Designing a Sustainable Supply Chain Network With a Financial Approach in a Catastrophic Situation

Abstract

The COVID-19 pandemic is having a significant impact on the financial supply chain (FSC), with the disruption of supply and demand causing economic chaos and business disruption for companies, their customers, suppliers, and related service providers. To mitigate the financial disruption caused by COVID-19, companies are turning to supply chain (SC) financing solutions to stabilize liquidity and maintain solvency. Sustainability in the three dimensions of economy, environment, and society as well as the integration of financial and material flows ensure the long-term survival of an SC. Therefore, this study proposes a model for integrated physical and financial planning of a stable closed-loop supply chain (SCLSC). This model aims to maximize profit, minimize environmental and social impacts, and minimize undesirable deviations of financial indicators from their target level. To cope with the multiple objectives of the model, the goal programming (GP) method was used and the model was implemented during the COVID-19 pandemic in Iran. The proposed model is designed for multiple periods and products. The study proposes a model for financial and physical planning during COVID-19.

1. Introduction

The concept of sustainable supply chain management (SSCM) aims to enable a well-defined and strategic fusion of an organization’s economic, environmental, and social aspects. This integration is realized through systematic collaboration between multiple organizations, with the overarching goal of improving the long-term performance of the entire supply chain (SC). Integrating supply chain management (SCM) concepts into a sustainable development framework is critical for promoting responsible and ecofriendly business practices. By aligning SCM with sustainability, organizations can achieve a balance between economic growth, social wellbeing, and environmental stewardship. SC managers must shift their focus to adapt to evolving processes, reduce operational costs, and simultaneously enhance the connectivity and agility of their organizations to foster value creation throughout the entire SCM. This dynamic transformation is essential for staying competitive and responsive in today’s rapidly changing business landscape [1]. It should be noted that despite the research conducted in the field of SSCM, there are still very few models that can institutionalize the principles of sustainability and maintain and integrate the three dimensions at the operational level of SC [2].

SCM process involves managing three types of flows: physical flows, information flows, and financial flows. Financial flows and decisions have much to do with SC planning in organizational planning [3]. Ultimately, the performance of an SC is determined by its financial performance in improving shareholder returns. Careful attention and strategic planning concerning financial management and physical logistics are essential to the sustained success of an SCM. Customer awareness of the negative environmental and social impacts of logistics operations has increased, making green supply chain management (GSCM) and SSCM key drivers in meeting all these expectations and ensuring competitiveness [4]. Considering the impact of environmental factors such as pollution prevention and waste management in addition to traditional expectations, a closed-loop supply chain (CLSC) emerges as a viable option for minimizing material waste throughout the product life cycle [5]. As Shapiro [6] points out, financial flows and business planning decisions have much to do with supply chain network design (SCND). Financial factors directly affect various areas of SC, such as procurement, production, and distribution. In addition, only with sound financial planning can equipment, products, and sales markets be developed effectively. To offer sustainable products and services, the financial and physical flows are important [7]. Therefore, careful attention and planning in the area of financial flow and physical flow are essential for the long-term successful operation of SC. Despite the importance of financial flow in SSCM, only physical flow has been addressed along the SC, and no such integrated financial-physical planning model has been presented. The epidemic COVID-19 not only endangered human lives but also caused serious problems in the field of economy. SCM, like other industrial activities, was greatly affected by this situation [8]. The same study presented the priorities for the next years in the context of SCM. Although increasing sustainability is not in the first three priorities, top priorities are related to the sustainability dimensions. For instance, when increasing visibility, more integrated networks cover all perspectives that are economic, social, and environmental. Moreover, SC studies related to COVID-19 showed that three pillars of sustainability are inevitably linked [9].

A new mathematical model for a cloud-based drone-enabled vehicle routing issue that takes into account a multiechelon SC was proposed by Farajzadeh et al. [10]. A multiobjective location-routing model for dental waste that takes environmental concerns into account was suggested by Kordi et al. [11]. To take into account the ambiguity and trustworthy group decision-making, Haseli et al. [12] proposed logistic hub location issues under fuzzy extended Z-numbers.

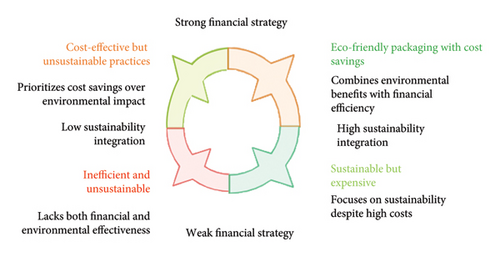

A SSC for a wellness tourist facility that takes into account service quality and discounts was proposed by Garjan, Paydar, and Divsalar [13]. Multiobjective home healthcare routing using a variable neighborhood search strategy was employed by Kordi et al. [11, 14]. A sustainable dental tourism SC that takes waste management into account was created by Charati et al. [15]. When designing a citrus SCN, Shahsavani, Goli, and Hajiaghaei-Keshteli [16] took environmental concerns and the circular economy into account. According to Cui and Yang [17], attaining SC resilience requires the integration of financial and operational operations. Businesses that embrace sustainable financial methods have a higher chance of achieving long-term profitability and stakeholder confidence, according to Mushtaq, Altaf, and Mustafa [18] investigation of the effects of green finance efforts on SC sustainability. Figure 1 shows the balancing sustainability and finance issues in SC.

- •

Minimizing profit and deviation from financial indicators in the economic dimension.

- •

Minimizing destructive environmental impacts in the ecological dimension.

- •

Maximizing social benefits in the social dimension.

A thorough analysis of the literature and research gaps is presented in the sections that follow and in Section 2. The suggested methods and problem statement are in Section 3, and the results and discussion are offered in Section 4. Lastly, in Section 5 conclusions and potential directions for further investigation are covered.

2. Literature Review

2.1. Survey on Related Works

The first part is about SSCNs, the second part is about financial aspects of the SC and the third part is about COVID-19 and SCs. This section ends with the research gap and innovation.

2.1.1. Green and Sustainable Supply Chain Networks

SSCM has garnered increasing attention from both industry practitioners and academia. It represents a pivotal focal point at the intersection of sustainability and SCM. This heightened interest can be attributed to various factors, including mounting pressures from internal and external stakeholders, community activists, and government regulations, as outlined by Jamalnia, Gong, and Govindan [19]. The concept of sustainability, as widely recognized, comprises three key dimensions: economic, environmental, and social, all crucial for fostering human development. In light of these dimensions, SSCM can be aptly defined as the management of economic factors and the flow of information and materials throughout the SC, while ensuring alignment with the requirements of economic, environmental, and social dimensions, as proposed by Jia et al. [20]. Future research must delve into these dimensions to provide a comprehensive understanding of the pandemic’s effects on SCs [21]. This definition underscores the intricate balance SSCM seeks to achieve, addressing the multifaceted needs of sustainable development while navigating the complexities of modern SC operations. The performance of an SC is intricately tied to its configuration. Therefore, SCND stands as a strategic decision-making process that encompasses vital choices regarding the quantity, locations, and capacities of network facilities, alongside considerations for material flow throughout the network [22, 23].

In this context, the concept of SSCN emerges as a new framework that endeavors to incorporate and integrate environmental, economic, and social considerations into the decision-making process, with the overarching goal of defining an optimal SC structure. This approach recognizes the evolving nature of SCM, where achieving sustainability necessitates a holistic and multifaceted approach to design and decision-making. Abbasi and Choukolaei [24] reviewed the GSC and CO2 emissions. Sahebjamnia, Fathollahi-Fard, and Hajiaghaei-Keshteli [25] presented novel hybrid metaheuristic algorithms modeling the supplier selection and allocation problems for designing a sustainable tire closed-loop supply chain network (CLSCN). Their model is for assessing and selecting the circular suppliers and then assigning optimal orders in the network. Their proposed multiobjective (MO) model considered all three dimensions of sustainability such as water footprint, costs of SC, carbon footprint, and the number of jobs created by optimizing the design for an agrofood industry. An integrated two-stage hybrid MCDM model based on analytic hierarchy process (AHP) and ordered weighted average (OWA) aggregation was proposed for the same by Allaoui et al. [26] considering three sustainability dimensions. Eskandari-Khanghahi et al. [27] proposed a metaheuristic algorithm to design and optimize a sustainable blood SCN in the time of a disaster and after it. The network is designed for determining the blood collection facilities in terms of their locations and capacities and the best route considering the minimization of the total cost and environmental factors while maximizing social effects. To handle uncertain parameters for a sustainable switchgrass-based bioethanol SCN, Ghaderi, Moini, and Pishvaee [28] proposed a novel MO stochastic model to maximize the performance of the SC and optimality robustness and feasibility robustness simultaneously. This was the first study including all the strategic and tactical decisions in sustainable bioenergy SCND.

Tsao et al. [29] proposed a multiechelon network that consists of four layers such as distribution centers, production centers, multiple suppliers, production centers, distribution centers, and customer zones. Their paper also studies took notice of the not only capability of production and distribution centers but also the range of capacity levels in the development of an SSCN. Yadav, Tripathi, and Singh [30] proposed a mixed-integer linear programming (MILP) model that combined online giants with local retailers’ distribution networks in a sustainable manner by adding another objective function to reduce carbon content. Rabbani et al. [31] presented a MO model for the SSCN that had five echelons such as factories, warehouses, customers, collection centers, and recycling centers to consider all dimensions of sustainability. Biuki, Kazemi, and Alinezhad [32] proposed a two-phase model the first phase is to determine the more sustainable-focused suppliers and the second phase is problem definition as a MILP to optimize integrated location, routing, and inventory problems for covering the three dimensions of the SSC. Durmaz and Bilgen [33] proposed a novel multistage solution that considers the related distance to ecological units vital for sustainability that was ignored in previous biomass supply SCND studies. Nayeri et al. [34] proposed a MO fuzzy robust optimization model that considers many strategic decisions such as technology selection, supplier selection, transportation mode selection, and carbon capacity-and-trade for the sustainable closed-loop supply chain network design (SCLSCND) simultaneously. Fathollahi-Fard et al. [35] designed an SSCN to guide water shortage and water consumption. The novelty of their study was in integrating the social engineering optimizer (SEO) approach to MO stochastic optimization to support the three dimensions of sustainability. Another study for designing an SSC for the perishable product was proposed by [36]. Green logistics networks were created by Abbasi, Daneshmand-Mehr, and Ghane Kanafi [37] and considered environmental factors in the design of a vaccine SCN.

They accomplished triple bottom lines of sustainability by minimizing CO2 emissions and total costs network actions and maximizing responsiveness to demands together. An integrated simulation-optimization model using ant colony optimization, fish swarm algorithm, and firefly algorithm was proposed by Goodarzian et al. [38] to design a sustainable medical SCN for the handling location, production, distribution, allocation, and inventory control of medicines during COVID-19 with variable neighborhood search and parameter tuning using RSM. A dairy SSCND was developed by Jouzdani and Govindan [39] to optimize the cost, energy consumption, and traffic jams related to such SCs operations, and they also investigated the effects of three TBLs of sustainability. Their study shows that the environmental impact of the chain may rise by 120% if intensifying the economic aspect is highly perishable products and the social impact may increase by 51% because of the highly congested road networks. A MILP model was developed by Salehi-Amiri et al. [40] to minimize the overall costs and decrease the amount of previously wasted subproducts to deal with the environmental and economic dimension of sustainability for the agricultural industry. Considering reuse or recycling materials and resources makes CLSCs serve sustainability as well as SSCN [41].

2.1.2. Financial Aspects of SC

Biglar, Hamta, and Rad [42] designed a model for physical decisions in SCND considering the financial decisions. In their model, the uncertainty of return the considered. Although financial flows are one of the main components of SCM, researchers have used mathematical models considering planning and controlling financial flows along SCs in combination with other models recently [3, 43].

Liu and Cruz [44] developed a vibrational inequality equilibrium model to investigate the impact of corporate financial risk and economic uncertainty on the values, profits, and decisions of SCs from a network perspective. Gonzalez, Abbasi, and Azhdarifard [45] defined costs in two categories, namely, business costs and investment costs in their study, the first group is costs for operating the SC such as production costs, transportation costs, and inventory holding costs and the second group is investment costs for facility relocation that are constrained by the available budget. They developed a mathematical model to determine relocation decisions by minimizing the sum of the business costs constrained by budget limitations. Guillén, Badell, and Puigjaner [46] proposed a deterministic model to combine the SC operations and financial parameters simultaneously that optimize the change in equity about the shareholders’ value of the organization.

According to Khan et al. [47], while operating in unpredictable situations, take into account the FSC, rapid information exchange through the use of cutting-edge technology, and financial performance in SCM. Shakibaei et al. [48] created a humanitarian SC that is robust and sustainable for the postdisaster relief effort. Using a case study, Jafari-Nodoushan et al. [49] developed a disruption-oriented SC while taking joint pricing and resilience into account. Using a case study of the automotive battery sector, Sadrabadi et al. [50] developed a green-resilient CLSC to maintain business continuity during interlinked interruptions. A finance strategy for a SSC was proposed by [51]. An FSC on company working capital and interbank lines of credit was provided by Rahman, Misra, and Kumar [52]. In an unpredictable environment, Zhao, Liu, and Zhang [53] investigated the financial SC’s blockchain-driven operating approach. A thorough assessment of SCN architecture with financial concerns was conducted by Jahani et al. [54]. The effect of SC partners’ differences in market power on a company’s financial performance was investigated by Gu et al. [55]. Using supervised neural networks, Bhat, Aljuneidi, and Li [56] looked into the dynamic study of a financial and economic SC system. [57] examined fuzzy logic, decentralized decision-making, and distributed decision-making. A model that integrates material and financial flow in SC master planning was studied by Kalantari, Pishvaee, and Yaghoubi [58].

Raghavan and Mishra [59] added that if a manufacturer and a retailer are linked in a SC, she has to solve a joint decision problem to maximize lenders’ profit. They developed a numerical model to investigate the understanding of the effects of the joint decisions on lender’s profit by changing various parameters such as various types of products having different salvage prices, various interest rates, and rates of production of defective quantity. Wang et al. [60] developed three heuristic approaches including the Greedy algorithm, Lagrangian relaxations, and Tabu searches to minimize total weighted travel distance for customer subjects considering budget constrained. Longinidis and Georgiadis [61] applied a multiobjective mixed integer nonlinear programming (MOMINLP) model to handle relationships between credit solvency and financial performance under economic uncertainty. Guillén, Badell, and Puigjaner [46] compared a conventional deterministic model SC scheduling modeling with a sequential approach that means firstly operations are decided and then finance parameters are fitted with a novel model by combining process operations and budgetary constraints at the same time. Compared with the conventional model, the novel model gave better results in the sense of change in equity. Arani and Torabi [62] addressed late payments and deliveries that are critical for SC because of their effect on cash flow and operations and the model also handles uncertainties in input data by using random fuzzy variables. Yousefi and Pishvaee [63] attempted the physical and financial flows in the global SC planning problem utilizing a fuzzy mathematical model. They developed a novel risk measure to handle the fluctuations of exchange rates for a crucial factor for global SCs.

2.1.3. COVID-19 Issues in SC

Billions of people all over the world were affected by the COVID-19 pandemic as well as the global SC because of a sudden decline in demand or a sudden spike in demand [64, 65]. In the uncertain post-COVID age, Abbasi et al. [66] created a circular economy-based, sustainable, and CLSCN. Abbasi et al. [21, 67] in the wake of the COVID-19 pandemic in the context of carbon pricing policies. In light of the heightened importance of social and environmental considerations amid the pandemic, all sectors must develop SSCN [38, 68]. The consequences and difficulties of the COVID-19 pandemic on global waste management for sustainable development were explored [69]. Research related to the impact of the COVID-19 pandemic on SCs has predominantly concentrated on the food and medical sectors, with limited attention given to the significant financial consequences experienced by the automotive and transportation industries [70, 71]. Using a case study in the USA, Abbasi et al. [21, 72] applied hybrid data mining and data-driven algorithms for a green logistics transportation network in the post-COVID era. Using the Iranian automotive sector as a case study, Abbasi et al. [37, 73] proposed a GCLSCN architecture during the COVID-19 pandemic. To cope with problems such as damage to the environment and shortage of resources, CLSCs are considered an alternative network design by combining forward and reverse flows. A sustainable recovery network for EOL items was created by Abbasi, Daneshmand-Mehr, and Ghane Kanafi [74] during the COVID-19 pandemic. Furthermore, despite numerous studies investigating various aspects of the COVID-19 outbreak, they often fail to encompass the three fundamental dimensions of sustainability essential for evaluating the impact of the pandemic on business and SC operations, thereby exposing them to significant risks [75, 76].

In the COVID-19 period, Moadab et al. [77] created a SCN that is responsive, robust, and sustainable while taking unpredictability into account. During the COVID-19 pandemic, Hosseini, Paydar, and Hajiaghaei-Keshteli [78] employed recovery strategies for ecotourism centers using the Fuzzy DEMATEL and Fuzzy VIKOR methodologies. A performance evaluation of the SSC during the COVID-19 pandemic was proposed by Abbasi et al. [74, 79]. The IoT-enabled sustainable reverse SC for COVID-19 pandemic wastes was used by [80]. Table 1 shows the perverse works in this area.

| No | Author(s) | Closed loop | Sustainable dimension | Flow type | COVID-19 focused |

|---|---|---|---|---|---|

| 1 | Sahebjamnia, Fathollahi-Fard, and Hajiaghaei-Keshteli [25] | ∗ | EN, EC, SO | P | |

| 2 | Allaoui et al. [26] | EN, EC, SO | P | ||

| 3 | Ahmed and Sarkar [81] | EN, EC | P | ||

| 4 | Eskandari-Khanghahi et al. [27] | EN, EC, SO | P | ||

| 5 | Tsao et al. [29] | EN, EC, SO | P | ||

| 6 | Samadi et al. [82] | ∗ | EN, EC, SO | P | |

| 7 | Yadav, Tripathi, and Singh [30] | EN, EC | P | ||

| 8 | Rabbani et al. [31] | EC | P | ||

| 9 | Zhen, Huang, and Wang [83] | ∗ | EN, EC | P | |

| 10 | Biuki, Kazemi, and Alinezhad [32] | EN, EC, SO | P | ||

| 11 | Durmaz and Bilgen [33] | EC | P | ||

| 12 | Nayeri et al. [34] | ∗ | EN, EC, SO | P | |

| 13 | Fathollahi-Fard et al. [35] | EC | P | ||

| 14 | Jabarzadeh et al. [36] | ∗ | EN, EC | P | |

| 15 | Goodarzian et al. [38] | EN, EC, SO | P | ∗ | |

| 16 | Jouzdani and Govindan [39] | EN, EC, SO | P | ||

| 17 | Salehi-Amiri et al. [40] | ∗ | EN, EC | P | |

| 18 | Salçuk and Şahin [84] | ∗ | EN, EC, SO | P | |

| 19 | Moadab et al. [77] | EN, EC, SO | P | ∗ | |

| 20 | Abbasi et al. [37, 73] | ∗ | EN, EC | p | ∗ |

| 21 | Cui and Yang [17] | EN, EC, SO | P, F | ||

| 22 | Mushtaq, Altaf, and Mustafa [18] | EN, EC | P, F | ||

| 23 | This study | ∗ | EN, EC, SO | P, F | ∗ |

- Abbreviations: EC, economy; EN, environment; F, financial; P, physical; SO, social.

- ∗Focused on a specific concept.

2.2. Identification of Research Gaps

The review of the proposed models for the strategic and tactical design of SSC shows that despite the importance of the financial flow and its integration with the physical flow, this issue has not been considered in the SSCND models and only the physical flow and decisions have been optimized. However, little research has been done to model the integrated design of physical and financial SSC without considering the sustainable development paradigm. Table 1 provides a comprehensive overview of the shortcomings of the current literature and the novelties of the current study. In this table, the studies were classified according to network type, sustainability dimension, type of flows, and COVID-19 related. These studies did not address the three dimensions of sustainability, financial flows, and COVID-19 in the CLSCNs simultaneously. Therefore, this study proposes a model for the integrated physical and financial planning of a SCLSC during the COVID-19 pandemic since this MOP is solved by the goal programming (GP) method.

- •

Designing a SSCN encompassing the three dimensions of sustainability.

- •

Designing a model for integrating the physical and financial planning of a sustainable CLSC.

- •

Providing an optimization answer for MOP by using the GP method during the COVID-19 pandemic.

- •

Suggesting model objectives to simultaneously maximize profit, minimize environmental and social impacts, and minimize undesirable deviations of financial indicators from their target levels.

3. Mythology and Problem Statement

This study focuses on analyzing the SC of a numerical example. Within this SC, the process starts with the production or recycling of products that eventually lead to the production of the final product. These products are then distributed to various distributors, who in turn sell them to customers. Waste is recycled by the customers and sold to distributors, who forward the waste to a waste collection center. The schematic representation of the SC under consideration can be seen in Figure 2. At the waste collection center, the waste is transferred to the recycling and production center, and the rest is sent to the landfill. This study aims to create a model for the economic, financial, environmental, and social optimization of the main planning of the presented SC. The main objectives of the program are the maximization of revenues; minimization of environmental and social impacts; and minimization of undesirable deviation of financial indicators from the ideal level.

- •

The location and number of manufacturers, retailers, and collection centers are already known.

- •

All manufacturers can produce all products.

- •

Production and collection centers have reliable storage of raw materials and products.

- •

Retail demand is met in the same period and is not transferred to the next period.

- •

Inventory of materials and products is transferred to the next period.

- •

The SCN is a multiproduct.

- •

The SCN is multiperiod.

- •

The raw materials of the collection centers are the returned waste of the retailers, which are separated and pressed in these centers.

- •

The raw materials for the production of the product include only the separated and pressed wastes sent from the collection centers.

- •

The problem during catastrophe situations.

- •

The capacity of production and collection centers is limited.

- •

The storage of raw materials and products in production centers, as well as the storage of unseparated and segregated waste in collection centers, is common and no separate building is considered.

- •

Accounts receivable for each period will be converted into cash in the next period.

- •

Noncurrent assets include only fixed assets and intangible assets are not considered.

3.1. Modeling Framework

In this section, the mathematical notations, objective functions, and constraints of the model are explained.

3.1.1. Indices

-

i: Production and Recycling Centers

-

j: Warehouse and Retailer Centers

-

c: Customer Centers

-

k: Collection Centers

-

d: Disposal Center

-

p: Products

-

t: Time period in catastrophe.

3.1.2. Physical Flow Parameters of the Economic Dimension

-

djpt: the demand of warehouse and retailer centers j for product p during the catastrophe period t

-

dcpt: the demand of customer center c for product p during the catastrophe period t

-

cappjt: maximum capacity of warehousing the product p in warehouse j during the catastrophe period t

-

cappkt: maximum capacity of collecting the product p in the collection center k during the catastrophe period t

-

cappdt: maximum capacity of disposing the retuned product p in the disposal center d during the catastrophe period t

-

cappit: maximum capacity of production and recycling the product p in the production and recycling center i during the catastrophe period t

-

θpt: product drop rate for converting waste into a product p during the catastrophe period t

-

rspkt: the amount of space required to store each unit of waste product p before pressing in node k during the catastrophe period t

-

vpkt: the variable cost of collecting each unit of product p in node k during the catastrophe period t

-

vcpt: the variable cost of production per unit of product p during the catastrophe period t

-

φφpt: the cost of maintaining each unit of unpressed waste product p during the catastrophe period t

-

φpt: the cost of maintaining each unit of pressed product waste p during the catastrophe period t

-

ecpt: the cost of maintaining each unit of product p in the period t

-

Spti: safety stock of product p during the catastrophe period t in node i

-

SSptk: safety stock of product p during the catastrophe period t in the node k

-

SWpti: safety stock of waste p during the catastrophe period t in node i

-

SSWptk: safety stock of waste p during the catastrophe period t in node k

-

pcpt: the purchase price of each unit of undressed product waste p during the catastrophe period t

-

gvpt: the amount of space required to store each unit of product p during the catastrophe period t

-

scfijp: cost of shipping a unit of product p from node i to node j

-

sctkip: cost of shipping a unit of pressed product waste p from collection center k to production and recycling center i

-

scsjkp: cost of shipping a unit of product waste p from retail j to collection center k

3.1.3. Physical Flow Parameters of the Environmental Dimension

-

eijpt: environmental impact of transporting a unit of product p from node i to node j during the catastrophe period t

-

ejcpt: environmental impact of transporting a unit of product p from node j to node c during the catastrophe period t

-

eckpt: environmental impact of transporting a unit of product p from node c to the node k during the catastrophe period t

-

ekdpt: environmental impact of transporting a unit of product p from node k to the node d during the catastrophe period t

-

ekipt: environmental impact of transporting a unit of product p from node k to the node i during the catastrophe period t

3.1.4. Physical Flow Parameters of the Social Dimension

-

NIpjt: the negative impact of product production p on the health of employees of node j during the catastrophe period t

-

NIpit: the negative impact of product production p on the health of employees of node i during the catastrophe period t

-

NIpct: the negative impact of product production p on the health of employees of node c during the catastrophe period t

-

NIpkt: the negative impact of product production p on the health of employees of node k during the catastrophe period t

-

NIpdt: the negative impact of waste production p on the health of node d staff during the catastrophe period t

-

rafijt: rates of road accidents on the way from the node i to node j during the catastrophe period t

-

ratkit: rates of road accidents on the way from the node k to the node i during the catastrophe period t

3.1.5. Financial Parameters

-

Drt: depreciation rate during the catastrophe period t

-

TDRt: the upper limit of the ratio of total liabilities to assets at the end of the period t

-

Taxrt: income tax rate at the end of the period t

-

QVt: the lower limit of the instantaneous ratio at the end of the period t

-

ROt: the lower limit of the rate of return on assets of shareholders at the end of the period t

-

scpt: sales price of each unit of product p at the end of the period t

-

Lt: long-term interest rates at the end of the period t

-

MinRt: minimum rate of return on assets at the end of the period t

-

FAt: fixed assets at the end of the period t

-

PDt: interest paid at the end of the period t

-

Qt: warehouse inventory value at the end of the period t

-

Nt: net sales at the end of the period t

-

At: current assets at the end of period t

-

ANtaxt: profit after tax at the end of the period t

-

HRTt: equity at the end of the period t

-

Pt: short-term liabilities at the end of the period t

-

Dt: long-term debt at the end of the period t

-

Taxt: taxable income during the period t

-

OTt: taxable operating profit during the period t

-

ψt: the amount of investment for fixed assets during the period t

-

CRt: liquidity rate in period t

-

IRPt: interest rates related to accounts received for the period t

-

RTRt: the lower limit of the turnover ratio of accounts received at the end of the period t

-

PMRt: low-profit margin rate at the end of the period t

-

FATRt: low fixed asset turnover rate at the end of period t

-

CWRt: customs duty rate at the end of the during the catastrophe period t

-

CCRt: the lower limit of the coverage rate at the end of the period t

-

curt: exchange rates at the end of the period t

-

St: short-term interest rates at the end of the period t

-

ctrt: customs duty rate at the end of the period t

3.1.6. Decision Variables

-

yijpt: the amount of product p shipped from the node i to node j during the catastrophe period t

-

yjcpt: the amount of product p shipped from the node j to node c during the catastrophe period t

-

yckpt: the amount of product p shipped from the node c to node k during the catastrophe period t

-

ykdpt: the amount of product p shipped from the node k to node d during the catastrophe period t

-

ykipt: the amount of product p shipped from the node k to node i during the catastrophe period t

-

λipt: the final level of product inventory p in the production center i during the catastrophe period t

-

λλipt: the final level of inventory of pressed waste of product p in production center i during the catastrophe period t

-

βkpt: the final level of inventory of unpressurized waste of the product p in the collection center k during the catastrophe period t

-

ββkpt: the final level of inventory of pressed product waste p in the collection center k during the catastrophe period t

-

ppskipt: the amount of pressed waste of the product p transported from the collection center k to the production and recycling center i in the period t

-

fgpipt: the number of product p produced in the production center i in the period t

-

fgsijpt: the amount of product p shipped from the production center i to retail j in the period t

-

upsjkpt: the amount of product waste p shipped from retail j to the collection center k the in period t

-

wppkpt: the amount of product waste pressed in the collection center k in the period t

-

BITt: the amount of income before interest and taxes at the end of the period t

-

RAt: accounts receivable at the end of the period t

-

CSHt: the amount of cash available at the end of the period t

-

the amount of downward deviation of the financial index type n during the catastrophe period t

-

the amount of upward deviation of the financial index type n during the catastrophe period t

-

NMSt: new stock issuance income at the end of the period t

-

NBt: new shares of shareholders during the catastrophe period t

3.2. Objective Function and Constraints

- 1.

Maximizing revenue;

- 2.

Minimizing environmental impacts;

- 3.

Minimizing the negative social effects;

- 4.

Minimizing the deviation of financial indicators from the desired limits;

()

The last ratio is the rate of return on equity. Accordingly, the amount of profit after tax is divided into equity. This ratio determines how much the shareholders earn per unit of their investment. It is shown in equation (13).

Equation (47) shows how equity is calculated to approximate financial ratios.

4. Results and Discussion

The COVID-19 epidemic began in early 2021 and since then, inflation has risen steadily above the Federal Reserve’s two targets. Possible causes for the chronically high inflation include the rebound in aggregate demand in late 2021 and early 2022, a tight labor market, disruptions in energy supplies, and disruptions in SCs for other commodities. Due to the confluence of these events, it is difficult to determine which factors have contributed most to the sustained rise in inflation since the beginning of 2021 and to what extent. Employment and the core PCE price index increase in response to an aggregate demand shock, but suppliers’ delivery times remain largely unaffected. The consequences of an SC shock bear a striking resemblance to previous approximations of the responses to a fundamental supply shock. SC disruptions lead to lower employment, higher core PCE prices, and longer supplier lead times.

The cost pressure shock increases the overall price level and at the same time reduces employment and suppliers’ delivery times. Nevertheless, the estimates are so imprecise that it is difficult to trust the implications presented in the point estimates. The inaccuracy of our model’s prediction could be interpreted as a reflection of the difficulties in distinguishing between SC and cost-push shocks, as a cost-push shock would be expected to lead to a significant increase in price levels. This, in turn, could call for caution when it comes to drawing clear conclusions. This Economic Commentary looks at the historical significance of the factors that have caused the steady rise in inflation since the start of 2021. We assess the relative contribution of supply and demand to inflation fluctuations by focusing on SC disruptions and drawing on statistics, economic theory, and narratives of historical events. Our estimates suggest that both SC problems and aggregate demand drivers have strongly accelerated inflation since the beginning of 2021.

According to these estimates, SC disruptions were responsible for most of the inflation during this period. SC events often had a greater impact on inflation than any other single shock, although demand, interest rate, and cost shocks also had an impact. The effects of SC shocks were likely caused by labor shortages or additional material shortages, transportation problems, or widespread production and transportation disruptions that made it more difficult for suppliers to fulfill orders. Indeed, it can be difficult to assess the significance of SC disruptions during this period because while there are many historical examples of positive SC shocks slowing delivery times, it is less obvious what exactly qualifies as a negative SC shock. It is likely that transportation was more available at the time, allowing delivery networks to move goods faster, or that SCs were more effective due to technological advances. It is also plausible that the SC shock we estimate is mixed with the general impact on supply outside of the COVID-19 period, where we are certain there were significant SC shocks. Consequently, rather than accurately identifying SC disruptions, our SC shock could represent the overall impact on supply at that time.

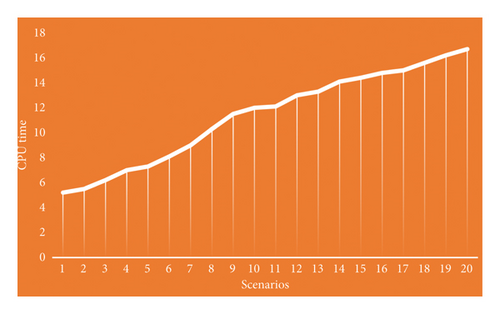

The model presented in the previous section is used in a numerical example in industry. The dimensions of the problem are shown in Table 2. The problem parameters are set based on the actual information to be analyzed. Planning is done in four quarterly periods so that the total planning period is 1 year. The mathematical model developed in this Lingo 19 software solution is coded and examined with a Lingo solver using optimization software. Table 3 shows the values of the parameters used in the numerical example. Table 4 shows the optimal threshold for the functional dimensions of sustainable development and financial ratios.

| Scenarios | Production and recycling centers | Warehouse and retailer centers | Customer centers | Collection centers | Disposal center | Products | Time period | CPU time |

|---|---|---|---|---|---|---|---|---|

| P1 | 1 | 2 | 2 | 1 | 2 | 1 | 2 | 5.2 |

| P2 | 2 | 3 | 2 | 2 | 2 | 2 | 3 | 5.5 |

| P3 | 2 | 4 | 4 | 3 | 3 | 3 | 5 | 6.2 |

| P4 | 5 | 6 | 5 | 4 | 5 | 3 | 4 | 7 |

| P5 | 6 | 4 | 5 | 6 | 7 | 4 | 2 | 7.3 |

| P6 | 6 | 5 | 4 | 5 | 8 | 4 | 1 | 8.1 |

| P7 | 7 | 6 | 4 | 7 | 8 | 4 | 3 | 9 |

| P8 | 9 | 6 | 5 | 7 | 8 | 5 | 2 | 10.3 |

| P9 | 10 | 7 | 6 | 8 | 9 | 5 | 3 | 11.5 |

| P10 | 11 | 7 | 7 | 8 | 9 | 6 | 2 | 12 |

| P11 | 11 | 8 | 8 | 9 | 10 | 6 | 3 | 12.1 |

| P12 | 11 | 8 | 9 | 9 | 11 | 6 | 4 | 13 |

| P13 | 12 | 9 | 10 | 10 | 12 | 6 | 3 | 13.3 |

| P14 | 13 | 10 | 10 | 10 | 13 | 6 | 4 | 14.1 |

| P15 | 14 | 11 | 10 | 11 | 14 | 6 | 5 | 14.4 |

| P16 | 15 | 13 | 10 | 11 | 15 | 7 | 5 | 14.8 |

| P17 | 16 | 14 | 10 | 11 | 16 | 7 | 4 | 15 |

| P18 | 17 | 14 | 11 | 12 | 17 | 8 | 3 | 15.6 |

| P19 | 17 | 15 | 12 | 13 | 18 | 9 | 6 | 16.2 |

| P20 | 18 | 15 | 15 | 14 | 19 | 10 | 6 | 16.7 |

| Parameters | Values |

|---|---|

| djpt | U (1, 1000) |

| dcpt | U (1, 1000) |

| cappjt | U (1, 5000) |

| cappkt | U (1, 5000) |

| cappdt | U (1, 5000) |

| cappit | U (1, 5000) |

| ejcpt | U (1, 100) |

| eckpt | U (1, 100) |

| Drt | U (0, 1) |

| Lt | U (1, 10) |

| HRTt | U (1, 10) |

| RTRt | U (1, 10) |

| rafijt | U (0, 1) |

| ratkit | U (0, 1) |

| Pt | U (1, 10) |

| PMRt | U (1, 10) |

| θpt | U (0, 1) |

| rspkt | U (1, 500) |

| vpkt | U (1, 700) |

| vcpt | U (1, 700) |

| φφpt | U (1, 1000) |

| φpt | U (1, 1000) |

| ecpt | U (1, 1000) |

| ekipt | U (1, 100) |

| TDRt | U (0, 1) |

| FAt | U (1, 2000) |

| Dt | U (1, 10) |

| FATRt | U (0, 1) |

| NIpjt | U (1, 100) |

| Taxrt | U (1, 500) |

| PDt | U (1, 1000) |

| Taxt | U (1, 500) |

| Spti | U (1, 100) |

| SSptk | U (1, 100) |

| SWpti | U (1, 100) |

| SSWptk | U (1, 100) |

| pcpt | U (1, 2000) |

| gvpt | U (1, 5000) |

| eijpt | U (1, 100) |

| NIpit | U (1, 100) |

| QVt | U (0, 1) |

| Qt | U (0, 1000) |

| OTt | U (0, 1) |

| CCRt | U (0, 1) |

| NIpct | U (1, 100) |

| MinRt | U (0, 1) |

| Nt | U (1, 2000) |

| ψt | U (1, 100) |

| scfijp | U (1, 1500) |

| sctkip | U (1, 1500) |

| scsjkp | U (1, 1500) |

| ekdpt | U (1, 100) |

| NIpkt | U (1, 100) |

| ROt | U (1, 10) |

| At | U (1, 10) |

| CRt | U (0, 1) |

| St | U (1, 10) |

| NIpdt | U (1, 100) |

| scpt | U (1, 1000) |

| ANtaxt | U (1, 100) |

| IRPt | U (1, 100) |

| ctrt | U (1, 100) |

| curt | U (1, 100) |

| CWRt | U (0, 1) |

| Importance of parameter | Desired limit | Performance variable |

|---|---|---|

| 0/2 | 22,000,768 | Lower-income limit |

| 0/1 | 12,000,000 | The upper limit of environmental impact |

| 0/15 | 35,0000,000 | Maximum social impact |

| 0/1 | 1 | Low limit of the instantaneous ratio |

| 0/1 | 0/6 | High debt to asset ratio |

| 0/15 | 0/04 | The low asset return rate |

| 0/2 | 0/1 | A low limit on return on equity ratio |

The design problems were coded and solved with the software LINGO Version 19 on a personal computer with an Intel CORE I7 @ 2.40 GHZ CPU and 8 GB internal RAM. The solutions to the design problems were then recorded. Figure 3 shows the different scenarios and the effects of the scenarios on CPU time. When comparing the solution approaches, it can be seen that the time required to solve the problem also increases as the size of the problem increases.

In this study, three performance dimensions of sustainable development together with four financial indicators were modeled on a target using the weighted ideal planning approach. Weighted ideal planning allows the decision maker to make different decisions by changing the weighting of the importance of the ideals and observing the effects of changing the importance of the ideals. The present study is also modeled and solved based on the information of a real sample. Table 5 summarizes the results of the model. It is noteworthy that the results are expressed based on the sum of the results of the four periods. According to this study, the income is higher than the expected minimum and the deviation from the economic ideal is close to the ideal. There is also a deviation toward the ideal in the social dimension. However, there is also a deviation toward the ideal in the environmental impact in the social dimension, but the environmental impact has exceeded what is permitted. This is due to the low weighting of the environmental dimension. Among the financial indicators, this is the only indicator that does not deviate in the direction of the ideal, as the indicator is also of minor importance.

| Outputs of the model | Performance variable | ||

|---|---|---|---|

| 0 | 2,034,250,015 | 213,4257,813 | Income |

| 0 | 12,125,690 | 131,246,240 | Environmental impact |

| 334,475,400 | 0 | 342,575,432 | Social impact |

| 0/005 | 0 | 0/995 | Instant ratio |

| 0/065 | 0 | 0/535 | Debt to asset ratio |

| 0 | 0/015 | 0/055 | Asset return rate |

| 0 | 0/018 | 0/118 | Return on equity ratio |

To examine the impact of the physical integration of financial integrity, this part of the investigation deals with the sensitivity of cash flow ideals. Accordingly, the weight of the importance of the financial ideals is set to zero and the model is solved with only three economic, environmental, and social ideals and in the same proportion as before (normalized). The results show that the elimination of the ideals related to the financial indicators leads to lower incomes and the financial indicators deviate from the ideal; however, improvements can be seen in the environmental and social performance of the model. According to Table 5, the elimination of the financial ideals resulted in a 4.6% reduction in income, a 7.6% reduction in environmental impact, and a 2.3% reduction in social impact. Examining the changes in all four financial indicators shows that these indicators are far from ideal. Look for environmental and social performance to move closer to the ideal and away from income performance. Ideally, you should be aware that taking the financial indicators into account leads to the control of income performance. By eliminating the indicators, the amount of income has decreased despite maintaining the importance of the three ideals of income, environment, and society. The results of this sensitivity analysis can be seen in Table 6.

| Performance variable | The nonfinancial model output value during the disaster | The output amount of the financial model during the disaster |

|---|---|---|

| Income | 200,003 | 278,134 |

| Environmental impact | 122,161 | 146,364 |

| Social impact | 335,832 | 342,575 |

| Instant ratio | 0/83 | 0/995 |

| Debt to asset ratio | 0/69 | 0/535 |

| Asset return rate | 0/048 | 0/055 |

| Return on equity ratio | 0/101 | 0/118 |

5. Conclusions and Future Research

The COVID-19 pandemic is having a significant impact on SC finance. The disruption of supply and demand is causing economic chaos and business disruption for companies, their customers, suppliers, and affiliated service providers. To mitigate the financial disruption caused by COVID-19, companies are turning to SC finance solutions to stabilize liquidity and maintain solvency. The pandemic has caused financial disruption in SCs and destabilized small and medium-sized enterprises in particular. To mitigate the financial disruption caused by COVID-19, companies are turning to SC financing solutions to stabilize liquidity and maintain solvency. The pandemic forced several companies to seek alternative and innovative ways of SC financing to keep SC funding stable in the face of the pandemic.

The SC funding ecosystem has reacted early to the COVID-19 crisis and some companies have explored new ways to fund their SC. The COVID-19 catastrophe has prompted treasurers around the world to make greater use of trade finance instruments to ensure faster access to FSC. Overall, the pandemic has highlighted the importance of SC financing for maintaining liquidity and solvency in times of crisis. The research results show the positive impact of financial indicators on the economic performance of the main program of a SCLSC; however, the consideration of financial indicators reduces the performance of the social and environmental dimension; therefore, it can be said that the integrated physical-financial design of the main SC planning leads to the strengthening of the economic dimension of the chain.

For an SC to survive and develop in the long term, it must grow in three dimensions: economic, environmental, and social. The ideal planning method was used to balance the objective nature of the model and the model was implemented in a concrete numerical example in the industry. A multiperiod and multiproduct model is proposed that takes into account production planning as well as distribution and waste collection. The results of this study show that the financial indicators are positively correlated with the economic performance of the main program of a stable, closed SC. However, the consideration of financial indicators leads to a deterioration of the social and environmental performance of the chain. Therefore, integrating the financial and physical aspects of SC planning can be seen as strengthening the economic dimension of the chain.

In this research, the main planning model for an SSC in the form of a multiproduct and multiperiod system in the plastics industry was presented using ideal planning. The objectives of the proposed model are maximizing income, minimizing negative environmental and social impacts, optimizing current ratio and gearing ratio, and maximizing return on investment and return on equity. Based on the ideal planning framework, a desirable threshold is considered for each of the above objectives, and the model’s final objective function minimizes the amount of deviation from the desired values. The physical decisions made include the amount of direct and reverse material flow between the production and pickup facility and the customer. Once the physical flow decision has been made, the financial results of the model are determined. Since the financial results of the model are considered in the objective function, the ideal boundary of the financial indicators influences the physical decisions. The analysis of the results shows that the inclusion of financial targets and indicators leads to improved profitability and that profitability decreases when the financial indicators are removed from the model.

The reduction in profitability in the proposed SSC core planning model means an improvement in the environmental and social performance of the SC. It can be concluded that the impact of financial and physical integration is limited only to the economic dimensions of SC and that the environmental and social dimensions of the chain are negatively affected by considering the financial indicators; therefore, considering the financial dimensions is recommended for situations where economic objectives are a priority for decision-makers. The development of the three indicators mentioned above shows that increasing the return on the non-financial model of equity is not only risky but also reduces the risk of nonrepayment of debt in the short and long term, creating ideal conditions for the investor. Consider the demand, production, and customer returns of the waste model. In addition, the model offered in this study can serve as a basis for SSC main planning in other industries, and its impact on the needs and requirements of other industries will be explored.

Nomenclature

-

- SC

-

- Supply chain

-

- CLSC

-

- Closed-loop supply chain

-

- SCN

-

- Supply chain network

-

- FSC

-

- Financial supply chain

-

- GP

-

- Goal programming

-

- SCM

-

- Supply chain management

-

- SCLSC

-

- Sustainable closed-loop supply chain

-

- SCLSCN

-

- Sustainable closed-loop supply chain network

-

- SCLSCND

-

- Sustainable closed-loop supply chain network design

-

- CLSCN

-

- Closed-loop supply chain network

-

- GCLSCN

-

- Green closed-loop supply chain network

-

- SSC

-

- Sustainable supply chain

-

- GSCM

-

- Green supply chain management

-

- SSCM

-

- Sustainable supply chain management

-

- MILP

-

- Mixed-integer linear programming

-

- SCND

-

- Supply chain network design

-

- SEO

-

- Social engineering optimizer

-

- MO

-

- Multiobjective

-

- MOMINLP

-

- Multiobjective mixed integer nonlinear programming

-

- COVID-19

-

- Coronavirus

-

- ESG

-

- Environmental, social, and governance

-

- AHP

-

- Analytic hierarchy process

-

- OWA

-

- Ordered weighted average

-

- MIP

-

- Mixed-integer programming

-

- MCDM

-

- Multicriteria decision-making

-

- CO2

-

- Carbon dioxide

-

- TBL

-

- Triple bottom lines

-

- MOO

-

- Multiobjective optimization

-

- MO

-

- Multiobjective

-

- MOP

-

- Multiobjective problem

-

- SCN

-

- Supply chain network

-

- RSM

-

- Response surface modeling

-

- CPU

-

- Central processing unit

-

- EOL

-

- End-of-life

Ethics Statement

The authors have nothing to report.

Consent

The authors have nothing to report.

Conflicts of Interest

The authors declare no conflicts of interest.

Author Contributions

Sina Abbasi: conceptualization, methodology, software, resources, data curation, formal analysis, supervision, investigation, validation, visualization, and writing the original draft. Amin Khoshkenar: conceptualization, methodology, software, resources, formal analysis, validation, and visualization. Burcu Devrim İçtenbaş: methodology, software, data curation, formal analysis, and validation. Shayan Etemadifar: methodology, software, resources, data curation, and formal analysis. Amin Sheykhian: reviewing and editing, validation, and data curation.

Funding

No funding was used in this study.

Open Research

Data Availability Statement

The data used to support the findings of this study are available from the corresponding author upon reasonable request.