Agricultural Economics and Economics: Influence and Counter-Influence, 1910–19601

Abstract

This paper examines the effects which agricultural economists had on developments in economics and on economic policies during the years 1910-1960. These developments are viewed against the backdrop of what was happening in the economy at large and particularly with respect to farmers, and of major books and articles in economics published in the period. Some ideas of agricultural economists and the influence they had are discussed. Agricultural issues and agricultural economists, in the broad sense, had a profound influence on the development of general economics and on economic policies during this period.

Introduction

In this paper I focus on the first fifty years of the sub discipline of agricultural economics, that is, 1910 to roughly 1960. My reason is that it is easier to see the forest for the trees when one is not up too close. Moreover, I consider this period to be the golden age of agricultural economics and the years in which the ideas and work of agricultural economists had the greatest impact on economics in general.

Furthermore, since economics, and therefore agricultural economics, is an empirical science, one must consider the development and flow of ideas against the historical backdrop and policy issues important at the time.

The plan of the paper is as follows: First, I survey broadly and briefly what was happening in the economy at large and particularly with respect to farmers.2 As I go, I mention some of the important developments and major books and articles in economics published from 1910–1960. Finally, I discuss some ideas of agricultural economists and influence which they had on our profession and outside it. I conclude that, until at least 1960, agricultural issues and agricultural economists in the broad sense had a profound influence on the development of general economics.

1. The Economy, Economics and the Farmers

1910–1921

In 1910, the total population of the United States was roughly 92 million, of whom the farm population is estimated as 32 million. Farmers were 31% of the labor force. There were 6.4 million farms, and their numbers increased only gradually until the mid 1930s (see table 1). William Howard Taft was President of the United States in 1910. He was a protégé of Theodore Roosevelt, who after serving nearly two full terms refused to run in the election of 1908 for another term. Taft ran against William Jennings Bryan (“Thou shall not crucify mankind on a cross of gold.”) and delivered the final knockout blow to Bryan, who had already lost the elections of 1896 and 1900. Taft, in general, carried out the policies of Theodore Roosevelt, emphasizing breaking up trusts and controlling monopolies. He strengthened the Interstate Commerce Commission, the original purpose of which was to regulate the railroads and prevent rate discrimination among markets and commodities, a matter of much concern to Midwest and Great Plains farmers.3

| 1910s | 1920s | 1930s | 1940s | 1950s | |

|---|---|---|---|---|---|

| Labor share | 31% | 27% | 21% | 18% | 12% |

| Farms, million | 6.4 | 6.4 | 6.3 | 6.0 | 5.4 |

| Farm size, acres | 138 | 148 | 157 | 175 | 216 |

| Export share | 45% | 42% | 32% | 22% | 22% |

- Source: Economic Research Service (2000). A History of American Agriculture, 1607–2000. (ERS-POST-12.) Washington DC. http://www.agclassroom.org/gan/timeline/index.htm

In this period, there was a great expansion of dry land farming in the Great Plains. Livestock raising was expanded in western states, facilitated by the Stock-Raising Homestead Act of 1916. Agricultural exports averaged 45% of total exports, much of it grain destined for Europe.

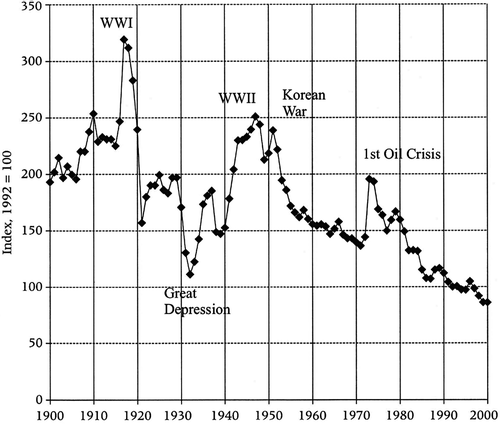

Woodrow Wilson was elected president as a Democrat in 1912 and took office in 1913. His policies were staunchly progressive. During his first term (1913–1916), he had the benefit of a congress controlled by the democrats and was able to pass many pieces of legislation of great importance to farmers, for example, the Federal Reserve Act, the Federal Trade Commission Act, the Clayton Antitrust Act, the Federal Farm Loan Act, and the Revenue Act of 1913, which established an income tax. Farmers were relatively prosperous in the run-up to the first world war. Real agricultural prices were increasing up to the end of the war (see figure 1). Population was increasing rapidly, domestic demand was stable, and Wilson's policies were responsive to farmers’ concerns.

Real prices received by farmers

Source:Gardner (2002, 129) based on data from U.S. Department of Commerce (1975); for data after 1970, please see U.S. Department of Agriculture, Agricultural Statistics, various years.

World War I erupted in 1914. Wilson, re-elected in 1916, was able to maintain U.S. neutrality until 1917. Foreign demand for U.S. farm products, superimposed upon strong domestic demand, caused agricultural prices to soar. But, as noted, in 1919, real agricultural prices began to decline sharply.

Notable economists of this era were Alfred Marshall (1842–1924), his student A. C. Pigou (1877–1959), and the influential American economist, Frank W. Taussig (1859–1940). The 8th edition of Marshall's Principles of Economics appeared in 1920. Marshall's primary interest was the determination of market prices and factor remunerations—supply and demand. Pigou, who wrote well into the 20th century, is best known for his Economics of Welfare (1924). Although not so influential or as well known today, mention should be made of Frank H. Knight's Risk, Uncertainty and Profit (1921). Taussig, except for brief service to Wilson's government, was professor and chair of Harvard's economics department from 1885 until 1935. Besides his influential text Taussig (1911), which went through 15 editions, and his editorship of the Quarterly Journal of Economics, his best known contribution was the study of tariffs (e.g., Taussig 1915). Concern with tariffs was echoed in the influential empirical work of two agricultural economists, Henry Moore and Henry Schultz, in the 1920's. True, most people do not think of them as agricultural economists, but they were in terms of the problems on which they worked.

1921–1940

From 1921–1940, prosperity eluded the American farmer. Real agricultural prices stayed low until World War II, and, indeed, never regained the heights they had reached in 1917–18. After the Korean War they began to fall again (see figure 1).

In 1920, the total population of the United States was just under 106 million; the farm population was close to 32 million; farmers thus accounted for 27% of the labor force. The number of farms was close to what it had been in 1910, but the average farm size had increased from 138 acres in 1910 to 148 in 1920. By 1930, the total population of the United States had reached nearly 123 million, but the farm population numbered only a bit fewer than 30.5 million and thus farmers accounted for 21% of the labor force. The number of farms had dropped slightly to 6.3 million but average acreage had increased to 157. Irrigation in dry land areas became significant. In 1940, the total population of the United States had risen to almost 132 million but the farm population was only 30.8 million and thus farmers represented only 18% of the total labor force. By 1960 farmers only represented only 8.3% of the total population of the United States (see table 1).

Total factor productivity, which had been increasing slowly from 1910 at 0.2% per year, increased sharply around 1938, to about 1.6% per annum (Gardner 2002, 43–45). Although there was some fluctuation in that annual rate, faster growth continued unabated until the end of the century. Thus, despite the decline in the proportion of the labor force engaged in agriculture, agricultural output increased per capita. Real agricultural prices fell sharply from the high levels attained during WWI and never recovered (Gardner 2002, 129). Real returns per farm during the period, after falling sharply in 1921, never quite recovered until the end of the 1930s (Gardner 2002, 84). Foreclosures averaged 2% per annum from 1926–1940, and were 4% in 1933 (Gardner 2002, 85; see figure 1, which depicts real prices received by farmers).4

Warren G. Harding succeeded Wilson in 1921 and was in turn succeeded by Calvin Coolidge in 1923. Both Harding and Coolidge were conservative Republicans. High tariffs were imposed against agricultural imports after WWI and in 1930 the Hawley-Smoot Act raised rates to prohibitive levels, leading to retaliation by other countries. This only made matters worse for farmers. Regulation of meat packing and of futures trading were also enacted during Harding's presidency. The idea of parity for farmers circulated in the 1920s and was embodied in various versions of the McNary-Haugen bill introduced in Congress every year from 1924 to 1927; it passed in 1928 only to be vetoed by President Coolidge. The basic plan involved the government purchasing the main agricultural commodities at “fair” prices, reselling what could be sold domestically and dumping the rest abroad. Return was to be prevented by high tariffs. The idea of parity, however, was to resurface in the farm legislation of the 1930s. Dumping, of course, was a form of price discrimination, as established in the Taussig-Pigou debate in the 1920s regarding railroad rates.5

Herbert Hoover, who had served under Harding and Coolidge as Secretary of Commerce, was elected president and took office in 1928. He had served as head of the American Relief Administration after WWI in the Wilson Administration but joined the Republican Harding Administration as Secretary of Commerce in 1921. President Hoover was opposed to agricultural subsidies but supported legislation to improve the conditions under which farmers might borrow, on the efficiency of agricultural marketing, on stability of markets for agricultural products, and on the creation and strengthening of farm cooperatives, which might control agricultural production. Under President Hoover the Agricultural Marketing Act was passed by Congress and signed into law in 1929 (Faushold 1977; Wilson 1977).

Notwithstanding its veneer of prosperity, the roaring twenties were a decade of rampant speculation and a run-up to the stock market collapse of 1929. In addition to stock markets, foreign exchange markets and commodity exchange markets were affected. Important economists of the period were Irving Fisher and John Maynard Keynes. Similar to many economists of the period, both Keynes and Fisher were concerned with general price inflation and its effects. Fisher's book (1930) set forth a common sense theory for determining interest rates, which is the basis for all such discussions today. Fisher's work on index numbers and money illusion (1922, 1928) stands today as definitive. The Keynes of the 1920s was not the Keynes of the immodestly titled The General Theory of Employment, Interest and Money (Keynes 1936), but the Keynes of the more accurately titled A Treatise on Money (Keynes 1930), and above all the Keynes of the theory of normal backwardation (Keynes 1923).6

The remainder of the period was dominated by the Great Depression and Dust Bowl conditions in the Great Plains. Real prices received by farmers fell almost 50% between 1929 and 1932 (Gardner 2002, 129). Bank failures, especially in rural areas, hit farmers especially hard. Franklin Delano Roosevelt ran for president as a Democrat in 1932 against Hoover and won by a landslide, promising—of all things!—deficit reduction. Nonetheless, Roosevelt continued the major relief programs of Hoover. In 1933, Congress passed the Glass-Steagall Act, which prohibited bank holding companies and created the Federal Deposit Insurance Corporation. The National Industrial Recovery Act, which effectively cartelized industries and re-created all the horrors of monopolies and trusts fought with such vigor by the progressive movement at the turn of the century, gave broad new powers to the Federal Trade Commission to regulate such behemoths. The Civilian Conservation Corps was created and the Agricultural Adjustment Administration (AAA) was formed to pay farmers to take land out of crops and cut herds. The Commodity Credit Corporation (CCC) was created in the same year to “stabilize, support, and protect farm income and prices.”7 Food stamps or its variants were proposed as early as 1932 (Roth 2001).

Government spending increased from 8% of GNP in 1932 to 10.2% in 1936. Unemployment fell from nearly 25% in 1933 to about 14% in 1937 but rapidly increased to over 19% in 1938 when a second recession began in 1937.8 Roosevelt won by another landslide in 1936. The economy grew rapidly during his second term but unemployment remained high and did not fall to under 10% until WWII began for the United States in 1941.

What were the important developments in economics during the period? Obviously, Keynes (1936), The General Theory of Employment, Interest and Money took the profession by storm—both for and against. It was surely the most important development during the two-decade period. But there were other important publications in this period. Following in the footsteps of his teacher Taussig, Viner (1923) published one of the most important books of the period titled Dumping: A Problem in International Trade. But he is far better known for his famous article “Cost Curves and Supply Curves” (1931) and its even more famous error, which every graduate student of economics knows.9 Reflecting concerns with monopoly pricing in the first half of the period, Joan Robinson (1933) and Edward Chamberlin (1933) simultaneously published books on imperfect or monopolistic competition. By this time, the Great Depression had hit with a vengeance, and little attention was paid by the economics profession generally to anything but its causes and those of the collapse of the financial system, and, when it appeared, to The General Theory. An exception was Simon Kuznets, who developed a precise measure of National Income and its components (1934, 1937). But behind all the brouhaha, notwithstanding a genuine concern for the poor, the unemployed and the homeless, a revolution was taking place in the economic theory of supply and demand.

In 1932, Hicks published Theory of Wages in which he laid the foundations for the modern theory of growth and producer behavior. In their two-part Economica paper, Hicks and Allen (1934) made a rediscovery of Slutsky (1915) the centerpiece of a comprehensive theory of the determination of supply and demand functions. The agricultural economist Henry Schultz–no relation of T. W. Schultz–brought the theory of demand to fruition in his monumental The Theory and Measurement of Demand (1938). In 1939, Hicks published a comprehensive extension to producers of Slutsky-Hicks-Allen. These “tools” have played a major role in analytical economics ever since. Henry Schultz's influence, which I will discuss in the next section of this paper, has advanced our knowledge of consumer behavior via the work of Richard Stone (1954).

1941–1960

By 1939 the U. S. economy had begun to recover. Europe was already at war. Agricultural research undertaken in the 1920s and 1930s began to pay off. The trend of total factor productivity growth in agriculture rose from about 0.4% per annum for the period 1910–1940 to 2.0% per annum for the period 1940–1996 (Gardner 2002, 44–46). Real prices received by farmers turned sharply upward although they never again reached the levels enjoyed by farmers during WWI (Gardner 2002, 129; please see figure 1). In 1940, the total population of the United States was 132 million, the farm population numbered just short of 31 million, and farmers were 18% of the labor force. There were just over 6 million farms with an average of 175 acres per farm. During the war, many former sharecroppers migrated to northern cities and industrial jobs. Agricultural exports averaged 22% of total U.S. exports during the 1940's. After WWII, agriculture and farmers became an increasingly smaller proportion of the work force and the American economy.

By 1950 the total population of the United States had reached over 151 million, the farm population had dropped to 25 million, and farmers were only 12% of the labor force (see table 1). The number of farms fell to 5.4 million with an average of 216 acres per farm. During the 1950s agricultural exports remained steady at 22% of total U. S. exports. Total factor productivity in agriculture continued its upward course of about 1.6% per annum (Gardner 2002, 44–46), whereas real prices received by farmers began to decline rapidly in 1948 with a brief upward blip in 1951 during the Korean War, reaching levels not seen since the beginning of the Great Depression in 1930. Real prices in the end fell below the lowest level reached at their nadir in 1932 by 1986–87 (Gardner 2002, 129; see figure 1).

In 1960 the total population of the United States was 180 million, the farm population only 15.6 million, and farmers made up only 8.3% of the labor force. The number of farms now reached 3.7 million, with an average of 303 acres per farm. Agricultural exports during the 1960s averaged slightly over 22%. A great demographic shift was well underway, with the younger generation of farm families leaving rural areas in droves. And yet farmers continued to produce vast quantities of food and fiber, barely contained by various farm programs to curb acreage and reduce herds.

During WWII the United States and its allies were primarily concerned with winning the war against the Axis powers. After the war ended in 1945, our preoccupation became the rehabilitation and recovery of both allies and foes. The great architect of this effort was George C. Marshall, who laid out his plan in a speech at Harvard on June 5, 1947. During the war demand for many basic commodities was held in check by rationing and prices were controlled. But after rationing was ended in 1946, pent-up demand surged, as did consumer prices. All of this was very bothersome to consumers and economists alike. However, as mentioned above, real prices paid to farmers rose sharply until after the Korean War armistice. Farmers have not had it better since WWI and its immediate aftermath.

Economists of this era were still debating the causes of the Great Depression. For a time the Keynesians appeared to have defeated the “monetarists”, that is, the arguments were deficient demand versus failure of the financial system to provide as much money as needed. Postwar inflation was also subject to this division of opinion, excess demand for goods and services versus too much money chasing too few goods. Quietly, however, two major breakthroughs occurred that were further to revolutionize economic thinking. In 1944 (second edition 1947), John von Neumann and Oskar Morgenstern published Theory of Games and Economic Behavior, and in 1947, Paul Samuelson published his Foundations of Economic Analysis. In the beginning, von Neumann and Morgenstern had little impact on the profession despite laudatory reviews and high hopes (e.g., Hurwicz, 1945). It took Thomas Schelling's The Strategy of Conflict (1960), in which he argued that games needed to be treated in extensive form, to make game theory the essential tool of economic theory that it is today. Samuelson's book, on the other hand, was arguably much more influential in the long run than the book by Hicks (1939), which it duplicated in certain respects,10 or von Neumann and Morgenstern. Samuelson's great contribution was not only to derive many meaningful economic aspects of the behavior of economic agents (consumers and producers) from maximizing, as Hicks did, but also to combine this idea with the concept of the interaction of individual agents in a stable equilibrium. In the process, Samuelson clarified and extended the Marshallian idea of comparative statics. Finally, another important book published in 1951 was Kenneth J. Arrow's Social Choice and Individual Values.

Because they are developments profoundly influenced by work in agricultural economics, advances in the econometrics of simultaneous equations estimation and identification and activity analysis are discussed in the next section. Now, however, I discuss the new insights in development economics, which had more to do with historical events than did the work of Samuelson, von Neumann and Morgenstern, et al., in general economics.

After the surrender of Nazi Germany to the allies in 1945, the Soviet Union sought to dominate Central and Eastern Europe. As Winston Churchill so famously put it in 1946, “… an iron curtain has descended across the Continent,” (Churchill 1946). The Soviets sought also to bring all of Germany under their control, not only the areas east of the Elbe which they occupied. In 1948, the United States, France, and Great Britain combined their occupation zones and introduced a common currency, the Deutsche Mark, to replace the old Reichsmark. The Soviets responded by severing all land and water communication between the non-Soviet zones and Berlin. The Cold War had begun in earnest and was to continue with various ups and downs (such as the Korean War and the Vietnam War) until 1991. During the Cold War, the western powers competed for allies around the world, especially Africa, Latin America, Southeast Asia and South Asia. Many saw the struggle in terms of the economic development of poor countries. Various national and international institutions were created with the principal aim of promoting international development, for example USAID. The World Bank originally had the goal of helping the countries of Western Europe, on both sides of WWII, recover from the destruction of the war, but was gradually transformed into an institution for world economic development. In 1954, the U.S. Congress passed legislation of particular interest to American farmers, P.L. 480, the Agricultural Trade Development Assistance Act, and renamed Food for Peace in 1961 by President John F. Kennedy. In signing the legislation into law, President Eisenhower tellingly stated that its purpose was to “… lay the basis for a permanent expansion of our exports of agricultural products with lasting benefits to ourselves and peoples of other lands.”11

Economists in the West had developed some illusions about how Soviet Russia had industrialized following the end of Lenin's New Economic Policy in the late 1920s. Many economists thought of agriculture as a reservoir of labor for industrial development. Focusing on the experience of very high unemployment and under-employment during the Great Depression, Harrod (1939) and Domar (1946) developed models of the steady state properties of the developed economy with no role for prices or for factor substitution. Rather, everything depended on the evolution of the capital in relation to population growth. Arthur Lewis (1954), on the other hand, looking towards the Soviet industrialization, saw agriculture as the source of labor to fuel a growing industrial sector resulting from per capita capital accumulation. Only sufficient savings and investment at a rate well ahead of the rate of growth of population would permit industrialization and economic growth. While Harrod and Domar saw their model as primarily applicable to possible issues in the post-war economies of the United States and other western countries of maintaining full employment, members of the economics profession seized on the model, together with the idea of surplus labor in agriculture, as a way of understanding economic development in terms of industrialization. More importantly, it was made the case for large amounts of foreign aid, especially in the form of investments in physical capital, to the poor developing countries of the world.

Unfortunately, there were two problems with the application of the Harrod-Domar model to underdeveloped and poor economies: first, the model itself assumed a fixed proportion between physical capital and labor, an assumption which proved fatal for its application to the long run growth in developed countries, as well as developing ones. Second, no matter how poor and destitute farmers may seem in the overwhelmingly agricultural poor countries of this world, there is no such thing as “surplus labor”, in the sense that labor can be withdrawn from the agricultural sectors in developing countries without reducing output if there is no compensating variation in other factors of production or changes in agricultural technology.

Despite the so-called Cambridge Capital Controversy involving the neo-Ricardian group centered in Cambridge, England, and the neoclassicists, centered in Cambridge, Massachusetts, most economists today accept the neoclassical paradigm of substitutability among factors of production, albeit with diminishing marginal rates of substitution.12 In a famous 1956 article, Solow (1956) showed that when factor substitution is permitted, together with associated diminishing marginal productivity of capital, physical capital alone cannot account for long run economic growth. As a consequence, in the long run investment cannot result in growth in per capita output. How long is long? One cannot say, but one leg of the development economists’ argument was demolished.13

The next leg of the development economists’ argument was knocked out from under them by T.W. Schultz (1902–1998), arguably the most influential of all American agricultural economists in the 20th century.14 I deal with Schultz (no relation to Henry Schultz) in some detail in the next section of this essay, but at this point I will discuss his argument that there is no such thing as surplus labor in agriculture.15 From early on in his life, T.W. Schultz knew what it was to be poor and disadvantaged. He also learned that the poor are efficient in using what they have in order to survive. He concluded that farmers are rational and make the best use of resources they have at their disposal, including their own labor and that of their families. In an early controversy with John D. Black, an agricultural economist then a member of Harvard University's Department of Economics, Schultz (1939a), then at Iowa State, argued that farm management studies were of limited usefulness in helping farmers achieve least cost and highest profit use of the resources at their disposal, precisely because the data on which the management studies were based came from observations on efficient and rational farmers. Current research programs of the World Bank and other institutions for the promotion of economic development and well being in poor countries are now increasingly focused on agricultural development.

2. Themes and Ideas in Agricultural Economics: Origins and Wider Influence

In this part of my paper, I look at the work of influential agricultural economists who worked during 1910–1960 and what that work may or may not have influenced in the thinking of the general economics profession. The conclusion which emerges from this overview of the first fifty years is that agricultural economists were always concerned with real problems and policies; the influence that they wielded on the general economics profession was due in large part to this orientation.

William Jasper Spillman (1863–1931): Farm Management and Estimation of Costs

The first president, from 1910–1912, of today's AAEA, Spillman was an agronomist turned agricultural economist. After making a few academic rounds, in 1894 he began his career in earnest at Washington State University. Spillman did many important things at WSU, like rediscovering Gregor Mendel's Law by breeding wheat (Johnson, L.P.V. 1948). In 1902 Spillman was invited to join the staff at the USDA. There, he wrote a few lines which would have warmed the cockles of T. W. Schultz's heart: “I was so much impressed with the vast amount of knowledge the better class of farmers had that in January, 1902, when I came to the National Department of Agriculture and found myself at liberty to plan my own work, I chose to begin the deliberate study of farm practice, with a view to getting together and analyzing the knowledge farmers had already gained in their experience,” (Taylor and Spillman 1922, 99). Except for the period 1918–1921, when a serious disagreement with the then Secretary of Agriculture forced him to resign, after he was reappointed in 1921 he spent the remainder of his life doing the work he loved.16 This led him to publish many papers on farm management practices, but most importantly, to attempt to verify what J. M. Cassels was later to call “The Law of Variable Proportions.” (Cassels 1936.) The classical economists, such as Malthus and Ricardo, had long regarded the principle of diminishing returns as the result of applying a variable factor of production to some fixed factor. The neoclassical economist John Bates Clark (1847–1938) was, to the best of my knowledge, the first to show that any factor of production could be treated symmetrically with any other. In competitive markets, each factor of production would receive its marginal product: labor, wages; land, rents (Clark 1891). In his great book, Risk, Uncertainty and Profit, Frank Knight (1921) made diminishing returns, in the sense of decreasing marginal productivity, the centerpiece of his story about how the economic system works. Spillman wanted to demonstrate this principle empirically.17 For example, in 1923 and 1924, Spillman published papers on the law of diminishing returns, his rubric for diminishing marginal productivity, and in 1924 Spillman and Lang published a book-length treatment.

Spillman is rightly credited with having established the field of farm management economics, a field that is important in every land-grant university in the nation, and is central to agricultural extension everywhere. But Spillman's work had an important unintended consequence of great moment. Moreover, misuse of his work in connection with the great debate on the tariff question was indirectly responsible for Henry Schultz's great work on demand.

Following the early work of Spillman and his group at the USDA, not only did the field of farm management burgeon, but the countless studies that were made at the USDA and all the land grant colleges began to be used for purposes for which they were not intended, for example, constructing synthetic estimates of elasticities of supply of farm products (Black 1924), and above all for studies of cost of production to provide better information for the setting of increasingly high tariffs (H. Schultz 1927). A few years into his career at Iowa State, T.W. Schultz (1939a; 1939b) engaged in a spirited debate with John D. Black (1939; 1940). Schultz focused on the differences between expectations and realizations as a fundamental source of misallocation of resources in farming. Black, on the other hand, seemed readier to accept a lack of knowledge about the underlying technical processes. Heady (1948) attempted to reconcile the differences between Black and Schultz under one overarching view of efficiency in the economic allocation of resources, subject to uncertain technical constraints.

There are good reasons to suppose that the contribution of one productive factor can more easily be isolated in agriculture than in industry. The technique of industry must often be such as to prevent our varying one factor at a time; there may be only one proportionate combination of factors that is feasible, or, though different combinations can be used, the change from one to another cannot be made by incremental changes in one factor alone. Even where variation is possible, its effects may be hard to distinguish, for the effect may be not so much to change the output of one product as to substitute one kind of product for another; or it may make itself felt only in the internal economies of the long run. In agriculture these difficulties may be absent. Crops may be grown and animals fed with different combinations of factors; variations may be made by small increments of one factor; changes in the quality of the product may not be so great as to prevent our expressing different outputs in a common physical unit; and the effects of variation may be directly apparent in the changes of the output thus measured, (Phelps-Brown 1936).

Phelps-Brown's description of industrial processes is prescient. What was needed to measure cost functions was some form of activity analysis. This was only to be developed during WWII by George Dantzig (1949; 1953), Leonid Kantorovich (1960) and Tjalling Koopmans (1949; 1951; 1960). Koopmans’ note on Kantorovich's paper makes it clear that Kantorovich's work preceded both his and Dantzig's, which were more-or-less contemporaneous.18 Economists began to work along these lines to develop “engineering production functions” (Manne and Markowitz 1963). But the agricultural economists were even quicker to pick up the new tools (Waugh 1951; Christensen and Mighell 1951; Heady and Chandler 1960.) Indirectly then, Spillman's work was the origin of modern production economics and of activity analysis, one of the most useful tools economics has ever produced.

Frederick Vail Waugh (1898–1974) and Zvi Griliches (1930–1999): Hedonics

Waugh had a long and productive career spent mostly at the USDA, where he started in 1932. After stints in the New Jersey Department of Agriculture, the Connecticut Agricultural Extension Service, the Massachusetts Division of Markets, and the New England Research Council, as well as a year abroad, he worked in various agencies of the USDA (Houck 1991, 1331). Waugh's Ph.D. (Columbia, 1929; summary 1928) laid the foundation for hedonic analysis as later developed by Court (1939) and in many papers (see the bibliography in Nerlove 2001), especially Griliches (1961). The work of both Waugh and Griliches ranged widely, but here I want to focus on the topic that connects them both–hedonic analysis.19

Waugh (1928) tries to isolate and measure certain quality factors affecting the prices of asparagus, tomatoes, and hot house cucumbers on the Boston market. For example, he regressed the price per lot of asparagus in Boston (May–July, 1927) on three different dimensions of quality: measures of color, size of stalks, and uniformity of spears. His purpose was to determine consumers’ relative valuations of these characteristics, which he regarded as useful information for asparagus producers. Later, Court (1939) and Griliches (1961) ran similar regressions with the purpose of discovering consumers’ preferences with respect to various options on the automobiles they purchased, so that an appropriate quality-adjusted measure of automobile price changes over time could be constructed.

As Waugh notes (1928, 186), “The practical value of such a study, if successful, is evident. Agricultural economists have been interested for years in the possibility of a better adjustment of production to market demand. This adjustment involves both the quantity of production and the quality of the commodities produced.” Now the problem with what Waugh is doing becomes clear. If in fact his estimates have such value and farmers do adjust to them, they will produce a greater quantity of those quality characteristics. If they can adjust, the relationship that Waugh finds will no longer hold. If they cannot, the analysis, while it may be of interest to us, has no practical value for them. Presumably the same problem arises in the Court (1939) and Griliches (1961) studies if automobile producers also can adjust the qualities and options on the automobiles they produce. Of what value then are their results?

In two papers published in the same year (Griliches 1961; Griliches and Adelman 1961), Griliches resurrected the earlier work of Waugh (1929), Court (1939), and Stone (1954, 1956), although he did not acknowledge Waugh's work until much later. The central idea probably originated independently in his work on the demand for tractors in U.S. agriculture. It is that a commodity can be decomposed into a bundle of attributes. The idea was later theoretically developed by Lancaster (1966). This idea has had a great impact on official statistical measurement of price changes, largely through Griliches's efforts, and in a variety of other fields, for example in the valuation of environmental amenities. The traditional method of adjusting for quality changes over time in the measurement of prices is to “match models”, that is, to use only prices for varieties of a commodity that are unchanged in specification between two adjacent periods, chaining pairs of periods over time. Difficulties arise for commodities, the varieties of which are changing rapidly over time or for totally new commodities. The hedonic technique (Waugh 1929; Court 1939) involves regressing unit prices for different varieties on measures of quality characteristics or attributes; if the varieties are distinguished by time periods, a simple technique for obtaining a quality-adjusted price index is to introduce dummy variables for periods in a multiple regression framework (Court 1939). Griliches's contribution to hedonics was largely to resurrect and to promote, with great vigor and effect, Court's formulation. And, of course, he used the technique very effectively in work on productivity growth and its sources.

The basic formulation in hedonic analysis is to obtain observations—on the unit prices of varieties of a differentiated commodity, units of which embody varying amounts of different attributes or qualities—be these clean air, greenness of stalk, or speed of multiplication. A regression, possibly nonlinear, is then used to estimate the so-called hedonic price function, the gradients of which are the implicit prices of the attributes, the ratios of which, in turn, are supposed to reflect consumers’ marginal rates of substitution among attributes or producers’ marginal rates of substitution or transformation, as the case may be. Unfortunately, just as in the case of ordinary demand analysis, using data on prices and quantities, there is an unresolved identification problem involved in trying to draw inferences about consumers’ preferences or producers’ production possibilities from such hedonic price functions. As Working (1927) pointed out long ago, price-quantity observations represent equilibria of demand and supply and only under special circumstances can regressions of price on quantity or of quantity on price be used to infer anything about the underlying supply and/or demand functions. The classic paper by Rosen (1974) shows that essentially the same identification problem exists for hedonic price functions. Observations on variety prices and on quantities of attributes associated with each variety and the number of units sold are, in general, jointly determined by supply and demand. The demand for attributes in various combinations is determined by consumer preferences, but the supplies of these attributes depend on the costs of producing them in various combinations, as well as on producers’ access to markets for the scarce resources used in production. A large and statistically significant coefficient for a particular quality attribute in an estimated hedonic price function, for example, may reflect not consumers’ high valuation of that attribute, but rather the difficulties that producers have in achieving that attribute per se, or in combination with other attributes. In general, the coefficients in the estimated hedonic regression reflect both supply and demand considerations, both producers’ costs and consumers’ preferences. There is a further problem: in hedonic analysis it is generally assumed that only one variety of each commodity is available, whether or not that is actually the case; all information about the quantities exchanged, if it exists, is suppressed. If indeed true, and if availability is exogenously determined, then the traditional hedonic regression is justified, but not otherwise. In my view, there is no excuse for discarding valuable information if you have it.

Griliches's response to the fundamental identification problem raised by Rosen and others was remarkable for one as concerned with appropriate measurement as he was. He essentially agreed and then moved on in the manner of the Scottish preacher, who is reported to have said, “Ay lads, there's a grave difficulty; let us look it in the eye and pass on.” He wrote (1988, 120): “My own view is that what the hedonic approach tries to do is to estimate aspects of the budget constraint facing consumers, allowing thereby the estimation of ‘missing prices’ when quality changes. It is not in the business of estimating utility functions per se, though it can also be useful for these purposes. … What is being estimated is actually the locus of intersections of the demand curves of different consumers with varying tastes and supply functions of different producers with possibly varying technologies of production. One is unlikely, therefore, to be able to recover the underlying utility and cost functions from such data alone, except in very special circumstances. Nor can theoretical derivations at the individual level really provide substantive constraints on the estimation of such ‘market’ relations.” And further (1986, 326): “… the hedonic hypothesis can be viewed as asserting the existence of a reduced form relationship [sic] between prices and the various characteristics of the commodity. That relationship need not be ‘stable’ over time, but changes that occur should have some rhyme and reason to them, otherwise one would suspect that the observed results are a fluke and cannot be used in the extrapolation necessary for the derivation of the missing prices …” We have learned from Haavelmo (1944) and Frisch (1934) the importance of structural estimation and inference as a basis for understanding behavior and policy formulation; such cannot be obtained from confluent relationships. Hedonic regressions are not even that when varying quantities of each variety are available. However, it may always be possible to make a case for hedonic regression of price on quantity and attributes, or of quantity on price and attributes, along the lines suggested by Working (1927). And the “bracketing theorem” might be usefully employed to set bounds on the implicit hedonic prices (see Schultz, 1938) This being said, however, it is doubtlessly true that Griliches and others would have gotten nowhere in the development and application of hedonic analysis had careful attention been paid to the formidable identification problem involved. Economic statistics, particularly with respect to price indices, would certainly have been poorer for it. In a disarming epigraph to their review of the identification problem for production functions, written with Jacques Mairesse (Griliches and Mairesse 1998), the authors quote Ragnar Frisch (1934, 274) on this point: “We have here one of those cases - so frequent in economic practice - where it can be ‘proved’ by abstract reasoning that a solution is not possible, but where life itself compels us nevertheless to find a way out.” I can think of nothing more appropriate to say about Griliches's great work on hedonics.

Arthur Hanau (1902–1985) and Mordecai J. B. Ezekiel (1899–1974): The Cobweb Theorem and Rational Expectations20

In 1927, Arthur Hanau published a report on his research on forecasting hog prices at the Berlin market. The period of gestation for a piglet is 114 days, or approximately 3.75 months; the period from birth (farrowing) until the hog is ready to be marketed (finished) is approximately six months in the United States, but it was considerably longer in the Germany of Hanau's time, on the order of twelve months. Allowing for some time to breed a sow, and after some experimentation, Hanau settled on a relation between the supply of hogs for slaughter, and the ratio of the price paid and an index of feed prices eighteen months previously. Since the current price revealed a negative correlation with the number of hogs brought to market in Berlin, Hanau concluded that hog prices followed a cyclical path. Eleven years later, Mordecai Ezekiel (1938) made much of that cyclical path in his famous article “The Cobweb Theorem.” Ezekiel was very familiar with Hanau's work and wrote a laudatory review in the Journal of the American Statistical Association in the year following Hanau's publication (Ezekiel 1928).

In the eleven years that intervened between Hanau's paper and Ezekiel's masterful exposition, a number of important papers were published on the possibility of cycles or instability in agricultural prices. Schultz (1930) was interested in interpreting the statistical relation between the price of an agricultural commodity and its quantity marketed in terms of demand functions. His work and that of Henry Moore (1925, 1929) met with a great deal of criticism. The basic question was how to interpret observations on market prices and quantities in terms of supply and demand equilibria. Tinbergen (1930) suggested a solution to the problem in terms of discontinuous supply adjustment, instantaneous demand adjustment, and static expectations. Ezekiel (1938) tried to synthesize all this into a general theory of cobweb phenomena.

Ezekiel's paper made “The Cobweb Theorem” and his famous diagram well-known to every student of economics. Ezekiel was attempting to explain apparent self-perpetuating fluctuations in the prices of some agricultural commodities observed by Hanau (1927). He cited Schultz (1930), Coase and Fowler (1935), Tinbergen (1930), Ricci (1930), Leontief (1934), and Kaldor (1934), who drew similar diagrams. Kaldor gave the name “Cobweb Theorem” to the phenomenon.

Ezekiel discusses a number of limitations and difficulties with the cobweb theory applied to agricultural commodities. Production must be determined completely by producers’ response to price under conditions in which individual producers expect their individual actions will have no effect on the price they will obtain in the market and on the assumption that the current price will hold when their production comes to market (static expectations). Prices must be set by the supply available. The time needed for changes in production requires at least one full period and is not a partial response occurring over several periods of time. These assumptions are obviously unrealistic for most agricultural commodities. Moreover, in the case of crops, weather may greatly alter actual production from that which is planned. Of course, in general, both supply and demand may be affected by stochastic shocks.

The cobweb theorem was subject to considerable criticism following Ezekiel (1938). Buchanan (1939) examined more closely the implications of the underlying assumptions for the supply response of producers of a disturbance in equilibrium. He questioned the assumption that “… while output changes according to the assumption that producers always expect the price ruling in the last period to prevail in the next, the supply curve remains unaltered. In other words, the supply curve is completely reversible throughout its whole length with respect to each period,” (1939, 68) Supply response is assumed to occur fully over one period; there is no partial adjustment and no difference between long run and short run supply response. With no entry and exit, producers always lose more net revenues in a period of low prices than they gain in a period of high prices. Eventually they must cease production altogether. Free entry only complicates matters. But the implication is that perpetual or divergent fluctuation cannot persist. Buchanan's careful examination of previous writers on the cobweb suggests a diversity of views on just what kind of supply response is consistent with the theorem (1939, 77–78) He also questions the assumption of no partial adjustment either over many periods or within one period (1939, 79) Finally he says, “… the inviolable assumption that people never learn from experience, no matter how protracted, is at least debatable.” (1939, 81). To say the least!

Åkerman (1957) introduced a difference between long and short run supply functions: “If a farmer has experienced an appreciable price change for one of his products … and, therefore, wants to extend its cultivation during the following year, he will meet with greater immediate difficulties than if the extension could be brought about gradually over a period of years. … All [earlier authors assume] … one unique normal supply schedule without distinguishing between short- and long-term schedules. This is the main reason why they have ascribed quite exaggerated properties to the cobweb phenomena.” (154–155) Åkerman regards the possibility of a growing disequilibrium rather improbable. (1957, 158).

Until Nerlove (1958a), almost all studies of agricultural supply response were based on the two questionable assumptions underlying Ezekiel's (1938) presentation of the Cobweb Theorem: static expectations and full adjustment to price changes within one period.21Nerlove (1958a, 1958b) introduced adaptive expectations and partial adjustment models of farmers’ response to price in a cobweb model.22 Nerlove found that the ratio of the slope of the demand curve to the slope of the supply curve would have to be larger in absolute value as the adaptive expectations model approached the traditional static expectations. Partial adjustment has the same effect. Thus, while the scope of stability of equilibrium is enhanced by adaptive expectations or partial adjustment or the two in combination, the possibility of theoretical instability and continuing losses by producers is by no means eliminated. Nerlove's study of agricultural supply response (1958a) was successful in demonstrating that farmers were indeed responsive to prices, which accounted for the great surpluses that were built up in the post-war years, and was indirectly but nonetheless deeply influenced by Ezekiel's famous paper.

But Ezekiel's paper had an influence of far more importance for macroeconomic theory. In his paper, “Rational Expectations and the Theory of Price Movements,” Muth (1961) advances the theory that expectations “… are essentially the same as the predictions of the relevant economic theory. In particular, the hypothesis asserts that the economy generally does not waste information, and that expectations depend specifically on the structure of the entire system.” Under this hypothesis, Muth describes producer behavior for a simple model of supply and demand with fixed production lag, that is, the model on which Ezekiel based his cobweb theorem. He finds that with positively serially correlated shocks to the supply function, rational price expectations are a weighted average of past prices in which the weights depend upon the parameters of both the demand and supply functions. When shocks persist forever (i.e., a unit root in supply shocks), the model reduces to adaptive price expectations of the sort used by Nerlove (1958a), only the coefficient of expectations is now a simple function of both the slopes of the supply and demand functions.

Thus was born the theory of rational expectations, with which Robert Lucas revolutionized macroeconomic theory (see Lucas 1972, 1976). It is a remarkable story that takes us from a little known Agrarökonom in 1927 to a Nobel Prize winner in 1995 and a revolution in macroeconomics.

Henry Ludwell Moore (1869–1958) and Henry Schultz (1893–1938): Demand Analysis and Identification of Economic Relations

- The testing of abstract theories.

- The estimation of the quantitative magnitudes of parameters of theoretical relationships.

- The discovery of empirical laws which provide the basis for an enlarged economic theory.”

Moore's first attempt to test an abstract theory is his book Laws of Wages (1911). Unfortunately, as Stigler points out (1962, 6), Moore's test comes a cropper in the extraordinarily naive (even by 1910 standards) theory of wage determination he elects to test.

Moore's next major work was on economic cycles (1914). Here he ran into an interesting problem. In Economic Cycles Moore attempts to establish a link between rainfall and prices. He first works out the relation between rainfall and cycles in weather. Next, he tries to establish the relation between the yields per acre of corn, oats, hay, and potatoes in a circumscribed area. The next step in Moore's chain is to associate annual changes in yield with changes in the prices of crops. Thus, Moore finds simple demand functions and price elasticities of demand for four individual crops. These are all downward sloping as intuition requires. But now Moore blunders. He tries his method out for a “representative” nonagricultural commodity, pig iron. But in this case, he obtains an upward sloping curve. He wrote on this disconcerting result (1914, 112), “Upon the assumption that all demand curves are of the negative type, it would be impossible for general prices to fall while the yield per acre of crops is decreasing. In consequence of the decrease in the yield per acre, the price of crops would ascend, the volume of commodities represented by pig-iron would decrease, and upon the hypothesis of the universality of the descending type of demand curves, the prices of commodities like pig iron would rise. In a period of declining yield of crops, therefore, there would be a rise of prices … But the facts are exactly the contrary.” So Moore invents a new type of demand curve, a “dynamic” demand curve. It was this sort of “improbable” result which motivated Elmer Working (1927) to write his famous paper, “What Do Statistical Demand Curves Show?”

Moore's most important and influential work was in the estimation of statistical supply and demand curves. At first, these were only a link in a chain of causation related to the generation of economic cycles. In Forecasting the Yield and Price of Cotton (Moore 1917), such attempts at estimation form the centerpiece of the analysis. And they had to do directly with southern cotton farmers’ attempts to cartelize and limit output to raise prices received for cotton. In the estimation of statistical demand curves, Moore has some interesting things to say about the ceteris paribus assumption reminiscent of Griliches's response to the fundamental identification problem in hedonic analysis. He wrote (1917, 67): “The method of multiple correlation, on the other hand, inquires, directly, what is the relation [between two variables], not ceteris paribus, but other things changing according to their natural order.” Moore seems to be rejecting the existence of the problem of separately identifying supply and demand. Clearly this confusion led him to his “dynamic demand curve” formulation for pig iron in his earlier work. Again, our focus here should be not on the implausibility of Moore's position but on Working's (1927) response, which had far-reaching consequences for econometric methods. In Synthetic Economics, Moore actually estimates a recursive system for potato supply and demand, making demand depend on current price and equal to supply in the current period, whereas supply depends on lagged price.23

We come now to the work of Henry Schultz, Moore's student and disciple. Whereas Moore was largely concerned with the methodological problems of statistical economics, Schultz was more concerned with applying the new techniques to real world policy issues, in particular the effects of tariffs on output and domestic demand for agricultural commodities. Schultz, in turn, was reacting to the attempts of Black and others to carry out “synthetic” supply and cost analyses based on farm management studies pioneered by Spillman. In “Cost of Production, Supply and Demand, and the Tariff” Schultz (1927, 193) wrote: “Scientifically to determine the effect of a tariff on conditions of supply we must work, not with cost curves, but supply and demand curves.”

So Henry Schultz set out to measure the elasticities of supply and demand for many important agricultural products: beef (1924), sugar (1925, 1928), corn, hay, wheat, potatoes, oats, barley, rye and buckwheat (1932), and finally his great work, The Theory and Measurement of Demand (1938), which covered many of the same commodities that Schultz had previously investigated. Schultz took price as the dependent variable in his regressions. He argued that, in annual observations, quantity was determined by weather and other factors independent of influences on the demand for a particular product so that quantity could be treated as independent in a regression context. As pointed out by Karl Fox and the group at the USDA assembled by F.V.Waugh in the immediate post-WWII era, however, this assumption is disputable. This group published a large number of studies in the 1950s, which were summarized by Waugh (1964).24 When a commodity has many uses including the possibility of storage, of which domestic consumer demand is only one, quantity cannot be taken as exogenous, even in an entire production cycle (Fox 1953). One of the earliest extensive uses of the simultaneous-equations techniques developed by the Cowles Commission group at the University of Chicago to individual commodities is this impressive group of studies.

Finally, in the early post-WWII period, the group at the Department of Applied Economics under the direction of Richard Stone undertook an extensive series of demand analyses, following in the Henry Schultz tradition, with the purpose of estimating the effects of the removal of rationing in Britain (Stone 1954). A large amount of research on demand systems and household behavior followed. This is the intellectual legacy of the American agricultural economist, Henry Schultz, who died at the tragically young age of only 45 in an automobile accident.

Theodore W. Schultz (1902–1998): Transforming Traditional Agriculture and the Department of Economics, University of Chicago25

Earlier in this essay I discussed the contribution of T.W. Schultz to the transformation of development economics in the post-WWII period. In this section, I discuss his contribution on other fronts; the first and foremost relates to the changes he wrought when he came to the Department of Economics of the University of Chicago in 1944, and especially after he became chairman of that illustrious department in 1946.

Schultz's main contribution to Chicago economics was not to its distinctive “public” image, which is largely that of Henry Simons, Friedman, Stigler, Wallis, and later Becker, Coase, Lucas, and Posner, but rather to the distinctive style of inquiry which emerged from the workshop system. In agricultural economics there is a long tradition of collaborative and interactive research stemming from the organization of land-grant institutions and the specific obligations of research and extension imposed on them. What Schultz and his student D. Gale Johnson (1916–2003), who arrived at Chicago with him in 1944, did was to adapt this land-grant institution to the Chicago setting. This system came to dominate Chicago graduate training and research in all fields of economics and has come to be widely imitated elsewhere, albeit nowhere with the success which has been achieved at Chicago.

Reder (1982, 2) writes that “… the dominant characteristic of a Chicago economist's professional environment is the frequency and intensity with which he engages in substantive discussion about on-going research. Seminars, workshops, and discussion groups exist elsewhere, but at Chicago the number is [now] very large, and the discussion intense. While students attend them [indeed, actively participate] …, workshops are not student discussion groups. Rather they are places where faculty members of all ranks, and visitors, discuss current research and debate new results. The tone of the workshop discussion is greatly influenced by the fact that senior faculty members attend, and participate actively. The senior faculty is not confined to the workshop's directors, but normally includes others. Workshops, therefore, are places where issues in current research are debated by leaders of the field immediately concerned and of adjacent fields as well.” The style of a workshop also differs substantially from the usual seminar or lecture elsewhere: elsewhere, the person presenting the seminar generally talks for most of the time with discussion confined to the last half hour (at best!). But at a Chicago workshop, the paper is distributed beforehand, read thoroughly by participants (or supposed to be), and the presenter is given only 10 minutes or so before debate is joined. Such a style is the consequence of an ongoing and coherent program of research.

In 1948, T.W. Schultz, who had already developed strong ties with the Rockefeller Foundation and related funding activities of the Rockefeller brothers, persuaded the Foundation to fund “… [a] program of research in agricultural economics under the direction of Professor T. W. Schultz.” This was to be a multidisciplinary effort to study “… the full efficient use of human effort and capital in agriculture, and to indicate policies for modifying circumstances that give rise to underemployment and poverty.” This program and the funds it provided for graduate student support led directly to the establishment of the Workshop in Agricultural Economics, which served as the model for other workshops at Chicago, and which has characterized the Chicago style for more than 50 years. Research to 1951 dealt largely with problems related to resources, particularly labor, and the consequences of macroeconomic instability on U.S. agriculture. In 1951, the Rockefeller Foundation renewed its grant, but emphasized the problem of low productivity and low income in U.S. agriculture. Problems of grain storage and price stability were also a continuing theme, with major pieces of research done by Robert Gustafson, Hendrik Houthakker, and Lester Telser. New work on natural resources was also undertaken by George Tolley under the auspices of this segment of the Rockefeller grant. Rockefeller support was renewed periodically throughout the 1950s and 1960s, even past Schultz's “official” retirement, and into the 1970s, but the emphasis gradually shifted towards development, problems of international stability, and human capital. From the beginning, when focus was on U.S. agricultural policies and how incentives to invest in agriculture were distorted, to the present emphasis on poor countries, the influence of the distinctive Chicago point of view is apparent. T.W. Schultz was both shaped by the Chicago School and did, himself, much to create it in its less doctrinaire form.

Much of the work at Chicago concerned the instability of agricultural prices, the particularly disastrous consequences of the vicissitudes of weather, which have constantly affected agriculture since it emerged 12,000 years ago, the increasing effects of cyclical instability in the growing nonagricultural economy in which agriculture is immersed, and the relative immobility of agricultural resources, both human and nonhuman. There was a great concern among agricultural economists, and indeed more generally, with instability and uncertainty in agriculture. These concerns led to considerable legislation, as well as research interest in both the problem of instability in agriculture generally and in the effects of policies, those proposed as well as those implemented, to deal with it and its consequence for farm people. D. Gale Johnson's 1945 Ph.D. dissertation, written under Schultz's direction and greatly inspired by him, dealt with the problem and consequences of price instability in agriculture (Johnson's dissertation was published as Johnson 1947). Many of T.W. Schultz's early papers dealt with the economic effects of agricultural programs, expectation formation, the effects of uncertainty, and agricultural adjustment in a changing economy. His first important book, Agriculture in an Unstable Economy (1945), dealt with this topic.

It is now more-or-less commonplace that the effects of macroeconomic policy and macroeconomic events on agriculture are far greater than the other way around, even in developing countries in which the agricultural sector bulks large. But in the United States of the 1930s and 1940s that was not a generally held view among economists; Schultz's work, inter alia, helped to dispel our professional myopia. More importantly, the beginnings of a more comprehensive view of the role of human capital were being developed. After the war, Schultz served as a consultant to the occupation forces in Germany under Lucius Clay. Although he rarely spoke about this experience and wrote only one paper directly related to it, I think it helped him to sharpen his ideas on the subject of human capital and its role in economic development, or, in this case, the recuperation of the German economy.

From the very beginning of his career, Schultz was preoccupied with the puzzle of why the “facts” failed to reflect the widely held view of the prevalence of diminishing returns in agriculture. His first published paper, “Diminishing Returns in View of the Progress in Agricultural Production” (Schultz 1932) dealt with this issue, but perhaps his most important essay on why we have not observed classical diminishing returns to agriculture was “The Declining Importance of Agricultural Land” (Schultz 1951).

The 1951 paper was pivotal in Schultz's thinking about capital, especially human capital, knowledge, natural resources, value, and growth. Much later in his 1977 Bicentennial Lecture to the Economic Research Service of the U.S. Department of Agriculture (reprinted in Origins of Increasing Returns, Schultz 1993), he wrote: “In thinking about nonrenewable natural resources, the common sense perception of their eventual exhaustion or permanent impairment as a source of amenities is not in dispute. … The critical unsettled economic question in this connection pertains to the changes over time in the substitution possibilities among natural resources, labor, and reproducible capital.” (Schultz 1993, 80). To understand these possibilities, he wrote “… We require an all-inclusive concept of capital. Reproducible tangible wealth is only one category of capital. Although natural resources are not reproducible, they are … another category of capital. Human agents are the most important category in this all-inclusive concept …” of capital (Schultz 1993, 73). Schultz's 1956 paper, “Reflections on Agricultural Production and Supply,” lays out the idea that the ‘unexplained growth in agricultural output should be explained by expanding the concept of inputs to account for their quality and to treating new knowledge and the contribution of public investments in such knowledge as inputs.” If inputs were correctly measured, he argued a “correct” index of output per unit of input ought to remain roughly constant. Here one can see the origins of growth accounting, human capital theory, and endogenous growth theory.

Now a word about T.W. Schultz's best known contribution, published a few years after my cut-off date, in 1964. In his scathingly vitriolic review of Transforming Traditional Agriculture (Schultz 1964), Thomas Balogh (1905–1985), later Lord Balogh, wrote (Balogh 1964): “No transforming of Chicago: this is an ill-informed and potentially mischievous book on a subject which is among the most vital and most urgent in the world. It is ill-informed because Professor Schultz ignores literature essential if a balanced judgment on the transformation of primitive peasant agricultural production is to be arrived at, and the basis for effective policy is to be found in the largest and most populous parts of the world.… It is also an unscientific book.” Time has treated Schultz's work with greater charity than it has Lord Balogh's review. It is difficult in retrospect to appreciate how revolutionary Schultz's views on the economics of development were. In one apt assessment, Anne Krueger wrote: “It is almost impossible, with hindsight, to understand how great Ted's contribution to understanding economic development was. Development was seen to be ‘different’ because ‘normal economics’ didn't apply. It was said to be that cultural obstacles, structural rigidities, dependence on primary commodities and other phenomena made developing economies different. At bottom, people (most of whom were then in agriculture) were thought to be set in their traditional ways, either too content or too ignorant to be willing to change or to respond to incentives. … Ted challenged all that frontally.”26

To sum it all up: I argue that T. W. Schultz was the most important agricultural economist of the 20th century. His influence was wide and deep and went much beyond development economics. The theory of human capital, understanding the absence of diminishing returns in agriculture, are just two; the people like Griliches, Gardner, and others whom he inspired; and the atmosphere of intellectual ferment, excitement, and interaction, which he and D. Gale Johnson created in the Economics Department, are among the other most important achievements.

3. Summary and Concluding Remarks

Agricultural economists were largely motivated by the issues of the times. Some of their work resulted in major new ideas and innovations in economics, but not before a long gestation period had passed. Table 2 summarizes the policy issues characterizing the period of 1910 to 1960 and the contributions of economists and agricultural economists to their resolution.

| 1910s | 1920s | 1930s | 1940s | 1950s/60s | |

|---|---|---|---|---|---|

| Political economy | Breaking up trusts, controlling monopolies | Agricultural import tariffs, dumping, Agricultural Marketing Act | Great Depression, Farm programs to curb acreage/reduce herds, Commodity Credit Corporation | Marshall Plan Cold War | Cold War Developing economies Foreign aid |

| Economic ideas | Marshall (determination of market prices, factor remuneration) Pigou (welfare economics, price discrimination) Taussig (tariffs, railroad rates) | Viner (dumping; cost curves/ supply curves) | Keynes Robinson/Chamherlin (monopolistic competition) Hicks/Allen (determination of supply/demand functions) | von Neumann/ Morgenstern (game theory) Samuelson (equilibrium and comparative statics) | Harrod / Domar – Lewis – Solow (growth models) TW Schultz (economics of being poor) |

In the period before World War I, agricultural economics was just beginning to emerge as a distinctive field within economics more generally. Farmers’ problems were national problems. Farmers were particularly impacted by railroad freight rates affecting the relation between prices in the centers of population on the East Coast, by U.S. export prices, by tariffs, and by prices received at the farm gate. Economists such as Marshall, Pigou, and Taussig were also interested in the determination of prices, the effects of monopolies, and the impact of tariffs.

Spillman was the foremost agricultural economist of the day. He contributed to the debates by analyzing farm costs and returns from a farm management point of view. But his work was later misapplied in the attempts to estimate agricultural supply responses by Black (1924) and others. Henry Schultz, an agricultural economist, pointed out that one needed estimates of both supply and demand elasticities in order to understand the effects of tariffs and railroad rates, and presumably also to affect prices at the farm gate. Schultz's work and that of others such as Elmer Working, Tinbergen, and Richard Stone inspired Marschak and Koopmans and others at the Cowles Commission at the University of Chicago in the development of econometric methods of structural estimation and identification. Their work in turn came back to affect Karl Fox at the U.S. Department of Agriculture and his leadership in an extensive series of structural econometric studies of agricultural commodities.

F.V. Waugh, who wanted to help vegetable growers in the Boston market area decide on qualities of vegetables to grow and ship, developed the first methods of hedonic price analysis. His work inspired Louis Court's hedonic analysis of the effects of automobile options on automobile prices, which in turn inspired Griliches's work on proper productivity analysis and factor quality changes over time. Erwin Diewert's work on price indices (e.g., Diewert and Mizobuchi 2009) was subsequently informed, as was the Boskin critique of the consumer price index.27

Spillman's work, which established the field of farm management, not only led to their misuse in attempts to resolve the tariff question and the critique by Henry Schultz, but to Phelps-Brown's critique of similar methods to study industrial costs and pricing for the cartels and monopolies established by the NIRA in the 1930s. In turn, this failure led Dantzig and Koopmans to invent linear programming and activity analysis.

Agricultural prices and production had always been fluctuating and subject to the vicissitudes of weather and farmers’ expectations. This instability led Arthur Hanau in 1927 to study the cyclical variation in hog prices in the Berlin market. Farmers’ problems during the Great Depression of the 1930s were magnified by the instability of agricultural prices. Mordecai Ezekiel published his famous paper on fluctuations in corn and hog prices and the cobweb theorem in 1938. Criticisms of his underlying assumptions on expectations and producers’ behavior led to a revolution in macroeconomics pioneered by Robert Lucas. Of perhaps equal importance was T.W. Schultz's work on agriculture in an unstable economy and the development of the concept of human capital. His work profoundly influenced how economists viewed the problem of the development of poor economies.

In the 50 years following the establishment of agricultural economics as a distinct subfield of economics, the importance of the agricultural sector and of farmers in the U.S. economy has dwindled; whereas 50 years ago the sector consisted of approximately one-third of the U.S. population, it now comprises slightly over 8% (see table 1). Indeed, in 2010, farm and ranch families accounted for just 2% of the U.S. population.28 I have shown, despite the declining importance of farmers and of agriculture in the United States, that the work of agricultural economists exerted considerable influence on general economics during these years. I have purposely not touched upon the years following 1960, partly because it seems to me that the interchange between agricultural economists and general economics became much more one-sided. Without greater hindsight, however, I am reluctant to pass judgment.