Dynamic Properties of the Solow Model with Increasing or Decreasing Population and Time-to-Build Technology

Abstract

We introduce a time-to-build technology in a Solow model with nonconstant population. Our analysis shows that the population dynamics may be a source of stability switches and Hopf bifurcations. The analytical results are obtained using the recent technique introduced by Beretta and Kuang (2002) in the studying of delayed differential equations with delay-dependent coefficients in characteristic equation. Numerical simulations are performed in order to illustrate the main dynamic features of the model.

1. Introduction

The relationship between economic activity and population dynamics is a multifaceted issue. On the one hand, demographic changes affect many economic variables such as labour force [1] or public spending for pension system [2–4]; on the other hand, macroeconomic environment may influence fertility choices [5–7], life time expectation [8, 9], and emigration and immigration decisions [10].

Taking into account these aspects, many authors have built models in which nonlinear mechanisms are sources of oscillating trajectories of the main demoeconomic variables. Day at al. [11] show the possibility of chaotic dynamics in a discrete overlapping generations model in which agents are assumed to determine the number of children in a trade-off between the cost of childbearing and private consumption; Feichtinger and Sorger [12] introduce, according to Easterlin theory, some feedback mechanisms into population dynamics able to generate oscillating birth trajectories; Benhabib and Nishimura [13] and Feichtinger and Sorger [12] show the existence of nonlinear dynamics in neoclassical models of fertility; Manfredi and Fanti [14, 15] study the occurrence of limit cycles or complex behaviours in Goodwin-type models in which the dynamics of the population of workers is introduced; Fanti and Gori [16] study the possibility of cyclical instability in an overlapping generations model with pay-as-you-go pension scheme.

In this paper we analyze another source of endogenous fluctuations in demoeconomic variables. In particular we focus on the relation between neoclassical production, population dynamics, and stability of equilibrium path using a Solow-type framework in which population evolves at a constant (positive or negative) rate and a time-to-build technology is introduced. From a theoretical point of view, it is interesting to note that in standard versions of the Solow and Ramsey models without delays but with a positive rate of population growth, because of the assumption of constant returns to scale, (i) the size of population does not influence the long run growth rate of the economy (this property is not shared by many endogenous growth models à la Romer that suffer from an unrealistic scale effect (see the criticism and the alternative approach proposed by Jones [26] who studies a model with results really similar to the Solow model)); (ii) the rate of growth of population determines the long run rate of capital accumulation to which the economy converges; (iii) there exists a unique globally attracting equilibrium, and trajectories converge monotonically to it (see [17, 18]). Instead, if population is decreasing and the interior equilibrium acts as a watershed for the trajectories of the model and the ratio of capital to labour and according to initial conditions may converge to zero or be divergent. Nevertheless, in all cited works, it is worthy to note that the time series seems to be too regular in order to describe the real evolutions of economic variables.

Instead, if temporal lags in the production of capital goods are introduced and the rate of growth of population is different from zero, the dynamical system that describes the time evolution of per capita physical capital and the associated characteristic equation involve delay-dependent coefficients. In this case, the results are really different with respect to models (e.g., [19–22]) with fixed population size (and then with delay independent parameters). In particular stability switches as well as Hopf bifurcations may arise for realistic values of time delay.

From an analytical point of view, in order to characterize the local dynamics of the system, we will use the recent approach introduced by Beretta and Kuang [23] and based on the existence of real zeros of particular functions Sj(τ). We will show that if n ≠ 0 then the system is able to produce stability switches and Hopf bifurcations when time delay varies. The paper is organised as follows. Section 2 presents the model. Section 3 studies the dynamic phenomena; Section 4 concludes the paper.

2. The Model

Lemma 1. For every τ ≥ 0, there exist a unique positive equilibrium if n > 0 and a unique positive equilibrium if n < 0 and δ + n > 0.

3. Stability and Existence of Hopf Bifurcation

Lemma 2. Let n ≠ 0. Then (8) has a positive root given by

Proof. Solving (8) for ω leads to (9), which is well defined if |(1 − α)δe−nτ − αn| > |n|. When n > 0, this means |(1 − α)δe−nτ − αn| > n; that is, (1 − α)δe−nτ − αn < −n and (1 − α)δe−nτ − αn > n. The first of these two inequalities yields 0 < δe−nτ < −n < 0. Let n < 0. Then the above condition reduces to (1 − α)δe−nτ − αn > −n. The conclusion follows.

Corollary 3. (1) Let n < 0. Then condition (10) is equivalent to τ > 0.

(2) Let n > 0. Then condition (10) is equivalent to

Proof. Let n < 0. Then (10) is (1 − α)δe−nτ − αn > −n. Hence, we get δe−nτ > −n, which is always satisfied being δ + n > 0 in this case. Let n > 0. Then (10) becomes (1 − α)δe−nτ − αn > n. A direct calculation yields the statement.

Proposition 4. The characteristic equation (6) has a pair of simple pure imaginary roots λ = ±iω*, ω* = ω(τ*) > 0, at τ* ∈ Γ, provided Sj(τ*) = 0 for some j ∈ ℕ0. Moreover, this pair of simple conjugate purely imaginary roots crosses the imaginary axis from left to right if Λ(τ*) > 0 and crosses the imaginary axis from right to left if Λ(τ*) < 0, where

Proof. First, we prove that λ = iω* is a simple root of (6). If λ = iω* is a repeated root, then D(iω*, τ*) = D′(iω*, τ*) = 0 holds true, leading to 1 + (iω* + n)τ* = 0, which is a contradiction. Differentiating (6) with respect to τ, we find

- (1)

Sj(τ) > Sj+1(τ), for τ ∈ Γ and j ∈ ℕ0. Therefore, Sj has no zeros in Γ for any j ∈ ℕ0 if S0 has no zeros in Γ.

- (2)

From (9), we have ω(0) > 0. Hence, S0(0) < 0.

- (3)

As , ω(τ) → 0, we derive S0(τ)→−∞ as .

- (4)

As τ → +∞, ω(τ)→+∞, we get S0(τ)→+∞ as τ → +∞.

Without loss of generality, we may suppose that if Sj(τ) has positive zeros, then dSj(τ)/dτ ≠ 0 at these points; that is, the zeros are simple. Applying Hopf bifurcation theorem for functional differential equations (see Hale’s book [25]), we can conclude the existence of a Hopf bifurcation.

Summing up all the above analysis, we can state the main results in the next two Theorems.

Theorem 5. Let n < 0.

- (i)

A stability switch always exists in (0, +∞) since the function S0(τ) has at least one positive simple zero in (0, +∞).

- (ii)

The function Sj(τ) has a finite number of positive simple zeros in (0, +∞), for any j ∈ ℕ0 and the number of these roots is odd; say τ1, τ2, …, τ2N+1 (τ1 < τ2 < ⋯<τ2N+1), respectively.

- (ii1)

Equation (3) undergoes a Hopf bifurcation at the equilibrium k* when τ = τr, r = 1,2, …, 2N + 1.

- (ii2)

k* is locally asymptotically stable for τ ∈ [0, τ1)∪(τ2l, τ2l+1) (l = 0,1, 2, …, N; τ0 = 0) and unstable if τ ∈ (τ2l+1, τ2l+2) (l = 0,1, 2, …, N; τ2N+2 = +∞).

- (ii1)

Theorem 6. Let n > 0.

- (i)

If α ≥ (δ − n)/(δ + n) holds or if α < (δ − n)/(δ + n) and the function S0(τ) has no positive simple zeros in (0, τc), then the equilibrium k* is locally asymptotically stable for all τ ∈ [0, τc).

- (ii)

If α < (δ − n)/(δ + n) holds, then the function Sj(τ) has a finite number of positive simple zeros in (0, τc), for any fixed j ∈ ℕ0 and the number of these roots is even; say τ1, τ2, …, τ2N (τ1 < τ2 < ⋯<τ2N), respectively.

- (ii1)

Equation (3) undergoes a Hopf bifurcation at the equilibrium k* when τ = τr, r = 1,2, …, 2N.

- (ii2)

k* is locally asymptotically stable for τ ∈ [0, τ1)∪(τ2l, τ2l+1) (l = 0,1, 2, …, N; τ0 = 0 and τ2N+1 = τc) and unstable if τ ∈ (τ2l+1, τ2l+2) (l = 0,1, 2, …, N − 1).

- (ii1)

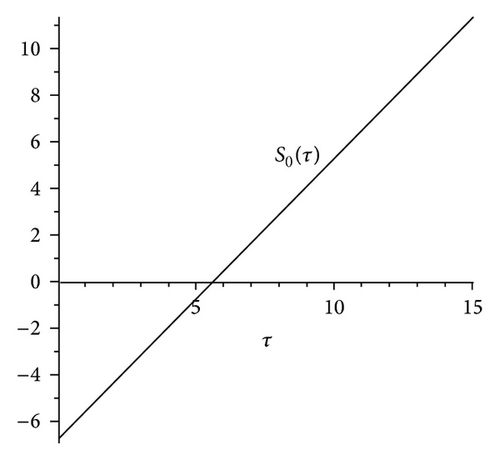

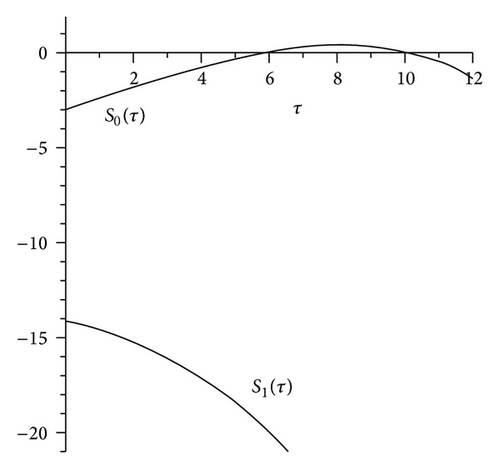

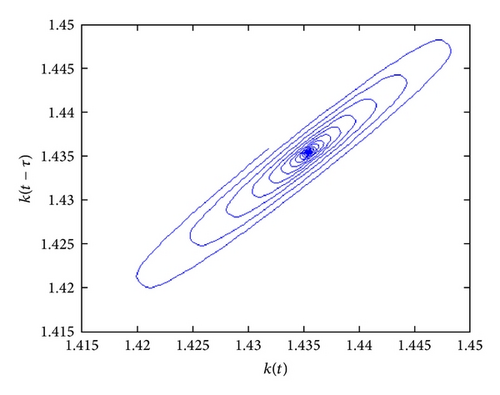

In the whole section τ may be interpreted as the number of months before capital can be used for production. We first consider (26). Figure 1 shows the existence of a unique zero for S0, τ1≅5.463. According to Theorem 5 the equilibrium is locally asymptotically stable for τ < τ1 and undergoes a Hopf bifurcation for τ = τ1. Just after this value a closed invariant curve exists. For large enough value of time delay no feasible trajectories exist.

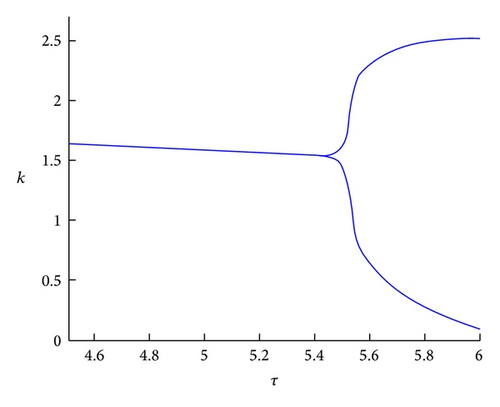

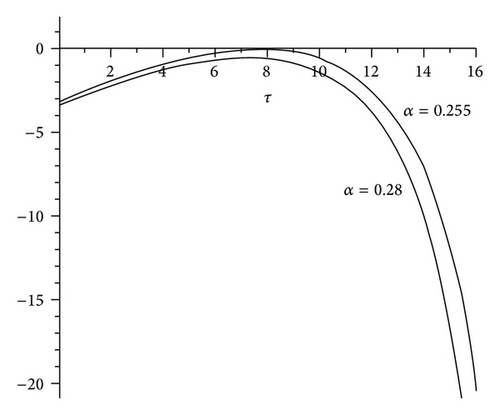

We now consider (27). If α is large enough (α > 0.791) we are in case (i) of Theorem 6 and no zero for S0 exists and the equilibrium is locally asymptotically stable. Numerically we verify that no zero exists until α > αtr , where αtr ≅0.255 is the value of alpha such that S0 is tangent to horizontal axis (see Figure 2(a)).

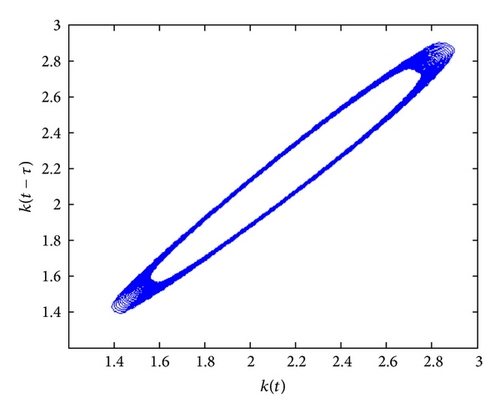

For α ∈ (0, αtr ) S0 has two positive zeros. We set α = 0.23 (see Figure 2(b)). The zeros of S0 are τ1≅5.7812 and τ2 = τN≅10.234.

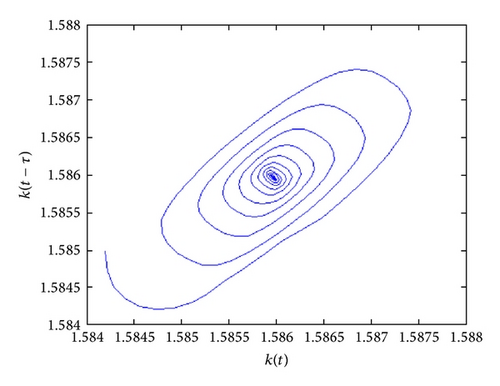

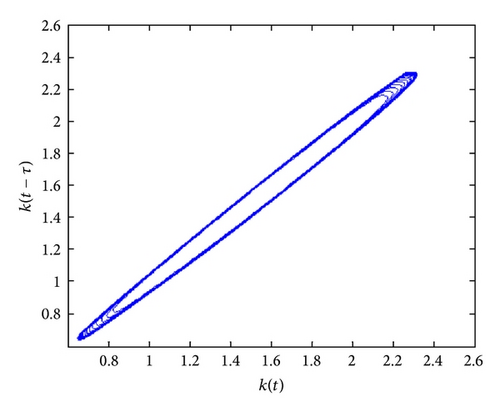

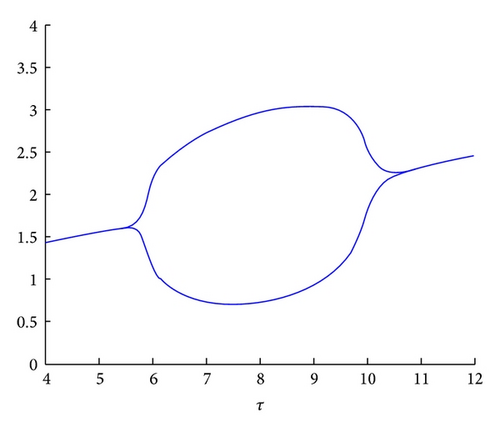

According to case (ii) in Theorem 6, we have that, for all τ ∈ (0,5.7812), the equilibrium is stable; for τ = 5.7812 the equilibrium undergoes a supercritical Hopf bifurcation and for τ ∈ (5.7812,10.234) a closed curve captures trajectories starting close enough to the unstable equilibrium; finally, for τ = 12.653 equilibrium undergoes a second Hopf bifurcation and the equilibrium becomes stable again (see the set of Figure 3). No other bifurcation occurs for larger values of τ.

4. Conclusions

In this paper we have presented a theoretical explanation of economic cycles due to demographic reasons. Our model makes use of the Solow model with exogenous saving rate, exogenous population growth, and time-to-build technology. The economic and demographic variables are related through production function. The model proposed in this paper has several features that distinguish it from other approaches to nonlinear evolution of demoeconomic variables. Different from some contributions on the topic (see, e.g., [1]), we do not introduce ad hoc feedback mechanisms in order to describe non linear phenomena. Furthermore, we do not model other sources of nonlinearities such as the age structure (see [12]) of population or behavioural assumptions on fertility rate or optimizing decisions on the number of children (see [13]). Nonetheless, comparable results in terms of dynamical properties are obtained. Thus, we can conclude that the existence of persistent cycles seems to be a quite general result because it relays on the coexistence of capital and nonconstant labour in production of goods. From a mathematical point of view, we have shown that the introduction of population dynamics drastically changes the results of the model with respect to the case n = 0 (see [22]). If n ≠ 0, the system is able to produce stability switches and Hopf bifurcations when time delay varies not observable for n = 0. In particular we have seen that when n < 0, time delay may play a destabilising role for intermediate values of the parameter and eventually it may stabilise.