The Productivity Slowdown in Advanced Economies: Common Shocks or Common Trends?

Prepared for the 2022 Ruggles Lecture at the International Association for Research in Income and Wealth conference in Luxembourg. A package with data and code to replicate the tables and figures in this paper, can be downloaded from https://doi.org/10.34894/RCIQ6B. We thank Antonio Fatas, Bart van Ark, conference participants, and several anonymous referees for helpful comments. We also thank Stephanie Stewart for excellent research assistance. The views in this paper are those of the authors and do not necessarily reflect the views of the Federal Reserve Bank of San Francisco or anyone else associated with the Federal Reserve System.

Abstract

This paper reviews advanced-economy productivity developments in recent decades. We focus primarily on the facts about, and explanations for, the mid-2000s labor-productivity slowdown in large European countries and the United States. Slower total factor productivity (TFP) growth was the proximate cause of the slowdown. This conclusion is robust to measurement challenges including the role of intangible assets, rankings of productivity levels, and data revisions. We contrast two main narratives for the stagnating TFP frontier: The shock of the Global Financial Crisis; and a common slowdown in TFP trends. Distinguishing these two empirically is hard, but the pre-recession timing of the U.S. slowdown suggests an important role for the common-trend explanation. We also discuss the unusual pattern of labor productivity growth since the start of the Covid-19 pandemic. Although it is early, there is little evidence so far that the large pandemic shock has changed the slow pre-pandemic trajectory of labor-productivity growth.

1 INTRODUCTION

Why has productivity growth been so slow across advanced economies since the mid-2000s? We attribute the proximate cause of the growth slowdown to a mid-2000s slowdown in total factor productivity (TFP) growth. We discuss some key uncertainties regarding measurement, which point to priorities for data collection and release. We contrast two competing narratives for the slowdown. One is the common shock of the Great Recession, which hit all major advanced economies after 2007; the other is a common slowdown in trend, plausibly linked to a reduced contribution from information and communications technology (ICT). We find that the timing supports the common-trend slowdown, largely independent of the Great Recession. Finally, we discuss the pandemic experience. Although it is early, there is little evidence so far that the large pandemic shock has changed the slow pre-pandemic trajectory for productivity growth.

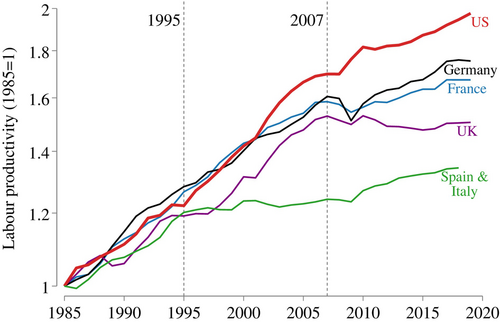

Figure 1 shows the data that motivate this paper. The figure shows the level of market-economy labor productivity for selected economies (normalized to one in 1985). After rising essentially in parallel prior to 1995, the U.S. pulled ahead, and Spain and Italy slowed dramatically. Since the mid-2000s, productivity growth in all major economies has been slow.

Notes: Market economy value added per hour. Sources: EU KLEMS (2012, 2021), ONS, and BEA-BLS. Spain & Italy is an unweighted average.

This slow-productivity growth trajectory is a crucial macroeconomic issue. It contributes to slow growth in GDP overall and in average incomes. It raises budget challenges for governments. Pre-pandemic, it was an important contributor to the widespread sense of economic stagnation.

In Section 2, we find that the slowdown after 2007 reflects a slowdown in TFP growth. This conclusion is based on growth accounting, in which the contribution of TFP is in labor-augmenting terms and the contribution of capital-deepening is in terms of the capital-output ratio; we prefer this accounting to the “standard” Solow (1957) accounting because it better accounts for the endogeneity of capital. The standard accounting, in the Solow (1956) model or other neoclassical growth models, attributes some of the contribution of TFP growth to the endogenous response of capital accumulation. Hence, we focus most of our subsequent analysis and discussion of the productivity slowdown on TFP growth.

Indeed, over time, TFP is the most important factor explaining patterns in labor productivity. Capital deepening (in terms of the capital-output ratio) sometimes makes a difference—helping explain, for example, why France and Germany saw slower labor productivity growth in the 1995–2007 period than in the preceding years, despite—in contrast to much of the literature—an apparent pickup in TFP growth. Capital deepening also matters for understanding relative labor-productivity levels. But with our preferred growth accounting, capital deepening does not contribute to the post-2007 slowdown in labor productivity growth.

In Section 3, we delve into some challenges in terms of data measurement and data inconsistencies. These data issues potentially affect interpretation and policymaking; they highlight the importance of having long, consistent, high-quality datasets. Some of the facts we identify appear more robust and reliable than others.

For example, was the mid-1990s pickup in TFP growth widely shared across countries? Our baseline estimates suggest that it was. But the current vintage of EU KLEMS data goes back only to 1995 and UK industry data have a major methodological break in 1998. Hence, conclusions for countries outside the U.S. (which has long, consistent time series data) requires comparing the pre-96 period and the post-95 period using data constructed with different methodologies. More broadly, different vintages of EU KLEMS give different answers regarding the 1995–2007 period.

Another example of a data challenge involves levels accounting. Such TFP levels require that output and inputs be adjusted for purchasing power parity (PPP). And, since we focus on the market economy, the adjustments need to be done at the industry level (including for intermediate inputs). Unfortunately, inconsistencies in the PPPs and price indices over time mean that the choice of base year for a constant PPP series substantial affect the results.

These data uncertainties mean it is challenging to have complete confidence in the answers to key questions for policymakers who seek to improve productivity performance. Appropriate policies require a view on questions such as, how do your growth rates compare with those in other countries? How far is your country from the overall frontier? And which sectors are leaders, and which are laggards? Reducing the uncertainties requires much more focus on collecting and publishing high-quality data within and across countries. There is a need for consistent long-term data series, as well as for quality control for tracking changes between vintages of data.

Still, though data uncertainty clouds some facts, the slowdown in TFP growth since the mid-2000s does appear robust. And it appears relatively robust that the U.S. was the overall market-economy leader in terms of TFP levels (though not necessarily in all sectors). So in Section 4, we compare two competing narratives about the mid-2000s TFP slowdown.

One view is that the Great Recession was a large common shock that hit everyone, more or less contemporaneously, and which knocked productivity growth off course. The Great Recession started at the end of 2007 as a modest U.S. recession; but it intensified and spread after Lehman's failure in September 2008. Financial constraints or other factors might have then led firms to invest less in R&D and other innovation spending.

However, as we discuss, the evidence from deep recessions or from banking/financial crises is mixed in terms of whether they persistently harm the level or growth rate of productivity; the evidence is stronger that deep recessions persistently harm labor markets. Still, the biggest challenge to the Great Recession-shock narrative is that the U.S. slowdown predated the Great Recession. So in our view, although we cannot rule out that the Great Recession might have played a role in some countries, it did not appear to play a primary role.

The second explanation, which is where we put most of the weight, is that the slowdown reflected a common slowdown in trend TFP growth that started in the mid-2000s. This slowdown followed the (in current data vintages) widely shared mid-1990s pickup in TFP growth. One interpretation consistent with the data and the literature is that information and communications technology (ICT) was a general-purpose technology (GPT) that boosted growth for a time—ex ante, one didn't know how long the growth-boost would last (Basu et al., 2004), but it came to an end in the mid-2000s (Fernald, 2015). The backdrop to this GPT boost was that ideas were getting harder to find (Bloom et al., 2023; Bloom et al., 2020). Indeed, the ICT boost may have sown the seeds of its own demise (Aghion et al., 2023; De Ridder, 2024) by, eventually, reducing incentives to innovate.

If frontier growth slowed, how does this transmit across countries? The slowing-trend narrative should apply broadly to countries close to the frontier. Ideas, after all, flow across borders. The growth-theory logic of conditional convergence implies that, though countries may have different steady-state levels of output per hour—where differences depend on structural aspects of the economy such as government policies (e.g., labor and product-market institutions), rule of law, education, population growth, and so forth—steady-state growth rates should roughly equal the growth rate of the frontier.1 Hence, a slowdown in frontier growth naturally implies that other countries with the same steady-state growth rates should see a similar slowdown. As we discuss in Section 4, if the U.S. slowed several years before the Great Recession (as the time series evidence suggests), then the European slowdown might have been visible only with a lag. Thus, the two narratives both have similar implications for the timing of the European slowdown.

Finally, in Section 5, we discuss the pandemic period. COVID-19 was another big shock. Labor productivity growth in the U.S., EU, and UK all initially rose strongly in 2020. But by mid-2022, as cyclical influences on labor productivity unwound, the level of productivity seemed broadly consistent with its slow pre-pandemic trend.

Our analysis builds on our earlier work, including Fernald (2015), Cette et al. (2016), Fernald et al. (2017), Fernald et al. (2020) and Fernald and Inklaar (2022). Chadha and Samiri (2022) and Goldin et al. (2024) provide recent surveys with broader references to the literature.

2 CONCEPTUAL FRAMEWORK, DATA, AND KEY FACTS

This section presents our conceptual framework, data, and key growth-accounting results. We find that differences in TFP growth explain the major differences over time and across the major countries we examine here. Since the mid-2000s, TFP growth has been lackluster everywhere. Capital-deepening and labor composition explain little or none of the slowdown—or even go the wrong way. We also find that the U.S. appears to be the overall market-economy leader in terms of the level of TFP, though that is not necessarily true in all sectors. Section 3 digs further into several sources of uncertainty regarding the data, though the main takeaways appear robust.

2.1 Accounting for Labor Productivity: TFP and Capital Deepening

This equation has been standard in growth accounting since Jorgenson and Griliches (1967). It refines the accounting in Solow (1957) with additional implications of neoclassical production theory for measuring capital, labor, and output. is output growth, is capital-services growth, is hours growth, and is labor composition growth. is the nominal share of payments to capital in revenue which, following standard practice, we take to be the average in years and ; () is labor's share. We assume the factor shares sum to one.2

A challenge with interpreting Equations (1) or (2) is that capital growth, and thus capital deepening (capital per hour worked), are endogenous. For example, in the Solow (1956) growth model, all growth in output per hour comes from TFP growth. But the Solow-Jorgenson-Griliches identity in Equation (1) would attribute some of that growth to increases in capital per hour. Perhaps most relevantly, a slowdown in trend TFP growth naturally leads to slower growth in capital per hour, because firms don't need as much capital with slower growth.3

Even though capital formation () is endogenous, in many models the capital-output ratio is stationary in steady state (through possibly with a trend due to trends in the relative price of investment goods). Slower growth in technology and labor naturally lead to a lower path for both capital and output. But, in neoclassical models, even though the capital-labor ratio declines, the capital-output ratio does not decline.

Thus, if we observe a decline in the capital-output ratio, it is consistent with special influences that have reduced capital relative to output. Such influences could reflect, say, unusual credit constraints or heightened uncertainty—both of which could, for example, have occurred following the financial crisis—that reduce investment (and, over time, capital) more than you would expect just from a weaker and slower-growing economy.

2.2 Data

Our main focus is market-sector growth accounting. We thus exclude government, education, health, and real estate, where measurement challenges—especially, the comparability of measurement across countries—are severe. In addition, the market economy is where models of growth and innovation most naturally apply. Constructing accounts for the market sector requires building up from industry datasets, using country-level KLEMS datasets.4 We briefly discuss the data here and provide further details in the data appendix.

For Continental Europe, our main source is EU KLEMS 2021 (Bontadini et al., 2021). Unfortunately, those data go back only to 1995. The short time span of these data complicates the analysis of productivity trends in recent decades. We merge the 2021 vintage with the 2012 vintage of EU KLEMS before 1995 so that we can analyze data back to 1980. An important caveat is that there are conceptual differences between the two vintages, notably in terms of what national accounts intangibles are included. In addition, as we discuss in Section 3.3, different vintages of EU KLEMS can look very different from each other.

For the UK, we use industry data from the UK's Office of National Statistics (ONS). These data incorporate the recent, and long overdue, shift by the ONS to using double deflation for their industry accounts (ONS, 2021). Because other countries long ago shifted to double deflation, this was a long-standing source of inconsistency between the UK and other countries. Unfortunately, the ONS took double deflation back only to 1998, so the data before and after that date are inherently inconsistent.

For the U.S., we use the BEA-BLS integrated production accounts (Bureau of Economic Analysis, BEA, 2022, combined with data from Eldridge et al., 2020) The virtue of this dataset is that it provides a long, consistent dataset (depending on the level of aggregation, back to either 1963 or 1947—far longer than we use here).

When we present figures on the level of TFP, we use Inklaar and Timmer's (2009) estimates for 1997. The biggest practical challenge in deriving the level of industry TFP is the need for PPP data for intermediate inputs. Inklaar and Timmer undertook the hard work involved in calculating consistent levels data. We then project levels forward and backwards using growth rates.

Growth accounting results Figure 2 shows the decomposition from Equation (3) for the same set of countries shown in Figure 1. For each time period—1980–1995, 1995–2007, and 2007–2019—the bars decompose market-economy labor productivity growth into the contributions of TFP (in blue), the capital-output ratio (green), and labor composition (orange). As a reminder, the contribution of TFP growth is in labor-augmenting form, so it is TFP growth divided by labor's share; and capital deepening is in terms of capital relative to output.

Notes: Growth-accounting contributions to market-economy labor productivity growth from Equation (3). Sources: EU KLEMS (2021, 2012), ONS (2022) and BEA (2022). ITA/ESP is an unweighted average. We show the decomposition from Equation (3), . France and Italy/Spain for the final period cover 2007–2018.

The figure illustrates several key observations. First, the U.S. and UK both saw faster growth in labor productivity in the 1995–2007 period than in the 1980–1995 period, even as continental Europe (Germany, France, and especially Italy/Spain) saw slower labor productivity growth.

Second, despite this pattern in labor productivity, all countries other than Italy and Spain saw faster TFP growth in the 1995–2007 period than in the earlier (1980–1995) or later (2007–2019) periods. For the 1995–2007 period, a large body of literature focused on the U.S. documented how semiconductor production, the Internet, and reorganizations of production to take advantage of faster information and communications (ICT) technology boosted TFP and labor productivity growth.5 Many studies have argued that Europe missed out on this IT-fueled boom (e.g., Timmer et al., 2010). But our data suggest that, at least in terms of TFP growth, northern Europe received a comparable ICT boom after 1995.

Despite faster TFP growth after 1995, labor productivity growth slowed in Germany and France because of a reduced contribution from capital deepening and labor composition. In Germany, the main driver was reduced capital deepening; in France, it was mainly labor composition.

Third, after 2007, TFP growth slowed dramatically in all countries other than Italy and Spain, where it slowed modestly and remained negative. In the case of the UK and France, the TFP contribution turned negative. For the U.S. and Germany, the contribution fell from a strong positive to barely positive.

A more general observation, and the key takeaway from this figure, is that differences in the contribution of (labor-augmenting) TFP growth account for most of the differences in labor productivity growth across countries and over time. Slowdowns or accelerations in labor productivity growth are mostly accompanied by changes in the contribution of TFP growth that go in the same direction, whereas capital deepening and labor composition have a greater tendency to show diverging dynamics. In fact, after 2007, capital deepening and labor composition together added as much or more to labor productivity growth in all countries shown than they had in the 1995–2007 period.6 TFP growth, not capital deepening or labor composition, more than explains the productivity slowdown.

Our view that capital deepening does not have an important independent role in explaining the UK, U.S. or European labor-productivity slowdown may seem surprising. It is “conventional wisdom” that investment in many countries fell sharply after 2007 and was slow to recover. But the relevant input for production is capital, and capital-input growth responds relatively slowly to changes in investment. And for productivity growth, it is capital growth relative to growth in output (in our decomposition) or labor (in the standard decomposition) that matters. Since output and labor growth were subdued in the aftermath of the Great Recession, the contribution of growth in the capital-output ratio was higher after 2007 than during the 1995–2007 period in most countries. From this perspective, we view the weakness in investment as primarily a symptom of other underlying issues that affected growth—namely, weak growth in TFP—not an independent contributor to the slowdown.7

This does not mean that investment and capital growth are unimportant. For example, as noted, capital growth explains the divergence in our data for the 1995–2007 period between TFP growth (which, in most countries, sped up relative to the pre-1996 period) and labor productivity growth (which slowed in many countries).

More generally, capital matters for understanding the level of labor productivity. Countries might have frictions of various sorts that suppress investment and the level of capital (and hence labor productivity) even if TFP is not suppressed. For example, it is a puzzle that the UK has long had a quite low rate of investment in tangible capital relative to other countries.

In addition, investment rates could themselves affect TFP growth to the extent that technology is embodied in capital. If firms reduce their investment rates, then the “new and improved” capital that incorporates the newest technology is not installed. Fernald and Inklaar (2022) consider a back-of-the-envelope calculation based on a two-sector growth model (where one sector produces investment goods), that suggests that embodied technical change is not a major consideration for understanding the post-2007 TFP slowdown. Nevertheless, other endogenous or exogenous growth models could give a different result.

With these caveats in mind, based on Figure 2, we focus on TFP for the remainder of this paper.

2.3 TFP Levels and Convergence

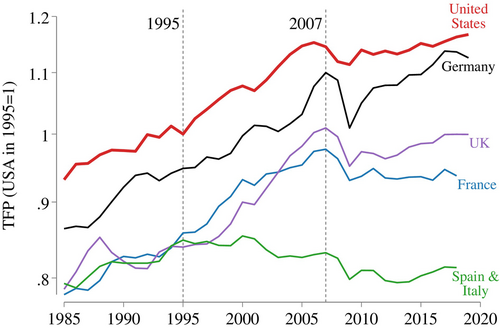

To compare TFP levels, we rely on the estimates of comparative TFP levels (U.S. = 1) for the year 1997 by Inklaar and Timmer (2009). We then use the TFP growth rates from EU KLEMS to estimate levels in earlier and later years. This method, which we reflect on in some detail in Section 3, provides a different perspective on the growth accounting.

As Figure 3 shows, throughout this period, the U.S. has the highest TFP level for the overall market economy. The period between 1995 and 2007 saw the largest shifts in relative position: The UK moved closer to U.S. levels, France and Germany maintained their relative position, and Spain and Italy fell sharply behind. The timing of a turning point around the Great Recession is also different. The U.S. peaked in 2006 whereas France, Germany and the UK peaked only in 2007. Since 2007, TFP in Germany and the UK largely maintained their positions relative to the U.S. In France, market economy TFP by 2018 was lower than in 2007.

Notes: Figure shows the market economy total factor productivity level, normalized to the USA in 1995 = 1. TFP level for 1997 is from Inklaar and Timmer (2009); the level is then extended forward and backward using growth rates.

For Italy and Spain, the period since 1995 has been one of near-continuous decline. The change in relative position is particularly sharp, declining from 85 percent of the U.S. level in 1995 to only 70 percent by 2018. These two countries as clearly different. A sizeable literature following Hsieh and Klenow (2009) argues that the introduction of the euro led to sizeable capital flows to southern Europe, leading interest rates to converge to lower northern-European levels. Given financial frictions, these flows increased misallocation and reduced aggregate TFP.8

In Section 4, we discuss two interpretations of the post-2007 TFP slowdown for the countries other than Italy and Spain. One is that there was a common slowdown in trend TFP growth. The frontier (i.e., the U.S.) slowed down markedly, increasing by only 2 percent (2007–2019) compared to an increase of 14 percent in the preceding 12 years (1995–2007). And as the frontier slowed, TFP growth in other countries slowed as well. A second explanation is that the Great Recession had such a large impact on innovation that subsequent growth was hampered.

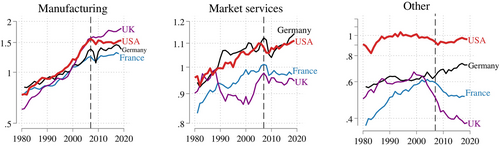

Even though the U.S. defines the TFP frontier for the overall market economy, drilling down to more detailed industries shows a varied picture. Figure 4 splits the market economy into manufacturing, market services and a group “other,” which includes agriculture, mining, utilities and construction. In terms of relative size, manufacturing makes up, on average, 26 percent of market economy value added, market services accounts for 57 percent and the “other” group 17 percent. In this figure, we have dropped Italy and Spain as the TFP dynamics in those countries are markedly different.

Notes: USA in 1995 equals 1. total factor productivity (TFP) level for 1997 is from Inklaar and Timmer (2009); the level is then extended forward and backward using growth rates. “Manufacturing” covers NACE division C; “market services” covers G through N and R through S; “other” covers A, B and D through F.

The U.S. TFP lead is clearest in the “other” group, but its TFP has remained nearly constant over this period. Germany has moved closer to the U.S. level, while France and the UK have fallen back. In manufacturing, the UK seems to be the TFP leader since 2007, an important measurement remark is that the introduction of double deflation (which we discuss in more detail in Section 3) has led to much more rapid growth in manufacturing TFP. The “other” figure makes this explicit, showing UK TFP declining by 24 percent since 2007 against a 14 percent increase in UK manufacturing TFP. Given that double deflation is a new methodology in the context of UK official statistics, a possibility is that subsequent methodological refinements might change the distribution of TFP growth between industries. As a result, the U.S. may still represent the frontier in manufacturing with Germany and France keeping pace. Finally, in market services, Germany's TFP level is ahead of the U.S. level in most years. Especially in France and the UK, TFP in market services since 2007 has fallen, increasing the gap relative to German TFP levels.

- TFP is the main factor accounting for differences in labor productivity growth across countries and over time.

- Since the mid-2000s, TFP growth has been lackluster across the large economies we analyze here.

- At the level of the market economy, TFP slowed because the productivity frontier (the U.S.) slowed, with similar slowdowns elsewhere.

- At a more disaggregated level, the frontier economy is sometimes different, but the pattern of slow TFP growth since the mid-2000s is evident in both manufacturing and market services.

These results depend somewhat on the data and choices we make, which we discuss in more detail in the next section. In Section 4, we turn to debates about the causes of the TFP slowdown in the mid-2000s. In Section 5, we turn to the more recent experience of the 2020s, which renewed the debates regarding shocks versus changes in trend, in the context of the lockdowns and disruptions of the Covid-19 pandemic.

3 MEASUREMENT AND DATA CHALLENGES

The problematic quality of economic data presents a continuing challenge… It should not cause us to despair, but we should not forget it either. Griliches (1986), p. 1509.

Analyzing productivity growth at the country or industry level raises substantial measurement issues. Accurate, Jorgensonian productivity measures require extensive data on the value and volume of output as well as a finely distinguished sets of inputs (see OECD, 2001). Cross-country comparisons of productivity are harder still, since concepts and classifications need to be harmonized; see, for example, Timmer et al. (2010) on the challenges involved in constructing the first version of the EU KLEMS database. In this section, we discuss several issues that are particularly relevant to our current analysis. We highlight areas where measurement-driven uncertainty may cloud our ability to draw clear conclusions and identify results that seem robust to such concerns.

3.1 Intangibles

A first area of discussion is where to draw the asset boundary, that is, how far to extend our concept of capital. There is a growing literature emphasizing the “capital” nature of spending on worker training, organizational structure, product design and other intangible assets (e.g., Corrado et al., 2009; Goodridge & Haskel, 2022). There is ample evidence of a long-lasting effect on output of investing in such intangible assets (Haskel & Westlake, 2018), though the nature of these assets makes it hard to unambiguously pin down their precise scope and impact.

Recent revisions to the System of National Accounts (SNA) have also expanded the asset boundary; the main additions were software in the 1993 SNA and research and development in the 2008 SNA. So, even though current SNA revision discussions do not foresee a further expansion, there is some interest in getting “ahead of the curve” by broadening the scope of capital beyond current SNA conventions. However, data that incorporate broader, non-SNA intangible assets are currently available only for the period since 1995, which would preclude the type of longer-run analysis we aim for here. Furthermore, our use of official data for the UK from the ONS and for the U.S. from BEA-BLS limits us to data based on SNA conventions.

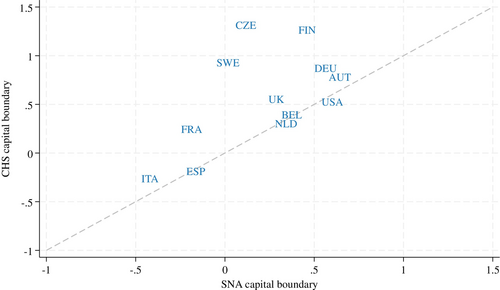

To see the effect of this choice, Figure 5 compares two measures of average annual market-economy TFP growth in the EU KLEMS database. One measure uses the SNA asset boundary, the other uses the CHS asset boundary. The time period, 1999 to 2017, is the longest available without dropping countries. Most countries are above the 45-degree line, implying faster TFP growth under the CHS boundary than the SNA boundary. A broader concept of capital might be expected to lead to smaller TFP (i.e., residual) growth. But expanding the asset boundary affects both capital input (on the right-hand side) and production (on the left-hand side), because the newly recognized assets must be produced. TFP growth may thus increase if investment in intangibles (output) is rising rapidly or decrease if the increase in capital input is the dominant effect.9

Notes: Figure shows average annual market-economy TFP growth (%) between 1999 and 2017 from EU KLEMS 2021, using either the “Growth Accounts Basic” dataset, which corresponds to the SNA capital boundary; or the “Growth Accounts Extended” dataset, which uses the Corrado et al. (2009) boundary and thus includes many more intangible assets. The dashed line is a 45-degree line.

Figure 5 illustrates that the net effect is heterogeneous across countries. For Spain, Belgium, the Netherlands and US, the net effect on TFP growth is zero or even negative; for Italy, France, the UK, Germany and Austria TFP growth comes out modestly higher, while Sweden, Czechia and Finland show rapid TFP growth under the CHS boundary and much lower growth under the SNA boundary. Excluding those three countries, the correlation of average growth rates is high at 0.9. This could mean that for the larger countries we focus on in our analysis, growth patterns for the more recent period would not be substantively different if we would use the CHS asset boundary. Of course, this does not imply that growth patterns in earlier years would also be similarly close.

Note also that the CHS-boundary series is not necessarily closer to “true” productivity growth than the SNA-boundary series. There remain large uncertainties about own-account investment, especially in broad categories such as organizational capital, which is proxied as 20 percent of managerial labor compensation. But how much of managerial time is spent on longer-term organizational change? Is that a constant fraction over time? Is the impact of organizational investment on output predictable (Le Mouel & Schiersch, 2020)? Which occupations contribute to organizational capital (Le Mouel & Squicciarini, 2015)? What is the right depreciation rate (Squicciarini & Le Mouel, 2012) or price index? It is conceivable that changing some of the measurement assumptions could lead to notable differences in the pattern of Figure 5.

3.2 Consistency over Time: Double Deflation

In addition to the asset boundary, other types of data revisions can affect growth rates. We highlight two examples here. The first is the introduction of double deflation in the UK National Accounts. The U.S. and other countries in Europe have long used double deflation, where gross output and intermediate inputs are separately deflated to arrive at a measure of real value added; but the UK introduced this method only in 2021, and only for the period since 1997 (ONS, 2021). Note that the introduction of double deflation impacts the distribution of value-added growth across industries but not the overall economy-wide growth rate.10

Table 1 compares average annual TFP growth according to single-deflated data to double-deflated data for the 1997–2020 period. We also compare to the 1970–1997 period, which still is based on single deflation. Comparing the last two columns shows that the introduction of double deflation has a substantial impact on TFP growth rates. For example, manufacturing TFP growth was revised massively upwards from 1.1 percent to 2.9 percent. Wholesale and retail trade, another large sector, goes from modest positive growth of 0.7 percent to declining productivity: −0.4 percent. Not all differences between the last two columns are due to double deflation; the large upward revision in telecommunication and information (industry J) is primarily due to the introduction of a new output deflator that declines rapidly.

| 1970–1997 | 1997–2020 | ||

|---|---|---|---|

| Single-deflated | Single-deflated | Double-deflated | |

| A. Agriculture | 1.0 | 0.4 | 1.6 |

| B. Mining | 1.2 | −4.2 | −6.0 |

| C. Manufacturing | 1.9 | 1.1 | 2.9 |

| D. Electricity & gas | 3.8 | −1.9 | −1.3 |

| E. Water | −1.4 | −1.2 | −3.7 |

| F. Construction | 0.0 | −0.6 | −1.5 |

| G. Wholesale & retail trade | 0.7 | 0.7 | −0.4 |

| H. Hotels & restaurants | 3.4 | −0.3 | −0.6 |

| I. Transport & storage | −1.2 | −1.0 | −1.6 |

| J. Telecommunication & information | −0.3 | 2.8 | 7.8 |

| K. Financial services | −0.6 | 0.8 | −0.3 |

| L. Real estate | −1.5 | 2.1 | 1.0 |

| M. Professional services | 0.0 | 1.6 | −0.2 |

| N. Administrative and support | 0.9 | 1.0 | −0.8 |

| R. Arts, entertainment & recreation | 0.8 | −0.4 | −0.5 |

| S–U. Other services | −3.6 | −1.7 | −1.9 |

| Market sector | 1.2 | 0.5 | 0.6 |

- Notes: This table shows average annual growth rates of total factor productivity (TFP) in the UK market sector industries, identified by 1-digit industry code and abbreviated description. The 1997–2020 “single-deflated” column is from the ONS Productivity Database published in April 2021, the 1997–2020 “double-deflated” column is from the same source, published in April 2022; the 1970–1997 “single-deflated” column is from the April 2022 dataset.

Including the 1970–1997 period highlights the challenge in interpreting the longer-run UK productivity performance. Based on the single-deflated series, manufacturing TFP growth slowed from 1.9 to 1.1 percent between the pre-1997 and post-1997 periods. In contrast, double deflation shows a massive acceleration in growth after 1997. But given the size of the revisions, it is also conceivable that a double-deflated pre-1998 series would show faster growth still.

In services there are also notable reversals in growth patterns. Under single deflation, financial and professional services both saw a sizeable pickup to positive TFP growth post-1997. But double deflation revised the post-1997 period to show declining TFP. Administrative and support services also show a sizeable post-1997 switch from positive to negative TFP growth.

These shifts in industry patterns are substantial and they lead to uncertainty about long-term (changes in) growth patterns. Yet this does not imply that everything is up for grabs. UK productivity growth is lower than it was before, despite rapid growth in ICT industries, such as telecommunication and information and parts of manufacturing. And, if anything, the decline in productivity growth looks even more broad-based than previously.

3.3 Consistency over Time: Versions of Productivity Data

The second data revision we discuss is for versions of productivity databases. The EU KLEMS database is the starting point for most international comparisons of industry-level productivity across advanced economies. The aim of this database has remained constant since its origins, namely, to provide productivity estimates for a common set of industries computed using a common methodology. But by 2022, there have been four institutes responsible for developing the database, the University of Groningen, The Conference Board, wiiw and LUISS.

Different versions of EU KLEMS show quite different TFP growth rates. Table 2 illustrates the differences for the market economy between 1995 and 2007, a period covered in all five versions. We find that the 2019 version is very different from the other versions. The differences are so large that we question whether the growth figures are based on a reliable implementation of the KLEMS methodology. So, while we include it for completeness' sake, our main comparison is of the other four versions.

| Germany | France | UK | US | |

|---|---|---|---|---|

| EU KLEMS version | ||||

| 2009 | 0.7 | 0.8 | 1.1 | 1.2 |

| 2012 | 1.1 | 0.9 | 1.2 | 1.0 |

| 2017 | 0.9 | 0.9 | 1.5 | 1.2 |

| 2021 | 1.1 | 0.9 | 1.1 | 1.3 |

| PM: 2019 | 1.7 | 1.3 | 1.6 | 1.6 |

- Notes: Each row corresponds to a different vintage of EU KLEMS. 2009 and 2012 versions were developed by the University of Groningen (O'Mahony & Timmer, 2009), the 2017 version by The Conference Board (Jäger, 2018), the 2019 version by wiiw (Stehrer et al., 2019) and the 2021 version by LUISS (2021).

Initial estimates for this period, in the 2009 version of EU KLEMS, showed a notable growth advantage for the UK and US compared with France and Germany. By the 2021 version, however, growth in Germany and the UK is now comparable and the differences across the four countries are notably smaller. More in general, we see differences of 0.1–0.4 percentage point per year across versions.

Because TFP growth is a residual (the growth in value added not accounted for by growth in factor inputs) changes to any component in that calculation affects TFP growth. Table 3 compares growth of value added, labor and capital and of TFP in the 2009 version and the 2021 versions. Growth of labor input (hours worked, adjusted for composition by educational attainment) is most similar across versions with, at most, a 0.1 percentage point difference. Value added revisions are a bit larger at about 0.3 percentage points, which likely reflects revisions to National Accounts.

| Germany | France | UK | US | |||||

|---|---|---|---|---|---|---|---|---|

| Version | 2009 | 2021 | 2009 | 2021 | 2009 | 2021 | 2009 | 2021 |

| Value added | 1.4 | 1.7 | 2.5 | 2.8 | 3.2 | 3.2 | 3.5 | 3.2 |

| Labor | −0.3 | −0.2 | 1.1 | 1.2 | 1.2 | 1.1 | 1.3 | 1.3 |

| Capital | 3.4 | 1.8 | 3.1 | 2.3 | 4.8 | 3.7 | 4.6 | 4.0 |

| TFP | 0.7 | 1.1 | 0.8 | 0.9 | 1.1 | 1.1 | 1.2 | 1.3 |

The largest difference is seen for capital input, with much lower growth of capital services in the 2021 version than the 2009 version—by more than 1–1/2 pp per year for Germany.11 Gouma and Inklaar (2023) also find that differences in the approach to capital measurement can account for most of the differences in TFP growth in a comparison across databases (EU KLEMS, PWT, OECD, Total Economy Database). The reasons are more complex and include whether the database relies on official statistics for capital stocks by (industry and) asset or whether the series are constructed from (official) investment series.

One way to view Tables 2 and 3 is that any given data release is best viewed as noisy signal of the underlying growth process, in particular for TFP. That suggests caution when interpreting differences in productivity growth across countries. That EU KLEMS has been developed outside the system of official statistics has broadly been an advantage, allowing for more experimentation and harmonization of methods. However, it is plausible that this has also led to more variation in results as different institutes make different methodological choices and the 2019 version seems to us a case in point that this makes an endeavor like EU KLEMS vulnerable. Moving to official data on industry TFP growth seems to us a clear statistical policy priority across Europe. In the meantime, we note that the current information implies that the US productivity growth advantage that was identified and highlighted in the mid-2000s (e.g., Timmer et al., 2010) is less impressive than it seemed at the time. Revisions to National Accounts, such as the shift from SNA1993 to SNA2008 as well as other changes in sources and methods, have also contributed to this result.

3.4 Consistency over Time: Productivity Levels

In the previous section, Figures 3 and 4 showed estimates of comparative productivity levels. These were based on the comparative productivity-level estimates for 1997 of Inklaar and Timmer (2009) combined with the productivity growth rates from our productivity growth dataset. This approach is sometimes referred to as providing a “constant purchasing power parities (PPP)” series, as presented, for example, in the World Development Indicators (WDI). An appealing implication of this approach is that if a country grows more rapidly than the United States then its comparative level will increase relative to the United States.

Though appealing, this approach depends on those 1997 productivity and PPP estimates. An alternative is what WDI refers to as a “current PPP” series, which uses the (by now) frequent new estimates of PPPs (relative prices across countries). Ideally, subsequent PPP estimates should be consistent with changes to relative prices: , where is the purchasing power parity between country and country at time and is the price level of country at time .

In practice, PPPs and price indexes over time are not consistent. This is partly due to differences in weighting (Inklaar & Rao, 2020) and partly due to differences in product sampling. Inklaar et al. (2022) discuss the evidence and explore explanations. They show that the root mean squared inconsistency (a type of prediction error) for comparative GDP levels in higher-income countries is on the order of 10–15 percent for the most recent pair of global price comparisons (World Bank, 2020).

It is for this reason that in official statistics, such as by Eurostat, only a “current PPP” GDP per capita series is provided. The motivation for this choice is that PPPs are for cross-country comparisons and that for subsequent comparisons, you should use subsequent PPP estimates, regardless of their (lack of) consistency with national deflators. For over-time (growth) comparisons, PPPs are not relevant, and you would use national deflators. That argument is also made in the Penn World Table (PWT, Feenstra et al., 2015), with one set of GDP, capital and productivity series for cross-country comparisons and another for over-time comparisons. At the same time, our discussion in the previous section suggests that drawing a clear line between these questions is not always straightforward. And if we see the degree of inconsistency as a form of measurement error in growth and levels (e.g., Rao et al., 2010), it can be sensible to compare “current PPP” and “constant PPP” series to establish which lessons are robust to measurement error of this type.

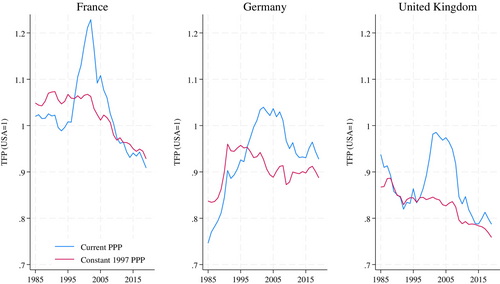

To illustrate what these inconsistencies imply for comparative productivity levels, we draw on the PWT, version 10.01. PWT provides a “current PPP” TFP series (CTFP), which uses the time series of PPP estimates to provide estimates of comparative productivity levels (USA = 1 in every year). We can also construct a “constant PPP” TFP series of the type shown in Figures 3 and 4, by using the TFP growth series (RTFPNA) and ‘anchoring’ this series to the comparative level (CTFP) in a particular year.

Figure 6 shows these two series for France, Germany and the UK, with the U.S. equal to one in every year. The “anchor” for the constant PPP series is 1997. (Since PWT is for the overall economy and there are some differences in concepts and measurement, the comparative levels in that year differ from those shown in Figure 3.) For France and the UK, the relative TFP trends are similar. For France, TFP in 1985 is above the US level (102–105 percent) and by 2019, this level has dropped to 91–93 percent of the US level. The UK starts at a lower level (87–94 percent) but also clearly declines, to 76–79 percent. Differences are larger for Germany, with the current PPP series showing more rapid increases in relative levels but also more substantial declines.

Notes: Sources is Penn World Table version 10.01. Current PPP series is CTFP from PWT, constant PPP is equal to the current PPP series in 1997 and extrapolated using TFP growth in each country relative to growth in the U.S. in earlier and later years. Period covered is 1985–2019.

But this figure also shows that choosing a different “anchor” year for the constant PPP series can lead to substantially different findings. The most extreme example is France, where the current PPP series peaks at 123 percent of the US level in 2002. Using that level to “anchor” France's TFP would have led to a “constant 2002 PPP” TFP level being higher than in the U.S. through the entire period. The “current PPP” series shows that this would have been misleading as under that series, France has a higher TFP level for only 22 of the 35 years covered, which is close to the 24 years for the “constant 1997 PPP” series. Likewise, if the UK series had been anchored to the 2002 “current PPP” level, then the early years of the period would have shown TFP levels exceeding those in the U.S., whereas the “current PPP” series never exceeds U.S. levels.

Another view, though, is that the “current PPP” series can show large swings that cannot be related to comparative growth dynamics. For example, between 1990 and 2007 the TFP growth performance of the UK and U.S. were fairly similar, which implies approximately constant relative TFP levels. But the “current PPP” series varies by more than 10 percentage points.

This differences between the “current PPP” and “constant PPP” series are hard to reconcile, so wholeheartedly adopting either option based on our understanding of comparative growth performance is not straightforward. Yet, for this set of countries, it is fairly robust that the U.S. has the highest productivity level, especially by the end of the period. From Inklaar and Timmer (2009), we also know that the 1997 U.S. TFP level for the market economy exceeds the TFP level for the total economy. So, it seems safe to conclude that the U.S. constitutes the market economy frontier throughout the period, as shown in Figure 3.

To wrap up the discussion of measurement in this section, we conclude that a number of questions are hard to answer with confidence. For example, how close are different countries to the TFP frontier? How much of a TFP growth advantage did the U.S. have? Which European country has grown fastest? By how much? And which sectors are contributing most to this advantage? These uncertainties pose a substantial challenge to policy makers, for whom these questions are key in deciding on concrete interventions. This uncertainty cannot be removed entirely, but the discussion in Section 3.3, on different versions of productivity data does point to the importance of (1) quality control to track changes between versions; (2) comparing to official series; and (3) aiming for consistent, long-term series to track changes more confidently over time.

Nevertheless, despite the need for caution, we can still discern a few robust patterns in the data. First, the U.S. appears to be at the market-economy frontier. Second, the U.S. probably had a modest TFP growth advantage between 1995 and the start of the financial crisis. Third, there was a broad-based decline in TFP growth after the mid-2000s.

4 COMPETING NARRATIVES: COMMON SHOCKS OR COMMON TRENDS?

Section 2 showed that all advanced economies saw a slowdown in TFP growth in the mid-2000s and that the U.S. appears to be at the overall frontier for the market economy. Section 3 argued that, despite uncertainties in the data, these takeaways appear robust. In this section, we contrast two hypotheses for the mid-2000s TFP slowdown. The first is that there was a common shock of the Great Recession that hit everyone. Such an event could have harmed investments in new innovation. The second is that that there was a common pre-recession slowdown in trend.12

The strongest evidence for the common-trends view comes from the U.S. data, where the mid-2000s slowdown occurred before the Great Recession. Hence, the Great Recession cannot explain the U.S. slowdown—at least, not all of it. The strongest evidence for the Great Recession as the cause is the timing for the UK, France, and Germany. Visually, Figure 3 shows that something seemed to change for these countries after 2007.

Since ideas flow across borders, if U.S. TFP growth at the frontier slowed prior to the crisis, one would expect to see a trend slowdown elsewhere as well. But there could easily be a lag. Unfortunately, a lag of a few years means that the common-trends story implies that Europe might have seen the slowdown only around 2007 or 2008—the same time as the Great Recession. Hence, for Europe, the two hypotheses are close to observationally equivalent. For this reason, break tests on the European data are not that helpful in distinguishing the role played by each hypothesis.13

Because of the U.S. timing, we put most of the weight on the common-trends explanation. Of course, counterfactuals are challenging—how would TFP have evolved in the U.S. and other countries in the absence of the Great Recession? Even if trend TFP growth slowed independently of the Great Recession, it is possible that, at least in some countries, the recession itself might then have been an additional contributor to disappointing growth. Experiences could differ across countries depending on factors such as the depth of the cyclical downturn, the degree to which the financial sector was impaired in each country, and the sectoral composition of production. Importantly, it could also depend on the response of policy and institutions.

4.1 The Common Shock of the Great Recession

The Great Recession was a major adverse shock that hit all advanced economies. It affected the financial sector, and financial crises tend in general to be associated with slower recoveries. For the UK and northern Europe, the timing seems to fit the sharp slowdown in TFP growth.

There is a long tradition in economics of treating business cycles and long-run trends as distinct phenomena. For example, in canonical real-business-cycle (RBC, e.g., Kydland & Prescott, 1982) and New-Keynesian models (e.g., Woodford, 2003), the business cycle reflects fluctuations around a trend that is given by a neoclassical growth model with exogenous technical change. In both classes of models, the trend in output per hour is typically driven by exogenous technological progress (with a trend that might be stochastic or deterministic). Shocks cause labor supply and employment to fluctuate around their steady-state levels. But these fluctuations do not, per se, affect the steady-state path of the economy, that is, its “natural rate.” As Blanchard (2018) puts it, the “natural rate hypothesis… has been the dominant paradigm in macroeconomics.”14

However, considerable research—especially since the 1980s, though some before—has challenged the theoretical and/or empirical presumption that employment and/or productivity evolve independently of business cycle fluctuations. Blanchard (2018) and Cerra et al. (2023) survey this research in detail; we highlight selected examples below. Broadly, there is evidence that deep recessions (financially related or otherwise) may permanently lower the level of GDP relative to its pre-recession trend. The channels for such hysteresis can work through labor markets or productivity.

The strongest empirical evidence applies to labor-market hysteresis. For example, Clark and Summers (1982) and Blanchard and Summers (1986) find substantial hysteresis in European labor markets: Recessions, they find, lead to very persistent increases in the actual and natural rates of unemployment as well as persistent declines in labor-force participation. Recent evidence is consistent with this finding for a broader range of countries. Blanchard (2018) looks at 22 advanced countries over 50 years. Disinflation episodes are particularly interesting because they reflect demand-driven recessions arising from monetary contractions. Blanchard finds that such episodes are associated with substantial increases in unemployment as far out as 14 years.

Along similar lines, Bluedorn and Leigh (2019) examine IMF forecast revisions for 34 advanced economies. They find that unexpected demand-driven surprises in employment cause revisions to employment forecasts 5 years ahead to change in the same direction and by more than one-to-one. These five-year ahead forecast revisions turn out to be unbiased, indicating that the perceived hysteresis effects on employment are real.

More narrowly, Furlanetto et al. (2021) look at U.S. data since 1983 in a quarterly VAR model that allows (some) demand shocks to have permanent effects on potential output. They find that these “permanent demand shocks” primarily affect long-run output through employment.

In other words, these papers all find evidence that demand-driven recessions and booms persistently (if not permanently) affect employment and, thereby, potential output. A range of theoretical arguments can support these sorts of hysteresis effects in labor markets. Blanchard and Summers (1986) suggest that unions might optimize contracts to benefit “insiders,” making it more challenging for “outsiders” (who don't have jobs) to be hired. Of course, there are many other potential arguments, as Bluedorn and Leigh (2019) and Cerra et al. (2023) discuss. For example, workers who lose jobs in downturns may lose skills and labor-market attachment, and thereby become less employable during the recovery.

In terms of productivity, the theoretical arguments for potential hysteresis effects are also clear. Since the 1980s, with the advent of endogenous growth models, a number of authors have developed models where business cycle fluctuations cause variations in innovation and long-run growth. Early examples include Shleifer (1986) and Stadler (1990). In Shleifer (1986), innovations are implemented only in periods of higher demand—so business-cycle booms are necessary for long-run growth. In Stadler's (1990) model, learning-by-doing is faster in booms and slower in recessions. In these early examples, endogenous technological change propagates non-technological shocks (such as monetary shocks). Fatás (2000) proposes a related mechanism (endogenous innovation is higher in booms and lower in recessions) and argues that business cycles appear to “cast long shadows.”

Following the global financial crisis, a number of (mainly) theoretical papers have argued that the productivity slowdown since the mid-2000s could, in fact, reflect the long shadows of the Great Recession. Examples include Anzoategui et al. (2019), Benigno and Fornaro (2017), Bianchi et al. (2019), and Garga and Singh (2021). Each of these papers has a slightly different dynamic stochastic general equilibrium (DSGE) model with endogenous technological progress. Non-technological shocks, such as financial shocks, propagate in part through endogenous technological change that reduces the level of TFP persistently (if not permanently).

We note that most of the theoretical papers in this literature emphasize mechanisms through which downturns lead to slower productivity growth. However, some papers have highlighted potential cleansing effects of recessions. For example, in a downturn, the opportunity cost of doing research is lower, which may spur innovation. In addition, low-productivity establishments may exit during downturns.15

However, the evidence from advanced-economy macro data for the widespread importance of the productivity channel is less compelling than the evidence for the labor channel. Blanchard (2018) finds limited evidence that disinflation episodes are associated with persistent declines in productivity. Indeed, depending on time horizon and how he detrends, Blanchard's estimated effects of a recession on productivity are often positive, not negative. Furlanetto et al. (2021) find that the permanent demand shocks they identify in U.S. data do not affect output per worker or output per hour.16 Furceri et al. (2021) look at “deep recessions” (those in the bottom 10th percentile in terms of output declines) in 18 advanced economies and 24 industries from 1970 to 2014. Deep recessions are associated with long-lasting declines in output, employment, and capital—but not in output per worker or within-industry 2021 (utilization-adjusted) TFP.17

Oulton and Sebastiá-Barriel (2016) look at growth-accounting variables following financial crises—using data that mainly predate the Great Recession. They find that, for advanced economies, the long-run level of TFP is typically not significantly affected. Advanced-economy GDP per capita is permanently lower after a financial crisis because employment per capita is permanently lower—consistent with the employment results in Blanchard (2018) and elsewhere—whereas capital per worker as well as TFP are unchanged. For developing economies, however (or for all countries when pooled), TFP as well as capital per worker are permanently reduced by financial crises. This evidence suggests that, while financial crises sometimes affect the level of productivity permanently, it does not always.

Some evidence does support the view that the Great Recession had an important effect on the productivity trend. Anzoategui et al. (2019) estimate their DSGE model on U.S. data. Their estimates suggest an important role for the Great Recession in (further) reducing productivity growth—on top of a pre-recession slowdown. Still, it is unclear whether their finding reflects the particular, hardwired structure of the model. That is, since the model will always explain the data perfectly, changes in the structure of a DSGE model (and even choices about data series) can lead to substantial changes in the parameters and shocks that the estimated model uses to fit the data.

Adler et al. (2017) summarize IMF work, using both firm and industry data, that supports the view that the Great Recession may have harmed TFP growth in some countries. The main channels they highlight include reduced investment in intangible assets; increased misallocation; and elevated uncertainty that might have tilted investment away from higher-risk, higher-return projects. For example, firm and financial-institution balance-sheet stresses may have combined to make it harder for firms to finance profitable investments in intangibles; it may have also shifted production away from the most-productive firms, increasing misallocation. Nevertheless, it is worth noting that they conclude that “the sharp deceleration in TFP occurred on the back of a precrisis slowdown” (p. 5) They further suggest that “the scars from the global financial crisis remain greater [in continental Europe] than in most other advanced economies” (p. 5), which they imply may be because of the greater shortfall in aggregate demand.18

The Great Recession narrative has clear implications for monetary and fiscal policy. As Cerra et al. (2023) emphasize, the potential for hysteresis implies potentially large benefits to early and aggressive macro stabilization policies. This policy recommendation follows whether the hysteresis arises in labor markets and employment (where we think the evidence is strongest) or in innovation and productivity.19 Of course, countries facing fiscal or currency crises may have been constrained in their ability to respond aggressively.

4.2 Common Trends

The biggest challenge to the Great Recession (common shocks) story is the timing for the United States which, as we now discuss, slowed before the Great Recession. Clearly, if productivity slowed before the recession, then the recession cannot have been its cause. So a natural alternative explanation is that trend productivity slowed at the frontier, for reasons unrelated to the Great Recession. Such a slowdown would be expected to affect all advanced economies.

Productivity growth varies over time for reasons that are challenging to link consistently to business cycle influences. Taking a very big picture view, prior to the industrial revolution, productivity growth everywhere was very slow—often non-existent for centuries or even millennia. But a revolution in productivity growth occurred, and the pace of productivity growth in advanced economies (and ultimately the world) was much faster in the past two centuries than earlier. Even looking just at the past 70 years, much has been written about the U.S. productivity slowdown in the early 1970s and its (temporary) recovery in the mid-1990s.20

Qualitatively as well as statistically, the evidence suggests that, following that mid-1990s pickup, U.S. TFP growth slowed before the Great Recession. Starting qualitatively, TFP growth from the end of 2004 through 2007 was slower than it was from the end of 2007 through 2019 (Fernald, 2014). In addition, even before the Great Recession, professional forecasters were at least partially downgrading long-run expectations about productivity growth (Antolin et al., 2017; Fernald et al., 2017). And academic papers written before the Great Recession noted the slowing pace (Jorgenson et al., 2008; Sichel et al., 2006).

Statistical evidence confirms this qualitative perspective (Fernald, 2014; Fernald et al., 2017). Fernald et al. (2017) provide several formal time-series statistical tests to date the slowdown. Tests for regime shifts (discrete breaks) estimate that, following the mid-1990s pickup, productivity slowed after the first quarter of 2006.21 Alternative Bayesian methods, which do not assume sharp breaks, place the peak growth rate in the late 1990s or early 2000s, with little probability mass on peak growth occurring after 2006.

Other statistical approaches on U.S. data tell the same story. Kahn and Rich (2007, updated) use a multivariate regime-switching model—with variables chosen from a growth model—and find that productivity growth switched from a high- to a low-productivity-growth regime at the end of 2004. Antolin-Diaz et al. (2017) use a dynamic factor model that allows for a smooth change in trend and also conclude that the U.S. slowdown predated the Great Recession. Eo and Morley (2022) develop a Markov-switching model in which recessions may (but need not) have permanent hysteresis effects; however, they find little evidence that the Great Recession had substantial hysteresis effects. Instead, the economy slowly recovered to a lower trend path that, consistent with other findings, predated the Great Recession.

This evidence together makes it difficult to argue that the Great Recession itself was the cause of the U.S. productivity slowdown. Fernald et al. (2017) interpret the disappointing output recovery after the Great Recession as largely reflecting a sharply slowing output trend—driven by slowing TFP and falling labor-force participation—that was largely independent of the Great Recession. The deep recession was then superimposed on that slowing trend.

A plausible story is that information and communications technology (ICT) provided an exceptional boost to trend TFP growth in the mid-1990s and early 2000s. But general-purpose technologies (GPTs) such as ICT typically boost growth only for a time. So the waning trend may have reflected a pause in—if not the end of—those exceptional gains (Fernald, 2014; Gordon, 2016).

Several authors have discussed formal stories that can justify a slowing trend. Bloom et al. (2020) focus on the backdrop of broadly slowing growth and argue that “ideas are getting harder to find”: research productivity has fallen steadily, wherever they look. This includes the productivity of research effort in semiconductors, agriculture, and medicine. Constant productivity growth, when it exists (e.g., Moore's Law) has required ever-increasing numbers of researchers to offset their declining productivity. From this perspective, the anomaly was the period of the 1990s/early 2000s, when the general-purpose technology nature of ICT may have temporarily raised research productivity (Fernald & Jones, 2014).

Several authors focus specifically on the role of ICT and argue that its boom sowed the seeds of its own demise. Aghion et al. (2023) and de Ridder (2024) propose endogenous-growth models where ICT initially spurs faster innovation; but eventually, it results in barriers to new innovation. In Aghion et al.'s (2023) model, ICT initially allows high-productivity (high process-efficiency/high intangibles/high markup) firms to expand into new areas. But eventually, expanding into new product lines means competing with other high-productivity firms—so the expected profits from innovation fall. For the same reason, the profitability of entry by new firms is also held down, explaining declining dynamism. De Ridder's (2024) story emphasizes the increasing importance of intangible capital, such as software, which scales easily. Competing with high-intangible (low marginal cost) firms requires substantial up-front investments in developing your own intangibles (and the returns are uncertain). Hence, intangibles become a barrier-to-entry that eventually leads to reduced dynamism and innovation.

The U.S. data, and these model mechanisms, are thus consistent with a slowing TFP trend that is largely independent of the Great Recession. Importantly, the mechanisms driving the U.S. slowdown should explain a broader advanced-economy slowdown, including in Europe.

First, ideas flow across borders. Hence, we would not expect a U.S. productivity slowdown to stay in the U.S. For example, if we take the U.S. as being at the productivity frontier (which it appears to be in the aggregate, though not necessarily sector-by-sector), then we would not expect what happens in the U.S. to stay in the U.S.

Second, the model mechanisms in Aghion et al. (2023) and de Ridder (2024) seek to explain not just the U.S. data but, rather, the world frontier. That is, the mechanisms are general and should apply equally to Europe as the United States. This is, of course, the flip side of the widespread expectation that Europe should have gotten the same IT boost in the 1990s that the United States did. It was widely considered a puzzle when earlier vintages of data suggested that Europe did not receive such a boost in the 1990s (e.g., Timmer et al., 2010; for the UK, see Basu et al., 2004). As we discussed, recent vintages of the data do find some evidence that continental Europe may have gotten a pickup; and the late-1990s pickup in TFP is now clear in the UK data.

That ideas flow across borders, and that global trends should be common, underpins the logic of conditional convergence. Taken literally, conditional convergence implies that countries should converge to their own steady-states relative to the frontier—and then to grow at roughly the same pace as the frontier. So, if the frontier slows, productivity in other countries that are close to the frontier should also slow. The visual evidence in Figure 3 is broadly consistent with the conditional convergence story for Germany, France, and the UK. Sometimes, country TFP advances towards the frontier, and sometimes it retreats. But stepping back, levels of TFP since 1985 have been surprisingly parallel to one another. (Clearly, Italy and Spain are different, which the conditional convergence logic would imply reflects a transition to a new, lower relative steady-state level.)

A variant of the common-trends interpretation is that data mismeasurement might have gotten worse. On balance, we do not consider it likely to explain the magnitude of the shortfall in TFP growth. Our views are shaped by earlier surveys by Byrne et al. (2016) and Syverson (2017), who find little evidence for the mismeasurement hypothesis because the timing and magnitude of the slowdown do not match the pattern of underlying causes for mismeasurement. Nevertheless, the measurement challenges are substantial and not going away. For example, Brynjolfsson et al. (2019) focus on the exclusion of free (digital) goods from the System of National Accounts and argue that welfare gains from Facebook alone would have added 0.05–0.11 percentage points to a broader measure of GDP. Byrne (2022) surveys the many challenges with appropriate measurement of a wide range of digital goods and services. Crouzet and Eberly (2021) point to the rising importance of intangibles as a potential source of mismeasurement and also argue that data mismeasurement has gotten worse and may account for a notable fraction of the U.S. productivity slowdown. At the same time, Corrado et al. (2022) report on the most extensive measurement of intangible investment and its impact on productivity growth and these still show a substantial slowdown in TFP growth in Europe and the U.S. So, while improving measurement should be important given the rising importance of intangibles and could help to reduce the measurement uncertainty, it still seems quite unlikely that the productivity slowdown would disappear from the data.

To the extent that the slowdown occurred in actual technological innovation, if the U.S. slowed around 2005, why did Europe appear to slow later? Ideas take time to diffuse, so a slowdown in the United States might show up in the Europe with a lag. For example, the International Monetary Fund (2015) finds a lag of three to 4 years between U.S. industry TFP innovations and European TFP innovations.22 As a concrete example, in the 1990s, the sharp UK TFP pickup occurred several years after the U.S. pickup (see Figure 9 in the next section). Thus, if there are lags, the “common trend” story is consistent with the Europe showing a sharp break right around the time of the Great Recession— even if the Great Recession had nothing to do with it.

Given the evidence that U.S. TFP growth slowed prior to the Great Recession, we put most of the weight on the common-trends explanation. Nevertheless, given the near-observational equivalence of the two narratives for Europe, we cannot rule out that the recession could have caused some country-specific idiosyncratic movements relative to the frontier.

5 PRODUCTIVITY IN A PANDEMIC

In 2020, the world economy experienced another severe shock, this one caused by the COVID-19 pandemic. Like other statistics, productivity data behaved in unusual ways from 2020 through mid-2022 (the latest data available as of this writing). Debates about shocks versus trends have been overarching themes in discussions of productivity since then.23

In this section, we argue that much of the unusual productivity pattern reflected the unusual cyclical movements in the economy. As of mid-2022, there is little evidence in U.S., UK, or euro-area data of a persistent change in trend productivity growth arising from the pandemic. Of course, it is still quite early, given that it can take years for changes in trend to be clearcut.

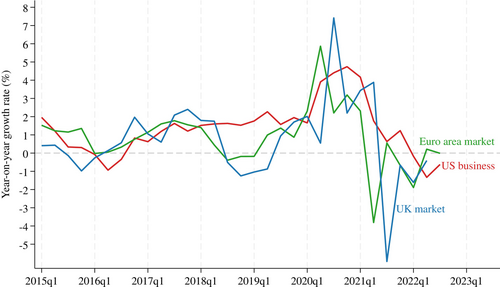

Figure 7 shows year-over-year growth in quarterly labor productivity for the U.S., UK, and euro area. The data correspond to the business sector in the U.S. and the market sector in the UK and euro area. The figure shows that, although the timing was not identical, productivity surged in all three regions in 2020. At their peaks, year-over-year growth rates were all far above the lackluster rates seen in the 2010s.

Notes: All measures are four-quarter changes in real value added per hour. UK data are from the Office of National Statistics. U.S. data are from Fernald (2014), where output averages expenditure- and income-side measures. Euro-area market-sector real value added is calculated by chain-subtracting industry real gross value added in “Public Administration, Education & Social Work” from total real GDP at basic prices; euro-area hours worked is from the ECB.

In 2020 and into 2021, there was considerable speculation—particularly in the U.S. press—that perhaps the shock of the pandemic had permanently boosted productivity.24 For example, businesses were arguably forced into rapid and coordinated learning about new, more digital ways of doing business. This learning was a form of intangible investment in knowledge that could raise the level of TFP. In addition, surveys (and some controlled experiments) suggested that many workers were more productive remotely.25 The initial surge in productivity superficially appeared to ratify these sources of potential benefits for the level, if not the growth rate, of productivity.

But not all of the speculated effects of the pandemic were positive for productivity. For example, firms devoted costly time and resources to protecting worker health, managing remote workers, repatriating supply chains, and otherwise dealing with the disruptions. Bloom et al. (2023) survey UK firms, and the responses indicate that firms expected COVID-19 to reduce the level of near- and medium-term TFP fairly substantially within firms. For example, firms reported needing to purchase additional intermediate inputs, such as cleaning services, which reduce the level of TFP.

And as Figure 7 shows, the initial productivity surge retreated in 2021 and 2022. In all three regions, year-over-year growth turned negative at some point—substantially so, in the UK and euro area— and has stayed low as of late 2022. Averaging through the ups and downs, in all regions, productivity growth from the end of 2019 (the eve of the pandemic) to the latest data (second quarter of 2022 for the UK; third quarter of 2022 for the U.S. and euro area) was roughly in line with its pre-pandemic pace.

Much of the speculation about the effects of the pandemic ignored cyclical effects on productivity. As Fernald and Wang (2016), Fernald and Li (2021, 2022), and Gordon and Sayed (2022) discuss, U.S. labor productivity since the mid-1980s has been countercyclical—namely, rising in recessions, when the unemployment rate rises. This cyclicality is not necessarily structural but is likely to depend on the nature of the shocks that hit the economy and how firms adjust. Indeed, as Biddle (2014) discusses, conventional wisdom about whether productivity is procyclical or countercyclical changed several times over the course of the 20th century. For example, capital deepening and labor composition tend to be countercyclical: in recessions, as workers lose jobs, capital rises relative to labor input or relative to output; and the workers who keep their jobs tend to have more education and experience. But TFP tends to be procyclical because of cyclical mismeasurement, since capital's workweek and labor effort are likely to fall in recessions. The relative magnitude of these procyclical and countercyclical forces may differ across countries (and over time) depending in part on labor-market norms and institutions.

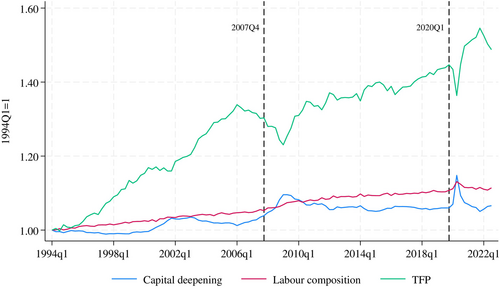

For the U.S. and UK, we can look at quarterly growth accounting to glean insights into why labor productivity surged in 2020 and then retreated. Figure 8 shows the accounting for the U.S., where we cumulate the contributions of capital deepening (in terms of the capital-output ratio), labor composition, and (labor-augmenting) TFP since the beginning of 1994 (see Equation 3).

Notes: Source is Fernald (2014). Quarterly data from 1994:Q2 through 2022:Q3. The capital-deepening contribution in terms of capital relative to output, . The contribution of TFP is in labor-augmenting form ().

The figure makes clear that TFP is the main driver of labor productivity growth over time. Both capital deepening and labor composition grow much less since the mid-1990s. But cyclical movements in all three series are also apparent. For TFP, there is a flat spot around the time of the 2001 recession; there is a sizeable drop and sharp rebound following the Great Recession.26 Capital deepening rises in every recession, reflecting that observed capital is relatively smooth whereas output falls. Following that increase, the capital-deepening contribution is flat or even negative for a period of time. Labor composition, the smoothest of the three series, also bumps up a bit around recessions, since younger and less-educated workers are more likely to lose jobs.

Since the pandemic, all three contributors have shown exceptionally large movements. The capital-deepening and labor-composition effects are clearly countercyclical, with the capital-deepening spike being particularly pronounced. The capital-deepening spike to some extent reflected industry composition. In 2020, the industries that disproportionately shut down were low-capital-intensity sectors such as leisure and hospitality.27 Similarly, labor composition contributed exceptionally in 2020, when workers with less education and experience disproportionally lost jobs. Both capital deepening and labor composition subsequently reversed.

TFP initially fell sharply, consistent with its typical recession pattern. But the economic recovery was rapid, and so was the rebound in TFP. In fact, TFP rose substantially above its pre-pandemic trend through 2021. But the spike in TFP has since reversed, and by the third quarter of 2022 it was back roughly to its pre-pandemic trend.

How do we make sense of these TFP movements? Fernald and Li (2022) argue that there were substantial movements in factor utilization. A decline in utilization during the worst of the pandemic (in the second quarter of 2022) quickly reversed. When the economy rebounded, firms reported difficulty filling positions; qualitatively, workers reported putting in exceptional effort as well as longer hours. By 2022, however, stories increasingly emphasized “burnout” and “quiet quitting,” suggesting that workers were reducing their exceptional efforts. By mid- to late-2022, the TFP contribution had returned most of the way towards its pre-pandemic trend.28