments towards FDI in developing nations and regions that possess liberal and stable policies, as well as abundant natural resources [11–14]. For policymakers, it is important to pay attention not only to the impact of FDI on the economic growth of the host country, but also to the impact of FDI on the environment of the host country. The academic circle has conducted a lot of research on the environmental effects of FDI, but has not reached a unanimous conclusion. Some scholars believe that FDI has a positive impact on the environment. Deng and Liu [15] found that the inflow of FDI can significantly improve the environmental performance of enterprises. Ehigiamusoe et al. [16] found that FDI can mitigate environmental pollution in China. Specifically, for every 1% increase in FDI, China’s carbon emissions decrease by 0.003%. The positive impact of FDI on the environment can primarily be attributed to the provision of technological assistance from developed countries. This technology spillover effect has contributed to environmental improvements [11, 17, 18]. While FDI has the potential to enhance environmental conditions, it does not necessarily imply that the environmental impact of unregulated FDI inflows is always beneficial. Specifically, the relocation of production activities and pollution from advanced economies to foreign nations, particularly low-income countries, may intensify environmental degradation rather than mitigate it. Most scholars have explored the negative relationship between FDI and the environment. Nguyen and Duong [19] conducted a study focusing on Vietnam and found that FDI leads to an increase in CO2 emissions, thereby having a detrimental effect on the environmental quality of Vietnam. Xuan [20] asserts that while FDI contributes to economic development, it also leads to environmental pollution due to variations in investment types and regulatory frameworks. Developing countries often place a higher emphasis on economic growth rather than environmental protection, resulting in the adoption of less stringent environmental regulatory measures. This leniency allows multinational enterprises (MNEs) to exploit regulatory loopholes and engage in various environmentally harmful activities. The investigation into the question of whether enterprises should assume the corresponding responsibility is a pressing matter that necessitates immediate scrutiny [8, 21, 22].

To what extent does the behavior of TNCs impact environmentally sustainable development (ESD) in host countries? Does the degree of leniency or stringency in national environmental regulatory policies exert a substantial influence on the ultimate outcome? clarifying these issues, in the context of the escalating climate crisis, has far-reaching significance and practical value for reducing carbon emissions and achieving ESD. This study aims to explore the impact of TNCs on the transition to renewable energy (RE) and environmental sustainability development. Different from previous studies, our research contributions are mainly reflected in the following three aspects. (1) Our study adopts a variety of analytical frameworks based on different countries and environmental regulatory policies, offering a comprehensive examination of the impact of MNCs on the transition to RE and carbon emissions, thereby enhancing existing research in the field. (2) The 28th Conference of the Parties (COP28) to the United Nations Framework Convention on Climate Change (UNFCCC) emphasized that excessive CO2 emissions from traditional energy sources exacerbate the climate crisis. As significant players in the energy sector, corporations bear the crucial responsibility of exploring the concept of “joint implementation” and accelerating the transition to sustainable and RE. This paper highlights the important regulatory role that corporate carbon footprint management (CFM) plays. (3) Existing literature lacks a simultaneous examination from both the perspectives of the home country and host country, as well as from the perspectives of corporations and governments, regarding the moderating role of corporate CFM and national regulatory policies in the impact of multinational corporate behavior on environmental sustainability. This study aims to fill this gap in the research.

2. Theoretical Model Derivation and Research Hypothesis

2.1. Theoretical Model Derivation

2.2. Research Hypothesis

MNCs operating in countries with weak environmental regulations can have a detrimental impact on environmental sustainability, manifested primarily in three ways. First, in order to reduce costs, MNCs may choose to establish production facilities in countries or regions with more lenient environmental oversight. The production process of MNEs requires a large amount of energy, and to minimize costs, they often rely on cheaper traditional energy sources, such as coal and oil. This results in significant greenhouse gas emissions. In regions with lax environmental regulations, the lower environmental standards typically lead companies to overlook the negative environmental impacts of their production processes, directly discharging pollutants into the environment, thereby exacerbating environmental degradation. Secondly, it is common for enterprises to disregard the potential ramifications of environmental externalities when participating in cross-border operations within host countries. This statement suggests that the operations of corporations have the potential to negatively impact the surrounding environment of the local community. However, these effects are often overlooked in the calculation of the company’s costs or profits. Lastly, multinational companies may exploit differences in environmental regulatory standards by relocating pollution-intensive industries to regions with lower environmental standards, thereby circumventing stricter regulations. The aforementioned practice has the potential to lead to environmental inequity and degradation, posing a considerable challenge for policymakers tasked with overseeing RQP.

However, for regions where the availability of RE sources is high and environmental regulations and technological infrastructures are well established, transnational enterprises have a positive impact on environmental sustainability. Given the prevailing host country policies, regulations, and international conventions, alongside the growing consumer demand for environmental protection and sustainability, it is noteworthy that certain MNEs have demonstrated a praiseworthy degree of environmental responsibility. These enterprises have recognized the significance of shifting towards RE sources in order to achieve environmental sustainability. As a result, in order to achieve environmental sustainability, many MNEs are actively adopting RE sources in their production processes in order to reduce carbon emissions and resource consumption. It is worth noting that the ability of MNCs to promote environmental sustainability may have different manifestations in different regions. In addition, the implementation of CFM strategies may also serve as an incentive for businesses to adopt a transformative approach to their business model. By engaging in such actions, companies can effectively meet their corporate social responsibility obligations, adopt sustainable energy sources, reduce dependance on traditional energy sources, improve their environmental standing, and strengthen their corporate brand reputation. Ultimately, these endeavors will empower individuals to attain environmentally sustainable practices. MNEs possess the capacity to adjust to market trends and meet the growing consumer demand for RE. Furthermore, as RE technologies continue to advance, there is a progressive reduction in their costs. This emerging trend has the potential to expedite the integration of these technologies within MNEs. It is worth noting that the economic feasibility of RE varies from region to region, and the economic feasibility of RE tends to be found in resource-rich regions, where firms integrate them into their energy supply chains as a strategy to achieve CFM goals and reduce costs.

-

H1. The activities conducted by MNEs exhibit a detrimental association with the concept of environmental sustainability.

-

H2. The operations conducted by MNEs play a crucial role in advancing the cause of environmental sustainability. This objective is accomplished by their diligent endeavors to mitigate carbon emissions through the implementation of sustainable energy transitions.

-

H3. Stable governance, rigorous RQPs, and efficient management of carbon footprints are essential elements that play a significant role in moderating the activities of MNCs and fostering environmental sustainability.

In all, Figure 1 reports the research framework of this paper.

3. Methodology and Data

3.1. Data Sources and Preliminary Analysis

The data sample used in our study includes a comprehensive representation of 218 countries or regions across the globe. The list of countries included in the analysis can be found in the do file. Given that MNCs operate across multiple countries and regions, incorporating data from multiple countries and regions allows for a more holistic examination of their business practices and their impact on the environmental sustainability of different regions. This approach mitigates the potential bias associated with focusing solely on individual countries or regions. Furthermore, to investigate the long-term effects of MNCs’ business activities on environmental sustainability, the dataset covers the period from 1998 to 2022. Ultimately, the data used in this study is panel data. Based on the data availability and the existing scholarly studies in the field, the dependent variable chosen for this research is environmental sustainability. The primary indicator used to assess this is the quantity of CO2 emissions. The primary focus of our study revolves around the business behavior of MNCs (organizational behavior management [OBM]), which serves as the core independent variable. Additionally, we have incorporated various additional variables into our analysis, including the RE transition (REN), the intensity of RQP, gross domestic product (GDP), GVS, and CFM. The REN is measured by the logarithm of the share of RE consumption in total final energy consumption. The intensity of RQP is assessed using the CPIA policy and institutions for environmental sustainability rating (1 = low–6 = high). GDP is measured by the logarithm of GDP (in constant U.S. dollars). GVS is evaluated through estimates of political stability and the absence of violence/terrorism. CFM is measured by the business extent of disclosure index, as the extent of business disclosure can partially reflect a company’s environmental responsibility. A higher business disclosure index indicates greater environmental awareness, which, in turn, suggests a higher level of CFM. A comprehensive representation of the sources of data is provided in Table 1.

| Variable | Code | Definition/measurement | Source | References |

|---|---|---|---|---|

|

LNCO2 | CO2 emissions (metric tons per capita) | World Bank Environmental, Social, and Governance (ESG) Database | [29, 30] |

|

LNOBM | Foreign direct investment, net inflows (% of per population) | World Bank Global Financial Development Database | [31, 32] |

|

LNREN | Renewable energy consumption (% of total final energy consumption) | World Bank Environmental, Social, and Governance (ESG) Database | [33, 34] |

| Intensity of national environmental regulatory policies | RQP | CPIA policy and institutions for environmental sustainability rating (1 = low to 6 = high) | World Bank Global Governance Database | [35] |

| GDP | LNGDP | GDP(now US Dollar) | World Bank Global Economic Prospects Database | [2, 29] |

|

GVS | Political stability and absence of violence/terrorism: estimate | World Bank Global Governance Database | [30, 36, 37] |

| Carbon footprint management | CFM | The business extent of disclosure index (0 = less disclosure to 10 = more disclosure) | World Bank Corporate Monitoring Database | [38] |

3.2. Descriptive Statistics

Table 2 presents the descriptive statistics for all variables. From the analysis of Table 2, it is evident that the sample sizes for CFM and RQP are relatively small. This suggests that the distribution of CFM and RQP across countries is not uniform, reflecting the real-world scenario. CO2 (LNCO2) emissions, REN (LNREN), multinational business activities (LNOBM), CFM, RQP, and GVS exhibit a minimal disparity between their mean and variance, indicating a higher level of data concentration. The longitudinal GDP (LNGDP) exhibits a significant standard deviation, indicating substantial variations in income disparities across different countries. In particular, a negative value for the REN (LNREN) indicates a lower level of RE adoption in the respective country or region, suggesting that the energy transition is not sustainable. A negative value for the business behavior of MNCs (LNOBM) reflects a net decrease in FDI inflows, implying that MNCs are not actively engaging in business operations. Similarly, a negative value for GVS suggests lower policy stability, which may fluctuate over time. Therefore, investigating the impact of uncertain policy environments on environmental sustainability becomes crucial.

| Variable | Abbreviation | Observation | Mean | Standard deviation | Min | Max |

|---|---|---|---|---|---|---|

| LNCO2 | lnco2 | 4079 | 2.1738 | 0.3648 | 0.6350 | 2.6619 |

| LNREN | lnren | 4275 | 2.5811 | 1.8652 | −4.6052 | 4.5462 |

| LNOBM | lnobmp | 3858 | 4.7826 | 2.2628 | −5.4908 | 12.1306 |

| CFM | cfm | 2612 | 5.1995 | 2.4892 | 0.0000 | 10.0000 |

| RQP | cpiaenviro | 1241 | 3.1381 | 0.5635 | 2.0000 | 4.0000 |

| LNGDP | lngdp | 4637 | 23.7261 | 2.3681 | 16.3616 | 29.0803 |

| GVS | pse | 4687 | 0.0044 | 0.9718 | −2.6129 | 1.5589 |

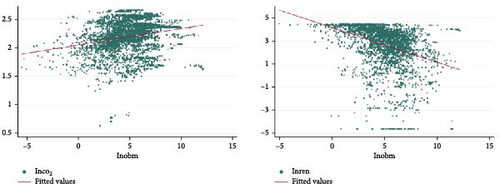

The scatterplot presented in Figure 2 illustrates the relationship between LNOBM (natural resource-based manufacturing) and the variables of CO2 (LNCO2) emissions and REN (LNREN). From the analysis of the trend line, it can be observed that there is a positive correlation between LNOBM and LNCO2, whereas LNOBM exhibits a negative correlation with LNREN.

3.3. Empirical Model Construction

4. Results and Discussion

4.1. Panel Data Estimation Results and Robustness Tests

Table 3 presents the results of the base regression estimation and the mechanism path regression estimation. The findings from the regression analysis reveal that the use of CO2 (LNCO2) emissions as the dependent variable shows a significant increase when multinational business behavior (LNOBM) is considered, although this increase is a little significant (p < 0.1). It means the enhancement of ESD is increased by 0.21% for each unit of OBM changed. This finding is detrimental to the promotion of ESD and supports the “pollution haven” hypothesis and the H1 hypothesis of this study. The H1 hypothesis posits that in the absence of stable policies and regulations for CFM, the operational behavior of MNCs leads to a significant rise in CO2 emissions, thereby undermining environmental sustainability. This observation aligns with the research conducted by Koçak and Şarkgüneşi [39] on the Black Sea, Balcilar et al. [2] on African countries, and Xiaoman et al. [40] on the Middle East. Similarly, the results of the estimation demonstrate that MNE business activity plays a significant role in facilitating the transition to RE. This is evident from the positive and statistically significant relationship observed between MNE business activity and REN when the latter is considered as the dependent variable (p < 0.05). It means the enhancement of REN is increased by 0.21% for each unit of OBM changed. Additionally, the use of REN as a mediating mechanism variable further supports the notion that MNE business activity positively influences the transition to RE. Accordingly, it can be inferred that there exists a disparity in the influence of MNEs’ business operations on environmental sustainability. On one hand, MNEs’ activities lead to an increase in CO2 emissions, thereby contributing to environmental degradation to some extent. On the other hand, MNEs’ business activities also play a role in promoting the transition to RE sources, resulting in a reduction of CO2 emissions and fostering environmental sustainability. In terms of significance, the effect of the latter is more substantial than that of the former, thereby providing support for hypothesis H2.

| Variables | Basic regression | Renewable energy transition as an intermediary variable |

|---|---|---|

| LNCO2 | LNREN | |

| LNOBM | 0.0021 ∗ | — |

| (1.72) | ||

| L.LNOBM | — | 0.0126 ∗∗ |

| (1.96) | ||

| CFM | −0.0022 ∗∗ | 0.0128 |

| (−1.97) | (1.50) | |

| RQP | 0.0078 ∗∗ | −0.0405 ∗∗ |

| (2.24) | (−2.54) | |

| LNGDP | 0.0218 ∗∗∗ | 0.0130 |

| (3.77) | (0.39) | |

| GVS | −0.0061 ∗∗ | −0.0063 |

| (−2.00) | (−0.40) | |

| Constant | 1.5082 ∗∗∗ | 3.4500 ∗∗∗ |

| (11.66) | (4.58) | |

| R-squared | 0.991 | 0.981 |

| Observations | 953 | 883 |

- Note: ∗∗∗, ∗∗, and ∗ denote significance levels at 1%, 5%, and 10%, respectively; t statistics in parentheses.

In regression models with endogeneity, wherein the independent variable is correlated with the error term, the ordinary least squares (OLS) estimator may exhibit failure or bias. The instrumental variable method is an econometric approach that aims to address endogeneity issues by incorporating exogenous Variables, also known as instrumental Variables. Therefore, this study employs the instrumental variable method to further examine the relationship between the business behavior of MNCs (LNOBM) and CO2 emissions. In our analysis, we employed natural resource rents as an instrumental variable, utilizing data sourced from the World Bank’s Development Indicators (WDIs) Database. The rationale behind this selection lies in the capacity of natural resource rents to mirror the factor endowment conditions of local natural resources. A higher endowment of natural factors tends to attract MNCs, resulting in increased MNC operational activities. This phenomenon is intricately connected to our core explanatory variables. Furthermore, there is a lack of direct correlation between natural resource rents and the error terms of the explanatory variables, specifically, CO2 emissions. Theoretically, this aligns with the principles guiding instrumental variable selection. Therefore, this paper employs natural resource rents as a strategic instrumental variable in exploring the relationship between MNC business activities and CO2 emissions. This deliberate choice enhances the robustness of our analytical framework, contributing to a more nuanced understanding of the intricate dynamics at play. As can be seen from the first-stage regressions and IV (2SLS) estimation columns in Table 4, the instrumental variables successfully pass the weak instrumental variables test (F-test of excluded instruments >10). Additionally, the nonidentifiable test (Kleibergen–Paap rk LM p-value < 0.1) and the endogeneity test Cragg–Donald Wald F statistic/Kleibergen–Paap Wald rk F statistic >Stock–Yogo weak ID test critical values (10% maximal IV size) are also satisfied. Moreover, the estimation results demonstrate consistent significance and direction with the underlying regression results, with only minor variations in the significant coefficients.

| Variables | IV: first-stage regressions | IV (2SLS) estimation | Alternative dependent variables | Alternative independent variables | ||

|---|---|---|---|---|---|---|

| LNCO2 | LNCO2 | LNCO2INT | LNFUEL | LNCO2 | LNCO2 | |

| Natural rent | 0.2910 ∗∗∗ | — | — | — | — | — |

| (6.43) | ||||||

| LNOBM | — | 0.0102 ∗ | 0.0368 ∗∗∗ | 0.0303 ∗∗ | — | — |

| (1.90) | (3.04) | (2.18) | ||||

| LNFDINIB | — | — | — | — | 0.0039 ∗∗∗ | — |

| (2.82) | ||||||

| PORTFDI | — | — | — | — | — | 0.0028 ∗∗∗ |

| (3.30) | ||||||

| CFM | −0.0012 | −0.0019 | −0.0044 | −0.0125 ∗ | −0.0009 | −0.0045 ∗∗∗ |

| (−0.03) | (−0.78) | (−0.53) | (−1.92) | (−0.63) | (−3.57) | |

| RQP | 0.1591 | 0.0074 | 0.0226 | 0.0345 | 0.0127 ∗∗∗ | 0.0071 ∗ |

| (1.52) | (0.96) | (0.71) | (0.75) | (2.89) | (1.78) | |

| LNGDP | 0.8209 ∗∗∗ | 0.0108 | 0.0557 | 0.0318 | 0.0185 ∗∗ | 0.0059 |

| (4.28) | (0.76) | (1.27) | (0.68) | (2.19) | (0.67) | |

| GVS | −0.0188 | −0.0067 | −0.0062 | −0.0697 ∗ | −0.0119 ∗∗∗ | −0.0137 ∗∗∗ |

| (−0.22) | (−1.03) | (−0.20) | (−1.93) | (−3.51) | (−4.62) | |

| F-test | 0.0000 | 0.0000 | — | — | — | — |

| (41.35) | (11.97) | |||||

| LM statistic | 0.0000 | 0.0000 | — | — | — | — |

| (20.37) | (20.367) | |||||

| CD Wald F statistic | 71.17 | 71.173 | — | — | — | — |

| KP Wald F statistic | 41.35 | 41.346 | — | — | — | — |

| SY (10%) | 16.38 | 16.38 | — | — | — | — |

| AR Wald test | 3.23 | — | — | — | — | — |

| Instruments | 19 | 18 | — | — | — | — |

| Groups/clusters | 75 | 75 | — | — | — | — |

| Constant | — | — | −1.2871 | 2.5123 ∗∗ | 1.4967 ∗∗∗ | 1.9646 ∗∗∗ |

| (−1.29) | (2.24) | (7.99) | (9.70) | |||

| R-squared | — | 0.560 | 0.984 | 0.984 | 0.991 | 0.993 |

| Observations | 893 | 893 | 376 | 324 | 615 | 453 |

- Note: ∗∗∗, ∗∗, and ∗ denote significance levels at 1%, 5%, and 10%, respectively; t statistics in parentheses.

This study employs a proxy variable approach to conduct robustness testing. The replacement of data is a crucial method for assessing the resilience of variables, as data are inherently prone to errors and omissions. Therefore, this paper aims to conduct a robustness test by substituting the dependent variable and replacing the independent variable. For the alternative dependent variable, the estimation of the dependent variable (LNCO2) is modified by substituting the dependent variable with CO2 intensity (expressed as kg per kg of oil equivalent energy use), denoted as LNCO2INT. The dependent variable, denoted by LNFUEL, represents the percentage of total energy consumption derived from fossil fuels. These two indicators were selected due to the strong correlation between CO2 emissions and the utilization of non-RE sources, particularly petroleum energy, which is known to generate significant quantities of CO2 during its combustion process. For the alternative independent variables, the estimation of the dependent variable (LNOBM) is substituted with FDI, net inflows (BoP, current US $), denoted as LNFDINIB. Replacing the dependent variable with Portfolio equity, net inflows (BoP, current US $), and the logarithm of FDI, denoted as PORTFDI, is justified. These two indicators are selected due to the recognition that cross-border business activities encompass not only FDI but also other forms of investment, such as portfolio investment. The estimation results presented in Table 4 demonstrates that the association between each alternative variable and the core dependent or independent variable is statistically significant (p < 0.05). This finding further confirms the reliability and validity of the regression results and supports hypothesis 1.

4.2. Estimation Results of the Moderating Variables

Table 5 presents the results of the estimation, incorporating the moderating variables. The results show that the moderating effects of RQP, carbon footprint management (CFM), and GVS all exhibit a statistically significant negative relationship (p < 0.1). However, the significance of various factors varies, with CFM being the most significant (p < 0.01), followed by RQP (p < 0.05), and finally GVS (p < 0.1). This statement highlights the significance of CFM in regulating the correlation between MNCs’ business operations and CO2 emissions. It emphasizes that CFM is the most effective approach in this regard. In essence, the management of carbon footprint can be considered as a form of corporate social responsibility. MNCs that take a proactive and spontaneous approach to CFM, with a specific focus on environmental sustainability issues, can effectively mitigate the negative impacts of their business activities on environmental degradation. This observation aligns with the research outcomes reported by Korhonen [41] and Saeed et al. [42]. In contrast, the implementation of mandatory RQPs in the host country can result in firms becoming more passive and compelled to regulate their activities. This, in turn, leads to an increase in the entry threshold for firms in the host country and raises the cost of their environmental governance. However, it is important to note that this approach can yield positive outcomes in terms of environmental governance. In addition, the presence of a stable government and the absence of violent conflict in the environment serve to moderately mitigate the negative environmental impact caused by the activities of MNEs. This observation aligns with the empirical reality. Overall, the validation of H3 is supported by the estimation of the moderating variables.

| Variables | LNCO2 | LNCO2 | LNCO2 |

|---|---|---|---|

| LNOBM × RQP | −0.0046 ∗∗ | — | — |

| (−2.52) | |||

| LNOBM × CFM | — | −0.0016 ∗∗∗ | — |

| (−3.46) | |||

| LNOBM × GVS | — | — | −0.0022 ∗ |

| (−1.94) | |||

| LNOBM | 0.0161 ∗∗∗ | 0.0101 ∗∗∗ | 0.0003 |

| (2.85) | (3.70) | (0.22) | |

| CFM | −0.0024 ∗ | 0.0021 | −0.0020 ∗ |

| (−1.90) | (1.21) | (−1.75) | |

| RQP | 0.0005 | 0.0082 ∗∗ | 0.0072 ∗∗ |

| (0.12) | (2.42) | (2.07) | |

| LNGDP | 0.0201 ∗∗∗ | 0.0241 ∗∗∗ | 0.0209 ∗∗∗ |

| (3.03) | (4.27) | (3.61) | |

| GVS | −0.0037 | −0.0057 ∗ | 0.0003 |

| (−1.13) | (−1.86) | (0.05) | |

| Constant | 1.5027 ∗∗∗ | 1.4316 ∗∗∗ | 1.5369 ∗∗∗ |

| (10.07) | (11.36) | (11.83) | |

| Observations | 850 | 953 | 953 |

| R-squared | 0.991 | 0.991 | 0.991 |

- Note: ∗∗∗, ∗∗, and ∗ denote significance levels at 1%, 5%, and 10%, respectively; t statistics in parentheses.

4.3. Results of Moment Quartile Regression (MM-QR) Estimation

According to the afore-mentioned analysis, variations in development, income distribution, and other factors between countries result in varying levels of technology and subsequently lead to disparate levels of CO2 emissions. Developed countries with advanced technology and high incomes have increasingly transitioned towards cleaner energy sources, thereby achieving environmental sustainability. In contrast, developing countries have not been able to fully benefit from this transition. In this paper, the sample is categorized based on the level of development, high income, and participation in the economic union. However, it is not feasible to conduct fixed effects model estimation due to potential data limitations and missing values. As a result, an alternative model is employed. Therefore, the present study employs moment quantile regression estimation to investigate the issue of heterogeneity. Unlike quantile regression, the MM-QR method not only estimates distributional heterogeneity but also preserves country-specific heterogeneity. It allows fixed effects to have an impact on the entire range of distributions, thereby improving efficiency and accommodating small sample behavior [43]. Therefore, this study utilizes the MM-QR method to investigate the impact of the independent variable on the dependent variable, taking into account heterogeneity effects. This approach is consistent with the work of Machado and Silva [43] and has also been employed by Zheng et al. [44] in their article. Tables 6–13 presented below display the outcomes of the moment-quantile regression estimates. Overall, these estimates reveal variations in distributional heterogeneity and scale heterogeneity among the variables.

| Variables | Location parameters | Scale parameters | Lower quantiles | ||

|---|---|---|---|---|---|

| Q0.1 | Q0.2 | Q0.3 | |||

| LNOBM | 0.0021 ∗ | −0.0009 | 0.0036 ∗∗ | 0.0032 ∗∗ | 0.0028 ∗∗ |

| (1.81) | (−1.57) | (2.12) | (2.11) | (2.07) | |

| CFM | −0.0022 ∗∗ | 0.0005 | −0.0030 ∗ | −0.0028 ∗ | −0.0026 ∗∗ |

| (−2.08) | (0.84) | (−1.79) | (−1.89) | (−1.97) | |

| RQP | 0.0078 ∗∗ | −0.0005 | 0.0085 ∗ | 0.0083 ∗ | 0.0081 ∗∗ |

| (2.37) | (−0.29) | (1.67) | (1.84) | (2.00) | |

| LNGDP | 0.0218 ∗∗∗ | −0.0022 | 0.0252 ∗∗∗ | 0.0243 ∗∗∗ | 0.0235 ∗∗∗ |

| (3.98) | (−0.86) | (3.36) | (3.59) | (3.76) | |

| GVS | −0.0061 ∗∗ | 0.0007 | −0.0072 ∗ | −0.0069 ∗ | −0.0066 ∗∗ |

| (−2.11) | (0.48) | (−1.76) | (−1.89) | (−1.98) | |

| N | 953 | 953 | 953 | 953 | 953 |

- Note: ∗∗∗, ∗∗, and ∗ denote significance levels at 1%, 5%, and 10%, respectively; t statistics in parentheses.

| Variables | Mid quantiles | Upper quantiles | ||||

|---|---|---|---|---|---|---|

| Q0.4 | Q0.5 | Q0.6 | Q0.7 | Q0.8 | Q0.9 | |

| LNOBM | 0.0024 ∗∗ | 0.0020 ∗ | 0.0016 | 0.0013 | 0.0010 | 0.0006 |

| (1.96) | (1.76) | (1.48) | (1.21) | (0.84) | (0.44) | |

| CFM | −0.0024 ∗∗ | −0.0022 ∗∗ | −0.0020 ∗∗ | −0.0019 ∗ | −0.0017 | −0.0014 |

| (−2.05) | (−2.07) | (−2.00) | (−1.87) | (−1.62) | (−1.29) | |

| RQP | 0.0079 ∗∗ | 0.0077 ∗∗ | 0.0075 ∗∗ | 0.0074 ∗∗ | 0.0072 ∗∗ | 0.0070 ∗∗ |

| (2.21) | (2.40) | (2.52) | (2.55) | (2.48) | (2.28) | |

| LNGDP | 0.0225 ∗∗∗ | 0.0216 ∗∗∗ | 0.0207 ∗∗∗ | 0.0201 ∗∗∗ | 0.0193 ∗∗∗ | 0.0183 ∗∗∗ |

| (3.92) | (3.98) | (3.89) | (3.74) | (3.45) | (3.07) | |

| GVS | −0.0063 ∗∗ | −0.0061 ∗∗ | −0.0058 ∗∗ | −0.0056 ∗∗ | −0.0053 ∗ | −0.0051 |

| (−2.08) | (−2.12) | (−2.07) | (−1.99) | (−1.83) | (−1.61) | |

| N | 953 | 953 | 953 | 953 | 953 | 953 |

- Note: ∗∗∗, ∗∗, and ∗ denote significance levels at 1%, 5%, and 10%, respectively; t statistics in parentheses.

| Variables | Location parameters | Scale parameters | Lower quantiles | ||

|---|---|---|---|---|---|

| Q0.1 | Q0.2 | Q0.3 | |||

| LNOBM × RQP | −0.0046 ∗∗∗ | 0.0000 | −0.0046 ∗ | −0.0046 ∗∗ | −0.0046 ∗∗ |

| (−2.67) | (0.02) | (−1.76) | (−1.97) | (−2.19) | |

| LNOBM | 0.0161 ∗∗∗ | −0.0014 | 0.0184 ∗∗ | 0.0178 ∗∗ | 0.0172 ∗∗∗ |

| (3.02) | (−0.56) | (2.35) | (2.54) | (2.71) | |

| CFM | −0.0024 ∗∗ | 0.0006 | −0.0034 ∗ | −0.0031 ∗ | −0.0029 ∗ |

| (−2.01) | (0.89) | (−1.74) | (−1.83) | (−1.91) | |

| RQP | 0.0005 | 0.0005 | −0.0004 | −0.0002 | 0.0001 |

| (0.13) | (0.29) | (−0.07) | (−0.03) | (0.01) | |

| LNGDP | 0.0201 ∗∗∗ | −0.0010 | 0.0218 ∗∗∗ | 0.0213 ∗∗∗ | 0.0209 ∗∗∗ |

| (3.21) | (−0.40) | (2.68) | (2.87) | (3.02) | |

| GVS | −0.0037 | 0.0002 | −0.0040 | −0.0039 | −0.0038 |

| (−1.20) | (0.16) | (−0.94) | (−1.02) | (−1.09) | |

| N | 853 | 853 | 853 | 853 | 853 |

- Note: ∗∗∗, ∗∗, and ∗ denote significance levels at 1%, 5%, and 10%, respectively; t statistics in parentheses.

| Variables | Mid quantiles | Upper quantiles | ||||

|---|---|---|---|---|---|---|

| Q0.4 | Q0.5 | Q0.6 | Q0.7 | Q0.8 | Q0.9 | |

| LNOBM × RQP | −0.0046 ∗∗ | −0.0046 ∗∗∗ | −0.0046 ∗∗∗ | −0.0046 ∗∗∗ | −0.0046 ∗∗∗ | −0.0046 ∗∗∗ |

| (−2.44) | (−2.72) | (−2.91) | (−3.00) | (−3.00) | (−2.87) | |

| LNOBM | 0.0166 ∗∗∗ | 0.0160 ∗∗∗ | 0.0155 ∗∗∗ | 0.0150 ∗∗∗ | 0.0146 ∗∗∗ | 0.0140 ∗∗∗ |

| (2.89) | (3.04) | (3.09) | (3.03) | (2.91) | (2.65) | |

| CFM | −0.0026 ∗∗ | −0.0023 ∗∗ | −0.0021 ∗ | −0.0019 ∗ | −0.0017 | −0.0015 |

| (−1.98) | (−2.00) | (−1.93) | (−1.75) | (−1.54) | (−1.20) | |

| RQP | 0.0003 | 0.0005 | 0.0007 | 0.0009 | 0.0011 | 0.0013 |

| (0.07) | (0.14) | (0.21) | (0.28) | (0.32) | (0.37) | |

| LNGDP | 0.0205 ∗∗∗ | 0.0200 ∗∗∗ | 0.0197 ∗∗∗ | 0.0193 ∗∗∗ | 0.0190 ∗∗∗ | 0.0186 ∗∗∗ |

| (3.15) | (3.22) | (3.20) | (3.11) | (3.00) | (2.79) | |

| GVS | −0.0037 | −0.0036 | −0.0036 | −0.0035 | −0.0034 | −0.0033 |

| (−1.15) | (−1.20) | (−1.21) | (−1.19) | (−1.14) | (−1.05) | |

| N | 853 | 853 | 853 | 853 | 853 | 853 |

- Note: ∗∗∗, ∗∗, and ∗ denote significance levels at 1%, 5%, and 10%, respectively; t statistics in parentheses.

| Variables | Location parameters | Scale parameters | Lower quantiles | ||

|---|---|---|---|---|---|

| Q0.1 | Q0.2 | Q0.3 | |||

| LNOBM × CFM | −0.0016 ∗∗∗ | 0.0003 | −0.0021 ∗∗∗ | −0.0020 ∗∗∗ | −0.0019 ∗∗∗ |

| (−3.66) | (1.32) | (−3.60) | (−3.76) | (−3.83) | |

| LNOBM | 0.0101 ∗∗∗ | −0.0024 ∗ | 0.0140 ∗∗∗ | 0.0128 ∗∗∗ | 0.0120 ∗∗∗ |

| (3.90) | (−1.95) | (4.16) | (4.23) | (4.22) | |

| CFM | 0.0021 | −0.0009 | 0.0036 | 0.0031 | 0.0028 |

| (1.27) | (−0.91) | (1.50) | (1.52) | (1.50) | |

| RQP | 0.0082 ∗∗ | −0.0005 | 0.0091 ∗ | 0.0088 ∗∗ | 0.0086 ∗∗ |

| (2.55) | (−0.31) | (1.81) | (2.01) | (2.18) | |

| LNGDP | 0.0241 ∗∗∗ | −0.0041 ∗ | 0.0307 ∗∗∗ | 0.0288 ∗∗∗ | 0.0273 ∗∗∗ |

| (4.51) | (−1.68) | (4.29) | (4.48) | (4.57) | |

| GVS | −0.0057 ∗∗ | 0.0013 | −0.0077 ∗ | −0.0071 ∗∗ | −0.0066 ∗∗ |

| (−1.97) | (0.91) | (−1.91) | (−1.98) | (−2.02) | |

| N | 953 | 953 | 953 | 953 | 953 |

- Note: ∗∗∗, ∗∗, and ∗ denote significance levels at 1%, 5%, and 10%, respectively; t statistics in parentheses.

| Variables | Mid quantiles | Upper quantiles | ||||

|---|---|---|---|---|---|---|

| Q0.4 | Q0.5 | Q0.6 | Q0.7 | Q0.8 | Q0.9 | |

| LNOBM × CFM | −0.0017 ∗∗∗ | −0.0016 ∗∗∗ | −0.0015 ∗∗∗ | −0.0014 ∗∗∗ | −0.0013 ∗∗ | −0.0011 ∗∗ |

| (−3.79) | (−3.57) | (−3.23) | (−2.91) | (−2.50) | (−2.03) | |

| LNOBM | 0.0109 ∗∗∗ | 0.0098 ∗∗∗ | 0.0089 ∗∗∗ | 0.0082 ∗∗∗ | 0.0074 ∗∗∗ | 0.0063 ∗∗ |

| (4.08) | (3.79) | (3.40) | (3.04) | (2.58) | (2.05) | |

| CFM | 0.0024 | 0.0020 | 0.0016 | 0.0014 | 0.0010 | 0.0006 |

| (1.41) | (1.21) | (0.97) | (0.77) | (0.53) | (0.29) | |

| RQP | 0.0084 ∗∗ | 0.0082 ∗∗∗ | 0.0080 ∗∗∗ | 0.0078 ∗∗∗ | 0.0077 ∗∗∗ | 0.0075 ∗∗ |

| (2.40) | (2.60) | (2.72) | (2.73) | (2.66) | (2.45) | |

| LNGDP | 0.0254 ∗∗∗ | 0.0236 ∗∗∗ | 0.0220 ∗∗∗ | 0.0208 ∗∗∗ | 0.0194 ∗∗∗ | 0.0177 ∗∗∗ |

| (4.59) | (4.45) | (4.17) | (3.88) | (3.47) | (2.95) | |

| GVS | −0.0061 ∗∗ | −0.0055 ∗ | −0.0051 ∗ | −0.0047 ∗ | −0.0043 | −0.0037 |

| (−2.01) | (−1.94) | (−1.80) | (−1.66) | (−1.45) | (−1.17) | |

| N | 953 | 953 | 953 | 953 | 953 | 953 |

- Note: ∗∗∗, ∗∗, and ∗ denote significance levels at 1%, 5%, and 10%, respectively; t statistics in parentheses.

| Variables | Location parameters | Scale parameters | Lower quantiles | ||

|---|---|---|---|---|---|

| Q0.1 | Q0.2 | Q0.3 | |||

| LNOBM × GVS | −0.0022 ∗∗ | 0.0002 | −0.0025 | −0.0024 | −0.0024 ∗ |

| (−2.04) | (0.31) | (−1.48) | (−1.64) | (−1.77) | |

| LNOBM | 0.0003 | −0.0008 | 0.0015 | 0.0012 | 0.0009 |

| (0.23) | (−1.31) | (0.90) | (0.76) | (0.63) | |

| CFM | −0.0020 ∗ | 0.0006 | −0.0029 ∗ | −0.0026 ∗ | −0.0024 ∗ |

| (−1.85) | (0.93) | (−1.71) | (−1.78) | (−1.83) | |

| RQP | 0.0072 ∗∗ | −0.0005 | 0.0079 | 0.0077 ∗ | 0.0076 ∗ |

| (2.19) | (−0.29) | (1.57) | (1.73) | (1.87) | |

| LNGDP | 0.0209 ∗∗∗ | −0.0014 | 0.0232 ∗∗∗ | 0.0225 ∗∗∗ | 0.0220 ∗∗∗ |

| (3.81) | (−0.56) | (3.09) | (3.35) | (3.54) | |

| GVS | 0.0003 | 0.0001 | 0.0001 | 0.0002 | 0.0002 |

| (0.05) | (0.03) | (0.02) | (0.03) | (0.03) | |

| N | 953 | 953 | 953 | 953 | 953 |

- Note: ∗∗∗, ∗∗, and ∗ denote significance levels at 1%, 5%, and 10%, respectively; t statistics in parentheses.

| Variables | Mid quantiles | Upper quantiles | ||||

|---|---|---|---|---|---|---|

| Q0.4 | Q0.5 | Q0.6 | Q0.7 | Q0.8 | Q0.9 | |

| LNOBM × GVS | −0.0023 ∗ | −0.0022 ∗∗ | −0.0021 ∗∗ | −0.0021 ∗∗ | −0.0020 ∗ | −0.0019 ∗ |

| (−1.93) | (−2.05) | (−2.09) | (−2.04) | (−1.91) | (−1.66) | |

| LNOBM | 0.0006 | 0.0003 | −0.0001 | −0.0003 | −0.0006 | −0.0009 |

| (0.43) | (0.20) | (−0.04) | (−0.21) | (−0.40) | (−0.61) | |

| CFM | −0.0022 ∗ | −0.0020 ∗ | −0.0017 ∗ | −0.0016 | −0.0014 | −0.0011 |

| (−1.87) | (−1.84) | (−1.71) | (−1.56) | (−1.30) | (−0.96) | |

| RQP | 0.0074 ∗∗ | 0.0071 ∗∗ | 0.0070 ∗∗ | 0.0068 ∗∗ | 0.0066 ∗∗ | 0.0064 ∗∗ |

| (2.04) | (2.20) | (2.30) | (2.31) | (2.24) | (2.05) | |

| LNGDP | 0.0214 ∗∗∗ | 0.0208 ∗∗∗ | 0.0202 ∗∗∗ | 0.0198 ∗∗∗ | 0.0193 ∗∗∗ | 0.0186 ∗∗∗ |

| (3.72) | (3.81) | (3.77) | (3.65) | (3.42) | (3.07) | |

| GVS | 0.0002 | 0.0003 | 0.0003 | 0.0003 | 0.0003 | 0.0004 |

| (0.04) | (0.06) | (0.06) | (0.07) | (0.07) | (0.07) | |

| N | 953 | 953 | 953 | 953 | 953 | 953 |

- Note: ∗∗∗, ∗∗, and ∗ denote significance levels at 1%, 5%, and 10%, respectively; t statistics in parentheses.

From the analysis of the base model moment quantile regression presented in Tables 6 and 7, it can be observed that the quantile heterogeneity of each variable is found to be statistically significant (p < 0.1). However, none of the parameter heterogeneity is deemed to be statistically significant (p > 0.1). It was observed that the level of nitrogen oxide emissions from motor vehicles (LNOBM) exhibited a positive correlation with the level of CO2 emissions from motor vehicles (LNCO2) in all quantitative groups. However, this correlation was found to be statistically significant only in certain groups. In the low and medium quantitative groups, specifically -, the coefficient exhibits a shift from high significance to moderate significance (p < 0.05–p < 0.1), and it is not statistically significant in other quantitative groups. However, it appears that there is a positive correlation between the increase in business activities of MNCs and the rise in CO2 emissions. The analysis reveals that CFM has a partial and nonstatistically significant effect (p > 0.1) on environmental sustainability in the high quantitative group. This suggests that the impact of CFM on environmental sustainability is positive, consistent with the findings of Korhonen [41] and Saeed et al. [42]. However, the significance of this effect diminishes as CFM increases. All estimates obtained from the moment-quantile regression analysis for the variable LNGDP exhibit positive significance, as anticipated, while also demonstrating distributional heterogeneity. GVS and environmental regulation are found to be significant factors in all quartile regression estimates with distributional heterogeneity, indicating that improvements in policy quality and GVS within each country can have a substantial impact on CO2 emissions. This finding is consistent with the results reported by Rafindadi et al [3].

Moving to Tables 8 and 9, it is evident that an interaction term between RQP and MNC business activities has been incorporated into the base regression. Given the incorporation of the interaction term, it becomes crucial to prioritize the examination of the coefficients and significance of the interaction term. Consequently, less emphasis is placed on the elaboration of the other variables. In the present model, it is observed that LNOBM × RQP, LNOBM, CFM, and LNGDP exhibit distributional heterogeneity, while none of them display scale heterogeneity. Furthermore, it is noteworthy that LNOB × MRQP consistently demonstrates a negative association with LNCO2, suggesting a negative moderating relationship. The persistent and statistically significant absolute value (p = 0.0046 < 0.01) indicates that, irrespective of the extent of MNEs’ operations, adherence to RQPs will result in a decrease in CO2 emissions, thereby promoting environmental sustainability. The underlying explanation for this outcome is that countries with limited MNE operations prioritize economic development as their primary objective. However, excessively stringent policies create high barriers to entry, making it challenging for host countries to attract FDI. Consequently, these countries adopt more lenient policies to entice FDI. As MNE activities increase, countries recognize that this approach is not conducive to sustainable development. Consequently, they intensify RQPs and shift their focus from solely economic development to achieving economic and ESD in tandem. Therefore, this observation indicates that there is no imperative to intensify development measures in order to mitigate environmental pollution issues or compromise domestic environmental regulations in order to attract foreign investment. Spontaneous corporate social responsibility often proves to be more effective than mandatory policies implemented by host countries. This observation aligns with the research conducted by Rondinelli and Berry [45] as well as Zhang and Wen [46]. However, the conclusion made by Hezri and Hasan [47] contradicts the findings of the study, which posited that policy enhancement has the potential to make a sustainable contribution to environmental impact.

Moving to Tables 10 and 11, with the incorporation of the interaction terms involving LNOBM and CFM, it becomes evident that the interaction term LNOBM × CFM exhibits distributional heterogeneity, akin to LNOBM, RQP, LNGDP, and GVS. Additionally, LNOBM and LNGDP display scale heterogeneity. The interaction term LNOBM × CFM exhibits a consistently significant negative relationship (p < 0.05), with the coefficient ranging from −0.0021 to −0.0011. This finding implies that nations with a lower presence of MNCs tend to adopt more stringent regulations on CO2 emissions and prioritize the promotion of ESD through the implementation of CFM. Conversely, countries with a higher prevalence of multinational business activities are less inclined to regulate CO2 emissions and may not prioritize environmental sustainability to the same extent. The rationale behind this finding is that in nations with limited multinational business operations, the expenses associated with CFM are lower. Consequently, companies in these countries find it comparatively easier to recognize the beneficial spillover effects of implementing CFM strategies. Conversely, the management of carbon footprints in countries characterized by extensive multinational business operations entails substantial time, labor, and financial expenditures, thereby posing significant challenges for companies to undertake independently. This finding aligns with the findings of Pourakbari–Kasmaei et al. [48] and Lee [49].

The relationship between MNE business activities and CO2 emissions, moderated by the GVS variable, is found to be negative. However, the significance of this relationship is not equally observed across all quartile points for each quantitative group, as indicated in Tables 12 and 13. Firstly, the statistical significance of the data does not reach a significant level (p > 0.1) until it only starts to show marginal significance (p < 0.1). It then becomes more significant at “-” (p < 0.05), but subsequently returns to being marginally significant (p < 0.1) at the moment quartiles. In terms of statistical significance, the groups classified as medium and high in terms of quantitative measures exhibit greater significance. This finding indicates that the influence of policy stability on the association between multinational business activities and CO2 emissions is ambiguous in politically unstable countries and in regions with limited multinational business activities. However, in countries with a higher presence of multinational business activities and greater political stability, GVS plays a crucial role in mitigating CO2 emissions, thereby fostering environmental sustainability. The research conducted by Khan et al. [37] is supported by this study.

5. Conclusions and Policy Recommendations

5.1. Conclusions

This study employs an empirical approach to examine the impact of MNCs’ business behavior on environmental sustainability. Additionally, it delves into the mechanistic role of the REN, along with the influence of RQPs, corporate CFM, and GVS. The estimation of parameters is conducted through the application of year and individual double fixed-effect models. To address robustness and endogeneity issues, we employ alternative dependent variables, replacement independent variables, and the instrumental variable model. Furthermore, the heterogeneity is estimated using MM-QR. The empirical findings lead to the following conclusions:

Firstly, the impact of MNCs’ business behavior on environmental degradation is noteworthy, lending support to the “pollution paradise” hypothesis. However, it is essential to acknowledge that MNCs’ business practices concurrently facilitate the REN. This proactive approach leads to a reduction in CO2 emissions, thereby fostering ESD.

Secondly, upon introducing interaction terms for RQP, corporate CFM, and GVS, our findings reveal that the adverse effects of MNCs’ business behaviors on environmental sustainability are alleviated through the moderation of RQP, corporate CFM, and GVS. It is crucial to note that these moderation effects exhibit heterogeneity.

Last but not least, within the realm of RQP, no discernible differences in the role of regulatory significance emerge. However, under the purview of corporate CFM, the regulatory influence of both the low-quantitative group and the medium-quantitative group becomes more pronounced. Similarly, under GVS regulation, the regulatory impact is more substantial for the medium-quantitative group and the high-quantitative group.

5.2. Policy Recommendations

The policy insights obtained based on the above results are:

5.2.1. Promote the REN in Countries

First, governmental departments can incentivize the development and implementation of policies, such as subsidies, tax breaks, and other financial incentives, to encourage firms to invest in RE projects. These incentives can be tailored to the specific nature of each country.

Second, establishing RE targets and formulating clear goals and timetables will encourage businesses to adopt RE to meet their energy requirements.

Third, fostering technological innovation is crucial. Providing support for research and development will enhance the efficiency and reduce the cost of RE technologies. In cases where the economy and technology of certain countries may not currently support green transformation and environmental governance, nations with strong economic capabilities and mature technology are urged to offer voluntary assistance and collaborate in progressing towards sustainable development.

5.2.2. Rationalization of the Regulatory Role of RQP

Whether it is the “pollution paradise hypothesis” or the “pollution halo hypothesis,” policies play a pivotal regulatory role. However, empirical results suggest that national regulation functions more like a “threshold,” with no significant difference between regulations that are too loose or too severe. The establishment of thresholds for RQP necessitates a global perspective, considering the context of global climate change and sustainable development. Analyzing the regulatory role within this broader framework is crucial for effective environmental governance. The United Nations plays an important role in this, and COP28 has made a detailed deployment of each country’s environmental governance obligations, so it is necessary to respond positively to the relevant UN policies to rationalize the deployment of national regulation.

5.2.3. Promote Corporate CFM and Improve GVS

Corporate CFM is a powerful means to regulate the environmental degradation of MNEs’ business activities, and it can be promoted through the following points to create conditions for ESD. First, government departments can implement carbon pricing mechanisms. Introduce a carbon market or carbon tax system to incentivize enterprises to reduce carbon emissions through economic means. Second, the government can set up a carbon footprint certification agency to certify and verify the carbon footprints of enterprises, prompting them to take more proactive measures to reduce emissions and to establish a green brand image for the enterprises. Third, promote carbon emission reduction in the supply chain. The government can encourage enterprises to promote carbon emission reduction in their supply chains. GVS is critical to the operations of MNEs in a country and to environmental sustainability.

5.3. Limitations and Future Recommendations

This paper systematically examines the influence of MNCs on the REN and environmental sustainability. However, certain limitations remain, particularly in three key aspects. First, due to data limitations, this study uses panel data for 218 countries and territories for the period 1998–2022. It is worth noting that there may be some data gaps or differences between countries or regions, which may affect the accuracy of the study’s results. To address this limitation, future research could strengthen the analysis by treating the data more carefully. Second, while MNCs contribute to environmental pollution through various means, such as oil spills, sewage discharge, and deforestation, this paper focuses solely on carbon emissions as a measure of environmental sustainability. This narrow approach overlooks other forms of environmental pollution. Future studies could broaden this perspective by investigating the impact of MNCs’ business behavior activities on a range of environmental pollution. Third, the use of the CFM index as a proxy variable for CFM in this study may lead to measurement errors, and future research could attempt a more scientific measure.

Conflicts of Interest

The authors declare no conflicts of interest.

Author Contributions

Conceptualization, formal analysis: Yali Liu and Haonan Chen. Methodology, software: Zhi Li, Hao Wang, and Xiaoyang Yang. All authors participated in the writing of the manuscript. All authors have read and agreed to the published version of the manuscript. In addition, all authors agree to take responsibility for the content and conclusions of the paper.

Funding

No funding was received for this research.

Open Research

Data Availability Statement

The data are available on request.