The role of mandatory lockup ratios in initial public offerings

Funding information: Fundamental Research Grant Scheme, Grant/Award Numbers: (FRGS/1/2018/SS01/UUM/02/7) (S/O Code, 14203)

Abstract

This paper examines the potential explanations for Initial Public Offering (IPO) lockup provisions. This study uses cross-sectional regression, robust least squares, and quantile regression on data for the period from 2000 to 2014. We explore the explanation of lockup as (i) a signal of firms' commitment to alleviate the moral hazard problem, or (ii) a signal of firms' qualities. The results document that firms retain higher proportions of their shares as a signal of commitment rather than quality. Besides that, firms with higher lockup ratios are more likely to engage high-quality underwriters for their listing exercise. The findings suggest that although the regulation requires major shareholders to lockup their entire shareholdings until 6 months after the IPO listing, they tend to keep higher proportions than the minimum requirement of 45% of the enlarged issued and paid up capital as a signal of commitment towards reducing the moral hazard problem. Thus, investors should recognise the signalling role of the lockup provision when they make investment decisions. Policymakers need to pay attention to the formulation of lockup provisions. While lockup is mandatory, the different percentages of shares locked up are of interest to this study. Further, the findings highlight the importance of lockup provisions in boosting the confidence of investors to participate in IPOs. This study provides new empirical evidence regarding the role of the lockup provision.

1 INTRODUCTION

A lockup provision arises when the regulators prohibit major shareholders from selling a specific portion of their shares for a specified duration following an Initial Public Offering (IPO) exercise. This period is known as the “lockup period”, and the date the shareholders are allowed to sell their shares is referred to as the “lockup expiry date”. Data on the lockup period is difficult to collect in the UK, unlike in the US where it is compulsory to publish the data during the IPO listing. In both countries, the lockup agreement involves negotiations between the issuers and underwriters. In contrast, in Malaysia, the Malaysian Securities Commission (SC) has published a guideline requiring all firms going for listing to comply with the lockup provision regulations. In Malaysia, the lockup provision is termed as the “share moratorium” and the information related to it is published in the prospectus, but a proper understanding of the share moratorium information is still lacking among investors.

In 1995, the SC allowed all firms in the construction, services, or specialised activities sector that were seeking listing on the Second Board or Main Board of Bursa Malaysia to choose between (1) providing a profit guarantee of 90% of the forecasted profit and maintaining annual profits of 90% for the following 2 years after listing; or (2) a share moratorium of the entire shares held by the substantial shareholders and promoters. Subsequently, the profit guarantee option was dispensed with in May 1999. At the same time, firms aiming to be listed on the Main Board were required to maintain a minimum lockup ratio of 45% of the enlarged issued and paid up capital, and promoters of MESDAQ (Malaysian Exchange of Securities Dealing and Automated Quotation) companies were required to hold at least 51%. In February 2008, the SC introduced a new rule prohibiting promoters from selling their entire shareholdings except for the promoters of Infrastructure Project Companies (IPCs), which were required to retain 45% of their shareholdings. The share moratorium policies and guidelines were tightened further in August 2009. The revised policies imposed a moratorium on the entire shareholdings and a six-month lockup period on all companies seeking listing including IPCs and companies going for listing on the ACE Market (Access, Certainty, Efficiency), formerly known as the MESDAQ Market (Mohd Rashid et al., 2014). While the revised rules seem more restrictive than the earlier ones, the lockup ratio interestingly shows an increasing trend, perhaps as a signal of commitment or quality, which has not been explored by previous researchers.

To the best of the authors' knowledge, very few studies have examined the determinants of the lockup ratio be it from the perspective of a developed, developing, or emerging market. While the lockup requirement in Malaysia is set as the entire shareholding held by insiders for 6 months, the different ratios of insider lockup and disposal during and after listing may reflect sensitive information. In this regard, this paper will explore certain questions that have not been addressed by previous researchers. There is a dearth of literature providing insights into why issuers generally opt for higher lockup ratios. Thus, this study aims to examine whether the higher lockup ratios signal issuers' commitment to reduce the moral hazard problem or highlight their qualities.

The aim of this paper is twofold. Firstly, we argue that a detailed analysis of the lockup ratios published in IPO prospectuses may provide differences in agreement due to either shareholders' commitment or their intention to signal growth to investors. We use shareholder retention and underwriter ranking to represent the commitment of insiders. The lockup ratio signifies insiders' commitment to hold their shares and reduce the severity of moral hazard after the IPO listing. Furthermore, firms use the lockup ratio as a bonding mechanism to protect investors from overestimation of the firms' future prospects. This study extends the signalling model proposed by Courteau (1995), which suggests that high-quality firms are likely to commit to higher lockup ratios. Brav and Gompers (2003) argued that insiders (pre-IPO shareholders) tend to commit to higher ratios when firms have less information asymmetry problems, as it is costly for low-quality firms to mimic this act. Recently, Albada et al. (2019) argued that shareholder retention conveys a signal of IPO quality and prospect. They also discovered a negative link between shareholder retention and investor heterogeneity, but their study did not investigate the relationship between shareholder retention and the lockup ratio. Further, we contend that the lockup provision by insiders is less likely to send a credible signal of commitment without certification by a third party. Thus, underwriter certification may be deemed as a credible signal of the quality of the information provided by issuers. Firms engaging highly ranked underwriters are more likely to be associated with high-quality, well-established IPOs. Firms with good-reputation underwriters will signal their actual values. Thus, investors will realise that it is worthwhile to invest in the IPOs made by these firms. In contrast, low-quality firms will find it difficult to maintain higher lockup ratios. Therefore, we contend that firms with prestigious underwriters have a commitment to ensure their qualities, and that firms are more likely to retain higher ratios as a tool of commitment.

Secondly, this paper seeks to provide an understanding of the association between growth hypothesis signalling models and the lockup ratio. Several previous studies argued that high-quality firms deliberately underprice their issues to signal their qualities (Grinblatt & Hwang, 1989). We contend that besides underpricing, firms may also use accounting performance such as earnings to signal their quality. In this paper, we use the changes in earnings before interest, tax, depreciation and amortisation (EBITDA) margin, research and development (RND) expenditures, and sales growth to measure the quality signal since these accounting performance ratios are difficult to manipulate. We argue that firms with strong growth prospects and higher profitability ratios should have lower lockup ratios. We also argue that firms with higher information asymmetry are more likely than the high-quality firms to lock higher proportions of their shares. The reason is that firms with higher levels of uncertainty and information asymmetry tend to compensate for the risk of investing in their firms by maintaining higher lockup ratios. They prefer to hold higher ratios to attract investors and convince those investors to subscribe to their IPOs.

Therefore, this study's objective is to examine the determinants of lockup provisions in the Malaysian market, given the lack of evidence in the existing literature on this issue. The action taken by the Malaysian regulators to continue enhancing the lockup provision regulations has motivated this study to examine the factors influencing firms to retain higher shareholding proportions than required by the regulations. In achieving the objective of this study, we examine the role of the lockup ratio as a signal of firms' commitment and quality.

This paper is organised as follows. Section 1 discusses the literature supporting the argument of this study. Section 2 elaborates on the data and methodology employed in this study. Section 3 discusses the findings regarding the determinants of the lockup ratio. Section 4 provides the conclusion and implication of the findings.

2 LITERATURE REVIEW

A past study by Brav and Gompers (2003) suggests that the lockup agreement serves as a commitment device to reduce the severity of moral hazard and information asymmetry. However, the findings of Brau et al. (2005) support the signalling role of the lockup agreement but fail to support the commitment hypothesis. Karpof et al. (2013) investigated the role of lockup agreements in their search for a solution to the high level of information asymmetry between insiders and investors. They found that the lockup agreement provides assurance to outside investors regarding the IPO quality. Hoque (2014) contended that post-IPO moral hazard issues can be mitigated by including lockup agreements in IPO exercises. Even though the influences of lockup on underpricing and liquidity have attracted high attention among academic researchers, few studies have been done on the determinants of the lockup ratio. While the Malaysian market regulators have imposed a mandatory lockup requirement, firms seem to have implemented different lockup ratios that are above the requirement. Therefore, we examined the prospectuses of firms seeking listing to determine the factors influencing the lockup provisions. If the lockup provisions are related to issuers' commitment to reduce uncertainty, the commitment hypothesis will be positively supported. On the other hand, if the lockup provisions convey information on firms' growth prospect or signal quality, then the hypothesis on signalling quality will be negatively supported.

We examined the commitment hypothesis in this study by looking at shareholder retention and underwriter ranking. Firm insiders such as pre-IPO owners have almost unlimited access to information on the firm. In contrast, new external investors have limited information, and most of the information they have is provided by the pre-IPO owners. Although there is a legal requirement on disclosure, particularly in the prospectus, pre-IPO owners may have the incentive and opportunity to misrepresent the information provided to the external investors (Che-Yahya et al., 2014; Mohan & Chen, 2001; Riley, 1979; Spence, 1976). Ritter and Welch (2002) demonstrated that based on the asymmetrical information theory, rational investors need assistance to mitigate their fears about a particular issue since they know that the firm is always better informed than the investors. “Insiders” are the people who are better informed about the firm and have access to “cheat sheets” such as the projected earnings. This study uses the argument by Albada et al. (2019) and Mohd-Rashid et al. (2018) that shareholder retention signals insider commitment as reflected in the higher proportion of shares locked up by the founders (lockup ratio). Therefore, we argue that firms lock up a higher proportion of insiders' shareholdings to signal commitment, thereby portraying themselves as good issuers that issue high-quality IPOs. Therefore, the following hypothesis has been developed:

Hypothesis 1.Shareholder retention is positively related to the IPO lockup ratio.

Underwriters play an important role in preventing insiders from trading a large number of shares immediately after the IPO listing and engaging in price stabilisation (Mohan & Chen, 2001). Therefore, in order to reduce the price stabilisation risk, it is reasonable to suggest that firms with more prestigious underwriters decide on higher lockup ratios to reduce the detrimental effects caused by the act of selling shares by insiders. On the other hand, Albada et al. (2019) suggest that firms that engage prestigious underwriters tend to have a lower level of investor's heterogeneity on the firms' values. Ong et al. (2021) posited that prestigious underwriters, as experts, can certify the quality of IPOs. They found that big firms, deemed to be of high quality due to their established operating history, tend to engage the service of reputable underwriters. Furthermore, these firms are usually fairly priced at close to the intrinsic values. This study extends the proposition by arguing that in ensuring the transparency and quality of IPOs, firms with prestigious underwriters prefer the founders to hold higher proportions of their shareholdings as a signal of commitment. Thus, this study proposes:

Hypothesis 2.Underwriter's reputation is positively related to the lockup ratio

In order to measure the quality signal, we used research and development (RND) allocations from the proceeds raised to represent the growth prospect and EBITDA margin and sales ratio as indicators of firms' profitability. RND is a highly intangible asset that is likely to indicate the quality (uncertainty) of a firm. We argue that IPO proceeds that are used for growth purposes such as RND indicate a superior and high-quality IPO. Investors may perceive such firm to be of high quality compared to other firms that use the IPO proceeds to settle their debts, as the former is using its funds for long-term investments. Accordingly, firms with less risk or uncertainty may set lower lockup ratios as they do not need to convince investors or persuade them to invest in the firms through higher lockup ratios. The importance of RND has been highlighted by Guo et al. (2006). One of the aspects scrutinised by investors in order to reduce their risk and enhance market efficiency during an IPO is the RND potential. Therefore, we hypothesise:

Hypothesis 3.RND is negatively associated with the IPO lockup ratio

Sales and EBITDA growth rates are more accurate than the earnings growth rate in predicting firms' growth (Zheng & Stangeland, 2007). Thus, we use the changes in recent EBITDA as a proxy for firm quality (Zheng & Stangeland, 2007). We use EBITDA profit margin instead of net profit margin since it is a more stable measurement and is expected to be less affected by non-operating items (Purnanandam & Swaminathan, 2004). We propose that firms with higher earnings growth rates are more likely to have lower lockup ratios as these firms do not need to certify the quality of their IPOs. In other words, we argue that good-quality firms may have lower lockup ratios because the publicly available accounting performance already signals the quality of these firms to investors. Hence, firms with good quality and growth do not have to convince investors regarding their values via higher lockup ratios. Therefore, we posit:

Hypothesis 4.Firms with higher EBITDA will have a lower lockup ratio

We argue that firms with higher sales revenues are less concerned about their profitability. We use the sales ratio as a proxy for sales growth rates (Cleary, 1999; Zheng & Stangeland, 2007). Our argument for sales growth is consistent with that for EBITDA, where high-quality firms may signal using their growth prospects and these firms have a lower risk of experiencing a decrease in earnings. Therefore, investors could foresee the cost of financial distress and the potential cost of failing to service the debt are lower in firms with high EBITDA and sales growth. Since the low risk signals good quality to investors, issuers will not be required to lock up higher ratios as a form of insurance. Accordingly, these firms will have lower lockup ratios. Thus, the hypothesis is as follows:

Hypothesis 5.Sales is negatively related to the IPO lockup ratio

3 MEASUREMENT OF VARIABLES AND MODEL SPECIFICATION

A brief discussion on the sample, data collection, and measurement of variables will be provided in this section. The following subsection will discuss the specification model.

3.1 Sample and data collection

Data for all the variables used in this study were obtained from Bloomberg, DataStream, and IPO prospectuses for the period of 2000–2014. The study duration is limited to 2014 to exclude the impacts of the country's political instability that drove investors away from the Malaysian market in 2015. In 2015, Malaysia was embroiled in a political crisis due to the 1MDB scandal that caught the attention of many investors globally. The dataset consists of 374 IPOs listed on the Main Market and MESDAQ on Bursa Malaysia. The final sample of 374 IPOs excludes financial firms and REITs due to different financial statement formats, outliers, and firms with missing data.

3.2 Model specification

(1)

(1)In addition to OLS regression, we also used a robust regression model, which is said to be not overly affected by the violation of OLS underlying assumptions (Huber, 1973). Robust least squares are particularly not highly sensitive to outliers. We also used the basic quantile regression model proposed by Koenker and Bassett Jr (1978) to examine the robustness of the influence of the independent variables on different levels of the lockup ratio. The rationale for using quantile regression is that this study's IPO sample consists of firms of different sizes. Further, the data residual is not normally distributed, indicating the presence of heavy-tailed distributions and outliers. OLS focuses on the dependent variable's mean, which is likely to be affected by extreme data and outliers. Quantile regression is expected to be more efficient, and it allows us to understand the impact of the independent variables on the dependent variable outside the data mean. Thus, quantile regression allows this study to examine the variables that may affect the upper and lower tails of the lockup ratio. We expect the impact will vary on different levels of the lockup ratio, and it is important to identify the factors influencing different subgroups of the lockup ratio. Previous studies have also used quantile regression to explain IPO anomalies (see Mehmood et al., 2020; Mehmood et al., 2021; Wei et al., 2021). In this study, we used the lowest quantile (i.e., the 25th quantile), median (i.e., the 50th quantile), and the highest quantile (the 75th quantile). Furthermore, we added a quadratic term to confirm the possibility of a non-linear relationship between shareholder retention and lockup ratio. The rationale is that shareholder retention provides a broader overview than the lockup ratio since the former involves all the original shareholders whereas the latter only focuses on the major shareholders or promoters.

The dependent variable in this study is the lockup ratio (LR). We argue that the different insider lockup ratios are due to insider commitment and signalling hypotheses. We used shareholder retention (SHRTN) to examine the commitment hypothesis. We argue that insiders' shareholding ratios help firms convince investors regarding the firms' quality. Therefore, the proportion of shares retained by insiders is a form of commitment that signals the quality of the IPO. The second variable is underwriter reputation (UW). We argue that firms that use prestigious underwriters are high-quality firms, and these firms try to demonstrate their commitment to outside investors by assigning higher lockup ratios to assure the investors regarding the IPOs' values.

For the signalling quality hypothesis, we used the research and development expenses allocation before firms are listed (RND). We argue firms that spend more on research and development are more concerned about their long-term performances, and firms that have high growth prospect tend to allocate a higher proportion of the IPO proceeds to RND. As such, these firms may not be overly concerned about signalling their qualities via the lockup ratio. Secondly, firms with high EBITDA and sales growth (SALES) before the IPO may expect the share price to increase after the listing and have greater underpricing. Zheng and Stangeland (2007) found a positive link between firms with high EBITDA growth rates and underpricing, implying that these firms are favoured by investors. Thus, we could expect high EBITDA and sales growth rates to signal high-quality firms to investors. As such, high-quality firms tend to have lower lockup ratios due to lower information asymmetries.

This study also acknowledges that other factors may have significant influences on the lockup ratio. Thus, we include the lockup period (DLP) as one of the control variables. We argue that there is a negative link between lockup period and lockup ratio. In Malaysia, the lockup period was set between 6 and 12 months by the SC, and in August 2009, the lockup period was reduced to 6 months. We argue that firms tend to hold a higher proportion of shares during a shorter lockup period to reduce uncertainty and information asymmetry. For the IPO offer size (OFFSIZE), established firms possess a longer operating history than younger firms. As a result, they are not required to commit to a larger lockup ratio because these firms are deemed to have low information asymmetry. Small firms are perceived as facing higher uncertainty and risk, thus they need to set higher lockup ratios as a form of insurance. We also presume that the involvement of institutional investors (PRIVATE) may reduce the severity of the information asymmetry problem; therefore, the issuers need not signal their quality using a higher lockup ratio. Institutional investors are thought to have access to insider information about companies, and hence, they will invest only in high-quality companies. In this instance, the founders need not hold a higher proportion of their shares to signal the quality of the firms. Finally, we also posit that market condition (MKT) is negatively associated with the lockup ratio. We argue that when the market condition is good, most investors prefer to make a quick return immediately after the listing. Further, market uncertainty or risk is high during a cold market condition. In this instance, insiders will signal firms' qualities by holding a higher proportion of their shares to reduce the uncertainty. Table 1 below provides a summary of the variables in Equation (1):

| Variable | Definitions |

|---|---|

| LR | Percentage of promoter lockup |

| SHRTN |

|

| UW | Underwriter ranking based on the amount of underwriting for the listing year. High ranking for a greater amount of shares underwritten, otherwise low ranking. |

| RND |

|

| EBITDA |

|

| SALES |

|

| DLP |

|

| OFFSIZE |  ; NOSI = number of shares issued at the IPO; POFFER = offer price of the IPO. ; NOSI = number of shares issued at the IPO; POFFER = offer price of the IPO. |

| PRIV |  ; where PRIV = number of shares issued through private placement. ; where PRIV = number of shares issued through private placement. |

| MKT |  ; MKTCONPre offerings = market condition prior to offering; RM = Average total daily return of Emas Index 3 months prior to offerings; and N = number of trading days in the period of 3 months prior to offer ; MKTCONPre offerings = market condition prior to offering; RM = Average total daily return of Emas Index 3 months prior to offerings; and N = number of trading days in the period of 3 months prior to offer |

4 FINDINGS AND DISCUSSION

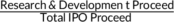

The graph in Figure 1 depicts the relationship between shareholder retention and lockup ratio. The curve shows a sharp increase in shareholder retention when the lockup ratio is higher. It indicates that pre-IPO ownership, consisting of the proportions of shares held by institutional investors, the public, directors, executive officers, and minority shareholders, may influence the lockup ratio. When the major shareholders' ownership, consisting of the stakes held by the firm's founders and substantial shareholders, is smaller and more fragmented, a larger number of shares tends to be disposed of as an offer-for-sale by the pre-IPO shareholders. This finding indicates the lockup ratio by the promoters (founders) is substantial in controlling the structure of pre-IPO ownership. As Figure 1 shows, shareholder retention tends to move positively with the lockup ratio. In other words, shareholder retention could serve as an effective signal that affects the lockup ratio. Shareholder retention refers to the entire portion held by pre-IPO shareholders, whereas lockup ratio refers to the portion held by the founders or also known as promoters in Malaysia. Thus, we may argue that engagement by insiders to hold higher proportions of shares signals commitment by insiders because they are informed investors, and their involvement could be interpreted as a signal of firms' growth prospects.

Panel A of Table 2 shows the descriptive statistics of the variables from January 2000 to December 2014 based on the mean and quartile results. For the preliminary analysis, the findings show the average lockup ratio (LR) of 56%, which is lower than the shareholder retention ratio (SHRTN) of 73%. The lockup ratio indicates that most listed firms in Malaysia maintain higher lockup ratios beyond the minimum requirement of 45%. Further, under the revised lockup ratio regime that requires the entire portion held by insiders to be locked up, firms seemed to prefer to commit to higher ratios, especially among the high-quality firms. Notably the shareholder retention is consistent with the public spread requirement for listing where at least 25% of the shares must be allocated to the public. In other words, the maximum shareholder retention during listing is 75% in order to fulfil the public spread requirement. However, the SC has waived this 25% public spread requirement for some firms. The average underwriter's ranking is 8, and this ranking is based on the underwritten amount. This finding indicates that on average, most of the IPOs in Malaysia engage highly reputable underwriters that provide “certification” of the quality of the IPOs, and these firms tend to benefit from a better valuation during listing. This argument is also consistent with the finding of Chemmanur and He (2011) that highly reputable underwriters are concerned about their reputation, and hence, they will work closely with the issuers to ensure the IPO prices are close to the intrinsic values. This argument is further supported by Ong et al. (2020), which stated that high-quality firms tend to have lower pricing errors or the valuations are close to the intrinsic values. The implication is that firms with reputable underwriters are reliable, and these underwriters are more committed to the firms' prospects to ensure the legitimacy indicator. As a result, insiders would retain higher ratios to strengthen the signal of commitment, ensuring that investors will not be trapped with holding shares in firms with poor prospects. This argument is consistent with the lockup ratio trends, especially in the Malaysian market, where large firms retain higher ratios as these firms have less information asymmetry problems. For research and development (RND), on average, 6% of the IPO proceeds are allocated for RND. According to Eberhart et al. (2004), RND may be associated with information asymmetry, and insiders may take advantage of it to gain profits from trading. Firms with a higher proportion of IPO proceeds allocated to RND are likely to be firms with lower uncertainty. The finding on sales growth rate is consistent with Zheng and Stangeland (2007), where the sales growth rate is high at about 29.3%. The median EBITDA is about 7.9%. Both EBITDA and sales growth indicate that firms with high EBITDA and sales have better access to resources and less uncertainty, and hence have a better potential.

| Panel A: By quartile of each variable | ||||||

|---|---|---|---|---|---|---|

| Variable | Total mean (N = 374) | 10th percentile (N = 374) | 25th percentile (N = 374) | 50th percentile (N = 374) | 75th percentile (N = 374) | 90th percentile (N = 374) |

| LR (%) | 56.86 | 54.38 | 69.76 | 74.66 | 79.02 | 87.28 |

| SHRTN (%) | 73.04 | 58.12 | 69.76 | 74.66 | 79.02 | 84.24 |

| UW | 8.34 | 1 | 4 | 8 | 12 | 16 |

| RND (%) | 6.56 | 0 | 0 | 0 | 8.33 | 28.05 |

| EBITDA (%) | 7.89 | −9.35 | 3.22 | 20.46 | 50.01 | 111.81 |

| SALES (%) | 29.93 | −17.65 | 6.14 | 19.37 | 39.11 | 83.16 |

| OFFSIZE | 17.02 | 15.95 | 16.28 | 16.76 | 17.44 | 18.20 |

| PRIV (%) | 45.31 | 0 | 8.71 | 54.63 | 74.00 | 83.5 |

| MKT (%) | 0.46 | −4.58 | −2.04 | 0.74 | 3.25 | 5.79 |

| Panel B: By quartile of Lockup ratio | ||||||

|---|---|---|---|---|---|---|

| LR (%) | 40–50 (N = 88) | 50–60 (N = 159) | 60–70 (N = 88) | 70–80 (N = 37) | 80–90 (N = 2) | All (N = 374) |

| SHRTN (%) | ||||||

| Mean | 72.63 | 71.57 | 75.20 | 74.58 | 85.01 | 73.04 |

| Median | 74.82 | 74.25 | 74.99 | 74.80 | 85.01 | 74.66 |

| UW | ||||||

| Mean | 7.63 | 8.32 | 8.68 | 9.21 | 10.00 | 8.34 |

| Median | 6.00 | 8.00 | 8.00 | 9.00 | 10.00 | 8.00 |

| RND (%) | ||||||

| Mean | 7.90 | 6.07 | 8.44 | 1.15 | 3.84 | 6.56 |

| Median | 0.00 | 0.00 | 0.00 | 0.00 | 3.84 | 0.00 |

| EBITDA (%) | ||||||

| Mean | 47.87 | 45.91 | −109.38 | 27.22 | 29.21 | 7.89 |

| Median | 29.74 | 17.61 | 17.43 | 20.96 | 29.21 | 20.46 |

| SALES (%) | ||||||

| Mean | 38.20 | 30.01 | 22.77 | 25.88 | 49.19 | 29.93 |

| Median | 20.39 | 20.28 | 18.31 | 17.16 | 49.19 | 19.37 |

| OFFSIZE | ||||||

| Mean | 16.79 | 17.03 | 17.03 | 17.42 | 17.69 | 17.02 |

| Median | 16.62 | 16.76 | 16.74 | 17.11 | 17.69 | 16.76 |

| PRIV (%) | ||||||

| Mean | 43.57 | 45.12 | 46.72 | 46.01 | 63.33 | 45.31 |

| Median | 52.18 | 50.98 | 56.36 | 53.12 | 63.33 | 54.63 |

| MKT (%) | ||||||

| Mean | 0.61 | 0.91 | −0.07 | −0.55 | 0.47 | 0.46 |

| Median | 0.91 | 1.13 | 0.14 | 0.18 | 0.47 | 0.74 |

- Note: Lockup ratio (LR); shareholder retention (SHRTN); underwriter's reputation (UW); research and development expenses allocation prior IPO (RND); EBITDA and sales growth (SALES) prior IPO; lockup period (DLP); offer-size (OFFSIZE); institutional investors (PRIVATE); market condition (MKT).

Panel B of Table 2 shows that shareholder retention and underwriter ranking increase when the lockup ratio is higher. On the contrary, the variables for the quality signal hypothesis (RND, Sales, and EBITDA) decrease when the lockup ratio is higher. We then performed regression analysis to confirm the relationships and summarised the results in Table 3. Model 1 is based on OLS regression and excludes the argument for the quality signal hypothesis. The main finding indicates that both shareholder retention and underwriter ranking are positively significant in explaining the lockup ratio. The finding is consistent with our earlier argument that shareholder retention signals insider commitment. It reduces ex-ante uncertainty, and consequently, the founders of the firms agree to retain at higher ratios than mandatorily required as a sign of commitment. In doing so, they forgo the opportunity to make handsome returns during the IPO exercise. Furthermore, firms use prestigious underwriters to signal their commitment to outside investors by reducing the uncertainty regarding their valuations. Firms with reputable underwriters are concerned about maintaining their reputation in the long term. These firms are likely to be transparent, and their insiders tend to commit to higher lockup ratios. In Model 2, we excluded the commitment hypothesis to examine the influence of the quality signal. The finding indicates that firms with higher lockup ratios are not doing so to signal their quality. The finding on the quality signal is in line with Brau et al. (2004), who argued that firms with higher lockup ratios are associated with higher information asymmetry as the lockup ratios are used to mitigate the agency costs. The findings show that all the quality signal variables are negatively associated with the lockup ratio but insignificant except for EBITDA. As for RND and SALES, the negative relationship indicates that firms that spend less on RND are firms with higher uncertainty and higher lockup ratios. These firms need to provide assurance to investors by maintaining higher lockup ratios. Furthermore, firms with low growth prospect (low EBITDA) tend to have higher lockup ratios. It appears that low-quality firms attempt to gain the confidence of outside investors by setting higher lockup ratios. In Model 3, we conducted the regression analysis using both commitment and quality signalling hypotheses, and the findings did not change. In Model 4, we tested the possibility of a quadratic relationship between shareholder retention and lockup ratio since insider lockup is part of shareholder retention. We found a linear relationship even after using the centring method to avoid the multicollinearity problem in Model 5. In Model 6, we used robust least squares regression to test the robustness of the OLS, which may have limitations due to violation of the assumptions. The findings from Model 6 are mostly consistent with Model 3 and none of the signalling variables is significant, which further strengthens our argument that firms set higher lockup ratios to signal commitment rather than quality.

| Variable | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 |

|---|---|---|---|---|---|---|

| Commitment hypothesis | ||||||

| SHRTN | 0.260 | 0.261 | 1.062 | 0.227 | 0.2598 | |

| (5.377)*** | (5.337)*** | (1.627)* | (4.086)*** | (4.6651)*** | ||

| SHRTN2 | −0.005 | −0.0057 | — | |||

| (−1.217) | (−1.313) | — | ||||

| UW | 0.156 | 0.163 | 0.147 | 0.147 | 0.1684 | |

| (1.694)* | (1.765)* | (1.496)* | (1.589) | (1.7442)* | ||

| Signalling hypothesis | ||||||

| RND | −0.011 | −0.015 | −0.020 | −0.020 | 0.0008 | |

| (−0.260) | (−0.382) | (−0.489) | (−0.484) | (0.0190) | ||

| EBITDA | −0.005 | −0.0003 | −0.0003 | −0.0003 | −0.0004 | |

| (−2.602)*** | (−1.949)* | (−2.081) | (−2.071)** | (−0.6008) | ||

| SALES | −0.005 | −0.007 | −0.006 | −0.006 | −0.0080 | |

| (−0.703) | (−0.876) | (−0.899) | (−0.837) | (−1.0090) | ||

| Control variables | ||||||

| DLP | −4.958 | −5.235 | −4.677 | −4.761 | −4.761 | −5.3067 |

| (−3.861)*** | (−4.084)** | (−3.547)*** | (−3.928)*** | (−3.664)*** | (−4.1354)*** | |

| OFFSIZE | 1.113 | −0.003 | 1.150 | 1.028 | 1.028 | 1.0912 |

| (2.191)** | (−0.009)** | (2.205)** | (2.001)** | (1.951)** | (2.0347)** | |

| PRIV | −0.003 | −0.003 | −0.001 | −0.002 | −0.0025 | −0.0062 |

| (−0.264) | (−0.184) | (−0.078) | (−0.165) | (−0.160) | (−0.3902) | |

| MKT | −0.148 | −0.132 | −0.150 | −0.149 | −0.149 | −0.1399 |

| (−1.540) | (−1.285) | (−2.205) | (−1.537) | (−1.525) | (−1.3599) | |

| C | 21.464 | 60.986 | 20.603 | −4.472 | 26.013 | 22.1947 |

| (1.830)** | (7.483)*** | (1.717)* | (−0.203)** | (2.060)** | (1.8313) | |

| Adjusted R2 | 0.124 | 0.06 | 0.120 | 0.122 | 0.122 | 0.129 |

| F-statistic | 9.820*** | 4.544*** | 6.679*** | 6.202*** | 6.202*** | — |

| Durbin-Watson stat | 2.06 | 2.06 | 2.05 | 2.05 | 2.05 | — |

| Ramsey RESET Test | 0.996 | 1.38 | 1.313 | 1.668 | 1.668 | — |

- Note: (N = 374). Lockup ratio (LR); shareholder retention (SHRTN); underwriter's reputation (UW); research and development expenses allocation prior IPO (RND); EBITDA and sales growth (SALES) prior IPO; lockup period (DLP); offer-size (OFFSIZE); institutional investors (PRIVATE); market condition (MKT).

- * Indicate significance at 10%.

- ** Indicate significance at 5%.

- *** Indicate significance at 1%.

The present study also controlled some variables that may have a significant influence on the lockup ratio. Based on the findings in Table 3, in all models, the lockup period is negatively significant in influencing the lockup ratio. After the regulators introduced a 6-month lockup period in the year 2009, most of the firm insiders kept higher shareholding ratios to mitigate the uncertainty regarding the IPO values after listing. In addition, offer size has a significant positive influence on the lockup ratio. Well-established firms tend to stay longer in business as these firms are likely to have a low level of information asymmetry. Other control variables are not significant. One such variable is institutional investors' involvement, which is negatively associated with the lockup ratio. This finding is in line with the result of Rock (1986), which found that institutional investors who were block traders normally had better insights into firms' qualities. Therefore, informed investors may be reluctant to participate in firms associated with uncertainty and information asymmetry problems (Tajuddin et al., 2015; Tajuddin et al., 2018). Accordingly, institutional investors would only show their interest in the firms they believe to have less uncertainty.

We also controlled the market condition variable 3 months before an IPO is listed. The finding in Table 3 shows a negative link between market condition and lockup ratio, but the relationship is insignificant. This finding indicates that during a bullish market condition, investors tend to subscribe to IPOs due to the expectation of higher initial returns (Zheng & Stangeland, 2007). Accordingly, insiders may keep lower proportions of the shares to earn quick returns during a bullish market condition.

Finally, we also included a quantile regression analysis in Table 4 to demonstrate the relationships between the main variables and the lockup ratio at different levels of the lockup ratio. The OLS result is based on the mean, and it is affected by outliers. Thus, the quantile median is used to substitute for the OLS. Based on the quantile regression result for the median in the high tail (the 75th quantile), the finding supports the argument by Gao (2010) that the lockup ratio serves as a signal of insider commitment rather than IPO quality or growth prospect. This argument is consistent with the finding that EBITDA is no longer significant in the median quantile.

| LR | |||

|---|---|---|---|

| Variable | 25th Quantile | 50th Quantile | 75th Quantile |

| Commitment hypothesis | |||

| SHRTN | 0.085 | 0.277 | 0.450 |

| (1.617)* | (4.390)*** | (7.043)*** | |

| UW | 0.195 | 0.223 | 0.085 |

| (1.803)* | (1.624)* | (0.625) | |

| Signalling hypothesis | |||

| RND | 0.003 | 0.040 | −0.002 |

| (0.064) | (0.686) | (−0.046) | |

| EBITDA | −0.001 | −0.0005 | 0.0002 |

| (−2.745)*** | (1.511) | (0.648) | |

| SALES | −0.012 | −0.008 | −0.0007 |

| (−0.760) | (−0.928) | (−0.088) | |

| Control variables | |||

| DLP | −2.640 | −5.440 | −7.835 |

| (−1.342) | (−2.773)*** | (−4.065)*** | |

| OFFSIZE | 0.960 | 1.545 | 1.108 |

| (1.226) | (2.491)*** | (1.563) | |

| PRIV | 0.003 | −0.026 | −0.013 |

| (0.165) | −1.358 | (−0.579) | |

| MKT | −0.054 | −0.039 | −0.222 |

| (−0.493) | (−0.265) | (−1.556) | |

| C | 28.397 | 12.972 | 16.744 |

| (1.699)* | (0.926) | (1.025) | |

| Pseudo R2 | 0.043 | 0.084 | 0.149 |

| Observations | 374 | 374 | 374 |

- Note: (N = 374). Lockup ratio (LR); shareholder retention (SHRTN); underwriter's reputation (UW); research and development expenses allocation prior IPO (RND); EBITDA and sales growth (SALES) prior IPO; lockup period (DLP); offer-size (OFFSIZE); institutional investors (PRIVATE); market condition (MKT).

- * Indicate significance at 10%.

- *** Indicate significance at 1%.

5 CONCLUSION

The lockup provision or also known as “share moratorium” in Malaysia refers to the prohibition imposed on major shareholders (promoters) from selling their shares for a specific duration after an IPO is listed. The share moratorium is disclosed in the prospectus. While the lockup provision is mandatory in Malaysia, some firms choose to hold at higher percentages than other firms. The different lockup ratios served as an impetus for us to conduct this study with the purpose to investigate the reasons and determinants of the lockup ratio. In examining the effects of commitment and signalling hypotheses, this study used OLS regression on IPOs listed from 2000 to 2014. For the robustness method, robust regression, quantile regression, and quadratic regression models were used to examine the consistency of the findings at different levels of the lockup ratio. The findings show that shareholder retention and underwriter ranking have significant positive influences on the lockup ratio. Therefore, we conclude that firms use higher lockup ratios to signal their commitment and to differentiate their quality from other firms. The lockup provision, as mentioned earlier, is mandatory in Malaysia, but most insiders tend to maintain higher lockup ratios as a signal of commitment. In addition, highly reputable underwriters use the lockup ratio to convince investors to subscribe to the shares by reducing the potential profits to be gained by insiders from selling their shares immediately in the aftermarket.

This study highlights that as long as pre-IPO shareholders (major or otherwise) retain their shares in a firm despite the opportunity to make an exit with handsome returns during the IPO exercise, investors may consider this decision as a positive signal regarding the value of the IPO in the immediate aftermarket. More importantly, this study has determined whether the lockup provision variables signal the commitment or quality of firms. Although the evidence appears to support the commitment hypothesis, more solid evidence is needed before a strong conclusion can be made. The findings of this study shed light on how issuers can signal their quality during the IPO listing process. Furthermore, policymakers should ensure that firms disclose information about lockup provisions in their prospectuses. Future research may choose different accounting variables that may lead to different results. In this study, the accounting variables showed negative values and missing data, which may be one of the reasons for the insignificant findings. Future research may use better proxies, such as leverage, to examine the signalling hypotheses. This study acknowledges the limitations of the variables used in examining the commitment and signalling hypotheses. Therefore, this study calls for further development of the model to determine the reasons behind the different lockup provisions used by firms.

ACKNOWLEDGMENTS

The authors also would like to acknowledge their gratitude for funding from the Fundamental Research Grant Scheme (FRGS/1/2018/SS01/UUM/02/7) (S/O Code: 14203) provided by the Ministry of Higher Education, Malaysia.

Biographies

Rasidah Mohd-Rashid is an Associate Professor of Finance at the School of Economics, Finance and Banking, Universiti Utara Malaysia (UUM). She joined the Universiti Utara Malaysia (UUM) in 2008. Her research areas are investment and corporate finance. She is currently the Managing Editor of the International Journal of Banking and Finance, published by UUM publisher and editorial board of Jurnal Pengurusan (a Scopus indexed journal). She is a Research Fellow at the Economic and Financial Policy Institute (ECoFI), Senior Associate Fellow at the Asian Research Institute for Corporate Governance (ARICG) and Associate Fellow at the Institute for Strategic & Sustainable Accounting Development (ISSAD). She is also a reviewer of few international refereed journals, including Emerging Market Finance and Trade, International Journal of Emerging Market, Journal of Financial Reporting and Accounting and others. She has published in a number of scholarly journals such as Economic Systems, Emerging Market Review, Borsa Istanbul Review, Pacific Accounting Review, Managerial Finance, Review of Behavioral Finance, Asian Academy of Management of Accounting and Finance, International Journal of Economics and Management, Asian Journal of Business and Accounting, Global Business Review, Journal of Islamic Accounting and Business Research, and others.

Assoc. Prof. Dr Ruzita Abdul-Rahim started her academic career in 1995 at Universiti Utara Malaysia and served Universiti Tenaga Nasional (1998-2006) before joining Universiti Kebangsaan Malaysia (UKM) in 2007. She is currently the Chair of Centre of Global Business and Digital Economy (GloBDE) Studies at the UKM. She was the Chief Editor in 2011-2013 for Jurnal Pengurusan (a Scopus indexed journal) and was in the Editorial Board of the journal and Capital Markets Review. She has supervised around 20 Ph.D. students, is an experienced examiner for Ph.D. theses and is a regular reviewer for many local and international journals. Her areas of specialization are Corporate Finance and Investment. In terms of research and publication, she has contributed to the literature on capital structure, behavioral aspects of capital asset pricing in the initial public offerings (IPOs), mutual funds and common stocks, and hedging of the foreign exchange exposures. With the (r)evolutionary development of financial technology (Fintech), she is recently developing an immense interest in digital securities and Fintech. She has started working on the conceptual and application aspects of these technologies in both Finance and Investment.

Karren is a Senior Lecturer in Finance based at The University of Waikato Joint Institute at Zhejiang University City College (NZUWI). Prior to this, she worked at the University of Malaya. In 2014, she graduated with a doctoral degree in finance from Massey University, New Zealand. Her research interest lies in the area of corporate finance, specifically on corporate debt financing, corporate governance, corporate risk-taking, fixed income securities, and multinational corporations. Her publications in international refereed journals include Journal of Corporate Finance, Journal of Banking and Finance, Emerging Markets Review, Pacific-Basin Finance Journal, and Journal of Economic Surveys.

Waqas Mehmood is a PhD candidate at the School of Economics, Finance and Banking, Universiti Utara Malaysia. His area of interest is Corporate Finance, Investment Finance, specifically in Initial public offerings. He is also a reviewer of a few international refereed journals including Pacific Accounting Review, Global Business Review, South Asian Journal of Business Studies, Journal of Financial Economic Policy, Nankai Business Review International and others. He has published in a number of scholarly journals such as Pacific Accounting Review, Review of Behavioral Finance, Global Business Review, International Journal of Business and Society and others.

Open Research

DATA AVAILABILITY STATEMENT

The data that support the findings of this study are available from the corresponding author upon reasonable request.