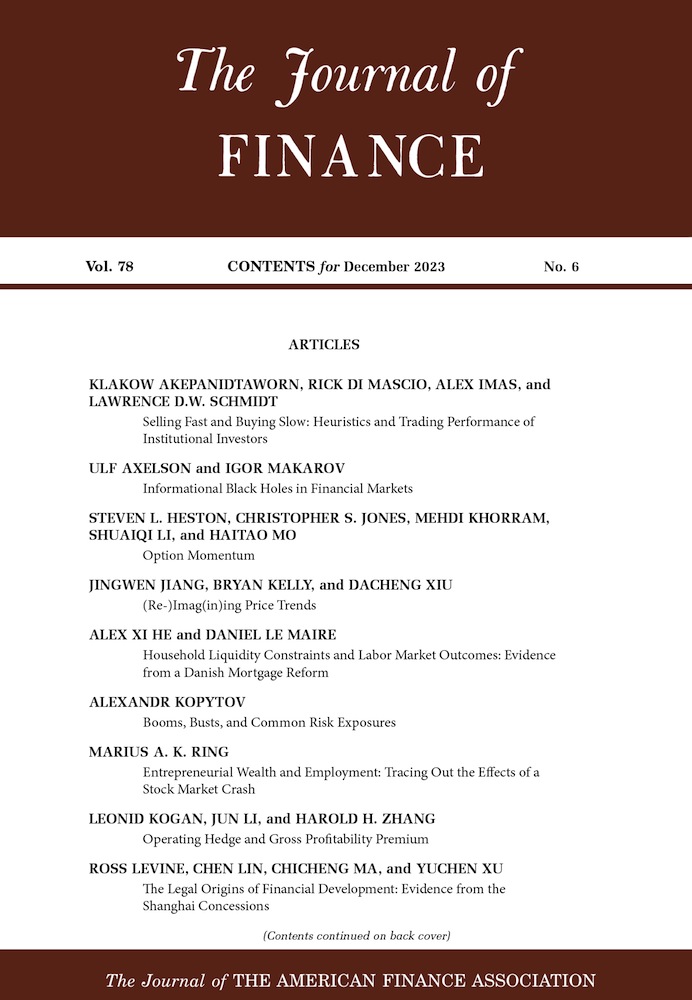

(Re-)Imag(in)ing Price Trends

JINGWEN JIANG

Search for more papers by this authorCorresponding Author

BRYAN KELLY

Correspondence: Bryan Kelly, School of Management, Yale University, 165 Whitney Ave., New Haven, CT 06511; e-mail: [email protected]

Search for more papers by this authorDACHENG XIU

Jingwen Jiang is with University of Chicago. Bryan Kelly is with Yale University, AQR Capital Management, and NBER. Dacheng Xiu is with University of Chicago. We are grateful for comments from Ronen Israel; Serhiy Kozak (discussant); Ari Levine; Chris Neely (discussant); and seminar and conference participants at Washington University in St. Louis, University of Oxford, University of Rochester, Rutgers Business School, Boston University, Chinese University of Hong Kong, ITAM Business School, Singapore Management University, National University of Singapore, Cheung Kong Graduate School of Business, University of Science and Technology of China, Nanjing Audit University, University of Iowa, University of Houston, Renmin University, Hong Kong University of Science and Technology, AEA/ASSA North American Meetings, SFS Cavalcade, Society of Financial Econometrics, China International Conference in Finance, Society of Quantitative Analysts, and INQUIRE UK. AQR Capital Management is a global investment management firm, which may or may not apply similar investment techniques or methods of analysis as described herein. The views expressed here are those of the authors and not necessarily those of AQR. We have read The Journal of Finance's disclosure policy and have no conflicts of interest to disclose.

Search for more papers by this authorJINGWEN JIANG

Search for more papers by this authorCorresponding Author

BRYAN KELLY

Correspondence: Bryan Kelly, School of Management, Yale University, 165 Whitney Ave., New Haven, CT 06511; e-mail: [email protected]

Search for more papers by this authorDACHENG XIU

Jingwen Jiang is with University of Chicago. Bryan Kelly is with Yale University, AQR Capital Management, and NBER. Dacheng Xiu is with University of Chicago. We are grateful for comments from Ronen Israel; Serhiy Kozak (discussant); Ari Levine; Chris Neely (discussant); and seminar and conference participants at Washington University in St. Louis, University of Oxford, University of Rochester, Rutgers Business School, Boston University, Chinese University of Hong Kong, ITAM Business School, Singapore Management University, National University of Singapore, Cheung Kong Graduate School of Business, University of Science and Technology of China, Nanjing Audit University, University of Iowa, University of Houston, Renmin University, Hong Kong University of Science and Technology, AEA/ASSA North American Meetings, SFS Cavalcade, Society of Financial Econometrics, China International Conference in Finance, Society of Quantitative Analysts, and INQUIRE UK. AQR Capital Management is a global investment management firm, which may or may not apply similar investment techniques or methods of analysis as described herein. The views expressed here are those of the authors and not necessarily those of AQR. We have read The Journal of Finance's disclosure policy and have no conflicts of interest to disclose.

Search for more papers by this authorABSTRACT

We reconsider trend-based predictability by employing flexible learning methods to identify price patterns that are highly predictive of returns, as opposed to testing predefined patterns like momentum or reversal. Our predictor data are stock-level price charts, allowing us to extract the most predictive price patterns using machine learning image analysis techniques. These patterns differ significantly from commonly analyzed trend signals, yield more accurate return predictions, enable more profitable investment strategies, and demonstrate robustness across specifications. Remarkably, they exhibit context independence, as short-term patterns perform well on longer time scales, and patterns learned from U.S. stocks prove effective in international markets.

Supporting Information

| Filename | Description |

|---|---|

| jofi13268-sup-0001-InternetAppendix.pdf1.5 MB | Appendix S1: Internet Appendix. |

| jofi13268-sup-0002-ReplicationCode.zip38.1 MB | Replication Code. |

Please note: The publisher is not responsible for the content or functionality of any supporting information supplied by the authors. Any queries (other than missing content) should be directed to the corresponding author for the article.

REFERENCES

- Bajgrowicz, Pierre, and Olivier Scaillet, 2012, Technical trading revisited: False discoveries, persistence tests, and transaction costs, Journal of Financial Economics 106, 473–491.

- Barberis, Nicholas, 2018, Psychology-based models of asset prices and trading volume, in B. Douglas Bernheim, Stefano DellaVigna and David Laibson, eds., Handbook of Behavioral Economics: Applications and Foundations 1, 79–175 (Elsevier, North-Holland).

- Barberis, Nicholas, Andrei Shleifer, and Robert Vishny, 1998, A model of investor sentiment, Journal of Financial Economics 49, 307–343.

- Blume, Lawrence, David Easley, and Maureen O'Hara, 1994, Market statistics and technical analysis: The role of volume, Journal of Finance 49, 153–181.

- Brock, William, Josef Lakonishok, and Blake LeBaron, 1992, Simple technical trading rules and the stochastic properties of stock returns, Journal of Finance 47, 1731–1764.

- Brown, David P., and Robert H. Jennings, 1989, On technical analysis, Review of Financial Studies 2, 527–551.

- Chen, Jou-Fan, Wei-Lun Chen, Chun-Ping Huang, Szu-Hao Huang, and An-Pin Chen, 2016, Financial time-series data analysis using deep convolutional neural networks, in 2016 7th International Conference on Cloud Computing and Big Data (CCBD), 87–92 (IEEE).

- Cohen, Naftali, Tucker Balch, and Manuela Veloso, 2020, Trading via image classification, Proceedings of the First ACM International Conference on AI in Finance 1–6.

- Cont, Rama, 2005, Long-range dependence in financial markets, in Jacques Lévy-Véhel and Evelyne Lutton, eds., Fractals in Engineering, 159–179 (Springer, London).

- Detzel, Andrew, Hong Liu, Jack Strauss, Guofu Zhou, and Yingzi Zhu, 2020, Learning and predictability via technical analysis: Evidence from bitcoin and stocks with hard-to-value fundamentals, Financial Management 50, 107–137.

- Dobrev, Dobrislav, 2007, Capturing volatility from large price moves: Generalized range theory and applications, Working paper, Department of Finance, Kellogg School, Northwestern University.

- Fama, Eugene F., and Kenneth R. French, 1988, Dividend yields and expected stock returns, Journal of Financial Economics 22, 3–25.

- Fama, Eugene F., and Kenneth R. French, 1993, Common risk factors in the returns on stocks and bonds, Journal of Financial Economics 33, 3–56.

- Frazzini, Andrea, Ronen Israel, and Tobias J. Moskowitz, 2018, Trading costs, Working paper, Yale University.

- Glorot, Xavier, and Yoshua Bengio, 2010, Understanding the difficulty of training deep feedforward neural networks, in Teh, Yee Whye and Titterington, Mike, eds., Proceedings of the Thirteenth International Conference on Artificial Intelligence and Statistics, 249–256 (JMLR Workshop and Conference Proceedings).

- Goodfellow, Ian, Yoshua Bengio, and Aaron Courville, 2016, Deep Learning (MIT Press, Boston, MA).

- Grundy, Bruce D., and Maureen McNichols, 1989, Trade and the revelation of information through prices and direct disclosure, Review of Financial Studies 2, 495–526.

- Gu, Shihao, Bryan Kelly, and Dacheng Xiu, 2020, Empirical asset pricing via machine learning, Review of Financial Studies 33, 2223–2273.

- Han, Yufeng, Guofu Zhou, and Yingzi Zhu, 2016, A trend factor: Any economic gains from using information over investment horizons?, Journal of Financial Economics 122, 352–375.

- Hoseinzade, Ehsan, and Saman Haratizadeh, 2019, CNNPRED: CNN-based stock market prediction using a diverse set of variables, Expert Systems with Applications 129, 273–285.

- Hu, Guosheng, Yuxin Hu, Kai Yang, Zehao Yu, Flood Sung, Zhihong Zhang, Fei Xie, Jianguo Liu, Neil Robertson, Timpathy Hospedales, and Qiangwei Miemie, 2018, Deep stock representation learning: From candlestick charts to investment decisions, in 2018 IEEE International Conference on Acoustics, Speech and Signal Processing (ICASSP), 2706–2710 (IEEE).

- Ioffe, Sergey, and Christian Szegedy, 2015, Batch normalization: Accelerating deep network training by reducing internal covariate shift, in Proceedings of the 32nd International Conference on International Conference on Machine Learning 37, 448–456.

- Jegadeesh, Narasimhan, and Sheridan Titman, 1993, Returns to buying winners and selling losers: Implications for stock market efficiency, Journal of Finance 48, 65–91.

- Jensen, Theis Ingerslev, Bryan T. Kelly, and Lasse Heje Pedersen, 2022, Is there a replication crisis in finance?, Journal of Finance (forthcoming).

- Ke, Zheng Tracy, Bryan T. Kelly, and Dacheng Xiu, 2021, Predicting returns with text data, Technical report, National Bureau of Economic Research.

- Kelly, Bryan, and Seth Pruitt, 2013, Market expectations in the cross-section of present values, Journal of Finance 68, 1721–1756.

- Kim, Taewook, and Ha Young Kim, 2019, Forecasting stock prices with a feature fusion LSTM-CNN model using different representations of the same data, PloS One 14, e0212320.

- Kingma, Diederik P., and Jimmy L. Ba, 2014, Adam: A method for stochastic optimization, in Proceedings of the 3rd International Conference on Learning Representations (ICLR).

- Lee, Jinho, Raehyun Kim, Yookyung Koh, and Jaewoo Kang, 2019, Global stock market prediction based on stock chart images using deep q-network, IEEE Access 7, 167260–167277.

10.1109/ACCESS.2019.2953542 Google Scholar

- Liu, Yang, Guofu Zhou, and Yingzi Zhu, 2020, Maximizing the Sharpe ratio: A genetic programming approach, Working paper, Tsinghua University.

- Lo, Andrew W., and Jasmina Hasanhodzic, 2009, The Heretics of Finance: Conversations with Leading Practitioners of Technical Analysis (Bloomberg Press, New York, NY).

- Lo, Andrew W., Harry Mamaysky, and Jiang Wang, 2000, Foundations of technical analysis: Computational algorithms, statistical inference, and empirical implementation, Journal of Finance 55, 1705–1765.

- Maas, Andrew L., Awni Y. Hannun, and Andrew Y. Ng, 2013, Rectifier nonlinearities improve neural network acoustic models, in Proceedings of the 30th International Conference on Machine Learning 28, 3.

- Mandelbrot, Benoit B., 2013, Fractals and Scaling in Finance: Discontinuity, Concentration, Risk (Springer Science & Business Media, Springer New York, NY).

- Menkhoff, Lukas, 2010, The use of technical analysis by fund managers: International evidence, Journal of Banking & Finance 34, 2573–2586.

- Murphy, John J., 1999, Technical Analysis of the Financial Markets: A Comprehensive Guide to Trading Methods and Applications (New York Institute of Finance. New York).

- Murray, Scott, Houping Xiao, and Yusen Xia, 2021, Charting by machines, Working paper, Georgia State University.

- Neely, Christopher J., David E. Rapack, Jun Tu, and Guofu Zhou, 2014, Forecasting the equity risk premia: The role of technical indicators, Management Science 60, 1772–1791.

- Pan, Sinno Jialin, and Qiang Yang, 2009, A survey on transfer learning, IEEE Transactions on Knowledge and Data Engineering 22, 1345–1359.

- Parkinson, Michael, 1980, The extreme value method for estimating the variance of the rate of return, Journal of Business 53, 61–65.

- Schwert, G. William, 2003, Chapter 15 anomalies and market efficiency, in Handbook of the Economics of Finance 1, 939–974 (Elsevier).

- Simonyan, Karen, and Andrew Zisserman, 2015, Very Deep Convolutional Networks for Large-Scale Image Recognition, in Proceedings of the International Conference on Learning Representations (ICLR).

- Srivastava, Nitish, Geoffrey Hinton, Alex Krizhevsky, Ilya Sutskever, and Ruslan Salakhutdinov, 2014, Dropout: A simple way to prevent neural networks from overfitting, Journal of Machine Learning Research 15, 1929–1958.

- Sullivan, Ryan, Allan Timmermann, and Halbert White, 1999, Data-snooping, technical trading rule performance, and the bootstrap, Journal of Finance 54, 1647–1691.

- Zeiler, Matthew D., and Rob Fergus, 2014, Visualizing and understanding convolutional networks, in David Fleet, Tomas Pajdla, Bernt Schiele, and Tinne Tuytelaars, eds., European Conference on Computer Vision, 818–833 (Springer, Cham).

- Zhu, Yingzi, and Guofu Zhou, 2009, Technical analysis: An asset allocation perspective on the use of moving averages, Journal of Financial Economics 92, 519–544.