The signaling role of trade credit in bank lending decisions: Evidence from small and medium-sized enterprises

Abstract

Using confidential data at the bank–firm loan-level, we provide direct evidence of the signaling role of trade credit in bank lending decisions. Especially for firms that are opaque in their relationship with banks, the findings reveal that trade credit ameliorates information asymmetries. We address the questions of whether and, if so, how the presence of trade credit affects banks’ decisions to grant commercial loans. We base the analysis on a sample of small and medium-sized enterprises to examine suppliers’ informational advantage in screening activities in relation to relationship lending arguments. We provide evidence that supports the role of trade credit as a signaling instrument in lending decisions. More precisely, the analysis suggests that trade credit plays a signaling role, increasing the probability of obtaining a loan. Suppliers bearing credit risk lead banks to lend to firms. Thus, a bank receiving this signal is more likely to grant a loan even though abnormal payment delays are perceived as negative and function as friction during the lending process. This paper has two implications: Banks should use suppliers to signal a “good” type of borrower and for firms, sharing credit information could ameliorate the rationing problems arising in the context of credit asymmetries.

1 INTRODUCTION

Trade credit is a widespread prominent source of financing for most firms and plays a crucial role in smaller firms. Empirical regularities refer to trade credit as the second most important source of external debt financing for small and medium-sized enterprises (SMEs; e.g., Demirguc-Kunt & Maksimovic, 2001).

The relevance of trade credit to SME financing led Berger and Udell (2006) to include trade credit among lending technologies, even if not provided by financial intermediaries. In the firm financing paradigm, trade credit is also considered a safety valve, especially for firms experiencing funding constraints (Molina & Preve, 2012; Petersen & Rajan, 1994). Studies on the recent financial crisis assert the role of trade credit in liquidity provision and the last resort lender, documenting a high trade credit dependence for constrained firms (Carbò-Valverde et al., 2016; Garcia-Appendini & Montoriol Garriga, 2013). Despite the relevance of the topic, empirical evidence on the ability of trade credit to reduce asymmetric information in lending decisions (e.g., loan approval) remains scarce. In general, information asymmetries require expensive screening and monitoring activities (Diamond, 1984). However, the effects can be mitigated, resulting in more favorable conditions in loan agreements (Chang et al., 2020; Cole, 1998; Cole et al., 2004; DeFranco et al., 2017; Ivashina 2009). Several studies show how the collection of private information should ameliorate asymmetric information issues in lending decisions. Among them, Biais and Gollier (1997) consider trade credit to be a signal that reveals private information to lenders. They introduce a theoretical signaling model that assumes that suppliers have an informational advantage in screening borrowers. Because suppliers have private information about their customers, they should be more effective in monitoring (Miwa & Ramseyer, 2008) and achieving cost savings in information collection (Jain, 2001). A wide range of empirical studies exploits the relationship between trade and bank financing to test the Meltzer hypothesis of the substitution effect among two forms of firm financing (Meltzer, 1960). Studies investigating the role of trade credit in lending decisions have provided limited evidence (e.g., Cook, 1999), and some studies are hampered by a lack of data related to bank lending decisions because they infer results based on the total debt of firms rather than internal information related to banks’ loan approval process (e.g., Agostino & Trivieri, 2014; Alphonse et al., 2004).

Based on this perspective, this paper aims to fill this gap by empirically examining the role of trade credit in terms of account payables in the loan approval process using inside information on the bank–firm relationship. Specifically, this study attempts to assess the role of trade credit in bank lending decisions (i.e., approving or denying a loan request) rather than focusing only on loans already granted as is the case in all previous studies. Therefore, we provide evidence of a complementary relationship between trade credit and bank loans based on a new perspective (the role of trade credit in the loan approval process) that has never been previously explored. In particular, we find that trade credit increases the probability of a borrower receiving a positive response to a loan request. This result may be related to a reputational mechanism based on which the trade credit provided by suppliers can be interpreted by a bank as a signal of the buyer's good reputation in the market. Our results show that this reputational mechanism is beneficial for all SMEs, especially those characterized by a higher level of opacity, which, given this specific aspect, may be subject to a credit rationing problem more than other SMEs (Berger & Udell, 1998).

These results contribute to the growing literature on the effect of credit information sharing on opaque firms, particularly in the SME context. The evidence also corroborates the importance of relationships in small business lending because relationships are still relevant and can benefit borrowers, especially those characterized by high intensity (Cole & Sokolyk, 2016). However, additional evidence on corporate failure extracted from our data does not exclude the existence of false signals related to banks’ lower monitoring ability with respect to trade creditors in the assessment of prospective debtors’ creditworthiness and ongoing activities as suggested by Biais and Gollier (1997).

This paper extends the literature in several ways. First, by exploiting unique data on bank lending rationing decisions, we directly address and explicitly test the signaling role of suppliers in lending decisions by using actual bank–firm data. Furthermore, we demonstrate that the substitution and complementary effects of trade credit on banks are not alternative effects such that a firm may prefer to use trade credit as the main form of short-term financing. Simultaneously, trade credit may be considered useful information for banks when making decisions regarding a loan request by the same firm.

The remainder of this paper is organized as follows. Section 2 reviews the related literature, and Section 3 develops the research hypotheses. Section 4 describes the data and provides summary statistics. Sections 5 and 6 report the methodology and discuss the results. Section 7 contains additional evidence on the role of trade credit in corporate failure, and Section 8 concludes.

2 RELATED LITERATURE

The literature on crises and their aftermath confirms that credit rationing to the SME sector has been economically significant (e.g., Ferrando et al., 2017; Presbitero et al., 2014). Previous empirical papers establish that financially constrained firms use trade credit to a larger extent (e.g., Demirguc-Kunt & Maksimovic, 2001; Fisman & Love, 2003; Petersen & Rajan, 1997). Recent studies jointly examine the effect of a crisis in terms of credit rationing and alternative forms of financing for small firms, validating the role of trade credit as a safety valve (Casey & O'Toole, 2014). Specifically, trade credit plays a crucial role in the type of lender of last resort during financial shocks (Taketa & Udell, 2007), conditioning the investment decisions of constrained firms in terms of capital expenditures (Carbò Valverde et al., 2016).

A plethora of studies have investigated trade credit and the motivations behind selling or buying products and services on credit (e.g., Elliehausen & Wolken, 1993). The common research question is why non-financial firms are involved in financial intermediation. This research can be split into two main literature strands concerning the motives behind trade credit usage that arise on the demand and supply sides. From the demand side, control protection and pooled transactions, which reduce the uncertainty of flow, reduce costs and constitute valid motives for selling products on credit (Chant & Walker, 1988; Ferris, 1981; Honoworth & Reber, 2003; Ono, 2001; Summers & Wilson, 2002; Wilner, 2000). Conversely, capital access, the informational advantage of goods suppliers, price elasticity, the easy repossession of collateral value and buyers’ earning quality are the principal reasons for the use of trade credit on the supply side (Biais & Gollier, 1997; Brennan et al., 1988; Danielson & Scott, 2004; Deloof & Jegers, 1999; Duarte et al., 2016; Emery, 1984; García-Teruel et al., 2014; Giannetti et al., 2011; Jain 2001; Petersen & Rajan, 1997; Pike & Cheng, 2001; Schwartz, 1974; Van Horen, 2007). Most of these theoretical arguments are also supported by empirical evidence. For instance, the findings of Petersen and Rajan (1997) show that trade credit usage is motivated by price discrimination. Additionally, Long et al. (1993) empirically validate the use of trade credit as a guarantee of product quality. The empirical findings also confirm that capital access, in terms of bank credit availability, affects the supply of trade credit. In particular, Petersen and Rajan (1994) find that relying less on trade credit results in a lower likelihood of being bank constrained. From this perspective, recent empirical studies have not produced unique results. Fabbri and Klapper (2008), who test the market power hypothesis, also test the importance of financial constraints. Their study reveals that access to bank financing and profitability are not significantly related to trade credit supply in the Chinese market. Love and Zaidi (2010) offer other evidence on Asian countries.

The findings of the authors above do not support the hypothesis that trade credit can help constrained SMEs during a crisis because financially constrained firms reduce their use and extension of trade credit. In contrast to the results of Tsurata (2015), in Japan, small businesses increase trade credit (both payables and receivables) if bank loan availability improves. In Europe, the findings confirm that credit-constrained firms are more likely to use and apply for trade credit (Casey & O'Toole, 2014); the same holds in the United States (Danielson & Scott, 2004) in the presence or absence of a shock. One possible explanation that can reconcile these findings is offered by Taketa and Udell (2007), who conclude that the relationship between trade credit and financial institution channels (complements or substitutes) can change across credit crunch periods and bubble periods. The effect of a shock depends on its typology. In particular, a negative (e.g., a credit crunch) and a positive (e.g., a bubble) financial shock can have different effects on trade credit and financial institution channels. Additionally, evidence from the extant empirical literature suggests that a nation's lending infrastructure affects financing decisions, which is in line with the theoretical framework of Berger and Udell (2006). Trade credit is particularly important in countries in which the financial system is not well developed, and industries with a higher dependence on trade credit exhibit higher growth rates (Demirguc- Kunt & Macksimovic 2001; Fisman & Love, 2003).

Despite the large number of empirical studies on trade credit motives collected in the review by Seifert et al. (2013), there is very little evidence on the informational competitive advantage of suppliers. The first assumption about the informational advantage of sellers over banks is from Mian and Smith (1992). Establishing cost advantages over competing lenders, these researchers refer to advantages in credit evaluation derived from regular contact with buyers and ongoing evaluations to produce information that can also be employed in credit extension decisions. This assumption was formalized in a theoretical model by Biais and Gollier (1997). Assuming that suppliers have private information about their customers, they argue that “trade credit can facilitate aggregation of the supplier's information with bank's information and thus alleviate an information asymmetry” (p. 904). More precisely, their three-agent model includes different types of buyers: good and bad. The buyer knows its own type, but the bank and supplier do not and have different signals about the type. Bank credit rationing arises because of imprecise signals on the buyer type when bank credit is the only source of financing and trade credit is not an option. By contrast, when sellers extend trade credit conditional on the receipt of a good signal from the buyer, the bank is induced to lend conditionally on their own positive signal. In this way, the information collected by the supplier is conveyed to the bank. Intuitively, if the seller is willing to bear the buyer's risk—extending credit in terms of delayed payments—the seller must have good information about the buyer. Thus, the authors conclude that “trade credit enables the private information of the seller to be used in the lending relationship and this additional information of the seller can alleviate credit rationing due to adverse selection” (p. 905).

Put differently, in the logic of the well-known delegated monitoring model of Diamond (1984), in which individuals invest in financial intermediaries to achieve economies of scale, the bank transfers the screening and monitoring process to firms that can more effectively carry out these tasks. Thus, trade credit is also a “result of the specialization and division of labour that occur within sophisticated financial markets” (Miwa & Ramseyer, 2008, p. 329). The informational comparative advantage of suppliers derives from their ability to collect information quickly and inexpensively because they are in the same industry as buyers (Jain, 2001) and have an existing day-to-day relationship. Suppliers are also better able to enforce non-collateralized debt repayment. The enforceability power of suppliers stems from the fact that they can threaten to stop supplying intermediate goods to their customers (Cunãt, 2007).

Empirically, Cook (1999) provides the first evidence of the signaling role of trade credit in periods characterized by structural changes in the Russian transition and a less developed economy. The findings allow the author to define trade credit as a screening device. Giannetti et al. (2011) find regularities between bank relationships and trade credit usage. They provide evidence of the signaling power of trade credit, which reveals favorable information to other lenders. However, their findings lead them to conclude that suppliers “enjoy an informational monopoly” in relation to “less informed banks” (Ibidem, p. 1288). Agostino and Trivieri (2014) test the informational advantage hypothesis of suppliers on the level of firm borrowing and provide evidence of the information content of trade credit for banks, especially when the relationship is weak, as measured by the increasing number of lenders and the fact that the bank cannot rely on soft information.

3 RESEARCH HYPOTHESES

- H1:

Trade credit has informative power and conditions banks’ loan approval decisions.

Information asymmetry represents one of the most important frictions that can affect firms’ access to finance in all types of financial systems. On the one hand, in market-based financial systems, firms characterized by a high degree of information asymmetry prefer to obtain financing from banks rather than use public debt (Anderson & Makhija, 1999; Denis & Mihov, 2003). On the other hand, in bank-based financial systems, although firms use banks as the main source of financing, firms with a higher degree of information asymmetry may be credit-rationed by financial intermediaries (De Andrés Alonso et al., 2005; García-Teruel et al., 2014; Stiglitz & Weiss 1981). In these cases, constrained firms may have an incentive to use alternative sources of financing as trade credit because of suppliers’ better ability to overcome the screening, monitoring and enforcement problems faced by financial institutions (Love, 2011).

- H2: Trade credit reduces the information asymmetry of opaque companies in their relationship with banks.

4 DATA AND SAMPLE FIRMS

Our data are from a proprietary loan-level database provided by one of the top five Italian banking groups. The database includes unique firm–bank identifiers, basic firm-level features and a set of loan-level characteristics, such as the results of loan requests (denied vs. approved).1 The dataset spans from 2009 to 2012 and is organized as an unbalanced panel. Moreover, all of the firms included in the sample are classified as SMEs, consistent with the European Commission's definition.2

These characteristics make the sample well-suited for analyzing relationship lending because Italian firms typically apply for loans at local bank branches instead of accessing bond or equity markets. Furthermore, none of the sample firms has issued public debt, and none are publicly listed. The size and legal characteristics of the sample firms and domestic banking laws ensure that banks do not have equity holdings in their client firms. For each borrower, we have information on the number and types of bank contacts per year, the credit rating, the contract terms, the share of firm debt provided by the bank, the total number of lenders and the date of the origination of the relationship with the bank.

Additionally, we use the Aida database managed by Bureau van Dijk to add some missing values to the balance sheet data. By matching the two datasets, we obtain an unbalanced panel of 47,105 firms that operated throughout Italy. Before obtaining the final dataset used in the regressions, we apply the following filters. Firms with missing values for any of the main variables are dropped. Moreover, the data related to continuous variables are winsorized at the 1% and 99% levels to address the problem of extreme outliers. In Table 1, we describe the variables used in the analysis and the relative summary statistics.

| Variables | Description | Median | Average | St. Dev | Skewness | |

|---|---|---|---|---|---|---|

| Accpay | Total account payables (thousands of euros) of firm i during year t | 231.39 | 438.35 | 654.61 | 5.56 | |

| Age | Age of firm i in year t | 11 | 14.09 | 10.73 | 1.2 | |

| Approval | A dichotomous variable related to the bank lending decision that takes the value of 1 if the bank approves the financing request of firm i at the end of year t and 0 otherwise | 1 | 0.96 | 0.185 | −4.88 | |

| Debt | The value of total year-end debt for firm i in year t | 784.84 | 1347.33 | 1983.17 | 12.95 | |

| Default | A binary variable that takes the value of 1 if loans are non-performing in year t and 0 otherwise | 0 | 0 | 0.05 | 18.52 | |

| Duration | The number of months that the bank and the firm have had a relationship | 70 | 102.58 | 91.56 | 1.2 | |

| Foreign | A binary variable that takes the value of 1 if firm i has purchased from the bank in year t at least one banking service related to import/export trading | 0 | 0.06 | 0.24 | 3.61 | |

| Extreme | A binary variable that takes the value of 1 if firm i has an average payables term higher than the average duration of the sector to which it belongs | 0 | 0.39 | 0.48 | 0.44 | |

| Growth | The percentage growth of total revenue of firm i between the end of year t–1 and the end of year t | 0.02 | 0.17 | 0.79 | 4.73 | |

| Lenders | The number of banks with which the borrower has loans | 3 | 3.78 | 2.61 | 1.22 | |

| Opac | A binary variable that takes the value of 1 if the age and size of firm i are less than their median values (simultaneously) and 0 otherwise | 0 | 0.27 | 0.44 | 1.02 | |

| Rating | This variable represents the borrower's creditworthiness, as calculated by banks’ internal borrower rating system, which is composed of 5 risk classes for solvent borrowers (i.e., 1 = least risky class; 5 = riskiest class); the subscript i identifies the borrower, and t indicates the year (2009–2012) |

R1 R2 R4 R5 |

0 0 0 0 |

0.39 0.29 0.10 0.01 |

0.48 0.45 0.30 0.11 |

0.42 0.89 2.57 8.31 |

| Size | The log value of the total revenue of firm i at the end of year t | 6.91 | 6.83 | 1.12 | −0.51 | |

| LMAs | A labor market area is the number of territorial units (clusters) in the region in which the firm's headquarters is located that identify as homogeneous labor markets | 39 | 37.17 | 12.31 | −.80 | |

| South | A binary variable that takes the value of 1 if firms are located in southern regions and 0 otherwise | 0 | 0.29 | 0.45 | 0.88 | |

| Tc | The ratio of total account payables (Accpay) to total year-end debt for firm i at the end of year t (Debt) | 0.31 | 0.34 | 0.21 | 0.5 | |

| Tc* | The ratio of total account payables (Accpay) to total year-end assets for firm i at the end of year t (Totassets) | 0.23 | 0.65 | 164.49 | 434.16 | |

| Totassets | The value of total assets of firm i at the end of year t | 824 | 1535.77 | 1981.05 | −0.11 |

- Note: This table reports the descriptive statistics of the variables employed in the econometric analysis. The numbers have been truncated at the second decimal.

5 MULTIVARIATE ANALYSIS

Specifically, we consider trade credit (TCit) as the ratio between trade payables and total debt, as well as other ratios, to check the robustness of the results. Because we assume that loan officers observe the past final year's volume, we also use the 1-year lagged value. Additionally, we scale payables by the firm's total assets (Tc*), as in Petersen and Rajan (1997) and other studies (e.g., Agostino & Trivieri, 2014; Garcia Teurel & Martínez-Solano, 2010), to address possible endogeneity concerns.

The vector Bit contains the bank assessment of firm creditworthiness. The credit analysis performed by the bank, typically a loan officer, aims to appraise the ability and willingness to repay the loan.

Credit analysts first use the economic prospectus and the borrower's past records, if available. The criteria used in the evaluation, known as the “five Cs of credit,” are capacity, capital, conditions, collateral and character (Thakor, 1995). Financial statements and the growth prospectus contain information useful for determining the borrower's capital and repayment capacity. Additional economic conditions, such as the macroeconomic environment or sector performance, also affect loan repayment. Furthermore, credit analysts are interested in the assets to be pledged as collateral that could easily be liquidated in the event of firm default. We use the internal rating as the overall evaluation of the firm's creditworthiness on a scale from 1 to 5; in the model, we include four rating dummies that take the value of 1 for the corresponding rating received and 0 otherwise. To avoid dummy traps, we do not include a rating 3 dummy.

The vector Rit considers the variables representing the relationship between the buyer and the bank, which enables the bank to gather information. One relationship variable is the length of the relationship between the firm and the bank (Duration). The length provides information on the strength of the borrower–lender relationship, and the unit of time is months. Another measure related to the strength of the relationship is its exclusivity between the firm and the bank, represented by the number of lenders that serve a firm (Lenders). Because a larger number of sources of financing may increase the bank's concerns over its ability to collect in the event of default (see Cole et al., 2004, p. 235), we expect a negative relationship (see also Cenni et al., 2015; Cole, 1998). Furthermore, we consider the number of banks as an inverse measure of the bank's information production (Carletti, 2004). Finally, the F component contains firm characteristics that could affect the firm's access to bank loans. In particular, the included control variables capture firm characteristics, such as firm Size; revenue Growth; South, if the firm is located in the southern part of Italy; Foreign, if the firm requests bank support for foreign operations (import and/or export), and sector, which can affect lending decisions by affecting the firm's quality, risk and creditworthiness (Aktas et al., 2012; Giannetti et al., 2011; Minetti et al., 2019; Ng et al., 1999; Petersen & Rajan, 1994, 1997; Summers & Wilson, 2002).

The magnitudes of the coefficients depend not only on the value of the covariates, xt (equation 1) but also on the value of the unobserved heterogeneity, ci. To estimate the partial effects at average and average partial effects (Wooldridge, 2010), we assume strict exogeneity conditional on the unobserved effects, ci (Chamberlain, 1984), and run a panel probit regression with random effects in Section 6.1. We then relax this assumption considering the possible endogeneity in Section 6.2 and allow for any serial correlation with the pooled probit estimator with clustered standard errors in Section 6.4.

6 RESULTS AND DISCUSSION

6.1 Signaling role of trade credit in bank lending decisions

In this section, we focus on the central research question of this study: Does trade credit play a role in lending decisions? Before we discuss the multivariate analysis based on equation (1), we preliminarily investigate the relationship between trade credit and firm creditworthiness because creditworthiness represents one of the most important dimensions considered in banks’ lending decisions. To that end, we perform a mean equality test to compare the level of trade credit and other variables related to different classes of risk, and we report the results in Table 2.

| Variable | Class of risk = 1 (low) group a | Class of risk ≠ 1 group b | t-test mean (b)–mean (a) | ||

|---|---|---|---|---|---|

| Obs. | Mean | Obs. | Mean | ||

| Accpay | 24,952 | 452.24 | 38,172 | 404.58 | −47.65*** |

| Debt | 24,952 | 1251.23 | 38,172 | 1322.31 | 71.08*** |

| Tc | 24,952 | 0.37 | 38,172 | 0.31 | −0.05*** |

| Duration | 24,952 | 4.53 | 38,172 | 3.83 | −0.70*** |

| Age | 24,952 | 16.77 | 38,172 | 12.35 | −4.41* |

| Growth | 24,952 | 0.08 | 38,172 | 0.22 | 0.13*** |

| Class of risk = 2 group a | Class of risk > 2 group b | t-test mean (a)–mean (b) | |||

|---|---|---|---|---|---|

| Accpay | 18,710 | 404.73 | 19,462 | 404.44 | −0.28 |

| Debt | 18,710 | 1257.98 | 19,462 | 1384.16 | 126.17*** |

| Tc | 18,710 | 0.33 | 19,462 | 0.30 | −0.02*** |

| Duration | 18,710 | 3.99 | 19,462 | 3.69 | −0.29** |

| Age | 18,710 | 13.40 | 19,462 | 11.34 | −2.06 |

| Growth | 18,710 | 0.17 | 19,462 | 0.26 | 0.08*** |

| Class of risk = 3 group a | Class of risk > 3 group b | t-test mean (a)–mean (b) | |||

|---|---|---|---|---|---|

| Accpay | 11,941 | 392.64 | 7521 | 423.19 | 30.55*** |

| Debt | 11,941 | 1344.95 | 7521 | 1446.41 | 101.45*** |

| Tc | 11,941 | 0.30 | 7521 | 0.29 | −0.01*** |

| Duration | 11,941 | 3.65 | 7521 | 3.74 | 0.09** |

| Age | 11,941 | 11.78 | 7521 | 10.64 | −1.14 |

| Growth | 11,941 | 0.27 | 7521 | 0.24 | −0.03** |

| Class of risk = 4 group a | Class of risk > 4 group b | t-test mean (a)–mean (b) | |||

|---|---|---|---|---|---|

| Accpay | 6646 | 425.97 | 875 | 402.13 | −23.83 |

| Debt | 6646 | 1452.85 | 875 | 1397.48 | −55.36 |

| Tc | 6646 | 0.29 | 875 | 0.28 | −0.014** |

| Duration | 6646 | 3.72 | 875 | 3.95 | 0.23** |

| Age | 6646 | 10.76 | 875 | 9.69 | −1.07 |

| Growth | 6646 | 0.26 | 875 | 0.08 | −0.18** |

| Class of risk = 5 (high) group a | Class of risk < 5 group b | t-test mean (a)–mean (b) | |||

|---|---|---|---|---|---|

| Accpay | 875 | 402.13 | 62,249 | 423.72 | 21.59 |

| Debt | 875 | 1397.48 | 62,249 | 1292.76 | −104.72** |

| Tc | 875 | 0.28 | 62,249 | 0.34 | 0.057*** |

| Duration | 875 | 3.95 | 62,249 | 4.11 | 0.16** |

| Age | 875 | 9.69 | 62,249 | 14.16 | 4.47 |

| Growth | 875 | 0.08 | 62,249 | 0.17 | 0.08** |

- Note: This table reports a two-group mean comparison t-test performed to compare the average difference between each combined group (by risk) with the group of remaining observations with higher risk. For example, for risk class 1 (risk class 2), the average values of accounts payable, TC and total debt are compared (in terms of difference) with the average values reported by firms in classes 2–5 (3–5). The average values of firms in class 5 are compared with all remaining observations. Class 1 is the lowest risk class, whereas class 5 is the highest.

- ***, ** and * indicate statistical significance at the 1%, 5% and 10% levels, respectively.

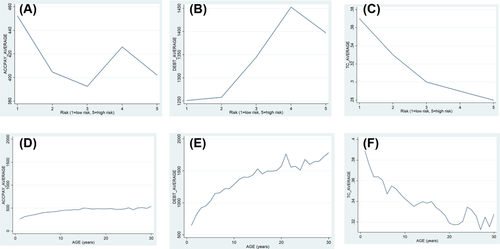

The ratio between account payables and total debt decreases with risk, such that the higher the risk of the borrower, the lower the trade credit ratio. This finding is not surprising because trade credit may be considered a reflection of firms’ reputation. Based on this analytical perspective, a borrower's increasing level of debt may induce suppliers to reduce the credit that they extend to the borrower (as shown in Figure 1 in the comparison of Accpay, Debt and Tc under different risk levels).

Furthermore, the comparison between age and risk shows that the former is inversely related to the latter because riskier firms are younger (see Figure 1). This evidence may reflect the effect of banks’ attitudes regarding holding established relationships with safer firms, or it may be a consequence of the higher level of (positive) hard and soft information available for mature firms, which positively affects the borrower's rating. Then, we examine the correlation between trade credit and age based on a graphical analysis and report the results in Figure 1. Interestingly, although account payables increase with age, their value scaled by debt (Tc) is higher among younger firms and lower among older firms because of the high total debt of the latter.

After this preliminary investigation, we examine the results of our main regression based on equation (1) and analyze the contribution of trade credit to the loan approval process. We employ Tc (the ratio between account payables and total debt) as the dependent variable for several reasons. The ratio of account payables to total debt captures the importance of trade credit in the financing of a firm's assets. Thus, the loan officers at the bank from which we collected the data are typically prone to consider the value of trade credit in relative terms (with respect to total debt) because the reporting scheme of the balance sheet that they employ is mainly oriented to note the relative values of each balance sheet item.

The results of the multivariate analysis are reported in Table 3 and generally provide evidence of the signaling role of payables in loan approvals. Consistent with our hypothesis, the bank choice of approval or denial seems contingent on the extension of credit from suppliers to buyers, ceteris paribus.

| (I) | (II) | (III) | (IV) | (V) | (VI) | (VII) | (VIII) | |

|---|---|---|---|---|---|---|---|---|

| Variable | Coefficients | Marginal effects | Coefficients | Marginal effects | Coefficients | Marginal effects | Coefficients | Marginal effects |

| Tc | 0.2982*** | 0.0227*** | – | – | – | – | – | – |

| (0.055) | (0.004) | |||||||

| Tct–1 | – | – | 0.2926*** | 0.0229*** | – | – | – | – |

| (0.051) | (0.004) | |||||||

| Tc* | – | – | – | – | 0.1346** | 0.0102** | – | – |

| (0.062) | (0.005) | |||||||

| Tc*t–1 | – | – | – | – | – | – | 0.1723*** | 0.0135*** |

| (0.059) | (0.005) | |||||||

| Extreme | −0.1124*** | −0.0085*** | −0.0921*** | −0.0072*** | −0.0856*** | −0.0065*** | −0.0791*** | −0.0062*** |

| (0.022) | (0.002) | (0.021) | (0.002) | (0.022) | (0.002) | (0.021) | (0.002) | |

| R1 | 0.2965*** | 0.0226*** | 0.3045*** | 0.0239*** | 0.3149*** | 0.0239*** | 0.3211*** | 0.0252*** |

| (0.030) | (0.002) | (0.030) | (0.002) | (0.030) | (0.002) | (0.030) | (0.002) | |

| R2 | 0.1151*** | 0.0088*** | 0.1263*** | 0.0099*** | 0.1220*** | 0.0093*** | 0.1332*** | 0.0104*** |

| (0.028) | (0.002) | (0.028) | (0.002) | (0.028) | (0.002) | (0.028) | (0.002) | |

| R4 | −0.3791*** | −0.0288*** | −0.3539*** | −0.0277*** | −0.3825*** | −0.0290*** | −0.3561*** | −0.0279*** |

| (0.030) | (0.002) | (0.031) | (0.003) | (0.030) | (0.002) | (0.031) | (0.003) | |

| R5 | −0.8043*** | −0.0612*** | −0.7840*** | −0.0614*** | −0.8121*** | −0.0617*** | −0.7920*** | −0.0621*** |

| (0.055) | (0.004) | (0.056) | (0.005) | (0.055) | (0.004) | (0.056) | (0.005) | |

| Duration | 0.0002 | 0.0000 | 0.0002 | 0.0000 | 0.0001 | 0.0000 | 0.0001 | 0.0000 |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| Lenders | −0.0247*** | −0.0019*** | −0.0237*** | −0.0019*** | −0.0287*** | −0.0022*** | −0.0268*** | −0.0021*** |

| (0.004) | (0.000) | (0.005) | (0.000) | (0.004) | (0.000) | (0.004) | (0.000) | |

| Size | −0.0397*** | −0.0030*** | −0.0389*** | −0.0030*** | −0.0257** | −0.0019** | −0.0291** | −0.0023** |

| (0.011) | (0.001) | (0.011) | (0.001) | (0.011) | (0.001) | (0.011) | (0.001) | |

| Growth | 0.0141 | 0.0011 | 0.0216* | 0.0017* | 0.0162 | 0.0012 | 0.0224* | 0.0018* |

| (0.012) | (0.001) | (0.012) | (0.001) | (0.012) | (0.001) | (0.012) | (0.001) | |

| Foreign | 0.0485 | 0.0037 | 0.0732* | 0.0057* | 0.0487 | 0.0037 | 0.0714 | 0.0056 |

| (0.042) | (0.003) | (0.044) | (0.003) | (0.042) | (0.003) | (0.043) | (0.003) | |

| South | −0.0986*** | −0.0075*** | −0.1009*** | −0.0079*** | −0.0973*** | −0.0074*** | −0.0968*** | −0.0076*** |

| (0.021) | (0.002) | (0.022) | (0.002) | (0.021) | (0.002) | (0.022) | (0.002) | |

| Constant | 2.0840*** | 2.0358*** | 2.0520*** | 2.0276*** | ||||

| (0.073) | (0.073) | (0.072) | (0.073) | |||||

| Observations | 63,132 | 63,132 | 59,250 | 59,250 | 63,136 | 63,136 | 59,284 | 59,284 |

- Note: This table shows the panel probit estimation for bank lending decisions and the predicted probabilities based on the model below:

The vector Bit contains the bank assessment of firm creditworthiness, the vector Rit contains relationship lending variables and Fit contains firm control variables. The coefficients are reported in odd-numbered columns, and the average marginal effects are reported in even-numbered columns. The dependent variable is Approval, which is a dichotomous variable for bank lending decisions that takes the value of 1 if the bank approves the request for financing of firm i in year t and 0 otherwise. Tcit is the ratio between trade payables and total debt; we also use the 1-year lagged value, TCit–1. Extreme is a binary variable that takes the value of 1 if firm i has an average payables term higher than the average duration of the sector to which it belongs. We include four rating dummies that take the value of 1 for the corresponding rating received and 0 otherwise. To avoid dummy traps, we do not include the rating 3 dummy. Duration is the length of the relationship between the firm and the bank in months. Lenders is number of lenders that serve a firm. Size is the log value of the total revenue of firm i at the end of year t. Growth is the percentage growth of the total revenue of firm i between the end of year t–1 and the end of year t. South is a binary variable that takes the value of 1 if firms are located in southern regions and 0 otherwise. Foreign is a binary variable that takes the value of 1 if firm i has purchased from the bank in year t at least one banking service related to import/export trading. Additionally, we scale payables by the firm's total assets (Tc*) and its lagged value (Tc*it–1) in columns V–VIII. All independent variables are defined in detail in Table 1, and the t-statistics are in parentheses.

- ***, ** and * indicate statistical significance at the 1%, 5% and 10% levels, respectively.

Approval is used as the dependent variable in the probit model discussed in Section 4, and the first column in Table 3 tests whether the presence of trade credit contains valuable credit quality information for banks and contributes to lending decisions. The coefficient of trade credit is positive and significant at all conventional levels. Because we assume that banks observe suppliers’ behavior ex-post (i.e., loan officers review the balance sheet from the most recent available year), we also consider the lagged value of Tc and note that the results remain unchanged. Thus, banks seem to incorporate the use of trade credit when granting loan decisions. The positive role of trade credit between buyers and suppliers in lending decisions is consistent with the models of Emery (1984) and Biais and Gollier (1997). The informational advantage of a supplier that collects information during day-by-day business relationships is recognized by the bank and factors into its decision. This evidence is useful for understanding how agreed-upon delayed payments affect bank decisions. Trade partners can serve not only as a signaling device but also as a means of monitoring because lenders, as trade partners, know the industry well and reduce their risk by closely monitoring borrowers (Miwa & Ramseyer, 2008).

The results seem to support H1: Bank lending decisions are influenced by trade credit, and trade credit plays a signaling role in the loan approval process. In particular, trade credit increases the likelihood of a firm to obtain a positive response to a loan request, ceteris paribus. Thus, banks seem to use trade credit information in lending decisions to efficiently allocate capital. The informational value derived from commercial credit is not assumed sic et simpliciter, but the bank uses and processes this information proactively, increasing the granularity of the information.

To gain deeper insights into the monitoring role of suppliers, we include in our regression the duration of payables in days. Specifically, based on previous studies (e.g., Giannetti et al., 2011), we include the binary variable Extreme, which indicates whether a firm has an average payables term with suppliers that is longer than the average duration of the sector to which it belongs (Extreme = 1) or not (Extreme = 0). The results of this inclusion show that a duration longer than the median negatively impacts banks’ final loan approval decisions (columns I–VIII, Table 3). One possible reason for this finding is that a greater extension of credit terms (Extreme = 1) could be symbolic of the liquidity tension of a firm, which could negatively affect loan granting decisions.

Not surprisingly, the bank's valuation of the borrower's creditworthiness, as determined by its internal rating system, affects loan approval decisions. Firms that belong to the least risky classes (R1 or R2) have a higher probability of obtaining a loan. Conversely, if the firm requesting financing receives a riskier valuation class (R4 or R5), the request is less likely to be granted.

The analysis of the contribution of trade credit to lending decisions also considers the effect of the repeated interactions between the bank and the firm because past experience with the firm could affect the denial or approval of a loan request. Before disentangling the role in the lending decision played by the presence of trade credit with pooled information gathered by the bank during its relationship with the firm, we briefly analyze the regression results of the relationship lending coefficients in Table 3. From the firm's perspective, a strong bank relationship is considered a valuable asset because it reduces the cost and increases the availability of credit.

In our main specification, we include the number of relationships that a firm has with financial intermediaries (Lenders) and the duration of the bank–firm relationship (Duration) to assess the strength and intensity of relationships as a source of soft information production and the effect on the probability of obtaining a loan. The negative coefficient (statistically significant at the 1% level) of Lenders in all specifications in Table 3 suggests that increasing the number of firm financial intermediary relationships reduces the probability of obtaining loans. Consistent with previous studies (e.g., Carletti, 2004), multiple lending relationships may represent an inverse measure of soft information production. Thus, the higher the number of lenders is, the lower the accumulation of soft information obtained by banks and, consequently, the lower the probability of a borrower establishing reliability using qualitative information.

Moreover, the relationship between Approval and Duration shows that firms involved in long-lasting relationships with banks are more likely to be approved, although this result was not statistically significant. In addition, firm characteristics, such as size (Size) and location (South), negatively affect the probability of obtaining a loan.

Because participation in a global supply chain can allow firms to receive liquidity from each other by allowing for the delayed payment of products (Minetti et al., 2019), we control our results by including Foreign, which captures the buyer's participation in the supply chain (without any information on the intensity of this participation). However, this variable does not seem to play a significant role in explaining the probability of the loan approval decision, and the other control variables seem to be statistically irrelevant (i.e., firm growth).

We estimate the average marginal effect to compute the impact and weight of each regressor (columns II, IV, VI and VIII of Table 3). As noted by Cameron and Trivedi (2005), in the non-linear model, the average behavior of individuals differs from the behavior of the average individual (marginal effects at the mean). This type of estimation should lead to results similar to those obtained based on ordinary least squares. From the previous regression (odd columns), we retain all of the effects of the variables in the model because the signs remain. This analysis allows us to discuss the magnitude of the coefficients with respect to the probability.

An increase of 1% in the ratio of payables to total debt increases the probability by 2.27% (see column II, Table 3), and a similar result is observed for previous year-end observations (Tct–1, columns VI and VIII, Table 3). Although firms benefit from the use of trade debt, extra delayed payments lower the probability of financing by 0.8% (column II, Table 3). Less risky firms (belonging to risk classes 1 and 2, i.e., R1 and R2) have the highest probability of requests being granted, whereas risky firms (belonging to risk classes 4 and 5, i.e., R4 and R5) show the opposite effect; specifically, the classification of a firm in the worst risk class (R5) reduces the probability of loan approval by approximately 6%, on average (columns II, IV, VI and VIII). These results reflect the tendency of banks to grant loans to low-risk borrowers to improve their allocative efficiency and preserve capital as a result of institutional changes, such as Basel II and the aftermath of the financial crisis.

6.2 Controlling for endogeneity

In the previous section, we assume that our trade credit variable affects the probability of obtaining a bank loan. Implicitly, we consider a causal relationship that moves in one direction—from bank finance to trade finance. However, one might be concerned that trade credit extension may be endogenous and that model misspecification, for example, because of omitted variables, could produce a biased estimation. Thus, we investigate a possible two-way relationship between both variables: bank loans and trade credit. For instance, the decision to buy a product on credit could be affected by the possibility or not of borrowing money from a bank. Ignoring this potential simultaneity could produce inconsistent parameter estimations. To handle endogeneity concerns, we use two-stage least squares (2SLS) for estimation. The standard remedy for this issue is to find an instrument for the endogenous regressor—in our case, the trade credit variable—that satisfies two conditions often referred to as the relevance and exclusion conditions (Roberts & Whited, 2013).

In an attempt to find the most appropriate instrumental variable, we explore the area of geo-economics in the analysis. Evidence of the role of geographical factors in examining economic and financial global systems has received increasing attention. The roles played by patterns of localization, polarization, the distribution of population and wealth, distance to financial powers or services and geopolitical institutions are under debate. Geo-finance research mostly explores individual firms’ positioning in financial networks, is at the forefront of explaining firms’ long-term growth performance and makes it possible to explore the interactions among co-located firms (Arjaliès, et al. 2019; Pichler & Wilhelm, 2001; Pollock, et al. 2004).

Based on this literature, we propose an instrument for trade credit, labor market areas (LMAs),3 that is, the number of territorial units (clusters) in the region in which the firm's headquarters are located and that identify homogeneous labor markets (Casado-Díaz & Coombes, 2011). According to the definition proposed by the Italian National Institute of Statistics (ISTAT, 1997), LMAs are described as places (intended as specified and delimited topographic areas) in which the population resides and works and that indirectly cover the needs of most of the population's social and economic relationships.

Considering a network of social and economic relationships, we exploit the informational value of LMAs to derive the day-by-day operations among economic operators. From an informational perspective, this favorable environment could be correlated with the firm's decision to extend trade credit based on the presence of this network of relationships as represented by local systems. Thus, the existence of LMAs ameliorates information asymmetries, improves the relationships among business operators and, in doing so, facilitates trade and encourages inter-firm credit. LMAs are often characterized by high productivity, learning specialization and know-how, and they bring overall benefits to the sector and support, integration and services activities, thereby completing the value chain of the local system.

In summary, we expect that firms located within LMAs should have a higher probability of increasing their volume of trade credit with suppliers in the same area (relevance condition). Regarding the exclusion condition, the presence of LMAs in the region in which the firm is located should not affect the bank lending decision. In fact, to the best of our knowledge, people's spatial movements and commutes should not directly affect the loan approval process because this process is mainly affected by borrower-specific variables. Thus, the instrumental variable chosen should not be correlated with the error term of equation (1).

Table 4 reports the first- and second-stage regression results (in columns II and IV and columns I and III, respectively) of the main specification. The results of the instrumental regression confirm the sign of the causal relationship among our variables of interest. The estimated effect of trade credit is positive and statistically significant across all specifications and exhibits the same sign pattern as in the ordinary panel probit model. The coefficients of the estimated exogenous regressors—R1 and R2—exhibit the reverse sign but are not statistically significant (columns I and III). In the first-stage regression, they show the expected sign because trade credit is inversely related to the buyer's risk. Furthermore, the 2SLS estimates enhance the statistical significance of the duration variable coefficients (+0.0012 and +0.0015 in columns I and III, respectively, and significant at all conventional levels). Thus, the general results shown in Table 4 indicate that we may have evidence that, at least in part, rejects our endogeneity concerns.

| (I) | (II) | (III) | (IV) | |

|---|---|---|---|---|

| Variable | Second stage | First stage | Second stage | First stage |

| Tc | 4.1576*** | – | – | – |

| (1.480) | ||||

| Tct–1 | – | – | 4.4962*** | – |

| (0.573) | ||||

| Extreme | −0.6842*** | 0.1529*** | −0.4556*** | 0.0939*** |

| (0.206) | (0.002) | (0.039) | (0.002) | |

| R1 | −0.0695 | 0.0708*** | −0.1215 | 0.0616*** |

| (0.203) | (0.002) | (0.115) | (0.003) | |

| R2 | 0.0315 | 0.0275*** | −0.0474 | 0.0239*** |

| (0.080) | (0.002) | (0.047) | (0.003) | |

| R4 | −0.2053 | −0.0132*** | −0.1190 | −0.0109*** |

| (0.134) | (0.003) | (0.093) | (0.003) | |

| R5 | −0.4656 | −0.0264*** | −0.2177 | −0.0372*** |

| (0.293) | (0.007) | (0.220) | (0.008) | |

| Duration | 0.0012*** | −0.0002*** | 0.0015*** | −0.0003*** |

| (0.000) | (0.000) | (0.000) | (0.000) | |

| Lenders | 0.0738* | −0.0229*** | 0.0876*** | −0.0227*** |

| (0.043) | (0.000) | (0.020) | (0.000) | |

| Size | −0.3463*** | 0.0801*** | −0.3374*** | 0.0727*** |

| (0.114) | (0.001) | (0.037) | (0.001) | |

| Growth | −0.0402* | 0.0117*** | 0.0054 | 0.0006 |

| (0.023) | (0.001) | (0.009) | (0.001) | |

| Foreign | 0.0441 | −0.0045 | 0.0515* | −0.0046 |

| (0.032) | (0.003) | (0.028) | (0.003) | |

| South | −0.0771*** | 0.0043** | −0.1429*** | 0.0243*** |

| (0.030) | (0.002) | (0.016) | (0.002) | |

| LMAs | – | 0.0002*** | – | 0.0002** |

| (0.000) | (0.000) | |||

| Constant | 2.2263*** | −0.2048*** | 1.3708*** | −0.0981*** |

| (0.321) | (0.006) | (0.434) | (0.007) | |

| Observations | 58,466 | 58,466 | 54,887 | 54,887 |

- Note: This table shows the results of an instrumental regression conducted to resolve the endogeneity concerns related to Tc (trade credit) that arose from the regression reported in Table 3. The instrumental variable is LMAs (labor market areas). Columns II and IV show the first-stage least squares regression in which the suspected endogenous variable (Tc) is the dependent variable.

Columns I and III report the second-stage regression in which the model-estimated values from stage one are used in place of the actual values of Tc. The dependent variable is Approval.

- The vector Bit contains the bank assessment of firm creditworthiness, the vector Rit contains relationship lending variables and Fit contains firm control variables. Tcit is the ratio between trade payables and total debt; we also use the 1-year lagged value, TCit–1. Extreme is a binary variable that takes the value of 1 if firm i has an average payables term higher than the average duration of the sector to which it belongs. We include four rating dummies that take the value of 1 for the corresponding rating received and 0 otherwise. To avoid dummy traps, we do not include the rating 3 dummy. Duration is the length of the relationship between the firm and the bank in months. Lenders is number of lenders that serve a firm. Size is the log value of the total revenue of firm i at the end of year t. Growth is the percentage growth of the total revenue of firm i between the end of year t–1 and the end of year t. South is a binary variable that takes the value of 1 if firms are located in southern regions and 0 otherwise. Foreign is a binary variable that takes the value of 1 if firm i has purchased from the bank in year t at least one banking service related to import/export trading. vi is the composite error term uncorrelated with Xi. All independent variables are defined in detail in Table 1.

6.3 The complementary effect of trade credit on opaque firms

In this section, we present the results of an exercise aiming to identify any possible impact of trade credit on lending decisions for opaque firms. Ferri and Murro (2015) demonstrate that when opaque firms match transactional banks, their probability of being credit-rationed increases. On the one hand, low-transparency firms may face constraints if financing banks, as financial intermediaries, are not inclined to grant a loan until a certain minimum level of tangible assets that could serve as collateral is achieved. On the other hand, trade credit may mitigate this friction because suppliers may have an informational advantage over traditional financial intermediaries (Biais & Gollier, 1997; Smith, 1987). In fact, suppliers are able to learn about their clients’ businesses and operations through their interactions with buyers because suppliers usually have face-to-face contact with their customers and the purchase orders received by their clients allow them to collect information on their investment opportunities and the business cycle. However, whether opaque firms, which could be subjected to credit constraints under this condition, can experience a beneficial effect from trade credit when requesting a loan remains an unexplored question. In other words, because trade credit may be a consequence of the borrower's good reputation from the perspective of suppliers, we are interested in analyzing whether the signaling role of trade credit is of a higher magnitude for opaque firms than for transparent firms.

The first problem in such an investigation is defining opaque firms. Following the view suggested by Bonaccorsi di Patti and Dell'Ariccia (2004), who used Italian data, we propose measuring firm opacity by combining the age and balance sheet data of each borrower. In particular, we create a dummy variable designated Opac, which takes the value of 1 if a firm simultaneously shows that the value of its Age and Size is less than the median value and 0 otherwise.

Then, we add Opac to our main regression, and the results are shown in Table 5. As reported in column I, the value of the binary variable is not statistically significant, suggesting that we cannot consider opacity as a friction that negatively affects the ability of banks to grant a loan. However, when we add the interaction between Opac and Tc, we note some findings that may help explain the different roles of trade credit in lending decisions when we separate opaque and transparent firms. According to the results reported in column III, while we note that the interaction term is not statistically significant, the calculation of the average marginal effect suggests that the coefficient of trade credit changes from approximately 0.4080 (statistically significant at the 1% level) for transparent firms (Opac = 0) to approximately 0.5344 (statistically significant at the 1% level) for opaque firms (Opac = 1). This change suggests that the role of trade credit in signaling the borrower's reputation increases for opaque firms.

| (I) | (II) | (III) | (IV) | |

|---|---|---|---|---|

| Variable | Coefficients | Marginal effects | Coefficients | Marginal effects |

| TC | 0.4455*** | 0.0404*** | 0.4080*** | 0.0402*** |

| (0.077) | (0.007) | (0.090) | (0.007) | |

| Opac | – | – | –0.0423 | –0.0003 |

| (0.059) | (0.003) | |||

| Opac x TC | – | – | 0.1264 | – |

| (0.155) | ||||

| R1t–1 | 0.2795*** | 0.0254*** | 0.2802*** | 0.0254*** |

| (0.040) | (0.004) | (0.040) | (0.004) | |

| R2t–1 | 0.1593*** | 0.0144*** | 0.1592*** | 0.0144*** |

| (0.038) | (0.003) | (0.038) | (0.003) | |

| R4t–1 | −0.1706*** | −0.0155*** | −0.1716*** | −0.0156*** |

| (0.043) | (0.004) | (0.043) | (0.004) | |

| R5t–1 | −0.4171*** | −0.0378*** | −0.4169*** | −0.0378*** |

| (0.105) | (0.010) | (0.105) | (0.010) | |

| Duration | 0.0001 | 0.0000 | 0.0001 | 0.0000 |

| (0.000) | (0.000) | (0.000) | (0.000) | |

| Lenders | −0.0395*** | −0.0036*** | −0.0395*** | −0.0036*** |

| (0.005) | (0.000) | (0.005) | (0.000) | |

| Extreme | −0.1887*** | −0.0171*** | −0.1896*** | −0.0172*** |

| (0.030) | (0.003) | (0.030) | (0.003) | |

| Foreign | 0.0445 | 0.0040 | 0.0437 | 0.0040 |

| (0.061) | (0.006) | (0.061) | (0.006) | |

| Growth | 0.0302 | 0.0027 | 0.0304 | 0.0028 |

| (0.019) | (0.002) | (0.019) | (0.002) | |

| South | −0.1237*** | −0.0112*** | −0.1241*** | −0.0113*** |

| (0.031) | (0.003) | (0.031) | (0.003) | |

| Opac | −0.0043 | −0.0004 | – | – |

| (0.036) | (0.003) | |||

| Constant | 1.7310*** | – | 1.7447*** | – |

| (0.053) | (0.056) | |||

| Observations | 26,865 | 26,865 | 26,865 | 26,865 |

- Note: This table shows the panel probit estimation for bank lending decisions and the predicted probabilities for opaque firms. We include in the model the binary variable Opac, which takes the value of 1 if a firm simultaneously shows that the values of its Age and Size are less than the median value and 0 otherwise, as well as its interaction with the trade credit variable, TCit:

- The vector Bit contains the bank assessment of firm creditworthiness, the vector Rit contains relationship lending variables and Fit contains firm control variables. The coefficients are reported in odd-numbered columns, and the average marginal effects are reported in even-numbered columns. The dependent variable Approval is a dichotomous variable for bank lending decisions that takes the value of 1 if the bank approves the request for financing of firm i in year t and 0 otherwise. Tcit the ratio between trade payables and total debt; we also use the 1-year lagged value, TCit–1. Extreme is a binary variable that takes the value of 1 if firm i has an average payables term higher than the average duration of the sector to which it belongs. We include four rating dummies that take the value of 1 for the corresponding rating received and 0 otherwise. To avoid dummy traps, we do not include the rating 3 dummy. Duration is the length of the relationship between the firm and the bank in months. Lenders is the number of lenders that serve a firm. Size is the log value of the total revenue of firm i at the end of year t. Growth is the percentage growth of the total revenue of firm i between the end of year t–1 and the end of year t. South is a binary variable that takes the value of 1 if firms are located in southern regions and 0 otherwise. Foreign is a binary variable that takes the value of 1 if firm i has purchased from the bank in year t at least one banking service related to import/export trading, All independent variables are defined in Table 1, and the t-statistics are in parentheses.

- ***, ** and * indicate statistical significance at the 1%, 5% and 10% levels, respectively.

Hence, these results appear to be consistent with the empirical evidence (albeit limited) that supports the complementary effect between trade credit and bank loans (Cook, 1999; García-Appendini, 2006; Ono, 2001), with the novelty of illustrating that opaque firms can benefit the most from this type of relationship.

6.4 Additional evidence

In this section, we provide additional analyses of the previous results to assess whether and, if so, how the signaling role of trade credit and its informational value play a significant role in ongoing interactions between banks and borrowers in the loan approval decision process. Specifically, we focus on three main aspects of firms: the risk profile and the relationship with banks in terms of Duration and Size. Table 6 reports the results of these additional analyses.

| (I) | (II) | (III) | (IV) | (V) | (VI) | (VII) | (VIII) | |

|---|---|---|---|---|---|---|---|---|

| Variable | Coefficients | Marginal effects | Coefficients | Marginal effects | Coefficients | Marginal effects | Coefficients | Marginal effects |

| Tc | 0.3013*** | 0.0281*** | 0.2564*** | 0.0195*** | 0.2206*** | 0.0169*** | 0.2151*** | 0.0165*** |

| (0.067) | (0.006) | (0.074) | (0.006) | (0.052) | (0.004) | (0.052) | (0.004) | |

| R1 | – | – | 0.2951*** | 0.0225*** | 0.2658*** | 0.0203*** | 0.2648*** | 0.0203*** |

| (0.030) | (0.002) | (0.030) | (0.002) | (0.030) | (0.002) | |||

| R2 | 0.1211*** | 0.0113*** | 0.1152*** | 0.0088*** | 0.1061*** | 0.0081*** | 0.1057*** | 0.0081*** |

| (0.028) | (0.003) | (0.028) | (0.002) | (0.028) | (0.002) | (0.028) | (0.002) | |

| R4 | −0.3795*** | −0.0354*** | −0.3792*** | −0.0289*** | −0.3663*** | −0.0280*** | −0.3667*** | −0.0281*** |

| (0.030) | (0.003) | (0.030) | (0.002) | (0.030) | (0.002) | (0.030) | (0.002) | |

| R5 | – | – | −0.8046*** | −0.0612*** | −0.7689*** | −0.0588*** | −0.7700*** | −0.0589*** |

| (0.055) | (0.004) | (0.055) | (0.004) | (0.055) | (0.004) | |||

| Duration | 0.0001 | 0.0000 | 0.0000 | 0.0000 | 0.0002 | 0.0000 | 0.0002 | 0.0000 |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| Duration#TC | – | – | 0.0005 | 0.0000 | – | – | – | – |

| (0.001) | (0.000) | |||||||

| Lenders | −0.0153*** | −0.0014*** | −0.0247*** | −0.0019*** | −0.0132*** | −0.0010*** | −0.0125*** | −0.0010*** |

| (0.005) | (0.000) | (0.004) | (0.000) | (0.004) | (0.000) | (0.005) | (0.000) | |

| Size | −0.0519*** | −0.0048*** | −0.0397*** | −0.0030*** | – | – | – | – |

| (0.013) | (0.001) | (0.011) | (0.001) | |||||

| Growth | 0.0132 | 0.0012 | 0.0144 | 0.0011 | 0.0130 | 0.0010 | 0.0138 | 0.0011 |

| (0.013) | (0.001) | (0.012) | (0.001) | (0.012) | (0.001) | (0.012) | (0.001) | |

| Extreme | −0.1195*** | −0.0111*** | −0.1123*** | −0.0085*** | −0.0556** | −0.0042** | −0.0549** | −0.0042** |

| (0.026) | (0.002) | (0.022) | (0.002) | (0.022) | (0.002) | (0.022) | (0.002) | |

| Foreing | 0.0250 | 0.0023 | 0.0488 | 0.0037 | 0.0529 | 0.0040 | 0.0532 | 0.0041 |

| (0.056) | (0.005) | (0.042) | (0.003) | (0.042) | (0.003) | (0.042) | (0.003) | |

| South | −0.0570** | −0.0053** | −0.0984*** | −0.0075*** | −0.0967*** | −0.0074*** | −0.0957*** | −0.0073*** |

| (0.025) | (0.002) | (0.021) | (0.002) | (0.021) | (0.002) | (0.021) | (0.002) | |

| Log(Totassets) | – | – | – | – | 0.1969*** | 0.0151*** | 0.2445*** | 0.0151*** |

| (0.035) | (0.003) | (0.059) | (0.003) | |||||

| Log(Debt) | – | – | – | – | −0.2808*** | −0.0215*** | −0.2361*** | −0.0218*** |

| (0.036) | (0.003) | (0.057) | (0.003) | |||||

| Log(Totassets)#Log(Debt) | – | – | – | – | −0.0068 | – | ||

| (0.007) | ||||||||

| Constant | 2.1148*** | 2.0971*** | 2.2865*** | 1.9800*** | ||||

| (0.077) | (0.074) | (0.080) | (0.314) | |||||

| Observations | 37,302 | 37,302 | 63,132 | 63,132 | 63,272 | 63,272 | 63,272 | 63,272 |

- This table shows additional evidence on the panel probit estimation for bank lending decisions and the predicted probabilities based on our main specification reported below:

- We restrict the analysis to a subsample of firms belonging to the central risk classes (R2, R3 and R4), excluding R3 to avoid dummy traps (columns I and II). We explore the interaction between the relationship lending variables (Duration) and trade credit (TC; columns III and IV). We control the size of the firm for the level of indebtedness (Debt; columns V–VIII). The vector Bit contains the bank assessment of firm creditworthiness, the vector Rit contains relationship lending variables and Fit contains firm control variables. The coefficients are reported in odd-numbered columns, and the average marginal effects are reported in even-numbered columns. The dependent variable is Approval, which is a dichotomous variable for bank lending decisions that takes the value of 1 if the bank approves the request for financing of firm i in year t and 0 otherwise. Tcit the ratio between trade payables and total debt; we also use the 1-year lagged value, TCit–1. Extreme is a binary variable that takes the value of 1 if firm i has an average payables term higher than the average duration of the sector to which it belongs. We include four rating dummies that take the value of 1 for the corresponding rating received and 0 otherwise. To avoid dummy traps, we do not include the rating 3 dummy. Duration is the length of the relationship between the firm and the bank in months. Lenders is the number of lenders that serve a firm. Size is the log value of the total revenue of firm i at the end of year t. Growth is the percentage growth of the total revenue of firm i between the end of year t-1 and the end of year t. South is a binary variable that takes the value of 1 if firms are located in southern regions and 0 otherwise. Foreign is a binary variable that takes the value of 1 if firm i has purchased from the bank in year t at least one banking service related to import/export trading. All independent variables are defined in detail in Table 1, and the t-statistics are in parentheses.

- ***, ** and * indicate statistical significance at the 1%, 5% and 10% levels, respectively.

First, we test whether the informational value of trade credit has different effects for firms belonging to the central risk classes (R2, R3 and R4) and the types of firms for which the informational value of soft information in the loan approval process could be more relevant. To test this hypothesis, we consider a subsample that excludes firms that belong to extreme risk classes (R1 and R5), and we run the model in equation (1) (excluding R3 to avoid the dummy trap problem). The results confirm that the informative power of trade credit holds (Table 6, columns I and II) and is more relevant when we exclude from the analysis the extreme risk classes (R1 and R5). Notably, although the duration of the bank–firm relationship does not play a significant role in the previous results, it now shows a positive correlation with the decision to grant a loan (statistically significant at the 1% level; see columns I and II, Table 6). This finding seems to confirm the insight related to the higher informational value of soft information for firms belonging to intermediate-risk classes.

Second, based on these findings, we further analyze the effect of a close relationship with a bank in terms of Duration and the relative role played by trade credit. In particular, to investigate how soft information collected by a bank through a long-lasting relationship interacts with the signaling role of inter-firm financing, we add an interaction term between Duration and TC to our main specification in equation (1). The results seem to support the idea that the role of trade credit loses significance for firms with a long-lasting relationship with a bank, as the impact on the probability of loan approval decreases (1.95%, column IV, Table 6); however, the interaction term is not statistically significant.

Third, we attempt to clarify an apparent contradiction that emerged in our results on the impact of Size because it shows a negative sign in all previous results (the larger the firm, the higher the probability that the firm will be credit-rationed). The basic idea that could explain this conflicting result is that larger firms may be more indebted and, thus, be less preferred by banks. Therefore, we add the level of the borrower's debt (Debt) to our econometric set and report the results in column V of Table 6. As expected, the success of a loan request is positively related to the total assets contributed by the borrower but is negatively related to the level of the borrower's debt. Moreover, the negative sign of the interaction term between Totasset and Debt reported in column VII suggests that the magnitude of the firm's size in loan decisions decreases based on Debt. However, these results should be interpreted with caution because of the lack of statistical significance of the interaction term.

Finally, we attempt to add more robustness to our econometric results by clustering the standard errors at the regional level. Specifically, because we employed a random effects panel probit estimator in the previous section, which has no robustness properties (Wooldrige, 2010), we now allow for any serial correlation and repeat equation (1) in the cross-sectional dimension. The new results with clustered errors are reported in Table 7, and it is possible to observe that the marginal effects at the means are coincident in this model.

| (I) | (II) | (III) | (IV) | |

|---|---|---|---|---|

| Variables | Coefficients | Coefficients | Coefficients | Coefficients |

| TC | 0.3342*** | – | – | – |

| (0.047) | ||||

| TCt–1 | – | 0.2970*** | – | – |

| (0.046) | ||||

| TC* | – | – | 0.1674*** | – |

| (0.057) | ||||

| TC*t–1 | – | – | – | 0.1776*** |

| (0.059) | ||||

| R1 | 0.3020*** | 0.3122*** | 0.3214*** | 0.3287*** |

| (0.022) | (0.022) | (0.024) | (0.022) | |

| R2 | 0.1149*** | 0.1261*** | 0.1221*** | 0.1329*** |

| (0.028) | (0.032) | (0.028) | (0.032) | |

| R4 | −0.3795*** | −0.3562*** | −0.3829*** | −0.3584*** |

| (0.040) | (0.033) | (0.039) | (0.033) | |

| R5 | −0.7990*** | −0.7826*** | −0.8068*** | −0.7903*** |

| (0.073) | (0.070) | (0.074) | (0.071) | |

| Duration | 0.0001 | 0.0000 | 0.0000 | −0.0000 |

| (0.000) | (0.000) | (0.000) | (0.000) | |

| Lenders | −0.0255*** | −0.0252*** | −0.0296*** | −0.0282*** |

| (0.006) | (0.006) | (0.006) | (0.007) | |

| Size | −0.0407*** | −0.0378** | −0.0260* | −0.0281* |

| (0.013) | (0.016) | (0.014) | (0.016) | |

| Growth | 0.0129 | 0.0207** | 0.0153* | 0.0216** |

| (0.009) | (0.010) | (0.009) | (0.010) | |

| Extreme | −0.1161*** | −0.0864*** | −0.0889*** | −0.0735*** |

| (0.033) | (0.026) | (0.032) | (0.026) | |

| Foreign | 0.0447 | 0.0683* | 0.0450 | 0.0665* |

| (0.037) | (0.036) | (0.038) | (0.036) | |

| South | −0.1026** | −0.1061** | −0.1008** | −0.1016** |

| (0.044) | (0.046) | (0.045) | (0.046) | |

| Year Dummy | Yes | Yes | Yes | Yes |

| Constant | 2.0330*** | 2.0005*** | 1.9987*** | 1.9922*** |

| (0.079) | (0.092) | (0.082) | (0.091) | |

| Observations | 63,132 | 59,250 | 63,136 | 59,284 |

- Note: This table reports the probit estimation with clustered standard errors at the regional level.

- The dependent variable is Approval, which is a dichotomous variable for bank lending decisions that takes the value of 1 if the bank approves the request for financing of firm i in year t and 0 otherwise. The vector Bit contains the bank assessment of firm creditworthiness, the vector Rit contains relationship lending variables and Fit contains firm control variables. The coefficients are reported in odd-numbered columns, and the average marginal effects are reported in even-numbered columns. Tcit is the ratio between trade payables and total debt; we also use the 1-year lagged value, TCit–1. Extreme is a binary variable that takes the value of 1 if firm i has an average payables term higher than the average duration of the sector to which it belongs. We include four rating dummies that take the value of 1 for the corresponding rating received and 0 otherwise. To avoid dummy traps, we do not include the rating 3 dummy. Duration is the length of the relationship between the firm and the bank in months. Lenders is the number of lenders that serve a firm. Size is the log value of the total revenue of firm i at the end of year t. Growth is the percentage growth of the total revenue of firm i between the end of year t–1 and the end of year t. South is a binary variable that takes the value of 1 if firms are located in southern regions and 0 otherwise. Foreign is a binary variable that takes the value of 1 if firm i has purchased from the bank in year t at least one banking service related to import/export trading. Additionally, we scale payables by the firm's total assets (Tc*) and its lagged value (Tc*it–1) in columns III and IV. All independent variables are defined in detail in Table 1, and the t-statistics are in parentheses.

- ***, ** and * indicate statistical significance at the 1%, 5% and 10% levels, respectively.

7 TRADE CREDIT AND CORPORATE FAILURE

The results shown thus far tell a story in which trade credit plays a beneficial role in the loan approval process, even if the effect is reduced in the presence of a close relationship with the bank (probably because of a substitution effect of soft information). Accounts payable can act as transmitters of a good reputation signal, while trade credit is another component of a company's debt and, as such, can be related to the company's bankruptcy. When a firm approaches bankruptcy, it is possible to identify changes in the supply of trade credit rather than changes in the demand for credit, depending on switching costs (Garcia-Appendini & Montoriol-Garriga, 2020). A trade debtor's failure may generate significant trade credit losses for suppliers and may be a trigger for a propagation mechanism such that debtor failures lead to creditor failures (Jacobson & Von Schedvin, 2015).

However, trade credit also represents a determinant of corporate failure given the buyer–seller collusion suggested by Biais and Gollier (1997). Specifically, the case of collusion between the seller and the buyer is represented by the potential attempt of the seller “to extend credit to bad buyer[s] even if this exposed him to a large credit risk because, contingent on the supplier extending trade credit, the bank would provide complementary financing” (Ibidem, p. 913). Hence, on the basis of the distorted signal, the bank erroneously attributes a good rating to the buyer. At this point, the buyer may reveal/disclose its type during the relationship, resulting in a non-performing loan. In contrast, the seller shares the surplus extracted by the bank with the buyer in the form of inflated prices or services.

In an attempt to disentangle this possible effect and, in a stricter sense, the role of trade credit in corporate failure, we consider an additional specification to observe the possible effect of trade credit on non-performing loans. In particular, as a measure of corporate distress, we employ the Defaultit variable, which takes the value of 1 if the ith firm has a non-performing loan in year t. Then, we apply a probit regression model to the panel of firms receiving a new loan in year t–1 and measure the marginal effect of trade credit in years t–1 and t–2 on firm failure risk.

The regression results are reported in Table 8. For both periods (t–1 and t–2), the average marginal effect for the TC variable is positive and significant, indicating that trade credit is associated with, on average, an increased likelihood of trade debtor failure in subsequent years (see columns II and IV of Table 8). Taken together with the results of the previous sections (where trade credit appears to facilitate loan approvals) and considering the low number of distressed firms in the sample, these findings do not allow us to exclude the presence of false signals in trade credit and the competitive edge that trade creditors have over banks in their ability to assess prospective debtors’ creditworthiness and ongoing activities (see, e.g., Biais & Gollier, 1997; Burkart & Ellingsen, 2004).

| (I) | (II) | (III) | (IV) | |

|---|---|---|---|---|

| Variables | Coefficients | Marginal effects | Coefficients | Marginal effects |

| Tct–1 | 0.4343* | 0.0026* | – | – |

| (0.255) | (0.002) | |||

| Tct–2 | – | – | 0.4735* | 0.0028* |

| (0.251) | (0.001) | |||

| R1t–1 | −0.6445*** | −0.0038*** | −1.0854*** | −0.0064*** |

| (0.192) | (0.001) | (0.325) | (0.002) | |

| R2t–1 | −0.2551* | −0.0015* | −0.2511* | −0.0015* |

| (0.130) | (0.001) | (0.134) | (0.001) | |

| R4t–1 | 0.4903*** | 0.0029*** | 0.4779*** | 0.0028*** |

| (0.111) | (0.001) | (0.114) | (0.001) | |

| R5t–1 | 0.7082*** | 0.0042*** | 0.8363*** | 0.0049*** |

| (0.172) | (0.001) | (0.170) | (0.001) | |

| Duration | −0.0006 | −0.0000 | −0.0003 | −0.0000 |

| (0.001) | (0.000) | (0.001) | (0.000) | |

| Lenders | 0.1689*** | 0.0010*** | 0.1713*** | 0.0010*** |

| (0.017) | (0.000) | (0.018) | (0.000) | |

| Size | −0.3313*** | −0.0020*** | −0.3236*** | −0.0019*** |

| (0.046) | (0.000) | (0.047) | (0.000) | |

| Growth | −1.0979*** | −0.0065*** | −1.1063*** | −0.0065*** |

| (0.131) | (0.001) | (0.135) | (0.001) | |

| Extreme | 0.1369 | 0.0008 | 0.1595 | 0.0009 |

| (0.107) | (0.001) | (0.115) | (0.001) | |

| Foreign | 0.1330 | 0.0008 | 0.1558 | 0.0009 |

| (0.197) | (0.001) | (0.203) | (0.001) | |

| South | −0.3357*** | −0.0020*** | −0.3064** | −0.0018** |

| (0.121) | (0.001) | (0.123) | (0.001) | |

| Constant | −1.7800*** | – | −1.9135*** | – |

| (0.267) | (0.279) | |||

| Observations | 37,720 | 37,720 | 34,788 | 34,788 |

- Note: This table reports the coefficients from the panel probit regressions estimating the corporate failure of a trade buyer associated with trade credit issuance in year t for 2009 to 2012.

- The dependent variable is non-performing loans (NPL), a binary variable that takes the value of 1 if a firm that obtained a loan in year t–1 experiences a non-performing loan in year t. The vector Bit contains the bank assessment of firm creditworthiness, the vector Rit contains relationship lending variables and Fit contains firm control variables. The coefficients are reported in odd-numbered columns, and the marginal effects are reported in even-numbered columns. Tcit is the ratio between trade payables and total debt; we also use the 1-year lagged value, TCit–1. Extreme is a binary variable that takes the value of 1 if firm i has an average payables term higher than the average duration of the sector to which it belongs. We include four rating dummies that take the value of 1 for the corresponding rating received and 0 otherwise. To avoid dummy traps, we do not include the rating 3 dummy. Duration is the length of the relationship between the firm and the bank in months. Lenders is the number of lenders that serve a firm. Size is the log value of the total revenue of firm i at the end of year t. Growth is the percentage growth of the total revenue of firm i between the end of year t–1 and the end of year t. South is a binary variable that takes the value of 1 if firms are located in southern regions and 0 otherwise. Foreign is a binary variable that takes the value of 1 if firm i has purchased from the bank in year t at least one banking service related to import/export trading. All independent variables are defined in Table 1, and the t-statistics are in parentheses.