Exploring Consumer and Producer Views of Verjuice: A Grape-Based Product Made from Viticultural Waste

Abstract

The wine sector is actively working to add value, increase sustainability, and reduce waste streams. One great example is to use thinned grapes, that are usually left to rot, to make verjuice. As verjuice has no identity standard, there is a wide scope for producers to innovate. Decisions regarding sensory characteristics and packaging are currently made by the verjuice producers, mainly winegrowers and winemakers but also chefs, without fully understanding the needs and wants of consumers. Using discussion groups and interviews, this study explored both consumer and producer views towards commercial verjuice regarding perceived sensory characteristics, possible end-uses, packaging, and desirable label elements. Similarities and differences were discovered between consumer views and verjuice producer practices. Consumers reported a diverse range of attributes beyond the sourness and sweetness that was the focus of producers, indicating potential for a broader range of applications of verjuice than currently considered. Sweeter variants were generally preferred for drinking, while sourer ones were favoured for cooking, although exceptions to this trend existed across consumers. Additionally, a mismatch between producer packaging choices and consumer preferences was identified, highlighting potential for producers to optimise packaging to better cater to consumer needs. This research explored an opportunity to create verjuice with desirable sensory characteristics for specific end-uses, providing product diversification for the wine industry’s revenue stream. Uncovering these consumer insights is key to better inform promotion of verjuice by producers and the agrifood sector seeking to enhance the value of their by-products.

1. Introduction

Grape growing and wine making produce large amounts of waste and by-products such as stalks, seeds, leaves, pomace, and lees. One undervalued viticultural waste product is unripe grapes derived from cluster thinning [1–3], which are usually left to rot. Cluster thinning is the removal of unripe grapes to achieve a yield balance in the vine, improve the quality of grapes remaining on the vine, and prevent overcropping [4, 5]. Considering grapes reach about 60% of their final mass at veraison time (transition from grape growth to berry ripening) and with a typical thinning rate of 30% [6], in a scenario of a vineyard with a production of 10 tons/ha, approximately 1.8 tons/ha of thinned unripe grapes could potentially be generated. Maximising value of waste streams is a challenge for the sustainability of the wine industry [7]. Indeed, the wine sector has looked for alternatives to convert by-product materials into food ingredients and/or products with high-added value [8, 9], hence minimising environmental impact and increasing profitability of these agro-industrial sectors. One great example is to press the unripe grapes to make verjuice: an unfermented acidic grape juice.

Verjuice has a long history of use as a seasoning in foods dating back to medieval times. The name verjuice derives from the French word “vert jus” (green juice), and it is mostly known as “verjuice” in English, but also called “agraz” in Spanish and “agresto” in Italian [10, 11]. It is widely used in other cuisines, regionally called “abe ghureh” (in Persian) or “koruk suyu” (in Turkish) [12]. While still a relatively unknown product in Western cuisine, verjuice has been revived as a food condiment as an alternative to vinegar and lemon juice for use in salad dressings and appetizers [9, 11, 13]. In recent years, research has extended applications of verjuice beyond traditional culinary use, mainly because of its phenolic composition [7, 14–16]. Additionally, it has also been used in the production of low-alcohol wines and beverages [17, 18]. Some producers have proposed verjuice as a beverage, to drink on its own or diluted in drinks. Although the verjuice applications are expanding, many consumers are still unfamiliar with this product and sometimes not even aware when it is an ingredient of a dish or a drink.

As verjuice has no agreed-upon standard of identity, there is a wide scope for producers to innovate given there is autonomy over variables such as grape picking time, production methods, and target end-uses. In fact, this reflects the variety in sensory characteristics found in commercial verjuice currently available in the market, where some are very sour, others sweeter. Sensory attributes characterising verjuice are mainly associated with their phenolics and acid content, contributing to sourness, bitterness and astringency, and to a lesser extent salty and sweet [8]. The same authors reported the most common aromas as herbaceous, cooked apple, pear, floral, and green apple, in experimental verjuice. However, further consumer evaluation is needed to understand to what extent these attributes are representative of commercial product currently available in the market. The existing literature reveals a noticeable gap in knowledge regarding understanding consumer views and attitudes towards verjuice products. Such research would help producers to innovate by making verjuice with desirable sensory signatures for different target end-uses.

Many companies have limited consumer science capability for understanding consumer attitudes and predicting behaviour. The failure of 50 to 75% of newly developed and launched consumer products in general can be attributed to this issue [19]. The sensory qualities of food are widely recognised as crucial drivers of consumer food preferences [20]. Moreover, extrinsic characteristics like health claims, brands, origin, production methods, and product descriptions have also been shown to impact food acceptability and consumer choice [21, 22]. Sautron et al. [23] developed a questionnaire that measures choice motives during food purchasing and identified local and traditional production, ethical and environmental labelling, taste, price, environmental limitations, health aspects, convenience, innovation, and the absence of contaminants as key factors influencing food choices. Furthermore, packaging and labels convey important information to consumers to make informed buying decisions. For wine products, the shape of the bottle, the colour of glass, and information in the label (e.g., sensory description, certification, etc.) can attract the attention of the potential wine purchaser, distinguishing it from several competitors [24, 25]. To date, there is no research published on consumer views towards verjuice sensory characteristics, end-uses, packaging, and label information.

In the context of verjuice production, decisions regarding sensory characteristics and packaging are currently made by the verjuice producers, mainly winegrowers and winemakers but also chefs, without a full understanding of the needs and wants of consumers. Lavrador [26] looked at comparing consumer and producer perspectives on wine sensory attributes, and some divergences were found. The findings showed that producers tend to value oenological quality, certification, and grape variety more than consumers and underrate the importance of back label information. Such gaps in product perception can also have implications in other marketing constructs [27], for example, branding, positioning, and consumer decision-making processes. In this context, to predict consumer preferences and maximise consumer acceptance, a deeper understanding of consumer perception towards verjuice products is required.

Consequently, the present study aimed to explore both consumer and producer views towards commercial verjuice products. To this end, discussion groups were conducted to identify consumer perceived sensory characteristics of verjuice, to explore possible end-uses and preferred packaging, and to understand label elements desired by consumers in a verjuice product. In parallel, semistructured interviews with verjuice producers were performed to understand business motivations and explore their decisions concerning verjuice production.

2. Materials and Methods

This study was assessed and considered low risk following the Massey University Human Ethics Committee process (Human Ethics Notification: 4000025468). Participants were given an information sheet providing all study details and asked to sign an informed consent form prior to participation.

2.1. Verjuice Samples

Thirteen commercial verjuice products were tasted across the discussion group sessions (Table 1). Verjuice products differed in grape variety, preservation treatments, and geographic location to represent a wide range of sensory characteristics among products.

| Discussion group | Pair | Verjuice number | Country | Grape variety |

|---|---|---|---|---|

| DG 1, 2, 3 | Pair 1 ∗ | 1 | United States | Chardonnay, Merlot |

| 2 | Portugal | Tinta Caiada, Touriga Nacional | ||

| DG 1 | Pair 2 | 3 | England | Pinot meunier, Pinot noir, Chardonnay |

| 4 | Australia | Information not available | ||

| DG 1 | Pair 3 | 5 | New Zealand | Chardonnay |

| 6 | New Zealand | Riesling | ||

| DG 1 | Pair 4 | 7 | Austria | Sauvignon blanc, Moscatel, Riesling, Pinot blanc, Chardonnay, Zweigelt |

| 8 | New Zealand | Cabernet Sauvignon | ||

| DG 2 | Pair 5 | 9 | Canada | Pinot noir, Chardonnay |

| 3 | England | Pinot menier, Pinot noir, Chardonnay | ||

| DG 2 | Pair 6 | 7 | Austria | Sauvignon blanc, Moscatel, Riesling, Pinot blanc, Chardonnay, Zweigelt |

| 8 | New Zealand | Cabernet Sauvignon | ||

| DG 2 | Pair 7 | 5 | New Zealand | Chardonnay |

| 6 | New Zealand | Riesling | ||

| DG 3 | Pair 8 | 10 | New Zealand | Merlot, Cabernet Sauvignon, Syrah |

| 11 | Australia | Semillon | ||

| DG 3 | Pair 9 | 9 | Canada | Pinot noir, Chardonnay |

| 3 | England | Pinot menier, Pinot noir, Chardonnay | ||

| DG 3 | Pair 10 | 12 | New Zealand | Chardonnay |

| 13 | Iran | Information not available | ||

- ∗Presented as first pair across all three groups.

2.2. Consumer Discussion Groups

Qualitative research is widely employed to explore consumer wants and needs, as well as to comprehend underlying reasons behind their choices, and to generate ideas for new products. Additionally, it enables a deeper understanding of consumer perception [28]. In this study, discussion groups were used as an exploratory qualitative research method to gather in-depth information regarding consumer views and attitudes towards verjuice products, to provide a basis for much needed future quantitative studies. A range of techniques were applied in these discussions to encourage participants to share their opinions regarding sensory attributes, possible uses, packaging, and label information, with no pressure to reach a consensus [29].

2.2.1. Participants

Volunteers were recruited through the Food Experience and Sensory Testing Lab (Feast) consumer database. Participants were preselected according to the following criteria: aged between 18 and 55 years old, not allergic or intolerant to any of the ingredients listed, enjoy cooking, willing to taste new foods and beverages, and agreed they like to drink sour beverages (e.g., tart juices and sour beer). Twenty participants from New Zealand (16 females and 4 males, 21–54 years old, mean age = 36.4 ± 9.4 years) attended the study, and about 60% of them were familiar with verjuice. Upon completion of the study, participants were offered a supermarket voucher and a snack treat as compensation for their time.

2.2.2. Discussion Group Structure

Three discussion groups (n = 6–8 participants per group), lasting up to 120 min, were conducted to enable the collection of a comprehensive range of opinions from consumers [30]. A detailed moderator guide was prepared to ensure the structure of all sessions was consistent. A pilot discussion group was conducted to refine and optimise elements within the session, such as the moderator guide, and to minimise unforeseen events.

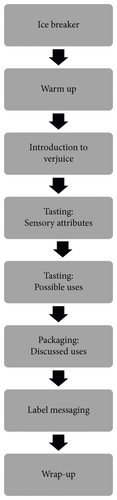

Each discussion group was structured as follows: (i) ice-breaker, (ii) warm-up, (iii) introduction to verjuice product, (iv) tasting discussion on sensory attributes, (v) tasting discussion on possible uses, (vi) packaging focused on discussed uses, and (vii) label messaging (Figure 1).

During the ice-breaker, participants provided a self-introduction and recounted what their favourite beverage was and why. As a warm-up, participants were provided with nine different images (glass of white wine, red wine, grape juice, cocktail, lemon juice, yoghurt sauce, mustard, balsamic vinegar, and cider vinegar) and, in pairs, were asked to select an image and describe how it looked, would taste, and how they would use it. Given the limited familiarity of consumers with verjuice, an introduction to the product was provided covering its definition, its origins as a viticultural by-product, and its versatility as a food condiment.

For the sensory discussion, verjuice samples (15 mL each) were served chilled (4 ± 1°C) in 30 mL clear plastic cups, covered with a lid to maintain headspace aroma, and labelled with three-digit random numbers. Eight verjuice samples were served in pairs in each discussion group, in a fixed order. As verjuice was unfamiliar to 40% of participants, the first pair, a sweet-sour contrast, was the same across all three groups ensuring all received the same reference products and facilitating meaningful comparisons between subsequent pairs of samples and across discussion group sessions. Sample presentation order was retained across participants to ensure consistency, enabling main themes and patterns to emerge from each sample at a time [30]. Pairs were chosen to represent the main differences between samples across sensory modalities (Table 1).

Participants tasted samples and wrote down words describing the sensory characteristics they experienced by appearance, taste, flavour, and mouthfeel, immediately discussing as a group after each pair. The aim was to identify the sensory characteristics for verjuice products, to inform a larger quantitative study. In the next activity, the same samples were presented again, in a fixed order, with participants asked to retaste and discuss how they might use each sample in a culinary or beverage context and to indicate the bottle colour (colourless, green, brown, dark/black, or any other) they would prefer for each verjuice product. Gluten free crackers (Fine Food Holdings Pty Ltd, Victoria, Australia) and filtered water were provided as palate cleansers. Following tasting, different photographs of containers, closures, and volumes (Figure S1) were listed in a check-all-that-apply (CATA) ballot, for participants to indicate which options were relevant in the use contexts identified in the previous activity. Participants were asked to indicate all the options that they considered appropriate for each use case. Finally, desirable elements on a verjuice label were discussed. Sessions were video recorded and conducted at the Feast Laboratory in Palmerston North, New Zealand.

2.3. Semistructured Interviews with Producers

Semistructured interviews, the most frequently used interview technique in qualitative research, were selected to gain a rich understanding and explore producer opinions towards verjuice products. This technique offers a focused, structured discussion during the interviews while still allowing the interviewer to ask follow-up questions based on participant responses [31].

2.3.1. Participants

Wine/grapegrowers and chefs from different countries (New Zealand, Australia, Portugal, Austria, England, United States, Canada, and Lebanon) were contacted directly by the researcher. Participants were preselected based on having manufactured and/or commercialised verjuice. A total of 11 participants attended an online interview.

2.3.2. Semistructured Interview Structure

Semistructured interviews (n = 1–2 participants per interview), lasting up to 70 min, were conducted to explore participant perceptions and opinions towards verjuice facilitating reciprocity between the interviewer and participant. A detailed interview guide was developed following Kallio et al. ’s five-step process [31]: (1) identifying the prerequisites for using semistructured interview, (2) retrieving and using previous knowledge, (3) developing the preliminary interview guide, (4) piloting the interview guide, and (5) completing the final interview guide. Some questions mirrored the key themes of the consumer discussion groups to allow further comparison. Two levels of questions (main themes and follow-up questions) were structured in four blocks with questions oriented around (i) understanding business motivations for making verjuice and current verjuice regulation in their country; (ii) business focus and selling channels of interest; (iii) decisions around verjuice production/processing incorporating questions related to their verjuice sensory profile and possible applications; and (iv) packaging, label messaging, and price. Interviews were digitally recorded. No tasting was involved during the interviews. Discussions regarding verjuice sensory profiles were carried out based on their experience and personal opinions towards their verjuice products.

2.4. Data Analysis

A reflexive thematic approach was used to facilitate the identification and coding of key themes in the dataset [32]. Coding consisted of sorting comments into similar labels on similar categories [30] and evolved throughout the analytical process. Themes are typically understood to constitute summaries of what participants said in relation to a particular topic or question [33], conceptualised as patterns in the data.

A predominantly inductive approach was adopted in the data analysis, meaning data were open-coded and respondent/data-based meanings were emphasised. This approach aimed to produce codes that were reflective of the content of the data and best represented meaning as communicated by participants. However, a degree of deductive analysis was employed to ensure that the open coding contributed to producing key themes that were meaningful [34]. The coding interpretation was undertaken by two researchers, as it is beneficial for the assistant moderator to also assist with data interpretation [30].

2.4.1. Consumer Discussion Group Data

In the discussion group, notes were taken by the moderator and assistant moderator during the sessions and, together with participant ballots, were transcribed into Excel to facilitate data analysis. Recordings were revisited when clarification was needed. For the sensory element, terms with the same meaning were combined into one attribute (e.g., “lemon,” “lemony,” and “lemon juice-like” were collated as “lemon flavour”). As identification of sensory characteristics was the main output, as opposed to individual sample profiling, attribute frequencies were not counted, rather sensory profiles were identified to summarise participant perceptions across different verjuice samples. For possible applications, comments from participants suggesting using verjuice in similar applications, either related to culinary uses or drinking options, were grouped into a key category (e.g., “with soda” and “with gin in place of tonic” were collated as “drink/cocktail”; and “vinegar replacement in salad” and “in place of apple cider vinegar” were collated as “dressing”). For the label, the same approach was used (e.g., “vitamins and nutrients” and “amount of sugar” were grouped as “nutritional table”). Packaging preference was analysed by calculating the citation counts for each item within the three packaging elements (container shape, closure type, and volume size) based on each key application. Then, the most often selected packaging items were identified for both culinary and drinking applications.

2.4.2. Producer Interview Data

During the semistructured interviews, the moderator and assistant moderator took notes, and recordings subsequently watched to verify the quality and accuracy of the data collected. Afterwards, a coding consensus was reached and refined through discussions. Notes were combined and transcribed into Excel to facilitate data analysis and the identification of key themes. Recordings were revisited when clarification was needed. The same data analysis approach was used as per the discussion groups.

3. Results

3.1. Sensory Profile

3.1.1. Consumer Sensory Characterisation of Verjuice

Participants cited words related to different sensory modalities, including appearance, taste, flavour, and mouthfeel attributes. Table 2 contains the complete list of words used by consumers to describe the verjuice samples.

| Attributes | Words used by consumers to describe a range of verjuice samples |

|---|---|

| Appearance | |

| Colour | Colourless, creamy white, beige colour, like white wine, lemon juice or apple juice, camomile tea, malt vinegar, faint or pale yellow straw, eggs colour, mustard yellow, light golden, yellow golden, rose gold, champagne colour, peachy colour, bright gold orange, amber, whiskey, similar to weak tea or coffee, orangey brown colours |

| Clarity | Clear, no sediments or particles, tiny particles, small precipitation, presence of sediments, transparent, translucent, a bit opaque, hint of turbidity, turbid, hazy or cloudy |

| Presence of bubbles | Still, no bubbles, not sparkling, few bubbles, like sparkling juice, slightly carbonated |

| Viscosity | Very thin, runny, watery, looks diluted, not viscous, some viscosity, slightly thick, a bit viscous, like diluted syrup, looks like oil |

| Taste | |

| Sweetness | Not sweet at all, slightly, a bit, very sweet |

| Sourness | Not very, slightly, a bit acidic, sour, tangy, tart, mild sour/acidity, just right, fresh, refreshing, slightly sharp, very, extremely, too strong, overpowering sour |

| Bitterness | A bit, slight, mild, very, extremely bitter |

| Salty | Little, salty, very salty |

| Umami | Umami, savour, savoury |

| Flavour | |

| Floral | Flowers, rose, rose water, sweet aromatic, feijoa |

| Unripe fruit | Unripe apple or grape, raw fruit, verjuice-like |

| Green apple | Green apple |

| Apple/pear | Apple or pear juice, apply undertone, old-fashioned apple |

| Grape/winey | White wine, Riesling grapes, red grapes, grape juice, winey |

| Tropical fruit | Papaya, passion fruit, stone fruit |

| Lemony/citrus | Lemon, lemony, citrus, lemonade, grapefruit, orange rind |

| Pomegranate | Pomegranate, pomegranate juice |

| Herbs | Dill herb, herby, herbal |

| Tea | Tea |

| Piney | Pine tree |

| Honey | Caramelized, honey notes, syrup, dessert wine |

| Dried fruit | Sultana, raisin, fig, tamarind |

| Nutty | Nuts |

| Earthy | Earthy, musty, mouldy |

| Woody | Oaky, woody, smokey |

| Fermented | Apple cider and vinegar, vinegar, fermented grapes, overmature apple |

| Chemical | Medicinal, chemical, phenolic |

| Mouthfeel | |

| Astringency | Not astringent, gentle, slightly, mellow, a bit dry, very, extremely dry and puckering |

| Smoothness | Not smooth, smooth, very smooth |

| Fizziness | Gentle sparkling, fizzy, bubble in the mouth, fresh, refreshing |

| Warmness | Mellow warm/burning sensation of alcohol, taste like spirit or alcohol |

| Viscosity | Runny, watery, not viscous, a bit sticky and syrupy |

For appearance, terms related to colour, clarity, presence or absence of bubbles, and viscosity. Colour tonality varied across samples, with terms ranging from colourless, lemon juice, yellow gold, rose gold, peach, bright gold orange, light brown, to orangey brown (Table 2).

The most discussed taste attributes were sourness, sweetness, and bitterness. Participants used various terms to describe intensity levels of sourness. More acidic products were noted to result in a sour aftertaste, including descriptors such as “strong acidity lingering” and “lasting longer.” Variation in sweetness was also perceived with terms ranging from “not sweet at all” to “very sweet.” Participants also used terms such as “balanced sweet/sour” for some samples. Mild to extremely were terms also used to describe the range of bitterness across the samples. Participants also noted some samples were perceived as salty and savoury (Table 2).

A wide range of flavour terms were cited and could be grouped into 18 categories including floral, unripe fruit, green apple, apple/pear (pome fruit), grape/winey, tropical fruit, lemony/citrus, pomegranate, herbs, tea, piney, honey, dried fruit, nutty, earthy/musty, woody, fermented, and chemical. The most common were lemony, apple, winey, woody, and fermented flavours. Participants often said the verjuice samples tasted like lemon or lemonade, nectarine, or grapefruit. When referring to apple or pear, specific terms including apple or pear juice, apply undertone, and old fashion apple were cited. Participants also described the samples with wine-related terms such as white wine or Riesling grapes, and some raised doubts that the products were nonalcoholic. Some samples reminded participants of apple cider, with a pungent acetic note similar to that found in wine vinegar or apple cider vinegar. Interestingly, participants also used words like woody and oaky to describe samples, even though barrel aging is not part of the verjuice making process. Other fruits were also listed including unripe apple or grape, green apple, pomegranate, and tropical ones such as papaya and passion fruit, but were only cited for some samples. Additionally, terms such as dessert wine with caramelized notes, sultana, raisin, fig, tamarind, and nutty were used for some of the samples. Others also thought some had a floral note using terms such as flowers, rose, or feijoa, characteristic of aromatic floral notes. A few samples were described as earthy, musty, mouldy, medicinal, chemical, or phenolic (Table 2).

Astringent and smooth were common attributes cited across the samples. Words such as dry and puckering were used but at noticeably different intensity levels. While most of the samples were considered smooth and “easy to drink,” some were noted to have sharp acidity and astringency. Interestingly, “refreshing” and “fresh” were often mentioned by participants to describe sensations related to fresh acidity, gentle sparkling, and fizziness. Surprisingly, some of the samples were described as having a warm, burning sensation of alcohol, similar to spirits, despite having no alcohol present. Overall, the verjuice samples were described as runny and not viscous, with some samples having slight in-mouth viscosity, stickiness, or syrupiness (Table 2).

3.1.2. Wine/Grapegrower and Chef Sensory Perception of Verjuice

Producers stated a range of terms related to different sensory modalities to describe their verjuice products (Table 3), but mainly characterised verjuice by acidity.

| Sensory modality | Range of descriptors used by producers to describe their verjuice |

|---|---|

| Appearance | |

| Colour | Dependent on vintage, not worry about colour tonality, good looking colour, colourless, shinning yellow to golden yellow, rose provenance wine colour |

| Clarity | Bright clear, no sediments, clean juice |

| Taste | |

| Sweetness | Not sweet, no sugar, not much residual sugar, low sweet, sweet |

| Sourness | Light, soft, mild, not sharp, round, fresh, acid, sour, tangy, tart, good level, malic, crisp, high, sharp |

| Bitterness | Low bitterness |

| Flavour | |

| Floral | Floral |

| Apple | Apple, apple cider smell |

| Green apple | Green apple |

| Citrus | Lemon, lime, citric, grapefruit, fresh, refreshing |

| Berry | Lighter berries, strawberry |

| Grape/winey | Semillon grape, Riesling grapes (petroleum) |

| Herbaceous | Grassy, herbal, rhubarb |

| Sulphur | Sulphur, savoury flint match |

| Mouthfeel | |

| Astringent | Not dry or puckering, a bit, dry, tannins, dry finish |

| Smooth | Round, flow in the palate, smooth |

- No tasting was involved during the interviews.

When asked to describe their verjuice’s sensory characteristics, they mostly used terms related to sourness and green notes such as citrus, lime, and lemon, often associating these with refreshing/fresh notes. Other aromatic attributes such as floral, apple, berry/strawberry, and grape were included by some producers. Most producers indicated that verjuice contains little residual sugar and, therefore, sweetness is low. One producer also stated that even though sweetness is low, “it adds to the texture” (P5). Others stated that verjuice is balanced in sweetness and sourness and has a “soft and round acidity” (P2). In addition, two producers (P6 and P7) mentioned that given the type of acidity present in verjuice (not acetic, as in vinegar, but mainly malic) it makes verjuice a more suitable ingredient in food-wine pairings. Only three producers mentioned bitterness or astringency as sensory characteristics present in verjuice, even after subtle probing. One producer said that other than acidity, sensory character is driven by tannins, with verjuice being “a bit astringent/dry but not too heavy” and characterised by a “round smooth texture” (P11). Another producer said that acidity is very high in their verjuice, giving a “dry finish,” but they were not worried about astringency given their target end-use for cooking (P4). Two producers (P4 and P9) referred to a sulphur flavour (“savoury flint match”).

3.2. Possible Applications

3.2.1. Consumers Indicated Applications

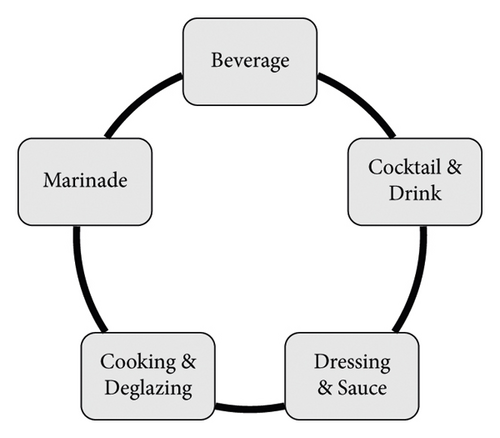

Participants indicated five main categories to use or incorporate verjuice in food applications: “as a beverage,” “in cocktails/drinks,” “to cook/deglaze,” “to marinate,” and “to prepare dressing/sauces” (Figure 2, see Table S1 in Supplementary material for list of comments in full). Most verjuice products were indicated for either drinking or culinary uses. Sweeter products tended to be preferred for drinking scenarios and sourer products for culinary applications, but this was not always the case. The comments sheets from participants indicated that two kinds of verjuice from NZ and the Canadian verjuice seemed to be less favoured for culinary uses, specifically dressing or sauces, in comparison to the other products. This could be because these NZ verjuice products were described as high in sweetness while the Canadian verjuice was often characterised by winey flavour and warm/burning sensation that reminded alcohol, aspects that are potentially not desired in dressing and sauces by NZ consumers. On the other hand, the Iranian product was not considered suitable as a beverage possibly due to its vinegary acetic note which was more associated with cooking.

For “as a beverage,” consumers referred to its potential as a nonalcoholic wine alternative, refreshing juice drink, and as a shot. Interestingly, some participants mentioned that they would use sourer verjuice as a drink to support digestion. One participant questioned if verjuice is safe for children, as they would like to put it in their child’s lunch box instead of other fruit juices. Participants indicated different verjuice products that would also perform well as a cocktail or mocktail ingredient, especially to replace lemon, lime, and/or wine. Different combinations with spirits were mentioned, and overall, participants referred to verjuice as an addition to reduce or balance sweetness in cocktails, nonalcoholic drinks, and fruit juices. Participants often referred to using verjuice instead of white wine, lemon, and vinegar to marinate and cook meat, chicken, fish, and seafood, to pickle vegetables, and to prepare stir fry, risotto, a curry or even black pudding. Verjuice was also discussed as “a citrus replacement in sweet or dessert preparations.” Finally, using verjuice as a seasoning or condiment in salad dressings, mixed with yoghurt, or to make white sauces was also often cited (Table S1).

3.2.2. Producers Suggested Applications

Producers referred to verjuice as a versatile ingredient with different applications (Table 4), but mainly for cooking and as an ingredient in a cocktail/mocktail. Most mentioned that verjuice is used as a replacement for lemon juice or vinegar in salad dressings (e.g., vinaigrettes), to prepare sauces (e.g., with mustard and herbs) and to marinate or cook/deglaze fish, meat, and vegetables. One example of preparation for marinades was to use verjuice as an acidic base adding smashed ginger and spices before curing fish to enhance flavours before cooking or to prepare ceviche. Notably producers often referred to verjuice as a “gourmet,” “premium,” “specialty,” or “niche” product, and one winegrower pointed out that “verjuice can be expensive for cooking given its more delicate acidity” as the volume needed is more than for wine vinegar. One winemaker mentioned that targeting verjuice as a wine alternative is more profitable than as a vinegar alternative. Interestingly, two producers referred to verjuice as a store cupboard kitchen ingredient as essential as salt, sugar, or lemons, but another mentioned that some consumers are not aware of verjuice in dishes and/or cocktails when eating out. Only one winegrower mentioned that they add verjuice to one of their wines during the winemaking process (Table 4).

| Key use | Comments by producers to describe ways to use verjuice |

|---|---|

| Beverage | |

| Drink as it is | Drink on its own, light sparkling drink |

| Wine replacement | Nonalcoholic option in restaurants and bars |

| Beverage production | In nonalcoholic spirit production, food-based fizzy and still drinks, premade cocktail/aperitifs, additive in nonalcoholic beverages, add to a wine during winemaking |

| Cocktail/drink | |

| Refreshing drink | With sparkling water, with soda as aperitif |

| Cocktail and mocktail | In cocktails (vodka, gin), in place of sour mix, in a mocktail |

| Cooking | |

| Cooking | Cooking ingredient base, essential store cupboard staple ingredient, cook or bake fish, suitable replacement of vinegar in food-wine pairing, used in high gastronomy |

| Deglaze | Grilling vegetables, frying fish |

| Baking | Bread making |

| Marinade | |

| Savoury | Replace lemon juice in marinades, curing fish, make ceviche, marinate meat, to enhance flavours |

| Dressing/sauce | |

| Dressing and sauce | Replacement of lemon juice and vinegar in salad dressing (vinaigrette, with olive oil, hazelnut oil), in place of wine for sauce (with mustard and herbs), acidity base or to soften acidity |

In terms of cocktails or mocktails, producers said that verjuice is used as an ingredient in either alcoholic or nonalcoholic mixtures by consumers who do not drink alcohol or are interested in nonalcoholic alternatives. Some producers offer two verjuice types, one targeted for cooking and another for drinking applications. One revealed they are experimenting with a carbonated/sparkling verjuice to position as a “refreshing drink” to diversify their portfolio. A few producers noted that verjuice could be consumed as a beverage on its own (P3, P9, and P11), especially by those who like sour products, but one pointed out that they did not target it as a beverage as the high acidity “can upset your stomach” (P8). One winegrower mentioned that their (still) verjuice was sold in a hotel as a fizzy beverage, where it was carbonated in-house and served as a nonalcoholic wine substitute. They added that verjuice is being used as an ingredient in commercial products such as nonalcoholic spirits, aperitifs, vermouth, and premade cocktail products. Of note, two winegrowers highlighted that verjuice is a good option in place of vinegar in food-wine pairings as vinegar is harder to balance against, “unless the wine has full body to handle it.” When discussing uses for verjuice, they also referred to their clients and selling channels. Most of them sold verjuice via the cellar door (“the explanation is needed as people do not know the product,” P11), online on the winery website, to club members, restaurants, cocktail bars, and delicatessen shops. Some sold directly to food industry manufacturers, distributers, or wholesale trade. Only one sold to wine shops, and another intended to sell to supermarkets. All producers sold verjuice nationally or locally, and only one (P11) exported their verjuice products.

3.3. Packaging Types and Label Information

3.3.1. Consumers Indicated Packaging

Different container colours and shapes, closure types, and volume sizes were preferred by consumers for different uses (Table 5). For use as a beverage or in cocktails, containers and closures associated with drinks were generally preferred. Glass bottles normally used for beverages such as wine, beer, kombucha, and spirits were often indicated as most appropriate. In terms of bottle colour, most of the participants indicated a preference for colourless or green bottle for verjuice characterised with an appealing colour and no particles. However, for verjuice with particles and an amber/orange/brown colour (V11, from Iran), brown and black/dark colour bottles were indicated. Screw cap, cork, and crown were the preferred closures, and an aluminium can with a pull-tab was also often suggested for drinking applications.

|

- Participants were asked to indicate all options that could be relevant in the contexts of the main uses discussed.

For cooking applications, participants indicated containers associated with seasonings, such as vinegar and olive oil, most often, followed by gin and wine bottle types. Screw caps with or without a doser were the most suggested closure types for cooking. In terms of volume, 500 mL was most frequently suggested across all the different use cases, followed by 375 mL and 750 mL. For cooking scenarios, participants preferred smaller volumes (500 mL and 375 mL), whereas larger volumes (750 mL and 500 mL) were more frequently indicated for drinking (Table 5).

Participants described different elements they would like on a verjuice label, such as the logo and company/winery name, location of origin, volume, manufacturing information, ingredients and allergens, nutritional content, health benefit and warning (if any), storage condition, shelf life, serving temperature, processing details, alcohol free, grape variety, year, certification, and award (if any) (see Table S2 in Supplementary material for a list of label elements in full). In addition, they wanted an image “that is attractive” on the front label, to help consumers associate verjuice with a grape product. Also, a brief story about verjuice incorporating its definition and highlighting its sustainability aspect was mentioned. A sensory description and suggested uses indicating whether the product is more suitable for cooking or drinking were also desired. Interestingly, a few participants suggested a QR code on the label, for consumers to access recipes on the company website. Finally, some participants also commented on indicating the recycling status of the packaging overall where, according to some of them, companies should aim for a plastic free cap given the sustainability credentials of the product (Table S2).

3.3.2. Producers Used Packaging

Producers mainly sold verjuice in glass wine bottles with screw caps, which were already part of their bottling line. Some used dark green or brown bottles to prevent light exposure; others chose transparent bottles to show their product’s colour. One winery used a different container shape and a cap with doser, usually used for seasonings like olive oil.

The most common bottle size was 750 mL across producers. Only two wineries opted for the smaller 500 mL size to reduce waste due to the product’s short shelf life and the fact that verjuice is not used at once, but used over time. Furthermore, one of these producers also provided a 250 mL option to enable customers to sample the product in smaller quantities. Another winery favoured the 375 mL bottle size to cater to higher demand for home consumption. Only one producer used an aluminium can with a pull-tab for their experimental carbonated verjuice, in addition to their still version. One producer also sells in bulk to a food industry manufacturer in “a bag in box” to restaurants.

In terms of label information, most producers use their own company logo and name and state location of origin, volume, manufacturing information, ingredients, and allergens. Some of the labels included nutritional facts (Table S2). Inclusion of recommended storage conditions and shelf life information varied across producers. Some producers stated a storage period, which varied between one and three years. One winegrower said that verjuice could be kept for about 10 years after production, but they usually only keep the product for five years in the winery. Another one said it tends to last for 3 years or more. “Refrigeration after opening” was identified on most labels; however, a best before date was often not present. Different statements were found across the labels analysed (Table S2), and those producers not specifying a best before date on the label mentioned different periods during the interviews such as “one to two weeks in the fridge after opening,” “within six weeks after opening it still tastes good,” or “probably after three months once opened.” Others admitted not knowing the shelf life of the product and so do not state it on the label.

Including other information, such as “whole berry pressed,” “cold pressed,” and “pasteurized,” was also present on the label. Stating that verjuice is nonalcoholic was only identified across four products, and some producers said during the interviews that they do not think this information is necessary on the label. The majority of the labels identified the grape varieties or blends used; however, year of harvest/production was only found on two labels. Producers with organic certification have identified that on the label, when possible. A few producers cultivating organic grapes said that they were not allowed to state “organic” on the verjuice label due to their use of sorbates. The sustainability element was identified on some labels, stating that “grapes are grown using environmentally sustainable practices” or “organically grown using biodynamic techniques.” Some producers chose to state that verjuice is “an acidic juice from unripe grapes,” “green, unripe juice,” “unfermented juice from green grapes,” “a mildly acidic liquid made by pressing unripe and unfermented grapes,” and “made from early harvested grapes when the grapes are still green,” but others said that a verjuice explanation on the label might not be enough for consumers. Most producers included a brief sensory description on the label, with the focus mainly on acidity and sweetness levels; only a few included flavour descriptors. Some suggested uses for cooking and/or drinking applications on the label, and one producer referred to their company website for recipes ideas. Most of the labels analysed included company website details; only two presented their social media information (Table S2).

3.4. Producer Motivations, Decisions, and Challenges concerning Verjuice Production

The main motivations cited for producing verjuice were the opportunity to diversify their business and to avoid overcropping and waste. However, some challenges were identified, including the lack of a clear classification for verjuice and high tariffs for export. Most winegrowers considered the ideal time to harvest grapes for verjuice making to be either before or at the beginning of veraison when acidity is pronounced. Nevertheless, producers indicated that their decisions were usually made with the benefit of the vine and wine in mind, rather than the verjuice specifically (Table 6).

| Concepts | Winegrower comments on business motivations, challenges, and decisions |

|---|---|

| Opportunity to diversify business | Open a market not available yet, other channels in the market by having verjuice, alternative product to the main business, curiosity “to have a go,” adding value to the business, verjuice production results as managing vines to make wine, add to the business but wine is the focus, important to have a nonalcoholic beverage option for a Muslim country, a nonalcoholic drink alternative to the portfolio |

| Avoid overcropping or waste | Pick green grapes to avoid overcropping, to decrease amount of grapes in the vine, to keep vine strength for next season because of a big frost, balance out the removal of grapes to have verjuice but in the benefit of wine, to use every bit of the vineyard (e.g., also use grape leaves for cooking), thinned grapes are by-product of viticulture, do not want to waste grapes, use spare grapes but no thinning |

| Product classification | Not specific classification or regulation, it has been produced at home traditionally, classified as a juice product probably, not sure about classification, grape juice or food product, verjuice is tax free in [country] so maybe is considered a food product, as a food product (an % of tax rate), follow the food standard/wine standard management plan, food regulation as there is a nutritional table, classified as essential food product, inspected by [country] agency as a food product (not a wine product), nonwine product but if produced in a winery get audit annually (ticked in the audit for verjuice), <12 degree Brix for verjuice |

| Export | Export wines not verjuice, it could be a plan for the future, not needed at the moment, a % go for export in Europe, cost of bureaucracy for export is high, with tariffs stopped selling overseas, big effort for little return |

| Picking time | Harvest time is based on what is happening in the winery, driven by vineyard in terms of a fruit block that needs crop reduction, pick before veraison, harvest early when there is no sugar to avoid fermentation (“at the perfect stage of unripeness”), when grapes just turned veraison, when there is enough size/volume to press so beginning of veraison, harvesting at the best window between getting a balance between good yield and good acidity level, pick grapes at veraison time when acidity is high before sugar level increases, combine yield so pick at veraison time and after 4–8 weeks, varies 50–60% yield |

| Cost and price | Cost recover method, no extra cost as fruit is already there so pay the vineyard itself, verjuice price depends on the grape price, cost is absorbed by the wine production, price is based on cost to run the vineyard, looked at gross margin of wine and the prices of other verjuice on the market, compared prices with competitors, price should be less than a wine bottle as the winemaking process that costs, lower price than entry level wine, prices vary according to selling channel and packaging (bottled or bulk) |

| Market demand | Decreased demand with COVID-19, online sells reduced after pandemic, increased demand in a very small base, when bottles are running low decision is made if making verjuice or not, pick own green grapes and buy green harvest from other wineries because of increased market demand, increased demand in the past 2-3 years as verjuice is becoming an additive in nonalcoholic beverages, sells are doubling each year so demand is increasing, a big demand, increased nonalcoholic beverages market |

| Advertisement and promotion | No marketing as verjuice is not make every year, just word of mouth as small production and not main focus, not much advertisement, no promotion as verjuice is not in the main business, no advertise because cannot cope with demand if that starts increasing too much, distributer catalogue portfolio with price list, see the customer and share recipes in the cellar door, local market, pin board, domestic food fairs and shows to get exposure, not that much on social media, on Facebook and Instagram, occasionally on Instagram, company website, newsletter online, online and airlines magazine, donation to top restaurants to cook with, donation to gastronomy courses, book recommending their product by a famous chef, inviting chefs and restaurant owners to taste verjuice in the cellar door, cooking shows in the TV increased sales |

| Type of consumer | People opened to experiment new things, epicurean curiosity, “gourmet” people, enjoy food, wine, drinks, eating out, local products and eating organic, vegetarian and vegan, active/sport people, like sour products, mid-old consumers (50–65 years), exposed to their wines, woman mainly, travellers, people who has disposable income |

When discussing costs and pricing strategies, many producers mentioned that they consider competitor prices before determining their own selling price. However, one producer emphasised that this approach can be affected by the selling channel and packaging format, especially when it comes to bottled versus bulk sales. The market demand and advertising strategies for verjuice varied among producers. Some noted a decrease in sales due to the COVID-19 pandemic, while the majority reported an increase in demand. While not all businesses advertised their verjuice products, most promoted them through their cellar doors as a means of introducing them to consumers. Producers mentioned various channels for promoting verjuice, including local markets, food fairs, cooking shows, social media, company websites, and magazines. According to producer opinions, verjuice consumers were typically perceived as those who enjoy experimenting with new products, foodies, and cocktail and/or mocktail enthusiasts (Table 6).

4. Discussion

The main objective of this study was to explore and compare consumer and producer views regarding verjuice products. The results revealed key themes for consideration in verjuice product development, particularly by the wine sector which is looking for ways to maximise value of waste streams and convert by-product materials into food ingredients and/or products with high-added value. Similarities and differences were found between consumers and producer views.

4.1. Verjuice Sensory Characterisation

Sensory characterisation of verjuice revealed large variability in terms of colour, taste, flavour, and mouthfeel. Overall, consumers used more words and terms to describe verjuice samples, compared to producers, which may be attributed to the large range of products and sensory space they evaluated. In terms of appearance, consumers seemed to appreciate verjuice characterised by lighter colours more than dark/brown colours, whereas colour does not seem to be a key consideration for producers, as most proposed verjuice as an ingredient, but absence of sedimentation/particles was considered crucial for product quality. However, when producers proposed verjuice as a beverage, an “attractive colour” was an important aspect to be considered. Producers commented that verjuice colour is also dependent on vintage as their decisions are driven by wine production, in terms of the grape block that needs thinning/crop reduction and grape variety used (white or red, or mixed). Although colour is one of the most important quality aspects of grape products, an agreed upon standard does not yet exist for defining the quality of verjuice [8]. Salah Eddine et al. [40] showed that the use of different grape cultivars in verjuice production affected sensory properties, with some cultivars being considered more suitable to obtain a verjuice with a more appreciable colour. The same authors found that most Lebanese consumers preferred verjuice from a red or black grape variety, and only a few preferred lighter coloured verjuice from a white grape variety. However, more and larger studies are needed to investigate the impact of grape variety on verjuice preferences by NZ consumers.

Acidity and sweetness were the key sensory aspects noted by both consumers and producers. Consumers had differing perceptions of sweetness and sourness in the verjuice samples. Among them, the ones characterised as “balanced sweet/sour” were particularly appreciated for broader applications. For producers, acidity is expected to be high due to the early grape picking time, mostly before or just at veraison, and sweetness is expected to be absent or low (not much residual sugar), but if verjuice was for drinking, some sweetness was desired,which can inform grape picking time decisions. Previous studies have shown that since verjuice is usually made from grapes harvested approximately 45 days after flowering, displaying a high amount of organic acids and a low sugar concentration, sourness is the key sensory characteristic [11, 12, 40]. Bitterness was also perceived by consumers at varying intensities from “a bit” to “extremely,” whereas producers considered bitterness low in their own verjuice products. Interestingly, salty and umami were terms stated only by consumers, but not by producers. One previous study revealed that a “too salty” perception in verjuice was responsible for a reduction in consumer overall liking, and it was suggested that saltiness should be carefully considered in future verjuice production [9].

Floral, pome fruit, green apple, citrus, and grape/winey were common flavours with positive connotations mentioned across consumers and producers. Other flavours, such as unripe fruit, tropical fruit, pomegranate, herbs, tea, piney, honey, dried fruit, nutty, earthy, woody, fermented, and chemical, were stated by consumers, whereas red berries, herbaceous, and sulphur were stated only by producers. For mouthfeel, both consumers and producers discussed astringency and smoothness when describing verjuice. Despite no expected fermentation, fizziness and warm/burning sensation of alcohol were perceived by some consumers. Dupas de Matos et al. [8] reported the most common verjuice aromas as herbaceous, cooked apple, pear, floral, and green apple, sensory aspects similarly stated by the consumers in the present study (Table 2). Interestingly, the harvest date did not seem to impact the aroma profile but did influence the taste. On the other hand, the use of preservatives (sulphite or sorbate) had the opposite effect. Verjuice treated with sorbate showed stronger pear and cooked apple notes, while those with sulphite displayed more pronounced herbaceous, green apple, and floral aromas. Also, the effect of grape variety was evaluated, with Merlot and Sauvignon blanc verjuice being the most fresh with the highest intensity for green apple and herbaceous aromas.

Within the present study, the use of verjuice products characterised by different grape varieties, production and preservative approaches was observed. Also, grape harvesting decisions were primarily driven by wine rather than verjuice production, contributing to variations in the sensory characteristics of the verjuice products evaluated by consumers . Consequently, further investigation is warranted to fully understand the degree to which these differences influence consumer acceptance or rejection.

4.2. Verjuice Applications

Verjuice was mainly considered as an alternative to vinegar and/or lemon juice in multiple culinary applications by both consumers and producers, including cooking, marinating, and salad dressings. Indeed, a few studies in the literature have focused on examining the sensory properties of verjuice as an ingredient in such composite food formulations. Dupas de Matos et al. [9] studied drivers of liking in verjuice compared to other common salad seasonings, and the study showed that overall liking did not differ for salads seasoned with verjuice and lemon juice, positioning verjuice as a valid salad seasoning alternative. In addition, those authors found the absence of the usual pungent vinegar aroma in verjuice to be a noteworthy sensory feature that could position verjuice as a more suitable alternative for individuals disliking vinegar and in food preparations where acetic acidity may be undesirable, as for example, in food-wine pairings. Interestingly, this consideration was also made by two of this study’s winegrowers highlighting that vinegar is more difficult to balance against in a food-wine pairing, compared to verjuice. Existing literature supports the suggestions made by consumers and producers, indicating that verjuice could be a potential alternative to vinegar in food preparations [8, 9, 12–14]. Other investigations have explored the effectiveness of marination liquids containing verjuice [36, 37]. Verjuice was proposed as an alternative to vinegar for pickle production and obtained similar liking scores to vinegar-pickled samples, indicating its potential as an acidifying alternative [14].

Consumers indicated more ways to use verjuice, either for drinking and cooking applications, than the producers, including using verjuice as a “wine replacement” in cocktails and to be added in sweet preparations, to moisten cakes and soak fruit to stop browning in fruit salads. On the other hand, producers considered verjuice more as a “sour base” in mixtures and essentially as an ingredient in savoury meals when cooking or baking. Consumers also suggested the use of sourer verjuice as a shot to support digestion, which was not stated by producers. Only producers discussed about the use of verjuice in beverage production, which is understandable given that a significant number of consumers remain unfamiliar or completely unaware of its inclusion as an ingredient in products. The findings from this study indicated that utilisation of verjuice in beverage production remains largely limited to a particular group of producers. This includes its incorporation in the production of nonalcoholic spirits, as an additive in nonalcoholic beverages, in the creation of premade cocktails and aperitifs, as well as its addition to wines. This limited adoption could be possibly attributed to two primary factors: first, a lack of awareness among potential producers about its viability in the market, and second, regulation restrictions in some countries. Verjuice has been included in the production of low-alcohol wines and beverages, as demonstrated by previous studies [17, 18]. Researchers have explored their use in blending with overripe grapes, early and delayed harvest grape must, resulting in improvements in pH, alcohol content, and sensory characteristics of the final products [17, 18, 38, 39]. These additional applications highlight the untapped potential application of verjuice, which is yet to be thoroughly explored by other producers in the wine industry.

4.3. Verjuice Packaging and Labelling Information

Both consumers and producers preferred glass bottles for verjuice and indicated screw caps as the commonly preferred closure types, for being easy to reseal. A preference for specific bottle colours based on the appearance characteristics of the product was indicated by consumers, while producers chose it primarily for preventing light exposure or, in some cases, for juice colour display. Consumers preferred different container shapes, closures, and packaging sizes based on the use-case scenarios (drinking versus cooking), while most of the producers used 750 mL wine bottles with screw caps because of the current integration into bottling processes in the winery. This can be directly attributed to several factors, such as lack of consumer research leading to a mismatch between the packaging choices made by verjuice producers and the preferences expressed by consumers. Also, producers may be limited by existing bottling processes and equipment in their wineries restricting their options when it comes to container shapes, closures, and packaging sizes, leading to a misalignment with consumer preferences towards verjuice. Previous research studies have shown that the shape of the wine bottle, the colour of glass, and information in the label (e.g., sensory description) can attract the attention of the potential purchaser, distinguishing it from several competitors [24, 25]. In fact, even though verjuice producers predominantly utilised glass wine bottles, alternative containers as well as caps with a doser, commonly employed for seasonings such as olive oil, have been considered. The winery employed this strategy to distinguish their products in the market and streamline the process of serving the beverages for bartenders, who were among their primary customers.

The importance of certain elements on the verjuice label was acknowledged by consumers and producers; however, variations were identified among the analysed verjuice labels indicating discrepancies between consumer wants and producer practices. Packaging and labels convey important information to consumers to make informed buying decisions. Wine producers tend to value more the oenological quality, certification process, and grape variety than consumers and underrate the importance of back label information [26]. On the other hand, consumers rely on multiple sources of information when evaluating beverages and food products. For wines, it includes their own knowledge and experience, the input of others, and information from other impersonal sources such as wine guides, reviews, advertising, point of sale materials, and labels [40]. In addition, the label is a key source of information for consumers, providing details on both intrinsic and extrinsic quality cues [41]. In the present study, consumers valued a brief story about verjuice incorporating its sustainability aspect on the label; however, producers sometimes emphasised more technical information (e.g., whole berry pressed and cold pressed) and practices in grape cultivation (e.g., organic farming and biodynamic techniques), rather than the environmentally sustainable aspect focused on the waste stream recovery related to verjuice production. This difference in emphasis or focus creates a gap between consumer preferences and the content provided by producers.

Consumers’ purchasing behaviour is affected by a range of different factors, which lead to differences in the way consumers approach food products [42]. For wine, sociodemographic differences are not very important, except to distinguish new versus long-term wine buyers. The other two important characteristics are wine involvement and sensory preferences towards the products [42]. This highlights the importance in promoting verjuice in order to increase consumer awareness and familiarity with the product, still relatively unknown in many countries. Social media are considered a key communication platform for both consumers and businesses [42]. While the majority of winery owners recognise the social, economic, and emotional benefits of social media, they are far from exploiting its full potential, partially due to barriers such as their agricultural mentality and the time-consuming nature of social media [43]. In this study, the market demand and advertising strategies for verjuice varied among producers, and while not all verjuice producers advertised their verjuice products, most promoted them through their cellar doors, but also in various other channels including local markets, food fairs, cooking shows, social media, company websites, and magazines. Although producers perceived verjuice consumers as those who enjoy experimenting with new products, foodies, and cocktail and/or mocktail enthusiasts, more market research is needed to confirm this consideration.

To the best of our knowledge, there is no research published on consumer views towards verjuice packaging and label information. Addressing these factors and bridging the gap between consumer and producer would require a better market research, enhanced communication channels, and flexible production processes that can accommodate consumer preferences without compromising on functional requirements. Another aspect is the diversity in the requirements for verjuice labelling, which vary depending on the country of production. Exploring possibilities in making verjuice in NZ would add further to the national and international wine industry reputation as being at the forefront of global wine industry innovation.

5. Conclusions

This exploratory and qualitative study discovered both similarities and differences between consumer views and producer practices regarding verjuice. Products exhibited a diverse sensory profile indicating that, despite grapes being unripe/not fully matured and lacking complete development of aroma compounds, consumers were able to perceive many flavour attributes beyond just sourness and sweetness, the otherwise primary features of this product. This opens an opportunity for producers to consider and promote their verjuice for a more diverse range of applications beyond current traditional uses. Various applications for verjuice were discussed, with sweeter variants typically favoured for drinking occasions and sourer for culinary purposes, although exceptions to this trend existed across consumers which is understandable given interindividual variations may occur. The findings identified an opportunity for innovation by making verjuice with desirable sensory signatures for different target end-uses, opening an opportunity for the wine industry which current producers have not fully explored for the potential and versatility of this product, probably because verjuice is not their core business.

The findings highlighted crucial themes that demand careful consideration in the development of verjuice products and its positioning in the market, particularly by the wine sector which has been actively exploring ways to enhance the value of waste streams and convert by-product materials into high-value food ingredients or products. A mismatch between packaging choices made by producers and preferences expressed by consumers regarding verjuice products was highlighted, which varied depending on intended use (drinking versus cooking). Although producer choice was primarily due to convenience of integrating verjuice bottling into existing winery operations, this research highlights an opportunity for producers to optimise packaging choices to better cater to consumer needs. Recognition of key elements on verjuice labels varied revealing some discrepancies between consumer preferences and producer practices. Thus, this research shows opportunities for verjuice producers to optimise product label information and design for particular market segments and target uses. Considering the versatility of verjuice in multiple food applications and its alignment with sustainability and circular narratives, it emerges as a product with promising economic potential. This applies not only for current producers but also for those in the wine sector who have not yet ventured into verjuice production and for those seeking nonalcoholic options in their portfolio considering the fast growing no-alcohol wine sector. Even though verjuice has been included in the production of wines in some countries, this adoption is still limited possibly due to regulation restrictions. Verjuice promotion is crucial to enhance consumer awareness and familiarity with the product and therefore expand its consumer base and market demand. This would lead to increased sales, market penetration, and opportunities for growth in the verjuice and wine industry. Future studies are now needed to deeply investigate the sensory drivers of liking in specific-use case scenarios with a larger consumer group, to support product diversification, thereby enhancing the revenue stream for the wine industry.

Conflicts of Interest

The authors declare that they have no conflicts of interest.

Authors’ Contributions

Amanda Dupas de Matos was responsible for conceptualisation, methodology, formal analysis, investigation, resources, data curation, original draft preparation, review and editing, visualisation, supervision, project administration, and funding acquisition. Robyn Maggs was responsible for investigation and data curation. Joanne Hort was responsible for resources, review and editing, and supervision.

Acknowledgments

The authors would like to thank all the consumers who generously dedicated their time and participated in this study. Additionally, the authors extend a special appreciation to the verjuice producers for their cooperation in sending their products to New Zealand, enabling their use in the consumer discussion groups. This research project was supported by the College of Sciences Massey University Research Fund (MURF) and the Food Experience and Sensory Testing (Feast) Laboratory, Massey University.

Open Research

Data Availability

The qualitative data used to support the findings of this study are included within the article and supplementary information file. The video recording and datasets generated have not been made available because of commercial confidentiality, participant privacy, and ethical restrictions.