Numerical Solutions of a Variable-Order Fractional Financial System

Abstract

The numerical solution of a variable-order fractional financial system is calculated by using the Adams-Bashforth-Moulton method. The derivative is defined in the Caputo variable-order fractional sense. Numerical examples show that the Adams-Bashforth-Moulton method can be applied to solve such variable-order fractional differential equations simply and effectively. The convergent order of the method is also estimated numerically. Moreover, the stable equilibrium point, quasiperiodic trajectory, and chaotic attractor are found in the variable-order fractional financial system with proper order functions.

1. Introduction

Variable-order fractional calculus (i.e., the fractional differentiation and integration of variable order) is the generalization of classical calculus and fractional calculus, which were invented by Newton and Leibnitz hundreds of years ago. Now the study on it becomes a hotpot in recent ten years [1–6]. It has turned out that many problems in physics, biology, engineering, and finance can be described excellently by models using mathematical tools from variable-order fractional calculus, such as mechanical applications [4], diffusion process [5], multifractional Gaussian noise [7], and FIR filters [8]. For more details, see [6, 9] and references therein.

As the generalized form of fractional differential equations (see [10–13] for a comprehensive review of fractional calculus and fractional differential equations), the variable-order fractional differential equations mean the differential equations with variable-order fractional derivatives [2, 4–6, 9]. For lack of direct viewing physical interpretation, the variable-order fractional calculus developed at a very low pace during the foregone several decades. In 1995, the fractional integration and differentiation of variable-order fractional are studied by Samko in [2], which contains mathematical analysis of variable-order fractional differential and integral operators but not variable-order fractional models. The later research results have shown that many complex physical phenomena can be better described by using variable-order fractional differential equations. For instance, an experimental investigation of temperature-dependent variable-order fractional integrator and differentiator is presented in [9]. Based on the investigation, it is easier to understand the physical meaning of variable-order fractional calculus and better to know how the variable-order fractional operators are applied in physical processes. As a concrete example, the variable-order fractional calculus through the description of a simple problem in mechanics is presented in [4]. A mathematical definition for the variable-order fractional differential operator is given and suitable for mechanical modelling therein. But to the best of our knowledge, there is no financial system described in variable-order fractional sense. We eagerly attempt to study the numerical methods for variable-order fractional differential equations and find their high-order numerical solutions.

Unfortunately, most variable-order fractional differential equations do not have an exact analytical solution, even with simply constant coefficients, since the order of equations is a function but not an integer. Thus the effective and applicable numerical techniques for solving such equations are always needed. The Adams-Bashforth-Moulton method, studied and discussed penetratingly in [14, 15], is a type of predictor-corrector methods and a relatively new approach to provide numerical approximation to various nonlinear problems, including fractional differential equations. In recent years, the application of the method is extended to more concrete physical and mathematical models (for more details, see [16–26]). But the work on numerical methods for variable-order fractional differential equations is still less common. Motivated by the work mentioned previously, we want to employ the Adams-Bashforth-Moulton method for solving a variable-order fractional financial system and obtain its high-order numerical results.

The remainder of the paper is organized as follows. In Section 2, we give some definitions and mathematical background of variable-order fractional calculus which are essential for understanding the financial system. In Section 3, we introduce the known Adams-Bashforth-Moulton method. In Section 4, numerical experiments are given. The effectiveness of the Adams-Bashforth-Moulton method for solving variable-order fractional differential equation is illustrated, and the convergent order is also estimated. Finally, we propose our conclusions in Section 5.

2. Preliminaries

In this part, we give some definitions of fractional derivative and variable-order fractional derivative. There exist different approaches for defining the fractional derivatives [11]; the common used cases are called Grünwald-Letnikov definition, Riemann-Liouville definition, and Caputo definition.

Definition 2.1 (see [11], [14].)Let n be a positive integer; then the nth order derivative of a given differentiable function f(t) is

Similarly, replacing integer n with noninteger q, one can have the following Grünwald-Letnikov fractional differential derivative.

Definition 2.2 (see [11], [14].)Let q be a positive real number, f ∈ 𝒞m[a, b], a ≤ t ≤ b and m = [q] + 1. Then

For describing the definitions of fractional differential operator and variable-order fractional differential operator of other types, we need the following Euler′s Gamma function.

Definition 2.3 (see [11], [14].)The function Γ : (0, +∞) → ℝ, defined by

Definition 2.4 (see [11].)The Riemann-Liouville fractional order derivative of f(t) is defined as

Definition 2.5 (see [11], [14].)Let q > 0 be a real number, f ∈ 𝒞m[0, t] and 0 ≤ τ ≤ t. Then the Caputo fractional derivative of f(t) is defined as

According to the previous definitions of fractional derivative, we can propose the variable-order fractional differential operator now. Replacing the constant order with a given function, the fractional derivative is indeed extended to the variable-order fractional sense.

Definition 2.6. Let q(t) be a positive real number, f ∈ 𝒞m[0, T], t ≤ T, and m = [max 0≤t≤T{q(t)}] + 1. Then

Definition 2.7. The Riemann-Liouville variable-order fractional derivative of f(t) is defined as

Definition 2.8 (see [1].)Let q(t) > 0 be a continuous and bounded function, f(τ) ∈ 𝒞m[0, t], and 0 ≤ τ ≤ t. Then

Remark 2.9. In most modelling applications, we note that the Caputo version is usually preferred in the descriptions of financial and physical models, because the initial conditions of the system have a straightforward financial and physical meaning, and therefore it is in general possible to provide these data, for example, by suitable measurements. Here, we consider the objective function f(·) in the interval [0, T] and suppose that f(·) satisfies some smoothness conditions in every subinterval of (0, t) with t ≤ T. For the sake of simplification, our fractional operator can be simplified as Dq.

Since the variable-order fractional differential operators are related to integration or summation, it may lead to the various definitions of such variable-order fractional differential operators: (1) to let the argument of q be the current time instant t; (2) to let the argument of q be the same as that of f, which is the integration variable τ. There is no need to list all the possible definitions of Grünwald-Letnikov variable-order fractional derivative, Riemann-Liouville variable-order fractional derivative, and Caputo variable-order fractional derivative here. For their concrete definitions, we refer to [6, Definition 6–14].

There is one more fundamental difference between differential operator of integer order and variable-order fractional (including fractional order) derivatives [14]. The former are local operators, and the latter are not. The meaning of “local” here is as follows. In order to calculate Dnf(x) for n ∈ ℕ, it is sufficient to know f in an arbitrarily small neighborhood of x. This follows from the classical representation of Dn as a limit of a difference quotient, and it also tells us a truth that the classical differential operator does not have memory property. However, to calculate Dnf(x) for n ∉ ℕ (i.e., n is a function related to x, or n is not an integer), the definitions tell us that we need to know f throughout the entire interval [0, x]. All the historical data are related to the current state value, and therefore we say that the fractional order differential operators and variable-order fractional differential operators have memory property. Specifically, since the variable-order fractional differential operator employs function as order, it does have time-varying long memory property when the order function is related to time.

3. The Adams-Bashforth-Moulton Method

Remark 3.1. Since the Adams-Bashforth-Moulton method has been successfully applied in differential equations with fixed fractional order, and the stability of the Adams-Bashforth-Moulton method has been verified in [14], then it is unnecessary to repeat them here. For variable-order fractional case, the fractional order is bounded, so that every iteration can be treated as one single step iteration for different fixed fractional orders. In what follows, we provide a test example to illustrate the effectiveness of such method in solving differential equations of variable-order fractional derivatives.

4. Numerical Experiments

In this section, two numerical examples are considered. In the first simple example, we compute its numerical solution with different step sizes and estimate the convergent order. While in the second example, it is found that with some proper parameters and order functions, the variable-order fractional financial system exhibits the stable equilibrium point, quasiperiodic trajectory, and chaotic motion. Three different cases, the integer order case, the fractional order case, and the variable-order case, are studied separately. Therefore we can see how different behaviors appear.

Example 4.1. Consider the following differential equation [29]:

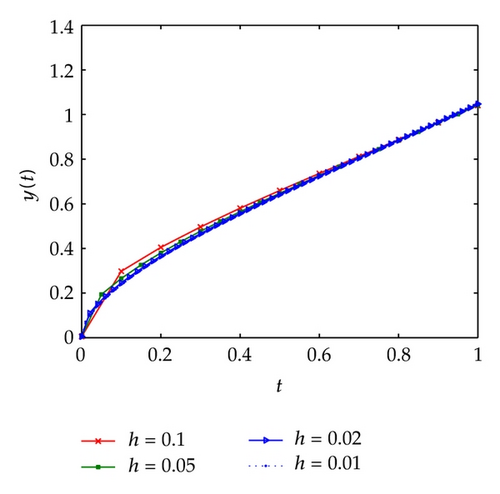

Applying the Adams-Bashforth-Moulton method, we evaluate the numerical solutions with different step sizes. Figure 1 shows the approximate solution for Example 4.1. From the figure, it is clear to see that the Adams-Bashforth-Moulton method can solve variable-order fractional differential equation simply and effectively. Moreover, we estimate the posteriori error and convergent order of the Adams-Bashforth-Moulton method in calculation which are shown in Table 1.

| Nodes | Step sizes | Maximum error | Convergent order α |

|---|---|---|---|

| 10 | h = 0.10 | 0.06266509659082 | 1.203 |

| 20 | h = 0.05 | 0.03020056515385 | 1.168 |

| 50 | h = 0.02 | 0.01002178106628 | 1.177 |

| 100 | h = 0.01 | 0.00329319942345 | 1.241 |

- Note: when estimating the convergent order, we employ formula α = log(maximum error)/log(step size). The theoretical convergent order provided by (3.7) is 1.667. We take the numerical solution with step size h = 0.005 as the exact results.

Furthermore, we can apply the corrector step in Adams-Bashforth-Moulton method for more times when solving fractional differential equations, since it has been shown that the number of corrector steps may be usefully varied to improve the convergence order, based on the fractional differential equations [14]. In what follows, applying the computing procedures once again, we treat the corrected value as predicted value and obtain more accurate numerical solutions. The study results are shown in Table 2.

| Nodes | Step sizes | Maximum error | Convergent order α |

|---|---|---|---|

| 10 | h = 0.10 | 0.00530525964432 | 2.275 |

| 20 | h = 0.05 | 0.00255679554111 | 1.993 |

| 50 | h = 0.02 | 0.00084844919337 | 1.808 |

| 100 | h = 0.01 | 0.00027880397466 | 1.777 |

Example 4.2. Consider the following variable-order fractional financial system:

We will solve the financial system (4.2) above by using the Adams-Bashforth-Moulton method. It is found that the variable-order fractional financial system (4.2) can exhibit the stable equilibrium point, quasiperiodic trajectory, and chaotic motion with different order functions. The phase portrait and largest Lyapunov exponent are used to identify the dynamics of the financial system (4.2). The positive largest Lyapunov exponent implies that the financial system (4.2) will generate chaotic motion. The dynamics of the financial system (4.2) is somewhat different from classical financial system whose order functions remain one, which is discussed in [30, 31]. In what follows, we start to study this example in three cases, and then see how different behaviors appear.

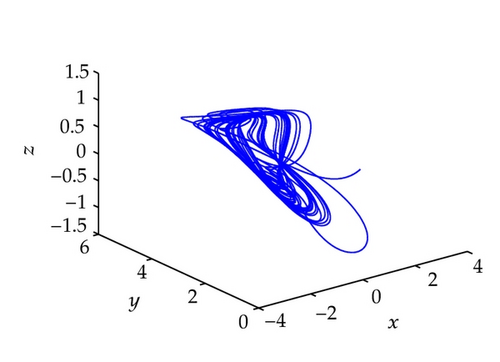

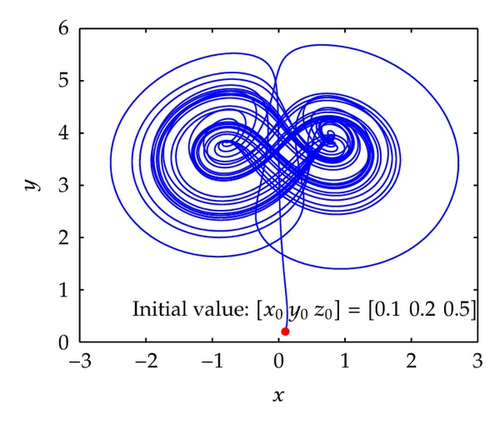

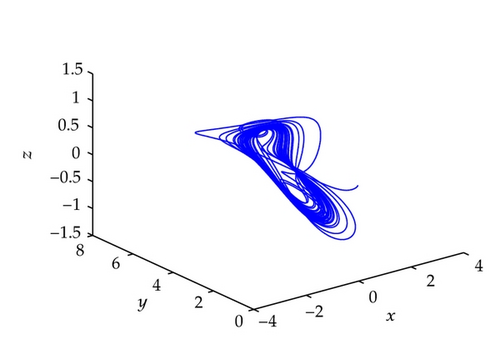

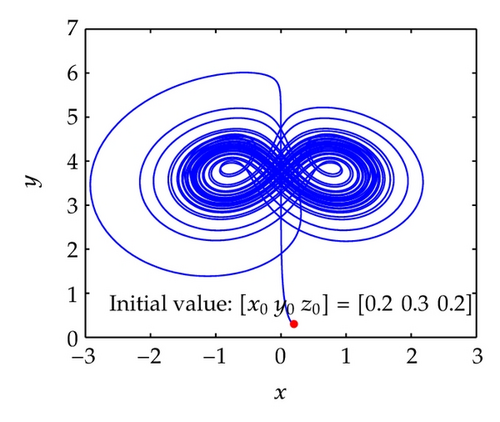

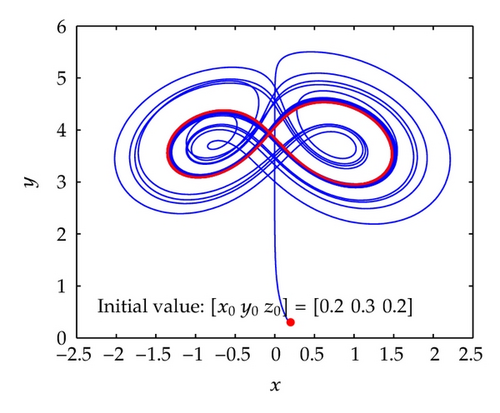

Case 1 (the integer order case). Let q1 = q2 = q3 = 1. Now the financial system (4.2) becomes a classical ordinary differential system. By the Adams-Bashforth-Moulton method, we can easily compute its numerical results and observe that the financial system (4.2) exhibits chaotic motion. The largest Lyapunov exponent of the system is 0.2292. The following Figure 2 shows our numerical simulations.

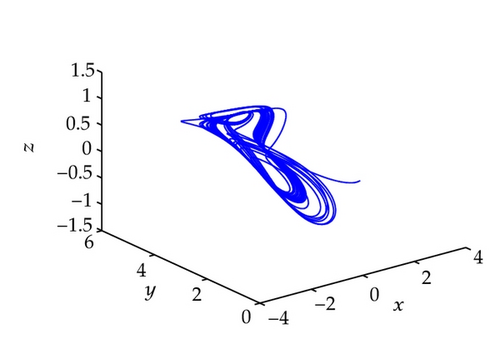

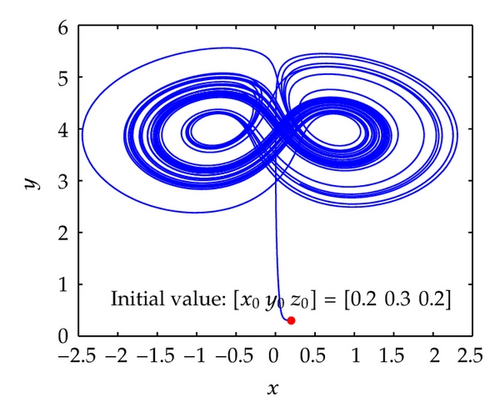

Case 2 (the fractional order case). First we choose the commensurate fractional order case: q1 = q2 = q3 = 0.95. Now the financial system (4.2) becomes a fractional order differential system. By the Adams-Bashforth-Moulton method, we can easily compute its numerical results and observe that the financial system (4.2) exhibits chaotic motion. The largest Lyapunov exponent of the system is 0.1734. Figure 3 shows our numerical simulations.

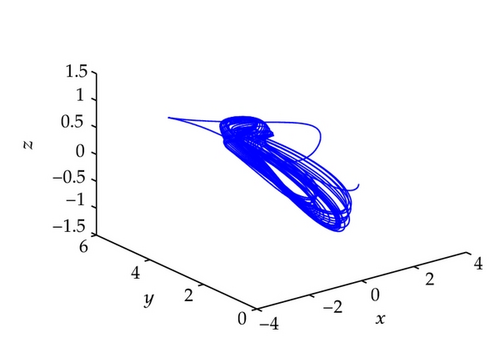

Furthermore, we consider the incommensurate fractional order case: q1 = 0.79, q2 = 0.95, q3 = 0.99. Now the financial system (4.2) also becomes a fractional order differential system. By the Adams-Bashforth-Moulton method, we can easily compute its numerical results and observe that the financial system (4.2) exhibits chaotic motion. The largest Lyapunov exponent of the system is 0.1551. Figure 4 shows our numerical simulations.

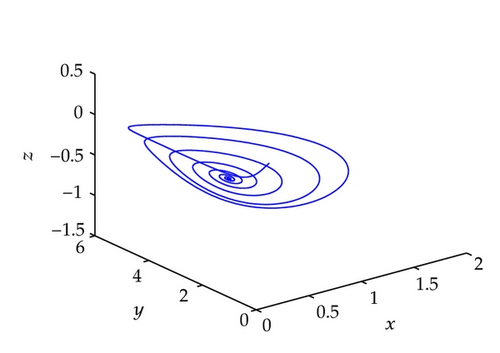

Case 3 (the variable-order case). Firstly, we choose q1(t) = 0.76 − (0.01/100)t, q2(t) = 0.88 − (0.06/100)t, and q3(t) = 0.82 − (0.36/100)t with t ∈ [0,100], which are rigid monotony decrease functions. Now the financial system (4.2) becomes a variable-order fractional financial system. Figure 5 shows the approximate solutions for Example 4.2. From the figure, it is clear to see that the Adams-Bashforth-Moulton method can solve variable-order fractional differential equation simply and effectively, and financial system (4.2) tends to the stable equilibrium point.

Secondly, we choose q1(t) = 0.99 − (0.01/100)t, q2(t) = 0.85 − (0.01/100)t, and q3(t) = 0.89 − (0.01/100)t with t ∈ [0,200], which are rigid monotony decrease functions. Now the financial system (4.2) becomes a variable-order fractional financial system. Figure 6 shows the approximate solutions for Example 4.2. From the figure, it is clear to see that the Adams-Bashforth-Moulton method can solve variable-order fractional differential equation simply and effectively, and financial system (4.2) tends to the quasiperiodic trajectory.

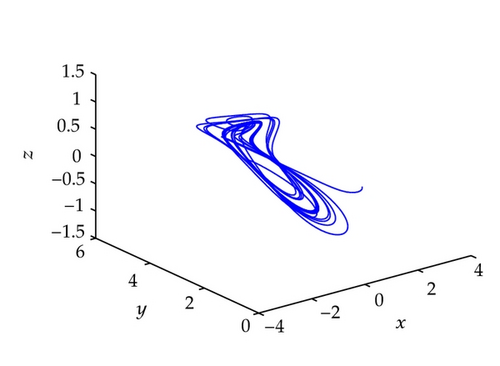

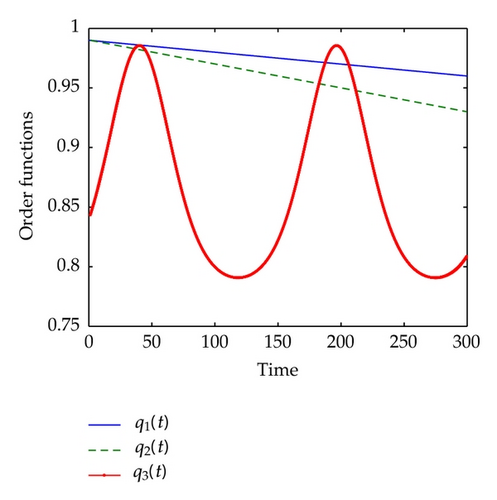

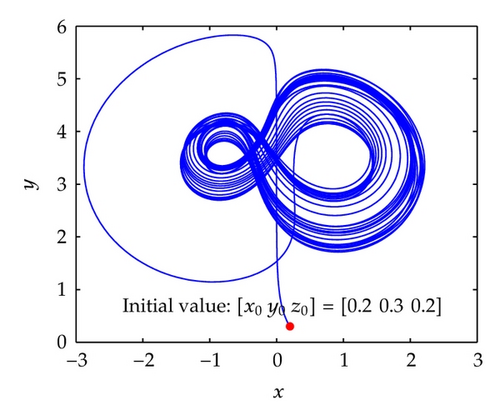

Furthermore, we study variable-order fractional financial system (4.2) with nonlinear order functions. In simulation, by choosing q1(t) = 0.99 − (0.01/100)t, q2(t) = 0.99 − (0.02/100)t, and q3(t) = (1/12)esin ((1/25)t) + 0.76 with t ∈ [0,300], we see that the chaotic attractor exists in such financial system. The largest Lyapunov exponent of the system is 0.1340. The following Figures 7 and 8 illustrate the order functions and numerical solution we obtain.

In practice, the stable equilibrium point and quasiperiodic trajectory mean that the financial system is stable during evolution, while the chaotic motion implies that the financial system is unpredictable.

5. Conclusions

Variable-order fractional calculus has been highly neglected since it was proposed. Nevertheless, the scientific community has found a large variety of applications which can be modeled and more clearly understood by using this branch of mathematics. Proposed as a generalization of a fractional financial system, a variable-order fractional financial system, which consists of interest rate, investment demand, and price index, has been studied in this paper. By using the Adams-Bashforth-Moulton method, we obtain the numerical solution of the variable-order fractional financial system. We estimate the convergent order of the Adams-Bashforth-Moulton method, which satisfies our theoretical analysis. Moreover, it is found that the variable-order fractional financial system exhibits chaotic attractor when proper order functions are chosen. According to the numerical examples, we can easily conclude that the Adams-Bashforth-Moulton method is a powerful technique to calculate approximate solutions of variable-order fractional equations.

Last but not the least, we hope our work about variable-order fractional calculus would generate interest from related scholars in the future and also hope that their work may result in significant contributions to this field.

Acknowledgments

The authors would like to thank the main editor and anonymous referees for their valuable comments and suggestions leading to improvement of this paper. The first author is partly supported by the National Natural Science Foundation of China (Grant no. 70921001), Research Fund for the Humanities and Social Sciences of Higher Education of China (Grant no. 06JD82002), and the Philosophy and Social Science Foundation Commissioned Project of Hunan Province, China (Grant no. 2010JD02). The second author is supported by the National Foundation for Studying Abroad (no. 201206370079).