Sharpe (Ratio) Thinking about the Investment Opportunity Set and CAPM Relationship

Abstract

In the presence of a risk-free asset the investment opportunity set obtained via the Markowitz portfolio optimization procedure is usually characterized in terms of the vector of excess returns on individual risky assets and the variance-covariance matrix. We show that the investment opportunity set can alternatively be characterized in terms of the vector of Sharpe ratios of individual risky assets and the correlation matrix. This implies that the changes in the characteristics of individual risky assets that preserve the Sharpe ratios and the correlation matrix do not change the investment opportunity set. The alternative characterization makes it simple to perform a comparative static analysis that provides an answer to the question of what happens with the investment opportunity set when we change the risk-return characteristics of individual risky assets. We demonstrate the advantages of using the alternative characterization of the investment opportunity set in the investment practice. The Sharpe ratio thinking also motivates reconsidering the CAPM relationship and adjusting Jensen′s alpha in order to properly measure abnormal portfolio performance.

1. Introduction

The mean-variance model of asset choice has been proposed by Markowitz [1] and used extensively in finance principally due to a strong intuitive appeal and the existence of closed-form solutions to the optimal portfolio choice and equilibrium problems. The papers by Merton [2] and Roll [3] are the two seminal papers where the authors provide a rigorous characterization of the investment opportunity set in the absence and in the presence of a risk-free asset.

In the absence of a risk-free asset the investment opportunity set is characterized by the vector of expected returns on risky assets and the variance-covariance matrix. In the presence of a risk-free asset the investment opportunity set is characterized by the vector of excess returns on risky assets and the variance-covariance matrix. To demonstrate the classical characterization of the investment opportunity set one typically employs a two-dimensional standard deviation-expected return space. Next one illustrates the construction of the minimum-variance frontier of risky assets. In the absence of a risk-free asset the efficient part of the minimum-variance frontier of risky assets coincides with the investment opportunity set. In the presence of a risk-free asset one draws a straight line (whose intercept and slope are equal to the risk-free rate of return and the maximum Sharpe ratio, resp.) which is tangent to the efficient frontier of risky assets.

In this paper we show that in the presence of a risk-free asset the investment opportunity set can alternatively be characterized in terms of the vector of the Sharpe ratios of risky assets and the correlation matrix. This implies that the changes in the characteristics of individual risky assets that preserve the Sharpe ratios of risky assets and the correlation matrix do not change the investment opportunity set. In other words, two apparently different sets comprised of the same number of risky assets (different in terms of the values of expected returns and standard deviations), that produce apparently different minimum-variance frontiers of risky assets, will generate exactly the same investment opportunity set if the risky assets in the two sets have the same Sharpe ratios and correlation matrix.

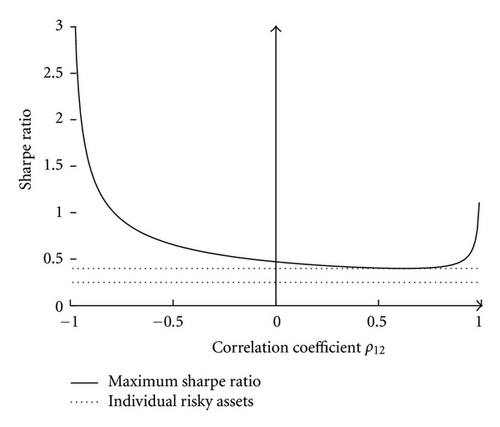

The alternative characterization of the investment opportunity set in the presence of a risk-free asset implies that the two-dimensional standard deviation-expected return space, although instructive in teaching, can be redundant and misleading in practice. A more straightforward depiction of the characteristics of individual risky assets and the investment opportunity set can be done in one-dimensional Sharpe ratio space. For the case of two risky assets the alternative characterization allows to visualize the maximum Sharpe ratio as a function of the correlation coefficient.

In addition, the alternative characterization of the investment opportunity set provides a simple answer to the question of what happens with the investment opportunity set when we change the risk-return characteristics of individual risky assets. In other words, if we change the values of the expected returns and standard deviations of individual risky assets, will it result in an improvement or worsening of the investment opportunity set? Using the classical characterization of the investment opportunity set, the answer is not clear. With the alternative characterization of the investment opportunity set by means of the Sharpe ratios of individual risky assets, the answer is rather trivial. We show that if the weight of a risky asset in the optimal risky portfolio is positive, then an increase in the Sharpe ratio of this asset results in an improvement of the investment opportunity set. Moreover, if the market is in equilibrium, then an increase in the Sharpe ratio of any risky asset results in an increase in the maximum Sharpe ratio.

Finally, the alternative characterization of the investment opportunity set has a clear appeal to the investment practice. In particular, it is well known that the risk-return characteristics of individual risky assets and the correlations among them are changing over time. Existing academic studies usually address only the changing nature of correlations and try to deduce how these changes affect the investment opportunity set. The alternative characterization of the investment opportunity set motivates the idea that one also needs to examine the changing nature of the Sharpe ratios, in addition to that of the correlation structure, in order to have a full picture of the evolution of the investment opportunity set.

The classical CAPM is, in fact, none other than the Markowitz portfolio theory in the presence of a risk-free asset combined with an equilibrium condition. Therefore, the Sharpe ratio thinking motivates reconsidering the CAPM relationship in terms of Sharpe ratios. We show that the classical expected return-beta relationship can alternatively be represented by a Sharpe ratio-rho relationship (rho denotes the correlation coefficient between the returns on a risky asset and the market portfolio). Moreover, the Sharpe ratio thinking motivates adjusting Jensen′s alpha in order to properly measure abnormal portfolio performance. Instead of Jensen′s alpha we propose to use Jensen′s alpha divided by the total risk. In this manner the adjusted Jensen′s alpha becomes a true reward-to-risk performance measure that cannot be manipulated by leverage.

The rest of the paper is organized as follows. In Section 2 we review the classical characterization of the investment opportunity set in the presence of a risk-free asset. In Section 3 we derive the alternative characterization of the investment opportunity set and perform a comparative static analysis. In this section we also present several theoretical examples and one real-world example that illustrate the derived relationships and demonstrate the advantages of the alternative characterization of the investment opportunity set. In Section 4 we reconsider the CAPM relationship and introduce an adjusted Jensen′s alpha. Section 5 summarizes the paper.

2. The Maximum Sharpe Ratio

The purpose of this section is to introduce the notation, the investor′s optimal portfolio choice problem, and to derive the expression for the maximum Sharpe ratio that characterizes the investment opportunity set in the presence of a risk-free asset. We do not provide all details of the derivation because there are no new results in this section. Our exposition in this section is similar to that in Huang and Litzenberger [4, Chapter 3].

3. Alternative Characterization of the Maximum Sharpe Ratio

Theorem 1. The maximum Sharpe ratio can be characterized in terms of the vector of Sharpe ratios of individual risky assets and the correlation matrix. In particular,

Proof. Define the diagonal matrix of standard deviations of the returns on individual risky assets

Corollary 1. In case the returns on the risky assets in the investment universe are not correlated, that is, ρij = 0 for i ≠ j, then the maximum Sharpe ratio equals

Proof. In this case R = In where In is the identity matrix of order n. For the identity matrix . Consequently,

Now we turn to the presentation of some examples.

Example 1 (n = 1). In this simplest case the investment universe consists of one risky asset and a risk-free asset. The application of (17) gives

Example 2 (n = 2 with graphical illustration). In this case the investment universe consists of two risky assets and a risk-free asset. The computation of the maximum Sharpe ratio gives

Example 3 (n = 3). In this case the investment universe consists of three risky assets and a risk-free asset. After more tedious but still straightforward calculations we obtain

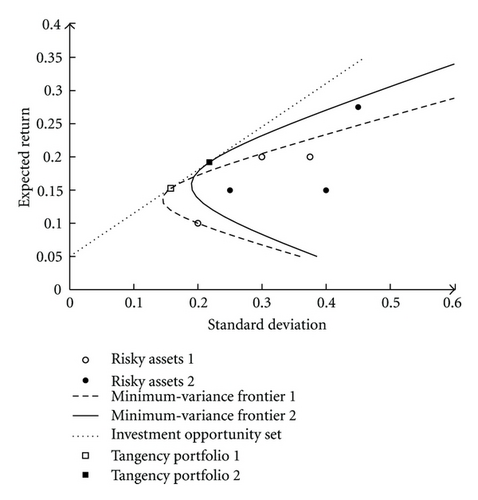

Example 4 (illustration of classical versus alternative characterizations for n = 3). This example illustrates the classical and alternative characterizations of the investment opportunity set in the presence of a risk-free asset. We suppose that the investment universe consists of a risk-free asset which provides the return of 5% and three risky assets that have the following Sharpe ratios: S(x1) = 0.50, S(x2) = 0.40, and S(x3) = 0.25. Given a particular value of a Sharpe ratio, there are infinite combinations of the expected return and standard deviation that produce this Sharpe ratio. For the sake of simplicity, we consider only two sets of risky assets, where each of the risky assets has the same Sharpe ratio as given above. In particular, the first set of parameters for the risky assets is E[x1] = 20%, σ1 = 30%, E[x2] = 20%, σ2 = 37.5%, E[x3] = 10%, and σ3 = 20%. The second set of parameters for the risky assets is E[x1] = 27.5%, σ1 = 45%, E[x2] = 15%, σ2 = 25%, E[x3] = 15%, and σ3 = 40%. The correlation coefficients between the returns of the risky assets are the same in both cases: ρ12 = 0.5 and ρ23 = ρ31 = −0.2.

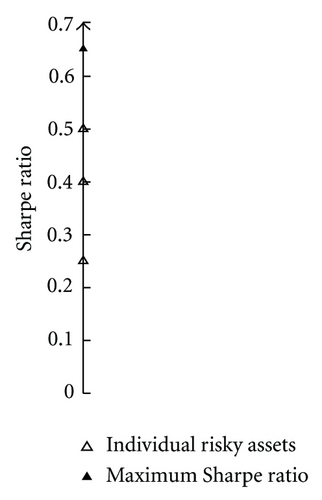

Figure 2(a) illustrates the classical characterization of the investment opportunity set. This is a two-dimensional standard deviation-expected return space. Observe that in this space the risk-return characteristics of the two sets of risky assets are seemingly different with different minimum-variance frontiers of risky assets and different compositions of the tangency portfolios. However, in both cases the investment opportunity set is the same straight line. Figure 2(b) presents an illustration of the alternative characterization of the investment opportunity set. This is a one-dimensional Sharpe ratio space. In contrast to the classical illustration, the two sets of risky assets fully coincide. The investment opportunity set is represented by the maximum Sharpe ratio.

A natural question to ask is what happens with the investment opportunity set when we change the values of the expected returns and standard deviations of individual risky assets. Will it result in an improvement or worsening of the investment opportunity set? Using the classical characterization of the investment opportunity set, the answer is not clear. A good guess would be the following: if we increase the expected return of a single risky asset while keeping the standard deviation of this asset at the same level, this should improve the investment opportunity set. In contrast, if we increase the standard deviation of a single risky asset while keeping the expected return at the same level, this should worsen the investment opportunity set. But what if we increase both the expected return and standard deviation? An alternative characterization of the investment opportunity set by means of the Sharpe ratios of individual risky assets makes it possible to provide the answer to this question.

Theorem 2. The sign of the first-order derivative of the maximum Sharpe ratio with respect to the Sharpe ratio of risky asset i coincides with the sign of the weight of risky asset i in the optimal risky portfolio. In particular,

Remark 1. This theorem says that if the weight of risky asset i in the optimal risky portfolio is positive, then an increase in the Sharpe ratio of asset i results in an increase in the maximum Sharpe ratio. Conversely, if the weight of risky asset i in the optimal risky portfolio is negative, then an increase in the Sharpe ratio of asset i results in a decrease in the maximum Sharpe ratio.

Remark 2. If the market is in equilibrium and all risky assets are in positive net supply, then the weights of all risky assets in the market portfolio are positive. Hence, if the market is in equilibrium, then an increase in the Sharpe ratio of any risky asset results in an increase in the maximum Sharpe ratio.

Proof. The vector of partial derivatives of with respect to S(xi) is given by (34). Observe that is a positive scalar and R−1S is a vector, where each element i is given by

The signs of the weights of risky assets in the investor′s optimal risky portfolio (as given by (8)) coincide with the signs of the weights of the risky assets in the tangency portfolio (as given by (15)), that is, sgn (wi) = sgn (wti). Let us write the weights of the risky assets in the tangency portfolio as

Example 5 (n = 2). Consider the case where the investment universe consists of two risky assets and a risk-free asset. Suppose that r = 5%, E[x1] = 9%, σ1 = 40%, E[x2] = 20%, σ2 = 40%, and ρ12 = 0.5. The Sharpe ratios of the assets are S(x1) = 0.1 and S(x2) = 0.375. The maximum Sharpe ratio in this case is given by (29) and equals . The weights of the risky assets in the tangency portfolio are wt1 = −0.3684 and wt2 = 1.3684. Note that asset 1 is inferior to asset 2 (since asset 1 has a much lower Sharpe ratio as compared to asset 2), the correlation coefficient between the returns on these two assets is rather large, and it is optimal to sell short asset 1.

The computation of the first-order derivatives of the maximum Sharpe ratio with respect to individual Sharpe ratios gives

Example 6 (real-world example with n = 15). Considerable academic research documents the benefits of international diversification; see, for example, Grubel [5], Levy and Sarnat [6], and Solnik [7]. The gains from international diversification supposedly stem from relatively low correlations among international stock markets. However, academic research also documents that the average correlation among international stock markets has been increasing over time; see King et al. [8], Longin and Solnik [9], and Goetzmann et al. [10]. Due to the deterioration in diversification opportunities, it is tempting to deduce that the efficiency of international investment has diminished (see, e.g., Eun and Lee [11]). In this example we consider the evolution of the international investment opportunity set through time from the point of view of an investor in the USA. In particular, our goal is to find out whether the efficiency of international investment has really deteriorated.

Our sample of 15 developed markets spans the period from January 1975 to December 2007. The 15 developed markets are Australia, Belgium, France, Germany, Hong Kong, Italy, Japan, the Netherlands, Norway, Singapore, Spain, Sweden, Switzerland, the UK, and the USA. The monthly value-weighted dollar returns for each country are obtained from the data library of Kenneth French (see http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html). Monthly risk-free rates of return, proxied by the monthly US T-Bill rates, are obtained from the Ibbotson SBBI 2009 Classic Yearbook. To examine the evolution of the investment opportunity set through time, we divide our overall sample period 1975–2007 into two subperiods: 1975–1991 and 1992–2007.

The maximum Sharpe ratio (computed using either (11) or (17)) of the optimal international portfolio amounts to 0.268 for the first subperiod and to 0.290 for the second subperiod. Yet, consistent with previous findings, the average correlation among international stock markets has increased from 0.466 to 0.581. That is, despite a significant increase in average correlation among stock markets, the investment opportunity set has improved through time, at least for an American investor. Without the knowledge of the alternative characterization of the maximum Sharpe ratio, all we can say is that the improvement of the investment opportunity set has been caused by some favorable changes in the excess returns and standard deviations of returns on international stock markets. The knowledge of the alternative characterization of the maximum Sharpe ratio motivates us to investigate the changes in the average Sharpe ratio. We find that the average Sharpe ratio of international stock markets has increased from 0.126 to 0.148. Thus, whereas the increased correlations have exerted a negative impact, the increased Sharpe ratios have exerted a positive impact on the investment opportunity set. The combined effect of both the increased correlations and increased Sharpe ratios has exerted a positive impact on the efficiency of international investment.

At the end of this example we would like to emphasize the advantage (in the investment practice) of using Sharpe ratios and correlations to describe the investment opportunity set. In particular, this example convincingly demonstrates that it is not enough to examine only the changes in diversification opportunities in order to deduce the changes in the investment opportunity set. One also needs to study the changes in the Sharpe ratios in order to have a complete picture of the evolution of the investment opportunity set.

4. The CAPM Relationship Reconsidered

So far we have reconsidered some results of the Markowitz portfolio theory in the presence of a risk-free asset. The classical CAPM is, in fact, none other than the Markowitz portfolio theory in the presence of a risk-free asset paired with an equilibrium condition. Therefore, it is pretty straightforward to reconsider the CAPM relationship in terms of Sharpe ratios.

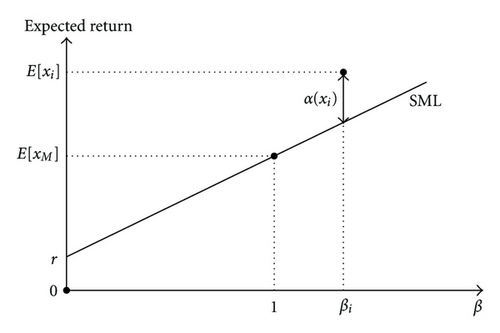

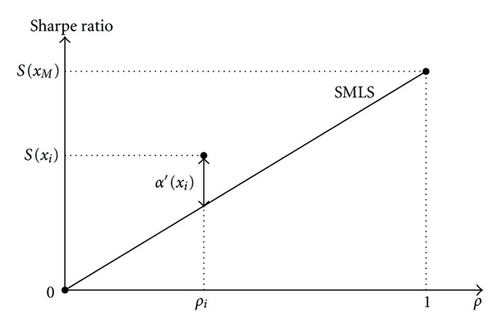

Figure 3(a) presents the classical illustration of the CAPM relationship. This is a beta-expected return space. SML denotes the security market line. It is a straight line with intercept r and slope E[xM] − r. If the market is in equilibrium, all assets should lie along the security market line. Figure 3(b) presents an alternative illustration of the CAPM relationship. This is a rho-Sharpe ratio space. SMLS denotes the security market line segment. It is a part of a straight line with zero intercept and slope S(xM). If the market is in equilibrium, all assets should lie along the security market line segment. Figure 3 also demonstrates the values of the Jensen′s alpha and the adjusted Jensen′s alpha for asset i which provides abnormal return.

5. Summary

In this paper we showed that in the presence of a risk-free asset the investment opportunity set can be characterized in terms of the vector of the Sharpe ratios of risky assets and the correlation matrix. Consequently, this implies that the changes in the risk-return characteristics of individual risky assets that preserve the Sharpe ratios and the correlation matrix do not change the investment opportunity set. We performed the comparative static analysis which provides a simple answer to the question of what happens with the investment opportunity set when we change the characteristics of individual risky assets. We demonstrated the advantages of using the alternative characterization of the investment opportunity set in the investment practice. Using the Sharpe ratio thinking we reconsidered the CAPM relationship and proposed how to adjust the Jensen′s alpha in order to properly measure abnormal portfolio performance.

Acknowledgment

The author is grateful to Steen Koekebakker and the anonymous referees for their comments.