Flight to Lottery Ahead of FOMC Announcements: Institutional Investors or Retail Investors?

Abstract

This paper studies the pre-Federal Open Market Committee (FOMC) announcement drift at the stock level. We hypothesize that investors have a higher propensity to speculate before the monetary policy announcements by the FOMC, due to the resolution of uncertainty and associated reduction in investors' fear. Indeed, we find evidence that there exists a drift of lottery-like stocks in the pre-FOMC window, when investors' fear gauge is lower, together with higher demand for lottery-like stocks and higher realized skewness. Moreover, we show that the demand for lottery-like stocks ahead of FOMC announcements is more prominent among institutional investors than retail investors. Our findings also identify the key role of transient and quasi-index institutional investors in our documented flight-to-lottery effect. Our findings advance the ongoing debates about the role of firms' investor heterogeneity in determining how monetary policy affects corporate managers' decisions. Our paper has important implications for central banks and managers by showing that investors' preference for lottery-like stocks increases before FOMC announcements.

Introduction

Monetary policy decisions can have a significant impact on business operations and financial markets. Corporate managers usually incorporate the potential impact of monetary policy into their financial planning and forecasting processes. Managers also need to be aware of the broader macroeconomic environment in which their organizations operate. Understanding monetary policy tools, goals and strategies can provide insights into the overall economic conditions and trends that may impact business decision-making.

The Federal Open Market Committee (FOMC) announcements are key dates in the calendar of investors, since they provide important information about the stance of monetary policy as well as the Fed's assessment of the economic outlook (Nakamura and Steinsson, 2018). In a seminal study, Lucca and Moench (2015) demonstrate that the stock market experiences large excess returns in anticipation of monetary policy decisions made at scheduled FOMC meetings.1 They point out that the pre-FOMC announcement drift is difficult to explain. Follow-up studies focus on the role of information signals prior to FOMC announcements in resolving uncertainty. These signals can take the form of informal communications from Fed officials to the public, or information leakage (Ai and Bansal, 2018; Bernile, Hu and Tang, 2016; Cieslak, Morse and Vissing-Jorgensen, 2019; Hu et al., 2022; Kurov et al., 2019). The magnitude of the drift has recently declined (Lucca and Moench, 2018), mainly occurring ahead of FOMC announcements that are associated with a press conference (PC), thereby highlighting the potential role of investors' attention (Boguth, Grégoire and Martineau, 2019).

In this paper, we examine the pre-FOMC announcement drift at the stock level by analysing lottery-like and non-lottery stocks. Kumar (2009) defines lottery-like stocks as those offering ‘a tiny probability of a huge reward and a large probability of a small loss’.2 An extensive literature documents that investors with speculative preferences concentrate their trading in stocks with lottery features, such as high idiosyncratic skewness (An et al., 2020; Bali, Cakici and Whitelaw, 2011; Bali et al., 2017). In order to speculate on the pre-FOMC announcement drift, stock investors must trade individual stocks that are feasible for trading and can benefit the most. We conjecture that investors' propensity to speculate, triggered by the resolution of uncertainty and associated reduction in investors' fear, increases in the window preceding the FOMC announcement. Since lottery-like stocks as speculative assets have the potential for extraordinarily high returns, we postulate that investors are incentivized to invest in lottery-like stocks prior to the FOMC announcements. In line with this rationale, the strong demand for lottery-like stocks in the pre-FOMC announcement window at the time when investors are less fearful, which we deem as ‘flight-to-lottery’, should push up their prices, hence generating the return differential between lottery-like and non-lottery stocks. We start our empirical analysis by categorizing US stocks in portfolios defined by the lottery characteristic, and then evaluate the performance of these portfolios, as well as the demand for lottery stocks, over the pre-FOMC window. Our evidence is novel and highlights that there is higher demand for lottery stocks in the pre-FOMC window, when the investors' fear gauge is lower, together with higher realized skewness and higher returns for lottery stocks. Moreover, our findings identify the key role of transient institutional investors, and cannot be explained on the basis of firm characteristic risks and common risk factors.

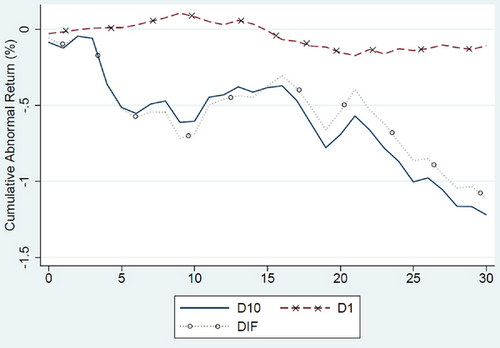

Our sample period is from September 1994 to December 2021, including 131 FOMC announcements before March 2011 and 56 announcements accompanied by PCs after then. To identify lottery-like and non-lottery stocks, we employ five lottery feature proxies following previous studies: high expected idiosyncratic skewness (Boyer, Mitton and Vorkink, 2010; Kumar, 2009), high idiosyncratic volatility (Ang et al., 2006; Kumar, 2009), high maximum daily return (Bali, Cakici and Whitelaw, 2011; Bali et al., 2017), low stock price (Kumar, 2009; Liu et al., 2020) and a high Z-score, which is the composite index of the previous four measures (Liu et al., 2020). As shown in Figure 1, we find that the pre-FOMC announcement drift of the average SPX constituents with the most (least) lottery features is greater (lower) than the drift of the average SPX constituents.3 This graphical evidence suggests that, to a certain extent, the trading of lottery-like stocks drives the pre-FOMC announcement drift documented by Lucca and Moench (2015).

Based on each of the above lottery features' NYSE breakpoints measured at the end of the month prior to the FOMC announcements, we sort stocks into ten decile portfolios from D1 to D10. Stocks in D10 are lottery-like stocks, while stocks in D1 are non-lottery stocks. To examine the potential implications of a preference for lottery-like stocks in the run-up to FOMC announcements, we compare the performance of portfolios D1 and D10 in the relevant windows. To rule out the impact of potential information leakage before the FOMC announcements, our pre-FOMC announcement windows start at the end of the previous day (t) and end 10 min before the scheduled FOMC announcement on day t.4 Econometric estimates reveal that, on average, the value-weighted returns on D10 increase 29.3–47.9 bps for all five lottery proxies during the pre-FOMC announcement windows. In addition, the positive pre-FOMC announcement drifts of D10 are larger than those of the corresponding D1. Further, neither the pre-FOMC announcement drift of lottery-like stocks nor the spread of the drifts between lottery-like and non-lottery stocks reverts in the 5-day window after the announcements.

In the above portfolio analyses, we do not explicitly control for firm characteristics associated with stock risk profiles. A risk-based explanation of our finding could be that investors view the FOMC announcements as high risk and uncertainty events, so they command compensation for holding stocks with greater risk. To control for firm characteristics that influence the risk–return tradeoff, we adopt Fama and MacBeth (1973) regressions and control for firm size, book-to-market, momentum, liquidity (Amihud, 2002), the sensitivity of stock returns to monetary policy announcement surprises (Ai et al., 2022), capital asset pricing model (CAPM) beta, economic uncertainty beta (Bali, Brown and Tang, 2017) and volatility beta (Ang et al., 2006). The pre-FOMC announcement drift of lottery-like stocks and its persistence during the 5-day post-FOMC announcement window remain robust. Our findings suggest that the higher returns on lottery-like stocks before the announcements cannot be explained by the risks associated with firm characteristics and common risk factors.

To the extent that buy and sell order imbalance reflects investors' trading preferences, we expect to see a distinctive difference between the lottery-like and non-lottery stocks, as well as between FOMC announcement days and the other trading days. We first investigate whether investors have a stronger preference for lottery-like stocks ahead of the FOMC announcements. Using daily transaction data, we find that the buy and sell order imbalance of lottery-like stocks is larger during the pre-FOMC announcement windows than the other trading days. Further, the increases in the order imbalance of lottery-like stocks are higher than those of non-lottery stocks. These results support the notion that stronger demand for lottery-like stocks ahead of the FOMC announcements drives up their prices.

Next, we analyse whether the flight-to-lottery phenomenon is driven by retail investors or institutional investors. Popular press and academic studies often view retail investors as behavioural noise traders and institutional investors as rational arbitrageurs. Previous studies suggest that retail investors are more attracted to lottery-like stocks than institutional investors, and their lottery preference leads to the overvaluation of lottery-like stocks (e.g. Kumar, 2009; Liu et al., 2020). Therefore, it could be the case that retail investors' preference for speculative assets drives up the price of lottery-like stocks ahead of the FOMC announcements. However, institutional ownership in the US stock market exceeded 50% in 1994 and was more than 70% at the end of our sample period in 2017.5 Thus, betting on lottery-like stocks is not necessarily a phenomenon driven by retail investors.

To this end, we focus on a subsample period from September 1994 to December 2000, during which we can identify the orders most likely made by retail investors. Our order imbalance results remain robust in the subsample. However, we do not find evidence that the retail order imbalance over the pre-FOMC announcement windows is larger for lottery-like stocks than for non-lottery stocks. Our finding indicates that FOMC announcement events tend to grab institutional investors' rather than retail investors' attention. Consistent with our findings based on transaction data, we further show that the pre-FOMC announcement drift of lottery-like stocks and the spread of the pre-FOMC announcement drifts between lottery-like and non-lottery stocks are larger among firms with higher transient and quasi-index institutional ownership (Bushee, 1998). This evidence suggests that the trading of institutional investors with short-term trading strategies plays an important role in the flight-to-lottery phenomenon.

The previous literature on the lottery anomaly shows that such a standard lottery trading portfolio, taking a long position on non-lottery stocks and a short position on lottery-like stocks, generates a positive alpha after adjusting for Fama and French's (1993) three factors and Carhart's 1997 momentum factor. Given that the spread of the pre-FOMC announcement drifts between lottery-like and non-lottery stocks is positive, we construct a refined lottery trading strategy by reverting the betting-against-lottery strategy during the pre-FOMC announcement windows but keeping the standard lottery trading portfolio unchanged during the other trading days. The refined lottery trading portfolio generates a significantly higher four-factor alpha than the standard lottery trading portfolios. Our refined lottery trading strategy indicates a profitable trading strategy (before transaction costs) for investors before the FOMC announcements.

In line with the conceptual framework outlined above, our evidence highlights the critical features of the market environment in which the propensity to speculate is higher ahead of the FOMC announcements. First, we examine whether the flight to lottery before the FOMC announcements creates financial gains for investors. If investors, especially institutional investors with short-term trading strategies, consistently bet on lottery-like stocks ahead of the FOMC meetings, they have to believe that the FOMC announcements could potentially bring these stocks a non-zero probability of high returns. Indeed, we find that lottery-like stocks have higher realized skewness, compared to non-lottery stocks, during the pre-FOMC announcement windows.

Second, we adopt the option implied volatility index (VIX) as our proxy for the investors' fear at the market level. We show that there is a larger decrease in the VIX ahead of the FOMC announcements than over the other trading days. Furthermore, this decline in investors' fear is more beneficial for the lottery-like stocks during the pre-FOMC announcement windows. Specifically, we regress portfolio returns of lottery-like and non-lottery stocks on the change in the VIX and find that the larger the decrease in investors' fear, the higher the pre-announcement drift of lottery-like stocks.

Our paper contributes to a strand of studies on investors' reactions to the announcements of new information. For example, Chang, Wu and Wong (2010) find that firms with more family control ownership experience significantly more negative stock market reactions to innovation announcements. Gregory et al. (2013) show that markets initially under-react to directors' trades in their own companies' shares but recognize that female executives' trades are informative in the long run. Chen and Chang (2020) study whether the group diversification and ownership structure of business groups influence intra-group spillover effects. They find that the stock price reactions of the announcing firms are positively associated with both the stock price reactions of their non-announcing group peers. Our paper highlights that investors' risk preference changes before the FOMC announcements, and more importantly, institutional and retail investors react to monetary policy information differently.

Our paper is related to the work of Liu et al. (2020), which shows that lottery-like stocks outperform non-lottery stocks before earnings announcements. By contrast, we find that, with respect to the monetary policy news which exerts market-wide impact, the pre-FOMC announcement drift of lottery-like stocks is persistent during the 5-day post-FOMC announcement period, while Liu et al. (2020) document an immediate reversal of the return spread between lottery-like and non-lottery stocks during the post-earnings announcement periods. It is important to emphasize that our findings only indicate that there is no short-term reversal of the pre-FOMC announcement drift of lottery-like stocks. The reversal of the pre-FOMC announcement drift of lottery-like stocks in the long term is inevitable due to the evidence in the literature that lottery-like stocks underperform non-lottery stocks on average. Liu et al. (2020) also show that the pre-earnings announcement drift of lottery-like stocks is only driven by retail investors, while our paper finds that the pre-FOMC announcement drift of lottery-like stocks is mainly driven by institutional investors. Previous studies on lottery-like stocks often attribute the lottery anomaly to the speculation of retail investors, while our paper shows that institutional investors also exhibit lottery preference in the face of monetary policy shocks. The findings of Liu et al. (2020) and our paper suggest that firm-level information events, such as earnings announcements, are related to individual stocks and are easy to process directly by retail investors, while market-level economic news announcements, such as FOMC announcements, are more likely to have implications for institutional investors. In a highly institutionalized US stock market, retail investors are not the only investors whose trading leads to stock return anomalies (e.g. Cao, Han and Wang, 2017; Edelen, Ince and Kadlec, 2016).

Implications for management practice

Our findings provide significant insights to corporate managers. The incentive of managers to deliver positive stock price growth to shareholders has been extensively studied both theoretically and empirically. It can arise due to many factors, including shareholder pressure and personal wealth concerns of the managers, linked to performance evaluation and compensation. While there is an ongoing debate about whether performance-related compensation is effective in aligning the interests of managers and shareholders, or rather complicates the agency problem,6 positive stock price growth is welcomed by all corporate stakeholders. Moreover, stock price appreciation can lead to higher investment, through various channels that include managerial overconfidence, as well as a higher propensity for mergers and acquisitions (M&As) and share buybacks.7 Hence, a multitude of key corporate decisions and relationships, as well as the personal wealth of the managers, are affected by developments in the stock price of the firm. Importantly, these arguments imply that several adverse outcomes may materialize if managers wrongly extrapolate longer-term developments from short-term trends in stock prices. In particular, and related to our findings, managers of lottery-type firms may observe the significant stock price appreciation in the run-up to FOMC announcements and form a belief that this positive trend may sustain in the longer term. This can arise from an overestimation of their contribution to the firm's positive stock returns and their ability to keep the stock price rising, and can lead to overinvestment, among other important outcomes. We should stress that the pre-FOMC positive stock price drift is likely to grab the attention of managers, since it is not only statistically significant but also economically important. Moreover, FOMC announcements are key dates in the calendar of business and finance executives, and occur relatively frequently (eight scheduled meetings per year). As Lucca and Moench (2015) highlight, at the market level, 80% of annual realized excess stock returns in their sample are accounted for by the pre-FOMC announcement drift. Our results show that the potential overconfidence of lottery firms' managers, based on the pre-FOMC trend, would be largely unfounded, since the short-term positive stock drift reverses in the longer term.

A recent strand of literature examines how monetary policy influences corporate managers' decisions. Gallo, Hann and Li (2016) find that aggregate firm earnings convey information about monetary policy, and the market reacts negatively to policy surprises, which leads to a negative relation between aggregate earnings and stock returns. Armstrong, Glaeser and Kepler (2019) find that accounting quality moderates firms' equity market response and future investment sensitivity to unexpected changes in monetary policy. Adra, Barbopoulos and Saunders (2020) show that an increase in the federal funds rate is associated with a lower M&A announcement return, a higher probability of deal withdrawal and more financing challenges for acquirers. Ottonello and Winberry (2020) show that firms with lower default risk are more responsive to monetary shocks. A gap in the previous studies is that the impact of monetary policy on corporate activities may depend on market reaction to the changes in monetary policy. Our paper helps to fill the gap by showing how the stock prices of firms with different characteristics may react differently before FOMC announcements.

Data and variables

Sample selection

The sample examined in this paper includes US public firms from September 1994 to December 2021. After February 1994, the FOMC started announcing its federal funds rate target, which reduces virtually all of the timing ambiguity associated with the rate changes (Bernanke and Kuttner, 2005).8 Lucca and Moench (2015) find that the pre-FOMC announcement drift of the SPX is more pronounced during the post-1994 period. There are 218 scheduled FOMC announcements in our sample period. Following Lucca and Moench (2015), we exclude two outlier announcements on 26 June 2002 and 28 January 2009 that have the most extreme negative and positive pre-FOMC announcement returns on the SPX, respectively, in our sample.

Among the remaining 216 FOMC meetings, the announcement dates and time stamps of news reports are available on the Federal Reserve Board's website. To examine the pre-FOMC announcement stock return drift, we collect the intra-day price data of the SPX and VIX from tick data and the intra-day stock price and order data of firms listed on the NYSE, AMEX and NASDAQ from the Trade and Quote (TAQ) database.9 Daily stock price, market value, trading volume and SPX component data are extracted from the Center for Research in Security Prices (CRSP). We include only common stocks, and drop observations with stock prices less than $1. Stock book value of equity data are obtained from Compustat. The FOMC PC data and daily VIX data are obtained from the Federal Reserve Bank of St. Louis' website. The return data of Fama and French's (1993) three factors (market excess return (RMRF), size factor (SMB) and value factor (HML)) and the daily rates on 1-month T-bills are obtained from Kenneth R. French's data library. Carhart's 1997 momentum factor (UMD) return data are collected from Wharton Research Data Services (WRDS). Firm institutional ownership data are from the Thomson Financial 13F database; institutional investor-type data are from Brian Bushee's website.

Table 1 provides summary statistics on the key variables (at the stock-month level) used in our empirical analysis. Since most of our analysis refers to stock returns and their summary statistics, we omit a detailed discussion of daily stock returns here and instead refer interested readers to the table.

| Variables | Obs. | Mean | SD | Min | P1 | P99 | Max |

|---|---|---|---|---|---|---|---|

| Expskew | 826,935 | 0.421 | 0.806 | −213.663 | −0.461 | 3.258 | 249.653 |

| Idvol | 1,150,779 | 0.033 | 0.021 | 0.003 | 0.009 | 0.102 | 0.811 |

| Maxret | 1,541,707 | 0.077 | 0.100 | −0.114 | 0.008 | 0.399 | 10.252 |

| Prc | 1,533,669 | −36.187 | 1890.685 | −436,000.000 | −167.030 | −1.130 | −1.000 |

| Z-score | 1,539,313 | 5.524 | 2.337 | 1.000 | 1.250 | 10.000 | 10.000 |

| Ln(Size) | 1,284,611 | 13.120 | 1.932 | 8.198 | 9.397 | 18.109 | 19.506 |

| Ln(BTM) | 1,206,758 | −0.795 | 0.874 | −4.352 | −3.456 | 0.858 | 0.947 |

| MOM(−1, −0) | 1,277,561 | −0.003 | 0.157 | −2.670 | −0.508 | 0.379 | 4.365 |

| MOM(−12, −1) | 1,187,709 | 0.064 | 0.482 | −3.742 | −1.200 | 1.552 | 5.768 |

| MOM(−36, −12) | 1,024,954 | 0.089 | 0.641 | −6.400 | −1.671 | 1.915 | 6.980 |

| Illiq | 1,284,432 | 0.000 | 0.002 | 0.000 | 0.000 | 0.001 | 0.030 |

| Beta | 1,170,232 | 1.074 | 0.865 | −26.745 | −0.456 | 3.800 | 22.601 |

| Beta | 1,096,932 | 3.727 | 165.414 | −9144.753 | −388.138 | 434.588 | 21,585.460 |

| Beta | 1,280,793 | 0.026 | 1.301 | −70.123 | −3.454 | 3.627 | 211.035 |

| Institutional ownership | 1,235,534 | 0.514 | 0.310 | 0.000 | 0.000 | 1.000 | 1.000 |

| Transient institutional ownership | 1,108,954 | 0.127 | 0.401 | 0.000 | 0.000 | 0.509 | 1.000 |

| Quasi-indexer ownership | 1,161,057 | 0.296 | 1.174 | 0.000 | 0.001 | 0.841 | 1.000 |

- This table reports the summary statistics of the key variables (at the stock-month level) used in our main empirical analyses. The sample period is from September 1994 to December 2021. The number of observations, mean, standard deviation, minimum, 1st percentile, 99th percentile and maximum are reported from left to right, in sequence for each variable.

Lottery proxies

To gauge the lottery feature of stocks, we follow previous studies on lottery-like stocks and construct the following five measures: expected idiosyncratic skewness (Expskew); idiosyncratic volatility (Idvol); maximum daily return (Maxret); stock price (Prc); and a composite Z-score based on the previous four lottery proxies. Stocks with a higher value of these five measures are more like lotteries.

Expskew: Kumar (2009) suggests that gamblers perceive high idiosyncratic skewness as a lottery feature. Using a cross-sectional model to estimate expected idiosyncratic skewness, Boyer, Mitton and Vorkink (2010) also find a negative relation between it and future stock returns. We adopt Boyer, Mitton and Vorkink's (2010) method (model 6 of table 2, p. 179) and calculate expected idiosyncratic skewness (Idskew) as our first measure of the lottery feature.

| SPX | |||

|---|---|---|---|

| LM's sample | Full sample | Full sample (PC) | |

| (1) | (2) | (3) | |

| 0.317*** | 0.220*** | 0.255*** | |

| −5.74 | (5.03) | (5.40) | |

| Intercept | 0.014 | 0.026* | 0.026* |

| −0.71 | (1.75) | (1.76) | |

| Obs. | 4174 | 6881 | 6881 |

| No. FOMC | 131 | 216 | 187 |

- This table presents the OLS regression results of Equation (1). The sample periods are from September 1994 to March 2011 (Lucca and Moench's (2015) sample, LM) in column (1) and from September 1994 to December 2021 in columns (2) and (3). The dependent variable is the log excess returns on the SPX from the close on day to 10 min before FOMC announcements on day for FOMC announcement days, and the close-to-close daily log excess returns on the SPX for non-announcement days. In columns (1) and (2), is equal to 1 on FOMC announcement days, and 0 otherwise. In column (3), is equal to one on the FOMC announcement days before March 2011 and on the FOMC announcement days after March 2011 which are accompanied by press conferences (PC), and 0 otherwise. The t-statistics reported in parentheses are calculated using the heteroscedasticity-consistent standard errors (White, 1980).

- , and denote statistical significance at the 1%, 5% and 10% levels, respectively.

Idvol: Ang et al. (2006) document a negative relation between idiosyncratic volatility and future stock returns. Kumar (2009) indicates that stocks with higher idiosyncratic volatility are more attractive to investors with gambling preferences. Following Kumar's (2009) method, we calculate idiosyncratic volatility (Idvol) as the standard deviation of the residual obtained by fitting a four-factor model to the time series of daily stock returns over the past 60 months. The four factors employed are Fama and French's (1993) three factors (RMRF, SMB and HML) and Carhart's 1997 momentum factor (UMD). When calculating Idvol, we require that a minimum of 36 valid monthly returns be used in the regression. Idvol is our second measure of the lottery feature.

Maxret: Bali, Cakici and Whitelaw (2011) find that a stock's maximum daily returns over a month are negatively associated with its future returns. They also find that the negative relation between idiosyncratic volatility and returns documented by Ang et al. (2006) is often reversed after controlling for maximum daily returns. Given that large maximum daily stock returns are like lottery payoffs, Bali, Cakici and Whitelaw (2011) conjecture that the negative relation between maximum daily returns and future returns is due to investors' preference for lottery-like stocks. Following their study, we adopt maximum daily stock returns within a calendar month (Maxret) as our third measure of the lottery feature.

Prc: Kumar (2009) suggests that speculators in a stock market are likely to extrapolate past extreme stock return events into the future, especially when the associated stocks happen to have low prices and high volatility. Given that speculators tend to be attracted to stocks with low prices in the hope of getting positive returns, we follow Liu et al. (2020) and use a stock's closing price, as our fourth measure of the lottery feature. To be consistent with the other four lottery proxies, we define Prc as the negative value of closing prices, so that stocks with a higher Prc are more lottery-like.

Z-score: Following Liu et al. (2020), we construct a monthly composite lottery measure Z-score, based on the rankings of Expskew, Idvol, Maxret and Prc. Each month, we calculate a stock's decile ranking based on each one of the four lottery measures. Stocks with a score of 10 (1) are the most (least) lottery-like stocks. We calculate Z-score as the average of the scores over the four lottery measures. We define Z-score as missing in a given month if more than two lottery measures are not available in the month.

Measurement of the demand for lottery-like stocks

Following Kumar (2009), we use buy and sell order imbalance to measure the change in investors' demand for lottery-like and non-lottery stocks. On FOMC announcement days, we calculate a portfolio's aggregate buyer-initiated (seller-initiated) dollar trading volume as the summation of the buyer-initiated (seller-initiated) dollar trading volume of all stocks in the portfolio, from the market close on day t to 10 min before the FOMC announcement on day t. On non-announcement days, a portfolio's aggregate buyer-initiated and seller-initiated dollar trading volumes are calculated from the market close on day t to the market close on day t. A trade is defined as buyer-initiated (seller-initiated) if the transaction price is above (below) the midpoint of the recent (the previous second) bid–ask quotes (Lee and Ready, 1991). If a transaction price is equal to the midpoint, we define the trade as buyer-initiated (seller-initiated) if the trade price is above (below) the most recent executed transaction price. To calculate the aggregate daily order imbalance () of a portfolio, we scale the difference in the aggregate buyer-initiated and seller-initiated dollar trading volume by the summation of the aggregate buyer-initiated and seller-initiated dollar trading volume.

In the calculation of , we do not differentiate orders by their size. Kumar (2009) shows that lottery preferences are more prominent among retail investors. To differentiate the preference between institutional investors and retail investors, we follow Yuan (2015) and estimate retail order imbalance (). Specifically, we consider only small-sized buy and sell trades that are less than $10,000 (in 1991 dollar value). Since institutional investors have commonly broken down their large orders into small ones to reduce transaction costs in recent years (Barber, Odean and Zhu, 2009; Yuan, 2015), we only calculate from September 1994 to December 2000 so that the accuracy of identifying trades initiated by retail investors is not undermined.

Econometric models and main results

Pre-FOMC announcement drift at the market level

In column (1) of Table 2, we replicate the specification and sample period in Lucca and Moench (2015) and obtain results that are very similar to theirs. Specifically, β is positive and statistically significant, suggesting that the mean log excess return on the SPX is 31.7 bps higher on 131 pre-FOMC announcement windows than the other non-announcement daily windows. The sum of β and β is equal to 33.1 bps, which is very close to the 33.5 bps reported in column (5) of table 2 of Lucca and Moench (2015) (p. 340).11 These results confirm the data of our FOMC announcement dates and regression specification.

In column (2) of Table 2, we examine the pre-FOMC announcement drift using our full sample with 216 FOMC announcements. β remains positive and statistically significant, but the economic impact drops from 31.7 bps in column (1) to 22.0 bps in column (2). After April 2011, the Chairman of the FOMC started to hold a PC at every other FOMC meeting. In the meetings with a PC, the FOMC releases a summary of its members' economic projections (SEP).12 The decrease in β from column (1) to column (2) is consistent with Lucca and Moench (2018) and Boguth, Grégoire and Martineau (2019), who find that the positive drift of the SPX is mainly observed ahead of FOMC announcements for meetings with a PC, while there is no evidence of excess returns ahead of FOMC announcements for meetings without a PC. One potential explanation is that investors pay more attention to scheduled announcements with a PC, since the SEP material is only released at the beginning of PCs (Boguth, Grégoire and Martineau, 2019; Lucca and Moench, 2018).

In column (3) of Table 2, we redefine to be equal to 1 on FOMC announcement days before March 2011 and on FOMC announcement days with a PC after March 2011, and 0 otherwise. The number of effective FOMC announcements decreases from 216 in column (2) to 187 in column (3). After dropping FOMC announcement days without a PC from the sample period after March 2011, β increases from 22.0 bps in column (2) to 25.5 bps in column (3).

Next, we examine whether there exists a difference in the pre-FOMC announcement drifts between lottery-like and non-lottery stocks in the SPX with an intraday second-by-second event study. At the end of each month, we sort all stocks listed on the NYSE, AMEX and NASDAQ into ten decile portfolios based on Z-score. Fama and French (2008) point out that microcap stocks comprise about 60% of US market stocks, but on average only account for 3% of market capitalization. They also show that microcap stocks tend to disproportionately inhabit anomaly long–short portfolios because the cross-sectional dispersion of anomaly variables is the highest among microcap stocks. To mitigate the impact of microcap stocks on our empirical results, we exclude the stocks with prices below $1 from our sample, as in Liu et al. (2020). Hou, Xue and Zhang (2020) also show that after mitigating the impact of microcaps via NYSE breakpoints and value-weighted returns, 65% of the 452 anomalies are not statistically significant at the 5% level. Following Hou, Xue and Zhang (2020), we use the NYSE breakpoints to construct decile portfolios.13 Stocks in decile portfolio 10 (D10) have the most lottery-like stock features and stocks in decile portfolio 1 (D1) have the least lottery-like stock features.

We calculate the average cumulative returns on the SPX constituents, lottery-like stocks in the SPX constituents and non-lottery stocks in the SPX constituents during the days of the scheduled FOMC announcements. We take the SPX constituents as lottery-like stocks if they are in D8, D9 and D10, and take the SPX constituents as non-lottery stocks if they are in D1, D2 and D3. On average, 70 (223) out of 500 stocks are defined as lottery (non-lottery) stocks across the FOMC meetings. Figure 1 shows that over Lucca and Moench's (2015) sample period, the pre-FOMC announcement drift of the average SPX constituents in D8, D9 and D10 is greater than the drift of the average SPX constituents, while the drift of the average SPX constituents in D1, D2 and D3 is lower than the drift of the average SPX constituents.

Pre-FOMC announcement drift at the stock level: Lottery-like versus non-lottery stocks

The results in Table 2 and Figure 1 show that there exists a positive pre-FOMC announcement drift of the SPX in our sample, and the drift is more prominent for the SPX constituents with lottery feature than those without lottery feature. We then proceed to compare the pre-FOMC announcement drifts of lottery-like stocks to those of non-lottery stocks for all stocks in our sample.14

Portfolio analyses. We sort all stocks listed on the NYSE, AMEX and NASDAQ into ten decile portfolios using the end-of-prior-month data of our five lottery feature measures. We exclude the stocks with prices below $1 from our sample. Stocks in decile portfolio 10 (D10) have the most lottery-like stock features and stocks in decile portfolio 1 (D1) have the least lottery-like stock features. For each decile portfolio, we calculate its value-weighted daily log excess returns over the 1-month T-bill rate, as recommended by Hou, Xue and Zhang (2020).15

Next, we replace the log excess return on the SPX by the log excess returns on our lottery-sorted decile portfolios, and re-estimate Equation (1). Columns (1)–(10) of Table 3 report β and β for ten decile portfolios. In column (11), the dependent variable is the log excess return on a portfolio that takes a long position on the corresponding D10 and a short position on the corresponding D1. For all five lottery proxies, we find a consistent pattern that β increases almost monotonically from D1 to D10, suggesting that the positive pre-FOMC announcement drift is stronger for lottery-like stocks than non-lottery stocks. Column (11) shows that β of the long–short portfolios (D10−D1) are positive and statistically significant. For example, in Panel E we sort stocks by Z-score, β is 0.468 with t-statistics equal to 4.63 for D10, while β is with t-statistics equal to for D1. β of D10−D1 is 0.485 with t-statistics equal to 4.46, suggesting that the mean log excess return on D10−D1 is 48.5 bps higher on pre-FOMC announcement windows than the other non-announcement daily windows. Portfolios formed on the other four measures display similar patterns. Specifically, the spreads of the positive pre-FOMC announcement drifts between D10 and D1 are 0.340%, 0.368%, 0.415% and 0.227% for Expskew, Idvol, Maxret and Prc, respectively, suggesting that lottery-like stocks have a higher pre-FOMC announcement drift than non-lottery stocks. The magnitude of β varies across the five lottery feature measures, which reflects the different natures of these measures.16

| D1 | D2 | D3 | D4 | D5 | D6 | D7 | D8 | D9 | D10 | D10D1 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) |

| Panel A. Proxy=Expskew | |||||||||||

| 0.115 | 0.052 | 0.184*** | 0.191*** | 0.177*** | 0.215*** | 0.298*** | 0.237*** | 0.370*** | 0.456*** | 0.340*** | |

| (1.54) | (0.66) | (3.02) | (2.98) | (3.13) | (3.62) | (4.38) | (3.19) | (4.96) | (5.38) | (3.99) | |

| Intercept | 0.048*** | 0.045*** | 0.050*** | 0.048*** | 0.051*** | 0.053*** | 0.045** | 0.042** | 0.039* | 0.033 | −0.015 |

| (3.30) | (3.26) | (3.53) | (3.17) | (3.26) | (3.25) | (2.57) | (2.10) | (1.91) | (1.45) | (−0.86) | |

| Panel B. Proxy=Idvol | |||||||||||

| 0.073 | 0.119** | 0.150** | 0.176** | 0.272*** | 0.229*** | 0.312*** | 0.323*** | 0.433*** | 0.441*** | 0.368*** | |

| (1.03) | (1.99) | (2.29) | (2.28) | (4.01) | (2.82) | (4.19) | (3.70) | (5.26) | (4.90) | (3.76) | |

| Intercept | 0.044*** | 0.044*** | 0.044*** | 0.043*** | 0.065*** | 0.042** | 0.040** | 0.042** | 0.062*** | 0.051** | 0.006 |

| (3.36) | (3.13) | (2.92) | (2.81) | (3.75) | (2.38) | (2.13) | (2.03) | (2.71) | (2.10) | (0.35) | |

| Panel C. Proxy=Maxret | |||||||||||

| −0.021 | 0.104** | 0.151*** | 0.212*** | 0.247*** | 0.248*** | 0.217*** | 0.259*** | 0.413*** | 0.394*** | 0.415*** | |

| (−0.21) | (2.03) | (2.89) | (3.01) | (4.04) | (3.27) | (2.71) | (2.89) | (4.58) | (3.88) | (3.20) | |

| Intercept | 0.050*** | 0.052*** | 0.048*** | 0.047*** | 0.044*** | 0.043** | 0.040** | 0.041** | 0.041* | 0.032 | −0.018 |

| (4.54) | (3.92) | (3.50) | (3.11) | (2.69) | (2.51) | (2.16) | (2.04) | (1.81) | (1.24) | (−0.83) | |

| Panel D. Proxy=Prc | |||||||||||

| 0.108* | 0.203*** | 0.272*** | 0.278*** | 0.259*** | 0.261*** | 0.299*** | 0.360*** | 0.327*** | 0.335*** | 0.227** | |

| (1.73) | (4.02) | (5.00) | (5.10) | (4.43) | (3.93) | (4.23) | (3.07) | (4.10) | (3.35) | (2.26) | |

| Intercept | 0.045*** | 0.049*** | 0.038** | 0.039** | 0.042*** | 0.041** | 0.048*** | 0.046** | 0.042** | 0.055** | 0.010 |

| (3.04) | (3.45) | (2.52) | (2.49) | (2.63) | (2.39) | (2.59) | (2.29) | (1.99) | (2.48) | (0.65) | |

| Panel E. Proxy=Z-score | |||||||||||

| −0.017 | 0.168*** | 0.138** | 0.246*** | 0.266*** | 0.296*** | 0.309*** | 0.407*** | 0.489*** | 0.468*** | 0.485*** | |

| (−0.23) | (3.35) | (2.18) | (3.57) | (4.07) | (4.02) | (4.03) | (4.66) | (5.36) | (4.63) | (4.46) | |

| Intercept | 0.051*** | 0.044*** | 0.053*** | 0.042*** | 0.051*** | 0.045** | 0.049** | 0.034 | 0.043* | 0.032 | −0.018 |

| (4.14) | (3.30) | (3.59) | (2.63) | (2.89) | (2.39) | (2.38) | (1.46) | (1.79) | (1.26) | (−0.90) | |

- This table presents the OLS regression results of Equation (1) based on the returns of lottery-sorted decile portfolios. For brevity, we only report the coefficients of and the intercept. The sample period is from September 1994 to December 2021, which includes 187 FOMC meetings and trading days. We adopt the lottery proxies' NYSE breakpoints in our portfolio construction. At the beginning of each month, stocks are sorted into ten value-weighted decile portfolios based on each of our five lottery proxies. Stocks in decile portfolio 10 (D10) have the most lottery-like features and stocks in decile portfolio 1 (D1) have the least lottery-like features. Stocks with prices below $1 are excluded from our analyses. In columns (1)–(10), the dependent variable is the log excess returns on the lottery-sorted decile portfolios from the close on day to 10 min before FOMC announcements on day for FOMC announcement days, and the close-to-close daily log excess returns on the lottery-sorted decile portfolios for non-announcement days. Column (11) reports the coefficients of for corresponding portfolios that take a long position on D10 and a short position on D1. is equal to 1 on the FOMC announcement days before March 2011 and on the FOMC announcement days after March 2011 which are accompanied by press conferences, and 0 otherwise. The t-statistics reported in parentheses are calculated using the heteroscedasticity-consistent standard errors (White, 1980).

- , and denote statistical significance at the 1%, 5% and 10% levels, respectively.

Table 4 shows that the coefficients of Proxy are all positive and statistically significant. Consistent with the results in our portfolio analyses, stocks with lottery-like features have higher pre-FOMC announcement returns than non-lottery like stocks, after controlling for a set of firm characteristics. Taken together, our results based on both the portfolio analyses and Fama–MacBeth regressions suggest that the pre-FOMC announcement drift is stronger among lottery-like stocks than non-lottery stocks.

| Proxy | Expskew | Idvol | Maxret | Prc | Z-score |

|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | |

| Proxy | 0.181* | 6.807*** | 1.200*** | 0.002*** | 0.034*** |

| (1.71) | (2.83) | (2.69) | (3.01) | (3.46) | |

| Ln(Size) | −0.027** | −0.009 | −0.024** | −0.013 | −0.004 |

| (−2.05) | (−0.74) | (−2.00) | (−1.06) | (−0.29) | |

| Ln(BTM) | 0.014 | 0.014 | 0.002 | −0.006 | 0.006 |

| (0.78) | (0.76) | (0.09) | (−0.30) | (0.36) | |

| MOM(−1, −0) | −0.402*** | −0.353*** | −0.469*** | −0.340*** | −0.425*** |

| (−3.33) | (−3.03) | (−3.48) | (−2.92) | (−3.44) | |

| MOM(−12, −1) | −0.091* | −0.118*** | −0.090** | −0.056 | −0.064 |

| (−1.94) | (−2.65) | (−2.08) | (−1.33) | (−1.46) | |

| MOM(−36, −12) | −0.037 | −0.028 | −0.015 | 0.012 | −0.009 |

| (−1.38) | (−1.10) | (−0.61) | (0.51) | (−0.35) | |

| Illiq | −18.186*** | −17.902*** | −16.416*** | −14.849*** | −17.108*** |

| (−4.70) | (−4.89) | (−4.55) | (−4.19) | (−4.67) | |

| Beta | 0.130*** | 0.120*** | 0.137*** | 0.150*** | 0.114*** |

| (3.47) | (3.52) | (4.10) | (4.18) | (3.47) | |

| Beta | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| (0.67) | (1.28) | (0.76) | (0.95) | (1.15) | |

| Beta | −0.008 | −0.001 | 0.003 | 0.004 | 0.003 |

| (−0.47) | (−0.04) | (0.15) | (0.21) | (0.17) | |

| Intercept | 0.491** | 0.159 | 0.419** | 0.366** | 0.044 |

| (2.36) | (0.76) | (2.30) | (2.02) | (0.22) | |

| Average adj. | 0.071 | 0.069 | 0.068 | 0.065 | 0.069 |

| Number of groups | 187 | 187 | 187 | 187 | 187 |

- This table presents the results of Fama-MacBeth regressions of Equation (2) based on the pre-announcement stock returns. The sample period is from September 1994 to December 2021, which includes 187 FOMC meetings. On each day of 187 FOMC announcements, we run a weighted least squares (WLS) regression of pre-announcement stock returns in excess of the SPX returns on lottery proxies and a list of lagged firm characteristics at the end of the previous month, with the weight being stock market capitalization. The time-series average of the regression coefficients is reported. Proxy is one of our five lottery measures. Ln(Size) is the natural log of market equity; Ln(BTM) is the natural log of book-to-market equity; MOM(−1, 0), MOM(−12, −1) and MOM(−36, −12) are the cumulative stock returns over the previous month, the previous year with a 1-month gap and the past 3 years with a 1-year gap, respectively; Illiq is Amihud's (2002) estimate of illiquidity; BetaCAPM is the CAPM beta estimated based on 60 monthly returns before the FOMC announcements; BetaδVIX is the loading on aggregate volatility risk (Ang et al., 2006); and BetaUNC is the loading on the economic uncertainty index (Bali, Brown and Tang, 2017). We winsorize all non-return independent variables at their cross-sectional 1st and 99th percentiles. Stocks with prices below $1 are excluded from our analyses. Huber-White standard errors (White, 1980) are adopted in the cross-sectional regressions. The time-series average of the cross-sectional regression t-statistics is reported in parentheses.

- , and denote statistical significance at the 1%, 5% and 10% levels, respectively.

Post-FOMC announcement drift of lottery-like stocks

We also examine whether the positive pre-FOMC announcement drift of lottery-like stocks reverses during the post-FOMC announcement periods. We repeat our portfolio analyses up to 4 days after the FOMC announcement. As reported in Tables A1 and A2 of our Online Appendix, there remains an absence of evidence that the positive pre-FOMC announcement drift of lottery-like stocks reverses during the 5-day post-FOMC announcement periods. Our results drawn from the post-FOMC announcement windows are consistent with Lucca and Moench (2015), who also find no evidence that the positive pre-FOMC announcement drift of the SPX reverses on the subsequent days after the FOMC announcements. But our results differ from those of Liu et al. (2020), who document positive lottery spreads before public firms' earnings announcements but negative lottery spreads during a 5-day period after earnings announcements. Since monetary policy shocks are market-wide whereas earnings announcements are firm-specific news, the economic intuition and underlying mechanism of lottery-like stocks' positive pre-FOMC announcement drift may be different from those of lottery-like stocks' positive pre-earnings announcement drift.

Previous studies show that non-lottery stocks outperform lottery-like stocks in the long term. Figure 2 presents the average cumulative abnormal returns on lottery-like stocks in our sample (D10, solid line), non-lottery stocks in our sample (D1, dashed line with cross) and their difference (D10−D1, dotted line with circle) during a 30-day period after the scheduled FOMC announcements.18 We observe that the average cumulative abnormal returns of stocks in D1 and D10 portfolios are very close to each other during the 5-day period after FOMC announcements. However, between day 5 and day 30 after FOMC announcements, non-lottery stocks do outperform lottery-like stocks. The average cumulative abnormal returns of stocks in D10−D1 are negative and exhibit a downward trend.

Institutional investors versus retail investors

We first study the trading orders of all investors during our full sample period from September 1994 to December 2021. Columns (1)–(3) of Table 5 compare the order imbalance, , between lottery-like and non-lottery stocks. Specifically, β of D10 is positive and statistically significant across all five lottery features. This finding suggests that there is a significantly higher buy-side order shock on lottery-like stocks during pre-FOMC announcement windows than the other trading days. β of D1 is also positive and statistically significant, except for the lottery feature Idvol. However, the differences in β between D10 and D1 are economically meaningful. Using Z-score as an example, the increase in the order imbalance of D10 during the pre-FOMC announcement windows is 2.7%, while it is only 0.9% for D1. Crucially, β of D10−D1 is positive and statistically significant, except for the lottery feature Prc, indicating that the increase in the spread between buy and sell orders from non-announcement days to announcement days is larger for lottery-like stocks than for non-lottery stocks. During non-announcement days, the demand for non-lottery stocks is generally higher than for lottery-like stocks, except for the lottery feature Prc, as indicated by β of D10−D1. Our evidence of stronger order imbalance on lottery-like stocks corroborates our findings on the outperformance of these stocks over the pre-FOMC announcement windows.

| OIB, 94–17 | OIB, 94–00 | ROIB, 94–00 | |||||||

|---|---|---|---|---|---|---|---|---|---|

| D1 | D10 | D10−D1 | D1 | D10 | D10−D1 | D1 | D10 | D10−D1 | |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) |

| Panel A. Proxy=Expskew | |||||||||

| 0.014*** | 0.032*** | 0.018*** | 0.020** | 0.061*** | 0.041*** | 0.031** | 0.025** | −0.006 | |

| (2.93) | (5.59) | (3.51) | (2.45) | (4.07) | (2.80) | (2.39) | (2.29) | (−0.37) | |

| Intercept | 0.031*** | 0.015*** | −0.015*** | 0.064*** | 0.019*** | −0.044*** | 0.059*** | 0.072*** | 0.013*** |

| (36.80) | (22.16) | (−18.77) | (31.81) | (9.17) | (−19.56) | (25.10) | (35.05) | (4.70) | |

| Panel B. Proxy=Idvol | |||||||||

| 0.006 | 0.034*** | 0.027*** | 0.000 | 0.065*** | 0.065*** | 0.015 | 0.028*** | 0.013 | |

| (1.34) | (6.32) | (4.84) | (0.03) | (5.34) | (4.64) | (1.43) | (3.00) | (1.15) | |

| Intercept | 0.031*** | 0.014*** | −0.018*** | 0.076*** | 0.013*** | −0.063*** | −0.006*** | 0.076*** | 0.082*** |

| (34.86) | (21.97) | (−19.55) | (38.97) | (7.67) | (−27.47) | (−3.10) | (41.48) | (36.43) | |

| Panel C. Proxy=Maxret | |||||||||

| 0.015*** | 0.031*** | 0.016*** | 0.028** | 0.058*** | 0.031* | 0.025*** | 0.030*** | 0.004 | |

| (3.36) | (6.16) | (3.01) | (2.35) | (5.01) | (1.82) | (2.84) | (3.37) | (0.42) | |

| Intercept | 0.018*** | 0.011*** | −0.007*** | 0.028*** | 0.014*** | −0.014*** | −0.034*** | 0.077*** | 0.111*** |

| (22.26) | (18.53) | (−8.07) | (14.00) | (8.25) | (−6.38) | (−17.62) | (42.35) | (50.74) | |

| Panel D. Proxy=Prc | |||||||||

| 0.024*** | 0.012*** | −0.012 | 0.052*** | 0.012 | −0.040*** | 0.049*** | 0.005 | −0.044*** | |

| (4.68) | (2.70) | (−1.47) | (5.72) | (1.13) | (−3.90) | (5.21) | (0.52) | (−3.99) | |

| Intercept | 0.030*** | −0.005*** | −0.035*** | 0.055*** | −0.036*** | −0.091*** | 0.133*** | 0.017*** | −0.116*** |

| (41.08) | (−7.09) | (−39.73) | (30.24) | (−22.12) | (−46.68) | (62.12) | (8.17) | (−46.95) | |

| Panel E. Proxy=Z-score | |||||||||

| 0.009** | 0.027*** | 0.017*** | 0.005 | 0.040*** | 0.035*** | 0.019* | 0.020** | 0.001 | |

| (2.00) | (5.63) | (3.47) | (0.60) | (3.83) | (3.31) | (1.74) | (2.23) | (0.11) | |

| Intercept | 0.032*** | 0.005*** | −0.027*** | 0.074*** | −0.012*** | −0.086*** | 0.027*** | 0.045*** | 0.019*** |

| (37.40) | (7.25) | (−29.97) | (41.98) | (−8.44) | (−43.83) | (13.47) | (24.96) | (7.96) | |

- This table presents the OLS regression results of Equations (3) and (4). For brevity, we only report the coefficients of and the intercept. At the beginning of each month, stocks are sorted into ten value-weighted decile portfolios based on each of our five lottery proxies. Stocks in decile portfolio 10 (D10) have the most lottery-like features and stocks in decile portfolio 1 (D1) have the least lottery-like features. Stocks with prices below $1 are excluded. In columns (1)–(3), the sample period is from September 1994 to December 2021, which includes 187 FOMC meetings and trading days. In columns (4)–(9), the sample period is from September 1994 to December 2000, which includes 51 FOMC meetings and trading days. The dependent variable is the order imbalance (OIB) or retail order imbalance (ROIB) of D1, D10 and D10−D1, from the close on day to 10 min before the announcement on day for FOMC announcement days, and OIB or ROIB of the corresponding portfolios from the close on day to the close on day for the other days. is equal to 1 on the FOMC announcement days, and 0 otherwise. The t-statistics reported in parentheses are calculated using the heteroscedasticity-consistent standard errors (White, 1980).

- , and denote statistical significance at the 1%, 5% and 10% levels, respectively.

Our findings in columns (1)–(3) of Table 5 suggest that the positive pre-FOMC announcement drift of lottery-like stocks is accompanied by an increase in the aggregate demand for such stocks. When there is an imbalance between buy and sell orders, market makers may absorb the order imbalance by serving as the trade counterparty. Liu et al. (2020) argue that market makers may demand greater compensation for bearing inventory risks due to the greater anticipated volatility associated with information events. Therefore, the increase in the demand of lottery-like stocks on pre-FOMC announcement windows may lead to a greater price run-up of lottery-like stocks ahead of the FOMC announcements.

Next, we focus on a subsample of the FOMC meetings from September 1994 to December 2000, during which we are able to identify the orders of retail investors, that is, buy and sell trades less than $10,000 based on the real dollar value in 1991. Kumar (2009) finds that lottery-like stocks are more attractive to retail investors. Liu et al. (2020) also document that the increase in retail order imbalance of lottery-like stocks is larger than that of non-lottery stocks before earnings announcements. Therefore, the positive pre-FOMC announcement drift of lottery-like stocks may be due to retail investors' attention-driven demand for lotteries before the FOMC announcements. The dependent variable in columns (4)–(6) of Table 5 is . We find that β and β of D1, D10 and D10−D1 are similar to those reported in columns (1)–(3), except for the lottery feature Prc. The dependent variable in columns (7)–(9) of Table 5 is , retail order imbalance. However, we do not find consistent evidence that the increases in the retail investor order imbalance of D10 are greater than those of D1. β of D10−D1 is statistically insignificant for our five lottery proxies. Contrary to Liu et al. (2020), our findings do not support the notion that the FOMC announcement events attract more attention of retail investors than institutional investors. When we classify investors into institutional and retail investors, our results in columns (4)–(9) suggest that the attention-driven demand for lottery-like stocks ahead of FOMC announcements is more prominent among institutional investors, instead of retail investors.

Our finding suggests that the demand for lottery-like stocks ahead of FOMC announcements is primarily driven by institutional investors, whereas Liu et al. (2020) find that retail investors show increased interest in lottery-like stocks before earnings announcements. Institutional investors typically possess greater resources, have extensive research and market analysis and possess superior trading capabilities compared to retail investors. These advantages enable them to actively trade and adjust their positions based on anticipated changes in monetary policy. Furthermore, institutional investors often have established investment strategies and risk management processes that are less influenced by short-term market fluctuations, such as earnings announcements. Last, due to their utilization of higher leverage in trading positions, institutional investors may experience a more significant impact on their funding costs as a result of changes in monetary policy, compared to retail investors.

Double sorting analyses: Institutional ownership and lottery features. The previous literature usually takes institutional investors as sophisticated and informed arbitrageurs and considers retail investors as behavioural and noise traders. Grossman and Stiglitz (1980) indicate that the existence of noise traders subsidizes arbitrageurs' information production cost. We have shown that the increase in order imbalance for lottery-like stocks is more pronounced among institutional investors before the FOMC announcements. In this section, we further study the role of institutional investors in the positive pre-FOMC announcement drift.

At the beginning of each month, we assign firms into the high (low) institutional ownership subsample if their institutional ownership is among the top (bottom) 50% of the firms at the end of the most recent quarter.19 Within the high and low institutional ownership subsamples, we further sort firms into ten decile portfolios (D1–D10) based on one of our five lottery proxies, as defined earlier. Then we estimate the differences in the pre-FOMC announcement drifts between D10 and D1 within each subsample. In columns (1)–(5) of Panel A of Table 6, we report the OLS regression results of Equation (1) based on the returns of long–short portfolios (D10−D1) for the high institutional ownership subsample. The coefficients of are all positive and statistically significant, suggesting that the pre-announcement drift of lottery-like stocks is larger than those of non-lottery stocks when institutional ownership is high. Columns (1)–(5) of Panel B present the same regression results for the low institutional ownership subsample. The coefficients of remain positive and statistically significant only for the lottery features Expskew, Idvol and Maxret. The pre-announcement drift of lottery-like stocks appears to be weaker in this subsample. In columns (1)–(5) of Panel C, we compare the differences in the pre-FOMC announcement drift of D10−D1 between the high and low institutional ownership subsamples. We find that the differences between the high and low institutional ownership subsamples are not statistically significant for the lottery features Expskew and Maxret, and are positive and statistically significant for the lottery featuress Idvol, Prc and Z-score. In sum, the results from the double-sorting analyses show no evidence that the pre-FOMC announcement drift of lottery-like stocks is stronger in the low institutional ownership subsamples, suggesting that the pre-FOMC announcement drift of lottery-like stocks is not mainly driven by retail investors.

| Institutional ownership | Transient institutional ownership | Quasi-Indexer ownership | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Proxy | Expskew | Idvol | Maxret | Prc | Z-score | Expskew | Idvol | Maxret | Prc | Z-score | Expskew | Idvol | Maxret | Prc | Z-score |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) | (13) | (14) | (15) | |

| Panel A. High-ownership subsample | |||||||||||||||

| 0.333*** | 0.394*** | 0.374*** | 0.235*** | 0.498*** | 0.346*** | 0.474*** | 0.492*** | 0.203** | 0.628*** | 0.362*** | 0.485*** | 0.416*** | 0.265*** | 0.567*** | |

| (3.82) | (4.15) | (2.87) | (2.58) | (4.64) | (3.44) | (3.77) | (4.02) | (1.98) | (4.87) | (3.86) | (3.67) | (3.59) | (2.63) | (4.88) | |

| Intercept | −0.020 | 0.005 | −0.017 | 0.007 | −0.011 | −0.019 | 0.000 | −0.010 | 0.019 | −0.011 | −0.016 | 0.013 | −0.012 | 0.017 | −0.002 |

| (−1.20) | (0.27) | (−0.85) | (0.40) | (−0.53) | (−1.07) | (0.01) | (−0.50) | (1.16) | (−0.52) | (−0.93) | (0.65) | (−0.60) | (1.00) | (−0.11) | |

| Panel B. Low-ownership subsample | |||||||||||||||

| 0.389*** | 0.188* | 0.322*** | −0.015 | 0.114 | 0.207** | 0.150* | 0.137 | 0.040 | 0.227** | 0.206** | 0.253*** | 0.350*** | −0.127 | 0.123 | |

| (3.23) | (1.78) | (2.72) | (−0.15) | (1.19) | (2.04) | (1.80) | (1.56) | (0.42) | (2.01) | (2.04) | (2.70) | (3.41) | (−1.24) | (1.22) | |

| Intercept | −0.021 | 0.005 | −0.023 | 0.036* | −0.024 | −0.002 | 0.041** | −0.028 | 0.034* | 0.012 | −0.005 | 0.029 | −0.016 | 0.042** | 0.023 |

| (−1.03) | (0.24) | (−0.99) | (1.83) | (−1.22) | (−0.08) | (2.25) | (−1.25) | (1.93) | (0.59) | (−0.25) | (1.39) | (−0.64) | (2.37) | (1.10) | |

| Panel C. High minus low | |||||||||||||||

| −0.056 | 0.206** | 0.053 | 0.250*** | 0.383*** | 0.139 | 0.325*** | 0.355*** | 0.163* | 0.401*** | 0.156 | 0.232** | 0.066 | 0.392*** | 0.443*** | |

| (−0.41) | (1.98) | (0.36) | (2.72) | (3.67) | (1.15) | (2.70) | (3.13) | (1.68) | (3.33) | (1.41) | (1.99) | (0.60) | (3.80) | (4.17) | |

| Intercept | 0.001 | 0.000 | 0.005 | −0.029* | 0.013 | −0.018 | −0.041**** | 0.017 | −0.015 | −0.023 | −0.010 | −0.016 | 0.004 | −0.025 | −0.025 |

| (0.05) | (0.02) | (0.32) | (−1.79) | (0.82) | (−1.12) | (−2.81) | (1.10) | (−0.99) | (−1.57) | (−0.64) | (−1.07) | (0.22) | (−1.50) | (−1.51) | |

- This table compares the pre-announcement lottery-sorted portfolio returns between firms with high and low institutional ownership. The sample period is from September 1994 to December 2021, which includes 187 FOMC meetings and trading days. In columns (1)–(5), (6)–(10) and (11)–(15), we assign firms to the high (low) institutional ownership subsample, transient institutional ownership and quasi-indexer ownership subsample at the beginning of each month, if their corresponding ownership measure is among the top (bottom) 50% of the firms at the end of the most recent quarter, respectively. In each subsample, firms are further sorted into ten value-weighted decile portfolios based on each of our five lottery proxies. Stocks in decile portfolio 10 (D10) have the most lottery-like features and stocks in decile portfolio 1 (D1) have the least lottery-like features. Stocks with prices below $1 are excluded. In Panels A and B, we report the OLS regression results of Equation (1) based on the returns of hedge portfolios (D10−D1) that take a long position on D10 and a short position on D1. In Panel C, we report the OLS regression results of Equation (1) based on the difference in the returns of D10−D1 between high and low institutional ownership subsamples. For brevity, we only report the coefficients of and the intercept. is equal to 1 on the FOMC announcement days before March 2011 and on the FOMC announcement days after March 2011 which are accompanied by press conferences, and 0 otherwise. The t-statistics reported in parentheses are calculated using the heteroscedasticity-consistent standard errors (White, 1980).

- , and denote statistical significance at the 1%, 5% and 10% levels, respectively.

Our results in columns (1)–(5) of Table 6 indicate that institutional investors are interested in the potential implications of an FOMC economic policy announcement for their portfolios. We next investigate which type of institutional investor actually trades lottery-like stocks before the FOMC announcements. Not all institutional investors are equally informed in terms of reacting to or processing information. Bushee (1998) classifies institutional investors into transient institutions which exhibit high portfolio turnover and own small stakes in portfolio management, dedicated institutions which provide stable ownership and take large positions in individual firms, and quasi-indexers which trade infrequently but own small stakes.

We hypothesize that transient institutions, characterized by aggressive trading based on short-term strategies, are more likely to trade on the pre-FOMC announcement premium. We assign firms into the high (low) transient institutional ownership subsample if their transient institutional ownership, as defined by Bushee (1998), is among the top (bottom) 50% of the firms at the end of the most recent quarter, and then repeat our analyses in columns (1)–(5) of Table 6. Columns (6)–(10) of Table 6 show that the pre-FOMC announcement drift of lottery-like stocks mainly exists in the high transient institutional ownership subsample, instead of the low transient institutional ownership subsample. The differences between the high and low transient institutional ownership subsamples are positive and statistically significant for the lottery feature Idvol, Maxret, Prc and Z-score.

Previous studies also suggest that index funds have increased the informativeness of stock prices (DeLisle, French and Schutte, 2017; Qin and Singal, 2015). Given the potential significance of stock indexing surrounding the FOMC meetings, we also repeat our double-sorting analyses using quasi-indexer ownership as classified by Bushee (1998). Columns (11)–(15) of Table 6 show that the pre-FOMC announcement drift of lottery-like stocks mainly exists in the high quasi-indexer ownership subsample. The differences between the high and low quasi-indexer ownership subsamples are positive and statistically significant for the lottery features Idvol, Prc and Z-score.

Although the intra-day order data of institutional investors is not available to us, our results indicate that the pre-FOMC announcement drift of lottery-like stocks is more likely driven by the trading of institutional investors with short-term trading strategies or quasi-indexer investors.

A refined lottery trading strategy

The lottery anomaly suggests that a standard lottery trading strategy taking a long position on non-lottery stocks and a short position on lottery-like stocks should have a positive risk-adjusted alpha. At the beginning of each month, we sort stocks into ten value-weighted decile portfolios based on each of our five lottery proxies estimated at the end of the previous month. Then we construct standard lottery trading strategies that take a long position on D1 and a short position on D10. These portfolios are re balanced every month. The monthly returns of these portfolios are their cumulative daily returns within each month. We estimated the alphas of these portfolios using a four-factor model that includes Fama and French's (1993) three factors (RMRF, SMB and HML) and Carhart's 1997 momentum factor (UMD). The odd-numbered columns of Table 7 report the four-factor model alphas. Consistent with the previous literature on lottery-like stocks, the alphas of the standard lottery trading portfolios are positive and statistically significant, except for Idskew.

| Proxy= | Expskew | Idvol | Maxret | Prc | Z-score | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| Lottery | Refined | Lottery | Refined | Lottery | Refined | Lottery | Refined | Lottery | Refined | |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | |

| RMRF | −0.529*** | −0.581*** | −0.686*** | −0.744*** | −0.774*** | −0.837*** | −0.338*** | −0.337*** | −0.717*** | −0.752*** |

| (−6.90) | (−7.41) | (−10.61) | (−10.68) | (−10.34) | (−11.04) | (−3.71) | (−3.67) | (−8.65) | (−9.24) | |

| SMB | −0.720*** | −0.634*** | −1.154*** | −0.997*** | −0.796*** | −0.636*** | −1.123*** | −1.014*** | −1.380*** | −1.204*** |

| (−6.40) | (−5.23) | (−14.19) | (−9.37) | (−10.30) | (−6.55) | (−10.71) | (−8.76) | (−12.22) | (−9.49) | |

| HML | 0.375*** | 0.412*** | 0.701*** | 0.715*** | 0.671*** | 0.703*** | −0.294** | −0.317** | 0.317*** | 0.328*** |

| (3.23) | (3.34) | (6.94) | (6.83) | (5.93) | (6.32) | (−2.32) | (−2.56) | (3.09) | (3.13) | |

| UMD | 0.528*** | 0.494*** | 0.197*** | 0.172*** | 0.247*** | 0.229*** | 0.623*** | 0.571*** | 0.538*** | 0.503*** |

| (8.93) | (7.58) | (3.98) | (3.02) | (3.49) | (3.68) | (7.22) | (6.05) | (8.79) | (6.80) | |

| 0.596** | 1.003*** | 0.486** | 0.948*** | 0.884*** | 1.341*** | 0.111 | 0.408 | 0.895*** | 1.373*** | |

| (2.26) | (3.58) | (2.05) | (3.54) | (3.31) | (4.53) | (0.40) | (1.37) | (3.46) | (4.79) | |

| Obs. | 328 | 328 | 328 | 328 | 328 | 328 | 328 | 328 | 328 | 328 |

| Adj. | 0.582 | 0.545 | 0.712 | 0.655 | 0.637 | 0.582 | 0.616 | 0.544 | 0.735 | 0.671 |

| Difference in | 0.407*** | 0.462*** | 0.457*** | 0.297*** | 0.478*** | |||||

| ProbChi | 0.000 | 0.000 | 0.005 | 0.007 | 0.000 | |||||

- This table compares the portfolio performance between a standard lottery trading portfolio and our refined lottery trading portfolio. The sample period is from September 1994 to December 2021. At the beginning of each month, stocks are sorted into ten value-weighted decile portfolios based on each of our five lottery proxies. The standard lottery trading portfolio is a hedge portfolio taking a long position on the bottom decile portfolios (D1) and a short position on the top decile portfolios (D10). Our refined lottery trading portfolios are the same as the standard lottery trading portfolios but opposite to the standard lottery trading portfolios over the pre-FOMC announcement windows, from the close on day to 10 min before the announcement on day . The refined lottery trading portfolios take a long position on D10 and a short position on D1 during the pre-FOMC announcement windows. The monthly value-weighted returns of D1 and D10 are calculated as their cumulative daily returns within each month. The monthly returns of the standard lottery trading portfolios and refined lottery trading portfolios are regressed on four factors: the market factor (RMRF), size factor (SMB), value factor (HML) and momentum factor (UMD). The even-numbered columns report the standard lottery trading portfolios (Lottery) and the odd-numbered of columns report the refined lottery trading portfolios (Refined). The t-statistics are reported in parentheses. The last two rows report the difference in the four-factor model alphas between the standard and refined lottery trading strategies and the p-value of the difference tests.

- , and denote statistical significance at the 1%, 5% and 10% levels, respectively.

Since we have documented a positive spread of pre-FOMC announcement drifts between lottery-like and non-lottery stocks, the standard lottery trading strategies could be refined during the pre-FOMC announcement windows. In the refined lottery trading strategies, we keep the same long positions on D1 and short positions on D10 as those of the standard lottery trading strategies during our sample period, but reverse the long and short positions from the close on day to 10 min before the FOMC announcement on day . The refined lottery trading strategies take advantage of our finding that lottery-like stocks outperform non-lottery stocks ahead of the FOMC announcements. The even-numbered columns of Table 7 report the regression results of the four-factor model on the monthly returns of the refined lottery trading strategies. Over our sample period, the alphas of the refined lottery trading portfolios are larger than those of the corresponding standard lottery trading portfolios. The differences in the alphas are statistically significant at the 1% level. The increases in the annualized alphas are 4.88% (Expskew), 5.54% (Idvol), 5.48% (Maxret), 3.56% (Prc) and 5.74% (Z-score). However, we need to bear in mind one important caveat when interpreting our results. The actual increase in the performance of the refined lottery trading portfolios might be much smaller due to the additional transaction costs before the FOMC announcements.

Features of market environment and propensity to speculate

In this section, we analyse the features of the market environment in which the propensity to speculate is higher ahead of the FOMC announcements. First, we examine whether the flight to lottery before the FOMC announcements creates financial gains for investors by considering the realized skewness of lottery versus non-lottery stocks. Second, we investigate whether lottery-like stocks benefit more, relative to non-lottery stocks, from the reduction in investors' fear during the pre-FOMC announcement windows.

Realized skewness

In Panel A of Table 8, we report the realized skewness of portfolio excess returns during the pre-FOMC announcement windows. We find that the pre-FOMC announcement returns of lottery-like stocks (D10) have higher realized skewness than non-lottery stocks (D1). In Panel B, we report the realized skewness of portfolio excess returns during the pseudo-FOMC announcement windows. For each of 187 FOMC announcement days in our sample, we randomly select a pseudo-announcement day spanning day to day , where is the FOMC announcement day. We calculate the realized skewness of portfolio excess returns during the 187 pseudo-announcement days. Then we repeat this process 100 times and report the average realized skewness of these 100 simulations.20 In Panel C, we report the differences in realized skewness between the actual and pseudo-FOMC announcements. We find that lottery-like stocks (D10) have higher realized skewness during the actual event windows than during the randomly selected pseudo-event windows. More importantly, the difference-in-differences of realized skewness (D10−D1) are higher in the actual event windows than during the randomly selected pseudo-event windows.

| Proxy | Expskew | Idvol | Maxret | Prc | Z-score |

|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | |

| Panel A. Pre-FOMC announcement windows | |||||

| D1 | −2.05 | −3.96 | −7.21 | −0.82 | −3.67 |

| D10 | 1.27 | −0.10 | 0.62 | 2.11 | 1.46 |

| D10−D1 | 1.84 | 1.66 | 3.83 | 2.04 | 2.07 |

| Panel B. Pseudo-FOMC announcement windows | |||||

| D1 | 0.18 | 0.16 | 0.16 | 0.13 | 0.10 |

| D10 | 0.32 | 0.31 | 0.35 | 0.48 | 0.13 |

| D10−D1 | 0.14 | 0.44 | 0.33 | 0.70 | 0.62 |

| Panel C. Actual events minus pseudo events | |||||

| D1 | −2.23 | −4.12 | −7.37 | −0.94 | −3.77 |

| D10 | 0.94 | −0.40 | 0.27 | 1.63 | 1.34 |

| D10−D1 | 1.70 | 1.22 | 3.50 | 1.34 | 1.44 |

- This table presents the realized skewness of the excess returns on decile portfolios based on each of five lottery proxies. The sample period is from September 1994 to December 2021, which includes 187 FOMC meetings. Each month, we sort stocks into ten value-weighted decile portfolios based on each of our five lottery proxies from the previous month. We exclude stocks that are less than $1 per share on the portfolio formation date. We only report the bottom (D1) decile lottery portfolios, the top (D10) decile lottery portfolios and their differences (D10−D1). In Panel A, we report the realized skewness of portfolio excess returns during the pre-FOMC announcement windows, from the close on day to 10 min before FOMC announcements on day for FOMC announcement days. In Panel B, we report the realized skewness of portfolio excess returns during the pseudo-FOMC announcement windows. Pseudo-announcement dates are randomly selected from a uniform distribution spanning day to day , where is the FOMC announcement day. We repeat this process 100 times and calculate the average realized skewness of these 100 simulations. In Panel C, we report the differences in realized skewness between pre-FOMC announcements and pseudo-FOMC announcements.

Investors' fear

The reduction in investors' fear, due to the resolution of uncertainty, ahead of FOMC meetings is a critical ingredient of our conceptual framework. We use the VIX, which is commonly accepted as an ‘investors’ fear gauge' by practitioners and academics (Bekaert, Engstrom and Xu, 2021; Bekaert and Hoerova, 2014; Da, Engelberg and Gao, 2015).

We start our analysis by regressing the change in the VIX on , the indicator variable for the pre-FOMC announcement windows. Since the intra-day data for VIX is available, we calculate the change in VIX as the close-to-close change for non-announcement days and as the change from the close on day to 10 min before FOMC announcements on day for FOMC announcement days. The sample period is from October 2003 to December 2021. As reported in Table A3 of our Online Appendix, the coefficient of VIX is negative and statistically significant, suggesting that there is a larger decrease in investors' fear ahead of the FOMC announcements than over the other trading days. Our finding of VIX is consistent with Hu et al. (2022), who document a pre-announcement reduction in VIX before important macroeconomics announcements, including non-farm payrolls, the Institute for Supply Management's manufacturing index and gross domestic product.

In Table 9, we examine the empirical relation between the change in the VIX and the pre-FOMC announcement drift of lottery-like stocks. Specifically, we regress the returns of lottery-sorted decile portfolios (D1 and D10) over the pre-FOMC announcement windows on the change in the VIX. We also regress the returns of a hedge portfolio taking a long position on lottery-like stocks (D10) and a short position on non-lottery stocks (D1) on the change in the VIX ahead of the FOMC announcements. We find that the coefficients of the change in the VIX are negative and statistically significant. Furthermore, our results highlight that the decline in investors' fear is more beneficial for the lottery-like stocks during the pre-FOMC announcement windows. Specifically, the VIX coefficient of D10 is larger in magnitude relative to D1. Also, the D10−D1 portfolio return response to the change in the VIX is negative and statistically significant, except for Expskew.

| D1 | D10 | D10−D1 | |

|---|---|---|---|

| Variables | (1) | (2) | (3) |

| Panel A. Proxy=Expskew | |||

| VIX | −0.628*** | −0.768*** | −0.140 |

| (−5.57) | (−4.34) | (−0.89) | |

| Intercept | 0.108* | 0.229** | 0.121 |

| (1.71) | (2.06) | (1.37) | |

| Panel B. Proxy=Idvol | |||

| VIX | −0.548*** | −0.802*** | −0.253** |

| (−8.48) | (−6.14) | (−2.31) | |

| Intercept | 0.081** | 0.206** | 0.125 |

| (2.07) | (2.07) | (1.37) | |

| Panel C. Proxy=Maxret | |||

| VIX | −0.477*** | −0.930*** | −0.453*** |

| (−8.35) | (−5.02) | (−3.09) | |

| Intercept | 0.056 | 0.147 | 0.091 |

| (1.52) | (1.21) | (0.78) | |

| Panel D. Proxy=Prc | |||

| VIX | −0.520*** | −0.988*** | −0.468*** |

| (−5.73) | (−5.51) | (−3.08) | |

| Intercept | 0.139** | 0.205* | 0.066 |

| (2.38) | (1.81) | (0.55) | |

| Panel E. Proxy=Z-score | |||

| VIX | −0.546*** | −1.000*** | −0.453** |

| (−8.06) | (−4.68) | (−2.55) | |

| Intercept | 0.077* | 0.236* | 0.159 |

| (1.82) | (1.92) | (1.41) | |