Regime Switching Model Estimates of the Impact of Financial Development on Renewable Energy Consumption: The Role of Geopolitical Risk in the Case of Emerging Economies

Abstract

Financial development and geopolitical risks are crucial for understanding the consumption of renewable energies (CREs), given the sustainability challenges of the global economy. This research examines the nonlinear impact of financial development on adopting renewable energies in 10 emerging countries facing geopolitical risks between 1985 and 2022. By employing two regime-switching approaches (panel threshold autoregressive (PTAR) and panel smooth transition autoregression (PSTAR)), the results indicate nonlinear correlations between domestic bank credit granted to the private sector and the adoption of renewable energies. The optimal threshold value of the PTAR model is 40.171, while those of the PSTAR model are 35.705 and 122.9. Below the thresholds of the PTAR and PSTAR models, financial development decreases the CREs. Beyond these thresholds, financial development promotes CRE through specific financial incentives, such as low-interest loans and tax credits for renewable energy projects, as well as the creation of specialized financial instruments, such as green bonds. Geopolitical issues have prompted governments to diversify their energy sources and intensify their investments in renewable energy to strengthen energy security and reduce dependence on the volatile fossil fuel markets. Therefore, in terms of policy implications, financial education, the mitigation of geopolitical risks, and renewable energy goals must be priorities in national development efforts to promote sustainable economic growth.

JEL Classification: C23, C54, K32, Q43

1. Introduction

Climate change is a pivotal economic concern worldwide, exerting pressure on industries and fiscal policies. Its far-reaching effects include resource availability, market dynamics, and socioeconomic disparities. It is primarily caused by global warming, which is projected to increase the global average temperature by 3–5°C by 2100 [1].

As per Conference of the Parties (COP) 27, the transition to a low-carbon economy is projected to need annual investments ranging from $4 to $6 trillion [2], highlighting the necessity for novel climate finance mechanisms and a dedicated fund to aid developing countries in managing climate change-induced loss and damage [3]. Furthermore, governments have established these financial mechanisms, including a specific fund to support affected developing nations, and the evolution of the financial sector will play a crucial role in the coming years. Actively contributing to research efforts aimed at reducing carbon dioxide (CO2) emissions represents a pivotal step towards achieving the objectives outlined in COP 27 [3].

The 28th COP (COP-28) emphasized the urgent need to actively work towards creating an economy that produces no carbon emissions, stressed the importance of keeping the global temperature increase to 1.5°C, provided guidance to countries on updating and strengthening climate plans by 2025, and called for speeding up the transition to green energy to ultimately achieve goals set out in the Paris Agreement. In light of these challenges, the concept of carbon neutrality has gained popularity as a strategic method for reducing climate change’s negative impacts [4–6].

According to the Intergovernmental Panel on Climate Change (IPCC) report, CO2 emissions represent more than 90% of total greenhouse gas emissions through fossil fuel consumption, significantly increasing carbon emissions and contributing substantially to environmental change and pollution [7–9].

Therefore, clean energy has the potential to replace fossil fuels, and many countries view renewable energy expansion as a key strategy to resolve energy supply issues and combat climate change, leading to a substantial increase in their investment in renewable energy [10–12].

Issues such as terrorism, warfare, and hostile international relations have aggravated the issue of geopolitical risk [13]. Over the past decade, several geopolitical events have occurred, such as the 9/11 attacks, the London and Madrid bombings, the Bombay attacks, the China–USA trade war, the United States–Iran conflict in January 2020, and the Russia–Ukraine war in February 2022.

Geopolitical risks can influence economic performance and investment decisions, affect natural resource rents, and affect financial markets [14, 15]. The world is experiencing unprecedented changes, and the characteristics of the times and history are becoming more obvious [16, 17].

Geopolitical events negatively impact the social, economic, and environmental spheres. Anser, Syed, and Apergis [18] identify two theoretical pathways that link geopolitical risk index (GPOR) and the environment: the “escalating effect,” where a decrease in consumption of renewable energy (CRE) leads to an increase in carbon emissions, and the “mitigating effect,” where a reduction in nonrenewable energy use and economic growth due to GPOR results in a decrease in CO2 emissions. Additionally, GPOR influences economic growth, research and development (R&D), innovation, technical progress, and therefore, clean energy investments [19].

The advancement of the financial sector is essential in the fight against climate change, as it directs resources and offers incentives for sustainable and low-carbon endeavors by providing specialized products and services that support energy-efficient technologies and environmentally friendly endeavors [20, 21]. In addition, green bonds have gained popularity as a means of financing climate and environmental projects, prompting companies to decrease emissions and shift toward a low-carbon economy [22]. Additionally, financial institutions can include climate risk evaluation, taking into account the potential risks and opportunities associated with climate change in different sectors [23, 24].

Several studies [25–27] have highlighted financial development as a critical factor influencing energy consumption. It can be defined as a country’s strategic enhancement of its financial institutions, which encompasses activities related to banking, foreign direct investment (FDI), and stock market operations [28, 29].

Financial development is characterized by an increase in economic activity as financial institutions extend higher loan amounts at lower costs to borrowers [28, 29]. This process not only enhances transparency between lenders and borrowers but also mitigates financial risks [30].

The relationship between financial development and energy consumption is complex, with financial activities driving energy demand and influencing policies related to both energy and finance [31]. Numerous studies have demonstrated that financial development impacts energy consumption levels, although the degree of this influence varies, reflecting two distinct schools of thought on the matter [32].

The first perspective posits that financial development leads to increased energy consumption by alleviating credit constraints, thus, enabling consumers to purchase high-value items that typically require significant energy inputs [32]. These large-ticket items often contribute to an overall rise in national energy consumption [30].

Additionally, the availability of loans facilitates firms in generating demand for their products and services, which drives industrialization and subsequently escalates energy consumption [28, 29]. Furthermore, a robust financial infrastructure simplifies access to affordable loans, enabling businesses to initiate new ventures or enhance existing ones through investments in plants, machinery, or additional labor, all of which contribute to increased energy demand [33].

Conversely, the second school of thought asserts that financial development can lead to a reduction in energy consumption. Proponents of this view argue that financial development encourages firms to invest in energy-efficient and advanced technologies [34, 35]. This investment fosters energy innovation, resulting in energy generation from alternative and cleaner sources, such as renewable energy [36]. Thus, understanding the dual impacts of financial development on energy consumption is vital for informing policy decisions aimed at promoting sustainable energy practices.

Recognizing the importance of financial development is essential, as it supports banking and stock market activities, thereby, driving economic growth and influencing energy consumption [37]. The relationship between financial development and energy consumption is complex: initially, financial development may boost energy demand by promoting industrial activity, while when the economy becomes mature, however, this relationship often shifts, encouraging investments in energy-efficient technologies that can reduce energy consumption.

Geopolitical risk further complicates this relationship by affecting energy supply stability and influencing financial markets. In regions with high geopolitical instability, financially developed economies may prioritize investments in renewable energy and domestic sources to mitigate dependency on foreign energy, potentially dampening the impact of financial development on energy consumption. Thus, the interaction between financial development, energy consumption, and geopolitical risk reflects a dynamic interplay that varies across economic and political contexts.

This study is driven by the necessity to examine the intricate interconnections between financial advancement, renewable energy utilization, and geopolitical risk—subjects that have been previously investigated, but not yet fully integrated within a unified conceptual framework. Prior studies have primarily concentrated on the direct impact of financial development on CRE. However, these analyses frequently neglect the nonlinear nature of this relationship and the influence of external factors, such as geopolitical risks, in shaping energy transitions. Furthermore, some studies indicate that financial development is associated with increased CRE, whereas others posit that the implications of financial growth may differ in emerging economies. Consequently, this study aims to address this gap by analyzing these relationships across countries at different economic stages, thereby, providing a more nuanced understanding of how financial development affects energy consumption in the context of geopolitical risks.

To address these gaps, we employ Hansen’s [38] panel threshold model and the panel smooth transition autoregression (PSTAR) model, building on the work of González, Teräsvirta, and Dijk [39] and González et al. [40]. These sophisticated econometric models permit the capture of nonlinearities and regime-switching behaviors, thereby, facilitating a more comprehensive analysis of the interaction between financial development and CRE and of the moderating effect of geopolitical risks. By integrating these variables, this study introduces a new dimension to the existing literature, offering more precise policy recommendations for the transition to sustainable energy sources in the context of global uncertainties.

This study’s contributions are multifaceted. First, it delves into the potential nonlinear relationship between banks’ domestic credit to the private sector (BDCPS) and CRE, offering insights into financial policies’ efficacity in promoting CRE in emerging economies. Second, it examines how geopolitical risk influences CRE, shedding light on the complexities of energy transitions in geopolitically dynamic regions. Third, the utilization of advanced econometric techniques enhances the analysis’s robustness, enriching the intricate interplay between financial development, geopolitical risks, and renewable energy adoption.

Additionally, the research contributes to economic literature by providing a comprehensive understanding of how financial development can act as a catalyst for renewable energy investments. By identifying thresholds in domestic credit that stimulate CRE, the study offers practical policy recommendations for governments and financial institutions in emerging economies. This not only highlights the importance of a stable financial environment in facilitating energy transitions but also underscores the necessity for tailored economic policies that consider both financial and geopolitical contexts to foster sustainable development.

The study organizes the remaining sections as follows: Section 2 provides theoretical and empirical literature as well as development hypotheses. Section 3 presents the empirical methodology based on the panel threshold autoregressive (PTAR) and PSTAR models. Section 4 presents the econometric analysis and empirical results, as well as a discussion of our findings’ significance. Section 5 concludes the study.

2. Literature Review

2.1. Financial Development–Renewable Energy Nexus

A well-developed financial system can enhance a country’s economic efficiency, thereby, affecting economic activity and energy demand [41]. In contrast, it overcomes pollution levels by facilitating firms’ adoption and utilization of modern and advanced cleaner technologies and energy-efficient practices [42].

Shahbaz et al. [43] used autoregressive distributed lag (ARDL) and VECM–Granger causality methodologies to examine the financial development, energy consumption, trade openness, and carbon emissions relationships in Indonesia. Their findings validated the notion that the progress of the financial sector and the facilitation of international commerce have a significant role in improving the environment.

Furthermore, Saud an Chen [34] and Shahbaz, Nasir, and Roubaud [44] discovered a positive correlation between financial development and carbon emissions reduction, indicating that financial development has a beneficial impact on the environment. Destek and Sarkodie [45] found a negative correlation between financial development and pollution in N-11 industrialized countries from 1977 to 2013, with a unidirectional relationship from ecological footprint to financial advancement. Similarly, Saud et al. [46] discovered that financial development and globalization contribute to ecological degradation in Belt and Road Initiatives (BRIs) nations [47–49].

Usman and Hammar [50] conducted a study on the influence of different factors on the ecological footprint in APEC countries between 1990 and 2017, using principal component analysis and the STIRPAT model. Their findings indicate that financial development and the use of renewable energy contribute positively to environmental quality. However, technical innovation, economic expansion, and population size have adverse long-term impacts on environmental quality.

In their study, Sheraz et al. [51] examine the relationship between CO2 emissions, financial development, renewable energy, globalization, and institutional quality across 64 countries participating in the BRI from 2003 to 2018. Their findings indicate that financial development and inadequate institutional quality increase CO2 emissions levels, whereas renewable energy and globalization reduce CO2 emissions.

Using the cross-sectional augmented distributed lag (CS-ARDL) econometric method in BRICS countries from 2000 to 2020, Dong et al. [52] showed that environmental pollution can go down with a 0.05% rise in green financing, renewable energy investment, and energy innovation. Furthermore, geopolitical risk shocks have a positive impact on the long-term development of green finance, indicating that geopolitical stability fosters sustainable investment.

Wang et al. [53] examined the impact of education and financial development on the use of renewable energy in N-11 countries from 1990 to 2016. They found that financial development leads to a significant increase in the use of renewable energy. However, education had no significant effect.

Athari [54] employs advanced econometric techniques to analyze a comprehensive dataset spanning 27 OECD economies between 2000 and 2019. The findings reveal that higher GEPU tends to negatively impact renewable energy demand, likely due to reduced investor confidence and policy delays. However, the authors prove that stringent environmental policies mitigate this adverse effect by providing a stable regulatory framework that encourages renewable energy investments.

Using fixed effects and quantile panel data approaches, Athari [55] investigates the impact of financial development and technological innovations on CRE in the BRICS countries, a group of five major emerging economies between 2000 and 2021. Their findings show that financial development and technological innovation are the key drivers, while economic growth is shown to have a negative impact. Additionally, economic openness and financial stability positively influence CRE, underscoring their contribution to environmental sustainability.

2.2. Geopolitical Risk–Renewable Energy Nexus

Energy has been perceived as a potential instrument, alongside other elements, capable of bolstering national security by executing efficient energy policies [56]. Yet, this transition not only spawns fresh geopolitical strategies but also underscores the urgency of embracing renewable energy sources amidst climate change [57].

Geopolitical risk exerts a significant impact on both crude oil prices and investments in renewable energy, along with environmental pollution. Furthermore, the performance of green energy stocks indicates their influence on both traditional and renewable energy prices [58, 59].

Geopolitical risks have a multifaceted impact on energy markets. Rasoulinezhad et al. [60], Ji, Li, and Sun [61], and Noguera-Santaella [62] drive fuel substitution, which affects oil prices, influences investor sentiment, and disrupts oil production and demand. These factors collectively shape the supply and demand dynamics of fossil fuels, influencing the transition toward renewable energy and resulting in varying levels of CO2 emissions.

Baloch, Danish, and Meng [63] conducted a study on the nonlinear relationships between financial development, economic growth, and energy consumption across OECD countries from 1980 to 2016. Their research reveals that the relationship between financial development and energy use, as well as between economic expansion and energy consumption, is nonlinear. Additionally, they proved that financial system progress is impacted by energy use and that there is a mutual connection between income and energy usage.

Raza et al. [27] investigate the nonlinear relationship between financial development and CRE among the leading countries in CRE using the panel smooth transition regression (PSTR) from 1997 to 2017. The results affirm that all indicators of financial development positively influence CRE; however, their effects vary significantly across different contexts. Furthermore, the findings indicate that economic growth and industrial structure exhibit a positive and significant association with CRE in both regimes. Interestingly, while the population demonstrates a negative correlation with CRE in a low-growth regime, this relationship shifts to positive in high-growth regimes.

Wang et al. [48] use a sample of 30 provinces in China for the period 1997–2017 to examine the relationship between financial development and energy consumption, based on the traditional convergence hypothesis. Their results show that there is a significant threshold effect between financial development and energy consumption, and there is an inverse U-shaped relationship between foreign investment ratio, financial efficiency, and energy consumption. Besides, the financial interrelationship ratio and insurance depth increase energy consumption. The trend of China’s energy consumption tends to be consistent. In the eastern region, the growth rate of energy consumption is negatively correlated with the initial level. There is only a convergence effect on energy consumption in the central region. However, the difference in energy consumption in the western region is continually expanding.

Using the two-step system GMM, Alsagr and van Hemmen [64] assess the impact of financial development and geopolitical risk on CRE in emerging markets from 1996 to 2015 and reveal a significant positive effect of financial development on the transition to renewable energy and that the effect of geopolitical risk on CRE is positive. Furthermore, the authors prove that financial development and geopolitical risk are more pronounced in the long term.

The study conducted by Syed et al. [65] investigated the impact of economic policy uncertainty and geopolitical risk on environmental pollution in the BRICS states. A correlation was found between geopolitical risk and CO2 emissions, with an increase observed in the lowest quartiles and a decrease in the middle and upper quartiles. Furthermore, variables such as GDP per capita, renewable and nonrenewable utilization, and the level of urbanization might influence the distribution of CO2 emissions. Cai and Wu [66] demonstrated that geopolitical threats had a beneficial effect on CRE in the USA, highlighting its importance. They also emphasized that renewable energy is vital for nations grappling with energy constraints.

In addition, Dutta and Dutta [67] discovered that geopolitical concerns are motivating countries that import crude oil to shift from predominantly relying on fossil fuel–based energy to renewable energy sources. In a similar vein, Su et al. [68] demonstrated that geopolitical threats have a dual effect on renewable energy generation, both promoting its growth and hindering it.

Matallah, Matallah, and Hilmi [69] use the ARDL model to look at how geopolitical risks affected the production of renewable energy in Egypt, Tunisia, and Turkey, three oil-importing countries in MENAT, from 1990 to 2020. Their findings emphasize that geopolitical risks positively impact renewable energy generation in the short term.

In their 2024 study, Shu et al. [70] examine the causal mechanisms linking geopolitical risk, uncertainty, financial development, renewable energy, and carbon intensity. They employ advanced econometric techniques to analyze a sample of 18 countries characterized by high geopolitical risk. These techniques include cointegration methods developed by Hatemi [71] and Maki [72], which account for structural breaks from 1985 to 2021. To get a full picture of the underlying dynamics, the study also uses fully modified ordinary least squares (FMOLSs), canonical cointegration regression (CCR) models, and static time-variant Granger causality tests. Their findings demonstrate the existence of a robust empirical relationship between geopolitical risk, financial development, renewable energy, uncertainty, and carbon intensity, even in the presence of structural breaks. Additionally, FMOLS and CCR models demonstrate that carbon intensity displays varying responses to alterations in geopolitical risk, renewable energy investments, uncertainty, and financial development.

Ben Abdallah et al. [73] use the panel threshold regression (PTR) and the PSTR models to look at how geopolitical risks and financial development affect the energy transition process in industrial economies. Their findings suggest that there is a nonlinear relationship between private credit and renewable energy, with a threshold of 39.361 in the PTR model. The PSTR model indicates a positive impact on renewable energy once it surpasses its thresholds of 35.605 and 122.35.

2.3. Hypotheses Development

Due to various contextual factors, the relationship between financial development and CRE may not always follow a linear trajectory. Although some studies have found a positive association, it is important to acknowledge the complexity of this relationship. Furthermore, the effectiveness of financial systems in mobilizing capital for renewable energy projects may vary across different regions and periods.

Additionally, socioeconomic factors such as income levels, urbanization rates, and energy demand patterns can further influence this interaction. Therefore, it is crucial to understand the nonlinear nature of this relationship to design tailored policies and strategies that promote sustainable energy transitions in diverse contexts.

Therefore, our study seeks to validate the proposed research hypothesis (H01): BDCPS exhibits a nonlinear correlation with the CRE.

It is hypothesized that the relationship between these variables may not follow a linear pattern and may instead exhibit a threshold relationship. In testing this assumption, we aim to contribute to an in-depth understanding of the complex dynamics between financial development and renewable energy deployment. This research endeavor is crucial in order to inform policymakers and stakeholders about the nuanced nature of promoting a sustainable energy transition in different socioeconomic contexts.

Suki et al. [74] employ augmented mean group analysis to examine the impact of GPOR on carbon emissions in the E-7 nations. Their findings provide evidence that GPOR leads to a reduction in carbon emissions. In a similar study, Bai [75] used augmented mean group analysis to examine the impact of GPOR on EF in Brazil, Colombia, Mexico, and Russia and presented empirical findings that GPOR reduces carbon emissions.

Geopolitical risk plays a crucial role in shaping the trajectory of renewable energy initiatives worldwide. As nations increasingly seek to transition toward sustainable energy sources, geopolitical dynamics can either accelerate or impede this progress. First, geopolitical tensions and conflicts can disrupt traditional fossil fuel supplies, leading countries to prioritize renewable energy as a means to enhance energy security.

Geopolitical risk encourages nations to invest more heavily in clean energy infrastructure and innovation, leading to this shift towards renewables. Additionally, geopolitical instability frequently encourages international collaboration, leading to the formation of alliances to develop technologies that facilitate access to clean energy resources.

Furthermore, heightened geopolitical tensions can also encourage countries to diversify their energy portfolios. This diversification strategy often includes greater investment in renewable energy sources such as solar, wind, and hydroelectric power, which are more resilient to geopolitical disruptions.

Unlike fossil fuels, which often rely on global supply chains and are affected by geopolitical tensions in producing regions, renewable energy technologies are typically more decentralized and domestically deployable, thereby, enhancing energy security and mitigating the impact of international conflicts.

Moreover, geopolitical risk can spur policy changes and investment incentives aimed at accelerating the deployment of renewable energy technologies as governments seek to mitigate the potential impacts of geopolitical instability on their energy systems. Thus, despite posing challenges, geopolitical risk can act as a catalyst for positive transformations in the renewable energy sector, fostering innovation and cooperation and advancing the shift toward a sustainable energy future.

Therefore, this study seeks to validate the proposed research hypothesis (H02): Geopolitical risk has a positive effect on CRE.

3. Methodology

3.1. Data and Variables

The research endeavor delves into the intricate interplay among geopolitical risk, financial development, and CRE across 10 emerging countries, namely, Brazil, China, India, Indonesia, Mexico, Russia, Saudi Arabia, South Africa, South Korea, and Turkey. The data are taken from the databases of World Development Indicators (WDI) and Caldara and Iacoviello [76]. The selection of these economies for investigation is strategic, driven by their significance in the global landscape and their shared characteristics. These countries collectively represent a substantial share of global GDP and trade, while also facing significant energy transition challenges as they balance fossil fuel reliance with increasing renewable energy adoption. Their varying levels of financial development, from emerging to more advanced financial systems, offer a valuable context for exploring the interaction between financial systems and CRE. Furthermore, the diverse geopolitical risks they encounter—stemming from political instability, regional conflicts, and global economic dependencies—provide a rich basis for analyzing the impact of such risks on renewable energy initiatives. The geographic and economic diversity of these nations ensures that the findings are broadly applicable, offering critical insights into the dynamics of sustainable energy development in emerging economies. Malaysia is excluded from the sample due to several factors due to its economic and financial development trajectory, which is more advanced compared to the other countries in the study, making it less comparable to nations facing more significant challenges in energy transitions and geopolitical risks. Moreover, Malaysia experiences lower geopolitical risks compared to other countries in the sample. The balanced panel data spanning from 1985 to 2022 offers a robust foundation for analyzing long-term trends and dynamics within these countries, providing valuable insights into how geopolitical shifts, financial advancements, and environmental considerations intersect over time.

In this comprehensive analysis, several key independent variables are examined to unravel the complexities of the nexus under study. In this context, the dependent variable—namely, the CRE as a percentage of total final energy consumption—serves as a crucial metric for gauging the sustainability and environmental friendliness of these economies. It illustrates the transition toward cleaner energy sources, despite the ongoing shifts in the political and economic landscape.

This study examines the moderating role of BDCPS in facilitating economic growth and channeling investments, with a particular focus on renewable energy projects. The study acknowledges the pivotal role of financial institutions in this process and recognizes the importance of BDCPS in supporting the growth of the private sector.

Furthermore, the study employs the GPOR, with a base value of 100, to assess the degree of political and security risks inherent in these countries, recognizing their potential influence on economic activities and investment climates.

Economic growth, measured as GDP per capita growth (GDPG) in percentage, serves as a fundamental indicator of overall economic performance and development trajectory.

The consumer price index (CPI) sheds light on inflationary pressures and economic stability, which are critical factors influencing investment decisions and policy formulation.

FDI as a percentage of GDP reflects the degree of attractiveness of these emerging markets to foreign investors, which shapes their economic landscapes.

Furthermore, the stock market turnover ratio (SMTR) in the percentage of GDP provides insights into the liquidity and activity levels in domestic stock markets, reflecting investor sentiment and market dynamics.

All variables are summarized in Table 1.

| Variables | Definition | Sources |

|---|---|---|

| CRE | Consumption of renewable energy (% of total energy consumption) | WDI (2023) |

| BDCPS | Banks’ domestic credit to the private sector (% of GDP) | WDI (2023) |

| GPOR | Geopolitical risk index (base = 100) | Caldara and Iacoviello [76] |

| GDPG | GDP per capita growth (annual %) | WDI (2023) |

| CPI | Inflation rate (% of consumer price index) | WDI (2023) |

| FDI | Foreign direct investments inward (% of GDP) | WDI (2023) |

| SMTR | Total number of shares traded over a period by the number of shares outstanding (% of GDP) | WDI (2023) |

- Note: WDI (https://databank.worldbank.org/source/world-development-indicators) and the GPOR variable is taken from https://www.matteoiacoviello.com/gpr.html.

- Abbreviations: SMTR, stock market turnover ratio; WDI, World Development Indicators.

3.2. Model Specification

The linear model’s RSSs is denoted as S0 and the nonlinear model’s RSSs is denoted as .

The coefficients of the lagged CRE (CREit−j) are and at each regime, where h = 1 or h = 2.

The sequence is the definition of the vector Xit of k variables. β = (β1, …, βk) is the vector of parameters, εit ~ ℵ(0, σ2) is the error term, μi represents the vector of individual fixed coefficients, and ρj are the autoregressive coefficients of the process yit. The transition function G(qit; γ; c) is related to the transition variable qit, the threshold parameter c, and the smoothing coefficient γ. The temporal dimension is denoted by the subscript t = 1, …, T, while each distinct dimension is denoted by the subscript i = 1, …, N.

Chebbi et al. [80] emphasize the advanced flexibility of the PSTAR model, which effectively captures both gradual changes and deviations occurring between extreme regimes. This flexibility is further enhanced by the model’s ability to incorporate regime-switching behavior, significantly enriching the understanding of complex variable dynamics. By accommodating such transitions, the PSTAR model remains robust in handling diverse scenarios, ranging from abrupt transitions to more nuanced and smooth regime shifts, as highlighted by González et al. [40]. Additionally, the PSTAR model allows for a more comprehensive exploration of nonlinear relationships and interactions across variables, particularly under changing conditions or thresholds.

The parameters are directly proportional to the slope parameter γ and are determined by the equation , where R1 denotes the Taylor expansion remainder.

The RSSs is denoted by RSS0 in linear panels with individual effects. RSS1 is the RSSs with K degrees of freedom in nonlinear panels with two regimes. T represents the number of observations per country, and N denotes the number of nations.

The coefficients of the lagged CRE (CREit−j) are and at each regime, h = 1 or h = 2.

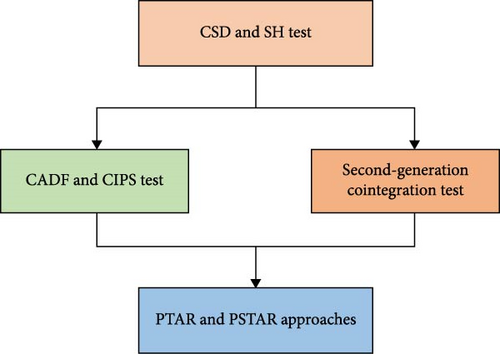

We summarize our empirical methodology as follows in Figure 1.

4. Empirical Results

4.1. Variables Description

Table 2 summarizes the statistical data for the dependent and independent variables in this study, presenting the mean and standard deviation, as well as the minimum and maximum values.

| Variables | CRE | BDCPS | GPOR | GDPG | CPI | FDI | SMTR |

|---|---|---|---|---|---|---|---|

| Mean | 20.477 | 51.633 | 97.843 | 4.021 | 62.988 | 1.590 | 48.932 |

| Median | 14.175 | 43.915 | 94.408 | 4.348 | 6.296 | 1.270 | 48.770 |

| Standard deviation | 18.440 | 37.491 | 28.605 | 4.584 | 266.465 | 1.523 | 18.611 |

| Minimum | 0.009 | 11.038 | 8.268 | −14.531 | −3.203 | −2.757 | 12.219 |

| Maximum | 63.915 | 185.364 | 199.103 | 17.013 | 2947.733 | 9.677 | 110.577 |

| Skewness | 0.684 | 1.453 | 0.400 | −0.611 | 6.695 | 1.201 | 0.355 |

| Kurtosis | 2.173 | 4.653 | 4.046 | 4.453 | 56.196 | 6.238 | 3.176 |

| JB statistic | 38.87 | 54.35 | 31.41 | 54.31 | 4.4 e + 04 | 117.9 | 8.674 |

| JB Probability | <0.001 | <0.001 | <0.001 | <0.001 | <0.001 | <0.001 | 0.013 |

| BB statistic | 5.64 | 16.88 | 25.04 | 3.67 | 12.57 | 2.53 | 50.70 |

| BB Probability | 0.060 | <0.001 | <0.001 | 0.159 | 0.002 | 0.282 | <0.001 |

- Abbreviations: BB, Born and Breitung [81] test; BDCPS, banks’ domestic credit to the private sector; CPI, consumer price index; CRE, consumption of renewable energy; FDI, foreign direct investment; GDPG, GDP per capita growth; GPOR, geopolitical risk index; JB, Jarque and Bera [82] test; SMTR, stock market turnover ratio.

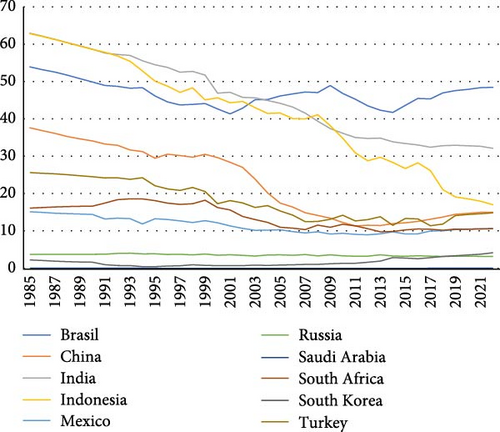

Figure 2 shows that the CRE variable has 380 observations that range from 0.009 to 63.915, with an average of 20.477, a strong concentration of around 14.175, and a standard deviation of 18.440. The set of 380 observations for the BDCPS variable ranges from 11.038 to 185.364, with a mean value of 51.633, a high concentration of 43.915, and a standard deviation value of 37.491. For the GPOR variable, there are 380 observations ranging from 8.268 to 199.103, with an average of 97.843, a high concentration of around 94.408, and a standard deviation of 28.605. Moreover, all variables have positive skewness and kurtosis except GDPG, which has a negative skewness and positive kurtosis, and the null hypothesis based on Jarque and Bera’s [82] and Born and Breitung’s [81] probabilities for all model variables is rejected.

To avoid biased projections, it is important to fix cross-sectional dependence (CSD) problems in panel datasets before testing for stationarity [83]. We also conduct Pesaran and Yamagata’s [84] slope heterogeneity test to prevent misleading results. Table 3 displays results from CD tests, proving the presence of cross-section dependence. In addition, the homogeneity test rejects the hypothesis of homogeneous slope coefficients. Consequently, the empirical analysis employs robust econometric techniques that accommodate slope heterogeneity.

| CSD Tests | Breusch and Pagan [85] | Friedman [86] | Frees [87, 88] | Pesaran and Yamagata [84] | Pesaran [83] |

|---|---|---|---|---|---|

| Statistic | 93.88 | 28.885 | 2.259 | 14.01 | 31.056 |

| p-value | <0.001 | <0.001 | <0.001 | <0.001 | 0.021 |

| Decision | Dependence | Dependence | Dependence | Dependence | Dependence |

| Homogeneity test | Test | Delta statistic | p-value | Decision | |

| Pesaran and Yamagata [84] | Standard | 15.558 | <0.001 | Heterogeneity | |

| Adjusted | 17.574 | <0.001 | Heterogeneity | ||

- Abbreviation: CSD, cross-sectional dependence.

In light of the cross-dependency issue highlighted in Table 3, we will proceed directly to the second-generation unit root test. Indeed, Pesaran’s [89, 90] CADF and CIPS unit root tests are employed for integration analysis due to their efficacy in addressing heterogeneity and CSD. According to Table 4 results, GPOR, GDPG, CPI, and FDI variables are stationary in level [I(0)] and BDCPS and SMTR variables are stationarity at the first difference [I(1)].

| Variables | CADF | CIPS | ||||||

|---|---|---|---|---|---|---|---|---|

| In level | In first difference | In level | In first difference | |||||

| C | C & T | C | C & T | C | C & T | C | C & T | |

| CRE | −1.794 | −2.264 | −3.905 ∗∗∗ | −4.301 ∗∗∗ | −1.912 | −2.481 | −5.135 ∗∗∗ | −5.508 ∗∗∗ |

| BDCPS | −1.805 | −2.417 | −3.911 ∗∗∗ | −4.067 ∗∗∗ | −1.685 | −2.223 | −5.313 ∗∗∗ | −5.439 ∗∗∗ |

| GPOR | −2.806 ∗∗∗ | −3.004 ∗∗∗ | −5.092 ∗∗∗ | −5.175 ∗∗∗ | −3.253 ∗∗∗ | −3.628 ∗∗∗ | −5.996 ∗∗∗ | −6.154 ∗∗∗ |

| GDPG | −2.941 ∗∗∗ | −3.328 ∗∗∗ | −4.999 ∗∗∗ | −4.996 ∗∗∗ | −4.426 ∗∗∗ | −4.804 ∗∗∗ | −5.691 ∗∗∗ | −5.811 ∗∗∗ |

| CPI | −2.400 ∗∗ | −2.583 | −4.573 ∗∗∗ | −4.664 ∗∗∗ | −2.627 ∗∗∗ | −2.780 ∗ | −5.186 ∗∗∗ | −5.321 ∗∗∗ |

| FDI | −2.785 ∗∗∗ | −3.014 ∗∗∗ | −5.110 ∗∗∗ | −5.239 ∗∗∗ | −3.124 ∗∗∗ | −3.427 ∗∗∗ | −5.533 ∗∗∗ | −5.866 ∗∗∗ |

| SMTR | −1.797 | −2.605 | −4.148 ∗∗∗ | −4.202 ∗∗∗ | −1.879 | −2.688 | −5.243 ∗∗∗ | −5.356 ∗∗∗ |

- Note: C represents constant. T represents a trend.

- Abbreviations: BDCPS, banks’ domestic credit to the private sector; CPI, consumer price index; CRE, consumption of renewable energy; FDI, foreign direct investment; GDPG, GDP per capita growth; GPOR, geopolitical risk index; SMTR, stock market turnover ratio.

- ∗, ∗∗, and ∗∗∗ represent the significance at 10%, 5%, and 1%, respectively.

Karavias and Tzavalis [91] contribute to the panel data analysis literature by proposing unit root tests that address structural fractures within individual series. These fractures may manifest as discontinuities in intercepts or intercepts and linear trends. Notably, their approach acknowledges that, while break dates should be consistent across all series, the gap between pre- and postbreak levels may differ. Table 5 displays the panel unit root test results. The results show that, despite the presence of structural breaks, all variables remain stationary in both the level and the first difference. This suggests a more stable and analytically manageable data structure for further analysis, which is consistent with the findings of the second-generation unit root test.

| Variables | In Level | In first difference |

|---|---|---|

| CRE | −14.020 ∗∗∗ (2020) | −29.089 ∗∗∗ (2020) |

| BDCPS | −17.084 ∗∗∗ (2020) | −34.139 ∗∗∗ (2020) |

| GPOR | −18.706 ∗∗∗ (1986) | −42.241 ∗∗∗ (2020) |

| GDPG | −26.334 ∗∗∗ (2020) | −48.223 ∗∗∗ (2020) |

| CPI | −18.860 ∗∗∗ (1995) | −39.964 ∗∗∗ (2020) |

| FDI | −17.221 ∗∗∗ (2020) | −36.524 ∗∗∗ (2020) |

| SMTR | −16.840 ∗∗∗ (2020) | −40.038 ∗∗∗ (2020) |

- Abbreviations: BDCPS, banks’ domestic credit to the private sector; CPI, consumer price index; CRE, consumption of renewable energy; FDI, foreign direct investment; GDPG, GDP per capita growth; GPOR, geopolitical risk index; SMTR, stock market turnover ratio.

- ∗∗∗Represents the significance at 1%.

The break dates identified in the unit root test highlight key moments when economic and geopolitical shocks have impacted the analyzed variables. The COVID-19 pandemic, which caused a global economic contraction and reduced GDP growth, FDI, and CRE, is largely responsible for the break-in in 2020. This crisis also led to volatility in financial markets, affecting interest rates and exacerbating geopolitical tensions. The breaks in 1995 and 1986, on the other hand, are associated with significant structural reforms and geopolitical shocks, illustrating how landmark events can transform long-term economic and financial dynamics.

These identified breaks justify the use of nonlinear model estimation techniques, as they indicate potential structural changes in the relationships between the variables over time. Nonlinear models, like the PSTAR and the PTAR models, are great at detecting these changes because they let the data behave in a variety of ways. This approach enhances the analysis by accommodating the complexities introduced by external shocks and policy changes, providing a more accurate representation of the dynamic relationships among economic factors.

Once the stationarity of the variables has been established, the next step is to examine the cointegration relationship between the model variables using the second-generation cointegration test proposed by Persyn and Westerlund [92]. As evidenced in Table 6, the variables are found to be cointegrated in the presence of CSD. These results are robust and accurate because they address issues such as dependent cross-sections and heterogeneity in the estimation process.

| Statistics | Value | p value | Decision |

|---|---|---|---|

| Gt | −3.670 | 0.003 | Cointegration |

| Ga | −10.524 | <0.000 | Cointegration |

| Pt | −5.536 | 0.001 | Cointegration |

| Pa | −11.375 | <0.000 | Cointegration |

4.2. Models’ Results

In this subsection, we move forward by estimating our model utilizing both the PTAR and PSTAR approaches, each with a single lag. The result of the χ2 test, equal to 12.11, indicates that employing a single lag is appropriate for both models. Consequently, we proceed with applying the PTAR (1) model. Following Table 7, the 1000-bootstrap procedure showed the existence of a threshold, with an estimated value equal to BDCPS = 40.171.

| Test | Threshold | F-test | Probability | Confidence interval | RSS | Residual variance |

|---|---|---|---|---|---|---|

| H0: no threshold | 40.171 | 70.827 | <0.001 | [26.251; 47.623] | 10,696.656 | 29.713 |

- Abbreviations: PTAR, panel threshold autoregressive; RSS, residual sum of square.

Table 8 displays the PTAR results, revealing that the estimated values are more significant than their signs, which are not easily interpreted. The results indicate that in low regimes, there is a negative and statistically significant association between banks’ domestic loans to the private sector and renewable energy use, which shifts to a positive and significant association in high regimes.

| Variables | BDCPSit−1 ≤ 40.171 | BDCPSit−1 > 40.171 | ||

|---|---|---|---|---|

| Coefficient | t-statistic | Coefficient | t-statistic | |

| CREit−1 | 0.366 | 2.124 ∗∗ | 0.121 | 2.624 ∗∗∗ |

| BDCPSit | −0.165 | −2.131 ∗∗ | 0.172 | 3.780 ∗∗∗ |

| GPORit | 0.174 | 3.189 ∗∗∗ | 0.223 | 2.254 ∗∗ |

| GDPGit | 0.259 | 1.994 ∗ | 0.065 | 2.887 ∗∗∗ |

| CPIit | −0.105 | −2.606 ∗∗∗ | 0.102 | 2.120 ∗∗ |

| FDIit | −0.284 | −5.234 ∗∗∗ | 0.189 | 2.878 ∗∗∗ |

| SMTRit | −0.151 | −3.284 ∗∗∗ | 0.667 | 2.226 ∗∗ |

- Abbreviations: BDCPS, banks’ domestic credit to the private sector; CPI, consumer price index; CRE, consumption of renewable energy; FDI, foreign direct investment; GDPG, GDP per capita growth; GPOR; geopolitical risk index; PTAR, panel threshold autoregressive; SMTR, stock market turnover ratio.

- ∗, ∗∗, and ∗∗∗ represent the significance at 10%, 5%, and 1%, respectively.

The analysis of the PTAR model results highlights the impact of various economic factors on CRE under two credit regimes. In the low-credit regime (BDCPS ≤ 40.171), an increase in past CRE leads to a significant 0.366% increase in current consumption, while GDP growth contributes to a 0.259% increase. Conversely, higher inflation results in a 0.105% decrease in CRE, and FDI has a substantial negative impact of 0.284%. Geopolitical risk enhances consumption by 0.174%, whereas an increase in domestic credit to the private sector and stock market turnover leads to decreases of 0.165% and 0.151%, respectively. In this regime, the relationship between BDCPS (domestic credit to the private sector) and CRE is negative and statistically significant. This suggests that, during periods of low economic activity or slow growth, an increase in bank credit to the private sector corresponds to a decrease in CRE, possibly due to limited capital flowing toward sustainable energy projects.

In the high regime, the dynamics show that past consumption contributes positively by 0.121%, while GDP growth, inflation, and FDI all positively influence CRE, increasing by 0.065%, 0.102%, and 0.189%, respectively. Moreover, greater domestic credit positively influences CRE by 0.172%, with stock market turnover demonstrating a remarkable effect, increasing consumption by 0.667%. These findings underscore the crucial role of economic conditions and financial accessibility in driving investments in renewable energy. Economic growth exerts a weak, though significant, effect on CRE in the low-credit regime, likely due to financial constraints. Both FDI and stock market turnover may have a statistically significant positive impact on CRE in this setting, potentially diverting resources away from green investments. Inflation also shows a statistically positive effect, suggesting that rising costs in a high-credit environment further increase renewable investments. In addition, geopolitical risk tends to have a positive impact in both regimes, with a stronger effect in the high-credit regime, indicating that regions with better credit access are more equipped to address external risks by investing in renewable and secure energy sources.

Testing linearity against the PSTAR serves two purposes: selecting the appropriate transition variable and determining the logistic transition function’s order. Table 9 shows the overall test results, which show that the null hypothesis was not true for both linear and single-threshold PSTAR models at the 1% level of significance. Therefore, PSTAR with two thresholds (r = 2) presents a compelling alternative, offering a nuanced understanding of the underlying dynamics.

| Tests | H0: r = 0 vs. H1: r = 1 | H0: r = 1 vs. H1: r = 2 | H0: r = 2 vs. H1: r = 3 | |||

|---|---|---|---|---|---|---|

| t-Statistic | Probability | t-Statistic | Probability | t-Statistic | Probability | |

| Wald (LM) | 33.509 | <0.001 | 47.853 | <0.001 | 3.611 | 0.164 |

| Fisher (LMF) | 5.875 | <0.001 | 7.455 | <0.001 | 1.562 | 0.153 |

| Likelihood ratio (LR) | 35.125 | <0.001 | 49.820 | <0.001 | 2.549 | 0.122 |

- Note: “r” refers to the number of regimes.

- Abbreviation: PSTAR, panel smooth transition autoregression.

In addition, the specification test sequence results indicate the selection of the m = 1 transition function. This implies the presence of multiple distinct phases or regimes in the data, each characterized by its transition function (Table 10).

| Order | Threshold (c) | Transition parameter (γ) | RSS | AIC | BIC |

|---|---|---|---|---|---|

| m = 1 | 6368.529 | 3.095 | 3.413 | ||

- Abbreviations: PSTAR, panel smooth transition autoregression; RSS, residual sum of square.

The PSTAR model was created by Fok, Van Dijk, and Franses [93], González, Teräsvirta, and Dijk [39], and González et al. [40]. It makes it easier to divide panel observations into different regimes, each with its coefficients, and it also lets you figure out different elasticities that can move smoothly between regimes. Unlike Hansen’s [38] PTAR, the PSTAR model offers advantages by allowing elasticity variations not only over time but also across countries.

Table 11 presents the results of the PSTAR model. The results demonstrate that economic, financial, and geopolitical factors exert a significant influence on the utilization of renewable energy (CRE) at various levels of BDCPS. A 1% increase in past CRE is associated with a 0.092% increase in CRE when BDCPS is less than or equal to 35.705. In the medium (35.705 ≤ BDCPS ≤ 121.95) and high (BDCPS > 121.95) regimes, the rise in BDCPS causes CRE to increase by 1.733% and 1.005%, respectively. Economic growth (GDPG) exerts a positive influence of 1.299% in the low regime, 1.212% in the medium regime, and 1.333% in the high regime. The BDCPS variable demonstrates a negative effect of −0.619% in the low regime, yet this shifts to positive impacts of 0.592% in the medium regime and 0.785% in the high regime. This indicates that elevated domestic credit levels markedly enhance CRE as they rise. FDI exhibits a notable shift in impact, moving from a negligible effect of 0.164% in the low regime to positive effects of 0.675% and 1.227% in the medium and high regimes, respectively. The impact of geopolitical risk (GPOR) is negative in the low regime, with an effect of −0.435%. This transitions to positive effects of 0.387% and 0.317% in the middle and high regimes, respectively. The CPI demonstrates a negligible effect of −0.021% in the low regime, a positive effect of 0.026% in the medium regime, and a pronounced positive effect of 0.108% in the high regime. Last, the SMTR demonstrates a minimal effect of −0.306% in the low regime, a positive effect of 0.402% in the medium regime, and a 0.251% effect in the high regime.

| CREit | BDCPSit−1 ≤ 35.705 | 35.705 < BDCPSit−1≤ 121.95 | BDCPSit−1 > 121.95 | |||

|---|---|---|---|---|---|---|

| Coefficient | t-statistic | Coefficient | t-statistic | Coefficient | t-statistic | |

| CREit−1 | 0.092 | 2.177 ∗∗ | 1.733 | 2.363 ∗∗ | 1.005 | 3.012 ∗∗∗ |

| BDCPSit | −0.619 | −7.627 ∗∗ | 0.592 | 8.144 ∗∗∗ | 0.785 | 2.936 ∗∗∗ |

| GPORit | −0.435 | −4.249 ∗∗∗ | 0.387 | 3.744 ∗∗∗ | 0.317 | 2.166 ∗∗ |

| GDPGit | 1.299 | 2.626 ∗∗∗ | 1.212 | 2.401 ∗∗ | 1.333 | 3.523 ∗∗∗ |

| CPIit | −0.021 | −0.508 | 0.026 | 0.621 | 0.108 | 5.171 ∗∗∗ |

| FDIit | 0.164 | −1.007 | 0.675 | 2.213 ∗∗ | 1.227 | 2.062 ∗∗ |

| SMTRit | −0.306 | −1.179 | 0.402 | 1.510 | 0.251 | 8.762 ∗∗∗ |

- Abbreviations: BDCPS, banks’ domestic credit to the private sector; CPI, consumer price index; CRE, consumption of renewable energy; FDI, foreign direct investment; GDPG, GDP per capita growth; GPOR, geopolitical risk index; PSTAR, panel smooth transition autoregression; SMTR, stock market turnover ratio.

- ∗∗ and ∗∗∗ represent the significance at 5% and 1%, respectively.

To resume, in the low regime (BDCPS ≤ 35.705), renewable energy exhibits limited persistence, with economic growth as a crucial driver despite significant geopolitical risk and minimal influence from inflation and FDI.

As credit becomes easier to get in the middle regime (35.705 < BDCPS ≤ 121.95), renewable investments become much more stable. This is because economic growth continues to help and FDI has a big effect. This shows that foreign capital is necessary to support renewable projects.

In the high regime (BDCPS > 121.95), all factors exhibit substantial effects on CRE, highlighting the resilience of renewable investments to inflation and the critical role of credit access and active capital markets in driving consistent growth. This analysis underscores the importance of robust financial systems, economic stability, and strategic responses to external challenges in fostering the development of renewable energy sectors.

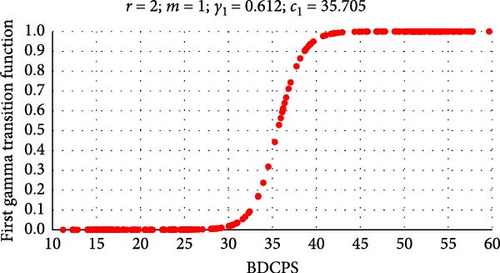

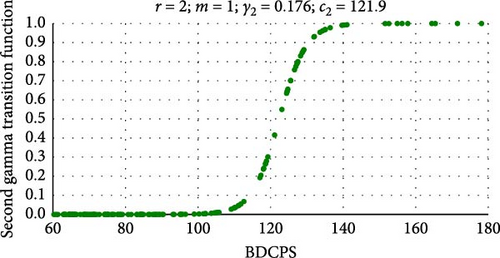

The estimated transition function of the PSTAR model for BDCPS regarding CRE in the country provides valuable insights into the dynamics of this relationship. According to Figure 3, with for a threshold equal to , the transition function exhibits a smooth transition. This suggests that once the threshold is surpassed, there will be a smooth and nonpronounced shift in the relationship between banking credit and CRE. Similarly, in Figure 4, with under a threshold of , the transition function maintains its smoothness, implying an abrupt transition from a weak to a strong regime.

In Figure 3, the first phase shows the link between credit and CRE, indicating that banks are not investing much in this area because they believe there are few opportunities. The intermediate phase is a turning point. Figure 3 shows that as this threshold is exceeded, credit allocation rises smoothly. This phase shows that banks are starting to see renewable energy as a beneficial investment. In the third phase, there is a strong link between credit and energy consumption. This shows that there is a big increase in renewable energy compared to earlier stages. Figure 4 shows that banks help the renewable energy sector grow by giving loans and other financial support.

The dynamics of credit allocation to renewable energy projects are crucial for advancing sustainable development goals and addressing climate change. The smoothness of the transition implies a gradual, but persistent trend toward increased investment in renewable energy, aligning with the broader socioeconomic objectives of reducing carbon emissions, enhancing energy security, and promoting inclusive growth.

Therefore, while the estimated transition function captures domestic dynamics, it is crucial to consider how global trends and cross-border interactions may impact the transition process. Moreover, innovative financial products, such as green bonds, carbon markets, and renewable energy investment funds, can provide new avenues for channeling investment toward sustainable projects. Further, the integration of financial markets allows for the efficient allocation of capital across borders, enabling investors to diversify their portfolios and access opportunities in renewable energy markets globally.

4.3. Results Discussion

The PTAR and PSTAR models demonstrate a discernible nonlinear relationship between financial development and CRE, thereby, substantiating the first hypothesis that the influence of financial development on energy efficiency exhibits variability contingent on varying credit levels. Below the threshold, the impact of financial development on renewable energy adoption may be constrained by limitations in credit availability and capital for green investments. However, above the threshold, where financial resources are more abundant, financial development significantly enhances CRE, as the private sector can allocate resources toward energy-efficient ventures. This nonlinear effect is consistent with the findings of Baloch, Danish, and Meng [63], Raza et al. [27], and Ben Abdallah et al. [73], which indicate that the allocation of financial resources to energy efficiency initiatives can significantly enhance a country’s sustainability performance.

As the financial system becomes more resilient, it encourages the use of alternative energy sources by providing incentives, tax benefits, and investment channels for renewable energy projects, particularly through public–private sector collaborations [94]. The increasing prevalence of environmentally-focused financial instruments, such as green bonds, reinforces this trend by expanding the funding options for environmentally-conscious initiatives, facilitating a consistent stream of capital towards sustainable investments. A robust financial system is essential to support this innovative funding approach, which is fundamental to the growth of renewable energy and to instilling investor confidence in sustainability. Furthermore, innovations such as blockchain and crowdfunding are broadening the scope for grassroots financing, particularly for small-scale renewable energy projects. This is achieved by reducing administrative obstacles and enhancing project transparency [95].

The models further underscore the positive impact of economic growth on renewable energy, suggesting that as economies expand, so do investments in sustainable technologies. Economic growth stimulates innovation in renewable energy technologies, thereby, facilitating a transition towards a more environmentally sustainable energy approach [96–98]. This trend reflects a growing commitment to sustainable development, with economic expansion becoming increasingly aligned with environmental stewardship. Consequently, countries are implementing policies to advance the use of renewable energy sources, acknowledging that such measures not only stimulate economic growth but also advance environmental protection.

FDI plays a dual role in the context of renewable energy. On the one hand, it contributes to the reduction of reliance on “dirty” energy sources, thereby, supporting the diffusion of green technology. On the other hand, it facilitates the transfer of environmentally friendly technologies from abroad. The FDI halo effect posits that domestic firms may emulate foreign firms’ energy-efficient practices, thereby, reinforcing green technology transfers that enhance energy efficiency [99–101]. This serves to reinforce the positive role of FDI in energy transformation across a range of economic contexts and technological levels, thereby, contributing to the development of a cleaner energy profile within host countries.

The findings from the PTAR and PSTAR models corroborate the second hypothesis, namely, that geopolitical risk has a positive influence on CRE. This confirms the results demonstrated by Alsagr and van Hemmen [64], Cai and Wu [66], and Ben Abdallah et al. [73]. This effect is observed to be consistent across both low- and high-regimes, with a particularly strong impact observed in the high regime. Geopolitical tensions, such as conflicts, trade disputes, or policy shifts, frequently disrupt traditional energy supply chains, thereby, increasing the attractiveness and urgency of renewable energy investments as a strategic alternative. The imperative to attain energy independence and diminish reliance on geopolitically vulnerable energy sources is a primary driver of this shift.

The results demonstrate that both low- and high-credit regimes exhibit a positive correlation between geopolitical risk and CRE, with a more pronounced effect observed in the latter. As demonstrated by Sohag et al. [102], geopolitical occurrences such as conflicts and policy alterations prompt investors to direct their capital toward more secure assets, including green bonds, particularly during market declines and periods of elevated risk. This flight to safety has the effect of raising bond prices and stabilizing the bond market, which in turn bolsters investment in renewables. Additionally, geopolitical factors influence the regulatory environment for green finance, potentially reinforcing the frameworks that facilitate sustainable investments [20].

An increase in geopolitical tensions has the potential to disrupt traditional energy markets, thereby, promoting a shift toward alternative energy sources as a result of the efforts of policymakers and investors to reduce dependency on vulnerable supply chains. The reinforcement of policies about renewable energy frequently serves to motivate governments that are confronted with elevated levels of risk, thereby, facilitating the acceleration of research and innovation within this sector. This reaction to geopolitical uncertainties is consistent with the models’ results, which indicate that CRE is particularly responsive to geopolitical dynamics when supported by financial development. Therefore, as global instability increases, financial markets adapt by directing resources toward renewable energy, thereby, supporting both energy security and sustainability objectives.

Furthermore, these findings reinforce the view that a unified global approach is essential to harmonize policies on renewable energy and environmental protection. Geopolitical factors, including trade tensions, resource competition, and climate change negotiations, influence the policies that facilitate the adoption of renewable energy and the reduction of carbon emissions. A unified strategy is an effective means of mitigating environmental risks, fostering economic resilience, and promoting social equity, particularly in a world that is increasingly impacted by geopolitical volatility. In light of these findings, it becomes evident that the interconnectivity of financial systems, renewable energy policies, and international relations plays a pivotal role in achieving sustainability targets, particularly in the context of intricate geopolitical landscapes.

5. Conclusion and Policy Implications

This study examines and estimates the impact of financial development and geopolitical risk on CRE in 10 developing nations from 1985 to 2022, using the PTAR and the PSTAR models. The results show that the relationship between financial development and the adoption of renewable energy sources is not linear; specifically, it is 40.171 in the PTAR model and 35.705 and 121.9 in the PSTAR model. This suggests that the impact of financial development on CRE may vary at different stages of financial maturity, potentially indicating saturation points where financial factors exert a greater influence.

Moreover, the research elucidates the influence of geopolitical risk on the patterns of CRE in emerging economies. The positive effect indicates that geopolitical tensions may paradoxically encourage investments in renewable energy. Furthermore, it demonstrates the crucial role that geopolitical stability plays in the formulation of long-term energy planning and investment strategies. Consequently, it is incumbent upon policymakers and industry stakeholders to devise strategies for addressing these challenges to foster an environment conducive to renewable energy development, even in the face of global uncertainty.

The findings highlight the practical implications of integrating geopolitical considerations into energy policy frameworks, suggesting that decision-makers should prioritize sustainable energy solutions as a means to enhance energy security and resilience in the face of uncertainties. By recognizing the significant impact of geopolitical risks on CRE, policymakers can create strategies that not only promote the adoption of renewables but also strengthen the overall stability of energy systems. This approach encourages investments in renewable technologies and infrastructure, fostering a more sustainable energy landscape that mitigates vulnerabilities associated with geopolitical tensions. Moreover, it emphasizes the need for financial mechanisms that facilitate access to credit for renewable projects, thereby, aligning economic growth with sustainable energy goals. Ultimately, the interplay between financial resources and geopolitical factors calls for a holistic strategy that supports the transition to renewable energy while safeguarding against external disruptions.

Furthermore, it is incumbent upon governments to establish robust legal and regulatory frameworks that will encourage long-term investments in renewable energy infrastructure. The implementation of transparent and consistent policies, such as feed-in tariffs, renewable portfolio standards, and carbon pricing mechanisms, can serve to attract both domestic and foreign investment in renewable energy sectors. Such frameworks should also incorporate risk-sharing mechanisms to protect investors from uncertainties linked to geopolitical events. Another crucial area for policy action is international collaboration. Countries can reinforce their alliances through the conclusion of regional energy trade agreements, the establishment of cross-border renewable energy grids, and the implementation of shared investment strategies in respect of large-scale renewable projects. Such collaboration can facilitate the creation of synergies that serve to reduce the vulnerabilities of individual countries while simultaneously promoting collective energy security.

It is also incumbent upon policymakers to give priority to the development of resilient supply chains for renewable energy technologies, such as critical minerals for batteries and solar panels. This may entail diversifying the countries from which these materials are sourced and investing in the expansion of domestic production capabilities. The establishment of strategic reserves of essential materials can serve to provide a buffer against geopolitical supply disruptions. Furthermore, targeted R&D funding can facilitate innovation in renewable energy technologies, storage solutions, and energy efficiency, thereby, ensuring continuous advancement despite external pressures. When coupled with public awareness campaigns designed to increase societal support for renewables, these policies can facilitate the creation of a sustainable and secure energy landscape that aligns with long-term climate goals and reduces geopolitical vulnerabilities.

As is the case with any research, the study is subject to several limitations that warrant careful consideration. First, the use of aggregated data across countries over an extended period may obscure the nuances of insights and variations within individual nations. Second, the study’s focus on emerging economies may limit the generalizability of its findings to developed countries with distinct institutional frameworks and economic dynamics.

These limitations underscore the necessity for a meticulous interpretation of the study’s findings and identify potential avenues for future research to enhance comprehension of these interactions. Overcoming these obstacles may require the refinement of data collection methodologies. Moreover, future studies could examine the potential of advanced econometric techniques or alternative models to more effectively elucidate the nonlinear relationships and dynamics involved in the adoption of renewable energy.

Consent

This article does not contain any studies with human participants performed by any of the authors.

Disclosure

The research endeavor delves into the intricate interplay among geopolitical risk, financial development, and renewable energy consumption across 10 emerging countries, namely, Brazil, China, India, Indonesia, Mexico, Russia, Saudi Arabia, South Africa, South Korea, and Turkey. We have used Stata 17 and MATLAB R21 software to run different programs.

Conflicts of Interest

The authors declare no conflicts of interest.

Author Contributions

All authors participated in the research design and the writing of the different sections of the article. Kamel Helali carried out the empirical analyses using data collected by Hamdi Becha. Maha Kalai, Mohamed Drira, and Hamdi Becha developed the theoretical background of the research. All authors discussed the results and contributed to the final manuscript.

Funding

Mohamed Drira acknowledges funding from the Social Sciences and Humanities Research Council of Canada and Saint Mary’s University.

Open Research

Data Availability Statement

The data are taken from the databases of World Development Indicators (WDI) and Caldara and Iacoviello [76]. The data that support the findings of this study are available on request from the corresponding author.