Impact of Mandatory Price Reporting Requirements on Level, Variability, and Elasticity Parameter Estimations for Retail Beef Prices

Abstract

Moving to scanner based and quantity-weighted monthly average retail beef price series has changed the price series significantly. Quantity-weighted price levels are lower and more volatile. Perhaps most important, calculated elasticities for the quantity-weighted averages are lower than for the historical simple average data. Elasticity estimates for simple average monthly price data are also larger than for weekly data, raising the possibility that historic demand analyses have significantly overstated own price demand elasticities.

The Mandatory Price Reporting Legislation of 1999 directed the U.S. Department of Agriculture to develop a broader and more representative set of retail meat prices. Historically, the Bureau of Labor Statistics (BLS) has compiled retail meat price data when collecting prices used in calculating the Consumer Price Index. If the sample of prices was considered to be statistically adequate, as with beef, pork, and chicken, the BLS provided monthly prices.

During the 1990s, the widespread and growing belief was that BLS-reported prices for beef were too high because they did not factor in the impact of large quantities sold at price discounts. Industry leaders were concerned that analyses indicating beef demand was declining might not be correct due to measurement problems. The beliefs were reinforced by privately produced data. Prices collected by Knight-Ridder from newspaper ads in major cities and reported in the Beef Business Bulletin published by the National Cattlemen's Beef Association (NCBA) were consistently below BLS-reported Choice beef prices.

The importance of which prices and how they are collected extends beyond concerns about whether BLS-reported beef prices have been too high. The more important issue may be whether measurement problems have been, for many years, biasing estimates of demand elasticity parameters. The projected economic impact on the beef sector of policy decisions such as a Dairy Herd Buyout depends directly on price impacts determined by the own-price demand elasticity for beef.

Details of the Study

The overall objective of this paper is to analyze the economic implications of changing to scanner-based and quantity-weighted monthly average prices for beef. Specific sub-objectives include (1) analyzing the differences between the means of simple average monthly prices (SAP) and quantity-weighted monthly average prices (QWP) for beef; (2) analyzing the variances of SAP and QWP for beef; and (3) estimating and analyzing the elasticity coefficients for SAP and QWP.

Hypotheses and Data

Three testable hypotheses are directly related to the objectives: (1) QWP will have smaller means than SAP with discounted prices in the calculations; (2) QWP will have larger variances than SAP with discount prices included; and (3) demand elasticity estimates will be smaller in absolute value for QWP than for SAP. Access to scanner data is limited. The Mandatory Price Reporting program calculated and extended scanner-based prices back to 1 January 2001. The Economic Research Service (ERS) arranged for the authors to secure a limited set of weekly price and quantity sold data under a cooperative agent agreement. Weekly store-level price and quantity data were collected for six separate specific beef cuts from two large stores from 1 January 2001 through 30 September 2003. The chain and stores within the chain providing the data were anonymous.

Conceptual Framework and Background

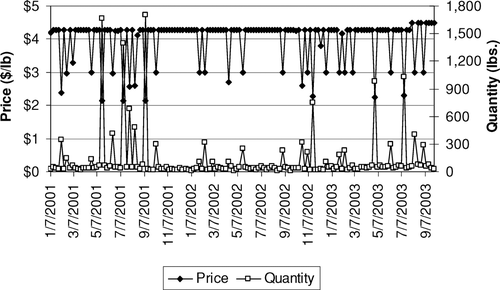

The conceptual framework for this analysis is a single-equation, quantity-dependent demand function. This simple specification is dictated by the available data. The data set contained 143 observations on weekly prices and quantities sold for each of the six cuts. The typical price pattern for a particular cut in any one store was a number of consecutive weeks at a regular price and then a discount price for one or more weeks. Figure 1 shows that London broil regularly sold in one of the large stores for about $4.39 per pound. Discount prices varied but generally averaged about $3.00 per pound.

Since the same price may prevail for up to twenty consecutive weeks, significant serial correlation exists. However, statistics such as means, variances, and correlations can be revealing. Simple correlations across the six beef cuts were generally low and not statistically significant. Consistent with low correlation, no variance inflation factors larger than 5.0 occurred, suggesting that significant multicollinearity was not present. If the cuts of beef are not highly correlated and there is no major collinearity, it is less likely that across-cut relationships will complicate the estimation of response parameters for individual cuts.

Weekly prices and quantities sold for London broil, store 1, January 2001 through September 2003

Since income data are not available on a monthly or weekly basis, an index developed for the NCBA was applied as a “demand deflator” to correct the price data for shifts in demand from exogenous sources. The process corrects prices for inflation and then adjusts the deflated price series for the influence of quantity changes from a base period. These “demand constant prices” are then related to the observed inflation-adjusted prices for each week or month and expressed as an index. By dividing the index into the observed prices, the influence of demand shifts is removed and the parameter estimations should more accurately express the true price—quantity relationship.

The  elasticity expression for the linear model is very convenient for developing useful insights. The mean price in

elasticity expression for the linear model is very convenient for developing useful insights. The mean price in  will be expected to be lower for QWP data and that mean price is the primary a priori source of the hypothesis for lower elasticity coefficients for QWP. The

will be expected to be lower for QWP data and that mean price is the primary a priori source of the hypothesis for lower elasticity coefficients for QWP. The ratio is the linear measure of the rate of response by buyers to a price change and will be the primary way that consumers show that they see the change in the price of the cut and are responding to it. A rate of response in some form will be included in every model type expressing quantity as a function of price.

ratio is the linear measure of the rate of response by buyers to a price change and will be the primary way that consumers show that they see the change in the price of the cut and are responding to it. A rate of response in some form will be included in every model type expressing quantity as a function of price.

Historically, consumers have likely considered the posted price discounts and specials in making their buying decisions. Changes in the BLS series may have been smaller than the actual price changes to which consumers have responded, however. If this is true, the prices and price changes in historical empirical demand analyses have been measured in error. Conceptually, this potential measurement error is important. The too-small price changes in the SAP series would decrease the absolute value of elasticity parameters for the QWP data compared with the SAP data.

The available research on the impact of scanner data on measures such as own-price demand elasticity is limited because, historically, the data have not been publicly available. Capps and Love find that aggregation of scanner price data typically reduces the absolute value of elasticity coefficients. In a separate effort, Capps examines issues of separability in scanner data for meats. Own-price demand elasticity measures from weekly store-level price data ranged from −1.15 for ground beef to −5.03 for beef briskets. Capps reports much larger elasticity coefficients in absolute value than we are accustomed to seeing if we have not examined scanner data that are showing short-term response relationships.

Recognizing the formidable obstacles to analysis, we present a simple application of a single-equation model that is the first step to future, more-refined analysis. Our preliminary findings suggest that moving to scanner-based prices could have far-reaching ramifications. More sophisticated analyses with better data will be needed.

Procedure

The weekly prices and quantities sold will be analyzed to establish baseline measures of the price-quantity relationships for selected beef cuts. A priori and consistent with Capps' findings, we would expect elasticity measures to be larger in absolute value for weekly data since calculating monthly average prices smoothes the price data. Preliminary investigation indicates that first differences of the weekly price series are larger than for monthly QWP series and much larger than for the SAP series.

Tests for differences in the means of the two types of monthly prices will be conducted from January 2001 through September 2003. Since the a priori expectation is that QWP will be lower, a one-tailed T-test will be used to test the hypothesis that the mean of SAP will be higher than the mean of QWP. A one-tailed F-test will then be used to determine whether the variance of the QWP is statistically larger than that of the SAP. The one-tailed F-test is appropriate since a priori expectations are that the variance of QWP will be larger with price discounts included.

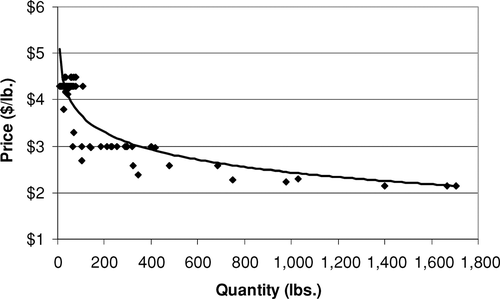

We chose the double log functional form to calculate elasticity parameters. The choice was supported by the price-quantity data for London broil (figure 2). The relationships for London broil and the other cuts are curvilinear and demonstrate the expected pattern in a scatter plot. Double log, linear, and quadratic functional forms were all estimated. The differences in statistical performance for the different model results were small.

The occasional very large weekly quantity numbers in both figures 1 and 2 may be due to a combination of low-price specials and weekly advertising. The presence of advertising is an important issue that will need to be dealt with in future analyses. The stores did not provide information on which weeks also had a weekly newspaper or in-store advertising program.

Typical price-quantity relationship for London broil, store-level data, January 2001 through September 2003

Figure 1 clearly demonstrates why the procedures must examine the large differences between SAP and QWP across cuts. Prices on London broil ranged from $4.39 to $2.19 with a pattern of low prices for one week, several weeks at the $4.39 “regular” price, then a low price or several consecutive low prices again. Porterhouse and Delmonico steaks and 92% ground beef also showed this general high—low pricing pattern. Sirloin and strip steaks were much more stable, with low prices seldom occurring.

Since we cannot use normal statistical analysis, our need to measure the price—quantity relationship rigorously was essential. The procedure we follow involves exploration of demand relationships. We want to be as confident as possible in the stability of the measures we can develop, which prompted the conceptualization of approaches to deal with the influence of substitutes and of other demand shifters such as changes in income.

The Findings

Table 1 shows monthly SAP and QWP by cuts and the probability statistics for a one-tail T-test (with unequal sample variances) of the hypothesis that the QWP will be significantly lower than the SAP from January 2001 through September 2003. The hypothesis is supported for all cuts except strip steak. Cuts that are frequently used as price specials show the most significant differences between SAP and QWP. Bigger differences between means when the cut is frequently used as a price special hold both for higher value cuts such as Delmonico steaks and lower value cuts such as ground beef. The chain pricing policy for strip steak was much different. Strip steak was maintained at the $9.19 “regular” price a high percentage of weeks across the study period. This early examination of the data shows that varying pricing policies by the chain or stores within a chain could be important determinants of the differences in mean levels of SAP and QWP for particular cuts of beef.

| Store 1 | Store 2 | |||||

|---|---|---|---|---|---|---|

| SAP ($/lb) | QWP ($/lb) | t-Test Probabilitya | SAP ($/lb) | QWP ($/lb) | t-Test Probabilitya | |

| Sirloin steak | 5.40 | 5.24 | 0.0398 | 5.40 | 5.30 | 0.0905 |

| London broil | 3.99 | 3.48 | 0.0000 | 3.99 | 3.52 | 0.0001 |

| Strip steak | 9.13 | 9.05 | 0.2378 | 9.13 | 9.08 | 0.2733 |

| Delmonico | 8.52 | 8.20 | 0.0013 | 8.52 | 8.17 | 0.0016 |

| Porterhouse | 7.43 | 7.02 | 0.0022 | 7.69 | 7.22 | 0.0005 |

| Ground beef, 92% | 2.94 | 2.81 | 0.0000 | 2.93 | 2.88 | 0.0090 |

- a The probability statistic for a one-tail t-test of means that SAP >QWP.

Historical research generally indicates that the demand for ground beef would be more inelastic than for higher priced beef cuts, perhaps because ground beef is seen as a “necessity” in the family food budget. If there is only a small quantity response to the frequent low-price specials for ground beef, then using quantity weights on weekly prices will not push monthly QWP sharply below SAP. Table 1 confirms this expectation with 5.0% or less differences for ground beef. In contrast, the differences in London broil SAP and QWP were sometimes over 40%, with the two prices differing by $1.55 per lb, during one month. The QWP averages for London broil show 13.0% and 12.0% declines from SAP averages for Stores 1 and 2, respectively (table 1). For strip steaks, however, QWP were below SAP in both Stores 1 and 2 by less than 1.0%. Technically, the hypothesis that the mean for QWP would be significantly lower than SAP is accepted for all cuts except strip steak.

| Store 1 | Store 2 | |||||

|---|---|---|---|---|---|---|

| SAP Variance ($/lb) | QWP Variance ($/lb) | f-Test Probabilitya | SAP Variance ($/lb) | QWP Variance ($/lb) | f-Test Probabilitya | |

| Sirloin steak | 0.056 | 0.197 | 0.0011 | 0.055 | 0.133 | 0.0210 |

| London broil | 0.062 | 0.453 | 0.0000 | 0.060 | 0.455 | 0.0000 |

| Strip steak | 0.111 | 0.238 | 0.0539 | 0.077 | 0.143 | 0.0840 |

| Delmonico | 0.106 | 0.229 | 0.0604 | 0.113 | 0.303 | 0.0063 |

| Porterhouse | 0.220 | 0.388 | 0.0930 | 0.179 | 0.393 | 0.0224 |

| Ground beef, 92% | 0.008 | 0.013 | 0.2389 | 0.008 | 0.009 | 0.8017 |

- a The probability statistic for a one-tail F-test that VarQWP > VarSAP.

Table 2 shows estimates of variance and the probability statistic for the F-test for the hypothesis that variance of QWP will be larger than of SAP. Ground beef does not show a statistically significant difference in the variance measures. The difference for strip steak is significant only at the 0.10 level. Differences in chain or store pricing policies may also help explain why the variance of QWP is smaller than the variance of SAP.

Table 3 provides measures of the price coefficients in double log Q = f(P) formulations using the baseline weekly data. The results are based on combined data from both large stores with a 0–1 shift variable employed to account for store differences. The NCBA demand index was used to adjust the price data for shifts in demand.

| Stores 1 and 2 Combined | |||

|---|---|---|---|

| Estimated Beta | t-Statistic | R2 | |

| Sirloin steak | −3.141 | −9.55 | 0.3808 |

| London broil | −4.519 | −26.05 | 0.7105 |

| Strip steak | −1.732 | −4.83 | 0.5854 |

| Delmonico | −3.073 | −10.99 | 0.5305 |

| Porterhouse | −2.183 | −10.03 | 0.6648 |

| Ground beef, 92% | −2.307 | −12.80 | 0.6270 |

The estimated beta coefficients are large in absolute value and vary across cuts, consistent with the differences in pricing policies already identified (table 3). The coefficients ranged from 1.732 to 4.519 in absolute value. These store-level coefficients, however, should not be viewed as estimates of demand elasticity for the entire market area. The intent of a price special is to attract new customers to the store. An unknown part of the response to lower prices is due to customers from other chains or stores buying at discount prices. If prices were reduced across the entire market area in the same week, the quantity response at the aggregate level would likely not be nearly as large as the responses shown. Therefore, differences in means, variances, and elasticity measures of SAP and QWP will come from what might be called a “partial market bias.”

Researchers investigating the quantity responses to price changes in retail food stores deal directly with this partial market bias. Some researchers attempt to disaggregate the response and the elasticity measure(s) into primary and secondary impacts, while others disaggregate the quantity response more directly and completely. The primary effect is essentially the part of the quantity response due to increased consumption of the particular beef cut at lower prices, consistent with the law of demand. The secondary effect is the part of the quantity response due to cut or brand switching in the same store and to meat buyers coming from other stores in the market area to buy more at the lower price.

Considering the Findings in the Context of Existing Research

The important point in examining the literature briefly is that we are not asserting that the demand elasticity for any beef cut in the entire market area would show absolute values of 4.0 or higher. Other researchers have confirmed that the entire metro or market areas will not show such a large quantity response to a price discount.

The findings of Hosken's study of a number of food categories across thirty metro areas are consistent with our observations. Certain meat cuts, he notes, are regularly put on sale, and the cuts used for price specials often vary across chains or stores. Van Heerde, Leeflang, and Wittink review the literature and find that the primary effect tends to be about one-third of the quantity response, and the secondary effect, two-thirds. The authors assert, however, that when store-level data are examined in detail, the decomposition of the price response is often essentially reversed with two-thirds becoming primary impact and one-third secondary impact.

Examining the findings with the cautions of partial market bias in mind, table 3 shows the expected negative and highly significant relationships between weekly prices and quantities. T-statistic levels are as large as −26.05 for London broil. The cut's −4.519 coefficient is essentially double ground beef and 2.6 times in absolute value of the coefficient on strip steak.

The possible impacts of substitutes on parameter estimations were a concern in the monthly analysis. If part of the quantity change is due to changes in prices of substitutes shifting demand, a portion of the size of the parameters is due to the substitutes. Since our demand index would not necessarily pick up all of that impact, we tried other beef cuts as substitutes, and we also included monthly prices of pork and chicken in the models.

Simple correlations were significant at the 0.05 level for only sirloin and porterhouse steaks and for London broil and sirloin steaks for the weekly data. The estimated beta on price for sirloin steak decreased by 9.7% with porterhouse steak prices in the model. The estimated beta for London broil price decreased only 1.0% with sirloin steak prices in the model.

Results were similar for SAP and QWP parameters with monthly pork or chicken prices added as substitutes. Monthly pork prices were weakly correlated with SAP for sirloin steak, strip steak, and London broil and with QWP for sirloin steak and strip steak. The estimated beta for QWP strip steak declined about 6.0% from −4.04 to −3.80 when pork prices were entered as a substitute. None of the other changes in the estimated betas were as large as 2.0% with pork prices included. No strong evidence suggested that the absence of pork as a potential substitute in the models was having a significant influence on the estimates of the elasticity for either the SAP or QWP series and no significant correlations were evident for chicken.

Table 4 shows that the absolute sizes of the final estimates of the beta coefficients for the QWP are typically smaller than the comparable measures for the SAP. The exception was for Porterhouse steak. Porterhouse steak was not as often on price special, the price discounts were relatively small, and the quantity response was often smaller than for other cuts. Overall, however, these findings are generally consistent with our hypothesis that the elasticity coefficients for QWP would be smaller because of the expected reduction in mean prices.

| Stores 1 and 2 Combined | ||||||

|---|---|---|---|---|---|---|

| SAP Monthly Data | QWP Monthly Data | |||||

| Beta Coefficient | t-Statistic | R2 | Beta Coefficient | t-Statistic | R2 | |

| Sirloin steak | −5.99 | −6.40 | 0.56 | −3.00 | −5.31 | 0.50 |

| London broil | −11.45 | −13.15 | 0.74 | −3.87 | −21.28 | 0.88 |

| Strip steak | −5.74 | −4.25 | 0.77 | −4.04 | −5.36 | 0.80 |

| Delmonico | −6.12 | −5.30 | 0.68 | −3.58 | −5.34 | 0.68 |

| Porterhouse | −1.17 | −1.28 | 0.79 | −1.38 | −2.36 | 0.80 |

| Ground beef, 92% | −1.97 | −2.21 | 0.11 | −0.37 | −0.55 | 0.05 |

The estimated betas for the QWP were also generally smaller than for the weekly data. Cuts like strip steaks, which are seldom used as low-price specials, were the exception. Using quantity weights in calculating QWP apparently lowers estimates of own-price demand elasticity in absolute value for most beef cuts compared with both SAP and weekly prices.

Comparing the baseline weekly and SAP measures across tables 3 and 4 yielded unexpected results. The estimated beta coefficients are larger in absolute value for the monthly SAP than for the weekly data for all cuts except porterhouse steak and ground beef. This is contrary to our expectations and to Capps' findings. If it is true that BLS prices are too high, however, because they do not include a large percentage of price discounts which make for the variable QWP, then the findings we are reporting here would appear to be inevitable.

To pursue the weekly to SAP comparisons, we looked in more detail at some of the descriptive measures of the different price series. The SAP series is clearly “smoothed” compared to the other series. The variances of the first differences of the SAP series ranged from 3.0% on ground beef to 22.0% on sirloin steak of the variance of the first differences for weekly prices. The average across cut was 12.5%, so the average ratio of the variance of first differences of the weekly to the SAP series is 8:1.

First differences of monthly changes will always be small compared with weekly prices, but these month to month SAP price changes are very small. Large changes in quantity that are prompted by discounted prices are being associated with small price changes. The ratio of a large quantity change to a small price change balloons to large levels. The quantity changes are measured correctly, the price changes are not. Support continues to grow for the strong conclusion that the prices collected historically by BLS are not the prices being observed by consumers.

We recognize that the partial market nature of the price response data will inflate store-level elasticity estimates. However, we have no apparent reason to argue that the relationships across the weekly, SAP, and QWP measures would change if the broader market were examined. Parameter estimates using SAP for the broader market area would still be expected to be larger than for QWP and for weekly prices, especially for cuts that are frequently used as price specials.

The important finding is that using simple average calculations on weekly prices to generate monthly prices in our historical beef price series has overstated price levels and inflated our empirical estimates of own-price demand elasticity parameters. The differences for some cuts are striking. The London broil cut, often used as a price special by the study retail chain, saw the estimated elasticity parameter for SAP data balloon to −11.45, compared with −4.52 for the weekly data and −3.87 for QWP. The statistical measures were strong for London broil with R2 levels of 0.71 to 0.88 in different weekly and monthly models. The t-statistics for London broil elasticity parameter estimations were −13.15, −21.28, and −26.05 for SAP, QWP, and weekly prices, respectively. The large disparity between the coefficients on SAP data and the baseline weekly coefficients raises difficult questions. The coefficients for SAP data are two to three times the coefficients on weekly data from table 3 on all cuts that tend to be used in price specials. It is most unlikely that these somewhat startling results are just due to the limited nature of these data and our simplistic analysis.

Summary, Conclusions, and Cautions

An immediate, strong conclusion from the analysis is that the widely held opinion that the historical BLS monthly prices for beef have been too high is true. The prices collected by BLS and reported by a number of government agencies have been higher than the prices that consumers use to make their buying decisions. As long as the chain or store uses one or more cuts as frequent price discount specials, the QWP will be significantly lower than the monthly SAP.

There is little question that the QWP do the better job of measuring what is actually happening at the fresh meat counter as consumers make buying decisions. The processes dealing with scanner beef prices as developed by ERS under the directives from the Mandatory Price Reporting legislation should be continued.

The variance of QWP will be consistently larger than for SAP. Any exception will be for cuts that are seldom used as price specials.

Related to the smoothing of the price data, SAP biases the level of own-price elasticities upward compared to baseline weekly and QWP estimations. How and where the bias occurs is clear: The price change measures coming from BLS data are smaller for SAP than for weekly prices or for QWP. The nature, size, and implications of the bias need further study.

A final conclusion deals with the importance of broad access by analysts to weekly data. If accessibility to the new scanner data is limited to only QWP measures with no accompanying detail on weekly prices or quantities, the scope of the analyses that can be conducted will be seriously curtailed. It would have been impossible to develop the baseline estimates of elasticity parameters without the weekly price and quantity data and the QWP measures could not have been calculated and analyzed.

A number of cautions must be considered in interpreting the findings in this study. The more important include

- BLS-reported monthly prices would not be exactly equal to the SAP prices in this analysis. BLS will collect some discounted prices as part of their ongoing collection process. The SAP we calculate and use are likely higher than BLS prices by some margin.

- The elasticity measures estimated in this analysis will be larger in absolute value than market-wide elasticities due to what we called the “partial market bias.” Our assertion that the relationship between elasticity parameters for the baseline weekly, SAP, and QWP will not change and that SAP elasticity estimates will still be too big on a market wide basis is logical but should be tested via empirical analysis.

- The monthly pork and chicken prices in the extended analysis that allowed for substitutes were national prices. If in-store prices for pork and chicken had been available, the results for both pork and chicken could have been different.

- The 9/11 disaster and a BSE crisis in Japan both occurred during the data period. The demand index used to adjust for demand shifts may not have captured and removed the full demand shifting impact of these market-distorting events or other atypical economic forces that may have been at work in the marketplace.

But if the errors in elasticity calculations using BLS data are confirmed to be as big in more complete analyses as they appear to be in this limited effort, much of our historical demand analysis may need to be rethought and redone.

Acknowledgments

The authors appreciate the support of Economic Research Service, U.S. Department of Agriculture on this project.