A Platform Service Supply Chain: Interaction Between AI Strategy Adoption and Pricing Mechanism Selection

Abstract

In the operation of service-sharing platforms, artificial intelligence (AI) strategy may or may not be adopted, alongside different pricing mechanism. The interaction between a platform’s decision to adopt the AI strategy and pricing mechanism selection is a valuable area for research. This paper examines the implications of a platform adopting or not adopting the AI strategy, focusing on two mechanisms: service provider pricing and platform pricing. The findings indicate that when consumers have a high sensitivity to the level of intelligent services, the platform should adopt the AI strategy, which may negatively impact the profits of both service providers. Platform pricing is more beneficial for the platform and high-quality service providers, while it reduces the profits of the low-quality service provider. When consumers have a low sensitivity to the level of intelligent services, adopting the AI strategy is more advantageous for the high-quality service provider and the platform itself. In addition, when service providers determine the service prices and consumers have a high sensitivity to the level of intelligent service levels, the platform is inclined to adopt the AI strategy, which may adversely affect the profits of both service providers.

1. Introduction

In today’s digital and information age, the rapid rise of the service-sharing economy model has become an integral part of global economic activities [1–3]. The service-sharing platform connects service providers and consumers to achieve resource sharing and maximize utilization, providing consumers with a more convenient, economical, and personalized service experience [4, 5]. Service sharing has been widely applied in various fields, covering multiple industries such as transportation, accommodation, catering, and finance [6]. By 2026, the expected revenue from the sharing economy is $1851 [7].

The application of artificial intelligence (AI) in the field of service sharing is increasingly showing great potential [8, 9]. AI can bring many benefits to service-sharing platforms, such as improving operational efficiency, enhancing user satisfaction, and reducing labor costs [10, 11]. For example, Airbnb uses AI to provide consumers with intelligent accommodation booking systems, intelligent facilities, and personalized recommendations to meet their preferences for sharing services [12]. Simultaneously, AI will also bring some challenges, such as requiring enterprises to invest a large amount of money and facing data security and privacy risks [13]. Influenced by consumer preferences and AI, sharing platforms must seek more effective strategies to increase occupancy rates and profitability.

Pricing decisions are crucial for platform operations and significantly impact profits [14, 15]. In the service-sharing economy, platforms typically employ two pricing mechanisms: platform pricing and service provider pricing [16]. Under the platform pricing mechanism, the platform directly sets service prices to maximize its profit, as seen with Uber and Lyft, which adjust prices based on supply and demand [17]. Under the service provider pricing mechanism, the platform does not directly control the price, and the service price is set by the service providers themselves. Typical examples include Airbnb and Booking.com [18]. The platform generates revenue by charging commissions for each transaction. However, service providers often struggle with pricing due to fluctuating demand and competitive uncertainty, leading to inefficiencies, such as Airbnb hosts having difficulty maximizing profits [19]. The change in service prices affects the overall profit of the platform: a higher service price may reduce transaction volume but increase the profit margin, while a lower price may increase trading volume but erode overall profits. At present, it is unclear which pricing strategy is more advantageous for the platform. Therefore, it is worth exploring how a platform can make the optimal pricing decisions.

- 1.

Does the platform adopt the AI strategy? How does the platform choose pricing mechanism?

- 2.

Can the platform and service providers benefit from adopting the AI strategy?

- 3.

How do the adoption of the AI strategy and pricing mechanism selection affect consumer surplus and social welfare?

This paper considers a platform service supply chain consisting of two service providers, a platform, and consumers. The platform has two pricing mechanisms: service provider pricing and platform pricing. The platform can also choose whether to adopt the AI strategy. The level of intelligent services affects consumers’ leasing choices. First, we construct profit maximization models for the platform and service providers under four different scenarios and obtain the optimal service price and/or intelligent service level. Then, we explore which scenario is more favorable for the stakeholders under four different scenarios.

The main contributions of this study lie in three aspects. First, this study investigates the interaction between the AI adoption strategy and pricing mechanism selection for a service-sharing platform. To our knowledge, this has not been explored in existing research. Therefore, this study fills the gap or limitation of existing research that only focuses on the pricing mechanism selection for a platform [16, 18]. Second, this study obtains the conditions for the platform to adopt the AI strategy and select the optimal pricing strategy, which can provide a key basis for the platform’s operational decisions. Third, unlike existing research (e.g., [16, 18]), we find that when service providers determine the service prices, if consumers have a high sensitivity coefficient to the level of intelligent services, the platform should adopt the AI strategy, which may harm the profits of both service providers.

The rest of this paper is arranged as follows. Section 2 reviews the relevant literature. Section 3 provides a description of the problem. In Section 4, the models and optimal results for four different scenarios are presented. Next, in Section 5, we provide a comparative analysis of the platform profits, consumer surplus, and social welfare. Section 6 summarizes the main conclusions and management implications of this paper and provides future research prospects. All the proofs are provided in the Appendix.

2. Literature Review

This research mainly involves two streams of literature: the pricing strategies of service-sharing platforms and the AI adoption strategy. In the following, we review the literature on these two streams.

The first stream literature studies the pricing strategies of service-sharing platform. Chi et al. [20] studied the optimal pricing and security investment of a service-sharing platform. They found that the perceived risk of consumers and the sensitivity coefficient of consumers to platform investment are the key factors affecting platform pricing. Zhou et al. [21] studied the optimal commission rate of a multiservice-sharing platform with self-scheduling capability. They found that platforms should reduce the fixed commission rates for the free-customer-commission and the dynamic-customer-commission (DCC) contracts compared with the optimal contracts, resulting in a decrease in their profits. Kung and Zhong [22] studied three pricing strategies for two-sided platforms in the sharing economy: membership-based pricing, transaction-based pricing, and cross-subsidization. They found that the three strategies were equivalent when there was no time discount and consumers’ order frequency was not price sensitive. Tian et al. [18] studied the optimal pricing mechanism selection for a shared platform. They pointed out that when there was a lot of information disclosed in online comments, service providers were more inclined to let the platform determine the service price. Yu et al. [23] studied pricing and quality strategies for an on-demand platform. They pointed out that as the potential demand market capacity expands, the platform will decrease prices to attract more customers and service providers until reaching certain markets, thereby obtaining a higher revenue. Chen et al. [24] studied two pricing strategies for an on-demand platform: transaction-based pricing policy (TBPP) and membership-based pricing policy (MBPP). They pointed out that compared with MBPP, adopting TBPP is beneficial for the platform but detrimental to customers and providers. Nie et al. [25] investigated pricing strategy selection for a platform with heterogeneous labor. They found that the market composition of labor and service quality can affect the labor-sharing platform’s pricing strategy. Sur et al. [26] used the Stackelberg model to analyze the optimal revenue-sharing rate between a sharing platform and a service provider. They indicated that potential demand was the most significant factor in affecting optimal revenue sharing. Unlike the above research, this study focuses on a platform service supply chain. We not only study the pricing strategy of a service sharing platform but also investigate the adoption strategy of AI. This study fills the gap in existing research.

The second stream of the literature studies AI. Although AI has been applied to sharing economy platforms, there is currently little research investigating the phenomenon in this context. Chen et al. [27] illustrated that AI can help sharing economy platforms by enhancing trust, matching assets, and understanding participants’ preferences and attitudes. Rong et al. [28] examined potential mechanisms for how sharing economy platforms can design and improve their service operations by matching their information processing capabilities with changing information processing requirements. They found that pricing strategies and building trust were initial strategies for increasing intellectual property on sharing economy platforms. Shao et al. [29] pointed out that a ride-sharing platform uses AI algorithms to guide and optimize routes, provide users with efficient travel choices, and enhance their experience of ride-sharing services. Wu et al. [30] used AI to introduce a regulatory approach that can achieve sustainable development of the sharing economy. Gerlick and Liozu [31] pointed out that the use of AI by a decision-maker can bring win-win results for both the decision-maker and consumers. Perez-Rodriguez et al. [32] studied that AI models play an important role in tourism demand forecasting. Unlike the abovementioned studies, we examine the interaction between the pricing strategy of a service-sharing platform and the adoption strategy of AI and explore the impact of the AI strategy adoption and pricing mechanism selection on consumer surplus and social welfare. The research in this paper makes up for the shortcomings or limitations of the existing research.

The abovementioned research mainly focuses on the pricing strategies of service-sharing platform. Unlike these studies, this study focuses on a platform service supply chain and explores whether a service-sharing platform should adopt AI strategy, as well as the interaction between AI strategy adoption and pricing mechanism selection.

3. Problem Description and Model Setting

In this study, we consider a platform service supply chain consisting of service providers (high-quality service provider and low-quality service provider) and a service sharing platform (referred to as the “platform”). Service providers control a large amount of assets and provide vertically differentiated leasing services to consumers through shared platforms. The platform can choose to adopt the AI strategy to analyze users’ historical data and behavior patterns, and the service-sharing platform can realize personalized recommendations to provide consumers with services that are more in line with their needs and preferences. This personalized recommendation can improve user satisfaction and increase user loyalty, thus promoting the long-term stable development of the platform. For example, well-known platforms such as Uber and Airbnb have widely applied AI technology, using intelligent algorithms to achieve intelligent matching between drivers and passengers, dynamic pricing, and other functions, improving service experience and optimizing platform operations. Generally, service-sharing platforms have two pricing mechanisms: first, each service provider determines the service price. Second, the platform determines the service price. Under each pricing mechanism, the platform shares profits with service providers based on a preset commission rate for each transaction. Then, consumers decide whether to choose high-quality or low-quality services based on the service price.

In this paper, i = H, L represents the high-quality service and low-quality service, respectively, j = NS(NP) indicates that when the platform does not adopt the AI strategy, the service price is determined by the service provider (platform), and j = AS(AP) indicates that when the platform adopts the AI strategy, the service price is determined by the service provider (platform). The related symbols involved in this study are described in Table 1.

| Notations | Definitions |

|---|---|

| Service price (decision variable) | |

| Intelligent service level (decision variable) | |

| mi | Service quality |

| α | Consumer valuation of services, α ~ U[0, 1] |

| r | The commission rate charged by the platform for service providers |

| β | The sensitivity coefficient of consumers to intelligent service level |

| c | The cost coefficient of platform investment in intelligent services |

| Consumer demand | |

| Service provider’s profit | |

| Platform’s profit | |

| CSj | Consumer surplus |

| SWj | Social welfare |

4. Optimal Outcomes

In this section, the optimal outcomes of the service providers and the platform for each scenario are given.

4.1. Scenario NS

Under Scenario NS, the service provider determines its service price. The platform’s profit comes from taking a predetermined commission from each transaction.

By solving equations (9) and (10), we can obtain the following lemma.

Lemma 1. Under Scenario NS, the optimal high-quality and the low-quality service prices are and .

Further, we can obtain that the demand and profit of the high-quality service provider are and . The demand and profit of the low-quality service provider are and . The platform profit is .

From Lemma 1, we can see that the optimal outcomes under Scenario NS are related to mH and mL. It is necessary for service providers to deeply evaluate the quality of the services they provide, because this not only involves meeting customer needs but also directly affects the complexity of pricing decisions. The level of service quality directly affects the consumer’s perception and satisfaction with the service, affecting the market competitiveness and brand image. Therefore, service providers need to consider how to balance service quality and price in their pricing strategy. High-quality service usually comes with high costs, but it may also attract more customers and build long-term customer relationships, resulting in sustained benefits for the business.

Corollary 1. Under Scenario NS, the effects of key parameters on the optimal result are shown in Table 2.

| Parameters | |||||

|---|---|---|---|---|---|

| mH | ↑ | ↑ | ↑ | ↑ | ↑ |

| mL | ↓ | ↓ | ↓ | ↓ | ↓ |

From Corollary 1, we can observe that as the quality of high-quality services improves, service prices will also increase accordingly, which will bring more profits to service providers and platforms. This is because there is a significant difference in consumers’ evaluations of high-quality and low-quality services. This differentiation reduces the level of competition between the two service providers, leading to an increase in service prices and profits for service providers while also driving up platform profits. Furthermore, we found that if the quality of low-quality services improves, service prices will correspondingly decrease, which will lead to a decrease in profits for service providers and platforms. This is because consumers pay more attention to service quality when making purchasing decisions, and intensified competition among service providers can lower prices, thereby reducing the profits of both service providers and platforms. Therefore, in a highly competitive market environment, service providers need to carefully weigh the relationship between service quality and price. Excessive service quality may lead to higher prices, but it may also attract more high-end customers and enhance brand value. Raising the level of low-quality services may lower prices, but the benefits from competition may be limited. Therefore, when developing pricing strategies, service providers need to fully consider market demand, competitive dynamics, and consumer preferences to achieve the optimal profit and market position.

We can obtain Corollary 2 by analyzing the effect of service quality on consumer surplus and social welfare.

Corollary 2. (∂CSNS/∂mH) > 0, (∂SWNS/∂mH) > 0, (∂CSNS/∂mL) > 0, and (∂SWNS/∂mL) > 0.

Corollary 2 shows that with the improvement of service quality, consumer surplus, and social welfare will also increase. This is because the difference in service quality increases the slow competition between the two service providers. Hence, as the quality of service improves, consumers can find the services that meet their needs at a lower cost when purchasing services. A better match between consumer preferences and services is likely to improve the efficiency of online markets, thereby further increasing consumer surplus and social welfare. This finding means that the improvement of the service quality not only means the increase of individual consumer satisfaction but also more importantly, the positive impact on the overall social welfare. With the continuous improvement of service quality, consumers will be more likely to obtain better experiences and value in market choices, which will motivate service providers to continuously improve their service quality level, thereby promoting the sustainable development and improvement of the market. By increasing consumer satisfaction and trust in services, good service quality will also win a wider customer base for enterprises, strengthen market competitiveness, and thus form a positive development cycle.

Overall, Corollary 2 not only illustrates the relationship between consumers and the market but also reflects the profound impact of service quality on the overall market ecology and social welfare, emphasizing the importance of continuously improving service quality to promote the healthy development of the economic system and the improvement of social welfare.

4.2. Scenario NP

Furthermore, the profit of the high-quality service provider and the low-quality service provider are and .

We can obtain Lemma 2 by solving equation (14).

Lemma 2. Under Scenario NP, the optimal high-quality and the low-quality service prices are and .

Furthermore, we can obtain that the demands of the high-quality and the low-quality service prices are and . The platform profit is . The profits of the high-quality and the low-quality service prices are and . The demand of the low-quality service provider is zero, which means that the low-quality service provider will be driven out of the market.

Similarly, consumer surplus is . Therefore, consumer surplus can be expressed as CSNP = mH/8. Social welfare is . Furthermore, we can obtain that SWNP = (3mH)/8.

We can obtain the following corollary by analyzing the effects of service quality on service prices, demands, and profits under Scenario NP.

Corollary 3. , , (∂CSNS/∂mH) > 0, and (∂SWNS/∂mH) > 0.

Corollary 3 states that as service quality improves, the profits of the platform and the high-quality service provider will increase while further increasing consumer surplus and social welfare. The fundamental reason for this finding is that improving service quality will directly enhance consumers’ demand and satisfaction with services, thus attracting more consumers to choose high-quality services, and thus promoting the profit growth of the platform and service providers. This positive cycle will promote the healthy development of the market and improve the overall level of social wellbeing. This finding highlights the multiple benefits of service quality for market participants. The high-quality service provider has won the trust and loyalty of consumers by providing quality services, thus achieving sustained profitability and market share growth. As a bridge connecting consumers and service providers, the platform also promotes the development of the market due to the improvement of service quality, which in turn improves the overall economic benefits. This virtuous circle also reflects the win–win interests of all parties in the market, emphasizing the importance of the concept of quality first for market development and social welfare.

4.3. Scenario AS

Under Scenario AS, the service providers determine the service prices, separately. The platform’s profit comes from taking a predetermined commission from each transaction.

In equation (17), eAS represents the level of intelligent services, and c represents the cost coefficient of the platform’s investment in the level of intelligent services.

We can obtain the following lemma by solving equations (15) and (16).

Lemma 3. Under Scenario AS, the optimal intelligent service level is , the optimal high-quality service price is , and the optimal low-quality service price is .

Furthermore, we can obtain the demand and the profit of the high-quality service provider are and . The demand and the profit of the low-quality service provider are and . The platform profit is .

4.4. Scenario AP

The profit functions of the high-quality and low-quality service providers are and .

We can obtain Lemma 4 by solving equation (21).

Lemma 4. Under Scenario AP, the optimal intelligent service level is eAP∗ = (βrmL(1 − β)/2(1 − β)cmL − rβ2), the optimal high-quality service price is , and the optimal low-quality service price is .

Furthermore, we can obtain the demand and the profit of the high-quality service provider are and . The demand and the profit of the low-quality service provider are and . The platform profit is .

According to Lemmas 3 and 4, the effect of the consumer sensitivity to the intelligent service level on the optimal results is complex. In Section 5, we provide further analysis through numerical examples.

5. Comparison Analysis

In this section, we first explore the platform’s pricing mechanism selection by comparing the platform profits under two pricing mechanisms, based on whether an AI strategy has been adopted or not. Second, when considering a pricing mechanism, we investigate whether a platform implements the AI strategy by comparing the platform’s profits with and without the AI strategy. Finally, we analyze the effect of adopting AI strategy and pricing mechanisms on consumer surplus and social welfare. In addition, we give numerical analysis to visualize the results obtained and gain additional management insights.

5.1. Pricing Mechanism Selection

When the platform does not adopt the AI strategy, we can obtain the following proposition by comparing the profits, service prices and consumer demands of the platform using different pricing mechanisms.

Proposition 1. , , and .

Proposition 1 shows that under Scenario NS, the profit of high-quality service provider is low, while the profit of low-quality service provider is high, and the profit of the platform is also relatively low. This shows that under the scenario, the high-quality service provider is more inclined to accept the price set by the platform because the high-quality service provider pays more attention to the service quality and reputation, while the low-quality service provider is more inclined to set their own prices and attract consumers through low prices. This phenomenon reflects the different preferences for service quality and price in the market, as well as the complex interaction of the profitability of various parties under different quality and pricing strategies. Considering the degree of consumer demand for high-quality service may lead to the high-quality service provider being willing to sacrifice a portion of their profits to grow market share and brand loyalty. On the other hand, the low-quality service provider may gain a certain market share by lowering prices in a highly competitive market, but this strategy may reduce the price level of the overall market, thus affecting the profitability of all service providers. Therefore, this proposition not only reveals the profit performance of different types of service providers and platforms in different situations but also implies the delicate balance between service quality, price strategy, and profit in the market competition. In practice, all parties need to consider market demand, competitive environment and long-term development goals, and formulate strategies in line with their own positioning to achieve sustainable profitability and market position.

Proposition 2. (i) , and (ii) , .

Proposition 2 shows that the demand of high (low)-quality services under Scenario NS is higher than that of high (low)-quality services under Scenario NP, and the price of high (low)-quality services under Scenario NS is lower than that of high (low)-quality services under Scenario NP. This is because, under Scenario NS, demand is higher when service providers compete on price. Under Scenario NS, there may be more market participants, leading to more competition among service providers. The increase in demand for high-quality services may be due to consumers’ pursuit of quality and experience, while the increase in demand for low-quality services may be due to price-sensitive consumers or mass market demands. Under this scenario, in order to compete for market share and attract more consumers, service providers may adopt more competitive pricing strategies, resulting in a decline in the price level. In addition, the market environment under Scenario NS may be more open and competitive, and the competition between service providers may not only be reflected in price but also may include service quality, innovation ability, and marketing strategy. The decline in prices may stimulate the vitality of the market and promote the improvement of consumer welfare, but it may also pose a challenge to the profitability of service providers and need to find other competitive strategies for differentiation. Overall, this proposition highlights the need for service providers to be flexible and balance price competition, service quality and profitability in a highly demanding and competitive market environment. Understanding the dynamics of consumer demand, market trends, and competitors and developing pricing strategies and service solutions that meet market needs will be key factors in achieving market advantage and sustained growth under Scenario NS.

When the platform adopts the AI strategy, by comparing the profit, service price, and consumer demand of the platform using different pricing mechanisms, we can obtain the following proposition.

Proposition 3. (i) If c > c1(β), then ; otherwise, . (ii) If c > c2(β), then ; otherwise, . (iii) If c < c3(β), then ; otherwise, .

Proposition 3(i) indicates that when the cost coefficient is large, the profit of the high-quality service provider under Scenario AS is larger than that under Scenario AP. This is because when the platform adopts the AI strategy, consumers not only focus on the quality of services but also pay more attention to the level of intelligent services. The increase in the level of intelligent services can enhance the advantages of low-quality services. The improvement of intelligent service level can increase the competitive advantage of the low-quality service provider, while the high-quality service provider may need to leverage other advantages to win the market. On the one hand, with the development of AI technology, consumers’ demand for intelligent and personalized services is gradually increasing, making the level of intelligent services one of the key factors in competition among service providers. Under Scenario AS, the high-quality service provider may have established certain advantages in service quality, but if they cannot keep up with the development trend of intelligent services, they may lose some market share. Proposition 3(ii) indicates that when the cost coefficient is large, the profit of the low-quality service provider under Scenario AS is smaller than that under Scenario AP. The low-quality service provider has the opportunity to compensate for the shortcomings in service quality and attract more consumers to choose the services by improving the level of intelligent services. In this situation, even if the cost coefficient is low, the high-quality service provider may face greater competitive pressure and need to make a balance between service quality, intelligent service level, and cost-effectiveness to maintain profitability. Proposition 3(iii) indicates that when the cost coefficient is small, the platform profit under Scenario AS is larger than that under Scenario AP. This finding suggests that in the era of intelligence, service providers need to constantly upgrade their level of intelligent services while maintaining a balance between service quality and cost-effectiveness. Understanding consumer needs, paying attention to market trends, and flexibly adjusting business strategies will be key factors in gaining competitive advantage and enhancing profitability in Scenario AS.

Proposition 4. (i) ; if c > (rβ2 + 2rβ2Λ4)/(4mL(1 − β)Λ4), then ; otherwise, . (ii) If c > c4(β), then ; otherwise, ; if c > c5(β), then ; otherwise, .

Proposition 4(i) indicates that the consumer demand under Scenario AS is larger than that under Scenario AP. When the cost coefficient is large, the consumer demand under Scenario AS is larger than that under Scenario AP. This is because when the platform provides intelligent services, the high-quality service provider sets the price based on consumer preferences, thereby attracting more consumers. The demand for the low-quality service is related to the cost of adopting the AI strategy on the platform. Proposition 4(ii) indicates that when the cost coefficient is large, the high (low)-quality service price under Scenario AS is larger than the high (low)-quality service price under Scenario AP. Consumer demand is closely related to service quality and pricing strategies. High-quality services and intelligent service often attract more consumers. High cost is a challenge for platforms, but intelligent services and pricing mechanisms can stand out in a fiercely competitive market and attract more consumers. The importance of the AI strategy for the service industry is increasing, as they can help platforms better understand consumer needs and achieve personalized and flexible pricing. Therefore, we can see the complex relationship between consumer demand, service quality, and pricing, as well as the important role of the AI strategy in shaping market patterns and consumer behavior.

5.2. AI Strategy Adoption

Proposition 5. (i) If , then ; otherwise, ; (ii) If , then ; otherwise, .

Proposition 5 states that when service providers determine service prices, if consumers have a low sensitivity coefficient to intelligent service levels, the platform is more inclined to not adopt the AI strategy, and this is more beneficial for both service providers. On the contrary, when the sensitivity coefficient of consumers to the level of intelligent service is high, the platform is more inclined to adopt the AI strategy, which is more favorable to the service providers. This is because the sensitivity coefficient of consumers to the level of intelligent services reflects their level of demand for technological innovation and service quality. When consumers are less concerned about intelligent service levels, it may be more cost-effective for the platform to choose not to adopt the AI strategy, as investing more resources in implementing AI may not significantly increase its market appeal. This finding has implications for platforms that need to consider consumer sensitivity to intelligent services when deciding whether to adopt the AI strategy. The platform needs to formulate corresponding strategies according to the characteristics of market demand and consumer groups. It also highlights the need for platforms and service providers to pay close attention to consumer feedback and needs and flexibly adjust strategies to adapt to market changes.

Proposition 6. (i) , . (ii) If mH > eAS∗/2, then ; otherwise, ; and if mL > 2eAS∗, then ; otherwise, .

Proposition 6(i) states that the adoption of the AI strategy increases consumer demand for both high-quality and low-quality services. This is because the adoption of the AI strategy can improve the efficiency, quality, and personalization of services, thereby increasing consumer demand for services. High-quality services are usually favored by consumers, and the adoption of the AI strategy can create better and more competitive products and services for both service providers, thus attracting more consumers. Proposition 6(ii) states that when the quality of high (low)-quality services on the platform is high, high (low)-quality service provider will set higher service price if the platform does not adopt the AI strategy. This is because not adopting the AI strategy makes it difficult for service providers to achieve cost-effectiveness, efficiency, and personalization. Therefore, they tend to compensate for these defects by raising prices to maintain profits. Therefore, the adoption of AI strategy by the platform can increase consumer demand for both high-quality and low-quality services, thus promoting competition and innovation in the market. Consumers are more inclined to choose higher quality and more personalized services, and platforms can better meet these needs by adopting the AI strategy, thereby improving the attractiveness and market share of services. It also highlights the important role of AI technology in the service industry and its impact on consumer demand and the market landscape.

Proposition 7. If , then and ; otherwise, , , and .

Proposition 7 points out that when the platform determines the service price, if the consumer is less sensitive to the intelligent service level, the platform’s choice not to adopt the AI strategy is more beneficial to the high-quality service provider and the platform. For the low-quality service provider, it is always more advantageous for the platform to adopt the AI strategy, regardless of the sensitivity coefficient of consumers to intelligent service levels. The reason behind this finding is that when consumers are less sensitive to intelligent service levels, the high-quality service provider has a more prominent advantage in providing services, while the adoption of the AI strategy may increase costs and contribute less value to the high-quality service provider. Therefore, the adoption of the AI strategy can improve the service level of the low-quality service provider, thereby improving their competitiveness. On the contrary, high-quality service providers, already have a high level of service, so the adoption of the AI strategy for platforms may not bring significant added value to them. In this case, the platform is more inclined to support low-quality service providers to improve the overall market service level.

Proposition 8. (i) , . (ii) If , then ; otherwise, ; and if β < (2cmL)/(2cmL + r), then ; otherwise, .

Proposition 8(i) shows that when the platform determines the service price, whether it chooses to adopt the AI strategy will not affect the consumer demand for high-quality services, while adopting the AI strategy will help improve the consumer demand for low-quality services. This is because high-quality services are attractive in their own right, and consumer demand is not affected by the platform’s adoption of the AI strategy. On the contrary, for the low-quality service provider, adopting the AI strategy can improve their service quality and efficiency, thus attracting more consumers.

Proposition 8(ii) points out that when the sensitivity coefficient of consumers to intelligent services is small, the price of high (low)-quality service when the platform does not adopt the AI strategy is higher than the price of high (low)-quality service when the platform adopts the AI strategy. This is because when consumers are less sensitive to intelligent services, they may pay less attention to the way the service is provided but pay more attention to the price and service quality. In this case, platforms may be inclined to adopt the AI strategy to improve efficiency and reduce costs, thus lowering prices when providing services and attracting more consumers, while maintaining service quality. In contrast, if the platform does not adopt the AI strategy, it may need to invest more manpower and resources, resulting in higher service costs, which are reflected in the service price.

The findings imply that in the field of intelligent services, the adoption of the AI strategy can not only improve service quality and user experience but also affect the price level of services to a certain extent, bringing more choices and competitive advantages to the market.

5.3. The Effect of AI Strategy Adoption and Pricing Mechanism Selection on Consumer Surplus and Social Welfare

Proposition 9. CSNS > CSNP and SWNS > SWNP.

Proposition 9 shows that consumer surplus and social welfare under Scenario NS are higher than those under Scenario NP. This is because when service providers compete on price, they tend to lower prices to attract more consumers, leading to an increase in aggregate demand. This competition will drive prices to lower levels, allowing consumers to buy services at more affordable prices, thereby increasing their surplus. In contrast, under Scenario NP, platforms monopolize pricing power and may set higher prices, limiting aggregate demand and resulting in lower consumer surplus and social welfare. This finding indicates that market competition can reduce prices, improve product quality, and increase consumers’ choices and interests, thus improving overall social welfare. It also highlights the significance of competition policy in maintaining fair and effective market competition, which benefits both consumers and society as a whole.

5.4. Numerical Analysis

In this section, we demonstrate the comparative results of intelligent service level, platform profit, consumer surplus, and social welfare through numerical examples and further provide some new findings and management insights on the AI strategy adoption of service-sharing platforms. We set mH = 0.8, mL = 0.6, r = 0.3, and c = 0.1. These parameter settings can ensure that the conditions of the optimal solution are met and will not affect the comparison results.

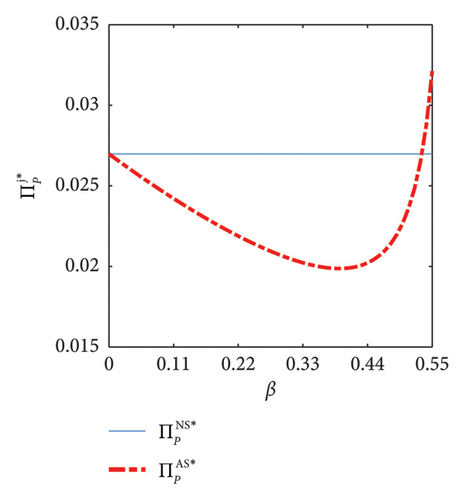

Figure 1 shows the comparison of and . From Figure 1, we can find that when the sensitivity coefficient of consumers to the intelligent service level is low, the platform will obtain larger profits without adopting the AI strategy; otherwise, when the sensitivity coefficient of consumers to the intelligent service level is high, the platform will obtain more profits by adopting the AI strategy. This is because when consumers attach great importance to intelligent service levels, the platforms adopting the AI strategy can better meet consumer needs and bring higher profits. This observation implies that in business decisions, intelligent service strategies need to be tailored to consumers’ preferences for intelligent service levels to maximize profits. Platforms need to flexibly respond to changes in market demand and weigh the relationship between AI adoption and profit to provide a level of intelligent service that meets consumer expectations, thus gaining more profit and market share. Therefore, it is crucial for platforms to have a deep understanding of consumer preferences and rationally formulate whether to adopt the AI strategy.

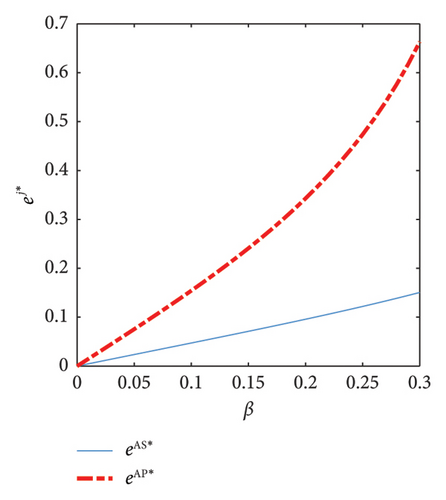

Figure 2 shows the comparison of eAS∗ and eAP∗. From Figure 2, we can see that the intelligent service level when the platform determines the service price is higher than the intelligent service level when the service provider determines the service price. This phenomenon may be because the platform has more resources and technical advantages and can better use the AI strategy to analyze market data, consumer behavior, and competitors’ pricing strategies so as to develop more competitive pricing schemes. In contrast, service providers may face the challenge of technological and information asymmetry, resulting in a low level of intelligent service when determining service prices. This observation means that in market competition, platforms using the AI strategy can better meet consumer demand and improve market competitiveness. Service providers, on the other hand, need to strengthen the application of intelligent technologies to improve their pricing power and achieve a better competitive position in the market. This differentiated level of intelligent services has a profound impact on the development of the market and the competitive landscape.

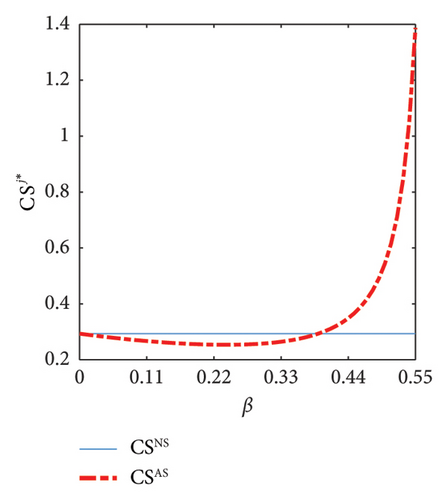

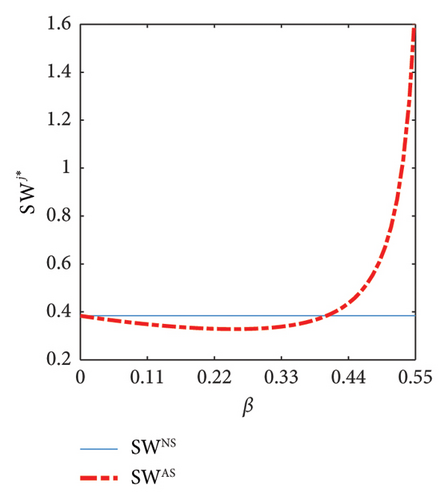

Figure 3 shows the comparison of consumer surplus and social welfare under different situations, respectively. From Figure 3, we can find that when the service provider pricing, if the sensitivity coefficient of consumers to intelligent service level is low, the consumer surplus and social welfare are higher when the platform does not adopt the AI strategy than when the platform adopts the AI strategy. The reason behind this phenomenon may be that consumers have insufficient cognition of AI services or have low expectations of their actual utility or it may be that consumers value interpersonal interaction or customized services more. In this case, the adoption of the AI strategy may cause a mismatch with consumer needs, leading to a decline in consumer surplus and social welfare. Therefore, this observation means that platforms need to fully consider consumer needs and preferences when deciding whether to adopt the AI strategy and avoid blindly pursuing technological innovation while ignoring the actual expectations of consumers. Balancing the relationship between technology and humanized services can truly improve consumer satisfaction and social welfare.

6. Conclusion

This paper studies the interaction between the AI strategy adoption and pricing mechanism selection in a service-sharing platform. We consider four scenarios for platform adoption or nonadoption of the AI strategy, service provider pricing mechanism, and platform pricing mechanism. This study presents the optimal results under different scenarios and conducts a sensitivity analysis of the optimal results. This study also explores the pricing mechanism selection of the platform and the conditions for adopting the AI strategy. Moreover, this study also analyzes the impact of adopting the AI strategy and pricing mechanism on consumer surplus and social welfare.

The important findings of this study are summarized as follows. First, when consumer sensitivity to the intelligent service level is high, the platform tends to adopt the AI strategy, which may harm the profits of both service providers. Platform pricing is more beneficial to the platform and high-quality service provider and reduces the profits of the low-quality service provider. Second, when the platform determines the service price, if the consumer’s sensitivity to the intelligent service level is low, it is more advantageous to choose not to adopt the AI strategy for the high-quality service provider and the platform. When service providers determine service prices, the platform tends to adopt the AI strategy if consumers have a high sensitivity coefficient to the intelligent service level, which may harm the profits of both service providers. Third, when the platform does not adopt the AI strategy, if the service providers determine the service price, the consumer surplus and social welfare will be greater. When the service provider pricing, if the sensitivity coefficient of consumers to intelligent service level is low, the consumer surplus and social welfare are higher when the platform does not adopt AI strategy than when the platform adopts AI strategy.

This study also provides management implications for service providers and P2P service platforms. First, platforms need to fully consider consumers’ sensitivity to intelligent services when formulating pricing mechanisms. For high-quality service providers, the platform pricing mechanism can bring greater profits, while low-quality service providers may face the risk of declining profits. Therefore, the platform should comprehensively evaluate the market demand and competitive situation to develop a pricing mechanism that can enhance consumer satisfaction and ensure profit. Second, service-sharing platforms should adjust the strategy flexibly in different market environments. If consumers do not have a strong demand for intelligent services, platforms can consider simplifying services, reducing operating costs and thereby enhancing the competitiveness and market share of high-quality service providers. At the same time, the platform should encourage service providers to improve their service quality in order to attract more users and promote overall profit growth. Third, platforms should pay attention to social benefits when making decisions, especially in the context of service provider pricing. The platform can help service providers better understand consumer needs by providing transparent pricing information and market data, thereby achieving a two-way improvement of consumer surplus and social welfare. In addition, the platform should encourage service providers to conduct reasonable pricing to ensure that the profits of itself and service providers are maintained without sacrificing the interests of consumers.

Future research can be expanded in two ways. First, this paper considers that service prices are fixed, and it would be interesting to discuss how the results would be different if service prices changed over time, etc. Second, it is interesting to explore the interaction of the AI strategy adoption and pricing mechanism across multiple platforms in a competitive market.

Conflicts of Interest

The authors declare no conflicts of interest.

Author Contributions

Xiaodong Wang: writing, methodology, visualization, formal analysis, and investigation. Zhao Zhu: supervision, conceptualization, and reviewing and editing. Pengfei Ma: methodology and reviewing and editing.

Funding

No funding was received for this work.

Acknowledgments

It is gratefully acknowledged that this study was supported by Department of Management Engineering, Inner Mongolia Vocational and Technical College of Communications, Chifeng, Inner Mongolia, China.

Appendix A: Proofs

Proof of Lemma 1. We substitute equations (3) and (4) into equations (9) and (10) can be further expressed as

We can obtain and by solving equations (A.1) and (A.2). Lemma 1 holds.

Proof of Lemma 2. We substitute equations (3) and (4) into equation (14) and it can be further expressed as

We can obtain and by solving and . Lemma 2 holds.

The proof of the remaining lemmas is easy to obtain and will not be repeated here.

Proof of Corollary 1. The first derivatives of , , , , and with respect to mH are , , , , , and . Obviously, we know that , , , , and .

The first derivatives of , , , , and with respect to mL are , , , , , and . Obviously, we know that , , , , and . Lemma 1 holds.

The proof of the remaining inferences is similar to Corollary 1 and will not be repeated here.

Proof of Proposition 1. It is easy to obtain , , and . Obviously, , , and .

Proposition 1 holds.

The proof of the remaining propositions is similar to that of Proposition 1 and will not be repeated here.

Proof of Proposition 3. The key thresholds are

Proof of Proposition 4. The key thresholds are

Open Research

Data Availability Statement

The data used to support the findings of this study are included within the article.