Asymmetric response of the US–India trade balance to exchange rate changes: Evidence from 68 industries

Abstract

The relationship between the trade balance and the exchange rate continues to attract attention by international economists and has entered into new territory, mostly due to advances in econometric methods. The introduction of asymmetric error-correction modelling and asymmetric cointegration using the nonlinear ARDL approach of Shin et al. (Festschrift in Honor of Peter Schmidt: Econometric methods and applications, Springer, 2014, 281) as compared to the symmetric and linear ARDL approach of Pesaran et al. (Journal of Applied Econometrics, 2001, 16, 289) has led us in a new direction to discover relatively better results. We apply these methods to the bilateral trade balance model of each of the 68 industries that trade between India and the USA. The nonlinear approach not only provides more support to the J-curve effect, but also yields support in favour of short-run and long-run asymmetric effects of exchange rate changes in most of the industries.

1 INTRODUCTION

Interest in the link between the trade balance and the real exchange rate keeps growing, mostly due to Magee's (1973) introduction of the J-curve phenomenon, which basically attempts to distinguish the short-run and the long-run effects of exchange rate changes on the trade balance. The trade balance may deteriorate in the short run but can improve in the long run due to a devaluation or depreciation. Bahmani-Oskooee and Hegerty (2010) and Bahmani-Oskooee and Ratha (2004), who reviewed the empirical literature, showed that a majority of the studies have used aggregate trade flows between one country and the rest of the world. These studies were criticised by Rose and Yellen (1989) for suffering from aggregation bias. To reduce the bias, they recommended disaggregating trade data by trading partners and using trade flows at the bilateral level. Their effort in trying to detect the short-run J-curve effect, or even a long-run relationship between the US trade balances with its six major partners and bilateral real exchange rates, was futile.

Rose and Yellen's (1989) approach was recently criticised by Bahmani-Oskooee and Fariditavana (2016) for assuming the effects of real bilateral exchange rate changes to be symmetric. Once Bahmani-Oskooee and Fariditavana (2016) argue for asymmetric effects and introduce non-linear adjustment of the real exchange rate into the bilateral trade balance model, they demonstrate that in most cases, indeed, currency depreciation or appreciation could have significant short-run and long-run asymmetric effects. They then recommend the asymmetry analysis to be applied to the experiences of other pairs of countries.

Following the recommendation of Bahmani-Oskooee and Fariditavana (2016), recently Bahmani-Oskooee and Saha (2017) considered the asymmetry experiences of India's bilateral trade balances with her 14 major trading partners and provided relatively more support for the J-curve effect which was attributed to separating depreciations from appreciations and introducing non-linear adjustment of the exchange rate. However, in the trade balance with the USA, one of the two largest trading partners of India, with more than 8% trade share, long-run asymmetric effects were insignificant.1 We wonder whether poor results in the case of trade with the USA could be due to using aggregate bilateral trade flows between the two countries. To determine the answer, we disaggregate the trade flows by commodity and consider bilateral trade balances of 68 3-digit SITC industries that trade between the two countries. These 68 industries conduct close to 71% of trade between the USA and India and they are the industries for which continuous time-series data were available. To compare our findings to previous studies, we first use the linear ARDL approach of Pesaran, Shin, and Smith (2001) where symmetry assumption is maintained. We then apply the non-linear ARDL approach of Shin, Yu, and Greenwood-Nimmo (2014) to identify industries which benefit from currency depreciation in the non-linear model if not in the linear model. To that end, we introduce the models and both the methods in Section 2. Our empirical results are presented in Section 3 with a summary and conclusion in Section 4. Finally, data definitions and sources are provided in an Appendix.2

2 THE MODELS AND THE METHODS

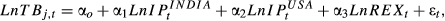

(1)

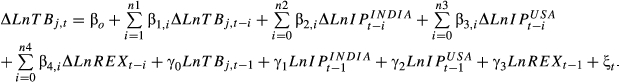

(1) (2)

(2) 's and its long-run effects by

's and its long-run effects by  . However, for the long-run effects to be valid, cointegration must be established. Pesaran et al. (2001) recommend applying the F test to establish joint significance of the linear combination of lagged level variables as a sign of cointegration. However, the F test in this set-up has new critical values that they tabulate. They argue that their upper bound critical value could be used when we have combination of I(0) and I(1) variables, ruling out pre unit root testing on the assumption that almost all macroeconomic variables are either I(0) or I(1). Since their critical values are asymptotic in nature and are for large samples, so for small sample such as this work Narayan (2005) provides the corresponding critical values that will be used in this paper.

. However, for the long-run effects to be valid, cointegration must be established. Pesaran et al. (2001) recommend applying the F test to establish joint significance of the linear combination of lagged level variables as a sign of cointegration. However, the F test in this set-up has new critical values that they tabulate. They argue that their upper bound critical value could be used when we have combination of I(0) and I(1) variables, ruling out pre unit root testing on the assumption that almost all macroeconomic variables are either I(0) or I(1). Since their critical values are asymptotic in nature and are for large samples, so for small sample such as this work Narayan (2005) provides the corresponding critical values that will be used in this paper.As mentioned before, the main assumption in models such as (2) is that the exchange rate changes have symmetric effects. However, as argued by Bahmani-Oskooee and Fariditavana (2016), this need not be the case if traders have different expectations when a currency depreciates versus when it appreciates. Furthermore, there is now clear evidence that import and export prices react to exchange rate changes in an asymmetric manner (Bussiere, 2013) which implies that import and export quantities and eventually the trade balance should follow the same path. Therefore, our next step is to modify (2) by introducing asymmetric effects of exchange rate changes.

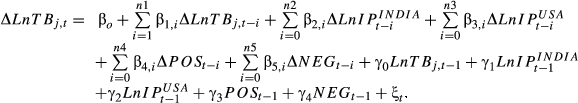

. This time-series variable includes positive changes (rupee appreciation), negative changes (rupee depreciation) and no changes. Using this series, we separate the positive changes from the negative changes and generate the two new series, one representing only rupee appreciation and the other one representing only rupee depreciation. This is done using the concept of the partial sum, where partial sum of positive changes (denoted by POS) signifies only rupee appreciation and partial sum of negative changes (denoted by NEG) signifies only rupee depreciation.5 The next step is to shift back to specification (2) and replace LnREX variable by POS and NEG variables. The new specification then takes the following form:

. This time-series variable includes positive changes (rupee appreciation), negative changes (rupee depreciation) and no changes. Using this series, we separate the positive changes from the negative changes and generate the two new series, one representing only rupee appreciation and the other one representing only rupee depreciation. This is done using the concept of the partial sum, where partial sum of positive changes (denoted by POS) signifies only rupee appreciation and partial sum of negative changes (denoted by NEG) signifies only rupee depreciation.5 The next step is to shift back to specification (2) and replace LnREX variable by POS and NEG variables. The new specification then takes the following form:

(3)

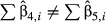

(3)Once this non-linear ARDL model is estimated and the joint significance of lagged level variables is established, several asymmetry hypotheses associated with rupee appreciation and rupee depreciation could be tested. First, if the optimum number of lags attached to ΔPOS is different than those attached to ΔNEG, that will be the evidence of short-run adjustment asymmetry. On the other hand, if the size or sign of the estimated coefficients obtained for ΔPOS differs from their counterpart estimates obtained for ΔNEG variable, that will justify short-run asymmetric effects. Although we can test to determine whether  for each value of i, we will avoid this due to volume of the results. Instead, we will apply the Wald test to determine whether

for each value of i, we will avoid this due to volume of the results. Instead, we will apply the Wald test to determine whether  . If true, that will support short-run cumulative or impact asymmetric effects of exchange rate changes on the trade balance of industry j. Finally, we will apply the Wald test to determine whether normalised long-run coefficient estimates obtained for the POS variable are significantly different than the one obtained for the NEG variable, that is, if

. If true, that will support short-run cumulative or impact asymmetric effects of exchange rate changes on the trade balance of industry j. Finally, we will apply the Wald test to determine whether normalised long-run coefficient estimates obtained for the POS variable are significantly different than the one obtained for the NEG variable, that is, if  . If true, that will justify long-run asymmetric effects.7

. If true, that will justify long-run asymmetric effects.7

3 THE EMPIRICAL RESULTS

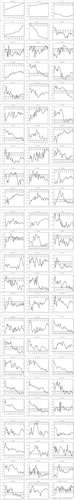

In this section, we estimate both the linear and the non-linear error-correction models (2) and (3), respectively, using annual data over the period of 1973–2014 from 68 3-digit SITC industries that trade between India and the USA. These were the only industries for which continuous data during our study period were available only on annual basis and they all together engage in 71% of trade between the two countries.8 In order to gain some insight about the performance of each industry, we plot the measure of the trade balance of each industry as well as other variables in Figure 1. As can be seen, the POS and NEG variables truly represent rupee appreciation and rupee depreciation, respectively.

Furthermore, while some variables such as the trade balance of industry 273 (i.e., LnTB273) oscillate most likely around its mean, that of industry 292 does not. This implies that the first variable is likely to be I(0), whereas the second one is I(1) or perhaps even I(2). However, in order to make sure that variables are either I(0) or I(1) which is a requirement of Pesaran et al.'s (2001) ARDL approach, we apply the augmented Dickey–Fuller (ADF) test to the level as well as to the first difference of each variable. The results are reported in Table 1, which reveals that while most variables are I(1), several variables are I(0). This indeed requires using Pesaran et al.'s (2001) bounds testing approach as explained in the previous section.

| Variables | Level | First difference | Variables | Level | First difference |

|---|---|---|---|---|---|

| LnIP INDIA | −0.81 [1]b | −4.56 [0]***e | 673 | −3.72 [0]*** | −5.75 [1] *** |

| LnIP USA | −0.63 [0]c | −4.69 [0]*** | 677 | −3.68 [0] *** | −5.75 [0] *** |

| Ln REX | −2.03 [0]d | −4.57 [0]*** | 678 | −1.42 [2] | −7.10 [1] *** |

| POS | −1.24 [0] | −5.18 [1]*** | 682 | −1.36 [1] | −10.02 [0] *** |

| NEG | −1.17 [2] | −3.14 [1]** | 692 | −1.61 [0] | −6.36 [0] *** |

| 122a | −3.21 [1]** | −5.26 [0]*** | 693 | −1.81 [0] | −5.31 [0] *** |

| 273 | −4.76 [0]*** | −7.02 [2]*** | 694 | −3.58 [0] *** | −6.04 [1] *** |

| 276 | −1.16 [4] | −7.70 [1]*** | 695 | −1.66 [0] | −6.17 [0] *** |

| 291 | −3.26 [0]** | −4.77 [3]*** | 697 | −2.92 [1]* | −9.59 [0] *** |

| 292 | −2.49 [3] | −6.24 [2]*** | 698 | −2.30 [0] | −7.24 [1] *** |

| 512 | −1.09 [0] | −5.77 [1]*** | 711 | −1.53 [0] | −4.41 [4] *** |

| 513 | −1.91 [0] | −7.36 [0]*** | 712 | −0.9 [2] | −5.96 [1] *** |

| 514 | −1.65 [4] | −5.22 [3]*** | 714 | −2.61 [1]* | −4.54 [0] *** |

| 531 | −2.34 [0] | −7.44 [0]*** | 715 | −3.09 [0]** | −3.07 [2]** |

| 541 | 0.08 [0] | −5.62 [0]*** | 717 | −1.31 [0] | −5.17 [2] *** |

| 551 | −3.65 [0]*** | −5.11 [2]*** | 718 | −0.21 [1] | −10.72 [0] *** |

| 553 | −2.52 [2] | −3.34 [0]** | 719 | −0.16 [4] | −4.44 [3] *** |

| 554 | −1.13 [0] | −1.67 [0] | 722 | −0.64 [1] | −8.72 [0] *** |

| 581 | −1.58 [2] | −6.57 [1]*** | 724 | −1.04 [0] | −5.08 [1] *** |

| 599 | −1.71 [0] | −6.53 [0]*** | 725 | −1.58 [2] | −5.33 [2] *** |

| 612 | −4.01 [2]*** | −6.41 [1]*** | 729 | −1.00 [0] | −4.97 [1] *** |

| 629 | −2.91 [0]* | −6.09 [1]*** | 732 | −1.26 [2] | −7.09 [1] *** |

| 632 | −0.58 [4] | −5.61 [4]*** | 733 | −2.57 [1] | −6.97 [1] *** |

| 641 | −2.08 [0] | −3.62 [3]*** | 812 | −2.17 [2] | −3.55 [1]** |

| 642 | −1.62 [0] | −6.00 [0]*** | 821 | −1.44 [0] | −5.09 [0] *** |

| 651 | −1.17 [2] | −6.44 [2]*** | 841 | −4.50 [0] *** | −6.59 [1] *** |

| 652 | −3.68 [1]*** | −4.85 [2]*** | 861 | −2.31 [0] | −5.49 [2] *** |

| 653 | −4.15 [3]*** | −5.44 [2] *** | 863 | −1.68 [0] | −6.23 [0] *** |

| 654 | −4.29 [0]*** | −7.38 [1] *** | 891 | −3.21 [0] ** | −7.23 [0] *** |

| 655 | −1.22 [0] | −6.25 [0] *** | 892 | −1.04 [0] | −4.41 [3] *** |

| 656 | −3.32 [0]** | −7.21 [0] *** | 893 | −2.42 [0] | −8.00 [0] *** |

| 657 | −1.84 [0] | −6.42 [0] *** | 894 | −4.38 [1]*** | −5.80 [0] *** |

| 661 | −1.61 [1] | −9.91 [0] *** | 895 | −0.81 [1] | −7.52 [0] *** |

| 663 | −3.22 [0]** | −5.55 [1] *** | 897 | −2.92 [0]* | −7.34 [0] *** |

| 664 | −1.41 [2] | −5.00 [1] *** | 899 | −2.59 [2] | −6.43 [2] *** |

| 665 | −2.96 [0]** | −6.34 [0] *** | 931 | −2.07 [1] | −9.18 [0] *** |

| 667 | −2.51 [2] | −4.25 [0] *** |

Notes

- aThe ADF test applied to Ln TB of each industry is identified by industry's code only.

- bMaximum number of lags imposed is 4.

- cNumbers inside the parentheses are the optimum lag order in the ADF test selected by Akaike's information criterion.

- dThe critical values for the ADF test statistic (for n < 50) at 1%, 5% and 10% levels are −3.58, −2.93 and −2.60, respectively.

- e***, ** and * indicate that the relevant test statistic is significant at 1%, 5% and 10% levels, respectively.

Since data are annual, we follow the literature and impose a maximum of four lags on each first-differenced variable and use the Akaike's information criterion to select an optimum model.9 We then report the results from each optimum model in several tables to be discussed below. For ease of understanding, if a coefficient estimate or a statistic is significant at the 10% (5%) level, it is indicated by * (**). Critical values from different sources reported at the end of each table are used to arrive at these significance levels.

Due to the volume of tables, we summarise the estimates of the linear ARDL model here but will make them available upon request. However, estimates of non-linear models are fully reported and discussed below. Estimates of the linear model for each industry revealed that the real bilateral exchange rate carried at least one significant coefficient estimate in 47 industries, implying that the real exchange rate changes had significant short-run effects on the trade balance of 47 industries. If we relied upon short-run concept of the J-curve tested originally by Bahmani-Oskooee (1985, 1989), that is, negative or insignificant coefficient estimates at lower lags followed by positive and significant estimates at higher lag, then there was support for this definition in nine industries coded as 612, 641, 653, 678, 692, 717, 719, 722 and 931. However, if we followed Rose and Yellen (1989) and defined the J-curve as short-run deterioration combined with long-run improvement, then there was evidence of the phenomenon in 27 industries coded 276, 513, 514, 554, 581, 629, 632, 655, 661, 665, 667, 673, 693, 695, 697, 698, 714, 725, 732, 812, 821, 863, 893, 894, 895, 897 and 899. In these industries, the real exchange rate carried a significantly positive coefficient in the long run. While almost all of these industries are small, two large industries, that is, 661 (Lime, cement, etc.) with 3.24% trade share and 667 (Pearls and precious and semi-precious stones) with 12% trade share, are in the list and seem to benefit from rupee depreciation in the long run. On the other hand, the second largest industry coded 541 (Medicinal and pharmaceutical products) with 7.85% share of trade was found to be hurt by rupee depreciation since exchange rate elasticity was significantly negative. This and other industries in which the exchange rate elasticity was significantly negative are industries in which either Indian import demand or the US import demand is inelastic. The long-run estimates further revealed that Indian income carried significant coefficient in 26 industries and the US income was significant in 30 industries.10 How do the results change if we move to the estimates of the non-linear ARDL model (3)? These estimates are reported in Tables 2-4.

| Industries (trade shares) | Short-run coefficient estimates | |||||||

|---|---|---|---|---|---|---|---|---|

| ∆POS t | ∆POS t−1 | ∆ POS t−2 | ∆ POS t−3 | ∆ NEG t | ∆ NEG t−1 | ∆ NEG t−2 | ∆ NEG t−3 | |

| 122—Tobacco manufactures (0.02) | −5.54 [0.6] | 15.35 [2.1]** | −4.93 [0.5] | 21.67 [2.7]** | −0.03 [0.0] | 0.16 [0.0] | −7.71 [1.2] | −12.32 [3.2]** |

| 273—Stone, sand and gravel (0.01) | −45.7 [2.7]** | −19.8 [1.4] | −10.1 [1.2] | 9.3 [1.0] | 1.71 [0.2] | −12.5 [2.0]** | ||

| 276—Other crude minerals (0.09) | 12.6 [2.9]** | 7.41 [2.2]** | 6.37 [1.7]* | 1.93 [0.8] | −7.6 [2.7]** | −4.7 [1.7]* | ||

| 291—Crude animal materials, n.e.s. (0.02) | −0.5 [0.1] | −27.8 [3.4]** | −12.4 [2.0]** | −7.8 [1.3] | −12.3 [3.7]** | |||

| 292—Crude vegetable materials, n.e.s. (0.41) | −6.8 [2.5]** | −1.6 [0.7] | −3.9 [1.6] | −1.8 [0.9] | 3.6 [2.4]** | 1.8 [1.0] | −0.7 [0.4] | 1.80 [1.7]* |

| 512—Organic chemicals (4.26) | −2.0 [0.7] | −4.2 [1.5] | 3.9 [2.4]** | 0.8 [0.5] | 3.2 [1.9]* | |||

| 513—Inorg. chemicals elems., oxides, halogen salts (0.35) | 9.9 [1.3] | 3.5 [0.6] | −9.6 [1.8]* | |||||

| 514—Other inorganic chemicals (0.25) | 8.0 [2.5]** | 6.9 [2.7]** | −6.4 [2.3]** | −8.9 [2.8]** | −5.0 [1.9]* | |||

| 531—Synth. organic dyestuffs, natural indigo & lakes (0.32) | 7.1 [2.4]** | −2.5 [1.1] | 1.2 [0.5] | 0.6 [0.3] | 4.1 [2.2]** | 3.2 [2.3]** | ||

| 541—Medicinal & pharmaceutical products (7.85) | −3.2 [1.8]* | −0.4 [0.5] | ||||||

| 551—Essential oils, perfume and flavour materials (0.30) | −3.5 [1.0] | 3.2 [2.2]** | ||||||

| 553—Perfumery, cosmetics, dentifrices, etc. (0.16) | 7.8 [1.4] | −10.4 [1.5] | −4.3 [0.7] | −9.0 [2.0]** | −10.8 [2.8]** | −4.4 [1.3] | ||

| 554—Soaps, cleansing and polishing preparations (0.10) | 0.5 [0.3] | 1.8 [1.2] | −5.3 [2.8]** | −4.0 [2.1]** | −4.0 [2.1]** | |||

| 581—Plastic materials, regenerd. cellulose and resins (3.09) | −4.9 [1.8] | 22.6 [5.1]** | 9.9 [4.7]** | 1.5 [0.7] | 3.9 [2.0]** | |||

| 599—Chemical materials and products, n.e.s. (1.32) | −2.5 [0.4] | 22.9 [2.6]** | 13.9 [1.9]* | −10.0 [2.5]** | −3.0 [0.7] | 2.0 [0.5] | 6.9 [2.1]** | |

| 612—Manuf. of leather or of artif. or reconst. leather (0.01) | −2.2 [0.7] | 3.7 [1.6] | −1.0 [0.6] | 1.2 [0.7] | 2.6 [1.6] | 3.3 [2.2]** | ||

| 629—Articles of rubber, n.e.s. (0.48) | −23.2 [2.8]** | −11.6 [1.7]* | −0.1 [0.0] | −7.3 [2.3]** | −4.0 [1.1] | −6.8 [2.6]** | ||

| 632—Wood manufactures, n.e.s. (0.10) | −11.2 [2.1]** | 2.2 [1.4] | ||||||

| 641—Paper and paperboard (0.27) | 21.4 [2.8]** | −30.3 [2.8]** | −12.6 [1.6] | 7.3 [1.2] | −9.1 [1.9]* | 11.7 [2.5]** | ||

| 642—Articles of paper, pulp, paperboard (0.08) | −6.0 [2.6]** | 2.2 [1.4] | ||||||

| 651—Textile yarn and thread (0.15) | −7.6 [1.5] | 15.4 [2.7]** | −1.8 [0.4] | −7.3 [2.0]** | −1.6 [0.5] | −0.8 [0.2] | 13.2 [3.2]** | 9.5 [4.2]** |

| 652—Cotton fabrics, woven ex. narrow or sepc. fabrics (0.09) | 2.4 [0.2] | −50. 8 [3.7]** | −28.2 [2.4]** | −3.2 [0.4] | ||||

| 653—Text fabrics woven ex narrow, spec, not cotton (0.42 | −12.0 [3.0]** | −14.2 [3.5]** | −10.4 [2.9]** | −10.2 [4.2]** | 6.4 [2.6]** | 9.9 [3.6]** | 6.5 [3.5]** | |

| 654—Tulle, lace, embroidery, ribbons, trimmings (0.05) | 1.0 [0.4] | −3.4 [1.8]* | 0.2]0.1] | −6.2 [3.6]** | ||||

| 655—Special textile fabrics and related (0.21) | −1.6 [0.9] | 2.1 [1.2] | −6.7 [3.6]** | −3.9 [1.9]* | ||||

| 656—Made up articles, wholly or chiefly (3.24) | −14.3 [4.1]** | −0.5 [0.2] | ||||||

| 657—Floor coverings, tapestries, etc. (1.20) | −9.8 [2.7]** | −2.3 [1.1] | ||||||

| 661—Lime, cement & fabr. bldg. mat. Ex glass/clay mat (3.24) | 10.4 [1.2] | −5.6 [1.2] | ||||||

| 663—Mineral manufactures, n.e.s. (0.15) | 8.3 [2.2]** | −4.9 [2.1] | −0.0 [0.0] | |||||

| 664—Glass (0.17) | 1.8 [0.6] | −1.9 [0.8] | −6.3 [2.5]** | |||||

| 665—Glassware (0.13) | 18.2 [4.1]** | −8.5 [3.0]** | ||||||

| 667—Pearls and precious and semi-precious stones (12.0) | 9.9 [2.4]** | 4.7 [1.7]* | −4.1 [1.6]] | −1.4 [0.5] | 0.5 [0.2] | −3.0 [1.6] | ||

| 673—Iron and steel bars, rods, angles, shapes, sections (0.20) | −3.8 [1.2] | 4.6 [3.2]** | ||||||

| 677—Iron and steel wire, excluding wire rod (0.10) | 12.3 [2.2]** | 1.2 [0.3] | 8.9 [2.3]** | 8.8 [2.4]** | ||||

| 678—Tubes, pipes and fittings of iron or steel (0.88) | 7.4 [1.7]* | −15.0 [2.5]** | −9.4 [3.1]** | −5.6 [2.0]** | −2.9 [0.8] | 4.4 [2.1]** | ||

| 682—Copper (0.08) | 1.6 [0.3] | 10.5 [1.9]* | −6.7 [1.7]* | −3.6 [1.1] | ||||

| 692—Metal containers for storage and transport (0.08) | 2.5 [0.5] | −0.2 [0.0] | 10.3 [3.1] | |||||

| 693—Wire products ex electric and fencing grills (0.03) | 11.3 [1.7]* | −19.4 [1.6] | −9.6 [1.0] | 13.3 [2.3]** | −5.2 [1.1] | −8.2 [1.7]* | −13.5 [2.4]** | 6.9 [2.0]** |

| 694—Nails, screws, nuts, bolts, rivets and sim. articles (0.18) | 7.7 [1.2] | −33.4 [4.1]** | −20.6 [3.0]** | −6.0 [1.6] | 7.2 [2.3]** | |||

| 695—Tools for use in the hand or in machines (0.28) | −0.3 [0.3] | 1.7 [2.1]** | −1.5 [1.8]* | |||||

| 697—Household equipment of base metals (0.40) | 12.9 [3.4]** | 7.0 [2.2]** | 11.2 [2.9]** | 12.2 [3.2]** | ||||

| 698—Manufactures of metal, n.e.s. (0.55) | 1.1 [0.5] | −4.2 [2.5]** | 0.8 [0.6] | 3.0 [2.0]** | ||||

| 711—Power generating machinery, other than electric (1.13) | 5.1 [1.9]* | 3.5 [1.5] | 7.5 [3.1]** | |||||

| 712—Agricultural machinery and implements (0.37) | 3.4 [1.3] | 4.6 [1.8]* | −0.8 [0.3] | −0.7 [0.2] | 4.5 [2.1]** | |||

| 714—Office machines (0.44) | 0.4 [0.1] | 0.5 [0.2] | ||||||

| 715—Metalworking machinery (0.19) | 7.2 [1.8]* | −6.0 [1.6] | −1.3 [0.8] | |||||

| 717—Textile and leather machinery (0.06) | 7.7 [2.2]** | −3.2 [2.3]** | ||||||

| 718—Machines for special industries (0.63) | −7.3 [3.0]** | 2.7 [2.6]** | ||||||

| 719—Machinery and appliances nonelectrical parts (3.99) | 1.8 [2.5]** | −0.5 [0.7] | 1.1 [1.6] | 1.8 [2.5]** | 2.0 [3.9]** | |||

| 722—Electric power machinery and switchgear (1.39) | −0.1 [0.1] | 10.5 [5.9]** | 4.1 [2.5]** | −4.3 [3.4]** | −4.9 [5.5]** | 0.2 [0.3] | 6.2 [5.3]** | 6.5 [8.5]** |

| 724—Telecommunications apparatus (1.02) | 1.6 [0.4] | −12.3 [3.6]** | −9.4 [3.0]** | −6.9 [2.3]** | 2.4 [0.9] | |||

| 725—Domestic electrical equipment (0.03) | −7.8 [1.1] | 6.0 [2.4]** | ||||||

| 729—Other electrical machinery and apparatus (1.12) | −3.3 [2.4]** | 1.7 [3.1]** | ||||||

| 732—Road motor vehicles (1.51) | 0.3 [0.1] | 3.1 [3.0]** | ||||||

| 733—Road vehicles other than motor vehicles (0.06) | −21.6 [1.6] | 40.2 [2.8]** | 18.2 [2.0]** | 3.1 [0.4] | 19.8 [2.0]** | 17.4 [2.8]** | ||

| 812—Sanitary, plumbing, heating & lighting fixtures (0.21) | 3.2 [1.5] | 1.9 [1.3] | −1.6 [1.4] | −5.3 [4.0]** | 2.1 [2.2]** | |||

| 821—Furniture (0.72) | 1.1 [0.3] | −9.7 [2.6]** | −1.1 [0.3] | −3.8 [1.6] | −5.9 [2.7]** | −4.3 [2.3] | ||

| 841—Clothing except fur clothing (5.44) | −9.1 [2.3]** | 4.4 [1.6] | −4.8 [2.2]** | |||||

| 861—Scientific, medical, optical, meas./contr. instrum. (1.31) | 1.5 [0.8] | −2.4 [1.6] | 0.1 [0.1] | −2.7 [1.6] | −1.9 [1.6] | |||

| 863—Developed cinematographic film (0.0006) | −8.2 [1.3] | −6.6 [1.1] | −3.9 [0.6] | 8.9 [1.6] | 9.2 [2.2]** | −17.7 [3.6]** | −19.6 [4.5]** | −5.9 [2.0]** |

| 891—Musical instruments, sound recorder and parts (1.14) | −7.7 [3.2]** | 3.1 [1.7]* | −2.0 [1.1] | −6.8 [3.3]** | −4.2 [2.5]** | |||

| 892—Printed matter (0.21) | −4.7 [2.7]** | 2.4 [3.7]** | ||||||

| 893—Articles of artificial plastic materials n.e.s. (0.32) | −1.5 [0.3] | 0.9 [0.2] | −9.3 [3.0]** | 3.6 [1.6] | ||||

| 894—Perambulators,toys, games and sporting goods (0.11) | 21.8 [3.2]** | 12.4 [1.2] | 28.6 [3.0]** | 6.7 [1.4] | −23.4 [4.5]** | −6.4 [1.6] | −4.9 [1.8]* | |

| 895—Office and stationery supplies, n.e.s (0.07) | −11.5 [1.4] | 0.4 [0.1] | −11.4 [2.2]** | 3.5 [0.7] | ||||

| 897—Jewellery and gold/silver smiths wares (2.55) | 4.2 [1.0] | 21.3 [4.6]** | 12.8 [3.1]** | −0.8 [0.3] | −6.3 [2.2]** | −3.9 [1.2] | −5.2 [2.7]** | |

| 899—Manufactured articles, n.e.s. (0.40) | −5.8 [2.1]** | −4.4 [1.9]* | −14.0 [4.5]** | −0.9 [0.4] | 0.2 [0.1] | 4.8 [2.1]** | ||

| 931—Special transactions not classd. accord. to kind (3.22) | −0.1 [0.0] | −1.5 [0.5] | 10.8 [3.6]** | 2.9 [1.7]* | ||||

Notes

- Numbers inside the parentheses are absolute values of the t-ratios. The critical value of standard t-ratio is 1.64 (1.96) at the 10% (5%) significance level.

- *Significance at the 10% level and ** at the 5% level.

| Industries (trade shares) | Long-run coefficient estimates | ||||

|---|---|---|---|---|---|

| Constant | Ln IP INDIA | Ln IP USA | POS | NEG | |

| 122—Tobacco manufactures (0.02) | −9.08 [0.2] | 14.86 [1.2] | −6.63 [0.6] | −24.66 [1.1] | 12.51 [1.3] |

| 273—Stone, sand and gravel (0.01) | −32.93 [1.1] | −30.58 [1.9]* | 20.07 [1.6] | 52.92 [2.1]** | −14.68 [2.0]* |

| 276—Other crude minerals (0.09) | −18.89 [3.6]** | −4.3 [4.0]** | 7.02 [4.1]** | 8.20 [5.3]** | 0.32 [0.4] |

| 291—Crude animal materials, n.e.s. (0.02) | −8.62 [0.7] | −17.29 [2.6]** | 10.29 [1.6] | 30.70 [2.8]** | −12.32 [3.7]** |

| 292—Crude vegetable materials, n.e.s. (0.41) | 1.84 [0.4] | 6.10 [4.7]** | −4.99 [3.0]** | −9.3 [4.6]** | 1.88 [3.1]** |

| 512—Organic chemicals (4.26) | 15.26 [1.4] | −3.40 [0.8] | −1.27 [0.30] | 4.16 [0.7] | −1.76 [0.8] |

| 513—Inorg. chemicals elems., oxides, halogen salts (0.35) | −20.19 [0.8] | −5.30 [0.6] | 9.58 [1.0] | 15.21 [1.1] | 7.51 [1.5] |

| 514—Other inorganic chemicals (0.25) | −7.80 [2.3]** | 0.40 [0.6] | 2.4 [2.4]** | 3.06 [2.7]** | 4.87 [7.6]** |

| 531—Synth. organic dyestuffs, natural indigo & lakes (0.32) | −19.84 [2.5]** | −11.20 [3.0]** | 10.61 [3.0]** | 18.30 [3.2]** | −3.62 [1.7]* |

| 541—Medicinal and pharmaceutical products (7.85) | 41.88 [4.7]** | 4.01 [1.4] | −12.70 [3.6]** | −7.35 [1.8]* | −0.92 [0.5] |

| 551—Essential oils, perfume and flavour materials (0.30) | −1.13 [0.2] | 5.02 [1.9]* | −2.87 [1.1] | −8.29 [2.0]** | 3.06 [2.0]** |

| 553—Perfumery, cosmetics, dentifrices, etc. (0.16) | −5.66 [0.6] | −13.91 [2.7]** | 7.20 [1.5] | 26.64 [3.2]** | −10.12 [4.2]** |

| 554—Soaps, cleansing and polishing preparations (0.10) | −42.88 [2.3]** | 0.29 [0.1] | 11.58 [1.9]* | 1.41 [0.3] | 11.12 [4.2]** |

| 581—Plastic materials, regenerd. cellulose & resins (3.09) | 53.31 [7.6]** | 21.70 [6.2]** | −23.81 [6.8]** | −34.91 [6.3]** | 11.71 [7.1]** |

| 599—Chemical materials and products, n.e.s (1.32) | 63.76 [3.8]** | 19.11 [2.9]** | −25.95 [3.5]** | −30.20 [2.9]** | 4.81 [1.7]* |

| 612—Manufacturer of leather or of artificial leather (0.01) | 21.18 [3.3]** | 2.92 [2.1]** | −8.30 [4.5]** | −2.89 [1.4] | −3.04 [2.6]** |

| 629—Articles of rubber, n.e.s (0.48) | −36.94 [4.0]** | −14.34 [4.0]** | 16.66 [4.0]** | 25.96 [4.7]** | −1.97 [1.4] |

| 632—Wood manufactures, n.e.s. (0.10) | 4.62 [2.1]** | 3.88 [4.7]** | −4.68 [5.4]** | −1.07 [0.8] | 0.73 [1.4] |

| 641—Paper and paperboard (0.27) | 15.84 [1.7]* | −21.01 [5.1]** | 8.39 [2.0]** | 37.60 [5.6]** | −10.78 [5.4]** |

| 642—Articles of paper, pulp, paperboard (0.08) | 44.09 [6.2]** | 7.88 [3.7]** | −16.08 [6.1]** | −9.64 [3.0]** | −0.17 [0.1] |

| 651—Textile yarn and thread (0.15) | 40.88 [2.5]** | 12.30 [2.3]** | −16.71 [2.4]** | −20.73 [2.5]** | 3.45 [1.9]* |

| 652—Cotton fabrics, woven (0.09) | −101.84 [2.6]** | −51.85 [2.2]** | 51.63 [2.4]** | 84.01 [2.3]** | −21.83 [1.9]* |

| 653—Text fabrics woven (0.42 0 | 7.89 [1.2] | −0.66 [0.5] | −3.89 [2.0]** | 1.87 [0.8] | −6.45 [6.1]** |

| 654—Tulle, lace, embroidery, ribbons, trimmings (0.05) | 6.44 [2.0]** | −0.42 [0.4] | −2.51 [2.2]** | 0.60 [0.4] | −2/10 [3.5]** |

| 655—Special textile fabrics and related (0.21) | −7.29 [0.6] | 2.50 [1.0] | 1.03 [0.3] | −3.49 [0.9] | 5.50 [2.2]** |

| 656—Made up articles, wholly or chiefly (3.24) | 17.09 [2.2]** | 10.88 [4.6]** | −12.03 [4.1]** | −14.27 [4.1]** | 5.13 [3.5]** |

| 657—Floor coverings, tapestries, etc. (1.20) | −34.40 [6.4]** | 7.73 [3.2]** | 5.19 [2.1]** | −9.78 [2.7]** | 6.77 [6.1]** |

| 661—Lime, cement and fabricated building materials (3.24) | −60.16 [1.6] | −31.31 [1.5] | 31.55 [1.6] | 47.58 [1.6] | −9.01 [0.9] |

| 663—Mineral manufactures, n.e.s. (0.15) | 34.74 [1.6] | 33.06 [1.7]* | −27.06 [1.7]* | −51.84 [1.7]* | 15.40 [1.7]* |

| 664—Glass (0.17) | 3.93 [0.2] | −1.70 [0.3] | 0.78 [0.1] | 5.04 [0.6] | 2.04 [0.5] |

| 665—Glassware (0.13) | −1.59 [0.3] | −6.93 [3.6]** | 3.84 [1.8]* | 13.90 [4.5]** | −2.66 [2.4]** |

| 667—Pearls and precious and semi-precious stones (12.0) | −32.22 [1.1] | −5.47 [1.1] | 10.05 [1.1] | 11.66 [1.6] | 1.42 [0.5] |

| 673—Iron and steel bars, rods, angles, shapes, sections(0.20) | −3.84 [0.6] | 3.83 [2.0]** | −1.48 [0.7] | −3.77 [1.2] | 4.26 [3.2]** |

| 677—Iron and steel wire, excluding wire rod (0.10) | −18.34 [1.5] | −22.09 [5.1]** | 17.29 [3.5]** | 33.21 [4.8]** | −8.77 [3.6]** |

| 678—Tubes, pipes and fittings of iron or steel (0.88) | −6.80 [0.8] | −13.03 [4.3]** | 8.22 [2.3]** | 21.66 [4.4]** | −6.50 [5.1]** |

| 682—Copper (0.08) | 17.63 [1.4] | 13.50 [2.1]** | −10.88 [1.7]* | −19.51 [2.0]** | 10.31 [3.4]** |

| 692—Metal containers for storage and transport (0.08) | 23.73 [2.5]** | −9.38 [−3.9]** | −0.61 [0.2] | 11.90 [2.9]** | −8.34 [4.6]** |

| 693—Wire products excluding electric and fencing grills (0.03) | −153.52 [2.5]** | −70.30 [3.2]** | 77.10 [2.9]** | 110.18 [3.4]** | −20.98 [2.7]** |

| 694—Nails, screws, nuts, bolts and rivets (0.18) | −66.90 [1.4] | −49.53 [1.4] | 42.31 [1.4] | 84.43 [1.5] | −21.98 [1.4] |

| 695—Tools for use in the hand or in machines (0.28) | 9.0 [4.0]** | 1.77 [2.8]** | −3.54 [4.3]** | 0.3 [0.3] | 1.29 [3.2]** |

| 697—Household equipment of base metals (0.40) | 4.81 [1.0] | −3.27 [2.7]** | −0.3 [0.2] | 6.54 [3.6]** | −1.43 [1.4] |

| 698—Manufactures of metal, n.e.s. (0.55) | 2.01 [0.4] | −1.99 [1.3] | −0.30 [0.2] | 6.28 [2.6]** | −1.83 [1.9]* |

| 711—Power generating machinery (1.13) | 20.66 [3.5]** | −4.39 [2.7]** | −1.87 [0.9] | 5.13 [1.9]* | −3.05 [2.7]** |

| 712—Agricultural machinery and implements (0.37) | 24.25 [1.6] | −3.89 [1.4] | −3.25 [0.8] | 5.58 [1.2] | −1.49 [0.5] |

| 714—Office machines (0.44) | −42.54 [3.5]** | −1.80 [0.5] | 12.47 [2.9]** | 0.60 [0.1] | 5.31 [2.1]** |

| 715—Metalworking machinery (0.19) | 23.31 [1.8]* | −1.30 [0.2] | −4.67 [0.7] | 3.37 [0.3] | −2.62 [0.8] |

| 717—Textile and leather machinery (0.06) | 1.54 [0.2] | −7.81 [2.5]** | 4.83 [1.7]* | 8.97 [1.9]* | −3.69 [2.0]** |

| 718—Machines for special industries (0.63) | 31.08 [6.6]** | 3.44 [2.3]** | −7.95 [4.7]** | −7.31 [3.0]** | 2.73 [2.6]** |

| 719—Machinery and appliances, nonelectrical parts (3.99) | 36.35 [4.9]** | −3.10 [2.5]** | −7.14 [3.6]** | 4.99 [2.4]** | −5.05 [3.7]** |

| 722—Electric power machinery and switchgear (1.39) | 49.60 [13.5]** | 5.14 [4.0]** | −15.08 [9.7]** | −7.34 [3.7]** | −1.56 [3.1]** |

| 724—Telecommunications apparatus (1.02) | −5.63 [0.5] | −13.42 [1.3] | 9.51 [1.4] | 23.30 [1.2] | −5.23 [0.9] |

| 725—Domestic electrical equipment (0.03) | 23.30 [2.4]** | 5.94 [1.3] | −7.69 [1.8]* | −7.83 [1.1] | 6.01 [2.4]** |

| 729—Other electrical machinery and apparatus (1.12) | 21.81 4.0]** | 5.96 [2.9]** | −8.13 [3.7]** | −7.36 [2.4]** | 3.77 [2.8]** |

| 732—Road motor vehicles (1.51) | 21.81 [4.0]** | 5.96 [2.9]** | −8.13 [3.7]** | −7.36 [2.4]** | 3.77 [2.8]** |

| 733—Road vehicles other than motor vehicles (0.06) | 13.58 [2.9]** | 0.49 [0.3] | −2.84 [1.7]* | 0.32 [0.1] | 3.07 [3.0]** |

| 812—Sanitary, plumbing, heating & lighting fixtures (0.21) | 167.26 [4.0]** | 58.98 [4.1]** | −74.37 [4.2]** | −87.48 [3.8]** | 17.17 [3.0]** |

| 821—Furniture (0.72) | −3.19 [0.7] | 1.28 [1.0] | −1.03 [0.6] | 2.88 [1.4] | 2.54 [3.6]** |

| 841—Clothing except fur clothing (5.44) | −50.80 [1.2] | −20.40 [1.1] | 22.93 [1.1] | 38.77 [1.3] | −2.98 [0.5] |

| 861—Scientific, medical and optical means (1.31) | 7.65 [1.6] | 6.06 [3.2]** | −7.34 [3.6]** | −6.37 [2.2]** | 2.21 [2.2]** |

| 863—Developed cinematographic film (0.0006) | 1.88 [0.3] | −1.18 [0.9] | 0.62 [0.4] | 1.88 [0.9] | −0.01 [0.0] |

| 891—Musical instruments, sound recorder and parts (1.14) | −35.87 [1.2] | 6.49 [1.0] | 5.57 [0.5] | −4.49 [0.4] | 13.82 [3.3]** |

| 892—Printed matter (0.21) | 25.51 [7.4]** | 8.65 [5.2]** | −10.75 [6.7]** | −13.45 [5.2]** | 3.33 [3.6]** |

| 893—Articles of artificial plastic materials n.e.s. (0.32) | 17.91 [1.5] | 7.15 [1.0] | −8.27 [1.3] | −5.60 [0.5] | 5.99 [1.7]* |

| 894—Perambulators,toys, games and sporting goods (0.11) | 726.05 [0.4] | 253.35 [0.4] | −327.47 [0.4] | −335.[0.3] | 67.50 [0.3] |

| 895—Office and stationery supplies, n.e.s (0.07) | 21.05 [3.8]** | 11.16 [4.5]** | −10.77 [4.3]** | −17.86 [4.6]** | 8.51 [6.5]** |

| 897—Jewellery and gold/silver smiths wares (2.55) | −30.71 [2.3]** | 5.58 [1.2] | 4.72 [0.9] | −10.30 [1.4] | 8.74 [4.6]** |

| 899—Manufactured articles, n.e.s. (0.40) | 16.90 [3.6]** | 2.89 [2.4]** | −6.16 [3.7]** | −1.35 [0.7] | 0.06 [0.1] |

| 931—Special transactions not classified (3.22) | 26.74 [1.9]* | 12.17 [1.3] | −13.04 [1.6] | −16.31 [1.1] | 5.74 [1.3] |

Notes

- Numbers inside the parentheses are absolute values of the t-ratios. The critical value of standard t-ratio is 1.64 (1.96) at the 10% (5%) significance level.

- *Significance at the 10% level and **at the 5% level.

| Industries (trade shares)g | Diagnostics | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| F a | ECM t−1 b | LM c | RESET d | CUSUM | CUSUMSQ | Adj. R2 | Wald-Short e | Wald-Long | |

| 122—Tobacco manufactures (0.02) | 3.29 | −0.5 [5.2]** | 14.78** | 0.95 | S | S | 0.58 | 1.09 | 1.62 |

| 273—Stone, sand and gravel (0.01) | 2.23 | −1.5 [5.2]** | 2.98* | 12.72** | S | S | 0.73 | 0.84 | 4.3** |

| 276—Other crude minerals (0.09) | 11.39** | 1.5 [10.3]** | 0.01 | 0.47 | S | S | 0.85 | 1.29 | 5.7** |

| 291—Crude animal materials, n.e.s.f (0.02) | 5.07** | −1.0 [5.5]** | 0.90 | 1.40 | S | S | 0.47 | 2.80* | 6.39** |

| 292—Crude vegetable materials, n.e.s. (0.41) | 3.77 | −1.6 [4.9]** | 4.60** | 1.23 | S | S | 0.71 | 5.17** | 19.86** |

| 512—Organic chemicals (4.26) | 4.21* | −0.6 [5.2]** | 2.66 | 5.81** | S | S | 0.72 | 6.06** | 0.53 |

| 513—Inorg. chemicals elems., oxides, halogen salts (0.35) | 2.07 | −0.7 [3.5]** | 0.55 | 1.76 | S | U | 0.35 | 0.91 | 0.30 |

| 514—Other inorganic chemicals (0.25) | 6.97** | −2.6 [6.4]** | 0.28 | 0.58 | S | S | 0.65 | 4.01 | 1.42 |

| 531—Synth. organic dyestuffs, natural indigo & lakes (0.32) | 7.59** | −0.9 [6.8]** | 0.34 | 5.73** | S | S | 0.64 | 0.44 | 8.09** |

| 541—Medicinal and pharmaceutical products (7.85) | 4.02* | −0.4 [4.8]** | 0.00 | 0.14 | S | S | 0.35 | 0.00 | 3.06* |

| 551—Essential oils, perfume and flavour materials (0.30) | 5.51** | −1.1 [5.7]** | 0.48 | 0.56 | S | S | 0.47 | 1.09 | 3.87** |

| 553—Perfumery, cosmetics, dentifrices, etc. (0.16) | 10.05** | −1.2 [7.9]** | 7.25** | 0.19 | S | S | 0.70 | 0.06 | 11.47** |

| 554—Soaps, cleansing and polishing preparations (0.10) | 5.33** | −0.4 [5.6]** | 0.11 | 0.49 | S | S | 0.57 | 3.76* | 0.57 |

| 581—Plastic materials, regenerd. cellulose and resins (3.09) | 15.43** | −1.2 [10.0]** | 10.35** | 6.27** | S | S | 0.90 | 0.81 | 43.09** |

| 599—Chemical materials and products, n.e.s (1.32) | 4.48** | −1.1 [5.4]** | 0.10 | 3.42* | S | S | 0.58 | 3.81* | 7.56** |

| 612—Manufacturer of leather or of artificial leather (0.01) | 8.43 ** | −0.9 [7.2]** | 2.40 | 0.50 | S | S | 0.77 | 0.38 | 0.01 |

| 629—Articles of rubber, n.e.s (0.48) | 5.87** | −1.8 [6.2]** | 2.63 | 4.63** | S | S | 0.74 | 0.33 | 16.97** |

| 632—Wood manufactures, n.e.s. (0.10) | 12.48** | −3.2 [8.5]** | 4.56** | 0.11 | S | S | 0.79 | 2.21 | 1.41 |

| 641—Paper and paperboard (0.27) | 9.91** | −1.6 [7.9]** | 4.06** | 0.72 | S | S | 0.71 | 0.51 | 32.30** |

| 642—Articles of paper, pulp, paperboard (0.08) | 2.04 | −0.4 [3.2]** | 3.44* | 0.31 | S | S | 0.24 | 1.21 | 0.02 |

| 651—Textile yarn and thread (0.15) | 9.49** | −1.4 [7.9]** | 6.00** | 5.79** | S | S | 0.78 | 1.93 | 6.00** |

| 652—Cotton fabrics, woven (0.09) | 4.04* | −0.6 [5.0]** | 8.23** | 0.50 | S | S | 0.48 | 7.42** | 4.92** |

| 653—Text fabrics woven (0.42 0 | 12.34** | −1.7 [8.8]** | 0.41 | 10.18** | S | S | 0.87 | 17.14** | 7.01** |

| 654—Tulle, lace, embroidery, ribbons, trimmings (0.05) | 6.6** | −1.3 [5.5]** | 3.11* | 0.86 | S | S | 0.60 | 0.22 | 1.16 |

| 655—Special textile fabrics and related (0.21) | 4.35* | −0.5 [5.0]** | 0.49 | 9.90** | S | S | 0.46 | 0.67 | 2.52 |

| 656—Made up articles, wholly or chiefly (3.24) | 4.11* | −0.8 [4.9]** | 1.59 | 0.82 | S | S | 0.55 | 2.87* | 4.10** |

| 657—Floor coverings, tapestries, etc. (1.20) | 18.60** | −1.1 [10.5]** | 0.10 | 2.20 | S | S | 0.83 | 2.24 | 2.17 |

| 661—Lime, cement and fabricated building materials (3.24) | 4.82** | −0.6 [5.4]** | 3.90** | 4.22** | S | S | 0.64 | 0.68 | 1.82 |

| 663—Mineral manufactures, n.e.s. (0.15) | 4.89** | 0.4 [5.4]** | 2.39 | 0.67 | S | S | 0.52 | 0.36 | 2.88* |

| 664—Glass (0.17) | 2.69 | −0.3 [3.8]** | 0.14 | 0.44 | S | S | 0.35 | 4.38** | 0.44 |

| 665—Glassware (0.13) | 4.71** | −1.3 [6.3]** | 7.64** | 0.10 | S | S | 0.54 | 16.83** | 12.16** |

| 667—Pearls and precious and semi-precious stones (12.0) | 3.68 | −0.5 [4.7]** | 1.45 | 0.73 | S | S | 0.41 | 7.00** | 1.31 |

| 673—Iron and steel bars, rods, angles, shapes, sections(0.20) | 3.72 | −0.8 [4.5]** | 3.83* | 0.04 | S | S | 0.40 | 0.25 | 1.91 |

| 677—Iron and steel wire, excluding wire rod (0.10) | 7.5** | −0.9 [6.5]** | 0.10 | 1.59 | S | S | 0.57 | 0.09 | 15.85** |

| 678—Tubes, pipes and fittings of iron or steel (0.88) | 8.97** | −1.7 [7.5]** | 0.63 | 0.45 | S | S | 0.75 | 0.38 | 21.78** |

| 682—Copper (0.08) | 6.04** | −1.0 [6.1]** | 2.52 | 0.48 | S | S | 0.70 | 3.69* | 5.37 |

| 692—Metal containers for storage and transport (0.08) | 7.13** | −1.0 [6.5]** | 0.05 | 0.25 | S | S | 0.52 | 0.18 | 9.03** |

| 693—Wire products excluding electric and fencing grills (0.03) | 4.16* | −0.50 [5.2]** | 0.35 | 3.3* | S | S | 0.68 | 1.01 | 10.78** |

| 694—Nails, screws, nuts, bolts and rivets (0.18) | 5.99** | −0.6 [6.2]** | 4.82** | 1.42 | S | S | 0.70 | 7.35** | 2.27 |

| 695—Tools for use in the hand or in machines (0.28) | 8.20** | −1.1 [6.9]** | 0.73 | 1.98 | S | S | 0.67 | 0.01 | 2.0 |

| 697—Household equipment of base metals (0.40) | 6.11** | −1.9 [5.6]** | 0.04 | 0.07 | S | S | 0.69 | 1.73 | 2.63 |

| 698—Manufactures of metal, n.e.s. (0.55) | 8.53** | −0.8 [6.9]** | 5.04** | 7.95** | S | S | 0.65 | 0.25 | 3.27* |

| 711—Power generating machinery (1.13) | 7.85** | −0.9 [6.7]** | 0.24 | 0.02 | S | S | 0.56 | 1.00 | 0.40 |

| 712—Agricultural machinery and implements (0.37) | 2.85 | −0.6 [4.1]** | 0.81 | 0.31 | S | S | 0.43 | 0.27 | 0.42 |

| 714—Office machines (0.44) | 5.16** | −0.6 [5.1]** | 0.11 | 0.15 | S | S | 0.46 | 1.50 | 0.92 |

| 715—Metalworking machinery (0.19) | 2.86 | −0.5 [4.2]** | 0.08 | 0.75 | S | S | 0.67 | 0.48 | 0.17 |

| 717—Textile and leather machinery (0.06) | 3.96 | −0.8 [4.7]** | 0.13 | 2.96* | S | S | 0.52 | 3.90** | 2.55 |

| 718—Machines for special industries (0.63) | 6.37** | −1.1 [5.9]** | 0.31 | 2.09 | S | S | 0.56 | 1.27 | 2.93* |

| 719—Machinery and appliances, nonelectrical parts (3.99) | 7.43** | −0.4 [6.5]** | 0.12 | 0.51 | S | S | 0.66 | 0.68 | 5.54** |

| 722—Electric power machinery and switchgear (1.39) | 30.80** | −1.4 [14.2]** | 7.17** | 3.34* | S | S | 0.93 | 0.19 | 5.70** |

| 724—Telecommunications apparatus (1.02) | 5.18** | −0.4 [5.6]** | 0.02 | 1.85 | S | S | 0.50 | 9.24** | 1.22 |

| 725—Domestic electrical equipment (0.03) | 6.72** | −1.1 [6.3]** | 0.10 | 0.00 | S | S | 0.58 | 1.24 | 0.87 |

| 729—Other electrical machinery and apparatus (1.12) | 2.16 | −0.4 [3.5]** | 0.59 | 5.38** | S | S | 0.36 | 0.74 | 3.37* |

| 732—Road motor vehicles (1.51) | 5.85** | −1.0 [5.7]** | 0.04 | 1.03 | S | S | 0.46 | 0.28 | 0.03 |

| 733—Road vehicles other than motor vehicles (0.06) | 11.23** | −1.0 [8.3]** | 3.23* | 0.25 | S | S | 0.70 | 1.36 | 8.34** |

| 812—Sanitary, plumbing, heating and lighting fixtures (0.21) | 9.42** | −1.1 [7.6]** | 0.01 | 0.15 | S | S | 0.89 | 4.27** | 0.05 |

| 821—Furniture (0.72) | 9.11** | −0.4 [7.5]** | 0.51 | 0.50 | S | S | 071 | 0.07 | 1.43 |

| 841—Clothing except fur clothing (5.44) | 9.09** | −1.4 [7.4]** | 0.11 | 0.07 | S | S | 0.74 | 1.62 | 4.09** |

| 861—Scientific, medical and optical means (1.31) | 2.59 | −0.8 [3.9]** | 1.00 | 0.44 | S | S | 0.44 | 1.95 | 0.00 |

| 863—Developed cinematographic film (0.0006) | 9.68** | −0.6 [7.8]** | 0.14 | 0.14 | S | S | 0.75 | 0.92 | 3.92** |

| 891—Musical instruments, sound recorder and parts (1.14) | 5.13** | −1.1 [5.6]** | 6.32** | 1.09 | S | S | 0.58 | 0.71 | 6.66** |

| 892—Printed matter (0.21) | 8.54** | −0.7 [7.1]** | 1.19 | 5.77** | S | S | 0.58 | 7.36** | 22.29** |

| 893—Articles of artificial plastic materials n.e.s. (0.32) | 3.40* | −0.6 [4.5]** | 1.29 | 0.09 | S | S | 0.71 | 2.15 | 0.59 |

| 894—Perambulators, toys, games and sporting goods (0.11) | 5.08** | 0.1 [5.8]** | 0.01 | 4.68** | S | S | 0.75 | 14.04** | 0.12 |

| 895—Office and stationery supplies, n.e.s (0.07) | 6.34** | −1.6 [6.2]** | 0.00 | 0.06 | S | S | 0.58 | 2.82* | 47.22** |

| 897—Jewellery and gold/silver smiths wares (2.55) | 8.62** | −1.0 [7.4]** | 10.52** | 1.91 | S | S | 0.66 | 8.39** | 2.00 |

| 899—Manufactured articles, n.e.s. (0.40) | 6.94** | −1.3 [6.6]** | 4.95** | 7.66** | S | S | 0.87 | 8.61** | 0.31 |

| 931—Special transactions not classified (3.22) | 2.84 | −0.5 [4.1]** | 5.12** | 0.92 | S | S | 0.72 | 1.87 | 1.60 |

Notes

- aThe critical value of the F test at the 10% (5%) significance level when there are three exogenous variables (k = 3) and 40 observations is 4.02 (4.80). These come from Narayan (2005, p. 1988). * (**) indicates a significant statistic at the 10% (5%) level.

- bNumber inside the parentheses in the ECMt−1 column is absolute value of the t-ratio, the critical value for k = 4 with 40 observations is −3.67 (−4.03) at the 10% (5%) significance level and these come from Banerjee et al. (1998, table 1, p. 276).

- cLM is the Lagrange multiplier test of residual serial correlation. It is distributed as chi-square with one degree of freedom. Its critical value at the 10% (5%) level is 2.71 (3.84).

- dRESET is Ramsey's test for misspecification. It is distributed as chi-square with one degree of freedom and its critical value at 10% (5%) level is 2.71 (3.84).

- eBoth Wald statistics are distributed as chi-square with one degree of freedom. The critical value at 10% (5%) level is 2.71 (3.84).

- fAbbreviation n.e.s. stands for not elsewhere specified.

- gTrade share is in percentage calculated for the year 2014. It is defined as sum of exports and imports of each industry as a per cent of sum of aggregate exports and imports between India and the USA.

Let us consider first the short-run estimates obtained for our measures of rupee appreciation (ΔPOS) and rupee depreciation (ΔNEG) reported in Table 2. From this table, we gather that either ΔPOS or ΔNEG carries at least one significant coefficient in all the industries except 661, 692, 714 and 861. Thus, either rupee appreciation or rupee depreciation has significant short-run effects on the trade balance of the remaining 64 industries. Given that the comparable number from the linear model was 47, these substantially increased cases must be attributed to the non-linear adjustment of the real bilateral exchange rate. From these short-run estimates, we also gather that the two variables take different lag order in 44 industries, providing support for short-run adjustment asymmetry. This indicates that the time it takes for rupee depreciation and appreciation to affect the trade balance of 44 industries are different. Clearly, size or sign of the short-run estimates associated with both the variables is also different in almost all the models, supporting short-run asymmetric effects. However, we need to apply the Wald test to determine whether the sum of the coefficients attached to ΔPOS is significantly different than the sum of the coefficients attached to ΔNEG. This test, which has a chi-square distribution with one degree of freedom and reported as Wald-Short in Table 4, reveals that there is evidence of short-run cumulative or impact asymmetry only in 21 industries coded as 291, 292, 512, 554, 599, 652, 653, 656, 664, 665, 667, 682, 694, 717, 724, 812, 892, 894, 895, 897 and 899, which are all small industries except 512 (organic chemicals with 4.26% trade share), 656 (made up articles with 3.24% trade share), 667 (pearls and precious and semi-precious stones with 12% trade share) and 897 (jewellery with 2.55% trade share).

In order to determine in how many industries the short-run asymmetric effects last into the long run, we turn to the long-run estimates in Table 3. Consider estimates associated with the POS and the NEG variables first. Clearly, either POS or NEG carries a long-run significant coefficient estimate in 54 industries. The comparable figure from the linear model was 27. Therefore, it appears that separating rupee appreciations from rupee depreciations and introducing non-linear adjustment of the real exchange rate increase the number of industries in which changes in the real bilateral exchange rate have significant long-run effects. Furthermore, if we follow the new definition of the J-curve due to Bahmani-Oskooee and Fariditavana (2016) and define it as short-run adverse or insignificant effects and long-run improvement associated either with POS or NEG variable, the hypothesis is supported in 44 industries.11

The above long-run effects are meaningful only if cointegration is established. To that end, in some cases where the F test is insignificant (e.g., industry 122), we rely upon an alternative test.

In this alternative test, we use long-run normalised estimates and our long-run model which includes the POS and NEG variables, but not the LnREX, and generate the error term, labelled as ECM. We then replace the linear combination of lagged level variables in (3) by ECMt−1 and estimate this new model after imposing the same optimum lag structure. A significantly negative coefficient obtained for ECMt−1 will be an indication of cointegration. Banerjee, Dolado, and Mestre (1998) who introduced this test within Engle and Granger (1987) cointegration method demonstrated that the distribution of the t test is nonstandard; hence, they tabulated new critical values for this test. Within the ARDL approach where variables could be combination of I(0) and I(1), Pesaran et al. (2001, p. 303) provide an upper and a lower bound critical values for the t test. Since Pesaran et al.'s critical values are for large samples, we shall rely upon Banerjee et al.'s values who provide them for small as well as large samples.12

From Table 4, we gather that in all 54 industries in which either the POS or the NEG variable was significant, cointegration is established by either the F or ECMt−1 test.13 Furthermore, although the normalised long-run estimates attached to POS and NEG variables are different in size or sign, an application of the Wald test to determine whether these estimates are significantly different provides support for the long-run asymmetric effects in 33 industries. The Wald statistic, reported as Wald-Long in Table 4, is significant in 33 industries including some of the large industries, that is, 541 (medicinal and pharmaceutical products with 7.85% trade share), 581 (plastic materials with 3.09% trade share), 656 (made up articles with 3.24% trade share) and 841 (clothing with 5.44% trade share). These long-run asymmetric effects were hidden in Bahmani-Oskooee and Saha (2017) who used aggregate bilateral trade balance between India and the USA and did not find significant long-run asymmetric effects. As for the long-run effects of the Industrial Production Index of India and the USA, we gather from Table 3 that both carry significant coefficients in a total of 40 of 68 industries, a substantial increase compared to the results from the linear models. More precisely, the Indian index carries its expected positive and significant coefficient estimate in 23 industries but significantly negative estimate in 17 industries. These 17 industries must be industries that are a close substitute for imports. As the Indian economy grows, it produces more of these goods at home, and hence, she imports less of them (Bahmani-Oskooee, 1986). Similarly, the US index carries significantly negative coefficient estimate in 26 industries but positive coefficient estimate in 14 industries. Again, these 14 industries must produce close substitutes in the USA.

In addition to the F and the ECMt−1 tests for cointegration, a few other statistics associated with each optimum model are also reported in Table 4. The Lagrange multiplier statistic is reported to check for serial correlation among the residuals. It is distributed as  , and as can be seen it is hardly significant, supporting autocorrelation-free residuals. Ramsey's misspecification test, that is, RESET, which is also distributed as

, and as can be seen it is hardly significant, supporting autocorrelation-free residuals. Ramsey's misspecification test, that is, RESET, which is also distributed as  is also reported. Again, this statistic is insignificant in almost all the models, implying that almost all optimum models are correctly specified. To establish stability of short-run and long-run coefficient estimates, following the literature, we apply the CUSUM and CUSUMSQ tests to the residuals of each optimum model. Although it is a common practice to visualise these tests graphically, due to volume of the results, we report the outcomes in Table 4 by indicating “S” for stable coefficients and “U” for unstable ones. Again, we hardly see unstable estimates. Finally, the size of adjusted R2 from each model is reported to judge the goodness of fit. Clearly, most optimum models enjoy good fits.14

is also reported. Again, this statistic is insignificant in almost all the models, implying that almost all optimum models are correctly specified. To establish stability of short-run and long-run coefficient estimates, following the literature, we apply the CUSUM and CUSUMSQ tests to the residuals of each optimum model. Although it is a common practice to visualise these tests graphically, due to volume of the results, we report the outcomes in Table 4 by indicating “S” for stable coefficients and “U” for unstable ones. Again, we hardly see unstable estimates. Finally, the size of adjusted R2 from each model is reported to judge the goodness of fit. Clearly, most optimum models enjoy good fits.14

4 CONCLUSION AND SUMMARY

One of the most highly researched topics in international economics is the concept of the J-curve which describes how the trade balance reacts to a devaluation or a depreciation. Research in this area has now moved into a new direction by investigating the asymmetric effects of exchange rate changes on the trade balance which relies upon estimation of non-linear models. A previous study that applied the linear ARDL approach of Pesaran et al. (2001) and the non-linear ARDL approach of Shin et al. (2014) to the bilateral trade balance model of India with her 14 largest trading partners did not find significant long-run asymmetric effects of exchange rate changes with the second largest partner, the USA and recommended disaggregating India–US trade flows by commodity and engaging in asymmetric analysis with a hope that disaggregated data will shed much more light on the effectiveness of rupee depreciation. Indeed, this is the main purpose of this paper.

In this paper, we disaggregate India–US trade flows by industry and consider the response of trade balance of each of the 68 industries to exchange rate changes. These 68 industries for which continuous annual time-series data over the period of 1973–2014 were available engage in 71% of the trade between the two countries. Like Bahmani-Oskooee and Saha (2017), who recommended disaggregation of data, we as well apply the linear ARDL approach of Pesaran et al. (2001) and the non-linear ARDL approach of Shin et al. (2014) to discover more and more evidence in support of the J-curve effect. Our findings could be best summarised by saying that from the linear model, we were only able to find evidence of the J-curve in 27 industries. However, this number increased to 44 when we shifted to the non-linear model. Thus, introducing the non-linear adjustment of the real bilateral rupee–dollar rate provided more support for the J-curve effect. In addition to this discovery, we also found overwhelming support for the asymmetric effects of the exchange rate changes on the trade balance of many industries. We found short-run “adjustment asymmetry” in 44 industries, implying that response time of the trade balance to rupee depreciation is different than its response to rupee appreciation in these industries. In almost all industries, there was also evidence of short-run asymmetric effects. However, significant short-run cumulative or impact asymmetry was evidenced only in 21 industries. Finally, significant long-run asymmetric effects were found in 33 industries. Small as well as large industries were included among the asymmetrically affected industries. These asymmetric effects were hidden when only aggregate bilateral trade flows between India and the USA were analysed. All in all, the findings are industry-specific and must be extended to commodity trade between other countries. These industry-specific findings have important policy implication. First, in some industries in which the exchange rate has no significant long-run effects, policymakers should not give up the exchange rate as a tool to promote trade. The insignificant effect could be due to the assumption of linear adjustment of the exchange rate. Non-linear adjustment should be accounted for where depreciation could be an effective policy, but appreciation may not have an impact. Second, when the rupee depreciates against the dollar, our asymmetric findings reveal that which industry will benefit and which ones will be hurt. Clearly, the size of exchange rate elasticity will provide additional information in this direction.

Notes

APPENDIX A

Data period, data source and data definition

Annual data over the period 1973–2014 are used to carry out the empirical analysis. They come from the following sources:

- World Integrated Trade Solution (World Bank): Industry-level data of bilateral trade between the USA and India.

- Direction of Trade Statistics of the International Monetary Fund (IMF): Aggregate data on exports and imports of bilateral trade between the USA and India to be used in measuring the trade shares of each industry.

- Nominal Bilateral Exchange Rates: International Financial Statistics (IFS) of the IMF.

- Industrial Production Index for USA and India: IFS of the IMF.

- Consumer Price Index for USA and India: IFS of the IMF.

Variables

TBj = trade balance of industry j defined as Mj/Xj where,

Mj = imports of Indian industry j from the USA.

Xj = exports of Indian industry j to the USA.

IPINDIA = industrial production index of India (measure of domestic income), base year = 2010.

IPUSA = industrial production index of the USA (measure of the US income), base year = 2010.

REX = the real bilateral exchange rate between Indian rupees and US dollars. It is defined as (PINDIA. NEX)/PUSA where, PINDIA is the price level in India, NEX is the nominal bilateral exchange rate defined as the number of US dollars per Indian rupee and PUSA is the price level in the USA. The price levels are measured by CPI, base year = 2010. Thus, a decline in REX reflects a real depreciation of rupee.