Intangibles From Intangible Capital Work: Their Valuation and Technological Change

Funding: This work was supported by European Union's Horizon 2020 under grant agreement no. 822259.

ABSTRACT

The paper explores the relationship between intangibles, technological change, and multifactor productivity (MFP) in four countries: Finland, Denmark, Norway, and Slovenia, between 2007 and 2019. An innovative approach using linked employer–employee data is employed to measure firm-level intangible assets within the areas of research and development (R&D), organizational capital (OC), and information and communication technology (ICT). Building on this, we introduce an Intangible-Biased Technological Change (IBTC) approach that measures the effective use and quality of R&D and organizational capital work. The results show that both intangibles and industry-specific IBTC contribute to higher MFP in the Nordic countries. IBTC is associated with growing productivity disparities among firms within the same industry. Nevertheless, we also find that R&D enhances absorptive capacity, leading to positive spillovers in inter-industry relationships, and that R&D-IBTC can also narrow differences in productivity between various industries.

1 Introduction

The understanding of the role of intangible assets in explaining productivity has become considerably clearer over the past two decades. Investment in intangible capital can shape the growth of productivity in various ways, given that it exhibits higher output elasticity than traditional capital, produces distinct spillover effects, contributes to wider productivity dispersion, and adds to the growth of firms that invest more heavily in acquiring knowledge. Existing empirical analyses show that intangibles substantially impact both firm-level and industry-wide productivity outcomes, along with productivity dispersion and dynamics. The seminal growth accounting studies by Corrado et al. (2009), Fukao et al. (2009), and Van Ark et al. (2009), together with more recent empirical approaches like those of Corrado et al. (2022), Roth (2024), Bontadini et al. (2024), and Piekkola and Rahko (2024) reveal that intangible capital's contribution to sustainable productivity growth is both significant and resilient. Research by Jona-Lasinio and Meliciani (2018) established that the share of intangible assets in total productivity growth ranged from 14% to just over 30% between 2000 and 2013 in the Netherlands, Denmark, Finland, and the United Kingdom. However, since 2007, a notable decline has been observed in the deepening of intangible capital (Goodridge and Haskel 2023).

Rico and Cabrer-Borrás (2019) find that intangible capital contributes to business productivity significantly and positively. Their research shows that various intangible assets—beyond just formal research and development, including aspects like training and organizational development—drive productivity growth. We examine Intangible-Biased Technological Change (IBTC), which refers to productivity changes within firms arising from shifts in the proportion of employees contributing to accumulating intangible assets, termed intangible capital workers. Technological change arises from the productivity of highly educated workers—often referred to as skill-biased technological change—or here from the productivity of intangible workers, determined primarily by the returns on the respective workforce shares (Hellerstein et al. 1999; Ilmakunnas and Piekkola 2014). In the context of skill-biased technological change, the increased presence of skilled workers boosts productivity because they tend to be more effective. However, the concept of IBTC contends that quality, as indicated by compensation levels, also positively influences multifactor productivity.

Further, the quality of intangible capital work may evolve over time. The measurement of IBTC is based on the marginal returns of research and development (R&D) and organizational capital (OC) associated with intangible work, using the relative wages of non-intangible workers as a benchmark (Piekkola 2020; Piekkola et al. 2024). OC is a critical component of broader intangibles (IC), as Corrado et al. (2021) noted. Analysis of IBTC and the intangibles–technological change relationship might prove particularly relevant, especially as economies are facing lower growth due to either declining investments in tangibles or the influence of unmeasured intangibles on total factor productivity (Gordon 2016; Jona-Lasinio and Meliciani 2018). Technology improves scaling opportunities, leading to an increase in output elasticity of non-intangible work, which as such does not measure technological change itself (IBTC). Scaling opportunities are rather an outcome of new technology that increases the profit margins from non-intangible work, following the insights of De Loecker et al. (2020).

This paper examines how intangible capital contributes to increased multifactor productivity (MFP) across various industries driven by technological enhancements attributable to intangible work. Technological change encompasses organizational technologies and, accordingly, the methods by which management and marketing professionals optimize productive activities, yet also know-how associated with product and process technologies and realizing the specifications of outputs (Lipsey and Carlaw 2004).

Piekkola et al. (2024) examine the contributions of research and development (R&D) and organizational capital (OC)—including management and marketing practices—to Intangible-Biased Technological Change (IBTC) in Finland, Denmark, Norway, and Slovenia, countries considered in this investigation. The authors refer to the concepts of R&D-IBTC and OC-IBTC, first articulated by Piekkola (2020), positioning both as critical components within the technical change framework in the production function.

Utilizing data from the GLOBALINTO intangible survey across Europe, Piekkola et al. (2024) describe how organizational capital, as a facet of broader intangibles that encompasses branding, design, and specialized information and communication technology (ICT), adds significantly to productivity, profit margins, and financial solvency. Moreover, R&D is shown to have an independent positive effect on these metrics. Protogerou et al. (2025) complement this work by employing the same dataset to establish that OC makes producing innovative outputs more likely.

The interaction between a firm's R&D investments and those on the industry level can influence R&D-IBTC since the quality of intangible activities is likely modulated by the intangibles possessed by a firm's collaborators and competitors. OC-IBTC similarly reflects this dynamic, yet it is characterized by its heterogeneity, which depends on the evolution of organizational forms (Dosi et al. 2000). Notably, human or educational capital is regarded as non-firm-specific, contingent on investments in intangibles and IBTC, which encapsulate a substantial portion of industry and firm-specific knowledge.

This paper analyzes the interrelationships between IBTCs, focusing on the interaction of OC and R&D capital and how this collective knowledge capital influences MFP. We use the preferred Wooldridge (2009) methodology for firm-level estimations of the level of MFP. The analysis departs from traditional total factor productivity (TFP) metrics that only account for tangible capital deepening and include intangible capital deepening. Therefore, MFP is not sensitive to temporal variations in gross returns from intangible investments.

The empirical investigation considers firm-level data from Finland, Denmark, Norway, and Slovenia. Sanandaji et al. (2022) introduce the “innovation triangle” concept in the intangible-intensive Nordic region, with Oslo, Helsinki, and Copenhagen on the vertices and Stockholm central to this nexus. The Copenhagen region is recognized as a prominent European innovation hub, while the Nordic region is identified as a vital center of global innovation (European Commission 2021). Slovenia, as a burgeoning, manufacturing-oriented, and innovative economy within the EU, provides an intriguing case for comparing the dynamics and contributions of intangibles and IBTC between emerging and frontier economies. The presented analysis uses a novel occupation-based methodology for measuring firm-level intangible investments, utilizing linked employer–employee data to understand these relationships comprehensively.

Technological advancements have continuously evolved in the Nordic countries, positively influencing MFP. Our analysis indicates that firms benefit from intangible capital deepening and industry-specific technological innovations. This means that intangible capital (IC) and its industry-specific benefits (IC-IBTC) are complementary. Notably, the value of IBTC rises as a firm approaches the leading companies in its industry in terms of MFP. In line with De Ridder (2024), we acknowledge efficiency as a crucial factor for greater productivity dispersion. Among the various explanatory factors, organizational capital related to OC-IBTC remains largely underexplored, although OC can exceed R&D-driven work, and OC workers are relatively better paid, especially in business services.

Lower intangibles and limited knowledge spillovers have been identified as reasons for Europe's relative innovation lag compared to the United States. This paper underscores the robustness of the innovation system in the Nordic countries. Still, the productivity effects of IBTC are heavily contingent upon a firm's MFP relative to the top-performing firms in its industry.

The paper is structured into six sections. Following this introduction, Section 2 reviews the relevant literature and presents hypotheses. Section 3 outlines the GLOBALINTO occupation-based methodology for measuring intangible capital and IBTC. Section 4 illustrates the evolution of intangibles, IBTC, and MFP across Finland, Denmark, Norway, and Slovenia. Section 5 details the estimated productivity and dispersion results. Finally, Section 6 discusses the implications of our findings for policy and provides a conclusion.

2 Theoretical Background and Hypotheses

Corrado et al. (2022) demonstrate that the declining productivity growth since the 2008 crisis can primarily be attributed to reduced labor and capital deepening. They argue that lower total factor productivity is linked to being dependent on spillover effects from intangible inputs rather than the intensity of their use. The paper illustrates this concept using the example of spillovers from a phone network, which arise from its existence rather than the hours worked on it. Corrado et al. (2022) estimate that this spillover accounts for one-fifth of the annual 1.2 percentage-point decline in intangible capital accumulation observed between 2007 and 2018, causing an annual reduction of 0.25 percentage points in total factor productivity growth. They also argue that the potential for productivity spillovers may have shifted following changes in the innovative environment, competition, regulation, and the protection of intellectual property rights. In a related analysis, Goodridge and Haskel (2023) highlight that the slowdown in multifactor productivity growth since the 2007 crisis is especially pronounced in the UK's more intangible-, knowledge-, technology-, and digital-intensive industries, again linked to the decline in intangible output.

The empirical findings of Corrado et al. (2021) support the findings of Aghion et al. (2021), who show that upstream production—the initial phases of the production process—can benefit greatly from investments in intangible capital, including R&D, software, and intellectual property. Innovation-driven growth in upstream industries adds significantly to productivity growth and leads to the restructuring of economies by replacing outdated and less productive processes, boosting overall economic performance. Further, in environments characterized by strong competition among innovative and highly productive firms, innovation is stimulated, while firms that lag behind may find it even harder to catch up.

Firms can enhance their absorptive capacity, with those investing more in R&D being better positioned to adapt and apply external knowledge (Cohen and Levinthal 1990). Such firms create a virtuous cycle of innovation-driven productivity gains by continuously improving their processes and products. We propose the concept of industry R&D-IBTC, which is likely to benefit firms closer to the technological frontier, as they tend to employ more qualified intangible assets. Firms can streamline their research processes and shorten innovation cycles by integrating research efforts with data analytics, software, and other information-based tools. Overall, investments in R&D and R&D-IBTC enable firms to generate higher returns on innovation, benefiting from the scalability and synergy between R&D and technology (Haskel and Westlake 2017).

Non-R&D intangibles—including organizational capital (OC)—typically exhibit higher output elasticities than the measured factor shares (Corrado, Haskel, Iommi, et al. 2017; Corrado, Haskel, and Jona-Lasinio 2017). Investment in OC fosters tacit knowledge exchange and can reduce cognitive, transactional, and organizational costs (Chesbrough 2003). OC and OC-IBTC interact with advanced information-based tasks or technologies. This combination permits firms to become more adaptable to the market, improve their decision-making, and lower information asymmetries (Laursen and Salter 2006). The aligning of organizational and technological aspects leads to more efficient innovation processes, supports new product designs, and improves the coordination of intangible resources (Crouzet et al. 2022; Wyatt 2005). Recent studies have confirmed that OC contributes to direct productivity improvements and enhances the returns on other innovation inputs (e.g., Protogerou et al. 2025; Piekkola 2024).

Shao and Lin (2002) state that investments in information technology (IT), a subset of intangible investments, can significantly improve technical efficiency. Their findings also highlight the importance of synergy between IT and organizational capabilities; without this synergy, productivity outcomes may fall short of optimal levels. Wyatt (2005) stresses the critical role of management in defining a firm's set of intangible capabilities. Crouzet et al. (2022) propose that “non-rivalry in use” may define the type of OC involved in creating intangible goods or services unique to the firm. OC can contribute to multifactor productivity (MFP) making intangibles (Piekkola 2024) or various forms of innovation more productive (Protogerou et al. 2025). Based on this analysis, we propose the following hypotheses:

Hypothesis 1.R&D and R&D-IBTC increase MFP.

Hypothesis 2.OC and OC-IBTC increase MFP.

Human capital is expected to have a more consistent impact on firms since, by definition, it is less specific to any organization. As investments in research and development (R&D), organizational capital (OC), and complementary technologies rise, the knowledge needed in higher-performing firms tends to become more generalized across various tasks. This knowledge spreads through learning by doing and can be transferred to other firms (see, e.g., Corrado, Haskel, and Jona-Lasinio 2017). It remains uncertain whether R&D or OC only benefits a select group of firms (the top performers) or contributes to overall productivity growth because certain R&D efforts add to general absorption capacity and the market adaptability of OC for new technologies.

Organizational capital is more deeply embedded in the organization itself; it is rooted in the practices, processes, and systems, which typically remain in place when employees are replaced (Atkeson and Kehoe 2005; Lev and Radhakrishnan 2005). Human capital will likely yield more uniform outcomes across various technologies, especially when the complexities associated with intangible assets are controlled. This leads to the following hypothesis:

Hypothesis 3.The returns to human capital are consistent across countries and technology types.

Aghion et al. (2021) suggest that competition and innovation on the productivity frontier further stimulate leading firms to enhance their performance at an accelerated rate while lagging firms drop further behind. Although this divergence may result in an expanded performance gap, the process also increases the industry's average MFP. Top-performing firms' innovation and expansion also encourage the diffusion of knowledge through various channels, including supply chains, licensing agreements, and labor mobility (Liu and Sickles 2024). If a sufficient number of firms capitalize on these spillover effects, industry-wide productivity levels can rise, effectively counterbalancing the stagnation or decelerated growth observed among the least productive entities.

Goodridge and Haskel (2023) show that industries characterized by high levels of intangible assets frequently exhibit pronounced performance disparities. Conducted via a growth accounting lens, their descriptive analysis reveals that the deceleration in MFP growth after the 2007 financial crisis is most evident in the UK's intangible-, knowledge-, technology-, and digital-intensive sectors. This phenomenon is chiefly attributed to the smaller spillover effects in industries that rely heavily on intangibles and were previously more strongly influenced by rapid advancements in knowledge (Corrado et al. 2022).

Firms operating closer to the productivity frontier are expected to benefit more from IBTC. Firms with higher MFPs demonstrate superior capabilities—encompassing financial resources, managerial skills, and human capital—which enable them to leverage innovations and other intangible assets more effectively.

Criscuolo et al. (2021) find that the labor productivity gap between a median performer and the frontier is explained by one-third through human factors, which is substantial when compared to the role of capital (20%). They also argue that unobserved intangibles are likely to lead to an even higher share of human factors. New skill requirements: branding, design, and a company's culture are captured in the organizational capital of managers and marketing experts. Aghion et al. (2021) provide evidence that investments in intangibles can revitalize or enhance entire industries. Costa (2012) examined the Italian yacht manufacturing sector, traditionally rooted in manufacturing, and showed that well-managed intangible resources and structured intellectual capital—like design expertise, brand reputation, and managerial know-how—could bring competitive advantages and elevate MFP levels.

The literature also underscores the importance of proximity to the technological frontier in cultivating the absorptive capacity for industry technology spillovers. The performance gap between leading firms and average firms in MFP terms can be exacerbated when the most productive firms effectively utilize or exploit IBTCs. In contrast, less productive firms encounter challenges in closing this gap (Nieto and Quevedo 2005). A meta-analysis by Ugur et al. (2020) reveals that R&D spillovers are particularly beneficial in inter-industry relationships rather than strictly within the confines of specific industries. Based on this discourse, the following hypothesis is proposed:

Hypothesis 4.IBTC is concentrated among high MFP firms, increasing their MFP and its dispersion within the industry; however, the economy-wide effects remain ambiguous.

We previously hypothesized (Corrado et al. 2022) that organizational capabilities (OC) and research and development (R&D) outputs generate spillovers that add to industry-wide MFP. Corrado et al. (2021) found that a 10-percentage-point rise in economic competencies (such as OC) correlates with an approximately 1-percentage-point rise in productivity dispersion between the top and bottom-performing firms. In contrast, more traditional forms of investment, like R&D, do not significantly correlate with higher productivity dispersion when comparing the 90th and 10th percentiles. However, they become positively significant when the top 10th percentile is compared with the median.

OC facilitates the flow of knowledge and supports managerial practices, yet the mechanisms by which OC output acts as a spillover on other firms remain unclear. OC often includes firm-specific and path-dependent practices that can prove challenging to replicate, serving as a source of enduring competitive advantage (Corrado et al. 2021). Conversely, R&D fosters new technologies and processes that other firms can more readily adopt. Companies with superior OC can advance more quickly, widening industry gaps. Once R&D knowledge is leaked or diffused, it becomes relatively more accessible, allowing competing firms to absorb it (Cohen and Levinthal 1990). R&D consequently helps to narrow the productivity gap among firms.

Hypothesis 5.OC increases within-industry MFP dispersion while R&D reduces it.

3 Methodology and Data

The present analysis considers datasets from official registers from national statistical institutions.1 Specifically, the data utilized for this analysis are linked employer–employee data. In the case of Denmark, Finland, and Norway, the datasets were meticulously prepared using register data respectively made available by Statistics Denmark, Statistics Finland, Statistics Norway, and the Statistical Office of the Republic of Slovenia.

From a methodological standpoint, the measurement of intangible investment relies on employee data, wherein occupational classifications serve as the principal criterion. This approach aligns with the objectives of the EU Horizon 2020 project GLOBALINTO and the preceding EU 7th Framework project INNODRIVE for identifying intangible capital (IC) work. Construction of the linked employer–employee dataset that is central to this analysis followed several methodical steps: (1) the identification of core occupational groups encompassing R&D, organizational capabilities (OC), and information and communication technology (ICT) experts within each firm, as informed by a comprehensive list of relevant occupational classifications (refer to Box A1); (2) the aggregation of individual wage incomes for these core occupational groups from employee-level data on the firm level; (3) the determination of intangible investments, calculated through the aggregated wage incomes coupled with an estimated multiplier reflecting the proportion of working time dedicated to generating new knowledge and the utilization of other productive factors (see Equation 1). An exposition of the multiplier is provided below, with additional details in Appendix A.

The resulting linked dataset facilitates in-depth firm-level analysis of intangible investments in technological change (IBTC), productivity measures, and productivity dispersion. It is important to note that ICT-driven technological change is excluded from this analysis because ICT occupations predominantly focus on ICT-related business services. Nevertheless, digitalization transcends individual sectors, establishing itself as a foundational technology rather than merely a sector-specific intangible asset. This aspect is accounted for while measuring multifactor productivity (MFP), recognizing that ICT investments can bring substantial productivity gains, particularly within sectors that actively utilize ICT.

Box A1 in Appendix A lists relevant occupations that engage in IC work, that is, organizational (management and marketing), R&D, and ICT occupations (Bloch et al. 2021; Piekkola et al. 2024). Building on earlier work and work in the GLOBALINTO project (Piekkola et al. 2024), we assume that only a share of working time is devoted to intangible investment. The share of labor cost dedicated to the production of intangible capital is 0.45 for ICT occupations, 0.6 for R&D occupations, and 0.4 for OC-related management and marketing occupations. We refer to this as the innovative share of IC work. For example, we assume that 60% of R&D workers' effort creates R&D capital that can be used in future periods. The remaining 40% is operational activities contributing to production in the same period.

The productivity analysis in Section 5 uses as the dependent variable multi-factor productivity MFP, which accounts for intangible capital in addition to labor and physical capital. It is thus unaffected by changes in returns to intangible capital by applying the approach in Wooldridge (2009) where the instrument used in the estimation is intermediate input. Wooldridge's approach simplifies the estimation process by integrating the control function approach within a GMM framework, making it more efficient and robust (Rovigatti and Mollisi 2018). MFP is generic, and innovation output should increase with MFP and less according to how it was created (producing itself, buying from the market, and allying with competitors). State variables are intangibles covering R&D and OC. Flexible variables are non-intangible capital workers, excluding intangible capital work and ICT, with the latter considered general-purpose technology. Intermediate investment is a proxy for productivity shocks (Levinsohn and Petrin 2003). It measures technological change more precisely over long periods, thus assuming a stable production function linking changes in output to changes in factor inputs, including intangibles and changes in productivity and scale effects. In addition, the approach accounts for general-purpose technology by including ICT effects. Finally, MFP is assumed to measure the technological change associated with above-normal profits, externalities, and “free lunches” (Lipsey and Carlaw 2004). Estimation is done separately in nine main Nace one-digit industries, and estimation results are available upon request from authors.

4 Descriptive Statistics

Table 1 presents the IC work shares of all work by type and in total (given the IC shares of working time at 45% for OC, 90% for R&D, and 60% for ICT employees).

| Year | OC | R&D | ICT | All | OC | R&D | ICT | All |

|---|---|---|---|---|---|---|---|---|

| Finland | Denmark | |||||||

| 2000 | 1.75 | 7.82 | 1.64 | 11.20 | 1.56 | 5.03 | 1.39 | 7.98 |

| 2002 | 1.77 | 8.27 | 1.72 | 11.75 | 1.53 | 5.37 | 1.41 | 8.31 |

| 2004 | 1.57 | 7.64 | 1.72 | 10.93 | 1.56 | 5.03 | 1.51 | 8.09 |

| 2006 | 1.75 | 7.14 | 1.69 | 10.59 | 1.67 | 5.23 | 1.51 | 8.41 |

| 2008 | 1.80 | 7.22 | 1.65 | 10.67 | 1.81 | 5.61 | 1.60 | 9.03 |

| 2010 | 1.33 | 7.22 | 2.41 | 10.97 | 2.27 | 7.14 | 2.50 | 11.90 |

| 2012 | 1.30 | 7.19 | 2.47 | 10.95 | 2.13 | 7.00 | 2.55 | 11.68 |

| 2014 | 1.27 | 7.14 | 2.40 | 10.82 | 2.12 | 6.97 | 2.61 | 11.70 |

| 2016 | 1.25 | 7.13 | 2.31 | 10.69 | 2.37 | 7.64 | 2.79 | 12.80 |

| 2018 | 1.54 | 7.40 | 2.01 | 10.95 | 2.35 | 7.57 | 2.85 | 12.77 |

| Norway | Slovenia | |||||||

|---|---|---|---|---|---|---|---|---|

| 2008 | 2.82 | 5.78 | 2.62 | 11.21 | 2.35 | 4.42 | 1.62 | 8.39 |

| 2010 | 2.98 | 6.58 | 2.59 | 12.15 | 2.76 | 4.46 | 1.67 | 8.89 |

| 2012 | 3.20 | 7.57 | 2.87 | 13.64 | 2.85 | 4.49 | 1.74 | 9.08 |

| 2014 | 3.18 | 8.07 | 2.90 | 14.15 | 2.95 | 4.58 | 1.82 | 9.35 |

| 2016 | 3.33 | 7.70 | 2.99 | 14.01 | 2.86 | 4.77 | 1.83 | 9.46 |

| 2018a | 3.20 | 7.47 | 3.10 | 13.78 | 2.93 | 4.93 | 1.83 | 9.69 |

- a 2017 for Slovenia.

As shown in Table 1, the shares of organizational capital work are growing over time for Denmark, Norway, and Slovenia, yet fluctuating downwardly in Finland. In 2018 (2017 for Slovenia), these shares in Norway were 3.2%, Denmark 2.4%, Slovenia 2.9%, and Finland 1.5% (in what follows, the sample covers firms with at least five employees and has a wide coverage of private sector industries, see Appendix A for details). These shares for organizational work of all work reported in Table 1 are smaller than in the earlier work by INNODRIVE due to the narrower choice of management and marketing occupations.

In recent years, R&D work shares have been approximately the same in the Nordic countries. In 2018, these shares were about 7.5% in the Nordic countries versus 4.9% (in 2017) in Slovenia. The trend in R&D shares is stable in Finland and slightly increasing in Slovenia, whereas shares rose by two percentage points or more in Denmark and Norway in the observed period. In 2018, the overall shares of IC work were 13.8% in Norway, 12.8% in Denmark, 11% in Finland, and 9.7% in Slovenia.

In our occupational measure of intangible capital, R&D consistently exceeds the sum of OC and ICT. This finding contrasts with many other studies where organizational or firm-specific human capital and ICT are among the most extensive subcategories of intangible investment (Bloom and Van Reenen 2010; Piekkola 2016). Norway's average R&D capital stock per employee is the highest, at around EUR 76.2 thousand in 2018 (2015€). Finland and Denmark had about the same R&D per employee at around EUR 45–50 thousand (in 2018), while accumulated R&D per employee was much lower in Slovenia at around EUR 24.2 thousand (in 2017). The results below show that R&D-IBTC is strongest in Denmark, indicating that IBTC does not go hand in hand with R&D intensity. In Norway, OC per employee was the highest at around EUR 27 thousand in 2018. The sum of the OC and ICT intensity is approximately EUR 18 thousand (2015€) in Finland and Denmark, EUR 40 thousand (2015€) in Norway, and EUR 9 thousand (2015€) in Slovenia.

On average, the relative quality of the IC work coefficient is positive as the ratios , are over zero in Equations (6) and (7). However, ratios are less than one suggesting that the actual relative quality of R&D and OC work is less than that implied by the initial wage ratios. Table B2 in the Appendix B shows that the initial relative quality of R&D work measured as firms' average R&D wage to non-IC wage ratio is 157% in Finland, 124% in Norway, 153% in Denmark, and 149% in Slovenia. The average OC wage to non-IC wage ratio is about 200% in Finland, Denmark, and Norway and around 50% in Slovenia.

The other component of the IBTC, besides the adjusted productivity ratio, is the share of IC work. In the data, the share of R&D workers and the relative quality of R&D work also correlate positively. R&D-IBTC, therefore, also accounts for the complementarity between the share of R&D and their relative value of R&D work. The total of the relative productivity quality of R&D work and its labor share is, on average, 1.11 in Finland, 1.05 in Norway, 1.12 in Denmark, and 1.06 in Slovenia. The respective figures for OC are 1.08 in Finland, 1.05 in Norway, and 1.04 in Denmark and Slovenia. IBTC is these figures minus one, indicating that, on average, higher quality has an additional effect on output, besides on how the output elasticity of non-IC work improves due to intangible workers (which are here around 80%, not reported). These also offer scaling benefits that increase profit margins, which effects are excluded from the IBTC.

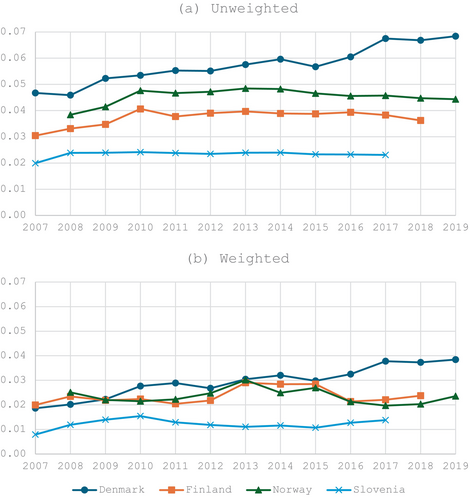

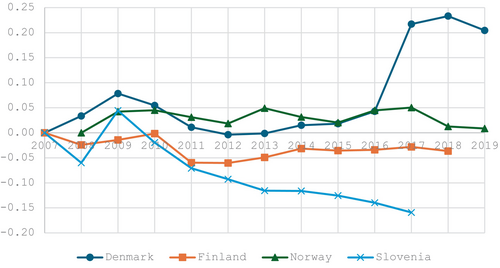

For Denmark, Norway, Finland, and Slovenia, Figure 1 shows unweighted mean values for R&D-IBTC (Figure 1a) and mean values weighted by firm revenue (Figure 1b). The weighted values can show the nationwide effects better, as discussed in Piekkola et al. (2024). In the analysis, what follows the year 2007 is taken as the first year, while the results for 2007 show that the estimates represent the earlier period 2000–2006 fairly well.

SMEs will likely dominate figures without weights since the median size of employees in our sample is 11 in Finland, 12.9 in Norway, 18.9 in Denmark, and 11 in Slovenia (see summary Table B2 in Appendix B). Figure 1b shows results that include firm revenue weights to highlight the contribution made by large firms.

Figure 1a shows that R&D-IBTC is highest in Denmark (0.052) and Norway (0.045) and double the values for Finland (0.027) and Slovenia (0.023). The elasticity of value added to non-intangible work (on average, about 0.8 in the Nordic countries) and the combined elasticity of tangible and intangible capital is about 0.15. The difference to constant returns to scale can be explained by the increase in profits brought about by the technological change of intangible capital work. For example, intangible capital affects profit margins through increased market power (De Loecker et al. 2020). Based on Figure 1a, a 100% increase in IBTC, such as a doubling of the share of R&D employees or the wage ratio, increases the value added by 5.2% in Denmark, 4.5% in Norway, and over double the figures for Finland (2.7%) and Slovenia (2.3%). Much of this increase is in the form of higher profits, making the profit increase in percent more pronounced than that of value added.

In Denmark, R&D-IBTC rose by almost 40% to 0.07 in the studied period until 2019. R&D-IBTC evolved fairly similarly in Finland and Norway, with no significant growth since 2010. Slovenia belongs to the EU countries with average R&D intensity and about 0.01–0.02 lower IBTC. Denmark improved its R&D-IBTC even though the R&D intensity did not grow on average since high-tech manufacturing has expanded. Norway has the second-highest R&D-IBTC. Even though Finland has become the laggard in the Nordic context, it still surpasses Slovenia.

The results point to a much lower level of R&D-IBTC, typically less than half of the unweighted levels. Figure 1a,b shows that R&D-IBTC has generally remained fairly stable over time, with minor fluctuations from year to year. The exception is Denmark, which may be attributed to the performance of its pharmaceutical sector. With weights, R&D-IBTC has been growing at a higher rate in Denmark (earlier up until 2010; R&D-IBTC also improved to a smaller extent in Slovenia).

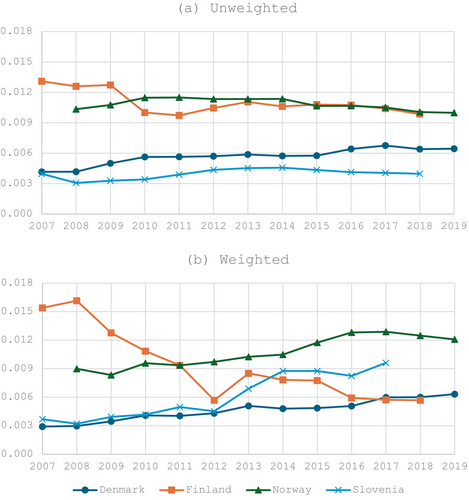

Figure 2 presents the results for organizational capital work biased technological change: OC-IBTC. On average, OC-IBTC is about one-quarter of R&D-IBTC, around 0.01 in Finland and Norway and 0.005 in Denmark and Slovenia. OC-IBTC shows greater heterogeneity since the trends differ in the countries. With revenue weights, OC-IBTC rises to about one-half of R&D-IBTC or one-third of total IBTC in the economies. The technological impact on GDP is hence about the same as its share of total intangible capital (the sum of R&D and OC) in Norway and Slovenia, higher in Denmark, and lower in Finland (see Table 1 on intangible worker shares and intangible intensities in Table B2 in the Appendix B). Large firms were mostly responsible for the slowdown in Finland's OC-IBTC.

Denmark does not stand out as a high OC-IBTC Nordic country. Bloch et al. (2023) relate the moderate level of OC jobs to the expansion of non-OC jobs, such as low-paid jobs in services, given the demand boom and increase in public and private services. However, in the estimation, we show that organizational change is more positively related to MFP in Denmark than in the other three countries.

5 Determinants of Productivity and Productivity Dispersion

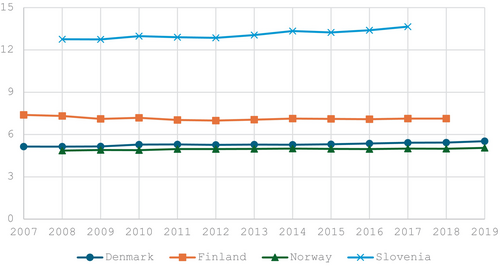

This section explains MPF by IBTC and intangibles. Figure 3 shows the estimated MFP over time using the Wooldridge (2009) method with intermediate input as an instrument; see Section 3.

Higher MFP suggests bigger residual profits (less competition), also due to the important role of manufacturing, especially in Slovenia, where, unlike in other countries, the returns to intangible inputs are much higher than the related expenditures (Piekkola et al. 2024). MFP has grown in Slovenia and, to some extent, in Denmark and Norway. MFP's average annual growth rate has been 4.2% in Slovenia, followed by 1.5% in Denmark and 0.9% in Norway. Finland is an exception with negative growth. The initial high level in 2007–2008 was followed by decreasing demand for Nokia mobile phones and paper and pulp industry products. Bringing the technological change aspects of MFP and IBTC together reveals that a decrease in technological change has not been a concern since 2017.

Table 2 presents the firm-level random effects estimates of MFP estimated separately in each country. The annual number of firms in the analysis is 21.2 thousand in Finland, 14.1 thousand in Denmark, 20.2 thousand in Norway, and 2.9 thousand in Slovenia. Explanatory variables include IBTCs and their interaction with the gap between MFP and average MFP for the top five firms in the industry in each year. Education is employees' average years of education (primary, secondary education 9 years, high school diploma, technical lowest tertiary degree 11 years, Bachelor's degree 13 years, Master's degree 17 years, Doctorate or equivalent 19 years). The estimation includes R&D, OC, and ICT stocks showing absorbing capacity or needed in the implementation of inventions. Employee Non-IC excludes intangible capital work, since it is already included in intangibles. Tangibles cover machinery, equipment, and buildings. Intangibles, tangibles, and employee Non-IC are in logarithmic. The estimation tests the IBTC part of Hypotheses 1 and 2 and whether Hypothesis 3 holds given 1 and 2. With these aims in mind, the production function is also assessed separately by main technology sectors: high-tech manufacturing, low-tech manufacturing, KIS, and basic private services (sectors are defined in Table B1). As controls, all estimations include dummies for NACE 4-digit industries, year dummies, and their interaction. The industry-specific changes in MFP over time are thereby also controlled.

| All | High-tech | Low-tech | KIS | Basic | All | High-tech | Low-tech | KIS | Basic | |

|---|---|---|---|---|---|---|---|---|---|---|

| Finland | Norway | |||||||||

| R&D-IBTC | 4.841* | 6.419* | 7.510* | 5.695* | 4.557* | 4.231*** | 5.105*** | 5.411*** | 4.230*** | 6.100*** |

| (0.059) | (0.251) | (0.152) | (0.113) | (0.096) | (0.046) | (0.149) | (0.132) | (0.061) | (0.138) | |

| MFP gap, R&D-IBTC | −2.084* | −3.035* | −2.602* | −1.955* | −2.378* | −1.619*** | −3.580*** | −2.956*** | −1.340*** | −3.248*** |

| (0.036) | (0.126) | (0.079) | (0.058) | (0.066) | (0.025) | (0.094) | (0.115) | (0.031) | (0.088) | |

| OC-IBTC | 24.720* | 24.939* | 23.690* | 26.824* | 22.012* | 22.283*** | 19.146*** | 24.029*** | 21.061*** | 23.898*** |

| (0.248) | (0.909) | (0.731) | (0.405) | (0.388) | (0.143) | (0.632) | (0.505) | (0.235) | (0.205) | |

| MFP gap, OC-IBTC | −11.441* | −11.636* | −11.653* | −11.893* | −11.126* | −12.701*** | −10.472*** | −17.366*** | −11.180*** | −14.253*** |

| (0.108) | (0.385) | (0.332) | (0.17) | (0.18) | (0.074) | (0.323) | (0.333) | (0.117) | (0.109) | |

| Log R&D | 0.021* | 0.021* | 0.024* | 0.019* | 0.023* | 0.023*** | 0.040*** | 0.019*** | 0.025*** | 0.022*** |

| (0.001) | (0.003) | (0.001) | (0.001) | (0.001) | (0.000) | (0.002) | (0.001) | (0.001) | (0.001) | |

| Log OC | 0.036* | 0.022* | 0.018* | 0.047* | 0.035* | 0.018*** | 0.007** | 0.014*** | 0.021*** | 0.018*** |

| (0.001) | (0.003) | (0.002) | (0.001) | (0.001) | (0.001) | (0.003) | (0.002) | (0.001) | (0.001) | |

| Log ICT | 0.023* | 0.007 | 0.011* | 0.036* | 0.013* | 0.038*** | 0.018*** | 0.013*** | 0.058*** | 0.025*** |

| (0.001) | (0.003) | (0.002) | (0.001) | (0.002) | (0.001) | (0.003) | (0.002) | (0.001) | (0.001) | |

| Log employee non-IC | 0.805* | 0.879* | 0.831* | 0.761* | 0.812* | 0.837*** | 0.842*** | 0.893*** | 0.807*** | 0.848*** |

| (0.002) | (0.009) | (0.006) | (0.004) | (0.003) | (0.002) | (0.008) | (0.005) | (0.003) | (0.002) | |

| Log tangible | 0.063* | 0.048* | 0.068* | 0.051* | 0.074* | 0.074*** | 0.070*** | 0.064*** | 0.072*** | 0.077*** |

| (0.001) | (0.004) | (0.002) | (0.001) | (0.001) | (0.001) | (0.003) | (0.002) | (0.001) | (0.001) | |

| Education | 0.064* | 0.029* | 0.045* | 0.075* | 0.068* | 0.079*** | 0.060*** | 0.031*** | 0.063*** | 0.108*** |

| (0.001) | (0.005) | (0.004) | (0.002) | (0.002) | (0.001) | (0.006) | (0.006) | (0.002) | (0.002) | |

| Obs | 212,048 | 14,025 | 29,032 | 64,817 | 104,174 | 202,067 | 9541 | 19,007 | 62,616 | 110,903 |

| R2 | 0.757 | 0.838 | 0.82 | 0.723 | 0.738 | 0.816 | 0.875 | 0.865 | 0.806 | 0.806 |

| Denmark | Slovenia | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| R&D-IBTC | 2.152* | 0.626* | 1.438* | 1.462* | 2.514* | 7.336* | 6.374* | 6.739* | 5.805* | 9.131* |

| (−0.028) | (−0.102) | (−0.122) | (−0.058) | (−0.036) | (0.185) | (0.441) | (0.312) | (0.497) | (0.308) | |

| MFP gap, R&D-IBTC | −2.585* | −3.810* | −2.140* | −3.290* | −2.060* | −4.793* | −4.396* | −4.656* | −5.407* | −5.302* |

| (−0.036) | (−0.104) | (−0.123) | (−0.062) | (−0.057) | (0.119) | (0.275) | (0.2) | (0.454) | (0.18) | |

| OC-IBTC | 2.694* | 4.943* | 4.904* | −0.121 | 3.532* | 35.942* | 28.029* | 37.157* | 32.667* | 41.603* |

| (−0.240) | (−0.710) | (−0.648) | (−0.443) | (−0.353) | (1.163) | (3.077) | (1.834) | (2.846) | (2.004) | |

| MFP gap, OC-IBTC | −26.309* | −26.455* | −26.894* | −23.419* | −29.402* | −26.221* | −18.337* | −26.740* | −33.122* | −28.704* |

| (−0.283) | (−1.100) | (−0.796) | (−0.493) | (−0.414) | (0.697) | (1.614) | (1.036) | (2.17) | (1.221) | |

| Log R&D | 0.027* | 0.031* | 0.020* | 0.028* | 0.025* | 0.074* | 0.087* | 0.056* | 0.105* | 0.062* |

| (0.000) | (−0.001) | (−0.001) | (−0.001) | (−0.001) | (0.003) | (0.008) | (0.005) | (0.006) | (0.006) | |

| Log OC | 0.021* | 0.013* | 0.013* | 0.025* | 0.024* | 0.092* | 0.132* | 0.062* | 0.100* | 0.090* |

| (−0.001) | (−0.001) | (−0.001) | (−0.001) | (−0.001) | (0.003) | (0.009) | (0.006) | (0.007) | (0.007) | |

| Log ICT | 0.021* | 0.011* | 0.001 | 0.036* | 0.016* | 0.009* | 0.005 | 0.008* | 0.011* | 0.008* |

| (−0.001) | (−0.002) | (−0.002) | (−0.001) | (−0.001) | (0.001) | (0.002) | (0.001) | (0.002) | (0.002) | |

| Log employee non-IC | 0.914* | 0.929* | 0.927* | 0.888* | 0.925* | 0.785* | 0.767* | 0.772* | 0.821* | 0.784* |

| (−0.001) | (−0.005) | (−0.004) | (−0.003) | (−0.002) | (0.005) | (0.011) | (0.008) | (0.01) | (0.01) | |

| Log tangible | 0.020* | 0.018* | 0.034* | 0.007* | 0.023* | 0.013* | 0.010* | 0.025* | 0.006* | 0.013* |

| (0.000) | (−0.002) | (−0.002) | (−0.001) | (−0.001) | (0.001) | (0.002) | (0.001) | (0.001) | (0.001) | |

| Education | 0.073* | 0.068* | 0.039* | 0.057* | 0.098* | 0.095* | 0.080* | 0.124* | 0.077* | 0.080* |

| (−0.001) | (−0.004) | (−0.006) | (−0.002) | (−0.002) | (0.003) | (0.007) | (0.006) | (0.007) | (0.007) | |

| Obs | 140,979 | 13,165 | 16,815 | 34,608 | 76,391 | 28,707 | 4396 | 8958 | 7991 | 7362 |

| R2 | 0.877 | 0.912 | 0.907 | 0.858 | 0.871 | 0.849 | 0.907 | 0.875 | 0.778 | 0.829 |

- Note: Estimations include year and industry dummies and their interactions.

- ***Significant at 1% level, **significant at 5% level, *significant at 10% level.

The positive R&D-IBTC coefficients are about the same for the different technology types, and the negative coefficients of the MFP gap interaction are also significant. The results imply that the R&D-IBTC effects are increasing in the level of MFP. Countries are surprisingly similar in how R&D-IBTC weakens when the MFP gap grows. All countries have invested in the quality of R&D that generates technological change, and the effect is stronger the smaller the MFP gap. Hypothesis 1 thus holds in all countries regarding R&D-IBTC and R&D. R&D-IBTC brings fewer benefits for firms with a larger MFP gap vis-à-vis the top five performers, showing that R&D-IBTC leads to increased productivity dispersion within industries.

OC and OC-IBTC have positive coefficients and are fairly similar across the countries, confirming Hypothesis 2. The average positive effects of OC-IBTC are still moderate compared to R&D-IBTC (sum of the direct effects and the interaction terms) because the negative coefficients of the interaction with the MFP gap are higher than those for R&D-IBTC. These results show that while IBTCs are important for signaling overall technological development, they show high variability for OC-IBTC, subject to the MFP gap. They also provide evidence concerning how economies can improve productivity and the source of technological evolution.

Hypothesis 3 states that returns to human capital are the same irrespective of the technology types after controlling for ICs and related IBTCs. We observe that returns to education, averaging 6.4% in Finland to 9.5% in Slovenia, vary greatly depending on the country or technology type. In Finland, an additional year of education raises MPF by about 7% within services and less in manufacturing. This observation is surprising given that human capital is scarcer in manufacturing. There is also some specialization since education returns are the highest in Slovenia's low-tech manufacturing. An additional explanation is that the remaining highly educated workers without engagement in IC form a minority of about 10%–20% of all highly educated. This category is particularly mixed and has the lowest salaries among tertiary-educated workers. We thus reject Hypothesis 3, stating that the returns are the same across the firms' technology types.

Hypotheses 1, 2, and 3 inherently suggest that complementarities exist between investment in any IC or human capital and related IC-IBTC because both depend on a firm's share of IC workers. Further, the correlation of the two IBTC components shows that firms with a bigger share of IC workers also tend to have IC workers of higher quality, strengthening the effect on MFP.

The results also support Hypothesis 4 in that both R&D- and OC-IBTCs are concentrated in high MFP firms and increase MFP dispersion within the industry. These observations indicate that the Nordic countries and Slovenia are intangibles-driven economies and that R&D- and OC-IBTC also depend similarly on MFP gaps.

However, we will see that results are modified when an average firm in the industry is considered and, hence, the productivity distribution between industries. The following analysis calculates the average distance of MFP in firms as the difference in the 90th and 10th deciles in the overall distribution of MFP in each NACE 2-digit industry. The figure first shows the development of productivity dispersion over time. The figures are unweighted averages, given that the tech types are fairly equal in size. In Figure 4, values are normalized to equal one in the first year, 2008; thus, the figures show deviations from unity in the later years.

Productivity dispersion has decreased in Slovenia. The vertical axes show log-point differences from the starting year. In Slovenia, the decrease in productivity log difference of 0.16 corresponds to a 17.5% narrowing of the productivity dispersion difference between 2008 and 2018. For Denmark, dispersion begins to increase in 2014 and thereafter is much larger from 2017 onwards. Meanwhile, mfp is relatively stable during this period. This result is somewhat puzzling, and we have not been able to determine a main source behind the increase in variation.

Next, in Table 3, we explain the differences between the MFP 90th and 10th on the industry level using the same explanatory variables as Table 2, including IBTCs and the interaction with MFP gaps. The explanatory variables are calculated as lagged mean values at the NACE 2-digit level instead of the firm level. Table 3 below shows the determinants of productivity dispersion.

| Finland | Norway | Denmark | Slovenia | |||||

|---|---|---|---|---|---|---|---|---|

| MFP 90th-10th | MFP | MFP 90th-10th | MFP | MFP 90th-10th | MFP | MFP 90th-10th | MFP | |

| Lagged MFP 90th-10th | 0.086*** | 0.064 | 0.693*** | 0.382*** | ||||

| (0.022) | (0.042) | (0.031) | (0.039) | |||||

| Lagged R&D-IBTC | −10.599 | −1.631 | 1.842 | −1.018 | 5.744*** | 2.179** | −6.974 | −1.829 |

| (5.844) | (3.059) | (1.396) | (1.275) | (1.465) | (1.02) | (3.991) | (3.692) | |

| Lagged MFP gap, R&D-IBTC | 8.931* | 4.233* | 0.195 | 2.023* | 1.225 | −0.523 | 7.819* | 2.935 |

| (3.775) | (1.980) | (0.885) | (0.811) | (2.652) | (1.632) | (3.629) | (3.357) | |

| Lagged OC-IBTC | 72.348*** | −14.12 | −32.842*** | 9.297* | 13.622 | 6.228 | 0.332 | 8.161 |

| (19.89) | (10.43) | (4.657) | (4.471) | (15.138) | (10.75) | (10.23) | (9.382) | |

| Lagged MFP gap, OC-IBTC | −37.580*** | 4.08 | 25.765*** | 0.045 | −22.145 | 8.083 | −3.395 | −9.618 |

| (10.049) | (5.276) | (2.489) | (2.527) | (19.583) | (13.679) | (10.62) | (9.757) | |

| Lagged log R&D | −0.075* | 0.069*** | −0.012 | −0.033* | −0.041*** | −0.022** | 0.110** | 0.042 |

| (0.03) | (0.016) | (0.014) | (0.013) | (0.016) | (0.011) | (0.041) | (0.038) | |

| Lagged log OC | 0.162** | 0.1096*** | 0.057** | 0.027 | 0.01 | 0.021 | 0.218*** | 0.143* |

| (0.05) | (0.026) | (0.019) | (0.018) | (0.033) | (0.024) | (0.061) | (0.057) | |

| Lagged log ICT | 0.273*** | −0.001 | 0.061*** | 0.133** | 0.139*** | 0.057*** | 0.026** | 0.016 |

| (0.043) | (0.023) | (0.013) | (0.012) | (0.023) | (0.017) | (0.01) | (0.009) | |

| Lagged log employee non-IC | 0.703*** | −0.074 | 0.216*** | 0.131** | −0.296*** | −0.155*** | −0.105* | −0.025 |

| (0.125) | (0.068) | (0.039) | (0.037) | (0.058) | (0.042) | (0.048) | (0.045) | |

| Lagged log tangible | −0.194*** | 0.274*** | 0.056*** | −0.053* | 0.081*** | 0.036*** | 0.039*** | 0.028*** |

| (0.042) | (0.023) | (0.015) | (0.014) | (0.013) | (0.009) | (0.011) | (0.01) | |

| Education | −0.013 | −0.013 | 0.061** | 0.037* | 0.049* | 0.012 | −0.002 | 0.006 |

| (0.045) | (0.024) | (0.02) | (0.018) | (0.028) | (0.02) | (0.007) | (0.007) | |

| Obs | 539 | 539 | 493 | 493 | 531 | 533 | 482 | 482 |

| R2 | 0.434 | 0.684 | 0.461 | 0.480 | 0.232 | 0.617 | 0.274 | 0.396 |

- Note: Estimations use mean values at NACE 2-digit industry level and explaining variables include constant.

- ***Significant at 1% level, **significant at 5% level, *significant at 10% level.

Average R&D in the industry yields a negative effect for MFP dispersion, except in Slovenia, and a nonsignificant effect in Norway. The nonsignificant effect in Norway likely relates to the fact that MFP dispersion within industries is lower in Norway (0.28) than in Finland (0.51) and Denmark (0.37). We showed that R&D increases MFP on the firm level, and the results here imply that R&D is important for absorbing knowledge while looking at productivity differences between industries. R&D spillovers are higher between industries than within them (Ugur et al. 2020) and Nordic countries rely more on R&D-driven growth across all industries. Investment in innovative property, R&D, is not significantly associated with higher productivity dispersion between the 90th and the 10th percentile, except for Slovenia. Given the contrasting results here, it remains unclear what the economy-wide effects of R&D-IBTC are on productivity differences between firms. Hypothesis 4 thus holds within industries with varying R&D-IBTC. The total effect remains unclear since it also depends on the shifts in size between the industries with varying productivity differentials.

Similarly to Corrado et al. (2021), OC increases productivity dispersion, albeit with nonsignificant effects in Denmark. The estimates show that a ten-percentage-point-higher investment in economic competencies—as proxied by OC here—is correlated with about a one-percentage-point-higher productivity dispersion (1.6% in Finland, 0.6% in Norway, 0.2% in Denmark, and 2.2% in Slovenia). Hypothesis 4 also holds on the level of the whole economy, and OC may contribute to MFP dispersion on an economy-wide level. OC is more firm-specific than R&D and does not increase absorptive capacity similarly to R&D. KIS and other services also use OC more intensely. These industries have been growing in size. Corrado et al. (2021) found that R&D is especially associated with higher productivity dispersion between the median and 10th percentiles, that is, concerning true laggards. Our results do not contradict this finding as the absorptive capacity of the least productive firms has been shown to be the lowest.

Our results for IBTC are analogous to those for respective intangibles. R&D-IBTC lowers between industry productivity differentials, making the economy-wide effects ambiguous. OC-IBTC increases productivity differences between industries so that economy-wide productivity dispersion increases. Corrado et al. (2021) find a decrease in productivity spillovers due to somewhat lower growth in intangibles that also leads to lower intangible spillovers. Another suggested reason for the decrease in TFP growth since 2007 is that the absorptive capacity of laggards has deteriorated.

The first finding fits our analysis as the quality of intangibles has not deteriorated over time, and thus lower growth in intangibles can lead to lower spillovers. One difference between ICs and IBTCs is that the latter is strongly linked to the MPF gap. This means IBTC likely has stronger effects on the increase in productivity dispersion within industries than IC. The latter finding also fits our results for IBTC since it decreases with the MPF gap. We netted out the variation in returns to intangibles in determining MFP but observed a rising share of intangible workers, except in Finland. Fair growth in the share of intangible capital workers could explain why GDP growth has been relatively strong in most Nordic countries. MFP was also shown in Section 5 to relate to a wide set of knowledge from human and intangible capital-related technological change in a fairly homogeneous manner. Yet, human capital growth and returns to education vary across countries.

There may be a relationship of reverse causality between productivity, intangibles, and innovation (Audretsch and Belitski 2020; Audretsch et al. 2014). The universality of our results and Hypotheses 1–3 can also be tested by looking in greater detail at the different innovation frameworks in the countries. Here, we show that technological adoption varies by technology type and country.

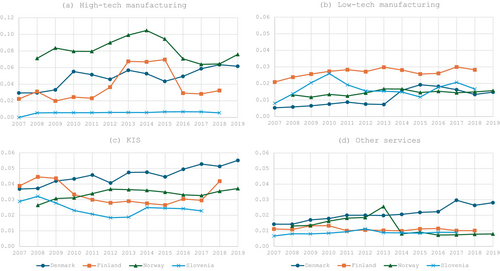

Figure 5 shows R&D-IBTC by technology types: high-tech and low-tech manufacturing, knowledge-intensive services (KIS), and other market services. High-tech manufacturing and KIS are the intangible-intensive sectors with expected higher productivity. We report the weighted figures with economy-wide effects that the biggest listed firms largely dominate. The high-tech industry includes top high-tech sectors such as pharmacy, computing, electronics, and optical products, which are the highest technology categories. It also includes medium high-tech sectors: chemical, electrical, and machinery equipment, motor vehicles, and other transport (Table B1 in the Appendix B).

Figure 5a reveals that R&D-IBTC is the highest in high-tech in Norway, whereas in Denmark it increased to about the same level by 2018. Denmark leads R&D-IBTC in KIS (Figure 5c). However, the industrial structure is different given that in Norway, other private services and medium-low tech manufacturing are large (see Table B1). This may be an important reason for lower MFP dispersion since innovative service firms in other Nordic countries are concentrated within consumer and business services and digital infrastructure/platforms with greater MFP dispersion.

In Denmark, the high-tech R&D-IBTC sector has expanded with a 50% increase in value added in 2008–2021. At the same time, rationalization led to the cutting of jobs by 13% to 228,300 persons by 2021. Danish high-tech industries have value added of EUR 31 billion in 2021, about twice the level in Finland or Norway. Finland is about on the same level as Denmark, yet with a decreasing trend.

Finland has a manufacturing focus (Sanandaji et al. 2022), with R&D being spread among a larger set of firms than in other countries, which includes a bigger concentration of technological development in the low-tech industry. Low-tech manufacturing continued to have high R&D-IBTC at around 0.025% and largely operates outside the Helsinki region.

Slovenia has the relatively highest technological progress (around 0.025) in KIS, which has boomed in the last 10 years. Slovenia also has a relatively high 20% share of high-tech manufacturing in the investigated sample of larger firms (but not generally). Nevertheless, R&D-IBTC is the lowest among the investigated countries in high-tech manufacturing without an improvement in low-tech (Figure 5b).

In Norway, the drop in oil prices in 2014–2015 negatively impacted R&D-IBTC in the high-tech sector and other services, while low-tech manufacturing and KIS remained unaffected. The overall decrease in R&D-IBTC since 2015, as shown in Figure 1, is mainly caused by high-tech manufacturing. Although MFP dispersion is low within industries, it remains high between the technology types.

KIS industries are important producers of purchased intangibles for other industries in global value chains (Tsakanikas et al. 2020). In 2017, their value-added share of the private sector was 16% in Denmark, 14.2% in Finland, 12.9% in Norway, and 6.5% in Slovenia (see Table B1 in the Appendix B, where KIS is the sum of KIS market, ICT-, R&D-, and OC-services). The Copenhagen region is a leading European innovation center, steering Denmark to perform well in KIS. IT platforms are a relatively new business sector, and the key concept is to set up online platforms to facilitate a given service. Other market services include NACE N (administrative and support service activities) here, which are also important intangible producers for use in other industries. These include rental and leasing activities, travel agencies, reservation services, and related activities. In Denmark, KIS plus NACE N and without the IT sector employs about 94,000 persons, more than the 73,000 in Norway and the 64,000 in Finland (with an annual rise of 1.6% since 2008).

IT industries as part of KIS also include telecommunication and manufacturers of computers and electronic and optical products. In this broad sense, the IT sector is about the same size in all Nordic countries, creating EUR 10 billion in value added in 2021. Yet, the ICT sector, including computer programming and information sectors (excluding telecommunication and NACE 25 electronic industry), is the highest at 7.3% in Finland in the considered industries, followed by Norway at 4.7%, Denmark at 4%, and Slovenia at 2.5% (see Table B1 in the Appendix B). The Helsinki area is a digitally focused innovation region concentrated on consumer services, digital infrastructure/platforms, and software. Relative to other Nordic regions, the Copenhagen area and Zealand have a special focus on the platform sector, digital meetings, and software innovation. Oslo focuses on finance/real estate, marketplace/trade, and transportation.

Large firms, especially, have maintained improved technological change in manufacturing since they are prone to possessing high MFP. The situation would be the opposite in services where the R&D-IBTC is instead twice as high when unweighted. The contrast is sharpest in other services where SMEs leading the technological change are developing faster than in KIS (except for Norway).

6 Conclusion

Intangible assets significantly influence aggregate and sectoral productivity dynamics, shedding light on the phenomenon whereby multifactor productivity (MFP) growth may decelerate or exhibit increased variability due to divergent firm-level attitudes to investments in intangibles. The macroeconomic productivity ramifications of this trend could lead to stagnation within the broader economy and greater productivity disparities among firms. Draghi (2024) indicates that investments in intangibles outpace those in tangible assets across advanced economies. This paradigm shift calls for reevaluating firm-level strategic orientations—shifting focus toward software, data, and branding—and underscores the intensification of productivity differentials among firms. Organizations that effectively harness intangible assets, such as advanced data analytics and well-structured organizational capital, tend to demonstrate superior productivity growth and enhanced resilience amid economic disruptions.

This paper quantifies the contributions of intangible capital to technological change IBTC across Finland, Denmark, Norway, and Slovenia, revealing a commendable absorption capacity for research and development (R&D) across industries. Conversely, organizational capital (OC) variations and associated technological advancements emerge as primary drivers of the increasing productivity disparities among sectors. Within industries, intangibles and IBTC correlate with heightened productivity dispersion. Notably, developments in intangible capital stocks per employee vary across the four countries examined. While R&D and organizational capital experienced ascents in Norway and Slovenia, there has been a decline in organizational capital over time in Finland and R&D capital in Denmark. However, R&D-IBTC has seen growth in Denmark's manufacturing and service sectors. The ongoing deepening of intangible capital in Nordic countries—excluding Finland—may thus elucidate the observed MFP growth.

MFP has demonstrated moderate growth, averaging the highest rate of 4.2% in Slovenia, followed by 1.5% in Denmark and 0.9% in Norway, with Finland exhibiting stagnation or declines. The growth trajectory in Slovenia is closely associated with a convergence process and the mismeasurement of intangibles. Piekkola et al. (2024) identified performance-based assessments of intangible assets as significantly exceeding those based on expenditures. MFP remains the highest, while IBTC is comparatively the lowest in Slovenia relative to its Nordic counterparts.

This evolving landscape conceals positive trends in both R&D- and OC-IBTC, particularly among large manufacturing firms and small to medium-sized enterprises (SMEs) in the services sector. Average technological change attributed to OC-IBTC is estimated to constitute one-quarter to one-half of R&D-IBTC, pronouncedly affecting the dispersion of productivity within the services domain. The technological advancements concomitant with the quality of intangible capital work are a pivotal avenue for adding to productivity across all the countries under study. Our findings substantiate the conclusions of De Ridder (2024) regarding the escalating significance of intangible capital, especially as firms exhibit variability in the efficiency with which they assimilate intangible inputs. More efficient firms, characterized by heightened IBTC, are positioned to generate elevated MFP and corresponding price markups relative to their competitors, facilitating increased production scaling and distribution of marginal costs over larger output units and enabling competitive pricing strategies.

The results of this analysis may provide valuable insights for policymakers in several dimensions. In the Nordic countries, IBTC has not seen a decline since the onset of the financial crisis. This may explain why multifactor productivity (MFP) has remained stable or grown, contrary to findings for the United Kingdom (Goodridge and Haskel 2023). This persistence, coupled with a consistent or rising level of intangible investment, has facilitated the recovery of GDP growth in the aftermath of Europe's financial and sovereign debt crises. It is imperative that intangible policy meticulously considers the performance metrics of intangible assets, focusing on the qualitative aspects of the workforce engaged in these investments.

Innovation policies should continue to prioritize intangibles while simultaneously fostering technological change on the sectoral level and enabling the efficient reallocation of resources from low to high MFP firms. Such reallocation is warranted provided that all firms within the industry possess the requisite research and development (R&D) capabilities to assimilate new technologies effectively.

As nations advance in their intangible investments, the influence of R&D-IBTC is anticipated to strengthen its role in driving technological evolution. It is acknowledged that firms operating in the same industry typically benefit from new technological advancements, with R&D serving as a critical component of absorptive capacity, particularly within the Nordic countries and Slovenia, when excluding firms that are notably lagging. Further, OC-IBTC is crucial for facilitating technological change, comprising approximately 50% of R&D-IBTC on average. This aspect is essential for retaining leading European firms, specifically in the Nordic region.

The competitive edge of the Nordic countries can be attributed to sustained investments in Knowledge-Intensive Services (KIS), which continue to present growth prospects. Denmark is recognized as a frontrunner in KIS and OC-IBTC, effectively enhancing MFP. This observation suggests that OC-IBTC may encapsulate Denmark's competitive advantages in organizational and marketing competencies, which have gradually strengthened over time. Notably, the KIS sector in Denmark is characterized by a considerable number of small and medium-sized enterprises (SMEs), which, on average, exhibit higher MFP than their larger counterparts. Slovenia exhibits a similar trajectory to the Nordic nations, although its KIS sector remains relatively nascent.

Finally, intangible investments in R&D are pivotal for amplifying productivity and addressing the average productivity dispersion observed across industries. Although R&D-IBTC is chiefly associated with providing superior opportunities to firms employing high-caliber R&D personnel, establishing sufficient R&D capacity adds to the capacity of firms to assimilate and leverage new technological advancements.

Acknowledgments

The work on this paper was financed primarily through the GLOBALINTO project (Capturing the value of intangible assets in microdata to promote the EU's Growth and Competitiveness), which was supported by the European Union's Horizon 2020 “The mechanisms to promote smart, sustainable, and inclusive growth” under grant agreement No. 822259. For Slovenia, the access to data and work after GLOBALINTO ended was also financed through contracts SN-ZRD/22-27/0510 (University of Ljubljana) and J5-4575, P5-0128 (ARIS). We are grateful for the support of the statistical offices: Statistics Denmark, Statistics Finland, the Statistical Office of the Republic of Slovenia, and Statistics Norway. For Slovenia, access to the data was granted under contract EF/960/150/2019, and supported by the User Relations section of the Data Publication and Communication Division. The partners of GLOBALINTO involved are the University of Vaasa, the University of Aarhus, Statistics Norway, and the University of Ljubljana. We wish to thank Leonard Nakamura and Catherine Robinson for their valuable comments and Aleš Gorišek and Daša Farčnik for their support in preparing the data for Slovenia.

Conflicts of Interest

The authors declare no conflicts of interest.

Endnotes

Appendix A: Data Sources

The Linked Employers and Employees Data (LEED) are based on national employer–employee registers that contain information about each employee's contracts, including wages, job tenure, and working hours (in Norway and Denmark) or an indicator for a full- or part-time employee (in Finland and Slovenia), and information on employees' education (by ISCED classification) and occupation (by ISCO08 classification). Using firm and personal identification numbers, these data were aggregated for different types of intangible work (see more details on this procedure, see Appendix B) to the firm level and then merged with other firm-level data.

- –

NACE code on the 2-, 3-, and 4-digit level.

- –

Number of employees in the firm.

- –

Labor costs.

- –

Investment in machinery.

- –

Book value of machinery (or 0.4 * fixed asset).

- –

Investment in buildings.

- –

Book value of buildings (or 0.6 * fixed asset).

- –

Intermediate inputs.

- –

Turnover.

- –

Value added.

The analysis is based on a sample of firms with at least five employees on average in the period of observation: 1999–2018 for Finland, 1999–2019 for Denmark, 1999–2017 for Slovenia, and 2008–2019 for Norway (the whole period is used to derive IBTCs, the rest of the analysis presented in this paper considered a shorter period from 2007 onward. The shorter period for Norway is due to the later implementation of the ISCO classification in the employer–employee register, although the SBS data are used from 2001 in order to calculate the tangible capital based on the longer time series). The average annual number of firms in the analysis is 19.4 thousand in Finland, 14.3 thousand in Denmark, 9.2 thousand in Slovenia, and 28.6 thousand in Norway.

The industries selected for the analysis are grouped into nine main groups by technology type (see Table B1).2 As Table B1 shows, Slovenia has a very high share of 20% of high-tech and medium-high-tech manufacturing in total value added (for the selected firms and industries) due to the relative importance of its automotive and pharmaceutical sectors. In Denmark, the combined share of high-tech and medium high-tech manufacturing is also high (23%), while in Finland and Norway it is around 15% and 8%, respectively. Slovenia has a very high share of medium-low and low-tech manufacturing (33% combined), compared with much lower shares in Finland (25%), Denmark (19%), and Norway (25%). Norway has the largest KIS market service sector (14.1%) and the greatest reliance on other private services (41.1%). In general, intangible services in the Nordic countries are about 14%–16% of the private sector, surpassing Slovenia at 6.5%.

The GLOBALINTO occupational approach to measuring firm-level intangible capital utilizes linked employer–employee data and occupational classifications. The first step involves the identification of relevant intangible capital occupations. Box A1 below shows the intangible capital work in bold: O = organizational capital occupation, RD = R&D occupation, and IT = ICT occupation.

BOX A1. GLOBALINTO intangibles capital occupations (based on ISCO08 occupation classification).

|

1 Manager 112 Managing Directors and Chief Executives 12 O Administrative and Commercial Managers 121 O Business Services and Administration Managers 122 Sales, Marketing, and Development Managers 1221 O Sales and Marketing Managers 1222 O Advertising and Public Relations Managers 1223 RD Research and Development Managers 13 Production and Specialized Services Managers 131 O Production Managers in Agriculture, Forestry, and Fisheries 132 O Manufacturing, Mining, Construction, and Distribution Managers 133 IT Information and Communications Technology Services Managers 134 O Professional Services Managers 14 Hospitality, Retail, and Other Services Managers 2 Professional 21 Science and Engineering Professionals 211 RD Physicists, chemists, and related professionals |

D Physical and Earth Science Professionals 212 RD Mathematicians, Actuaries, and Statisticians 213 RD Life Science Professionals 214 RD Engineering Professionals (excluding Electrotechnology) 215 RD Electrotechnology Engineers 2151 Electrical Engineers 2152 RD Electronics Engineers R&D 2153 IT Telecommunications Engineers 216 RD Architects, Planners, Surveyors, and Designers 22 Health Professionals 221 RD Medical Doctors 222 RD Nursing and Midwifery Professionals 223 Trad. and Complementary Medicine Professionals; 224 Paramedical Practitioner 226 RD Other Health Professionals 23 Teaching Professionals 24 Business and Administration Professionals 241 O Finance Professionals 242 O Administration Professionals 243 Sales, Marketing, and Public Relations Professionals 25 IT Information and Communications Technology Professionals 26 Legal, Social, and Cultural Professionals 3 Technicians and Associate Professional 31 Science and Engineering Associate Professionals 311 RD Physical and Engineering Science Technicians 312 Mining, Manufacturing, and Construction Supervisors; 313 Process Control Technicians 314 RD Life Science Technicians and Related Associate Professionals 315 Ship and Aircraft Controllers and Technicians 32 Health Associate Professionals 321 RD Medical and Pharmaceutical Technicians 33 Business and Adm. Associate Professionals; 34 Legal, Social, and Cultural Associate Professionals; 35 IT Information and Communications Technicians |

In the second step, intangible investments are constructed using wage incomes for IC workers and the estimates of the share of work that contributes to the creation of intangibles and the use of tangible and intermediate inputs in the production of intangibles.

Building on earlier work and work in the GLOBALINTO project (Piekkola et al. 2024), we assume that only a share of working time is devoted to intangible investment. It is thus assumed that the share of labor cost dedicated to the production of intangible capital is 0.45 for ICT occupations, 0.6 for R&D occupations, and 0.4 for OC-related management and marketing occupations.

The parameter, , is the price of each of the three types of intangibles. We use the investment deflator for R&D, the innovation property investment deflator (which includes R&D, software, and database) for ICT, and the labor costs weighted average of the producer price deflator over business services (NACE 69–73) for OC.

where is the initial investment, is the initial intangible capital stock, is the depreciation rate, and is the growth of the intangible capital stock of type IC (R&D, OC, ICT) using the geometric sum formula. The initial investment, , is the first 3-year average for the corresponding type of investment and the growth rate of all intangibles, , is set at 2%. The depreciation rate for organizational investments is set at 20% following the survey by Lev et al. (2016) and paper by Squicciarini and Le Mouel (2012). Recent estimates of R&D depreciation rates are closer to the 15% relied on here than the 20% figure used in Corrado et al. (2016). ICT investments are assigned a 33% depreciation rate.

Appendix B: Industries by Technology Type and Summaries

| Technology type | Main industries | Other | Value added shares in 2017, % | |||

|---|---|---|---|---|---|---|

| FIN | NOR | DEN | SLO | |||

| High-tech manufacturing | Electronics 21 and Pharmacy 26 | 4.5 | 1.5 | 12 | 6 | |

| Medium-high technology manufacturing | Chemical 20, electrical equipment 27, machinery and equipment 28 | Motor vehicles 29, other transport 30 | 10.5 | 5 | 11 | 13.6 |

| Medium-low technology manufacturing | Refined petroleum 19, rubber and plastic products 22, basic metals 24 | Repair and installation of machinery and equipment 33–34, energy 35 | 14.9 | 19.7 | 9 | 25.1 |

| Low technology manufacturing | Food 10, textile 13, paper 17 | Beverages 11, tobacco 12, textiles 13, wearing apparel 14, leather 15, wood and wood product 16, printings 18, furniture 31, other 32 | 10.8 | 5.8 | 10 | 8.1 |

| KIS market (knowledge-intensive market services, excl. finance, and high-tech services) | Transport 50–51 (not land), publishing 58, telecommunication 61, arts, entertainment, and recreation R | Motion picture 59 programming, broadcasting 60, other professional activities 74, 75, 78, 80 | 12.0 | 14.1 | 9 | 7.5 |

| ICT services | Computer programming, consultancy 62, information service activities 63 | 7.3 | 4.7 | 4 | 2.5 | |

| R&D services | Architectural, engineering 71, R&D 72 | 3.8 | 4.5 | 8 | 2.2 | |

| OC services | Legal 69, head office 70, advertising, market research 73 | 3.1 | 3.7 | 4 | 1.8 | |

| Other private services | Wholesale trade 45–47, land transport 49, warehouse 52, accommodation, food and beverages 56, real estate 68 | Rental and leasing 77, travel agency 79 | 33.1 | 41.1 | 33 | 33.4 |

| Mean | Median | Std | N | Mean | Median | Std | N | |

|---|---|---|---|---|---|---|---|---|

| Finland | Norway | |||||||

| Value added/L | 85.5 | 63.2 | 442.0 | 237 | 108 | 80.5 | 386 | 228 |

| Employee | 68.0 | 18.0 | 331.0 | 237 | 44.6 | 12.9 | 241 | 228 |

| Total capital/L | 294.0 | 189.0 | 855.0 | 237 | 515 | 128 | 4037 | 228 |

| Output elasticity of employment (excl. IA work) | 0.806 | 0.814 | 0.112 | 237 | 0.879 | 0.891 | 0.127 | 228 |

| Output elasticity of capital | 0.161 | 0.146 | 0.087 | 237 | 0.158 | 0.125 | 0.106 | 228 |

| Output elasticity of relative quality of R&D work | 0.489 | 0.466 | 0.585 | 184 | 1.720 | 1.410 | 2.280 | 90 |

| Output elasticity of relative quality of OC work | 0.542 | 0.472 | 0.409 | 128 | 0.715 | 0.613 | 0.841 | 155 |

| Initial relative quality (wages) of R&D work | 1.570 | 1.390 | 0.590 | 184 | 1.24 | 1.18 | 0.19 | 109 |

| Initial relative quality (wages) of OC work | 2.300 | 2.110 | 0.925 | 128 | 1.45 | 1.40 | 0.22 | 186 |

| Relative quality of R&D work × LR&D/LNOIC | 1.110 | 1.020 | 0.935 | 183 | 1.05 | 1.03 | 0.13 | 80 |

| Relative quality of OC work × LOC/LNOIC | 1.080 | 1.050 | 0.481 | 128 | 1.05 | 1.02 | 0.09 | 152 |

| RD-IBTC | 0.031 | 0.003 | 0.074 | 183 | 0.015 | 0.004 | 0.025 | 80 |

| OC-IBTC | 0.012 | 0.003 | 0.019 | 128 | 0.008 | 0.002 | 0.014 | 152 |

| Denmark | Slovenia | |||||||

|---|---|---|---|---|---|---|---|---|

| Value added/L | 122 | 81.9 | 4258 | 225 | 36.3 | 26.3 | 90.4 | 101 |

| Employee | 64.2 | 18.3 | 347 | 225 | 0.0 | 0.0 | 0.2 | 101 |

| Total capital/L | 165 | 61.2 | 838 | 225 | 57.1 | 22.1 | 408.3 | 101 |

| Output elasticity of employment (excl. IA work) | 0.830 | 0.876 | 0.305 | 225 | 0.736 | 0.001 | 0.000 | 101 |

| Output elasticity of capital | 0.119 | 0.110 | 0.326 | 108 | 0.233 | 0.000 | 0.000 | 101 |

| Output elasticity of relative quality of RD work | 0.894 | 0.834 | 0.561 | 88 | 0.843 | 0.001 | 0.002 | 35 |

| Output elasticity of relative quality of OC work | 0.352 | 0.338 | 0.295 | 109 | 0.219 | 0.000 | 0.001 | 50 |

| Initial relative quality (wages) of RD work | 1.53 | 1.48 | 0.26 | 225 | 1.49 | 1.45 | 0.30 | 43 |

| Initial relative quality (wages) of OC work | 2.01 | 1.92 | 0.52 | 88 | 1.97 | 1.89 | 0.55 | 57 |

| Relative quality of R&D work × LR&D/LNOIC | 1.12 | 1.06 | 0.18 | 88 | 1.06 | 1.04 | 0.34 | 35 |

| Relative quality of OC work × Loc/LNOIC | 1.04 | 1.02 | 0.07 | 108 | 1.04 | 1.00 | 0.52 | 50 |

| RD-IBTC | 0.052 | 0.007 | 0.093 | 88 | 0.023 | 0.003 | 0.055 | 35 |

| OC-IBTC | 0.005 | 0.002 | 0.008 | 108 | 0.004 | 0.000 | 0.017 | 50 |

- Note: Observations (N) are in thousands, and value-added and total capital intensities are in thousands of 2015 euros.

Appendix C: Data Access and Stata Codes