Hopf Bifurcation in a Cobweb Model with Discrete Time Delays

Abstract

We develop a cobweb model with discrete time delays that characterise the length of production cycle. We assume a market comprised of homogeneous producers that operate as adapters by taking the (expected) profit-maximising quantity as a target to adjust production and consumers with a marginal willingness to pay captured by an isoelastic demand. The dynamics of the economy is characterised by a one-dimensional delay differential equation. In this context, we show that (1) if the elasticity of market demand is sufficiently high, the steady-state equilibrium is locally asymptotically stable and (2) if the elasticity of market demand is sufficiently low, quasiperiodic oscillations emerge when the time lag (that represents the length of production cycle) is high enough.

1. Introduction

Time series of prices of nonstorable goods are observed on a daily basis and are subject to strong fluctuations, while production of such commodities requires a longer time period (for instance, from sowing to harvest with regard to agricultural ones). The cobweb model, originally developed by Kaldor [1] with linear supply and demand, (see also Ezekiel [2].) has been extensively investigated in a discrete time deterministic context (e.g., [3–8]). (For a stochastic version of a discrete time cobweb model see Brianzoni et al. [9].) It essentially served to explain the reasons why prices of commodities in the agricultural sector fluctuate over time. According to that model, farmers operate in a market where production must be chosen before prices are observed (i.e., there exists a time lag in supply). Producers’ choices, therefore, depend on prices they expect to prevail at harvest time. By assuming that farmers take the current price as an estimate of the expected price (static expectations), stability of the market equilibrium is shown to depend on relative elasticities of supply and demand. Assume that farmers plant wheat and corn at a certain date, and they are forced to sell their entire production. If they expect that the price of wheat will be high and that of corn low, they will plant a large amount of wheat in the future. Nevertheless, it is possible that market interactions between supply and demand (or, alternatively, other reasons related, for instance, to unexpected weather events and so on; see [9]) do cause a price for wheat lower than the expected one. As a consequence, producers’ decisions will be modified accordingly giving rise to price fluctuations. The traditional cobweb model with static expectations, therefore, represents a very useful tool for the analysis of price dynamics. However, only three different kinds of phenomena can be observed if supply and demand are linear: convergence towards the steady-state equilibrium, cycle of period two, and unbounded fluctuations.

The interest in the study of price dynamics has led Hommes [3] to extend the discrete time cobweb model by introducing adaptive expectations (Adaptive expectations have been introduced in the original cobweb model by Nerlove [10].) and nonlinear supply and demand curves. In his work, he showed that chaotic behaviours in prices can occur even if supply and demand are monotonic. (Artstein [11] and Jensen and Urban [12] found that chaotic price dynamics can arise also in the model with static expectations if either the supply curve or demand curve is nonmonotonic.) Subsequently, Gallas and Nusse [13] have deepened some mathematical properties of that model with adaptive expectations, while Mammana and Michetti [14, 15] have analysed the role of memory and expectations in such a context.

By considering quantity instead of price as the main variable, Onozaki et al. [4, 5] provided examples of the importance of behaviours other than rational expectations as a source of complex dynamics in the cobweb model. In particular, the former paper takes into account adaptive adjustments on the quantity produced instead of adaptive expectations on prices (as in [3]). With this behavioural rule, farmers partially adjust production in the direction of the best response (represented by the quantity that maximises expected profits). By assuming a nonlinear (monotonic) market demand, they showed—by using the Homoclinic Point Theorem—that topological chaos can occur in a model whose dynamics is characterised by a one-dimensional map. From an economic point of view, chaos occurs more likely the faster suppliers adjust production and the more inelastic the market demand is. The latter paper extends the former one by introducing behavioural heterogeneity of producers.

To capture in a better way the functioning of a market whose price fluctuations are observed on a daily basis, this paper extends Onozaki et al.’s [4] by considering a continuous time cobweb model with discrete time delays. The time delay is introduced to describe a specific aspect of agricultural commodity markets: the production cycle of nonstorable goods, in fact, is elapsed from sowing time to harvest time (see [16], for an analysis of a continuous time cobweb model with time delays). In this paper, we consider an economy with consumers whose marginal willingness to pay is determined by an isoelastic demand, and homogeneous farmers that face quadratic costs. Producers behave as adapters and take into account the profit maximising quantity as a target to adjust production. The dynamics of the economy is characterised by a single delay differential equation. In this context, we show that (1) if the elasticity of market demand is sufficiently high, the steady-state equilibrium is locally asymptotically stable (prices adequately react to clear the market) and (2) if the elasticity of market demand is sufficiently low, quasiperiodic oscillations emerge when the time lag (that represents the length of production cycle) is high enough.

The rest of the paper is organised as follows. Section 2 sets up the cobweb model with homogeneous producers that operate as adapters. Section 3 characterises local stability properties and local bifurcations of equilibria of the resulting one-dimensional delay differential equation. Section 4 studies stability properties and the direction of the Hopf bifurcation. Section 5 provides some numerical experiments to validate the theoretical results established in previous sections. Section 6 outlines the conclusions.

2. The Model

3. Existence of Equilibria and Local Bifurcations

Assume now that τ > 0 in (11). We will investigate location of the roots of the transcendental equation. First, we examine when this equation has zero or pure imaginary roots. Now, it is immediate that the former cannot occur.

Lemma 1. Let β > 1. The characteristic equation (11) associated with (9) has a pair of purely imaginary roots λ = ±iω0 at a sequence of critical values τj, where

Proof. Let λ = iω be a root of the characteristic equation (11) where ω > 0. Substituting this in (11), separating real and imaginary parts of the resulting equation, we obtain the solution of (11) as follows:

Lemma 2. λ = iω0 is a simple purely imaginary root of the characteristic equation (11) and all the other roots λ ≠ iω0 satisfy λ ≠ imω0 for any integer m.

Proof. If λ = iω0 were not simple, that is, P(iω0, τj) = P′(iω0, τj) = 0, then we would have 1 + ατj + iω0τj = 0, which is a contradiction. In order to establish the last part of the lemma, let us suppose there exists a root λm such that P(λm, τ0) = 0 and λm = imω0, for some m ≠ 0, ±1. From (14), we get , namely, m2 = 1. This completes the proof.

Lemma 3. The following transversality condition:

Proof. Let λ(τ) = ν(τ) + iω(τ) denote the roots of (11) near τj satisfying the conditions ν(τj) = 0 and ω(τj) = ω0. Differentiating the characteristic equation (11) with respect to τ, using (11), and solving for dλ/dτ term, we get

The previous lemma implies that the root of characteristic equation (11) near τj crosses the imaginary axis from the left to the right as τ continuously varies from a number less than τj to one greater than τj by Rouché’s theorem.

Proposition 4. If τ ∈ [0, τ0), all roots of (11) have negative real parts. If τ = τ0, all roots of (11) except λ = ±iω0 have negative real parts. If τ ∈ (τj, τj+1), for j = 0,1, 2, …, (11) has 2(j + 1) roots with positive real parts.

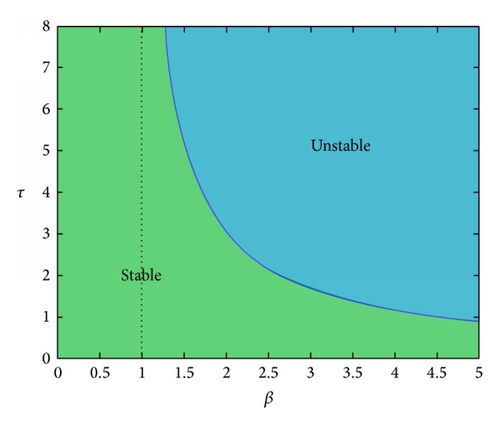

Summing up, we can state the following results (see Figure 1).

Theorem 5. Let ω0 and τj be defined as in (12) and (13), respectively. For (9), the following statements are true.

- (1)

If β ≤ 1, the positive equilibrium x* is locally asymptotically stable for all τ ≥ 0.

- (2)

If β > 1, the positive equilibrium x* is locally asymptotically stable for τ ∈ [0, τ0) and unstable for τ > τ0.

- (3)

If β > 1, (9) undergoes a Hopf bifurcation at the positive equilibrium x* when τ = τj, j = 0,1, 2, ….

4. Stability and Direction of the Hopf Bifurcation

5. Numerical Simulations

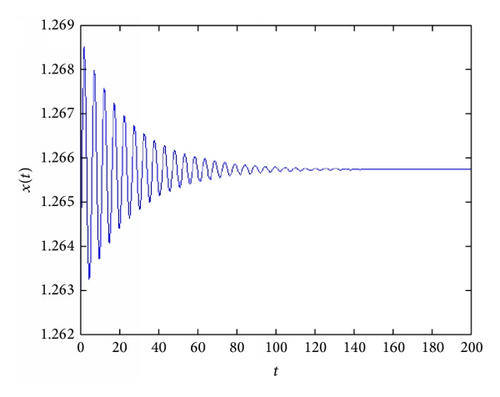

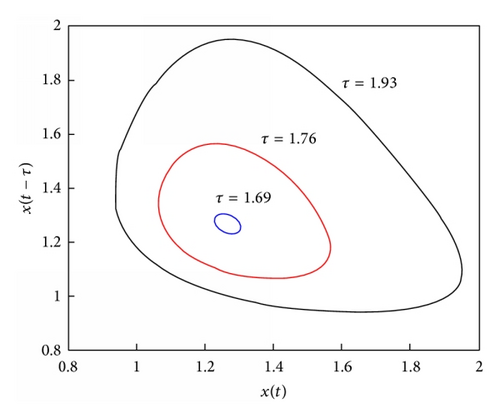

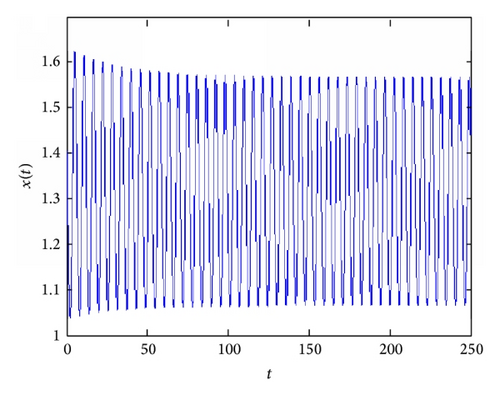

We now illustrate the theoretical results stated in previous sections by performing some numerical simulations. For this purpose, we fix the following parameter set: α = 0.4, β = 3, c = 0.77, n = 1, and b = 0.3 and let τ vary. With this parameter values, the steady-state equilibrium is x*≃1.266 and the Hopf bifurcation occurs at τ0≃1.689. When τ < τ0 (but sufficiently high), the dynamics of the quantity produced by farmers are oscillatory and convergent towards the equilibrium (as shown in Figure 2). Just after the Hopf bifurcation value of τ, there exists an attracting closed invariant curve and then the dynamics of quantities show persistent oscillations. To this purpose, Figure 3 shows the dependency of the length of the diameter of the closed invariant curve on the time lag τ. In particular, the figure depicts three different closed invariant curves for three different values of τ, that is, τ = 1.69 (blue curve), τ = 1.76 (red curve), and τ = 1.93 (black curve). It clearly shows that the length of the diameter of the closed invariant curve increases with τ. This implies that when τ is sufficiently high (i.e., the length of productive cycle is large), the amplitude of fluctuations of quantities (and prices) may be relevant (see Figure 4).

6. Conclusions

This paper extended the discrete time cobweb model by Onozaki et al. [4] with discrete time delays that characterise the length of production cycle. The model economy consists of homogeneous farmers that behave as adapters and refer to the expected profit-maximising quantity (with static expectations) as the target to which production is directed; that is, producers partially adjust their output by moving towards the best response. “Such adjustment is a behavioral response to uncertainty and adjustment costs” [4, page 102]. In a discrete time framework, Onozaki et al. [4] showed that the model can generate topological and observable chaos by applying the Homoclinic Point Theorem. In a continuous time version of that model, we found that the size of time lag in production matters for the emergence of nonlinear dynamics. In particular, by means of Hassard techniques we characterise existence and stability properties of the Hopf bifurcation that occurs when the time delay is sufficiently high. After the supercritical Hopf bifurcation, quasiperiodic oscillations can be observed when time delay increases. In addition, several numerical simulations (not reported in the paper) seem to suggest that more complex phenomena (such as high period cycles or chaotic attractors, shown by [4]) cannot occur in this context.

This model could be extended especially by considering heterogeneous producers, to stress how small perturbations can generate important changes in the structure of the dynamic system and different dynamic behaviours than when firms are homogeneous.

Conflict of Interests

The authors declare that there is no conflict of interests regarding the publication of this paper.