A Comparative Study on Prediction of Human Capital Efficiency in Acquisition Using the Neurofuzzy System

Abstract

This study aims to identify the relevance of using the results obtained by applying the adaptive neural fuzzy inference system (ANFIS) methodology to make managerial decisions related to acquisitions as a strategic option. The aim of this study is to identify the outcomes of changes in human capital, represented by the human capital efficiency (HCE) indicator, which occurred as a consequence of the acquisition process, and to determine the impact of such changes on operating profit (OP), return on assets (ROAs), and productivity (PRO). An ANFIS was used to classify OP, ROA, and PRO based on the HCE before and after acquisition. Skillful prediction could play a pivotal role in management and improve socioeconomic domain. HCE recorded better prediction of PRO (R2 = 0.937) and ROA (R2 = 0.940) after acquisition than before acquisition (R2 = 0.649 and R2 = 0.674, respectively) for all dataset. The influence of HCE on OP remained substantial both prior to (R2 = 0.896) and subsequent to (R2 = 0.938) the acquisitions. The study considering different input parameters simultaneously is believed to be the first on a small scale and to attract interest not only for management and business but also for a wide range of one interested in different applications of ANFIS.

1. Introduction

Companies employ different growth strategies in accordance with their current environmental circumstances and business opportunities to achieve predetermined strategic objectives. Acquisitions, as a viable strategic option, are an efficient approach for achieving the targeted business performance. This is especially important in the current market environment, which is characterized by intensifying competitive pressure and deteriorating financial conditions that make it difficult to invest in new organizational capacity and establish new client bases. Due to their immanent strategic character, acquisitions enable companies to grow more quickly, increase market power and profitability, and increase total value for stakeholders [1]. In accordance with the resource-based view (RBV) of the firm, acquisitions may also be driven by the purchase of rare and valuable resources that cannot be obtained in the market in any other manner. This category of resources should certainly include employees and their knowledge, as well as other intangible elements of the organization’s assets [2]. As opposed to earlier points of time, when acquisitions were carried out solely for the purpose of achieving economic and technical benefits, acquisitions nowadays are used as a means of achieving competitive advantage in a different way, in which knowledge, technology, software, and other elements of intangible assets are of central importance. Transformational changes occurring in the business sector have presented several avenues for gaining competitive advantage through the utilization of human capital (HC) [3].

Acquisitions provide several benefits to initiators of business combinations. If due diligence is properly completed to evaluate the soft elements of the organization, the acquirer may access the target company’s valuable intangible assets, that is, its HC [4]. In a knowledge-based economy, HC is an important determinant of sustainable competitive advantage because it is an asset that is rare, valuable, inimitable, and nonsubstitutable [5–7]. Furthermore, the RBV of the firm emphasizes that resources that are rare, valuable, and difficult to imitate should be intangible and based on implicit or explicit knowledge rather than tangible such as physical assets (land, buildings, machinery, and financial assets). The exchange of knowledge between companies performing the process of acquisition enables the development of a new form of knowledge that can be effectively used in innovative products, services, and business processes. Newly created knowledge should be more useable and valuable than the particular knowledge of the companies entering the acquisition process and, as such, should provide added value and a synergistic effect [8, 9].

Reviewing the existing research and articles, it can be concluded that there are few studies analyzing the postacquisition effects of acquisitions on HC and performance. The results of a study conducted by Siegel and Simmons [10], which focused on HC as a component of intellectual capital indicated that acquisitions had a positive effect on increasing productivity (PRO) and performance. According to certain studies, the impacts of horizontal acquisitions are greater because the employees of the two organizations possess complementary expertise that they can easily integrate [11, 12]. In horizontal acquisitions, the similarity in HC may demotivate employees for sharing knowledge over time. Several studies have shown that the positive impact of HC on performance can be greater in organizations whose employees possess diverse knowledge and are willing to share it and learn something new [13–15]. It is particularly characteristic of international acquisitions for foreign companies to introduce new methods of work, management, and technological capabilities [16–18].

HC is the most frequently examined component of intellectual capital in the postacquisition phase, yet there is little research on this topic. As with intellectual capital in general, enhancing the efficiency of HC following an acquisition positively affects the performance of acquired organizations [19–22]. Therefore, the improvement in HC that can occur after the implemented acquisitions leads to the development of new competencies that increase employee PRO and, therefore, have a positive effect on the achieved performance [23]. HC obtained through continuous development and learning is an essential factor in determining PRO and may significantly contribute to achieving high levels of performance [24, 25].

Although the positive impact of HC on financial performance has been confirmed in the case of horizontal acquisitions, the effect is greater in the case of diversifying acquisitions because it involves specific knowledge of employees from different fields [13–15]. A higher value of HC after acquisition has a positive impact on investment, assets, profitability, and employee PRO [19–21]. A relatively limited number of studies on the impact of HC changes on the performance of acquisitions in the postacquisition period is the motivation for this research.

In response to financial constraints and competitive pressures, acquisitions are strategic responses that enable companies to capitalize on distinctive resources to drive growth and value creation. HC transformation is a critical component of this process, as intangible assets such as employee expertise and innovation are essential for organizational success. The integration of knowledge between acquiring and target companies, the application of new or advanced management approaches and techniques, the development of existing employees, and the better application of existing knowledge after acquisition enhance human capital efficiency (HCE), fostering synergistic knowledge capable of being used for innovative products, services, and business processes. Integration of resources after acquisitions can support collaboration between employees, as well as resource optimization, further amplifying the impact of HC on performance. Postacquisition improvements in HCE can lead to increased PRO, profitability, and operational efficiency, contributing to achieving long-term sustainability and value creation.

1.1. Objective of the Paper

Our study aimed to identify the impact of acquisitions on the efficiency of HC. The purpose of this study is to predict the selected performance of acquired companies using the combined application of the value-added intellectual coefficient (VAIC™) method and the ANFIS method to improve the managerial decision-making process in the implementation of acquisitions. The VAIC is a metric that was introduced by Pulic to assess the efficiency of intellectual capital [26]. The VAIC is concerned with the efficiency of three forms of capital: HC, structural capital (SC), and physical and financial capital employed (CE), with the observed categories being able to be analyzed separately or combined. On the other hand, the adaptive neurofuzzy inference system (ANFIS) is a neural network model that focuses on the Takagi–Sugeno fuzzy inference system (FIS) [27]. ANFIS is a hybrid method that integrates the capabilities of neural network and fuzzy system, therefore leveraging the benefits offered by both techniques.

By considering the available studies, we were able to identify those in which ANFIS is used to analyze the HC in a broader context. The ANFIS method was used to predict work efficiency as a function of noise level, type of tasks, and exposure times [28]. Compared with this study, which is focused on the work efficiency of individual performers, our study is focused on the efficiency of the total available human capital in organizations. In the second one, ANFIS was used for the evaluation of intellectual capital in business and education [29]. As an indirect measure for intellectual capital, consumer market capital was observed via qualitative methods, namely, interviews with a group of undergraduates. In contrast to the present study, our research is centered on the concept of HC, which has been assessed using a quantitative approach. Also, a summary of prior research on the influence of HC on business performance pre- and postmergers and acquisitions reveals shortcomings that present opportunities for further investigation. They generally overlook the relationship between HCE and cross-level performance, failing to identify the causes of performance changes and only reporting differences in performance postacquisition [20]. Furthermore, in the evaluation of HC, composite indicators that evaluate HCE at the organizational level were not used but indicators related to the specific characteristics of employees were used [10, 19].

Several reasons may be provided to illustrate the originality and novelty of this study. First, the quantitative VAIC™ and ANFIS methods were used in this study. In previous studies, each of the aforementioned methods was employed separately, but their combined application in the same study was not revealed. Previous studies have shown that ANFIS can model nonlinear and complex relationships in ambiguous fuzzy modeling environments [30]. They are reliable for handling sophisticated parameters in decision-making and provide more accurate predictions than regression models, which are typically employed in studies applying the VAIC™ method. This provides a strong foundation for managerial and investment decisions. Therefore, we decided to use the ANFIS technique to examine the relationships between the input variable (HCE) and three output variables (operating profit (OP), return on assets (ROAs), and PRO), which were derived from the VAIC™ method and with the closing of an important business transaction such as an acquisition. HCE is an essential component within the VAIC™ model, wherein it is determined by a relationship between value added and investment in HC [31], while a company’s ROA evaluates its operational efficiency in generating profits from its assets [32]. Our study combines VAIC™ and ANFIS methods to analyze dynamics of HCE in acquisition and its impact on organizational performance, leveraging on advantages of both techniques. While VAIC™ measures components of intellectual capital efficiency by calculating composite indicators, as a static method, it lacks the capacity to capture nonlinear relationships and complex interactions between “cause and effect” indicators. ANFIS, a hybrid of fuzzy logic and neural networks, is integrated to address this limitation while excelling in modeling nonlinear and complex relationships, enabling a more nuanced understanding of how HCE interacts with performance metrics such as OP, ROA, and PRO. This combination provides a holistic perspective on HC’s role in acquisitions, ensuring rigorous measurement and detailed analysis of its impact on performance. Second, the study includes data on acquisitions for the period between 2004 and 2021, which is a sufficiently lengthy timeframe. Third, data for the computations were sourced from official financial reports presented 3 years before the acquisition and 3 years after the acquisition. In reviewing the available research, we determined that there is a study that includes “three plus three” years in mergers [33], as well as a study related to mergers and acquisitions [34]. However, no study has focused entirely on acquisitions over the past 2 decades. Fourth, the sample covers all acquisitions in the Republic of Serbia during the specified period in which the acquirer took over more than 51% of the target company’s ownership. Studies that analyze the performance of acquisitions in both the preacquisition and postacquisition periods are relatively common in developed economies [35–38]. However, such analyses remain limited across much of Europe, particularly in developing and transitional economies. The Republic of Serbia, as a representative of a developing country within Southern Europe, presents a unique and underexplored context, including gradual institutional reform, regulatory improvements, foreign investment liberalization, and market integration efforts, especially following its EU accession aspirations. Despite this progress, the number of empirical studies examining acquisition outcomes in Serbia remains limited. Notably, only a few studies have investigated some aspects of acquisition outcomes in Serbia. For example, Marković and Savović [39] reported improved postacquisition performance in the cement industry, while Savović [40], in a qualitative study, highlighted the role of transformational leadership in postacquisition success. However, these studies neither explicitly focus on the impact of HC on postacquisition outcomes nor utilize advanced predictive methodologies such as ANFIS. This makes the present study particularly valuable.

The paper is structured as follows. After the introductory remarks, a review of the literature is presented. The next section explains the data and indicators as well as the methods used in the study. After that, the results are presented in a separate section, followed by a section related to the discussion of the obtained results. Finally, concluding remarks are provided, which include the explanation of the potential limitations of the study and directions for future research.

2. Theoretical Background

HC represents a combination of knowledge, skills, experience, and the overall ability of employees to perform tasks and achieve organizational goals [41, 42]. HC is the most important and prevalent component of intellectual capital [43–45]. These are intangible resources associated with employees, such as knowledge, skills, experience, creativity, innovation, and eagerness to learn and develop [46, 47]. HC encompasses the overall health of individuals and employees [25]. Cecchi [48] highlights that HC includes the values and organizational culture of a company, yet it is something that the company cannot own itself. HC is developed through education and learning in the workplace, but it also depends on employees’ attitudes toward life and work [41]. It can be either generic or specific, but the latter is more important for establishing a competitive advantage because it represents competencies unique to employees in a particular organization [47]. In other words, HC may be a source of competitive advantage if it contains employees’ tacit knowledge, which is difficult to identify, codify, and imitate [49]. In contrast to other components of intangible assets, however, an organization cannot own HC, which necessitates special efforts to identify, develop, and retain employees’ valuable knowledge [50]. HC stands out as a pivotal element of intellectual capital, conferring a competitive edge at the microeconomic level due to its encompassment of specific knowledge, skills, and innovation held by employees. Simultaneously, there is an emphasis on the assertion that the efficiency of HC serves as a determinant of economic development. However, the acknowledgment that employees can carry their HC with them when they leave organizations underscores the necessity for companies and national economies to invest in and retain individuals possessing valuable and unique knowledge [45, 48]. It is crucial to note that HC extends beyond mere development and investment; effective implementation is paramount. The presence of valuable HC within a company holds significance only when management adeptly harnesses and leverages it [51]. HC constitutes the amalgamation of all knowledge and qualities that influence a company’s performance. Frequently regarded as the fifth factor of production alongside traditional elements such as land, labor, capital, and entrepreneurship, HC’s significance lies in a company’s capacity to cultivate and leverage the distinctive knowledge and energy of its workforce [52]. Because of aforementioned, the value of a company should be evaluated within the framework of its capability to develop and harness employees’ unique knowledge and energy. Thanks to HC, companies can devise and implement innovative approaches to resource utilization, as well as contemporary strategies for growth and development aligned with strategic goals [51]. Augmenting HC is often associated with an elevation in employees’ PRO within an organization [48].

The significance of HC should also be contextualized within the realm of sustainable development, particularly pertinent in today’s era of limited energy resources. The innovation resulting from HC gives rise to the formulation of new business models and management practices geared toward carbon emission reduction. This, at a macro level, contributes to sustainable development and mitigates the adverse environmental impact of business operations, serving as another advantage of HC and a determinant of competitive advantages [53]. Apart from enhancing economic development, HC ensures a positive environmental impact, underscoring the necessity of investing in employees’ knowledge [54]. The sustainability of HC is also significant in accelerating the digitalization of business processes, given that knowledge, technical skills, creativity, and innovation are fundamental factors in the digital economy [55]. In the digital era, the education and development of HC emerge as pivotal strategic decisions for human resource managers [51]. Examining HC in the context of the digital economy, Rodchenko et al. [55] identify leadership, self-development abilities, adaptability, mobility, organizational culture, creative and intellectual potential, and willingness to learn as determinants of HCE.

Nevertheless, due to the challenge of independently developing knowledge resources and capacities, companies frequently resort to acquiring other companies along with their HC.

In accordance with the postulates of the resource-based theory of the firm, the need to acquire valuable and distinctive intangible resources in the acquisition process is emphasized. The goal is to improve organizational performance by acquiring intellectual resources and bringing them to a higher level than before to the acquisition. In general, acquisitions are approached whenever an organization cannot achieve certain performance independently. Consequently, performance in acquisition processes, particularly in the postacquisition era, has been the subject of numerous studies in this field. There is no single position in the assessment of organizational performance in the postacquisition period. A number of researchers who have studied various types of performance have shown that the performance of acquired firms increases in the postacquisition period [35, 36, 56, 57]. However, there are also examples where the deterioration of postacquisition performance has been confirmed [35, 37, 38], where the reason is often cited as poorly conducted due diligence, in which the soft resources of the takeover target, such as HC, were not adequately assessed [58, 59]. Companies may regret misjudgments during the due diligence process or its absence. Uncertainty or inaccurate information can evoke negative emotions among employees, emphasizing the need for thorough preparation in acquisition processes, particularly when preserving HC is a priority. Conversely, it is essential to prevent situations where employees develop unrealistic expectations from acquisitions, as this may later result in decreased satisfaction (hangover effect) and attrition from the organization [60]. A potential synergistic effect can result from the unique combination of organizations’ knowledge and intellectual resources throughout the acquisition process. The competencies of their employees stand out as the most crucial success factor since performance in the postacquisition phase depends on the willingness of employees from both firms to collaborate and share resources, knowledge, and information [22]. The synergistic effects in the postacquisition period results from the successful integration of the intellectual capital of two organizations and are supported by three mechanisms: (1) mutual transfer of intellectual resources, (2) sharing of knowledge, and (3) joint development of entirely new knowledge [58].

In certain articles, the effect of individual components on organizational performance was analyzed, with HC being the most frequently cited example. HC has a beneficial effect on performance because a higher degree of employee competence results in quality products and services, innovative and creative behavior, and increased PRO [61–65]. The favorable effect of HC on PRO is also attributable to increased investments in employee training, as employees receive specialized and unique knowledge [63]. A study from the hotel industry revealed that HC is unquestionably essential for successful hotel operations but that its efficiency must be monitored because positive and negative variations over time are possible due to the influence of numerous environmental factors [66]. A study on the development of HC in the context of Industry 4.0 showed that cognitive skills play the most important role, followed by emotional skills and behavioral skills [67]. In addition, prior research has demonstrated that employee development practices and knowledge management have a positive effect on HC [68]. This demonstrates that HC is not a static category but rather a dynamic combination of skills, knowledge, and experience that can be enhanced over time and has measurable positive business effects.

Previous studies have confirmed the relevance of HC for various acquisition outcomes, though often using simple or indirect indicators and without integrating advanced predictive methods. For instance, Ge and Huang [19] modeled the influence of HC, to be measured through proxies such as education and work experience, on postacquisition performance using return-based models like daily abnormal returns. Lee et al. [12] conceptualized HC more broadly as a component of organizational capital, incorporating investments not only in employees but also in IT, marketing, and R&D, while measuring performance via stock returns. Lin et al. [21] operationalized HC through income per employee and examined its effects on indicators such as ROA and earnings before interest and taxes (EBIT, underlining the role of skilled labor in acquisition success. Similarly, qualitative studies by Jordão et al. [22] and Rodríguez-Sánchez et al. [23] identified a general postacquisition increase in HC and emphasized its strategic importance, especially in international acquisitions, though without quantifying its direct performance effects. In contrast to these studies, our research provides a novel contribution in four key domains. First, it focuses explicitly on HCE as a measurable input derived from the VAIC method. Second, it employs the ANFIS method, a robust neurofuzzy inference system capable of capturing complex, nonlinear, and dynamic relationships between HCE and performance, allowing comparison before and after acquisition, and evaluating the difference in effects. Third, it applies this combined approach across a comprehensive national sample of all major acquisitions in the Republic of Serbia between 2004 and 2021, providing a rare case study from a developing European economy. Finally, in contrast to the previously cited studies, this research examines relationship between HC and acquisition performance using three important indicators: ROAs, employee PRO, and OP.

Neurofuzzy systems have found growing applications in the management studies, particularly in marketing and finance. However, their potential in supporting human resource management decisions is also recognized. One notable application is in ranking employees based on performance, as demonstrated by Giotopoulos et al. [69], who used ANFIS to develop a hybrid model that integrates decision rules with fuzzy logic reasoning to gain deeper insights into employee performance drivers. Similarly, Solichin and Saputri [70] applied ANFIS to optimize the selection process for assigning employees to international development programs. Their study, which involved employees in Indonesia, considered variables such as prior performance, job classification, seniority, and personal characteristics to identify the most suitable candidates for new branch offices in Vietnam. Amri et al. [71] also employed ANFIS in the recruitment and selection process, arguing that traditional methods are often insufficient for identifying talented employees. Their findings revealed that ANFIS significantly reduced evaluation errors and increased decision-making accuracy while also enhancing transparency due to the explicit nature of its rule-based structure. In Serbia, Pamučar et al. [72] applied ANFIS in combination with fuzzy mathematical modeling to improve human resource allocation in the Petrohemic industry, demonstrating the system’s efficiency in handling complex, uncertain environments. Moreover, ANFIS has been used to predict work efficiency under varying conditions such as noise exposure and task complexity [28]. In broader organizational contexts, Arab and Forghani [73] used ANFIS to evaluate product and organizational performance although their study relied on survey data, which can introduce subjectivity. Similarly, Pokrovskaia et al. [29] used ANFIS for intellectual capital assessment in education and business using qualitative inputs such as interviews, which may also affect objectivity.

While these studies confirm the versatility and accuracy of ANFIS across various HC and business-related applications, none have explored its use in evaluating the relationship between HCE and organizational performance specifically in the context of acquisitions. The studies using ANFIS to evaluate the effects of HC on the performance of acquisitions, both in the preacquisition and postacquisition periods, do not exist, which support originality to this study. To the best of our knowledge, this study is the first to apply ANFIS to predict postacquisition performance outcomes using financial data, combining it with the VAIC method to provide an objective analysis of HC’s impact in strategic organizational change such as acquisitions. This study introduces a novel methodological approach by evaluating HCE, measured via the VAIC method, with the ANFIS modeling to capture nonlinear dynamics in performance before and after acquisition. Unlike earlier research that relied on linear or qualitative methods, our approach enables a more precise, data-driven analysis across a national sample. Moreover, by comparing ANFIS with traditional models such as multiple linear regression (MLR), we demonstrate that ANFIS significantly improves predictive accuracy, further validating its application in this research domain.

3. Materials and Methods

- 1.

Defining sampling criteria.

- 2.

Formation of a preliminary sample.

- 3.

Data collection and processing.

- 4.

Formation of a final sample.

- 5.

Application of the VAIC™ method.

- 6.

Application of the ANFIS method

Only organizations that were the matter of acquisition could be included in the sample because of objective of the study. The first elimination criterion in this context was the acquisition of at least 51% of ownership by the target company. After defining the sampling criteria, a preliminary analysis and selection of organizations were conducted. During this phase of the research, a large number of acquisitions were identified in which a smaller percentage of ownership was acquired than the predetermined criteria; thus, they were excluded from the preliminary sample. This phase was concluded with a preliminary sample of 140 organizations of various sizes and activities. The analysis and processing of these companies’ financial data in accordance with the established research plan revealed a lack of necessary data in some cases due to the inability to access the required financial reports. Consequently, the sample was reduced to 118 companies whose data were available for further processing and analysis. In the subsequent step, the data collection and processing of the acquired companies were conducted between 2004 and 2021. The manufacturing sector accounts for 62% of the sample structure’s organizations, the service sector accounts for 25%, and the trade sector accounts for 13%.

3.1. Input/Output Data

The model presented in this study establishes relationships between the HCE coefficient (Input) and OP, ROA, and PRO (Output) in two time periods (before and after acquisition). The independent variable in our study was HC, represented by the HCE coefficient, determined using the VAIC™ method. Organizational performance is the dependent variable and is measured using three indicators: OP, ROA, and PRO. The data used to calculate the coefficients were obtained from official financial reports. The evaluation of the efficiency of HC in acquisitions should be based on data that overlaps a sufficiently long time period for changes to occur and be quantified. Vennet [74] suggested that an adequate time interval consists of 3 years before and 3 years after acquisitions, with year of the acquisitions omitted from the analysis, as this is the period during which formal takeover procedures occur and no significant performance or analysis-relevant changes occur. In this study, the aforementioned approach was applied in its entirety, and for the calculation of HCE and performance, data from the financial reports of the acquired companies were used for the 3-year period both before and after the acquisition. The year in which the acquisition was completed was considered a transitional period and was, therefore, unsuitable for observation.

Tables 1 and 2 list the input and output variables before and after acquisitions used in this study, respectively. The main goal was to determine the influence of the HCE coefficient on the given outputs before and after acquisition.

| Input/outputs | Min | Max | Std. | |

|---|---|---|---|---|

| Input | HCE | −37 | 30 | 4.06 |

| Output 1 | OP | −2181 | 258 | 156.74 |

| Output 2 | ROA | −105 | 63 | 14.84 |

| Output 3 | PRO | 0 | 2.5 | 0.24 |

| Input/outputs | Min | Max | Std. | |

|---|---|---|---|---|

| Input | HCE | −7 | 88 | 9.31 |

| Output 1 | OP | −111 | 64 | 19.04 |

| Output 2 | ROA | −32 | 31 | 9.25 |

| Output 3 | PRO | 0 | 0.38 | 0.07 |

3.2. Measurement

A unique methodology for measuring HC still does not exist [75], which highlights the importance of identifying relevant approaches for quantifying this element of intellectual capital. Years ago, various models for measuring HC have emerged, many of which are rooted in broader intellectual capital frameworks. For example, the Scandia Navigator model regarded HC as one component of intellectual capital, alongside SC. It employed a hybrid approach that integrated both quantitative and qualitative indicators across four organizational focus areas: financial, customer, process, and renewal and development [76, 77]. Similarly, Bontis [78] proposed a qualitative model using 20 statements to assess HC, as well as structural and relational capital. Vidotto et al. [79] followed a comparable path, developing a scale aimed solely at measuring HC. However, these qualitative approaches are inherently vulnerable to subjectivity and bias, depending heavily on respondent perception and the quality of the research process.

From a quantitative perspective, some models calculate HC by aggregating wages, taxes, and training costs [80]. Yet, these frameworks often interpret such employee-related expenditures as costs rather than investments, failing to capture their value-creating potential. Veselinović et al. [81] attempted to link the value of intellectual capital to employee investment, but their model includes complex variables such as depreciation, amortization, and EBIT, making practical application difficult. Gates and Langevin [82] suggested that HCE should reflect both financial inputs and intangible outputs such as innovation and creativity. Kujansivu and Lönnqvist [83] also noted that relying solely on employee earnings is insufficient and stressed the importance of treating these expenditures as long-term investments.

The VAIC method directly addresses many of these limitations, which is why it stands out as frequently used and favored approaches for measuring the components of intellectual capital. VAIC was developed by A. Pulić with the aim of supporting management in evaluating company potential and capabilities [26]. Unlike subjective or highly complex models, VAIC is grounded in standardized, objective, and publicly available financial data, ensuring consistency and transparency. As the required data are derived from audited financial reports, the reliability of the input variables is significantly higher than that of survey-based methods. Moreover, the simplicity, replicability, and scalability of VAIC make it especially suitable for longitudinal, multicompany research designs, such as our study, which require methodological consistency across different time periods and organizational contexts.

3.3. ANFIS Methodology

Because of its noise immunity, strong normalization, robustness, generalization capabilities and fault tolerance, the ANFIS [86] can be effective in determining and classifying HC for the prediction of OP, ROA, and PRO. As ANFIS represents a system of intelligent techniques that integrates a FIS and an artificial neural network [87], it is used to assess the relevance and effect of intangible resources on performance [88, 89]. ANFIS is a fusion of neural networks and fuzzy logic, constructing predictive models that mimic the brain’s functionality, comprising adaptive and fixed nodes connected by links. Adaptive nodes dictate learning rules for minimizing errors. The application of neural networks brings the advantage of employing universal approximators, enhancing the membership function and knowledge creation based on input variables [90]. ANFIS aims to refine the membership function to develop comprehensive insights [91–93].

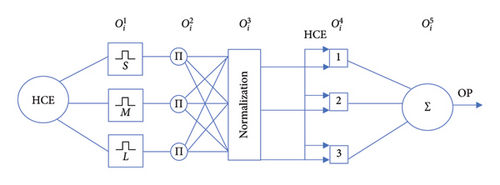

Given ANFIS’s constraint of allowing only a single output, we develop separate ANFIS models for each specific output variable (OP, ROA, and PRO), both before and after acquisition. This decision was made to clearly illustrate their respective dependencies on HCE. In Figure 1, we present the ANFIS architecture focusing solely on one output parameter, denoted as OP. It is important to note that the architectures for other output parameters, ROA and PRO, remain identical, differing only in the specific output parameter they represent.

Figure 1 represents ANFIS layers, where A1 is one of the three membership functions describing the input variable HCE and Y is the set of output variables (OP, ROA, and PRO).

- •

Layer 1: the nodes of the first layer () represent the quantified values of the input datasets. Each node is described by one of the Gaus bell-shaped membership functions defined as follows:

() -

where {ai, bi, ci} is the parameter set and x is the input.

- •

Layer 2: each node in this layer calculates the minimum input value of the fuzzy neural network. The output values of the Layer 2 nodes are the rule signification:

() - •

Layer 3: each i-node in this layer calculates the total weight of i-rule from the rule base using the following equation:

() - •

Layer 4: this layer has three nodes that represent the output values. Each node in this layer is connected to a normalized neuron from the previous layer. A defuzzification neuron computes the weighted consequent value of a given rule as follows:

() -

where n is the total number of rules in the fuzzy rules’ base.

- •

Layer 5: the only node of the fifth layer is the fixed node in which the output result of the ANFIS is calculated. This is a fuzzy set that determines the membership degrees of the possible values of OP, ROA, and PRO. Defuzzification was performed at the fifth level node. The output value is a real number.

()

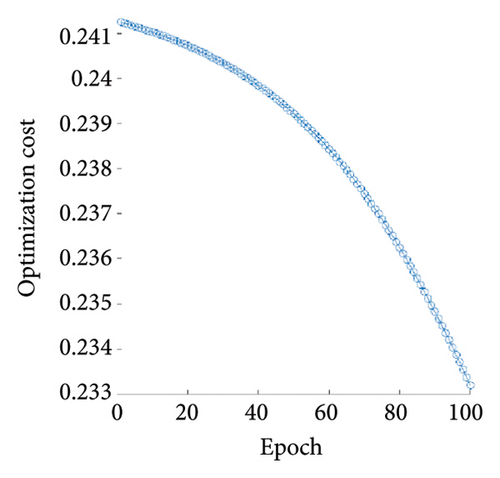

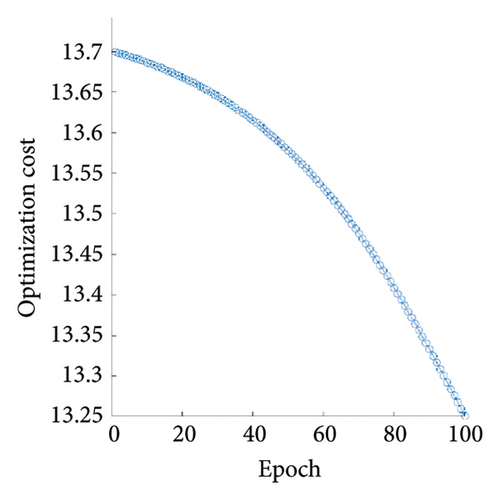

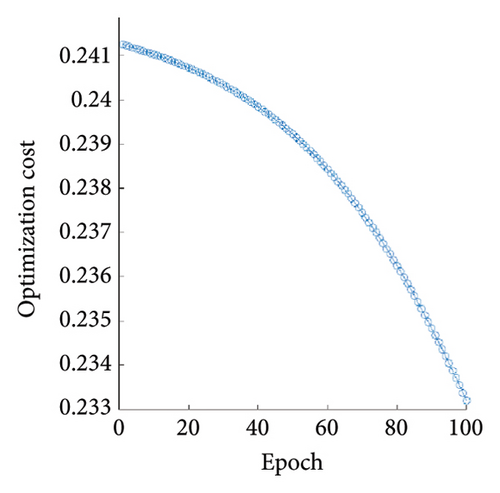

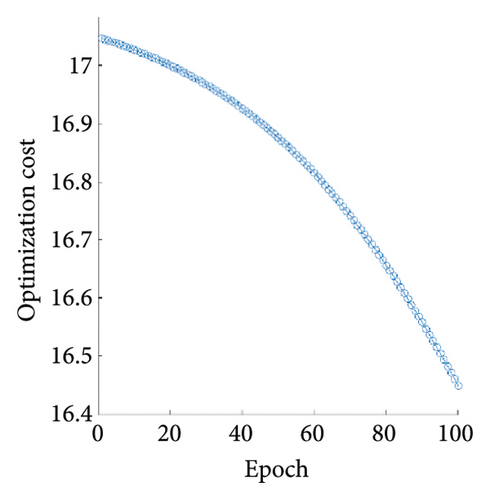

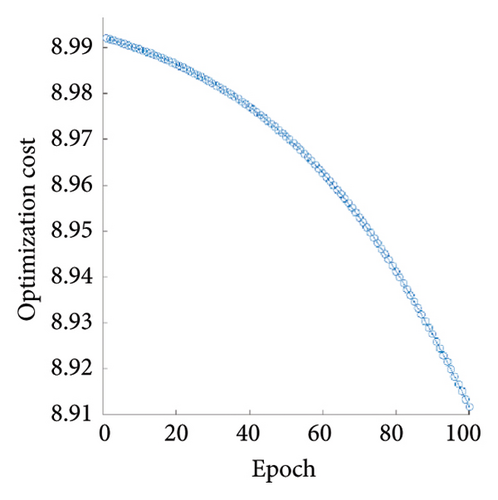

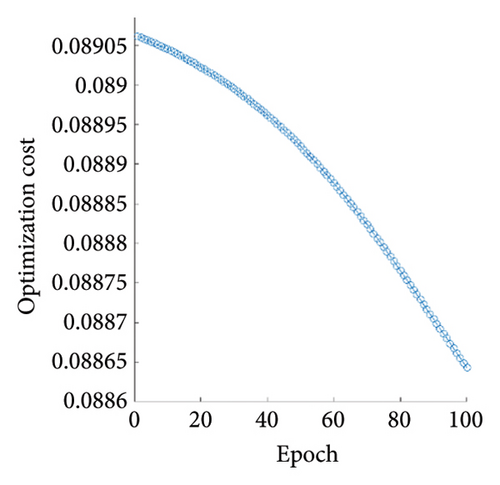

ANFIS training was performed in 100 epochs, so RMSEs are represented in Figure 2. It clearly demonstrates that the RMSE value decreases as the number of epochs increases. This illustrates the decrease in error when the model undergoes training to achieve accuracy.

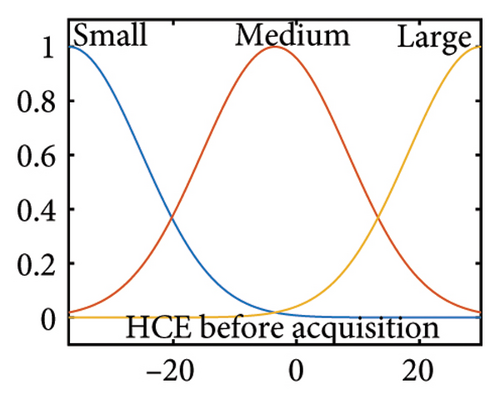

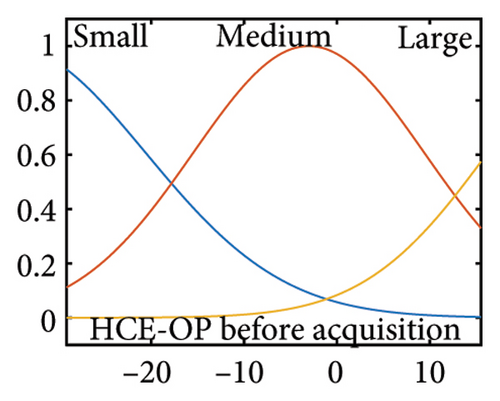

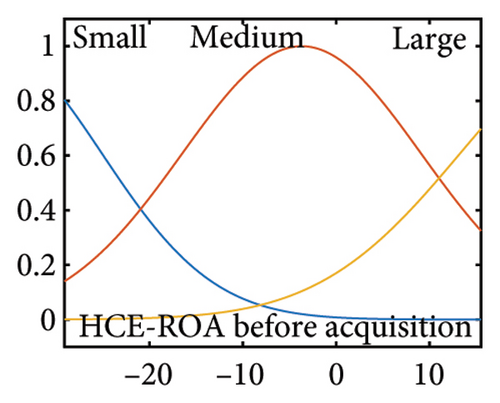

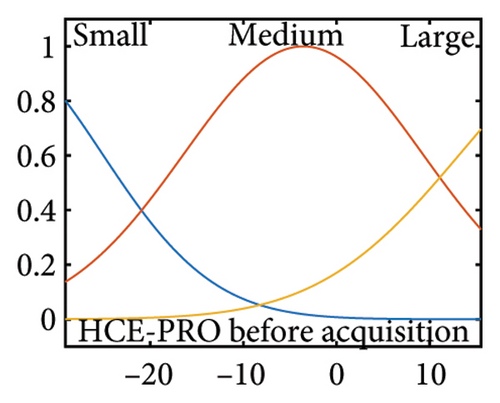

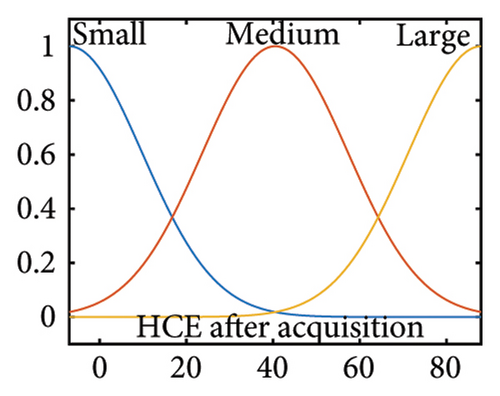

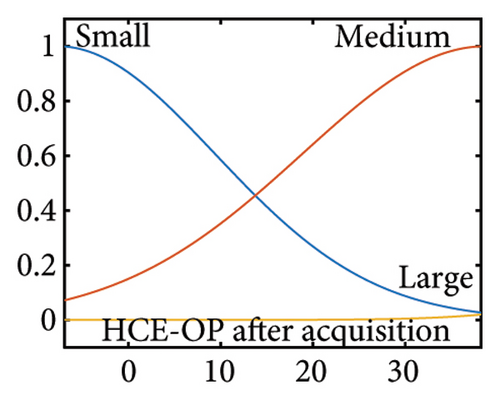

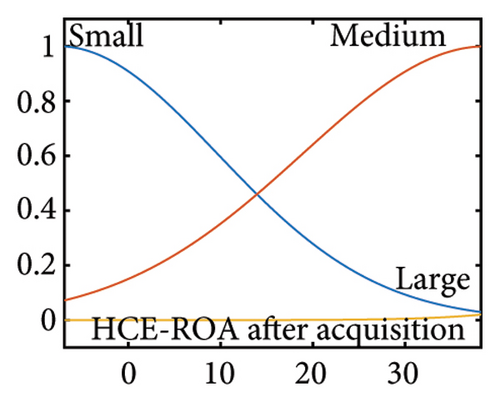

The output values (OP, ROA, and PRO) are computed using a “Sugeno” FIS with a single input fuzzy set, denoted as HCE. This fuzzy set is characterized by three Gaussian membership functions, each defined by two parameters (μ and σ), as shown in the left part of Figure 3. Throughout the learning process, these membership functions underwent modifications in their shapes. The updated appearance of the functions is illustrated in the right portion of Figure 3. Table 3 presents the parameters of both input and output variables before and after tuning, as well as before and after acquisition. In our analysis, we used crisp data for the output in the “Sugeno” FIS, which can either be crisp or linear functions.

| Input/output data | HCE | OP | HCE | ROA | HCE | PRO | |

|---|---|---|---|---|---|---|---|

| Before acquisition | |||||||

| FIS | Small | 11.86, −37 | −2181 | 11.86, −37 | −105 | 11.86, −37 | 0 |

| Medium | 11.86, −3.5 | −961.5 | 11.86, −3.5 | −21 | 11.86, −3.5 | 1.25 | |

| Large | 11.86, 30 | 258 | 11.86, 30 | 63 | 11.86, 30 | 2.5 | |

| ANFIS | Small | 14.8, −35.38 | −1102.64 | 11.9, −36.98 | −5.78 | 11.84, −37 | 0.28 |

| Medium | 12.46, −3.03 | −6.99 | 12.81, −3.7 | −13.32 | 12.81, −3.57 | 0.46 | |

| Large | 13.2, 29.42 | 369.25 | 15.01, 28.25 | 60.76 | 15.06, 28.33 | −0.84 | |

| After acquisition | |||||||

| FIS | Small | 16.81, −7 | −111 | 16.81, −7 | −32 | 16.81, −7 | 0 |

| Medium | 16.81, 40.5 | −23.5 | 16.81, 40.5 | −0.5 | 16.81, 40.5 | 0.38 | |

| Large | 16.81, 88 | 64 | 16.81, 88 | 31 | 16.81, 88 | 0.75 | |

| ANFIS | Small | 17.06, −7.68 | −12.36 | 17.23, −7.55 | −1.83 | 16.83, −7.9 | 0.21 |

| Medium | 19.89, 38.73 | 108.69 | 19.92, 38.77 | 24.42 | 19.62, 38.76 | −0.13 | |

| Large | 17.7, 87.84 | −4846.61 | 17.73, 87.84 | −1246.56 | 18.23, 87.71 | 14.72 | |

We divided the database, consisting of 325 input/output data pairs, into two sets. The first set, comprising 280 input/output data pairs, was used to train the ANFIS model. The remaining 45 data pairs were reserved to test the model’s performance on unknown input data.

- •

IF HCE is Small, THEN OP is Small and ROA is Small and PRO is Small;

- •

IF HCE is Medium, THEN OP is Medium and ROA is Medium and PRO is Medium;

- •

IF HCE is Large, THEN OP is Large and ROA is Large and PRO is Large.

The rule base and membership functions of the fuzzy logic systems were developed based on the authors’ prior experience with applying fuzzy logic in both economic and engineering contexts.

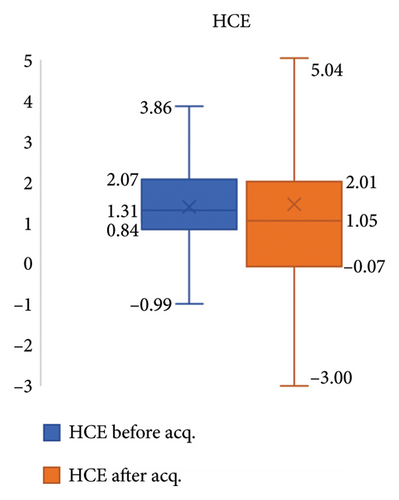

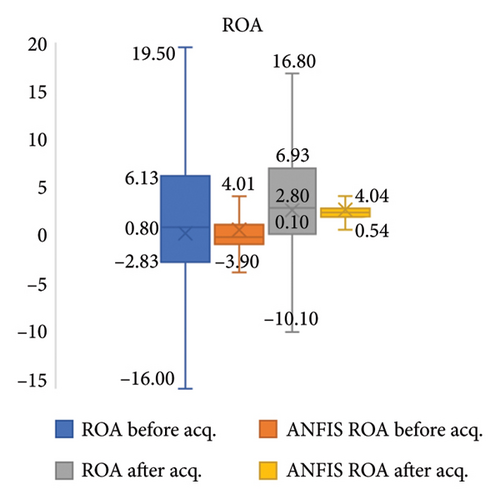

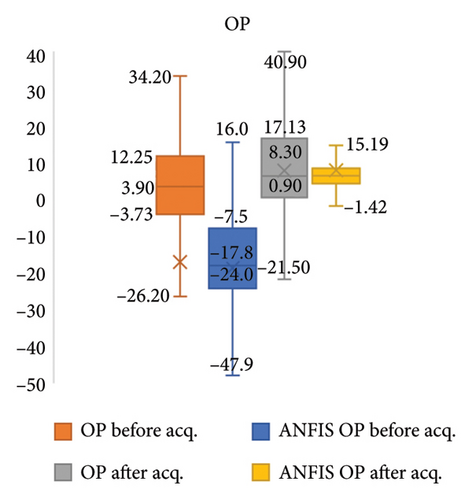

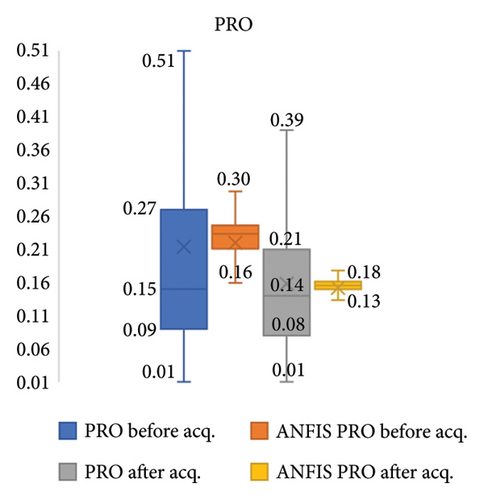

Figure 4 presents box-plot diagrams showing additional data related to the median, first and third quartiles, as well as the lower and upper limits of the datasets used in our calculations before and after the acquisition.

4. Results

- •

≫ [data] = HCE1;

- •

≫ trn_data = data(1:2:end,:);

- •

≫chk_data = data(2:2:end,:);

- •

≫[data] = HCE2;

- •

≫trn_data = data(1:2:end,:);

- •

≫chk_data = data(2:2:end,:);

There were two sets of data. One is before acquisition (HCE1), and the other one is after acquisition (HCE2). The function “exhsrch” conducts an exhaustive search of the available inputs to identify the set of inputs that have the greatest impact on the HCE, before and after acquisition.

- •

≫ exhsrch(1,trn_data,chk_data);

- •

≫ exhsrch(2,trn_data,chk_data);

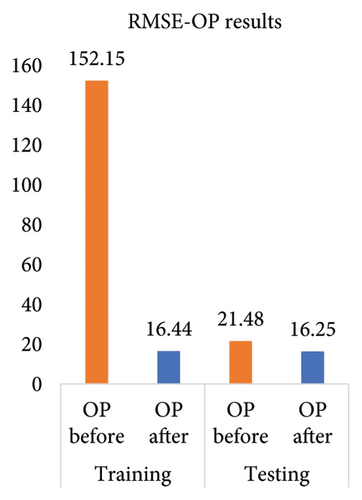

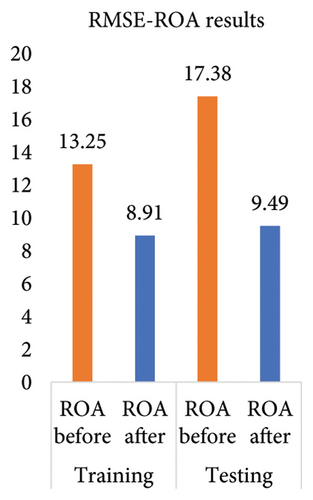

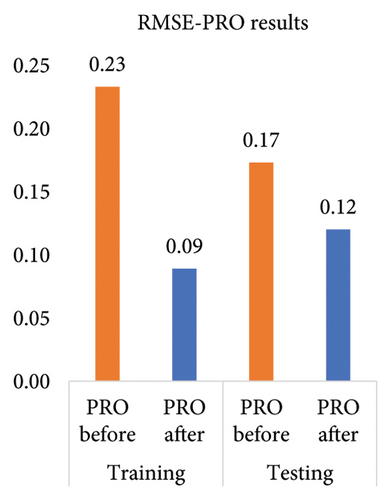

To evaluate the predictive performance of ANFIS, we compared it against MLR, a widely used benchmark technique for data modeling and prediction. Table 4 represents the RMSE of ANFIS and MLR predictions of the OP, ROA, and PRO based on HCE before and after acquisition, respectively.

| Dataset | Training dataset | Testing dataset | ||||

|---|---|---|---|---|---|---|

| RMSE before acquisition | ||||||

| Parameter | OP | ROA | PRO | OP | ROA | PRO |

| ANFIS | 152.15 | 13.25 | 0.233 | 21.48 | 17.48 | 0.173 |

| MLR | 149.52 | 13.33 | 0.233 | 29.36 | 17.38 | 0.171 |

| RMSE after acquisition | ||||||

| Parameter | OP | ROA | PRO | OP | ROA | PRO |

| ANFIS | 16.44 | 8.91 | 0.089 | 16.25 | 9.49 | 0.12 |

| MLR | 16.79 | 9.84 | 0.090 | 16.61 | 10.08 | 0.12 |

- Note: All MLR tests confirmed the statistical significance of the intercept and the HCE coefficients, with values below 0.05. When evaluating predictive accuracy using RMSE, ANFIS outperformed MLR. Specifically, for all parameters before the acquisition, ANFIS achieved RMSE values that were 33.82% lower than those obtained with MLR. After the acquisition, ANFIS continued to demonstrate better performance, with RMSE values reduced by 22.13% compared with MLR. Given these results, we proceed with the ANFIS model in the subsequent analysis.

All MLR tests confirmed the statistical significance of the intercept and the HCE coefficients, with p values below 0.05. When evaluating predictive accuracy using RMSE, ANFIS outperformed MLR. Specifically, for all parameters before the acquisition, ANFIS achieved RMSE values that were 33.82% lower than those obtained with MLR. After the acquisition, ANFIS continued to demonstrate better performance, with RMSE values reduced by 22.13% compared with MLR. All RMSE values reported in Table 4 are statistically significant at the p < 0.05 level. Given these results, we proceed with the ANFIS model in the subsequent analysis.

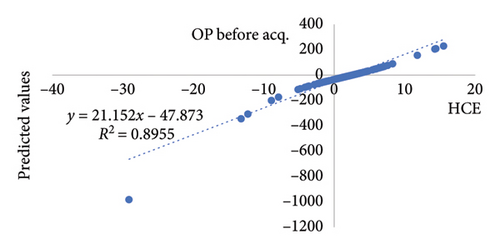

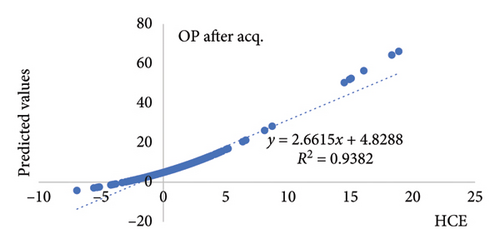

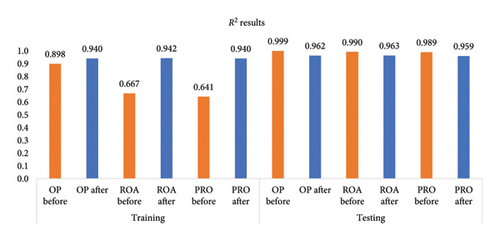

Figures 5 and 6 represent the ANFIS prediction of OPs based on HCE before and after acquisition, respectively. Comparison of the results presented in Figures 5 and 6 shows better prediction of OPs after acquisition (R2 = 0.938) than before acquisition (R2 = 0.896).

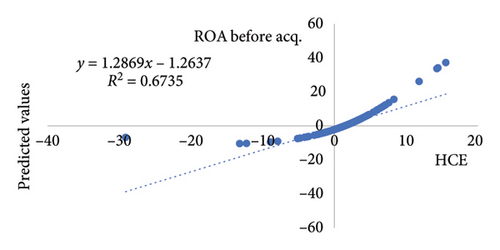

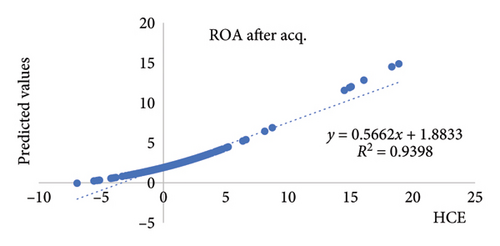

Figures 7 and 8 show the ANFIS prediction of ROA based on HCE acquisition before and after the acquisition, respectively. The comparison of the findings presented in Figures 7 and 8 indicates stronger prediction of ROA postacquisition (R2 = 0.940) compared with preacquisition (R2 = 0.674).

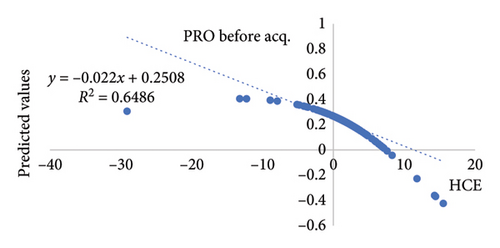

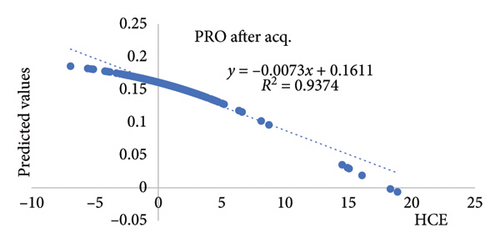

Figures 9 and 10 show the ANFIS prediction of PRO based on the HCE before and after acquisition, respectively. The analysis of the results shown in Figures 9 and 10 demonstrates a higher prediction of PRO following acquisition (R2 = 0.937) than that of prior to acquisition (R2 = 0.649) based on HCE.

Table 5 represents the R2 of ANFIS prediction of the OP, ROA, and PRO based on HCE before and after acquisition, respectively. The R2 values for the whole data set are also presented in Figures 5, 6, 7, 8, 9, and 10.

| Training dataset | Testing dataset | All data | ||||||

|---|---|---|---|---|---|---|---|---|

| R2 before acquisition | ||||||||

| OP | ROA | PRO | OP | ROA | PRO | OP | ROA | PRO |

| 0.898 | 0.667 | 0.641 | 0.999 | 0.990 | 0.989 | 0.896 | 0.674 | 0.649 |

| R2 after acquisition | ||||||||

| OP | ROA | PRO | OP | ROA | PRO | OP | ROA | PRO |

| 0.940 | 0.942 | 0.940 | 0.962 | 0.963 | 0.959 | 0.938 | 0.940 | 0.937 |

The comparison of dependent variables OP, ROA, and PRO before and after acquisition for both the training and testing datasets is presented in Figure 11.

The analysis of scatter plots and the coefficient of determination R2 (Table 5) demonstrated that HCE as an input exhibits better prediction after acquisitions for OP, PRO, and ROA performance indicator for the complete dataset. Calculating the difference between the coefficient of determination R2 after and before acquisitions, a significant positive difference of 0.266 for ROA and 0.288 for PRO is recorded, which indicates better prediction after acquisitions for these performance indicators. A positive discrete difference of 0.042 was calculated for OP. Previous result demonstrates that HCE had a constant strong effect on OP, both prior to and post the acquisition. The least prediction is present for PRO (R2 = 0.649) in the period that includes the dataset before acquisitions. The best prediction was recorded for output ROA in the postacquisition period (R2 = 0.940) for all dataset. In summary, from the above, it can be concluded that HCE has a stronger impact on PRO and ROA in the postacquisition period, as well as on OP, but without significant changes in the period following acquisitions.

5. Discussion

The study’s findings indicate that HC as measured by the HCE indicator provides a significant prediction for OP (R2 = 0.938), ROA (R2 = 0.940), and PRO (R2 = 0.937) in the postacquisition period and is greater than the period preceding the acquisition. Studies affirming the positive influence of HC on the aforementioned organizational performance are abundant [6, 43, 46, 47, 63, 66, 97]. Furthermore, a substantial number of studies focus solely on comparing pre- and postacquisition performance [33–37, 56]. Nevertheless, the limited research on the influence of HC on pre- and postacquisition performance emphasizes the importance of this study. PRO improvement after acquisitions was confirmed in a longitudinal study conducted by Siegel and Simmons [10]. The results demonstrate an increase in the impact of HC on performance, suggesting that acquisitions influence the relationship between HC and performance. Increased utilization of a company’s current resources, especially intangible resources that contain HC, can explain the increased efficiency of HC following acquisitions. According to Hassett, this conclusion indirectly supports prior research that identifies the prospect of gaining rare resources, such as HC, as a primary acquisition motive [4]. In addition, the stronger influence of HC on performance in the postacquisition phase might be attributed to the adoption of new management practices and work methods by acquiring firms [17, 18]. The relationship between HC and PRO, a performance that is fundamentally employee related, demonstrates the significance of human capital [98] as a component of intellectual capital with the greatest value creation potential.

The implications of the study are related to the results of previous research. In general, our study confirmed that there are changes in HC in the postacquisition period but that these changes have positive effects on performance and increase PRO. These findings align with the results obtained by Siegel and Simmons in their research [10]. The increase in PRO and OP in the postacquisition period due to HC confirms the results of previous studies that also identified a positive change in profitability and employee PRO, as noted by Ge and Huand [19] and Li et al. [20]. Indirectly, our study’s findings support the notion that acquisitions are frequently prompted by the possibility of acquiring a valuable intangible asset, which refers primarily to HC [2]. The development of HC through learning and continuous development has a positive effect on the creation of economic value [59], as shown by the increase in OP during the postacquisition period, as indicated by the study’s findings. The foregoing indicates that HC has the potential to create value and enhance the performance of acquired firms. In addition, it appears to be one of the primary drivers toward the acquisition as a business combination.

The findings of this study may have practical implications for postacquisition managerial decision-making and performance management. The results obtained in this context demonstrate the importance of HC management in acquisition. The possibility that HC has a favorable effect on performance in the postacquisition period provides managers with direction for focusing on various components of HC. The successful management of HC following a takeover depends on the mapping of these elements throughout the due diligence process [63]. Inadequate attention to HC in the due diligence process during acquisitions can lead companies to misjudge or neglect this crucial aspect, ultimately resulting in mediocre organizational performance and the loss of valuable HC from the organization [60]. Managers are directed to establish suitable HR procedures that concentrate on maintaining talent in the firm following a takeover by HC, a crucial component of intellectual capital.

Previous studies and the theoretical background based on the RBV [5] of a firm suggest that companies become acquisition targets because of their HC, which has the potential to create value through synergistic action with the acquiring firm. Our findings potentially suggest that companies become acquisition targets because they fail to manage HC effectively or because they have market potential but lack the HC required to realize it. The implementation of strategic changes in HC management practices can potentially provide improvements in performance. The findings of this study indicate that the development of HC can lead to performance improvements during the postacquisition period. Put simply, the allocation of resources towards enhance HC, encompassing various aspects such as training, healthcare, mental wellbeing, and personal growth, has the potential to yield substantial performance improvements. It is important to consider that the study analyzed acquisitions when there was a transfer of ownership over 51%, and it is reasonable to assume that the new owner possesses complete managerial control over the acquired firm. This allows management to implement novel management strategies and practices in HC management to enhance performance.

The model employed in this study presents several notable advantages. It utilizes the VAIC methodology, a comprehensive approach developed for measuring HCE and assessing a company’s resource utilization. The study adheres to Vennet’s recommendation by conducting a longitudinal analysis with a 3-year interval both before and after acquisitions, ensuring a robust examination of changes in HCE. Data sourced from official financial reports enhance the study’s reliability and transparency in calculating HCE and performance indicators. The unique methodology, VAIC, provides a structured and systematic way to assess the impact of HC on organizational performance, considering various factors such as total wages, benefits, and investments in employees. Furthermore, the study integrates both pre- and postacquisition performances, offering a holistic understanding of how HCE evolves during and after acquisition processes. However, the model also encounters certain limitations. The sample of acquisitions is considered homogeneous without categorization, limiting the generalizability of findings to specific acquisition contexts. The geographical limitation to acquisitions in Serbia, an emerging economy, may restrict the applicability of the study’s conclusions to diverse economic settings. The chosen 3-year time frame for analysis, although recommended, may not capture longer-term effects or variations in HCE and organizational performance. The assumption that acquisitions involve a transfer of ownership over 51%, granting complete managerial control, may not universally apply, affecting the transferability of findings to different ownership structures. The study acknowledges the absence of a unique methodology for measuring HC, posing challenges in comparing findings across studies with alternative approaches. In addition, focusing on a limited set of output variables (OP, ROA, and PRO) may constrain a nuanced understanding of the broader impact of HC on organizational performance. Despite these limitations, the study’s model offers a comprehensive approach to measuring HCE, emphasizing the importance of careful consideration for interpreting and applying the findings accurately.

When it comes about ANFIS, its application in this study offers numerous advantages for predicting HCE and its impact on organizational performance in acquisition scenarios. Known for its noise immunity, robustness, and normalization capabilities, ANFIS ensures reliable predictions by resisting the influence of random fluctuations and handling data from different scales effectively. Its generalization capabilities are crucial for applying learned patterns to new data, enhancing its adaptability to various acquisition contexts. However, the ANFIS model comes with certain limitations. Its effectiveness heavily depends on the quality and representativeness of the training data, posing challenges if the data are inaccurate or biased. The complexity of ANFIS models may hinder interpretability, making it challenging for users to understand the underlying logic and relationships. Moreover, the model may require significant computational resources, particularly for training and optimization, potentially displaying challenges in resource-constrained environments.

Our study has certain research limitations. In this context, it can first be stated that the sample of realized acquisitions is viewed as homogeneous, without any prior categorization or stratification, such as distinguishing between domestic and international acquisitions or categorizing them based on industry type. Second, it should be noted that all the acquisitions included in the sample comprised transactions in Serbia, a country categorized as an emerging economy. It is worth mentioning that the degree of HC development in Serbia is typically lower than that in the developed economies of Western nations. Furthermore, the study model incorporates three dependent output variables, which appear to be a justifiable. However, a greater number of output variables may offer further elucidation of the effect of HC. Finally, the sample consists of publicly announced acquisitions, while acquisitions achieved through private transactions are not included in the sample.

6. Conclusions

The results are consistent with previous studies on the impact of HC on performance. From the perspective of a managerial decision-maker, the results obtained by applying the ANFIS methodology suggest that acquisition as a strategic option has a purpose because it drives a change in HC that leads to a positive impact on OP, ROA, and PRO. This shows that acquisitions represent real strategic options that contribute to value creation. The results of the study showed that the HCE impact on ROA and PRO in the postacquisition period (R2 = 0.940 and R2 = 0.937, respectively) is stronger than the impact in the preacquisition period (R2 = 0.674 and R2 = 0.647, respectively) for all dataset. For the period before the acquisition, the coefficient of determination for the tested relations shows moderate values, while in the period after the acquisition, it demonstrates high values. The above results indicate that the acquisitions accelerated the process of organizational restructuring and encouraged investments in knowledge-intensive assets to improve their performance. HC demonstrates the ability to realize a strong leverage effect on performance in the period after acquisitions. In this way, clear guidelines are obtained for making managerial decisions that are based on the development of a program for the improvement of HC after the acquisition process with a certain outcome in the domain of expected performance.

In addition, investing in HC improvement programs in the postacquisition period is expected to have positive effects on OP. The coefficient of determination for OP remained stable in the postacquisition period (R2 = 0.938) and generally high as well as in the preacquisition period (R2 = 0.896). This finding suggests that acquisitions as business combinations have a positive impact on the relationship between HC and performance observed in the study. By comparing the coefficients of determination R2 after and before the acquisition, a positive difference of 0.266 for ROA and 0.290 for PRO was determined. The results confirm a discrete increase in the positive impact of human capital on OP in the postacquisition period, while both values remain high and indicate strong impact of HCE on OP.

Our study deployed a combination of the VAIC and ANFIS methods to establish the relationship between the observed independent and dependent variables. The combined utilization of the aforementioned methods has shown predictive power in assessing the efficiency of HC in acquisitions. This evaluation confirmed its analytical significance and potential for practical implementation in management decision making related to acquisitions.

Within the realm of practical consequences, this study unequivocally demonstrates the significance of HC in attaining required performance. Furthermore, it highlights the potential impact on performance through the implementation of HC management programs following an acquisition. This emphasizes the importance of retaining exceptional employees within the organization, as they are the essence of HC. Moreover, investments in HC in the postacquisition period can have a positive impact on value creation, with a high rate of attaining desired results.

The future scope of the study should involve diversifying the types of acquisitions considered, including distinctions between domestic and international transactions or categorizing them based on industry types. Expanding the geographical scope to encompass acquisitions from various countries aims to identify cultural, regulatory, or economic factors influencing the relationship between HC and postacquisition performance. A more in-depth industry-specific analysis is proposed to discern how HC’s impact on performance varies across different sectors, enabling tailored strategies for HC management. In addition, the future studies should explore a broader set of dependent output variables, encompassing innovation, customer satisfaction, and employee engagement, to gain a holistic understanding of HC’s multifaceted impact. Integrating qualitative methods, such as interviews and case studies, could provide better contextual insights, enhancing quantitative findings. Comparative analysis between emerging economies and developed economies could highlight the role of economic development in shaping the relationship between HC and postacquisition performance. Furthermore, a detailed examination of specific strategic changes in HC management postacquisition and exploration of potential nonlinear relationships between HC and performance indicators are proposed to refine managerial understanding and implementation of effective HC strategies.

Conflicts of Interest

The authors declare no conflicts of interest.

Funding

This research received no external funding.

Open Research

Data Availability Statement

The datasets generated and/or analyzed during the study are available from the corresponding author upon reasonable request.