Heterogeneous firms, financial constraints and export behaviour: A firm-level investigation for China

Abstract

We study the impact of access to finance on exports using Chinese firm-level data. We distinguish two modes of external finance, namely bank loans and issuing stocks to shareholders. We not only consider the impact either of these has individually on export behaviour, but also their interaction. We build the two external sources, as well as internal finance, into a heterogeneous firm-type model, which allows us to investigate the relationship between financial constraints and firms’ exports. We examine the model's predictions empirically using a comprehensive longitudinal firm-level data set from China. Our empirical results are consistent with the theoretical predictions. Firms who have more interest expenditure or can issue stocks to their shareholders have higher propensity to export and export more. Moreover, the more financial options a firm has, the better a firm performs in terms of export volume and export propensity.

1 INTRODUCTION

The Chinese economy dominates the academic and public debate on many issues, two of which are exports and finance. China has, over the last three decades, shown unprecedented export growth, which has made it the top exporting nation in the world in 2014, well ahead of the United States and Germany.1 At the same time, access to finance is known to be problematic for many firms, in particular privately owned small firms in China, leading to severe credit constraints.2

Several papers investigate the link between financial constraints and Chinese firms’ exports.3 Du and Girma (2007) show using bank loans normalised by total assets that access to bank loans is associated with greater export market orientation. Li and Yu (2013) conclude that Chinese firms with fewer credit constraints export more, and foreign enterprises that enjoy lower credit constraints have higher exports than domestic companies. Manova, Wei, and Zhang (2011) demonstrate that limited credit availability hinders firms entering more destination markets, using financial vulnerability measured at sector level. Egger and Kesina (2013) approximate credit constraints by four internal financial variables and find that the credit-constrained firms are less likely to be exporters and have lower export quotas.

We study in this paper the impact of access to finance on exports using Chinese firm-level data. We distinguish two modes of external finance, namely bank loans and issuing stocks to shareholders. We not only consider the impact either of these has individually on export behaviour, but also their interaction. This allows us to investigate whether there are complementarities in the use of these sources of finance—is “the more, the better” true for exporting? We build the two external sources, as well as internal finance, into a heterogeneous firm-type model, which allows us to investigate the relationship between financial constraints and firms’ exports. We examine the model's predictions empirically using a comprehensive longitudinal firm-level data set from China. As far as we are aware, this is the first paper to consider these different financial options in theory and empirics.

Our paper contributes to the current literature in several aspects. First, our theoretical model captures three different financial channels including internal liquidity endowment, external borrowing and issuing stocks. Second, Wagner (2014) points out that the reliability of relevant studies suffers from diverse proxy variables for financial constraints such as liquidity ratio, cash flow and other financial ratios. Unlike previous studies, we utilise information on interest expenditure and a dummy variable whether a firm can issue stocks or not to measure the financial constraints directly. Third, we further investigate the interrelationship between different financial options, which we find to be important but is overlooked by previous studies.

Theoretical predictions indicate that some firms are prevented from exporting due to financial constraints, and firms would be more likely to export and export more if they were less restricted by financial constraints. These constraints could be alleviated through better access to external financial resources or issuing stocks to shareholders. Our empirical results are strongly consistent with the theoretical predictions. Firms who have more interest expenditure or can issue stocks to their shareholders have higher propensities to export and export more. Moreover, the more financial options a firm have, the better a firm performs in terms of export volume and export propensity. Finally, the effects of the relaxation of financial constraints on export behaviour are stronger for state-owned enterprises (SOEs), firms located in the Eastern region and large-scale firms, as these appear to be less financially constrained.

The remainder of the paper is organised as follows. Section 2 develops the theoretical model. Section 3 introduces the data, sets up the empirical model and introduces estimation approaches. Section 4 analyses benchmark results, subsample results and robustness checks. The last section concludes.

2 THE MODEL

To motivate the subsequent empirical analysis, we present a simple theoretical framework within which we can interpret our empirics. Our theoretical model follows Li and Yu (2013) and expands on the number of financing options available to a firm.

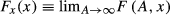

Consider two countries, home and foreign (henceforth foreign country is denoted with an asterisk *). Labour is the only factor of production, and the size of the population is L at home. There are two sectors, where the first sector produces a single homogeneous good at constant returns to scale that is freely traded and chosen as the numeraire, and the price of the homogeneous good can be normalised to one. Each unit of labour in this sector produces a given number of units of the homogeneous good  , where

, where  is the labour input for

is the labour input for  units of the homogeneous good. We assume that wages in both countries are determined by the productivity in this sector. The second sector produces a continuum of differentiated goods under monopolistic competition.

units of the homogeneous good. We assume that wages in both countries are determined by the productivity in this sector. The second sector produces a continuum of differentiated goods under monopolistic competition.

2.1 Demand and production

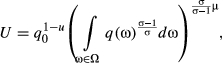

(1)

(1) denotes each variety,

denotes each variety,  is the set of varieties available to the consumers,

is the set of varieties available to the consumers,  is a constant elasticity of substitution between each variety and

is a constant elasticity of substitution between each variety and  is the share of expenditure on the differentiated sector. The aggregate price index in the differentiated sector is as follows:

is the share of expenditure on the differentiated sector. The aggregate price index in the differentiated sector is as follows:

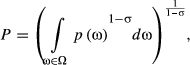

(2)

(2) is the price of each variety. We can derive the demand function for a representative consumer for differentiated good

is the price of each variety. We can derive the demand function for a representative consumer for differentiated good  as Melitz (2003):

as Melitz (2003):

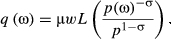

(3)

(3) (4)

(4) is the total expenditure for the differentiated goods at home.

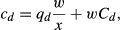

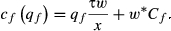

is the total expenditure for the differentiated goods at home. to enter into the domestic market equal to wCd. In order to enter foreign markets via exporting, firms pay upfront entry costs w*Cf and iceberg transportation costs. The productivity of each firm

to enter into the domestic market equal to wCd. In order to enter foreign markets via exporting, firms pay upfront entry costs w*Cf and iceberg transportation costs. The productivity of each firm  is subject to a random distribution. Therefore, the cost functions for the firm with productivity

is subject to a random distribution. Therefore, the cost functions for the firm with productivity  of entering into domestic market and foreign markets separately are as follows:

of entering into domestic market and foreign markets separately are as follows:

(5)

(5) (6)

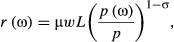

(6) over the unit cost as the pricing rule at both domestic and foreign markets:

over the unit cost as the pricing rule at both domestic and foreign markets:

(7)

(7) (8)

(8) (9)

(9) (10)

(10) (11)

(11) (12)

(12)The typical conclusions of the Melitz model apply in our theoretical framework. Firms will enter domestic or foreign markets through self-selection. Only the more productive firms whose productivity is higher than the cut-off productivity can make profits after covering entry costs and survive in the foreign markets. The less productive firms can only produce for the domestic market. The least productive firms exit from both markets.

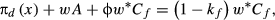

2.2 Export decision under financial constraints

To start with, we assume that there are no liquidity or credit constraints for firms to finance their domestic production. We suppose that exporters can finance the upfront entry costs through three options: (i) internally retained earnings; (ii) external borrowing from financial institutions and (iii) issuing stocks.

Internal financing through retained earnings mainly consists of domestic profits  , and the liquidity endowment wA.4

, and the liquidity endowment wA.4  are drawn from a joint distribution with c.d.f.

are drawn from a joint distribution with c.d.f.  over

over  and

and  over

over  . For simplicity, we assume there is no cost for this internal financial channel in case the export project fails, which means we do not take the opportunity costs into consideration.

. For simplicity, we assume there is no cost for this internal financial channel in case the export project fails, which means we do not take the opportunity costs into consideration.

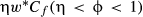

Firms can also obtain financial support from external financial institutions. The costs of borrowing depend on the risks of the export project. Assume the success probability of an export project for firm  is

is  , which is public information and increasing with productivity

, which is public information and increasing with productivity  . The investors will set up different interest rates and corresponding repayments

. The investors will set up different interest rates and corresponding repayments  according to the success probability. Under normal circumstances, firms must offer tangible assets as collateral. Suppose firms can offer a fraction of domestic fixed costs as collateral which is

according to the success probability. Under normal circumstances, firms must offer tangible assets as collateral. Suppose firms can offer a fraction of domestic fixed costs as collateral which is  . If firms are successful on foreign markets, the investors can recover costs and reap the benefits summing to

. If firms are successful on foreign markets, the investors can recover costs and reap the benefits summing to  . If the export project fails, however, investors are left with the collateral

. If the export project fails, however, investors are left with the collateral  .

.

Firms have a third channel to finance their export project, which is issuing stocks internally and externally. They should pay dividends to their shareholders, which also depends on the success probability of the export project  . We assume firms finance a fraction of the upfront entry costs

. We assume firms finance a fraction of the upfront entry costs  through issuing stocks. If the export project is successful, the shareholders can acquire dividends, which are proportional to the amount of finance through issuing stock

through issuing stocks. If the export project is successful, the shareholders can acquire dividends, which are proportional to the amount of finance through issuing stock  . If the export project fails, they do not distribute dividends to their shareholders.5

. If the export project fails, they do not distribute dividends to their shareholders.5

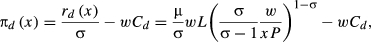

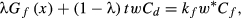

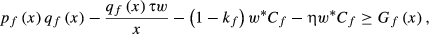

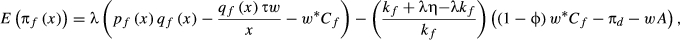

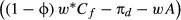

(13)

(13) (14)

(14) (15)

(15) (16)

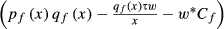

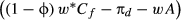

(16) is the proportion of finance through external borrowing from different financial intermediaries. The first constraint demonstrates that investors receive zero profit because of perfect competition in the external financial market. The second constraint illustrates that firms must generate sufficient net revenue to pay the repayment

is the proportion of finance through external borrowing from different financial intermediaries. The first constraint demonstrates that investors receive zero profit because of perfect competition in the external financial market. The second constraint illustrates that firms must generate sufficient net revenue to pay the repayment  to the investors if the export project succeeds.6 The third constraint stipulates the proportion of externally financed funds. In this equation, we can see that firms can finance their export project through the domestic profit

to the investors if the export project succeeds.6 The third constraint stipulates the proportion of externally financed funds. In this equation, we can see that firms can finance their export project through the domestic profit  , the liquidity endowment wA, issuing stocks

, the liquidity endowment wA, issuing stocks  and the external borrowing

and the external borrowing  .

. (17)

(17) (18)

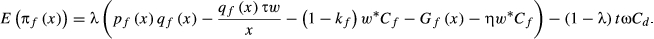

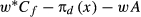

(18) is the export profit

is the export profit  with no financial constraints. From the above equation, we know that firms need higher profits to survive in foreign markets due to the extra costs caused by the financial constraints. These depend on the amount they borrow

with no financial constraints. From the above equation, we know that firms need higher profits to survive in foreign markets due to the extra costs caused by the financial constraints. These depend on the amount they borrow  and the success probability of the export project

and the success probability of the export project  .

. (19)

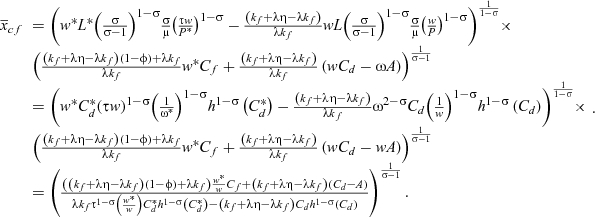

(19)Given the success probability of export project  , we can show that the right part of the above equation is a positive constant.7 The profit maximising problem for expected export profits is equivalent to maximising the export profit

, we can show that the right part of the above equation is a positive constant.7 The profit maximising problem for expected export profits is equivalent to maximising the export profit  under no financial constraints since firm productivity, domestic profit and liquidity endowment are predetermined when they decide to export. Therefore, we have some Melitz-style results such as optimal export price (Equation 8) and export profit (Equation 10).

under no financial constraints since firm productivity, domestic profit and liquidity endowment are predetermined when they decide to export. Therefore, we have some Melitz-style results such as optimal export price (Equation 8) and export profit (Equation 10).

However, we cannot treat Equation 12 as the cut-off productivity level of entering foreign markets with financial constraints. In fact, firms might or might not be bound by the financial constraints. Hence, we should consider different scenarios. If firms have sufficient domestic profit or liquidity endowment, they can internally finance the upfront entry costs for foreign markets, so that they are not subject to the external financial constraints. In this case, the amount firms would borrow from financial intermediaries  is zero, and the cut-off productivity level of entering foreign markets is the same as in Equation 12.

is zero, and the cut-off productivity level of entering foreign markets is the same as in Equation 12.

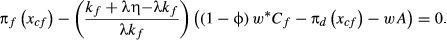

from external investors or raise it from shareholders. So the cut-off productivity level of entering foreign markets with financial constraints is determined by the following:

from external investors or raise it from shareholders. So the cut-off productivity level of entering foreign markets with financial constraints is determined by the following:

(20)

(20) (21)

(21)Firms whose productivities are below this cut-off productivity level of entering foreign markets  will not be able to export due to financial constraints, even though some firms would be productive enough to export if there were no financial constraints.

will not be able to export due to financial constraints, even though some firms would be productive enough to export if there were no financial constraints.

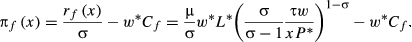

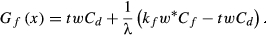

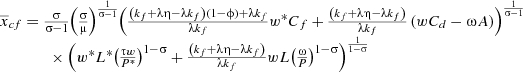

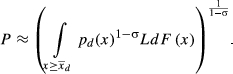

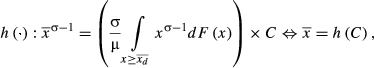

2.3 Open economy equilibrium

(22)

(22) in the following way for convenience:

in the following way for convenience:

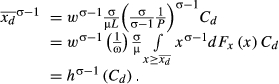

(23)

(23) . We suppose foreign firms have the same productivity distribution as domestic firms,

. We suppose foreign firms have the same productivity distribution as domestic firms,  . We can rewrite the different cut-off productivities using h(·):8

. We can rewrite the different cut-off productivities using h(·):8

(24)

(24) (25)

(25) (26)

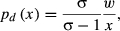

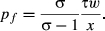

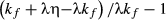

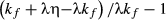

(26)Firms with productivities above  serve the domestic market. Only those firms with a productivity above

serve the domestic market. Only those firms with a productivity above  are able to export because they are both productive enough and have sufficient liquidity to afford the fixed costs. While those firms whose productivities lie between

are able to export because they are both productive enough and have sufficient liquidity to afford the fixed costs. While those firms whose productivities lie between  could potentially profitably export but are blocked by the financial constraints.

could potentially profitably export but are blocked by the financial constraints.

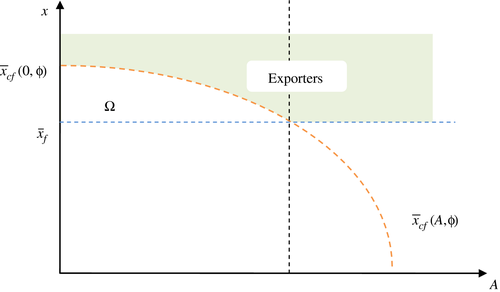

Equation 26 apparently reflects that  is a decreasing function with respect to

is a decreasing function with respect to  ; hereafter, we denote

; hereafter, we denote  as

as  . A low value of

. A low value of  will raise the cut-off productivity of entering foreign markets, which can be compensated with a high level of productivity in order to generate sufficient liquidity from domestic market and have a better access to external finance for the upfront entry costs. The reason why more productive firms can have better access to external finance is that they usually yield more net revenue and thus offer better repayment prospects to financial intermediaries. On the contrary, firms who are endowed with a large amount of exogenous liquidity (large

will raise the cut-off productivity of entering foreign markets, which can be compensated with a high level of productivity in order to generate sufficient liquidity from domestic market and have a better access to external finance for the upfront entry costs. The reason why more productive firms can have better access to external finance is that they usually yield more net revenue and thus offer better repayment prospects to financial intermediaries. On the contrary, firms who are endowed with a large amount of exogenous liquidity (large  ) can cover the upfront entry costs on their own and lower the threshold of entering foreign markets, and they can export even when they face external financial constraints or have low productivities. Judging from the above analysis, we find that the firm's productivity and the financial constraints can make up for each other. The financial constraints adversely affect the exports of some firms rather than all firms.9 In other words, there will be a set of financially constrained exporters which is shown by the following proposition:

) can cover the upfront entry costs on their own and lower the threshold of entering foreign markets, and they can export even when they face external financial constraints or have low productivities. Judging from the above analysis, we find that the firm's productivity and the financial constraints can make up for each other. The financial constraints adversely affect the exports of some firms rather than all firms.9 In other words, there will be a set of financially constrained exporters which is shown by the following proposition:

Proposition 1.If  and

and  are continuously distributed from

are continuously distributed from  , and if

, and if

Proof.See Appendix B.

Proposition 1 predicts that there must be some firms who could successfully export if they had sufficient funds to cover the entry costs, but they are prevented from exporting because they are actually financially constrained. Therefore, there is a negative relationship between firms’ export and financial constraints.

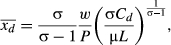

We demonstrate Ω in Figure 1. The area between the straight line  and curve

and curve  are Ω, firms located in this area are willing to export, but they are prevented by the financial constraints. Firms locating in the dark area can successfully export.

are Ω, firms located in this area are willing to export, but they are prevented by the financial constraints. Firms locating in the dark area can successfully export.

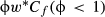

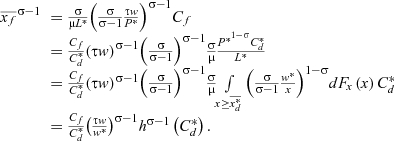

We know from Equation 26 that there are some other factors impacting firm export decisions. First, we observe that the cut-off productivity of entering foreign markets  is a decreasing function with respect to the proportion of finance through issuing stock

is a decreasing function with respect to the proportion of finance through issuing stock  , which means an increase in

, which means an increase in  lowers the threshold

lowers the threshold  . Therefore, it is easier for firms to export and export more, if they can relax the financial constraints through issuing stock. Moreover, as shown in Equation 19,

. Therefore, it is easier for firms to export and export more, if they can relax the financial constraints through issuing stock. Moreover, as shown in Equation 19,  is the amount firms should borrow from financial intermediaries; thus, we can treat

is the amount firms should borrow from financial intermediaries; thus, we can treat  as the interest rate firms should pay to the investors. Equation 26 indicates that the higher the interest rate

as the interest rate firms should pay to the investors. Equation 26 indicates that the higher the interest rate  , the higher the curve

, the higher the curve  . As a consequence, the higher cost of borrowing from financial intermediaries prevents more firms from exporting. Second, the more firms allocate dividends to their shareholders (large

. As a consequence, the higher cost of borrowing from financial intermediaries prevents more firms from exporting. Second, the more firms allocate dividends to their shareholders (large  ), the higher the threshold of profitable exports, as dividends eat up firms’ liquidity and accordingly lower their abilities to enter into foreign markets.

), the higher the threshold of profitable exports, as dividends eat up firms’ liquidity and accordingly lower their abilities to enter into foreign markets.

Finally, we see from Equation 26 that an exchange rate appreciation (the higher  ) raises the cut-off productivity,10 which means an exchange rate appreciation impedes firms’ exports through the following two effects. On the one hand, the appreciation leads to higher price of domestic products denominated in foreign currencies, which make incumbent exporters less competitive and reduce their exports. On the other hand, the nominal value of the upfront entry costs increases due to the exchange rate appreciation, making it more difficult for exporters break even. We summarise the above findings in Proposition 2.

) raises the cut-off productivity,10 which means an exchange rate appreciation impedes firms’ exports through the following two effects. On the one hand, the appreciation leads to higher price of domestic products denominated in foreign currencies, which make incumbent exporters less competitive and reduce their exports. On the other hand, the nominal value of the upfront entry costs increases due to the exchange rate appreciation, making it more difficult for exporters break even. We summarise the above findings in Proposition 2.

Proposition 2.Ceteris paribus, firms find it easier to export to foreign markets if they: (i) can raise funds through issuing stocks; (ii) allocate less dividends to shareholders; (iii) can borrow money from external investors at lower interest rates; (iv) have more liquidity endowments; (v) are confronted with an exchange rate depreciation.

Proposition 2 predicts that firms who experience less financial constraints through issuing stocks to shareholders, borrowing from external investors and acquiring more liquidity endowments are more likely to export and export more.

3 DATA, SPECIFICATION AND METHODOLOGY

3.1 Data

Based on this theoretical motivation, we move to the empirical analysis of the relationship between access to finance and exports. In this section, we first proceed to describe the data set, then construct the empirical model and discuss estimation methods.

To investigate the relation between financial constraints and firms’ exports, we use a longitudinal firm-level data set from the Annual Surveys of Industrial Production (ASIP) between 2005 and 2009 conducted by the Chinese Government's National Bureau of Statistics (NBS).11 The firm-level data set is a census of all non-state firms with more than 5 million RMB in sales (about 600,000) plus all state-owned firms, which covers 301,961 firms in 2006. The data set provides, inter alia, information on output, wages, employment, value added, export value, profits, fixed assets as well as information on interest expenditure and whether the firm can issue stocks.

We drop observations with negative values for output and number of employees. Moreover, following Feenstra, Mandel, Reinsdorf, and Slaughter (2013), we drop observations violating accounting standards as follows:

- liquid assets are greater than total assets;

- total fixed assets are greater than total assets;

- the net value of fixed assets is greater than total assets,

- the firm's identification number is missing.

We also drop firms with less than eight employees.12 After this cleaning, we obtain a sample with 1,649,163 observations, which accounts for about 60% of the original data set.13 The remaining sample is described in Table 1.

| 2005 | 2006 | 2007 | 2008 | 2009 | |

|---|---|---|---|---|---|

| Number of firms | 264,714 | 294,397 | 330,981 | 370,395 | 389,216 |

| Number of exporting firms | 74,764 | 78,511 | 78,412 | 80,848 | 77,150 |

| Proportion of exporting firms | 28.2% | 26.7% | 23.7% | 21.8% | 20% |

| Average exporting value | 63,653 | 76,891 | 93,422 | 91,154 | 87,094 |

Note

- The unit of average exporting value is 1,000 RMB.

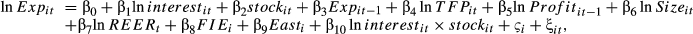

3.2 Specification

denotes firms’ exports measured in two alternative ways: the first is an export dummy equal to 1 if a firm exports in time t. This variable is used to model the decision to export. The second approach is to use the log export volume as dependent variable.

denotes firms’ exports measured in two alternative ways: the first is an export dummy equal to 1 if a firm exports in time t. This variable is used to model the decision to export. The second approach is to use the log export volume as dependent variable.On the right-hand side of the equation, we have first two alternative measures of access to external finance: we first measure firms’ external financing ability with the interest expenditures ( ) as in Li and Yu (2013).14 The rationale is that the scale of interest expenditure identifies the firms’ capacity to borrow:15 the more a firm spends on interest, the higher may be the borrowing and, hence, the less a firm is bound by financial constraints.

) as in Li and Yu (2013).14 The rationale is that the scale of interest expenditure identifies the firms’ capacity to borrow:15 the more a firm spends on interest, the higher may be the borrowing and, hence, the less a firm is bound by financial constraints.

The second is a dummy variable whether a firm is a stock corporation or not ( ). If a firm can issue stocks to their shareholders, then the dummy variable is equal to 1, otherwise, it is 0. We judge if a firm is a stock corporation from its registration type.16 We also include the interaction term between interest expenditure and stock dummy. We may hypothesise that a firm which has access to both finance options simultaneously can perform better in terms of export activity. The theoretical model predicts that firms may find it easier to export to foreign markets if they are less restricted by the financial constraints, which can be realised through borrowing from financial intermediaries or issuing stocks to their shareholders. We thus expect positive coefficients on interest expenditure, stock dummy and their interaction term.

). If a firm can issue stocks to their shareholders, then the dummy variable is equal to 1, otherwise, it is 0. We judge if a firm is a stock corporation from its registration type.16 We also include the interaction term between interest expenditure and stock dummy. We may hypothesise that a firm which has access to both finance options simultaneously can perform better in terms of export activity. The theoretical model predicts that firms may find it easier to export to foreign markets if they are less restricted by the financial constraints, which can be realised through borrowing from financial intermediaries or issuing stocks to their shareholders. We thus expect positive coefficients on interest expenditure, stock dummy and their interaction term.

The vector of control variables includes other firm-level characteristics that have been identified in the literature as important for explaining export activity. We include  , which is the one-year lagged indicator of firms’ exports. This proxies for the firm's exporting experience (Alvarez & López, 2013; Roberts & Tybout, 1997). To measure firm performance, we include total factor productivity, firm profits and firm size. The latter is measured using total fixed assets (Liu & Zhang, 2008). Furthermore, the vector contains dummies for whether a firm is foreign-owned or not, and whether it is located in Eastern China.17 Our theoretical model also highlights the impact of the real exchange rate. To capture this, we include the RMB exchange rate in year t, measured as the real effective exchange rate (REER).

, which is the one-year lagged indicator of firms’ exports. This proxies for the firm's exporting experience (Alvarez & López, 2013; Roberts & Tybout, 1997). To measure firm performance, we include total factor productivity, firm profits and firm size. The latter is measured using total fixed assets (Liu & Zhang, 2008). Furthermore, the vector contains dummies for whether a firm is foreign-owned or not, and whether it is located in Eastern China.17 Our theoretical model also highlights the impact of the real exchange rate. To capture this, we include the RMB exchange rate in year t, measured as the real effective exchange rate (REER).

There are two components in the error term:  are a set of industry dummies capturing industry-specific fixed effects,18

are a set of industry dummies capturing industry-specific fixed effects,18  consists of a firm-specific time invariant fixed effect and the idiosyncratic remaining error term, which is robust to heteroscedasticity. We report basic statistical information of key variables in Table 2.

consists of a firm-specific time invariant fixed effect and the idiosyncratic remaining error term, which is robust to heteroscedasticity. We report basic statistical information of key variables in Table 2.

| 2005 | 2006 | 2007 | 2008 | 2009 | ||

|---|---|---|---|---|---|---|

| Non-exporters | Total sales | 65,780 | 73,578 | 85,772 | 85,047 | 101,451 |

| Interest expenditure | 780 | 817 | 956 | 1,063 | 1082 | |

| Fixed assets | 68,593 | 72,124 | 76,640 | 75,124 | 98,211 | |

| Employees | 187 | 175 | 170 | 176 | 158 | |

| Profit | 3,916 | 4,722 | 6,005 | 5,336 | 6,535 | |

| TFP | 3.91 | 4.03 | 4.19 | 4.31 | 4.48 | |

| Stock | 0.0822 | 0.0737 | 0.0757 | 0.0613 | 0.0619 | |

| Exporters | Total sales | 166,905 | 196,976 | 237,190 | 231,988 | 254,297 |

| Interest expenditure | 1,430 | 1,685 | 2,103 | 2,287 | 2,155 | |

| Fixed assets | 146,826 | 165,913 | 197,598 | 185,014 | 234,816 | |

| Employees | 437 | 441 | 454 | 427 | 424 | |

| Profit | 9,911 | 11,830 | 15,269 | 13,366 | 15,555 | |

| Stock | 0.0600 | 0.0516 | 0.0436 | 0.0433 | 0.0444 |

Note

- The statistics are averages. Negative value of interest expenditure means the interest income.

3.3 Methodology

In any firm-level analysis of export activity, endogeneity of the key regressors caused by either reverse causality or omitted variables need to be discussed. This is potentially also a problem for our analysis. However, we feel that in our particular case two arguments supporting the exogeneity of our financial variables can be made. First, whether a firm is a stock company is a dummy variable defined by the initial firm registration type. As this decision was made when the firm was established, it is unlikely to be influenced by current export activity or any unobserved contemporaneous firm effects. Second, we measure interest payments which are paid after the borrowing decision. In other words, it reflects a borrowing decision made in the past which is again unlikely to be correlated with contemporaneous exports or other firm characteristics. Still, a possible endogeneity of regressors, which we cannot completely rule out, should be kept in mind when interpreting the results.

As we have two different types of dependent variables, we also employ different estimation techniques established in the literature. When we exploit the export dummy variable, we adopt a random effects probit model (REPM), which allows for a firm-specific effect and that was implemented by Bernard and Jensen (2004) to model the export decision of US firms conditional on a lagged dependent variable. When measuring exports in terms of export volume, we employ system GMM estimation (Arrelano & Bover, 1995; Blundell & Bond, 1998), which is also implemented by Bernard and Jensen (2004). This is a more appropriate estimator in the presence of a continuous dependent variable with a lagged dependent variable on the right-hand side.

3.4 Measure of firm productivity

We adopt the Olley–Pakes (OP) method to estimate firm productivity using value added to measure production as in Melitz and Polanec (2015).19 We use fixed assets and the number of employees as measures of capital and labour. We utilise the perpetual inventory method to calculate capital stocks assuming a 15% depreciation rate.20 Given the OP method requires the real terms of firm's input and output, we use different price deflators for inputs and outputs. The value added is deflated with sector-level producer price indices, and the fixed assets are deflated with province-level price indices of investment in fixed assets.21

4 EMPIRICAL RESULTS

4.1 Baseline estimations

We first look at how a firm's decision to export is affected by financial access estimated by the random-effects probit model (REPM). The likelihood-ratio tests reject the null hypothesis of no random effects. Table 3 reports the estimation results using the interest expenditure to measure the financial constraints (column (1)), adopting the stock dummy (column (2)), including interest expenditure, stock dummy and their interaction (column (3)), including year dummies rather than exchange rate movements (column (4)) and using standardised volume variables rather than logarithm (column (5)) respectively.22

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

|

0.021*** | 0.047*** | 0.073*** | 0.0683*** | |

| (5.281) | (11.00) | (7.736) | (7.736) | ||

|

0.046*** | 0.036*** | 0.0493*** | 0.0511*** | |

| (−6.787) | (4.841) | (10.99) | (10.99) | ||

|

0.0481*** | 0.034*** | 0.709*** | ||

| (4.223) | (62.13) | (62.13) | |||

|

0.310*** | 0.297*** | 0.266*** | 0.257*** | 0.168*** |

| (62.49) | (78.99) | (11.56) | (12.58) | (12.58) | |

|

0.290*** | 0.257*** | 0.321*** | 0.161*** | 0.161*** |

| (15.29) | (−17.80) | (66.11) | (2.630) | (2.630) | |

|

0.184*** | 0.213*** | 0.319*** | 0.757*** | 0.785*** |

| (22.97) | (35.46) | (−16.49) | (16.28) | (16.28) | |

|

0.587*** | 0.702*** | 0.676*** | 0.578* | 0.503* |

| (−30.08) | (40.28) | (−15.58) | (1.651) | (1.651) | |

|

−0.114*** | −0.108*** | −0.155*** | ||

| (−26.37) | (−33.99) | (0.959) | |||

|

0.484*** | 0.499*** | 0.126*** | 0.803*** | 0.715*** |

| (24.79) | (34.97) | (34.19) | (32.71) | (32.71) | |

|

0.629*** | 0.574*** | 0.266*** | 0.262*** | 0.166*** |

| (41.75) | (49.55) | (9.043) | (8.355) | (8.355) | |

| Industry fixed effects | YES | YES | YES | YES | YES |

| Year fixed effects | NO | NO | NO | YES | YES |

| Wald test | 557.67 | 390.21 | 443.67 | 477.32 | 477.32 |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| Log-likelihood | −402.45 | −678.87 | −518.97 | −433.65 | −433.65 |

| Likelihood-ratio test | 46.17 | 88.68 | 101.23 | 85.42 | 85.42 |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| Observations | 117,261 | 190,556 | 117,261 | 117,261 | 117,261 |

Notes

- t-values are in the parentheses after coefficients.

- p-Values in the parentheses after tests.

- Significant at *10%, **5% and ***1%.

As can be seen in Table 3, the signs of the estimated coefficients for all explanatory variables are generally in line with expectations. The coefficients of the financial variables are positive and statistically significant in all specifications, indicating that firms with more borrowing and the ability to issue stocks are more likely to export to foreign markets. Moreover, we find that the coefficients on the interaction term between interest expenditure and stock dummy are positive and statistically significant, which suggests a stronger effect of interest expenditure on the export decision for firms, which can issue stocks. This indicates that the two alternative means of financing reinforce each other. In short, our findings strongly support the prediction that firms who are less restricted by financial constraints (through borrowing or issuing stocks) have a higher propensity to export and firms who have access to both financial options are more likely to export.

Furthermore, we find that an appreciation in the real exchange rate is associated with a lower probability of exporting, conditional on other covariates. Other controls include exporting experience, firm productivity, firm size, profits, foreign firm dummy and east dummy for which we obtain positive coefficients with high significance.

We continue to investigate the relationship between financial access and export ability in Table 4, where we report results from specifications using (the log of) export volume as dependent variable.23 As before, column (1) uses the interest expenditure to measure the financial constraints. Column (2) includes the stock dummy. Column (3) includes interest expenditure, stock dummy and their interaction. Column (4) excludes year dummies and includes exchange rate movements. The standardised coefficients are reported in column (5). Looking at the specification tests, we find that the AR (1) and AR (2) tests indicate that there is first-order serial correlation but no second-order serial correlation in the residuals, which validates our specifications. Furthermore, the Hansen-J test of over-identifying restrictions cannot reject the null hypothesis at any conventional level of significance.24

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

|

0.044*** | 0.025*** | 0.049*** | 0.053*** | |

| (5.90) | (6.569) | (3.916) | (3.916) | ||

|

0.029*** | 0.132** | 0.069*** | 0.089*** | |

| (−3.3) | (2.009) | (26.89) | (26.89) | ||

|

0.0492*** | 0.012*** | 0.104*** | ||

| (−5.050) | (10.78) | (10.78) | |||

|

0.716*** | 0.676*** | 0.355*** | 0.255*** | 0.311*** |

| (35.78) | (73.74) | (10.45) | (20.62) | (20.62) | |

|

0.118*** | 0.380*** | 0.526*** | 0.229*** | 0.218*** |

| (3.41) | (33.99) | (8.280) | (7.171) | (7.171) | |

|

0.162*** | 0.010*** | 0.833*** | 0.264*** | 0.328*** |

| (3.19) | (4.16) | (13.70) | (9.101) | (9.101) | |

|

0.07** | 0.149*** | 0.313*** | 0.131*** | 0.342*** |

| (2.30) | (42.33) | (9.947) | (8.22) | (8.22) | |

|

−1.842*** | −1.511*** | −2.380*** | ||

| (−27.60) | (40.79) | (−30.14) | |||

|

0.144*** | 0.152*** | 0.212*** | 0.181*** | 0.167*** |

| (10.50) | (14.37) | (11.87) | (11.10) | (11.10) | |

|

0.042*** | 0.045* | 0.0386** | 0.0566 | 0.0452 |

| (3.09) | (1.76) | (2.552) | (0.540) | (0.540) | |

| Industry fixed effects | YES | YES | YES | YES | YES |

| Year fixed effects | NO | NO | NO | YES | YES |

| AR (1) | −19.21 | −18.11 | −24.50 | −20.66 | −20.66 |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| AR (2) | 2.01 | 1.71 | 1.34 | 0.78 | 0.78 |

| (0.044) | (0.087) | (0.181) | (0.324) | (0.324) | |

| Hansen | 16.43 | 12.28 | 14.80 | 15.88 | 15.88 |

| (0.142) | (0.158) | (0.128) | (0.133) | (0.133) | |

| Observations | 92,075 | 146,413 | 100,520 | 100,520 | 100,520 |

Notes

- Robust t-values in parentheses after coefficients.

- p-Values in the parentheses after tests.

- ***p < .01, **p < .05, *p < .1.

As indicated in Table 4, the signs of all estimated coefficients from different specifications meet our expectations and are in line with those obtained in Table 3. The results in column (1) suggest that a 10% increase in interest expenditure leads to a 0.44% growth of export volume, ceteris paribus. We also find that the ability to issue stocks is associated with higher export volume. The statistically significant and positive interaction term indicates that the more financial channels a firm has, the better a firm performs in terms of export volume.

Regarding other controls, we still find that exchange rate appreciations are associated with lower export volumes. Furthermore, the positive and significant coefficients found for other controls show that exporting experience, firm productivity, firm size, profit scale, foreign firm dummy and east dummy positively relate to firms’ export ability.

4.2 Investigations for subsamples

The connection between finance access and firms’ exports may differ with firm heterogeneities. For example, access to finance may be different for state-owned compared to private firms, or firms with foreign ownership. This may also be reflected in differences across firm sizes, or different locations with different financial markets. In this section, we look at differences across types of firms, which allows us to gain more detailed policy implications. We investigate the effect of financial constraints on firms’ exports according to firm ownership, firm locations and firm sizes.

4.2.1 Different firm ownerships

In China, state-owned enterprises (SOEs) receive more fiscal subsidies, tax mitigation and financial supports because of their relationship with government (Guariglia & Mateut, 2010; Zhang, Zhou, & Gu, 2003). By contrast, private-owned enterprises (POEs) find it more difficult to obtain loans from financial institutions due to their small-scale, poor guarantee capacities and low repayment abilities. In this subsection, we investigate the impact of financial constraints on firms’ exports for firms of different ownerships.25 Table 5 reports the marginal effects derived from the estimation results for the export decision using random effects probit model,26 while the two-step system GMM estimation results for export volume are shown in Table 6.

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| SOEs | COEs | POEs | HIEs | FIEs | |

|

0.073*** | 0.069*** | 0.017*** | 0.026* | 0.025* |

| (6.12) | (3.46) | (11.96) | (1.95) | (1.68) | |

|

0.145 | 0.112* | 0.015*** | 0.299*** | 0.445 |

| (−0.33) | (−5.04) | (−0.10) | (2.86) | (0.75) | |

|

0.199*** | 0.073*** | 0.004*** | 0.116*** | 0.071 |

| (7.49) | (4.16) | (6.17) | (2.96) | (0.91) | |

|

0.253*** | 0.251*** | 0.325*** | 0.365*** | 0.383*** |

| (7.63) | (11.48) | (46.95) | (18.60) | (18.74) | |

|

0.115 | 0.251*** | 0.424*** | 0.461*** | 0.205*** |

| (0.97) | (2.67) | (14.46) | (6.43) | (3.04) | |

|

0.024*** | 0.067*** | 0.099*** | 0.038** | 0.089*** |

| (5.84) | (3.05) | (15.20) | (2.55) | (5.42) | |

|

0.025*** | 0.056* | 0.021** | 0.069*** | 0.013 |

| (6.58) | (1.95) | (2.35) | (3.53) | (0.62) | |

|

−0.184*** | −0.947*** | −0.616*** | −0.859*** | −0.631*** |

| (−4.17) | (−7.92) | (−26.50) | (−9.60) | (−12.74) | |

|

0.053 | 0.083 | 0.338*** | 0.114** | 0.066 |

| (−0.30) | (−0.66) | (11.00) | (2.19) | (1.02) | |

| Industry fixed effects | YES | YES | YES | YES | YES |

| Wald test | 100.47 | 306.08 | 390.1 | 370.20 | 36.95 |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| Log-likelihood | −80.43 | −109.69 | −200.54 | −44.45 | −52.74 |

| Likelihood-ratio test | 9.97 | 10.02 | 181.56 | 75.65 | 52.74 |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| Observations | 2,112 | 2,024 | 51,254 | 19,008 | 23,599 |

Notes

- Robust z-values in parentheses.

- The marginal effects are reported in this table.

- p-Values are in the parentheses after tests.

- ***p < .01, **p < .05, *p < .1.

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| SOEs | COEs | POEs | HIEs | FIEs | |

|

0.058** | 0.004* | 0.035*** | 0.050*** | 0.055*** |

| (2.43) | (2.19) | (8.63) | (8.74) | (9.82) | |

|

0.114*** | 0.112*** | 0.109*** | 0.103*** | 0.101*** |

| (3.92) | (3.09) | (5.05) | (6.13) | (5.96) | |

|

0.108*** | 0.101** | 0.007*** | 0.019*** | 0.033*** |

| (3.92) | (2.36) | (4.53) | (4.53) | (3.34) | |

|

0.713*** | 0.946*** | 0.645*** | 0.519*** | 0.613*** |

| (10.81) | (14.47) | (30.86) | (15.05) | (24.76) | |

|

−0.045 | 0.226* | 0.369*** | 0.428*** | 0.295*** |

| (−0.36) | (1.84) | (15.93) | (11.68) | (10.48) | |

|

0.135*** | 0.065* | 0.025*** | 0.039*** | 0.020*** |

| (4.75) | (1.86) | (4.58) | (4.64) | (3.03) | |

|

0.033*** | 0.005*** | 0.111*** | 0.186*** | 0.154*** |

| (7.72) | (7.12) | (16.74) | (15.74) | (15.27) | |

|

−3.276*** | −1.247** | −1.244*** | −1.282*** | −1.564*** |

| (−7.16) | (−2.17) | (−15.20) | (−12.10) | (−15.98) | |

|

0.228** | 0.137* | 0.069*** | 0.077*** | 0.027 |

| (2.15) | (1.86) | (−3.96) | (−3.80) | (1.35) | |

| Industry fixed effects | YES | YES | YES | YES | YES |

| AR (1) | −4.52 | −2.43 | −14.61 | −4.05 | −10.25 |

| (0.000) | (0.025) | (0.000) | (0.000) | (0.000) | |

| AR (2) | 0.71 | −1.34 | 0.61 | 0.60 | 0.70 |

| (0.477) | (0.180) | (0.544) | (0.550) | (0.486) | |

| Hansen | 20.00 | 15.03 | 15.78 | 12.07 | 18.71 |

| (0.130) | (0.142) | (0.126) | (0.167) | (0.132) | |

| Observations | 1,574 | 1,288 | 39,361 | 15,552 | 19,357 |

Notes

- Robust t-values in parentheses.

- p-Values in the parentheses after tests.

- ***p < .01, **p < .05, *p < .1.

As illustrated in Table 5, the large coefficient on interest expenditure for SOEs suggests the strongest effect of interest expenditure on the exporting probability for the SOEs due to their lower financial constraints.27 Meanwhile, we find that the effect of interest expenditure is weakest for the POEs, which means that access to this channel of finance does not matter much for export activity of POEs. This may indicate that they are facing financial constraints when it comes to obtaining finance from external financial institutions. With regard to the stock dummy, we see that the coefficients for POEs and HIEs are statistically significant, indicating that for these groups of firms issuing stocks is importantly associated with export activity. This does not seem to be the case, however, for SOEs or firms with investments from non-Chinese investors (FIEs). The possible reason for this result for SOEs lies in that they have more financial options so that they do not rely on issuing stocks to finance their exports.

Lastly, we find the coefficients on the interaction term between interest expenditure and stock dummy to be positive and significant for all types of firms (with the exception of FIEs). This suggests that the more financial options a firm has, the more likely a firm is to export. The statistically insignificant coefficients on all financial variables for FIEs indicate that these firms do not rely on access to finance in China to finance their operations. They may be more reliant on finance from the parent company or generally the home country.

Table 6 shows a somewhat different picture for the export volume of exporting firms. We find that the coefficients on the financial variables are statistically significant and positive for all firm types, including FIEs. There also do not seem to be any strong differences in coefficient sizes across firm types (with the exception of COEs). This suggests that the financial options matter differently for firms to decide whether or not to export (Table 5), but that this is not the case for firms deciding on the export volume once they have entered the export market. This is in line with the idea that access to finance is important to overcome the sunk costs of exporting (which determine export decision) rather than the variable costs.

4.2.2 Different firm locations

The level of financial development varies widely across China. Eastern China is the most financially developed region. Firms situated in Eastern China gain better access to financial support at lower costs; therefore, they may be less restricted by financial constraints (Li & Hu, 2014). We divide China into the east region and the rest region in order to investigate the relation between the financial constraints and firms’ exports. Table 7 presents the estimation results for firms situated in different regions.

| Dependant variable | Export volume | Export decision | ||

|---|---|---|---|---|

| East | Rest | East | Rest | |

| (1) | (2) | (3) | (4) | |

|

0.534** | 0.456*** | 0.0781*** | 0.0361*** |

| (2.308) | (3.229) | (8.579) | (7.074) | |

|

0.074*** | 0.0681*** | 0.0562*** | 0.0481*** |

| (2.835) | (4.816) | (2.714) | (5.485) | |

|

0.468** | 0.010*** | 0.0544** | 0.0745*** |

| (2.522) | (4.078) | (2.038) | (5.707) | |

|

0.215** | 0.480*** | 0.419*** | 0.312*** |

| (2.491) | (4.016) | (38.21) | (54.05) | |

|

0.506*** | 0.413* | 0.399*** | 0.379*** |

| (4.918) | (1.669) | (9.776) | (15.96) | |

|

0.872*** | 0.587*** | 0.107*** | 0.0776*** |

| (6.410) | (2.654) | (−11.66) | (−14.64) | |

|

0.434*** | 0.344** | 0.0275** | 0.0107 |

| (7.315) | (2.379) | (2.022) | (1.539) | |

|

−2.181*** | −3.190*** | −5.290*** | −3.486*** |

| (−12.28) | (−6.934) | (−22.96) | (−23.46) | |

|

0.0766** | 0.187 | 0.351*** | 0.574*** |

| (2.727) | (0.565) | (9.397) | (23.51) | |

| Industry fixed effects | YES | YES | YES | YES |

| AR (1) or Wald test | −6.10 | −4.51 | 153.7 | 363.65 |

| (0.000) | (0.000) | (0.000) | (0.000) | |

| AR (2) or log-likelihood | −2.09 | 0.08 | −168.13 | −232.19 |

| (0.036) | (0.935) | |||

| Hansen or LR test | 14.61 | 16.23 | 548.78 | 150.48 |

| (0.120) | (0.106) | (0.000) | (0.000) | |

| Observations | 57,173 | 43,347 | 62,988 | 54,273 |

Notes

- Robust t-values in parentheses.

- Columns (1)–(2) are estimated by xtabond2. Columns (3)–(4) are estimated by xtprobit. Columns (3)–(4) report the marginal effects.

- p-Values in the parentheses after tests.

- ***p < .01, **p < .05, *p < .1.

From Table 7, we find that the coefficients on the two financial variables appear larger for firms from the Eastern regions in terms of both export volume and export propensity. This finding suggests a stronger effect of the relaxation of financial constraints on firms’ export for exporters from Eastern China, because they have better access to financial supports in the most financially developed regions.

4.2.3 Different firm sizes

The possibility to borrow from financial institutions relates to firm size. Large-scale firms are more likely to acquire financial supports because they normally enjoy more revenue and are able to provide more collateral than small firms.28 We divide exporters into large and small firms using the average value of the fixed assets as the threshold. Table 8 displays the estimation results.

| Dependant variable | Export volume | Export decision | ||

|---|---|---|---|---|

| Large | Small | Large | Small | |

| (1) | (2) | (3) | (4) | |

|

0.746** | 0.237*** | 0.047*** | 0.054*** |

| (2.07) | (2.66) | (5.25) | (10.21) | |

|

0.089** | 0.067 | 0.047*** | −0.145 |

| (2.31) | (0.90) | (2.79) | (−1.35) | |

|

0.477** | 0.813*** | 0.065*** | 0.019 |

| (2.25) | (3.26) | (3.02) | (0.97) | |

|

0.292 | 0.699*** | 0.332*** | 0.301*** |

| (1.41) | (15.65) | (31.57) | (51.85) | |

|

0.227 | 0.036 | 0.281*** | 0.355*** |

| (1.32) | (0.58) | (6.92) | (15.28) | |

|

0.300*** | 0.148*** | 0.057*** | 0.092*** |

| (3.16) | (4.48) | (6.25) | (17.30) | |

|

0.252 | 0.035 | 0.024* | 0.044*** |

| (−1.50) | (−1.64) | (1.88) | (6.00) | |

|

−1.647*** | −2.284*** | −3.771*** | −4.347*** |

| (−2.73) | (−11.53) | (−15.59) | (−29.73) | |

|

−0.226 | −1.082** | 0.227*** | 0.437*** |

| (−0.20) | (−2.31) | (4.97) | (13.75) | |

|

0.349* | 0.106* | 0.126*** | 0.301*** |

| (1.68) | (1.85) | (3.29) | (12.63) | |

| Industry fixed effects | YES | YES | YES | YES |

| AR (1) or Wald test | −3.36 | −4.98 | 125.9 | 39.72 |

| (0.000) | (0.000) | (0.000) | (0.000) | |

| AR (2) or log-likelihood | −1.25 | 1.68 | −115.85 | −275.59 |

| (0.212) | (0.094) | |||

| Hansen or LR test | 10.72 | 13.05 | 204.43 | 227.50 |

| (0.097) | (0.118) | (0.000) | (0.000) | |

| Observations | 37,984 | 54,091 | 45,312 | 71,949 |

Notes

- Robust t-values in parentheses.

- Columns (1)–(2) are estimated by xtabond2. Columns (3)–(4) are estimated by xtprobit. Columns (3)–(4) report the marginal effects.

- p-Values in the parentheses after tests.

- ***p < .01, **p < .05, *p < .1.

As shown in Table 8, the estimated coefficients of interest expenditure for large firms appear somewhat larger than for small firms in both specifications of export volume and export decision. Additionally, concerning the results of the stock dummy, we discover significant coefficients for large firms but insignificant coefficients for small firms. What we find indicates that large firms, which are less financially constrained benefit in terms of export propensity and volume, while small-scale firms are more vulnerable to financial constraints.

4.3 Robustness checks

In this section, we implement several robustness checks to check the reliability of our estimation results thus far. The first concern is endogeneity. Notwithstanding our discussion in Section 3.3 above, one may suspect that interest expenditure is endogenous. To address this issue, we perform an IV-GMM estimation using firm's weighted monetary supply as an instrumental variable as in Li and Yu (2013).29

Columns (1)–(2) of Table 9 report the results of IV-GMM estimation. Several tests were performed to justify the instruments. First, the Sargan statistics cannot reject the null hypothesis of validity of overidentification restrictions, indicating that the set of instruments are valid. Second, the Anderson canon. corr. LM statistics of under-identification reject the null hypothesis that the instruments are uncorrelated with the endogenous variable. Finally, the Cragg–Donald F test of weak identification also rejects the null hypothesis, again indicating the instruments are relevant. After addressing endogeneity, the coefficients of interest expenditure, stock dummy and the interaction term remain significantly positive, which is consistent with the baseline estimates and the theoretical predictions.

| Dependant variable | (1) | (2) |

|---|---|---|

| Export volume | Export decision | |

|

0.676** | 0.295*** |

| (2.105) | (7.574) | |

|

0.682* | 0.804* |

| (1.745) | (1.649) | |

|

0.265* | 0.163* |

| (−1.826) | (1.733) | |

|

0.0874*** | 0.0424*** |

| (5.629) | (6.525) | |

|

0.165*** | 0.758*** |

| (3.529) | (6.610) | |

|

0.0376*** | 0.0147*** |

| (7.332) | (6.286) | |

|

0.0103 | 0.120* |

| (0.126) | (1.670) | |

|

−1.677*** | −0.779*** |

| (−4.298) | (−5.067) | |

|

0.137 | 0.151*** |

| (1.476) | (2.652) | |

|

0.100* | 0.133*** |

| (1.816) | (5.605) | |

| Industry fixed effects | YES | YES |

| Anderson canon. LM statistic or AR (1) | 10.598 | 12.28 |

| (0.000) | (0.000) | |

| Cragg–Donald Wald F statistic or AR (2) | 17.59 | 18.28 |

| Sargan or Hansen | 13.43 | 10.15 |

| (0.141) | (0.927) | |

| Observations | 71,277 | 82,156 |

| R-squared | 0.399 | 0.641 |

Notes

- Robust t-statistics in parentheses.

- Columns (1)–(2) are estimated by xtivereg2.

- p-Values in the parentheses after tests.

- ***p < .01, **p < .05, *p < .1.

5 CONCLUDING REMARKS

The goal of this paper is to shed light on the influence of access to finance on firms’ exports. We set out a simple heterogeneous firm-type model to motivate our empirical analysis, which looks at the effect of access to external finance as well as issuing stocks on firms’ export behaviour. We use firm-level data on Chinese manufacturing firms for 2005–09.

Theoretical predictions suggest that some firms are prevented from exporting due to financial constraints, and firms would be more likely to export and export more if they were less restricted by such constraints. Financial constraints can be alleviated through better access to external financial resources (banks) or issuing stocks to their shareholders. Our empirical investigations are in line with the theoretical predictions. Firms who have more interest expenditure or can issue stocks to their shareholders have higher propensities to export and export more. Moreover, the more financial options a firm has, the better a firm performs in terms of export volume and export propensity. Finally, the effects of the relaxation of financial constraints on export behaviour are stronger for SOEs, firms located in Eastern China, and large-scale firms as these are less financially constrained.

Our results are consistent with previous studies for China pointing to a positive and significant impact of the relaxation of financial constraints on both export volume and export propensity (Du & Girma, 2007; Egger & Kesina, 2013; Li & Yu, 2013; Manova et al., 2011). However, we expand on these studies by adding different forms of finance and investigating the possible interaction between these different financial resources.

More generally, the paper adds to the large body of work on the real effects of financial frictions. Many studies suggest that financial frictions have adverse effects on economic growth, investment and economic volatility (Aghion, Angeletos, Banerjee, & Manova, 2010; Clementi & Hopenhayn, 2006; Rajan & Zingales, 1998). Many other studies find that the financial frictions play a negative role for multinational firm activity and cross-border capital flows (Antras & Caballero, 2009; Antras, Desai, & Fritz Foley, 2009; Chor & Manova, 2012).

Cultivating financial markets are essential to the survival and development of exporters (Manova, 2010). However, financial resources are rare and unevenly distributed in China. Private-owned firms, firms located in non-Eastern regions, and small firms face stronger financial constraints.

Our study hence has many policy implications. First, the government could increase the availability of financial resources in order to stimulate more firms to enter export markets. This could be done through, for example, loosening financial controls or encouraging financial innovations. Second, more financial resources could be distributed to POEs and small-scale firms through government interventions because they experience more financial constraints. The state-owned banks could be encouraged to lend to small firms with lower interest rates. Access to the stock exchange could be liberalised. In order to do this, a reform of the current listing system from current approval and sponsor system may be necessary in order to allow more firms to be listed on the stock market. Finally, preferential financial policies could be given to the under-developed regions in order to reduce the inequality of the financial development.

ACKNOWLEDGEMENTS

This work is supported by National Natural Science Foundation of China (Grant No. 71663003).

Notes

is the amount firms should borrow from financial intermediaries, which is no less than zero.

is the amount firms should borrow from financial intermediaries, which is no less than zero.

is bounded, so that firms with a productivity above

is bounded, so that firms with a productivity above  do not need any exogenous liquidity. Thus, they are not affected by financial constraints.

do not need any exogenous liquidity. Thus, they are not affected by financial constraints.

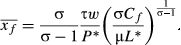

APPENDIX A

and

and  , we can rewrite the cut-off productivities in the following way:

, we can rewrite the cut-off productivities in the following way:

APPENDIX B: PROOF OF PROPOSITION 1

Proposition 3.If  and

and  are continuously distributed from

are continuously distributed from  , and if,

, and if,

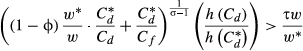

Proof.All firms whose productivities lie between  could potentially profitably export but are prevented because of the financial constraints. A necessary and sufficient condition for Ω to be non-empty is that

could potentially profitably export but are prevented because of the financial constraints. A necessary and sufficient condition for Ω to be non-empty is that  . Making

. Making  , and

, and  , we substitute equation 25 and 26 into

, we substitute equation 25 and 26 into  , which will be held when following formula satisfy:

, which will be held when following formula satisfy:

APPENDIX C: ESTIMATES OF OLS, FE AND SYSTEM GMM

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | |

|---|---|---|---|---|---|---|---|---|---|---|

| OLS | FE | OLS | FE | OLS | FE | OLS | FE | OLS | FE | |

|

0.849*** | 0.118*** | 0.848*** | 0.118*** | 0.847*** | 0.106*** | 0.850*** | 0.121*** | 0.848*** | 0.118*** |

| (469.5) | (25.70) | (469.5) | (25.69) | (598.2) | (30.63) | (472.1) | (26.35) | (469.5) | (25.70) | |

|

0.0172*** | 0.0735*** | 0.0176*** | 0.0740*** | 0.0171*** | 0.0736*** | ||||

| (9.421) | (21.39) | (9.615) | (21.48) | (9.257) | (21.18) | |||||

|

0.0314*** | 0.0540** | 0.108*** | 0.278*** | 0.0626* | 0.0583 | ||||

| (−3.236) | (−2.513) | (−3.181) | (−3.636) | (−1.833) | (−0.759) | |||||

|

0.0509*** | 0.0808** | 0.0962** | 0.0335*** | 0.0293*** | 0.0408*** | ||||

| (−3.285) | (−2.086) | (2.097) | (3.114) | (5.632) | (−6.0377) | |||||

|

0.214*** | 0.0874*** | 0.215*** | 0.0873*** | 0.239*** | 0.102*** | 0.221*** | 0.0781*** | 0.215*** | 0.0873*** |

| (26.59) | (5.377) | (26.63) | (5.372) | (39.01) | (8.578) | (27.57) | (4.786) | (26.63) | (5.368) | |

|

0.00534*** | 0.0425*** | 0.00556*** | 0.0425*** | 0.00211 | 0.0430*** | 0.00648*** | 0.0434*** | 0.00551*** | 0.0425*** |

| (2.889) | (13.91) | (3.005) | (13.91) | (1.518) | (19.49) | (3.507) | (14.15) | (2.980) | (13.91) | |

|

0.0667*** | 0.156*** | 0.0671*** | 0.156*** | 0.0842*** | 0.179*** | 0.0787*** | 0.175*** | 0.0670*** | 0.156*** |

| (26.52) | (24.07) | (26.64) | (24.09) | (52.81) | (40.42) | (36.11) | (27.17) | (26.56) | (24.08) | |

|

−1.638*** | −0.964*** | −1.639*** | −0.963*** | −1.595*** | −0.916*** | −1.623*** | −0.852*** | −1.639*** | −0.963*** |

| (−39.68) | (−21.78) | (−39.71) | (−21.75) | (−49.66) | (−27.99) | (−39.36) | (−19.31) | (−39.72) | (−21.75) | |

|

0.0909*** | 0.133*** | 0.0826*** | 0.127*** | 0.0612*** | 0.155*** | 0.0740*** | 0.132*** | 0.0812*** | 0.126*** |

| (10.23) | (4.051) | (8.930) | (3.843) | (8.445) | (6.329) | (8.002) | (3.965) | (8.748) | (3.820) | |

|

0.0324*** | 0.101*** | 0.0329*** | 0.100*** | 0.0336*** | 0.0497** | 0.0382*** | 0.0875** | 0.0333*** | 0.0998*** |

| (3.491) | (2.938) | (3.550) | (2.923) | (4.858) | (2.176) | (4.120) | (2.545) | (3.593) | (2.915) | |

| Industry fixed effects | YES | YES | YES | YES | YES | YES | YES | YES | YES | YES |

| Observations | 100,520 | 100,520 | 100,520 | 100,520 | 162,797 | 162,797 | 100,520 | 100,520 | 100,520 | 100,520 |

| R-squared | 0.785 | 0.47 | 0.785 | 0.47 | 0.781 | 0.39 | 0.785 | 0.38 | 0.785 | 0.47 |

Notes

- Robust t-statistics in parentheses.

- ***p < .01, **p < .05, *p < .1.