Unexpected management forecasts and future stock returns

Abstract

This study investigates the effect of managerial discretion regarding initial earnings forecasts on future stock returns for Japanese firms. We estimate the unexpected portion of initial management earnings forecasts (“unexpected forecasts”) based on the findings of fundamental analysis research and define it as a proxy for forecast management. Using this measure, we find that firms with higher unexpected forecasts are related to negative abnormal returns over the subsequent 12 months. By contrast, the expected portion of earnings forecasts is not related to future abnormal returns. These results suggest that the market tends to appropriately price the credible portion of management forecasts, while overpricing the less credible portion. Further analysis reveals that the relationship between unexpected forecasts and future returns is (1) distinct from accruals anomaly, notably (2) in the 6-month return window, (3) in the first half of the sample period (especially in 2005 and 2006), (4) in extreme unexpected forecast news and (5) in a poor information environment. This study extends the literature by focusing on a more desirable research setting in Japan, compared to other studies, to explore management forecasts and present new implications for the market pricing of management earnings forecasts.

1 INTRODUCTION

Many studies document that management earnings forecasts are useful for stock market investors (Ajinkya & Gift, 1984; Frost, 1997; Hutton et al., 2003; Jennings, 1987; Patell, 1976; Penman, 1980; Rogers & Stocken, 2005; Skinner, 1994; Waymire, 1984). Some also reveal that management forecasts are systematically upwardly biased, suggesting that managers may be incentivized to bias their initial earnings forecasts (Iwasaki et al., 2023; Kato et al., 2009; Rogers & Stocken, 2005). This study investigates the effect of managerial discretion over initial earnings forecasts on future stock return. In other words, we investigate whether investors can see through forecast management at the initial forecast announcement date.

We use a new measure to evaluate the forecast management at the forecast announcement date drawn from Iwasaki et al. (2023) and Kitagawa and Shuto (2021). They develop a prediction model based on the findings of fundamental analysis research (Abarbanell & Bushee, 1997; Lev & Thiagarajan, 1993) to decompose the forecast change in earnings by managers (“forecast innovations”)1 into expected and unexpected portions (“expected forecasts” and “unexpected forecasts,” respectively). We adopt unexpected forecasts as the proxy for the forecast management, and examine whether stock investors fully anticipate the implications of forecast management.

We use a sample of Japanese firms because their reporting practice for management forecasts has features that are useful to our study (Iwasaki et al., 2023; Kato et al., 2009). First, most listed firms report point management forecasts conforming with the recommendations of the Tokyo Stock Exchange (TSE). Second, listed companies are obliged to report their main accounting earnings for the current year and their earnings forecasts for these items for the next year simultaneously. These factors are expected to mitigate sample selection bias and measurement error of the variables, which provides a useful setting to test our hypothesis.

This study seeks to better understand the economic consequences of bias in management earnings forecasts. Market participants use management forecast announcements, especially in Japan, as a crucial source of latest information. For example, previous studies reveal that stock price reactions around the announcement date are more pronounced for forecast earnings than for actual earnings (Conroy et al., 1998; Darrough & Harris, 1991). Recent studies document that forecast-based earnings benchmarks at the earnings announcement, that is, forecast innovations, have incremental information content beyond actual earnings surprise measures around the announcement date (Asano, 2009; Iwasaki et al., 2023; Kato et al., 2009).

The significant economic consequences may induce Japanese managers to manage their earnings forecasts. Iwasaki et al. (2023) adopt unexpected forecasts as a proxy for forecast management and provide evidence that Japanese firm managers are likely to manage their earnings forecasts to obtain higher stock returns on the earnings announcement date.2 Moreover, Iwasaki et al. (2023) find that firms with upward forecast management are more likely to miss their earnings forecasts at fiscal year-end and to revise their forecasts downward to meet their earnings forecasts during the same period. These findings imply that management earnings forecasts containing a high unexpected portion are less credible than those containing a low unexpected portion. Despite the practical importance of management earnings forecasts as a significant source of decision making, research on how unexpected forecast management affects future stock performance is scarce. Ng et al. (2013) analyze management forecasts under voluntary disclosure in the United States and provide evidence that more credible forecasts are associated with a larger reaction around management forecasts and a smaller post-management forecast drift, suggesting that the credibility of management forecasts can remedy the market's mispricing of management forecasts. However, the relationship between the credibility of management forecasts and future stock returns in situations in which the former are extensively disclosed, such as in Japan, remains unclear. Exploring the relationship between management forecast bias and future stock price could enhance the understanding of stock market efficiency and help investors use management earnings forecasts more efficiently.

Thus, this study investigates whether investors fully comprehend the implications of unexpected forecasts for the credibility of management earnings forecasts. Specifically, we examine the relationship between unexpected forecasts and future returns. We predict that investors have difficulty in evaluating the credibility of management forecasts because these depend heavily on firms’ private information. Hence, we hypothesize that investors naively fail to anticipate the lower credibility of higher unexpected forecasts (i.e., overpriced unexpected forecasts) at the initial forecast announcement dates, and thus, a negative relationship between unexpected forecasts and future abnormal stock returns will occur.

Our hedge-portfolio test, which comprises a portfolio long in firms in the most negative decile and short in firms in the most positive decile of unexpected forecasts, yields an abnormal return of 5.5% over 12 months. By contrast, we find that a hedge-portfolio test based on expected forecasts does not yield significant positive abnormal returns over 12 months. We conduct regression analysis and find that unexpected forecasts are negatively associated with future returns. These results suggest that the market tends to appropriately price the credible portion of management forecasts while overpricing the less credible portion.

This study includes several additional analyses to verify the validity of our results. First, we investigate whether the relationship between unexpected forecasts and future returns is distinct from an accruals anomaly (Collins & Hribar, 2000; Richardson et al., 2005; Sloan, 1996; Xie, 2001). The theoretical background of the relationship between unexpected forecasts and future returns is similar to that of a discretionary accruals anomaly. This is because both are caused by managerial discretion that results in a bias in earnings. Importantly, the Japanese listed firms report realized earnings and management forecast simultaneously, suggesting that the measurement periods of discretionary accruals and unexpected forecast anomalies are the same. Therefore, our main findings may be explained with reference to the accruals anomaly. After controlling for discretionary accruals, we find that unexpected forecasts are negatively associated with future returns suggesting that the mentioned anomalies are distinct.

Second, we focus on an alternative explanation for our results based on risk pricing in efficient markets by investigating abnormal stock returns over the short window around subsequent announcements of management forecast revisions. Our results reveal a significant positive relationship between unexpected forecasts and short-window returns around subsequent forecast revision announcement dates. This implies that abnormal stock returns earned through a trading strategy based on unexpected forecasts are less likely to be caused by incorrectly measured risk.

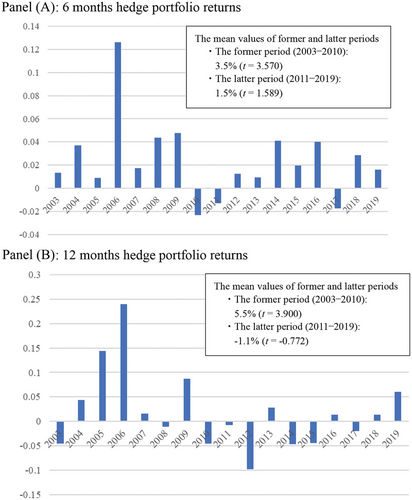

Third, we provide a deeper understanding of the mispricing hypothesis. Specifically, the unexpected forecasts anomaly is observed only in the subsamples with low sophisticated investors (i.e., institutional and foreign investors) ownership. Moreover, the unexpected forecasts anomaly is more distinct in the first half of the sample period (especially in 2005 and 2006) compared to the second half, suggesting the existence of the learning effect. These are consistent with market mispricing.

Fourth, we investigate the relationship between unexpected forecasts and future outcomes and find that firms with higher unexpected forecasts are more likely to miss their earnings forecasts. Accordingly, our argument that earnings forecasts containing higher unexpected forecasts are less credible is generally validated. Finally, we provide some evidence through additional analyses. First, we find no significant relationship between Ng et al.’s (2013) measure of unexpected forecasts and future returns. Second, we examine the effect of outliers and find that extreme unexpected forecast news increases investor mispricing. Third, the good information environment attenuates investors’ mispricing of unexpected forecasts. Fourth, we confirm that our results are robust to the standard error bias highlighted by Chen et al. (2023). Finally, our results are robust to controlling for insider ownership and scale effects.

This study contributes to the literature in several ways. First, we reveal the economic consequences of unexpected forecasts management. Previous studies demonstrate that while management forecasts have information contents (Kato et al., 2009), managers opportunistically report their earnings forecasts and their forecast management is related to subsequent forecast revisions and errors (Iwasaki et al., 2023). We extend these studies by showing that investors do not fully understand the implications of forecast management and price corrections occur after the issuance of initial earnings forecasts.

We extend Ng et al.’s (2013) research by focusing on a more desirable research setting in Japan and present different implications for the market pricing of management earnings forecasts. In contrast to Ng et al. (2013), who focus on US firms with voluntary disclosure of management forecasts, we focus on the Japanese setting, in which managerial forecast earnings are almost compulsorily disclosed. When firms that disclose managerial forecasts in the United States have unique characteristics (e.g., strong incentives to disclose high-quality information or an excellent information environment), interpreting the results becomes difficult owing to the problem of self-selection bias (see Section 2 for details). Ng et al. (2013) establish that the market underreacts more to less credible forecasts, while we provide evidence suggesting that the market in Japan overprices more to unexpected (less reliable) forecasts at the announcement and results in a subsequent correction. In other words, it implies that while the US market can determine the credibility of management forecasts at the announcement to a certain degree, the Japanese market cannot accurately discern the credibility of management forecasts. The reason for these different results may be that, in addition to the differences in institutional backgrounds between the United States and Japan, we directly estimate the unexpected portion of management earnings forecasts. Ng et al. (2013) use several proxy variables for management, but do not directly estimate the unexpected portion of management forecasts. Thus, investors may not see through the unexpected forecasts appropriately.

Second, our study contributes to the literature on fundamental analysis. Existing literature documents that the fundamental signals available from financial statements are related to future earnings and stock returns (Abarbanell & Bushee, 1997, 1998; Mohanram, 2005; Ou & Penman, 1989; Piotroski, 2000; Wahlen & Wieland, 2011). We extend these studies by providing further evidence that unexpected management forecasts estimated using the fundamental signals presented in Abarbanell and Bushee (1997, 1998) are also useful for predicting future returns.

Finally, we reveal that the relationship between unexpected forecasts and future returns is not explained by the accruals anomaly. More importantly, we demonstrate the usefulness of the investing strategy based on unexpected forecasts and (discretionary) accruals. Studies reveal the efficacy of combining two investing strategies such as book-to-market ratio and F-score (Piotroski, 2000; Piotroski & So, 2012), momentum and F-score (Ahmed & Safdar, 2018; Chen et al., 2016), sales growth and F-score (Ahmed & Safdar, 2017), F-score or G-score (Mohanram, 2005) and V/P ratio (Frankel & Lee, 1998; Li & Mohanram, 2019). In line with these studies, we demonstrate that an investing strategy based on unexpected forecasts and (discretionary) accruals earns larger returns than an individual strategy.

The remainder of this paper is organized as follows. Section 2 summarizes the literature and develops our research hypotheses. Section 3 explains the variable measurements used and the research design for testing our hypotheses. Section 4 outlines the sample selection procedure and describes the descriptive statistics. Section 5 reports the empirical results of the relationship between unexpected forecasts and future performance. Section 6 summarizes the results of the additional analyses. Finally, Section 7 concludes with a summary.

2 HYPOTHESIS DEVELOPMENT

2.1 Management forecasts practice in Japan

-

Listed companies are expected to release point forecasts of annual earnings on each annual earnings announcement date and revisions of these forecasts on interim earnings announcement dates. Thus, managers provide initial forecasts for year t when year t – 1 earnings are announced, and revisions (including confirmations) when interim earnings are announced.

-

Managers are expected to provide forecasts for sales, operating income, earnings before extraordinary items and taxes, net income, earnings per share and dividend per share.

-

Forecasts must be updated if there are “significant” revisions in management estimates, defined as either changes in sales estimates of 10% (or more), or in earnings estimates of 30% (or more; the “Significance Rule”), or both. In contrast to the initial forecasts encouraged by the stock exchange listing rules, these revisions are required under the Act (Securities Listing Regulations, Rule 405, Paragraphs 1 and 3).

These management earnings forecast practices in Japan differ from those in the United States and offer a useful research setting for our analysis. First, management forecast disclosure is effectively mandated in Japan (Kato et al., 2009; Iwasaki et al., 2023). Although management forecasts expected by the TSE comprise a voluntary disclosure without legal backing, almost all firms provide such forecasts in accordance with the TSE's recommendation.3 Owing to the comprehensive availability of observables, studies using Japanese firms are free from self-selection bias (Ishida et al., 2021; Iwasaki et al., 2023; Kato et al., 2009). This is a clear difference from those examining US firms with voluntary disclosure of management forecasts and is a major benefit of focusing on Japanese firms.4

Second, listed companies are obliged to simultaneously report the main accounting items of the current year and the management forecasts of these items on annual earnings announcement dates. Hence, we can form all the portfolios for the hedge-portfolio strategy based on unexpected forecasts at the beginning of each fiscal year, which can reduce any bias caused by differences in issue dates.5

Finally, while many US firms tend to provide range-estimated forecasts, Japanese listed companies provide point-estimated forecasts.6,7 Some studies provide evidence that range forecasts can introduce a measurement error problem (Ciconte et al., 2014; Jensen & Plumlee, 2020).8 However, point-estimated forecasts in Japanese management forecasts practice do not introduce such bias. Thus, the Japanese system provides a useful setting in which to investigate the effects of management earnings forecasts on future stock returns.

2.2 Literature on the relationship between unexpected forecasts and future earnings

The credibility of management earnings forecasts has been a central concern in accounting research, because managers have an incentive to bias them (Rogers & Stocken, 2005). Several studies investigate the credibility of management earnings forecasts by identifying the determinants of their systematic bias (Frost, 1997; Kato et al., 2009; Ota, 2006; Rogers & Stocken, 2005). In general, they explore the determinants of earnings forecasts errors at fiscal year-end to evaluate the credibility of management earnings forecasts.9 Kasznik (1999) examines management earnings forecasts in terms of earnings management, and demonstrates that managers tend to use discretionary accruals and revise forecasts downward to meet their own forecast earnings.

Kato et al. (2009) and Iwasaki et al. (2023) are more relevant for our study because they focus on the initial management earnings forecasts for a sample of Japanese firms. Managers in Japanese firms are likely to have an incentive to manage their earnings forecasts because, as indicated by previous market-oriented research, market participants use management forecast announcements as a crucial source of new information. Several recent studies reveal that forecast innovations, the forecast-based earnings benchmark at the earnings announcement, contain incremental information content beyond actual earnings surprise measures around the announcement date (Asano, 2009; Iwasaki et al., 2023; Kato et al., 2009). Further, many studies provide evidence that stock price reactions around the announcement date are more pronounced for forecast earnings than for actual earnings (Conroy et al., 1998; Darrough & Harris, 1991). Finally, an analysis based on Ohlson's (2001) valuation framework shows that management forecasts have the highest correlation with and incremental explanatory power for stock prices (Ota, 2010). These results suggest that management earnings forecasts have higher information content than actual annual earnings in the Japanese stock market and may induce Japanese managers to manage their earnings forecasts.10

Consistent with this view, Kato et al. (2009) suggest that initial management earnings forecasts for a fiscal year are systematically upward biased, and managers revise their forecasts downward during the fiscal year to meet their forecasts. Iwasaki et al. (2023) measure the unexpected portion of initial management forecasts and reveal that managers control their initial earnings forecasts to meet forecast innovations. Iwasaki et al. (2023) also document that firms with higher unexpected forecasts tend to revise their forecasts downward after issuing initial forecasts.

2.3 Hypothesis on the relationship between unexpected forecasts and future returns

We extend previous studies showing that firms with higher unexpected forecasts are more likely to miss their forecasts and revise them downward (Iwasaki et al., 2023). We examine whether markets fully understand the implications of such behavior for the credibility of management earnings forecasts. Many studies have indicated that management earnings forecasts are positively associated with current stock returns, attributable to the ability of earnings forecasts to summarize value relevant information (Ajinkya & Gift, 1984; Frost, 1997; Hutton et al., 2003; Jennings, 1987; Patell, 1976; Penman, 1980; Rogers & Stocken, 2005; Skinner, 1994; Waymire, 1984). Regarding Japanese firms, some studies have revealed that stock price reactions around announcement dates are more pronounced for management earnings forecasts for year t + 1 than for actual annual earnings for year t. That is, management earnings forecasts have higher information content than actual annual earnings around the announcement date in the Japanese stock market (Conroy et al., 1998; Darrough & Harris, 1991; Ota, 2010). Furthermore, Kato et al. (2009) indicate that forecast innovations are associated with announcement period stock returns after controlling for both an earnings surprise and a dividend surprise measure. Finally, forecast revisions subsequent to the initial forecasts also have a significantly positive association with announcement period stock returns, indicating that the revisions’ announcements can surprise investors (Gotoh, 1997; Kato et al., 2009). Taken together, these results suggest that management earnings forecasts have information content because they influence stock prices.

However, the effect of management earnings forecasts on future returns has been largely ignored. Ng et al. (2013), who examine the effect of the credibility of management forecasts on post-management forecasts drift in return, are an exception.11 In particular, they document an underreaction to management forecasts news at the announcement and a significant post-management forecasts drift in return. They also find that more credible forecasts are associated with a larger reaction around the management forecasts and a smaller post-management forecast drift in return. The results suggest that the market overly discounts less credible forecasts, resulting in a greater underreaction and a subsequent correction. In other words, this implies that the market can determine the credibility of management forecasts at the announcement to a certain degree.

Although Ng et al. (2013) present interesting evidence, as already noted, it may contain problems associated with focusing on management forecasts, which is a voluntary disclosure. For example, the results may be difficult to interpret if there is a characteristic that firms issuing management forecasts have incentive to provide higher quality financial reporting. Therefore, the relationship between the credibility of management forecasts and future stock returns is not fully explored.

We can assume two contrary predictions about the consequences of unexpected forecasts. If investors anticipate the implication of unexpected forecasts for the credibility of management earnings forecasts, we can predict that these are not associated with future abnormal returns. In other words, managers would not be able to raise stock prices by discretionarily increasing earnings forecasts. This is because investors are likely to properly discount low-quality earnings forecasts. However, if investors naively fail to understand the implications of the lower credibility of unexpected forecasts, these forecasts will have a negative association with future abnormal returns. Specifically, if investors naively ignore the current unexpected forecasts expected to cause forecast errors and revisions, they will be surprised by bad performance announcements in subsequent periods, leading to negative abnormal returns in later periods.

Considering Japan's institutional background, we expect the latter explanation (mispricing hypothesis) to be valid. First, the disclosure of management forecasts is effectively mandated in Japan and is a crucial source of information for investors (Conroy et al., 1998; Darrough & Harris, 1991; Ota, 2010). Therefore, managers have a strong incentive to manipulate their earnings forecasts. However, even though disclosure is semi-mandatory, management forecasts are not audited. Furthermore, previous studies argue that litigation costs in Japan are lower than those in the United States, which induces managers of Japanese firms to conduct forecast management more aggressively (Iwasaki et al., 2023; Kato et al., 2009). Therefore, while there are regulations that encourage the disclosure of management forecasts, there is no institutional system that guarantees the reliability of management earnings forecasts.

Second, analysts’ earnings forecasts can help explain the objectivity of management forecasts, but there are differences in the information environment for analysts between Japan and the United States. Compared to the US market, analyst coverage of firms is relatively low in Japan, and analyst forecasts are not issued as often as in the United States (Nara & Noma, 2013a). There is also evidence that Japanese investors respond more to management forecasts than to analysts’ forecasts (Ota, 2010). In addition, previous studies on Japanese firms provide evidence that analysts revise their own forecasts in line with management forecasts when they are released (Nara & Noma, 2013b; Ota & Kondo, 2011). Therefore, there are relatively few indices to evaluate the objectivity of management forecasts in Japan.

Finally, the mispricing hypothesis is similar to the theoretical explanation of the accruals anomaly (Collins & Hribar, 2000; Richardson et al., 2005; Sloan, 1996; Xie, 2001). Studies reveal that investors overestimate the persistence of accruals that are components of actual earnings and, thus, overprice these accruals. In addition to evidence from the US market, studies indicate that the accruals anomaly exists in the Japanese stock market (Kubota et al., 2010; Leippold & Lohre, 2012; Pincus et al., 2007).12 Given the evidence of accrual mispricing in the Japanese stock market, we predict that the mispricing hypothesis will also apply to the relationship between unexpected forecasts and future abnormal returns. This is because unexpected management for initial forecasts is less perceptible and more difficult for investors to detect than earnings management. Investors may be able to detect earnings management by analyzing accounting items in financial statements, but it will be more difficult for them to see through the forecasts management because these depend heavily on a firm's private information. Thus, we predict a negative relationship between unexpected forecasts and future returns and propose the following hypothesis:

Hypothesis 1.: Unexpected forecasts are negatively related to future returns.

3 RESEARCH DESIGN

3.1 Variable measurement

where

CEARNt = (net income for year t – net income for year t – 1)/total assets at the end of year t – 1. CHGEARNt-1 = (net income for year t – 1 – net income for year t – 2)/total assets at the end of year t – 1. AB fundamental signalst-1 = fundamental signals for the current fiscal year t proposed by Lev and Thiagarajan (1993) and Abarbanell and Bushee (1997). Detailed definitions of the variables are summarized in the Appendix. HISTBIASt-1 = 2-year average of the absolute value of the forecast error based on initial forecast. The forecast error based on initial forecast for year t – 1 = (actual earnings for year t – 1 – management earnings forecast released at the same time as actual earnings for year t – 2)/total assets at the end of year t – 1. ABSERRORt-1 = absolute value of the forecast error based on last forecasts. The forecast error based on last forecast for year t – 1 = (actual earnings for year t – 1 – the latest management forecasts for year t – 1)/total assets at the end of year t – 1. NUMREVt-1 = number of revisions during year t – 1. BONDt-1 = 10-year government bond yield for year t – 1. CHGGDPt-1 = annual growth rate of nominal GDP for year t – 1.

Our estimation model is based primarily on the first-order serial correlation model for changes in annual earnings in accordance with the findings of previous studies on earnings persistence (Bernard & Thomas, 1990; Brown & Kennelly, 1972; Freeman & Tse, 1989). Thus, we include the current change in net income (CHGEARNt) as an independent variable.15

Furthermore, we include nine fundamental signals variables empirically supported by previous fundamental analysis research (Abarbanell & Bushee, 1997; Lev & Thiagarajan, 1993) to improve the model's explanatory power. The fundamental signals include changes in inventory (INVt-1), accounts receivables (ARt-1), capital expenditures (CAPXt-1), gross margin (GMt-1), selling and administrative expenses (S&At-1), effective tax rate (ETRt-1), total accruals (CTACt-1),16 audit qualification dummy (AQt-1) and sales revenue per employee (LFt-1). Detailed definitions of each fundamental signal are provided in the Appendix. Lev and Thiagarajan (1993) indicate that these signals are significantly associated with contemporaneous stock returns, whereas Abarbanell and Bushee (1997) demonstrate that the association between signals and contemporaneous returns can be explained by their ability to predict future earnings. Following Lev and Thiagarajan (1993) and Abarbanell and Bushee (1997), fundamental signals variables are defined as having a negative association with future performance. Thus, these variables are expected to have a negative association with CEARNt.17

Furthermore, we control for two factors: manager bias and future macroeconomic expectations. First, we use the 2-year average of the absolute value of the forecast error based on initial forecast (HISTBIASt-1) to capture the historical manager forecast bias. Second, we add the absolute value of the forecast error on last forecasts (ABSERRORt-1) and the number of revisions (NUMREVt-1) as control variables. Next, we add the 10-year government bond yield (BONDt-1) to control for future macroeconomic expectations. Finally, we add the annual growth rate of nominal GDP (CHGGDPt-1) as a proxy for future GDP change.

FIt for year t is measured by the management forecasts for year t + 1 less the actual earnings for year t. Both EFt and FIt are divided by total assets at the end of year t – 1. A larger UFt implies more upward forecast management.21

3.2 Forecast management and future returns

To test our hypothesis, we first conduct an analysis using a hedge-portfolio test method commonly used for testing mispricing of accounting information (Frankel & Lee, 1998; Sloan, 1996; Xie, 2001). Specifically, we group firms into portfolio deciles each year based on their ranking of unexpected forecasts and form a hedge portfolio that takes a long position in the most negative unexpected forecasts decile and a short position in the most positive. We investigate the hedge portfolio returns beginning 4 months after the fiscal year-end and running to the 6th and 12th month for evidence of price correction.22 Hedge portfolio returns are calculated using 6- and 12-month size-adjusted buy-and-hold returns, as defined below. If investors overprice unexpected forecasts in the portfolio formation year, as our hypothesis suggests, the hedge portfolio returns in subsequent years will be positive because of investors’ delayed price response to information about the credibility of management forecasts.

where

BHAR6mt+1 (BHAR12mt+1) = size-adjusted abnormal return calculated as the firms’ buy-and-hold return beginning at the start of the 4 months after the fiscal year-end t and ending at the end of the third month after the interim (fiscal) year-end t + 1, minus the buy-and-hold return on a size-matched portfolio over the same period. UFt = forecast innovation (FIt) minus expected forecasts (EFt). FIt = (management forecasts for year t + 1 minus actual net income for year t)/total assets at the end of year t – 1. EFt = expected forecasts/total assets at the end of year t – 1. AB fundamental signalst = fundamental signals for current fiscal year t proposed by Lev and Thiagarajan (1993) and Abarbanell and Bushee (1997). Carhart four factorst = risk factors for current fiscal year t proposed by Carhart (1997).

Our primary concern with the independent variable is the unexpected forecasts (UFt), as described in Subsection 3.1.23 The negative coefficient of UFt signifies that investors do not fully understand and overestimate the credibility of unexpected forecasts, consistent with our hypothesis. Conversely, if investors anticipate the implication of unexpected forecasts for the credibility of management forecasts, we expect that UFt is not significantly associated with BHAR6mt+1 and BHAR12mt+1. Furthermore, to examine the effect of expected forecasts on future stock returns, we include EFt as an independent variable and predict that there is no significant association between EFt and BHAR6mt+1 and BHAR12mt+1.

Moreover, we control for several variables that explain future firm performance. First, we include nine fundamental signals for the current fiscal year t (AB fundamental signalst), as defined in Subsection 3.1. (INVt, ARt, CAPXt, GMt, S&At, ETRt, CTACt, AQt and LFt). As previously described, these variables are expected to have a negative association with future earnings. Thus, we expect that all these variables will be negatively related to future forecast errors and revisions.

Furthermore, we control for Carhart's (1997) risk factors (Carhart four factorst) of market beta (BETAt), firm size (SIZEt), book-to-market ratio (BMt) and momentum effect (MOMENTt). BETAt is calculated with a market model using monthly returns over the 60-month period ending in the current fiscal year t. SIZEt is the natural log of the market value of equity at the end of year t, and BMt corresponds to the book value of equity at the end of year t divided by the market value of equity at the end of year t. MOMENTt is the monthly buy-and-hold stock return over fiscal year t. These variables are expected to represent unknown risk factors and are positively correlated to future expected returns (Carhart, 1997; Fama & French, 1993). The expected signs of the coefficients on BETAt, BMt and MOMENTt are positive, and SIZEt is negative. Finally, we control for year- and industry-fixed effects.

4 SAMPLE SELECTION AND DESCRIPTIVE STATISTICS

4.1 Sample selection procedure

Our sample selection procedure is summarized in Table 1. The necessary data on financial statements, management forecasts and stock price are all obtained from the Nikkei NEEDS Financial QUEST database. After excluding financial institutions (banks, securities companies, insurance companies and credit and leasing financial institutions), we identify listed companies that report consolidated financial statements for the calendar years 2003 to 2019. Our initial sample comprises 56,673 firm-year observations. For this sample period, we delete firm-year observations as follows: (1) whose fiscal year does not end in March, (2) those with changing fiscal year-ends, (3) with missing data needed to calculate forecast innovations, errors and revisions and (4) with missing financial statements and stock data needed for our analyses. These criteria yield a final sample size of 29,326 firm-year observations. The untabulated results reveal that about 99.6% of observations (56,472 of 56,673) in our initial sample include forecast data. This indicates that most Japanese firms issue forecast information, and is consistent with the findings of studies that have argued that Japanese forecasting practices are effectively mandated (Iwasaki et al., 2023; Kato et al., 2009).

| Criteria | Firm-years |

|---|---|

| Firm-years with data on consolidated financial statements during 2003−2019a | 56,673 |

| Less: | |

| Fiscal year does not end in March | (16,750) |

| Changing in accounting month within firm-years necessary for our analyses | (136) |

| Missing data for calculating forecast innovations, current and future forecast errors | (5221) |

| Missing financial statements and stock data necessary for our analyses | (5240) |

| Final sample | 29,326 |

- Note: The data necessary for this study are available from the Nikkei NEEDS Financial QUEST. The industry is based on the Nikkei industry classification code (Nikkei gyousyu chu-bunrui). The financial statements data are acquired from consolidated financial statements.

- a Excluding financial institutions (banks, securities companies and insurance companies) and other financial institutions (credit and leasing).

4.2 Descriptive statistics

Descriptive statistics for our sample are provided in Table 2. To avoid outlier effects, we winsorize all sequential variables at 1% and 99%. While the average of unexpected forecasts (UFt), the variable of our primary concern, is 0.015, the average of expected forecasts (EFt) is −0.006. The untabulated results reveal that the mean value of scaled management forecast is 0.033. That is, on average, approximately 45% of initial management earnings forecasts are composed of unexpected forecasts.

| Mean | p25 | P50 | P75 | SD | Skewness | Kurtosis | N | |

|---|---|---|---|---|---|---|---|---|

| BHAR6mt+1 | 0.007 | −0.125 | −0.015 | 0.104 | 0.218 | 1.378 | 7.898 | 29,326 |

| BHAR12mt+1 | −0.002 | −0.189 | −0.039 | 0.128 | 0.321 | 1.522 | 8.637 | 29,326 |

| FIt | 0.009 | −0.002 | 0.003 | 0.011 | 0.033 | 3.486 | 22.253 | 29,326 |

| UFt | 0.015 | −0.005 | 0.007 | 0.026 | 0.036 | 1.534 | 8.642 | 29,326 |

| EFt | −0.006 | −0.014 | −0.002 | 0.008 | 0.027 | −0.504 | 5.336 | 29,326 |

| INVt | 0.021 | −0.107 | 0.005 | 0.118 | 0.288 | 1.555 | 10.902 | 29,326 |

| ARt | −0.001 | −0.082 | −0.006 | 0.070 | 0.175 | 0.538 | 7.539 | 29,326 |

| CAPXt | −0.106 | −1.841 | 0.247 | 2.488 | 18.959 | −5.630 | 130.404 | 29,326 |

| GMt | −0.011 | −0.061 | −0.004 | 0.050 | 0.160 | −1.296 | 15.733 | 29,326 |

| S&At | −0.006 | −0.058 | −0.004 | 0.048 | 0.112 | −0.250 | 5.998 | 29,326 |

| ETRt | 0.003 | −0.001 | 0.000 | 0.002 | 0.016 | 3.358 | 26.549 | 29,326 |

| CTACt | 0.002 | −0.034 | 0.001 | 0.036 | 0.073 | 0.140 | 5.956 | 29,326 |

| AQt | 0.012 | 0.000 | 0.000 | 0.000 | 0.110 | 8.897 | 80.158 | 29,326 |

| LFt | −0.011 | −0.066 | −0.009 | 0.050 | 0.129 | −0.482 | 6.571 | 29,326 |

| BETAt | 9.976 | 8.726 | 9.773 | 11.028 | 1.696 | 0.507 | 2.874 | 29,326 |

| SIZEt | 1.280 | 0.704 | 1.107 | 1.658 | 0.806 | 1.457 | 6.408 | 29,326 |

| BMt | 0.011 | −0.200 | −0.036 | 0.147 | 0.363 | 1.795 | 9.998 | 29,326 |

| MOMENTt | 0.007 | −0.125 | −0.015 | 0.104 | 0.218 | 1.378 | 7.898 | 29,326 |

- Note: BHAR6mt+1 = Size-adjusted return calculated as the buy-and-hold return on the security (including dividends) for 6 months beginning at the start of the 4 months after fiscal year-end. BHAR12mt+1 = Size-adjusted return calculated as the buy-and-hold return on the security (including dividends) for 12 months beginning at the start of the 4 months after fiscal year-end. FIt = (management forecasts for year t + 1 minus actual net income for year t)/total assets at the end of year t – 1. UFt = forecast innovation (FIt) minus expected forecasts (EFt). FIt = (management forecasts for year t + 1 minus actual net income for year t)/total assets at the end of year t – 1. EFt = expected forecasts/total assets at the end of year t – 1. EFt = Expected forecasts/total assets at the end of year t – 1. INVt = Δ Inventory in year t – Δ Sales in year t. The variable is merchandise and finished goods when available, total inventory otherwise. ARt = Δ Accounts receivable in year t – Δ Sales in year t. The variable is accounts receivable when available, accounts and notes receivable otherwise. CAPXt = Δ Industry capital expenditure in year t – Δ Firm capital expenditure in year t. Industry capital expenditure = aggregating capital expenditure for all firms with the same the Nikkei medium classification industry code. Firm capital expenditure = change in gross property, plant and equipment for a firm. GMt = Δ Sales in year t – Δ Gross margin in year t. S&At = Δ Selling and administrative expenses in year t – Δ Sales in year t. ETRt = Average effective tax rate from year t – 4 to year t – 1 – effective tax rate in year t. Effective tax rate = income taxes/income before income taxes. Each variable is acquired from the parent-only financial statement. CTACt = (total accruals for year t minus total accruals for year t – 1)/total assets at the end of year t. Total accruals are calculated as follows. Total accruals = (change in current assets – change in cash and deposits) – (change in current liabilities – change in financing items) – (change in allowance for doubtful debts + change in provision for retirement benefits or provision for retirement allowance + change in provision for directors’ retirement benefits + change in other long-term provision + depreciation). Financing items = change in short-term loans payable + change in commercial papers + change in current portion of long-term loans payable + change in current portion of straight bonds and convertible bonds. AQt = Dummy variable set to 0 if auditor's opinion in year t is unqualified, and 1 if auditor's opinion is qualified, or other.

- LFt = (sales revenue per employee for year t – 1 – sales revenue per employee for year t)/sales revenue per employee for year t – 1. Sales revenue per employee = sales/the number of employees at year-end. BETAt = Historical beta calculated using monthly returns over the 60-month period ending at the current fiscal year-end t. SIZEt = Natural log of market value of equity at the end of year t. BMt = Book value of equity at the end of year t/market value of equity at the end of year t. MOMENTt = Monthly buy-and-hold stock return over fiscal year t. The definitions of all of the fundamental signals except for ETR and CTAC (i.e., INV, AR, CAPX, GM, S&A, AQ and LF) are taken from Lev and Thiagarajan (1993). The Δ operator represents a percentage change in the percentage change in the variable based on 2-year average expectation model, which is the same as that of previous studies (Abarbanell & Bushee, 1997; Lev & Thiagarajan, 1993). For example, ΔSales in year t = {Salest − E(Salest)}/E(Salest), where E(Salest) = (Salest-1 + Salest-2)/2. All other variables with Δ operator are calculated utilizing the same procedure.

The Pearson and Spearman rank-order correlation matrix among the variables used in our regression analyses is reported in Table 3. Consistent with our hypothesis, we find that UFt is significantly and negatively associated with BHAR6mt+1 and BHAR12mt+1. These results indicate that investors overprice unexpected forecasts and that firms with higher unexpected forecasts are more likely to earn lower future returns in year t + 1.

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) | (13) | (14) | (15) | (16) | (17) | (18) | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (1) BHAR6mt+1 | 0.66 | −0.04 | −0.02 | −0.02 | −0.01 | 0.02 | 0.01 | −0.01 | −0.01 | 0.01 | −0.01 | −0.04 | 0.00 | −0.03 | 0.01 | 0.04 | 0.01 | |

| (2) BHAR12mt+1 | 0.64 | −0.03 | −0.04 | 0.01 | −0.02 | 0.01 | 0.01 | 0.01 | −0.01 | 0.01 | −0.01 | −0.05 | 0.00 | −0.02 | 0.04 | 0.01 | −0.02 | |

| (3) FIt | −0.05 | −0.03 | 0.59 | 0.10 | 0.04 | 0.01 | −0.02 | 0.17 | 0.12 | 0.00 | −0.04 | 0.07 | 0.08 | 0.04 | −0.10 | −0.07 | −0.09 | |

| (4) UFt | −0.06 | −0.04 | 0.70 | −0.60 | 0.01 | −0.06 | 0.00 | 0.08 | 0.13 | 0.07 | −0.01 | 0.15 | 0.17 | −0.03 | −0.13 | 0.03 | 0.03 | |

| (5) EFt | 0.02 | 0.03 | 0.27 | −0.49 | 0.00 | 0.07 | −0.02 | 0.07 | −0.02 | −0.08 | −0.05 | −0.14 | −0.12 | 0.07 | 0.01 | −0.09 | −0.16 | |

| (6) INVt | −0.02 | −0.02 | 0.03 | 0.02 | 0.01 | 0.09 | 0.00 | 0.08 | 0.19 | −0.04 | 0.08 | −0.03 | 0.20 | 0.00 | 0.01 | 0.02 | −0.06 | |

| (7) ARt | 0.01 | 0.00 | −0.01 | −0.03 | 0.03 | 0.09 | 0.03 | −0.03 | 0.05 | −0.01 | 0.14 | −0.05 | 0.07 | −0.03 | 0.02 | −0.01 | 0.02 | |

| (8) CAPXt | 0.00 | 0.01 | 0.00 | 0.05 | −0.07 | 0.00 | −0.01 | −0.02 | −0.02 | 0.02 | 0.01 | −0.03 | −0.01 | 0.01 | 0.00 | −0.01 | 0.02 | |

| (9) GMt | −0.01 | 0.01 | 0.19 | 0.11 | 0.08 | 0.05 | −0.05 | −0.02 | −0.15 | −0.06 | −0.06 | −0.01 | 0.04 | −0.01 | −0.05 | 0.09 | −0.23 | |

| (10) S&At | −0.02 | −0.01 | 0.15 | 0.17 | −0.06 | 0.17 | 0.07 | −0.01 | −0.05 | −0.06 | −0.05 | 0.02 | 0.53 | −0.04 | −0.05 | 0.12 | −0.18 | |

| (11) ETRt | 0.01 | 0.00 | 0.00 | 0.08 | −0.10 | −0.04 | −0.01 | 0.01 | −0.09 | −0.06 | 0.03 | 0.01 | −0.05 | 0.04 | −0.04 | 0.00 | 0.04 | |

| (12) CTACt | −0.01 | −0.02 | −0.06 | −0.01 | −0.06 | 0.09 | 0.14 | 0.01 | −0.09 | −0.06 | 0.06 | 0.00 | −0.03 | 0.01 | 0.01 | −0.02 | 0.04 | |

| (13) AQt | −0.03 | −0.04 | 0.07 | 0.18 | −0.15 | −0.02 | −0.04 | −0.01 | 0.00 | 0.02 | 0.03 | 0.00 | 0.00 | −0.01 | −0.02 | 0.01 | 0.01 | |

| (14) LFt | −0.01 | 0.00 | 0.07 | 0.18 | −0.15 | 0.18 | 0.11 | 0.00 | 0.09 | 0.55 | −0.06 | −0.04 | 0.00 | −0.03 | −0.05 | 0.12 | −0.16 | |

| (15) BETAt | 0.01 | 0.02 | 0.09 | 0.02 | 0.09 | 0.01 | −0.02 | 0.02 | −0.03 | −0.04 | 0.05 | 0.01 | −0.01 | −0.04 | 0.15 | −0.14 | 0.02 | |

| (16) SIZEt | −0.01 | 0.00 | −0.16 | −0.16 | 0.01 | 0.00 | 0.01 | 0.00 | −0.03 | −0.04 | −0.04 | 0.01 | −0.02 | −0.03 | 0.13 | −0.48 | 0.16 | |

| (17) BMt | 0.02 | 0.01 | −0.02 | 0.08 | −0.13 | −0.02 | −0.03 | −0.01 | 0.08 | 0.11 | −0.01 | −0.03 | 0.03 | 0.11 | −0.13 | −0.48 | −0.23 | |

| (18) MOMENTt | 0.00 | −0.03 | −0.10 | 0.01 | −0.13 | −0.03 | 0.03 | 0.03 | −0.22 | −0.17 | 0.06 | 0.05 | 0.01 | −0.13 | 0.09 | 0.13 | −0.22 |

- Note: Spearman (Pearson) correlations are above (below) the diagonal. BHAR6mt+1 = Size-adjusted return calculated as the buy-and-hold return on the security (including dividends) for 6 months beginning at the start of the 4 months after fiscal year-end. BHAR12mt+1 = Size-adjusted return calculated as the buy-and-hold return on the security (including dividends) for 12 months beginning at the start of the 4 months after fiscal year-end. FIt = (management forecasts for year t + 1 minus actual net income for year t)/total assets at the end of year t – 1. UFt = Forecast innovation (FIt) minus expected forecasts (EFt). FIt = (management forecasts for year t + 1 minus actual net income for year t)/total assets at the end of year t – 1. EFt = expected forecasts/total assets at the end of year t – 1. EFt = Expected forecasts/total assets at the end of year t – 1. INVt = Δ Inventory in year t – Δ Sales in year t. The variable is merchandise and finished goods when available, total inventory otherwise. ARt = Δ Accounts receivable in year t – Δ Sales in year t. The variable is accounts receivable when available, accounts and notes receivable otherwise. CAPXt = Δ Industry capital expenditure in year t – Δ Firm capital expenditure in year t. Industry capital expenditure = aggregating capital expenditure for all firms with the same Nikkei medium classification industry code. Firm capital expenditure = change in gross property, plant and equipment for a firm. GMt = Δ Sales in year t – Δ Gross margin in year t. S&At = Δ Selling and administrative expenses in year t – Δ Sales in year t. ETRt = Average effective tax rate from year t – 4 to year t – 1 – effective tax rate in year t. Effective tax rate = income taxes/income before income taxes. Each variable is acquired from the parent-only financial statement. CTACt = (total accruals for year t minus total accruals for year t – 1)/total assets at the end of year t. Total accruals are calculated as follows. Total accruals = (change in current assets – change in cash and deposits) – (change in current liabilities – change in financing items) – (change in allowance for doubtful debts + change in provision for retirement benefits or provision for retirement allowance + change in provision for directors’ retirement benefits + change in other long-term provision + depreciation). Financing items = change in short-term loans payable + change in commercial papers + change in current portion of long-term loans payable + change in current portion of straight bonds and convertible bonds. AQt = Dummy variable set to 0 if auditor's opinion in year t is unqualified, 1 if auditor's opinion is qualified or other. LFt = (sales revenue per employee for year t – 1 – sales revenue per employee for year t)/sales revenue per employee for year t – 1. Sales revenue per employee = sales/the number of employees at year-end. BETAt = Historical beta calculated using monthly returns over the 60-month period ending at the current fiscal year-end t. SIZEt = Natural log of market value of equity at the end of year t. BMt = Book value of equity at the end of year t/market value of equity at the end of year t. MOMENTt = Monthly buy-and-hold stock return over fiscal year t. The definitions of all of the fundamental signals except for ETR and CTAC (i.e., INV, AR, CAPX, GM, S&A, AQ and LF) are taken from Lev and Thiagarajan (1993). The Δ operator represents a percentage change in the percentage change in the variable based on 2-year average expectation model, which is the same as that of previous studies (Abarbanell & Bushee, 1997; Lev & Thiagarajan, 1993). For example, ΔSales in year t = {Salest − E(Salest)}/E(Salest), where E(Salest) = (Salest-1 + Salest-2)/2. All other variables with Δ operator are calculated utilizing the same procedure. Bold indicates statistically significant values at less than 0.1 level of significance using a two-tailed t-test.

5 MAIN RESULTS

5.1 Portfolio test

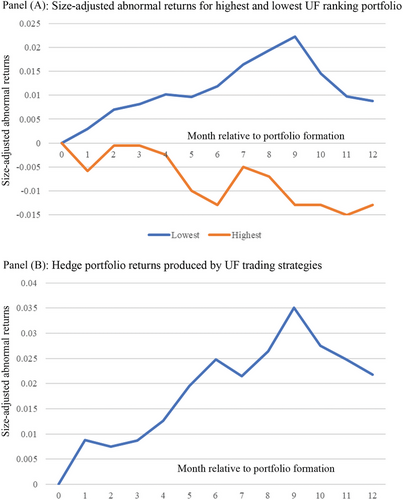

The average size-adjusted abnormal return for each unexpected forecasts decile and for the hedge portfolio based on UFt are summarized in Table 4. While the size-adjusted returns for the most positive unexpected forecasts decile are all negative in 6 (−0.013) and 12 months (−0.013); those for the most negative unexpected forecasts decile are all positive in 6 (0.012) and 12 months (0.009). The size-adjusted abnormal returns for the highest-minus-lowest hedge portfolio are 0.025 (t-value = 3.662) in 6 months and 0.022 (t-value = 2.152) in 12 months.24 These results are consistent with the market's overestimation of the credibility of unexpected forecasts and its overpricing in year t.

| Portfolio | Ranked by UF | Ranked by EF | ||

|---|---|---|---|---|

| Ranking | 6 months | 12 months | 6 months | 12 months |

| Lowest (–) | 0.012 | 0.009 | 0.003 | −0.013 |

| 2 | 0.012 | 0.001 | 0.010 | 0.001 |

| 3 | 0.007 | −0.007 | 0.002 | −0.007 |

| 4 | 0.010 | −0.007 | 0.015 | 0.002 |

| 5 | 0.014 | 0.005 | 0.008 | −0.002 |

| 6 | 0.008 | −0.004 | 0.011 | −0.004 |

| 7 | 0.009 | −0.011 | 0.008 | −0.001 |

| 8 | 0.005 | 0.000 | 0.013 | 0.009 |

| 9 | 0.011 | 0.005 | 0.006 | −0.005 |

| Highest (+) | −0.013 | −0.013 | −0.001 | −0.002 |

| Hedge | 0.025*** | 0.022** | 0.004 | −0.011 |

| (t-Value) | (3.662) | (2.152) | (0.585) | (−1.102) |

| N | 29,326 | 29,326 | 29,326 | 29,326 |

- Note: UFt = Forecast innovation (FIt) minus expected forecasts (EFt). FIt = (management forecasts for year t + 1 minus actual net income for year t)/total assets at the end of year t – 1. EFt = expected forecasts/total assets at the end of year t – 1. EFt = Expected forecasts/total assets at the end of year t – 1. Size-adjusted abnormal returns are calculated as the buy-and-hold return on the security (including dividends) beginning at the start of the 4 months after fiscal year-end t and ending at the end of the indicated months (i.e., 6 and 12) less the buy-and-hold return on a size-matched portfolio over the same period.

- *** and ** = Statistically significant at the 0.01 and 0.05 levels using a two-tailed t-test, respectively.

To compare these results, we form a hedge portfolio based on expected forecasts (EFt). The size-adjusted abnormal returns for the highest-minus-lowest hedge portfolio ranked by EFt are 0.004 (t-value = 0.585) and −0.011 (t-value = −1.102). Thus, the size-adjusted abnormal returns for the expected forecasts-based hedge portfolio are not significantly positive, inconsistent with the results of the hedge portfolio based on unexpected forecasts.

To further illustrate the pattern of returns in relation to forecast management, the size-adjusted abnormal returns over 12 months starting 4 months after the fiscal year-end for the highest and lowest portfolios are plotted in Panel A of Figure 1 and the hedge portfolio in Panel B. In Panel A, we observe a generally upward (downward) trend in abnormal returns for the lowest (highest) portfolio. The graph in Panel B reveals that the hedge portfolio returns are consistently positive throughout the analytical period, with a clear upward trend. Note that in Panel B, the hedge portfolio returns have a rapid upward trend until month 10 (i.e., 0.035), but they drop significantly thereafter. This is because realized earnings are announced in month 10 in the Kessan Tanshin as described in footnote 22. This graphical evidence conforms to the statistical findings in Table 4.

5.2 Regression analyses

The results of the regression analysis of Model (4) are reported in Table 5. We find that unexpected forecasts are significantly and negatively associated with size-adjusted abnormal returns in year t + 1. The coefficients of UFt, −0.313 and −0.357, are significantly negative (t-values = −2.600 and −1.858), when the dependent variable is BHAR6mt+1 and BHAR12mt+1, respectively. However, the coefficient of EFt is not significant, implying that expected forecasts are not significantly associated with the size-adjusted abnormal return in year t + 1 and, thus, the market does not misprice expected forecasts.

| Model (4) | |||||

|---|---|---|---|---|---|

| Dependent variable | BHAR6mt+1 | BHAR12mt+1 | |||

| Independent variables | Exp. sign | Coefficient | t-Value | Coefficient | t-Value |

| Constant | (?) | −0.007 | (−0.177) | −0.113** | (−2.023) |

| UFt | (–) | −0.313*** | (−2.600) | −0.357* | (−1.858) |

| EFt | (?) | −0.140 | (−0.823) | 0.000 | (−0.001) |

| INVt | (–) | −0.011 | (−1.115) | −0.020 | (−1.524) |

| ARt | (–) | 0.020 | (1.219) | 0.021 | (0.910) |

| CAPXt | (–) | −0.000 | (−0.421) | −0.000 | (−0.129) |

| GMt | (–) | 0.006 | (0.271) | 0.033 | (1.446) |

| S&At | (–) | −0.009 | (−0.273) | −0.009 | (−0.277) |

| ETRt | (–) | 0.081 | (0.870) | 0.060 | (0.618) |

| CTACt | (–) | −0.035* | (−1.785) | −0.057 | (−1.639) |

| AQt | (–) | −0.006 | (−1.515) | 0.009* | (1.973) |

| LFt | (–) | 0.005 | (0.205) | 0.003 | (0.086) |

| BETAt | (+) | 0.007 | (0.249) | 0.009 | (0.371) |

| SIZEt | (–) | −0.002 | (−0.852) | 0.004 | (1.375) |

| BMt | (+) | 0.013*** | (2.947) | 0.028*** | (3.773) |

| MOMENTt | (+) | 0.003 | (0.179) | −0.015 | (−1.113) |

| Year dummies | Yes | Yes | |||

| Industry dummies | Yes | Yes | |||

| Adj. R2 | 0.018 | 0.031 | |||

| N | 29,326 | 29,326 | |||

- Note: BHAR6mt+1 = Size-adjusted return calculated as the buy-and-hold return on the security (including dividends) for 6 months beginning at the start of the 4 months after fiscal year-end. BHAR12mt+1 = Size-adjusted return calculated as the buy-and-hold return on the security (including dividends) for 12 months beginning at the start of the 4 months after fiscal year-end. FIt = (management forecasts for year t + 1 minus actual net income for year t)/total assets at the end of year t – 1. UFt = Forecast innovation (FIt) minus expected forecasts (EFt). FIt = (management forecasts for year t + 1 minus actual net income for year t)/total assets at the end of year t – 1. EFt = expected forecasts/total assets at the end of year t – 1. EFt = Expected forecasts/total assets at the end of year t – 1. INVt = Δ Inventory in year t – Δ Sales in year t. The Inventory variable is merchandise and finished goods when available, total inventory otherwise. ARt = Δ Accounts receivable in year t – Δ Sales in year t. The variable is accounts receivable when available, accounts and notes receivable otherwise. CAPXt = Δ Industry capital expenditure in year t – Δ Firm capital expenditure in year t. Industry capital expenditure = aggregating capital expenditure for all firms with the same the Nikkei medium classification industry code. Firm capital expenditure = change in gross property, plant and equipment for a firm. GMt = Δ Sales in year t – Δ Gross margin in year t. S&At = Δ Selling and administrative expenses in year t – Δ Sales in year t. ETRt = Average effective tax rate from year t – 4 to year t – 1 – effective tax rate in year t. Effective tax rate = income taxes/income before income taxes. Each variable is acquired from the parent-only financial statement. CTACt = (total accruals for year t minus total accruals for year t – 1)/total assets at the end of year t. Total accruals are calculated as follows. Total accruals = (change in current assets – change in cash and deposits) – (change in current liabilities – change in financing items) – (change in allowance for doubtful debts + change in provision for retirement benefits or provision for retirement allowance + change in provision for directors’ retirement benefits + change in other long-term provision + depreciation). Financing items = change in short-term loans payable + change in commercial papers + change in current portion of long-term loans payable + change in current portion of straight bonds and convertible bonds. AQt = Dummy variable set to 0 if auditor's opinion in year t is unqualified, 1 if auditor's opinion is qualified or other. LFt = (sales revenue per employee for year t – 1 – sales revenue per employee for year t)/sales revenue per employee for year t – 1. Sales revenue per employee = sales/the number of employees at year-end. BETAt = Historical beta calculated using monthly returns over the 60-month period ending at the current fiscal year-end t. SIZEt = Natural log of market value of equity at the end of year t. BMt = Book value of equity at the end of year t/market value of equity at the end of year t. MOMENTt = Monthly buy-and-hold stock return over fiscal year t. The definitions of all of the fundamental signals except for ETR and CTAC (i.e., INV, AR, CAPX, GM, S&A, AQ and LF) are taken from Lev and Thiagarajan (1993). The Δ operator represents a percentage change in the percentage change in the variable based on 2-year average expectation model, which is the same as that of previous studies (Abarbanell & Bushee, 1997; Lev & Thiagarajan, 1993). For example, ΔSales in year t = {Salest − E(Salest)}/E(Salest), where E(Salest) = (Salest-1 + Salest-2)/2. All other variables with Δ operator are calculated as the same procedure. All variables are winsorized at 1% by year. t-Statistics are corrected for heteroskedasticity, and cross-sectional and time-series correlation using a two-way cluster at the firm and year level proposed by Petersen (2009).

- ***, ** and * = Statistically significant at the 0.01, 0.05 and 0.1 levels using a two-tailed t-test, respectively.

With respect to the control variable, INVt, CAPXt, S&At, CTACt, AQt, BETAt and BMt have their expected signs, but only CTACt, AQt and BMt are statistically significant at the conventional levels. These findings are consistent with the portfolio results in Table 4. Overall, the results in this section suggest that investors cannot fully anticipate the implications of unexpected forecasts for their credibility and thus overprice unexpected forecasts in the portfolio formation year, consistent with our hypothesis.

6 ADDITIONAL ANALYSES

6.1 Relationship between unexpected forecasts and discretionary accruals anomalies

We investigate whether the relationship between unexpected forecasts and future returns is distinct from the accruals anomaly. The theoretical background on the relationship between them is similar to that on the accruals anomaly because both are caused by managerial discretion and bias. As previously stated, Iwasaki et al. (2023) reveal that managers in Japan engage in forecast management in considering stock market reaction. Consistent with their findings, several studies demonstrate that managers issue more optimistic forecasts when they have incentive to inflate stock prices (e.g., stock issuance) (Lang & Lundholm, 2000; Rogers & Stocken, 2005). Meanwhile, other studies provide evidence that managers also conduct earnings management in response to stock market reaction. For example, managers are likely to engage in upward (downward) earnings management before stock issuance (e.g., Erickson & Wang, 1999; Rangan, 1998; Teoh et al., 1998). These results suggest that managerial opportunism affects both the reversal of accruals and credibility of management forecasts, causing both accruals and unexpected forecasts anomalies in our study.

Otherwise, if managers are optimistic (pessimistic) about future prospects, both management forecasts and accruals will be positive (negative). For example, managers will report smaller loan loss provisions (therefore more positive accruals) and more positive earnings forecasts when they have optimistic future prospects and vice versa. Consistent with this argument, Gong et al. (2009) and Xu (2010) provide evidence that management earnings forecasts are optimistic (pessimistic) when accruals are more positive (negative). This suggests that managerial bias also affects both the reversal of accruals and credibility of management forecasts, causing accruals and unexpected forecasts anomalies. Importantly, the Japanese listed firms report realized earnings and management forecast simultaneously, suggesting that the measurement periods of accruals and unexpected forecast anomalies are the same. Therefore, these arguments lead to the prediction that our main findings may simply reflect accruals anomaly.

The regression results of Model (5) are reported in Table 6. The coefficients of DACt are significantly negative, indicating the existence of discretionary accruals anomaly in the Japanese stock market.26 Importantly, the coefficients of UFt in both columns remain significantly negative even after controlling for the effect of DACt. Therefore, we conclude that the relationship between unexpected forecasts and the subsequent size-adjusted abnormal returns is not fully explained by the effects of the accruals anomaly.

| Model (5) | |||||

|---|---|---|---|---|---|

| Dependent variable | BHAR6mt+1 | BHAR12mt+1 | |||

| Independent variables | Exp. sign | Coefficient | t-Value | Coefficient | t-Value |

| Constant | (?) | −0.007 | (−0.171) | −0.112 | (−2.015) |

| UFt | (–) | −0.324*** | (−2.648) | −0.374* | (−1.928) |

| EFt | (?) | −0.135 | (−0.802) | 0.008 | (0.032) |

| DACt | (–) | −0.112** | (−2.490) | −0.176*** | (−2.629) |

| INVt | (–) | −0.009 | (−0.870) | −0.017 | (−1.287) |

| ARt | (–) | 0.025 | (1.419) | 0.029 | (1.177) |

| CAPXt | (–) | −0.000 | (−0.413) | −0.000 | (−0.122) |

| GMt | (–) | 0.006 | (0.284) | 0.034 | (1.466) |

| S&At | (–) | −0.011 | (−0.360) | −0.014 | (−0.403) |

| ETRt | (–) | 0.076 | (0.824) | 0.052 | (0.556) |

| CTACt | (–) | −0.006 | (−0.248) | −0.011 | (−0.361) |

| AQt | (–) | −0.006 | (−1.464) | 0.010** | (2.094) |

| LFt | (–) | 0.002 | (0.095) | −0.001 | (−0.021) |

| BETAt | (+) | 0.007 | (0.252) | 0.009 | (0.377) |

| SIZEt | (–) | −0.002 | (−0.862) | 0.004 | (1.359) |

| BMt | (+) | 0.013*** | (2.931) | 0.028*** | (3.760) |

| MOMENTt | (+) | 0.002 | (0.144) | −0.016 | (−1.190) |

| Year dummies | Yes | Yes | |||

| Industry dummies | Yes | Yes | |||

| Adj. R2 | 0.018 | 0.031 | |||

| N | 29,326 | 29,326 | |||

- Note: BHAR6mt+1 = Size-adjusted return calculated as the buy-and-hold return on the security (including dividends) for 6 months beginning at the start of the 4 months after fiscal year-end. BHAR12mt+1 = Size-adjusted return calculated as the buy-and-hold return on the security (including dividends) for 12 months beginning at the start of the 4 months after fiscal year-end. FIt = (management forecasts for year t + 1 minus actual net income for year t)/total assets at the end of year t – 1. UFt = Forecast innovation (FIt) minus expected forecasts (EFt). FIt = (management forecasts for year t + 1 minus actual net income for year t)/total assets at the end of year t – 1. EFt = expected forecasts/total assets at the end of year t – 1. EFt = Expected forecasts/total assets at the end of year t – 1. DACt = Discretionary accruals for year t estimated using the model in Dechow et al. (1995). INVt = Δ Inventory in year t – Δ Sales in year t. The Inventory variable is merchandise and finished goods when available, total inventory otherwise. ARt = Δ Accounts receivable in year t – Δ Sales in year t. The variable is accounts receivable when available, accounts and notes receivable otherwise. CAPXt = Δ Industry capital expenditure in year t – Δ Firm capital expenditure in year t. Industry capital expenditure = aggregating capital expenditure for all firms with the same the Nikkei medium classification industry code. Firm capital expenditure = change in gross property, plant and equipment for a firm. GMt = Δ Sales in year t – Δ Gross margin in year t. S&At = Δ Selling and administrative expenses in year t – Δ Sales in year t. ETRt = Average effective tax rate from year t – 4 to year t – 1 – effective tax rate in year t. Effective tax rate = income taxes/income before income taxes. Each variable is acquired from the parent-only financial statement. CTACt = (total accruals for year t minus total accruals for year t – 1)/total assets at the end of year t. Total accruals are calculated as follows. Total accruals = (change in current assets – change in cash and deposits) – (change in current liabilities – change in financing items) – (change in allowance for doubtful debts + change in provision for retirement benefits or provision for retirement allowance + change in provision for directors’ retirement benefits + change in other long-term provision + depreciation). Financing items = change in short-term loans payable + change in commercial papers + change in current portion of long-term loans payable + change in current portion of straight bonds and convertible bonds. AQt = Dummy variable set to 0 if auditor's opinion in year t is unqualified, 1 if auditor's opinion is qualified or other. LFt = (sales revenue per employee for year t – 1 – sales revenue per employee for year t)/sales revenue per employee for year t – 1. Sales revenue per employee = sales/the number of employees at year-end. BETAt = Historical beta calculated using monthly returns over the 60-month period ending at the current fiscal year-end t. SIZEt = Natural log of market value of equity at the end of year t. BMt = Book value of equity at the end of year t/market value of equity at the end of year t. MOMENTt = Monthly buy-and-hold stock return over fiscal year t. The definitions of all of the fundamental signals except for ETR and CTAC (i.e., INV, AR, CAPX, GM, S&A, AQ and LF) are taken from Lev and Thiagarajan (1993). The Δ operator represents a percentage change in the percentage change in the variable based on 2-year average expectation model, which is the same as that of previous studies (Abarbanell & Bushee, 1997; Lev & Thiagarajan, 1993). For example, ΔSales in year t = {Salest − E(Salest)}/E(Salest), where E(Salest) = (Salest-1 + Salest-2)/2. All other variables with Δ operator are calculated utilizing the same procedure. All variables are winsorized at 1% by year. t-Statistics are corrected for heteroskedasticity, and cross-sectional and time-series correlation using a two-way cluster at the firm and year level proposed by Petersen (2009).

- ***, ** and * = Statistically significant at the 0.01, 0.05 and 0.1 levels using a two-tailed t-test, respectively.

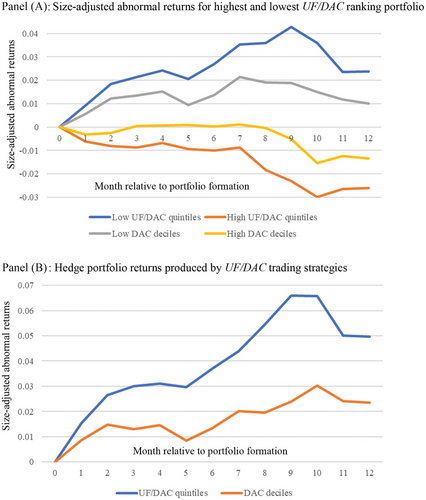

The size-adjusted abnormal returns produced by UF and DAC quintile portfolios are plotted in Figure 2. We also plot the abnormal returns by DAC decile portfolio (Xie, 2001) in comparison. Panel A reveals an upward (downward) trend in abnormal returns for the lowest (highest) UF and DAC quintile portfolio and Panel B shows that the hedge portfolio returns are consistently positive throughout the sample period.27 The abnormal returns by the UF and DAC portfolio are larger than those by the DAC decile portfolio. Specifically, the hedge portfolio returns by the UF and DAC portfolio earn 5.0% while those by the DAC decile portfolio earn 2.3%. This evidence is in line with the findings in Table 6.

6.2 Risk hypothesis

In this section, we conduct additional analyses (risk hypothesis) concerning the alternative explanations for our main findings. Our finding that unexpected forecasts are negatively associated with subsequent size-adjusted abnormal returns is consistent with our hypothesis (i.e., the mispricing hypothesis) that investors do not accurately measure the credibility of initial management forecasts and, thus, overprice unexpected forecasts. However, the efficient market hypothesis posits an alternative explanation based on the risk compensation notion that changes in the risk information contained in unexpected forecasts may cause the significant relationship between unexpected forecasts and future stock returns. To address this issue, we observe the market reaction to forecast revisions (FRRETt+1) by the UFt portfolio in Table 4, where, FRRETt+1 is the sum of size-adjusted buy-and-hold returns over the 3-day window (days from “0” to “+2”) surrounding management forecast revisions announced for year t + 1.28 The definition of the size-matched portfolio used to calculate the expected stock returns is the same as that described in Subsection 3.2. Firms that do not revise their forecasts during the period are excluded from the sample.29 As a result, our sample consists of 29,148 firm-year observations.

On the one hand, if investors overestimate the implications of unexpected forecasts for the credibility of management forecasts, the announcements of subsequent forecast revisions will be a surprise for investors and cause them to modify their misvaluations of the initial management forecasts. Therefore, under the mispricing hypothesis, we expect UFt to have a negative association with FRRETt+1. On the other, if the risk hypothesis is supported, we expect that UFt will not have a significant correlation with FRRETt+1.

The results are summarized in Table 7. Firms in a higher (lower) UFt portfolio experience lower (higher) abnormal returns around the forecast revision announcement day, which is consistent with the mispricing hypothesis. A comparative analysis of the magnitudes of the hedge portfolio returns in Tables 4 and 7 indicates that the abnormal returns earned by the hedge portfolio based on unexpected forecasts are concentrated in the days around the announcement of subsequent forecast revisions. Specifically, approximately 45.5% ( = 0.010/0.022) of the hedge portfolio return is clustered in 3 days, even though the announcement period windows employed in Table 7 contain less than 10% of the total trading days in Table 4. 30 These results are consistent with the mispricing hypothesis, rather than the risk hypothesis, presented in our main analysis.

| Portfolio | Ranked by UFt |

|---|---|

| Ranking | FRRET t+1 |

| Lowest (–) | 0.003 |

| 2 | 0.003 |

| 3 | 0.000 |

| 4 | 0.001 |

| 5 | 0.002 |

| 6 | −0.001 |

| 7 | −0.004 |

| 8 | −0.003 |

| 9 | −0.005 |

| Highest (+) | −0.007 |

| Hedge | 0.010* |

| (t-value) | (1.836) |

| N | 29,148 |

- Note: FRRETt+1 = Sum of the size-adjusted abnormal return around subsequent forecast revision announcement. Stock returns around the announcement are measured as the compounded stock returns earned over the 3-day window surrounding each announcement (days from “0” to “+2”) minus the compounded value-weighted return on a size-matched portfolio earned over the same window. UFt = Forecast innovation (FIt) minus expected forecasts (EFt). FIt = (management forecasts for year t + 1 minus actual net income for year t)/total assets at the end of year t – 1. EFt = expected forecasts/total assets at the end of year t – 1.

- * = Statistically significant at the 0.1 level using a two-tailed t-test.

6.3 Exploring the mispricing hypothesis

First, we investigate the effect of investor sophistication on the relationship between unexpected forecasts and future returns. If this relationship is caused by investor mispricing, it will be weaker for firms with a higher proportion of sophisticated investor ownership. For example, Collins et al. (2003) find that the accruals anomaly is weaker in firms with a higher level of institutional ownership. Therefore, we divide the sample into two subsamples based on the sophisticated investors ownership and re-estimate Model (4) for each subsample. Here, we define sophisticated investors ownership as the proportion of domestic institutional investor shareholdings (INSTt) and that of foreign investor shareholdings (FOREIGNt). We obtain the data on institutional and foreign ownership from the NEEDS-Cges (Corporate governance evaluation system) database of Nikkei Media Marketing, Inc.

The results are presented in Table 8. There is a significant association between unexpected forecasts and future returns only in the subsamples with low institutional and foreign investor shareholdings. This suggests that sophisticated investors make investment decisions considering unexpected management forecasts.

| Panel A: Low ownership subsample (below median) | |||||

|---|---|---|---|---|---|

| Model (4) | Model (4) | ||||

| Divided by INSTt | Divided by FOREIGNt | ||||

| Dependent variable | BHAR12mt+1 | BHAR12mt+1 | |||

| Independent variables | Exp. sign | Coefficient | t-Value | Coefficient | t-Value |

| Constant | (?) | −0.028 | (−0.883) | 0.000 | (0.016) |

| UFt | (–) | −0.362** | (−2.553) | −0.426*** | (−3.169) |

| EFt | (?) | 0.073 | (0.306) | 0.234 | (1.349) |

| Control variables | Yes | Yes | |||

| Year dummies | Yes | Yes | |||

| Industry dummies | Yes | Yes | |||

| Adj. R2 | 0.035 | 0.035 | |||

| N | 12,983 | 12,986 | |||

| Panel B: High ownership subsample (above median) | |||||

|---|---|---|---|---|---|

| Model (4) | Model (4) | ||||

| Divided by INSTt | Divided by FOREIGNt | ||||

| Dependent variable | BHAR12mt+1 | BHAR12mt+1 | |||

| Independent variables | Exp. sign | Coefficient | t-Value | Coefficient | t-Value |

| Constant | (?) | −0.119** | (−2.083) | 0.049 | (0.927) |

| UFt | (–) | −0.650 | (−1.562) | −0.533 | (−1.617) |

| EFt | (?) | 0.399 | (1.296) | 0.188 | (0.531) |

| Control variables | Yes | Yes | |||

| Year dummies | Yes | Yes | |||

| Industry dummies | Yes | Yes | |||

| Adj. R2 | 0.030 | 0.032 | |||

| N | 12,972 | 12,981 | |||