The China Growth Miracle: The Role of the Formal and the Informal Institutions

Abstract

This paper examines why China, in spite of its ordinary institutions, can grow so rapidly and for so long. Since each region in China has different quality of institutions and growth rates, we look into provincial and city data for this investigation. The variables formal and informal institutions are added into the conventional cross-section growth equation. The quality of the formal (informal) institution is taken from an opinion survey on the effectiveness of city governance conducted by the World Bank in 2006 (can be measured by the share of township-and-village enterprise in each province during 1978–2002 or by the trust index from surveys). We conclude that it is the informal institution that drives the rapid growth in China. Further investigation, using panel data and Arellano-Bond system GMM estimator, which controls for the missing fixed effect in cross-provincial regressions and provides useful instrument, confirms.

1 Introduction

This paper addresses the perplexing question raised by many scholars, on why China, in spite of its ordinary institutions, can grow so rapidly and for so long. This ‘China Growth Miracle’ posts a challenge to the conventional wisdom (for example, Acemoglu and Johnson, 2005; Xu and Li, 2005; Du et al., 2008; Vieira et al., 2012; Lu et al., 2013 among others) that there is a strong causation from the quality of institution to economic growth.

Cross-country regressions on growth and institutions could not provide an answer, but could only suggest that China may be an outlier. It is therefore tempting to conclude that institutions may not be that important for the case of China since it is still at its transition stage of economic development. Alternatively, Bardhan (2002) and Xu et al. (2007) suggest that the criteria for good institutions, such as property right protection and the rule-of-law, may only be relevant to well-functioned mature market economies. For transitional economies, where the markets are still in their embryonic form, other criteria, such as a proper balance between centralisation and decentralisation of government to promote performance, could be more useful indicators for effective or good institutions.

In this paper, we investigate whether or not ‘good’ institutions are important for economic growth in China. Since each region in China has different regional institutional quality and growth rates, we will look into provincial and city-level data for answers. We will use multiple measures of government efficiency to gauze the regional government efficiency, and a new set of instrumental variables.

Other than the formal institutions, the informal institution usually plays a significant role in governance in the developing countries. A formal institution governs through a well-structured organisation and is usually rule-based. An informal institution governs through relations/network and reciprocity within the community, based on shared social values and norms (Williamson, 2000).1 While the formal institution governs by direct coercion through the state mechanism, the informal institution governs by consensual control and voluntary compliance in the community. Williamson (2000) thinks that the informal institution is a more important institution than the formal institution as the former constraints the action of the latter and that it takes longer to change than the latter. Historically, China's informal institution, based on the Confucian communitarian ethos, was vital in governing China because of its huge land mass and population which raised the monitoring cost of the central government. The social values in China stress communitarian ethics rather than individualism. These social values proved to be a useful mechanism to maintain law and order and effective governance in rural or distant areas. Authority from the central government was supplemented by those from the local elites/gentries, who had relied on the local social network and communitarian ethics of the local population to govern. Hence, the informal institution improved the effectiveness of the formal institution. China was governed quite successfully by this mixture of formal and informal institutions for more than two thousand years.

By looking back into Chinese history, we see that the quality of the informal institution must have played an important role in the governance of the Chinese society. Although the informal institution persists for a very long period of time (Williamson, 2000), it is hard to judge how much of the informal institution today come from China's past. Nonetheless even today, transactions in the Chinese economy rely more heavily on ‘guanxi’, a network of informal arrangements, than on the formal contracts (Su and Fung, 2013). To find out the recent impact of the informal institution, we need to find a good measurement for the informal institution, an issue the present paper will address.

This paper finds that it is the strength of the informal institution which has aided China's growth and development over the last four decades in spite of its mediocre formal institution. There are clearly mutual interactions between the formal and the informal institutions in China (see Helmke and Levitsky, 2004). The treatment of these interactions will be discussed in subsection 3b Are the formal and the informal institutions substitute or complement for each other? Would the presence of the formal institution ‘crowd-out’ the informal institution? In this paper, we find some evidence from the Chinese regional data that the formal and the informal institutions are close complements.

A caveat in this paper is the weak theoretical relationship between institutions and growth. As pointed out by Acemoglu and Robinson (2010), we only have a very preliminary understanding of the relationship between political power, institutions and economic performance. We still do not know exactly why some dictatorships, such as those in Asia, are developmental, while others dictatorships, such as those in Africa and Latin America, are not. While the theoretical literature may have produced ambiguous predictions, the empirical literature may be able to offer some insightful empirical regularity. In a recent review of the empirical work on institution and long-run growth, Vieira et al. (2012) concluded that, overall, the quality of institutions matters in predicting long-run growth in cross-country studies. Our paper follows this fruitful line of empirical investigation and tests the important contribution from China's informal institution, in addition to its formal institution.2

The remainder of this paper is organised as follows. 2 lays down the theoretical framework and predictions from the conventional growth model for empirical study. 3 tests of the predictions, using provincial and city-level data. New instrumental variables are introduced in the 2SLS regressions. 4 extends part of the framework to panel regressions, using the Arellano-Bond System generalised method of moments (GMM) estimators. 5 concludes.

2 The Framework

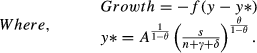

(1)

(1)Equation 1 is from the standard Solow long-run equilibrium growth model in the literature. The variable Growth above is the real per capita GDP growth of province or city; f is the parameter of convergence; y is the initial per capita GDP and y* is the long-run equilibrium value of per capita GDP. θ is the capital share; A is a parameter that captures the quality of the formal and informal institutions, human capital and the technology; s is the marginal propensity to save; n is the population growth rate; γ (δ) is the technological innovation rate (capital depreciation rate). We impute a value of 0.1 for the sum of the technological innovative rate and capital depreciation rate. In equation (2) in 3 below, the variable y* is represented by the quality of the formal and the informal institutions, the level of education, investment, as well as n + γ + δ.

2.1 The Formal Institution

To measure the efficiency of the formal institution, we employ an opinion survey data set on the effectiveness of local government in Chinese cities, a survey conducted by the World Bank in 2004–05. The survey from the World Bank has the 11 measures on a selected 120 cities in China. Table 1 summarises the categories. The World Bank experts argue that these broad measures by and large should capture local government efficiency. These 11 measures are very comprehensive and relevant for China. They contain the elements from the conventional rule-of-law, bureaucratic efficiency and corruption indices, items which are in most of the institution-growth regressions in the literature (see Vieira et al., 2012).

| Coefficient | SE | |

|---|---|---|

| Tax and Fees | −0.370*** | 0.039 |

| Entertainment costs | −0.361*** | 0.041 |

| Bureaucratic interaction | −0.264*** | 0.052 |

| Private SMEs with Bank | 0.154** | 0.061 |

| Expectation of informal payments for loans | −0.238*** | 0.055 |

| Combined times for export and import clearance | −0.298*** | 0.050 |

| Output losses from power or transport | −0.102 | 0.066 |

| Labour over-staffing | −0.420*** | 0.030 |

| Confidence in courts (protection of property and contract rights) | 0.351*** | 0.040 |

| University-educated workers | −0.243*** | 0.057 |

| Private firms surveyed | 0.354*** | 0.043 |

| Observations | 120 | |

| Trace | 11 | |

| Rho | 0.4952 | |

| SE(Rho) | 0.0276 |

Notes:

- (i) This table reports the coefficients from principle component analysis in the construction of the Government Efficiency Index (GEI); the data are from World Bank (2006). The (first) component chosen has an eigenvalue 3.922 and proportionally explained 35.66%.

- (ii) **Distinguishes the significance level at 5%; and *** at 1%, respectively.

From the World Bank survey data, we construct a government efficiency index, GEI, the weights of which come from the estimated coefficients in the principle component analysis of the eleven measures. The principle component analysis is reported in Table 1.

Note that in Table 1, the items ‘university-educated workers’ and ‘labour over-staffing’ measure the underutilisation of skilled labour force and over-staffing firms, respectively. Both account for the regulatory inefficiency of local government. The item ‘confidence in Courts’ in Table 1 is identical to the item defined elsewhere in the World Bank document (2006) as the ‘protection of property and contract rights’, a variable commonly used in the literature in regressions related to growth and institutions. We have run regressions using ‘protection of property and contract rights’ instead of the constructed GEI. The results, available from the authors upon request, are roughly the same as those using the GEI variable, but slightly less robust, and hence not reported in this paper.

2.2 The Choice of The Instrumental Variables for the GEI

The usual reversed causality, that economic growth may lead to a better institution, and possible omitted variables in the regression post an identification problem. Moreover, the GEI is only a very crude measure of the institutional quality of provinces and cities, creating ‘errors in the variable’. For this reason, we pick the lagged value of GEI as regressor and a suitable set of instrumental variables for the lagged GEI variable.

The conventional instruments for the (formal) institution are the geographical variables and the historical variables such as colonial past, legal origin and ethnolinguistic fractionalisation (see Vieira et al., 2012). Following the conventional wisdom and limited by the availability of data, we pick coastal area dummy, past colonial port dummy and ethnolinguistic fractionalisation as instruments for the GEI.3

Other than the above, another less common instrument in the literature is the executive constraints on government (Glaeser et al., 2004). From the work by Bardhan (2002), Li and Zhou (2005), Xu (2011), Xu and Wang (2011), the central government of China controls the regional officials by job rotation among regional officials and by promotion of regional officials to work in the central government. This is a salient feature in the organisation of the central government of China.4 Since the statistics on rotation and promotion of officials are available public information, they can be used as indices for the executive constraints of regional officials. More importantly, the set of organisational rules and conducts, upon which the rotation and promotion of regional officials are based, should be independent of the economic conditions in individual province or city. This is because, in principle, a codified set of organisational rules and conducts set by the central government should be uniform and non-discriminatory for all the regions in China. Nonetheless, the set of rules and conduct codes is complex and could include requirements that are unrelated to officials' performance. Since each region has different objective conditions, complex requirements would result in different performance of officials in different regions. Consequently, the quality of institutions would not be uniform across different regions, de facto, in spite of a common set of rules and code of conducts, de jure. As long as rotation and promotion are based on the set of rules and conducts that are set across-the-board, they should be independent of the residual term in the regional regressions and hence can be good instrument for the GEI. Their relationship with the performance of the formal institution will be discussed below.

Rotation of regional officials increases the quality of local institutions. We will call this ‘horizontal’ mobility. Horizontal mobility trains the officials and increases the exchange of experience among them. Through rotation, the officials can learn more about governing and multitasking. More importantly, rotation of regional officials weakens the alliance of local interests with local officials and the chance for corruption (Xu and Wang, 2011).

Promotion of officials to the central government, or ‘vertical’ mobility, increases the control of the central government over regional officials. It also disciplines the performance of the regional officials to work in line with the preferred goals set by the central government (Xu and Wang, 2011). Therefore, depending on what are the goals set by the central government, increasing the control of the central government can be good or bad for economic growth (see Bardhan, 2002; Xu, 2011; Xu and Wang, 2011). Empirical work on the benefits of centralisation in China has produced mixed results (see Xu 2011). In our constructed sample, there is a weak negative correlation between the GEI and the vertical mobility of officials. This means, in our sample, further increase in centralisation is bad for the economy.

Based on the information from the officials' resume available from the Xinhua Net and other government websites, we construct the rate of officials who have moved horizontally (rotated) or vertically (promoted or demoted) in each province, down to the sub-provincial and prefecture city level.5 Further details on the construction of these mobility rates can be found in the Appendix A (see also Xu and Wang, 2011).

We can therefore construct a simple mobility index which equals to the rate of ‘horizontal' rotation of officials minus the rate of ‘vertical’ mobility of officials for each city and for each province in our sample. The mobility index should capture the executive constraints on local officials from the central government and should be a good candidate to instrument institutional quality.

We also choose the effective tax rates as instrument because commercial tax policy are set by the central government for all the regions to follow. But the commercial tax policy has many contingencies. Again, because each region has different objective conditions, the effective tax rate in each region differs. The effective tax rate affects the performance of the local government. Hence, it can be an additional instrument for the quality of regional institution (GEI).6 Table 5 in 3 reports the regression of GEI with respect to this set of instruments.

2.3 The Informal Institution

Gorodnichenko and Roland (2011) and many others classify the social values around the world into two groups: individualism and collectivism. The collectivist ethos places individual interest below the community interest and constraints the activities of individuals that hurt community interests similar to the effects from the formal institution. The social values in China are classified as collectivism. The informal institution, based on collectivist social values, has played a very important role in governing China in the past and perhaps even today.

It is difficult to measure the quality of informal institution. In the literature, Nannicini et al. (2010) use blood donation in different regions of Italy to measure the amount of social capital or the quality of the informal institution in that region. In this paper, we will employ two measurements for the informal institution. The first one is the output share (valued added) of the township-and-village enterprises in the province as measures for the strength of the informal institution for that province. The second one, which is more in line with the traditional method, is to use opinion surveys on the trust among the citizens of that region. The reasons for the choice of the output share of the township-and-village enterprises (trust survey index) will be discussed in the following subsection 2.3.1 (2.3.2).

2.3.1 Output Share of the Township-and-village Enterprises (TVEs)

China embarked on an ambitious economic reform since the early 1980s. To be able to restructure the state-owned-enterprises politically, the central government set policies to encourage alternative form of enterprises which had a lot of autonomy from the central government. The retreat of the central government had left a vacuum in regional governance. This was where the regional informal institutions could come in to fill this vacuum.

The quality of informal institutions is affected by many regional factors, for example, the regional ethnic groups, the commonality of dialects, the traditions, the social networks (guanxi). As China is a geographically large and heterogeneous country, the differences in the regional informal institutions can be quite large. Moreover, depending on the nature of local informal institutions, they could be growth-enhancing or growth-retarding institutions (Glaeser et al., 2002). Hence, a tractable way to measure the quality of the regional informal institution is by appraising the performance of the township-and-village enterprises. These enterprises were collectively owned by the people in the respective townships or villages. The community leader(s) very often directed the enterprise. Needless to say, the legal property rights in these communities were poorly defined. It is the informal social networks and social values within the community that enforce the implicit agreements between the workers and the enterprises. Successful (unsuccessful) township-and-village enterprises should reflect the quality of growth-enhancing (growth-retarding) informal institution from which they had sprouted.

Another advantage of using successful township-and-village enterprises is that they are related to the stock of social capital in the community. Civic organisations have often been used in the literature to measure the stock of social capital (see Glaeser et al., 2002; Guiso et al., 2004). Although township-and-village enterprises engaged in productions and distributions, they were closer to informal organisations than to the well-structured firms in developed countries. As such, they captured the stock of neighbourhood networks and civic engagements (guanxi) in the community, well suited to measure the stock of social capital in that community (see comments in footnote 1).

For the above reasons, the ratio of the value-added of the township-and-village enterprises over the total GDP within the province, averaged over 1978–2002, can be a good proxy for the quality of the effective informal institution of that province.7 We call this ratio, the TVE. To test causality, we will use the lagged value of the TVE variable in the cross-sectional regressions.

Beginning in 1979, the central government launched several economic reforms. In principal, these reform policies should apply uniformly among all the provinces. Most of the reforms were market liberalisation reforms, where the management of the non-state own enterprise was left, as much as possible, to the private sector. Therefore, the informal organisation within the TVE is the effective informal institution, de facto. Nonetheless, the output shares of the township-and-village enterprises as well as other regional sectors could be affected by these reforms in the formal institution. Omitting these policy variables, which were difficult to identify, could bias our estimated coefficient of the TVE variable. To alleviate this bias, an instrument for the TVE variable is need. We will return to this issue in subsections 3b and d. For the regressions in 3, we will use the lagged value of the TVE to lessen this bias.

2.3.2 The Trust Surveys

In the literature on the impact of informal institution (or social capital) on economic growth, researchers (Knack and Keefer, 1997) use the opinion survey, such as the World Value Surveys, on the amount of trust among the citizens in the community to reckon the quality of informal institution. There were four waves of social opinion surveys from different regions of China collected by the China General Social Survey Open Database (CGSS), in which one part of the opinion survey questions is on the trust among the commoners in Chinese cities similar to the survey question commonly used in the World Value Survey database. The trust question asked in the World Values Survey is ‘In general, do you think that most people can be trusted, or can't you be too careful?’

The trust questions from the CGSS 2005 survey should be the closest to the trust question asked in the World Values Survey. Moreover, the size of the database and the trust questions in the 2005 survey are larger and more comprehensive than the database from other years. For these reasons, we choose the 2005 survey database for our empirical analysis (see Table A1 in Appendix B for further details).

The battery of trust questions in the CGSS 2005 survey are listed in Table 2. Each trust question pertains to different types of persons in the community. Since the trust rankings from these questions are highly correlated, we therefore construct an index, based on princi-pal component analysison the set of trust-related questions, to measure the ‘latent’ trust variable of the commoners in the respective province. We will call this constructed index, TRUST.

| In Disinterested Social Encounters, Do You Trust | Coefficient | SE |

|---|---|---|

| E14a. Your immediate neighbours? | 0.306*** | 3.381 |

| E14b. People in your community (village/town/city) who are not your immediate neighbours? | 0.388*** | 6.133 |

| E14e. Your relatives? | 0.414*** | 7.984 |

| E14f. Your colleagues? | 0.388*** | 6.103 |

| E14g. Your causal friends/acquaintances? | 0.370*** | 5.365 |

| E14h. Former classmates? | 0.348*** | 4.598 |

| E14i. People you meet in other communities who are from the same village/county/city as yours? | 0.362*** | 5.300 |

| E14m. Strangers? | 0.212* | 1.942 |

| Observations | 24 | |

| Trace | 8 | |

| Rho | 0.8224 | |

| SE(Rho) | 0.0379 |

Notes:

- (i) The reported statistics are from component one of the principal component analysis using the survey questions from China General Social Survey 2005. (ii) The eigenvalue (of component one) is 4.57; the proportion explained is 57.11%.

- (iii) *The significance level at 10% and *** the significance level at 1%.

There are 92 cities in the CGSS-2005 data set covering 26 provinces. Of the 92 cities, 46 of them overlaps with those from the World Bank sample (see notes from Table 1). In the construction of the city-level TRUST index, after deleting the uncompleted survey questions from some cities, we only have 41 cities in our sample. However, in the construction of the provincial-level TRUST index, we can use all 92 cities sample, because here we need not be restricted to the overlaps with the World Bank sample. After deleting the uncompleted questions, we still have 72 cities in our sample. We construct 24 provincial-level TRUST indices by averaging the city-level TRUST indices within respective provinces.

The TVE data series covers more provinces and longer periods than those covered by the CGSS opinion survey. More importantly, the correlation between TRUST and TVE, from the overlapped provinces of the two data sets, is positive and significant (see Table A1 in Appendix B).

3 Section 3: Empirical Findings

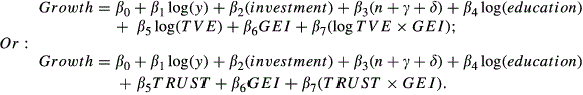

(2)

(2)A cross-product term is added into equation 2 above, to find out whether the formal and the informal institutions are substitute or complement to one another.

Since the township-and-village enterprises were located in the rural area and only some were located in the cities, the TVE index can only be constructed at the provincial level. Because of the nature of the TVE and the GEI, the former is constructed at the provincial level and the latter at city level, we will carry out two sets of regressions: one set of regressions exploits the variations across provinces and the other set across the cities. They will be discussed in the following sub-sections.

3.1 Provincial Level Regressions

We first examine the impact of institutions on economic growth at the provincial level. Since the GEI is from the city level, a provincial index GEI has to be constructed from some form of aggregation of the city-level GEI. One way to construct the provincial GEI is to average the GEI of all the cities within the province. This regression is reported in Appendix C. This method restricts the provincial GEI to the arithmetic mean of the city GEI. An alternative method is to assume that the city GEI equals to an unspecified aggregate provincial GEI plus idiosyncratic city-level ‘shocks’. Therefore, a more efficient alternative estimation method is to put all the city GEI and the corresponding provincial variables into the regressions at the provincial level. Let the estimation generates its own aggregate provincial GEI by minimising all the errors in the equation including the idiosyncratic city-level ‘shocks’. This is reported in Tables 3-5.

| Regression No | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) |

|---|---|---|---|---|---|---|---|---|---|---|

| Log(y) | −1.364* | −0.744** | −0.799* | −0.688* | −0.651 | −0.876** | −0.670* | −0.815** | −0.825*** | −1.147*** |

| (−1.801) | (−2.441) | (−1.929) | (−1.752) | (−1.623) | (−2.112) | (−1.680) | (−2.006) | (−3.081) | (−3.371) | |

| Log(investment) | 2.867 | 1.177 | 0.994 | 1.201 | 1.172 | 0.997 | 1.204 | 1.175 | −0.632 | −0.291 |

| (0.971) | (1.138) | (0.883) | (1.098) | (1.070) | (0.899) | (1.112) | (1.036) | (−1.190) | (−0.556) | |

| Log(n + γ + δ) | −38.745*** | −22.935*** | −26.517*** | −22.461*** | −23.005*** | −6.487*** | −2.404*** | −3.004*** | −24.86*** | −24.351*** |

| (−3.354) | (−5.752) | (−4.669) | (−4.999) | (−4.935) | (−4.953) | (−5.094) | (−4.619) | (−5.287) | (−4.942) | |

| Log(education) | 0.112 | 1.031 | 2.051 | 0.840 | 0.625 | 2.226 | 0.768 | 1.807 | 2.133 | 3.012 |

| (0.026) | (0.468) | (0.828) | (0.386) | (0.280) | (0.938) | (0.352) | (0.806) | (0.812) | (1.218) | |

| Log(TVE) | 0.869*** | 0.904*** | 1.149*** | 0.940*** | ||||||

| (3.566) | (3.282) | (2.935) | (3.012) | |||||||

| TRUST | 0.030*** | |||||||||

| (2.950) | ||||||||||

| GEI | 0.00700 | −0.00300 | 0.0330 | −0.076** | ||||||

| (0.682) | (−0.290) | (0.674) | (−1.983) | |||||||

| Log(TVE)×GEI | −0.0130 | 0.00400 | −0.00100 | 0.027** | ||||||

| (−0.750) | (1.095) | (−0.367) | (2.273) | |||||||

| TRUST × GEI | 0.0001*** | |||||||||

| (2.704) | ||||||||||

| Constant | 104.520*** | 64.281*** | 74.021*** | 62.961*** | 63.783*** | 74.177*** | 62.726*** | 65.855*** | 71.779*** | 74.579*** |

| (3.325) | (4.641) | (3.688) | (3.878) | (3.853) | (3.920) | (3.919) | (3.740) | (4.704) | (4.481) | |

| Observations | 30 | 120 | 120 | 120 | 120 | 120 | 120 | 120 | 110 | 110 |

| Adjusted R2 | 0.213 | 0.252 | 0.169 | 0.247 | 0.243 | 0.178 | 0.247 | 0.204 | 0.261 | 0.221 |

| R 2 | 0.321 | 0.284 | 0.204 | 0.285 | 0.287 | 0.213 | 0.285 | 0.244 | 0.295 | 0.257 |

| F | 3.021 | 11.70 | 8.800 | 10.11 | 8.981 | 9.081 | 9.953 | 8.284 | 11.98 | 11.14 |

Notes:

- (i) The Government Efficiency Index, GEI, is constructed from the 120 cities in China in 2004 (see notes in Table 1 for detail). (ii) Growth is the average real per capital GDP growth (2004–08); y, the average per capita GDP (2000–03); Investment, the average investments over 2004–08; Education, average years of education from 2000 to 2003 at the provincial level; (n + γ + δ), the average population growth rate plus technological innovation and depreciation rates, times 100, from 2004 to 2008. They are taken from China Economic Information Network Statistics Database (2012). TVE is the average (1978–2002) value-added output share of the township-and-village enterprises in each province, taken from China Township and Village Enterprises Statistics 1978–2002. TRUST index is constructed from the CGSS-2005 opinion survey (see notes from Table 2). (iii) Tibet, Hong Kong, Macau and Taiwan are excluded from the sample. (iv) The t-values are in parentheses.

- (v) *Significance level at 10% ** at 5%; *** at 1%, respectively.

| Regression No | (1) | (3) | (4) | (6) | (9) | (10) |

|---|---|---|---|---|---|---|

| Dependent Variable | GEI | GEI | GEI | Log(TVE) × GEI | GEI | TRUST× GEI |

| Log(GDP per capita) | 12.120** | 16.801*** | 50.622*** | 18.485*** | 2880.692*** | |

| (2.425) | (4.447) | (4.462) | (4.624) | (4.508) | ||

| Log(investment) | 18.401** | 14.744* | 41.297* | 28.722*** | 4671.861*** | |

| (2.249) | (1.828) | (1.811) | (3.058) | (3.124) | ||

| Log(n + γ + δ) | 181.057*** | 182.941*** | 468.289** | 271.628*** | 44684.43*** | |

| (2.770) | (2.795) | (2.616) | (3.167) | (3.239) | ||

| Log(education) | −28.635 | −39.629* | −127.134** | −15.849 | −1691.215 | |

| (−1.219) | (−1.736) | (−2.126) | (−0.609) | (−0.399) | ||

| Log(TVE) | 5.832** | 34.322*** | ||||

| (2.325) | (4.480) | |||||

| TRUST | −0.078 | 15.895 | ||||

| (−0.605) | (0.792) | |||||

| Mobility index of regional officials | 2.049 | 2.514 | 2.221 | 5.837 | 2.085 | 329.246 |

| (0.905) | (1.108) | (0.971) | (0.888) | (0.875) | (0.886) | |

| Effective tax rate | −77.040 | −44.499 | −43.119 | −143.022 | −40.453 | −6525.492 |

| (−1.591) | (−0.931) | (−0.899) | (−1.049) | (−0.793) | (−0.790) | |

| Colonial port | 5.565 | 4.739 | ||||

| (1.406) | (1.191) | |||||

| Coastal province | 5.456* | 2.841 | ||||

| (1.932) | (0.766) | |||||

| Ethnolinguistic fractionalisation | 57.018*** | 70.200*** | 45.964** | 138.747** | 62.668*** | 9829.139*** |

| (3.823) | (3.841) | (2.216) | (2.403) | (2.913) | (2.911) | |

| Constant | −20.000 | −582.529*** | −581.780*** | −1579.884*** | −893.945*** | −151557.6*** |

| (−1.287) | (−2.996) | (−2.916) | (−2.882) | (−3.478) | (−3.624) | |

| Observations | 116 | 116 | 116 | 116 | 106 | 106 |

| Adjusted R2 | 0.196 | 0.259 | 0.273 | 0.395 | 0.270 | 0.308 |

| R 2 | 0.230 | 0.317 | 0.324 | 0.437 | 0.326 | 0.361 |

| F | 7.915 | 6.608 | 8.707 | 16.30 | 6.970 | 9.195 |

Notes:

- (i) The variables in the regression come from China Economic Information Network Statistics Database (2012) and China Township and Village Enterprises Statistics 1978–2002. TRUST index is constructed from the CGSS-2005 opinion survey (see notes from Table 2). (ii) Taiwan, Hong Kong and Macau are excluded. The regional of Beijing, Tianjin, Shanghai and Chongqing are excluded from the sample because there are no data on the mobility of regional officials from these regions. (iii) The specification in Regression (X) here would be used for the 2SLS of the corresponding Regression (X) in Table 5. (iv) The t-values are in parentheses.

- (v) *Significance level at 10%, ** at 5%, and *** at 1% respectively.

| Regression No | (3) | (4) | (6) | (9) | (10) |

|---|---|---|---|---|---|

| Log(y) | −1.637*** | −2.035** | −1.297*** | −2.013*** | −1.808*** |

| (−2.782) | (−2.421) | (−3.130) | (−3.170) | (−3.463) | |

| Log(investment) | 0.751 | 0.574 | 0.937 | −1.385* | −1.425** |

| (0.606) | (0.423) | (0.808) | (−1.791) | (−2.023) | |

| Log(n + γ + δ) | −32.737*** | −36.697*** | −28.475*** | −36.750*** | −36.366*** |

| (−5.456) | (−4.717) | (−5.716) | (−4.510) | (−5.023) | |

| Log(education) | 7.195*** | 8.585*** | 6.246*** | 7.581*** | 6.888*** |

| (2.937) | (2.608) | (3.348) | (3.872) | (3.795) | |

| Log(TVE) | −0.382 | ||||

| (−0.975) | |||||

| TRUST | 0.004 | ||||

| (0.485) | |||||

| GEI | 0.066*** | 0.090** | 0.071*** | ||

| (3.023) | (2.490) | (3.010) | |||

| Log(TVE) × GEI | 0.015*** | ||||

| (3.950) | |||||

| TRUST × GEI | 0.0004*** | ||||

| (3.589) | |||||

| Constant | 85.011*** | 96.137*** | 73.768*** | 104.259*** | 104.041*** |

| (4.474) | (3.976) | (4.479) | (4.109) | (4.682) | |

| Hansen statistic | 5.356 | 1.879 | 6.835 | 0.696 | 1.460 |

| p-value | 0.253 | 0.391 | 0.077 | 0.706 | 0.691 |

| Observations | 116 | 116 | 116 | 106 | 106 |

| Adjusted R2 | 0.335 | 0.344 | 0.331 | 0.503 | 0.501 |

| R 2 | 0.364 | 0.378 | 0.360 | 0.531 | 0.525 |

| F | 14.04 | 12.32 | 14.38 | 31.77 | 32.77 |

Notes:

- (i) The Government Efficiency Index, GEI, is constructed from the 120 cities in China in 2004 (see notes in Table 1 for detail). (ii) The dependent variable, Growth, is the average real per capital GDP growth (2004–08); y, the average per capita GDP (2000–03); Investment, the average investments over 2004–08; Education, average years of education from 2000 to 2003, at the provincial level; (n + γ + δ), the average population growth rate, technological innovation and depreciations, times 100, from 2004 to 2008. These variables are taken from China Economic Information Network Statistics Database (2012). TVE is the average (1978–2002) value-added output share of the township-and-village enterprises in each province, taken from China Township and Village Enterprises Statistics 1978–2002. The TRUST index is constructed from the CGSS-2005 opinion survey (see notes from Table 2). (iii) Tibet, Hong Kong, Macau and Taiwan are excluded from the sample. (iv) The 2SLS Regression (X) reported here uses the specification in Table 4, the corresponding Regression (X), as the first stage. (v) The reported R2 are from Stage 2 regressions. (vi) The t-values are in parentheses.

- (vii) *Significance level at 10%, ** at 5%, and *** at 1% respectively.

In Table 3, we present the ordinary least squares (OLS) estimation of equation 2. In general, the estimated coefficient of both TVE and TRUST is robust, positive and significant, while the estimated coefficient from GEI is insignificant. Tables 4 and 5 present the result of a 2SLS estimation using the aforementioned instruments for the GEI variable.

In Table 5, after the GEI is instrumented, the impact on Growth is now significant at the one per cent level. The cross-product term is also significant, suggesting that the formal and the informal institutions are complementary.8

3.2 Discussion of Results and Caveats

As mentioned in the introduction, Helmke and Levitsky (2004), among others, articulate on the interactions between the formal and informal institutions. For example, the government can block the development of the TVEs. The informal institutions can likewise sabotage the policies from the central government by many forms of passive inaction or active opposition. Helmke and Levitsky (2004) call the latter accommodating or competing reactions from the informal institution, respectively. The formal and the informal institution can also be substitutive or complementary to one another depending on the nature of the tasks and compatibility. Since the detail mechanism of the interactions is unknown and impossible to model with precision, it is more fruitful to treat them as co-movements or correlated variables. We can therefore infer from these interactions that the covariance between the formal and the informal institution variables must be non-zero, which creates near multicollinearity in the estimations. This would lower the value of the t-statistics and decrease their significance. Fortunately, the estimated coefficients of the log(TVE) and the TRUST variable in our OLS estimations are already statistically significant (see Tables 3 and ; and A2 in Appendix C). Moreover, the property of OLS estimators is unbiased under multicollinearity. Hence, the presence of multicollinearity would not affect our inference for these two variables.

| Regression No. | OLS, Robust Estimation | IV Estimation | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (5) | (6) | (9) | (10) | (3) | (6) | (10) | |

| Log(y) | 0.744** | 0.592* | 0.811** | 0.824** | 0.790* | 0.026 | −0.115 | 0.336 | 0.300 | −0.163 |

| (2.357) | (1.764) | (2.089) | (2.018) | (1.949) | (0.067) | (−0.318) | (0.620) | (0.645) | (−0.328) | |

| Log(investment) | 1.137*** | 0.753** | 1.224*** | 1.037*** | 1.203*** | 0.589 | 0.408 | 0.473 | 0.405 | 0.0780 |

| (4.083) | (2.449) | (3.807) | (3.172) | (3.548) | (1.211) | (0.928) | (0.927) | (0.864) | (0.123) | |

| Log(n + γ + δ) | −21.675*** | −21.030*** | −21.353*** | −22.041*** | −21.583*** | −24.360*** | −24.736*** | −23.573*** | −20.457*** | −27.573*** |

| (−4.037) | (−4.012) | (−3.914) | (−4.094) | (−3.985) | (−2.887) | (−3.032) | (−4.200) | (−3.685) | (−3.945) | |

| Log (education) | 2.246 | 0.477 | 2.211 | 0.171 | 2.276 | −1.869 | −1.849 | 5.508* | 4.583 | 7.703** |

| (0.762) | (0.166) | (0.743) | (0.057) | (0.765) | (−0.435) | (−0.458) | (1.971) | (1.489) | (1.977) | |

| Log(TVE) | 0.931** | 1.716** | ||||||||

| (2.160) | (2.152) | |||||||||

| TRUST | 0.004 | |||||||||

| (0.477) | ||||||||||

| GEI | −0.00800 | 0.0960 | 0.0490 | |||||||

| (−0.465) | (1.004) | (1.038) | ||||||||

| Log(TVE) × GEI | −0.0390 | −0.00200 | 0.017* | |||||||

| (−1.149) | (−0.274) | (1.790) | ||||||||

| TRUST × GEI | 0.00008 | −1.04e−06 | ||||||||

| (1.252) | (−0.014) | |||||||||

| Constant | 47.439*** | 50.125*** | 45.977*** | 47.978*** | 46.566*** | 70.614*** | 73.868*** | 50.621*** | 45.739*** | 63.455*** |

| (3.043) | (3.268) | (2.850) | (3.153) | (2.899) | (3.166) | (3.608) | (2.814) | (2.632) | (3.568) | |

| Hansen statistic | 0.694 | 7.032 | 7.296 | |||||||

| p-value | 0.405 | 0.218 | 0.200 | |||||||

| Observations | 120 | 120 | 120 | 120 | 120 | 41 | 41 | 116 | 109 | 36 |

| Adjusted R2 | 0.134 | 0.157 | 0.129 | 0.160 | 0.127 | 0.080 | 0.098 | 0.155 | 0.219 | 0.148 |

| F | 12.37 | 9.629 | 10.14 | 7.717 | 10.10 | 3.366 | 4.320 | 8.577 | 10.96 | 3.626 |

Notes:

- (i) There are 41 overlapped cities between the World Bank sample and the CGSS 2005 sample, from which the city-level TRUST can be constructed. TVE is the average (1978–2002) value-added output share of the township-and-village enterprises in each province, from China Township and Village Enterprises Statistics 1978–2002. The Government Efficiency Index, GEI, is constructed from the 120 cities in China in 2004. Growth is the average real per capital GDP growth (2003–07); y, the average per capita GDP (2000–04); Investment, the average investments over 2003–07; Education, average years of education from 2000 to 2004, at the provincial level; (n + γ + δ), the average population growth rate, technological innovation and depreciation rates, times 100, from 2003 to 07. These variables are taken from China Economic Information Network Statistics Database (2012). (ii) The R2 in IV-estimates are from Stage 2 regressions. (iii) The t-values are in parentheses.

- (iv) *Significance at 10%, ** at 5%, and *** at 1% levels respectively.

As for the GEI variable, the estimated coefficient is largely insignificant under OLS estimation (see Table 3), most likely due to the presence of aforementioned multicollinearity. To overcome the interaction with the informal institution, we use IV for the estimation of the coefficient for GEI. The results are shown in Table 5. Once IVs are used, the estimated coefficient for the GEI variable becomes significant.

Another way to deal with the interactions of the two institutions is to instrument both the GEI and the log(TVE) (or TRUST) variables. We have given the GEI with the full sets of available instruments and hence the best chance to work in Table 5. In Table 7, we will instrument the informal institution with the instruments Coastal Province and Past Colonial Ports, which capture western influence on Chinese social values, in addition to Ethnolinguistic Fractionalisation. Fractionalisation affects community solidarity, an important element of the informal institution. We will instrument the GEI with the Mobility Index of Officials and the Effective Tax Rate. The Stage 1 regression of the instrumental variables is reported in Table 8.

| Regression No | (1) | (2) | (3) | (4) | (5) | (6) | (7) |

|---|---|---|---|---|---|---|---|

| Log(y) | −0.503** | −0.858*** | −0.738*** | −0.487** | −0.575** | −1.243*** | −0.645** |

| (−2.150) | (−3.254) | (−3.038) | (−2.095) | (−2.524) | (−3.661) | (−2.308) | |

| Log(investment) | 1.389 | 1.944* | 1.747 | 0.415 | 0.388 | 2.057* | 0.339 |

| (1.280) | (1.837) | (1.624) | (0.726) | (0.682) | (1.916) | (0.615) | |

| Log(n + γ + δ) | −26.346*** | −22.348*** | −24.631*** | −19.343*** | −20.679*** | −19.101*** | −17.363*** |

| (−5.034) | (−5.037) | (−5.323) | (−4.208) | (−4.506) | (−4.287) | (−3.764) | |

| Log(education) | 5.332*** | 5.358*** | 5.389*** | 5.949*** | 6.074*** | 2.650 | 2.166 |

| (3.094) | (3.385) | (3.325) | (4.382) | (4.356) | (1.297) | (0.793) | |

| Log(TVE) | 1.331*** | 2.220*** | |||||

| (3.195) | (4.265) | ||||||

| TRUST | 0.039*** | 0.047*** | |||||

| (3.908) | (4.487) | ||||||

| GEI | 0.070*** | 0.058*** | 0.039*** | ||||

| (3.519) | (3.114) | (2.654) | |||||

| Log(TVE) × GEI | 0.026*** | ||||||

| (4.488) | |||||||

| TRUST × GEI | 0.0004*** | ||||||

| (4.175) | |||||||

| Constant | 60.934*** | 49.208*** | 57.443*** | 41.462*** | 50.911*** | 49.334*** | 46.138*** |

| (3.667) | (3.367) | (3.792) | (3.084) | (3.697) | (3.231) | (3.122) | |

| Observations | 116 | 116 | 116 | 106 | 106 | 120 | 110 |

| Adjusted R2 | 0.306 | 0.338 | 0.333 | 0.464 | 0.429 | 0.271 | 0.219 |

| R 2 | 0.336 | 0.373 | 0.362 | 0.495 | 0.457 | 0.302 | 0.255 |

| F | 9.694 | 11.98 | 12.78 | 20.11 | 18.22 | 14.35 | 12.53 |

| GEI | Log(TVE) | TRUST | |

|---|---|---|---|

| Mobility index of regional officials | 4.349* | ||

| (1.897) | |||

| Effective tax rate | −120.487** | ||

| (−2.428) | |||

| Colonial port | 0.155 | 7.856** | |

| (1.384) | (2.545) | ||

| Coastal province | 0.159 | −8.820*** | |

| (1.572) | (−3.457) | ||

| Ethnolinguistic fractionalisation | 2.922*** | 57.111*** | |

| (7.472) | (4.686) | ||

| Constant | 47.054*** | −0.161 | 102.191*** |

| (7.552) | (−0.422) | (8.461) | |

| Observations | 116 | 120 | 110 |

| Adjusted R2 | 0.0620 | 0.279 | 0.214 |

| R 2 | 0.0790 | 0.297 | 0.236 |

| F | 5.188 | 24.17 | 10.35 |

From Table 7, upon instrumentation, both the formal and the informal institutions, and the product term, have the predicted positive significant signs. The positive impact of the instrumented informal institution is further confirmed in the panel GMM regressions in 4.

3.3 City-level Regressions

We next turn to estimations using city-level data. The city-level data are collected from China Economic Information Network Statistics Database (2012) and China Statistical Yearbook for Regional Economy (2002). Since the variables TVE and Education are only available from the provincial data, we have to assume that the informal institutions and education within a province are fairly homogenous. Hence, we will continue to use the provincial TVE and provincial Education for the cities in the respective province in the regressions. This is reported in Table 6.

Noteworthy are the possible unbalance samples of city-level TRUST data. Of the 120 cities from the World Bank sample (see notes from Table 1), there are only 41 overlapped cities with the CGSS 2005 Survey sample, from which the city-level TRUST index can be constructed. This is one-third of the total sample of cities.9 The first stage instrumental variable regressions are reported in Appendix D.

From Table 6, while the estimated coefficient of TVE remains strong, the estimated coefficient of the GEI is insignificant even after the variable is instrumented. The cross-product term is marginally significant with instruments. The estimated coefficients of the TRUST variable and its attending cross-product term are insignificant. The estimated coefficient on the initial level of per capita GDP is positive. One plausible explanation for the positive coefficient for the log(y) is that the y* in equation 1, instead of staying at a constant value, also moves upwards with y over time. The estimated coefficient from log(y) could be biased upwards and positive, as suggested by Barro (1998). Moreover, our city sample is a group of larger and wealthier cities than the other cities in China.10 Rapid economic development from this group of cities was often aided by favourable central government policies. Divergence city growth is therefore likely.

We also perform a test in which both the GEI and the log(TVE)/TRUST variables are instrumented in the manner described in subsection 3b. We find there is little difference between these new results and those presented in Table 6 and hence not reported. The test results are available from the authors upon request.

It appears that the TRUST variable is not as robust as the TVE variable in all the above tables. This is perhaps due to the smaller sample size in the TRUST data set.

4 Section 4: Panel Regressions

An overall assessment of the above cross-sectional regressions suggests that the impact of GEI is weaker than that from TVE. Because of the plausibility of weak instruments and that the error term may not be iid, we have also tried other methods of estimation. The limited information maximum likelihood is useful for weak instruments, while the two-step GMM is useful for non-iid error term (see Vieira et al., 2012). Since the estimates from these two methods are very similar to those obtained from the two-stage least-square (2SLS) regressions reported in Tables 4 and 5, we will not report the new estimations. But they are available upon request.

Similar to most cross-sectional regressions in the literature, the province-specific effects (fixed effects) have been neglected in the above cross-regional estimations. This could potentially cause bias in the estimated coefficients. In this section, we will exploit the time series property of the TVE variable. We will employ the panel Arellano-Bond GMM-system estimation method to control for the province-specific effects and hence eliminate a potential source of omitted variable bias.

A noteworthy concern, mentioned at the end of subsections 2c(i) and 3b, is the omission of the interactions with the formal institution in the regressions. Instruments are needed. The benefit of the Arellano-Bond GMM-system estimation method is the lagged values of TVE are used to instrument the TVE variable in the current regression.

While the variable for the formal institution, GEI, is instrumented using the method described in subsection 2b, the variable(s) for the informal institution, either TVE or TRUST, has not been instrumented. The Arellano-Bond system GMM estimator allows the TVE variable to be instrumented by its past values. Since the TRUST variable has only one year of data, we cannot use its lagged values as instrument. The GEI variable is a weak predictor in the above cross-sectional regressions. Moreover, we only have one year of cross-sectional GEI data. For these reasons, the GEI variable is treated as an omitted variable and will be dropped from the following panel regressions. The time series for the variable Education in the data is very short. The estimated coefficient for Education from the cross-sectional regressions in the above tables is also insignificant. Therefore, we will also drop the variable Education in the panel regressions. We will use system GMM method rather than difference-GMM method because of the well-known statistical problems (potential bias and inaccuracy) associated with Difference-GMM estimator, in particular when the regressors (such as the TVE variable) are persistent (see Vieira et al., 2012).

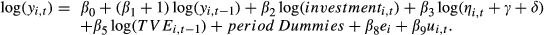

(3)

(3)In equation 3, i(t) distinguishes the provinces (periods), and ei is the provincial fixed effect. The cross-product term in (2) is dropped together with the variable GEI and Education.

In Table 9, the dependent variable is per capita GDP growth, instead of log(yt) as in equation 3. Regression (1) in Table 9 presents a baseline estimation in which the endogenous variables are log(yt−1) and log(TVEt−1), and with no a priori restriction on the number of lags and the choice of instrumental variables. To check the robustness of the baseline result, log(investmentt) is included into the list of endogenous variables in the estimation, reported in regression (2).

| Regression No | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Baseline | Collapsed instrument | Two-step; Collapsed Instrument; 2-lags | ||

| Log(per capita GDP) | −0.918** | −0.712** | −0.511 | −0.989 |

| (−1.727) | (−1.788) | (−0.666) | (−0.662) | |

| Log(investment) | 0.740 | 0.598 | 1.008 | 1.113 |

| (1.087) | (0.870) | (1.136) | (0.844) | |

| Log(n + γ + δ) | −12.937 | −10.601 | −3.362 | −16.269 |

| (−1.391) | (−1.224) | (−0.292) | (−0.691) | |

| Log (TVE) | 1.563*** | 1.560*** | 2.517*** | 2.309*** |

| (4.362) | (4.113) | (5.636) | (3.290) | |

| Hansen statistics (p-value) | 0.660 | 1.000 | 0.114 | 0.015 |

| Hansen difference (p-value) | 0.988 | 0.995 | 0.073 | 0.001 |

| AR(2); (p-value) | 0.990 | 0.674 | 0.680 | 0.615 |

| Number of instruments | 51 | 69 | 23 | 17 |

| Number of groups (provinces) | 30 | 30 | 30 | 30 |

Since proliferation of instruments may be a concern when the Hansen difference statistics is close to one, the number of instrument can be reduced by collapsing the instrument matrix in the regression. This result is presented in regression (3). The Hansen difference statistic is reduced substantially from 0.988 to 0.073.

Regression (4) presents the two-step procedure, using the Windmeijer correction, which can potentially reduce the weak instruments bias of the system GMM, if any. In regression (4), the number of instruments is collapsed and the time lag is restricted to two-period lag.

Finally, a check on the time series property of the log(TVE) variable would be helpful. In Table 10, the maximum value of log(TVE), over time, is about three times larger than its minimum value. The value of its standard deviation is around 28 per cent of its mean. There is sufficient variation over time. Hence, to choose the lagged values of log(TVE) as instruments should be reasonable.

| Variable | N | Mean | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|---|

| Log(TVE) | 120 | 2.780 | 0.490 | 1.190 | 3.750 |

| Log(TVE)j,. | 30 | 2.370 | 0.590 | 1.130 | 3.540 |

| Log(TVE).,t | 31 | 2.330 | 0.660 | 1.150 | 3.020 |

| TRUST | 110 | 158.9 | 12.62 | 125.2 | 184.1 |

| GEI | 120 | 29.25 | 15.43 | -8.270 | 71.30 |

Note:

- The subscripts j and t denote province and time respectively. log(TVE) is the variable from Table 9. Variable log(TVE).,t averages all the provincial log(TVE) for the period t, where t is from 1978 to 2008; while log(TVE)j,. averages log(TVE) over all the time periods for province j.

To sum up, from the estimated coefficients in the panel regressions, the explanatory variable log(TVE), instrumented by lagged values, has a positive and significant impact on the provincial per capita GDP growth.

5 Section 5: Concluding Remarks

In 2005, Transparency International ranked China very low in the corruption index. Of a total score of 10, where 10 is the least corrupted country, China scored 3.2, similar to other high corruption countries such as, India (scored 2.9), Egypt (3.4) and Morocco (3.2). Again in 2011, China scored 3.6, in the same category as India (3.1) and Indonesia (3). The corruption index, a common measure on the quality of institutions, suggests that the formal institution in China is mediocre at best. In contrast, from the World Values Survey around 2007, the trust index of China stood at 52.2. The higher the value of the index, the more trusting is society. China is a high-trust country, above many, and in line with those countries in Northern Europe. The trust index of Sweden stood at 68.0, the USA at 39.6, Japan at 39.1, Russia at 26.7, South Africa at 17.5, Morocco at 13 and Brazil at 9.2. The cross-country trust indices from the World Values Survey suggest that the informal institution in China is strong and robust.

China's formal institution is improving since the inception of the economic reform initiated by Deng Xiaoping in 1978. There were progressive reforms in the market economy, commercial laws, banking sector, state enterprises, regional governance and so forth (see Hasan et al., 2009). But at the same time, there are forces that undermine these improvements. Corruption has grown by leaps and bounce since 1978, the Gini coefficient on income inequality has risen from 0.2 to over 0.5, political patronage and ‘princelings’ have become more prevailing, etc. Allen et al. (2005, p. 57), among many others, even argued that ‘China is an important counterexample to the findings in the law, institutions, finance and growth literature: neither its legal nor financial system is well developed, yet it has one of the fastest growing economies’. Allen et al. (2005) suggested that it was the alternative informal financing and governance, based on reputation and personal relationships, that has supported the growth of the financial sector in China. If we compare China's formal institution with those from the group of developing countries, China's formal institution should score high marks. But on the balance, it is perhaps fair to say that, in spite of the pace (rate) of improvement, the quality (level) of China's formal institution is, at best, average by international standard.

The present paper addresses the question why China grows so fast in spite of its mediocre formal institution? This ‘China puzzle’ posts a challenge to some conventional wisdom that institution is an important determinant to economic growth. Is China's case exceptional?

Using provincial and city-level cross-sectional data, this paper finds that the quality of the ‘formal’ institution from different regions does matter to their respective regional economic growth. The supporting evidence is reasonable but less robust overall: from the provincial data, the estimated coefficient from the quality of the formal institution is statistically significant, whereas from the city-level data, most of the estimated coefficients are insignificant.

As for the informal institution, we use output share of township-and-village enterprises and the TRUST index as proxies. The township-and-village enterprises were the flagship performers in the Chinese economy in the 1980s and 1990s, both in terms of productivity and sectorial growth. The output share of township-and-village enterprises was about four-fifths of the total output of non-state sector (see Chow, 2007). These enterprises were collectively owned by the people in the respective townships or villages. The success stories of the township-and-village enterprises in that period suggest that the informal institution in China is quite strong. Personal connections (guanxi) for enforcing business transactions have been strong, even up to today. The present paper finds significant and robust evidence, from both cross-sectional and time series estimations, that the quality of the ‘informal’ institution has a positive impact on economic growth. Our empirical findings should not be interpreted as an indictment that China's formal institution does not play a role in China's growth. On the contrary, China's economic reforms, initiated by Deng Xiaoping in 1978, actually started at the formal institution. We are arguing that it is the strength of the informal institution, which has augmented the effectiveness of the ‘formal’ institution and offers a plausible explanation for China's growth miracle! The current research also finds some evidence that the ‘formal’ and the ‘informal’ institution would not ‘crowd-out’ each other. Rather, they interact and play a complementary role with each other.

Needless to say, the choice of the valued-added share of TVE as proxy for the informal institutions has its short-comings. The virtue of using this proxy is the availability of both cross-sectional and time series data for the TVE variable. Moreover, the high correlation between the Trust variable and the TVE variable suggests that the use of the TVE as a proxy should be reasonable. The current proxies for the informal institution will require future research to improve upon.

Notes

Appendix A

a. The Cities and Provinces Used in This Paper

Cities: Anqing, Anshan, Baoding, Baoji, Baotou, Beijing, Benxi, Cangzhou, Changchun, Changde, Changsha, Changzhou, Chengdu, Chenzhou, Chongqing, Chuzhou, Dalian, Daqing, Datong, Deyang, Dongguan, Foshan, Fushun, Fuzhou, Ganzhou, Guangzhou, Guilin, Guiyang, Haerbing, Haikou, Handan, Hangzhou, Hefei, Hengyang, Huanggang, Huhehaote, Huizhou, Huzhou, Jiangmen, Jiaxing, Jilin, Jinan, Jingmen, Jingzhou, Jinhua, Jining, Jinzhou, Jiujiang, Kunming, Langfang, Lanzhou, Leshan, Lianyungang, Linyi, Liuzhou, Luoyang, Maoming, Mianyang, Nanchang, Nanjing, Nanning, Nantong, Nanyang, Ningbo, Qingdao, Qinhuangdao, Qiqihaer, Quanzhou, Qujing, Sanming, Shanghai, Shangqiu, Shangrao, Shantou, Shaoxing, Shenyang, Shenzhen, Shijiazhuang, Suzhou, Taian, Taiyuan, Taizhou, Tangshan, Tianjin, Tianshui, Weifang, Weihai, Wenzhou, Wuhan, Wuhu, Wulumuqi, Wuxi, Wuzhong, Xiamen, Xian, Xiangfan, Xianyang, Xiaogan, Xining, Xinxiang, Xuchang, Xuzhou, Yancheng, Yangzhou, Yantai, Yibin, Yichang, Yichun, Yinchuan, Yueyang, Yuncheng, Yuxi, Zhangjiakou, Zhangzhou, Zhengzhou, Zhoukou, Zhuhai, Zhuzhou, Zibo, Zunyi.

Provinces: Anhui, Liaoning, Hebei, Shaanxi, Neimenggu, Beijing, Jilin, Hunan, Jiangsu, Sichuan, Chongqing, Heilongjiang, Shanxi, Guangdong, Fujian, Jiangxi, Guangxi, Guizhou, Hainan, Zhejiang, Hubei, Shandong, Yunnan, Gansu, Henan, Shanghai, Tianjing, Xinjiang, Ningxia, Qinghai.

b. The Construction of the Mobility Indices of Official

We review the resumes of all the city mayors (prefectural leaders) and party secretaries (secretary of the municipal committee of the Chinese Communist Party) in the 120 cities and record the information on how long he/she had been in the current job, age, whether or not he or she had been transferred out or into the current job from another job of the same-level, and whether or not he or she had been transferred from or into a higher level job. From these records, we can construct the share of officials (prefectural leaders and party secretaries) who has been rotated to another same-level job (horizontal mobility) or promoted/demoted from a higher level job (vertical mobility) during the sample period 2000–04. We follow the same method of construction used by Xu and Wang (2011). In their research, they construct a data set on provincial officials from the 31 provinces in China, which we cannot use. Here, we have to re-compile a data set for city officials from the 120 cities in China.

Appendix B

a. Trust Surveys from CGSS

The opinion survey was taken from China General Social Survey Open Database (CGSS) sponsored by the Renmin University of China (http://www.cssod.org/search.php?key=CGSS). There are four waves of survey (2003, 2005, 2006 and 2008).

In the CGSS 2003 survey, the survey question related to trust is: ‘do you trust strangers?’ In the CGSS 2006 survey, the survey question, somewhat related to trust question from the World Values Survey, is: ‘how much does the interviewee trust the interviewer?’ The trust score is evaluated by the interviewer rather than by the interviewee. In the CGSS 2008 survey, the question asked is: ‘what is the degree of trust between you and the person who is important to you in getting your current job?’ We do not think trust questions from 2006 and 2008 come close to the trust question asked in the World Values Survey. They will not be used in our investigation.

Table A1 provides the pairwise correlation coefficients between the trust questions from different waves and the TVE variable. A close examination on the battery of survey questions in 2005 (see Table 2) reveals that they are reasonably close to trust question asked in the World Values Survey that is often used in the literature. From the Table A1, we can see that the trust questions from 2006 and 2008 surveys are unsuitable for statistical investigation. The log (TVE) variable strongly correlates with the TRUST variable is particularly noteworthy.

| Log(TVE) | TRUST Index 2005 | Trust Question 2003 | Trust Question 2006 | Trust Question 2006 | |

|---|---|---|---|---|---|

| Log(TVE) | 1 | ||||

| TRUST index 2005 | 0.521*** | 1 | |||

| Trust question 2003 | 0.289 | 0.131 | 1 | ||

| Trust question 2006 | 0.247 | 0.0650 | −0.0910 | 1 | |

| Trust question 2008 | 0.0880 | 0.250 | 0.0990 | −0.0570 | 1 |

Notes:

- (i) Number of observation: 24 provinces.

- (ii) ***Statistically significance at the 1% level.

Appendix C

| Regression No | (2) | (3) | (6) | (9) | (10) | (3) | (6) | (10) |

|---|---|---|---|---|---|---|---|---|

| OLS, Robust Estimation | IV-Estimation | |||||||

| Growth | Growth | Growth | Growth | Growth | Growth | Growth | Growth | |

| Log(y) | −1.122 | −1.535 | −1.655* | −1.497* | −2.552** | −2.822* | −1.205 | −1.203 |

| (−1.516) | (−1.616) | (−1.952) | (−1.846) | (−2.655) | (−2.052) | (−1.345) | (−1.437) | |

| Log(investment) | 3.296 | 2.812 | 2.914 | 0.393 | −0.577 | 2.535 | 3.027 | 0.137 |

| (1.151) | (0.891) | (0.970) | (0.240) | (−0.341) | (0.919) | (1.056) | (0.105) | |

| Log(n + γ + δ) | −29.086** | −39.17*** | −38.17*** | −24.17 | −38.069** | −44.48*** | −37.86*** | −22.278** |

| (−2.703) | (−3.440) | (−3.272) | (−1.648) | (−2.124) | (−3.273) | (−3.310) | (−2.124) | |

| Log(education) | −0.579 | 0.718 | 1.285 | 2.772 | 3.892 | 6.444* | 4.393 | 7.835*** |

| (−0.156) | (0.175) | (0.329) | (0.513) | (0.886) | (1.825) | (1.192) | (3.153) | |

| Log(TVE) | 1.285** | |||||||

| (2.707) | ||||||||

| TRUST | 0.037** | |||||||

| (2.135) | ||||||||

| GEI | 0.0130 | 0.133* | ||||||

| (0.362) | (1.918) | |||||||

| Log(TVE) × GEI | 0.00800 | 0.017** | ||||||

| (0.961) | (2.053) | |||||||

| TRUST × GEI | 0.0004** | 0.0002 | ||||||

| (2.335) | (1.178) | |||||||

| Constant | 76.137** | 105.72*** | 102.69*** | 69.61 | 117.538** | 116.44*** | 90.770*** | 58.543* |

| (2.518) | (3.287) | (3.386) | (1.697) | (2.220) | (3.202) | (3.144) | (1.790) | |

| Hansen statistic | 1.396 | 4.416 | 5.994 | |||||

| p-value | 0.238 | 0.491 | 0.424 | |||||

| Observations | 30 | 30 | 30 | 24 | 24 | 26 | 26 | 20 |

| Adjusted R2 | 0.332 | 0.187 | 0.0320 | 0.249 | 0.335 | 0.338 | 0.307 | 0.346 |

| R 2 | 0.447 | 0.327 | 0.199 | 0.412 | 0.480 | 0.470 | 0.445 | 0.518 |

| F | 4.346 | 3.296 | 2.209 | 1.726 | 2.322 | 2.877 | 3.309 | 4.812 |

| Regression No | (1) | (3) | (6) | (10) |

|---|---|---|---|---|

| Dependent Variable | GEI | GEI | Log(TVE) × GEI | TRUST × GEI |

| Log(y) | 16.277* | 39.880 | 3002.568 | |

| (2.073) | (1.685) | (1.107) | ||

| Log(investment) | 8.804 | 28.686 | 4744.613 | |

| (0.588) | (0.647) | (1.778) | ||

| Log(n + γ + δ) | 117.9 | 513.516 | 58652.63 | |

| (0.861) | (1.360) | (1.292) | ||

| Log(education) | 0.607 | −112.523 | −467.921 | |

| (0.016) | (−1.152) | (−0.060) | ||

| Log(TVE) | 37.386** | |||

| (2.833) | ||||

| TRUST | 10.402 | |||

| (0.280) | ||||

| Mobility index of regional officials | 7.488** | 9.488 | −0.325 | −806.410 |

| (2.138) | (1.525) | (−0.017) | (−0.466) | |

| Effective tax rate | −251.591* | −115.6 | −44.581 | 10881.9 |

| (−1.910) | (−0.790) | (−0.105) | (0.254) | |

| Colonial port | 13.712 | 904.833 | ||

| (0.743) | (0.580) | |||

| Coastal province | 7.174 | 227.343 | ||

| (0.396) | (0.116) | |||

| Ethnolinguistic fractionalisation | 128.511 | 11054.87** | ||

| (1.237) | (2.577) | |||

| Constant | 62.029*** | −412.7 | −1601.921 | −192365.5 |

| (3.943) | (−0.980) | (−1.407) | (−1.332) | |

| Observations | 26 | 26 | 26 | 20 |

| Adjusted R2 | 0.116 | 0.159 | 0.496 | 0.246 |

| R 2 | 0.186 | 0.361 | 0.698 | 0.643 |

| F | 9.484 | 8.259 | 12.05 | 9.036 |

| Regression No | (1) | (2) | (3) | (4) | (5) | (6) | (7) |

|---|---|---|---|---|---|---|---|

| Log(y) | −1.697** | −1.666** | −1.767** | −2.172** | −2.401*** | −1.321* | −1.588* |

| (−2.429) | (−2.249) | (−2.100) | (−2.983) | (−3.202) | (−1.825) | (−2.062) | |

| Log(investment) | 3.702 | 4.102 | 4.154 | 1.307 | 1.214 | 3.722 | 1.737 |

| (1.301) | (1.447) | (1.459) | (0.924) | (0.859) | (1.268) | (1.037) | |

| Log(n + γ + δ) | −33.941*** | −27.558** | −28.890*** | −29.987** | −36.578*** | −25.556* | −13.56 |

| (−3.601) | (−2.241) | (−3.013) | (−2.335) | (−3.665) | (−2.018) | (−0.858) | |

| Log(education) | 5.997 | 5.711 | 5.897 | 6.022** | 5.920** | 0.371 | 2.220 |

| (1.590) | (1.494) | (1.573) | (2.415) | (2.438) | (0.096) | (0.476) | |

| Log(TVE) | 0.915 | 1.799* | |||||

| (1.117) | (2.007) | ||||||

| TRUST | 0.066** | 0.099* | |||||

| (2.344) | (1.766) | ||||||

| GEI | 0.126** | 0.119** | 0.117* | ||||

| (2.314) | (2.179) | (1.974) | |||||

| Log(TVE) × GEI | 0.046** | ||||||

| (2.323) | |||||||

| TRUST × GEI | 0.001** | ||||||

| (2.670) | |||||||

| Constant | 78.098*** | 59.678* | 65.495** | 72.025* | 99.563*** | 64.746* | 31.94 |

| (3.394) | (1.903) | (2.536) | (1.836) | (3.359) | (1.809) | (0.704) | |

| Observations | 26 | 26 | 26 | 20 | 20 | 30 | 24 |

| Adjusted R2 | 0.385 | 0.377 | 0.407 | 0.491 | 0.474 | 0.250 | 0.208 |

| R 2 | 0.508 | 0.526 | 0.525 | 0.652 | 0.612 | 0.380 | 0.380 |

| F | 4.827 | 4.403 | 4.813 | 6.082 | 5.726 | 3.479 | 1.692 |

Notes:

- (i) See notes in Table A2. (ii) The variable GEI, log(TVE), TRUST and the variables in cross-product terms are predicted values taken from Stage 1 regressions in Table A5. (iii) The t-values are in parentheses.

- (iv) *Significance level at 10%, ** at 5%, and *** at 1% respectively.

| GEI | Log(TVE) | TRUST | |

|---|---|---|---|

| Mobility index of regional officials | 5.244 | ||

| (1.305) | |||

| Effective tax rate | −232.480* | ||

| (−1.947) | |||

| Colonial port | 6.067 | ||

| (1.012) | |||

| Coastal province | 5.136 | ||

| (0.925) | |||

| Ethnolinguistic fractionalisation | 3.440*** | 59.826* | |

| (4.368) | (1.903) | ||

| Constant | 52.398*** | −0.647 | 98.596*** |

| (3.255) | (−0.879) | (3.403) | |

| Observations | 26 | 30 | 24 |

| Adjusted R2 | 0.177 | 0.315 | 0.0630 |

| R 2 | 0.308 | 0.339 | 0.104 |

| F | 5.407 | 19.08 | 3.621 |

Notes:

- Because of the small sample, we use the only the significant instrument, Ethnolinguistic Fractionalisation, for the TRUST and Log(TVE) variables. (ii) *Significance level at 10% and *** at 1%, respectively.

The regressions in above tables support the results in Tables 4 and 5. In Tables A4 and A5 we are testing the case where both the formal and informal institutions are instrumented. Stage 1 regressions are reported in Table A5. Their predicted values are used in stage 2 regressions in Table A4.

Appendix D

| Regression No | (1) | (3) | (4) | (6) | (10) |

|---|---|---|---|---|---|

| Dependent Variable | GEI | GEI | GEI | Log(TVE) × GEI | TRUST × GEI |

| Log(y) | 7.672*** | 6.810*** | 19.265*** | 1898.134** | |

| (3.209) | (2.900) | (2.633) | (2.143) | ||

| Log(investment) | 10.809*** | 8.795*** | 26.940*** | 4192.093*** | |

| (4.181) | (3.034) | (3.182) | (4.104) | ||

| Log(n + γ + δ) | 40.90 | 43.23 | 85.130 | 7671.066 | |

| (0.831) | (0.902) | (0.639) | (0.536) | ||

| Log(education) | −0.611 | −15.57 | −38.799 | −20129** | |

| (−0.024) | (−0.623) | (−0.628) | (−2.506) | ||

| Log(TVE) | 5.706** | 33.764*** | |||

| (2.098) | (3.631) | ||||

| TRUST | 76.225*** | ||||

| (4.374) | |||||

| Mobility index of regional officials | 4.349* | 4.011* | 3.182 | 10.114 | 735.346 |

| (1.897) | (1.825) | (1.487) | (1.392) | (0.858) | |

| Effective tax rate | −120.487** | −106.841** | −102.001** | −273.242* | −12252.01 |

| (−2.428) | (−2.175) | (−2.080) | (−1.939) | (−0.876) | |

| Colonial port | 2.955 | 4749.348*** | |||

| (0.278) | (4.772) | ||||

| Coastal city | 9.874 | −923.577 | |||

| (0.897) | (−1.070) | ||||

| Ethnolinguistic fractionalisation | 11.745 | 9847.086*** | |||

| (0.246) | (4.106) | ||||

| Constant | 47.054*** | −170.4 | −145.1 | −404.876 | −30462.26 |

| (7.552) | (−1.243) | (−1.097) | (−1.078) | (−0.788) | |

| Observations | 116 | 116 | 116 | 109 | 36 |

| Adjusted R2 | 0.062 | 0.191 | 0.207 | 0.362 | 0.676 |

| R 2 | 0.079 | 0.233 | 0.255 | 0.421 | 0.768 |

| F | 5.188 | 5.287 | 5.899 | 11.49 | 25.71 |