Always be Prepared: Lessons Learned From Risk-Coping Strategies of Thai Households in the Wake of Two Major Economic Crises

ABSTRACT

This paper aimed to comparatively examine the function of three risk-coping strategies, namely savings, borrowings, and work-hour adjustments, during two major economic crises in Thailand. Using the Socioeconomic Survey (SES) collected by the National Statistical Office (NSO) in Thailand, we examined data from the 1998 financial crisis and the 2021 COVID-19 outbreak. The empirical methods were the two-step estimation method and the income decomposition technique, with an emphasis on correcting an endogeneity problem with an instrumental variable approach. The results showed that risk-coping strategies respond more strongly to income shocks during crisis periods than in noncrisis periods. Borrowing was the most important risk-coping strategy, followed by work-hour adjustments employed by Thai households to smooth their consumption against transitory income shocks caused by unemployment in crisis and noncrisis periods. On the contrary, we found that Thai households are less prudent.

1 Introduction

The well-being of a large number of households in developing countries is vulnerable owing to exposure to distinct types of shock. Several vulnerable households, such as farming and informal workers, have low and uncertain incomes. Consequently, any shock, such as weather, health, and economic shocks, often acutely threatens these households' well-being. Thailand faced distinct challenges during the 1997 Asian Financial Crisis and the 2020 COVID-19 pandemic. The 1997 crisis, characterized by currency devaluation and widespread business closures, significantly reduced household incomes. In contrast, the 2020 pandemic disrupted labor-intensive sectors like tourism and manufacturing, disproportionately affecting informal workers and marginalized groups. These crises underscore the vulnerability of Thai households and the critical role of social safety nets.

Globally, similar patterns were observed. During the 1997 financial crisis, households in Indonesia and South Korea faced income declines, forcing them to rely on strategies such as reduced food consumption, asset liquidation, and extended family support. In contrast, households in India and Brazil experienced severe income disruptions during the COVID-19 pandemic due to lockdowns and unemployment, causing them to turn to government transfers, informal borrowing, and community-based support systems. Meanwhile, federal stimulus payments and expanded unemployment benefits helped sustain household consumption in the United States. These examples demonstrate that, while households in developing countries often relied on informal networks, developed economies benefited from formal safety nets, revealing disparities in coping mechanisms.

Situating Thai households within this global context provides valuable insights into shared challenges and the need for tailored policy interventions. Thai households also faced significant challenges, such as being unable to pay for essential services like healthcare and education, with many struggling to afford daily necessities. This financial strain forced families to adopt severe coping strategies, such as withdrawing children from school, relying on informal loans, and reducing food consumption. These strategies underscore the importance of financial systems and safety nets in mitigating the impact of shocks, as emphasized in the permanent income hypothesis (PIH).

According to the PIH, how much shock affects a household's consumption also depends on the completeness of credit markets, the existence of formal and informal insurance, and social safety nets; the more complete the credit market and insurance results in a corresponding reduced shock impact. These findings highlight the urgent need for policymakers to design and implement adaptive social protection programs that address the diverse impacts of economic shocks. By focusing on household resilience, such policies can mitigate the adverse effects of future crises and contribute to long-term stability. In addition, this study bridges theoretical frameworks like the PIH with empirical evidence from the 1997–1998 Asian Financial Crisis and the 2020–2021 COVID-19 pandemic in Thailand. By exploring deviations from theoretical predictions due to liquidity constraints and socioeconomic disparities, this study enhances our understanding of household responses to shocks.

In Thailand, the COVID-19 outbreak has negatively impacted the economy since early 2020. The country's economic growth plunged from 2.26% in 2019 to −6.01% and 1.60% in 2020 and 2021, respectively. The unemployment rate soared from 0.72% in 2019 to 1.69% and 1.93% in 2020 and 2021, respectively. However, a substantial economic crisis like COVID-19 is nothing new for Thailand. The Thai country faced a more wide-ranging economic crisis due to economic mismanagement in the 1990s.1 Thailand's economic growth declined by 5.65% to −2.75% and −7.63% in 1997 and 1998, respectively. The unemployment rate shot-up from 0.87% in 1997 to 3.40% in 1998, then slightly decreased to 2.97% in 1999.

With regard to the two economic crises outlined above, it is hard to reject that economic crises significantly affect Thai households' well-being. However, as indicated earlier, the well-being of Thai households is only marginally affected if they have access to financial services or if risk-coping strategies exist in response to an income shock due to an economic crisis. As a result, this paper aimed to comparatively examine the function of Thai households' risk-coping strategies during the two periods of crises.2 The different strategies employed to manage the financial circumstances of Thai households when faced with crises should manifest a certain degree of difficulty depending on the preparation of Thai households. Additionally, the difference in the strategies used during the two crisis periods possibly also mirrors the completeness of the social protection systems implemented by the Thai government.3

Economic crises can affect the well-being of households through many channels, such as rising goods and services prices, interest rates, and unemployment. Much of the literature, for example, Meng (2003), Benito (2006), Campos and Reggio (2015), Christelis et al. (2015), Hurd and Rohwedder (2016), Ganong and Noel (2019), Harmenberg and Öberg (2021), Gupta and Kishore (2022) and Fagereng et al. (2024) have examined the impact of unemployment on households' consumption. The results of these previous studies are, to a certain extent unanimous, in that unemployment reduces households' spending on goods and services to a certain degree. However, little attention has been focused on how households smooth their consumption when they face unemployment.

Until now, although several studies have examined the use of consumption smoothing mechanisms in response to income shocks caused by a range of factors such as weather and health, research that focuses on unemployment shocks, especially during crisis periods, is still scant. Only a few mechanisms have been examined by some literature. These include savings (Alderman 1996; James et al. 2007; Fella et al. 2020), borrowings (Sullivan 2008; Hundtofte et al. 2019; Braxton et al. 2020; Garber et al.2024), and social protection schemes, such as government cash transfers and unemployment insurance (Gruber 1997; East and Kuka 2015; Ganong and Noel 2019; Gupta and Kishore 2020; Adu-Ababio 2024). However, it should be noted that most of these studies examined these mechanisms statically rather than dynamically. The results of these previous studies undoubtedly enhanced our understanding of how households smooth their consumption in the face of unemployment during each specific period. However, we cannot observe whether these mechanisms continue to function or function effectively over time, which is important information for policymakers to design, improve, and develop optimal social protection programs.

Using data from the Thai Socioeconomic Surveys (SES), this paper primarily employed a two-step estimation method and the income decomposition technique to comparatively examine how Thai households smoothed their consumption through savings, borrowings, and work-hour adjustments, when they experienced a typical transitory income shock due to unemployment following two substantial crises (i.e., during the 1997–1998 Thailand financial crisis and during the 2020–2021 COVID19 outbreak). In addition, this paper also addressed the possibility of the endogeneity problem of the unemployment variable, which was initially used to estimate transitory income by using the instrumental variable (IV) method. By using ordinary least squares (OLS) to estimate the income equation subject to an endogeneity problem of unemployment, it was able to produce biased coefficients. As a result, the estimated transitory income generated by these biased coefficients may be unreliable. This paper employed regional unemployment to instrument the unemployment of household members.

The rest of the paper is organized as follows: Section 2 presents primary evidence of an association between risk-coping strategies and economic environments in Thailand. Section 3 presents our empirical strategies. Section 4 describes data and sample selection. In Section 5, the results are presented. Lastly, we conclude with Section 6.

2 The Response of Risk-Coping Strategies to an Economic Environments in Thailand: Primary Evidence

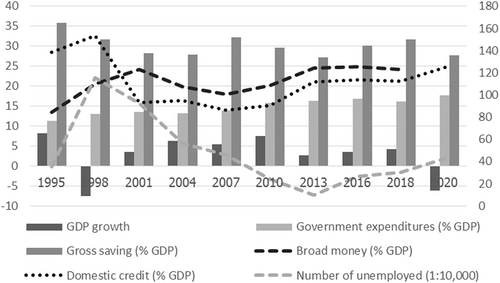

From a macro perspective, there exists primary evidence of an association between economic environments and consumption smoothing mechanisms, especially during two periods of economic crisis as shown in Figure 1. In 1998, borrowing (domestic credit) and broad money per GDP, which represents the completeness of the credit market and the use of consumption smoothing mechanisms, clearly increased in response to negative economic growth and an increase in unemployment. Additionally, a decrease in gross savings indicates two plausible incidents: a decrease in response to negative economic growth and the use of savings as a consumption smoothing mechanism. Nevertheless, it should also be noted that gross savings still decrease even though economic growth rebounds after a crisis. This may imply that gross savings declined in response to crises in 1998 and 2020.

As is typical in financial crises, the economic crisis caused by COVID-19 in 2020 resulted in negative economic growth and an increase in the number of unemployed in Thailand. However, borrowing still responded positively, while savings decreased compared to 2018. This may imply that Thailand's consumption smoothing mechanisms were again in effect. Additionally, it should be noted that, apart from private consumption smoothing mechanisms, the Thai government also increased its expenditure to alleviate the negative impact of the crisis. Indicating that, to some extent, private and public mechanisms were being used to support consumption smoothing in Thailand. A case study from rural Northern Thailand during the 1997 financial crisis illustrates how a farming household relied on informal borrowing from community savings groups to navigate income shocks while sustaining essential consumption. Similarly, an urban household in Bangkok demonstrated a shift toward digital platforms for accessing short-term loans during the COVID-19 pandemic, showcasing the evolving role of technology in mitigating economic impacts. These examples provide practical insights into household-level adjustments during crises.

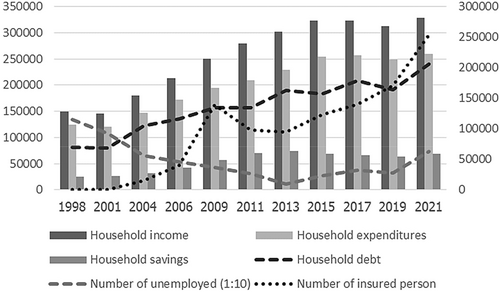

While the macro-level data provides a broad understanding, micro-level analysis is essential to uncover household-specific dynamics. However, unlike the macro perspective, the connection between economic environments and consumption smoothing mechanisms appears less evident in the case of the micro perspective, as shown in Figure 2. At first glance, we found only a large number of unemployed, which is consistent with the two periods of crisis in 1998 and 2021, while other variables, except household debt, do not respond clearly to the crisis as found in the case of the macro perspective. Household-level analysis reveals nuances in savings behavior, such as the percentage of household income allocated to savings. We found that household savings were around 16.83% and 20.97% of income in 1998 and 2021, respectively, while savings were around 25.10% and 21.39% of income in 2011 and 2015, respectively. These imply that households may reduce their savings to smooth their consumption when they face crises and then turn back to increase their savings when the crisis is over. Nevertheless, the irrevocable conclusion of these issues should be clarified when we complete the empirical strategies section.

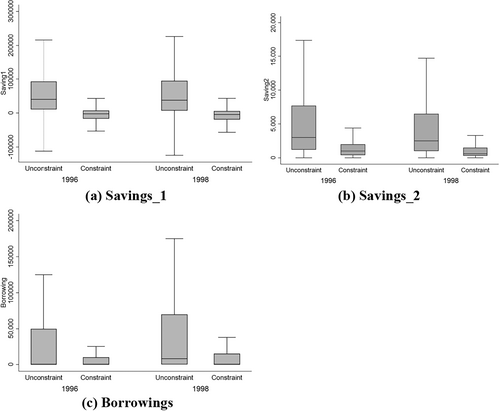

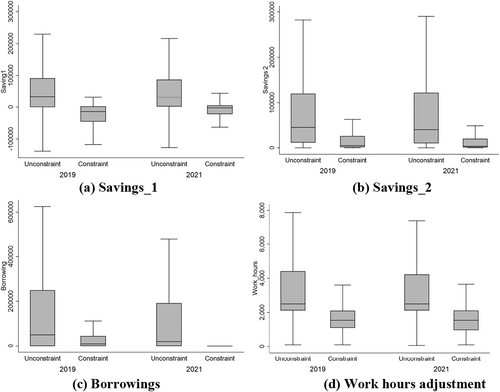

In the case of a micro-perspective, we primarily examine further by comparing the use of risk-coping strategies between the crisis and noncrisis periods and between constrained and unconstrained households using sample households used in the analysis of this paper. Comparing the 1996 noncrisis and 1998 crisis periods in Figure 3, we find that the median of savings_1, savings_2, and borrowings of constrained households is slightly lower than unconstrained households. These imply that there is a slight difference in the use of savings_1, savings_2, and borrowings to smooth consumption between the 1998 crisis and 1996 noncrisis periods. Comparing all risk-coping strategies, we find that households use the most in savings_1, followed by borrowings and savings_2, respectively. As with Figure 3, we find that there is minimal difference in the use of all risk-coping strategies to smooth consumption between the 2021 crisis and 2019 noncrisis periods in Figure 4. Evidence of the lower median for all risk-coping strategies of constrained households compared with unconstrained households is clearer. However, the difference in using risk-coping strategies between the crisis and noncrisis periods is not as clear. Nevertheless, one should be aware that the information appearing in Figures 3 and 4 does not directly indicate the response of risk-coping strategies to unemployment. Empirical evidence as to whether Thai households use risk-coping strategies in response to income shock due to unemployment will be examined in Section 5.

Recent studies on household finance during crises, particularly in the context of COVID-19, provide valuable insights into the interplay of public and private mechanisms. For example, Gupta and Kishore (2022) analyzed the role of government stimulus payments in sustaining household consumption during the COVID-19 pandemic, highlighting the interplay between public interventions and private mechanisms. Similarly, Harmenberg and Öberg (2021) identified long-term shifts in household savings behavior in response to economic uncertainty, emphasizing the importance of credit market accessibility. These findings complement the evidence presented here, underscoring the need for further research to identify mechanisms that effectively mitigate the impacts of crises.

There are some research examining the use of risk coping strategies in developing countries, particularly Asian countries. Heltberg and Lund (2009) show that Pakistan households lack effective coping options and use mostly self-insurance and informal credit in response to income shocks. Nguyen (2019) found that negative income shocks encourage migration in Nietnam. Berloffa and Modena (2013) investigate whether Indonesian farmers respond differently to income shocks (crop loss). They found that while nonpoor farmers smooth consumption relative to income, poor households use labor supply to compensate the income loss, and, on average, they save half of this extra income. Stefani et al. (2022) shows low-wage workers in Cambodia, Nepal, and Veitnam who were more likely to be employed informally and to work in the services sector were the most affected. These workers have little means to smooth consumption when faced with negative income shocks, as their stock of savings tends to be limited, and they often lack access to financial services, or to other self-insurance mechanisms. Despite these contributions, existing studies often overlook the nuanced responses of households in developing countries, particularly in contexts where informal safety nets and community-based mechanisms play a significant role. This study bridges the gap by providing a comparative analysis of macro- and micro-level data, offering a more comprehensive understanding of household strategies for resilience. By focusing on the quantitative findings, it emphasizes the importance of tailored policy frameworks that account for both structural and household-specific factors.

3 Empirical Strategies

3.1 A Main Approach

However, regarding Equation (2), it is possible that the income of households and unemployment are jointly determined by unobservable household characteristics embedded in the error term, such as ability and preferences, which can result in the endogeneity of unemployment, that is, E(υirt৷Unirt) ≠ 0. As a result, OLS estimation may be inconsistent and produce biased coefficients.

The IV method is one common technique widely employed in economics to correct endogeneity concerns. Several famous economic papers, such as Rosenzweig and Wolpin (2000), Angrist and Krueger (2001), and Stock and Trebbi (2003), suggest that IV estimators can avoid the bias caused by using OLS estimation subject to endogeneity problems. Regarding the IV method, this paper mainly employed the two-stage least squares estimator (2SLS) to estimate the income equation. Following this estimator, we first regressed the income of households in Equation (2) on IVs rather than unemployment. However, it is widely accepted that finding valid IVs that satisfy the two main conditions of valid IVs (i.e., the relevance and orthogonality conditions) is not simple. In this paper, we employed regional unemployment, specifically provincial unemployment, as an IV to estimate transitory income. Regional unemployment is highly correlated with unemployment and is orthogonal to unobserved household characteristics. Several researchers, such as Gregg (2001), Gregg and Tominey (2005), Caicedo and Van Gameren (2016), and Chen (2019), use regional unemployment as an IV for unemployment. In addition, Carroll et al. (2003) also employs the region that households resides to be an IV for job-loss. Wooldridge (2002) indicates that economists often employ regional variation variables such as prices and taxes as IV for endogenous regressors appearing in individual-level equations. This is because regional variation variables can be assumed to be exogenous to each individual.

According to the PIH, when estimating Equation (6), it is generally expected that δ2 > 0 in all risk-coping strategy equations implies that households use either savings, borrowings, or work hour adjustments to smooth their consumption.7

Additionally, to shed light on the function of risk-coping strategies more clearly against economic crises, this paper used another strategy of testing our hypotheses using the noncrisis period of data. We compared the 1996 and 2019 years, which were noncrisis periods, to the 1998 and 2021 crisis periods, respectively. As a result, another hypothesis of this paper is that risk-coping strategies during the crisis period should have a higher response to income shocks due to unemployment compared to the noncrisis period.

Finally, this paper also examined the impact of liquidity constraints, which is one of the main causes of departure from the PIH prediction. We used two criteria to divide households into two groups: constrained and unconstrained households.8 Constrained households either earned less than 6000 baht per month (for the 1996 and 1998 years) and less than 7500 baht per month (for the 2019 and 2021 years) or reported that they could not borrow from any source over the previous 12 months (self-report data). Unconstrained households, on the other hand, earned more than 6000 baht and baht per month, respectively, or reported that they were able to borrow over the previous 12 months. With regard to the existence of liquidity constraints, this paper hypothesizes that constrained households (which are mostly poor) are more likely to employ available risk-coping strategies to smooth their consumption. Unconstrained households (which are wealthier), conversely, are less likely to employ risk-coping strategies, especially high-cost risk-coping strategies.

3.2 Robustness Check

4 Data Description

To examine the function of consumption smoothing mechanisms in response to adverse shocks in Thai households during the two crisis periods, the cross-sectional data set collected from the National Statistical Office (NSO), Thailand, was used in this study. The Thai Socioeconomic (SES) data set is nationally representative, providing information on basic household socioeconomic factors and reporting the socioeconomic data of Thai households, including income, expenditures, debt, and household characteristics in all provinces and municipal and nonmunicipal areas. Its representativeness ensures a comprehensive understanding of household-level economic behaviors across Thailand, enhanced by the inclusion of both monetary and nonmonetary income sources.

The data set uses stratified random sampling with clustering; all data was weighted in all the calculations to ensure that the results are representative of the country. The data from two crisis periods, the Thailand financial crisis, and the COVID-19 outbreak, was employed to compare the use of consumption smoothing mechanisms. However, due to the nonavailability of data for some periods, especially during the years 1997 and 2020, the years when the crises started, we used SES data from 1998 to 2021 adjacent to the crisis periods, and the crisis effect was still extensively found. These years reflect the crisis effects extensively, maintaining the relevance of the analysis. Data from 1996 to 2019 represents the situation before the crisis periods.

As our study aimed to investigate how savings, borrowing, and work-hour adjustments can serve as important consumption-smoothing mechanisms during times of crisis. We obtained savings data from the summary of household information, which records the monthly income and expenditures per household. Savings_1 indicated the difference between the monthly income per household and the total monthly expenditures per household. To represent a household's savings per year, we multiplied by 12. This approach, while standardizing results for annual estimates, assumes a uniform distribution of income and expenditures throughout the year, potentially introducing bias by overlooking seasonal variations, such as higher expenses during school terms or festive seasons. Borrowing represented the total debt amount (at the end of the previous month), recorded in the SES survey's Assets and Liabilities of Household section. Unlike savings, borrowing data was not scaled to annual estimates, as it reflects a snapshot of total outstanding debt. While this approach provides a clear picture of household debt levels, it may fail to capture changes in borrowing behavior across different periods, such as temporary spikes during harvests or other financially demanding events. To determine the total income of Thai households per year, we derived it from the total monthly income multiplied by 12, including monetary and nonmonetary income sources. The monetary income included salaries and wages. While nonmonetary income comprised estimated rental income of free-occupied houses, unpaid goods and services, unpaid food and beverages, and other sources such as education scholarships, inheritance, gifts, proceeds from insurance, lottery winnings, commissions, and gambling. As with savings, income was annualized by multiplying monthly figures by 12. This method, while practical, may not adequately account for seasonal income fluctuations, particularly in households dependent on agriculture or informal labor, where earnings can vary significantly throughout the year.

We determined the total annual working hours of households by using data from the Income from Wages and Salaries section, which records the number of hours worked per day. Multiplying this number by 365 days represented the total annual household working hours. This approach assumes a consistent pattern of work throughout the year, which may not be accurate for households engaged in seasonal or casual employment. Women, in particular, who often face fluctuating employment conditions due to caregiving responsibilities or informal work, may experience discrepancies in work hours captured by this method. These limitations necessitate a cautious interpretation of annualized work-hour data. Future research should incorporate longitudinal surveys or more granular data collection methods to enhance accuracy.

Finally, we adjusted household income, borrowing, saving, and assets by using the Provincial Consumer Price Index (PCPI) as provided by the Internal Commercial Department of the Ministry of Commerce during each year of data collection to obtain real values from the nominal figures derived from each survey period. After applying editing and data cleaning techniques, the final data set comprised households surveyed in 1996, 1999, 2019, and 2021, with sample sizes of 25,226, 23,758, 45,251, and 46,555 households, respectively. The summarized data is presented in Table A1, while the variable description is shown in Table A2.

| 1996 | 1998† | |||

|---|---|---|---|---|

| OLS | 2SLS | OLS | 2SLS | |

| 0.290 (0.033)*** | 0.289 (0.033)*** | 0.261 (0.017)*** | 0.261 (0.018)*** | |

| 0.274 (0.031)*** | 0.268 (0.034)*** | 0.210 (0.018)*** | 0.226 (0.018)*** | |

| 0.264 (0.035)*** | 0.265 (0.035)*** | 0.238 (0.019** | 0.238 (0.019)** | |

| R2 | 0.477 | 0.476 | 0.497 | 0.49 |

| No. of households | 25,181 | 23,737 | ||

| 2019 | 2021† | |||

| OLS | 2SLS | OLS | 2SLS | |

| 0.360 (0.017)*** | 0.360 (0.017)*** | 0.394 (0.021)*** | 0.396 (0.022)*** | |

| 0.357 (0.015)*** | 0.742 (0.079)*** | 0.400 (0.020)*** | 0.376 (0.022)*** | |

| 0.329 (0.018)*** | 0.329 (0.018)*** | 0.368 (0.023)*** | 0.370 (0.023)*** | |

| R2 | 0.637 | 0.637 | 0.629 | 0.629 |

| No. of households | 45,251 | 46,455 | ||

- Note: (1) *, **, and *** represent significance level of 10%, 5%, and 1%, respectively. (2) Robust standard errors, clustered by households, are presented in parentheses. (3) All specifications include household member classified by aged 0–5, 6–11, 12–17, 18–60, and 60 up and household head's occupations. (4) All specifications were also controlled with regional effects.

- † denotes the crisis peroid.

| 1996 | 1998† | 2019 | 2021† | |||||

|---|---|---|---|---|---|---|---|---|

| OLS | 2SLS | OLS | 2SLS | OLS | 2SLS | OLS | 2SLS | |

| Savings_1 | ||||||||

| 0.909 (0.033)*** | 0.910 (0.000)*** | 0.938 (0.018)*** | 0.939 (0.017)*** | 0.839 (0.017)*** | 0.839 (0.017)*** | 0.805 (0.022)*** | 0.804 (0.022)*** | |

| 0.925 (0.031)*** | 0.931 (0.034)*** | 0.990 (0.017)*** | 0.973 (0.018)*** | 0.842 (0.016)*** | 0.457 (0.079)*** | 0.800 (0.020)*** | 0.823 (0.022)*** | |

| 0.935 (0.035)*** | 0.934 (0.035)*** | 0.961 (0.019)*** | 0.961 (0.019)*** | 0.870 (0.018)*** | 0.870 (0.018)*** | 0.831 (0.023)*** | 0.829 (0.023)*** | |

| R2 | 0.788 | 0.238 | 0.845 | 0.845 | 0.796 | 0.796 | 0.767 | 0.767 |

| Borrowings | ||||||||

| 0.640 (0.085)*** | 0.639 (0.085)*** | 0.850 (0.096)*** | 0.849 (0.096)*** | 0.553 (0.037)*** | 0.552 (0.037)*** | 0.684 (0.056)*** | 0.692 (0.056)*** | |

| 0.638 (0.084)*** | 0.625 (0.088)*** | 0.837 (0.095)*** | 0.832 (0.098)*** | 0.642 (0.039)*** | 2.653 (0.307)*** | 0.763 (0.056)*** | 0.662 (0.058)*** | |

| 0.617 (0.090)*** | 0.618 (0.091)*** | 0.827 (0.103)*** | 0.827 (0.103)*** | 0.497 (0.040)*** | 0.495 (0.040)*** | 0.622 (0.060)*** | 0.635 (0.060)*** | |

| R2 | 0.157 | 0.157 | 0.209 | 0.209 | 0.173 | 0.174 | 0.181 | 0.179 |

| Work hour adjustment | ||||||||

| — | — | — | — | 0.0004 (0.00003)*** | 0.0005 (0.00004)*** | 0.0005 (0.00005)*** | 0.0005 (0.00005)*** | |

| — | — | — | — | 0.004 (0.00007)*** | 0.060 (0.0009)*** | 0.004 (0.00007)*** | 0.001 (0.00005)*** | |

| — | — | — | — | 0.0003 (0.00004)*** | 0.0003 (0.00005)*** | 0.0004 (0.00005)*** | 0.0005 (0.00005)*** | |

| R2 | — | — | — | — | 0.581 | 0.581 | 0.578 | 0.579 |

- Note: (1) *, **, and *** represent significance level of 10%, 5%, and 1%, respectively. (2) Robust standard errors, clustered by households, are presented in parentheses. (3) All specifications include household member classified by aged 0–5, 6–11, 12–17, 18–60, and 60 up and household head's occupations. (4) All specifications were also controlled with regional effect, and (5) Number of sample households are 25,226, 23,758, 45,251 and 46,455 in 1996, 1998, 2019 and 2021 respectively.

- † denotes the crisis peroid.

While the data set is comprehensive and robust, certain limitations must be acknowledged. The reliance on cross-sectional data introduces potential sampling bias, as household dynamics and changes over time are not captured. Additionally, time frame restrictions in data collection necessitate the use of adjacent years rather than the exact crisis periods, which may attenuate the immediacy of the observed impacts to some extent. These methodological limitations, including the assumptions about uniformity in annualized figures for savings, income, and work hours, may contribute to an incomplete picture of household behaviors during crises. Addressing these constraints through longitudinal data collection and more precise seasonal adjustments could provide deeper insights into household responses to crises. Despite these constraints, the data set offers significant insights, and future research employing longitudinal data could further enrich the findings.

5 Results

5.1 Main Results

Table A3 presents the estimates of the income regression using OLS, which was the first-step estimation method. Interestingly, we found that the unemployment coefficients were negative and significant at the 1% level for all studied periods. This implied that unemployment caused by either crisis or noncrisis reduces the income of Thai households. These findings are supported by many previous studies (e.g., Hurd and Rohwedder 2016; Ganong and Noel 2019; Harmenberg and Öberg 2021; Gupta and Kishore 2022), which implicitly indicate the negative impact of unemployment on income through the decrease in consumption of households.

| 1996 | 1998† | 2019 | 2021† | |||||

|---|---|---|---|---|---|---|---|---|

| OLS | 2SLS | OLS | 2SLS | OLS | 2SLS | OLS | 2SLS | |

| Savings_1 | ||||||||

| 0.428 (0.023)*** | 0.429 (0.023)*** | 0.457 (0.028)*** | 0.438 (0.028)*** | 0.534 (0.043)*** | 0.603 (0.043)*** | 0.517 (0.081)*** | 0.527 (0.082)*** | |

| 0.404 (0.053)*** | 0.436 (0.042)*** | −0.784 (0.175)*** | 0.712 (0.028)*** | 0.309 (0.097)*** | 0.622 (0.043)*** | −0.679 (0.424) | −0.317 (0.325) | |

| 0.546 (0.022)*** | 0.545 (0.022)*** | 0.612 (0.027)*** | 0.609 (0.027)*** | 0.717 (0.038)*** | 0.700 (0.038)*** | 0.831 (0.056)*** | 0.831 (0.056)*** | |

| R2 | 0.144 | 0.144 | 0.196 | 0.205 | 0.330 | 0.323 | 0.283 | 0.282 |

| Borrowings | ||||||||

| 0.201 (0.034)*** | 0.201 (0.034)*** | 0.253 (0.067)*** | 0.263 (0.067)*** | −0.127 (0.165) | −0.287 (0.190) | −0.217 (0.199) | −0.235 (0.199) | |

| 0.188 (0.068)*** | 0.175 (0.056)*** | 0.290 (0.335) | 0.016 (0.058) | 0.434 (0.272) | −0.073 (0.165) | 3.426 (0.979)*** | 2.549 (0.747)*** | |

| 0.129 (0.033)*** | 0.129 (0.033)*** | 0.011 (0.059) | 0.022 (0.059) | −0.239 (0.158) | −0.185 (0.151) | −0.202 (0.117)* | −0.201 (0.117)* | |

| R2 | 0.045 | 0.045 | 0.041 | 0.043 | 0.052 | 0.052 | 0.097 | 0.097 |

| Work hour adjustment | ||||||||

| — | — | — | — | 0.004 (0.0005)*** | 0.004 (0.0005)*** | 0.003 (0.0008)*** | 0.003 (0.0008)*** | |

| — | — | — | — | 0.014 (0.001)*** | 0.005 (0.0005)*** | 0.044 (0.006)*** | 0.034 (0.004)*** | |

| — | — | — | — | 0.003 (0.0004)*** | 0.003 (0.0004)*** | 0.002 (0.0005)*** | 0.002 (0.00005)*** | |

| R2 | — | — | — | — | 0.577 | 0.578 | 0.550 | 0.549 |

- Note: (1) *, **, and *** represent significance level of 10%, 5%, and 1%, respectively. (2) Robust standard errors, clustered by households, are presented in parentheses. (3) F-statistics in the first stage of most IV estimations were reported > 100 but no reported. (4) All specifications include household member classified by aged 0–5, 6–11, 12–17, 18–60 and 60 up and household head's occupations. (5) All specifications were also controlled with regional effects. (6) Number of sample households are 9,940, 7,795, 5,576, and 4,730 in 1996, 1998, 2019 and 2021 respectively.

- † denotes the crisis peroid. Income < 6,000 for the year 1996 and 1998 and income < 7500 for the year 2019 and 2021.

Furthermore, the results of this paper show that the negative effect of unemployment on income was more prominent in the 1998 and 2021 crisis periods than in the 1996 and 2019 noncrisis periods. The income of households in the 1998 crisis was nevertheless cut down by unemployment less than in the 2021 crisis. Suggesting that the impact of lockdown measures due to the 2021 COVID-19 outbreak on household income had a greater effect on household income than that of the 1998 financial crisis.

Tables A4 and A5 contain parameter estimates as a result of the two-stages estimation method, instrumented with regional unemployment. The first-stage unemployment regressions presented in Table A4 suggest a positive and statistically significant association, at the 1% level, between household members' unemployment and regional unemployment for all studied periods. These findings are consistent with many previous studies, such as Gregg (2001), Gregg and Tominey (2005), Caicedo and Van Gameren (2016), and Chen (2019). Notably, the size of the coefficient for regional unemployment in the 1996 and 1998 years is around twice that of the 2019 and 2021 years. This implies that household members' unemployment was less affected by regional unemployment after the 1998 period.

| 1996 | 1998† | 2019 | 2021† | |||||

|---|---|---|---|---|---|---|---|---|

| OLS | 2SLS | OLS | 2SLS | OLS | 2SLS | OLS | 2SLS | |

| Savings_1 | ||||||||

| 0.923 (0.033)*** | 0.924 (0.033)*** | 0.951 (0.017)*** | 0.952 (0.017)*** | 0.845 (0.017)*** | 0.845 (0.017)*** | 0.805 (0.021)*** | 0.808 (0.022)*** | |

| 0.945 (0.033)*** | 0.947 (0.034)*** | 1.008 (0.017)*** | 0.984 (0.018)*** | 0.852 (0.016)*** | 0.893 (0.021)*** | 0.799 (0.020)*** | 0.828 (0.023)*** | |

| 0.950 (0.036)*** | 0.950 (0.036)*** | 0.973 (0.018)*** | 0.974 (0.019)*** | 0.876 (0.018)*** | 0.876 (0.018)*** | 0.831 (0.023)*** | 0.834 (0.023)*** | |

| R2 | 0.786 | 0.786 | 0.845 | 0.845 | 0.796 | 0.796 | 0.767 | 0.767 |

| Borrowings | ||||||||

| 0.651 (0.091)*** | 0.649 (0.091)*** | 0.868 (0.100)*** | 0.868 (0.101)*** | 0.556 (0.038)*** | 0.554 (0.038)*** | 0.684 (0.056)*** | 0.691 (0.057)*** | |

| 0.648 (0.093)*** | 0.631 (0.095)*** | 0.867 (0.102)*** | 0.851 (0.105)*** | 0.671 (0.042*** | 0.370 (0.048)*** | 0.762 (0.056)*** | 0.661 (0.060)*** | |

| 0.621 (0.097)*** | 0.622 (0.097)*** | 0.840 (0.108)*** | 0.841 (0.107)*** | 0.497 (0.041)*** | 0.494 (0.040)*** | 0.622 (0.060)*** | 0.633 (0.061)*** | |

| R2 | 0.146 | 0.146 | 0.201 | 0.201 | 0.166 | 0.167 | 0.181 | 0.172 |

| Work hour adjustment | ||||||||

| — | — | — | — | 0.0004 (0.00004)*** | 0.0004 (0.00004)*** | 0.0005 (0.00005)*** | 0.0005 (0.00005)*** | |

| — | — | — | — | 0.005 (0.00008)*** | −0.003 (0.00007)*** | 0.004 (0.00007)*** | 0.001 (0.00005)*** | |

| — | — | — | — | 0.0003 (0.00004)*** | 0.0003 (0.00004)*** | 0.0005 (0.00005)*** | 0.0004 (0.00005)*** | |

| R2 | — | — | — | — | 0.563 | 0.563 | 0.578 | 0.564 |

- Note: (1) *, **, and *** represent significance level of 10%, 5%, and 1%, respectively. (2) Robust standard errors, clustered by households, are presented in parentheses. (3) F-statistics in the first stage of most IV estimations were reported > 100 but no reported. (4) All specifications include household member classified by aged 0–5, 6–11, 12–17, 18–60 and 60 up and household head's occupations. (5) All specifications were also controlled with regional effects. (6) Number of sample households are 15,246, 15,929, 39,647, and 41,711 in 1996, 1998, 2019 and 2021 respectively.

- † denotes the crisis peroid. Income > 6000 for the year 1996 and 1998 and income > 7500 for the year 2019 and 2021.

| 2019 | 2021† | |||

|---|---|---|---|---|

| OLS | 2SLS | OLS | 2SLS | |

| Savings_1 | ||||

| 0.851 (0.021)*** | 0.851 (0.021)*** | 0.791 (0.026)*** | 0.790 (0.026)*** | |

| 0.851 (0.020)*** | 0.890 (0.024)*** | 0.778 (0.025)*** | 0.808 (0.027)*** | |

| 0.882 (0.023)*** | 0.882 (0.023)*** | 0.817 (0.028** | 0.816 (0.028** | |

| R2 | 0.798 | 0.798 | 0.755 | 0.755 |

| Borrowings | ||||

| 0.724 (0.060)*** | 0.721 (0.060)*** | 0.815 (0.079)*** | 0.821 (0.079)*** | |

| 0.734 (0.061)*** | 0.621 (0.066)*** | 0.812 (0.079)*** | 0.758 (0.082)*** | |

| 0.647 (0.064)*** | 0.642 (0.064)*** | 0.731 (0.084)*** | 0.743 (0.084)*** | |

| R2 | 0.208 | 0.210 | 0.198 | 0.197 |

| Work hour adjustment | ||||

| 0.0005 (0.00005)*** | 0.0005 (0.00005)*** | 0.0006 (0.00005)*** | 0.0006 (0.00005)*** | |

| 0.004 (0.0001)*** | −0.005 (0.00006)** | 0.005 (0.0001)*** | 0.001 (0.00006)*** | |

| 0.0003 (0.00005)*** | 0.0003 (0.00006)** | 0.0005 (0.00006)*** | 0.0005 (0.00006)*** | |

| R2 | 0.526 | 0.525 | 0.533 | 0.534 |

| No. of households | 22,577 | 23,638 | ||

- Note: (1) *, **, and *** represent significance level of 10%, 5%, and 1%, respectively. (2) Robust standard errors, clustered by households, are presented in parentheses. (3) F-statistics in the first stage of most IV estimations were reported > 100 but no reported. (4) All specifications include household member classified by aged 0–5, 6–11, 12–17, 18–60 and 60 up and household head's occupations. (5) All specifications were also controlled with regional effects.

- † denotes the crisis peroid.

Apart from the high relationship between household members' unemployment and regional unemployment, as an IV method, another piece of evidence that indicates whether regional unemployment is a valid IV for household members' unemployment is the first-stage F-statistic of the 2SLS regression. It is worth noting that for all the studied periods, the F-statistic values are much higher than the rule-of-thumb value of 10 suggested by Staiger and Stock (1997). These affirm that regional unemployment highly satisfies the relevance condition.

Table A5 presents the income regression results from the second stage of the 2SLS estimation, which used the IV of regional unemployment to account for the endogeneity of household members' unemployment. The estimated coefficients of household members' unemployment are still negative and statistically significant at the 1% level for all studied periods, as previously shown in Table A3. However, it is important to note that the magnitude of most unemployment coefficients is much larger than those estimated by OLS regression in Table A3. These findings suggest that OLS estimation may underestimate the actual impact of unemployment on household income.

Using the estimated coefficients from Tables A3 and A5, we then generated three types of estimated income shown in Equations (3-5). The estimation results of the response of risk-coping strategies to income estimated by the OLS two-step and the 2SLS estimation method are reported in Table 1. Nevertheless, we primarily examine the impact of income shock due to unemployment on household consumption in Table 1, before we report and discuss how Thai households implement risk-coping strategies in response to transitory income shocks, which are our highlighted results. This is because the results from Table 1, according to the PIH, can be also employed to verify the estimation results of the response of risk-coping strategies to income shock. If the strict version of PIH is violated in consumption equation, it sholud be violated in saving equation also. Table 1 indicates that the strict version of PIH, which predicts that transitory income shock should not affect consumption, is rejected.10 We find that the estimated coefficients of transitory income are positive and statistically significant at the 1% level for all studied periods. This evidence is in line with Paxson (1992) and Sirisankanan (2013, 2016). Therefore, it reveals that Thailand's credit market is still incomplete, and risk-coping strategies of Thai households function to a certain extent.

Next, we examine the results of the response of risk-coping strategies to transitory income shock due to unemployment in Table 2, which is a full sample case. There is significant compelling evidence that should be pointed out. First, we find the effect of all types of estimated income is positive and statistically significant at the 1% level in all risk-coping strategy equations, models, and periods. Comparing the impact of two major income types, permanent income and transitory income on risk-coping strategies, we find that the impact of permanent and transitory income on risk-coping strategies is slightly different on average, except the case of income estimated by 2SLS in the 2019 year.11 However, we find that the impact of transitory income on work-hour adjustments is much higher than the impact of permanent income. All in all, this evidence is theoretically consistent with the results of Table 1, which indicate that the prediction of a strict version of PIH is rejected. This is because we find either the non-zero estimated coefficients of transitory income in the consumption equation or the positive estimated coefficients of transitory income in risk-coping strategy equations.

Second, comparing the response of risk-coping strategies between the crisis and noncrisis periods, we find that the savings_1 propensity out of transitory income in the 1998 crisis period is larger than in the 1996 noncrisis period, while the results are reversed in the case of income estimated by OLS between the 2021 crisis and 2019 noncrisis periods. Nevertheless, in the case of income estimated by 2SLS, we find that the savings_1 propensity out of transitory income is much higher in the 2021 crisis period than in the 2019 noncrisis period. Unlike the savings_1 equations, we find borrowings to have a higher response to transitory income in the 1998 crisis period than in the 1996 noncrisis period. The estimated coefficients of transitory income are around 0.80 on average in the 1998 crisis period, which is higher than 0.60 in the 1996 noncrisis period. The same as between the 1998 and 1996 periods, the impact of transitory income on borrowings is still larger in the 2021 crisis period than in the 2019 noncrisis period. Nevertheless, this evidence is found only in the case of income estimated by OLS. Differently with savings_1 and borrowing, we find little evidence of the use of work-hour adjustments as a risk-coping strategy. The impact of transitory income on work-hour adjustments between the 2021 crisis and the 2019 noncrisis periods is slightly different.

Finally, we compare the response of savings_1, borrowings, and work-hour adjustments to income shock due to unemployment. We find that Thai households use more savings_1 as a risk-coping strategy to smooth their consumption than borrowings when we compare between the 1998 crisis and 1996 noncrisis periods. Similarly, comparing the 2021 crisis and 2019 noncrisis periods, Thai households still mostly implement savings_1 to smooth their consumption against income shock due to unemployment, followed by borrowings and work hour adjustments, respectively. Unless the case of income is estimated by 2SLS, the estimated coefficients of transitory income, on average, are approximately 0.80, 0.60, and 0.02 for savings_1, borrowings, and work hour adjustment, respectively. However, it should be noted that the response of both savings_1 and borrowings to income shock due to unemployment is likely to decline when we compare the 1996 and 1998 periods with the 2019 and 2021 periods. This may occur from many causes. Firstly, the effect of the 2021 crisis on Thai households is smaller than the 1998 crisis. Secondly, the Thai government provided many more support programs for Thai households during the 2021 crisis than the 1998 crisis. Lastly, Thai households not only have less savings but also have more difficulty accessing financial services owing to a high accumulation of household debts.

Tables 3 and 4 present the use of risk-coping strategies for constrained and unconstrained households classified by household income. In the case of constrained households, in Table 3, evidence of the use of risk-coping strategies is less clear, particularly when we compare the 1996 noncrisis and 1998 crisis periods as well as between the 2019 noncrisis and 2021 crisis periods. Considering the 1996 noncrisis and 1998 crisis periods, we find households use both savings_1 and borrowings in response to income shock due to unemployment in the 1996 noncrisis periods but not in the 1998 crisis period (except the case of income estimated by 2SLS). The same as between the 1996 noncrisis and 1998 crisis periods, savings_1 responds to income shock in the 2019 noncrisis period but not the 2021 crisis period, while borrowings respond to income shock only in the 2021 crisis period. Nevertheless, we find constrained households significantly employ work-hour adjustment as a risk-coping strategy to smooth their consumption against income shock. Moreover, the results also show that constrained households significantly increased work hours during the 2021 crisis period compared with the 2019 noncrisis period.11

The above evidence is compatible with the stylized facts of constrained households in that they usually have both low savings and a lack of collateral assets for borrowings. Thus, they are less likely to employ both savings and borrowings to smooth their consumption against income shock due to unemployment. These findings align with Sirisankanan (2015) and Paweenawat (2022), which found that Thai households are less prudent. In addition, Pootrakool et al. (2005) also support our results, as they found that Thai household savings are low at the micro and macro levels. On the contrary, constrained households still significantly employ work-hour adjustment as a risk-coping strategy. This is because the remainder of household members, who are still employed, can increase work hours to obtain extra money for smoothing their consumption when their households face income shock due to the unemployment of other household members.

Unlike constrained households, in Table 4, we find the response of risk-coping strategies, particularly savings_1 and borrowings, to income shock for unconstrained households. Comparing the 1996 noncrisis and the 1998 crisis periods, we find that the response of savings_1 and borrowings to transitory income shock is higher in the 1998 crisis period than in the 1996 noncrisis period. The estimated propensities to savings_1 out of transitory income range from 0.98 to 1.00 in the year 1998, while these estimated coefficients are approximately 0.94 in the year 1996. Meanwhile, the borrowings propensity out of transitory income range from 0.85 to 0.86 in the year 1998, which is also higher than in the 1996 range from 0.63 to 0.64. As with the years between 1996 and 1998, borrowings are still more employed as a major risk-coping strategy in the 2021 crisis period than in the 2019 noncrisis period. The estimated propensity to borrow out of transitory income shock due to unemployment ranged from 0.66 to 0.76 in the year 2021, whilst these estimated coefficients ranged from 0.37 to 0.67 in the year 2019.

In the case of savings_1, however, we find the propensities to savings_1 out of transitory income are slightly lower for the year 2021 compared with the year 2019. We still find unconstrained households also employ work-hour adjustments as a risk-coping strategy against income shock in the case of income estimated by 2SLS. It is nevertheless important to note that work-hour adjustments are less implemented for unconstrained households compared with constrained households. The work hour adjustment propensity out of transitory income ranges from −0.003 to 0.005 for unconstrained households, while these estimated coefficients range from 0.005 to 0.04 for constrained households. This compelling evidence is quite reasonable when we compare the use of risk-coping strategies between constrained and unconstrained households. As mentioned earlier, unconstrained households are mostly middle and high-income households. Thus, they have some savings and some collateral assets to borrow money from both formal and informal borrowing sources. Consequently, they can employ both savings and borrowings as shock absorbers. Meanwhile, when unconstrained households have both savings and borrowings to some extent, unconstrained households are less likely to increase work hours to obtain extra income for smoothing their consumption.

Technically, the labor supply curve of unconstrained households is likely to be a backward-bending supply curve. This is because they will work less and have more leisure when they have enough income. On the contrary, constrained households that mostly lack both savings and borrowing are likely to consider leisure as an inconsequential good. Household members who are still employed will consequently work more hours and spend less time on leisure to compensate for the unemployment of other household members, particularly when they face income shock.

Tables 5 and 6 compare the response of risk-coping strategies to income shock due to unemployment between constrained and unconstrained households classified by self-reporting. Unlike constrained households classified by income, in Table 5, we find constrained households classified by self-reporting implement all risk-coping strategies in response to income shock. The propensity to borrow and work hour adjustment out of transitory that range from 0.75 to 0.81 and 0.001 to 0.005, respectively, in the 2021 crisis period, are higher than those in the 2019 noncrisis period that range from 0.62 to 0.73 and −0.005 to 0.004, respectively. However, the response of savings_1 to transitory income in the year 2021 is slightly less than in the year 2019. In Table 6, we find that unconstrained households have much more increased borrowings in the year 2021 than in the year 2019, while the estimated coefficients of transitory income in savings_1 equations are slightly different between the years 2019 and 2021 as between the years 1996 and 1998. However, in the same case of comparing constrained and unconstrained households classified by income, we find that the estimated propensity out of work hour adjustment decreased from 0.002 in the year 2019 to 0.001 in the year 2021 and decreased from 0.002 in the year 2019 to 0.001 in the year 2021 in case of income estimated by 2SLS and OLS, respectively. This evidence is consistent with the results of Table 4, in which unconstrained households have a backward backward-bending labor supply curve. Specifically, unconstrained households consider leisure as normal goods rather than inferior goods. Thus, they spend more time on leisure and work fewer hours, even if they face income shock.

| 2019 | 2021† | |||

|---|---|---|---|---|

| OLS | 2SLS | OLS | 2SLS | |

| Savings_1 | ||||

| 0.829 (0.027)*** | 0.829 (0.027)*** | 0.823 (0.035)*** | 0.822 (0.035)*** | |

| 0.836 (0.024)*** | 0.851 (0.027)*** | 0.825 (0.032)*** | 0.842 (0.036)*** | |

| 0.859 (0.029)*** | 0.859 (0.028)*** | 0.849 (0.037)*** | 0.848 (0.037)*** | |

| R2 | 0.796 | 0.796 | 0.783 | 0.783 |

| Borrowings | ||||

| 0.350 (0.052)*** | 0.351 (0.052)*** | 0.512 (0.085)*** | 0.514 (0.085)*** | |

| 0.440 (0.054)*** | 0.362 (0.052)*** | 0.606 (0.085)** | 0.512 (0.087)*** | |

| 0.318 (0.055)*** | 0.321 (0.055)*** | 0.482 (0.090)*** | 0.485 (0.089)*** | |

| R2 | 0.120 | 0.120 | 0.145 | 0.145 |

| Work hour adjustment | ||||

| 0.0004 (0.00005)*** | 0.0004 (0.00005)*** | 0.0004 (0.00008)*** | 0.0004 (0.00008)*** | |

| 0.005 (0.0001)*** | 0.002 (0.00007)*** | 0.004 (0.0001)*** | 0.001 (0.00009)*** | |

| 0.0004 (0.00006)*** | 0.0004 (0.00006)*** | 0.0004 (0.00009)*** | 0.0004 (0.00009)*** | |

| R2 | 0.640 | 0.640 | 0.631 | 0.631 |

| No. of households | 22,674 | 22,817 | ||

- Note: (1) *, **, and *** represent significance level of 10, 5, and 1 percent, respectively. (2) Robust standard errors, clustered by households, are presented in parentheses. (3) F-statistics in the first stage of most IV estimations were reported > 100 but no reported. (4) All specifications include household member classified by aged 0–5, 6–11, 12–17, 18–60 and 60 up and household head's occupations. (5) All specifications were also controlled with regional effects.

- † denotes the crisis peroid.

5.2 Results From Robustness Check

Apart from using income estimated from both OLS and 2SLS as the robustness check, as explained in Section 3.2, we also check the resulting robustness of the saving equation using another definition and check all risk-coping strategies with the Tobit regression. Table A6 presents the savings_2 equation estimation using a full sample. The results of the estimated coefficients of transitory income are insignificantly different between the 1996 noncrisis and 1998 crisis periods. Only in the case of income estimated by OLS, the propensity to savings_2 out of transitory income is slightly higher in the 1998 year than the 1996 year. Nevertheless, the results are aligned with savings_1 when we compare the 2019 noncrisis and 2021 crisis periods. The estimated propensity to savings_2 out of transitory income ranges from 0.63 to 0.78 in the 2021 year are higher than those in the 2019 year ranging from −0.65 to 0.57.

In addition, the same results with savings_1 are also found in the case of constrained and unconstrained households. We find constrained households less implement savings_2 in response to income shock due to unemployment than unconstrained households comparing between the 1996 and 1998 years. Additionally, this kind of evidence is much clearer when we compare the use of savings_2 in response to income shock between 2019 and 2021. Specifically, we rarely find that constrained households employ savings_2 to smooth their consumption. This also supports the previous study by Pootrakool et al. (2005), which indicated that Thai households, especially those with low levels of income, education, or financial literacy, are likely to face savings deficiency. On the contrary, unconstrained households significantly implement savings_2 in response to income shock due to unemployment.

Table A7 presents the results of the Tobit regression using a full sample. First, considering the case between the 1996 noncrisis and 1998 crisis periods, the results show that the propensity to savings_2 and borrowings out of transitory income is higher in 1998 than in 1996 unless the case of income estimated by 2SLS. For alignment between 1996 and 1998, we still find households utilized both savings_2 and borrowings significantly higher in response to income shock in the 2021 year than the 2019 year. However, this kind of evidence was not found in the case of work-hour adjustments.

6 Conclusion

In this paper, we comparatively examined the function of three risk-coping strategies, namely savings, borrowings, and work hour adjustment, during two major economic crises in Thailand. The data used in this paper was obtained from the SES collected by the NSO in Thailand. We employ the OLS two-step estimation method and income decomposition as the baseline estimation methods. Nevertheless, we checked the robustness of the results using the IV method as the second estimation strategy to address the endogeneity problem that may arise from the relationship between unemployment and unobserved household characteristics.

The results of this paper reveal that Thai households prepare themselves to some extent. Thai households can implement both savings and borrowings to smooth their consumption when they face income shock due to the unemployment of certain household members. Nevertheless, the use of risk-coping strategies is different between constrained and unconstrained households when household income is employed as a classifying criterion. Unconstrained households can implement savings_1, savings_2, and borrowings in response to income shock, while they employ work-hour adjustments to smooth their consumption. On the contrary, the results of constrained households are not as clear in terms of using borrowings, particularly savings_1 and savings_2 to smooth their consumption. In addition, we find reasonable results in which constrained households increase work hours more than unconstrained households when they face income shock.

The 1997 Asian Financial Crisis and the 2020 COVID-19 pandemic presented distinct challenges to Thai households. The financial crisis primarily impacted the export-driven and manufacturing sectors due to systemic banking and currency failures. In contrast, the health crisis disrupted service-oriented sectors like tourism and retail through lockdowns and mobility restrictions, disproportionately affecting informal workers. These structural differences underscore the varied nature of household impacts, with the financial crisis amplifying monetary constraints and the health crisis exacerbating vulnerabilities in nonmonetary dimensions such as food security and healthcare access. This comparative context is crucial for interpreting the effectiveness of risk-coping mechanisms across different crisis types.

There are some policy implications that should be suggest regarding to the results of this paper. Firstly, the Thai government should enhance financial accessibility despite the improvements in Thailand's financial inclusion over the past decade. The results of this paper indicate that Thai households, particularly constrained households, implement borrowings to sustain their well-being against income shocks in both crisis and noncrisis periods. Secondly, Thai households, particularly constrained households, have a low response of savings to income shocks. Evidence from this paper and previous research suggests that Thai households tend to be less prudent. Therefore, the Thai government should encourage households to increase their savings, either voluntarily or involuntarily. Efforts could include promoting financial literacy programs, providing tax incentives for saving, and introducing mandatory savings schemes. Saving is a low-cost risk-coping strategy compared to other strategies such as borrowing, work hour adjustment, and asset selling. Moreover, the use of household savings against income shocks can also save the government budget by reducing the need for aid during crises. Lastly, evidence of the negative impact of unemployment on income, the less use of savings and borrowing, increasing in work hours indicates that Thai household welfare may be vulnerable in the long run. Therefore, improving and extending the Unemployment Insurance scheme to cover more Thai people should be another approach to sustainably protect the welfare of Thai households. However, these policy recommendations may encounter challenges, including fiscal constraints, administrative inefficiencies, and disparities in access to resources. Addressing these obstacles requires innovative solutions such as public-private partnerships, streamlined administrative processes, and targeted assistance to marginalized groups.

In addition to these immediate coping mechanisms, it is crucial to consider the long-term impacts of economic crises on Thai households. These include intergenerational effects, such as reduced access to education and adverse health outcomes caused by prolonged financial strain and limited healthcare access. Addressing these extended consequences requires a comprehensive approach to policymaking that not only focuses on short-term solutions but also strengthens household resilience over time. While this study emphasizes economic strategies, integrating perspectives from disciplines such as psychology and sociology could provide deeper insights into household resilience. For instance, exploring stress-induced decision-making or the role of social capital during crises could inform more holistic support systems. The findings from this study lay the groundwork for the further exploration of household coping mechanisms. Future research should build on these interdisciplinary insights to enhance understanding and inform the development of comprehensive policies that ensure sustained welfare and stability.

Author Contributions

Aeggarchat Sirisankanan: conceptualization, formal analysis, methodology, software, project administration, supervision, funding acquisition, investigation, visualization, writing – original draft, writing – review and editing. Papar Kananurak: conceptualization, software, data curation, resources, project administration, supervision, validation, writing – original draft, writing – review and editing.

Acknowledgments

This study project is financially supported by Mahasarakham University.

Ethics Statement

This study application has been reviewed and approved by the Ethics Committee for Research involving Human Subjects, Mahasarakham University, Thailand. Approval number is 129–180/2023.

Conflicts of Interest

The authors declare no conflicts of interest.

Endnotes

Appendix

| Variable | The year 1996 | The 1998 crisis | The year 2019 | The 2021 crisis | ||||

|---|---|---|---|---|---|---|---|---|

| Mean | Std. | Mean | Std. | Mean | Std. | Mean | Std. | |

| Household income | 143,013.3 | 199,081.5 | 164,663.5 | 234,666.0 | 298,376.1 | 340285.2 | 313,095.2 | 352,565.7 |

| Borrowing | 60,098.0 | 285,473.5 | 85,445.0 | 374,318.8 | 162,141.2 | 493,595.6 | 205,161.5 | 599,974.1 |

| Savings_1 | 40,736.8 | 158,203.1 | 48,722.5 | 188,158.7 | 65,266.9 | 243,876.2 | 67,435.4 | 247,196.7 |

| Savings_2 | 7091.6 | 93,137.2 | 5881.3 | 42,574.6 | 147,409.8 | 481,373.2 | 157,659.3 | 554,770.6 |

| Workhour | — | — | — | — | 1621.8 | 2032.1 | 1563.4 | 1985.2 |

| Land | 3.69 | 10.58 | 3.38 | 10.46 | 3.94 | 9.95 | 4.20 | 10.77 |

| Unemployment | 0.71 | 0.86 | 0.76 | 0.90 | 1.14 | 1.12 | 1.19 | 1.14 |

| HH_Sex | 0.74 | 0.44 | 0.74 | 0.44 | 0.59 | 0.49 | 0.57 | 0.49 |

| HH_Age | 47.70 | 15.01 | 48.15 | 14.71 | 55.49 | 14.99 | 56.24 | 14.82 |

| HH_Edu | 5.65 | 4.93 | 6.01 | 5.11 | 8.37 | 3.91 | 8.56 | 3.96 |

| HH_Farmer | 0.32 | 0.47 | 0.32 | 0.47 | 0.24 | 0.43 | 0.25 | 0.43 |

| HH_Employee | 0.22 | 0.42 | 0.22 | 0.41 | 0.22 | 0.42 | 0.22 | 0.41 |

| HH_Employer | 0.46 | 0.49 | 0.45 | 0.50 | 0.38 | 0.48 | 0.39 | 0.48 |

| Mem0–5 | 0.36 | 0.61 | 0.35 | 0.60 | 0.14 | 0.40 | 0.13 | 0.39 |

| Mem6–11 | 0.39 | 0.65 | 0.39 | 0.64 | 0.19 | 0.47 | 0.19 | 0.46 |

| Mem12–17 | 0.39 | 0.67 | 0.40 | 0.67 | 0.20 | 0.46 | 0.20 | 0.47 |

| Mem18–60 | 2.12 | 1.12 | 2.15 | 1.16 | 1.58 | 1.10 | 1.58 | 1.13 |

| Mem_60up | 0.36 | 0.64 | 0.37 | 0.64 | 0.61 | 0.77 | 0.66 | 0.78 |

| Male6–11 | 0.20 | 0.45 | 0.20 | 0.45 | 0.10 | 0.33 | 0.10 | 0.32 |

| Female6–11 | 0.19 | 0.44 | 0.19 | 0.44 | 0.09 | 0.32 | 0.09 | 0.32 |

| Male12–17 | 0.20 | 0.46 | 0.20 | 0.46 | 0.10 | 0.32 | 0.10 | 0.33 |

| Female12–17 | 0.19 | 0.46 | 0.20 | 0.46 | 0.10 | 0.32 | 0.10 | 0.32 |

| Pri_male18–60 | 0.20 | 0.44 | 0.20 | 0.46 | 0.29 | 0.50 | 0.27 | 0.49 |

| Pri_female18–60 | 0.22 | 0.45 | 0.23 | 0.46 | 0.33 | 0.49 | 0.30 | 0.48 |

| Sec_male18–60 | 0.19 | 0.43 | 0.21 | 0.45 | 0.29 | 0.52 | 0.31 | 0.53 |

| Sec_female18–60 | 0.14 | 0.38 | 0.17 | 0.41 | 0.26 | 0.48 | 0.28 | 0.50 |

| Un_male18–60 | 0.17 | 0.42 | 0.19 | 0.46 | 0.15 | 0.38 | 0.16 | 0.39 |

| Un_female18–60 | 0.18 | 0.44 | 0.21 | 0.48 | 0.19 | 0.44 | 0.22 | 0.47 |

| Male_60up | 0.15 | 0.36 | 0.16 | 0.37 | 0.27 | 0.45 | 0.28 | 0.46 |

| Female_60up | 0.20 | 0.41 | 0.21 | 0.42 | 0.34 | 0.50 | 0.37 | 0.52 |

| Number of observations | 25,226 | 23,758 | 45,251 | 46,555 | ||||

| Variables | Variable description |

|---|---|

| Household income | Annual household income (Baht) |

| Borrowings | The amount of total debt of household (Baht) |

| Savings_1 | Annual household income minus annual household expenditure (Baht) |

| Savings_2 | Value of household financial assets (Baht) |

| Work hour adjustment | Number of hours worked per year |

| Land | Number of land. (Unit is Rai, i.e., around 0.39 acre) |

| Unemployment | Number of unemployed household members. |

| Head_Sex | Male household head (Male = 1, otherwise = 0) |

| Head_Age | Age of household head. |

| Head_Edu | Year in school of household head. |

| Mem0–5 | Number of household members aged under 6 years |

| Mem6–11 | Number of household members aged between 6 and 11 years. |

| Mem12–17 | Number of household members aged between 12 and 17 years. |

| Mem18–60 | Number of household members aged between 18 and 60 years. |

| Mem_60up | Number of household members aged over 60 years. |

| Male6–11 | Number of male household members aged between 6 and 11 years. |

| Female6–11 | Number of female household members aged between 6 and 11 years. |

| Male12–17 | Number of male household members aged between 12 and 17 years. |

| Female12–17 | Number of female household members aged between 12 and 17 years. |

| Pri_male18–60 | Number of male household members aged between 18 and 60 years and have primary level education. |

| Pri_female 18–60 | Number of fmale household members aged between 18 and 60 years and have primary level education. |

| Sec_male18–60 | Number of male household members aged between 18 and 60 years and have secondary level education. |

| Sec_female18–60 | Number of female household members aged between 18 and 60 years and have secondary level education. |

| Un_male18–60 | Number of male household members aged between 18 to 60 years and have higher education. |

| Un_female18–60 | Number of female household members aged between 18 to 60 years and have higher education. |

| Male_60up | Number of male household members aged over 60 years. |

| Female_60up | Number of female household members aged over 60 years. |

- Note: Regarding Table A1, HH_Farmer, HH_Employee and HH_Employer present household head who are farmer, employee and employer, respectively.

| 1996 | 1998† | 2019 | 2021† | |

|---|---|---|---|---|

| Head_sex | 11,883.720 (3561.938)*** | 24,783.310 (2925.907)*** | 17,662.030 (3571.683)** | 17,432.190 (3774.898)*** |

| Head_age | 8254.940 (360.195)*** | 11,347.600 (485.341)*** | 10,900.580 (520.309)*** | 9784.204 (492.929)*** |

| Head_age2 | −68.857 (3.676)*** | −93.706 (4.514)*** | −80.651 (4.707)*** | −68.622 (4.353)*** |

| Head_edu | 4013.236 (693.167)*** | 6151.934 (575.214)*** | 19,671.360 (637.038)*** | 21,858.800 (608.661)*** |

| Unemployed | −14,976.900 (1764.365)*** | −15,566.140 (2171.679)*** | −21,079.340 (2559.140)*** | −24,427.690 (2709.452)*** |

| Male6_11 | 10,969.530 (2378.437)*** | 12,512.200 (3730.670)*** | 35,396.740 (5319.764)*** | 42,951.350 (5135.813)*** |

| Female6_11 | 9618.475 (2799.193)*** | 18,229.180 (4505.463)*** | 30,472.560 (4836.259)*** | 36,703.340 (4786.790)*** |

| Male12_17 | 19,011.140 (2554.179)*** | 22,237.250 (2853.391)*** | 47,919.730 (4913.975)*** | 48,470.750 (4617.441)*** |

| Female12_17 | 24,503.520 (2774.629)*** | 19,847.740 (2776.383)*** | 59,541.810 (6175.921)*** | 46,564.460 (5227.206)*** |

| Pri_male18_60 | 13,694.320 (1755.839)*** | 15,034.740 (2974.270)*** | 48,283.400 (2929.066)*** | 56,126.690 (2930.395)*** |

| Pri_female18_60 | 17,268.600 (2060.821)*** | 26,757.560 (4049.668)*** | 55,060.450 (3325.131)*** | 55,421.150 (3195.962)*** |

| Sec_male18_60 | 38,765.670 (3112.356)*** | 41,399.060 (4374.963)*** | 66,456.190 (3190.756)*** | 60,959.970 (3260.553)*** |

| Sec_female18_60 | 48,468.890 (4085.638)*** | 55,709.630 (4535.052)*** | 77,140.760 (3407.065)*** | 68,572.610 (3138.980)*** |

| Un_male18_60 | 104,387.000 (8578.966)*** | 102,095.000 (5856.501)*** | 188,810.900 (6182.269)*** | 184,985.000 (6276.938)*** |

| Un_female18_60 | 130,842.700 (6367.151)*** | 130,244.000 (5679.494)*** | 212,279.700 (5292.880)*** | 208,995.400 (6421.695)*** |

| R2 | 0.269 | 0.253 | 0.287 | 0.295 |

| No. of households | 25,226 | 23,758 | 45,251 | 46,455 |

- Note: (1) *, **, and *** represent significance level of 10%, 5%and 1%, respectively. (2) Robust standard errors, clustered by households, are presented in parentheses Income equations also include land, household member who age 0–5, male and female who age over 60 as well as regional effect. This table nevertheless do not present these variables due to the limitation of table space. Dependent variable: Household income (in level).

- † denotes the crisis period.

| 1996 | 1998† | 2019 | 2021† | |

|---|---|---|---|---|

| Regional_Unemployed | 0.698 (0.044)*** | 0.707 (0.039)*** | 0.409 (0.017)*** | 0.217 (0.016)*** |

| Head_sex | 0.021 (0.012)* | −0.004 (0.021) | −0.009 (0.008) | −0.008 (0.007) |

| Head_age | −0.003 (0.002) | −0.011 (0.002)*** | −0.031 (0.001)*** | −0.028 (0.001)*** |

| Head_age2 | 0.00007 0.00002)*** | 0.0002 (0.00002)*** | 0.0003 (0.00001)*** | 0.0003 (0.00001)*** |

| Head_edu | −0.027 (0.002)*** | −0.027 (0.001)*** | 0.015 (0.001)*** | 0.017 (0.001)*** |

| Male6_11 | −0.032 (0.009)*** | −0.026 (0.010)** | 0.889 (0.010)*** | 0.943 (0.009)*** |

| Female6_11 | −0.033 (0.010)*** | −0.044 (0.011)*** | 0.886 (0.011)*** | 0.942 (0.009)*** |

| Male12_17 | 0.376 (0.012)*** | 0.421 (0.012)*** | 0.886 (0.010)*** | 0.917 (0.009)*** |

| Female12_17 | 0.376 (0.012)*** | 0.436 (0.012)*** | 0.919 (0.011)*** | 0.938 (0.009)*** |

| Pri_male18_60 | 0.086 (0011)*** | 0.096 (0.012)*** | 0.192 (0.008)*** | 0.215 (0.008)*** |

| Pri_female18_60 | 0.107 (0.011)*** | 0.098 (0.012)*** | 0.291 (0.008)*** | 0.303 (0.008)*** |

| Sec_male18_60 | 0.275 (0.013)*** | 0.253 (0.013)*** | 0.172 (0.007)*** | 0.195 (0.007)*** |

| Sec_female18_60 | 0.262 (0.015*** | 0.274 (0.014)*** | 0.280 (0.008)*** | 0.315 (0.007)*** |

| Un_male18_60 | 0.463 (0.019)*** | 0.423 (0.018)*** | 0.208 (0.011)*** | 0.204 (0.010)*** |

| Un_female18_60 | 0.318 (0.016)*** | 0.347 (0.016)*** | 0.226 (0.009)*** | 0.251 (0.008)*** |

| R2 | 0.341 | 0.366 | 0.673 | 0.706 |

| First-stage F-stat | 247.017 | 325.984 | 568.94 | 189.154 |

| No. of households | 25,226 | 23,758 | 45,251 | 46,455 |

- Note: (1) *, **, and *** represent significance level of 10%, 5%, and 1%, respectively. (2) Robust standard errors, clustered by households, are presented in parentheses Income equations also include land, household member who age 0–5, male and female who age over 60 as well as regional effect. This table nevertheless do not present these variables due to the limitation of table space.

- † denotes the crisis period.

| 1996 | 1998† | 2019 | 2021† | |

|---|---|---|---|---|

| Head_sex | 12,548.770 (3571.404)*** | 24,608.670 (2937.083)*** | 18,056.040 (3630.757)*** | 15,889.230 (3955.505)*** |

| Head_age | 8159.446 (363.569)*** | 11,120.610 (499.595)*** | 11,508.690 (761.032)*** | 6706.406 (1064.682)*** |

| Head_age2 | −66.213 (3.783)*** | −90.538 (4.886)*** | −87.717 (7.843)*** | −31.096 (12.310)** |

| Head_edu | 2965.158 (824.578)*** | 5580.203 (781.173)*** | 19,367.010 (641.460)*** | 23,806.470 (816.061)*** |

| Unemployed | −53,124.130 (14,177.790)*** | −36,170.030 (15,803.890)** | −1410.146 (15,840.770)*** | −135,415.500 (33,995.370)*** |

| Male6_11 | 9817.903 (2473.078) | 11,920.460 (3792.686)*** | 17,703.170 (15,325.560) | 148,295.700 (32,592.300)*** |

| Female6_11 | 8338.784 (2781.874)*** | 17,343.780 (4553.955)*** | 12,810.520 (14,781.040) | 141,945.000 (32,732.320)*** |

| Male12_17 | 33,439.380 (5387.093)*** | 30,944.310 (7137.144)*** | 30,221.770 (26331.970)** | 151,110.400 (31628.410)*** |

| Female12_17 | 38,841.140 (5946.073)*** | 28,871.380 (7445.632)*** | 41,248.080 (15,402.090)*** | 151,424.500 (32,412.250)*** |

| Pri_male18_60 | 17000.030 (2244.076)*** | 17017.68 (3324.437)*** | 44394.630 (4131.055)*** | 80395.980 (8196.501)*** |

| Pri_female18_60 | 21,374.810 (2669.124)*** | 28,744.560 (4474.194)*** | 49,305.720 (5350.409)*** | 89,160.760 (10,828.800)*** |

| Sec_male18_60 | 49,388.360 (5198.360)*** | 46,674.740 (6425.147)*** | 63,050.360 (4378.697)*** | 82,841.780 (7584.898)*** |

| Sec_female18_60 | 58,729.710 (5952.618)*** | 61,478.720 (6642.810)*** | 71,645.600 (5376.810)*** | 103,571.100 (11,386.650)*** |

| Un_male18_60 | 122,241.800 (11,375.860)*** | 110,964.400 (9573.615)*** | 184,668.000 (6873.250)*** | 207,772.900 (9945.979)*** |

| Un_female18_60 | 143,236.200 (8336.100)*** | 137,531.500 (8527.581)*** | 207,799.900 (6305.546)*** | 237,112.500 (11062.350)*** |

| R2 | 0.251 | 0.249 | 0.286 | 0.257 |

| No. of households | 25,226 | 23,758 | 45,251 | 46,455 |

- Notes: (1) *, **, and *** represent significance level of 10%, 5%, and 1%, respectively. (2) Robust standard errors, clustered by households, are presented in parentheses Income equations also include land, household member who age 0–5, male and female who age over 60 as well as regional effect. This table nevertheless do not present these variables due to the limitation of table space.

- † denotes the crisis period.

| 1996 | 1998† | 2019 | 2021† | |||||

|---|---|---|---|---|---|---|---|---|

| OLS | 2SLS | OLS | 2SLS | OLS | 2SLS | OLS | 2SLS | |

| Full sample | ||||||||

| 0.096 (0.028)*** | 0.096 (0.028)*** | 0.083 (0.027)*** | 0.083 (0.027)*** | 0.696 (0.040)*** | 0.696 (0.041)*** | 0.845 (0.057)*** | 0.845 (0.056)*** | |

| 0.084 (0.025)*** | 0.095 (0.028)*** | 0.087 (0.030)*** | 0.087 (0.030)*** | 0.575 (0.042)*** | −0.647 (0.294)** | 0.628 (0.055)*** | 0.782 (0.058)*** | |

| 0.098 (0.030)*** | 0.098 (0.030)*** | 0.086 (0.031)*** | 0.086 (0.030)*** | 0.662 (0.043)*** | 0.661 (0.043)*** | 0.815 (0.060)*** | 0.815 (0.060)*** | |

| R2 | 0.027 | 0.027 | 0.128 | 0.128 | 0.201 | 0.201 | 0.227 | 0.228 |

| Constrainted households classified by income | ||||||||

| 0.045 (0.005)*** | 0.045 (0.005)*** | 0.024 (0.004)*** | 0.024 (0.004)*** | 0.260 (0.123)** | 0.208 (0.123)* | 0.478 (0.393) | 0.455 (0.386) | |

| 0.023 (0.009)** | 0.026 (0.007)*** | −0.023 (0.022) | 0.023 (0.004)*** | 0.172 (0.195) | 0.210 (0.117)* | −1.594 (1.557) | −1.204 (1.178) | |

| 0.038 (0.005)*** | 0.038 (0.005)*** | 0.019 (0.004)*** | 0.019 (0.004)*** | 0.207 (0.119)* | 0.224 (0.116)* | 0.048 (0.139) | 0.049 (0.139) | |

| R2 | 0.031 | 0.031 | 0.021 | 0.021 | 0.012 | 0.012 | 0.013 | 0.012 |

| Unconstrainted households classified by income | ||||||||

| 0.098 (0.030)*** | 0.098 (0.030)*** | 0.084 (0.029)*** | 0.084 (0.029)*** | 0.693 (0.041)*** | 0.693 (0.041)*** | 0.845 (0.057)*** | 0.846 (0.058)*** | |

| 0.087 (0.028)*** | 0.096 (0.030)*** | 0.091 (0.033)*** | 0.089 (0.032)*** | 0.546 (0.045)*** | 0.740 (0.051)*** | 0.628 (0.056)*** | 0.781 (0.060)*** | |

| 0.101 (0.032)*** | 0.100 (0.032)*** | 0.088 (0.032)*** | 0.088 (0.032)*** | 0.657 (0.043)*** | 0.658 (0.044)*** | 0.815 (0.060)*** | 0.816 (0.061)*** | |

| R2 | 0.026 | 0.026 | 0.126 | 0.126 | 0.197 | 0.197 | 0.227 | 0.226 |

- Note: (1) *, **, and *** represent significance level of 10%, 5%, and 1%, respectively. (2) Robust standard errors, clustered by households, are presented in parentheses. (3) F-statistics in the first stage of most IV estimations were reported > 100. (4) All specifications include household member classified by aged 0–5, 6–11, 12–17, 18–60 and 60 up and household head's occupations. (5) All specifications were also controlled with regional effects. (6) Number of sample households are 15,246, 15,929, 39,647, and 41,711 in 1996, 1998, 2019, and 2021, respectively.

- † denotes the crisis peroid. Income > 6000 for the year 1996 and 1998 and income > 7500 for the year 2019 and 2021.

| 1996 | 1998† | 2019 | 2021† | |||||

|---|---|---|---|---|---|---|---|---|

| OLS | 2SLS | OLS | 2SLS | OLS | 2SLS | OLS | 2SLS | |

| Savings_2 (Tobit regression) | ||||||||

| 0.095 (0.004)*** | 0.095 (0.004)*** | 0.082 (0.001)*** | 0.082 (0.001)*** | 0.709 (0.008)*** | 0.709 (0.008)*** | 0.860 (0.008)*** | 0.861 (0.008)*** | |

| 0.082 (0.007)*** | 0.093 (0.004)*** | 0.087 (0.002)*** | 0.087 (0.001)*** | 0.605 (0.018)*** | −0.341 (0.261) | 0.651 (0.019)*** | 0.797 (0.009)*** | |

| 0.098 (0.004)*** | 0.097 (0.004)*** | 0.086 (0.001)*** | 0.086 (0.001)*** | 0.672 (0.008)*** | 0.672 (0.008)*** | 0.826 (0.009)*** | 0.828 (0.009)*** | |

| Log likelihood | −315,136.40 | −315,136.49 | −275,787.70 | −275,787.02 | −620,179.63 | −620,179.97 | −641,899.40 | −641,892.62 |

| Borrowings (Heckman estimation: the second stage) | ||||||||

| 0.907 (0.018)*** | 0.906 (0.018)*** | 1.084 (0.017)*** | 1.083 (0.017)*** | 0.819 (0.014)*** | 0.818 (0.014)*** | 1.048 (0.015)*** | 1.053 (0.015)*** | |

| 0.863 (0.033)*** | 0.861 (0.022)*** | 1.027 (0.037)*** | 1.028 (0.024)*** | 0.725 (0.040)*** | 0.715 (0.027)*** | 0.893 (0.041)*** | 0.962 (0.017)*** | |

| 0.856 (0.019)*** | 0.857 (0.019)*** | 1.026 (0.018)*** | 1.027 (0.018)*** | 0.717 (0.015)*** | 0.715 (0.015)*** | 0.959 (0.016)*** | 0.969 (0.016)*** | |

| Log likelihood | −177,011.20 | −177,012.90 | −192,901.20 | −192,902.60 | −335,824.10 | −335,817.40 | −375,640.10 | −375,659.60 |

| Work hour adjustment (Tobit regression) | ||||||||

| — | — | — | — | 0.0007 (0.00004)*** | 0.0007 (0.00004)*** | 0.0007 (0.00004)*** | 0.0007 (0.00004)*** | |

| — | — | — | — | 0.007 (0.00009)*** | 0.101 (0.001)*** | 0.007 (0.00009)*** | 0.002 (0.00004)*** | |

| — | — | — | — | 0.0005 (0.00004)*** | 0.0005 (0.00004)*** | 0.0006 (0.00004)*** | 0.0006 (0.00004)*** | |