CEO characteristics: a review of influential publications and a research agenda

Abstract

This paper provides a systematic review of literature pertaining to CEO characteristics and firm performance. The CEO of a firm provides critical leadership, social capital, and legitimacy, and as such exerts significant influence on firm performance. By using a bibliographic mapping approach, we identify the fifty-one most influential publications on CEO characteristics. This field has developed from a few Upper Echelon Theory publications into four distinct categories. We review each of these to identify the main contributions to this research area and to outline research gaps and future research trends.

1 Introduction

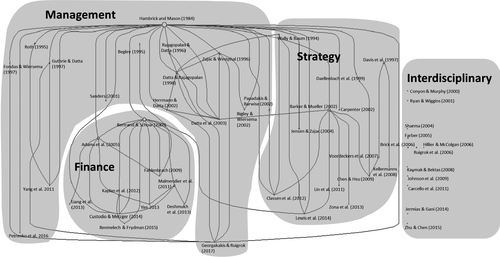

This article presents a systematic review of influential publications among 532 journal articles published from 1984 to 2019 pertaining to chief executive officer (CEO) characteristics and firm performance. Using the bibliographic visualisation software HistCite™ for the analysis enables us to create citation maps of publications in a research field (Garfield, 2004; Linnenluecke et al., 2017). Bibliographic mapping is a method that identifies which publications are important within a research field (as measured by number of citations), how each publication is related to others, and assesses major contributions of these publications to the research field over time (Linnenluecke et al., 2017). Using HistCite™-generated results as guidance, we identify the 51 most influential publications in the field of CEO characteristics over the last 35 years. CEO characteristics research has developed from a few publications on Hambrick and Mason’s (1984) Upper Echelon Theory (UET) into four distinct categories. We review each of these to identify the main contributions to this research area and to outline research gaps and future research trends. The analysis shows that the main research streams related to CEO characteristics comprise Management, Strategy, Finance, and Interdisciplinary. In parallel with these developments, research in the CEO characteristics field is focused mainly on strategies and decision-making of listed firms but also innovative approaches such as family firms and interdisciplinary research.

The citation map developed in this study, however, is not able to offer a full account of emerging research trends and directions, as new publications have fewer citations (Linnenluecke et al., 2017). Manual assessment of recent publications since 2015 (2015–2019) facilitates discussion of important emerging research trends in four key areas, namely expansion of the scope of CEO characteristics, entrepreneurship and open innovation, emerging markets and political activity, and new methodologies. With a highlight on possible pathways for future research, this paper outlines these emerging trends to integrate existing knowledge and pursue innovative research opportunities to expand the research frontier.

This study proceeds as follows. The review methodology is presented in Section 2. The key research streams are then explored, namely Management (Section 3), Finance (Section 4), Strategy (Section 5) and Interdisciplinary (Section 6). Section 7 presents emerging themes and Section 8 concludes this article and provides suggestions for future research.

2 Review methodology

Publications for inclusion in this literature review were identified through Boolean searches within the Social Sciences Citation Index, an online academic citation database within the Web of Science–Clarivate Analytics platform. An advanced search was conducted for journal articles with the term ‘CEO*’ OR ‘chief executive officer*’ and ‘characteristic*’ in the title, abstract, or keywords. The asterisk (*) was included as a wildcard symbol to search for variations of the terms (e.g. CEOs, chief executive officers and characteristics). The search was restricted to publications classified as belonging to the areas of ‘management’, ‘business’, ‘business finance’, and ‘economics’ to ensure relevance. A total of 532 records were identified.

The 532 records were downloaded from the Web of Science and imported into HistCite™ (version 12.03.17). The records were manually cleaned by checking the title, abstract, and keywords of each record, and, if necessary, referring to the full text of the publication to determine its relevance to this review. Thirty-nine publications not related to this review were removed, leaving 493 records in the data set. A cited reference search was also used to identify a further two publications as per Garfield (2004), leading to a final data set of 495 records across 144 publication sources published from 1984 to 2019 (cut-off: 8 March 2019).

The annual output of publications on CEO characteristics in management, business, business finance, and economics is mapped in Figure 1. Since 2000, there has been a growing body of research focused on CEO characteristics in different domains. The citation map created within HistCite™ plots the top 51 cited publications within the data set along a timeline based on its Local Citation Score (LCS). There is as yet no consensus regarding how many publications should be included in a citation map, but a large number renders the citation map less readable. This study selects the top 51 publications as this provides a sufficiently comprehensive, significant and legible map. The citation cut-off is an LCS of 3. Each paper is identified as a node and lines illustrate the citation linkages between articles. Some nodes are larger than others, illustrating a higher number of citations (measured by LCS). Citation details and LCS for each publication in the map are listed in the Appendix. The main research streams related to CEO characteristics (grey shaded and labelled) comprise Management, Strategy, Finance, and Interdisciplinary. These four streams, which can be considered as different lines of enquiry, have developed over time and contribute to a comprehensive understanding of CEO characteristics. These streams are reviewed in detail in the following sections.

3 Management

The management research stream is based on Hambrick and Mason’s (1984) Upper Echelon Theory (UET), described in detail in Section 3.1. CEO characteristics and their use in the management literature stream are discussed in Section 3.2.

3.1 Upper echelon theory

Drawing on literature in organisational behaviour and strategic management, the UET states that CEOs’ or top executives' experiences, values and characters highly affect their strategic decisions and, in turn, influence organisational outcomes (Hambrick and Mason, 1984; Datta and Rajagopalan, 1998; Herrmann and Datta, 2002; Hambrick, 2007). Further, Hambrick and Mason (1984) argue that observable managerial characteristics of CEOs or top management team (include age, functional tracks, other career experiences, education, socioeconomic roots, financial positions and group characteristics) affect strategic decision-making and organisational performance rather than psychological characteristics (cognitive base values). However, the basic logic of the Carnegie School states that complex decisions are mainly the result of behavioural factors, including the values and cognitive orientation of the core participants (Cyert and March, 1963; Herrmann and Datta, 2002). This indicates that differences in cognitive views and characteristics of executives or managers influence all aspects of the strategic decision-making process, choices and organisational performance, including issue identification (Dutton and Duncan, 1987), information search (Herrmann and Datta, 2002), information or message processing (Cyert and March, 1963), selective specification, chosen methods of work (Herrmann and Datta, 2002); product innovation (Lyon and Ferrier, 2002), international diversification (Olson et al., 2006), mergers and acquisitions (Krug et al., 2014), capital structure (Chen et al., 2010), productivity and firm performance (Chen and Hsu, 2009) and corporate social responsibility (Petrenko et al., 2016). In other words, executives’ or managers’ decision-making processes and actions are driven by their beliefs, experiences, assumptions and values. Top executives bring their prior experiences, preferences and dispositions into their decision-making processes and leadership behaviours (Finkelstein & Hambrick 1996; Carpenter et al., 2004; Bamford et al., 2006. As such, CEOs exert a significant influence on firm outcomes.

UET has subsequently been applied to different contexts such as firm strategies, firm innovation, organisational structure, planning formality, firms’ time to IPO, corporate social responsibility, industry factors and the international arena (e.g. Miller and Toulouse, 1986; Bantel and Jackson, 1989; Finkelstein and Hambrick, 1990; Datta and Rajagopalan, 1998; Papadakis and Barwise, 2002). For example, Rajagopalan and Datta (1996) explore environmental and industry factors to explain variations in CEO characteristics, finding that variations in CEO firm tenure, level of education, functional background and functional heterogeneity are explained proportionally by industry conditions. Datta and Rajagopalan (1998) further explore the linkage between industry structure and the characteristics of CEO successors, revealing that industry product differentiation and industry growth rate are significantly linked to CEO successor characteristics. In the international arena, Roth (1995) demonstrates that CEOs must be ‘internationally networked’ in a high interdependence environment.

3.2 CEO characteristics

CEOs have varying background and demographic characteristics that may result in differences in cognitive orientation and thus strategic decision-making (Hambrick and Mason, 1984; Rajagopalan and Datta, 1996). The concept of experience is defined to involve life experience (age), firm experience (tenure) and functional experience (functional specification) (Zajac and Westphal, 1996; Herrmann and Datta, 2002). A CEO’s characteristics may provide signs or information to investors, underwriters and other financial intermediaries regarding a firm’s value (Zimmerman, 2008). There are several advantages to using demographic factors, such as objectivity, parsimony and testability (Hambrick and Mason, 1984). These characteristics have been analysed in the literature regarding their influence on CEO succession (Section 3.2.1), CEO power, stock ownership, and stock option pay (Section 3.2.2), firms’ time to IPO (Section 3.2.3) and CEO narcissism (Section 3.2.4).

3.2.1 CEO succession

A considerable body of research focuses on CEO succession because selection of a new CEO is a critical decision that represents a defining event in a firm’s life (Datta and Rajagopalan, 1998). Furthermore, Kesner & Sebora (1994) note that CEO succession is ‘an important, unique, and very visible event’ that has profound effects on firm performance and strategy. Both pre-succession experience (Guthrie and Datta, 1997) and post-succession experience (Herrmann and Datta, 2002) of CEOs are important factors. Guthrie and Datta (1997) report that pre-succession firm size and risk are linked with the age of appointed CEOs and pre-succession profitability and advertising intensity are associated with type of functional background experience. Besides, Herrmann and Datta (2002) note that major strategic changes occur in post-succession periods with CEO successors presenting strategies and decisions which reflect their knowledge and experience. Further, Georgakakis & Ruigrok (2017) find that appointment of an outsider CEO has benefits derived from both the organisational adaptation perspective and the organisational disruption perspective. More recently, Datta et al.,(2003) have highlighted the significance of the post-succession phase, indicating that CEO openness to change is negatively correlated with strategic persistence in the post-succession period, which strongly supports the theoretical predictions derived from UET (Hambrick and Mason, 1984; Datta et al., 2003). Datta et al.(2003) note that organisations can derive significant benefits from choosing CEOs whose prior experience and background are consistent with the firm’s desired strategic direction.

3.2.2 CEO power, stock ownership and stock option pay

Studies examining CEO compensation packages (Westphal and Zajac, 2001), CEO successors’ characteristics (Zajac and Westphal, 1996) and firms’ board composition (Westphal and Zajac, 1995) typically model and test associations between power and specific outcomes (Bigley and Wiersema, 2002). Westphal and Zajac (1995) extend the perspective of UET (Hambrick and Mason, 1984) by providing evidence of associations between outside director characteristics and top management characteristics. There is an intrinsic limitation in this line of enquiry as the power of CEOs can only be measured as the ability to bring about a preferred or intended effect (Bigley and Wiersema, 2002). As boards often implement incentives such as stock option pay with the intention of achieving incentive alignment and altering firm outcomes, stock-based incentives clearly affect decision-making (Amburgey and Miner, 1992; Westphal and Zajac, 1993; Sanders, 2001). When CEOs are compensated with stock option pay, firms are more likely to engage in acquisitions and divestitures; in contrast, when CEOs own stock, firms are less likely to be engaged in acquisitions and divestitures (Sanders, 2001).

3.2.3 Firms’ time to IPO

CEO characteristics are also influential in terms of firms’ time to initial public offering (IPO), particularly regarding the CEO’s prior executive experience, network and age (Yang et al., 2011). Age is argued to affect commitment to the status quo as well as willingness to accept change (Hambrick and Mason, 1984; Yang et al., 2011). Using a sample of CEOs of firms in the US software industry, Yang et al.(2011) demonstrate that younger CEOs, CEOs with prior executive experience and CEOs with a larger social network take firms public earlier.

3.2.4 CEO narcissism

Building on the logic of UET (Hambrick and Mason, 1984), Petrenko et al.(2016) show that CEO narcissism could lead to agency behaviours which may result in negative financial implications for firms. Moreover, the propensity of a firm to participate in corporate social responsibility (CSR) may be influenced by the CEO’s preferences and priorities derived from their values and personal traits (Petrenko et al., 2016). There is an increasing body of literature on managerial decisions to spend organisational time and effort raising CSR in addition to determinants of CSR. Chatterjee and Hambrick (2007) highlight that narcissism is a common trait in CEOs, and Petrenko et al.(2016) indicate that narcissistic CEOs have a positive impact on levels and profile of organisational CSR. Overall, there is a distinct lack of knowledge regarding executives’ psychological characteristics given the emphasis of UET on the influence of executive personality characteristics on firm strategic decisions (Petrenko et al., 2016).

4 Finance

The finance research stream explores the influence of CEO characteristics on corporate financing decisions and financial policies. Bertrand and Schoar’s (2003) investigation of systematic behavioural differences in corporate decision-making across managers is one of the early influential publications in this stream, revealing that older executives are financially more conservative (on average) and executives who hold an MBA degree appear to be more aggressive. A range of other factors has since been explored in the literature, including financial experience (Section 4.1), military experience and survival of the Great Depression (Section 4.2), founder CEOs and CEO–chairperson duality (Section 4.3) and CEO overconfidence (Section 4.4).

4.1 Financial experience

CEOs have unique management styles based on their prior experiences, with significant implications for firm performance (Adams et al., 2005). Supplementing studies that investigate CEO personal characteristics (Kaplan et al., 2012) and CEO personal traits (Malmendier et al., 2011), Custodio & Metzger (2014) demonstrate that CEOs with a financial background (i.e. financial expert CEOs) are able to manage financial policies more actively, hold less cash, issue more debt, engage in more share repurchases, invest less in research and development, produce less innovation, raise external financing in times of poor credit conditions, are more responsible regarding dividend and capital gains, and are prone to be employed by more mature firms or more diversified firms. Kaplan et al.(2012) further demonstrate that general ability, communication, interpersonal skills and execution skills are necessary for effective CEOs.

4.2 Military experience and survival of the Great Depression

In addition to work experience of CEOs, military service may also impact behaviours of servicemen or women (Benmelech and Frydman, 2015). Duffy (2006) provides evidence from sociology and organisational behaviour perspectives that hands-on leadership experience is required during military service, creating a strong foundation for decisions under pressure or in a financial crisis. Benmelech and Frydman (2015) find that military CEOs have lower investment, lower leverage ratios, lower expenditure on research and development, lower likelihood of corporate fraud and perform better during industry busts. Malmendier et al.(2011) find that CEOs with military experience are prone to choose more aggressive policies (including higher leverage ratios). Extending their analysis to include the Great Depression, Malmendier et al.(2011) find that CEOs who grew up during the Great Depression are debt conservative, equity conservative, and more reliant on internal financing. More broadly, their results regarding experience of the Great Depression and military experience imply that personal events can have a lifelong impact on risk attitudes and choices (Malmendier et al., 2011).

4.3 Founder CEOs and CEO–chairperson duality

Building on UET (Hambrick and Mason, 1984) and existing financial literature on managerial effects on firm outcomes (e.g., Bertrand and Schoar, 2003), Adams et al.(2005) demonstrate that founder CEOs and CEO–chairperson duality has a positive impact on stock returns. In line with this logic, based on the phenomenon that founders comprise 11 percent of CEOs of US public firms, Fahlenbrach (2009) provides further evidence that founder CEO firms are systematically distinct from successor–CEO firms regarding firm valuation, investment behaviour and stock market performance. Namely, founder CEO firms have a higher valuation, a higher stock market performance, make more mergers and acquisitions, and invest in more research and development and capital expenditures than non-founder CEO firms (Fahlenbrach, 2009). However, in the Chinese banking sector, Liang et al.,(2013) fail to find a significant relationship of CEO–chairperson duality on ROA, which may be due to the prevalence of small boards, more frequent board meetings, more independent boards and fewer politically connected board members.

4.4 CEO overconfidence

In contrast to the literature on managerial fixed effects (e.g., Bertrand and Schoar, 2003; Frank and Goyal, 2007) above and beyond traditional firm-, market- and industry-level determinants of capital structure, several studies illustrate that CEO overconfidence plays an important role in dividend policy. Malmendier et al.(2011) demonstrate that managerial factors have considerable explanatory power for corporate financing decisions and financial policies in terms of overconfidence. They report that overconfident CEOs employ less external financing, conditional on accessing external capital and issue less equity than their peers. Consistent with Malmendier et al.(2011), Deshmukh et al.(2013) find that overconfident CEOs overestimate external financing costs and schedules, reducing reliance on external financing via cutting down the dividend payout. Furthermore, they also show that the magnitude of the positive stock price response to announcements of dividend growth is higher in firms with more uncertainty regarding CEOs’ overconfidence level.

5 Strategy

This stream of research examines the link between an executive’s prior experience and a firm’s strategy, in line with UET (Hambrick and Mason, 1984). Based on the strategic choice paradigm (Child, 1972), which postulates that key managers have considerable control over an organisation’s future direction, many studies have investigated the relationships between top management characteristics and firm strategy (e.g., Datta et al., 2003). Wally and Baum (1994) were one of the first to incorporate a wider range of individual characteristics, including cognitive ability, intuition, tolerance for risk, propensity to act, centralisation, formalisation, size and industry effect. They find that CEO’s cognitive ability, use of intuition, risk tolerance and propensity to act are positively correlated with rapid strategic decisions. This stream of literature comprises stewardship theory (Section 5.1), research and development strategy (Section 5.2), international, diversification and acquisition strategy (Section 5.3), family firms (Section 5.4) and environmental strategy (Section 5.5).

5.1 Stewardship theory

In addition to UET (Hambrick and Mason, 1984) and agency theory (Jensen and Meckling, 1976), the stewardship theory has also been used to explain the composition of the board of directors or top management teams (Davis et al., 1997). In particular, Davis et al.(1997) reconcile the differences between agency theory and stewardship theory, demonstrating that top managers or CEOs under agency theory are identified as rational individuals that seek to maximise their own utility, whereas under stewardship theory they act as stewards whose behaviours are ordered such that pro-organisational, collectivistic behaviours have higher utility than individualistic, self-serving behaviours. Further, the authors suggest that CEOs or managers that act as stewards have centralised control of the firm and view firm performance as their own wealth maximisation (Davis et al., 1997).

6 Research and development strategy

In today’s rapidly changing world, investing in innovation is parallel with holding options for the future (Daellenbach et al., 1999). Research and development expenditure (as an input to the innovation process) is one of the most important strategic decisions made by CEOs or top managers, potentially leading to future competitive advantage, productivity and higher firm performance (Ettlie, 1998; Barker and Mueller, 2002; Grant, 2002; Chen and Hsu, 2009). Daellenbach et al.(1999) were among the first to investigate the relationship between the commitment to innovation (or research and development spending) and characteristics of top management teams and CEOs. The authors reveal a significantly positive relationship between research and development expenditure and technically oriented CEOs or top executives, indicating that firms willing to strengthen their innovation strategy should hire CEOs or top executives with technical backgrounds and working experience (Daellenbach et al., 1999).

Barker and Mueller (2002) extend the work of Daellenbach et al.(1999), finding that CEO characteristics play a significant role in firm research and development expenditure, even when controlling for corporate strategy and ownership structure. They find that research and development expenditure is higher in firms with CEOs that are younger, have more investment in firm stock, and have greater professional experience in marketing/research and development/engineering (Barker and Mueller, 2002). Furthermore, Barker and Mueller (2002) also find that longer CEO tenure is related to an increase in research and development expenditure, indicating that CEOs may shape research and development expenditure to match their own preferences over time. More recently, Lin et al.(2011) investigated the impacts of CEO characteristics on firms’ innovation efforts in the Chinese context, finding that CEO education level, professional background and political connections have positive impacts on firms’ research and development activities. This indicates that well-designed CEO incentive schemes contribute to increased research and development activities and promote competitiveness and performance of firms in the long term (Lin et al., 2011).

Furthermore, CEO–chairperson duality or separation of CEO and chair positions is an important element for research and development strategy. In their investigation of the relationships among family ownership, CEO duality and research and development investment in Taiwanese electronic firms, Chen and Hsu (2009) demonstrate that the mutual effect of family ownership and CEO duality ratio is negatively correlated with research and development investment. Zona et al.(2013) examine how board composition affects firm innovation, demonstrating that the effect of the outside board ratio on research and development expenditure is positively moderated by firm size, whereas the impact of board demographic diversity (measured from CEO’s responses in five different dimensions: functional background, industry background, education background, age, and personality and values) on research and development expenditure is negatively moderated by firm size.

6.1 International, diversification and acquisition strategy

Building on UET, Carpenter (2002) examines the relationship between top management team heterogeneity and firm performance in terms of the internationalisation strategies of firms. Carpenter (2002) demonstrates that educational background, functional background and tenure of top management teams are positively and significantly related to firm international strategy, with a stronger relationship between short-tenured top management teams and firm international strategy. Diversifications and acquisitions as corporate strategy decisions are usually complicated; acquisitions in particular are commonly regarded as significant elements for achieving a preferred diversification level (Salter and Weinhold, 1978; Jensen and Zajac, 2004). Jensen and Zajac (2004) offer one of the first studies to jointly consider demographic characteristics (UET perspective) and governance positions (agency theory), exploring how executives and directors drive firm strategy in terms of corporate diversification level and acquisition activity. The authors find that firms with CEOs with a finance background are significantly more likely to be highly diversified and are associated with more acquisition activities than firms with CEOs lacking a finance background.

6.2 Family firms

Family firms are usually categorised as small- and medium-sized firms, a description that encompasses the majority of businesses. Family firms play a significant role in economic production, employment and wealth creation (Corbetta and Montemerlo, 1999; IFERA 2003; Zahra et al., 2004; Voordeckers et al., 2007; Kellermanns et al., 2008). Drawing on different perspectives from agency theory (Jensen and Meckling, 1976), resource dependency theory (Hillman et al., 2000; Pfeffer and Salancik, 2003), stewardship theory (Davis et al., 1997), institutional theory (DiMaggio and Powell, 1983), and social network theory (Gulati and Gargiulo, 1999), Voordeckers et al.(2007) find that CEO–chairperson duality, CEO education, generation transition and family firms’ objectives play significant roles in board composition of family firms. Specifically, CEO–chairperson duality and CEO education have negative effects on board composition in family firms, indicating that the greater the CEO’s power, the higher the CEO’s education level, and the lower the possibility of employing outside directors.

From the view of board composition, Classen et al.(2012) show that a higher percentage of non-family members in the top management team (or board) results in a wider search breadth of family firms (i.e. it is more likely that family firms will access a variety of external resources or partnerships). Moreover, Chen and Hsu (2009) provide further evidence on the mutual effect of family ownership and CEO–chairperson duality that is negatively correlated with research and development investment. In addition, when the firm CEO is also a chairperson, the negative relationship of family ownership and research and development investment becomes stronger; when firms have more independent directors, this negative relationship becomes weaker (Chen and Hsu, 2009). Therefore, the improved corporate governance from more independent directors may not only stimulate more research and development investment, but also efficiently monitor and offer resources that can lower firm investment risks (Chen and Hsu, 2009).

Firm innovation is necessary for profitability, long-term survival and growth (Classen et al., 2012). Family firms are encouraged to build various partnerships to access a wide range of external resources to support and promote innovation processes (Classen et al., 2012). In turn, search breadth or holding a variety of partner agreements plays an important role in the innovation processes of small- and medium-sized enterprises as they usually have restricted information and resources compared with large enterprises (Street and Cameron, 2007). Based on UET (Hambrick and Mason, 1984) and further evidence regarding CEO education and background (Wally and Baum, 1994; Barker and Mueller, 2002), Classen et al.(2012) demonstrate that CEO educational level has a significantly positive effect on the search breadth of family firms. This result suggests that the selection of a well-educated CEO will improve a firm’s engagement in innovation and external resource acquisition.

On the other hand, entrepreneurial behaviour is considered as a crucial factor for firms’ profitability and firm growth (Lumpkin and Dess, 1996). Lumpkin and Dess (1996) illustrate the concept of entrepreneurial orientation (includes autonomy, innovativeness, risk taking, proactiveness and competitive aggressiveness) and present significant impact of entrepreneurial orientation on firm performance. Kellermanns et al.(2008) explore the relationship of CEO characteristics (including CEO age, CEO gender, CEO tenure and generational involvement) to entrepreneurial behaviour and subsequent firm growth. The authors did not find a significant effect of CEO age and CEO gender but identified a negative relationship between CEO tenure and entrepreneurial behaviour, which indicates that CEOs with longer tenure may be more concerned with issues pertaining to succession rather than firm growth.

6.3 Environmental strategy

With increasing climate change concerns, firms’ environmental actions have attracted scholars to begin to explore characteristics of firm executives that may drive the diversity of environmental practices (Bansal and Roth, 2000; Delmas and Toffel, 2008; Lewis et al., 2014). Combining perspectives from institutional theory (Bansal and Clelland, 2004; Delmas and Toffel, 2008) and UET (Hambrick and Mason, 1984), Lewis et al.(2014) examine how CEO characteristics (including CEOs with MBA degrees, CEOs with law degrees and CEO tenure) affect firms’ strategic responses to the Carbon Disclosure Project (CDP). The results show that CEOs who hold MBA degrees and have short tenure (or newly appointed CEOs) have a positive impact on environmental strategies, indicating that firms with these CEOs are more like to voluntarily disclose firms’ environmental information (Lewis et al., 2014). In direct contrast, firms with CEOs who hold law degrees are less likely to disclose their environmental information, even in the presence of institutional pressures to do so (Lewis et al., 2014). Hence, CEO characteristics play crucial roles in explaining firms’ responses to institutional pressures via different environmental strategies.

7 Interdisciplinary

The majority of publications in the previously discussed research streams focus on perspectives derived from UET (Hambrick and Mason, 1984). However, the interdisciplinary stream of research offers more evidence regarding the impact of CEO characteristics in a range of disciplines, including principal–agent (Section 6.1), auditing (Section 6.2), corporate governance (Section 6.3), accounting (Section 6.4) and risk management (Section 6.5).

7.1 Principal–agent

The principal–agent problem has been well examined in the literature, including characteristics of CEOs and board members. Increased scrutiny of corporate governance practices in the United Kingdom in the 1990s, particularly in the wake of reports by the Cadbury (1992), Greenbury (1995), and Hampel (1998) committees, revealed controversial payment levels of CEOs in the UK (although payment levels remain below their counterparts in the US) (Conyon and Murphy, 2000). Economic theory also suggests that in order to maximise shareholder wealth, firms should tie CEO compensation to stock performance (Ryan and Wiggins, 2001). Conyon and Murphy (2000) find that CEO age and CEO–chairperson duality is positively related to pay-performance sensitivity or CEO effective ownership percentage. In line with these results, Ryan and Wiggins (2001) find further evidence that CEO characteristics influence executive compensation policies, documenting that CEO age has a concave relationship with cash bonuses, implying that firms pay less cash bonuses to both the youngest and oldest executives. Additionally, CEO tenure has a negative effect on stock options, suggesting that long-tenured CEOs with aggregated stock are less interested in equity-based compensation than newly appointed CEOs (Ryan and Wiggins, 2001). This finding can be explained by differences in CEO horizon, wherein newly appointed CEOs are more focused on building their reputation whereas long-tenured CEOs are encountering retirement issues (Ryan and Wiggins, 2001). However, in direct contrast, Brick et al.(2006) argue that there are no correlations between future firm performance and CEO and board compensation and CEO characteristics including CEO gender, CEO experience and CEO duality.

7.2 Auditing

Prior research has documented that a low level of corporate governance is associated with company fraud (Farber, 2005). Increasing occurrences of fraud have attracted significant research attention, particularly regarding whether CEO characteristics play a role in a firm’s fraudulent activities. Due to contextual differences between the US and Australia, it remains unclear whether CEO characteristics play a role in fraudulent activities in Australia. The high incidence of company fraud in Australia has led to the publication of several regulatory reports that advocate that the board of directors should improve their monitoring mechanisms through board independence and separation of CEO and chairperson to prevent fraud (Maslen, 1997). Sharma (2004) provides evidence in the Australian context that CEO duality is positively linked to the occurrence of company fraud. In addition, Sharma (2004) also demonstrates that the proportion of independent directors on the board and the proportion of independent institutional shareholders are significantly inversely correlated with the probability of company fraud. These results indicate that independent board directors and independent institutional shareholders play important monitoring and controlling roles regarding fraudulent behaviour.

Consistent with Sharma (2004), Farber (2005) provides empirical evidence that fraudulent firms in the United States in 1997 typically have more dependent board members and CEO duality. The results also indicate that three years after fraud detection, these fraudulent firms improved their governance to restore their reputation by adding independent external board members (Farber, 2005). This emphasises the significance of managerial influence regarding potential engagement in fraudulent activities. Extending Farber’s (2005) study, Johnson et al.(2009) find that between 1991 and 2005, CEOs who are long-tenured are more likely to influence other executives to cooperate in committing fraud. Furthermore, firms with CEOs who are close to retirement or who serve on small boards are more likely to engage in fraudulent activities, as these CEOs believe they are unlikely to suffer reputational damage if caught.

7.3 Corporate governance

While publications in the previously discussed three streams describe the monitoring function of board members, Ruigrok et al.(2006) focus on corporate governance, particularly board involvement in strategic decision-making. From the perspective of agency theory regarding conflicts of interest between shareholders and top executives, board members should engage in a decision-making process to prevent CEOs or executives from unduly prioritising their own self-interests (Jensen and Meckling, 1976). Ruigrok et al.(2006) report a negative correlation between CEO duality and board involvement in strategic decision-making, which indicates that powerful CEOs are more likely to constrain board engagement in strategic decision-making.

Following the publication of the Cadbury Report (1992), corporate governance in the United Kingdom underwent significant reform, particularly in terms of board composition. Hillier and McColgan (2006) find that board independence and the separation of the roles of CEO and chairperson is negatively significantly related to director ownership and family affiliations, which indicates that changes in board composition are more likely to occur in response to changes in managerial control.

In addition to the empirical evidence of board independence and CEO duality in developed markets, including the United Kingdom (Hillier and McColgan., 2006), the United States (Conyon and Murphy, 2000; Farber, 2005; Jermias and Gani, 2014), Australia (Sharma, 2004) and Switzerland (Ruigrok et al., 2006), Kaymak and Bektas (2008) provide evidence in the emerging Turkish market, finding that CEO duality has a negative impact on bank performance and board independence. Jermias and Gani (2014) demonstrate that the negative influence of CEO duality and board independence on firm performance can be diminished by board capital, defined as ‘the ability of board members to perform manager-monitoring activities and to provide advice and counsel to management’. Agency theory implies that managerial share ownership has a significant influence on firm performance, as share ownership gives CEOs or executives voting rights in corporate decisions. Jermias and Gani (2014) conclude that managerial share ownership has a positive effect on firm performance and that board capital can enhance this positive effect.

7.4 Accounting

Existing research highlights the significance of audit committee independence and financial expertise. However, there is significantly less research in the accounting field, such as firm restatements. An exception is Carcello et al.(2011), who find a positive relationship between CEO–chairperson duality and firm restatements.

7.5 Risk management

Narcissistic CEOs are likely to manage firms differently compared to their non-narcissistic counterparts (Zhu and Chen, 2015). Utilising Chatterjee and Hambrick’s (2007) measurements for CEO narcissism, Zhu and Chen (2015) find that CEOs prefer new directors with similar narcissistic traits and prior experience. In addition, CEO power is positively related to new directors having similar characteristics and similar prior experience with narcissistic CEOs. More importantly, consistent with Chatterjee and Hambrick (2007, 2011), Zhu and Chen (2015) also find that CEO narcissism positively affects risk-taking spending, implying that new directors with similar narcissistic traits to the CEO may be more supportive regarding risk-taking spending.

8 CEO characteristics: emerging trends

The citation map developed in this paper favours publications on CEO characteristics that have been highly cited and does not offer a full account of emerging research trends and directions, as new publications have fewer citations. Manual assessment of recent publications since 2015 facilitates discussion of important emerging research trends in four key areas, namely expansion of the scope of CEO characteristics (Section 7.1), entrepreneurship and open innovation (Section 7.2), emerging markets and political activity (Section 7.3) and new methodologies (Section 7.4).

8.1 Expansion of the scope of CEO characteristics

Researchers continue to be attracted to CEO characteristics and have recently expanded the scope of CEO characteristics, including CEO narcissism (Olsen and Stekelberg, 2015; Petrenko et al., 2016; Ham et al., 2018), CEO gender (Faccio et al., 2016), CEO connectedness (Khanna et al., 2015) and CEO humility (Ou et al., 2018). New research on CEO narcissism explores its effect on corporate social responsibility (Petrenko et al., 2016), corporate tax sheltering (Olsen and Stekelberg, 2015) and firm investment policies and outcomes (Ham et al., 2018). Studies on CEO gender demonstrate that male and female CEOs vary in their risk-taking behaviours and efficiency of capital allocation (Faccio et al., 2016). With increasing occurrences of corporate fraud, researchers have also begun to scrutinise the connectedness of CEOs with top executives (Khanna et al., 2015). In contrast to overconfident and narcissistic CEOs, researchers have also begun to take an interest in CEOs who are humble or modest to document associated effects on firm performance (Ou et al., 2018). The emerging field of research in the area of expanding CEO characteristics indicate that future research could investigate whether and how broader CEO characteristics affect strategic choices and organisational performance.

8.2 Entrepreneurship and open innovation

Researchers are also increasingly interested in the topics of entrepreneurship and open innovation. Recent studies provide further insights into how CEO characteristics perform in entrepreneurship activities (Wei and Ling, 2015; D’Angelo and Presutti, 2019) and open innovation (Ahn et al., 2017; Nuruzzaman et al., 2019). Open innovation is also considered to constitute an important firm decision. Recent research demonstrates that CEOs’ positive attitude, entrepreneurial orientation and education impact open innovation (Ahn et al., 2017). In addition, Nuruzzaman et al.(2019) argue that CEO characteristics in turn have impacts on subsidiary innovation. As recent research already shows the relevance of CEO characteristics and innovation activities, future research could focus on this relevance in different contexts.

8.3 Emerging markets and political activity

Instead of testing developed markets, namely the United States, researchers have begun to focus on other transitional economies, such as corporate entrepreneurship in China (Wei and Ling, 2015), budgeting practices of small- and medium-sized enterprises (SMEs) in Turkey (Zor et al., 2019) and open innovation modes in Korea (Ahn et al., 2017). Existing literature shows that developing markets with different regulations, different stock market settings and different investment behaviours present a wide variety of future research (Linnenluecke et al., 2016). Researchers continue to examine corporate political activities in line with country-specific and global political changes. For example, Rudy and Johnson (2019) use UET to examine whether CEOs’ characteristics affect firms’ invest in political activity. Research on corporate political activities includes articles introducing innovative research directions by focusing on the performance outcomes of the firms that invest in political activities, effects of other CEO characteristics and gain from political investments (Rudy and Johnson, 2019).

8.4 New methodologies

The existing literature mainly employs annual data and surveys. Rudy and Johnson (2019) estimate the relationship between CEO demographic factors and corporate political activities via 27 years of annual data based on large US firms. Nuruzzaman et al.(2019) construct the sample from the Management, Organization and Innovation (MOI) Surveys, administered jointly by the European Bank for Reconstruction and Development (EBRD) and the World Bank to investigate whether CEO characteristics have impacts on subsidiary innovation. However, the appointments and resignations of CEOs constitute daily-based data. This may lead to firms having two or more different CEOs within the same year, which may result in unreliable findings. Discrepancies between appointment or resignation dates and firm-level annual data can be resolved by event study methodology, which can be adapted and extended to assess whether CEO characteristics are important for firms (Ramiah et al., 2013). Moreover, Akhtar et al.(2017) examine multinational’s tax evasion via the event study method and multivariate regressions. Sandler and Sandler (2014) note that an event study typically accompanies difference-in-differences estimations, regression discontinuity, instrumental variables and other analysis. Thus, future research should consider combining the event study method and difference-in-differences approach to overcome discrepancies between appointment or resignation dates and firm-level annual data.

9 Conclusion

This study employs the bibliographic mapping approach to identify the most influential publications on CEO characteristics over the last 50 years. The main research streams are identified as Management, Finance, Strategy and Interdisciplinary. Each of these areas is discussed and reviewed in detail which enables us to provide a review of highly cited articles on CEO characteristics within the broader research conversation and identifies key academic contributions by top-cited publications. Following examination and review of publications published since 2015 (2015–2019) related to CEO characteristics, this study also outlines emerging research trends and highlights opportunities for future research. These emerging trends include additional CEO characteristics (CEO narcissism, gender, connectedness and humility); entrepreneurship and open innovation; emerging markets; firm investments in corporate political activities; and new methodologies for future research. With a highlight on possible pathways for future research, this paper outlines these emerging trends to integrate existing knowledge and pursue innovative research opportunities to expand the research frontier.

Appendix

| Rank | Author | Journal | LCS | GCS |

|---|---|---|---|---|

| 1 | Hambrick and Mason (1984) | Academy of Management Review | 126 | 3764 |

| 2 | Bertrand and Schoar (2003) | Quarterly Journal of Economics | 61 | 729 |

| 3 | Barker and Mueller (2002) | Management Science | 34 | 294 |

| 4 | Adams et al.(2005) | Review of Financial Studies | 26 | 343 |

| 5 | Datta and Rajagopalan (1998) | Strategic Management Journal | 20 | 118 |

| 6 | Kaplan et al.(2012) | Journal of Finance | 20 | 131 |

| 7 | Davis et al.(1997) | Academy of Management Review | 19 | 1192 |

| 8 | Malmendier et al.(2011) | Journal of Finance | 19 | 222 |

| 9 | Herrmann and Datta (2002) | Journal of International Business Studies | 16 | 118 |

| 10 | Rajagopalan and Datta (1996) | Academy of Management Journal | 15 | 88 |

| 11 | Roth (1995) | Academy of Management Journal | 11 | 137 |

| 12 | Zajac and Westphal (1996) | Academy of Management Journal | 11 | 204 |

| 13 | Papadakis and Barwise (2002) | British Journal of Management | 11 | 113 |

| 14 | Sanders (2001) | Academy of Management Journal | 10 | 232 |

| 15 | Farber (2005) | Accounting Review | 10 | 346 |

| 16 | Wally and Baum (1994) | Academy of Management Journal | 9 | 194 |

| 17 | Brick et al.(2006) | Journal of Corporate Finance | 9 | 213 |

| 18 | Lin et al.(2011) | Journal of Corporate Economics | 9 | 57 |

| 19 | Carpenter (2002) | Strategic Management Journal | 8 | 256 |

| 20 | Jensen and Zajac (2004) | Strategic Management Journal | 8 | 166 |

| 21 | Chen and Hsu (2009) | Family Business Review | 8 | 135 |

| 22 | Daellenbach et al.(1999) | R&D Management | 7 | 75 |

| 23 | Datta et al.(2003) | British Journal of Management | 7 | 58 |

| 24 | Guthrie and Datta (1997) | Journal of Management Studies | 6 | 48 |

| 25 | Ruigrok et al.(2006) | Journal of Management Studies | 6 | 78 |

| 26 | Yim (2013) | Journal of Financial Economics | 6 | 79 |

| 27 | Lewis et al.(2014) | Strategic Management Journal | 6 | 59 |

| 28 | Ryan and Wiggins (2001) | Journal of Corporate Finance | 5 | 84 |

| 29 | Bigley and Wiersema (2002) | Administrative Science Quarterly | 5 | 85 |

| 30 | Petrenko et al.(2016) | Strategic Management Journal | 5 | 60 |

| 31 | Fondas and Wiersema (1997) | Journal of Management Studies | 4 | 42 |

| 32 | Conyon and Murphy (2000) | Economics Journal | 4 | 118 |

| 33 | Voordeckers et al.(2007) | Journal of Small Business Management | 4 | 100 |

| 34 | Kellermanns et al.(2008) | Family Business Review | 4 | 173 |

| 35 | Johnson et al.(2009) | Review of Finance | 4 | 117 |

| 36 | Yang et al.(2011) | Journal of Small Business Management | 4 | 23 |

| 37 | Carcello et al.(2011) | Contemporary Accounting Research | 4 | 69 |

| 38 | Zona et al.(2013) | British Journal of Management | 4 | 34 |

| 39 | Jermias and Gani (2014) | British Accounting Review | 4 | 18 |

| 40 | Custodio and Metzger (2014) | Journal of Financial Economics | 4 | 25 |

| 41 | Benmelech and Frydman (2015) | Journal of Financial Economics | 4 | 41 |

| 42 | Begley (1995) | Journal of Business Venturing | 3 | 104 |

| 43 | Sharma (2004) | Auditing: A Journal of Practice & Theory | 3 | 56 |

| 44 | Hillier and McColgan (2006) | European Financial Management | 3 | 14 |

| 45 | Kaymak and Bektas (2008) | Corporate Governance - An International Review | 3 | 39 |

| 46 | Fahlenbrach (2009) | Journal of Financial and Quantitative Analysis | 3 | 105 |

| 47 | Classen et al.(2012) | Journal of Small Business Management | 3 | 63 |

| 48 | Deshmukh et al.(2013) | Journal of Financial Intermediation | 3 | 49 |

| 49 | Liang et al.(2013) | Journal of Banking and Finance | 3 | 56 |

| 50 | Zhu and Chen (2015) | Strategic Management Journal | 3 | 14 |

| 51 | Georgakakis and Ruigrok (2017) | Journal of Management Studies | 3 | 10 |

References

- The Carnegie School is built on the belief of explaining organizations and pointing out the necessity of understanding how psychology, economics, sociology and political science all drive decision making (Gavetti et al.,2007).