Research on the Operating Efficiency of Chinese Listed Pharmaceutical Companies Based on Two-Stage Network DEA and Malmquist

Abstract

The development of pharmaceutical companies, which is an important part of the national economy and industry, is closely related to people’s livelihood issues. With the era of big data, this paper uses the two-stage DEA and Malmquist method to evaluate the efficiency of listed Chinese pharmaceutical companies. From a static and dynamic perspective, it analyses the total factor productivity index, pure efficiency change index, scale efficiency index, and so on. The results show that government subsidies have not had a positive impact on most Chinese pharmaceutical companies, and for films, diseconomies of scale caused by rapid expansion should be avoided.

1. Introduction

Since the outbreak of the COVID-19, medical health has become the primary topic of concern for the government and the public. The operation of pharmaceutical companies has become the focus of discussion. At present, China’s pharmaceutical manufacturing industry has long been in a state of low industry concentration, high product homogeneity, and weak technological innovation capabilities. It has a large gap with the international advanced level. In recent years, China’s various medical reform policies and regulations have been promulgated one after another. It has brought many uncertain factors to the development of the pharmaceutical industry. How to adapt to changes in the external environment and further improve operating efficiency has become an important issue facing the government and enterprises. Based on the above background, this article focuses on the research on the operating efficiency of pharmaceutical companies, innovatively combining the DEA method with Malmquist, taking 164 listed companies in China as a sample, and studying their operating conditions during the five-year period from 2015 to 2019.

The structure of the following parts of this article is as follows. Section 2 collects current scholars’ research on the efficiency evaluation of pharmaceutical companies; Section 3 introduces the related content of the two-stage network DEA and Malmquist index method in this article; Section 4 outlines the research of this article process, sample selection, and two-stage DEA data analysis. Section 5 uses Malmquist to analyse the dynamic effects of the data and finally summarizes the research results of this article.

2. Literature Review

At present, many scholars use the DEA method to measure the actual situation of the operating efficiency of pharmaceutical companies and provide suggestions for improvement of the company’s operations. For example, Wang [1] selected Chinese biopharmaceutical companies from 2017 to 2019 as a research sample and established a static DEA model to measure their financing efficiency. The results show that although the overall financing efficiency of Chinese biotech companies is not high, the level of it is increasing year by year. And Zhang Zicheng [2] innovatively combined the AHP method with the DEA method, finding that, compared with the scale factor, the deficiency of technology hinders the operating performance of companies such as Lunan Pharmaceutical firm. Meanwhile, Li et al. [3] used a two-step method of factor analysis and SE-DEA model to calculate the financial data of 58 listed pharmaceutical companies in China from 2009 to 2013 and concluded that the overall inefficiency of the pharmaceutical industry is also due to insufficient investment on scale and technology.

Among them, some scholars even divide medical companies into groups to study their operational status in different regions [4, 5]. The research found that there are indeed differences in the operating efficiency as well as in terms of technological innovation of pharmaceutical companies in different regions [6, 7]. For example, Xiong [8] used the panel data of technological innovation of medical companies listed in Guangdong, Shandong, Zhejiang, and Jiangsu as samples to study the allocation of technological innovation resources of pharmaceutical manufacturers in four provinces in China from 2015 to 2017 and finally came to the following conclusions: in the province, Jiangsu pharmaceutical companies have the advantage of pure technical efficiency in innovation activities, while Guangdong pharmaceutical companies performed better in scale efficiency with regard to technological innovation. However, the traditional DEA model cannot study the influencing factors in the process. Therefore, the research studies on the two-stage network DEA model and the Malmquist index method have received widespread attention from many scholars.

Regarding the two-stage network DEA, such method has been applied to plenty of fields. For example, Lewis et al. applied the undirected network DEA method to the efficiency evaluation of Major League Baseball [9]. Additionally, Liang et al. used a two-stage network DEA model to analyse the input-output efficiency of 50 universities in China [10], while Li et al. applied the DEA model under the two-stage expansion structure to the research on the efficiency of R&D in China’s provincial regions [11]. At the same time, some researchers also combine two-stage network DEA with other methods. For instance, Chen et al. [12] and Kao [13] combined it with the two-stage additive efficiency decomposition DEA method to study the relative efficiency of 24 non-life insurance companies in Taiwan. Lee and Johnson combined Malmquist under the network DEA structure to study the performance of the semiconductor manufacturing industry [14]. It can be seen that the two-stage network DEA has been widely used in insurance companies, universities, and other industry research. However, research in the pharmaceutical industry is still relatively rare.

Regarding the Malmquist index method, scholars have also made great achievements. In the field of sustainable e-agriculture, Pan and others used the 31 provinces as the research objects and explored the sustainable development efficiency of agriculture in mainland China through DEA and Malmquist productivity index models [15]. In the medical industry, Hashimoto and Haneda [16] used the conventional DEA method and the Malmquist productivity index method to measure the R&D efficiency of the Japanese pharmaceutical industry from the enterprise level and the industry level, respectively. Empirical evidence shows that the total factor productivity of Japan’s pharmaceutical industry is declining, and the main reason for the decline is the sharp decrease in technological changes. What is more, Pannu et al. [17] used the output-oriented VRS model and the Malmquist productivity index method to measure the increase in efficiency and productivity of the Indian pharmaceutical industry over a 10-year period, finding that the increase was mainly due to the growths in technical efficiency. Furthermore, Zhiyue and Qiu [18] also used the Malmquist index method to conduct an empirical analysis of the operating efficiency of China’s biopharmaceutical industry from both horizontal and vertical aspects. The results show that the overall operating efficiency of the biopharmaceutical industry is not ideal, and there is a large difference in efficiency between provinces and cities.

In summary, it can be seen that scholars have used many different methods to study the operating efficiency of pharmaceutical manufacturing enterprises, but the research still has the following shortcomings. Firstly, most research studies on the efficiency of pharmaceutical manufacturing enterprises use nonparametric methods. When measuring enterprise efficiency, some scholars only consider a certain aspect of static or dynamic and thus cannot comprehensively analyse the efficiency level and development trend of pharmaceutical manufacturing enterprises. Secondly, there are few literatures on the research of listed pharmaceutical companies using the two-stage network DEA and Malmquist index method, most of which focus on the traditional DEA method. Finally, in the literature on efficiency influencing factors, the selection of variables is relatively limited, and there are few literatures that consider the R&D capabilities of enterprises. For pharmaceutical manufacturing companies, environmental variables are very important and have a very large impact on the efficiency of the company. Therefore, the external environment of the company should be considered when studying the efficiency of the company. Based on the above deficiencies, this paper uses the two-stage network DEA and Malmquist index method to study the operating efficiency of enterprises from both static and dynamic perspectives. When studying the factors affecting the operating efficiency of enterprises, environmental variables have been added and considered from multiple angles in the article, striving for a more comprehensive selection of influencing factors.

3. Research Method

3.1. Two-Stage Network DEA

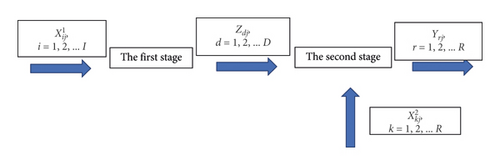

In the traditional DEA model, we only know the final efficiency values of the entire process, but the specific situation in the whole process is unknown. The information provided by the traditional DEA model is not enough, and the guidance to managers is limited. The two-stage network DEA model can open the “black box” of the production system, which can effectively measure the complex production network. Therefore, this paper also adopts the two-stage network DEA model for performance evaluation and pays more attention to the progressive relationship between the two stages based on the research results of other scholars. Its internal structure is shown in Figure 1.

-

The first-stage model (model 1) is given by

(1)(2)(3)(4) -

Model 1 adds a constraint on the basis of the traditional CCR model, that is, the last constraint. Its purpose is to ensure that the optimal solution of the first stage makes the efficiency value of the second stage not more than 1, so as to ensure that the second stage model must have a feasible solution; otherwise, there may be no feasible solution. Therefore, this constraint is necessary, which was not considered in the previous two-stage DEA model. In model 1, Ur, Vi, Wd, tk, respectively, represent the weights of the corresponding variables, after considering the study conducted by Cheng and Zheng [19]. The efficiency of each DMU can be obtained by model 1. Record the efficiency of the DMU0 as .

-

Then second-stage model (model 2) is given by

(5)(6)(7)(8)(9)

Solving (5)–(9) can get the efficiency of the second-stage DMU, noting as the efficiency of the second stage. So far, it can be concluded that the total efficiency of the two-stage system DMU0 is (10).

3.2. Malmquist Index

-

TFP is total factor productivity index:

(10) -

PEC is pure efficiency change index:

(11) -

SE is scale efficiency index:

(12) -

TC is technical change index:

(13) -

The formula of total factor productivity is

(14)

4. Empirical Analysis

4.1. Sample Selection

With reference to the definition of pharmaceutical companies, combined with the description of the main business in the annual report of the A-share listed pharmaceutical company and the proportion of the main business in operating income, the study sample is determined. At the same time, to ensure the validity of the analysis results, ST, PT, and ST∗ companies were excluded, and 164 listed pharmaceutical companies were finally identified as the research samples. The data of inputs and outputs comes from Cathay Pacific database and the annual public report of enterprise.

4.2. Variable Selection

4.2.1. The First Stage of Input and Output Variables

The selection of variables is based on character of listed pharmaceutical companies, and we fully inspect the business characteristics and operation of listed pharmaceutical companies. The inputs selected are gross costs (X1 ), total number of employees (X2 ), and net value of fixed assets (X3 ), and the output is gross revenue (Y1 ).

4.2.2. The Second Phase of Input and Output Variables

This paper comprehensively examines the business characteristics and operation of listed pharmaceutical companies. Government subsidies (X5 ) as a new input are added to the second stage, and the other input is the gross revenue (X4 ) that is the output of first stage, and the final output is net profit (Y2 ). More details are shown in Table 1.

| Variable type | Variable name | Measure | |

|---|---|---|---|

| The first stage | Output | Gross costs | Gross costs in corporate annual reports |

| Input | Total number of employees | Total number of in-service staff | |

| Net value of fixed assets | Net value of fixed assets in corporate annual reports | ||

| Gross revenue | Gross revenue in corporate annual reports | ||

| The second stage | Output | Net profit | Total profit − income tax |

| Input | Gross costs | — | |

| Government subsidies | Government subsidies that are included in the current profit and loss | ||

4.3. DEA Efficiency Analysis in the First Stage

In first stage (shown in Table 2), no listed pharmaceutical company’s technical efficiency reached 1 during 2015–2019. There are 119 companies with technical efficiency between 0.6 and 1.0, accounting for 73%, indicating that the technical efficiency of these companies is good. The efficiency values of the eight securities companies (Chongqing Taiji Industry, Baiyunshan, Kelun, Huabei, Hisun, Harbin, China Medicine, and Renfu) are below 0.4, indicating that the technical efficiency level of these companies is relatively low, and they need to increase investment.

| Company name | The first stage | The second stage | Total |

|---|---|---|---|

| Adisseo | 0.731807447 | 0.70427645 | 0.718041949 |

| Anke Bio | 0.701258545 | 0.65681619 | 0.679037367 |

| Osaikon | 0.77517144 | 0.677756486 | 0.726463963 |

| Baiyunshan | 0.383760611 | 0.329568568 | 0.35666459 |

| Bdyy | 0.621063253 | 0.668172657 | 0.644617955 |

| Beilu | 0.755456729 | 0.662521895 | 0.708989312 |

| Porton | 0.626443198 | 0.653894142 | 0.64016867 |

| None | 0.708205489 | 0.644792119 | 0.676498804 |

| Changchun High-Tech | 0.754140117 | 0.760920762 | 0.757530439 |

| Changjiang Runfa Medicine | 0.622444299 | 0.581956694 | 0.602200497 |

| Changshan Pharma | 0.705379957 | 0.663215003 | 0.68429748 |

| DAJY | 0.611416622 | 0.570090491 | 0.590753556 |

| Dezhan | 0.800138709 | 0.776221753 | 0.788180231 |

| Jiao | 0.68813071 | 0.761262056 | 0.724696383 |

| DBBT | 0.715738024 | 0.641593159 | 0.678665591 |

| VC | 0.463121349 | 0.46703195 | 0.465076649 |

| Dongcheng | 0.67384118 | 0.680702372 | 0.677271776 |

| Nhwa Pharm | 0.655734649 | 0.667349718 | 0.661542183 |

| Ekzy | 0.679041427 | 0.578708106 | 0.628874767 |

| Fangsheng | 0.700194471 | 0.656633368 | 0.678413919 |

| Fengyuan | 0.58132929 | 0.49193138 | 0.536630335 |

| Fczy | 0.678039919 | 0.651980945 | 0.665010432 |

| Fayy | 0.64776847 | 0.593446924 | 0.620607697 |

| Fosun Pharm | 0.469682442 | 0.744647296 | 0.607164869 |

| Fuxiang | 0.699215567 | 0.600348021 | 0.649781794 |

| Guangji | 0.686416693 | 0.640838606 | 0.66362765 |

| Kwong Sang Hong | 0.739991067 | 0.650835677 | 0.695413372 |

| Guang Yuyuan | 0.697803931 | 0.643573172 | 0.670688552 |

| Lark | 0.630381464 | 0.657746723 | 0.644064093 |

| Glsj | 0.677120987 | 0.682796241 | 0.679958614 |

| Sinopharm Hyundai | 0.496221436 | 0.397513751 | 0.446867593 |

| Harbin Pharm | 0.34428928 | 0.475791143 | 0.410040211 |

| Haili Bio | 0.727883095 | 0.652682123 | 0.690282609 |

| Hnhy | 0.609983775 | 0.528580996 | 0.569282386 |

| Hepalink | 0.64389566 | 0.594403859 | 0.619149759 |

| Haishun New Pharma | 0.750928424 | 0.661675715 | 0.706302069 |

| Haisco | 0.720451696 | 0.487743987 | 0.604097841 |

| Hisoar | 0.645544623 | 0.65460421 | 0.650074417 |

| Haixin | 0.627599087 | 0.672097746 | 0.649848417 |

| Hisun | 0.353460494 | 0.409015554 | 0.381238024 |

| Han Sen Pharm | 0.668777752 | 0.663899646 | 0.666338699 |

| Hybio | 0.636033086 | 0.580810237 | 0.608421662 |

| Hengrui | 0.837490527 | 0.961302739 | 0.899396633 |

| Chase Sun | 0.547733919 | 0.410016 | 0.478874959 |

| NCPC | 0.36259657 | 0.447801928 | 0.405199249 |

| Huahai | 0.543995409 | 0.553533665 | 0.548764537 |

| Hualan Bio | 0.807931213 | 0.595846914 | 0.701889064 |

| Huaren | 0.595328472 | 0.659644838 | 0.627486655 |

| HRSJ | 0.541774861 | 0.574425738 | 0.558100299 |

| China Resources Double-Crane | 0.568038828 | 0.54622275 | 0.557130789 |

| Huashen Technology | 0.719199418 | 0.674035569 | 0.696617493 |

| Walter Dyne | 0.664596536 | 0.687196219 | 0.675896377 |

| Yanbian FC | 0.778142258 | 0.63590963 | 0.707025944 |

| Kyrgyzstan | 0.601616926 | 0.496027976 | 0.548822451 |

| Jichuan | 0.683807204 | 0.487854907 | 0.585831056 |

| Jimin | 0.681185309 | 0.657322504 | 0.669253906 |

| JYPC | 0.685562921 | 0.649641211 | 0.667602066 |

| Joincare pharm | 0.610082457 | 0.454142296 | 0.532112376 |

| Jiangzhong | 0.642567847 | 0.736567664 | 0.689567756 |

| Jincheng | 0.639785389 | 0.569178368 | 0.604481878 |

| Jinhe Bio | 0.623354577 | 0.649028661 | 0.636191619 |

| Jinling | 0.546235719 | 0.635576844 | 0.590906281 |

| Jinshiya | 0.715796667 | 0.644757882 | 0.680277274 |

| Jingxin | 0.68571291 | 0.570388142 | 0.628050526 |

| Jinghua | 0.636944978 | 0.641649287 | 0.639297132 |

| Jingfeng | 0.606488959 | 0.543530495 | 0.575009727 |

| Jiuqiang | 0.786956228 | 0.700046207 | 0.743501218 |

| Jiuzhitang | 0.645201026 | 0.516603024 | 0.580902025 |

| Jiuzhou | 0.628567115 | 0.584155422 | 0.606361268 |

| CONBA | 0.543861375 | 0.481004348 | 0.512432862 |

| Kanghong | 0.665245011 | 0.527460836 | 0.596352924 |

| Kangyuan | 0.61414204 | 0.577926992 | 0.596034516 |

| Kangzhi | 0.684816087 | 0.656415871 | 0.670615979 |

| KHB | 0.727976507 | 0.591841298 | 0.659908903 |

| Kelun | 0.378799441 | 0.493231698 | 0.43601557 |

| Sunflower | 0.556170097 | 0.511400244 | 0.533785171 |

| Kunming Pharm | 0.534324416 | 0.551964191 | 0.543144303 |

| Lummy | 0.625056228 | 0.628112755 | 0.626584491 |

| LAYN | 0.721614484 | 0.661566479 | 0.691590481 |

| Lisheng Pharma | 0.657353855 | 0.679177139 | 0.668265497 |

| Livzon Pharm | 0.71738134 | 0.628871094 | 0.673126217 |

| LEADMAN | 0.714944289 | 0.624498345 | 0.669721317 |

| Lianhuan pharm | 0.698888411 | 0.670367118 | 0.684627765 |

| Lingkang | 0.725743874 | 0.584694518 | 0.655219196 |

| Lingrui Pharm | 0.666997747 | 0.677070779 | 0.672034263 |

| Long jin Pharm | 0.753570272 | 0.647133166 | 0.700351719 |

| Lukang Pharm | 0.509027638 | 0.460965245 | 0.484996442 |

| Mike Bio | 0.742422513 | 0.650407694 | 0.696415103 |

| M.k. | 0.654220437 | 0.562356283 | 0.60828836 |

| Palin Bio | 0.703269836 | 0.65109186 | 0.677180848 |

| PIEN TZE HUANG | 0.763824558 | 0.726005071 | 0.744914814 |

| Julie Plec | 0.709624166 | 0.469789228 | 0.589706697 |

| plyy | 0.489613809 | 0.53054052 | 0.510077164 |

| CHEEZHENGTTM | 0.714689814 | 0.613582646 | 0.66413623 |

| Qidi | 0.691053939 | 0.654977334 | 0.673015636 |

| Qianhong Biopharma | 0.70228214 | 0.679203457 | 0.690742799 |

| Qianjin Pharm | 0.612647181 | 0.607590824 | 0.610119003 |

| Qianyuan | 0.664973414 | 0.556845497 | 0.610909455 |

| Renfu | 0.322406425 | 0.42016555 | 0.371285988 |

| Renhe Pharmacy | 0.596351472 | 0.672679619 | 0.634515546 |

| rpsw | 0.651166925 | 0.5912946 | 0.621230762 |

| Saisheng | 0.761947778 | 0.701836844 | 0.731892311 |

| SAM | 0.671926336 | 0.659700513 | 0.665813424 |

| Shanhe Pharmacy | 0.734791349 | 0.650221186 | 0.692506268 |

| Shkb | 0.698069521 | 0.680387876 | 0.689228698 |

| Shanghai RAAS Blood Products | 0.676407378 | 0.605561928 | 0.640984653 |

| Shenqi | 0.646589105 | 0.581969742 | 0.614279423 |

| Biological Stock | 0.760202981 | 0.756042924 | 0.758122952 |

| Salvage Pharm | 0.463144872 | 0.502413614 | 0.482779243 |

| Sts | 0.739781567 | 0.689149244 | 0.714465406 |

| Scyy | 0.699966811 | 0.603380282 | 0.651673546 |

| Beijing SL Pharm | 0.773760654 | 0.68883442 | 0.731297537 |

| Stellite | 0.667760149 | 0.642702048 | 0.655231099 |

| Shsw | 0.73692057 | 0.657203864 | 0.697062217 |

| Tat | 0.60265023 | 0.544697259 | 0.573673745 |

| Taiji Group | 0.399279671 | 0.498518625 | 0.448899148 |

| Taloph Pharm | 0.61924255 | 0.644434623 | 0.631838587 |

| Teyi | 0.698667383 | 0.66716684 | 0.682917112 |

| Tasly | 0.41666853 | 0.630275487 | 0.523472009 |

| Tiantan Biological | 0.733010668 | 0.657600328 | 0.695305498 |

| Tianyao Pharm | 0.646240088 | 0.613143357 | 0.629691722 |

| Thdb | 0.77883326 | 0.706539764 | 0.742686512 |

| Thjm | 0.567809163 | 0.564386742 | 0.566097953 |

| TRT | 0.499628521 | 0.691621404 | 0.595624963 |

| Wanbangde | 0.427406852 | 0.537992679 | 0.482699766 |

| Wondfo | 0.715009555 | 0.631798868 | 0.673404211 |

| WEDGE INDUSTRIAL | 0.736184308 | 0.643355439 | 0.689769873 |

| Weiming | 0.711826016 | 0.650321829 | 0.681073922 |

| Wowu | 0.770567021 | 0.675840362 | 0.723203692 |

| Wohua | 0.703903392 | 0.661188132 | 0.682545762 |

| Wosen | 0.671912477 | 0.552904143 | 0.61240831 |

| AMD | 0.750945781 | 0.61052309 | 0.680734436 |

| Xianju Pharm | 0.609803878 | 0.607517262 | 0.60866057 |

| Xiangxue Pharm | 0.56837251 | 0.537740093 | 0.553056301 |

| Sunflower | 0.55841059 | 0.566683692 | 0.562547141 |

| NHU | 0.632654979 | 0.4122508 | 0.52245289 |

| Xinhua | 0.488947377 | 0.556767052 | 0.522857214 |

| Xinbang | 0.440203247 | 0.395079286 | 0.417641267 |

| SALUBRIS | 0.715240078 | 0.63026292 | 0.672751499 |

| BROTHER | 0.697594871 | 0.621553604 | 0.659574237 |

| Yabao | 0.558060463 | 0.567098443 | 0.562579453 |

| Yatai | 0.59468608 | 0.568673089 | 0.581679584 |

| Yananbikang | 0.585080092 | 0.503340182 | 0.544210137 |

| Yiling Pharm | 0.591814993 | 0.635212897 | 0.613513945 |

| Yifan | 0.659880029 | 0.609050879 | 0.634465454 |

| Yibai | 0.564093323 | 0.437330699 | 0.500712011 |

| Yisheng | 0.661646927 | 0.603737031 | 0.632691979 |

| Yiduoli | 0.648099384 | 0.597623845 | 0.622861614 |

| Chinataurine | 0.692881108 | 0.647370414 | 0.670125761 |

| Gloria Pharm | 0.479739963 | 0.433218753 | 0.456479358 |

| Baiyao | 0.50362558 | 0.819177469 | 0.661401524 |

| Zhejiang Medicine | 0.500873109 | 0.515343568 | 0.508108338 |

| Zhenbao Island | 0.66468048 | 0.494783002 | 0.579731741 |

| zdzy | 0.568909321 | 0.561712443 | 0.565310882 |

| Zhifei | 0.821043844 | 0.783585599 | 0.802314721 |

| Zhongguancun | 0.603226518 | 0.546917339 | 0.575071929 |

| China Medicine | 0.326022175 | 0.619902235 | 0.472962205 |

| Zhongheng Group | 0.699336493 | 0.716431982 | 0.707884238 |

| Zhongmu | 0.534061049 | 0.625219552 | 0.579640301 |

| Zhongxin | 0.523656226 | 0.64705675 | 0.585356488 |

| Zsyy | 0.728308394 | 0.611906374 | 0.670107384 |

| JLZX | 0.70032643 | 0.554290101 | 0.627308266 |

| Zuoli | 0.658487779 | 0.492143686 | 0.575315732 |

Five securities companies, Adisseo, Changchun High-Tech, Hualan Biological Engineering, Hengrui, and Zhifei, have achieved technology effectiveness in some years. Adisseo’s technical efficiency is effective in 2016 and has dropped significantly after 2016, and the technical efficiency can be improved by referring to the operation method of 2016 when the technology is effective (see Table 3 for specific annual data).

| Company name | Year | |||

|---|---|---|---|---|

| 2015-2016 | 2016-2017 | 2017-2018 | 2018-2019 | |

| Adisseo | 1 | 0.538826377 | 0.748769622 | 0.639633789 |

| Anke Bio | 0.69893892 | 0.731620495 | 0.671113197 | 0.703361568 |

| Osaikon | 0.713077361 | 0.75673785 | 0.813339088 | 0.817531461 |

| Baiyunshan | 0.328542111 | 0.356320523 | 0.546507045 | 0.303672764 |

| Bdyy | 0.589761232 | 0.62883886 | 0.592320492 | 0.673332429 |

| Beilu | 0.701152973 | 0.769964623 | 0.718534493 | 0.832174827 |

| Porton | 0.617509415 | 0.622015319 | 0.606350945 | 0.659897114 |

| None | 0.709527587 | 0.749839674 | 0.680641517 | 0.692813179 |

| Changchun High-Tech | 0.644238901 | 0.693875856 | 0.678445711 | 1 |

| Changjiang Runfa Medicine | 0.661073921 | 0.633858532 | 0.577628241 | 0.617216502 |

| Changshan Pharma | 0.702574435 | 0.737444456 | 0.654896914 | 0.726604025 |

| DAJY | 0.608034181 | 0.612562673 | 0.565649446 | 0.659420187 |

| Dezhan | 0.778248014 | 0.8859713 | 0.801172953 | 0.735162569 |

| Jiao | 0.695876014 | 0.752555196 | 0.784627533 | 0.519464099 |

| DBBT | 0.698427402 | 0.732910456 | 0.683799871 | 0.747814366 |

| VC | 0.356746951 | 0.369605175 | 0.596620054 | 0.529513216 |

| Dongcheng | 0.685298529 | 0.713356357 | 0.65224054 | 0.644469293 |

| Nhwa Pharm | 0.566050744 | 0.595888879 | 0.559629612 | 0.90136936 |

| Ekzy | 0.695893135 | 0.642142688 | 0.56111062 | 0.817019263 |

| Fangsheng | 0.690430635 | 0.7072366 | 0.668234842 | 0.734875807 |

| Fengyuan | 0.507954055 | 0.513382048 | 0.500312529 | 0.803668528 |

| Fczy | 0.673318722 | 0.706559734 | 0.637287549 | 0.694993671 |

| Fayy | 0.640199162 | 0.622882581 | 0.47487985 | 0.853112289 |

| Fosun Pharm | 0.440829161 | 0.453177832 | 0.491647136 | 0.49307564 |

| Fuxiang | 0.69509172 | 0.713319861 | 0.655317677 | 0.733133012 |

| Guangji | 0.665875845 | 0.685465131 | 0.666509377 | 0.727816419 |

| Kwong Sang Hong | 0.731211949 | 0.758118876 | 0.703598927 | 0.767034517 |

| Guang Yuyuan | 0.705727447 | 0.728802756 | 0.672683165 | 0.684002357 |

| Lark | 0.592069879 | 0.607690808 | 0.548144601 | 0.77362057 |

| Glsj | 0.646076312 | 0.70291605 | 0.642642634 | 0.716848951 |

| Sinopharm Hyundai | 0.550500314 | 0.31927442 | 0.586702033 | 0.528408978 |

| Harbin Pharm | 0.232904004 | 0.239750504 | 0.452243584 | 0.452259029 |

| Haili Bio | 0.720958825 | 0.755724092 | 0.683383826 | 0.751465636 |

| Hnhy | 0.593723249 | 0.615663681 | 0.533902785 | 0.696645384 |

| Hepalink | 0.613624689 | 0.594913319 | 0.565038631 | 0.802005999 |

| Haishun New Pharma | 0.730858479 | 0.770599806 | 0.71368573 | 0.788569679 |

| Haisco | 0.694950719 | 0.689640795 | 0.627724818 | 0.86949045 |

| Hisoar | 0.536160514 | 0.598345145 | 0.58053481 | 0.867138023 |

| Haixin | 0.598921852 | 0.651676624 | 0.60413451 | 0.655663364 |

| Hisun | 0.279462381 | 0.291252982 | 0.396970805 | 0.446155807 |

| Han Sen Pharm | 0.622641145 | 0.670338249 | 0.638264052 | 0.743867561 |

| Hybio | 0.706990021 | 0.762095736 | 0.569815841 | 0.505230747 |

| Hengrui | 0.659908876 | 0.690053233 | 1 | 1 |

| Chase Sun | 0.590616729 | 0.546391865 | 0.485056058 | 0.568871023 |

| NCPC | 0.261478601 | 0.273294764 | 0.476531644 | 0.439081271 |

| Huahai | 0.510939772 | 0.532978902 | 0.422450272 | 0.70961269 |

| Hualan Bio | 0.724489053 | 0.75903868 | 0.74819712 | 1 |

| Huaren | 0.547811923 | 0.60655341 | 0.573018429 | 0.653930126 |

| HRSJ | 0.421806748 | 0.424780128 | 0.642346121 | 0.678166446 |

| China Resources Double-Crane | 0.396338204 | 0.412017952 | 0.746295359 | 0.717503796 |

| Huashen Technology | 0.692282897 | 0.748644224 | 0.673121394 | 0.762749156 |

| Walter Dyne | 0.64905781 | 0.687320156 | 0.604331968 | 0.717676209 |

| Yanbian FC | 0.728434735 | 0.796358227 | 0.622973596 | 0.964802474 |

| Kyrgyzstan | 0.690648563 | 0.723721435 | 0.676558269 | 0.315539437 |

| Jichuan | 0.654593403 | 0.687752464 | 0.658917181 | 0.733965769 |

| Jimin | 0.667207312 | 0.715203145 | 0.639062034 | 0.703268743 |

| JYPC | 0.676163429 | 0.660551878 | 0.674564338 | 0.730972038 |

| Joincare Pharm | 0.42609937 | 0.779556709 | 0.42013106 | 0.814542688 |

| Jiangzhong | 0.577983092 | 0.660234497 | 0.621771461 | 0.710282338 |

| Jincheng | 0.604349975 | 0.635628024 | 0.540328079 | 0.778835478 |

| Jinhe Bio | 0.620488457 | 0.622315827 | 0.593163862 | 0.657450163 |

| Jinling | 0.457693647 | 0.464485434 | 0.485300003 | 0.77746379 |

| Jinshiya | 0.739579461 | 0.794884842 | 0.642073972 | 0.686648392 |

| Jingxin | 0.615013047 | 0.645371162 | 0.600849303 | 0.881618128 |

| Jinghua | 0.654292046 | 0.695723085 | 0.644925134 | 0.552839647 |

| Jingfeng | 0.655470879 | 0.625155781 | 0.56168705 | 0.583642128 |

| Jiuqiang | 0.775537026 | 0.80576769 | 0.741353597 | 0.825166597 |

| Jiuzhitang | 0.638432251 | 0.632345693 | 0.526816311 | 0.783209851 |

| Jiuzhou | 0.531129929 | 0.563082683 | 0.553227164 | 0.866828683 |

| CONBA | 0.424959572 | 0.448091924 | 0.76318362 | 0.539210385 |

| Kanghong | 0.649678902 | 0.676913482 | 0.617801313 | 0.716586348 |

| Kangyuan | 0.547173659 | 0.538412405 | 0.521974436 | 0.84900766 |

| Kangzhi | 0.681459875 | 0.718856205 | 0.658583409 | 0.68036486 |

| KHB | 0.679909201 | 0.70601526 | 0.646219781 | 0.879761787 |

| Kelun | 0.309440068 | 0.306632161 | 0.481370093 | 0.417755441 |

| Sunflower | 0.503468625 | 0.542712714 | 0.541164765 | 0.637334286 |

| Kunming Pharm | 0.487752766 | 0.494592469 | 0.456784207 | 0.698168222 |

| Lummy | 0.59477378 | 0.650148325 | 0.620139476 | 0.63516333 |

| LAYN | 0.706666281 | 0.764250345 | 0.658484063 | 0.757057246 |

| Lisheng Pharma | 0.652358213 | 0.658225585 | 0.633802648 | 0.685028972 |

| Livzon Pharm | 0.483127888 | 0.90147395 | 0.765854345 | 0.719069177 |

| LEADMAN | 0.685277868 | 0.739693609 | 0.685479669 | 0.749326011 |

| Lianhuan Pharm | 0.672599294 | 0.711757269 | 0.670159541 | 0.741037539 |

| Lingkang | 0.698902905 | 0.743402231 | 0.696586279 | 0.764084079 |

| Lingrui Pharm | 0.674401636 | 0.672389024 | 0.614906134 | 0.706294196 |

| Long Jin Pharm | 0.731845112 | 0.770452444 | 0.718767022 | 0.793216512 |

| Lukang Pharm | 0.427468486 | 0.46570682 | 0.460332769 | 0.682602477 |

| Mike Bio | 0.708027483 | 0.72319852 | 0.645149742 | 0.893314305 |

| M.k. | 0.708395924 | 0.726482926 | 0.56873759 | 0.613265307 |

| Palin Bio | 0.671391314 | 0.718181986 | 0.666425242 | 0.757080803 |

| PIEN TZE HUANG | 0.684930611 | 0.750405659 | 0.661039196 | 0.958922766 |

| Julie Plec | 0.707704329 | 0.723714045 | 0.673462726 | 0.733615566 |

| Plyy | 0.406959748 | 0.414853778 | 0.427735839 | 0.708905869 |

| CHEEZHENGTTM | 0.686682951 | 0.725135357 | 0.678237865 | 0.768703082 |

| Qidi | 0.666806547 | 0.68236924 | 0.64498398 | 0.770055989 |

| Qianhong Biopharma | 0.71938682 | 0.719385025 | 0.656560098 | 0.713796618 |

| Qianjin Pharm | 0.530656791 | 0.548629069 | 0.522713754 | 0.848589111 |

| Qianyuan | 0.638506467 | 0.671543368 | 0.62791026 | 0.721933561 |

| Renfu | 0.334218803 | 0.413272744 | 0.149231487 | 0.392902669 |

| Renhe Pharmacy | 0.533268479 | 0.506914813 | 0.519999497 | 0.8252231 |

| Rpsw | 0.638039028 | 0.654974398 | 0.617845497 | 0.693808777 |

| Saisheng | 0.754473392 | 0.796748489 | 0.72770648 | 0.76886275 |

| SAM | 0.680909431 | 0.689598358 | 0.594020614 | 0.72317694 |

| Shanhe Pharmacy | 0.713262981 | 0.747755843 | 0.701291618 | 0.776854953 |

| Shkb | 0.690613654 | 0.721026937 | 0.655361928 | 0.725275566 |

| Shanghai RAAS Blood Products | 0.815937216 | 0.711632966 | 0.29512233 | 0.882937 |

| Shenqi | 0.646515892 | 0.665122901 | 0.604905717 | 0.669811909 |

| Biological Stock | 0.776300364 | 0.857731961 | 0.733310511 | 0.673469086 |

| Salvage Pharm | 0.405423981 | 0.471147411 | 0.570580408 | 0.405427689 |

| Sts | 0.745342868 | 0.789809576 | 0.695943443 | 0.728030381 |

| Scyy | 0.621324992 | 0.736624764 | 0.67014276 | 0.771774728 |

| Beijing SL Pharm | 0.754959569 | 0.822479251 | 0.739066637 | 0.778537157 |

| Stellite | 0.64699861 | 0.679791002 | 0.648708242 | 0.695542742 |

| Shsw | 0.706490688 | 0.749047972 | 0.701812101 | 0.790331518 |

| Tat | 0.583302035 | 0.579802833 | 0.530612746 | 0.716883304 |

| Taiji Group | 0.368697953 | 0.288373447 | 0.505506669 | 0.434540617 |

| Taloph Pharm | 0.60505421 | 0.644707882 | 0.569453781 | 0.657754327 |

| Teyi | 0.685639388 | 0.710137044 | 0.667309716 | 0.731583384 |

| Tasly | 0.344736323 | 0.364398246 | 0.547507961 | 0.410031592 |

| Tiantan Biological | 0.56685493 | 0.735139685 | 0.705597237 | 0.924450822 |

| Tianyao Pharm | 0.567784075 | 0.640100799 | 0.568366328 | 0.808709151 |

| Thdb | 0.690420152 | 0.76073724 | 0.692058634 | 0.972117015 |

| Thjm | 0.700759308 | 0.682066065 | 0.62099078 | 0.2674205 |

| TRT | 0.449941637 | 0.452561856 | 0.578565313 | 0.517445278 |

| Wanbangde | 0.350398153 | 0.410898312 | 0.464547495 | 0.483783447 |

| Wondfo | 0.706033933 | 0.749163259 | 0.666377487 | 0.738463539 |

| WEDGE INDUSTRIAL | 0.718041181 | 0.768397698 | 0.690260111 | 0.76803824 |

| Weiming | 0.748177009 | 0.769128321 | 0.619853486 | 0.710145248 |

| Wowu | 0.739298451 | 0.784243922 | 0.7386125 | 0.820113211 |

| Wohua | 0.674322938 | 0.710157045 | 0.659012071 | 0.772121516 |

| Wosen | 0.619303412 | 0.571491875 | 0.797393821 | 0.699460802 |

| AMD | 0.689966569 | 0.789941263 | 0.71329527 | 0.810580022 |

| Xianju Pharm | 0.514464857 | 0.566490622 | 0.540109586 | 0.818150446 |

| Xiangxue Pharm | 0.537783667 | 0.540068623 | 0.481275233 | 0.714362519 |

| Sunflower | 0.540029523 | 0.598998632 | 0.388532054 | 0.706082152 |

| NHU | 0.517692055 | 0.603883517 | 0.66053792 | 0.748506424 |

| Xinhua | 0.402109863 | 0.430156322 | 0.437174929 | 0.686348395 |

| Xinbang | 0.43011624 | 0.428808192 | 0.361237255 | 0.540651302 |

| SALUBRIS | 0.744881615 | 0.779294136 | 0.697651488 | 0.639133074 |

| BROTHER | 0.663383853 | 0.719528977 | 0.583598178 | 0.823868476 |

| Yabao | 0.453418706 | 0.507914392 | 0.515088977 | 0.755819777 |

| Yatai | 0.687624616 | 0.723497946 | 0.658661044 | 0.308960713 |

| Yananbikang | 0.615088274 | 0.598667978 | 0.63509745 | 0.491466664 |

| Yiling Pharm | 0.535399897 | 0.54629301 | 0.521004694 | 0.764562368 |

| Yifan | 0.62137248 | 0.706145232 | 0.543427556 | 0.768574846 |

| Yibai | 0.601819983 | 0.583245952 | 0.344474902 | 0.726832453 |

| Yisheng | 0.640708057 | 0.679203014 | 0.623539381 | 0.703137255 |

| Yiduoli | 0.61878647 | 0.601097854 | 0.566968291 | 0.80554492 |

| Chinataurine | 0.65392248 | 0.715865276 | 0.674513572 | 0.727223103 |

| Gloria Pharm | 0.619802462 | 0.583161465 | 0.534749776 | 0.181246147 |

| Baiyao | 0.407703292 | 0.415325832 | 0.598683278 | 0.592789916 |

| Zhejiang Medicine | 0.39694149 | 0.393998731 | 0.627437898 | 0.585114319 |

| Zhenbao Island | 0.615637011 | 0.630467145 | 0.565464187 | 0.847153576 |

| Zdzy | 0.53930568 | 0.541502435 | 0.447281659 | 0.74754751 |

| Zhifei | 0.659011263 | 0.779383924 | 0.84578019 | 1 |

| Zhongguancun | 0.607984942 | 0.597661057 | 0.559189938 | 0.648070137 |

| China Medicine | 0.298293719 | 0.284321785 | 0.389396559 | 0.332076638 |

| Zhongheng Group | 0.6583369 | 0.730823738 | 0.660884453 | 0.747300882 |

| Zhongmu | 0.46697542 | 0.505701728 | 0.480753041 | 0.682814008 |

| Zhongxin | 0.425869997 | 0.478604566 | 0.475336345 | 0.714813998 |

| Zsyy | 0.672284742 | 0.721839471 | 0.64125814 | 0.877851223 |

| JLZX | 0.658045275 | 0.724715509 | 0.596666189 | 0.821878746 |

| Zuoli | 0.647050689 | 0.667106722 | 0.616372459 | 0.703421246 |

4.4. DEA Efficiency Analysis in the Second Stage

In the second stage (shown in Table 2), there is no company that has reached technical efficiency of 1 during 2015–2019, indicating that all the companies were not effective. There are 97 companies with a technical efficiency value of 0.6–1.0, accounting for 59.5%, which is significantly lower than the first stage. Only 3 companies had technical efficiency below 0.4 (Sinopharm, Xinbang, and Baiyunshan). The technical efficiency in second stage is generally low, but companies with lower efficiency have been promoted, which may be correlated with government subsidies.

Adisseo, Dezhan Health, Jiao, Hengrui, Livzon Group, Shanghai RAAS, and Zhifei Biotechnology have achieved technical efficiency of 1 in some years. And Adisseo is the same as the first stage, the technical efficiency is effective in 2016 and has dropped dramatically after 2016. The technical efficiency of Dezhan Health and Jiao pharmaceutical companies in the second stage has increased; we believe that the first stage is relevant to the second stage in these companies. However, the average technical efficiency of Hualan Biological is below 0.6 in the two stages, for the resources cannot be well utilized (see Table 4 for specific annual data).

| Company name | Year | |||

|---|---|---|---|---|

| 2015-2016 | 2016-2017 | 2017-2018 | 2018-2019 | |

| Adisseo | 1 | 0.649837545 | 0.625737431 | 0.541530825 |

| Anke Bio | 0.765162026 | 0.476189062 | 0.772255149 | 0.613658522 |

| Osaikon | 0.843778066 | 0.441445985 | 0.850780731 | 0.575021161 |

| Baiyunshan | 0.128029731 | 0.338472809 | 0.44681541 | 0.404956323 |

| Bdyy | 0.890834395 | 0.445222754 | 0.727676509 | 0.608956969 |

| Beilu | 0.808544991 | 0.447781474 | 0.735202266 | 0.658558851 |

| Porton | 0.790606856 | 0.452864356 | 0.741151893 | 0.630953461 |

| None | 0.899553352 | 0.412224769 | 0.692164738 | 0.575225616 |

| Changchun High-Tech | 0.697331634 | 0.534086802 | 0.974210731 | 0.83805388 |

| Changjiang Runfa Medicine | 0.758278202 | 0.457208597 | 0.757178228 | 0.355161748 |

| Changshan Pharma | 0.839430913 | 0.452268392 | 0.722949426 | 0.63821128 |

| DAJY | 0.498749812 | 0.453046771 | 0.736062102 | 0.592503277 |

| Dezhan | 1 | 0.540144516 | 0.907325608 | 0.65741689 |

| Jiao | 1 | 0.695657355 | 1 | 0.349390869 |

| DBBT | 0.79160979 | 0.443887279 | 0.725436161 | 0.605439407 |

| VC | 0.52176685 | 0.452560475 | 0.4923262 | 0.401474275 |

| Dongcheng | 0.875632334 | 0.456954862 | 0.768638857 | 0.621583435 |

| Nhwa Pharm | 0.902685534 | 0.481101741 | 0.812506347 | 0.47310525 |

| Ekzy | 0.663965694 | 0.492139653 | 0.741589175 | 0.417137904 |

| Fangsheng | 0.83728348 | 0.445912668 | 0.729448377 | 0.613888946 |

| Fengyuan | 0.381700772 | 0.448248178 | 0.729255255 | 0.408521314 |

| Fczy | 0.810829455 | 0.450323096 | 0.733612414 | 0.613158813 |

| Fayy | 0.853851088 | 0.462652138 | 0.626676033 | 0.430608438 |

| Fosun Pharm | 0.405879589 | 0.887608474 | 0.863039604 | 0.822061518 |

| Fuxiang | 0.686147937 | 0.40302621 | 0.65968793 | 0.652530008 |

| Guangji | 0.781783744 | 0.438862422 | 0.728105584 | 0.614602675 |

| Kwong Sang Hong | 0.833600898 | 0.445235421 | 0.721873605 | 0.602632782 |

| Guang Yuyuan | 0.873544633 | 0.467173716 | 0.78987118 | 0.443703159 |

| Lark | 0.856359723 | 0.507355275 | 0.834541643 | 0.432730249 |

| Glsj | 0.762864498 | 0.498932775 | 0.802401553 | 0.666986138 |

| Sinopharm Hyundai | 0.304326441 | 0.467872765 | 0.522609903 | 0.295245894 |

| Harbin Pharm | 0.471907832 | 0.498927974 | 0.51892983 | 0.413398936 |

| Haili Bio | 0.845981594 | 0.452963586 | 0.715761969 | 0.596021344 |

| Hnhy | 0.546132286 | 0.451209071 | 0.73929906 | 0.377683569 |

| Hepalink | 0.570692829 | 0.455773586 | 0.833748227 | 0.517400795 |

| Haishun New Pharma | 0.875191121 | 0.441283929 | 0.718583719 | 0.61164409 |

| Haisco | 0.265247759 | 0.462094574 | 0.770404638 | 0.453228976 |

| Hisoar | 0.806777693 | 0.483733043 | 0.841284576 | 0.486621529 |

| Haixin | 0.869599312 | 0.45122025 | 0.748838002 | 0.618733421 |

| Hisun | 0.295330677 | 0.469935051 | 0.434672128 | 0.436124359 |

| Han Sen Pharm | 0.842792274 | 0.449054927 | 0.739269782 | 0.624481603 |

| Hybio | 0.741190863 | 0.482159427 | 0.64940653 | 0.450484128 |

| Hengrui | 0.994006619 | 0.851204335 | 1 | 1 |

| Chase Sun | 0.510934768 | 0.252963632 | 0.388183145 | 0.487982456 |

| NCPC | 0.446958138 | 0.442893623 | 0.485019512 | 0.416336438 |

| Huahai | 0.483631419 | 0.517819876 | 0.744562547 | 0.468120819 |

| Hualan Bio | 0.488018688 | 0.463275133 | 0.825155867 | 0.606937968 |

| Huaren | 0.858322442 | 0.445957989 | 0.72614299 | 0.608155932 |

| HRSJ | 0.39055996 | 0.606296731 | 0.659827456 | 0.641018804 |

| China Resources Double-Crane | 0.532023886 | 0.544202986 | 0.588679129 | 0.519985 |

| Huashen Technology | 0.899423723 | 0.461862909 | 0.723906959 | 0.610948685 |

| Walter Dyne | 0.842502696 | 0.497242721 | 0.767143201 | 0.641896259 |

| Yanbian FC | 0.442623386 | 0.657329408 | 0.887815963 | 0.555869763 |

| Kyrgyzstan | 0.455180857 | 0.466836149 | 0.763056261 | 0.299038639 |

| Jichuan | 0.692456078 | 0.269019483 | 0.480891191 | 0.509052877 |

| Jimin | 0.843175982 | 0.447230193 | 0.72593401 | 0.612949828 |

| JYPC | 0.902264504 | 0.405752965 | 0.710764503 | 0.579782874 |

| Joincare Pharm | 0.320679344 | 0.446019187 | 0.442365325 | 0.607505328 |

| Jiangzhong | 0.968578156 | 0.488910163 | 0.806995681 | 0.681786657 |

| Jincheng | 0.680587626 | 0.446883725 | 0.726463433 | 0.422778688 |

| Jinhe Bio | 0.767555971 | 0.454800853 | 0.751896726 | 0.621861095 |

| Jinling | 0.882151804 | 0.462632532 | 0.777149818 | 0.420373223 |

| Jinshiya | 0.818824975 | 0.430337738 | 0.708029409 | 0.621839405 |

| Jingxin | 0.754271786 | 0.3997261 | 0.669011225 | 0.458543459 |

| Jinghua | 0.818896414 | 0.46479897 | 0.771305173 | 0.511596589 |

| Jingfeng | 0.659628837 | 0.462586912 | 0.756245434 | 0.295660795 |

| Jiuqiang | 0.888800059 | 0.475114126 | 0.779541159 | 0.656729486 |

| Jiuzhitang | 0.682939594 | 0.388385296 | 0.576221175 | 0.418866032 |

| Jiuzhou | 0.70068303 | 0.459376494 | 0.75017596 | 0.426386203 |

| CONBA | 0.450840367 | 0.532007534 | 0.572159801 | 0.36900969 |

| Kanghong | 0.630861917 | 0.383874254 | 0.632910424 | 0.462196751 |

| Kangyuan | 0.569889462 | 0.483812562 | 0.800075831 | 0.457930115 |

| Kangzhi | 0.860448512 | 0.447077729 | 0.722807424 | 0.595329819 |

| KHB | 0.75874045 | 0.446262253 | 0.731865553 | 0.430496937 |

| Kelun | 0.392192554 | 0.491878068 | 0.573939315 | 0.514916857 |

| Sunflower | 0.397069408 | 0.402221867 | 0.677747189 | 0.568562512 |

| Kunming Pharm | 0.484712539 | 0.482852557 | 0.787863272 | 0.452428396 |

| Lummy | 0.757591911 | 0.446024294 | 0.735699424 | 0.57313539 |

| LAYN | 0.82616477 | 0.46673708 | 0.735088104 | 0.618275961 |

| Lisheng Pharma | 0.892289898 | 0.44823865 | 0.743782606 | 0.632397402 |

| Livzon Pharm | 0.330476519 | 1 | 0.621269109 | 0.563738749 |

| LEADMAN | 0.744491132 | 0.439674197 | 0.708587278 | 0.605240773 |

| Lianhuan Pharm | 0.883381664 | 0.449882686 | 0.733590338 | 0.614613785 |

| Lingkang | 0.487342648 | 0.461147315 | 0.755609423 | 0.634678684 |

| Lingrui Pharm | 0.820570294 | 0.469108287 | 0.768403276 | 0.650201258 |

| Long Jin Pharm | 0.825269505 | 0.445474296 | 0.7213483 | 0.596440566 |

| Lukang Pharm | 0.709307544 | 0.271967764 | 0.448405964 | 0.41417971 |

| Mike Bio | 0.829672491 | 0.491963544 | 0.816516452 | 0.463478288 |

| M.k. | 0.702540171 | 0.461798568 | 0.750504723 | 0.334581671 |

| Palin Bio | 0.800366688 | 0.44299407 | 0.733746558 | 0.627260125 |

| PIEN TZE HUANG | 0.9045343 | 0.538290845 | 0.947536174 | 0.513658965 |

| Julie Plec | 0.549521085 | 0.305111815 | 0.499939327 | 0.524584684 |

| Plyy | 0.533402894 | 0.421972728 | 0.708018213 | 0.458768245 |

| CHEEZHENGTTM | 0.565148659 | 0.465429448 | 0.761471867 | 0.662280612 |

| Qidi | 0.86117892 | 0.441527153 | 0.709508207 | 0.607695056 |

| Qianhong Biopharma | 0.874606048 | 0.456315537 | 0.750563573 | 0.635328671 |

| Qianjin Pharm | 0.739246108 | 0.471814504 | 0.779924867 | 0.439377818 |

| Qianyuan | 0.831338985 | 0.404575277 | 0.655154668 | 0.336313058 |

| Renfu | 0.334414205 | 0.618045999 | 0.176055483 | 0.552146513 |

| Renhe Pharmacy | 0.888111873 | 0.496037076 | 0.837040815 | 0.469528713 |

| Rpsw | 0.594394568 | 0.433880869 | 0.709930487 | 0.626972475 |

| Saisheng | 0.929682934 | 0.476157778 | 0.77599003 | 0.625516632 |

| SAM | 0.905264682 | 0.451150287 | 0.680555861 | 0.60183122 |

| Shanhe Pharmacy | 0.847924844 | 0.432928146 | 0.710008765 | 0.610022991 |

| Shkb | 0.848089711 | 0.471499157 | 0.758909287 | 0.643053348 |

| Shanghai RAAS Blood Products | 1 | 0.54470828 | 0.409520354 | 0.468019077 |

| Shenqi | 0.714762096 | 0.381344561 | 0.617613041 | 0.61415927 |

| Biological Stock | 0.965359357 | 0.549223179 | 0.870620483 | 0.638968678 |

| Salvage Pharm | 0.689364433 | 0.415308201 | 0.706749477 | 0.198232344 |

| Sts | 0.935757517 | 0.472141333 | 0.74357052 | 0.605127606 |

| Scyy | 0.739153533 | 0.426485993 | 0.676414771 | 0.571466831 |

| Beijing SL Pharm | 0.733749939 | 0.506947781 | 0.832842848 | 0.681797114 |

| Stellite | 0.803378896 | 0.437370993 | 0.715251262 | 0.614807042 |

| Shsw | 0.890410616 | 0.434761769 | 0.700177597 | 0.603465476 |

| Tat | 0.842586294 | 0.360807923 | 0.584823244 | 0.390571577 |

| Taiji Group | 0.67919953 | 0.452980777 | 0.474001541 | 0.387892653 |

| Taloph Pharm | 0.842636824 | 0.438224781 | 0.689161525 | 0.607715363 |

| Teyi | 0.836358694 | 0.453682077 | 0.749014352 | 0.629612238 |

| Tasly | 0.717299163 | 0.615735065 | 0.675224149 | 0.512843572 |

| Tiantan Biological | 0.678613559 | 0.591061254 | 0.860246774 | 0.500479724 |

| Tianyao Pharm | 0.857677116 | 0.448393948 | 0.737240947 | 0.409261416 |

| Thdb | 0.900688131 | 0.545722415 | 0.888741777 | 0.491006733 |

| Thjm | 0.744976147 | 0.47311369 | 0.785334315 | 0.254122817 |

| TRT | 0.836177972 | 0.656151609 | 0.703560723 | 0.570595311 |

| Wanbangde | 0.792851861 | 0.453600664 | 0.482306406 | 0.423211786 |

| Wondfo | 0.718234154 | 0.423654128 | 0.712394655 | 0.672912535 |

| WEDGE INDUSTRIAL | 0.78623338 | 0.450705667 | 0.727173666 | 0.609309043 |

| Weiming | 0.801846721 | 0.489019559 | 0.697530662 | 0.612890373 |

| Wowu | 0.915178281 | 0.444228865 | 0.732530156 | 0.611424148 |

| Wohua | 0.849951067 | 0.451158165 | 0.726657243 | 0.616986053 |

| Wosen | 0.293538834 | 0.36896297 | 0.927581915 | 0.621532855 |

| AMD | 0.565789697 | 0.46605309 | 0.755941006 | 0.654308568 |

| Xianju Pharm | 0.722129826 | 0.46975224 | 0.788610822 | 0.449576159 |

| Xiangxue Pharm | 0.56594413 | 0.450246609 | 0.728601595 | 0.406168036 |

| Sunflower | 0.775727247 | 0.435119495 | 0.472627581 | 0.583260445 |

| NHU | 0.744446192 | 0.084792409 | 0.174517515 | 0.645247085 |

| Xinhua | 0.686150026 | 0.418580131 | 0.691475644 | 0.430862405 |

| Xinbang | 0.37146641 | 0.482379256 | 0.29706599 | 0.42940549 |

| SALUBRIS | 0.828950689 | 0.45514634 | 0.744067755 | 0.492886897 |

| BROTHER | 0.867361567 | 0.491290966 | 0.722969193 | 0.404592688 |

| Yabao | 0.62538223 | 0.465981424 | 0.776164146 | 0.400865973 |

| Yatai | 0.791869911 | 0.458579905 | 0.749488501 | 0.274754037 |

| Yananbikang | 0.609592291 | 0.525754839 | 0.495889903 | 0.382123694 |

| Yiling Pharm | 0.732199742 | 0.505748671 | 0.83520904 | 0.467694136 |

| Yifan | 0.895380366 | 0.428163195 | 0.614491215 | 0.498168738 |

| Yibai | 0.622820274 | 0.32775112 | 0.386250987 | 0.412500415 |

| Yisheng | 0.615818561 | 0.450233859 | 0.733856106 | 0.615039599 |

| Yiduoli | 0.768370215 | 0.454151698 | 0.749092834 | 0.418880633 |

| Chinataurine | 0.790572254 | 0.445496958 | 0.734787151 | 0.618625291 |

| Gloria Pharm | 0.425375138 | 0.473021826 | 0.735198757 | 0.099279291 |

| Baiyao | 0.676420897 | 0.831225519 | 0.898534261 | 0.870529199 |

| Zhejiang Medicine | 0.648977621 | 0.470928238 | 0.508877262 | 0.43259115 |

| Zhenbao Island | 0.366714214 | 0.44796952 | 0.719005835 | 0.445442437 |

| Zdzy | 0.666462777 | 0.477272075 | 0.688004343 | 0.415110578 |

| Zhifei | 0.794312561 | 0.48858374 | 1 | 0.851446092 |

| Zhongguancun | 0.638431487 | 0.361048475 | 0.600829723 | 0.58735967 |

| China Medicine | 0.600385661 | 0.632935767 | 0.705012728 | 0.541274783 |

| Zhongheng Group | 0.779488337 | 0.516431725 | 0.842980772 | 0.726827094 |

| Zhongmu | 0.891791426 | 0.461595881 | 0.758629587 | 0.388861314 |

| Zhongxin | 0.784299166 | 0.500035996 | 0.833734288 | 0.470157549 |

| Zsyy | 0.712236556 | 0.493776655 | 0.805881833 | 0.435730452 |

| JLZX | 0.56839467 | 0.487351822 | 0.7538412 | 0.407572713 |

| Zuoli | 0.506830635 | 0.327842837 | 0.530045226 | 0.603856046 |

4.5. Overall Efficiency Analysis

In the overall efficiency analysis (shown in Table 2), there are 109 companies with efficiency between 0.6 and 1.0, accounting for 66.9%, and it shows that the technical efficiency of the second stage is less than that of the first stage.

Comparing Hengrui (the highest efficiency) and Baiyunshan (the lowest efficiency), we found that Hengrui did not receive government subsidies in the 2018 and 2019, but the technical efficiency reached 1, and Baiyunshan has received government subsidies, but the technical efficiency rises first and then decreases.

For Zhifei Bio with the second highest efficiency, its efficiency in 2018 and 2019 was significantly higher than in 2016 and 2017, and the government subsidies received by Zhifei Bio in 2018 and 2019 were significantly lower than before. The second-to-last-ranked company, Medicare, reached a low point in 2018, followed by a significant rebound next year, when it was not subsidized by the government in 2019.

It can be concluded that government subsidies have no obvious effect for most companies, but it has a positive impact on enterprises with low efficiency in a short term. The government may need to reconsider the way of subsidies to pharmaceutical companies, such as the capital subsidies to equipment upgrades and talent introduction (see Table 5 for specific annual data).

| Company name | Year | |||

|---|---|---|---|---|

| 2015-2016 | 2016-2017 | 2017-2018 | 2018-2019 | |

| Adisseo | 1 | 0.594331961 | 0.687253527 | 0.590582307 |

| Anke Bio | 0.732050473 | 0.603904778 | 0.721684173 | 0.658510045 |

| Osaikon | 0.778427713 | 0.599091917 | 0.832059909 | 0.696276311 |

| Baiyunshan | 0.228285921 | 0.347396666 | 0.496661228 | 0.354314544 |

| Bdyy | 0.740297813 | 0.537030807 | 0.6599985 | 0.641144699 |

| Beilu | 0.754848982 | 0.608873049 | 0.726868379 | 0.745366839 |

| Porton | 0.704058135 | 0.537439838 | 0.673751419 | 0.645425288 |

| None | 0.804540469 | 0.581032222 | 0.686403127 | 0.634019398 |

| Changchun High-Tech | 0.670785268 | 0.613981329 | 0.826328221 | 0.91902694 |

| Changjiang Runfa Medicine | 0.709676062 | 0.545533564 | 0.667403235 | 0.486189125 |

| Changshan Pharma | 0.771002674 | 0.594856424 | 0.68892317 | 0.682407653 |

| DAJY | 0.553391996 | 0.532804722 | 0.650855774 | 0.625961732 |

| Dezhan | 0.889124007 | 0.713057908 | 0.85424928 | 0.696289729 |

| Jiao | 0.847938007 | 0.724106276 | 0.892313767 | 0.434427484 |

| DBBT | 0.745018596 | 0.588398867 | 0.704618016 | 0.676626886 |

| VC | 0.4392569 | 0.411082825 | 0.544473127 | 0.465493745 |

| Dongcheng | 0.780465431 | 0.58515561 | 0.710439698 | 0.633026364 |

| Nhwa Pharm | 0.734368139 | 0.53849531 | 0.686067979 | 0.687237305 |

| Ekzy | 0.679929415 | 0.567141171 | 0.651349898 | 0.617078583 |

| Fangsheng | 0.763857057 | 0.576574634 | 0.69884161 | 0.674382377 |

| Fengyuan | 0.444827414 | 0.480815113 | 0.614783892 | 0.606094921 |

| Fczy | 0.742074088 | 0.578441415 | 0.685449982 | 0.654076242 |

| Fayy | 0.747025125 | 0.542767359 | 0.550777941 | 0.641860364 |

| Fosun Pharm | 0.423354375 | 0.670393153 | 0.67734337 | 0.657568579 |

| Fuxiang | 0.690619828 | 0.558173035 | 0.657502803 | 0.69283151 |

| Guangji | 0.723829795 | 0.562163776 | 0.697307481 | 0.671209547 |

| Kwong Sang Hong | 0.782406423 | 0.601677149 | 0.712736266 | 0.684833649 |

| Guang Yuyuan | 0.78963604 | 0.597988236 | 0.731277172 | 0.563852758 |

| Lark | 0.724214801 | 0.557523041 | 0.691343122 | 0.603175409 |

| Glsj | 0.704470405 | 0.600924412 | 0.722522094 | 0.691917544 |

| Sinopharm Hyundai | 0.427413377 | 0.393573592 | 0.554655968 | 0.411827436 |

| Harbin Pharm | 0.352405918 | 0.369339239 | 0.485586707 | 0.432828982 |

| Haili Bio | 0.783470209 | 0.604343839 | 0.699572898 | 0.67374349 |

| Hnhy | 0.569927767 | 0.533436376 | 0.636600922 | 0.537164476 |

| Hepalink | 0.592158759 | 0.525343452 | 0.699393429 | 0.659703397 |

| Haishun New Pharma | 0.8030248 | 0.605941868 | 0.716134725 | 0.700106885 |

| Haisco | 0.480099239 | 0.575867685 | 0.699064728 | 0.661359713 |

| Hisoar | 0.671469103 | 0.541039094 | 0.710909693 | 0.676879776 |

| Haixin | 0.734260582 | 0.551448437 | 0.676486256 | 0.637198392 |

| Hisun | 0.287396529 | 0.380594016 | 0.415821467 | 0.441140083 |

| Han Sen Pharm | 0.732716709 | 0.559696588 | 0.688766917 | 0.684174582 |

| Hybio | 0.724090442 | 0.622127582 | 0.609611185 | 0.477857438 |

| Hengrui | 0.826957748 | 0.770628784 | 1 | 1 |

| Chase Sun | 0.550775748 | 0.399677749 | 0.436619602 | 0.528426739 |

| NCPC | 0.354218369 | 0.358094194 | 0.480775578 | 0.427708854 |

| Huahai | 0.497285595 | 0.525399389 | 0.58350641 | 0.588866754 |

| Hualan Bio | 0.606253871 | 0.611156906 | 0.786676493 | 0.803468984 |

| Huaren | 0.703067183 | 0.5262557 | 0.649580709 | 0.631043029 |

| HRSJ | 0.406183354 | 0.51553843 | 0.651086789 | 0.659592625 |

| China Resources Double-Crane | 0.464181045 | 0.478110469 | 0.667487244 | 0.618744398 |

| Huashen Technology | 0.79585331 | 0.605253566 | 0.698514176 | 0.686848921 |

| Walter Dyne | 0.745780253 | 0.592281438 | 0.685737585 | 0.679786234 |

| Yanbian FC | 0.58552906 | 0.726843818 | 0.75539478 | 0.760336119 |

| Kyrgyzstan | 0.57291471 | 0.595278792 | 0.719807265 | 0.307289038 |

| Jichuan | 0.673524741 | 0.478385974 | 0.569904186 | 0.621509323 |

| Jimin | 0.755191647 | 0.581216669 | 0.682498022 | 0.658109286 |

| JYPC | 0.789213967 | 0.533152421 | 0.692664421 | 0.655377456 |

| Joincare Pharm | 0.373389357 | 0.612787948 | 0.431248192 | 0.711024008 |

| Jiangzhong | 0.773280624 | 0.57457233 | 0.714383571 | 0.696034497 |

| Jincheng | 0.6424688 | 0.541255874 | 0.633395756 | 0.600807083 |

| Jinhe Bio | 0.694022214 | 0.53855834 | 0.672530294 | 0.639655629 |

| Jinling | 0.669922726 | 0.463558983 | 0.63122491 | 0.598918507 |

| Jinshiya | 0.779202218 | 0.61261129 | 0.67505169 | 0.654243898 |

| Jingxin | 0.684642416 | 0.522548631 | 0.634930264 | 0.670080794 |

| Jinghua | 0.73659423 | 0.580261028 | 0.708115153 | 0.532218118 |

| Jingfeng | 0.657549858 | 0.543871346 | 0.658966242 | 0.439651462 |

| Jiuqiang | 0.832168543 | 0.640440908 | 0.760447378 | 0.740948042 |

| Jiuzhitang | 0.660685922 | 0.510365495 | 0.551518743 | 0.601037942 |

| Jiuzhou | 0.615906479 | 0.511229588 | 0.651701562 | 0.646607443 |

| CONBA | 0.43789997 | 0.490049729 | 0.667671711 | 0.454110037 |

| Kanghong | 0.640270409 | 0.530393868 | 0.625355868 | 0.589391549 |

| Kangyuan | 0.558531561 | 0.511112483 | 0.661025134 | 0.653468887 |

| Kangzhi | 0.770954193 | 0.582966967 | 0.690695416 | 0.63784734 |

| KHB | 0.719324825 | 0.576138757 | 0.689042667 | 0.655129362 |

| Kelun | 0.350816311 | 0.399255114 | 0.527654704 | 0.466336149 |

| Sunflower | 0.450269017 | 0.47246729 | 0.609455977 | 0.602948399 |

| Kunming Pharm | 0.486232652 | 0.488722513 | 0.622323739 | 0.575298309 |

| Lummy | 0.676182846 | 0.548086309 | 0.67791945 | 0.60414936 |

| LAYN | 0.766415526 | 0.615493713 | 0.696786083 | 0.687666604 |

| Lisheng Pharma | 0.772324056 | 0.553232118 | 0.688792627 | 0.658713187 |

| Livzon Pharm | 0.406802204 | 0.950736975 | 0.693561727 | 0.641403963 |

| LEADMAN | 0.7148845 | 0.589683903 | 0.697033474 | 0.677283392 |

| Lianhuan Pharm | 0.777990479 | 0.580819977 | 0.70187494 | 0.677825662 |

| Lingkang | 0.593122777 | 0.602274773 | 0.726097851 | 0.699381382 |

| Lingrui Pharm | 0.747485965 | 0.570748655 | 0.691654705 | 0.678247727 |

| Long Jin Pharm | 0.778557308 | 0.60796337 | 0.720057661 | 0.694828539 |

| Lukang Pharm | 0.568388015 | 0.368837292 | 0.454369366 | 0.548391093 |

| Mike Bio | 0.768849987 | 0.607581032 | 0.730833097 | 0.678396297 |

| M.k. | 0.705468047 | 0.594140747 | 0.659621157 | 0.473923489 |

| Palin Bio | 0.735879001 | 0.580588028 | 0.7000859 | 0.692170464 |

| PIEN TZE HUANG | 0.794732455 | 0.644348252 | 0.804287685 | 0.736290866 |

| Julie Plec | 0.628612707 | 0.51441293 | 0.586701026 | 0.629100125 |

| Plyy | 0.470181321 | 0.418413253 | 0.567877026 | 0.583837057 |

| CHEEZHENGTTM | 0.625915805 | 0.595282402 | 0.719854866 | 0.715491847 |

| Qidi | 0.763992733 | 0.561948196 | 0.677246094 | 0.688875522 |

| Qianhong Biopharma | 0.796996434 | 0.587850281 | 0.703561836 | 0.674562645 |

| Qianjin Pharm | 0.634951449 | 0.510221787 | 0.651319311 | 0.643983464 |

| Qianyuan | 0.734922726 | 0.538059322 | 0.641532464 | 0.529123309 |

| Renfu | 0.334316504 | 0.515659371 | 0.162643485 | 0.472524591 |

| Renhe Pharmacy | 0.710690176 | 0.501475944 | 0.678520156 | 0.647375907 |

| Rpsw | 0.616216798 | 0.544427634 | 0.663887992 | 0.660390626 |

| Saisheng | 0.842078163 | 0.636453134 | 0.751848255 | 0.697189691 |

| SAM | 0.793087056 | 0.570374323 | 0.637288238 | 0.66250408 |

| Shanhe Pharmacy | 0.780593912 | 0.590341994 | 0.705650192 | 0.693438972 |

| Shkb | 0.769351682 | 0.596263047 | 0.707135607 | 0.684164457 |

| Shanghai RAAS Blood Products | 0.907968608 | 0.628170623 | 0.352321342 | 0.675478039 |

| Shenqi | 0.680638994 | 0.523233731 | 0.611259379 | 0.641985589 |

| Biological Stock | 0.870829861 | 0.70347757 | 0.801965497 | 0.656218882 |

| Salvage Pharm | 0.547394207 | 0.443227806 | 0.638664943 | 0.301830016 |

| Sts | 0.840550192 | 0.630975455 | 0.719756982 | 0.666578994 |

| Scyy | 0.680239263 | 0.581555378 | 0.673278766 | 0.671620779 |

| Beijing SL Pharm | 0.744354754 | 0.664713516 | 0.785954743 | 0.730167136 |

| Stellite | 0.725188753 | 0.558580997 | 0.681979752 | 0.655174892 |

| Shsw | 0.798450652 | 0.591904871 | 0.700994849 | 0.696898497 |

| Tat | 0.712944165 | 0.470305378 | 0.557717995 | 0.553727441 |

| Taiji Group | 0.523948741 | 0.370677112 | 0.489754105 | 0.411216635 |

| Taloph Pharm | 0.723845517 | 0.541466331 | 0.629307653 | 0.632734845 |

| Teyi | 0.760999041 | 0.581909561 | 0.708162034 | 0.680597811 |

| Tasly | 0.531017743 | 0.490066656 | 0.611366055 | 0.461437582 |

| Tiantan Biological | 0.622734244 | 0.66310047 | 0.782922006 | 0.712465273 |

| Tianyao Pharm | 0.712730596 | 0.544247373 | 0.652803637 | 0.608985283 |

| Thdb | 0.795554142 | 0.653229828 | 0.790400206 | 0.731561874 |

| Thjm | 0.722867728 | 0.577589877 | 0.703162547 | 0.260771659 |

| TRT | 0.643059805 | 0.554356733 | 0.641063018 | 0.544020294 |

| Wanbangde | 0.571625007 | 0.432249488 | 0.473426951 | 0.453497617 |

| Wondfo | 0.712134043 | 0.586408694 | 0.689386071 | 0.705688037 |

| WEDGE INDUSTRIAL | 0.75213728 | 0.609551683 | 0.708716889 | 0.688673642 |

| Weiming | 0.775011865 | 0.62907394 | 0.658692074 | 0.661517811 |

| Wowu | 0.827238366 | 0.614236394 | 0.735571328 | 0.715768679 |

| Wohua | 0.762137003 | 0.580657605 | 0.692834657 | 0.694553785 |

| Wosen | 0.456421123 | 0.470227422 | 0.862487868 | 0.660496829 |

| AMD | 0.627878133 | 0.627997177 | 0.734618138 | 0.732444295 |

| Xianju Pharm | 0.618297341 | 0.518121431 | 0.664360204 | 0.633863302 |

| Xiangxue Pharm | 0.551863899 | 0.495157616 | 0.604938414 | 0.560265277 |

| Sunflower | 0.657878385 | 0.517059063 | 0.430579818 | 0.644671298 |

| NHU | 0.631069124 | 0.344337963 | 0.417527717 | 0.696876755 |

| Xinhua | 0.544129945 | 0.424368226 | 0.564325286 | 0.5586054 |

| Xinbang | 0.400791325 | 0.455593724 | 0.329151623 | 0.485028396 |

| SALUBRIS | 0.786916152 | 0.617220238 | 0.720859622 | 0.566009985 |

| BROTHER | 0.76537271 | 0.605409971 | 0.653283686 | 0.614230582 |

| Yabao | 0.539400468 | 0.486947908 | 0.645626561 | 0.578342875 |

| Yatai | 0.739747264 | 0.591038926 | 0.704074772 | 0.291857375 |

| Yananbikang | 0.612340283 | 0.562211409 | 0.565493676 | 0.436795179 |

| Yiling Pharm | 0.633799819 | 0.526020841 | 0.678106867 | 0.616128252 |

| Yifan | 0.758376423 | 0.567154214 | 0.578959385 | 0.633371792 |

| Yibai | 0.612320129 | 0.455498536 | 0.365362945 | 0.569666434 |

| Yisheng | 0.628263309 | 0.564718437 | 0.678697744 | 0.659088427 |

| Yiduoli | 0.693578342 | 0.527624776 | 0.658030562 | 0.612212776 |

| Chinataurine | 0.722247367 | 0.580681117 | 0.704650362 | 0.672924197 |

| Gloria Pharm | 0.5225888 | 0.528091646 | 0.634974266 | 0.140262719 |

| Baiyao | 0.542062095 | 0.623275676 | 0.74860877 | 0.731659557 |

| Zhejiang Medicine | 0.522959555 | 0.432463484 | 0.56815758 | 0.508852734 |

| Zhenbao Island | 0.491175612 | 0.539218332 | 0.642235011 | 0.646298006 |

| Zdzy | 0.602884228 | 0.509387255 | 0.567643001 | 0.581329044 |

| Zhifei | 0.726661912 | 0.633983832 | 0.922890095 | 0.925723046 |

| Zhongguancun | 0.623208215 | 0.479354766 | 0.58000983 | 0.617714904 |

| China Medicine | 0.44933969 | 0.458628776 | 0.547204643 | 0.43667571 |

| Zhongheng Group | 0.718912618 | 0.623627731 | 0.751932612 | 0.737063988 |

| Zhongmu | 0.679383423 | 0.483648804 | 0.619691314 | 0.535837661 |

| Zhongxin | 0.605084581 | 0.489320281 | 0.654535316 | 0.592485773 |

| Zsyy | 0.692260649 | 0.607808063 | 0.723569987 | 0.656790838 |

| JLZX | 0.613219972 | 0.606033666 | 0.675253694 | 0.61472573 |

| Zuoli | 0.576940662 | 0.497474779 | 0.573208842 | 0.653638646 |

5. Dynamic Effect Analysis

The efficiency of the two-stage network DEA model varies from year to year, and the efficiency value of different years is not comparable, so time series analysis cannot be carried out. To make up for the shortcomings of the traditional two-stage network DEA, this paper adds the Malmquist index to study the total factor productivity of listed pharmaceutical companies in 2015–2019 and quantify its decomposition limit. The results are shown in Table 6.

| EC | SC | TC | PC | TFP | |

|---|---|---|---|---|---|

| 2015-2016 | 1.1841 | 2.7910 | 1.0109 | 0.4242 | 1.1970 |

| 2016-2017 | 0.5162 | 1.4472 | 1.1211 | 0.3567 | 0.5787 |

| 2017-2018 | 0.9815 | 2.4676 | 1.0018 | 0.3978 | 0.9833 |

| 2018-2019 | 0.5188 | 1.2176 | 1.0034 | 0.4260 | 0.5205 |

| Mean | 0.8001 | 1.9808 | 1.0343 | 0.4012 | 0.8219 |

The average total factor productivity (TFP) is 0.8219 that has fallen by an average 17.81%. Viewed from the decomposition index, the mean of EC is 0.8001; that is, EC has decreased by an average of 19.99%. The mean of PC is 0.4012, with the rate of decline in each averaging over 59.88% a year. SC is 1.9808, with an average annual growth rate of 98.08%. It shows that the operating efficiency of listed pharmaceutical enterprises depends on the scale expansion and makes up for low management efficiency. The average technology change (TC) is 1.0343, and it has risen by nearly 3.43% per year. The technology change has been improved between 2015 and 2019.

The listed pharmaceutical companies rely on product development and can be combined with innovative technologies. For the pharmaceutical industry, the level of research and development of products indirectly affects the level of industry development. The drugs or pharmaceutical equipment is very important; if the level of medical technology research and development is not advanced enough, the progress of medical level will be affected. Therefore, the listed pharmaceutical enterprises should rely on the existing advanced technology achievements, improving their own technology, to improve operating efficiency.

6. Conclusion

This paper firstly divides the two subsystems by using the two-stage network DEA and analyses the operating efficiency of 1,63 listed pharmaceutical companies in China from 2015 to 2019. Secondly, Malmquist index is used for dynamic analysis; the total factor productivity and decomposition limit were obtained. Finally, we make some suggestions based on the results of the study.

From the results, the technical efficiency of the second phase is less than that of the first stage; government subsidies have no positive impact on most companies. It is possible that enterprises move government subsidies elsewhere rather than pharmaceutical companies. It is also possible that government subsidies have increased, enterprises are more willing to invest in product development and enterprises expansion, and it is difficult to see the improvement of operational efficiency in the short term. However, the government subsidies have a positive impact on enterprises with low efficiency in a short term. To ensure the efficiency of investment and avoid waste of resources, government needs to choose the object of subsidies carefully and reformulate policies that encourage pharmaceutical listed companies. And according to the Malmquist index results, enterprises should pay attention to risk prevention and avoid rapid expansion bringing in diseconomies of scale. All in all, enterprises should improve management level and technological capabilities and shift scale growth to total factor productivity.

However, there are also some limitations. Regarding the data resources, the data we chose cannot exactly predict the operational situations among current Chinese medical firms, since there is more uncertainty in the market, especially during the COVID-19 period, which is likely to be a potential direction that other scholars can study further in the future. Concerning variables, this article analyses the operational efficiency of 164 firms; researchers can only choose several companies to make an in-depth analysis instead of the whole industrial analysis.

Conflicts of Interest

The authors declare there are no conflicts of interest regarding the publication of this paper.

Acknowledgments

This research was financially supported by Guangdong Planning Office of Philosophy and Social Sciences Project (Youth): Research on cross-border social responsibility of private foreign trade enterprises in Guangdong and the reconstruction of legitimacy—Perspective of the organization to piece together. (Project number: GD20YGL09). And it also supported by Department of Education of Guangdong Province “Innovative projects with characteristics of ordinary universities” project: Research on Sustainable Development of Foreign Trade in Guangdong Province Based on Energy Footprint (Project no. 2019WTSCX158). Moreover, it is also supported by Key Discipline-International Business Construction and Development Project (Project no. HS2019CXQX17).

Open Research

Data Availability

The data used to support the findings of this study are available from the corresponding author upon request.