0-1 Test for Chaos in a Fractional Order Financial System with Investment Incentive

Abstract

A new integer-order chaotic financial system is extended by introducing a simple investment incentive into a three-dimensional chaotic financial system. A four-dimensional fractional-order chaotic financial system is presented by bringing fractional calculus into the new integer-order financial system. By using weighted integral thought, the fractional order derivative′s economics meaning is given. The 0-1 test algorithm and the improved Adams-Bashforth-Moulton predictor-corrector scheme are employed to detect numerically the chaos in the proposed fractional order financial system.

1. Introduction

References [4–7] analyzed some complex behavior of system (1), such as bifurcation and chaos. Reference [8] introduced fractional calculus into system (1) and studied its complex dynamics [9]. References [10, 11] studied chaos control of the fractional-order form of system (1). Reference [12] proposed an uncertain fractal-order form of system (1) and studied its chaos control via adaptive sliding mode. Reference [13] proposed an uncertain and stochastic form of system (1) with multiple delays. Reference [14] proposed a discrete form of system (1) and studied its Neimark-Sacker bifurcation. References [15, 16] presented a form of system (1) with time-delayed feedback and studied its dynamics and control. Reference [17] studied Hopf-pitchfork bifurcation and periodic phenomena in the system (1) with time delays. Reference [18] extended system (1) with the average profit margin.

The remainder of this paper is organized as follows. In Section 2, we give some preliminaries, such as Caputo fractional derivative’s economics meaning, numerical solutions of the system (3), and the 0-1 test algorithm. In Section 3, we numerically illustrate the chaos existence of the proposed financial system by using the improved Adams-Bashforth-Moulton predictor-corrector scheme and 0-1 test algorithm. Finally conclusions in Section 4 close the paper.

2. Preliminaries

2.1. Caputo Fractional Derivative and Its Economics Meaning

2.1.1. Weighted Integral

The integer integral and derivative are very helpful to understand fractional integral and derivative. An integral can be thought of as an area or a generalization of area.

Definition 2. Given a weighted factor f(x) and a function g(x) for a ≤ x ≤ b, the definite weighted integral is a real number whose geometrical interpretation is the signed area under the graph of weighted function y = f(x)g(x) for a ≤ x ≤ b.

When f(x) = 1, the weighted integral completely degenerates into a common integral.

2.1.2. Caputo Fractional Derivative

Loosely speaking, a derivative can be interpreted as a kind of change ratio. More specifically it is the measure of infinitesimal change ratio of the output over the infinitesimal change of the input. For example, consider the following.

Definition 3. The first order derivative of function f(t) with respect to t is given by

Definition 4. The 2nd order derivative of function f(t) with respect to t is given by

Definition 5. The mth order derivative of function f(t) with respect to t is given by

And there are several definitions of fractional derivatives, roughly speaking, which can be thought of as generalized above derivatives. The Caputo definition is a common notation of fractional derivative. Briefly the Caputo fractional derivative is a kind of weighted change ratio in a time interval. More specifically, the Caputo fractional derivative can be considered as a kind of weighted integral of the integer order derivative of a function on an interval. In this paper, we will adopt the following Caputo definition.

Definition 6. The qth order fractional derivative of function f(t) with respect to t is given by

The functions f(m)(t) in Definitions 5 and 6 are the same. When Kq(t − τ) is regarded as a kind of weight, then can be regarded as a kind of weighted integral with respect to f(m)(t). What is more, f(m)(t) can be regarded as mth order change ratio of the function f(t) at t; that is, there is no memory effect in f(m)(t). However, can be regarded as a weighted integral of the mth order derivative of the function f(t) on the whole interval [a, b], and the weight Kq(t − τ) depends on the specific time; that is, there are memory effects in .

2.1.3. Caputo Fractional Derivative’s Economics Meaning

In economics, let me illustrate a concrete example like the system (3), for the investment demand function y(t), its integer order derivative y(m)(t), and its fractional order derivative , y(m)(t) can be regarded as mth order change ratio of the investment demand y(t) at the time t; that is, it is unrelated to any time before the time t; that is, there is no memory effect in y(m)(t). However, can be regarded as a weighted integral of all mth order derivative of the investment demand y(t) on the whole time interval [0, t]; that is, does not only depend on the time t, but also depends on any time before the time t; that is, there are memory effects in . In the system (3), m = 1 and its memory effects are easier to be understood, so we will not repeat them here. In fact, a lot of economics variables have memory effects; for example, our past economic behavior may affect our present and future ones. In other research fields, there are also a lot of memory effects, such as psychological shadow, escalation of commitment, sunk cost effect, lazy battery effect, and shape memory effect. As mentioned above, there are some memory effects in financial systems, so the fractional derivative may be more suitable to study them.

2.2. Numerical Solutions of Fractional Order System

Based on the improved Adams-Bashforth-Moulton predictor-corrector scheme [26–29], one can solve fractional-order ordinary differential equations. The numerical calculation formula of fractional-order system (3) can be described as follows.

2.3. The 0-1 Test Algorithm

There are many approaches to detect chaos, but 0-1 test is one of the simplest and most effective ones, which was proposed by Gottwald and Melbourne [30] and also has already been successfully tested for various discrete or continuous systems, such as [31–45].

In this section, we introduce the detailed steps of the 0-1 test algorithm to robustly distinguish regular from chaotic dynamics in deterministic continuous dynamical systems. In fact, one can directly implement the 0-1 test algorithm if the given time series is generated from a discrete time system. But if the given time series is generated from a continuous time system, there may be a well-known oversampling issue that must overcome it. So the oversampling issue should be considered when we distinguish regular from chaotic dynamic system (3).

Consider a set of measurement data ϕ0(i) obtained from a continuous time system, where i = 1,2, …,T, and T is the amount of the data, the 0-1 test algorithm can be described as follows.

Step 1. Rearrange the initial measurement data with an optimal sampling time.

The average mutual information [46] between ϕ0(i) and ϕ0(i + τ) is defined as

The value τ corresponding to the first local minimum of the mutual information I(τ) is the optimal sampling time. Thus we can rearrange the initial measurement data ϕ0(i) into the finely sampled measurement data ϕ(j) in the following way:

Step 2. Choose a random number c ∈ (π/5, 4π/5) and define the following new coordinates (pc(n), sc(n)):

Step 3. Define the mean square displacement Mc(n) as follows:

Step 4. Define the modified mean square displacement Dc(n) as follows:

Step 5. Define the median value of correlation coefficient K as follows:

Step 6. Interpret outputs as follows.

- (1)

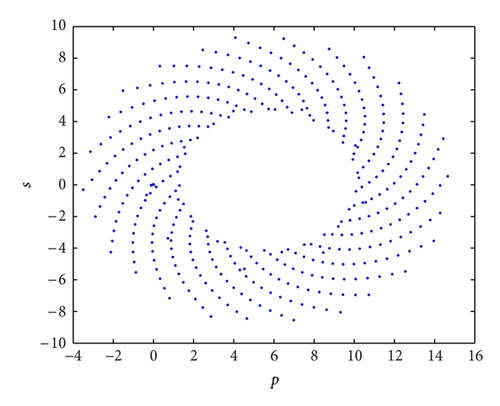

K ≈ 0 indicates the underlying dynamics is regular (i.e., periodic or quasiperiodic), whereas K ≈ 1 indicates the underlying dynamics is chaotic.

- (2)

Bounded trajectories in the (p, s) plane imply the underlying dynamics is regular (i.e., periodic or quasiperiodic), whereas Brownian-like (unbounded) trajectories imply the underlying dynamics is chaotic.

3. Some Basic Properties of the System (3)

3.1. Symmetry and Invariance

Obviously, the four-dimensional system (3) has a natural symmetry about the coordinate plane y-u since the coordinate transformation (x, y, z, u)→(−x, y, −z, u) satisfies the system is invariant for all values of the system parameters.

3.2. Dissipativity and the Existence of Attractor

3.3. Equilibrium and Stability

Theorem 7 (see [47].)Consider a nonlinear autonomous fractional order system as follows:

By simple computation, one can obtain that system (3) has only one equilibrium point E0(0,0, 0, −1).

Proposition 8. The equilibrium point E0 is unstable.

Proof. For the equilibrium point E0, the Jacobian matrix is

It is easy to get its eigenvalues corresponding to the equilibrium J(E0) as follows: , , , and .

Obviously λ1 > 0, that is, |arg(λ1)| = 0, thus the equilibrium point E0 is unstable based on Theorem 7.

This proposition is proved.

4. 0-1 Test for Chaos in the System (3)

In the next two subsections, some properties of the system (3) will be, respectively, discussed by varying investment incentive intensity d and investment demand derivative q2. The abovementioned Adams-Bashforth-Moulton predictor-corrector scheme and 0-1 test algorithm can be employed to get the desired numerical solutions of system (3).

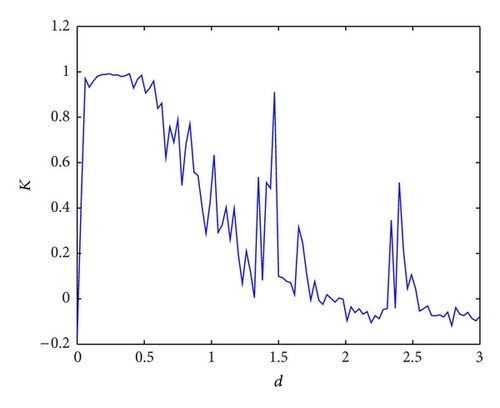

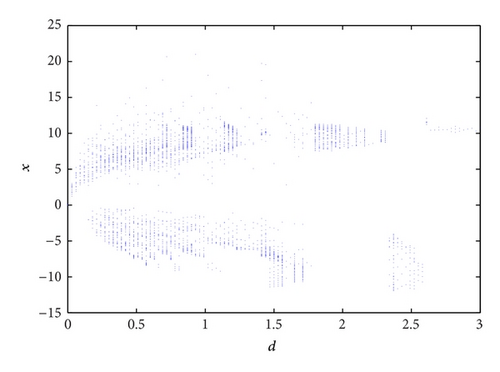

4.1. Varying d and Fixing q1 = 0.96, q2 = 0.94, q3 = 0.92, q4 = 0.78, a = 3, b = 0.4, and c = 0.4

To simplify representation, one can fix q1 = 0.96, q2 = 0.94, q3 = 0.92, q4 = 0.78, a = 3, b = 0.4, and c = 0.4 in this subsection. When the investment incentive intensity d varies, the corresponding K values are shown in Figure 1(a). The bifurcation diagram of interest rate x with increasing the investment incentive intensity d is presented in Figure 1(b). Obviously the bifurcation diagram well coincides with the K diagram. The two abovementioned figures both show that system (3) changes gradually from chaos to stability as the investment incentive intensity d grows larger.

From Figure 1, the complex dynamical behavior of the system (3) can be clearly understood. When the investment incentive intensity d is determined by its corresponding K ≈ 1, the system (3) is chaotic. Whereas the investment incentive intensity d is determined by its corresponding K ≈ 0, the system (3) is regular.

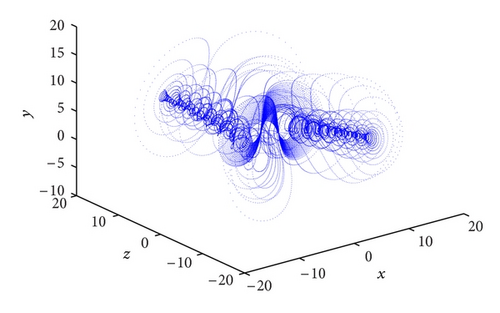

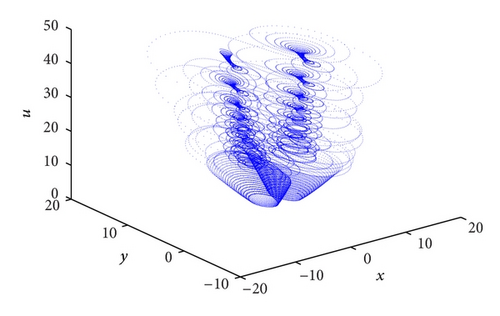

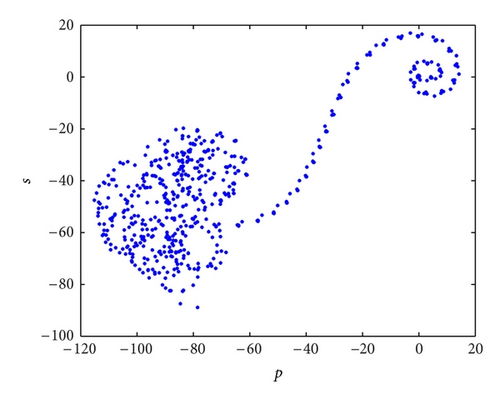

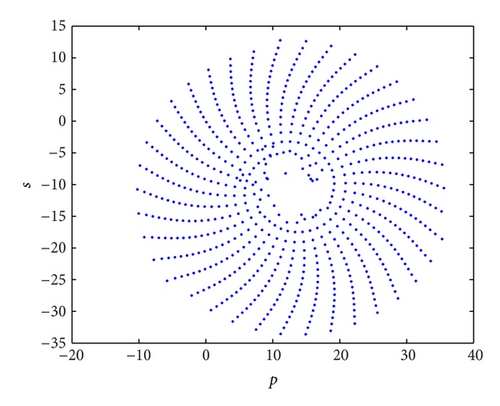

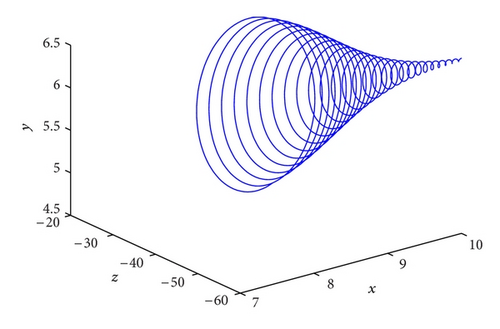

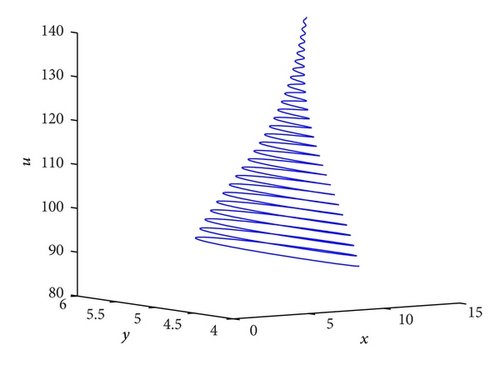

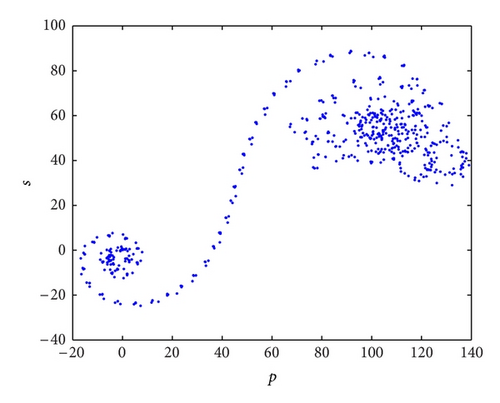

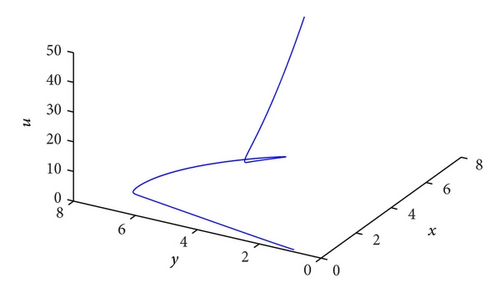

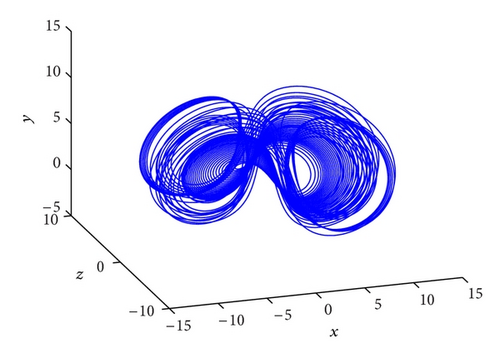

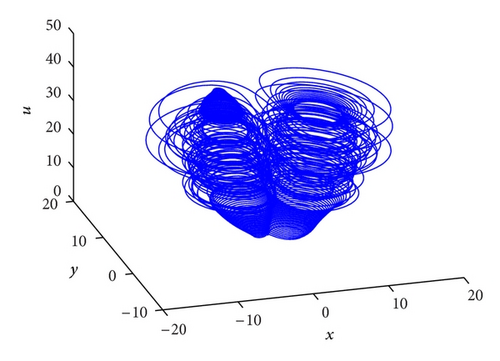

Let me take two specific examples as illustrations in the system (3). When the investment incentive intensity d = 0.1, its corresponding phase portraits are strange attractors as shown in Figure 2 and its trajectories in the new (p, s)-plane are Brownian-like as shown in Figure 3(a); that is, the system (3) is chaotic. Whereas the investment incentive intensity d = 2.8, its corresponding phase portraits are quasiperiodic as shown in Figure 4 and its trajectories in the new (p, s) plane are bounded as shown in Figure 3(b); that is, the system (3) is regular (quasiperiodic).

4.2. Varying q2 and Fixing q1 = 0.98, q3 = 0.97, q4 = 0.78, a = 3, b = 0.4, c = 0.4, d = 0.1

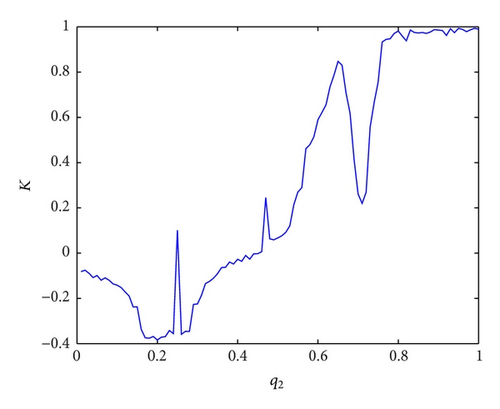

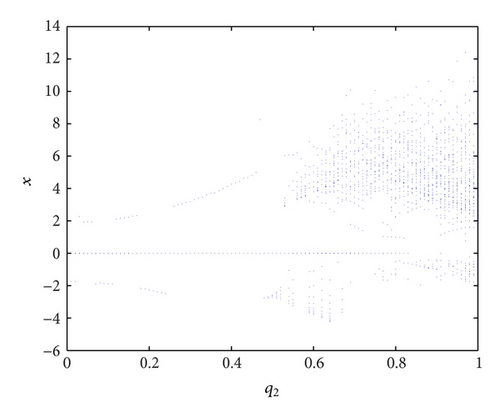

In the following subsection, q1 = 0.98, q3 = 0.97, q4 = 0.78, a = 3, b = 0.4, c = 0.4, d = 0.1 are fixed. When d varies, the corresponding K values are shown in Figure 5(a). The bifurcation diagram of interest rate x with increasing the investment demand derivative q2 is given in Figure 5(b). Obviously the bifurcation diagram well coincides with the K diagram, too. Figure 5 shows that the system (3) changes gradually from stability to chaos as the investment demand derivative q2 grows larger.

From Figure 5 of the system (3), when the investment demand derivative q2 is determined by its corresponding K ≈ 1, the system (3) is chaotic. Whereas the investment demand derivative q2 is determined by its corresponding K ≈ 0, the system (3) is regular.

For example, in the system (3), when the investment demand derivative q2 = 0.4, its corresponding phase portraits are quasiperiodic as shown in Figure 7 and its trajectories in the (p, s) plane are bounded as shown in Figure 6(a); that is, the system (3) is regular (quasiperiodic). Whereas the investment demand derivative q2 = 0.89, its corresponding phase portraits are strange attractors as shown in Figure 8 and its trajectories in the (p, s) plane are Brownian-like as shown in Figure 6(b); that is, the system (3) is chaotic.

5. Conclusion

A government is used to employing investment incentive to regulate financial systems. In this paper, a simple investment incentive is introduced into the classical chaotic financial system, and a 4-D chaotic financial system is obtained. What is more, there are some memory effects in the financial systems, so the 4-D fractional-order chaotic financial system is proposed by introducing the fractional calculus into the mentioned 4-D integer-order financial system. With the improved Adams-Bashforth-Moulton predictor-corrector scheme, phase portraits and bifurcation diagrams are illustrated, and then K value diagram and Plots in new coordinates (p, s) space are given by using the 0-1 test algorithm. Thus chaotic dynamics is distinguished from regular dynamics in the 4-D fractional-order chaotic financial system by the abovementioned methods.

Conflict of Interests

The authors declare that there is no conflict of interests regarding the publication of this paper.

Acknowledgments

This work is supported partly by Excellent Young Scientist Foundation of Shandong Province (Grant no. BS2011SF018), National Social Science Foundation of China (Grant no. 12BJY103), Humanities and Social Sciences Foundation of the Ministry of Education of China (Grant no. 11YJCZH200), and National Natural Science Foundation of China (Grant no. 71272148).