Industry tournament incentives and corporate innovation

Abstract

Our paper examines the relationship between industry tournament incentives for CEOs and corporate innovation. We find that the external pay gap is positively associated with subsequent innovation output and its economic value. Our results are robust to using different industry classifications, alternative measures of industry tournament incentives and innovation, and various controls for corporate governance, business strategy, and CEO attributes. We employ a quasi-natural experiment and an instrumental-variable approach to mitigate endogeneity concerns. We also find evidence of a positive and significant relationship between industry tournament incentives and idiosyncratic risk. Overall, the evidence is consistent with our contention that aspirant CEOs undertake innovation projects which can generate uncertain but potentially rewarding outcomes that increase the likelihood of the aspirant standing out and winning the tournament or extracting the tournament-induced benefits internally.

1 INTRODUCTION

A long-standing strand of literature acknowledges that innovation is a key driver of economic growth (e.g., Aghion & Howitt, 1992; Grossman & Helpman, 1990; Moshirian et al., 2021). It is important to understand the conditions that foster corporate innovation. Unlike routine tasks or procedures, innovation activities are risky, unpredictable and tend to be associated with high agency costs (Holmstrom, 1989). Tournament theory argues that the large pay gap between the CEO and lower-ranked executives provides promotion tournament incentives for non-CEO senior executives to make greater efforts and undertake riskier investments (Hvide, 2002; Lazear & Rosen, 1981). Shen and Zhang (2018) find that such internal tournament incentives are positively related to firms’ innovative efficiency. Nevertheless, a larger strand of the literature has focused on CEO incentives and characteristics as determinants of corporate innovation, partly due to the fact that the CEO is more important in determining corporate decisions compared to other top executives.1 In a given firm, the CEO is at the top of the promotion ladder and his/her tournament incentives have long been overlooked. Coles et al. (2018, 2020) are the first to point out that CEOs’ tournament incentives arise outside the firm in the external labor market and can be empirically measured by the pay gap between the CEO and the highest-paid CEO among similar firms. Given the dominant role played by CEOs in shaping business strategy where innovation is a core component, this paper aims to understand how industry tournament incentives influence corporate innovation.

CEOs differ in their willingness to engage in innovation activities because the payoffs to innovation projects are highly uncertain and the probability of failure is substantial (Bhagat & Welch, 1995). Equity-based incentives in the form of stocks and stock options can reduce CEOs’ inherent risk aversion and motivate them to pursue risky but potentially value-enhancing investments (Coles et al., 2006). Industry tournament incentives represent another source of incentive alignment where the aspirant CEO earns the tournament prize (i.e., the external pay gap) if unseating the highest-paid (leader) CEO. The potential external opportunity also puts pressure on the current firm's board of directors to increase the aspirant CEO's compensation internally, so the CEO need not move to extract benefits from the industry tournament.2 Given the option-like character of the tournament, the aspirant CEO prefers more volatility in the outcome and such preference is stronger when the tournament prize is larger (Coles et al., 2020). Coles et al. (2018) show that R&D expenditures, as an indicator of the riskiness of firm investment policy, increase with the industry pay gap. The greater investment undertaken by the aspirant CEO in R&D—an important input to the innovation process, however, does not necessarily translate into better innovation performance. Along with R&D expenditures, other inputs to the innovation process are physical and human capital, managerial and employee effort, and creativity (Atanassov, 2013). If other inputs are not effectively employed, high R&D expenditures are less likely to result in successful innovation. Compared with R&D expenditures, patent-based metrics capture a firm's innovation output that encompasses the successful usage of all (both observable and unobservable) innovation inputs and are thus superior to R&D expenditures to reflect innovation performance.3 In this paper, we propose two competing hypotheses to examine the effect of industry tournament incentives on innovation performance captured by patent-based metrics.

Our first hypothesis argues that industry tournament incentives encourage CEOs to make greater efforts, leading to better innovation performance, and it is termed “the effort hypothesis.” Theoretically, an increase in the size of the tournament prize (i.e., the external pay gap) is expected to increase the aspirant's efforts and expected performance (Coles et al., 2020). Coles et al. (2018) document empirical evidence of Tobin's Q being positively associated with the external pay gap. Higher stock market performance can manifest itself through enhanced innovation performance. Hirshleifer et al. (2013) demonstrate that innovative efficiency is a strong positive predictor of future stock returns. Exploiting shocks to CEO status due to awards granted by major media outlets, Ammann et al. (2016) show that observing a peer promoted to superstar status incentivizes competing CEOs, leading to significant positive stock market performance accompanied by increased innovation efficiency and quality in the competitors’ firms. In the management literature, Terwiesch and Xu (2008) argue that tournament theory provides an appropriate framework for explaining the outcomes of innovation contests. Cultivating innovation requires significant managerial involvement, long-term commitment, and a willingness to take risks. External labor market incentives offer a solution to the agency problems associated with monitoring difficulties for CEOs (Coles et al., 2018, 2020). Given that managerial efforts are a fundamental input to the innovation process, we expect a positive relationship to emerge between industry tournament incentives and corporate innovation performance.

Our alternative hypothesis asserts that industry tournament incentives may induce excessive risk-seeking behavior, resulting in poorer innovation performance, and it is referred to as “the risk-seeking hypothesis.” The option-like payoff structure of the tournament can increase managerial appetite for risk-taking in order to increase the probability of winning the event. The extant literature has documented that such risk-taking is often pursued at the expense of efficiency and can lead to dysfunctional consequences. For instance, Hvide (2002) and Gilpatric (2009) theoretically demonstrate that tournaments generate perverse incentives for competitors to engage in wasteful risk-taking. Haβ et al. (2015) document empirical evidence that firms with larger within-firm promotion-based tournament incentives have greater propensities to commit fraud. James and Issac (2000) demonstrate a positive association between tournament incentives and excessive risk-taking behaviors by fund managers which lead to poor performance. The innovation process is risky and idiosyncratic. R&D expenditures are often viewed as indicating the riskiness of firm investment policy and represent one observable input to innovation. Successful innovation, however, requires the effective utilization of all innovation inputs (both observable and unobservable). Coles et al.’s (2020) model predicts that the preference for higher risk by the aspirant CEO is stronger when the tournament prize is higher. In pursuing risky innovation projects, managers may substitute R&D expenditures for other inputs by spending an excessive amount and this may hurt innovation (Atanassov, 2013). Taken together, it is a valid concern that high industry tournament incentives may lead to excessively risky and inefficient innovation activities which adversely affect innovation output.

In sum, it remains an empirical question whether industry tournament incentives spur or impede corporate innovation performance. To test the above two hypotheses, we use the National Bureau of Economic Research (NBER) patent database to examine the quantity and quality of a firm's innovation output. Industry tournament incentives for CEOs are measured by the gap between a firm's CEO compensation and the maximal CEO pay among similar (industry, size) firms following Coles et al. (2018). Besides firm and industry attributes, our baseline regression specification includes controls for CEO attributes (CEO tenure and age, CEO overconfidence, and managerial ability), CEO incentives (CEO delta and vega, and CEO entrenchment), and within-firm tournament incentives (pay gap between the CEO and other top executives). Based on 11,354 firm-year observations over the 1992–2005 period, we show that industry tournament incentives are positively associated with corporate innovation outcomes as measured by patent, citations-per-patent and total citation counts, and the effect is over and above that of within-firm tournament incentives and economically substantial. In particular, a one-standard-deviation increase in the industry pay gap increases the number of truncation-adjusted patents (citations per patent) in the following year by 2% (4.5%) of its mean.4 Our results are robust to using different industry classifications and additional controls for other CEO attributes, business strategy, and corporate governance mechanisms. Using alternative measures of innovation, we further demonstrate that industry tournament incentives lead to higher innovation impact, greater innovative efficiency, and more widespread and original patents. The latter suggests that CEOs with higher industry tournament incentives engage more in exploratory than exploitative innovation strategies.5 These findings are consistent with the effort hypothesis that industry tournament incentives encourage CEOs to exert greater efforts, resulting in better innovation performance.6

Our baseline regression specification also includes year fixed effects to control for common economic shocks and CEO-firm fixed effects to account for unobserved CEO-firm characteristics and to address the potential endogenous CEO-firm matching bias. As argued by Coles et al. (2018), the CEO's board of directors tends to have little control over the external pay gap, and therefore our analysis is less likely to be contaminated by endogeneity problems.7 Nevertheless, we employ a quasi-natural experiment and an instrumental variable approach to mitigate the potential endogeneity of the industry pay gap and our findings remain robust.

As Holmstrom (1989) points out, the innovation process is unpredictable and idiosyncratic. Consistent with this notion, we find that a higher industry pay gap is associated with higher firm idiosyncratic risk and total risk and more industry-adjusted R&D expenditures. The evidence identifies a possible channel through which industry tournament incentives motivate corporate innovation. In particular, the industry pay gap encourages the aspirant CEO to undertake risky and potentially rewarding innovation activities so as to increase the chance of winning the tournament prize. We also find that higher industry tournament incentives are associated with a greater economic value of patents, and this evidence indicates a potential channel for industry tournament incentives to improve firm valuation. In addition, we show that innovation output matters for CEO future compensation. For CEOs moving to CEO positions at other firms, the change in total compensation is greater for those with innovation output compared to the ones without innovation output. Internally, increasing innovation by CEOs with large industry pay gaps also increases their future compensation.

This paper contributes to the literature examining the impact of managerial incentives on corporate innovation productivity. Theoretically, Manso (2011) argues that the optimal innovation-motivating compensation schemes for managers should include rewards for long-term success in addition to tolerance for early failures. Consistent with this view, prior empirical research documents evidence on the importance of option-based long-term and risk-taking incentives in spurring corporate innovation (e.g., Baranchuk et al., 2014; Lerner & Wulf, 2007; Mao & Zhang, 2018). Rank-order tournaments are schemes of relative performance evaluation and proposed as optimal labor contracts when monitoring is difficult, costly, and unreliable (Lazear & Rosen, 1981). With option-like features, tournaments can induce the participants to exert more effort and encourage their risk-taking behavior. Shen and Zhang (2018) find that within-firm tournament incentives are positively related to innovative efficiency. We demonstrate that firms led by CEOs faced with higher industry tournament incentives generate better innovation outcomes, and the effect of industry tournament incentives well exceeds the effect of within-firm tournament incentives. This is consistent with the dominant role of the CEO within the senior executive team in shaping corporate innovation policies.

Our findings also contribute to the growing literature investigating the economic and financial implications of industry tournament incentives. Tournament theory evolved as a way to explain the large pay gap between the CEO and other top executives which has received considerable attention from academic researchers and business practitioners alike. Although the CEO has already won a previous internal promotion tournament, tournament incentives for CEOs could exist in the external labor market. Coles et al. (2018) propose measuring industry tournament incentives external to the firm by its CEO's industry pay gap, and link this measure to firm valuation, risk, and investment and financial policies. Recent research has investigated the multifaceted implications of external tournament incentives. For instance, Huang et al. (2019) find that industry tournament incentives induce CEOs to deploy cash strategically to capture its product market benefits, leading to an increased level and marginal value of cash holdings. Kubick and Lockhart (2016) show that external labor market incentives motivate CEOs to adopt more aggressive tax policies. Huang et al. (2020) document distortions in corporate disclosure driven by industry tournament incentives. Tan (2021) shows evidence of industry tournament incentives reducing audit fees. It is widely recognized that innovation is a significant driver of long-run economic growth. We find strong and robust evidence of industry tournament incentives spurring corporate innovation.8 Our findings also complement Coles et al. (2018) by showing innovation productivity as a possible channel for industry tournament incentives to positively affect firm valuation.

It should be noted that our measures of innovation quality, based alternatively on the citation count or the stock market reaction to the patent grant, all follow the innovation literature and necessarily rely on information revealed after the innovation has been undertaken. Both patent and citation counts suffer from a truncation bias as the NBER patent database ends in 2006.9 In addition, the usual caveat of market participants’ potentially illusory expectations and thus mispricing applies to the measure of the economic value of patent calculated based on stock market reaction to the patent grant.

The rest of the paper is structured as follows. Section 2 describes the data and methodology. Section 3 presents the empirical results and discussions. Section 4 concludes.

2 DATA AND METHODOLOGY

2.1 Data sources

We collect CEO compensation data from ExecuComp over 1992–2005.10 We control for firm characteristics using accounting data from Compustat, stock return data from the Center for Research in Security Prices, and institutional ownership data from Thomson Reuters 13F database. Firm-year observations must have nonmissing CEO industry pay gap and main control variables to be included in the sample. We merge CEO compensation data and firm characteristics data with patent-related data from the NBER patent database. Following the innovation literature, we set the patent-based innovation output to zero for firm-year observations that are not present in the NBER patent database. Firms that operate in Fama-French 30 industries without any filed patent in the sample period are excluded from the sample.11 The final sample, excluding financial and utility firms, consists of 11,354 firm-year observations associated with 1734 unique firms and 2816 unique CEOs from 1992 to 2005.12

2.2 Variable measurement

2.2.1 Measures of innovation

Existing literature has developed two proxies to capture firm innovation: R&D expenditures and patenting activity. Between the two measures, patenting activity is considered a better proxy, as it measures innovation output and captures how effectively a firm has utilized its innovation inputs, both observable and unobservable. In contrast, R&D expenditures are only one particular observable input and fail to capture the quality of innovation. Therefore, following existing innovation literature, we use a firm's patenting activity to measure innovation.13

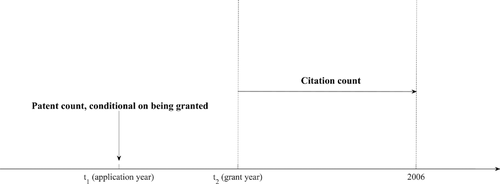

We construct output-oriented measures of innovation using the latest version of the NBER patent database which contains patent and citation information from 1976 to 2006. Figure 1 shows a timeline for the measurements of patent and citation. Our first measure of innovation reflects the quantity of a firm's innovation output and is calculated as the number of patent applications filed by a firm in a given year that are eventually granted. Hall et al. (2001) recommend using application year because the actual timing of the patented innovation is closer to the application year than to the subsequent grant year.14 There is, on average, a 2-year lag between patent application and patent grant. This, in turn, leads to a truncation bias in patent counts toward the end of the sample period. As suggested by Hall et al. (2001), we include year fixed effects in our regressions to address this truncation issue. Further, we follow Hall et al. (2005) and Fang et al. (2014) to estimate the application-grant lag distribution and compute the truncation-adjusted patent count as raw patent count divided by the cumulative application-grant lag distribution. Additionally, following Atanassov (2013), we construct another adjusted measure of patent count by scaling the number of patents for each firm-year by the average number of patents of all firms in the NBER patent database for that year.

Our second measure of innovation is the number of citations per patent, which reflects the importance and quality of a firm's innovation output. It is calculated as the total number of citations ultimately received on the firm's patents applied for (and eventually granted), scaled by the number of patents applied for (and eventually granted) during the year.15 As illustrated in Figure 1, citations are counted starting from the patent grant year until the end of the sample period. Therefore, this measure also suffers from a truncation bias because patents tend to receive citations over a long period after the patents are granted. We follow the recommendations of Hall et al. (2001) and adjust the citation count of each patent in three different ways. For the first adjustment, we multiply each patent's citation count by the weighting index from Hall et al. (2001, 2005) that is created by econometrically estimating the distribution of the citation lag.16 For the second adjustment, we scale each patent's citation count by the average citation count of all patents in the same year. For the third adjustment, we scale each patent's citation count by the average citation count of all patents in the same year and technology class. For each type of adjustment, we then sum up the adjusted citation count across all patents applied for during each firm-year and compute the corresponding average number of adjusted citations per patent for each firm-year.

Our third measure of innovation is the impact of innovation which is defined as the total number of citations ultimately received by the patents applied for (and eventually granted) during a given year. The citation count of each patent is adjusted in three different ways, as explained above. The impact of innovation measure takes into account both the numbers of patents and the number of citations per patent.

We merge the patent data with the CEO compensation data and firm characteristics data. Following the innovation literature (see, e.g., Atanassov, 2013; He & Tian, 2013; Huang et al., 2020; Kogan et al., 2017; Mao & Weathers, 2019; Mao & Zhang, 2018), we set the patent count, citations-per-patent count and total citation count to zero for firm-year observations that are not present in the NBER patent database because this patent database covers the entire universe of firms that have filed patents with the USPTO. Following Kogan et al. (2017) and Custódio et al. (2019), we exclude firms that operate in FF30 industries without any filed patent in the sample period. Due to the right skewness of the innovation measures in our final sample, we winsorize these variables at the 99th percentile.

For robustness tests, we also calculate additional measures of innovation. First, following Chan et al. (2001) and Hirshleifer et al. (2013), we measure innovative efficiency as the ratio of the number of patent applications filed by a firm in year t, scaled by its R&D capital, which is defined as the 5-year cumulative R&D expenses over (t-4, t) assuming an annual depreciation rate of 20%. We alternatively use the truncation-adjusted patent count and the year-adjusted patent count in constructing the innovative efficiency measure. A higher value of this measure suggests a more efficient use of observable resource input, namely, R&D expenditures, into innovation and a higher level of innovative efficiency. Second, generality is the median of the generality scores of all patents applied for in a given year, and the generality score of an individual patent is defined as one minus the Herfindahl index of the technology class distribution of all subsequent patents that have cited this particular patent (Trajtenberg et al., 1997). A higher generality score suggests that the patent has a widespread impact. Finally, originality is the median of the originality scores of all patents applied for in a given year. The originality score of a patent is defined as one minus the Herfindahl index of the technology class distribution of all patents that have been cited by this particular patent (Trajtenberg et al., 1997). A patent that cites other patents in dispersed technology classes is influenced by prior innovations in a variety of fields and deemed to have greater originality. Following Lerner and Seru (2017), we also scale the individual patent's generality (originality) scores by the average generality (originality) scores of all patents in the same year and technology class and use the median of the scaled generality (originality) scores of all patents applied for in a given year as alternative measures of innovation.

2.2.2 Measures of industry tournament incentives

We collect CEO compensation data from the Compustat ExecuComp database, which starts coverage from 1992. We use the Fama-French 30 industry classification (FF30) to group firms based on their product market. Coles et al. (2018, 2020) suggest that every CEO has the incentive to compete for the position of the highest-paid CEO in the industry. The difference between the highest CEO pay and the pay of the aspirant CEO is the tournament prize. An increase in the size of the prize increases the aspirant CEO's efforts, risk-taking incentives, and expected performance. We follow Coles et al. (2018) and construct our primary measure of the CEO industry tournament incentives, denoted by Indgap1, as the compensation gap between the CEO for a given firm and the second-highest-paid CEO in the same industry.17

Further, in the competitive benchmarking process employed by firms when determining executive compensation, firms tend to use peer groups based on industry and size (Bizjak et al., 2008). We subsequently follow Coles et al. (2018) to divide firms in each industry into two size groups based on whether annual net sales are above or below the industry median. Our second measure of industry tournament incentives, denoted by Indgap2, is the compensation gap between the CEO and the second-highest-paid CEO in the same industry and size group.18

For robustness checks, we compute the same industry tournament incentive measures based on the Fama-French 48 industry classification (FF48).

2.2.3 Other explanatory variables

Following the innovation literature (see, e.g., Atanassov, 2013; Fang et al., 2014; He & Tian, 2013; Hirshleifer et al., 2012; Sapra et al., 2014), we include controls for firm size, firm age, cash flow, cash flow volatility, sales growth, leverage, asset tangibility, investment in intangible assets, capital expenditures, growth opportunities, industry concentration, and institutional ownership. Firm size is proxied by the natural logarithm of sales. Firm age is approximated by the number of years since the firm's first appearing on Compustat. Cash flow is operating cash flow scaled by total assets.19 Asset tangibility is proxied by net property, plant, and equipment (PPE) scaled by total assets. Investment in intangible assets is R&D expenditures scaled by total assets. Growth opportunities are proxied by Tobin's Q. The relationship between innovation and industry concentration is captured by a sales-based Herfindahl index (constructed based on FF30 classification) and its square.

To control for within-firm tournament incentives, we follow Kini and Williams (2012), Burns et al. (2017), and Shen and Zhang (2018) to calculate Firm gap as the difference between the CEO's total compensation and the total compensation of the median VP (vice-presidents—senior executives other than the CEO).20 We include all VPs in the pay gap measure construction. To control for CEO incentives arising from executive compensation structure, we include CEO delta and vega, computed following the methodology and assumptions described in Core and Guay (2002) and Edmans et al. (2009). CEO delta is the change in the value of the CEO's accumulated equity-based compensation to a 1% change in the stock price, and CEO vega is the change in the value of the CEO's accumulated equity-based compensation to a 1% change in stock return volatility. Additional controls for CEO attributes that could affect the CEO's risk-taking incentives and thereby the firm's patenting activity are CEO age and CEO tenure.

Hirshleifer et al. (2012) find that firms with overconfident CEOs accept greater risk, invest more heavily in innovative projects and achieve greater innovation performance. Additionally, higher managerial ability could lead to better economic outcomes such as greater innovation output. In contrast, CEO entrenchment is likely to be associated with poorer firm performance. Following Campbell et al. (2011), we identify overconfident CEOs as those who hold exercisable stock options that are more than 100% in the money at least twice during the sample period. The overconfidence classification is assigned beginning with the first time the CEO exhibits the option-holding behavior. We control for managerial ability using the managerial ability score developed in Demerjian et al. (2012). The CEO pay slice, defined as the fraction of the total compensation of the top five executives that goes to the CEO, is our measure of CEO entrenchment (Bebchuk et al., 2011).

Following Coles et al. (2018), we also control for industry-level factors that are related to the industry tournament prize. These are industry stock return volatility and the number of CEOs (firms) in the industry comparison group. All control variables related to firm characteristics are winsorized at the 1st and 99th percentiles to remove the influence of extreme outliers. We provide detailed descriptions of all variables in the Appendix.

2.3 Baseline specification

2.4 Descriptive statistics

Table 1 contains summary statistics of innovation variables (Panel A), CEO incentives (Panel B), baseline control variables (Panel C), and summary statistics for raw patent count by FF30 industry (Panel D). As explained earlier, we restrict the sample to those firm-year observations where we can calculate the industry tournament incentives and the baseline control variables.

| Panel A: Innovation variables | ||||

|---|---|---|---|---|

| Variable | Observations | Mean | Median | SD |

| Innovation quantity | ||||

| Number of patents, raw (Patent) | 11,354 | 15.42 | 0 | 70.90 |

| Number of patents, truncation-adjusted (WPatent) | 11,354 | 17.70 | 0 | 78.19 |

| Number of patents, year-adjusted (YPatent) | 11,354 | 0.45 | 0 | 2.04 |

| Innovation quality | ||||

| Citations per patent, raw (CitePat) | 11,354 | 1.69 | 0 | 4.60 |

| Citations per patent, truncation-adjusted (WCitePat) | 11,354 | 4.06 | 0 | 9.52 |

| Citations per patent, year-adjusted (YCitePat) | 11,354 | 0.36 | 0 | 0.80 |

| Citations per patent, year-and-technology-class-adjusted (YTCitePat) | 11,317 | 0.38 | 0 | 0.82 |

| Panel B: CEO incentive variables | ||||

|---|---|---|---|---|

| Variable | Observations | Mean | Median | SD |

| Indgap1 ($000) | 11,354 | 25,760.09 | 14,770.65 | 32,037.56 |

| Indgap2 ($000) | 11,140 | 15,313.52 | 6,449.45 | 24,995.00 |

| Firm gap ($000) | 11,354 | 2,535.67 | 1,213.32 | 4,498.90 |

| CEO delta ($000) | 11,354 | 1,303.43 | 297.05 | 14,395.55 |

| CEO vega ($000) | 11,354 | 108.82 | 43.28 | 188.63 |

| CEO total compensation ($000) | 11,354 | 3,598.81 | 1,980.76 | 5,362.32 |

| Panel C: Baseline control variables | ||||

|---|---|---|---|---|

| Variable | Observations | Mean | Median | SD |

| CEO tenure | 11,354 | 6.99 | 5 | 7.65 |

| CEO age | 11,354 | 55.71 | 56 | 7.69 |

| CEO overconfidence dummy | 11,354 | 0.38 | 0 | 0.48 |

| Managerial ability | 11,354 | 0.01 | −0.02 | 0.13 |

| CEO slice | 11,354 | 0.37 | 0.36 | 0.11 |

| Total assets ($000,000) | 11,354 | 3,054.42 | 873.82 | 5,811.46 |

| Sales ($000,000) | 11,354 | 2,970.09 | 953.09 | 5,255.06 |

| Firm age | 11,354 | 23.81 | 20 | 15.07 |

| Tobin's Q | 11,354 | 2.13 | 1.64 | 1.58 |

| Sales growth | 11,354 | 0.15 | 0.10 | 0.24 |

| Capital expenditures/Assets | 11,354 | 0.07 | 0.05 | 0.06 |

| PPE/Assets | 11,354 | 0.30 | 0.25 | 0.22 |

| Leverage | 11,354 | 0.21 | 0.20 | 0.17 |

| Cash flow (ROA) | 11,354 | 0.15 | 0.15 | 0.10 |

| Cash flow volatility | 11,354 | 0.04 | 0.02 | 0.05 |

| R&D/Assets | 11,354 | 0.04 | 0.01 | 0.06 |

| Stock return | 11,354 | 0.19 | 0.11 | 0.55 |

| Institutional holdings | 11,354 | 0.61 | 0.64 | 0.21 |

| Herfindahl index (Hindex) | 11,354 | 0.03 | 0.02 | 0.02 |

| Industry # CEOs (Ind # CEOs) | 11,354 | 96.76 | 68.00 | 68.19 |

| Industry return volatility | 11,354 | 0.05 | 0.05 | 0.01 |

| Panel D: Summary statistics by FF30 industry | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Patent count | Correlation with sales | ||||||||

| FF30 industry | Observations | Mean | Median | Std dev | Min | Max | Total | Same year | One-year forward |

| Food products | 328 | 3.9878 | 0 | 9.8409 | 0 | 109 | 1,308 | 0.1575* | 0.1901* |

| Beer and liquor | 29 | 3.3448 | 0 | 8.7312 | 0 | 40 | 97 | 0.5645* | 0.5880* |

| Recreation | 215 | 6.3535 | 0 | 16.0442 | 0 | 116 | 1,366 | 0.0481 | 0.0100 |

| Printing and publishing | 207 | 0.8019 | 0 | 2.4124 | 0 | 17 | 166 | 0.4262* | 0.4356* |

| Consumer goods | 285 | 26.4246 | 4 | 85.4267 | 0 | 594 | 7,531 | 0.8105* | 0.7896* |

| Apparel | 211 | 1.4597 | 0 | 5.0011 | 0 | 38 | 308 | 0.6661* | 0.6780* |

| Healthcare, medical equipment, pharmaceutical products | 1,113 | 18.7978 | 0 | 54.0720 | 0 | 431 | 20,922 | 0.5116* | 0.5234* |

| Chemicals | 475 | 24.3684 | 2 | 64.5472 | 0 | 522 | 11,575 | 0.7030* | 0.6850* |

| Textiles | 91 | 2.1538 | 0 | 4.5361 | 0 | 29 | 196 | −0.0915 | −0.1147 |

| Construction and construction materials | 496 | 2.7077 | 0 | 7.7246 | 0 | 63 | 1,343 | 0.3516* | 0.3675* |

| Steel works etc. | 330 | 2.5242 | 0 | 7.1731 | 0 | 65 | 833 | 0.1160* | 0.0984 |

| Fabricated products and machinery | 613 | 23.9462 | 3 | 62.6954 | 0 | 586 | 14,679 | 0.4674* | 0.4631* |

| Electrical equipment | 129 | 12.8372 | 1 | 26.5762 | 0 | 141 | 1,656 | 0.6720* | 0.6643* |

| Automobiles and trucks | 333 | 14.0841 | 1 | 44.9610 | 0 | 562 | 4,690 | 0.6427* | 0.6030* |

| Aircraft, ships, and railroad equipment | 155 | 24.2968 | 1 | 66.2215 | 0 | 381 | 3,766 | 0.4988* | 0.4897* |

| Precious metals, nonmetallic, and industrial metal mining | 137 | 0.9489 | 0 | 2.7979 | 0 | 23 | 130 | −0.0930 | −0.1026 |

| Petroleum and natural gas | 585 | 12.3778 | 0 | 38.4755 | 0 | 289 | 7,241 | 0.3269* | 0.3297* |

| Communication | 250 | 5.3480 | 0 | 22.5068 | 0 | 193 | 1,337 | 0.4648* | 0.4697* |

| Personal and business services | 1,313 | 11.5133 | 0 | 83.9781 | 0 | 847 | 15,117 | 0.6577* | 0.6320* |

| Business equipment | 1,575 | 44.9054 | 2 | 138.6764 | 0 | 847 | 70,726 | 0.5304* | 0.5223* |

| Business supplies and shipping containers | 337 | 11.1662 | 0 | 34.0277 | 0 | 285 | 3,763 | 0.3474* | 0.3615* |

| Transportation | 337 | 0.1276 | 0 | 0.8856 | 0 | 10 | 43 | 0.5489* | 0.5353* |

| Wholesale | 455 | 0.2747 | 0 | 1.2859 | 0 | 12 | 125 | 0.2711* | 0.2645* |

| Retail | 898 | 0.0735 | 0 | 0.4543 | 0 | 7 | 66 | 0.1162* | 0.1098* |

| Restaurants, hotels, motels | 245 | 0.0367 | 0 | 0.2279 | 0 | 2 | 9 | 0.2093* | 0.2217* |

| All others | 212 | 28.6698 | 0 | 108.6521 | 0 | 847 | 6,078 | 0.7542* | 0.7517* |

| Total | 11,354 | ||||||||

- Panels A–C report summary statistics of the main variables for the sample of firm-year observations from 1992 to 2005. Panel D presents summary statistics for the raw patent count and the correlation between the raw patent count and contemporaneous and 1-year forward sales across FF30 industries. The * indicates significance at the 5% level or above. (See the Appendix for definitions of the variables.)

On average, a firm in our sample has 15.42 patents (applied for and eventually granted) per year and each patent receives 1.69 citations. The patent counts adjusted for truncation and year effects are 17.70 and 0.45, respectively. The citations-per-patent counts adjusted using the weight index, for year effects, for year and technology class effects are 4.06, 0.36, and 0.38, respectively. The mean (median) values of industry pay gap, based on industry and size-based half industry, are $25.8 million ($14.8 million) and $15.3 million ($6.4 million), respectively. The internal pay gap is substantially smaller than the external tournament prize, with the mean (median) value being $2.5 million ($1.2 million). The mean (median) values of CEO delta and CEO vega are $1.3 million ($0.3 million) and $0.11 million ($0.043 million), respectively.

The average sample firm size is $3 billion in total assets. Annual sales average about $3 billion. The average Tobin's Q is 2.13. Institutional investors hold on average 61% of shares in our sample firms. Panel D shows there is substantial variation in the number of patents both within and across FF30 industries. For most industries, the raw patent count is significantly positively correlated with contemporaneous and 1-year forward sales.21

3 RESULTS

3.1 Baseline empirical results

The odd-numbered columns of Table 2 report the results of estimating Equation (1) using our first measure of industry tournament incentives, Indgap1, based on FF30 industry. To conserve space, in the main analysis we only report the results where the number of patents and citations are truncation-adjusted. Consistent with our expectation, the coefficient on our main variable of interest is positive and significant for all measures of innovation. Using the results in Column 1, a one-standard-deviation increase in the industry pay gap increases the number of truncation-adjusted patents in the following year by 2% of its mean.22 Similarly, the results in Column 3 imply that a one-standard-deviation increase in the industry pay gap increases the number of truncation-adjusted citations per patent in the following year by 4.5% of its mean.23 Thus, the effect of industry tournament incentives on motivating innovation appears to be economically significant.

| INNOV_QUANTITY | INNOV_QUALITY | INNOV_IMPACT | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Ln(1+Indgap1) | 0.0284 | 0.0162 | 0.0359 | |||

| (3.56)*** | (2.24)** | (2.69)*** | ||||

| Ln(1+Indgap2) | 0.0186 | 0.0123 | 0.0271 | |||

| (3.46)*** | (2.21)** | (2.75)*** | ||||

| Ln(1+Firm gap) | 0.0172 | 0.0199 | 0.0044 | 0.0059 | 0.0342 | 0.0386 |

| (1.43) | (1.61) | (0.25) | (0.32) | (1.29) | (1.40) | |

| Ln(1+CEO delta) | 0.0455 | 0.0443 | 0.0017 | 0.0008 | 0.0439 | 0.0413 |

| (2.56)** | (2.48)** | (0.07) | (0.04) | (1.20) | (1.11) | |

| Ln(1+CEO vega) | 0.0110 | 0.0113 | −0.0024 | −0.0024 | −0.0021 | −0.0018 |

| (0.84) | (0.86) | (−0.16) | (−0.16) | (−0.08) | (−0.07) | |

| Ln(1+CEO age) | 0.7386 | 0.8608 | 0.9330 | 1.1691 | 2.9816 | 3.5274 |

| (0.37) | (0.43) | (0.33) | (0.41) | (0.63) | (0.74) | |

| Ln(1+CEO tenure) | −0.1451 | −0.1377 | −0.0765 | −0.0726 | −0.2174 | −0.2103 |

| (−4.26)*** | (−4.03)*** | (−1.63) | (−1.55) | (−2.68)*** | (−2.57)** | |

| CEO overconfidence | 0.1057 | 0.1111 | 0.0353 | 0.0397 | 0.1554 | 0.1630 |

| (2.52)** | (2.69)*** | (0.67) | (0.75) | (1.81)* | (1.88)* | |

| Managerial ability | −0.1952 | −0.1987 | 0.1632 | 0.1583 | −0.0384 | −0.0298 |

| (−1.54) | (−1.57) | (1.14) | (1.11) | (−0.14) | (−0.11) | |

| CEO slice | −0.0742 | −0.0947 | 0.0188 | 0.0283 | −0.1735 | −0.1675 |

| (−0.69) | (−0.85) | (0.14) | (0.19) | (−0.76) | (−0.70) | |

| Ln(Sales) | 0.0937 | 0.0797 | 0.0676 | 0.0547 | 0.1691 | 0.1491 |

| (2.27)** | (1.93)* | (1.29) | (1.02) | (1.86)* | (1.63) | |

| Ln(1+Firm age) | 0.0754 | 0.0913 | −0.0341 | −0.0247 | 0.3062 | 0.3208 |

| (0.59) | (0.71) | (−0.20) | (−0.14) | (1.03) | (1.07) | |

| Q | 0.0306 | 0.0320 | 0.0224 | 0.0248 | 0.0630 | 0.0663 |

| (2.83)*** | (2.92)*** | (1.68)* | (1.83)* | (2.83)*** | (2.94)*** | |

| Sales growth | −0.0179 | −0.0023 | 0.0851 | 0.0945 | 0.0675 | 0.0899 |

| (−0.31) | (−0.04) | (1.36) | (1.50) | (0.58) | (0.76) | |

| Capital expenditures/Assets | −0.1893 | −0.1906 | −0.1079 | −0.1145 | −0.3726 | −0.3921 |

| (−0.96) | (−0.95) | (−0.36) | (−0.38) | (−0.78) | (−0.81) | |

| PPE/Assets | 0.3427 | 0.3356 | 0.1986 | 0.1891 | 0.6984 | 0.6825 |

| (2.07)** | (2.00)** | (0.86) | (0.81) | (1.80)* | (1.74)* | |

| Leverage | −0.1852 | −0.1712 | −0.1901 | −0.1741 | −0.3909 | −0.3743 |

| (−1.86)* | (−1.71)* | (−1.46) | (−1.31) | (−1.68)* | (−1.58) | |

| Cash flow | −0.3151 | −0.2976 | 0.0355 | 0.0391 | −0.5003 | −0.5064 |

| (−1.78)* | (−1.66)* | (0.18) | (0.20) | (−1.47) | (−1.47) | |

| Cash flow volatility | −0.1390 | −0.1665 | −0.3154 | −0.3357 | −0.3774 | −0.4142 |

| (−0.53) | (−0.63) | (−1.09) | (−1.13) | (−0.75) | (−0.81) | |

| R&D/Assets | 0.6282 | 0.5666 | 0.5419 | 0.4556 | 1.5289 | 1.3968 |

| (1.38) | (1.23) | (1.15) | (0.97) | (1.98)** | (1.80)* | |

| Stock return | −0.0268 | −0.0288 | 0.0095 | 0.0077 | −0.0095 | −0.0121 |

| (−1.94)* | (−2.05)** | (0.53) | (0.42) | (−0.32) | (−0.40) | |

| Institutional holdings | 0.0694 | 0.0668 | 0.1047 | 0.0994 | 0.2704 | 0.2603 |

| (0.95) | (0.89) | (1.08) | (1.01) | (1.63) | (1.54) | |

| Hindex | 11.9572 | 12.6832 | 19.2164 | 21.5042 | 40.0519 | 43.4089 |

| (2.99)*** | (3.02)*** | (3.74)*** | (4.14)*** | (4.62)*** | (4.82)*** | |

| Hindex squared | −32.5881 | −37.4655 | −56.6887 | −69.5409 | −121.1740 | −140.2341 |

| (−2.08)** | (−2.16)** | (−2.86)*** | (−3.42)*** | (−3.50)*** | (−3.66)*** | |

| Ln(Ind # CEOs) | 0.0779 | 0.0926 | −0.1671 | −0.1297 | −0.1373 | −0.0737 |

| (0.62) | (0.73) | (−0.97) | (−0.75) | (−0.51) | (−0.27) | |

| Industry stock return volatility | 1.0689 | 1.0340 | −1.1098 | −1.5280 | −1.5805 | −2.1580 |

| (0.61) | (0.59) | (−0.55) | (−0.75) | (−0.43) | (−0.58) | |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| CEO-firm FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 11,354 | 11,140 | 11,354 | 11,140 | 11,354 | 11,140 |

| R-squared | 0.151 | 0.149 | 0.200 | 0.200 | 0.225 | 0.226 |

- The table presents the results from OLS regressions of innovation output on industry tournament incentives. The sample period is 1992–2005. The dependent variable is indicated by the column heading. INNOV_QUANTITY is the natural logarithm of one plus the number of truncation-adjusted patents applied for (and eventually granted) during the year (WPatent). INNOV_QUALITY is the natural logarithm of one plus the number of truncation-adjusted citations received on the firm's patents applied for (and eventually granted), scaled by the number of patents applied for (and eventually granted) during the year (WCitePat). INNOV_IMPACT is the natural logarithm of one plus the total number of truncation-adjusted citations received by the patents applied for (and eventually granted) during the year (WCite). Indgap1 is the pay gap between the total compensation of the second-highest-paid CEO in the same FF30 industry and the CEO's total compensation. Indgap2 is the pay gap between the total compensation of the second-highest-paid CEO in the same FF30 industry and size group and the CEO's total compensation. All independent variables are lagged by 1 year. Definitions of the variables are provided in the Appendix. All regressions include CEO-firm and year fixed effects. Standard errors are heteroskedasticity-consistent and clustered at the firm level. t-statistics are reported in parentheses. *, **, and *** indicate significance at the 10%, 5%, and 1% levels, respectively.

The even-numbered columns of Table 2 report the results of estimating Equation (1) with our second measure of industry tournament incentives, Indgap2, based on FF30 size-based half industry. The industry pay gap again enters positively and significantly in all regressions. Using the results reported in Columns 2 and 4, we find that a one-standard-deviation increase in this size-based half industry pay gap increases the number of truncation-adjusted patents and the number of truncation-adjusted citations per patent in the following year by 1.2% and 3.3% of the corresponding mean, respectively.

Among the control variables, the internal pay gap is positive but falls short of being significant. The coefficient on CEO overconfidence is positive and significant in the patent (INNOV_QUANTITY) and total citation (INNOV_IMPACT) regressions, consistent with the findings of Hirshleifer et al. (2012). On the other hand, Managerial ability and the CEO pay slice enter insignificantly in all regressions. Larger firms tend to produce more patents. Tobin's Q is positively associated with future innovation output. Like Atanassov (2013) and Sapra et al. (2014), we find evidence of an inverted U-shape relationship between innovation and industry concentration, measured by the Herfindahl index of sales based on FF30 classification.24

3.2 Alternative measures of innovation

We report the results for alternative measures of innovation in Table 3 using Indgap1. Similar to Table 2, Columns 1–5 of Table 3 (Panel A) show evidence of a robust positive relationship between the industry tournament incentives and the quantity, quality, and impact of firm-level innovation output.25 The relationship between the external pay gap and innovative efficiency shown in Columns 6 and 7 is also positive. In Panel B, the alternative dependent variables are the unadjusted and scaled generality and originality. We find that the coefficient on the industry pay gap remains significantly positive.

| Panel A: Industry tournament incentives and innovation impact and efficiency | |||||||

|---|---|---|---|---|---|---|---|

| Innovation quantity | Innovation quality | Innovation impact | Innovative efficiency | ||||

| Ln (1+YPatent) | Ln (1+YCitePat) | Ln (1+YTCitePat) | Ln (1+YCite) | Ln (1+YTCite) | Ln (1+WPatent/RDC) | Ln (1+YPatent/RDC) | |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

| Ln(1+Indgap1) | 0.0052 | 0.0064 | 0.0057 | 0.0227 | 0.0211 | 0.0024 | 0.0001 |

| (2.72)*** | (2.40)** | (2.08)** | (2.58)*** | (2.35)** | (2.36)** | (1.94)* | |

| Ln(1+Firm gap) | 0.0067 | 0.0030 | 0.0050 | 0.0271 | 0.0280 | 0.0024 | 0.0001 |

| (2.11)** | (0.45) | (0.77) | (1.82)* | (1.91)* | (1.24) | (1.35) | |

| Ln(1+CEO delta) | 0.0087 | 0.0013 | −0.0006 | 0.0356 | 0.0318 | 0.0024 | 0.0001 |

| (2.24)** | (0.18) | (−0.07) | (1.76)* | (1.56) | (0.80) | (0.68) | |

| Ln(1+CEO vega) | 0.0004 | 0.0033 | 0.0032 | 0.0020 | 0.0024 | −0.0017 | −0.0001 |

| (0.15) | (0.72) | (0.67) | (0.13) | (0.16) | (−0.71) | (−1.09) | |

| Ln(1+CEO age) | 0.2967 | −0.0814 | 0.2973 | 0.9176 | 1.5789 | 0.1904 | 0.0036 |

| (0.58) | (−0.09) | (0.32) | (0.36) | (0.62) | (0.55) | (0.24) | |

| Ln(1+CEO tenure) | −0.0416 | −0.0168 | −0.0209 | −0.1320 | −0.1324 | −0.0075 | −0.0002 |

| (−4.32)*** | (−1.04) | (−1.28) | (−2.93)*** | (−2.98)*** | (−1.21) | (−0.66) | |

| CEO overconfidence | 0.0386 | 0.0150 | 0.0082 | 0.1218 | 0.1096 | 0.0168 | 0.0006 |

| (3.52)*** | (0.81) | (0.44) | (2.53)** | (2.31)** | (2.70)*** | (2.53)** | |

| Managerial ability | −0.0402 | 0.0134 | 0.0091 | −0.1239 | −0.1626 | 0.0035 | 0.0007 |

| (−1.15) | (0.27) | (0.17) | (−0.75) | (−0.97) | (0.18) | (0.89) | |

| CEO slice | −0.0333 | 0.0177 | −0.0015 | −0.1188 | −0.1197 | 0.0120 | 0.0004 |

| (−1.23) | (0.34) | (−0.03) | (−0.91) | (−0.92) | (0.68) | (0.63) | |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

| Ln(Sales) | 0.0423 | 0.0023 | −0.0043 | 0.0960 | 0.0782 | −0.0181 | −0.0007 |

| (3.73)*** | (0.14) | (−0.24) | (1.95)* | (1.54) | (−2.63)*** | (−2.45)** | |

| Ln(1+Firm age) | 0.0945 | −0.0936 | −0.0747 | 0.1739 | 0.2089 | −0.0194 | −0.0004 |

| (3.04)*** | (−1.70)* | (−1.28) | (1.07) | (1.26) | (−0.79) | (−0.35) | |

| Q | 0.0089 | 0.0070 | 0.0093 | 0.0374 | 0.0418 | 0.0029 | 0.0001 |

| (2.63)*** | (1.40) | (1.88)* | (2.68)*** | (3.01)*** | (1.47) | (1.23) | |

| Sales growth | 0.0036 | 0.0307 | 0.0302 | 0.0367 | 0.0416 | 0.0041 | 0.0002 |

| (0.27) | (1.29) | (1.17) | (0.51) | (0.56) | (0.36) | (0.44) | |

| Capital expenditures/Assets | −0.0337 | −0.0090 | −0.0220 | −0.1392 | −0.1707 | 0.0363 | 0.0017 |

| (−0.66) | (−0.09) | (−0.21) | (−0.54) | (−0.65) | (0.81) | (0.95) | |

| PPE/Assets | 0.1038 | 0.0372 | 0.0158 | 0.4373 | 0.4150 | 0.0380 | 0.0011 |

| (2.33)** | (0.48) | (0.20) | (2.04)** | (1.90)* | (1.01) | (0.71) | |

| Leverage | −0.0346 | −0.0107 | −0.0153 | −0.1146 | −0.1384 | −0.0327 | −0.0012 |

| (−1.34) | (−0.24) | (−0.34) | (−0.87) | (−1.06) | (−2.14)** | (−2.05)** | |

| Cash flow | −0.1790 | −0.0095 | −0.0011 | −0.4532 | −0.4217 | 0.0324 | 0.0011 |

| (−3.12)*** | (−0.13) | (−0.02) | (−2.26)** | (−2.09)** | (1.23) | (1.04) | |

| Cash flow volatility | 0.0312 | −0.0451 | −0.0517 | −0.0893 | −0.1430 | 0.0109 | 0.0012 |

| (0.54) | (−0.36) | (−0.41) | (−0.28) | (−0.45) | (0.25) | (0.71) | |

| R&D/Assets | 0.1576 | 0.0716 | −0.0156 | 0.7568 | 0.5949 | −0.1566 | −0.0058 |

| (1.02) | (0.38) | (−0.08) | (1.75)* | (1.39) | (−2.22)** | (−2.15)** | |

| Stock return | −0.0049 | −–0.0015 | −0.0036 | −0.0125 | −0.0153 | 0.0004 | 0.0000 |

| (−1.39) | (−0.20) | (−0.49) | (−0.69) | (−0.83) | (0.17) | (0.47) | |

| Institutional holdings | 0.0045 | 0.0055 | 0.0131 | 0.1454 | 0.1573 | 0.0166 | 0.0007 |

| (0.22) | (0.16) | (0.38) | (1.51) | (1.68)* | (1.27) | (1.32) | |

| Hindex | 3.0063 | 5.1585 | 6.0706 | 21.0279 | 21.6651 | 1.9508 | 0.0833 |

| (3.26)*** | (3.39)*** | (3.59)*** | (4.62)*** | (4.62)*** | (2.71)*** | (2.84)*** | |

| Hindex squared | −7.9958 | −17.0252 | −19.9279 | −66.8692 | −69.1310 | −6.0861 | −0.2498 |

| (−2.52)** | (−2.69)*** | (−2.67)*** | (−3.51)*** | (−3.39)*** | (−2.22)** | (−2.38)** | |

| Ln(Ind # CEOs) | −0.0021 | −0.0443 | 0.0330 | −0.0907 | 0.0236 | 0.0136 | 0.0007 |

| (−0.07) | (−0.82) | (0.63) | (−0.64) | (0.17) | (0.55) | (0.64) | |

| Industry stock return volatility | −0.0100 | −0.4562 | −0.5001 | −1.3797 | −1.5472 | −0.3667 | −0.0130 |

| (−0.02) | (−0.63) | (−0.67) | (−0.61) | (−0.70) | (−1.34) | (−1.23) | |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| CEO-firm FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 11,354 | 11,354 | 11,317 | 11,354 | 11,317 | 10,788 | 10,788 |

| R-squared | 0.117 | 0.101 | 0.099 | 0.175 | 0.170 | 0.073 | 0.081 |

| Panel B: Industry tournament incentives and patent characteristics | ||||

|---|---|---|---|---|

| Generality | Originality | Scaled generality | Scaled originality | |

| (1) | (2) | (3) | (4) | |

| Ln(1+Indgap1) | 0.0058 | 0.0076 | 0.0115 | 0.0150 |

| (2.41)** | (3.69)*** | (2.41)** | (3.94)*** | |

| Ln(1+Firm gap) | 0.0007 | 0.0065 | 0.0030 | 0.0094 |

| (0.18) | (1.84)* | (0.36) | (1.42) | |

| Ln(1+CEO delta) | 0.0033 | 0.0030 | 0.0115 | 0.0068 |

| (0.54) | (0.54) | (0.93) | (0.64) | |

| Ln(1+CEO vega) | 0.0010 | 0.0039 | 0.0040 | 0.0073 |

| (0.26) | (1.07) | (0.53) | (1.05) | |

| Ln(1+CEO age) | 0.1840 | 0.2041 | −0.2829 | 0.0285 |

| (0.31) | (0.39) | (−0.24) | (0.03) | |

| Ln(1+CEO tenure) | −0.0149 | −0.0198 | −0.0188 | −0.0317 |

| (−1.37) | (−2.01)** | (−0.88) | (−1.75)* | |

| CEO overconfidence | 0.0123 | 0.0265 | 0.0290 | 0.0471 |

| (1.05) | (2.24)** | (1.28) | (2.14)** | |

| Managerial ability | 0.0089 | 0.0139 | −0.0081 | 0.0231 |

| (0.21) | (0.39) | (−0.09) | (0.34) | |

| CEO slice | −0.0035 | −0.0222 | 0.0001 | −0.0074 |

| (−0.09) | (−0.65) | (0.00) | (−0.12) | |

| Ln(Sales) | 0.0278 | 0.0123 | 0.0504 | 0.0299 |

| (2.30)** | (1.14) | (2.07)** | (1.50) | |

| Ln(1+Firm age) | −0.0048 | −0.0671 | −0.0404 | −0.1319 |

| (−0.12) | (−1.87)* | (−0.52) | (−2.02)** | |

| Q | 0.0079 | 0.0017 | 0.0187 | 0.0045 |

| (2.16)** | (0.54) | (2.34)** | (0.76) | |

| Sales growth | 0.0034 | 0.0057 | 0.0049 | 0.0157 |

| (0.24) | (0.37) | (0.15) | (0.54) | |

| Capital expenditures/Assets | −0.1080 | −0.1230 | −0.1890 | −0.2045 |

| (−1.58) | (−1.92)* | (−1.41) | (−1.72)* | |

| PPE/Assets | 0.0635 | 0.0436 | 0.1409 | 0.0829 |

| (1.09) | (0.83) | (1.24) | (0.86) | |

| Leverage | −0.0431 | −0.0227 | −0.0755 | −0.0473 |

| (−1.18) | (−0.78) | (−1.02) | (−0.87) | |

| Cash flow | −0.0307 | −0.0036 | −0.0992 | −0.0096 |

| (−0.61) | (−0.08) | (−0.94) | (−0.11) | |

| Cash flow volatility | −0.1463 | −0.0039 | −0.3241 | 0.0296 |

| (−1.90)* | (−0.05) | (−1.94)* | (0.21) | |

| R&D/Assets | 0.0885 | 0.2405 | 0.1304 | 0.4395 |

| (0.71) | (2.11)** | (0.49) | (2.02)** | |

| Stock return | 0.0013 | 0.0000 | −0.0005 | −0.0015 |

| (0.27) | (0.00) | (−0.05) | (−0.18) | |

| Institutional holdings | −0.0103 | 0.0126 | −0.0346 | 0.0178 |

| (−0.48) | (0.60) | (−0.81) | (0.45) | |

| Hindex | 4.3389 | 3.1792 | 7.9481 | 5.7050 |

| (3.08)*** | (2.61)*** | (3.07)*** | (2.63)*** | |

| Hindex squared | −10.5677 | −8.1735 | −19.6272 | −14.7723 |

| (−1.83)* | (−1.65)* | (−1.87)* | (−1.72)* | |

| Ln(Ind # CEOs) | 0.0274 | 0.0449 | 0.0218 | 0.0551 |

| (0.72) | (1.31) | (0.30) | (0.87) | |

| Industry stock return volatility | −0.7114 | −0.3702 | −1.1051 | −0.1583 |

| (−1.20) | (−0.66) | (−0.89) | (−0.15) | |

| Year FE | Yes | Yes | Yes | Yes |

| CEO-firm FE | Yes | Yes | Yes | Yes |

| Observations | 10,199 | 11,310 | 10,197 | 11,310 |

| R-squared | 0.083 | 0.108 | 0.072 | 0.106 |

- The table presents the results from OLS regressions of innovation output on industry tournament incentives. The sample period is 1992–2005. The dependent variable is indicated by the column heading. Innovation Quantity is calculated using the number of year-adjusted patents applied for (and eventually granted) during the year (YPatent). Innovation quality is calculated using the number of year-adjusted citations received on the firm's patents applied for (and eventually granted), scaled by the number of patents applied for (and eventually granted) during the year (YCitePat), and the number of year-and-technology-class-adjusted forward citations scaled by the number of patents applied for (and eventually granted) during the year (YTCitePat). Innovation impact is calculated using the total number of citations received by the patents applied for (and eventually granted) during the year. The citation count of each patent is adjusted for year effects (YCite), and for year and technology class effects (YTCite). Innovative efficiency is calculated using the number of patent applications filed by a firm in year t, scaled by its R&D capital (RDC) which is the 5-year cumulative R&D expenses over (t-4, t) assuming an annual depreciation rate of 20%. The patent counts are adjusted for truncation (WPatent) and year effects (YPatent). Generality is the median of the generality scores of all patents applied for in a given year. Originality is the median of the originality scores of all patents applied for in a given year. The scaled generality (originality) is the median of the generality (originality) scores scaled by the average generality (originality) scores of all patents in the same year and technology class. In both panels, Indgap1 is the pay gap between the total compensation of the second-highest-paid CEO in the same FF30 industry and the CEO's total compensation. All independent variables are lagged by 1 year. Definitions of the variables are provided in the Appendix. All regressions include CEO-firm and year fixed effects. Standard errors are heteroskedasticity-consistent and clustered at the firm level. t-statistics are reported in parentheses. *, **, and *** indicate significance at the 10%, 5%, and 1% levels, respectively.

In both panels, the results for the control variables are similar to those reported in Table 2. The internal pay gap, CEO overconfidence, and Tobin's Q are generally positively associated with future innovation output. There is robust evidence of an inverted U-shape relationship between the alternative innovation measures and industry concentration. In sum, these tests demonstrate that our main findings are robust to alternative measures of innovation output.

3.3 High-technology firms

High-technology firms need to produce a steady stream of innovations in order to survive in hyper-competitive technology markets (D'Aveni, 1994). If industry tournaments are to motivate innovation, we expect the incentive effect of industry tournaments to be more pronounced in high-technology firms, where innovation is a key source of competitive advantage not only for the firm but also for the aspirant CEO seeking to win the tournament.

We use the Massachusetts High Technology Council definition of a high-technology firm which has been employed by several earlier studies to identify high-technology firms (Balkin & Gomez-Mejia, 1987; Koberg et al., 1994; Balkin et al., 2000). Specifically, we create a dummy variable, Hi-Tech, which takes a value of 1 if the firm's average annual R&D spending as a percentage of annual sales during the sample period 1992–2005 is at or above the 5% benchmark and 0 otherwise.26 Our variable of interest is the interaction term between the industry pay gap and Hi-Tech. We expect this interaction term to enter positively in the extended regression, where Hi-Tech itself is subsumed by the CEO-firm fixed effects.

Table 4 (Panel A) reports the result of this analysis. We also report the F-test of the linear combination between Indgap1 and the interaction term, which captures the total effect of the industry pay gap for high-technology firms. This total effect is statistically significant in all regressions except one.

| Panel A: Dummy Hi-Tech defined at the firm level | ||||||

|---|---|---|---|---|---|---|

| INNOV_QUANTITY | INNOV_QUALITY | INNOV_IMPACT | INNOV_QUANTITY | INNOV_QUALITY | INNOV_IMPACT | |

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Ln(1+Indgap1) | 0.0172 | 0.0138 | 0.0177 | |||

| (2.16)** | (1.70)* | (1.26) | ||||

| Ln(1+Indgap1)×Hi-Tech | 0.0589 | 0.0160 | 0.0994 | |||

| (2.50)** | (0.95) | (2.77)*** | ||||

| Ln(1+Indgap2) | 0.0133 | 0.0145 | 0.0192 | |||

| (2.48)** | (2.56)** | (1.97)** | ||||

| Ln(1+Indgap2)×Hi-Tech | 0.0256 | −0.0073 | 0.0421 | |||

| (1.68)* | (−0.49) | (1.54) | ||||

| Ln(1+Firm gap) | 0.0161 | 0.0082 | 0.0386 | 0.0197 | 0.0099 | 0.0446 |

| (1.35) | (0.49) | (1.47) | (1.60) | (0.56) | (1.63) | |

| Other control variables | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| CEO-firm FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 11,354 | 11,354 | 11,354 | 11,140 | 11,140 | 11,140 |

| R-squared | 0.154 | 0.204 | 0.230 | 0.150 | 0.205 | 0.230 |

| F-test (p-value) | 0.0009 | 0.0479 | 0.0005 | 0.0079 | 0.6040 | 0.0202 |

| Panel B: Dummy Hi-Tech defined at the industry level (three-digit SIC industries) | ||||||

|---|---|---|---|---|---|---|

| INNOV_QUANTITY | INNOV_QUALITY | INNOV_IMPACT | INNOV_QUANTITY | INNOV_QUALITY | INNOV_IMPACT | |

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Ln(1+Indgap1) | 0.0177 | 0.0110 | 0.0175 | |||

| (2.26)** | (1.45) | (1.29) | ||||

| Ln(1+Indgap1)×Hi-Tech | 0.0671 | 0.0359 | 0.1197 | |||

| (2.56)** | (1.68)* | (2.76)*** | ||||

| Ln(1+Indgap2) | 0.0132 | 0.0115 | 0.0169 | |||

| (2.41)** | (2.05)** | (1.73)* | ||||

| Ln(1+Indgap2)×Hi-Tech | 0.0321 | 0.0085 | 0.0657 | |||

| (1.96)* | (0.52) | (2.18)** | ||||

| Ln(1+Firm gap) | 0.0156 | 0.0077 | 0.0377 | 0.0197 | 0.0100 | 0.0446 |

| (1.31) | (0.46) | (1.44) | (1.60) | (0.56) | (1.63) | |

| Other control variables | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| CEO-firm FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 11,354 | 11,354 | 11,354 | 11,140 | 11,140 | 11,140 |

| R-squared | 0.154 | 0.204 | 0.230 | 0.150 | 0.205 | 0.230 |

| F-test (p-value) | 0.0011 | 0.0211 | 0.0012 | 0.0042 | 0.1990 | 0.0049 |

| Panel C: Continuous Hi-Tech calculated at the industry level (FF30 industry) | ||||||

|---|---|---|---|---|---|---|

| INNOV_QUANTITY | INNOV_QUALITY | INNOV_IMPACT | INNOV_QUANTITY | INNOV_QUALITY | INNOV_IMPACT | |

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Ln(1+Indgap1) | 0.0205 | 0.0093 | 0.0169 | |||

| (2.65)*** | (1.23) | (1.27) | ||||

| Ln(1+Indgap1)×Hi-Tech | 1.1277 | 1.0538 | 2.8059 | |||

| (2.09)** | (2.33)** | (2.89)*** | ||||

| Ln(1+Indgap2) | 0.0135 | 0.0093 | 0.0148 | |||

| (2.50)** | (1.68)* | (1.54) | ||||

| Ln(1+Indgap2)×Hi-Tech | 0.7076 | 0.4987 | 1.8182 | |||

| (1.97)** | (1.38) | (2.69)*** | ||||

| Ln(1+Firm gap) | 0.0157 | 0.0073 | 0.0369 | 0.0195 | 0.0099 | 0.0442 |

| (1.31) | (0.43) | (1.41) | (1.58) | (0.55) | (1.62) | |

| Other control variables | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| CEO-firm FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 11,354 | 11,354 | 11,354 | 11,140 | 11,140 | 11,140 |

| R-squared | 0.153 | 0.205 | 0.231 | 0.150 | 0.205 | 0.231 |

- The table presents the results from OLS regressions of innovation output on industry tournament incentives. The sample period is 1992 to 2005. The dependent variable is indicated by the column heading. INNOV_QUANTITY is the natural logarithm of one plus the number of truncation-adjusted patents applied for (and eventually granted) during the year (WPatent). INNOV_QUALITY is the natural logarithm of one plus the number of truncation-adjusted citations received on the firm's patents applied for (and eventually granted), scaled by the number of patents applied for (and eventually granted) during the year (WCitePat). INNOV_IMPACT is the natural logarithm of one plus the total number of truncation-adjusted citations received by the patents applied for (and eventually granted) during the year (WCite). Indgap1 is the pay gap between the total compensation of the second-highest-paid CEO in the same FF30 industry and the CEO's total compensation. Indgap2 is the pay gap between the total compensation of the second-highest-paid CEO in the same FF30 industry and size group and the CEO's total compensation. In Panel A, hi-tech takes a value of 1 if the firm's average annual R&D spending as a percentage of annual sales during 1992–2005 is at or above the 5% benchmark, and 0 otherwise. In Panel B, Hi-Tech takes a value of 1 for firms in three-digit standard industry classification code (SIC) industries with codes 283, 357, 366, 367, 382, 384, and 737, and 0 otherwise. In Panel C, hi-tech is calculated as the cross-sectional median of all firms’ high-technology intensiveness in that industry, where each firm's high-technology intensiveness is calculated as the time series median of its annual gross growth in R&D expenses during 1992–2005. All independent variables are lagged by 1 year. Definitions of the variables are provided in the Appendix. All regressions include CEO-firm and year fixed effects. Also reported at the bottom of Panels A and B is the p-value for the F-test of the linear combination of Ln(1 + Indgap1) plus Ln(1 + Indgap1) × Hi-Tech. Standard errors are heteroskedasticity-consistent and clustered at the firm level. t-statistics are reported in parentheses. *, **, and *** indicate significance at the 10%, 5%, and 1% levels, respectively.

In Panel B, we follow Brown et al. (2009) to identify high-technology firms. Excluding aerospace which has very few firms and whose R&D is funded mostly by the U.S. government, by far the largest three-digit high-tech industries are drugs standard industry classification code (SIC 283), office and computing equipment (SIC 357), communications equipment (SIC 366), electronic components (SIC 367), scientific instruments (SIC 382), medical instruments (SIC 384), and software (SIC 737). Accordingly, the alternative industry-based Hi-Tech takes a value of 1 for firms in these seven three-digit SIC industries, and 0 otherwise. The interaction term between the industry pay gap and the alternative industry-based Hi-Tech has the expected sign and is significant in all regressions except one.

In Panel C, we construct an alternative industry-level high-technology intensiveness following Hsu et al. (2014). We first calculate each firm's high-technology intensiveness as the time series median of its annual gross growth in R&D expenses during the sample period 1992–2005. For each FF30 industry, the industry high-technology intensiveness is calculated as the cross-sectional median of all firms’ high-technology intensiveness in that industry. The interaction term between the industry pay gap and this alternative Hi-Tech has the expected sign and is significant in all regressions except one.27

Taken together, the evidence in Table 4 suggests that the incentive effect of industry tournaments is stronger where innovation represents a core component of firms’ business strategy to achieve sustained competitiveness and success. At the same time, it should also be noted that the coefficient on Indgap1, which by itself captures the incentive effect for non-high-technology firms, is significant in a number of patents, citations-per-patent, and total citations regressions, indicating that the incentive effect of the external pay gap is not likely to be limited to high-technology firms only.

3.4 Endogeneity

To further address the endogeneity concerns, we resort to a quasi-natural experiment based on exogenous changes to the enforceability of noncompetition employment agreements. These agreements represent covenants in employment contracts designed to reduce the possibility that managers will accept employment offers from rival firms. However, the deterrence ability depends on the enforceability of these agreements (Garmaise, 2011). Changes in the enforceability of these noncompetition agreements affect the ability of CEOs to join rival firms and capture the tournament prize and therefore represent an exogenous shock to the industry tournament incentives. Greater enforcement of noncompetition agreements makes industry tournament incentives less effective, thereby reducing their impact on firm innovation output.

We obtain changes in state laws governing the enforcement of noncompetition agreements for our sample period 1992–2005 from Garmaise (2011) and Huang et al. (2019). Specifically, the enforceability of noncompetition agreements increased in Florida in 1996 and Louisiana in 2003; and it decreased in Texas in 1994 and Louisiana in 2001. Following the empirical approach described in Garmaise (2011), we construct a variable named ΔEnforce that takes the value of +1 for firms headquartered in Florida in 1997–2005; takes the value of −1 for firms headquartered in Texas in 1995–2005 and for firms headquartered in Louisiana in 2002–2003; is set equal to 0 otherwise. In our sample, ΔEnforce has a mean (median) of −0.0622 (0) and a standard deviation of 0.3387.

We add ΔEnforce and the interaction term between the industry pay gap and ΔEnforce to our baseline regression. This extended specification represents a difference-in-differences analysis. The variable of interest is the interaction term, the coefficient on which is predicted to be negative, consistent with the expectation of a lower impact of industry tournament incentives on firm innovation output when the enforceability of noncompetition agreements increases.

Panels A and B of Table 5 report the results of this analysis. As predicted, the coefficient on the interaction term is significantly negative in all the regressions except one. We also report the F-test of the linear combination of the industry pay gap minus the interaction term, which captures the total effect of the industry pay gap when the enforceability of noncompetition agreements decreases. The total effect is significant in all regressions.28 The coefficient on ΔEnforce itself is either insignificant or positive. The positive direct effect of ΔEnforce is not surprising given that innovation activities require a long-term managerial commitment while an increase in the enforceability of noncompetition employment agreements reduces the ability of executives to move to rival firms, hence, to a certain extent, reinforcing their commitment to their current firms. Overall, the result of this difference-in-differences analysis suggests that the positive relationship between industry tournament incentives and firm innovation is not likely to be spurious.

| INNOV_QUANTITY | INNOV_QUALITY | INNOV_IMPACT | INNOV_QUANTITY | INNOV_QUALITY | INNOV_IMPACT | |

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Ln(1+Indgap1) | 0.0241 | 0.0148 | 0.0314 | |||

| (3.12)*** | (2.02)** | (2.30)** | ||||

| Ln(1+Indgap1) × ΔEnforce | −0.0527 | −0.0242 | −0.0644 | |||

| (−2.10)** | (−1.41) | (−2.14)** | ||||

| Ln(1+Indgap2) | 0.0170 | 0.0116 | 0.0257 | |||

| (3.22)*** | (2.08)** | (2.59)*** | ||||

| Ln(1+Indgap2) × ΔEnforce | −0.0345 | −0.0284 | −0.0500 | |||

| (−2.19)** | (−2.30)** | (−2.48)** | ||||

| ΔEnforce | 0.4905 | 0.1820 | 0.5511 | 0.2812 | 0.2042 | 0.3650 |

| (2.04)** | (1.02) | (1.84)* | (2.06)** | (1.63) | (1.91)* | |

| Ln(1+Firm gap) | 0.0177 | 0.0089 | 0.0411 | 0.0199 | 0.0102 | 0.0449 |

| (1.47) | (0.52) | (1.56) | (1.61) | (0.57) | (1.64) | |

| Other control variables | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| CEO-firm FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 11,354 | 11,354 | 11,354 | 11,140 | 11,140 | 11,140 |

| R-squared | 0.153 | 0.204 | 0.229 | 0.150 | 0.205 | 0.229 |

| F-test (p-value) | 0.0027 | 0.0251 | 0.0016 | 0.0021 | 0.0020 | 0.0004 |

- The table presents the results of a difference-in-differences analysis. The sample period is 1992–2005. The dependent variable is indicated by the column heading. INNOV_QUANTITY is the natural logarithm of one plus the number of truncation-adjusted patents applied for (and eventually granted) during the year (WPatent). INNOV_QUALITY is the natural logarithm of one plus the number of truncation-adjusted citations received on the firm's patents applied for (and eventually granted), scaled by the number of patents applied for (and eventually granted) during the year (WCitePat). INNOV_IMPACT is the natural logarithm of one plus the total number of truncation-adjusted citations received by the patents applied for (and eventually granted) during the year (WCite). Indgap1 is the pay gap between the total compensation of the second-highest-paid CEO in the same FF30 industry and the CEO's total compensation. Indgap2 is the pay gap between the total compensation of the second-highest-paid CEO in the same FF30 industry and size group and the CEO's total compensation. ΔEnforce takes the value of +1 for firms headquartered in Florida in 1997–2005; takes the value of −1 for firms headquartered in Texas in 1995–2005 and for firms headquartered in Louisiana in 2002–2003; and is set equal to 0 otherwise. Within-state number of competitors in the industry is included as an additional control together with all the baseline controls. All independent variables are lagged by 1 year. Definitions of the variables are provided in the Appendix. All regressions include CEO-firm and year fixed effects. Also reported at the bottom of the panel is the p-value for the F-test of the linear combination of Ln(1+Indgap1) minus Ln(1 + Indgap1) × ΔEnforce. Standard errors are heteroskedasticity-consistent and clustered at the firm level. t-statistics are reported in parentheses. *, **, and *** indicate significance at the 10%, 5%, and 1% levels, respectively.

In another attempt to address the endogeneity concerns, we employ an instrumental variable approach. Our instrument for the industry pay gap is drawn from Coles et al. (2018) and represents the sum of total compensation of all other CEOs in the same industry (or the same size-based half industry), except the highest-paid CEO. This modified measure of the industry ability to pay is meant to capture the contemporaneous correlation of pay in an industry and varies across firms in the industry by construction. The correlation between Indgap1 (Indgap2) and the corresponding instrument, both in log forms, is 0.6282 (0.6267) and significant at the 1% level. Further, the inclusion of an extensive set of control variables in both regression stages should increase the likelihood that the instrument meets the exclusion condition.

We report the results of the instrumental variable (IV) regressions in Table 6. The industry pay gap is Indgap1 in Panel A and Indgap2 in Panel B. The first-stage regression results are shown in Column 1 of each panel. Consistent with our expectation, the coefficient on each instrument is positive and significant at the 1% level. The first-stage F-statistic is 770.129 for Indgap1 and 972.939 for Indgap2, strongly indicating that our instrument satisfies the relevance condition. Likewise, the Kleibergen–Paap LM test rejects the null hypothesis of under-identification, and the Kleibergen–Paap Wald test rejects the null hypothesis of weak instruments. These results further suggest that our instrument is robust. Turning to the second-stage regressions reported in Columns 2–4 of each panel, we observe that the instrumented industry pay gap enters positively and significantly in all regressions. The results are therefore consistent with our expectation of a positive relationship between industry tournament incentives and firm-level innovation performance. However, since our models are exactly identified in Table 6, we cannot assess the validity of the assumption that the suggested instrument is uncorrelated with the residuals in the second stage.

| Panel A: Industry tournament incentives measured by the pay gap in the same industry group | ||||

|---|---|---|---|---|

| First-stage | Second-stage regressions | |||

| Ln(1+Indgap1) | INNOV_QUANTITY | INNOV_QUALITY | INNOV_IMPACT | |

| (1) | (2) | (3) | (4) | |

| Ln(Ind Sum CEO comp) | 2.3616 | |||

| (27.75)*** | ||||

| Instrumented Ln(1+Indgap1) | 0.0964 | 0.0872 | 0.1836 | |

| (4.40)*** | (3.45)*** | (3.92)*** | ||

| Ln(1+Firm gap) | −0.2747 | 0.0329 | 0.0208 | 0.0684 |

| (−8.87)*** | (2.44)** | (1.16) | (2.37)** | |

| Other control variables | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| CEO-firm FE | Yes | Yes | Yes | Yes |

| Observations | 10,780 | 10,780 | 10,780 | 10,780 |

| First-stage F-test (p-value) | 0.0000 | |||

| Kleibergen–Paap LM statistic | 378.476*** | 378.476*** | 378.476*** | |

| Kleibergen–Paap Wald F-statistic | 770.129*** | 770.129*** | 770.129*** | |

| Panel B: Industry tournament incentives measured by the pay gap in the same industry and size group | ||||

|---|---|---|---|---|

| First-stage | Second-stage regressions | |||

| Ln(1+Indgap2) | INNOV_QUANTITY | INNOV_QUALITY | INNOV_IMPACT | |

| (1) | (2) | (3) | (4) | |

| Ln(Ind Sum CEO comp) | 2.3828 | |||

| (31.19)*** | ||||

| Instrumented Ln(1+Indgap2) | 0.0289 | 0.0350 | 0.0694 | |

| (2.64)*** | (2.64)*** | (3.18)*** | ||

| Ln(1+Firm gap) | −0.4937 | 0.0243 | 0.0155 | 0.0564 |

| (−11.85)*** | (1.83)* | (0.81) | (1.91)* | |

| Other control variables | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| CEO-firm FE | Yes | Yes | Yes | Yes |

| Observations | 10,560 | 10,560 | 10,560 | 10,560 |

| First-stage F-test (p-value) | 0.0000 | |||

| Kleibergen–Paap LM statistic | 328.937*** | 328.937*** | 328.937*** | |

| Kleibergen–Paap Wald F-statistic | 972.939*** | 972.939*** | 972.939*** | |

- The table presents the results of the instrumental-variable regressions. The sample period is 1992–2005. The dependent variable is indicated by the column heading. INNOV_QUANTITY is the natural logarithm of one plus the number of truncation-adjusted patents applied for (and eventually granted) during the year (WPatent). INNOV_QUALITY is the natural logarithm of one plus the number of truncation-adjusted citations received on the firm's patents applied for (and eventually granted), scaled by the number of patents applied for (and eventually granted) during the year (WCitePat). INNOV_IMPACT is the natural logarithm of one plus the total number of truncation-adjusted citations received by the patents applied for (and eventually granted) during the year (WCite). In Panel A, Indgap1 is the pay gap between the total compensation of the second-highest-paid CEO in the same FF30 industry and the CEO's total compensation. In Panel B, Indgap2 is the pay gap between the total compensation of the second-highest-paid CEO in the same FF30 industry and size group and the CEO's total compensation. The instrument for Indgap1 (Indgap2) is the sum of total compensation of all other CEOs in the same industry (size-based half industry), except the highest-paid CEO. All independent variables are lagged by 1 year. Definitions of the variables are provided in the Appendix. All regressions include CEO-firm and year fixed effects. Also reported at the bottom of each panel are the p-value of the F-test of excluded instruments, the statistic of the Kleibergen–Paap LM test of under-identification, and the F-statistic of the Kleibergen–Paap Wald test of weak identification. Standard errors are heteroskedasticity-consistent and clustered at the firm level. t-statistics are reported in parentheses. *, **, and *** indicate significance at the 10%, 5%, and 1% levels, respectively.

3.5 Firm unsystematic risk and the riskiness of investment policy

Coles et al.’s (2020) model of industry tournament incentives predicts that the tournament prize provides aspirant CEOs with the incentive to take higher risk. Increasing firm risk through corporate policies can generate uncertain but potentially extreme performance that increases the likelihood of the aspirant winning the tournament. Coles et al. (2018) find evidence consistent with the model's implication, that is, industry tournament incentives have a positive effect on firm risk measured by the variance of daily stock returns over the next year.

In the context of our study, the heightened risk-taking incentive provided by the industry tournament prize, in turn, supplies a plausible explanation for the positive and significant relationship between industry tournament incentives and subsequent firm innovation. Innovation projects arguably fit well into the category of riskier investment projects as they involve the exploration of untested new approaches. Furthermore, the nature of innovation projects implies an increase in a firm's unsystematic risk as the firm explores new, uncharted territory. For this reason, we expect to find a positive relationship between the industry pay gap and the firm's unsystematic risk.