Nonexistence of Harberger-Laursen-Metzler Effect with Endogenous Time Preference in an Imperfect Capital Market

Abstract

This paper investigates the spending and current-account effects of a permanent terms-of-trade change in a dynamic small open economy facing an imperfect world capital market, where the households’ subjective discount rate is a function of savings. Under the assumption that the bond holdings are measured in terms of home goods, it is shown that when the discount rate is a decreasing function of savings, there does not necessarily exist a stable state; however, when the discount rate is an increasing function of savings, a saddle-path stable steady state comes into existence and the Harberger-Laursen-Metzler effect does not exist unambiguously; that is, an unanticipated permanent terms-of-trade deterioration leads to a cut in aggregate expenditure and a current-account surplus. The short-run effects obtained by the technique by Judd (1985, 1987) and Zou (1997) are consistent with the results from the long-run analysis and diagrammatic analysis.

1. Introduction

This paper aims at studying the Harberger-Laursen-Metzler (hereafter H-L-M) effect that a terms-of-trade deterioration causes a reduction in national savings and a current-account deficit, in a dynamic small open economy. In this model, the subjective discount rate is allowed to be increasing or decreasing in savings and the home country faces an imperfect international capital market, where the cost of borrowing is an increasing function of its indebtedness. We find that a terms-of-trade deterioration results in a cut in consumption and a current-account surplus, which are contrary to the H-L-M effect.

Firstly, a Fisherian interpretation would be that an increase in savings makes the consumer more patient. A second interpretation is a variation on the perennial theme of the “spirit of capitalism,” the desire to accumulate wealth as an end in itself (Weber, 1920, 1958 [10, 11]). A recent literature (Zou, 1994, 1995, 1998 [12–14]; Bakshi and Chen, 1996 [15]; Smith, 1999, 2001 [16, 17]) models the spirit of capitalism by incorporating the stock of wealth as an argument in the utility function. Marshall provides another view of the spirit of capitalism. It is not the stock of wealth, but rather the accumulation of wealth, or the flow of savings that confers utility. It is not the amount accumulated, but rather the act of accumulating that matters. Thirdly, Marshallian preferences make the discount factor a function of current consumption, albeit indirectly, through saving. … The Marshallian taste for savings provides an underlying psychological rationale for why the discount factor should be a decreasing function of consumption ….

It seems that all of the three interpretations can be questioned. First of all, an increase in savings leads people to image a higher level of consumption in the future. For example, man who eats an apple every day may expect more apples per day in the future after he increases his current savings. An apple cannot satisfy him anymore. That means the future utility with the same consumption will be less after savings increase: the more the people save today, the less the utility of their consumption in the future is. That is to say, savings make people more impatient. So the subjective discount rate should be an increasing function of current savings. Secondly, according to the “spirit of capitalism,” people derive utility from the accumulated wealth. A better formalization is to put this factor in the utility function, rather than put it in the subjective discount rate. If savings are always positive, wealth will increase all the time. Then utility will increase as time goes on when consumption does not change. However, according to Marshallian time preference in Gootzeit et al. [5], positive savings lead to a decrease in both discount factor and utility in course of time which is contrary to the “spirit of capitalism.” Finally, according to Das [6], the subjective discount rate which is a decreasing function of consumption is intuitively more plausible than the one in Uzawa [1]. Since savings decrease with consumption, the subjective discount rate which is an increasing function of savings seems to be the normal case, other than the one presented in Marshallian time preference.

Adding to the complexity as well as the realism of our analysis, we weaken the assumption of Marshallian time preference to focus on two cases, Cases 1 and 2. In Case 1, the representative household has Marshallian time preference and, in Case 2, the subjective discount rate is an increasing function of savings.

Obstfeld [2] examines the H-L-M effect with Uzawa [1] utility function. He shows that an unanticipated permanent worsening of the terms of trade will cause a surplus in the current-account if initial steady-state bond holdings measured in units of foreign goods are nonpositive and consumption measured in units of domestic goods will fall. He studies both the case with perfect capital mobility and the case with imperfect mobility. The two cases have the same result which is contrary to those obtained in Harberger [18] and Laursen and Metzler [19].

Huang and Meng [20] base their analysis on Das [6] utility function with the discount rate being a decreasing function of instantaneous utility. Their analysis shows that if the economy is initially at steady state, the short-run response of an adverse permanent terms-of-trade shock is that spending rises sharply and then both spending and bond holding fall gradually to new, lower long-run levels. This result reverses the findings in Obstfeld [2] and is consistent with the H-L-M effect.

Angyridis and Mansoorian [21] study the H-L-M effect in a perfect capital market when the households have Marshallian time preference in Gootzeit et al. [5], where the subjective discount rate is a decreasing function of current savings. However, they have supposed that the concave utility function U is negative to satisfy the inequality , which guarantees their system to be saddle-point stable. Angyrids and Mansoorian also show that an adverse terms-of-trade change occasions a deficit in the current-account.

The present paper revises the H-L-M effect in an imperfect international capital market. We find that, in Case 1, when households have Marshallian time preference, there does not necessarily exist a stationary state; in Case 2, when the discount rate is an increasing function of savings, a saddle-point stable steady state comes into existence. Then we investigate the long-run and short-run effects of terms-of-trade deterioration on consumption and bond holdings and find that a terms-of-trade deterioration leads to a cut in consumption and a current-account surplus, which is contrary to the H-L-M effect.

The rest of this paper is organized as follows. Section 2 describes the lifetime maximization problem of the representative agent in a world of imperfect capital mobility when the bond holdings are measured in terms of home goods. Section 3 obtains the steady state and examines the effects of a permanent deterioration in the terms of trade on steady-state consumption and bond holdings. Section 4 investigates the short-run effects of terms-of-trade deterioration on consumption and the current-account at the initial equilibrium, using a technique developed by Judd [22, 23], Zou [24], and Cui et al. [25]. Some concluding remarks are presented in Section 5.

2. The Model

The following assumption characterizes the instantaneous utility function u(·, ·) and the discount-rate function δ(·).

Assumption 1. (i) Utility function u(·, ·) is nonnegative, strictly increasing in both of its arguments, strictly concave, and twice continuously differentiable. In addition,

- (ii)

Case 1:

-

Case 2:

In order to avoid noninterior solutions to household’s lifetime consumption problem, we make the assumption in (i) which follows the assumption in Obstfeld [2].

It can be shown that Assumption 1 guarantees global monotonicity and quasiconcavity of U.

The following assumption characterizes the world rate of interest .

Assumption 2. Consider

According to Assumption (1a), the constraint (iii) above can never be binding and may be ignored in solving this problem.

3. Dynamics and Long-Run Analysis

3.1. Dynamic System

3.2. The Steady State

The full dynamics of the economy is described by two differential equations (25) and (27) with the transversality condition.

The following analysis is based on the assumption in Case 2 of Assumption 1.

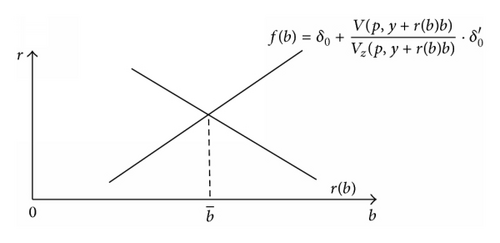

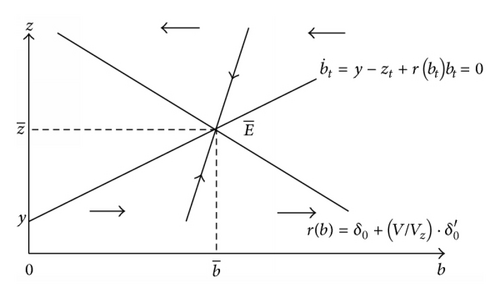

3.3. The Optimal Path

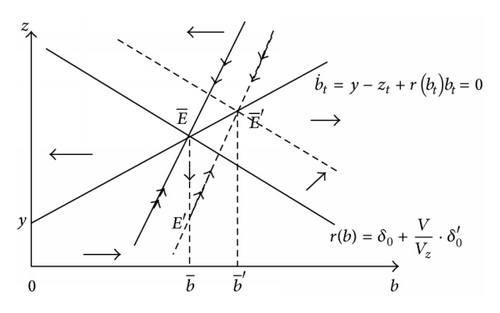

Note that z is not necessarily stationary on the curve described by (45). The point of intersection of the two curves in the plane is the steady state where both b and z are stationary. Bond holdings are increasing to the right of the curve and decreasing to its left. We note for future reference that the point (0, y) always lies on the line.

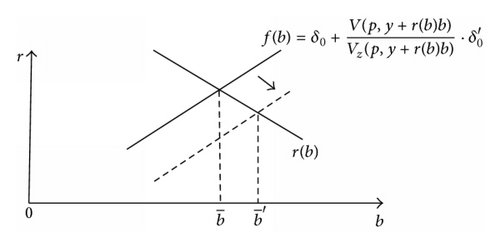

3.4. The Harberger-Laursen-Metzler Effect

Equation (49) means that an unanticipated permanent deterioration of terms of trade results in a rise in steady-state bond holdings and consumption.

We can also find out the short-run effect in Figure 4. The convergent path leading to the new steady state necessarily passes below the initial steady state . The bond holdings cannot change instantaneously, the consumption jumps to point E′ immediately, and the current-account goes up to surplus (this will be proved in the next section). However, after the shock, bond holdings b and consumption z increase along the convergent path from point E′ to the new steady state .

The intuition is easy to grasp. The steady states of bond holdings and consumption are a higher level than before. Since income is fixed and bond holdings cannot be changed instantaneously, consumption will be cut to gain a rise in bond holdings, resulting in a current-account surplus. This is contrary to the H-L-M effect.

4. Short-Run Analysis

In the last section, we discussed the effects of an unanticipated permanent deterioration on the steady-state consumption and bond holdings. In this section, the short-run effects of this shock on consumption and the current-account at the initial equilibrium will be examined.

The short-run effects obtained with the above technique conform to the analysis in the last section; that is, the deterioration in the terms of trade will result in a current-account surplus, which is contrary to the H-L-M effect.

5. Conclusions

This paper has examined the terms-of-trade deterioration in a small open economy facing an imperfect world capital market. It is shown that, in the small open economy with imperfect capital mobility, there does not necessarily exist a steady state under Marshallian time preference. However, a saddle-point stable steady state comes into existence when the discount rate is an increasing function of savings.

Under the assumption that bond holdings are determined in terms of home goods, we find that the permanent terms-of-trade deterioration leads to an increase in the steady-state bond holdings and consumption. From the diagrammatic analysis and short-run analysis, we find that consumption will be cut immediately and the current-account will meet a surplus, which is contrary to the H-L-M effect.

The present paper assumes that the subjective discount rate is an increasing function of savings, which needs empirical and theoretical justification. Moreover, this paper could be extended in the following ways. Firstly, we could analyse the effects of various shocks such as fiscal policy, monetary policy, and distortionary taxation. Secondly, this small open economy model could be extended to a big-country model with both capital accumulation and foreign asset holdings. Thirdly, we could extend this model to a RBC model, incorporating labor supply and production. Fourthly, we could examine the effect of exchange rate between two countries on the current-account. Finally, we could examine the H-L-M effect in a two-country world economy with endogenous time preference.

Conflict of Interests

The authors declare that there is no conflict of interests regarding the publication of this paper.

Acknowledgments

This work is supported by Training Program for the Major Fundamental Research of Central University of Finance and Economics (Grant no. 14ZZD001), Beijing Nova Program no. Z131109000413029, and Beijing Finance Funds of Natural Science Program for Excellent Talents no. 2014000026833ZK19. The authors would like to thank Professor H. F. Zou for his extensive help and encouragement.