Symmetric and asymmetric effects of exchange rate: Evidence from capital market and financial sector in Nigeria

Funding information: University of Economics Ho Chi Minh City, Vietnam, Grant/Award Number: IBR_RF026

Abstract

The study analyses the symmetric and asymmetric impacts of exchange rate volatility and fluctuations, respectively on the capital market and financial sector in Nigeria. This analysis entails using monthly data from January 2010 to April 2018 and the autoregressive distributed lag (ARDL) bounds testing framework. The linear ARDL result shows that exchange rate volatility negatively but significantly impacts financial development and capital market in the short-run and long-run. Results of the asymmetric effect show that exchange rate depreciation negatively and insignificantly affects the capital market while exerting a significant positive impact on the financial market in both short-run and long-run at about 0.06 and 0.04% respectively for both sectors. However, currency appreciation positively influences the capital market at 1.23 and 0.66%, but negatively affects the financial sector at 0.09 and 0.02% in the short- and long-run respectively. Thus, the study calls for effective public policy management since exchange rate volatility and currency depreciation pose a bad omen to the capital market. This entails public regulation of the key macroeconomic indicators by encouraging the central bank to maintain interest rates that are favorable toward expanding the productive capacity of private investors. Such policy can also be supported by providing affordable access to investment funds.

1 INTRODUCTION

The development of both the financial sector and capital market is essential to the growth and development of a country as it defines the strength of its currency vis-à-vis the other foreign currencies. This, to a large extent, also shapes the interest of public affairs, which sole aim is to regulate the activities of both financial sector and capital market, through the activities of Central Bank and the Securities and Exchange Commission. According to Levine (1997) and Omojolaibi et al. (2016), the financial sector provides the needed impetus to boost economic growth through its credit creation activities. The sector can also stimulate economic activities by enhancing productive activities through credit allocation to the private investors in desired areas of interest at a point in time (Abdalla & Murinde, 1997; Mesagan, Ogbuji, Alimi & Odeleye, 2019; Ogbuji et al., 2020). Again, the attempt by the financial operators to develop the financial system requires a significant contribution from the capital market. This is hinged on the fact that the capital market provides support for financial firms to draw their funding and improve their operations. Usually termed as a contact point in which financial instruments with low liquidity and long maturity dates are traded, the capital market also provides a means for local and foreign investors to acquire portfolio investments (Chatrath et al., 1996; White & Woodbury, 1980). This brings to the fore how exchange rate fluctuation impacts both the capital market and financial sector.

The reason for this present discourse is that exchange rate movements can work through the channel of interest rate parity to determine the volume of inflow of foreign capital into the local stock markets. It also has the potential to impact the financial sector through the number of foreign portfolio investments that it attracts into the capital market. It, therefore, implies that exchange rate policies a country implements have the tendency to shape the returns on shareholders' funds. As noted in studies like Osemene and Arotiba (2018), Rajapakse (2019), Santosa and Santoso (2019), Adeniyi and Kumeka (2020), and Mesagan (2021), the volatility of exchange rates can as well create uncertainty in an economy. If its volatility risks are considered inimical to investment by stockholders, thereby reducing investors' optimism in the process. Such aura of uncertainty created by its volatility risk can make local and foreign investors to dawdle in releasing their financial assets to particular projects. The Nigerian economy is not alienated from such adverse impacts because the country has witnessed and still experiences massive exchange rate movements since the periods of financial deregulation (Abiola & Ajibola, 2017; Yusuf et al., 2020; Zubair & Aladejare, 2017). Thus, it becomes critical to analyze the situation and recommend policy. In addition, since the Nigerian capital market provides the channel for mobilizing funds for investment purposes and serves as the backbone for the private sector to thrive, it requires attention.

Proponents of the efficient market hypothesis (EMH) expect the capital market to function efficiently in providing information to investors so that the real prices of securities bought and sold can reflect their intrinsic values (see Eisenhardt, 1989; Malkiel & Fama, 1970; Mesagan et al., 2021). Stock market efficiency can range from the transactions of the shares of companies to the transfer of football players (Mesagan & Amadi, 2017). In the opinion of Jovanovic et al. (2016), a capital market that inspires investors to buy company shares is said to be efficient because it offers good turnover possibilities. Yet, arbitrage might still exist even if the market is efficient. This can always be attributable to the lack of information. It thus means that capital markets can only be useful if the signals to investors are clear. However, incessant exchange rate fluctuations and volatilities can potentially weaken the market and render it inefficient. For instance, studies like Kalu (2016) and Osemene and Arotiba (2018) attributed the sluggishness of the Nigerian capital market to the exchange rate volatility risk, which has created difficulties in investment decisions in the country.

Similarly, Mordi (2006) and Mesagan, Alimi, and Yusuf (2018) noticed that the Naira has continued fluctuating against the US dollar despite the efforts of the Nigerian monetary authority to stabilize the exchange rate. With the experiences of nations with more stable exchange rates, Aghion et al. (2009) affirmed that developing nations like Nigeria still has a long way to go in stemming the tide of financial shocks and promote growth. The reason is that persistence exchange rate fluctuations pose a severe challenge to financial stability and restricts the domestic credit mobilization capacity. Therefore, this argument provides motivation for this study examining exchange rate effects on both the financial and capital markets. In fact, a recent study by Akinmade et al. (2020) anticipated this problem by examining how the Nigerian economy is enhanced by the manipulation of the country's stock market. Onifade, Ay, et al. (2020) then traced the Nigerian problem to trade and unemployment issues, while studies such as Uzuner et al. (2017) and Onifade, Çevik, et al. (2020) analyzed countries economic problems in terms of the fiscal spending patterns of the government.

However, with the discussion from all of these previous studies, the fact remains that an enormous gap exists in the literature regarding the link between the exchange rate and the financial sector. While scholarly attention in prior studies like Aghion et al. (2009), Acosta et al. (2009), Héricourt and Poncet (2015), as well as Ehigiamusoe and Lean (2019) has been drawn toward the nexus between financial development and exchange rate, it is not yet exhaustive. Also, bearing in mind the specific nature of resource-rich nations, a recent study by Adedoyin et al. (2020) considered the roles of geographical and policy uncertainties on the export-propelled Malaysian economy, while both Mesagan, Yusuf, and Ogbuji (2019) and Eregha and Mesagan (2020) examined economic performance through the deficit financing channel. Nevertheless, the fact that these studies omitted the capital market in their expositions provides a compelling argument for its inclusion in this study. This is because the exchange rate movement might not always have similar effects on both the financial sector and the capital market, since they have their unique features. In addition, combining the symmetric and asymmetric impacts of exchange rate on both sectors stands this study out from the rest.

Specifically, the study analyses the symmetric impact of exchange rate volatility on the capital market and financial sector performance. It analyses the effect of exchange rate asymmetries, in terms of appreciation and depreciation, on both the financial sector and the capital market. By examining both the symmetric impacts of exchange rate volatility and the asymmetric effects of its fluctuations, the study is innovative and extends the frontiers of knowledge. Again, the role of the study in the current time is hinged on its ability to provide the policy framework that Nigeria can leverage on to improve its financial sector and capital market through the exchange rate channel. The rest of the paper follows this structure: Section 2 involves the review of literature; Section 3 shows the empirical model; Section 4 presents the empirical findings, while Section 5 ends the study and recommends policies.

2 REVIEW OF LITERATURE

Researches have been conducted in related areas as identified in Section 1, but the actual impact on either the financial sector or the capital market is still not clear. For instance, Abdalla and Murinde (1997) analyzed the link between stock prices and exchange rates in Pakistan, India, the Philippines, and Korea between 1985 and 1994 using monthly observations. Result revealed that aside from Philippines, exchange rate unidirectionally caused stock prices in Pakistan, India, and Korea. Betts and Devereux (2000) conducted a similar study in a pricing-to-market model, which combined the local currency price-setting arrangement and the imperfectly competitive firms' market segmentation. Examining the situation between home and foreign nations, results indicated that if a nation's market is segmented along with sticky prices, it will positively affect exchange rate volatility and welfare. They also showed that monetary policy is a beggar-thy-neighbor instrument in an environment with pricing-to-market, as an unexpected currency depreciation reduced domestic welfare. Jorion (1991) examined how US dollar movements affected the US industries and exchange rate pricing risk in its stock market from 1971 to 1987. Although, no exchange rate risk pricing was found, it did confirm the exposure of its shares to residual exchange rate variability risk. Chatrath et al. (1996) examined the correlation between the exchange rates variability and levels of trading in currency futures among some major currency pairs. Results showed that in the exchange rate changes, currency futures trading positively and significantly enhanced exchange rate movement, while a positive association was found between its volatility and the stages of futures trading activities in the sample of countries.

Moreover, Aghion et al. (2009) analyzed the situation in 83 countries between 1960 and 2000. Findings showed that in financially less-developed nations, volatility in exchange rate significantly reduced growth, while in advanced nations, it insignificantly affected growth. Mitra (2017) analyzed the Indian stock market return and those from the four actively traded currency pairs. It found bi-directional spillover in volatility between the foreign exchange market return and the Indian stock market. It also observed a long-run association between both markets. Osemene and Arotiba (2018) linked foreign portfolio investment and exchange rate volatility in Nigeria. Using monthly data between 2007 and 2016, it revealed that its volatility positively and significantly enhanced foreign investment inflow, while that from the bureau-de change had a significantly adverse impact on investment inflow into the country. Manu and Bhaskar (2018) used three market indices and four currency pairs and observed that exchange rate fluctuations positively impacted the next day's stock prices, while its volatility significantly determined stock market performance. Recently, while employing a causality analysis, Yildirim et al. (2021) found that the price of gold in Turkey is determined by the demand and supply forces together with daily announcements, while the gold price and interest rates which are the major financial instruments were mutually intensifying.

Regarding exchange rate asymmetries, Bahmani-Oskooee and Saha (2016) examined the situation via stock prices between developing and advanced nations between 1973 and 2015. Findings confirmed the existence of exchange rate asymmetric effects on the price of stock. Cuestas and Tang (2017) analyzed the situation among Chinese firms. Results showed that currency appreciation or depreciation varied across firms owing to ownership or trade balance discrepancies. Mahapatra and Bhaduri (2019) examined how exchange rate fluctuations affected the Indian capital market and found that currency fluctuations for the post-financial crisis period significantly impacted stock market returns. Analyzing the volatility effects, Abiola and Ajibola (2017) found a significant positive nexus between exchange rate volatility and prices of stocks. They also found bi-directional causal nexus between both. Zubair and Aladejare (2017) analyzed annual data covering 1986–2015 and found that volatility in exchange rate insignificantly impacted the stock market in Nigeria. Rajapakse (2019) extended the study to Sri Lanka and found similar result with Zubair and Aladejare (2017). Meanwhile, Santosa and Santoso (2019) enquired if the Indonesian capital market overreacts to exchange rate volatility in a 12-month period between 2018 and 2019. Results did not confirm overreaction between the bearish and end of bullish period, as investors' reaction was found to be consistent over the study period. Lastly, Jacob and Kattookaran (2019) analyzed the period between 1995 and 2018 in India and found that the volatility of exchange rate negatively and significantly impacted the capital market. Also, using the volatility spillover framework, Alola et al. (2019) confirmed that exchange rate is key among the variables that received spillover effects from tourism in Turkey. They also revealed that exchange rate contributed a spillover effect of over 5.7% to other variables, meaning that exchange rate is a crucial macroeconomic indicator in Turkey between 1985 and 2016 in terms of giving and receiving spillovers.

Furthermore, while the aforementioned studies have provided the motivation for this study in examining exchange rate effects on the financial market, some other studies like Uzuner et al. (2017), Mesagan, Yusuf, and Ogbuji (2019), Akinmade et al. (2020), Onifade, Ay, et al. (2020), Onifade, Çevik, et al. (2020), Adedoyin et al. (2020), and Eregha and Mesagan (2020), controlled for key macro-economic variables like unemployment, export, deficit financing, and GDP. Akinmade et al. (2020) analyzed how the Nigerian economy is enhanced by the manipulation of the country's stock market between 2002 and 2016. Findings revealed that manipulating the stock market altered its efficiency by scaring away genuine traders. It also opined that the dis-investment created and its associated financial risks lowered the capacity of the stock market to support an enhanced performance of the economy. Also, still on Nigeria, Onifade, Ay, et al. (2020) traced the Nigerian problem to trade and unemployment issues and found that terms of trade had less substantial effect on unemployment, while domestic investment and trade openness exerted significant impacts on Nigeria's unemployment. Both Uzuner et al. (2017) and Onifade, Çevik, et al. (2020) analyzed countries economic problems in terms of the fiscal spending patterns of the government. While Uzuner et al. (2017) affirmed that government spending positively and significantly enhanced economic performance, Onifade, Çevik, et al. (2020) deficit financing strongly propelled output growth. The deficit financing argument was also expounded in both Mesagan, Yusuf, and Ogbuji (2019) and Eregha and Mesagan (2020), which found that growth performance of resource nations is hinged on the nature of deficit finance of their fiscal deficits. Nevertheless, the fact that prior studies often omitted the capital market provides a compelling argument for this study. In addition, this study stands out from the rest by combining the symmetric and asymmetric impacts of exchange rate on both the financial sector and the capital market.

3 EMPIRICAL MODEL

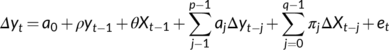

(1)

(1) is the vector of the dependent variables that stands for both financial and capital market proxies, while

is the vector of the dependent variables that stands for both financial and capital market proxies, while  is the vector of regressors, which include exchange rate volatility (EXCV), broad money supply (BMS), consumer price index (CPI), income per capita (INC), prime lending rate (PLR), and the treasury bill rate (TBR).

is the vector of regressors, which include exchange rate volatility (EXCV), broad money supply (BMS), consumer price index (CPI), income per capita (INC), prime lending rate (PLR), and the treasury bill rate (TBR).  is the difference operator,

is the difference operator,  is the monthly time series,

is the monthly time series,  is the intercept term, the first terms on the right hand side of Equation (1)

is the intercept term, the first terms on the right hand side of Equation (1)  capture the long-run impact of the regressors, the second terms

capture the long-run impact of the regressors, the second terms  capture their short-run effects, while

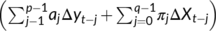

capture their short-run effects, while  is the white noise residual term. Meanwhile, for the asymmetric impact of exchange rate, the study uses the nonlinear ARDL of Shin et al. (2014), and it is specified as:

is the white noise residual term. Meanwhile, for the asymmetric impact of exchange rate, the study uses the nonlinear ARDL of Shin et al. (2014), and it is specified as:

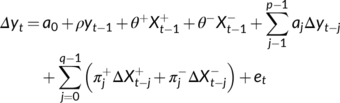

(2)

(2) and

and  represent the long-run asymmetric effects, while

represent the long-run asymmetric effects, while  and

and  capture the short-run asymmetric impacts of exchange rate. All the others remained as earlier explained. Aside from the linear and NARDL approaches, we use the Autoregressive Conditional Heteroskedasticity (ARCH) and the Generalized Autoregressive Conditional Heteroskedasticity (GARCH) methods to generate the exchange rate volatility series (see Engle, 1982). This is done because the ARCH ML test presented in Table 1 indicates exchange rate volatility shocks persistence as the summation of the ARCH and GARCH coefficients are significant and large (i.e., 0.13 + 0.84 = 0.97). Data for the study are collected from the Nigerian Securities and Exchange Commission's statistical bulletins (Securities and Exchange Commission, Nigeria, 2019).

capture the short-run asymmetric impacts of exchange rate. All the others remained as earlier explained. Aside from the linear and NARDL approaches, we use the Autoregressive Conditional Heteroskedasticity (ARCH) and the Generalized Autoregressive Conditional Heteroskedasticity (GARCH) methods to generate the exchange rate volatility series (see Engle, 1982). This is done because the ARCH ML test presented in Table 1 indicates exchange rate volatility shocks persistence as the summation of the ARCH and GARCH coefficients are significant and large (i.e., 0.13 + 0.84 = 0.97). Data for the study are collected from the Nigerian Securities and Exchange Commission's statistical bulletins (Securities and Exchange Commission, Nigeria, 2019).| Variables | Coefficients | Probability |

|---|---|---|

| C | 17.5862 | 0.0000 |

| RESID(−1)2 | 0.1302 | 0.0439 |

| GARCH(−1) | 0.8449 | 0.0000 |

- Source: Authors' Computation.

4 RESULTS AND DISCUSSION

4.1 Results

In this study, we present the stylized facts, descriptive statistics, correlation analysis, the stationarity test, and the empirical result using the ARDL framework. In the study, the bounds test critical values of Pesaran et al. (2001) are used to confirm the existence of a long-run relationship among the regressors. Some post-estimation tests are also conducted to provide support for the suitability of the ARDL model.

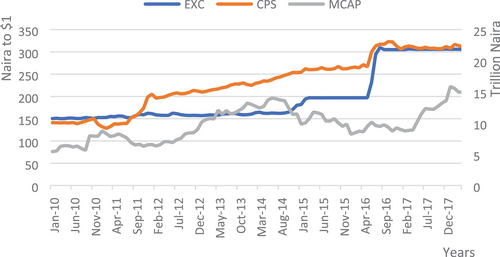

From Table 2, evidence shows that exchange rate, which stood at 150.33 in January 2010 depreciated to 161.31 in January 2012 before appreciating slightly to 156.96 in January 2013. From that period till January 2017, the exchange rate continues to depreciate in the country, with a slight appreciation from 305.20 in January 2017 to 305.78 in January 2018. The capital market experienced an improvement in market capitalization from 5.44 trillion in January 2010 to 8.74 trillion in January 2011 before witnessing a slight fall to 6.57 trillion in January 2012. This was found to be temporal as the market improved in 2013 up to January 2014 to 13 trillion.

| Periods | Financial sector ( trillion) | Capital market ( trillion) | Exchange rate ( to $1) |

|---|---|---|---|

| Jan-2010 | 10.081998 | 5.441588 | 150.33 |

| Jan-2011 | 9.416707 | 8.744171 | 152.57 |

| Jan-2012 | 14.641551 | 6.579106 | 161.31 |

| Jan-2013 | 14.992713 | 10.19132 | 156.96 |

| Jan-2014 | 16.064255 | 13.00547 | 160.23 |

| Jan-2015 | 18.165675 | 9.84663 | 181.78 |

| Jan-2016 | 18.885224 | 8.22521 | 197 |

| Jan-2017 | 21.878063 | 8.97299 | 305.2 |

| Jan-2018 | 21.988953 | 15.8958 | 305.78 |

- Source: Authors' Compilation from Securities and Exchange Commission statistical bulletins (Securities and Exchange Commission, Nigeria, 2019).

However, the country's recession from 2015 coupled with the period of consistent currency depreciation crashed the capital market from 2015 to 2017, as market capitalization stood at 8.97 trillion in January 2017, which coincides with the recovery period. The slight appreciation of the local currency in 2018 made the market capitalization to significantly improve to 15.89 trillion. Similar trend is experienced with the financial sector as private sector credits which was 10.08 trillion in January 2010 dropped to N 9.41 trillion in January 2012, but since then it had maintained a consistent increase to 21.98 trillion in January 2018. The trend analysis, presented in Table 2 and Figure 1, suggest that exchange rate movement has a closer relationship with the capital market than the financial sector. Hence, exchange rate policies must be geared toward stimulating the capital market for a long-term transmission to the financial sector.

Source: Authors' Computation from SEC bulletins (2020)

In Table 3, the descriptive statistics of the variables used in the study are presented. From Table 3, the average value of Exchange Rate, Credit to Private Sector, Consumer Price Index, and Broad Money Supply, is ₦ 197.58 to 1 US dollar (USD), ₦ 16,519,001 million, 163.38%, and ₦ 16,738,503 million respectively between January 2010 and April 2018. Also, the mean value of Market Capitalization, Income, Prime Lending Rate, Treasury Bills Rate is ₦ 9816.85 billion, ₦ 21,415,797 million, 16.89%, and 10.12% respectively over the study period. In terms of the maximum values, Exchange Rate, Credit to Private Sector, Consumer Price Index, and Broad Money Supply, over the study period, is ₦ 309.73 to 1 USD, ₦ 23,069,635 million, 254.52%, and ₦ 24,520,635 million respectively. Also, the maximum value of Market Capitalization, Income, Prime Lending Rate, and Treasury Bills Rate is ₦ 15,895.80 billion, ₦ 31,647,993 million, 19.05%, and 15.25% respectively over the same period. Regarding their minimum values, Exchange Rate, Credit to Private Sector, Consumer Price Index, and Broad Money Supply, is ₦ 150.08 to 1 USD, ₦ 9,178,290 million, 103.13%, and ₦ 10,446,374 million, respectively. The minimum value of Market Capitalization, Income, Prime Lending Rate, and Treasury Bills Rate is ₦ 5441,588 billion, ₦ 12,790,378 million, 15.73%, and 1.04% over the coverage period.

| Variables | Descriptive | Measurement unit | Mean | SD | Max. | Min. |

|---|---|---|---|---|---|---|

| BMS | Broad Money Supply | ₦ Million | 16,738,503 | 4,192,507 | 24,520,635 | 10,446,374 |

| CPI | Consumer Price Index | % | 163.38 | 42.74 | 254.5190 | 103.13 |

| CPS | Credit to Private Sector | ₦ Million | 16,519,001 | 4,306,597 | 23,069,635 | 9,178,290 |

| EXC | Official Exchange Rate | ₦ to $ | 197.58 | 59.72 | 309.73 | 150.08 |

| MCAP | Market Capitalization | ₦ Billion | 9816.85 | 2589.72 | 15,895.80 | 5441.588 |

| INC | Income | ₦ Million | 21,415,797 | 0.70 | 31,647,993 | 12,790,378 |

| PLR | Prime Lending Rate | % | 16.89 | 3.63 | 19.05 | 15.73 |

| TBR | Treasury Bills Rate | % | 10.12 | 5,130,531 | 15.25 | 1.04 |

- Source: Authors' Compilation (2020).

In Table 4, we present the correlation matrix to check the possibility of multicollinearity among the regressors. Evidence from Table 4 suggests that treasury bills rate, market capitalization, money supply, private sector credit, income, exchange rate, lending rate, and the consumer price index are not strongly correlated. In Table 4, only market capitalization and bank credit to the private sector have a reasonably strong correlation at 0.5137. This, however, does not constitute a substantial correlation coefficient. This also serves as a justification for using both indicators to capture the capital market and financial sector, respectively, as there is a reasonably secure link between them. With this, we can confirm that there is no perfect multicollinearity among the regressors, and we can progress with the estimation.

| TBR | MCAP | BMS | CPS | Y | EXC | PLR | CPI | |

|---|---|---|---|---|---|---|---|---|

| TBR | 1 | |||||||

| MCAP | 0.2479 | 1 | ||||||

| BMS | 0.3459 | 0.2881 | 1 | |||||

| CPS | 0.4598 | 0.5137 | 0.3674 | 1 | ||||

| INC | 0.4111 | 0.1712 | 0.3465 | 0.2594 | 1 | |||

| EXC | 0.3602 | 0.3832 | 0.4847 | 0.0388 | 0.3484 | 1 | ||

| PLR | −0.1636 | −0.0178 | 0.2064 | 0.2385 | 0.1937 | 0.3666 | 1 | |

| CPI | 0.3686 | 0.4177 | 0.0722 | 0.0439 | 0.4543 | 0.3244 | 0.2720 | 1 |

- Source: Authors' Computation (2020).

Table 5 shows the unit root result based on the ADF test. As presented in the table, we observe that both the treasury bills rate and lending rate are stationary at levels, while the market capitalization, income, exchange rate, broad money supply, and credit to the private sector, are stationary at first difference. The implication is that the regressors converge to their long-run equilibrium and are mean-reverting also. The fact that both dependent variables are stationary at the first difference supports using the ARDL framework. Having confirmed stationarity of the regressors, we now present the ARDL bounds test to the existence of cointegration among the variables.

| Regressors | ADF test statistics | Critical values @ 5% | Stationarity status |

|---|---|---|---|

| BMS | −11.1022* | −2.89123 | I (1) |

| CPI | −3.23514* | −2.89155 | I (1) |

| CPS | −8.06501* | −2.89123 | I (1) |

| EXC | −6.89703* | −2.89155 | I (1) |

| MCAP | −8.93605* | −2.89123 | I (1) |

| INC | −12.6027* | −3.46169 | I (1) |

| PLR | −3.09774** | −2.89093 | I (0) |

| TBR | −3.30656** | −2.89093 | I (0) |

- Note: ** and * denotes stationarity of the variables at “Levels” and “First Difference” respectively.

- Source: Authors' Compilation (2020).

Table 6 is presented to determine the existence of long-run association among the regresand and the regressors. In Table 6, we present the bounds tests for all four models pertaining to both the capital market and financial sector development. With the chosen lag lengths from the AIC, we test all hypotheses. In Models 1 and 2 or financial development, Table 6 shows that the computed F-values of 3.68 and 5.93 respectively exceed both the lower and upper bounds of 2.32 and 3.50 respectively at 5% critical level. Similarly, regarding the two models estimated for the capital market at 5% critical level, the computed F-values at 3.97 and 3.89 respectively also exceed those of the lower (2.32) and upper bounds (3.50). This implies that we reject the hull hypotheses and confirm the existence of cointegration for all models. After confirmation of the long-run relationship, we present the empirical result in Tables 7 and 8.

| Regressed variables | Models | F-stats. | |||||

|---|---|---|---|---|---|---|---|

| Financial development | Model 1 |

|

3.6847** | ||||

| Model 2 |

|

5.9317*** | |||||

| Capital market | Model 1 |

|

3.9731** | ||||

| Model 2 |

|

3.8904** | |||||

| 1% | 5% | 10% | |||||

| I(0) | I(1) | I(0) | I(1) | I(0) | I(1) | ||

| Critical bound values | 2.96 | 4.26 | 2.32 | 3.50 | 2.03 | 3.13 | |

- Note: Key: **, *** mean that we reject the null hypothesis at 5, and 1% respectively. The appropriate Lag lengths selected by Akaike Information Criterion (AIC). Source: Authors' Compilation (2020).

- Abbreviation: ARDL, autoregressive distributed lag.

| Explanatory variables | Dependent variables | |||

|---|---|---|---|---|

| Capital market | Financial development | |||

| Short-run | Long-run | Short-run | Long-run | |

| CPS(−1) | - | - | 0.1922*** (0.0684) | 0.7077*** (0.0557) |

| MCAP(−1) | 0.0801** (0.0465) | 0.8973*** (0.0468) | - | - |

| EXCV | −0.0858** (0.0501) | −0.0965** (0.0493) | −0.0806*** (0.0215) | −0.0740*** (0.0184) |

| INC | −0.1245 (0.1174) | −0.0547 (0.1185) | 0.0879 (0.0560) | 0.1584*** (0.0485) |

| TBR | 0.0026 (0.0023) | 0.0022 (0.0023) | 0.0031** (0.0012) | 0.0044*** (0.0010) |

| BMS | −0.0941 (0.1205) | −0.1014 (0.1208) | 0.1483 (0.0803) | 0.2773*** (0.0687) |

| PLR | 0.0098 (0.0116) | 0.0035 (0.0121) | 0.0065 (0.0065) | 0.0199*** (0.0058) |

| CPI | 0.0025** (0.0011) | 0.0024** (0.0010) | 0.0008** (0.0004) | 0.0009 (0.0004) |

| Constant | 4.7115** (0.0512) | 4.1012 (2.0168) | 0.2874 (0.9319) | −1.6485** (0.8372) |

| ECT(−1) | −0.725** (−2.248) | - | −0.941*** (3.691) | - |

- Note: Key: **, ***, represent significance at 5%, 1% levels, while ( ) presents the std. error.

- Source: Authors' Compilation (2020).

| Explanatory variables | Dependent variables | |||

|---|---|---|---|---|

| Capital market | Financial development | |||

| Short-run | Long-run | Short-run | Long-run | |

| CPS(−1) | - | - | −0.1737** (0.0760) | 0.7326*** (0.0718) |

| MCAP(−1) | −0.1382*** (0.0500) | 0.8738*** (0.0512) | - | - |

| EXC+ | −0.0006 (0.0005) | −0.0004 (0.005) | 0.0006*** (0.0002) | 0.0004** (0.0002) |

| EXC− | 0.0123** (0.0047) | 0.0066 (0.0048) | −0.0009 (0.0021) | −0.0002 (0.0022) |

| INC | 0.3568** (0.1449) | −0.1750 (0.1485) | 0.0654 (0.0617) | 0.1555*** (0.0561) |

| TBR | 0.0011 (0.0027) | 0.0003 (0.0028) | 0.0028** (0.0013) | 0.0041*** (0.0011) |

| BMS | 0.4729** (0.1895) | −0.2959 (0.1938) | 0.1132 (0.0884) | 0.2735*** (0.0785) |

| PLR | −0.0032 (0.0131) | −0.0043 (0.0136) | 0.0044 (0.0067) | 0.0182*** (0.0062) |

| CPI | 0.0025** (0.0010) | 0.0023** (0.0010) | 0.0007 (0.0004) | −0.0002 (0.0004) |

| Constant | 1.4535 (5.5650) | 8.6080** (4.6283) | 0.1202 (1.8504) | −2.7579 (1.8132) |

| ECT(−1) | −1.318** (1.732) | - | −1.024*** (2.105) | - |

- Note: Key: **, ***, represent significance at 5%, 1% levels, while ( ) presents the std. error.

- Source: Authors' Compilation (2020).

Evidence in Table 7, which presents the impact of exchange rate volatility on both markets, indicates that its impact on the capital market in both the short-run and long-run is negative. For both, increases in exchange rate volatility makes market capitalization to fall by about 8.5 and 9.6% respectively while keeping the other variables fixed. Another interesting part of this result is that both are significant at 5%. The implication of this is that highly volatile exchange rates are inimical to the performance of Nigeria's capital market because they shrink market capitalization. Conversely, a reduction in exchange rate volatility enhances the country's capital market performance. A similar result is obtained with the financial sector, as exchange rate volatility increases bring about 8 and 7.4% reductions to financial sector development in the short-run and long-run, and it is significant at 1% too. Moreover, the error correction terms (ECT) are negative and significant at −0.725 and −0.941 for capital market and financial sector, respectively. It implies that the short-run misalignment is temporal as it will return to the long-run growth path, while the adjustment speed is 72.5 and 94.1% respectively. The ECT also supports the result of the bounds test cointegration in Table 5 that the long-run relationship exists.

With the asymmetric result presented in Table 8, evidence shows that in both short- and long-run, there is asymmetric impact of exchange rate on the capital market as both appreciation and depreciation have different signs. Specifically, exchange rate depreciation (EXC+) negatively, but insignificantly impacts the capital market. When the other variables are kept constant, the reduction of the exchange rate brings about 0.06 and 0.04% decrease to market capitalization in both the short- and long-run. Meanwhile, exchange rate appreciation (EXC−) positively impacts the capital market in the short-run and long-run by about 1.23 and 0.66% respectively. It is an interesting result because Nigeria is an import-dependent nation and exchange rate fluctuations (i.e., depreciation/appreciation) are expected to have different impacts on stock market indices in import-oriented and export-oriented nations.

In addition, Table 8 shows that exchange rate depreciation has a positive and significant impact on the financial sector in both the short-run and long-run. The evidence in Table 8 indicates that depreciation effect on the financial sector at 0.06 and 0.04% respectively is similar to the capital market effect, albeit, in a more significant level at 1 and 5% for short- and long-run respectively. Meanwhile, local currency appreciation exerts a negative and trivial impact on financial development over the short- and long-term. Considering that the error correction terms are negative at −1.318 and −1.024, and significant at 5 and 1% for both capital market and financial development models means that the short-term errors would adjust to their long-runs. It also indicates that the speed of adjustment is 131.8 and 102.4% respectively and confirms the bounds test cointegration result in Table 6 for the existence of long-run relationship.

4.2 Discussion

The first implication of our result is that highly volatile exchange rates are substantially inimical to both the capital market and financial sector in Nigeria. The economic intuition is that as volatility of exchange rate rises, the performance of the country's financial sector and capital market drops in both the short- and long-run, but this situation might change if the exchange rate is less volatile. This is largely expected because as an upsurge in the volatility of exchange rates increases the shocks that both capital market and financial sector are exposed to, thereby, slowing down their growth processes. More specifically, high volatility in exchange rate increases currency value uncertainty, and impairs the local capital market. Moreover, through the risks that are generated by such volatilities, private investments into both sectors could be hindered also. For instance, in the case of the capital market, investors might suspend the accumulation of new stocks, and can even be discouraged from buying other forms of debt instruments until there is a clear direction occasioned by exchange rate stability. The fact that exchange rate volatility significantly impacts both sectors corroborate earlier findings of studies such as Aghion et al. (2009), Abiola and Ajibola (2017), Manu and Bhaskar (2018), and Alola et al. (2019), that exchange rate volatility significantly affects stock market indices. It is, however, at variance with those of Zubair and Aladejare (2017) and Rajapakse (2019), which found that exchange rate volatility insignificantly impacted the stock performance.

In terms of its negative sign on both sectors, the current situation with the Covid 19 is a clear example, as stated in Olunkwa et al. (2021). This is because, for crude oil net exporting nations like Nigeria, the continuous decline in oil receipts has caused massive volatility to the exchange rate, which has adversely affected the capital market. This apparently means that the uncertainty created by exchange rate volatility in Nigeria has severely reduced the funds going into the country's financial institutions and therefore, aligns with findings from Aghion et al. (2009), Kalu (2016), and Abiola and Ajibola (2017), which revealed that exchange rate volatility is destructive to stock performance. It is also in synch with Jacob and Kattookaran (2019), which negative effect of volatility on stock market. However, the result is at variance with Bahmani-Oskooee and Saha (2021), which that volatility had a positive impact on exports in India. Also, our result contrasts that of Chatrath et al. (1996), which found a positive association between exchange rate volatility and the stages of futures trading activities in the sample of countries used.

Again, with the apparent evidence that exchange rate depreciation negatively and insignificantly impacts the capital market while its appreciation is positive. It suggests that a depreciation raises the prices of foreign goods and expands the cost of production for Nigerian firms, consequently lowering productivity, reducing their stock values, and impeding the capital market performance. However, an appreciation intuitively improves the capital market by reducing import prices, lowers production costs, and improves the stock prices. The fact that appreciation is significant in the short-run reveals its substantial role in stimulating the country's capital market than depreciation. Moreover, the result that depreciation is significantly positive on the financial sector in both periods, while appreciation is negative, implies that when Nigerian Naira (N) depreciates and stock prices dwindle, investors move their funds to other financial institutions. This helps the sector to expand its cash flow, improves its short- and long-run performance, and then free up more funds for the private sector. Conversely, a currency appreciation enhances the capital market better, making investors to divert their resources away from the banking sector, thereby constraining its performance in both short- and long-run. Lastly, showing that appreciation is mostly insignificant on both sectors, as against depreciation, confirms the usual occurrence of Naira depreciation in Nigeria. This remains an accurate picture as Naira consistently loses its value against the USD, sliding from N150.33 to $1 in January 2010 to N305.61 to $1 in April 2018 (see Table 2). Generally, the results support the findings from Bahmani-Oskooee and Saha (2016) and Kumar et al. (2021) that exchange rates have an asymmetric impact on the stock market. It is also in tune with Cuestas and Tang (2017) that effects of currency appreciation or depreciation varies across firms owing to trade balance discrepancies.

5 CONCLUSIONS

This research used the linear ARDL method was used to analyze the symmetric impact of exchange rate volatility and the nonlinear ARDL to determine its asymmetric effect on both capital market and the financial sector. The empirical results showed that exchange rate volatility negatively but significantly impacted financial development and capital market in both the short-run and long-run. In terms of the asymmetric impact, we found that currency depreciation negatively and insignificantly impacted the capital market over the short-term and long-term, while it exerted a significant positive impact on the financial market in both periods. Furthermore, exchange rate appreciation positively enhanced the capital market in both periods, while it negatively impacted financial development in both periods too. Except its significant short-run impact on the capital market, exchange rate appreciation remained insignificant on both indicators in all other periods. We, therefore, conclude that exchange rate volatility negatively impacted both capital market and financial sector. Also, currency appreciation adversely impacted both sectors, while its appreciation is performance-enhancing to the capital market but performance-reducing to financial development.

Having confirmed that exchange rate volatility and currency depreciation pose bad omen to the capital market, this calls for effective public policy management. In doing this, public regulation of the key macroeconomic indicators can be employed by making the central bank and other regulatory bodies to maintain interest rates that are favorable toward expanding the capacity of private investors to produce. The government can also support such regulation by providing affordable access to investment funds. This will guarantee the expansion of local productive capacity and help to stabilize the exchange rate through import substitution. Consequently, the eroding of risks associated with exchange rate volatility will improve the stock performance of local firms, thereby enhancing the performance of the capital market. Over the long term, the local currency will appreciate, and both capital and financial markets will benefit more. Regarding the asymmetric effect, the government's desired direction about which to promote first between the capital market and financial development should inform policy direction on the exchange rate movements in the country.

ACKNOWLEDGMENTS

Authors appreciate the anonymous reviewers as well as the handling editors of the journal for their valuable comments that has significantly improved the content of this study. However, the usual disclaimer applies. This research is partly funded by University of Economics Ho Chi Minh City, Vietnam.

Biographies

Ekundayo Peter Mesagan is a senior lecturer in the School of Management and Social Sciences, Pan-Atlantic University. He is also a research fellow in the Institute of Business Research, University of Economics Ho Chi Minh City, Vietnam. He has published in several notable journals, and he teaches Energy and International Economics.

Xuan Vinh Vo is currently the Dean of the Institute of Business Research, University of Economics Ho Chi Minh City. Also, he serves as the Director of the Research Centre for International Management Research at CFVG. He is a seasoned researcher with publications in several international journals such as International Review of Finance, Energy Economics, Emerging Markets Finance and Trade, Journal of Corporate Finance, etc.

Idimmachi Pius Amadi is a student of Covenant University, Ota, who is currently undergoing his Bachelor's Degree in Economics. His interests are Research, Technology, Economics and Finance.

Open Research

DATA AVAILABILITY STATEMENT

Data available on request from the authors.