Dynamic Pricing Strategy for Trade-in Program of Smart Interconnected Products Considering the Digital Intelligence Level

Abstract

In practice, trade-in programs have been widely used to collect the old smart interconnected products (which are abbreviated as SIPs) and promote the new ones for sale. The SIPs trade-in pricing strategy is studied when the digital intelligence level is considered by using the game-theoretical method in our paper. The results show that the digital intelligence level has a positive effect on the selling price of SIPs and the demand under the dynamic pricing (which is abbreviated as DP) strategy. In the extended model, when the digital intelligence level is very high, it is suitable for the firm to select the DP strategy. On the other hand, the firm selects the static pricing (which is abbreviated as SP) strategy. When customers prefer to purchase the second-generation SIPs, the firm chooses the single rollover (which is abbreviated as SR) strategy or selects the dual rollover (which is abbreviated as DR) strategy. The firm obtains the same profit under two different strategies.

1. Introduction

1.1. Background and Motivation

The fifth generation mobile communication technology has accelerated the pace of transformation to the information society, and it will enter into the era of the internet of things. It combines artificial intelligence technology and the customer industry, resulting in many intelligent services and experience scenarios, and the concept of smart interconnection has also emerged. With the application of the concept of smart interconnection, many smart interconnected products (SIPs) (e.g., smartphones, smart water heaters, or smart TV) have emerged, which have a profound impact on people’s lifestyle. The SIPs include three core elements: physical components, intelligent components, and interconnected components. Therefore, firms and customers can obtain information and data related to the product life cycle through the internet during the use of SIPs [1–3].

The update speed of SIPs is very quick, which can lead to a lot of waste products. For example, it has accumulated about 1.83 billion old mobile phones since 2014 in China. The Department of Industry and Information Technology predicts that it will produce about 4.61 billion mobile phones in 2018, and it will increase to 4.99 billion in 2019, respectively. Furthermore, the number will rise to 5.24 billion when the 5G technology is used. In addition, it was stimulated by the trade-in policy between 2009 and 2012, and the selling quantity of the smart home appliance increased very quickly. The production of smart home appliances, such as televisions, refrigerators, or computers, has reached 500 million units. Nowadays, all these smart home appliances have already entered into the update period, in 2020, and the storage of waste home appliances has reached 137 million units.

Thus, a new round of promoting consumption policy will be proposed. In January 2021, the plan to promote mass consumption and key consumption to unleash the rural consumption potential was issued by the Ministry of Commerce in China, and it points out that the customers will be encouraged to buy environmentally friendly furniture with subsidies. In February 2024, the fourth meeting of the Central Economic Commission in China emphasized that it should promote a new round of equipment renewal and trade-in for consumer goods of the whole society. Thus, to effectively collect old SIPs, trade-ins have been widely used. Thus, the trade-in program has become an important way to collect old SIPs [4].

A very important problem during SIPs’ trade-ins is the pricing problem. To retain old customers and obtain repeat buy, firms offer the trade-in rebate to replacement buyers [5]. Different from traditional functional products, SIPs obtain the relevant data of the product’s life cycle when the customers use them. Customers can much more clearly understand the usage status, the useful life, and other information of SIPs and make a more accurate selection about whether to participate in trade-ins or not. Through the smart components, firms can more clearly understand customer’s usage habits and the residual value of SIPs and can make more accurate decisions. Thus, firms have to consider product life cycle and product replacement in the process of trade-ins.

Compared to traditional functional products, SIPs are composed of smart components, interconnection components, and other components. Smart components can store and manage data to realize the digitization of SIPs. Interconnection components are used for online connection, and data transmission is used to realize the intelligentization of SIPs. The combination of digital and intelligent can be referred as to the digital intelligence level which is considered as the most important feature of SIPs. It can be reflected through intelligent function, interactive experience, and intelligent decision. Thus, in the process of the trade-in dynamic pricing (DP) strategy for SIPs’, we analyze the impact of digital intelligence level on customer’s choice behavior and firms’ trade-in pricing strategy. Table 1 gives the difference between the traditional functional products and SIPs.

| Points | Traditional functional products | SIPs |

|---|---|---|

| Intelligent function | Physical components, as the core parts of traditional functional products, can achieve basic physical functions and meet the basic needs of users. Due to the lack of installation of smart components and interconnection components, traditional functional products cannot provide users with complex experience scenarios | As a key attribute of SIPs, intelligent functions are generally equipped with sensors and data communication modules, which can handle more complex experience scenarios and meet users’ operational needs in different scenarios. The functional intelligence brought about by this hardware upgrade is the basis for stimulating users to choose products |

| Interactive experience | Traditional functional products are not equipped with smart components and cannot provide users with various interactive experience scenarios through methods such as voice recognition and motion recognition. Meanwhile, traditional functional products only provide users with a one-way service experience but lack a two-way interactive experience | The interaction operation of SIPs has undergone significant changes. New interaction methods such as voice recognition, motion recognition, and biometric recognition have been successively applied to the products for not only liberating users’ hands but also bringing differentiated competitive advantages to the related products |

| Personalized service | Traditional functional products have a simple structure, single function, convenient operation, and a popular target audience. They can meet the basic needs of users, but they cannot provide personalized services for users | SIPs have complex structures, diverse functions, and convenient operations and have received extensive attention and high praise from the general public. They can provide users with customized and personalized services |

| Intelligent decision-making | Traditional functional products can meet the basic data storage requirements. However, due to the absence of interconnection components, data information such as consumers’ usage habits and the residual value of products cannot be promptly fed back to enterprises, and thus cannot provide data support for the operation and management as well as decision-making of enterprises | SIPs have intelligent components and connected components. They can not only store consumers’ usage habits, the residual value of products, and other data in a timely manner but also transmit them to enterprises promptly. Through data mining, visual analysis, and other methods, enterprises can provide support for their operation and management as well as decision-making |

This paper analyzes the trade-in pricing strategy for SIPs considering the digital intelligence level. We analyze the following questions: (1) what is the impact of the digital intelligence level on the customer’s behavior and the firm’s trade-in DP strategy?, (2) what is the firm’s optimal trade-in pricing strategy when the digital intelligence level is considered?, and (3) what is the optimal product replacement strategy under the trade-in DP strategy when the digital intelligence level is considered?

One firm sells two successive-generation SIPs to customers in two periods. The firm decides the selling price and the trade-in rebate of SIPs. In the basic model, the firm uses the single rollover (SR) strategy to achieve the product replacement. We analyze the customer’s choice behavior and the firm’s optimal pricing decision when the firm uses the DP strategy and considers the digital intelligence level. Moreover, we obtain two extended models. Table 2 gives several examples about the research topic of this study in the real-world.

| Real-world examples | Details |

|---|---|

| Haier firm | Haier has sold SIPs to customers by using the self-owned store in JD.com. For example, the smart air conditioner can realize the control of the whole house by adding the network system. In addition, the special energy efficiency system will automatically monitor the operating status, operating parameters, and indoor and outdoor ambient temperature and humidity of the home heating and cooling system all day. Therefore, the average selling price of Haier’s smart air conditioner is 800 yuan–1000 yuan higher than that of traditional air conditioners |

| Huawei firm | Huawei has produced and sold the smart interconnected vehicles (i.e., AITO-M7 and AITO-M9) to customers in the vehicle shop. As is known to us, the average selling price of all these smart interconnected vehicles is 80,000 yuan–100,000 yuan higher than that of traditional fuel vehicles |

The results are that (i) the digital intelligence level has a positive impact on the selling price and the demand under the DP strategy; (ii) when the digital intelligence level is very high, it is suitable for the firm to select the DP strategy. Otherwise, it is better for the firm to choose the static pricing (SP) strategy; and (iii) when customers prefer to purchase the second-generation product, the firm can choose the SR strategy or the dual rollover (DR) strategy. The firm can obtain the same profit under these two different product rollover strategies.

1.2. Contribution and Structure

Our paper is most related to Liu et al. [6]. The main difference between them is that (1) Liu et al. [6] just analyzed the pricing strategy of trade-ins for the traditional functional products. However, this paper analyzes the pricing strategy of trade-ins for SIPs. (2) Liu et al. [6] discuss the DP strategy of trade-ins for the traditional functional products. However, this paper analyzes the DP strategy of trade-ins for SIPs, and we analyze the effect of the digital intelligence level on the customer’s purchase behavior and the firm’s pricing strategy of trade-ins.

Moreover, according to the differences between the two kinds of products given in Table 1, we use the digital intelligence level as a very important feature to measure SIPs and the digital intelligence level is introduced into the process of trade-in for SIPs. The digital intelligence level will affect the utility of customers. Subsequently, the digital intelligence level will affect customers’ demand for SIPs. Ultimately, it will influence the trading-in pricing strategy of firms. This is a very prominent innovation point in this paper. However, in the other existing literature, the impact of the digital intelligence level on customer utility has not been considered, and thus the influence of the digital intelligence level on trading-in pricing strategy has not been taken into account.

Thus, the contribution is that (1) this paper discusses the trade-in pricing strategy for SIPs and compares the DP strategy with the SP strategy for SIPs. (2) Most literature does not analyze the effect of the digital intelligence level on the firm’s trade-in pricing strategy. This paper analyzes the effect of the digital intelligence level on the firm’s trade-in pricing strategy for SIPs.

The literature review is presented in Section 2. Section 3 builds the model. Section 4 considers the firm’s DP strategy. In Section 5, we consider the two extension models. Section 6 derives the results and provides the conclusion of the study.

2. Literature Review

The literature can be divided into three parts: (1) the pricing strategy problem, (2) the trade-in SP strategy of the traditional functional product, and (3) the trade-in DP strategy of the traditional functional product.

2.1. The Pricing Strategy Problem

A large number of papers have discussed the pricing strategy by using different methods. For example, Hendalianpour [7] has built one game model for the pricing and inventory strategy for the perishable products. Hendalianpour et al. [8] have analyzed the pricing strategy and coordination mechanism in the two-level supply chain (SC). Liu et al. [9] have discussed the optimum retail price in a two-level SC. Liu et al. [10] have discussed the optimal inventory level in a two-level SC. Ruidas et al. [11] have discussed the pricing strategy for the new and updated product in some areas by using the optimal inventory method. Liu et al. [12] have analyzed the pricing strategy of the fast consuming goods which are sold in two ways: physical and online sales. Ruidas [13] has discussed the firm’s pricing strategy and the production inventory strategy when the firm was faced with both the primary and updated product market. Zhao et al. [14] have come up with a new method to discuss the optimal pricing strategy while using blockchain in omnichannel retailing. Wang et al. [15] have discussed the best trade-in provider in e-commerce SC and the pricing strategy when considering the impact of the selling model. Hu et al. [16] studied the manufacturer’s traded-in resale strategy and pricing strategy in the presence of the online P2P platform. Zheng et al. [17] have discussed the trade-in pricing strategy when the manufacturer adopts different brand’s trade-in strategies. The above literature mainly discusses the pricing strategy under different kinds of conditions. However, they do not analyze the firm’s trade-in pricing strategy of the traditional functional product.

2.2. The Trade-in SP Strategy of the Traditional Functional Product

The theoretical research in the trade-in pricing strategy of the traditional functional product rose in the 1990s and has accumulated a fruitful result. However, the existing relevant literature mainly discusses the SP strategy. In addition, some literature analyzes the trade-in pricing strategy of traditional functional products under the situation of the complete monopoly market, without considering the digital intelligence level. The impact of the digital intelligence level, the customer’s strategic behavior, or the product’s rollover strategy on the trade-in pricing strategy of SIPs is not analyzed.

Due to the extremely complicated operation process of trade-ins, in the early stage, we studied the pricing strategy under the situation of the complete monopoly market. The SP strategy is widely used in the trade-in process. Levinthal and Purohit [18], Ackere and Reyniers [19], and Fudenberg and Tirole [20] analyzed the monopoly pricing of trade-in products or the production strategy of upgrading products from different angles but did not involve the impact of product residual value and recovery income on the SP strategy of the product. Based on the residual value and recycling income, Ray et al. [21] have established an independent trade-in model and analyzed the SP strategy of enterprises. Then, some literature analyzed the SP strategy in the process of trade-ins completely monopolized markets under various circumstances. Feng et al. [22] analyzed the SP strategy of online and offline trade-in business. Ma et al. [23] analyzed the SP strategy under different trade-in strategies. Miao et al. [24] introduced trade-ins into the closed-loop SC and analyzed the SP strategy under three recycling modes: centralized recycling, retailer recycling, and manufacturer recycling. Dou and Choi [25] combined the green technology with trade-in to analyze the SP and environmental effect under different recycling modes. Cao et al. [26] combined the return strategy with trade-in to analyze the optimal SP strategy under the full return strategy and partial return strategy. Yi and Chen [27] analyzed the problem of optimal SP strategy under two trade-in strategies. Rao et al. [28] pointed out that trading old for new can effectively alleviate the “lemon problem” in the secondary market, thereby improving the economic effect of enterprises. Ma et al. [29] considered the market segmentation and consumer utility in the trade-in process. All the above literature has just discussed the trade-in SP strategy; however, the DP strategy is widely used in the firm.

2.3. The Trade-in DP Strategy of the Traditional Functional Product

Compared to the SP strategy, the DP strategy is an intertemporal price discrimination behavior focusing on demand uncertainty [30]. Recent literature pays more attention to the DP strategy. However, these studies are all based on the monopolistic market and analyze the DP strategy of trade-ins, without considering the influence of consumers’ strategic behavior. Gu et al. [31] discussed the DP decision under the autonomous trade-in model but did not consider consumers’ perception of the residual value of old products. Assuming that the old products recycled by trade-in can be sold directly in the market, Chen et al. [32] analyzed the DP strategy of a single manufacturer. Different from the above literature, Han et al. [33] discussed the condition that a single enterprise offers a new one under the DP strategy. Li et al. [34] analyzed the DP strategy of monopolistic firms under the “trade-in for remanufacturing” scenario. Zhao et al. [14] analyzed the pricing strategy of the automobile producer.

All the above literature has just discussed the trade-ins’ DP strategy of the traditional functional product; however, they did not analyze the trade-in DP strategy of SIPs.

Different from the above literature, our paper discusses the impact of the data intelligence level on implementing the operational strategy of CLSC with an online platform. Finally, the comparison between the literature and our paper is shown in Table 3.

| Studies | Pricing strategy | Product rollover strategy | Trade-in rebate decision | Age-dependent trade-in rebates | Digital intelligence level | ||

|---|---|---|---|---|---|---|---|

| Static pricing | Dynamic pricing | Single rollover | Dual rollover | ||||

| Ray et al. [21] | √ | × | × | √ | √ | × | × |

| Miao et al. [24] | √ | × | √ | √ | √ | × | × |

| Gu et al. [31] | √ | × | × | √ | √ | × | × |

| Chen et al. [32] | √ | × | √ | × | √ | × | × |

| Han et al. [33] | √ | × | × | √ | √ | × | × |

| Feng et al. [22] | √ | × | √ | × | √ | × | × |

| Li et al. [34] | × | √ | √ | × | √ | × | × |

| Xiao et al. [35] | × | √ | √ | √ | √ | × | × |

| Ma et al. [29] | √ | × | √ | × | √ | × | × |

| Cao et al. [36] | √ | × | √ | × | √ | × | × |

| Yuan et al. [37] | √ | √ | √ | √ | √ | × | × |

| This study | √ | √ | √ | √ | √ | √ | √ |

3. Model Setup

First, the firm can sell two-generation SIPs to customers in two periods. The firm uses the SR strategy, in which two-generation products X1 and X2 are sold with the prices p1 and p2, respectively, and when the X2 is sold in the market, the X1 will stop selling. By referring to the study of Yuan et al. [37], we assume that the higher the degree of the digital intelligence level, the greater the utility for customers. Thus, we should quantify the digital intelligence level of SIPs in which the digital intelligence level of X1 is L and the level of X2 is (1 + θ)L. During Period 2, the firm provides the trade-ins in which the replacement customer who has bought the X1 (the residual value is s, 0 ≤ s ≤ θ) [16, 23, 29] agreed to purchase X2 with the price p2 − r, where the r can be seen as the trade-in rebate. To simplify the analysis, we omit the unit production cost of X1 and X2 [16, 23].

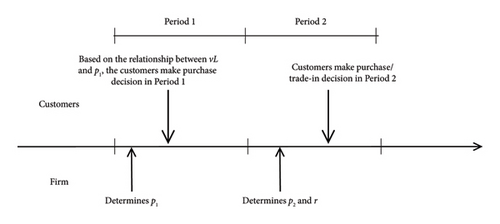

All customers arrive at the market at the beginning of Period 1, and the potential market size is simplified to 1 [6, 38]. Due to considering the digital intelligence level L, the customer’s total valuation of X1 is vL, and v obeys the uniform distribution within the domain [0, 1] [6, 16]. The customer’s total valuation of X2 is (1 + θ)vL, and θ (θ ≥ 0) is the incremental value of X2 over X1. Figure 1 describes the order of event when the firm uses the DP strategy. The firm decides the p1 in Period 1 and determines the p2 and r in Period 2. In Period 1, comparing the relationship between vL and p1, the customer makes purchase decision. In Period 2, the customer who has bought the X1 will decide whether to participate in trade-ins or not, and others who did not purchase the X1 will decide whether or not to buy the X2.

To make the paper easier to understand, all relevant notations are shown in Table 4.

| Notations | Describes |

|---|---|

| Xi | The two-generation products, where i ∈ [1, 2], 1 means the old generation products, and 2 means the new generation products |

| v | The customer’s valuation of X1 |

| L | The digital intelligence level of X1 |

| θ | The incremental value of X2 over X1 |

| pi | The selling price of Xi, where i ∈ [1, 2] |

| r | The trade-in rebate provided by the firm |

| s | The residual value of X1 |

| The number of customers who purchase X1 in Period 1, where j ∈ [D, S], D means the DP strategy, and S means the SP strategy | |

| The number of customers who purchase X2 in Period 2, where j ∈ [D, S] | |

| The number of customers who take part in the trade-ins in Period 2, where, j ∈ [D, S] | |

| π2 | The firm obtains the profit in Period 2 |

| πt | The firm obtains the total profit in two periods |

4. DP Strategy

We analyze the customer’s choice behavior and the firm’s optimal pricing decision when the firm uses the DP strategy.

4.1. Customer’s Choice Behavior

First, we should analyze the buying behavior in Period 1. According to the customer utility theory, the customer who will buy X1 can get the utility of CS1B = vL − p1. Otherwise, customers do not buy the SIPs in Period 1 and will wait to the second period. Then, the customer’s choice behavior will be analyzed in Period 2. Customers who have bought X1 will take part in trade-ins, and they can get the utility of CS2T = vL(1 + θ) − p2 + r − s; customers who have bought X1 will not take part in trade-ins, and they can get the utility of CS2NT = s; customers who do not buy X1 will buy X2, and they can get the utility of CS2B = vL(1 + θ) − p2; and customers who do not buy any products, they can get the utility of CS2NB = 0. In the two periods, the customer’s optimal purchasing behavior follows the threshold value strategy. The represents the customer’s threshold value in Period 1. The customer will buy X1 when the valuation is higher than the threshold value ; otherwise, the customer will choose to wait to Period 2. Then, and represent the customer’s threshold value in Period 2. In Period 2, the customers who have bought X1 will take part in trade-ins when the customer’s valuation satisfies ; customers who have bought X1 will not take part in trade-ins when the customer’s valuation satisfies . The customer who does not buy X1 will buy X2 when the customer’s valuation satisfies . The customer who does not buy X1 will buy nothing when the customer’s valuation satisfies . We can get the thresholds in Table 4 by comparing the customer’s indifference condition. Thus, the number of customers who take part in trade-ins is . The number of customers who will purchase X2 is .

Of course, some customers want to return their old SIPs and obtain the trade-in rebate in cash under the condition of pt > 0 [26, 35] when the firm provides the trade-ins, assuming that all different types of customers exist simultaneously.

4.2. Firm’s DP Strategy

We should analyze the game model between SIPs’ firm and the customer when the firm uses the DP strategy, and we can obtain the optimal result.

The first term is denoted as the firm’s profit obtained from customers who participate in the trade-in program. The second term is denoted as the firm’s profit obtained from customers who purchase X2. The above constraints make sure that the pricing and demand are non-negative and rational in Period 2. Constraint (2) ensures that only the customer who does not buy X1 will buy X2. Constraint (3) ensures that only the customer who does buy X1 will take part in the trade-in program. Constraint (4) ensures that the trade-in rebate is not higher than the selling price of second-generation products.

The first term is denoted as the firm’s profit obtained from customers who buy X1 in Period 1. The second term is denoted as the firm’s optimal profit obtained from Period 2. Constraints (6) and (7) ensure that the pricing and demand are non-negative and rational in Period 1. We solve the firm’s total profit in two periods by using the backward induction method, and the results are as shown in Proposition 1 (Proof of Proposition 1 can be seen in the Appendix).

Proposition 1. Considering the trade-ins and the SR strategy, when the firm follows the DP strategy, then we can get the following results:

- (i)

The optimal selling prices, , , and the optimal trade-in rebate rD are as follows: , , and rD = ((7s)/4) − L(1 + θ)/4.

- (ii)

The optimal quantities under different customer’s choice behavior are as follows: , , and .

We can get the following results: (1) , which suggests that the customers who have bought X1 in Period 1 take part in the trade-ins in Period 2; (2) some customers who do not buy X1 in Period 1 would like to buy X2 in Period 2. Others who do not buy X1 in Period 1 do not want to buy X2; (3) the digital intelligence level not only impacts the selling price of the two-generation products but also affects the customer’s choice behavior under different situations. Moreover, the incremental value and the residual value impact the selling price and quantities in different ways.

Lemma 1. The impacts of L, θ, and s on the selling price of two-generation products and the customer’s choice behavior are shown in Table 5.

| Parameters | Variables | ||||||

|---|---|---|---|---|---|---|---|

| r∗ | |||||||

| L | ↑ | ↑ | ↓ | ↑ | ↓ | ↑ | ↑ |

| θ | ↑ | ↑ | ↓ | ↑ | ↓ | ↑ | ↑ |

| s | ↑ | ↑ | ↑ | ↓ | ↑ | ↓ | ↑ then ↓ |

First, we would like to explain Table 5 in detail. Table 5 shows us the impact of the digital intelligence level (L), the incremental value of X2 over X1 (θ), and the residual value of X1 (s) on the firm’s optimal decision. In addition, in Table 6, the up-arrow (↑) means that one parameter has a positive effect on the variable. The down-arrow (↓) means that one parameter has a negative effect on the variable.

| Notations | Describes | Value |

|---|---|---|

| Indifference point for customers between trading in X1 for X2 and using X1 in Period 2 | (p2 − r + 2s)/(L(1 + θ)) | |

| Indifference point for customers between buying X2 and nothing in Period 2 | p2/L(1 + θ) |

Second, Lemma 1 and Table 6 describe the impact of relevant parameters on firm’s optimal pricing, demand, and profit. The digital intelligence level has the same impact on the selling price of products, the demand, and the firm’s optimal profit. Furthermore, the , , and r∗ increase in the residual value s. However, the demands and decrease in the residual value s. For the firm’s optimal profit, the more innovative the X2 is, and the higher the digital intelligence level is, the much higher the profit the firm gets. On the other hand, the effect of the residual value on the firm’s profit is bell-shaped. Maybe, the higher residual value damages the firm’s optimal profit.

5. Extension

We will discuss whether the result is different when some conditions change. First, we will compare the results between the DP strategy and the SP strategy. Second, we will discuss the difference between the SR strategy and the DR strategy.

5.1. The SP Strategy

The DP strategy represents an intertemporal price discrimination approach, which focuses on the demand uncertainty [30]. On the contrary, the SP strategy mainly refers to the firm that decides the selling price of products before the release of the new product. In this extended model, we should compare the impact of the SP strategy on the customers’ choice behavior and the firm’s profit in the two periods.

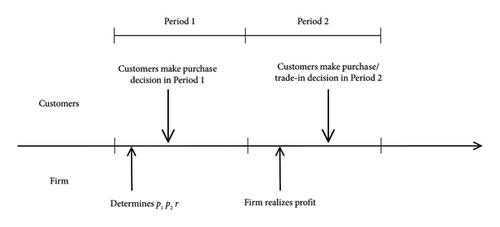

The order of events when the firm uses the SP strategy is shown in Figure 2. In Period 1, the firm determines all variables including p1, p2, and r. Customers make purchase decision to maximize their total utility in the two periods. First, we should analyze the customer’s purchase behavior in the two periods. According to the customer utility theory, customers who have not bought X1 will not buy X2, and they can get the utility of CSNN = 0; customers who have not bought X1 will buy X2, and they can get the utility of CSNB = vL(1 + θ) − p2; customers who have bought X1 will not take part in the trade-ins, and they can get the utility of CSBN = vL − p1 + s; and customers who have bought X1 will participate in the trade-ins, and they can get the utility of CSBT = vL − p1 + vL(1 + θ) − p2 + r − s. In the two periods, the customer’s optimal purchasing behavior follows the threshold strategy. The represents the indifference point for customers between buying X2 and buying nothing. The represents the indifference point for customers between keeping use X1 and buying X2. The represents the indifference point for customers between trade-in buying X2 and keeping use X1. Customers who have bought X1 will participate in the trade-in program when the valuation is higher than the threshold value . Customers who have bought X1 will not participate in the trade-in program when the valuation meets ; The customer who does not buy X1 will choose to buy X2 when the customer’s valuation meets ; The customer who does not buy X1 will choose to buy nothing when the customer’s valuation satisfies . Thus, the number of customers who have bought X1 will participate in the trade-in program is q2T = 1 − (2s + p2 − r)/(L(1 + θ)). The number of customers who have bought X1 will not participate in the trade-in program is q1B = 1 − (p2 − p1 + s)/(Lθ). The number of customers who will buy X2 is q2B = (p2 − p1 + s)/(Lθ) − p2/L(1 + θ).

The first term is denoted as the firm’s profit obtained from customers who buy X1 and participate in trade-ins. The second term is denoted as the firm’s profit obtained from customers who buy X1 in Period 1. The third term is denoted as the firm’s profit obtained from customers who buy X2 in Period 2. Constraints (9) and (10) ensure that the pricing and demand are non-negative and rational in Period 1. Constraint (11) ensures that only the customer who does not buy X1 will buy X2. Constraint (12) ensures that only the customer who does buy X1 will participate in trade-ins. Constraint (13) ensures that the trade-in rebate is lower than the selling price of X2. We solve the firm’s total profit by using the backward induction method and get the results in Proposition 2 (Proof of Proposition 2 can be seen in the Appendix).

Proposition 2. Considering the trade-in program and the SR strategy, when the firm follows the SP strategy, then we can get the following result:

- (i)

The optimal selling price, , , and the optimal trade-in rebate rS are as follows: , , and rS = (14s − 3Lθ)/8.

- (ii)

The optimal quantity under different customer’s choice behavior is as follows: , , and .

From Proposition 2, we can get the following result: (1) In this case, , which suggests that the customer who has bought X1 takes part in trade-ins in Period 2 and (2) some customers who do not buy X1 will buy X2, and others who do not purchase X1 will choose to buy nothing.

Proposition 3. Comparing the equilibrium result between the DP strategy and the SP strategy, we have (the Proof of Proposition 3 can be seen in the Appendix)

- 1.

, , rD < rS

- 2.

, ,

Proposition 3 suggests that (1) the equilibrium pricing under the SP strategy is higher than that under the DP strategy. However, the relationship of equilibrium quantity is no opposite. (2) The pricing of the new generation product is much higher () when the firm follows the SP strategy. More customers would like to purchase the new generation products () under the SP strategy. In addition, the customer who would like to purchase repeatedly under the DP strategy is higher than that under the SP strategy (, ). (3) We have . This suggests that the firm’s SP strategy cannot alleviate the customer’s delayed purchase behavior which is very different from other literature. In this paper, we consider that the firm sells two-generation products to customers in two periods. The new generation products have much higher digital intelligence levels than the old ones, and the pricing of new generation products is higher than that of the old ones, and it can bring a much higher marginal revenue for the firm. Thus, the customer’s delayed purchase behavior will not necessarily bring profit loss to the firm. The firm can improve the total profit by using the SP strategy.

Proposition 4. Comparing the firm’s total equilibrium profit between the two kinds of pricing strategy, we have (Proof of Proposition 4 can be seen in the Appendix)

- 1.

When (s(2 + 7θ + 9θ2))/(4(1 − θ)(1 + θ)2) < L, we have .

- 2.

When 0 < L < (s(2 + 7θ + 9θ2))/(4(1 − θ)(1 + θ)2), we have .

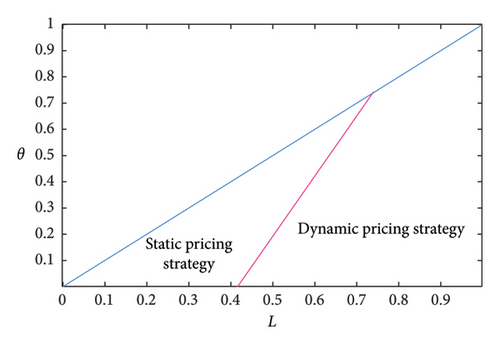

To easily understand the above proposition, we assume that s ∈ (0, 1), L ∈ (0, 1), θ ∈ (0, 1), and we can obtain Figure 3.

From Proposition 4 and Figure 3, when the digital intelligence level is very high, it is more suitable for the firm to choose the DP strategy. Otherwise, the firm chooses the SP strategy. When the digital intelligence level is in the high level, it will attract much more customers to buy new products. Moreover, when the firm provides trade-ins, customers who have bought X1 will take part in trade-ins in the second period. Others who have not bought X1 will purchase X2 in Period 2. In this case, the firm can improve two-generation product’s selling quantity by using the DP strategy. On the other hand, when the digital intelligence level is very low, the firm promises a relatively attractive price for the customer at the beginning of Period 1 by using the SP strategy so that the firm can obtain more profit.

5.2. The DR Strategy

The firm uses the DR strategy with trade-ins, in which two-generation products X1 and X2 are sold with the prices p1 and p2, respectively, and when the X2 is sold in the market, the X1 is sold to the customer with the discounted price pd (0 ≤ pd ≤ p1) in the second period. Other parameters and conditions are similar to the basic model.

The first term is denoted as the firm’s profit obtained from the customers who take part in the trade-ins. The second term is denoted as the firm’s profit obtained from the customers who purchase X2. The third term is denoted as the firm’s profit obtained from the customers who purchase X1 with the discounted price. Constraints (15)–(17) ensure that only customers who do not buy X1 will buy X2 and X1 with the discounted price. Constraint (18) ensures that only customers who do buy X1 will take part in the trade-ins in Period 2. Constraint (19) ensures that the trade-in rebate is lower than the selling price of the second-generation product. Constraint (20) ensures that the discounted price is not higher than the selling price of the first-generation product. Since π2 is the jointly concave function of p2, pd, r, we can obtain the firm’s optimal pricing strategy in Period 2.

The first term is denoted as the firm’s profit obtained from customers who buy X1 in Period 1. The second term is denoted as the firm’s optimal profit obtained from Period 2. Constraints (22) and (23) ensure that the pricing and demand are non-negative and rational in Period 1. We solve the firm’s total profit and the results are shown in Proposition 5.

Proposition 5. Considering the trade-ins and the DR strategy, when the firm follows the DP strategy, then we can get the result (Proof of Proposition 5 can be seen in the Appendix) as

- i.

In Case I, when the customer prefers to purchase X2, the optimal solution is , , , rDD = ((7s)/4) − L(1 + θ)/4, , , , and .

- ii.

In Case II, when the customer prefers to purchase X1 with the discounted price, the optimal solution is , , , rDD = ((7s)/4) − L(1 + θ)/4, , , , and .

- 1.

In Case I, customers who choose waiting to the second period will purchase X2. In Case II, they prefer to purchase X1 with the discounted price. The difference between the above two cases is mainly reflected in the price position of X1 and X2. The selling price of X1 is much higher under Case II, and other prices are the same under the two cases. The X1 has much more space for price reduction (), which makes the price discount in X1 more attractive in Period 2. Therefore, the customer prefers to purchase X1 with the discounted price in Period 2 under Case II, and the customer would like to buy X2 in Period 2 under Case I.

- 2.

In the above two cases, we have , which suggests that all customers who have bought X1 will take part in trade-ins in Period 2. This is because we have assumed that the marginal cost of the two-generation products is zero. The marginal revenue brought to the firm by the trading-in program is , which is higher than the marginal cost of producing a new product. The firm will encourage all customers who have bought X1 to take part in trade-ins.

- 3.

In the above two cases, we have , which implies that the price of the second-generation product is higher than the price of the first-generation product when the firm uses the DP strategy. For example, the price of the Huawei Mate 40 Pro is 6099 and the price of the Huawei Mate 40 Pro+ is 8499. The price of iPhone 12 is 4499 and the price of iPhone is 5199.

Proposition 6. Comparing the firm’s total equilibrium profit between the SR strategy and the DR strategy, we have (Proof of Proposition 6 can be seen in the Appendix)

- i.

In Case I, when the customer prefers to purchase X2, we have .

- ii.

In Case II, when the customer prefers to purchase X1 with the discounted price, on one hand, θL2 − 2sL − (s2(3θ + 2)/(1 + θ)2) > 0, and we have ; otherwise, θL2 − 2sL − (s2(3θ + 2)/(1 + θ)2) < 0, and we have .

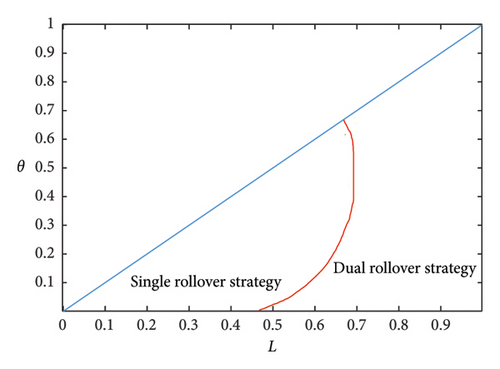

To easily understand the above proposition, we assume that s ∈ (0, 1), L ∈ (0, 1), and θ ∈ (0, 1), and we can obtain Figure 4.

Proposition 6 suggests that (i) when the customer prefers to purchase X2, the firm can choose the SR strategy or select the DR strategy. The firm gets the same profit under these two different strategies. (ii) When the customer prefers to purchase X1 with the discounted price, under certain condition, the firm selects the DR strategy. On the other hand, it is good to select the SR strategy for the firm.

6. Conclusions

6.1. Concluding Remark and Major Finding

This paper mainly discusses the DP strategy for the trade-in program of SIPs considering the digital intelligence level. We first build the analytical model to decide the optimal selling price and the optimal trade-in rebate when the firm uses the DP strategy. Then, we build two extended models where (1) we compare the DP strategy and the SP strategy considering the digital intelligence level and (2) we compare the SR strategy and the DR strategy considering the digital intelligence level.

We obtain the following results. First, in the basic model, the digital intelligence level has a positive impact on the selling price and the market demand under the DP strategy. In the extended model, when the digital intelligence level is very high, it is more suitable for the firm to choose the DP strategy. Otherwise, it is better for the firm to choose the SP strategy. When the customers prefer to purchase the second-generation products, the firm chooses the SR strategy or selects the DR strategy. The firm obtains the same profit under two different strategies.

6.2. Managerial Insight and Future Research

We give the following managerial insight: (1) The government should offer some useful methods to improve the enterprise data application service system. In addition, the government can provide enterprises with personalized services that can improve the efficiency of enterprises’ digital intelligent transformation and reduce the cost of digital intelligent transformation. (2) The enterprise should constantly improve the mechanism of talent introduction and improve the efficiency of talent introduction. In addition, the enterprise should continue to introduce high-quality and high-level talents, so that it can effectively improve the digital intelligence level of products. (3) The customers should actively participate in the trade-in activities of smart intelligent products and return their old products to the enterprise. In addition, customers should buy much more SIPs and improve the utilization efficiency of products and promote the replacement of SIPs.

We analyzed the DP strategy for trade-ins of SIPs considering the digital intelligence level. In the future, we can spawn the following research. First, the impact of the government subsidies on the trade-in pricing strategy of SIPs needs to be explored. Second, the influence of the asymmetric information between the customers and the enterprises on the trade-in pricing strategy of SIPs also should be discussed.

Conflicts of Interest

The authors declare no conflicts of interest.

Author Contributions

Shujun Liu conceptualized the study and wrote the original study. Jiaxi Guo edited the article.

Funding

No funding was received for this study.

Appendix

Proof of Proposition 1. Considering the trade-ins with the SR strategy, when the firm uses the DP strategy, the number of customers who purchase X1 is and the number of customers under different situations in Period 2 is q2T = 1 − (p2 − r + 2s)/(L(1 + θ)) and . The firm’s profit in Period 2 is

The Hessian matrix is . We have −(4/L(1 + θ)) < 0, . The Hessian matrix is negative. Defining that (∂π2/∂p2) = 0, and (∂π2/∂r) = 0, we have the optimal solution under no subjection that and . In order to satisfy the constraint in the second period, the selling price p1 should meet the condition that . There is no difference between buying X1 and waiting for X2 to launch when the customer’s willingness to pay is . That is, , and we have . The above constraint is added to the optimization problem in the first period.

Proof of Proposition 2. Considering the trade-ins with the SR strategy, when the firm uses the SP strategy. The number of customers who have bought X1 will participate in the trade-ins is . The number of customers who have bought X1 will not participate in the trade-ins is . The number of customers who will buy X2 is . The firm’s profit in the two periods is

The Hessian matrix is . We have −(2/(Lθ)) < 0,

The Hessian matrix is negative. By defining that (∂πt/∂p1) = 0, (∂πt/∂p2) = 0, and (∂πt/∂r) = 0, we have the optimal solution under no subjection that , , and rS = (14s − 3Lθ)/8.

Since the constraint cannot be satisfied, while the other constraints are met, we set in equilibrium. Thus, we have , , rS = (14s − 3Lθ)/8, , , and .

Proof of Proposition 3. Considering the SR strategy for the trade-ins, comparing the equilibrium prices and demand between the DP strategy and the SP strategy, we have , , rD − rS = −(L(2 − θ)/8) < 0, , , and .

Proof of Proposition 4. Considering the SR strategy for the trade-ins, comparing the firm’s total equilibrium profit in two periods between the DP strategy and the SP strategy, we have

Assuming that . The function π(s) is the concave function with s. If (∂π(s)/∂s) = 0, when 0 < s < (4L(1 − θ)(1 + θ)2)/(2 + 7θ + 9θ2) (i.e., (s(2 + 7θ + 9θ2))/(4(1 − θ)(1 + θ)2) < L), ; when (4L(1 − θ)(1 + θ)2)/(2 + 7θ + 9θ2) < s < θ (i.e., 0 < L < (s(2 + 7θ + 9θ2))/(4(1 − θ)(1 + θ)2), .

Proof of Proposition 5. Considering the DR strategy for trade-ins, there are two different situations when the firm uses the DP strategy. Thus, two optimization pricing problems should be solved. The demand for purchase X1 in the first period is , where x+ = max{x, 0}.

- 1.

In Case I, the customers prefer to purchase X2, and we define that the is the indifference point for customers between buying X1 and taking part in trade-ins and keeping X1 in the second period. The is the indifference point for customers between buying X1 and X2 in the second period. The is the indifference point for customers between buying X1 and nothing in the second period. Thus, the indifference condition of customers is that , , and . The threshold value is , , and . The number of customers who have bought X1 will take part in trade-ins is q2T = 1 − (p2 − r + 2s)/(L(1 + θ)). The number of customers who have not bought X1 will purchase X2 is . The number of customers who will purchase X1 at the discounted price is q2D = (p2 − pd/Lθ) − pd/L. The optimization pricing problem in Period 2 is

() -

The Hessian matrix is . We have −(1 + 2θ)/(Lθ(1 + θ)) < 0,

() -

The Hessian matrix is negative. Defining that (∂π2/∂p2) = 0, (∂π2/∂pd) = 0, and (∂π2/∂r) = 0, we have the optimal solution under no subjection that , , . In order to satisfy the constraint in Period 2, the selling price p1 should meet the condition that . There is no difference between buying X1 and waiting for X2 to launch when the customer’s willingness to pay is . That is, , and we have . The above constraint is added to the optimization problem in Period 1.

() -

Since the second derivative function , the firm’s profit function is concave, we have the optimal solution under no subjection that . This optimal solution cannot meet the above constraint that (L(1 + θ) − 3s)/(L(1 + θ)) ≤ (2p1/L(1 − θ)) ≤ (L(1 + θ) + s)/(2L(1 + θ)). Thus, the equilibrium solution satisfies . The equilibrium price and quantities are as follows: , , , rDD = ((7s)/4) − L(1 + θ)/4, , , , .

- 2.

In Case II, the customers prefer to purchase X1 with a discounted price, and the indifference condition of customers is that: , , and . The threshold value is , , and .

The number of customers who have bought X1 will take part in the trade-in program is q2T = 1 − (p2 − r + 2s)/(L(1 + θ)). The number of customers who have not bought X1 will purchase X2 is q2B = (p2 − pd/Lθ) − p2/L(1 + θ). The number of customers who will purchase X1 at the discounted price is . The optimization pricing problem in Period 2 is

The Hessian matrix is . We have −(2(1 + θ))/(Lθ) < 0,

The Hessian matrix is negative. Defining that (∂π2/∂p2) = 0, (∂π2/∂pd) = 0, and (∂π2/∂r) = 0, we have the optimal solution under no subjection that , , . In order to satisfy the constraint in Period 2, the selling price p1 should meet the condition that . There is no difference between buying X1 and waiting for X1 with the discounted price in Period 2 when the customer’s willingness to pay is . That is, , and we have . The above constraint is added to the optimization problem in Period 1.

Proof of Proposition 6.

- i.

In Case I, when the customers prefer to purchase X2, the , the firm’s total profit between the SR strategy and the DR strategy is equivalent, i.e., .

- ii.

In Case II, when the customers prefer to purchase X1 with the discounted price, the firm’s total profit under the SR strategy is . On one hand, θL2 − 2sL − (s2(3θ + 2)/(1 + θ)2) > 0, and we have . On the other hand, θL2 − 2sL − (s2(3θ + 2)/(1 + θ)2) < 0, and we have .

Open Research

Data Availability Statement

The data used to support the findings of this study are available from the corresponding author upon request.