[Retracted] Function Extraction Based on CFPS and Digital Financial Index: Data Mining Techniques for Prognosis of Operational Risks of Financial Institutions

Abstract

Financial deregulation, financial globalization, and the increasing variety and technological sophistication of the commodities offered by financial services have made the operations of financial institutions more complex. Compared with credit risk and market risk, financial institutions’ transaction risk management plays an increasingly important role in financial practice. As an emerging technology, big data mining technology has a unique advantage in optimizing the processing and management of large amounts of data. Big data mining technology not only has the common functions of finding, comprehensively managing all kinds of information, collecting and analyzing data, and conducting statistics but also should have the ability to process information that is hidden and useful in the database through data mining technology. Based on CFPS and data mining technology, this paper analyzes the operational risk of financial institutions, analyzes the causes of the operational risk of financial institutions, discusses the measures to avoid the operational risk of financial institutions, and draws corresponding conclusions.

1. Introduction

In today’s globalized economy, financial risk affects the whole market economy and its possible harm cannot be underestimated. Financial institutions play an important role in the financial system, so it is necessary to study the operational risks of financial institutions and take corresponding preventive and control measures. Operational risk is one of the common risks of financial institutions. In many financial institutions, the losses caused by operational risks are significantly greater than credit risks and market risks. As financial activities become increasingly complex, operational risk management plays an increasingly important role in the operations of financial institutions. Operational risk is becoming an increasingly important risk factor for financial institutions worldwide. The focus is on identifying, measuring, and monitoring operational risk. Operational risk refers to fluctuations in customer revenues or cash flows, lack of adequate internal controls, system or control failures, and loss of control of events at financial institutions. Operational risk management typically involves identifying the financial institution’s risks, assessing the financial institution’s risks, ensuring that an effective capital planning and monitoring program is in place, monitoring risks, risk exposures, and corresponding capital requirements on an ongoing basis, taking steps to control or reduce risk exposures, and reporting to senior management and the Board of Directors on the financial institution’s risk exposures and capital position. A sound internal governance structure is the foundation for effective operational risk management, and therefore, internal controls should be incorporated into the day-to-day operations of a financial institution to ensure that it conducts its business activities as efficiently as possible and provides reliable, timely, and complete information while complying with applicable laws and regulations. Although operational risk has not been studied for a long time, in recent years, it has been listed as a major risk that financial institutions need to face simultaneously, as well as market risk and credit risk. Given the complexity of operational risks and the severity of damage, effective prevention of operational risks has become an active issue for financial institutions. Operational risk assessment rules facilitate, to some extent, the analysis of the operational risk profile of financial institutions, develop appropriate operational risk management strategies, and provide a theoretical basis for financial institutions to identify risks and conduct risk analysis when designing overall operational risk management [1].

In the field of work risk research in financial institutions, the maturity of data collection methods and approaches provides a wide scope for the application of workplace risk management techniques. The collection of data from a large number of sources provides us with valid data to help us analyze, develop, and implement such methods. This allows us to analyze existing facts more rationally and to predict and control the future more accurately. The rapid development and attention of professionals and scholars in various fields have been made possible by the rapid development of computer technology and its widespread availability throughout the world. The main technical conditions are as follows: first, the development of technology and business capabilities has enabled the public sector and individuals to place greater emphasis on mining data. Secondly, in addition to improving data management tools, improving the efficiency of information utilization and reducing storage costs have played an important role in the development of data extraction technologies. In addition, after decades of theoretical and technical development, statistics has been successfully applied in many fields, laying the foundation for data exploitation and contributing significantly to the development of this approach. The purpose of this paper is to analyze and study the methods of processing and analyzing job risk data by taking advantage of the powerful advantages of data extraction techniques for job risk analysis to fill the gaps in job risk data. The analysis of job risk data features provides substantial support for the application of data extraction techniques in the context of job risk [2].

In the process of analyzing the business risks of financial institutions, this paper uses data extraction techniques in the data processing process to analyze the business risks of financial institutions through data extraction and CFPS analysis methods to analyze the development background of financial institutions, the causes of job risks, and the exploration of measures.

2. Research Background

2.1. Overview of Data Mining Technology

The latest foreign big data analysis and its mining methods in the field of large databases related to the scope and content of research have been very mature and extensive and have achieved many significant and representative technical results. The ongoing research on how to use knowledge and data systems in database modeling and related services has largely led to a number of fairly significant technical advances with some important representative values so far [3]. The academic results can be summarized as follows: methods such as induction and analysis oriented to the relational attributes of data features are used to find relational attribute differentiation rules and feature rules for data attributes in relational database models. In order to be able to go deeper into solving the most complex uncertainty problems in Dury rough data collection theory, evidence-theoretic models and fuzzy set theory are also applicable to the computation and analysis of databases, leading to practical models and technical applications of phase research methods. Compared with other similar research and practice projects jointly conducted abroad, the Chinese team members in China have been late in developing the ability to quickly analyze and mine network data and to continuously discover and acquire the value of network knowledge and have been late in transforming some technical research results and carrying out research practice and application work. It has not been further developed to form a more complete and mature force of such a technical system. Currently, most of the professionals or researchers engaged in research or development work are concentrated in universities and some research institutes or companies. The most important recent research results are summarized as follows: (1) an in-depth study by the Institute of Systems Engineering of the National Natural Science Foundation of China in Beijing shows that the method and its practical application in the field of knowledge system detection are not clear; (2) an in-depth theoretical study of data cubic algebra; (3) optimization and improvement of the rule-building algorithm of Jilin University, including East China University of Science and Technology, Beijing University, Fudan Zhejiang University, China University of Technology, and the Institute of Mathematics of the Chinese Academy of Sciences efforts; (4) based on Nanjing University, based on Sichuan University, based on Shanghai Jiao Tong University, and so on to carry out the knowledge resource discovery mechanism and for unstructured data network data mining problems such as empirical research; and (5) the Chinese Academy of Sciences Institute of Computing Technology, Tsinghua University Chinese Academy of Sciences group of professors, Shi Zhongzhi, and other multiperson data mining tool designed and developed a multiperson strategy knowledge discovery analysis platform, using decision tree algorithm which can detect all kinds of abnormal situation information in local tax systems such as Guangdong to provide services to taxpayers [4].

2.2. Review of Operational Risk in Financial Institutions

Compared with foreign research on operational risk, operational risk analysis in China still remains at the stage of scholarly research. Due to the property rights and information disclosure system of commercial financial institutions in China, many of these cases involve fraudulent acts by internal and external parties and involve the reputation of commercial financial institutions, so most financial institutions know little about this aspect and are reluctant to disclose it [5]. In addition, Chinese trade and financial institutions do not have specific loss data and reports for risk management operations or transactions. As a result, operational risk has not improved in our practice. However, after China’s accession to the World Trade Organization, the economic system has shifted from a planned economy to a market economy, and Chinese trade and financial institutions have continued to reform. Operational risk will play a very important role in Chinese business and financial institutions. In the past two years, more and more experts and scholars have started to focus on this area. In China, some scholars have applied data mining techniques in the financial field, such as Yang Tian, Huang Yijing, Liu Fei, and Luo Xiang, who analyzed the application of data mining techniques in the early warning system of financial crisis of listed companies. However, the application of data extraction techniques in the field of workplace risk is still very low [6]. Except for the use of hybrid models based on expert rules and genetic algorithms to share workplace risk, no Chinese scientists have applied data mining techniques to workplace risk. Therefore, combining data extraction methods with financial operational risk research has a very broad research area and great research value. In contrast, international research on operational risk is more systematic and, to some extent, scientifically based. Many professionals and scientists are assessing job-related risks. Mr. Chase has developed an effective credit assessment model using a hybrid data extraction approach of clusters and neural networks [7]. Beisens et al. investigated credit risk assessment using neural networks and decision tables. Gene combined neural network knowledge and transactions to predict the interest rates of corporate bonds and government debt. Although his integrated model is not very successful in predicting North Korean interest rates, it has a significant advantage over stochastic models in predicting U.S. interest rates. Corporate bonds are valued on a summary and return basis, allowing for a better assessment of the bond’s condition. Using a similar rule, these bonds are valued at previous interest rates. Hashimi et al. predicted the financial institution participation model using a neural network model that takes data from over 200 financial institutions as input to the neural network and decomposes it into 28 liquidity and credit risk factors. The model correctly classified 96% of the data from all four financial institution ownership structure tests with an estimated accuracy of 11%. The neural technique was used to obtain better results in the design of liquidity analysis and decision models [8].

3. Research Methods and Materials

3.1. Main Concepts

3.1.1. Data Mining Techniques

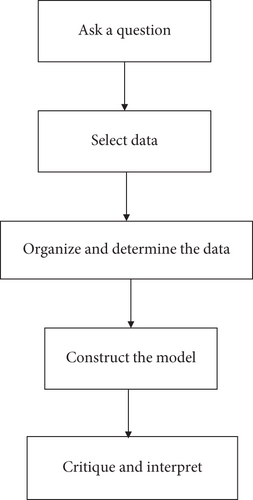

(1) The Meaning of Data Mining Technology. The data extraction method is a decision support process of data collection center to the research object. Data mining is not a single discipline, but a mixture of many disciplines. Through data mining, researchers can fully exploit empirical and theoretical knowledge to provide decision support, which is also the task of data mining. The obtained knowledge can supplement the existing knowledge system, support and help decision makers in the decision-making process, and be stored in the relevant knowledge base as new knowledge. At present, only the initial application of data mining technology in the fields of finance, financial institutions, and geographic information systems is inseparable from the lack of core technology. Data mining is a continuous exchange process between human and machine with many closely related steps. The key steps are problem formulation, data selection, organization of identified data, model building, judgment, and interpretation, all of which are subject to an iterative process [9], as shown in Figure 1.

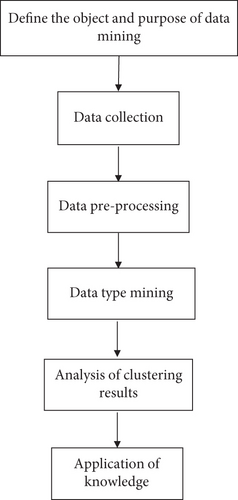

(2) The Main Processes of Data Mining Techniques. Data mining, as a deep data research and analysis method, is a process from proposing a solution to determining it. If this technology is applied to the system of predetermination and inspection of operational risks of financial institutions, it can improve the level of operational risk control of financial institutions and make the work twice as effective [10]. The main process of data mining technology is shown in Figure 2.

Step 1. Identifying data mining objects and targets: data mining target identification and finding are the first and the most important step in the data mining process. The final result cannot be predicted, but the research problem can be predicted by data mining.

Step 2. Data acquisition: data collection is laborious and requires a lot of time and effort. It requires the collector to carefully collect a variety of data and information in their daily educational activities, some of which are directly available and some of which must be found through research [11].

Step 3. Data preprocessing: this step converts the collected data into a data model, which is analyzed and modeled according to different algorithms, and therefore, different algorithms have different requirements for the data model [12].

Step 4. Data clustering mining: the data model is divided into several groups using cluster mining techniques. Words are classified based on similarity, and the greater the similarity, the more likely they are to be grouped together. This step is the process of selecting and implementing the clustering algorithm and the input data model [13].

Step 5. Analysis of clustering results: this process is to select and analyze the information mined from the clustered data and to judge the results of multiple sets of attributes [14].

Step 6. Application of knowledge: this is the final step; i.e., the useful information obtained in the previous step is applied to the prognosis of the operational risk of the financial institution, which leads to useful conclusions and enlightens the prognosis of the operational risk of the financial institution, which is the purpose of the thesis research [15].

3.1.2. CFPS and Digital Finance

(1) Meaning of CFPS. CFPS is the abbreviation of China Household Survey, which covers three dimensions: rural (household) infrastructure and environment, population, household income, and personal education, and reflects China’s economic development and social changes in a more general way. Since it can fully reflect China’s economic development and social changes, it is especially important for the research with financial markets, and in this paper, CFPS is used to analyze the impact of China’s economic development and social changes on financial markets [16].

(2) Digital Finance. Digital finance, as a means of information dissemination, reduces information asymmetry and poor processing while reducing transaction costs. In particular, as an information channel to expand the scope and coverage of financial services and improve the quality of information, the effectiveness of information dissemination and the expansion of the scope of dissemination are fully considered when using new information technologies such as big data, cloud computing, and artificial intelligence [17].

3.2. Main Formula and Algorithm Flow

- (1)

According to clustering methods, algorithms based on density, grid, and model are not suitable for these small and medium data types, so this kind of data mining can be studied and analyzed according to the classical algorithms k-mean and k-center algorithms. According to the definition of the k algorithms, the number of categories required for the study can be expressed. The basic idea of these two classical n algorithms is to k divide individual objects into classes so that similar objects have high similarity and objects in different classes have low similarity. The mean value of each class is the reference value for the k-means algorithm, while the k-centroid algorithm uses the point object at the center of the class as the reference value to calculate the dissimilarity [18]. The k-centered algorithm has an advantage over the k-mean algorithm when outliers are present in the data objects, which is related to the fact that the center is insensitive to outliers and the mean is more sensitive to outliers. However, the k-centered algorithm is more complex than the k-mean algorithm. Assuming that the complexity of the k-mean algorithm is represented by x, we calculate

where n denotes the number of classes and t denotes the number of iterations.

- (2)

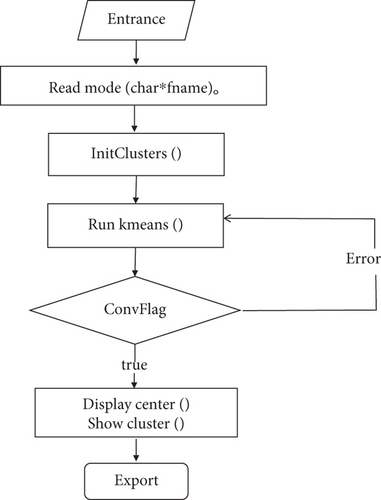

The main algorithm process: in the k-mean algorithm, the function LoadPatterns (Char∗fname) serves to load the sample data information into the process of the program, and the main purpose of this function is to read out the relevant information from the database file km.dat and convert the data in the file into the sample Patten[i][j] array [19].

The function RunKMeans() serves as the main procedure of the algorithm; the main procedure is to compare the distance of all objects to the center of each cluster. Then, the objects are divided into the classes with the nearest class centers, and the cluster centers are calculated again according to the redivision, and if the class centers do not change in any way, then the clustering process is terminated [15].

The function InitClusters() functions as the initialization process of the class centers, and the function starts by using the first K data in the data sample as the starting class centers.

The ConvFlag is used as an identifier for whether the clustering is complete or not, the function ShowCenters() represents the cluster centers described by the algorithm, and the function ShowClusters() represents the identifier number of the samples described by the algorithm [20]. This is shown in Figure 3.

4. Results and Discussion

4.1. Operational Risk Analysis of Financial Institutions

- (1)

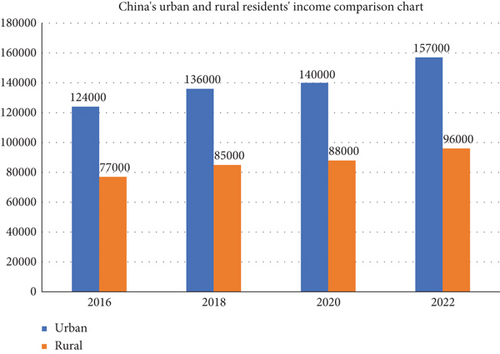

The impact of changes in household income on the financial market: the analysis investigated the average income amount of urban and rural households in China from 2016 to 2022 and concluded that the increase in household income is very beneficial to the development of the financial market; the specific data are as follows: in 2016, the average income amount of urban residents in China was 124,000 yuan and 77,000 yuan in rural areas; in 2018, in urban residents in China, the average income amount is 136,000 yuan and 85,000 yuan in rural areas; in 2020, the average income amount of urban residents in China is 140,000 yuan and 88,000 yuan in rural areas; in 2022, the average income amount of urban residents in China is 157,000 yuan and 96,000 yuan in rural areas; from the data, it can be seen that the income of urban and rural residents in China is improving year by year, which means that as the income level increases, people are willing to invest in financial items such as savings and wealth management may increase, as shown in Figure 4

- (2)

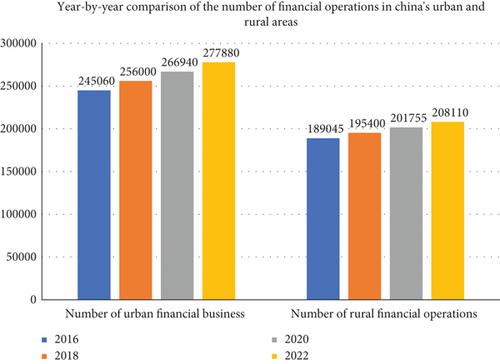

The impact of the number of savings, loans, and other financial services on the financial market: the number of urban financial services is 245,060 in 2016, 256,000 in 2018, 266,940 in 2020, and 277,880 in 2022; the number of rural financial services is 189,045 in 2016, 195,400 in 2018 and 2020, 201755 in 2016, 201755 in 2018, 208110 in 2020, and 208110 in 2022; from the analysis of the data, it can be seen that the number of both urban and rural financial services is increasing year by year, which shows that the financial market is developing well, as shown in Figure 5

- (3)

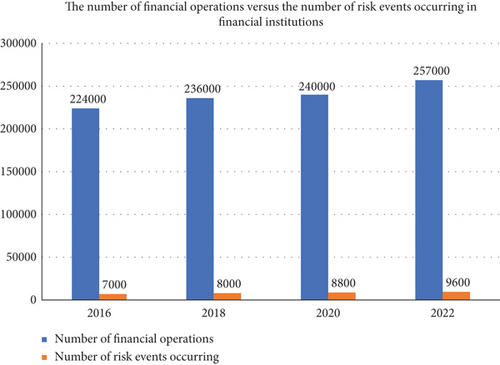

The relationship between the number of operational risk events of financial institutions and the number of financial operations: in 2016, the number of financial operations in China was 224,000 and the number of risk occurrences of financial institutions was 7,000; in 2018, the number of financial operations in China was 236,000 and the number of risk occurrences of financial institutions was 8,000; in 2020, the number of financial operations in China was 240,000 and the number of financial institutions’ risk is 8800; the number of financial operations in China is 257000 in 2022, and the number of financial institution risk is 9600, which proves that the number of financial institutions’ operational risk and the number of financial operations have roughly proportional growth relationship, but because the number of financial operations in China is gradually increasing, with the rising trend of financial operation risk, it is necessary to take reasonable measures. The number of financial operations and the number of financial businesses in China are increasing gradually, as shown in Figure 6

- (4)

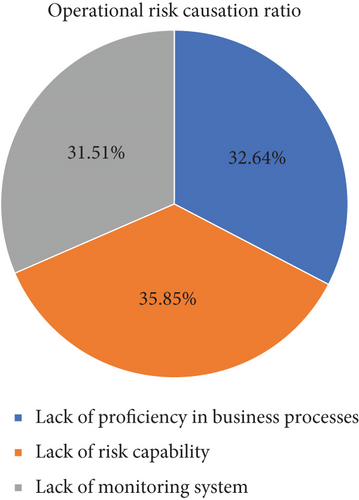

Financial institutions’ operational risk causation ratio: the main analysis of the three main causation ratios of operational risk, unskilled business process, lack of risk capability, and lack of monitoring system accounts for the proportion of financial institutions’ operational risk comparison as follows: 32.64% for unskilled business process, 35.85% for lack of risk capability, and 31.51% for lack of monitoring system, thus proving that the three main causation ratios are balanced. The three factors are the same as the main factors that constitute the occurrence of operational risks in financial institutions, as shown in Figure 7

- (5)

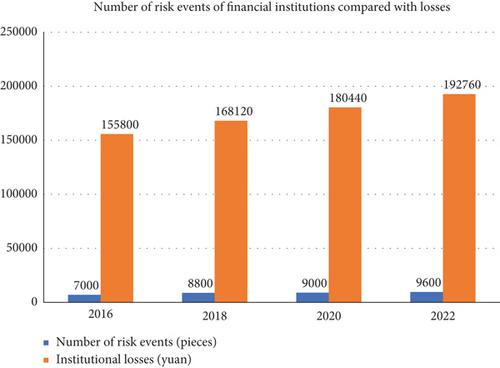

Analysis of the impact of operational risk of financial institutions: the more the number of operational risk events, the greater the loss of financial institutions: the total number of risks of financial institutions in 2016 is 7000, and the loss of financial institutions is 155800; the total number of risks of financial institutions in 2018 is 8800, and the loss of financial institutions is 168120; the total number of risks of financial institutions in 2020 is 9000, and the loss of financial institutions is 180,440; in 2022, the total number of financial institution risks is 9,600 and the loss of financial institutions is 192,760; from the data analysis, it can be seen that the loss of financial institutions is proportional to the number of financial institutions’ operational risk events, as shown in Figure 8

4.2. Analysis of Results

The above-mentioned points lead to the following result discussion: the causes and measures of operational risks of financial institutions are discussed in depth, respectively.

4.2.1. Causes of Operational Risks of Financial Institutions

The design of business processes and operations of financial institutions is not adapted to the business processes of financial institutions, which determines that financial institutions cannot have a good quality of work. Most of the accounting processes of financial institutions are designed to be operational, with overemphasis on risk control and lack of consideration of the feasibility of system implementation, resulting in rules and procedures that are incompatible with accounting operations, which affects the implementation of the system. Secondly, in the process of accounting operations, some loopholes exist in some business operations, and some business authorization operations are not standardized, which increases the possibility of operational risks. For example, when opening a personal account, the account holder must have a valid certificate, but some financial institutions can handle the process of opening an account by providing a copy of the situation, violating the terms of account opening and forming a hidden problem. In addition, the operation of financial institutions has become more difficult due to the renewal and upgrading of their business systems. With the emergence of new business products, operators are unable to conduct business training in a timely manner, which has an impact on business management and is detrimental to the development of financial institutions. Finally, the accounting system of some financial institutions cannot be updated in a timely manner, the scope of business is expanding, and the system process cannot adapt to the needs of risk prevention, which easily brings losses to financial institutions.

The accounting operation business process execution process is the performance of financial institutions’ accounting operation business process specification. It can reduce the probability of operational risks, but most financial institutions have some problems in the process of accounting operations. First, the implementation of business process is not strictly supervised and some staffs miss the operation steps. The main reason is that staffs do not establish proper awareness of accounting operation business process and are not familiar with the operation steps, which can easily cause risky accidents. Secondly, some branches of financial institutions have lax work management, such as ignoring the illegal operation of cashiers and not conducting business review in time. In this case, the supervision is too lax and not strict enough, which is very likely to cause risky accidents and affect the quality of accounting operation risks of financial institutions. In addition, the internal accounting supervision of some financial institutions is too superficial and fails to deeply understand the importance of internal accounting supervision, which reduces the degree of preventing operational risks and leads to a loose process of implementing accounting operation business processes, making it difficult to achieve effective risk control.

At present, most financial institutions can control operational risks through a series of means such as authorization review, but with the lack of systematic prediction ability, there are still some loopholes. With the continuous improvement of information technology, if financial institutions cannot monitor the risk points of accounting business processes in real time through information technology, they cannot adapt to the needs of social development, lack risk warning capability, and rely too much on manual supervision, which increases the difficulty of operational risk control. For example, in the actual financial institution system, large transactions need to be authorized for processing, but some financial institutions do not follow the settings for authorization of cumulative transaction volume, so most cashiers violate the rules when processing large transactions by splitting them into small ones to avoid delegation of authority. Secondly, the accounting system of most financial institutions lacks the risk control capability to monitor and review all aspects of the business process in real time, resulting in failure to remedy risks in a timely manner, causing huge losses to the financial institutions and exposing them to greater risks.

Personnel management cannot adapt to the development of financial institutions in recent years, the business volume of financial institutions has been increasing, but the growth rate of financial institutions’ personnel is small and uncoordinated, and most financial institutions lack sufficient accounting business personnel, mainly due to cost savings and personnel transfer, and face serious personnel mobility challenges, insufficient level of human resource management, and no humane management ideas, so it is extremely easy to cause accounting business risks. In addition, the structure of accounting business personnel in financial institutions is not reasonable. At present, most of the staff structure tends to be young, with strong ability to learn and handle knowledge and innovative thinking, but young employees lack certain work experience and have the ability to choose their career due to the advantage of age, and financial institutions attach less importance to their work, so the level of staff management is low and has not been improved. Finally, cashiers in financial institutions also lack sufficient training and certain risk awareness, resulting in errors that cannot be dealt with in a timely manner and a lower standard of operating process, thus increasing the possibility of risks.

With the increasing competition in the market, financial institutions are paying more and more attention to the evaluation of marketing indicators such as loans in order to improve their competitiveness. In recent years, the difficulty of marketing indicator tasks has gradually increased and the evaluation model is relatively simple, which tends to cause a certain amount of evaluation pressure. Most of the employees will form the one-sided thinking of “emphasizing business development and neglecting risk control”, emphasizing business development and lacking awareness of accounting system, which will accumulate various business risks of financial institutions in the long run and is not conducive to the stable development of financial institutions. In addition, the lack of sufficient communication and feedback between accounting staff and accounting managers makes it difficult to balance the standardized operation of accounting business with the flexibility of market demand, leading to the contradiction between risk control and business development and affecting the effectiveness of risk management.

4.2.2. Risk Measures for Financial Institutions’ Operations

The standardization of accounting operation business processes in financial institutions is an important factor leading to operational risks, so the standardization of accounting operation processes must be strictly controlled. First of all, financial institutions should improve the accounting operation business process system, improve the adaptability of business processes and operations, distinguish different operations as the scope of business expands and the volume of business increases, establish management mechanisms for various operations such as parameters, information maintenance, and data, improve the standardization of business operations, and appropriately establish risk analysis systems and major event reporting systems, according to the actual situation of financial institutions themselves. Make the operators participate in the process of system development, so that the business process design of accounting operations can be more in line with the front office operations and effectively prevent risks. Secondly, financial institutions should strengthen the standardization of accounting business operating environment, divide business types according to business requirements, improve the accuracy of business operations, raise the system awareness of accounting practitioners, standardize employee behavior, strengthen risk management education, establish reward and punishment systems, clarify responsibilities, and realize effective process control. Finally, in order to solve the system update problem, financial institutions should explain the new business before the system update so that employees can quickly understand the business, avoid mistakes, and improve the service level of financial institutions.

Since accounting operations run through the whole process of financial institutions’ operations, improving the level of supervision and control of accounting operations business processes can effectively improve the risk management capability of financial institutions. Firstly, the business operation and supervision capability should be strengthened so that employees strictly follow the business process, and if there are irregularities, they should be handled strictly in accordance with the regulations and consciously resist irregularities against employees and should be given appropriate incentives to strengthen employees’ self-awareness of compliance with the regulations. Secondly, supervision should be strengthened to improve the ability of financial institutions to prevent risks, especially in terms of operating licenses, to enhance supervision, review the rationality of cashier business operations, and improve the level of supervision. In addition, financial institutions should strengthen internal inspection, identify and analyze the risks of accounting business operations, supervise business processes, improve the professional level of internal accounting supervisors, and ensure the effectiveness of internal inspection. Finally, financial institutions should establish a sound internal accounting inspection system, improve the binding force on accounting inspectors, clarify regulations, improve the strictness of supervision, and effectively reduce the occurrence of operational risk accidents.

In order to improve the efficiency of risk management, financial institutions should monitor the transaction behavior in real time, strengthen the improvement and consolidation of the early warning system, and combine typical prevention cases so that accounting operations can be carried out normally. First of all, the management should establish an early warning information management system and standardize all aspects of early warning information, and accounting institutions should establish a management mechanism for obtaining, analyzing, and feeding back information. Financial institution branches should also establish corresponding responsible person system, standardize operation details, strengthen prevention and control work and timely research and analysis to discover abnormal events, discover operation risks, develop measures to cope with nonabnormal events, eliminate early warnings in a timely manner, establish corresponding rectification mechanisms, and improve early warning operation risks of financial institutions. Secondly, financial institutions should strictly control the authorization of transaction links, realize effective process control, coordinate and unify the front and back office of financial institutions, seriously implement the tracking and feedback of early warning information, and improve the control level of accounting operation risks. Finally, financial institutions should establish a risk compensation mechanism to ensure that financial institutions minimize operational risk losses when they occur, in addition to predicting and controlling risks, so that financial institutions can carry out accounting operations smoothly.

Strengthening the rationality of personnel structure of accounting operations of financial institutions is the main body of accounting operations of financial institutions; therefore, the rationality of personnel structure and the rationality of personnel ability is the basis of risk management; therefore, it is necessary to further optimize the personnel structure and improve the quality and ability of personnel. First of all, financial institutions can recruit from abroad to ensure that financial institutions have sufficient reserves of accounting operation personnel, properly establish incentive mechanisms to improve the motivation of employees, solve the problem of the ratio of the number of employees to the number of operations in financial institutions, fully consider the ability and age of employees when determining the duties of positions, assign appropriate work according to their actual situation, improve the awareness of people-oriented management in financial institutions, and care and respect for employees so that they can develop their own values, improve their efficiency, and enhance their risk control capabilities. Secondly, with the development of business, the existing knowledge structure of accounting practitioners can no longer adapt to the development speed of financial institutions, so it is necessary to conduct relevant business training to improve the business ability of practitioners and ensure their accurate operation of new business. In addition, accountants should establish a sense of risk prevention and strengthen risk control by intercepting and identifying fraudulent acts of financial institutions. First of all, the management of financial institutions must help to improve risk awareness, focus on the construction of internal control, establish a perfect internal control system, improve the phenomenon of financial institutions’ heavy business, improve their management level, effectively reduce the possibility of various risks, center on business development, and ensure the normal implementation of internal control. Secondly, reeducation of employees should be strengthened to raise the level of their awareness of risk internal control, establish correct risk management ideas, implement risk management ideas in depth, make employees take responsibility for risk prevention, recognize the importance of internal control, discover risk points in time, and improve the effectiveness of risk management in accounting operations of financial institutions.

5. Conclusion

In the process of analyzing the business risks of financial institutions, this paper uses data extraction techniques in the data processing process to analyze the business risks of financial institutions through data extraction and CFPS analysis methods to analyze the development background of financial institutions, the causes of operational risks, and measures to explore. The following conclusions are drawn.

The main causes of operational risks of financial institutions are as follows: the design of business processes and operations of financial institutions not adapting to the business processes of financial institutions, the specification of accounting operations business processes of financial institutions, the lack of systematic forecasting capabilities, the failure of personnel management to adapt to the development of financial institutions in recent years, and the existence of conflicts between risk control and business development.

The measures to solve the operational risks of financial institutions are as follows: standardization of operational business processes, improvement of the level of supervision and control of operational business processes, improvement of the efficiency of risk management, and rationalization of personnel structure and personnel capacity.

To sum up, financial institutions must improve their competitiveness and management level in order to stand firmly in the market. In order to improve the risk management of accounting business of financial institutions, they should standardize accounting business, improve supervision and control, ensure accurate business processes, strengthen early warning systems, enhance risk control capabilities, train and retrain employees, strengthen internal controls, balance risk management and business development, and promote the regulatory development of financial institutions.

Conflicts of Interest

The authors declare no conflicts of interest.

Open Research

Data Availability

The dataset can be accessed upon request.