Strategic entry deterrence in the audit industry: Evidence from the merger of professional accounting bodies

Abstract

Studies show that incumbents reduce prices in response to higher entry threats in consumer industries. We provide new insights on the importance of an incumbent firm's reputation to the limit-pricing decision by examining a professional service industry where the supplier's reputation serves as an existing barrier. The recent staggered passage of mergers of three Canadian accounting certification bodies exogenously increases the probability of future entry to incumbent audit firms. Employing difference-in-differences analyses and a strict fixed-effects structure (client-firm, audit-firm, province and year-month fixed effects), we find that incumbent audit firms reduce audit fees in response to a higher entry threat induced by the merger. The microstructure of the audit industry provides further insights—non-Big-4 audit firms reduce fees after the merger, while Big-4 audit firms can withstand higher entry threats and do not adjust fees.

1 INTRODUCTION

New entrants to a market will increase competition, threatening and disrupting the operations of incumbent firms. Incumbents are thus unlikely to welcome new entrants. Instead, they will resort to various ways to either deter entry before it occurs or drive out entrants ex post. As a strategy to deter ex-ante entry, limit pricing where incumbents lower their preentry prices in response to an increase in entry threat gains support from early theoretical research (e.g., Bain, 1956) as well as later theoretical research incorporating information asymmetry (Milgrom & Roberts, 1982). Compared to theoretical work on limit pricing, empirical studies are less conclusive and relatively sparse with contradicting evidence from survey studies (Singh et al., 1998; Smiley, 1988), and the supporting evidence mostly concentrated in consumer goods industry such as airlines and cable TV industry (Goolsbee & Syverson, 2008; Savage & Wirth, 2005; Seamans, 2013). We provide new evidence from a professional service industry where we rely on a quasi-experiment to identify the entry threat.

Different from the consumer goods such as airlines and TV programs that consumers can directly derive utility from and compare, services such as independent audit services are mainly purchased for signaling quality and providing assurance. Given that the service requires significant expertise, the quality of the service is difficult to evaluate and compare.1 Therefore, the demand of the service relies on the supplier's reputation. It is thus not clear whether the limit pricing documented in consumer goods industries as an entry deterrence strategy will be adopted in a professional service industry.

Professional accountants working in audit firms provide assurance services on firms’ financial statements to investors in capital markets. Thus, the audit industry plays a vital role to firms, capital markets and the overall economy. Auditing requires expertise and thus the audit industry is regulated with a limited number of service providers licensed to operate in the market. Since the 1970s, regulators have been increasingly concerned that the high market concentration could give audit firms monopolistic or oligopolistic pricing powers over their clients. In light of this concern, the potential effects of entry threats on incumbent audit firms’ pricing are in itself a topic that warrants academic attention. In this paper, we investigate whether and when entry threats affect audit pricing using a quasi-experimental setting, where a profession-wide merger at the level of professional accounting bodies induced an exogenous increase in the expected future entries to incumbent audit firms.

The recent staggered approvals by the Canadian provincial legislations to merge Canada's three professional accounting bodies and their respective professional designation offer a unique quasi-experimental setting to identify an exogenous increase in the threat of entry. From 2012 to 2014, the three Canadian professional accounting bodies—the Chartered Accountants (CAs), the Certified Management Accountants (CMAs) and the Certified General Accountants (CGAs)—unified into a new designation, Chartered Professional Accountants (CPAs) (hereafter, the CPA merger). Before the CPA merger, CAs generally enjoyed the reserved privilege of public accounting to themselves. By unifying CAs with the other accounting bodies, the merger relaxes the restrictions to enter the public-accounting industry for two reasons. First, after the CPA merger, the candidacy to apply for public-accounting licenses is no longer restricted to CAs, rather it is extended to all candidates of the newly united CPA designation. Second, the merger harmonizes the certification requirements and thus results in a new requirement level that is lower than those previously for CAs.

Labor economics theory predicts that less restrictive occupational requirements attract more individuals to enter a regulated profession (Lott, 1987). Accordingly, we expect that the approval of the CPA merger leads to an expected increase in the number of future public accountants. An expected increase in the number of public accountants also translates into more qualified individuals who will become eligible to invest and open their own firms. Due to these potential impacts, the approval of the CPA merger may raise the probability of future entry and thus lead to an exogenous increase in the entry threat to the incumbent audit firms.2

Using a difference-in-differences design with client-firm, audit-firm, province and year-month fixed effects to exploit the staggered approval of the CPA merger, we examine whether and when (i.e., conditions under which) audit firms, facing an increased probability of future entries, will preemptively lower audit fees to deter potential entries.3 One audit firm can have multiple locations across Canadian provinces, and each firm location can have multiple engagement partners. The partners are required to be designated in their province. For a given auditor and client, only when the auditor's local province (i.e., the province in which her office resides) approves the merger, do we consider the auditor's submarket to be shocked with an increase in entry threats. The same auditor's submarkets in other provinces are used as controls. This alleviates the possibility that changes in fees relate to any specific auditor-firm-wide factors. In addition, even though the approval of the CPA merger increases entry threats to incumbent audit firms, it is unlikely to result in actual entries immediately. Thus, the audit-fee changes upon the merger approval are more likely to reflect audit firms’ preemptive strategies against potential entries than their reactive actions to actual entrants. The staggered-shock design also significantly reduces the likelihood of having a confounding event that explains the treatment effect (Bertrand & Mullainathan, 2003).

Incumbents, threatened by potential future entries, could either lower their prices from a previous monopolistic/oligopolistic level to signal a lower cost (Milgrom & Roberts, 1982) or increase their customer base (Klemperer, 1987) in order to deter entry. In the context of the audit industry, the market is oligopolistic with limited existing service providers and segmented into submarkets with differential entry barriers.4 Further, information is far from complete. The pricing strategy and the cost structure are complicated, as they vary by firms and even differ by engagements for the same partner at a given firm. This makes it difficult to gauge an incumbent firm's profitability. To the extent that some audit firms are threatened by an increase in the probability of new entrants due to the CPA merger, they will be more inclined to agree to fee concessions to preemptively deter entry. Consequently, we expect the CPA merger to lead to lower audit fees.

We further explore the segmented nature of the audit industry to understand the conditions under which the merger leads to significant fee reductions. First, we explore factors that can strengthen the credibility of the threat. We expect that incumbent audit firms in a submarket with high existing entry barriers find the merger to induce a less credible threat. For example, for the market of Big-4 auditors and large auditees where existing barriers are high due to the high requirement of reputation that can only be built over an extended period of time, it is unlikely that the threat induced by the CPA merger would reduce the existing entry barriers to a sufficiently low level to trigger new entrants. As these firms are more protected by the high level of existing entry barriers, there is little need to deter entry. Accordingly, we hypothesize that the fee reduction due to the merger will be mitigated either partially or completely by high entry barriers that make the threat less credible or not credible at all.

Second, we explore cross-sectional variations in the strength of the threat by exploiting institutional differences among Canadian provinces. Ex ante, we expect the shock to be stronger when there are more CMA and CGA members relative to the CA members sitting on the CPA governance boards (i.e., the (CMA + CGA)/CA ratio is higher).5 First, when there are more CMAs and CGAs in a province, we expect a larger increase in the candidate pool for public-accounting licenses.6 Second, the composition indicates the relative bargaining powers of the former CA, CMA and CGA bodies when setting future governing policies. With fewer CAs on the board, new policies are less likely to protect the CAs’ privilege over the CMAs and CGAs, in which case we expect the merger's effect on entry threats to be stronger. We thus predict the fee reduction to be larger in provinces in which fewer CAs relative to CMAs and CGAs are on the CPA governance board.

Our findings support the hypotheses. First, we find that the approval of the CPA merger on average leads to a 7% ($4,191) reduction in audit fees, consistent with at least some incumbent audit firms agreeing to fee concessions in order to deter potential entrants. We further find that the reduction in fees is not significant for the submarket with Big-4 auditors, and is significantly mitigated for submarkets with large clients. In addition, our results show that the effect of the CPA merger is significant only when the increase in entry threats is expected to be greater in provinces in which CMAs and CGAs have a greater presence relative to the CAs on the governing board. Notably, the cross-sectional analyses on the threat intensity provide validation for the use of the CPA-merger setting to identify entry threats. We further provide additional validation of our setting using Big-4 auditors and large clients as placebo tests. In additional analyses, we explore potential mechanisms for audit firms’ strategic entry deterrence and find that the reduction in fees is significant only for nonindustry leaders (and is not significant for industry leaders). This result indicates that auditees’ bargaining power and auditors’ concession are likely mechanisms. Finally, we do not find audit quality changes in response to the approval of the CPA merger.

This paper offers several contributions. First, this study contributes to the economics and management literature on entry deterrence (e.g., Bresnahan & Reiss, 1991; Goolsbee & Syverson, 2008; McCann & Vroom, 2010; Parise, 2018; Prince & Simon, 2015; Sigfried & Evans, 1994; Simon, 2005; Whinston & Collins, 1992). Prior research shows that the incumbent firms in the airline industry reduce prices, lower service quality and extend debt maturity to longer periods in response to the rise of a credible entry threat (Goolsbee & Syverson, 2008; Parise, 2018; Prince & Simon., 2015). Seamans (2012) further finds that incumbent firms in cable television use limit pricing in a way consistent with the degree of information asymmetry as predicted in Milgrom and Roberts (1982). The existing evidence is mostly concentrated in consumer industries. Different from prior research, we examine entry deterrence in an important professional service industry where information asymmetry is high but the demand of the service is highly dependent on a supplier's reputation.

Second, our evidence adds to the debate about the competitiveness of the audit industry that has long since been a concern for regulators. Although we have accumulated some knowledge about the effect of audit-firm exits, due to mergers, from both anecdotal evidence (e.g., Arthur Andersen's bankruptcy) and archival research (e.g., Ding & Jia, 2012), little is understood about the threat of potential entrants. The CPA mergers across different provinces offer a unique quasi-experiment to study how an exogenous increase in entry threats causally affects audit pricing. In addition, the audit industry in Canada is segmented into multiple audit submarkets with differential entry barriers, and hence, provides a useful setting to study when preemptive entry deterrence arises as an equilibrium choice.

Finally, the empirical evidence in this paper is of potential interest to regulators and rule-setting agencies in the context of the recent US regulatory reform to harmonize cross-state occupational licensing rules. Although our setting is about the unification of licensing requirements across job functions and the policy debate in the United States is about the unification of licensing requirements across states, the underlying similarities between the two lie in an increase in labor mobility and a relaxation of occupation restrictions. Both these factors are identified among the most important deterrents to foster competition (Council of Economic Advisors, 2016).7 We believe that our study provides timely and relevant evidence on effects of the unification of licensing requirements on professional service fees.8

2 EMPIRICAL SETTING

2.1 Audit industry and audit fees

The determination of audit fees has been extensively studied in the literature.9 Simunic (1980) provides a theoretical framework and initial empirical evidence on the competitiveness of the audit industry. Simunic (1980) develops a model of the production function for audit firms, which explains the relation of audit fees to production costs both in a competitive market and in a monopolistic market. He uses the submarket for small companies, where competition is assumed to prevail, as a benchmark to examine the competitiveness of the submarket for large companies. He concludes that “the hypothesis that price competition prevails throughout the market for audits of publicly-held companies cannot be rejected” (Simunic, 1980, p. 187). More recently, van Raak et al. (2020) investigate how audit-market structure (both market concentration and client mobility) affects audit quality and audit pricing.

Our study provides evidence on how fees in the audit industry respond to an increase in entry threats, which constitutes an important dimension of the competitive nature of the audit industry. Unlike prior studies, the unique setting enables us to identify an exogenous change in the expectation of new entries before any actual changes, and to examine whether audit firms change their pricing strategy preemptively. This adds to the debate in the literature on whether preemptive entry deterrence would arise as an equilibrium outcome (Farrell & Klemperer, 2007; Klemperer, 1987; Milgrom & Roberts, 1982; Seamans, 2013; Selten, 1978). Moreover, the setting allows us to evaluate the level of existing entry barriers in different submarkets by studying whether audit fees in different submarkets react differently to the increase in entry threats. Such evaluations provide new insights about the competitiveness of different submarkets to the literature as well as to regulators.

Labor input is an important factor in the audit industry. Different frictions in the labor market have been studied in prior literature. Aobdia et al. (2017) study the impact of immigrants on the labor supply and find that foreign-born individuals fill in the gaps in the native-born audit labor market, suggesting that immigrants complement the native-born labor supply in the audit industry.

Our study differs from prior work in the following ways. Instead of focusing on a specific occupational rule, we focus on a change in the licensing-granting bodies (i.e., their merger). Hence, we emphasize exogenous changes in entry threats (that are emphasized in the economics literature), whereas prior studies focus on realized changes in labor markets. We are also the first to document the impact of the merger of self-regulatory accounting governing bodies as well as their relative political powers on audit fees.

2.2 The merger of the Canadian professional accounting bodies and their respective designations

The recent provincially legislated unification of multiple Canadian accounting designations has significantly changed the public-accounting licensing landscape in Canada. Historically, the accounting profession in Canada consisted of three professional bodies, each with their own professional designations and certification requirements—the CAs, CMAs and CGAs. The certification requirements for CAs were much more closely aligned with the requirements to obtain public-accounting licenses than those for CMAs and CGAs.10

In contrast, the CGA and CMA designations had less restrictive education requirements and lower training requirements, and were generally regarded as insufficient to practice public accounting, and thus were more likely to be chosen by candidates who would accept a smaller set of career options in order to incur lower costs. In summary, the premerger certification requirements led to a situation where CMA and CGA members were less likely to obtain public licenses, and practically reserved the privilege of practicing public accounting for the CA designation.11

The CPA merger was initiated by the governing bodies of the CAs, CMAs and CGAs with a purpose to harmonize different certification requirements and to promote the accounting profession. In October 2011, Quebec was the first province to release an update on the CPA merger, followed by British Columbia, Alberta, Newfound and Labrador, Saskatchewan, Manitoba, Nova Scotia, Yukon, Prince Edward Island and lastly Ontario. By the end of 2014, all provincial governments had officially approved the CPA merger and amended provincial legislations in their jurisdictions (see Table 1 for approval dates).12 There are two points worth mentioning. First, a province (e.g., Ontario) has full independence over its merging decision, and thus, the province's merger decision is independent of other provinces. Thus, ex ante, there is significant uncertainty regarding whether and when the merger would be passed, as well as which accounting bodies would join the merger. In fact, several provinces had been back and forth on the merger proposal. For example, the merger in Quebec in 2012 was the fifth attempt since 1973 that Quebec's accounting profession tried to merge forces.13 As another example, the CGA and CMA in Ontario announced that they were withdrawing from merger discussions in that province on May 15, 2012.14 Thus, it was difficult to anticipate the voting results or approval dates. Second, the fact that the merger was ultimately approved does not mean that it was the existing CAs who favored the change. In fact, a designation's (i.e., CA's, CMA's and CGA's) decision to join the merger is made through members’ votes, and thus, independent of other designations. Alberta CAs initially voted no on the merger. Therefore, the result is more likely to represent a compromise between different parties rather than a unanimous decision. The exception is Quebec, in which case the merger decision was voted by the board of directors (rather than members) of each of the three designations.

| Province | Province abbreviation | Approval date |

|---|---|---|

| Quebec | QC | May 16, 2012 |

| Saskatchewan | SK | June 6, 2013 |

| Newfoundland and Labrador | NL | June 21, 2013 |

| Ontario | ON | June 27, 2013 |

| Alberta | AB | June 28, 2013 |

| British Columbia | BC | September 25, 2013 |

| Manitoba | MB | January 30, 2014 |

| New Brunswick | NB | April 23, 2014 |

| Nova Scotia | NS | May 24, 2014 |

- Note: This table presents the approval dates of the CPA merger in Canadian provinces for firms in our final sample. A detailed timeline of the key developments in Canadian provinces is presented separately in Table A1.

After the merger, the unified CPA designation also has a public-accounting stream and a nonpublic-accounting stream, similar to the structure of the previous CA designation. The certification requirements for the unified CPA designation are similar to those of the previous CA designation in that the public-accounting stream is closely aligned with public-accounting licensures, and the nonpublic-accounting stream has a similar education requirement with more flexible training options. The merger mandated all registered and prospective CA, CMA and CGA candidates who had not yet received their designations, to be moved to the CPA program, thus making the CMA and CGA candidates equally eligible as the CA candidates to enroll in the CPA public-accounting stream.15

The staggered passage of the CPA unification act leads to the expectation of a gradual growth in qualified public accountants for two reasons. First, the CPA merger extends the candidacy to enter the public-accounting stream from a restricted group of CAs to all candidates of the unified CPA designation. It leads to higher enrollment in the CPA public-accounting stream, and thus increased the number of eligible candidates who can automatically qualify for public licenses when receiving professional designations. Second, a key mandate of the merger is to harmonize the differences in certification requirements among CA, CGA and CMA designations. The unification process results in a certification requirement level that is below that of the previous CA designation. For instance, the minimum university average grade requirement reduces to 65% under the new CPA program from the previous CA requirement of 70% in Ontario.16 Further, certain in-class training, which was the main form of the CA education, is replaced by online education.

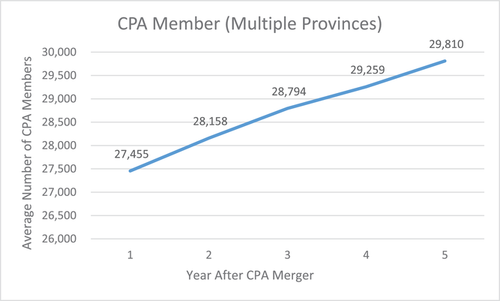

According to labor economics theory, less restrictive licensing requirements will draw more individuals to enter the profession. To validate this assumption, we collect statistics from CPA annual reports released by provincial CPA associations. Figure 1 shows that the number of CPA members on average increased by 9% within five years after the CPA merger. According to staff members at CPA Ontario, the number of students who choose the public-accounting stream in the new CPA program exceeds the number of CA students before the merger date and the examination pass rate is higher. These individuals will eventually qualify as public accountants, which reduce salaries to a new equilibrium where the expected return of becoming a public accountant equals the cost of obtaining the license (Lott, 1987). Therefore, we expect that the approval of the CPA merger leads to an expected increase in the number of qualified public accountants.

The number of CPA members after the CPA merger

Note: This figure presents the average number of CPA members by the year after the CPA merger. We collect the CPA membership information from provincial CPA associations’ annual reports to the extent that this information is disclosed; data are only available for Alberta, British Columbia, Manitoba, Newfoundland and Labrador, Ontario, Prince Edward Island and Quebec. We note that the number of CPA members on average increased by 9% within five years after the CPA merger

With more qualified public accountants, more individuals will also be eligible to invest and open their own firms. Although the newly designated CPAs may not be able to immediately start firms to serve large clients, existing CPAs, especially those working at the management and senior management levels, would find it more feasible to start their own practices. Because the CPA merger will increase the supply of newly designated individuals, it thus attracts both new and more experienced CPA holders to start new businesses. The expectation of an increase in the supply of public accountants and audit firms finds support among practitioners and in statistics. A report issued by CPA Canada in 2012 identified the expected establishment of more audit firms in Canada as a major consequence of the merger. According to the statistics from CPA British Columbia's annual reports, the number of public licensed firms increases after the merger.17

In summary, we argue that the approval of the CPA merger increases the expected probability that new firms will enter the audit industry, and thus raises the level of entry threats to incumbent audit firms, especially non-Big-4 firms and those who audit smaller clients.

The unique setting ensures that the change is primarily driven by entry threats in expectation rather than an actual increase in the number of public accountants or audit firms. Any real effect of the CPA merger on audit firms (e.g., audit quality, supply of public accountants, etc.) would likely take effect in the long run, as the total time required for an individual to fully complete CPA licensing process is 4.5 years (i.e., 2 years of coursework plus 30 months of practice experience). Yet, young professionals’ decisions to start new firms are part of their career planning, and thus, fostered early in their career. Thus, it is optimal for audit firms to react quickly to strengthen existing client relations through fee concession and to signal lower profits to potential entries. Therefore, we consider the CPA merger to be a relatively clean setting to examine the causal impacts of entry threats.

3 HYPOTHESES DEVELOPMENT

When threatened by potential entries, incumbent firms can preemptively lower their prices and thus depress short-term profitability in an attempt to deter new entrants and secure higher profits in the future. With complete information, preemptive actions are not subgame perfect and are thus irrational (Selten, 1978). However, when information asymmetry exists, incumbent firms can signal lower profitability to potential entrants by lowering prices preemptively, so preemptive entry deterrence arises as an equilibrium strategy (Milgrom & Roberts, 1982; Seamans, 2013).

- H1: The approval of the CPA merger leads to lower audit fees.

- H2: The approval of the CPA merger has a less pronounced effect on audit fees in submarkets where the credibility of entry threats is ex ante lower (due to high entry barriers).

Next, we explore how the predicted fee reduction varies with the extent to which the CPA merger exogenously increases entry threats. Ex ante, we expect the shock to be stronger in provinces where it is more likely that new entrants will materialize. We expect the new entrants and thus the entry threats to be stronger when more CMA and CGA members serve on the governance boards relative to the CA members for two reasons. First, CPA Canada states that the board composition represents the composition of accountants (including CAs, CMAs and CGAs) in the province, so we expect more new entrants in provinces with more CMA and CGA members relative to the CA members. For example, to a province with 90% of the accountants being CAs, the entry-threat shock is weaker than in a province with 10% of the accountants of being CAs.

- H3: The approval of the CPA merger has a more pronounced effect on audit fees in provinces where the increase in entry threats is ex ante greater.

4 RESEARCH DESIGN

4.1 Sample

Our sample period is from 2011 to 2015, corresponding to the approvals of the provincial CPA merger from 2012 to 2014. We obtain the approval dates of the CPA merger and the timeline of key developments from the CPA Canada website.18 The sample firms are from Audit Analytics’ Canadian Public Company Intelligence Module (hereafter, Audit Analytics Canada), which provides auditor locations, audit fees, filing dates of the financial statements and clients’ financial data for companies filing with the System for Electronic Document Analysis and Retrieval (SEDAR) in Canada. We use Thomson Datastream Worldscope to supplement clients’ financial data when they are missing in Audit Analytics Canada, and eliminate auditees and audit firms outside Canada. The resulting sample consists of Canadian firms that file with SEDAR in Canada and are audited by Canadian audit firms; see Table 2 for the sample construction.

| Sample construction | No. of Obs. | |

|---|---|---|

| 1 | Audit-fee sample from Audit Analytics’ Canadian Public Company Intelligence Module (2011–2015) | 21,278 |

| 2 | Merge with audit opinions data to obtain auditor locations from Audit Analytics | (1992) |

| 3 | Exclude companies and auditors outside Canada | (2299) |

| 4 | Merge with companies’ financial statement data from Worldscope | (1501) |

| 5 | Require companies to have at least five observations in the sample period | (3086) |

| 6 | Require control variables to have nonmissing values | (5885) |

| 7 | Final sample | 6515 |

- Note: This table summarizes our sample construction process and the final sample size of our study.

Our final sample has 6515 auditee firm-year observations after requiring nonmissing values for all test and control variables. Table 3 presents summary statistics of auditee firm-level characteristics. We control for these auditee characteristics in the regression analyses.

| ln AuditFees | Market-to-Book | Leverage | ROA | New Financing | Loss | Total Asset | Total Asset Growth | Current Ratio | December Year-end | |

|---|---|---|---|---|---|---|---|---|---|---|

| N | 6515 | 6515 | 6515 | 6515 | 6515 | 6515 | 6515 | 6515 | 6515 | 6515 |

| Mean | 11.38 | 2.942 | 0.2780 | −0.9690 | 0.2590 | 0.7180 | 10.20 | 0.4890 | 6.532 | 0.5620 |

| P25 | 10.31 | 0.585 | 0.0000 | −0.4460 | 0.0000 | 0.0000 | 8.204 | −0.171 | 0.7460 | 0.0000 |

| P50 | 11.07 | 1.277 | 0.0083 | −0.1010 | 0.0000 | 1.0000 | 10.06 | 0.0135 | 1.840 | 1.0000 |

| P75 | 12.30 | 2.613 | 0.247 | 0.0138 | 1.0000 | 1.0000 | 12.27 | 0.232 | 5.121 | 1.0000 |

| SD | 1.480 | 6.069 | 0.9360 | 3.5850 | 0.4380 | 0.4500 | 2.985 | 3.1240 | 14.44 | 0.4960 |

| Audit-Reporting Lag | Restatements | Going-Concern Opinions | Strong Shock | Big-4 Auditor | Large Auditee | Industry Leader | Small Profit | No. of Segments | Pct Foreign Sale | |

|---|---|---|---|---|---|---|---|---|---|---|

| N | 6515 | 6515 | 6515 | 6515 | 6515 | 6515 | 6515 | 6515 | 6515 | 6515 |

| Mean | 198.9 | 0.0441 | 0.4690 | 0.6150 | 0.5060 | 0.4990 | 0.3110 | 0.0783 | 0.2150 | 0.0475 |

| P25 | 88.00 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| P50 | 140.0 | 0.0000 | 0.0000 | 1.0000 | 1.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| P75 | 247.0 | 0.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 0.0000 | 0.0000 | 0.0000 |

| SD | 155.9 | 0.205 | 0.4990 | 0.4870 | 0.5000 | 0.5000 | 0.4630 | 0.2690 | 0.7320 | 0.2010 |

- Note: This table presents the summary statistics of audit firms’ fees and auditees’ characteristics. All variables are defined in Table A2.

4.2 Identification strategy and empirical models

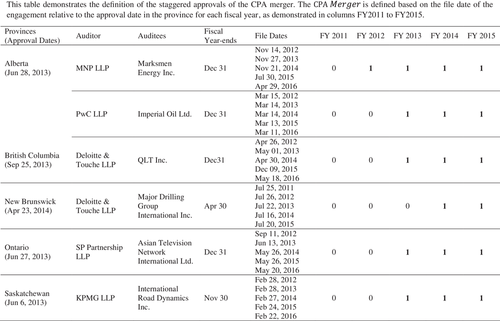

We use a difference-in-differences design with a strict fixed-effects structure that exploits the approvals of the CPA merger as a source of exogenous variations in potential entry threats to identify the effects of entry threats on audit fees.19 Our research design is similar to Bertrand and Mullainathan (2003) in that we use staggered shocks that affect different firms at different points in time as our identification strategy. Figure 2 illustrates the staggered difference-in-differences design by presenting auditor-client examples in different provinces. In particular, because several provinces in our sample approved the CPA merger in the same calendar year, we further use the timing of the audit engagements to maximize the extent of the staggered nature of the shocks in our setting. We rely on the CPA unification timeline to identify the first event for which the uncertainty of the merger is substantially resolved in each province.20 Generally speaking, the legislation process can be broadly divided into three phrases: the initiation (for public feedback), voting approval and passage of legislation. For most provinces, the first dates that the uncertainty resolves would be the approval date from members’ votes.21

Demonstration of the staggered-shock research design

Note: This table demonstrates the definition of the staggered approvals of the CPA merger. The is defined based on the file date of the engagement relative to the approval date in the province for each fiscal year, as demonstrated in columns FY2011–FY2015

There are several advantages of this research design. First, the difference-in-differences specification employed with exogenous shocks enables us to make causal inferences (e.g., Hope et al., 2017). Second, the staggered shocks allow us to have a larger and more comparable control sample. Specifically, we can use all firms with auditors in the provinces that are not approving the CPA merger at a given time as controls to those with auditors in the provinces that are approving the CPA merger at the same time. Third, using staggered shocks, we test whether the trends of fees in all provinces that have approved the CPA merger would be the same as the trends in absence of the staggered approvals, whereas a single-shock design would test whether the premerger period fees are on average lower than postmerger period fees pooled together. Thus, staggered shocks significantly reduce the likelihood of having a confounding factor that explains the treatment effect, because such a confounding factor is unlikely to be correlated with the staggered approvals of the CPA merger.22

is an indicator variable equal to one if an auditee files its financial statements audited by audit firm after the date that the CPA merger is approved by province , and 0 otherwise, and is a vector of control variables. We define using the financial statements filing date, as it closely coincides with the auditor's sign-off and invoicing dates.23,24 Figure 2 provides auditor-client examples to illustrate how we define .

Following prior literature, we additionally include several time-varying control variables that have been shown to explain variations in audit fees (e.g., Aobdia, 2019; Bruynseels & Cardinaels, 2013; Gul & Goodwin, 2010; Hope et al., 2012). Our control variables include market-to-book ratio, leverage ratio, return on assets, issuance of new debt, loss in the current year, total assets, asset growth, current ratio, December year-end indicator and the audit-reporting lag.25 In addition, to ensure that our results are not driven by a change in audit quality, we further control for the propensity to just meet or beat a zero earnings threshold (i.e., small profits). We also control for audit risk and client complexity (proxied by the number of business segments, percentage of foreign sales to total sales and restatements), as well as auditor independence (proxied by going-concern opinions). estimates the effect of the CPA merger on fees, and as posited by H1, we expect to be negative.26

5 EMPIRICAL RESULTS

Table 4 presents the empirical results on the effect of the CPA merger on audit fees, corresponding to H1. Column (1) presents the base model; the coefficient on is negative (−0.0633) and significant at the 1% level (using two-tailed tests). In Column (2), we find that Merger continues to be significantly negative after including audit-firm, province and time fixed effects (−0.0825), and after further controlling for time-varying auditee characteristics (−0.0679) in Column (3). Finally, in Column (4), we further control for audit quality and continue to find that Merger is significantly negative (−0.0692), suggesting that the CPA merger results in an average reduction in fees of 6.92% after controlling for audit quality and other time-varying firm characteristics.27 In addition, the coefficients on Market-to-Book, Return on Assets (ROA), Total Assets, and Current Ratio are also significant. It is also worth noting that the adjusted R2s from the regressions are high due to the inclusion of the very extensive fixed effects. The high explanatory power indicates that omitted variables are unlikely to be a major concern.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Audit fees | Audit fees | Audit fees | Audit fees | |

| Variable of interest | ||||

| Merger | −0.0633*** | −0.0825*** | −0.0679*** | −0.0692*** |

| (−4.44) | (−2.75) | (−2.62) | (−2.67) | |

| Controls | ||||

| Market-to-Book | 0.0023** | 0.0022** | ||

| (2.26) | (2.23) | |||

| Leverage | 0.0063 | 0.0065 | ||

| (0.43) | (0.44) | |||

| ROA | −0.0217*** | −0.0215*** | ||

| (−6.42) | (−6.47) | |||

| New Financing | −0.0015 | −0.0028 | ||

| (−0.10) | (−0.20) | |||

| Loss | 0.0096 | 0.0151 | ||

| (0.51) | (0.73) | |||

| Total Assets | 0.2037*** | 0.2026*** | ||

| (12.99) | (13.49) | |||

| Asset Growth | −0.0001 | −0.0003 | ||

| (−0.05) | (−0.12) | |||

| Current Ratio | −0.0021*** | −0.0021*** | ||

| (−2.89) | (−2.85) | |||

| December Year-end | 0.0877 | 0.0892 | ||

| (0.99) | (1.02) | |||

| Audit-reporting Lag | −0.0000 | −0.0000 | ||

| (−0.14) | (−0.10) | |||

| Restatements | −0.0265 | |||

| (−0.79) | ||||

| Going-Concern Opinions | 0.0001 | |||

| (0.00) | ||||

| Small Profit | 0.0200 | |||

| (0.91) | ||||

| No. of Segments | 0.0526 | |||

| (1.41) | ||||

| Pct Foreign Sale | 0.0053 | |||

| (0.05) | ||||

| Audit firm FE | N | Y | Y | Y |

| Province FE | N | Y | Y | Y |

| Year-month FE | N | Y | Y | Y |

| Auditee firm FE | Y | Y | Y | Y |

| Observations | 6515 | 6515 | 6515 | 6515 |

| Adjusted R2 | 0.949 | 0.960 | 0.966 | 0.966 |

- .

- Note: This table presents the results of the effect of the CPA merger on audit fees. Column (1) presents the base model with auditee-firm fixed effects. Column (2) further includes audit-firm, province and time fixed effects. Column (3) controls for auditee characteristics. Column (4) further controls for audit quality. All variables are defined in the Table A2; t-statistics are in parentheses; FE stands for Fixed Effects.

- *p < 0.1.

- **p < 0.05.

- ***p < 0.01 (two-sided tests).

Table 5 provides empirical results on whether the effect of the CPA merger is mitigated when the existing entry barriers are high (H2). We provide separate results for the cross-sectional analyses of Big-4 auditors and auditee size. Columns (1) and (2) show that the reduction in fees is driven by non-Big-4 auditors and muted for Big-4 auditors; in particular, the coefficients on are negative (−0.1334 and −0.1121, respectively) and significant at the 1% level, and the coefficients on are positive (0.1763 and 0.0908, respectively) and significant at the 1% level, suggesting that fees decrease by 11.21% for non-Big-4 firms and do not change significantly for Big-4 auditors ( insignificant).

| Entry barrier proxy | Big-4 auditors | Large auditees | ||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Audit fees | Audit fees | Audit fees | Audit fees | |

| Variables of interest | ||||

| Merger | −0.1334*** | −0.1121*** | −0.1146*** | −0.0905*** |

| (−6.68) | (−3.81) | (−5.86) | (−3.20) | |

| MergerEntry Barrier | 0.1763*** | 0.0908*** | 0.1450*** | 0.0436* |

| (6.22) | (3.24) | (5.33) | (1.67) | |

| Entry Barrier | . | . | 0.1440*** | −0.0057 |

| . | . | (3.44) | (−0.15) | |

| −0.0213 | −0.0469 | |||

| p-value = 0.47 | p-value = 0.11 | |||

| Controls | Y | Y | Y | Y |

| Audit Firm FE | N | Y | N | Y |

| Province FE | N | Y | N | Y |

| Year-Month FE | N | Y | N | Y |

| Auditee Firm FE | Y | Y | Y | Y |

| Observations | 6515 | 6515 | 6515 | 6515 |

| Adjusted R2 | 0.959 | 0.966 | 0.960 | 0.966 |

- .

- Note: This table presents the results of the effect of the CPA merger on audit fees, by the level of the existing entry barriers for audit submarkets. The existing entry barrier is proxied by Big-4 auditors and Large auditees in Columns (1) and (2) and Columns (3) and (4), respectively. The entry barriers are lower (higher) in submarkets of non-Big-4 (Big-4) auditors and larger (smaller) auditees. The Big-4 audit firms, measured as an indicator variable equals 1 when the audit firm is a Big-4 firm, and 0 otherwise. The large auditees, measured as the indicator variable that equals 1 if an auditee's total assets are above the median of those for all auditees in a city, and 0 otherwise. All variables are defined in the Table A1; t-statistics are in parentheses; FE stands for Fixed Effects.

- *p < 0.1.

- **p < 0.05.

- ***p < 0.01 (two-sided tests).

Similarly, in Columns (3) and (4), the coefficients on are negative (−0.1146 and −0.0905, respectively) and significant at the 1% level, and the coefficients on are positive (0.1450 and 0.0436, respectively, although the latter is only marginally significant), indicating that the fee reduction, on average, is 9.05% for small clients and 4.69% for large clients.28 Collectively, these findings lend support to H2 and imply that the audit-fee reduction due to the CPA merger is mitigated in audit submarkets where the existing entry barriers are high due to higher reputation.

Next, Table 6 shows the empirical results on the ex-ante shock intensity (H3) for each audit submarket. In Columns (1) and (3), the coefficients on are both negative (−0.0889 and −0.0644, respectively), but significant only in Column (1). The result indicates that a stronger shock leads to lower audit fees for audit firms in the submarket of non-Big-4 auditors, where existing barriers are low and thus the entry threats to incumbent audit firms are ex-ante credible. Columns (1) and (3) show that β1 is statistically insignificant, and the sum of β1 and β2 is statistically significant, using both non-Big-4 auditor and smaller auditee specifications. These findings suggest that the CPA merger leads to lower audit fees only in the submarkets of non-Big-4 auditors and smaller clients when the ex-ante merger shock intensity is stronger.

| Audit submarket | Big-4 auditors | Large auditees | ||

|---|---|---|---|---|

| Subsample | Non-Big-4 auditors | Big-4 auditors | Smaller auditees | Larger auditees |

| Existing entry barrier | Low | High | Low | High |

| (1) | (2) | (3) | (4) | |

| Audit fees | Audit fees | Audit fees | Audit fees | |

| Variable of interest | ||||

| Merger | −0.0004 | −0.0630 | −0.0645 | −0.0347 |

| (−0.01) | (−1.60) | (−1.42) | (−0.87) | |

| Merger Strong Shock | −0.0889** | 0.0143 | −0.0644 | −0.0240 |

| (−2.01) | (0.39) | (−1.55) | (−0.63) | |

| p-value = 0.04 | p-value = 0.24 | |||

| −0.0893** | −0.0487 | −0.1289*** | −0.0587 | |

| p-value = 0.02 | p-value = 0.24 | p-value < 0.01 | p-value = 0.15 | |

| Controls | Y | Y | Y | Y |

| Audit Firm FE | Y | Y | Y | Y |

| Province FE | Y | Y | Y | Y |

| Year-Month FE | Y | Y | Y | Y |

| Auditee Firm FE | Y | Y | Y | Y |

| Observations | 3,217 | 3,298 | 3,266 | 3,249 |

| Adjusted R2 | 0.901 | 0.959 | 0.931 | 0.967 |

- .

- Note: This table presents the results of the effect of the CPA merger on audit fees, by the shock intensity. The ex-ante strong shocks are measured, as the indicator variable that equals 1 for an audit firm located in a province where the number of CMA and CGA members on the governance board relative to the CA members (i.e., the (CMA + CGA)/CA ratio) is greater than the median. Columns (1) and (2) present the results for subsamples of non-Big-4 auditors and Big-4 auditors, respectively. Columns (3) and (4) show results for subsamples of larger auditees and smaller auditees, respectively. The entry barriers are lower (higher) in submarkets of non-Big-4 (Big-4) auditors and larger (smaller) auditees. All variables are defined in the Table A2; t-statistics are in parentheses; FE stands for Fixed Effects.

- *p < 0.1.

- **p < 0.05.

- ***p < 0.01 (two-sided tests).

We further provide placebo tests, using audit submarkets where existing entry threats are high (i.e., submarkets for Big-4 auditors and large auditees) and hence the entry threats induced by the shock are ex ante less credible to incumbent firms. In Columns (2) and (4), the coefficients on are statistically insignificant, revealing that (1) CPA merger identifies credible entry threats in submarkets where existing entry barriers are low, and (2) audit firms that face credible entry threats reduce service prices. In terms of the economic significance, incumbent audit firms in submarkets for non-Big-4 auditors and small auditees, on average, reduce audit fees by 8.93% and 12.89%, respectively, when they face ex-ante stronger shocks on entry threats, whereas the fee reductions due to a stronger shock are statistically insignificant and lower in magnitudes for Big-4 auditors and large auditees (4.87% and 5.87% in Columns (2) and (4), respectively).

6 ADDITIONAL ANALYSES AND ROBUSTNESS TESTS

6.1 The timing and mechanisms of the fee reductions

As discussed in Section 2.2, we argue that the approval of the CPA merger leads to an expectation of an increased likelihood of new entrants, which results in a fee reduction by non-Big-4 auditors and auditors with smaller clients. Because the fee reduction is used as a preemptive strategy to deter entry, we should observe the fee reduction happen quickly after the merger approval. This is indeed what we find in our main results presented in Tables 4–6.

Given that our design focuses on capturing changes right around the merger approval, our results are unlikely to be driven by actual changes in labor costs caused by the merger as it takes a few years for the candidates to obtain licenses under the new regime. One could, however, argue that there is a possibility that audit firms may want to cut bonuses due to an expected rather than actual decrease in labor costs as a result of an expected increase in the number of public accountants, which results in lower audit fees. There are two reasons why it is unlikely for a bonus cut to explain our results. First, bonuses represent a small percentage of audit employees’ total compensation in audit firms in Canada (i.e., approximately 3.5%).29 Second, those auditors who do not want to accept a bonus cut at the current firm can consider leaving for another audit firm. Absent an actual increase in the number of public accountants, cutting bonus does not seem to be a valid equilibrium strategy for the audit firms. For these reasons, we believe it is unlikely that the magnitude of the fee reduction we observe can be fully explained by a reduction in labor costs. That said, we cannot fully rule out this possibility due to the lack of data on employee salaries data at audit firms.

Next, we provide further insights into the mechanisms behind the immediate negative effect on audit fees by studying the price negotiation between auditors and auditees. Specifically, we conduct cross-sectional analyses of their relative bargaining power within an audit submarket. We expect the extent of a fee reduction through price negotiations between auditors and auditees to be weaker when auditees have less bargaining power over auditors. When an audit firm is an industry leader that possesses more specialized industry expertise than its competitors, the auditee has lower bargaining power in price negotiations with its auditor (e.g., Numan & Willekens, 2012). As such, we expect the reduction in audit fees to be smaller when the audit firm is an industry leader in audit submarkets where existing entry barriers are low.

Table 7 shows the results. Columns (1) and (3) show that the coefficients on are negative (−0.0698 and −0.1233) at the 10% level or better, while the coefficients on are positive (0.1143 and 0.0860) at the 5% level. The results indicate that audit fees charged by audit firms that are not industry leaders, on average, decrease by 6.983% for non-Big-4 auditors and by 12.33% for small auditees due to the CPA merger. In contrast, industry leaders face less severe downward pricing pressure, as such, their audit fees do not change significantly ( insignificant in Columns (1) and (3)).

| Audit submarket | Big-4 auditors | Large auditees | ||

|---|---|---|---|---|

| Subsample | Non-Big-4 auditors | Big-4 auditors | Smaller auditees | Larger auditees |

| Existing entry barrier | Low | High | Low | High |

| (1) | (2) | (3) | (4) | |

| Audit fees | Audit fees | Audit fees | Audit fees | |

| Variable of interest | ||||

| Merger | −0.0698* | −0.0520 | −0.1233*** | −0.0562 |

| (−1.90) | (−1.29) | (−3.03) | (−1.39) | |

| Merger × Industry Leader | 0.1143** | −0.0002 | 0.0860** | 0.0183 |

| (2.48) | (−0.01) | (1.98) | (0.51) | |

| p-value = 0.02 | p-value = 0.11 | |||

| Industry Leader | −0.1129* | 0.1354*** | −0.0096 | 0.1104** |

| (−1.69) | (2.76) | (−0.18) | (1.98) | |

| 0.0445 | −0.0522 | −0.0373 | −0.0379 | |

| p-value = 0.37 | p-value = 0.18 | p-value = 0.46 | p-value = 0.33 | |

| Controls | Y | Y | Y | Y |

| Audit Firm FE | Y | Y | Y | Y |

| Province FE | Y | Y | Y | Y |

| Year-Month FE | Y | Y | Y | Y |

| Auditee Firm FE | Y | Y | Y | Y |

| Observations | 3217 | 3298 | 3266 | 3249 |

| Adjusted R2 | 0.901 | 0.960 | 0.932 | 0.967 |

- .

- Note: This table presents the results of the effect of the CPA merger on audit fees for audit industry leaders. Industry Leader equals 1 if the audit firm has the biggest market share based on audit fees in a two-digit Standard Industrial Classification (SIC) industry and a Canadian city, and 0 otherwise. Columns (1) and (2) present the results for subsamples of non-Big-4 auditors and Big-4 auditors, respectively. Columns (3) and (4) show results for subsamples of larger auditees and smaller auditees, respectively. The entry barriers are lower (higher) in submarkets of non-Big-4 (Big-4) auditors and larger (smaller) auditees. All variables are defined in the Table A2; t-statistics are in parentheses; FE stands for Fixed Effects.

- *p < 0.1.

- **p < 0.05.

- ***p < 0.01 (two-sided tests).

We further provide placebo tests, using Big-4 auditors and large auditees. In Columns (2) and (4), we find that neither the CPA merger nor being an industry leader significantly affect the price charged by a Big-4 auditor and the price paid by a large auditee. These findings further support our hypotheses and suggest that the auditees’ bargaining and auditors’ concessions are likely mechanisms for the negative effect of the merger on audit fees.

6.2 Additional robustness tests

Our conclusions are not sensitive to different model specifications. That is, the inferences remain the same after controlling for auditor tenure, a time trend, a nonlinear function of auditee size, as well as replacing year-month fixed effects with year fixed effects (untabulated). In addition, to ensure that our inferences are not driven by firms that are cross-listed or directly listed abroad, we exclude auditees listed on foreign stock exchanges and find that our conclusions remain unchanged. Furthermore, the CPA merger has not led to significant changes in audit quality proxied by restatements and going-concern opinions (untabulated), implying that audit quality unlikely explains the changes in audit fees and that we likely identify a change in expectation of entry threats rather than any realized audit-quality effects in our setting.

Finally, we conduct a test employing pseudo-approval dates. Specifically, we define the CPA merger to be approved in the year before its actual approval by the province. Untabulated results show that the reduction in audit fees due to the CPA merger does not occur until the approval of the CPA merger through voting.30

7 CONCLUSION

We study the “microeffect of a macromerger” of self-regulatory professional accounting bodies in Canada, which offers a unique setting to study the causal effect of an increase in the threat of entry on audit fees. We document that audit fees decrease in response to an exogenous increase in entry threats induced by the CPA merger, and that the fee reduction is more pronounced when the entry threat is expected to be greater and less pronounced when the entry threat is expected to be lower due to higher reputation. Our evidence suggests that the degree of the fee reduction is related to the relative bargaining power between the auditor and the auditee. In sum, the negative effect that the approval of the CPA merger has on audit fees suggests that audit firms are either more willing to give clients’ fee breaks proactively or are more likely to agree to clients’ fee concessions due to the increased entry threat. In either case, the fee reduction reflects audit firms’ increased incentive to deter future entry.

The paper also contributes to the literature on entry deterrence in the broader management and economics literature by providing empirical evidence on a professional service industry. The findings indicate that occupational licensure creates an entry barrier that protects the small players in the audit industry, and that relaxing licensing requirements induces these firms to strategically lower their prices to deter potential entrants. Occupational licensure has little impact on the big players in the audit industry due to their reputation for expertise. Equally importantly, the magnitude of fee reduction due to the CPA merger is affected by existing entry barriers, which leads to different consequences for Big-4 and non-Big-4 auditors, and small and large clients.

ACKNOWLEGEMENTS

We appreciate valuable comments from Daniel Aobdia, Muhammad Azim, Mahfuz Chy, Michael Marin, Michael Shen, Shibin Tang, Dushyant Vyas, Jingjing Wang, Ping Zhang, and seminar participants at the Financial Accounting and Reporting Section (FARS) Midyear Meeting, the Canadian Academic Accounting Association (CAAA) Annual Meeting, and the Rotman School of Management.

APPENDIX

| Dates | Key developments | |

|---|---|---|

| 2015 | December 18 | CPA Nova Scotia legislation receives Royal Assent |

| December 11 | CPA Nova Scotia legislation passes third reading | |

| November 27 | CPA legislation formally merges Nova Scotia accounting bodies | |

| September 01 | CPA Manitoba has been established through legislation | |

| July 01 | CPA legislation proclaimed in Alberta | |

| June 30 | CPA Manitoba legislation receives Royal Assent | |

| June 24 | CPA legislation proclaimed in British Columbia | |

| June 17 | CPA Manitoba legislation receives third and final reading | |

| May 11 | CPA legislation received Royal Assent in Nova Scotia | |

| April 22 | Unification legislation introduced in the Nova Scotia House of Assembly | |

| April 01 | CPA legislation proclaimed in Prince Edward Island | |

| March 25 | CPA legislation received Royal Assent in British Columbia | |

| February 11 | CPA legislation introduced in British Columbia | |

| 2014 | December 17 | Unification legislation passed in Alberta Legislature |

| December 01 | CPA Manitoba Joint Venture announces introduction of legislation | |

| November 27 | CPA Prince Edward Island legislation receives passage | |

| November 25 | Unification legislation introduced in Alberta Legislature | |

| November 24 | CPA Newfoundland and Labrador legislation receives passage | |

| November 10 | Saskatchewan accountants unite as CPA legislation proclaimed | |

| October 02 | It's official! 190,000 PROS, one designation | |

| July 08 | Three Nova Scotia bodies enter merger agreement and request new legislation | |

| July 03 | Yukon accounting bodies sign merger agreement | |

| June 18 | CPA Ontario and CGA Ontario vote to support unification | |

| May 24 | Nova Scotia's three accounting bodies receive approval to move forward with merger agreement | |

| May 01 | New bylaws in Prince Edward Island allow members to use CPA designation | |

| May 01 | CPA Ontario and CGA Ontario release Unification Agreement—key terms to their members | |

| April 23 | CPA New Brunswick legislation receives passage | |

| April 11 | CPA Bermuda legislation receives passage and amended Act now in effect | |

| April 09 | CPA Saskatchewan legislation receives passage | |

| April 03 | Nova Scotia CAs, CMAs and CGAs release merger proposal | |

| April 02 | Ontario's CMAs now members of CPA Ontario | |

| April 01 | Three Manitoba accounting bodies sign Joint Venture Agreement | |

| February 03 | Three Ontario bodies sign MOU to unify the profession in that province | |

| January 30 | CGA Manitoba members vote to support merger agreement | |

| 2013 | December 19 | Three Manitoba bodies announce merger agreement |

| November 11 | CPA Saskatchewan announces introduction of legislation | |

| October 17 | Three Saskatchewan bodies sign Joint Venture Agreement | |

| October 09 | CPA Canada welcomes positive CGA member vote result | |

| September 25 | Three BC bodies approve joint venture plan and pass new bylaws that regulate the use of CPA designation | |

| 2013 | September 17 | The P is for professional: CPA Canada launches multimedia advertising campaign |

| September 16 | CGA-Canada announces member vote as the Integration Agreement between CPA Canada and CGA-Canada is approved | |

| July 09 | CGA-PEI announces positive vote results | |

| June 28 | Positive vote from Alberta CAs supports three-way unification | |

| June 27 | CA and CMA bodies in Ontario announce positive vote results | |

| June 21 | Three accounting bodies in Newfoundland and Labrador sign unification agreement | |

| June 17 | CMA Manitoba and CA Manitoba sign Joint Venture Agreement and provide update on CGA Manitoba | |

| June 06 | CA and CMA bodies in Saskatchewan announce positive vote results and sign Joint Venture Agreement | |

| May 15 | ICAO and CMA Ontario release provincial unification proposal | |

| May 09 | British Columbia's three accounting bodies sign unification proposal | |

| April 24 | CPA Canada welcomes CGA bodies return to unification talks | |

| April 01 | A new leaf: CPA Canada's new visual identity introduced | |

| March 22 | NBICA, CMA NB and CGA-NB release provincial merger proposal | |

| March 13 | CPA Canada bylaw published | |

| January 01 | National CPA Canada organization established | |

| 2012 | October 11 | Saskatchewan CAs and CMAs release merger proposal |

| July 25 | The Institute of Chartered Accountants of Nova Scotia and CMA Nova Scotia release provincial merger proposal | |

| June 07 | The ICAPEI and CMA PEI release provincial merger proposal | |

| May 17 | CGA Alberta and CMA Alberta release provincial merger proposal | |

| May 16 | Quebec legislation uniting three accounting bodies receives passage | |

| March 28 | Quebec government introduces legislation to unite CA, CMA and CGA designations | |

| March 23 | Update on Manitoba member advisory vote | |

| March 15 | Newfoundland and Labrador accounting bodies release provincial merger proposal | |

| March 15 | Update on Alberta unification discussions | |

| March 05 | Saskatchewan accounting bodies release provincial merger proposal | |

| January 24 | ICABC, CMA BC and CGA-BC release provincial merger proposal | |

| January 20 | CA Manitoba and CMA Manitoba release provincial merger proposal | |

| January 17 | Canada's three legacy accounting bodies issue Unification Framework | |

| January 15 | PEI CGAs join merger talks | |

| 2011 | December 07 | Saskatchewan CGAs join merger talks |

| November 02 | Newfoundland and Labrador CGAs enter merger discussions | |

| November 01 | Alberta CGAs join merger talks | |

| October 28 | CGA-Canada enters exploratory merger talks | |

| October 24 | CGAs in British Columbia join merger talks | |

| October 04 | Quebec CA–CMA–CGA merger update | |

| September 16 | CGAs enter exploratory merger talks in Ontario | |

| May 24 | Member consultation on unification begins and Position Paper released | |

- Note: The following table presents the timeline of the key developments of the CPA merger. The dates in bold are the dates used to define Merger because they represent the first time uncertainty about the passage of the CPA merger that is resolved.

| Panel A: Dependent variable and test variables | |

| ln AuditFees | The audit fees, measured as the natural logarithm of audit fees; the audit fees in Tables 2 and 3, measured as the raw audit fees (in $1000) |

| Merger | The CPA merger, measured as the indicator variable that equals 1 if an auditee contracts with an audit firm located in a province that has approved the CPA merger, and 0 otherwise |

| Strong Shock | The ex-ante strong shocks, measured as the indicator variable that equals 1 for an audit firm located in a province where the number of CMA and CGA members on the governance board relative to the CA members (i.e., the (CMA + CGA)/CA ratio) is greater than the median, and 0 otherwise |

| Entry Barrier | The existing entry cost due to barriers other than the one induced by the CPA merger; two proxies are used, including Big-4 Auditor and Large Auditee |

| Big-4 Auditor | The Big-4 audit firms, measured as an indicator variable equal to 1 when the audit firm is a Big-4 firm, and 0 otherwise |

| Large Auditee | The large auditees, measured as the indicator variable that equals 1 if an auditee's total assets are above the median of those for all auditees in a city, and 0 otherwise |

| Industry Leader | The indicator variable that equals 1 if the audit firm has the biggest market share based on audit fees in a two-digit SIC industry and a Canadian city, and 0 otherwise |

| Panel B: Control variables | |

| Market-to-Book | The market-to-book ratio, measured as the ratio of market value of equity to book value of equity |

| Leverage | The leverage, measured as the ratio of total short-term and long-term debts to total assets |

| ROA | The profitability ratio, measured as the ratio of the net income scaled by the total assets at fiscal year-end |

| New Financing | The indicator variable that equals 1 if an auditee raises new debts or equities, and 0 otherwise |

| Loss | The indicator variable that equals 1 if an auditee has negative net income, and 0 otherwise |

| Total Assets | The total assets, measured as the logarithm of total assets at the fiscal year-end (in $millions) |

| Asset Growth | The asset growth rate, measured as the current year's total assets scaled by last year's total assets |

| Current Ratio | The current ratio, measured as the ratio of total current assets to total current liabilities |

| December Year-end | The indicator variable that equals 1 if an auditee has a December year-end, and 0 otherwise |

| Audit-Reporting Lag | The audit-reporting lag, measured as the number of days between an auditee's year-end date and its audit report date |

| Restatements | The indicator variable that equals 1 if an auditee's financial statements as at the current fiscal year-end are restated in the sample period, and 0 otherwise |

| Going-Concern Opinion | The indicator variable that equals 1 if an auditee receives a going-concern opinion from its audit firm, and 0 otherwise |

| Small Profit | The indicator variable that equals 1 if an auditee's ROA is between 0% and 3%, following Aobdia (2019) |

| No. of Segments | The number of business segments, from BUSSEG in Compustat SEGMENTS. |

| Pct Foreign Sale | The percentage of an auditee's total sale that is as sales outside Canada, from GEOGRAPHIC in Compustat SEGMENTS |

REFERENCES

- 1 Semadeni (2006) argues that “making comparative assessments of the quality of the offering across different firms” is difficult in professional services industries due to the lower barrier of imitation and limited intellectual property protection.

- 2 Increases in the number of qualified public accountants and in the number of audit firms are expected by CPA Canada to be major consequences of the merger in a public report issued in May 2012.

- 3 This research design allows us to draw causal inferences with greater confidence. Compared to a difference-in-differences design with a single shock, we obtain a larger control sample, as the single-shock design usually requires the control sample to not have been treated, whereas the control sample in the staggered-shock framework is not restricted to firms that have not been treated (Bertrand & Mullainathan, 2003). This especially suits our setting in that all provinces have approved the CPA merger during our sample period, providing us with a sample of audit firms in all provinces.

- 4 In our sample, the median number of audit firms that have a local office in a given local submarket (i.e., a city) is two; more than 75% of cities have fewer than four audit firms operating directly in the area. We observe fewer audit offices per city primarily because the population in Canada is highly concentrated in a few major cities. Thus, we observe that most cities have just a few audit offices to serve much smaller population. The median number of offices may not be directly comparable to the US average to infer the competitiveness of the market.

- 5 The CPA governance boards are set up to govern issues arising in the transitional period of the CPA merger. The composition of the board member reflects the composition of the different professional accounting bodies in the province.

- 6 According to CPA Canada, the governance board composition represents the number of CAs, CMAs and CGAs in the province.

- 7 In 2015, the Council of Economic Advisers released a report on best practices and provided recommendations to reform occupational licensing to promote cross-state unification and labor geographic mobility (Occupational licensing: A framework for policymakers. https://obamawhitehouse.archives.gov/sites/default/files/docs/licensing_report_final_nonembargo.pdf). Since then, at least 11 state legislators have proposed 15 reforms in line with these recommendations, and 4 state bills have been passed (Labor market monophony: Trends, consequences, and policy responses. https://obamawhitehouse.archives.gov/sites/default/files/page/files/20161025_monopsony_labor_mrkt_cea.pdf).

- 8 Importantly, we document that unification has different economic consequences for different market players, so state legislators, when drafting future reforms, should carefully consider the market structure in their respective submarkets (e.g., states) and possible consequences for different players within the submarkets.

- 9 Hay et al. (2006) provide a meta-analysis of both audit-demand and audit-supply attributes.

- 10 Specifically, the CA designation had two streams—candidates enrolled in the public-accounting stream would qualify for public-accounting licenses automatically upon obtaining CA designations, so the certification requirements were virtually the same as the public-accounting licensing requirements; candidates in the nonpublic-accounting stream followed the same education requirement as those in the public-accounting stream but could opt out of audit or tax training, as a result, they would not be granted a public license when receiving a CA designation.

- 11 In more recent years, the reserved privilege of the CA designation to provide public-accounting services was challenged under the Agreement of Internal Trade (AIT) in courts, and as a result, it was slightly relaxed by two regulatory attempts. First, public-accounting licenses could be granted to qualified CMAs and CGAs who had successfully completed extensive, additional, required education and training requirements. Second, CA candidates could be enrolled in a nonpublic-accounting stream, in which they would be opted out from specific audit and tax training requirements and would not be granted the public-accounting licenses upon obtaining the CA designation. In practice, few people chose these two options, and hence, they did not change the inherent differences existing among the CA, CMA and CGA certification requirements, which made the public-accounting licenses virtually exclusive to the CA designations. We acknowledge that these two options could work against finding the hypothesized results. The nonpublic-accounting stream is not a particularly popular career option.

- 12 Few public firms exist in Yukon and Prince Edward Island, and thus, they are not in our final sample.

- 13 Luis Millan (November 2011). Quebec accountants formally sanction unity. The Bottom Line.

- 14 Jeff Buckstein (June 2012). Ontario talks off, merger in trouble. The Bottom Line.

- 15 For legacy CMA, CGA and CA members, the differences were expected to gradually disappear over the next decade, by the end of which period all legacy CMA and CGA members would enjoy the same rights as the legacy CA members.

- 16 The CPA Path Decision Tree by CPA Ontario (http://www.cpaontario.ca/Students/PEP/1014page17397.pdf).

- 17 Although it is difficult to directly validate an anticipate increase in audit firms, we expect that the actual number of audit firms should either increase or do not change because while the CPA merger attracts potential entries, lowering audit fees deters new entries. According to the statistics from CPA British Columbia's annual reports, the number of public licensed firms generally increased after the merger (data only available for British Columbia after the CPA merger). Also, we observe a statistically insignificant increase in the number of actual audit firms reported in Audit Analytics after the merger. The evidence is generally consistent with our expectation although this evidence itself cannot fully validate our assumption.

- 18 See Table A1 for the timeline.

- 19 We do not cluster standard errors because the number of clusters is too small in our tests (Petersen, 2009). However, inferences are robust after clustering standard errors by firm.

- 20 See Table A1 for the timeline.

- 21 An exception is Quebec, in which case the merger decision was voted by the board of directors of each of the three orders and passed immediately after the vote. The passage date is the only available date from our search of CPA publications and news media, and it is close to board directors’ approval date. Thus, we use the passage date for Quebec. The inferences are robust to legislation passage dates for all other provinces.

- 22 We acknowledge the relatively clustered nature of the merger approval dates for many provinces, but the early approval by Quebec at least gives us a standard single-shock difference-in-differences design. In addition, to further identify the effects of provinces in which merger approval dates are clustered in the same calendar year, we take advantage of the variation in audit clients’ year-ends (or the timing of audit engagements). As fee concessions often occur at the end of audit engagements, we define audit engagements completed before the approval dates to be in the preperiod and those completed after the approval dates to be in the postperiod.

- 23 We do not use auditees’ fiscal year-end because audit engagements, in many cases, are conducted after their fiscal year-ends.

- 24 The auditor and the auditee set a base engagement fee in the engagement letters before the start of an engagement, but the actual audit fees vary based on additional audit procedures required by various nonroutine events (e.g., employee termination, poor internal documentation and system changes). According to anonymous senior managers at audit firms in Canada, audit firms set internal goals to charge for extra events in addition to the base audit fees (e.g., at least 10% of the fixed fees). Frequent price negotiations on these event-based extra charges occur at the time of invoicing when partners and senior managers decide whether and how much extra to charge and to forgive. On one hand, partners and senior managers have considerable leeway to decide whether and how much discounts to apply to auditees, so they can use such discounts to curb favors with auditees in anticipation of future businesses. On the other hand, auditees have strong incentives to bargain down the extra charges, as the event-based fees may reflect poorly on management. Our test considers these negotiation opportunities, and thus, we define based on the sign-off date relative to the approval dates.

- 25 All variables are defined in Table A2.

- 26 A negative suggests either a smaller increase in the treatment than the control firms or a greater decrease in the treatment than the control firms.

- 27 With the difference-in-differences design, it is possible that treatment firms experience a smaller increase in fees by 6.92% relative to the control firms. For example, if the control firms on average experience a 10% increase in fees, then the treatment firms only experience approximately an average of 3.08% increase in fees. Alternatively, it could also be the case that control firms experience an increase in fees consistent with the overall time trend but treatment firms experience a slight decrease in fees, resulting in the same difference-in-differences effect. We adopt the standard language of using “smaller increase” to describe a negative difference-in-differences effect in this section as fees exhibit an increasing trend in our sample period.

- 28 The Pearson correlation between Big-4 and our proxy for “large auditees” is 0.37.

- 29 Data from Payscale.com (https://www.payscale.com/research/CA/Job=Auditor/Salary).

- 30 In untabulated analyses, we further investigate whether the reduction in audit fees is short-lived and reverts in the following years. In particular, as the CPA merger initiates a long-term action plan to unify the accounting bodies, the entry threat continues to exist in the years after the CPA merger is approved. Thus, we do not expect the reduction in fees to reverse. We find that the CPA merger leads to a reduction of 7.14% in audit fees in the first year and the reduction maintains at 8.52% after the first year, indicating that the reduction in audit fees is not a short-lived one-time event.