Development of Solar Electricity Supply System in India: An Overview

Abstract

Solar electricity supply system has grown at very rapid pace in India during the last few years. A total of 1047.84 MW of grid connected photovoltaic projects and 160.8 MW of off-grid systems have been commissioned under different policy mechanisms between January 2010 and November 2012. It is observed that solar capacity development has achieved a greater height under state policies (689.81 MW) than others. A study is made in this paper of various national and state level schemes, incentives, packages, instruments, and different mechanisms to promote solar photovoltaics and its effectiveness.

1. Introduction

The changing lifestyle with rapid industrialization has made electricity an indispensable and essential commodity over the years. During the last few decades, increasing prices of electricity with increasing demand and decreasing fossil fuel reserves have raised many concerns for policy makers, investors, and customers. Moreover, existing supply chain also poses a challenge of carbon foot print due to its dependency on fossil fuels like coal and oil for electricity generation [1–3].

The solar energy received by the earth is more than 15,000 times the world’s commercial energy consumption and over 100 times the world’s known coal, gas and oil reserves. And this energy is readily available during the day for anyone to tap and that too free and without any constraint.

Initially used to supply electricity to satellites due to its high generation cost, solar technologies and its potential have improved enough to supply electricity not only to remote locations but also to supplement the national grid power at multimegawatt levels [7].

In India, wind- and solar-based systems have been getting good response under the conducive environment created through different policy measures. In this paper, our focus is only on the development of solar-based electricity supply systems. There are different kinds of support measures to promote grid connected and off-grid solar systems. We discuss these in detail in the subsequent sections.

2. India’s Potential for Solar Energy

India is located in the northern hemisphere, lying between latitudes 8°4′N and 37°6′N and longitudes 68°7′E and 97°25′E; the country is divided into almost two equal halves by the Tropic of Cancer (23°30′N). The southern half which coincides with peninsular India lies in the tropical zone, while the northern half belongs to the subtropical zone.

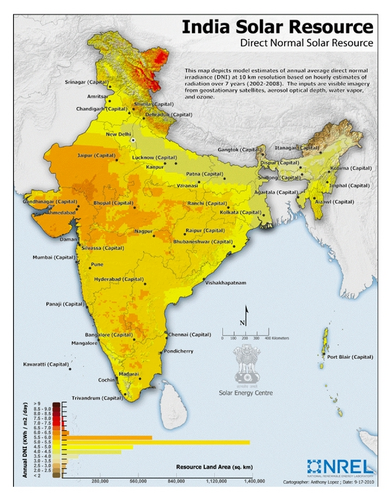

Due to its locational advantage, on average, the country experiences 250 to 300 sunny days per year and receives an average hourly radiation of 200 MW/km2. The annual global radiation varies from 1600 to 2200 kWh/m2 [6], which is typical of the tropical and subtropical regions. NREL recently released 10 km resolution solar resource maps for India based on the SUNY satellite. Figure 1 shows the annual average direct normal irradiance (DNI) across India, which illustrates that most areas of the country have greater than 5 kWh/m2/day of DNI. This image shows the areas of highest resource occurring in the state of Gujarat, Rajasthan, and the high-elevation Himalayan region. Figure 1 also shows large areas with annual average DNI greater than 5.5 kWh/m2/day in the state of Madhya Pradesh, Chhattisgarh, and Maharashtra and smaller land areas with similar resources in several other states. This area could be further increased by the use of building-integrated PV. Though large-scale CSP has not yet been deployed in India; one study has estimated that this technology alone could generate 11,000 TWh per year for India (Table 1). In addition, it also offers huge potential for decentralized distributed electricity supply system, which can address the problem of electricity to a remote location with less/lower transmission losses.

DNI class (kWh/m²/year) |

Land area suitable for CSP development (km²) | CSP generating potential (TWh/year) |

|---|---|---|

| 2,000–2,099 | 83,522 | 7,893 |

| 2,100–2,199 | 11,510 | 1,140 |

| 2,200–2,299 | 5,310 | 550 |

| 2,300–2,399 | 7,169 | 774 |

| 2,400–2,499 | 3,783 | 426 |

| 2,500–2,599 | 107 | 13 |

| 2,600–2,699 | 976 | 119 |

| 2,700–2,800+ | 120 | 15 |

| Total | 112,497 | 10,930 |

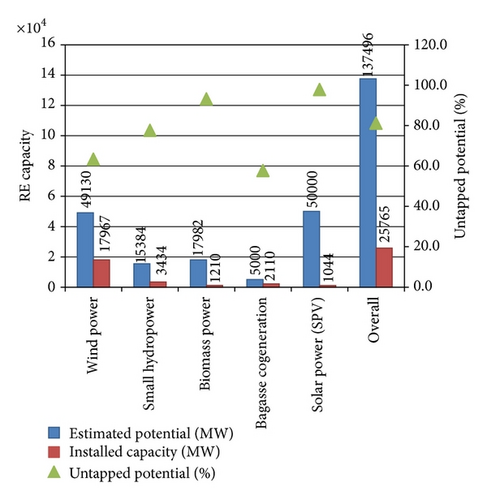

In spite of huge solar energy potential, the portfolio of RE has developed in a very unique way in India, though, lately introduced wind power technology has left behind all the traditional RE technologies such as biomass, solar power, and SHP as shown in Figure 2. It also demonstrates that solar power has the maximum untapped potential as 97.9% of estimated potential of 50000 MW. And the overall untapped potential of 81.3% seeks immediate attention of policy makers for exploiting this available RE resource in a very efficient and effective manner to overcome the problem of electricity shortage.

3. Development of Solar Electricity System under Different Policy Measures in India

Government of India has recognized the importance of solar energy as one of the sustainable sources of energy under National Action Plan for Climate Change (NAPCC). NAPCC aims to derive 15% of its energy requirements from RE sources by the year 2020 [10]. Various policy measures, such as preferential tariff or fixed tariff or feed-in tariff (FiT), RPO, excise duty exemption, and soft loan, have been implemented to achieve the above-mentioned target.

RPO is one of the tools which have been implemented by many countries to achieve their ambitious RE goals [11, 12]. In India, state electricity regulatory commissions (SERCs) determine the obligated entities, which generally include distribution companies, captive consumers, and any open-access users. Then these SERCs fix a certain proportion of electricity consumption as RPO targets for the above-mentioned obligated entities. Due to significant cost difference in solar and nonsolar RE technologies [13], most of the states have come up with their separate targets for solar electricity, as shown in Table 2. As per the National Tariff Policy, it is envisaged that the targets for solar RPO shall be 0.25% by 2012-2013 extending to 3% by 2022 [14], but only the state of Bihar has followed it in its solar policy the way it is expected.

| State | RPO (%) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| FY 2012 | FY 2013 | FY 2014 | FY 2015 | FY 2016 | FY 2017 | FY 2018 | FY 2019 | FY 2020 | FY 2021 | FY 2022 | |

| Andhra Pradesh | 0.25 | 0.25 | 0.25 | 0.25 | 0.25 | 0.25 | |||||

| Arunachal Pradesh | No regulation issued for RPO by the power department | ||||||||||

| Assam | 0.10 | 0.15 | 0.20 | 0.25 | |||||||

| Bihar | 0.25 | 0.25 | 0.50 | 0.75 | 1.00 | 1.25 | 1.50 | 1.75 | 2.00 | 2.50 | 3.00 |

| Chhattisgarh | 0.25 | 0.50 | |||||||||

| Delhi | 0.10 | 0.15 | 0.20 | 0.25 | 0.30 | 0.35 | |||||

| JERC (Goa and UT) | 0.30 | 0.40 | |||||||||

| Gujarat | 0.50 | 1.00 | |||||||||

| Haryana | 0.00 | 0.05 | 0.75 | ||||||||

| Himachal Pradesh | 0.01 | 0.25 | 0.25 | 0.25 | 0.25 | 0.25 | 0.50 | 0.75 | 1.00 | 2.00 | 3.00 |

| Jammu and Kashmir | 0.10 | 0.25 | |||||||||

| Jharkhand | 0.50 | 1.00 | |||||||||

| Karnataka | 0.25 | ||||||||||

| Kerala | 0.25 | 0.25 | 0.25 | 0.25 | 0.25 | 0.25 | 0.25 | 0.25 | 0.25 | 0.25 | 0.25 |

| Madhya Pradesh | 0.40 | 0.60 | 0.80 | 1.00 | |||||||

| Maharashtra | 0.25 | 0.25 | 0.50 | 0.50 | 0.50 | ||||||

| Manipur | 0.25 | 0.25 | |||||||||

| Mizoram | 0.25 | 0.25 | |||||||||

| Meghalaya | 0.30 | 0.40 | |||||||||

| Nagaland | 0.25 | 0.25 | |||||||||

| Orissa | 0.10 | 0.15 | 0.20 | 0.25 | 0.30 | ||||||

| Punjab | 0.03 | 0.07 | 0.13 | 0.19 | |||||||

| Rajasthan | 0.50 | 0.75 | 1.00 | ||||||||

| Sikkim | No regulation issued for RPO by the power department | ||||||||||

| Tamil Nadu | 0.05 | ||||||||||

| Tripura | 0.10 | 0.10 | |||||||||

| Uttarakhand | 0.03 | 0.05 | |||||||||

| Uttar Pradesh | 0.50 | 1.00 | |||||||||

| West Bengal | 0.25 | 0.30 | 0.40 | 0.50 | |||||||

- Source: SERCs order on RPO regulations [29].

A study conducted by MNRE shows that most of the states could not install capacity of solar system as per their RPO compliance requirement for the year 2012-2013 as on 12th of November 2012 (Table 3). The states like Uttar Pradesh (422.7 MW), Haryana (172.2 MW), Maharashtra (151.3 MW), and so forth, are far away from their RPO target. However, states of Gujarat (488.3 MW), Rajasthan (82.3 MW), and Karnataka (61.1 MW) have already surpassed their RPO requirement. Other states like Madhya Pradesh, Orissa, Punjab, and Uttarakhand may soon exceed their targets.

| State | Projected demand* (MU) |

Solar RPO target (2012-2013) |

Solar RPO target (2012-2013) | Capacity required for meeting solar RPO | Total capacity tied up as on 31.11.2012* | Installed capacity as on 31.11.2012 | Gap to be fulfilled in 2012-2013 |

|---|---|---|---|---|---|---|---|

| 2012-2013 | % | MU | MW | MW | MW | MW | |

| Andhra Pradesh | 98,956 | 0.25 | 247.39 | 148.6 | 75.5 | 23.75 | 73.1 |

| Assam | 6,810 | 0.15 | 10.21 | 6.1 | 5 | — | 1.14 |

| Bihar | 15,272 | 0.75 | 114.54 | 68.8 | 0 | — | 68.82 |

| Chhattisgarh | 21,174 | 0.50 | 105.87 | 63.6 | 29 | 4.00 | 34.61 |

| Delhi | 28,598 | 0.15 | 42.90 | 25.8 | 2.525 | 2.53 | 23.25 |

| JERC (Goa and UT) | 12,860 | 0.40 | 51.44 | 30.9 | 1.7 | 1.69 | 29.21 |

| Gujarat | 79,919 | 1.00 | 799.19 | 480.2 | 968.5 | 689.81 | (488.3) |

| Haryana | 40,167 | 0.75 | 301.25 | 181.0 | 8.8 | 7.80 | 172.2 |

| Himachal Pradesh | 8,647 | 0.25 | 21.62 | 13.0 | 0 | — | 13.0 |

| Jammu and Kashmir | 14,573 | 0.25 | 36.43 | 21.9 | 0 | — | 21.8 |

| Jharkhand | 6,696 | 1.00 | 66.96 | 40.2 | 36 | 16.00 | 4.2 |

| Karnataka | 65,152 | 0.25 | 162.88 | 97.9 | 159 | 14.00 | (61.1) |

| Kerala | 21,060 | 0.25 | 52.65 | 31.6 | 0.025 | 0.03 | 31.6 |

| Madhya Pradesh | 53,358 | 0.60 | 320.15 | 192.3 | 213.21 | 7.25 | (20.9) |

| Maharashtra | 150,987 | 0.25 | 377.47 | 226.8 | 75.5 | 21.00 | 151.3 |

| Manipur | 608 | 0.25 | 1.52 | 0.9 | 0 | — | 0.9 |

| Mizoram | 418 | 0.25 | 1.04 | 0.6 | 0 | — | 0.6 |

| Meghalaya | 2,154 | 0.40 | 8.62 | 5.2 | 0 | — | 5.2 |

| Nagaland | 596 | 0.25 | 1.49 | 0.9 | 0 | — | 0.9 |

| Orissa | 24,284 | 0.15 | 36.43 | 21.9 | 54 | 13.00 | (32.1) |

| Punjab | 48,089 | 0.07 | 33.66 | 20.2 | 51.825 | 9.33 | (31.6) |

| Rajasthan | 55,057 | 0.75 | 412.93 | 248.1 | 330.4 | 201.15 | (82.3) |

| Tamil Nadu | 91,441 | 0.05 | 45.72 | 27.5 | 18.105 | 17.05 | 9.4 |

| Tripura | 1,010 | 0.10 | 1.01 | 0.6 | 0 | — | 0.6 |

| Uttarakhand | 11,541 | 0.05 | 5.77 | 3.5 | 5.05 | 5.05 | (1.6) |

| Uttar Pradesh | 85,902 | 1.00 | 859.02 | 516.1 | 93.375 | 12.38 | 422.7 |

| West Bengal | 41,896 | 0.25 | 104.74 | 62.9 | 52.05 | 2.05 | 10.9 |

| Total | 2,537.2 | 2,179.59 | 1,047.84 | ||||

- Source: CEA base data for 2011-2012 and escalated for 2012-2013 based on 18th EPS escalation rates for the same period; *based on the data provided by NVVN, state agencies, and project developers. Italic numbers are the surplus capacity built-up.

However, when annual solar capacity requirement for RPO compliance is analyzed (Table 4), it is found that India would need ~34,000 MW of solar capacity to achieve the target of 3% contribution from solar electricity till 2022. It means that set RPO targets are not sufficient to have a solar energy dominant RE development scenario [15]. The policy makers expect to fill this gap with states’ solar energy promotion policies and programmes. Most of the states have come up with their solar energy specific policies which are discussed in detail in subsequent sections.

| Year | Energy demand (MU)* (A) |

Solar RPO (%) (B) |

Solar energy requirement (MU) for RPO compliance (A × B) |

Solar capacity requirement for RPO compliance (MW) |

Solar capacity requirement for solar dominant scenario (MW)# |

|---|---|---|---|---|---|

| 2011-2012 | 953,919 | 0.25 | 2,385 | 1,433 | 514 |

| 2012-2013 | 1,022,287 | 0.25 | 2,556 | 1,536 | 2414 |

| 2013-2014 | 1,095,555 | 0.50 | 5,478 | 3,291 | 5414 |

| 2014-2015 | 1,174,074 | 0.75 | 8,806 | 5,291 | 8414 |

| 2015-2016 | 1,258,221 | 1.00 | 12,582 | 7,560 | 12414 |

| 2016-2017 | 1,348,399 | 1.25 | 16,855 | 10,127 | 17490 |

| 2017-2018 | 1,443,326 | 1.75 | 25,258 | 15,176 | 22490 |

| 2018-2019 | 1,544,936 | 2.25 | 34,761 | 20,885 | 28490 |

| 2019-2020 | 1,653,700 | 2.50 | 41,343 | 24,839 | 35490 |

| 2020-2021 | 1,770,120 | 2.75 | 48,678 | 29,247 | — |

| 2021-2022 | 1,894,736 | 3.00 | 56,842 | 34,152 | — |

- Note: *based on the National Electricity Plan for Generation January 2012.

- #Source: WISE, Pune [15].

As far as state-wise installation is concerned, Table 5 clearly demonstrates that states of Gujarat (65.83%) and Rajasthan (19.20%) have major share in total installed capacity (1047.87 MW). Other states like Andhra Pradesh (23.75 MW) and Maharashtra (21.00 MW) also have significant contribution. However, it is quite remarkable that out of 26 states 19 have shown their presence in the class of solar India in spite of relatively high generation cost (Table 5). It is expected that when cost will reduce with increasing capacity, states which have low or no capacity may contribute significantly.

| Sr. no. | States | Installed capacity (MW) | ||||||

|---|---|---|---|---|---|---|---|---|

| JNNSM | State policy | RPSSGP/GBI scheme | REC | Other | Total | % of total | ||

| 1 | Andhra Pradesh | 12.00 | — | 9.75 | — | 2.00 | 23.75 | 2.27 |

| 2 | Arunachal Pradesh | — | — | — | — | 0.03 | 0.03 | 0.00 |

| 3 | Chhattisgarh | — | — | 4.00 | — | — | 4.00 | 0.38 |

| 4 | Delhi | — | — | — | — | 2.53 | 2.53 | 0.24 |

| 5 | Goa and UT | — | — | — | — | 1.69 | 1.69 | 0.16 |

| 6 | Gujarat | — | 689.81 | — | — | — | 689.81 | 65.83 |

| 7 | Haryana | — | — | 7.80 | — | — | 7.80 | 0.74 |

| 8 | Jharkhand | — | — | 16.00 | — | — | 16.00 | 1.53 |

| 9 | Karnataka | 5.00 | — | — | — | 9.00 | 14.00 | 1.34 |

| 10 | Kerala | — | — | — | — | 0.03 | 0.03 | 0.00 |

| 11 | Madhya Pradesh | — | — | 5.25 | 2.00 | — | 7.25 | 0.69 |

| 12 | Maharashtra | 11.00 | — | 5.00 | — | 5.00 | 21.00 | 2.00 |

| 13 | Orissa | 5.00 | — | 7.00 | — | 1.00 | 13.00 | 1.24 |

| 14 | Punjab | 2.00 | — | 6.00 | — | 1.33 | 9.33 | 0.89 |

| 15 | Rajasthan | 137.50 | — | 10.00 | 2.75 | 50.90 | 201.15 | 19.20 |

| 16 | Tamil Nadu | 5.00 | — | 5.00 | — | 7.05 | 17.05 | 1.63 |

| 17 | Uttarakhand | — | — | 5.00 | — | 0.05 | 5.05 | 0.48 |

| 18 | Uttar Pradesh | 5.00 | — | 7.00 | — | 0.38 | 12.38 | 1.18 |

| 19 | West Bengal | — | — | — | — | 2.05 | 2.05 | 0.20 |

| Total | 182.50 | 689.81 | 87.80 | 4.75 | 83.01 | 1047.87 | ||

Moreover, Table 6 shows that the installed capacity (1047.87 MW) under various policy measures is dominated by state policies (65.83%) which is in particular the success mantra of state of Gujarat (689.81 MW). The peculiarity of theses installation scenarios should be taken into account while devising the policy for future.

| Projects | Capacity (MW) | % of total |

|---|---|---|

| Projects under JNNSM | 182.5 | 17.42 |

| Projects under the state policy | 689.81 | 65.83 |

| Projects under RPSSGP/GBI scheme | 87.8 | 8.38 |

| Projects under REC scheme | 4.75 | 0.45 |

| Other projects | 83.01 | 7.92 |

| Total | 1047.87 | |

3.1. Development under JNNSM

To achieve the long-term goal of NAPCC, Jawaharlal Nehru National Solar Mission (JNNSM) was launched on 11th January, 2010, with an objective to maximize generation of power from solar energy. Thus, it also constitutes a major contribution by India to the global effort to meet the challenges of climate change. The immediate aim of the mission is to focus on setting up an enabling environment for solar technology penetration in the country both at a centralized and decentralized level [16].

Table 7 shows JNNSM’s targets with time line. The first phase (up to March 2013) focuses on promoting off-grid systems including hybrid systems to serve the population which is located in remote areas. For the first phase modest targets were set under the expectation that this development would bring down costs under enabling framework and support for entrepreneurs to develop markets. This cost reduction would help in creating conducive environment to achieve the ambitious targets of the second phase (2013–17) and third phase (2017–2022).

| 2010–2013 | 2013–2017 | 2017–2022 | |

|---|---|---|---|

| Utility grid power including roof top (MW) | 1000–2000 | 4000–10000 | 20000 |

| Off-grid solar applications (MW) | 200 | 1000 | 2000 |

| Solar collectors (sq. m) | 7 million | 15 million | 20 million |

To attract the investors, JNNSM devises various incentive instruments such as RE Voucher/Stamp, Capital Subsidy, Interest Subsidy, Viability Gap Funding (VGF), and Green Energy Bonds. However, the capacity built is only 182.5 MW which is concentrated around few states like Rajasthan (137.5 MW), Andhra Pradesh (12 MW), Maharashtra (11 MW), and so forth (refer: Table 5) under first phase (as on 31st of November, 2012). This seeks immediate attention of policy makers for reviewing their implementation strategy.

Recently announced JNNSM second phase policy mandate [17] includes the learning from the initial setback. It gives more weightage to state scheme (5400 MW) than central scheme (3600 MW) for target capacity installation (Table 8). It also focuses more on VGF for incentivizing the projects.

| Segment | Share (%) | Capacity | Central scheme | State scheme |

|---|---|---|---|---|

| Solar PV | 70 | 6300 | 2520 | 3780 |

| Solar thermal | 30 | 2700 | 1080 | 1620 |

| Total | 10000 | 3600 | 5400 | |

To make the efforts more concentrated and specific, in a recent initiative, MNRE has given approval to the development of 54 solar cities [18]. As of now (January 21, 2013), 8 master plans have been approved for eight cities—Agra and Moradabad from Uttar Pradesh; Thane and Kalyan-Dombivli from Maharashtra; Indore from Madhya Pradesh; Kohima from Nagaland; and Aizawl from Mizoram and Chandigarh [18]. Thus by reducing scale, MNRE expects better solar capacity development in the near future.

3.2. Development under REC

The REC mechanism is a market-based instrument to promote renewable sources of energy and development of market in electricity, leading to the sustainable development of the country. REC mechanism has been designed to address the mismatch between availability of renewable electricity and the requirement of the obligated entities to meet their RPO by purchasing green attributes of RE remotely located in the form of REC. The implementation issues as well as institutional framework for India have been discussed in detail by Singh [19, 20] and MNRE [21]. Goyal and Jha [22] discussed in detail the framework to promote RE through a framework which puts into place Renewable Purchase Obligation (RPO) mechanism.

In India, RECs trading began in March 2011, on the platform of Indian Energy Exchange (IEX) and Power Exchange of India (PXI). Though during initial period it could not perform as per expectation, but the performance has been improving during the last few months, as shown in Table 10. But still due to large unmet demand, solar REC price has been hovering around the forbearance price (Table 9) of Rs. 13400/REC. However, a recent notification by MNRE [23] which clarified state agencies for allowing use of solar REC to nonsolar RPO if it is above its minimum prescribed limit may increase the liquidity of solar REC market which is expected to decrease the price of it.

| REC prices till 2011 | REC prices for 2012–2015 | |

|---|---|---|

| Forbearance price | 17000 | 13400 |

| Floor price | 12000 | 9300 |

- *1 REC = 1 MWh.

- 21 USD = INR 54.5 as of September 20, 2012.

| Year | Month | Buy bids (REC) |

Sell bids (REC) |

Cleared volume (REC) |

Cleared price (Rs/REC) |

No. of participants |

|---|---|---|---|---|---|---|

| February | 11 | — | — | — | 1 | |

| March | 30,001 | — | — | — | 3 | |

| April | — | — | — | — | — | |

| May | — | — | — | — | — | |

| June | — | — | — | — | — | |

| 2011 | July | — | — | — | — | — |

| August | 1 | — | — | — | 1 | |

| September | 7 | — | — | — | 4 | |

| October | 1 | — | — | — | 1 | |

| November | 43 | — | — | — | 2 | |

| December | 495 | — | — | — | — | |

| January | 2,635 | — | — | — | 10 | |

| February | 582 | — | — | — | 9 | |

| March | 5,782 | — | — | — | 26 | |

| April | 289 | — | — | — | 9 | |

| May | 1,637 | 149 | 5 | 13,000 | 16 | |

| 2012 | June | 9,489 | 541 | 336 | 12,750 | 17 |

| July | 8,554 | 419 | 93 | 12,800 | 11 | |

| August | 1,728 | 310 | 129 | 12,850 | 13 | |

| September | 1,317 | 1,094 | 735 | 12,500 | 23 | |

| October | 1,263 | 864 | 820 | 12,680 | 19 | |

| November | 1,458 | 758 | 733 | 12,720 | 21 | |

| December | 1,608 | 977 | 931 | 12,620 | 36 | |

Though the capacity installed under this mechanism is only 4.75 MW (Table 6), but capacity registered under this mechanism has reached close to 20 MW [24]. And the present high price of REC holds bright prospects for this newly launched incentive scheme.

3.3. Development under RPSSGP/GBI Scheme

Rooftop Photovoltaic (PV) and Small Solar Power Generation Programme (RPSSGP) is a Generation-Based Incentives (GBIs) programme of the Ministry of New and Renewable Energy (MNRE) under the JNNSM for rooftop and other small solar plants. As of now, the installed capacity of 87.8 MW, which is well distributed across many states (Table 5), has been developed under this scheme. Due to limited access to smart grid/net metering connectivity, this incentive has not yet been harnessed to its fullest by the developers.

3.4. Development under the State Policy

Most of the states have been using preferential tariffs as a tool to promote solar energy in their states (Table 11). But, due to huge financial burden, states of Gujarat and Andhra Pradesh have switched their focus from preferential tariff to REC market in their recently announced solar policies [25, 26]. Moreover, state of Gujarat has also made provision for sharing Clean Development Mechanism (CDM) benefits to developers, starting from 100% in first year after commissioning, and thereafter reducing it by 10% every year till the sharing becomes equal (50 : 50) between the developers and the consumers [25].

| State/centre | Solar PV | Solar thermal | ||

|---|---|---|---|---|

| Tariff (Rs/kWh) | Control period | Tariff (Rs/kWh) | Control period | |

| CERC |

|

FY 2012-2013 |

|

FY 2012-2013 |

| Andhra Pradesh |

|

2010-2011 and 2011-2012 |

|

2010-2011 and 2012-2013 |

| Bihar |

|

Up to March 31, 2015 commissioning |

|

Up to March 31, 2015 commissioning |

| Gujarat |

|

Jan 29, 2012 to March 31, 2015 |

|

Jan 29, 2012 to March 31, 2015 |

| Haryana |

|

3 years (till FY 2013–FY 2015) | 12.17 | 3 years (till FY 2013–FY 2015) |

| Karnataka | 14.5 (including rooftop and small solar PV plants) | Up to March 31, 2013 commissioning | 11.35 | Up to March 31, 2013 commissioning |

| Kerala | 15.18 (including incentives) | For projects commissioned before Dec. 31, 2009 | ||

| Madhya Pradesh |

|

Aug 2012 to March 2014 | 12.65 | Aug 2012 to March 2014 |

| Maharashtra |

|

FY 2010–2014 (5 years from the date of commencement) |

|

FY 2010–2014 (5 years from the date of commencement) |

| Orissa |

|

Plant commissioned in FY (2012-2013) onwards |

|

Plant commissioned in FY (2012-2013) onwards |

| Punjab |

|

FY 2012–2016 (5 years from the notification of order) |

|

FY 2012–2016 |

| Rajasthan |

|

|

FY 2012-2013 | |

| Tamil Nadu |

|

FY 2010-2011 (till 31/05/12) |

|

FY 2010-2011 (till 31/05/12) |

| Uttarakhand |

|

FY 2009–2012 (3 years from the commencement of these regulations) |

|

FY 2009–2012 (3 years from the commencement of these regulations) |

| Uttar Pradesh | 15 (commissioned by Dec 2011, not covered under GOI incentive scheme) | FY 2010–2014 (5 years) | 13 (commissioned by Dec 2011, not covered under GOI incentive scheme) | FY 2010–2014 (5 years) |

| West Bengal |

|

FY 2013–2017 (5 years) | NA | NA |

Likewise several states have also come up with many other encouraging policies like Accelerated Depreciation (AD) on capital investment, soft loan for financing, reduced or no transmission and wheeling charges, no cross subsidy surcharge for open-access transactions, reduced or no intra-state Availability-Based Tariff (ABT), nonapplicability of merit order dispatch principles, exemption from electricity tax, tax concessions, refund of stamp duty and registration charges paid for land purchase, single window clearance, faster power evacuation approval, and so forth [25–27].

4. Conclusion

The study concludes that though JNNSM first phase could not perform up to the expectations, the state level policies have been doing well to fill the gap. The recently announced JNNSM Phase II target composition of 3600 MW for central and 5400 MW for states, changes in policies and schemes in light of the experience of Phase I, and development of 54 solar cities are likely to impact the National Solar Mission performance and enhance the overall visibility of solar-based electricity generation and utilization.

Abbreviations

-

- CDM:

-

- Clean development mechanism

-

- CSP:

-

- Concentrated solar power

-

- DNI:

-

- Direct normal irradiance

-

- FiT:

-

- Feed-in tariff

-

- GBIs:

-

- Generation-based incentives

-

- GoI:

-

- Government of India

-

- IEX:

-

- Indian energy exchange

-

- IMD:

-

- Indian meteorological department

-

- JNNSM:

-

- Jawaharlal Nehru national solar mission

-

- MNRE:

-

- Ministry of new and renewable energy

-

- NAPCC:

-

- National action plan for climate change

-

- NREL:

-

- National renewable energy laboratory

-

- PV:

-

- Photovoltaic

-

- PXI:

-

- Power exchange of India

-

- RE:

-

- Renewable energy

-

- REC:

-

- Renewable energy certificate

-

- RPO:

-

- Renewable purchase obligation

-

- RPSSGP:

-

- Rooftop photovoltaic and small solar power generation programme

-

- SERC:

-

- State electricity regulatory commission

-

- SHP:

-

- Small hydropower

-

- VGF:

-

- Viability gap funding.