Language and innovation

Abstract

Strong-future-time reference (FTR) languages require speakers to grammatically mark future events, while weak-FTR languages do not. Using data from 34 countries, we find that firms in countries where strong-FTR languages are spoken have fewer patent counts and citations than those in countries where weak-FTR languages are spoken. Further evidence shows that strong-FTR languages affect inventors’ perceptions and beliefs about future rewards from innovation. Moreover, due to interactions between people speaking different languages, globalization attenuates the negative impact of language FTR on innovation. To further support these findings, we provide evidence from a single country with a multilingual environment to control for omitted country-level characteristics. Our study emphasizes the impact of language on corporate innovation and sheds light on the importance of informal institutions in economic outcomes.

1 INTRODUCTION

North (1991) emphasizes the importance of both formal and informal institutions in determining resource allocation and economic growth. While the existing literature highlights the importance of formal institutions (e.g., laws and regulations) for organizational behaviors (Acemoglu et al., 2001; Beck et al., 2016; La Porta et al., 1999, 2004; Rodrik et al., 2004), less attention has been given to the impact of informal institutions (e.g., common values, cognitions, beliefs, traditions, customs, sanctions and norms) on economic outcomes (North, 1991, 2005). Formal institutions such as financial development (Hsu et al., 2014), banking competition (Cornaggia et al., 2015), property rights protection (Lin et al., 2010) and policy uncertainty (Bhattacharya et al., 2017) have been proven to play an important role in innovation, which is vital for a firm's long-term competitive advantage and a country's economic growth. However, formal institutions only provide part of the answer to the understanding of innovation. Several studies have examined the role of informal institutions in shaping patterns of innovation (Dakhi & De Clercq, 2004; Knack & Keefer, 1997; Naranjo-Valencia et al., 2011; Saxenian, 1996),1 but languages, as an important type of informal institution that can shape innovation, have not been deeply investigated. To fill this gap, we provide cross-country evidence for the real effect of languages on economic activity from the perspective of technological innovation.

Dahl (1985) states that languages differ in how they grammatically reference the future. The particular language feature that underlies our study is future-time reference (FTR), which refers to whether the language requires speakers to grammatically mark future events. For example, English is a strong-FTR language that requires speakers to encode a distinction between present and future events, while German does not. To refer to future timing, an English speaker has to use future tense as denoted by will or going to. By contrast, a German speaker can reference a future event by using the present tense. The Sapir–Whorf Hypothesis (SWH) proposes that language structure may shape individuals’ beliefs and behaviors by affecting their perception of time. Specifically, grammatically separating the future and the present leads speakers to disassociate the future and the present, to feel that the future is more distant and thus decrease the perceived present value of future rewards, devaluing future rewards. Abundant research in linguistics and psychology supports SWH and shows that languages discipline individuals’ decision-making and behaviors (Boroditsky, 2001; Evans & Levinson, 2009; Wolff & Holmes, 2011). Linking language to individual economic decisions, M. K. Chen (2013) finds that individuals speaking weak-FTR languages are more likely to engage in long-term-oriented behaviors, such as saving more, smoking less, practicing safer sex and being less obese. Subsequent studies attempt to associate language FTR with managers’ choices in the corporate domain. For example, S. Chen et al. (2017) show that firms located in countries where weak-FTR languages are spoken tend to have more precautionary savings. Liang et al. (2018) argue that firms located in countries where weak-FTR languages are spoken tend to invest more in corporate social responsibility and R&D. As innovation is a long-term process with high uncertainty (Holmstrom, 1989), SWH predicts that firms in countries where strong-FTR languages are spoken will engage in fewer innovative activities.

Using a large sample of firms from 34 countries, we show that firms in countries where strong-FTR languages are spoken are less likely to engage in innovative activities than firms in countries where weak-FTR languages are spoken. After controlling for various firm-specific characteristics, formal institutions such as legal origin and patent rights protections and other informal institutions such as culture, we find that firms located in countries where strong-FTR languages are spoken register fewer patents and receive fewer citations than their weak-FTR counterparts. Economically, a strong-FTR language lowers patent counts by almost 11.2% from the mean value. Similarly, a strong-FTR language reduces citation counts by almost 27% from the mean value.

In today's business environment, a firm may face various degrees of international involvement through competing with foreign firms, catering to international customers and hiring international professionals. It is inevitable that a firm will be exposed to multilingual environments. Globalization increases cross-country interactions, brings multiple languages and blurs the boundaries of languages. Therefore, we expect that the impact of language FTR is attenuated in a more globalized country. Our regression result is consistent with our conjecture.

Because language structure is clearly out of a firm's control, it is unlikely that the causation goes from innovation to language FTR. However, our findings are subject to omitted variable bias due to the correlation between language and country-level characteristics. We adopt several methods to control for omitted variable bias to identify the causal effect. First, we control for a variety of country characteristics ranging from formal institutions such as legal origin, religion and intellectual property protection to informal institutions such as various cultural attributes. Second, although we control for a battery of country-level characteristics, our results might still be biased due to other observable and unobservable country-level attributes. To further alleviate these concerns, we conduct within-country tests by studying a single country with a multilingual environment. The within-country tests avoid omitted country-level bias because all firms face the same country-level characteristics.

To investigate the underlying economic mechanism of our findings, we collect information on CEO birthplace and inventor nationality in our sample. We distinguish whether the CEO (inventor) is from a strong-FTR-speaking country and rerun our regression. We find that firms with CEOs (inventors) from countries where strong-FTR languages are spoken are associated with lower innovation output, indicating that language FTR shapes perceptions and beliefs around future rewards from innovation. Another advantage of investigating inventor language is that we are able to directly control for country fixed effects to alleviate the concern of omitted variable bias.

Finally, we perform a variety of additional tests to ensure the robustness of the main results. First, we adopt four alternative measures to define language FTR. Specifically, we assign language into weak and strong-FTR groups using two stronger criteria (Inflectional FTR and Prediction FTR). In addition, we apply two continuous measures (Verb Ratio and Sentence Ratio) based on a word-frequency analysis of online weather forecasts. Second, we choose to use 2-year-ahead and 3-year-ahead innovation outputs as alternative dependent variables because innovation represents a long-term investment in intangible assets. We also adopt the log value of one plus citations per patent to proxy for the quality of innovation. Finally, our findings might be driven by specific countries. To rule out this possibility, we exclude US firms and countries with multiple official languages, and the main results still hold.

This paper makes several contributions to the existing literature. First, innovation is an important driver of a country's economic growth (Solow, 1957). Thus, many papers identify various drivers that promote innovation, including firm characteristics (Custódio et al., 2017; Faleye et al., 2014; Manso, 2011; Sunder et al., 2017; Tian & Wang, 2011), institutional factors such as intellectual property rights (Gould & Cruben, 1996; Lerner, 2009), information quality (Huang et al., 2020; K. Park, 2018), labor laws (Acharya et al., 2013; Francis et al., 2018), cooperation (Jorde & Teece, 1990; K. Li, 2018) and work environment (Bloom et al., 2011; Mao & Weathers, 2019). However, little attention has been paid to whether informal institutions can enhance innovation. Since M. K. Chen (2013) documented how language can shape individuals’ perceptions of saving and health behaviors, increasing attention has been given to the impact of language on economic behaviors. Extending M. K. Chen's (2013) work, our paper provides empirical evidence that language can be an informal institution that forms people's cognitions and beliefs about innovation, thereby promoting corporate innovation.

Second, our study is closely related to the emerging literature on how language affects individual behaviors (Boroditsky, 2001; Evans & Levinson, 2009). While previous research has documented the role of language structure in shaping individual cognition and behavior (M. K. Chen, 2013; Sutter et al., 2015), we show how language structure shapes economic organizations’ choices when they face intertemporal trade-offs. The prior literature documents the impact of language FTR on future-oriented corporate policies (Liang et al., 2018), precautionary cash holdings (S. Chen et al., 2017), earnings management (Kim et al., 2017) and investment efficiency (Kim et al., 2020). We add to this literature by focusing on corporate innovation. The most relevant research is Liang et al. (2018), who find that firms in countries with weak-FTR languages tend to invest more in corporate social responsibility and R&D. However, it is necessary to distinguish between innovation inputs and innovation outputs. If a large fraction of these inputs does not lead to productive outcomes, then greater innovation input does not necessarily mean more substantial innovative activities.2 Therefore, instead of focusing on R&D investments, we provide further evidence on the quantity and quality of innovation outputs, which are measured by the total number of patent counts, the total number of patent citations and the average number of citations received by each patent.

Third, our study contributes to the emerging literature on the characteristics of inventors that sheds light on the supply side of innovation. Prior research examines the effect of individuals’ characteristics on innovation, such as the individual's IQ and education (Toivanen & Väänänen, 2016), parental education and income (Aghion et al., 2017), personal ability (Nicolaou et al., 2008) and peer effects (Nanda & Sørensen, 2010). Bell et al. (2019) further show that exposure to an innovative environment during childhood has significant causal effects on children's propensities to invent. However, limited papers study the impact of the characteristics of corporate inventors on corporate innovation due to a lack of personal information on corporate inventors. We add to this literature by investigating the impact of corporate inventors’ language FTR on innovation. Using information about the nationality of corporate inventors around the world, we demonstrate that inventors’ language FTR shapes their perceived present value of future rewards from innovation, thereby impacting the innovation outputs of their firms.

The remainder of the paper is organized as follows. Section 2 reviews the related literature and develops our testable hypothesis. Section 3 describes the data and variables. Section 4 reports the empirical results and robustness tests. Section 5 presents the robustness analysis, and Section 6 concludes the paper.

2 LITERATURE REVIEW AND HYPOTHESIS DEVELOPMENT

SWH, also known as the linguistic relativity principle, indicates that differences in the way languages encode cultural and cognitive categories affect the way people think (Whorf, 1956). Berlin and Kay (1969) demonstrate that there are universal semantic constraints in the field of color terminology, and differences in color naming across languages lead to differences in color cognition or perception. For example, the indigenous language Zuni does not differentiate between yellow and orange, and speakers have trouble telling the two colors apart. However, Russian speakers have different words for light blue and dark blue, and they are better than English speakers at picking out varying shades of the hue.

Dahl (2000) describes a set of languages that he calls “futureless” as those not requiring obligatory FTR use in prediction-based contexts. A certain feature of languages that is related to our paper is whether the language requires speakers to separate time between the present and the future or whether future events can be left unmarked. This feature is a central characteristic of the strong- versus weak-FTR classification of languages (Thieroff, 2000). Researchers have shown that language can have far-reaching effects on behavior (Boroditsky, 2001; Evans & Levinson, 2009). M. K. Chen (2013) shows that speakers of weak-FTR languages are likely to engage in more future-oriented behavior, such as saving money and making good health decisions, than those who speak strong-FTR languages. Using an experimental approach, Sutter et al. (2015) find that weak-FTR German-speaking primary school children are more likely to delay gratification than strong-FTR Italian-speaking children.

Several papers extend M. K. Chen's (2013) findings to organizations and examine the relation between language FTR and corporate policies. Kaplan (2008) argues that decisions within an organization are fundamentally social processes that are negotiated among members of the organization. Therefore, variations in the language used within the organization during discussion and the negotiation process are critical to organizational outcomes. Liang et al. (2018) find that firms in countries with strong-FTR languages tend to engage in more future-oriented corporate policies with regard to corporate social responsibility and R&D expenses than those with weak-FTR languages. S. Chen et al. (2017) show that weak-FTR languages that speak about future events in the present tense lead firms to perceive that future adverse credit events are more imminent and have higher precautionary cash holdings. Similarly, Kim et al. (2017) find that accrual-based and real earnings management are less prevalent in countries with weak-FTR languages because speakers care more about the future consequences of earnings management. Kim et al. (2020) investigate the impact of time encoding in languages on investment efficiency. They find that the probability of underinvestment is approximately 6% lower for firms in countries with weak-FTR languages than for firms in countries with strong-FTR languages.

Building on the notion that strong-FTR languages are associated with less future-oriented behaviors, we predict that firms in countries with strong-FTR languages are less engaged in innovative activities than those in countries with weak-FTR languages. As suggested by M. K. Chen (2013), language FTR can affect individuals’ perceived present value of future rewards through two channels.3 The first channel is that languages shape how people feel about distant future events, mathematically viewed as the discount rate. Consider an innovation project that rewards R in the future with certainty. If a strong-FTR language that obligates speakers to use a future tense makes those future rewards seem more distant, then the corresponding discount rate will be higher, and the perceived present value of innovation will be lower. Thus, inventors speaking strong-FTR languages innovate less. Kim et al. (2020) provide consistent evidence on the discount rate channel. Compared with strong-FTR speakers, weak-FTR speakers are more likely to invest in a project for any given level of cost of capital. The second channel through which language FTR affects innovation is that language determines the precision of beliefs about the timing of future rewards. Because the value of future rewards is a strictly convex function of time, ambiguity about the timing of future rewards results in more long-term behaviors (M. K. Chen, 2013). Such a response to timing uncertainty is supported by experimental studies (Kacelnik & Bateson, 1996; Redelmeier & Heller, 1993).4 Thus, the perceived present value of innovation is lower for strong-FTR language speakers.

- H1: Firms in countries with strong-FTR languages engage in less innovative activities than those in countries with weak-FTR languages.

3 DATA AND DESCRIPTIVE STATISTICS

3.1 Innovation output

We measure a firm's innovation output using patent data from the European Patent Office (EPO) Worldwide Patent Statistical Database (PATSTAT). This database is provided by the EPO and has been used extensively in economic research (Chang et al., 2015; Moshirian et al., 2021; Xie et al., 2021). PATSTAT contains bibliographic data, citations and family links for approximately 70 million patent applications from more than 80 countries. Following common practice in the innovation literature, we measure innovation output using two patent-based metrics (Hall et al., 2005; Tian & Wang, 2011). The first metric is the patent count for each firm in each year (Patent), which is defined as the number of patent applications filed in a year that are eventually granted. We measure the patent count based on the year of application rather than the year it is granted because the former measures the actual time of innovation according to Griliches (1987). Patents nevertheless exhibit an enormous variation in their importance or value, and thus a simple count measure cannot capture the technological and economic importance of a patent (Trajtenberg, 1990). Consequently, it is necessary to distinguish between innovation quantity and quality. We define a variable to proxy for patent quality as the number of citations received by patents (Citation), as more important patents receive more references.

As the literature illustrates, patent data are subject to truncation problems (Hall et al., 2005). The first truncation problem arises because patent applications appear in our sample only after they are granted. However, due to the application-grant lag, patents may not be granted yet if the application was made near the end of our sample period. Thus, we may underestimate the number of patents at the end of our sample period. Following Hall et al. (2005), we adjust the raw patent count data in the last few years of our data coverage using the application-grant lag distribution of patents.5 The second type of truncation problem concerns the citation counts. Patents continue receiving citations after the end of the database coverage period (Hall et al., 2001). To adjust the citation counts, we adopt the fixed-effect adjustment approach suggested by Hall et al. (2001) and Dass et al. (2017). Specifically, we divide the raw value of the citation counts by the average number of citations in the same technological class and in the same application year. We then sum the adjusted number of citations for each firm year to calculate the number of citations. Because innovation is a long-term process, we adopt 1-year-ahead innovation output as our main dependent variable in the regression analysis.

3.2 Language FTR

Our main explanatory variable is the FTR of languages, which is developed from the European Science Foundation's Typology of Languages in Europe (EUROTYP) project. In this project, Dahl (2000) describes a set of languages he calls “futureless” as those not requiring obligatory FTR use in prediction-based contexts. Following M. K. Chen (2013), we define weak-FTR languages as those that Dahl (2000) calls “futureless” and Thieroff (2000) calls “weakly grammaticalized future” languages. Strong-FTR languages are the exact complement of weak-FTR languages. By checking the official language of the country where a firm's headquarters is located, we define a dummy variable (Strong FTR) as one if the country's official language is a strong-FTR language. We focus on headquarters because it is the typical location of daily operations by a firm's top management and key technical staff (Cantwell, 2009). Table 1 shows the coded languages and FTR values across countries in our sample. Twenty-two of 34 countries in the sample speak a strong-FTR language, which accounts for 71% of our total sample observations. This pattern is consistent with M. K. Chen (2013).

| Country | Dominant language | FTR | Freq. | Percentage |

|---|---|---|---|---|

| Argentina | Spanish | Strong | 33 | 0.03 |

| Australia | English | Strong | 2290 | 2.32 |

| Austria | German | Weak | 702 | 0.71 |

| Belgium | Dutch | Weak | 594 | 0.6 |

| Canada | English | Strong | 4523 | 4.59 |

| Chile | Spanish | Strong | 92 | 0.09 |

| China | Mandarin | Weak | 14,789 | 14.99 |

| Colombia | Spanish | Strong | 22 | 0.02 |

| Denmark | Danish | Weak | 845 | 0.86 |

| Finland | Finnish | Weak | 1109 | 1.12 |

| France | French | Strong | 3919 | 3.97 |

| Germany | German | Weak | 4808 | 4.87 |

| Greece | Greek | Strong | 102 | 0.1 |

| Hong Kong | Mandarin | Weak | 151 | 0.15 |

| Hungary | Hungarian | Strong | 101 | 0.1 |

| Ireland | English | Strong | 84 | 0.09 |

| Israel | Hebrew | Strong | 1292 | 1.31 |

| Italy | Italian | Strong | 1031 | 1.05 |

| Japan | Japanese | Weak | 834 | 0.85 |

| Malaysia | Malay | Weak | 300 | 0.3 |

| Mexico | Spanish | Strong | 213 | 0.22 |

| The Netherlands | Dutch | Weak | 890 | 0.9 |

| Norway | Norwegian | Weak | 527 | 0.53 |

| Poland | Polish | Strong | 357 | 0.36 |

| Portugal | Portuguese (EU) | Strong | 71 | 0.07 |

| Republic of Korea | Korean | Strong | 7673 | 7.78 |

| Romania | Romanian | Strong | 41 | 0.04 |

| Spain | Spanish | Strong | 781 | 0.79 |

| Sweden | Swedish | Weak | 1597 | 1.62 |

| Switzerland | Swiss German | Weak | 1115 | 1.13 |

| Thailand | Thai | Strong | 122 | 0.12 |

| Turkey | Turkish | Strong | 492 | 0.5 |

| The United Kingdom | English | Strong | 3914 | 3.97 |

| The United States | English (US) | Strong | 43,220 | 43.82 |

| Total | – | – | 98,634 | 100 |

- Note: This table presents the sample distribution by country. It also shows the dominant language in each country and whether it is a strong- or weak-FTR language. The dominant language of each multilingual country is defined as the most spoken primary language in the country. The classification is consistent with the prior literature (M. K. Chen, 2013; S. Chen et al., 2017; Kim et al., 2017, 2021).

In our robustness analysis, we use four alternative measures of language FTR. Inflectional FTR is a dummy variable defined by a stronger criterion: the presence of an inflectional future tense. This group includes most Romance languages but excludes English. Prediction FTR is a subset of overall FTR but restricts its use to prediction-based contexts such as weather forecasts. We employ two continuous measures constructed by M. K. Chen (2013) based on a word-frequency analysis of online text of weather forecasts. Verb Ratio is calculated as the number of grammatically future-marked verbs divided by the total number of future-referring verbs. Sentence Ratio counts the share of sentences addressing future weather, thereby containing a grammatical future marker.

3.3 Control variables

Financial data are retrieved from the BvD Osiris database. We first control for a set of firm-level characteristics. We adopt R&D expense scaled by total assets (R&D/TA) to proxy for innovation input.6 Tangible assets are measured as property, plant and equipment (PPE) scaled by total assets (PPE/TA). Because innovative activities require substantial investment, financially constrained firms will suppress innovation (Bergemann & Hege, 2005). We include the SA index constructed by Hadlock and Pierce (2010) to measure financial constraints as an additional control variable. We also include the natural logarithm of total assets (Size) for firm size, return on assets (ROA) to measure firm performance, cash-to-assets ratio (Cash/TA) to account for the effects of cash holdings and financial leverage (Leverage) to represent capital structure. LogFirmAge is calculated as the log value of the number of years since a firm was established and is used to control for the life-cycle effect. Additionally, we control for the Herfindahl index (HHI) and its squared term (HHI2), as Aghion et al. (2005) suggest an inverted U-shape between product market competition and innovation.

In addition to firm-level controls, we add a set of country-specific control variables, including economic, legal, cultural and religious variables. First, we include the GDP growth rate (GDP growth) obtained from the World Bank in the regression model to control for macroeconomic conditions. Second, we include legal origin to control for the overall legal environment. Our sample includes four types of legal origin: the United Kingdom, France, Germany and Scandinavia. Moreover, we include patent rights to control for intellectual property rights; better protection of intellectual property rights potentially enhances the benefits from innovation (Czarnitzki & Toole, 2011; Varsakelis, 2001). The patent rights index is obtained from W. G. Park (2008). Third, we include a battery of cultural attributes, such as individualism, uncertainty avoidance, masculinity, power distance and long-term orientation (Hofstede, 1984, 2001). Fourth, we include a dummy variable to define whether the majority of a country's inhabitants are Catholic. Fifth, we measure the legal rights of creditors against defaulting debtors in different jurisdictions following Djankov et al. (2007) using an aggregated index that varies between 0 (poor creditor rights) and 4 (strong creditor rights) for 133 countries. We measure whether the country has strong creditor rights using the dummy variable Credit Rights, which equals one if the creditor rights index is 3 or 4 or zero otherwise. Finally, prior research reveals that ownership concentration, which is related to minority shareholder protection and corporate control mechanisms, varies among countries (Aminadav & Papaioannou, 2020; La Porta et al., 1999). We measure ownership concentration using the equity share of the three largest shareholders following Aminadav and Papaioannou (2020). We retrieve shares owned by the 10 largest shareholders of each firm from the BvD Orisis database. Because many firms in our sample disclose incomplete information about the largest 10 shareholders, we aggregate the firm-level ownership concentration to a country-level measure (C3) representing the average equity share of the three largest shareholders in the country.

All continuous variables are winsorized at the 1% level at both tails of their distributions. Detailed variable definitions are provided in the Appendix. Panel A of Table 2 presents the sample construction steps. We collect financial data for all firms covered by the Osiris database from 1984 to 2015 and obtain a sample including 74,497 unique firms and 735,936 firm-year observations. We then exclude financial firms (SIC codes 6000–6999) and utility firms (SIC codes 4900–4999) and drop firms without location information. Following common practice in the innovation literature (Hirshleifer et al., 2012; Moshirian et al., 2021), we drop firms that have never owned any patent during the entire sample period. We also require firms to have non-missing information for all variables in the baseline regression. After this filtering process, the final sample includes 8909 firms and 98,634 firm-year observations in 34 countries from 1984 to 2015, including almost all large economies in the world. The last two columns in Table 1 list the countries in our sample. Our sample includes developed countries (e.g., the United States and the United Kingdom) and developing countries (e.g., China and Malaysia).

| Panel A. Sample construction steps | ||

|---|---|---|

| Steps | Num. of firms | Num. of Obs. |

| 1. All firms with financial data | 74,497 | 735,936 |

| 2. (–) Drop financial and utility firms | −12,535 | −115,164 |

| 61,962 | 620,772 | |

| 3. (–) Merge with SIPO patent data | ∖ | ∖ |

| 4. (–) Drop firms without location data | −4522 | −35,637 |

| 57,440 | 585,135 | |

| 5. (–) Drop firms that never have any patents | −45,452 | −427,246 |

| 11,988 | 157,889 | |

| 6. (–) Drop obs. with missing control variables | −3079 | −59,255 |

| 8909 | 98,634 | |

| Panel B. Descriptive statistics | |||||

|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | |

| VARIABLES | N | Mean | SD | Min | Max |

| LnPatt+1 | 98,634 | 1.045 | 1.444 | 0 | 5.832 |

| LnCitt+1 | 98,634 | 0.879 | 1.539 | 0 | 6.142 |

| Strong FTR | 98,634 | 0.713 | 0.452 | 0 | 1 |

| Prediction FTR | 98,350 | 0.720 | 0.449 | 0 | 1 |

| Inflectional FTR | 98,350 | 0.085 | 0.279 | 0 | 1 |

| Verb Ratio | 98,228 | 0.631 | 0.393 | 0 | 1 |

| Sentence Ratio | 98,228 | 0.674 | 0.417 | 0 | 1 |

| Size | 98,634 | 12.500 | 2.140 | 5.164 | 17.220 |

| ROA | 98,634 | −0.008 | 0.175 | −0.808 | 0.288 |

| Leverage | 98,634 | 0.193 | 0.169 | 0 | 0.672 |

| Cash/TA | 98,634 | 0.202 | 0.217 | 1.0E–04 | 0.979 |

| PPE/TA | 98,634 | 0.254 | 0.192 | 3.7E–05 | 0.952 |

| LogFirmAge | 98,634 | 2.998 | 0.981 | 0 | 4.883 |

| R&D/TA | 98,634 | 0.044 | 0.085 | 0 | 0.411 |

| HHI | 98,634 | 0.167 | 0.187 | 0.016 | 1 |

| HHI2 | 98,634 | 0.063 | 0.156 | 2.7E–04 | 1 |

| SA Index | 98,634 | −3.554 | 1.225 | −7.501 | −0.958 |

| GDP Growth | 98,634 | 0.001 | 0.049 | −0.157 | 0.125 |

| French Legal Origin | 98,634 | 0.084 | 0.277 | 0 | 1 |

| German Legal Origin | 98,634 | 0.308 | 0.462 | 0 | 1 |

| Scandinavian Legal Origin | 98,634 | 0.041 | 0.199 | 0 | 1 |

| Catholic | 98,634 | 0.147 | 0.354 | 0 | 1 |

| Patent Rights | 98,634 | 3.193 | 1.017 | 1.33 | 4.14 |

| Power Distance | 98,634 | 48.130 | 17.060 | 13 | 90 |

| Masculinity | 98,634 | 57.420 | 13.640 | 5 | 88 |

| Long-term Orientation | 98,634 | 50.210 | 27.950 | 21 | 100 |

| Indulgence | 98,634 | 53.230 | 19.130 | 0 | 78 |

| Creditor Rights | 98,634 | 0.356 | 0.479 | 0 | 1 |

| C3 | 98,634 | 0.487 | 0.112 | 0.413 | 0.905 |

| KOFGI | 98,634 | 76.710 | 7.886 | 56.040 | 89.190 |

| FDI_GDP | 98,606 | 0.023 | 0.025 | −0.005 | 0.164 |

| Time Preference | 94,715 | 0.697 | 0.087 | 0.440 | 0.890 |

| Rule | 41,349 | 0.149 | 0.011 | 0.127 | 0.171 |

| Credit Market | 40,509 | 174.900 | 46.240 | 21.960 | 345.700 |

| Stock Market | 42,232 | 138.300 | 83.800 | 0.308 | 822.300 |

- Note: In this table, we present the sample construction steps in Panel A and the descriptive statistics of all variables in Panel B. Variable definitions are listed in the Appendix.

3.4 Descriptive statistics

Panel B of Table 2 reports the descriptive statistics for the variables in our sample. Due to the highly right-skewed distribution of patents and citations, we adopt the log value of one plus patent counts (LnPat) and the log value of one plus citation counts (LnCit) to proxy for innovation output in our analysis. Additionally, because innovation is a long-term process, we adopt the 1-year-head values of LnPat and LnCit as the dependent variables in the regression. The mean values of LnPat and LnCit are 1.045 and 0.879, respectively. Regarding language structure, the mean value of Strong FTR is 0.713, suggesting that 71% of firm-year observations are from countries where strong-FTR languages are spoken. For the four alternative measures of language FTR, while approximately 10% of observations are from countries with inflectional FTR languages, 72% of the observations are from countries where languages that fall within the classification of prediction FTR are spoken. This pattern is consistent with the strictness of the criterion used to classify language FTR. Regarding the continuous measures based on the online text of weather forecasts, Verb Ratio and Sentence Ratio exhibit little difference, with mean values of 0.631 and 0.674, respectively. Regarding firm-level variables, the mean firm size is 12.50, and the average leverage ratio is 19%. The mean value of ROA is slightly negative, while the untabulated median value is 0.034. For the average firm, cash holdings account for 20% of total assets, R&D expenses account for 4.4% of total assets and fixed assets account for 25.4% of total assets.

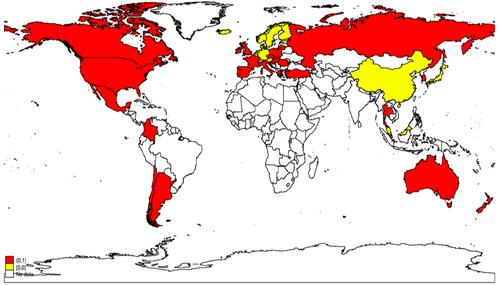

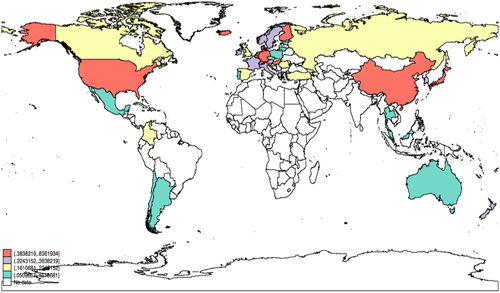

We also present the country-level descriptive statistics for language structures and innovation output on the map. Figures 1 and 2 show the distribution of the dominant language's FTR and the distribution of average innovation output. We can observe that countries with weak-FTR languages (such as Finland, Switzerland, Germany, Japan and China) are also associated with more innovation output, which provides some preliminary evidence for our hypothesis. Interestingly, despite being one of the most innovative countries, the United States uses a strong-FTR language.7

4 EMPIRICAL RESULTS

4.1 Baseline regression

We report the results for the baseline regression in Table 3. Under all specifications, the coefficients of Strong FTR are negative and statistically significant, indicating that strong-FTR languages are associated with fewer innovation outputs in terms of both quantity and quality. This result is consistent with our hypothesis that firms in countries where strong-FTR languages are spoken engage in less innovative activity than those in countries where weak-FTR languages are spoken. Economically, a strong-FTR language lowers patent counts by almost 11.2% (= abs(exp(−0.119)−1)), compared with a weak-FTR language. Similarly, switching from a weak-FTR language to a strong-FTR language reduces citation counts by almost 27% (= abs(exp(−0.315)−1)). The coefficients of other control variables are generally consistent with previous studies. For example, firm size and profitability are positively related to innovation output, suggesting that larger and profitable firms are more likely to engage in innovative activities (Hall & Ziedonis, 2001; Lerner, 1995). The coefficient of leverage is negative and highly significant, indicating that financially constrained firms are less likely to invest in long-term projects (Atanassov, 2013; Whited, 1992). The same rationale is applied to the financial constraint index. By contrast, the coefficient of cash holdings is positive and highly significant, implying that sufficient internal funds promote long-term investment (Himmelberg & Petersen, 1994). As innovation input, R&D is positively related to innovation output. Patent rights are positively associated with innovation because stronger patent protection benefits innovators. As expected, a long-term orientation is positively related to innovation because innovation is a long-term process. Because Catholics have a higher level of risk aversion, Catholic-dominated countries are more likely to avoid risky projects (Halek & Eisenhauer, 2001).

| (1) | (2) | |

|---|---|---|

| VARIABLES | LnPatt+1 | LnCitt+1 |

| Strong FTR | −0.119* | −0.315*** |

| (−1.690) | (−5.293) | |

| Size | 0.311*** | 0.302*** |

| (29.621) | (27.840) | |

| ROA | 0.204*** | 0.225*** |

| (3.851) | (3.712) | |

| Leverage | −0.465*** | −0.422*** |

| (−6.524) | (−5.860) | |

| Cash/TA | 0.469*** | 0.572*** |

| (8.314) | (9.205) | |

| PPE/TA | 0.112 | 0.115 |

| (1.412) | (1.431) | |

| LogFirmAge | 0.127*** | 0.091*** |

| (5.151) | (3.514) | |

| R&D/TA | 3.153*** | 3.075*** |

| (20.082) | (17.031) | |

| HHI | −0.499** | −0.787*** |

| (−2.124) | (−3.735) | |

| HHI2 | 0.294 | 0.709*** |

| (1.318) | (3.549) | |

| SA Index | 0.111*** | 0.082*** |

| (4.704) | (3.595) | |

| GDP Growth | 0.424*** | 0.421*** |

| (4.127) | (4.011) | |

| French Legal Origin | 0.136 | 0.216 |

| (0.768) | (1.413) | |

| German Legal Origin | 0.222 | 0.222** |

| (1.592) | (1.962) | |

| Scandinavian Legal Origin | 0.800*** | 0.142 |

| (3.555) | (0.753) | |

| Patent Rights | 0.236*** | 0.163*** |

| (3.650) | (2.942) | |

| Power Distance | 0.003 | 0.004 |

| (0.748) | (1.357) | |

| Masculinity | 0.002 | −0.002 |

| (0.997) | (−1.026) | |

| Long-term Orientation | 0.006** | 0.000 |

| (2.189) | (0.190) | |

| Indulgence | −0.003 | −0.002 |

| (−1.335) | (−1.105) | |

| Catholic | 0.037 | −0.142** |

| (0.431) | (−1.982) | |

| Creditor Rights | −0.002 | 0.234** |

| (−0.013) | (2.335) | |

| C3 | 0.547* | −0.406 |

| (1.792) | (−1.580) | |

| Constant | −4.384*** | −3.217*** |

| (−8.669) | (−7.542) | |

| Industry×Year FE | Yes | Yes |

| Continent×Year FE | Yes | Yes |

| Observations | 98,634 | 98,634 |

| R2 | 0.319 | 0.302 |

- Note: In this table, we examine whether language FTR is related to corporate innovation. Variable definitions are listed in the Appendix. Robust standard errors clustered at the firm level are reported in parentheses.

- The symbols ***, ** and * denote significance at the 1%, 5% and 10% levels, respectively.

4.2 Moderating effect of globalization

Globalization is a process of creating networks of connections among actors at multicontinental distances and facilitating the flows of people, information, capital and goods across different cultures and language backgrounds. Interactions between people speaking different languages force people to adapt to each other's language and ways of thinking. Thus, globalization removes the cross-border barriers of countries, brings together people who speak different languages and creates a multilingual environment. Consequently, globalization blurs the boundary between weak- and strong-FTR languages by forming a multilingual environment. A firm headquartered in a more globalized country is exposed to a multilingual environment. We conjecture that the impact of language on innovation can be moderated by the home country's exposure to globalization. To measure exposure to globalization, we first retrieve the KOF Globalization Index (KOFGI) from Eidgenössische Technische Hochschule Zürich. The KOFGI, introduced by Dreher (2006), measures globalization along the economic, social and political dimensions for almost every country in the world since 1970. It has become widely used in the academic literature and policy research (Potrafke, 2015). The second measure of globalization is net foreign direct investment divided by GDP (FDI_GDP) retrieved from the World Bank. Due to the increased international linkages and spillovers of managerial and technological knowledge, FDI could alter the cognitive tendencies in organizational decision-making (Robertson & Warson, 2004).

To investigate the moderating effect of globalization, we interact the KOFGI and the FDI ratio with language FTR. In Table 4, we show that the interactions of KOFGI and Strong FTR are positive and statistically significant in all specifications. Similarly, the interactions of FDI_GDP and Strong FTR are also positive and statistically significant above the 95% confidence level. As expected, globalization exposes a firm to a multilingual environment, attenuating the impact of language on innovation.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| VARIABLES | LnPatt+1 | LnCitt+1 | LnPatt+1 | LnCitt+1 |

| Strong FTR | −2.029*** | −1.026** | −0.327*** | −0.450*** |

| (−3.989) | (−2.490) | (−4.315) | (−7.034) | |

| Strong FTR_KOFGI | 0.025*** | 0.011** | ||

| (3.870) | (1.980) | |||

| KOFGI | −0.027*** | −0.045*** | ||

| (−2.793) | (−5.221) | |||

| Strong FTR_FDI | 3.438*** | 1.478** | ||

| (4.692) | (2.450) | |||

| FDI_GDP | −3.840*** | −3.224*** | ||

| (−5.875) | (−5.644) | |||

| Size | 0.311*** | 0.301*** | 0.312*** | 0.302*** |

| (29.596) | (27.776) | (29.715) | (27.888) | |

| ROA | 0.209*** | 0.229*** | 0.209*** | 0.229*** |

| (3.951) | (3.790) | (3.947) | (3.777) | |

| Leverage | −0.463*** | −0.419*** | −0.461*** | −0.419*** |

| (−6.492) | (−5.822) | (−6.476) | (−5.821) | |

| Cash/TA | 0.465*** | 0.566*** | 0.468*** | 0.572*** |

| (8.263) | (9.110) | (8.309) | (9.202) | |

| PPE/TA | 0.129 | 0.139* | 0.117 | 0.119 |

| (1.628) | (1.731) | (1.470) | (1.474) | |

| LogFirmAge | 0.134*** | 0.095*** | 0.127*** | 0.090*** |

| (5.384) | (3.648) | (5.133) | (3.487) | |

| R&D/TA | 3.178*** | 3.097*** | 3.163*** | 3.083*** |

| (20.249) | (17.135) | (20.168) | (17.078) | |

| HHI | −0.296 | −0.639*** | −0.408* | −0.736*** |

| (−1.252) | (−3.013) | (−1.777) | (−3.556) | |

| HHI2 | 0.163 | 0.611*** | 0.233 | 0.679*** |

| (0.727) | (3.032) | (1.062) | (3.434) | |

| SA Index | 0.115*** | 0.084*** | 0.111*** | 0.082*** |

| (4.843) | (3.654) | (4.703) | (3.583) | |

| GDP Growth | 0.262*** | 0.181* | 0.461*** | 0.452*** |

| (2.629) | (1.755) | (4.478) | (4.267) | |

| French Legal Origin | 0.047 | −0.277 | 0.148 | 0.182 |

| (0.217) | (−1.490) | (0.857) | (1.209) | |

| German Legal Origin | 0.291* | 0.026 | 0.105 | 0.083 |

| (1.870) | (0.192) | (0.768) | (0.747) | |

| Scandinavian Legal Origin | 0.731*** | −0.047 | 0.577** | −0.062 |

| (3.143) | (−0.241) | (2.570) | (−0.329) | |

| Patent Rights | 0.305*** | 0.330*** | 0.258*** | 0.179*** |

| (4.237) | (5.227) | (4.077) | (3.273) | |

| Power Distance | −0.001 | 0.001 | 0.001 | 0.002 |

| (−0.268) | (0.345) | (0.193) | (0.875) | |

| Masculinity | −0.001 | −0.007*** | 0.000 | −0.003* |

| (−0.526) | (−2.944) | (0.172) | (−1.796) | |

| Long-term Orientation | 0.008*** | 0.005** | 0.007*** | 0.002 |

| (2.771) | (2.183) | (2.769) | (0.904) | |

| Indulgence | 0.001 | 0.004 | −0.001 | −0.000 |

| (0.500) | (1.631) | (−0.345) | (−0.110) | |

| Catholic | 0.056 | 0.023 | 0.044 | −0.121* |

| (0.595) | (0.295) | (0.506) | (−1.678) | |

| Creditor Rights | −0.036 | 0.163 | −0.010 | 0.231** |

| (−0.280) | (1.592) | (−0.080) | (2.325) | |

| C3 | 0.890*** | 0.187 | 0.346 | −0.588** |

| (2.692) | (0.665) | (1.156) | (−2.299) | |

| Constant | −2.702*** | −0.734 | −4.146*** | −3.029*** |

| (−3.449) | (−1.090) | (−8.207) | (−7.108) | |

| Industry×Year FE | Yes | Yes | Yes | Yes |

| Continent×Year FE | Yes | Yes | Yes | Yes |

| Observations | 98,634 | 98,634 | 98,606 | 98,606 |

| R2 | 0.320 | 0.303 | 0.320 | 0.303 |

- Note: In this table, we examine whether globalization and foreign direct investment influence the effect of language FTR on corporate innovation. Variable definitions are listed in the Appendix. Robust standard errors clustered at the firm level are reported in parentheses. The symbols ***, ** and * denote significance at the 1%, 5% and 10% levels, respectively.

4.3 Within-country analysis

Our regression results might be biased due to an omitted variable correlated with both language and corporate innovation. Due to the multicollinearity problem, we are unable to add country-fixed effects to control for time-invariant country characteristics. To alleviate the concern that omitted country characteristics are correlated with both language and firm characteristics, we investigate the impact of language within two multilingual countries where both strong- and weak-FTR languages coexist. Among the countries in our sample, Belgium has three official languages: Dutch, French and German. Both Dutch and German are classified as weak-FTR languages, while French is classified as a strong-FTR language. Switzerland has four official languages: German, French, Italian and Romansh. German is classified as a weak-FTR language, while the other three languages are classified as strong-FTR languages. Therefore, as multilingual countries, Belgium and Switzerland provide unique settings to control for time-invariant country characteristics. If we still find a significantly negative impact of strong-FTR languages on innovation within each multilingual country, the negative effect we show is more likely to be a language effect rather than a country-specific effect. We present the results from the within-country analysis based on Belgian and Swiss firms in Table 5. The coefficients of Strong FTR are significantly negative in columns 1 and 2 after controlling for a set of firm-specific characteristics, industry-by-year fixed effects and country-by-year fixed effects. The within-country analysis shows consistent results with the baseline regression, thus alleviating the concern that the observed impact of language FTR on innovation is spurious due to country-level factors correlated with both language and corporate innovation.

| (1) | (2) | |

|---|---|---|

| VARIABLES | LnPatt+1 | LnCitt+1 |

| Strong FTR | −0.243*** | −0.166** |

| (−4.400) | (−2.510) | |

| Size | 0.333*** | 0.239*** |

| (14.798) | (10.827) | |

| ROA | 0.140 | 0.781*** |

| (0.531) | (2.886) | |

| Leverage | −0.350 | −0.392 |

| (−1.568) | (−1.553) | |

| Cash/TA | 0.864*** | 0.570** |

| (3.780) | (2.452) | |

| PPE/TA | 0.145 | −0.194 |

| (0.592) | (−0.812) | |

| LogFirmAge | −0.240*** | −0.263*** |

| (−3.375) | (−4.911) | |

| R&D/TA | 2.179*** | 1.493*** |

| (4.327) | (3.696) | |

| HHI | −1.026 | −2.370*** |

| (−1.144) | (−2.768) | |

| HHI2 | 0.944 | 2.056** |

| (1.070) | (2.393) | |

| SA index | −0.124*** | −0.096*** |

| (−2.813) | (−2.750) | |

| Industry×Year FE | Yes | Yes |

| Country×Year FE | Yes | Yes |

| Observations | 1573 | 1573 |

| R2 | 0.328 | 0.306 |

- Note: In this table, we examine whether language FTR is related to corporate innovation in two multilingual countries, that is, Belgium and Switzerland. Variable definitions are listed in the Appendix. Robust standard errors clustered at the firm level are reported in parentheses. The symbols ***, ** and * denote significance at the 1%, 5% and 10% levels, respectively.

4.4 Underlying economic mechanism

SWH predicts that languages encode cultural and cognitive categories that affect the way people think. M. K. Chen (2013) found that individuals speaking weak-FTR languages are more likely to engage in long-term-oriented behaviors, such as saving more, smoking less, practicing safer sex and being less obese. Thus, our results depend on the assumption that languages shape people's perceived present value of future rewards from innovation. To further examine the underlying mechanisms, we focus on two types of people who are crucial in innovative activities, namely, CEOs and inventors. The CEO formulates innovation strategies and determines the R&D investment of a firm, while inventors are the main contributors to daily innovative activities.

Following Kim et al. (2017), we collect the birthplaces of US firms’ CEOs and define a dummy variable CEO_Strong_FTR. This variable equals one if the CEO is born in a country with a strong-FTR language and zero otherwise. We lose a significant number of observations for this analysis, and the sample contains only 2894 firm-year observations. Columns 1 and 2 in Table 6 present the results. Since all firms in this sample are US firms, we cannot include country-level control variables and continent-by-year fixed effects. The coefficients of CEO_Strong_FTR are negative and statistically significant in columns 1 and 2, suggesting that a strong-FTR language shapes CEOs’ perception of future events and results in fewer long-term-orientation behaviors such as innovation.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| VARIABLES | LnPatt+1 | LnCitt+1 | LnPatt+1 | LnCitt+1 |

| CEO_Strong_FTR | −0.403*** | −0.198* | ||

| (−2.741) | (−1.772) | |||

| Inventor_Strong_FTR | −0.709*** | −0.300*** | ||

| (−19.016) | (−8.250) | |||

| Size | 0.295*** | 0.197*** | 0.314*** | 0.306*** |

| (6.612) | (4.828) | (29.525) | (27.782) | |

| ROA | −0.082 | −0.019 | 0.208*** | 0.223*** |

| (−0.308) | (−0.085) | (3.947) | (3.664) | |

| Leverage | −1.168*** | −1.105*** | −0.442*** | −0.405*** |

| (−2.947) | (−3.450) | (−6.233) | (−5.570) | |

| Cash/TA | 0.267 | 0.203 | 0.468*** | 0.569*** |

| (0.902) | (0.806) | (8.370) | (9.099) | |

| PPE/TA | 0.194 | 0.140 | 0.152* | 0.159* |

| (0.465) | (0.393) | (1.919) | (1.947) | |

| LogFirmAge | −0.051 | 0.002 | 0.112*** | 0.079*** |

| (−0.299) | (0.015) | (4.482) | (2.966) | |

| R&D/TA | 1.791** | 1.138** | 3.111*** | 3.078*** |

| (2.513) | (2.050) | (19.933) | (16.937) | |

| HHI | 0.112 | 0.359 | −0.066 | −0.505** |

| (0.118) | (0.454) | (−0.281) | (−2.360) | |

| HHI2 | −0.669 | −0.726 | 0.018 | 0.522** |

| (−0.744) | (−0.920) | (0.082) | (2.575) | |

| SA Index | 0.038 | 0.034 | 0.102*** | 0.072*** |

| (0.432) | (0.520) | (4.327) | (3.124) | |

| Constant | −2.462*** | −1.901*** | −2.366*** | −2.806*** |

| (−4.166) | (−3.465) | (−14.317) | (−16.664) | |

| Observations | 2894 | 2894 | 98,634 | 98,634 |

| Industry × Year FE | Yes | Yes | Yes | Yes |

| Country × Year FE | No | No | Yes | Yes |

| R2 | 0.274 | 0.204 | 0.341 | 0.313 |

- Note: In the first two columns, we mark language FTR using the birthplace of US firms’ CEOs and investigate the relationship between CEOs’ language FTR and corporate innovation. In the last two columns, we examine whether inventors’ language FTR is related to corporate innovation. CEO_Strong_FTR is a dummy variable indicating whether the CEO was born in a country with a strong-FTR language, and Inventor_Strong_FTR is a dummy variable indicating whether there is at least one inventor from countries with strong-FTR languages. Other variables are defined in the Appendix. Robust standard errors clustered at the firm level are reported in parentheses.

- The symbols ***, ** and * denote significance at the 1%, 5% and 10% levels, respectively.

In addition, we collect information on inventors’ nationality from the BvD Osiris database. We drop companies that do not disclose inventors’ nationality and retrieve information on 230,533 inventors from all over the world. Based on nationality, we distinguish whether inventors speak a strong- or weak-FTR language.8 We define a new dummy variable (Inventor_Strong_FTR) if a firm has at least one inventor speaking a strong-FTR language. We then rerun our regression at the firm level to investigate whether firms with strong-FTR language-speaking inventors are less likely to have higher innovation quantity and quality. We show the regression results in columns 3 and 4 of Table 6. As expected, we find that firms with strong-FTR language-speaking inventors have lower innovation output in terms of both quantity and quality. This finding is consistent with SWH claims that a strong-FTR language demotes inventors’ long-term orientation and, in turn, reduces their innovation efficiency. In untabulated results, we further exclude the US companies because the United States is the largest immigrant country, and inventors of US companies are more likely to speak a language different from their nationality. Our results still hold.

5 ROBUSTNESS ANALYSIS

5.1 Alternative measures of language FTR

Following EUROTYP and M. K. Chen's (2013) strong-criterion classification, we classify languages into strong- and weak-FTR languages in our baseline regressions. In this section, we investigate whether the results hold under four alternative classifications of language FTR: (1) Inflectional FTR, a stronger criterion identifying the presence of an inflectional future tense, including most Romance languages but excluding English; (2) Prediction FTR, a subset of strong FTR restricted to prediction-based contexts such as a weather forecast; (3) Verbal Ratio, counting the number of verbs that are grammatically future-marked divided by the total number of future-referring verbs; (4) Sentence Ratio, the share of sentences regarding future weather containing a grammatical future marker. Both Verb Ratio and the Sentence Ratio are continuous variables based on online full-sentence weather forecasts scraped by M. K. Chen (2013).

Table 7 shows the results with the four alternative classifications of language FTR as independent variables. Columns 1–4 show the results for the two stronger criteria of FTR classifications: Inflectional FTR and Prediction FTR. Both are significantly negatively associated with innovation outputs and with a larger economic magnitude. Moreover, we adopt two continuous variables based on online weather forecasts scraped by M. K. Chen (2013), Verb Ratio and Sentence Ratio. These measures capture not only the tense but also the “aspect” that can indicate the future in a language (Liang et al., 2018). In columns 5–8, we quantitatively obtain the same results. Both Verb Ratio and Sentence Ratio are significantly negatively associated with innovation outputs, suggesting that a higher percentage of grammatically future-marked verbs and sentences leads to less innovative activities. Overall, Table 7 suggests that the negative relation between strong-FTR language and innovative outputs is robust to alternative FTR measures.

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

|---|---|---|---|---|---|---|---|---|

| VARIABLES | LnPatt+1 | LnCitt+1 | LnPatt+1 | LnCitt+1 | LnPatt+1 | LnCitt+1 | LnPatt+1 | LnCitt+1 |

| Inflectional FTR | −0.355** | −0.554*** | ||||||

| (−2.211) | (−4.148) | |||||||

| Prediction FTR | −0.154** | −0.320*** | ||||||

| (−2.179) | (−5.315) | |||||||

| Verb Ratio | −0.147* | −0.350*** | ||||||

| (−1.673) | (−4.687) | |||||||

| Sentence Ratio | −0.147* | −0.325*** | ||||||

| (−1.920) | (−4.970) | |||||||

| Size | 0.312*** | 0.305*** | 0.312*** | 0.303*** | 0.313*** | 0.304*** | 0.312*** | 0.303*** |

| (29.558) | (27.987) | (29.559) | (27.872) | (29.627) | (27.936) | (29.616) | (27.928) | |

| ROA | 0.202*** | 0.222*** | 0.205*** | 0.224*** | 0.206*** | 0.224*** | 0.205*** | 0.224*** |

| (3.801) | (3.655) | (3.865) | (3.687) | (3.876) | (3.691) | (3.867) | (3.688) | |

| Leverage | −0.470*** | −0.431*** | −0.466*** | −0.423*** | −0.468*** | −0.425*** | −0.467*** | −0.425*** |

| (−6.579) | (−5.972) | (−6.530) | (−5.874) | (−6.534) | (−5.885) | (−6.530) | (−5.884) | |

| Cash/TA | 0.469*** | 0.578*** | 0.465*** | 0.569*** | 0.467*** | 0.572*** | 0.466*** | 0.571*** |

| (8.313) | (9.298) | (8.239) | (9.137) | (8.274) | (9.194) | (8.256) | (9.173) | |

| PPE/TA | 0.105 | 0.096 | 0.112 | 0.111 | 0.105 | 0.103 | 0.106 | 0.106 |

| (1.320) | (1.193) | (1.405) | (1.371) | (1.309) | (1.278) | (1.327) | (1.305) | |

| LogFirmAge | 0.127*** | 0.086*** | 0.128*** | 0.091*** | 0.126*** | 0.089*** | 0.127*** | 0.089*** |

| (5.114) | (3.332) | (5.159) | (3.504) | (5.084) | (3.411) | (5.110) | (3.437) | |

| R&D/TA | 3.165*** | 3.077*** | 3.171*** | 3.086*** | 3.171*** | 3.083*** | 3.171*** | 3.084*** |

| (20.139) | (17.022) | (20.177) | (17.074) | (20.185) | (17.059) | (20.188) | (17.064) | |

| HHI | −0.495** | −0.871*** | −0.448* | −0.748*** | −0.458* | −0.785*** | −0.442* | −0.761*** |

| (−2.116) | (−4.198) | (−1.894) | (−3.536) | (−1.928) | (−3.695) | (−1.857) | (−3.574) | |

| HHI2 | 0.285 | 0.777*** | 0.259 | 0.697*** | 0.270 | 0.725*** | 0.258 | 0.708*** |

| (1.281) | (3.915) | (1.154) | (3.463) | (1.199) | (3.590) | (1.144) | (3.498) | |

| SA Index | 0.111*** | 0.080*** | 0.112*** | 0.083*** | 0.111*** | 0.082*** | 0.111*** | 0.083*** |

| (4.626) | (3.475) | (4.667) | (3.610) | (4.630) | (3.558) | (4.645) | (3.576) | |

| GDP Growth | 0.416*** | 0.437*** | 0.413*** | 0.411*** | 0.428*** | 0.439*** | 0.423*** | 0.433*** |

| (4.022) | (4.179) | (3.979) | (3.872) | (4.068) | (4.084) | (4.024) | (4.030) | |

| French Legal Origin | 0.237 | 0.350** | 0.126 | 0.196 | 0.076 | 0.137 | 0.083 | 0.149 |

| (1.267) | (2.214) | (0.712) | (1.280) | (0.427) | (0.878) | (0.465) | (0.960) | |

| German Legal Origin | 0.417*** | 0.574*** | 0.228 | 0.227* | 0.235 | 0.216* | 0.229 | 0.220* |

| (3.008) | (5.174) | (1.586) | (1.951) | (1.574) | (1.786) | (1.554) | (1.845) | |

| Scandinavian Legal Origin | 1.098*** | 0.697*** | 0.794*** | 0.180 | 0.784*** | 0.252 | 0.776*** | 0.239 |

| (4.931) | (3.769) | (3.573) | (0.965) | (3.361) | (1.268) | (3.317) | (1.199) | |

| Patent Rights | 0.321*** | 0.255*** | 0.260*** | 0.184*** | 0.257*** | 0.208*** | 0.261*** | 0.206*** |

| (4.039) | (3.697) | (3.994) | (3.250) | (3.750) | (3.436) | (3.846) | (3.467) | |

| Power Distance | 0.008** | 0.012*** | 0.004 | 0.005* | 0.004 | 0.006** | 0.004 | 0.006* |

| (2.038) | (3.727) | (1.004) | (1.772) | (1.027) | (2.081) | (0.974) | (1.905) | |

| Masculinity | 0.004* | 0.002 | 0.003 | −0.001 | 0.002 | −0.001 | 0.002 | −0.001 |

| (1.856) | (0.853) | (1.180) | (−0.544) | (0.977) | (−0.397) | (0.893) | (−0.586) | |

| Long-term Orientation | 0.003 | −0.005* | 0.006** | 0.001 | 0.005* | 0.001 | 0.006* | 0.001 |

| (0.891) | (−1.916) | (2.269) | (0.527) | (1.875) | (0.404) | (1.945) | (0.536) | |

| Indulgence | −0.005* | −0.005** | −0.002 | −0.001 | −0.003 | −0.002 | −0.003 | −0.001 |

| (−1.847) | (−2.178) | (−0.979) | (−0.497) | (−1.138) | (−0.905) | (−1.098) | (−0.728) | |

| Catholic | 0.201* | 0.083 | 0.067 | −0.111 | 0.071 | −0.074 | 0.070 | −0.085 |

| (1.780) | (0.872) | (0.765) | (−1.519) | (0.799) | (−0.979) | (0.783) | (−1.143) | |

| Creditor Rights | 0.016 | 0.218** | 0.014 | 0.247** | −0.012 | 0.246** | −0.006 | 0.250** |

| (0.122) | (2.161) | (0.114) | (2.446) | (−0.093) | (2.343) | (−0.044) | (2.384) | |

| C3 | 0.488 | −0.245 | 0.371 | −0.547** | 0.500 | −0.466 | 0.483 | −0.470 |

| (1.518) | (−0.924) | (1.153) | (−2.014) | (1.473) | (−1.612) | (1.430) | (−1.636) | |

| Constant | −4.922*** | −4.154*** | −4.485*** | −3.439*** | −4.475*** | −3.569*** | −4.471*** | −3.558*** |

| (−9.727) | (−9.663) | (−8.996) | (−8.157) | (−8.690) | (−8.135) | (−8.676) | (−8.116) | |

| Industry×Year FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Continent×Year FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 98,347 | 98,347 | 98,347 | 98,347 | 98,225 | 98,225 | 98,225 | 98,225 |

| R2 | 0.320 | 0.302 | 0.320 | 0.303 | 0.320 | 0.302 | 0.320 | 0.303 |

- Note: In this table, we examine whether language FTR is related to corporate innovation by using alternative measures for strong-FTR language. Variable definitions are listed in the Appendix. Robust standard errors clustered at the firm level are reported in parentheses.

- The symbols ***, ** and * denote significance at the 1%, 5% and 10% levels, respectively.

5.2 Alternative measures of innovative activities

In this section, we adopt alternative measures for innovation output. First, because innovation involves a long-term process, it may take several years to convert human capital investment into patents. In our baseline regressions, we adopt 1-year-ahead innovation output as the main dependent variable. To ensure that our results are due to the selection of forward years, we also employ the 2-year- and 3-year-ahead innovation outputs as alternative dependent variables. We rerun our baseline regression and report the results in Table 8. Columns 1–4 of Table 8 show that the coefficients of Strong FTR are negative and statistically significant, with similar economic magnitudes to those in Table 3. Second, the main dependent variables used in the baseline model are the number of patent counts and the number of citations received by patents. Both measure the overall innovative activities within a firm. However, it is necessary to distinguish between innovative activities and innovation effectiveness. Hu et al. (2017) suggest that non-innovation-related motives for acquiring patents, such as strategic considerations and government policy incentives, may have played an important role in the patenting surge in China. If patents are obtained as a result of non-innovative incentives, they are unlikely to be related to efforts aimed at creating new technology. Therefore, to measure innovation effectiveness, we adopt the log value of one plus citations per patent as an alternative measure of innovation quality. We report the regression result in column 5 of Table 8. Table 8 shows that the coefficient of strong-FTR language is also negative and highly significant.

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

|---|---|---|---|---|---|---|---|

| VARIABLES | LnPatt+2 | LnCitt+2 | LnPatt+3 | LnCitt+3 | LnCitPatt+1 | Patt+1 | Citt+1 |

| Strong FTR | −0.121 | −0.334*** | −0.146* | −0.365*** | −0.074*** | −0.567*** | −1.474*** |

| (−1.554) | (−4.968) | (−1.790) | (−5.129) | (−5.110) | (−2.591) | (−6.545) | |

| Size | 0.330*** | 0.318*** | 0.337*** | 0.323*** | 0.059*** | 0.746*** | 0.756*** |

| −28.308 | −25.975 | −27.376 | −25.001 | −21.96 | −34.383 | −32.138 | |

| ROA | 0.299*** | 0.338*** | 0.384*** | 0.425*** | 0.086*** | 1.091*** | 0.676*** |

| −4.704 | −4.616 | −5.586 | −5.413 | −3.974 | −6.408 | −4.032 | |

| Leverage | −0.497*** | −0.467*** | −0.499*** | −0.448*** | −0.115*** | −0.449** | −0.334* |

| (−6.060) | (−5.497) | (−5.689) | (−4.910) | (−5.478) | (−2.555) | (−1.858) | |

| Cash/TA | 0.504*** | 0.562*** | 0.498*** | 0.559*** | 0.182*** | 0.723*** | 1.068*** |

| −7.66 | −7.653 | −7.078 | −7.17 | −8.758 | −4.886 | −7.027 | |

| PPE/TA | 0.151* | 0.146 | 0.168* | 0.171* | 0.055** | 0.478** | 0.645*** |

| −1.665 | −1.555 | −1.728 | −1.703 | −2.378 | −2.307 | −2.687 | |

| LogFirmAge | 0.119*** | 0.089*** | 0.108*** | 0.083*** | −0.026*** | 0.132*** | 0.013 |

| −4.423 | −3.12 | −3.818 | −2.785 | (−3.515) | −2.582 | −0.259 | |

| R&D/TA | 3.616*** | 3.663*** | 3.735*** | 3.793*** | 0.892*** | 6.685*** | 6.278*** |

| −19.089 | −16.596 | −18.457 | −16.085 | −14.982 | −18.808 | −15.585 | |

| HHI | −0.665** | −0.899*** | −0.650** | −0.871*** | −0.277*** | −0.008 | 1.463 |

| (−2.555) | (−3.768) | (−2.330) | (−3.406) | (−4.970) | (−0.011) | −1.472 | |

| HHI2 | 0.406* | 0.752*** | 0.393 | 0.704*** | 0.270*** | −1.085 | −2.776** |

| −1.648 | −3.322 | −1.494 | −2.92 | −4.897 | (−1.377) | (−2.284) | |

| SA Index | 0.106*** | 0.086*** | 0.100*** | 0.084*** | −0.010* | 0.026 | −0.063 |

| −4.114 | −3.408 | −3.734 | −3.173 | (−1.766) | −0.618 | (−1.402) | |

| GDP Growth | 0.169** | 0.262*** | 0.132 | 0.505*** | −0.056* | 0.155 | 0.639* |

| −2.058 | −3.005 | −1.397 | −5.156 | (−1.721) | −0.832 | −1.88 | |

| French Legal Origin | 0.288 | 0.443*** | 0.357* | 0.510*** | 0.121*** | 1.809*** | 1.655** |

| −1.492 | −2.59 | −1.775 | −2.836 | −3.22 | −3.302 | −2.346 | |

| German Legal Origin | 0.366** | 0.442*** | 0.398** | 0.463*** | 0.160*** | 1.283** | 1.359** |

| −2.406 | −3.496 | −2.509 | −3.492 | −5.837 | −2.221 | −2.519 | |

| Scandinavian Legal Origin | 0.863*** | 0.263 | 0.891*** | 0.276 | 0.066 | 2.301*** | 2.079*** |

| −3.555 | −1.265 | −3.528 | −1.259 | −1.439 | −3.329 | −2.712 | |

| Patent Rights | 0.240*** | 0.177*** | 0.241*** | 0.180*** | 0.071*** | 0.868*** | 0.977*** |

| −3.376 | −2.818 | −3.209 | −2.711 | −4.857 | −3.062 | −2.887 | |

| Power Distance | 0.004 | 0.006* | 0.005 | 0.006* | 0.003*** | 0.019* | 0.031* |

| −1.115 | −1.81 | −1.167 | −1.68 | −3.978 | −1.645 | −1.748 | |

| Masculinity | 0.001 | −0.003 | 0.001 | −0.003 | −0.001** | 0.01 | −0.004 |

| −0.447 | (−1.388) | −0.451 | (−1.169) | (−2.063) | −1.217 | (−0.407) | |

| Long-term Orientation | 0.005 | −0.001 | 0.004 | −0.002 | −0.002*** | −0.006 | 0.002 |

| −1.634 | (−0.581) | −1.356 | (−0.821) | (−3.316) | (−0.610) | −0.143 | |

| Indulgence | −0.003 | −0.003 | −0.003 | −0.003 | −0.001** | 0 | −0.012 |

| (−1.120) | (−1.213) | (−1.165) | (−1.237) | (−2.559) | −0.05 | (−1.198) | |

| Catholic | 0.019 | −0.166** | 0.012 | −0.176** | −0.042** | 0.172 | 0.235 |

| −0.206 | (−2.067) | −0.125 | (−2.086) | (−2.437) | −0.455 | −0.488 | |

| Creditor Rights | 0.131 | 0.400*** | 0.18 | 0.431*** | 0.120*** | 1.062*** | 1.759*** |

| −0.923 | −3.519 | −1.198 | −3.542 | −4.787 | −3.364 | −3.936 | |

| C3 | 0.295 | −0.802*** | 0.196 | −0.860*** | −0.393*** | −1.393 | −4.719*** |

| −0.887 | (−2.788) | −0.566 | (−2.866) | (−6.538) | (−1.308) | (−3.555) | |

| Constant | −4.546*** | −3.235*** | −4.551*** | −3.239*** | −0.411*** | −12.274*** | −9.509*** |

| (−8.271) | (−6.819) | (−7.957) | (−6.512) | (−3.916) | (−7.302) | (−4.375) | |

| Industry×Year FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Continent×Year FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 78,693 | 78,693 | 70,503 | 70,503 | 98,634 | 97,434 | 95,558 |

| R2 | 0.324 | 0.303 | 0.326 | 0.306 | 0.219 | − | − |

- Note: In this table, we examine whether language FTR is related to corporate innovation by adopting alternative measures for innovation output and an alternative estimation approach. We employ the 2-year-ahead innovation output as an alternative dependent variable in columns 1 and 2, the 3-year-ahead innovation output as an alternative dependent variable in columns 3 and 4 and the log value of one plus citations per patent as an alternative measure of innovation quality in column 5. In columns 6 and 7, we adopt the Poisson model with fixed effects as the estimation approach. Variable definitions are listed in the Appendix. Robust standard errors clustered at the firm level are reported in parentheses.

- The symbols ***, ** and * denote significance at the 1%, 5% and 10% levels, respectively.

5.3 Alternative estimation approach

In this section, we re-examine the previous main findings using an alternative estimation approach. The raw patent counts and patent citations are count data, and the Poisson distribution is usually a reasonable description of these variables. Therefore, we employ the Poisson model with multidimensional fixed effects and use the maximum-likelihood method to re-estimate the baseline model. The last two columns of Table 8 report the estimation results of the Poisson model. The dependent variables in columns 6 and 7 are raw patent counts and raw patent citations in year t+1, respectively. The coefficients of Strong FTR are negative and significant at the 1% level. Given that other explanatory variables in the model are held constant, compared with firms in countries with weak-FTR languages, firms in countries with strong-FTR languages are expected to have 43.3% (e−0.567– 1 = –43.3%) fewer raw patent counts and 225.5% (e−1.474– 1 = –225.5%) fewer raw patent citations. Therefore, when we adopt the Poisson model, our previous findings that firms in countries with strong-FTR languages engage in less innovative activities than those in countries with weak-FTR languages still hold.9

5.4 Alternative sample

One concern regarding our results is that they may be driven by US firms, which account for 44% of the observations in our sample. As the most innovative country in the world, the specific country-level characteristics of the United States might result in biased regression results. To alleviate this concern, we drop US firms and rerun our regression in Panel A of Table 9. In addition, incorrect FTR coding for multilingual countries may bias our results. Therefore, we exclude countries with multiple official languages (such as Belgium, Malaysia and Switzerland) and rerun the regression in Panel B. Another concern is that our results might be driven by zero-patent observations. We rerun our regression using the non-zero-patent observations in Panel C. Panels A–C of Table 9 show that our results still hold in all specifications.

| (1) | (2) | |

|---|---|---|

| VARIABLES | LnPatt+1 | LnCitt+1 |

| Panel A. Exclude US firms | ||

| Strong FTR | −0.181** | −0.322*** |

| (−2.366) | (−5.155) | |

| Industry×Year FE | Yes | Yes |

| Continent×Year FE | Yes | Yes |

| Observations | 55,243 | 55,243 |

| R2 | 0.292 | 0.235 |

| Panel B. Exclude multilingual countries | ||

| Strong FTR | −0.191** | −0.340*** |

| (−2.495) | (−5.142) | |

| Industry×Year FE | Yes | Yes |

| Continent×Year FE | Yes | Yes |

| Observations | 96,616 | 96,616 |

| R2 | 0.324 | 0.305 |

| Panel C. Non-zero patent observations | ||

| Strong FTR | −0.283*** | −0.649*** |

| (−2.640) | (−5.983) | |

| Industry×Year FE | Yes | Yes |

| Continent×Year FE | Yes | Yes |

| Observations | 47,952 | 47,952 |

| R2 | 0.416 | 0.407 |

| Panel D. Add additional controls | ||

| Strong FTR | −0.243** | −0.508*** |

| (−2.389) | (−5.833) | |

| Time Preference | −0.316 | −1.098*** |

| (−0.606) | (−2.596) | |

| Rule | −15.566** | −21.342*** |

| (−2.305) | (−4.121) | |

| Credit Market | 0.002** | 0.002*** |

| −2.438 | −2.758 | |

| Stock Market | −0.002*** | −0.001** |

| (−3.945) | (−2.060) | |

| Industry×Year FE | Yes | Yes |

| Continent×Year FE | Yes | Yes |

| Observations | 37,471 | 37,471 |

| R2 | 0.279 | 0.257 |

- Note: In this table, we conduct a series of robustness tests. Specifically, we exclude US firms in Panel A, exclude multilingual countries in Panel B, focus only on firms with non-zero patents in Panel C and add four additional control variables in Panel D. All regressions include the same control variables used in Table 3, but their coefficients are not tabulated. Variable definitions are listed in the Appendix. Robust standard errors clustered at the firm level are reported in parentheses.

- The symbols ***, ** and * denote significance at the 1%, 5% and 10% levels, respectively.

5.5 Additional controls

In this subsection, we add more country-level controls to our regression to ensure that our results are not due to country-omitted variable bias. Specifically, we add rule of law, credit market development and stock market development in the regression to control for the legal environment and financial market development. In Panel D of Table 9, we show that our findings still hold.

6 CONCLUSION

Strong-FTR languages require speakers to grammatically mark future events, while weak-FTR languages do not. The prior literature has shown that weak-FTR languages are associated with more future-oriented behaviors, such as an individual's perception of saving and health behaviors (M. K. Chen, 2013), corporate social responsibility (Liang et al., 2018), precautionary cash holdings (S. Chen et al., 2017), earnings management (Kim et al., 2017) and investment efficiency (Kim et al., 2020). In this paper, we focus on corporate innovation, an important driver of economic growth. Specifically, we attempt to investigate whether language, as an informal institution, has any impact on corporate innovation by shaping inventors’ perception of long-term innovation. Given that strong-FTR languages increase the psychological distance from the future and make the timing of future rewards more accurate, inventors speaking strong-FTR language perceive a lower present value of innovation projects than their weak-FTR language counterparts. Using a large sample of firms from 34 countries, we show that firms in countries where strong-FTR languages are spoken are less likely to engage in innovative activities than firms in countries where weak-FTR languages are spoken. Moreover, we show that language indeed shapes inventors’ perceptions of innovation by changing their perceived present value of innovation. Our results are robust to alternative measures of language FTR, alternative estimation methods, subsamples and potential omitted variables. Our study contributes to the emerging literature on how language affects individual behaviors and organizational decisions. In addition to the incentive schemes, executive characteristics, institutional investors and formal institutions studied in the prior literature, we propose that language can be an informal institution that drives innovations.

ACKNOWLEDGMENTS

Prof. Dongmin Kong acknowledges the financial support from the Major Project of National Social Science Foundation of China (grant no.: 21ZDA010). Prof. Yanan Wang acknowledges the financial support from the National Natural Science Foundation of China (grant no. 72002219). Prof. Jian Zhang acknowledges the financial support from the National Natural Science Foundation of China (grant no. 71802160), and the PRC Ministry of Education Youth Project for Humanities and Social Science Research (grant no. 18XJC630008).

APPENDIX: VARIABLE DEFINITIONS

| Variables | Definition | Data source |

|---|---|---|

| LnPat | Log value of patents | EPO |

| LnCit | Log value of citations | EPO |

| LnCitPat | Log value of the ratio of citations to patents | EPO |

| Strong FTR | Indicator variable equal to one if a language is a strong-FTR language according to M. K. Chen's (2013) strong-criterion coding and zero otherwise | M. K. Chen (2013) |

| Inflectional FTR | Indicator variable equal to one if the language has an inflectional future tense and zero otherwise | M. K. Chen (2013) |

| Prediction FTR | Indicator variable equal to one if the language has prediction-based FTR markers and zero otherwise | M. K. Chen (2013) |

| Verb Ratio | Calculated as the number of verbs that are grammatically future-marked divided by the total number of future-referring verbs | M. K. Chen (2013) |

| Sentence Ratio | Calculated as the proportion of sentences regarding the future that contains a grammatical future marker | M. K. Chen (2013) |

| Size | Log value of total assets | BvD Osiris |

| ROA | Return on assets | BvD Osiris |

| Leverage | Total debts divided by total assets | BvD Osiris |

| Cash/TA | Cash holdings scaled by total assets | BvD Osiris |

| R&D/TA | R&D expense scaled by total assets | BvD Osiris |

| PPE/TA | Property, plant and equipment scaled by total assets | BvD Osiris |

| SA index | Financial constraint index constructed by Hadlock and Pierce (2010) | BvD Osiris |

| LogFirmAge | Log value of the number of years since the firm was established | BvD Osiris |

| HHI | Herfindahl index calculated by sales | BvD Osiris |

| HHI2 | Squared term of Herfindahl index | BvD Osiris |

| GDP growth | GDP growth rate of a country in the year | The World Bank |

| KOFGI | KOF Index of Globalization | ETH Zurich |

| FDI_GDP | Net outflows of the foreign direct investment divided by GDP | The World Bank |

| Patent Rights | Average of the index of patent protection | W. G. Park (2008) |

| rule | Rule of law | The World Bank |

| Credit Market | Market capitalization of listed domestic companies as a percentage of GDP (scaled by 100) | The World Bank |

| Stock Market | Domestic credit to private sectors as a percentage of GDP (scaled by 100) | The World Bank |

| Time Preference | Percentage of survey participants in each country | Wang et al. (2016) |

| Power Distance | National culture index related to power distance between different members of a society (scaled by 100) | Hofstede Website |

| Masculinity | National culture index related to the level of masculinity in a society (scaled by 100) | Hofstede Website |

| Long Term Orientation | National culture index related to the long-term orientation of a society (scaled by 100) | Hofstede Website |

| Indulgence | National culture index related to the level of indulgence in a society (scaled by 100) | Hofstede Website |

| Catholic | Dummy = 1 if the largest proportion of a country's population practices the Catholic religion | La Porta et al. (1999) |

| French legal origin | Dummy = 1 for French legal origin | La Porta et al. (1999) |

| German legal origin | Dummy = 1 for German legal origin | La Porta et al. (1999) |

| Scandinavian legal origin | Dummy = 1 for Scandinavian legal origin | La Porta et al. (1999) |

| Credit Rights | Dummy = 1 if the creditor rights index is 3 or 4; otherwise, it is zero | Djankov et al. (2007) |

| C3 | The average equity share of the three largest shareholders in this country | BvD Osiris |

REFERENCES

- 1 For example, Saxenian (1996) suggests that the cultural differences between the Boston area and California lead to different patterns of innovation and entrepreneurship in those areas. Naranjo-Valencia, Jiménez-Jiménez and Sanz-Valle (2011) find that organizational culture is an important determinant of innovation. Specifically, adhocracy cultures foster innovation strategies, and hierarchical cultures promote imitation. Knack and Keefer (1997) suggest that an environment with a higher level of social trust has a higher probability of innovation. Dakhi and De Clercq (2004) point out that social networks bridge diverse domains of knowledge and financial resources, which increases the propensity for innovation.

- 2 For example, Hu et al. (2017) reveal a weak correlation between patents and R&D in China. Z. Chen et al. (2018) show a significant increase in reported R&D that is partly driven by firms relabeling expenses as R&D due to a Chinese policy that gives substantial tax cuts to firms with R&D investment over a threshold.