Does a Lingua Franca matter in bilateral international trade?

Abstract

This article explores the impact of language proficiency on international trade by using panel data analysis. To do so, we construct a time-variant test-score-based measure of common language. Controlling for the standard gravity model variables, we find strong empirical evidence that English proficiency promotes bilateral trade flows through facilitating direct communication. We confirm that this finding is robust even when we estimate its effects separately on goods and services trade flows at a disaggregated level. Furthermore, we show that institutional similarities between trading partners play a role that is similar to communication easiness in trade. Our study provides a policy implication for government support for attaining second language fluency.

1 INTRODUCTION

Language is an important economic variable that cannot be ignored, especially in the international trade field. Sharing common official languages facilitates international economic transactions. On the other hand, the high degree of dissimilarity between the official languages of each trading partner could impose significant language-related barriers on trade, that is, communication costs which are referred to as trade costs in other studies.

As discussed by Fink et al. (2005), the communication costs in international trade measure the ease of communicating between international buyers and sellers, and thus are seen as part of trade cost affecting bilateral trade cross borders. Therefore, communication is necessary and important in the cross-country business. For example, buyers and sellers always need to discuss the specifications of products/services, details of contracts, as well as the production and delivery process. Sometimes, they also have to exchange opinions and ideas to customize products/services. These interactions are primarily based on the common language they use. Thus, the communication language proficiency evidently influences the ease of communication in the international trade context.

In addition, Gong (2013) argues that trade costs include not only transportation costs and tariffs, but also a set of factors that are difficult to measure, such as search costs and language barriers. Sun and Zhang (2018) also discuss that language differences between countries have formed an invisible obstacle in bilateral trade. Similar findings are also shown by other studies that use various measurements of linguistic distance (ease of communication) and focus on different languages, such as English and Spanish (see Hosein et al., 2022; Nakagawa & Sugasawa, 2022, among others).

Yet there is no consensus about an appropriate empirical index for ease of communication. Most studies measure such linguistic distances based on official languages between countries. However, we claim that the previous measures of language distances do not consider the possibility that successful communications can take place without knowing international trade partners' mother languages. A lingua franca such as English or Chinese can be used as a medium of communication in international trade. As long as the same lingua franca is widely used in both countries, we expect to observe significant international trade even if they do not share a common language. That is, a lingua franca could play a role that is equivalent to sharing a common language in international trade.

This article quantifies the impact of the language factor on bilateral trade in a gravity framework. We consider the previously seldom used test-score-based approach as an alternative to measure linguistic distance. Therefore, the linguistic distance in our study is cardinal and very straightforward. Specifically, our study mainly focuses on the impact of English language fluency-measured by the standardized language test scores-on bilateral trade flows. This test is based on reading and listening abilities, which are communication abilities with more expected direct effect on international trade. Our study is complementary to Hutchinson (2005), which examines the effect of linguistic distance by using a measure of time-invariant language test scores. In contrast to Hutchinson (2005), we consider a time-variant measure of common language, which allows us to conduct a panel data regression analysis. Our study extends Ku and Zussman (2010), which estimates the effect of lingua franca on international trade flows. They consider the Test of English as a Foreign Language (TOEFL) as a measure of language proficiency in English. Unlike ours, however, their measure has potential shortcomings. The TOEFL scores are required for international applicants to be admitted to colleges and universities in the United States. Therefore, the TOEFL examinees are most likely students wishing to study abroad, which means the test scores could not fully represent the English proficiency levels within a country. Another downside of the measure is that the test scores are not reported in consecutive periods, which means their empirical analysis could be significantly constrained. In the empirical analysis, we estimate the effect of language proficiency on bilateral trade flows separately between goods and services. We use the Poisson Pseudo-Maximum Likelihood (PPML) method, which is widely adopted in recent international trade studies (e.g., see Brodzicki & Uminski, 2018; Larch et al., 2019; Sun & Reed, 2010, among others). We address the potential endogenous issue of our ease of communication index using the economy openness (i.e., international trade/GDP ratio) as the instrument variable. In addition, we control for various factors, such as institutional similarity, geographic distance, and regional trade agreements. The results confirm that language similarity has a significantly positive effect on bilateral trade flows. However, heterogeneous responses are found. The effect is particularly strong in goods trade. The estimated effects also differ significantly between imports and exports. We further conduct a robustness test at the disaggregated level of goods and services. It is qualitatively robust compared to our empirical findings. This article also provides a policy implication that as the world becomes increasingly interdependent, it is worthwhile for governments to invest in second language education.

The layout of the article is as follows. The next section offers a short overview of previous literature. Section 3 introduces our structural gravity model and provides a variable description. Section 4 discusses empirical results and assess their robustness. The last section concludes with an economic policy related remark.

2 LITERATURE REVIEW

The gravity equation is one of the most frequently used models in international economics. Tinbergen (1962) proposes a well-known theoretical model for considering the role of common language in the gravity framework. Trade flows between two countries are proportional to their economic aggregates and inversely proportional to the geographical distance. In the literature, language is considered the part of communication cost that could affect the scale of bilateral trade volume and trade flows. Baldwin and Taglioni (2007) point out common mistakes in empirical implementation, such as omitted variables and mismeasured variables. They particularly show that a misspecified equation produces biased estimates. Anderson and Van Wincoop (2003) develop a traditional gravity equation by incorporating multilateral trade resistance, which is consistent with the theoretical foundation.

Numerous empirical studies attempt to find the effect of language on international trade by using various measures or indexes.1 Egger and Lassmann (2012) point out the problem that the use of dummy variable of common language in a gravity model could capture confounding economic, cultural and institutional determinants. Hutchinson (2002) employs the proportion of English speakers as either a first or a second language for 34 countries in the gravity model. Boisso and Ferrantino (1997) and Wagner et al. (2002) use the measure of the probability that a randomly chosen exporter and importer would speak the same language. Recently, different measures of linguistic distance are further constructed by indexing difficulty associated with learning a foreign language (Chiswick & Miller, 1998) or by indexing dissimilarity between a pair of languages taken from the World Atlas of Language Structures (Lohmann, 2011). Also, Isphording and Otten (2013) propose the use of a Levenshtein distance measure, which can be easily computed for any pair of country languages. The distance is basically measured based on selecting words having the same meaning from any pair of country languages and then comparing the pronunciation of the words. Their empirical finding is qualitatively consistent with Chiswick and Miller (2005), which uses the test-score-based approach.

A number of subsequent studies examine the role of language in the gravity framework. Language distance could increase transaction costs and a common language between trading partners could promote bilateral trade volume. For example, Melitz (2008) provides empirical evidence that having the same official language facilitates bilateral trade and that similarities of language and culture also have a great impact on the trade volume.2 Carr (1987) argues that language plays a role similar to currency in international trade, which can reduce transaction costs. Oh et al. (2011) show the role of a common language in promoting trade and foreign direct investment (FDI) flows. Their empirical results also indicate that speaking a common language has more impacts on FDI flows than on trade volume. Some recent studies, such as Nakagawa and Sugasawa (2022) and Hosein et al. (2022), also show that common languages are beneficial for economic integration and development.

Fidrmuc and Fidrmuc (2016) show a strong positive relationship between the probability of communicating in English and bilateral trade. Our study is similar to Fidrmuc and Fidrmuc (2016) in that we focus on the importance of English proficiency in international trade. While they only consider the countries within the European Union, we utilize more sample countries in the analysis. Using a different identification strategy, Egger and Lassmann (2015) also investigate the effect of common languages on international trade. They focus on Switzerland, which is a multilingual country consisting of four geographically distinct native language zones. By using transaction-level data, they find common native languages affect extensive trade margins (e.g., the number of bilateral transactions).

The previous empirical studies report various estimates for the direct effect of a common language on bilateral trade. For example, Frankel and Rose (1998) show that the use of the same official language promotes 1.8 times more trade than in the absence of a common language. A similar finding is provided in Melitz and Toubal (2014): their estimated magnitudes are about 1.3 to 1.6. They also provide empirical evidence that common spoken languages have greater impacts on trade than common official languages. Anderson and Van Wincoop (2004) report that the costs imposed by language-related barriers are equivalent to a 7% tax level on trade in industrialized countries.3 Isphording and Otten (2013) construct the linguistic distances by considering language dissimilarities and find a modest effect. If we consider the language distance distribution between the lower quartile and the upper quartile, the magnitude difference of language effect on trade is approximately 4%. The empirical results by Egger and Lassmann (2015) show that sharing native languages fosters more imports by 16.5% and number of import transactions by 19.6%, respectively.

Santos Silva and Tenreyro (2006) point out that the ordinary least squares estimator for the gravity model is suffered from heteroscedasticity and zero trade flows typically observed in the trade data. In addition, the collinearity issue arises from the time-invariant fixed effects and unobserved country-pair trade barriers. To avoid such estimation problems, they suggest the use of the PPML method. Also, they present simulation evidence that the PPML estimator is well behaved in estimating a gravity model, taking a log-linearization form with positive trade flows only. Santos Silva and Tenreyro (2011) provide further simulation evidence that the PPML estimator still performs well even when large zeros of the dependent variable in the sample are observed. Therefore, we adopt the PPML approach as in Bahar and Rapoport (2018) and Baier et al. (2019) to estimate our gravity equation, controlling for multi-dimension fixed effects (i.e., Chen & Novy, 2022; Demir & Im, 2020).

3 THEORETICAL FRAMEWORK

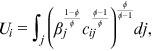

has a utility function with constant elasticity of substitution (CES) over composite goods imported from country

has a utility function with constant elasticity of substitution (CES) over composite goods imported from country  for

for  . This utility function, with a demand shifter attached to imports from country

. This utility function, with a demand shifter attached to imports from country  , can be defined by

, can be defined by

represents country

represents country  's imports from country

's imports from country  ,

,  indicates the elasticity of substitution among imported goods from different countries for

indicates the elasticity of substitution among imported goods from different countries for  , and

, and  is a country-specific demand shifter. Note that

is a country-specific demand shifter. Note that  refers to the total expenditure by country

refers to the total expenditure by country  on its imports from all other countries. In addition,

on its imports from all other countries. In addition,  denotes import price, and it can be specified as

denotes import price, and it can be specified as

and trade costs

and trade costs  between country

between country  and country

and country  , where

, where  . We follow the recent trade literature assuming that

. We follow the recent trade literature assuming that  's are iceberg trade costs. The representative consumer in country

's are iceberg trade costs. The representative consumer in country  maximizes her utility by spending on imports from origin country

maximizes her utility by spending on imports from origin country  , that is,

, that is,  :

:

is the consumer price index in country

is the consumer price index in country  , and it is calculated as

, and it is calculated as

equals the demand from all its importers, including itself (see Anderson & Van Wincoop, 2003). Finally, the trade flow from the origin (i.e., country

equals the demand from all its importers, including itself (see Anderson & Van Wincoop, 2003). Finally, the trade flow from the origin (i.e., country  ) to the destination (i.e., country

) to the destination (i.e., country  ) is given by the structural gravity schedule

) is given by the structural gravity schedule

is the world aggregated output.

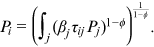

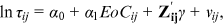

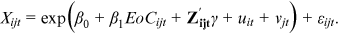

is the world aggregated output. ) as a function of Ease of Communication (EoC) and other relevant gravity variables between two countries,

) as a function of Ease of Communication (EoC) and other relevant gravity variables between two countries,  . We further specify the trade costs following a log-linear form:

. We further specify the trade costs following a log-linear form:

includes the control variables in our regression models.

includes the control variables in our regression models.

, and

, and  captures the idiosyncratic disturbances in bilateral trade flows, while

captures the idiosyncratic disturbances in bilateral trade flows, while  and

and  control for the exporter-time and importer-time fixed effects, respectively.

control for the exporter-time and importer-time fixed effects, respectively.In this article, we focus on the impact of EoC on bilateral trade flows by utilizing the English Proficiency Index (EPI). EF Education Group creates the index through the EF standardized language test scores. In particular, the EF test is given in English, combining two sections: reading and listening. The EF English proficiency test scores are divided into six reference levels defined by the Common European Language Reference Standard.

Specifically, the EPI for a country is constructed based on participants' test scores for the EF standardized English tests. The EPI scores are standardized by EF Education Group, using weighted components, including English tests and previous years' indices to stabilize scores over years.4 Only countries with more than 400 participants are considered in our analysis. Note that due to the online adaptive test, our sample covers countries with relatively high Internet penetration rate.

To capture the effects of English language proficiency on bilateral trade directly, we construct our  variable using the logarithm of the average value EPI scores by trading partners. Moreover, we are particularly interested in testing for the existence of the substitution effect between communication ease and institutional similarities. To achieve this goal, our regression model includes a variable for institutional similarity (IS), and we introduce the interaction term between EoC and IS. In particular, IS represents the average value of three indices, containing a common legal system, a common religion, and a common colonizer for a pair of countries since 1945. Finally, we incorporate several gravity control variables for trading partners in

variable using the logarithm of the average value EPI scores by trading partners. Moreover, we are particularly interested in testing for the existence of the substitution effect between communication ease and institutional similarities. To achieve this goal, our regression model includes a variable for institutional similarity (IS), and we introduce the interaction term between EoC and IS. In particular, IS represents the average value of three indices, containing a common legal system, a common religion, and a common colonizer for a pair of countries since 1945. Finally, we incorporate several gravity control variables for trading partners in  , including log geographical distance (Distance), contiguity (Contiguity), and belonging to the same free trade agreements (FTA) in their history.

, including log geographical distance (Distance), contiguity (Contiguity), and belonging to the same free trade agreements (FTA) in their history.

Moreover, English proficiency may be affected by the openness of an economy. For example, countries with larger international trade volume call for relatively higher English proficiency, which potentially results in a reverse-causality issue. Thus, we use the lagged trade volume of each country pair as the instrument variable for the  variable, as discussed by Ginsburgh et al. (2017) and Ginsburgh and Weber (2020).

variable, as discussed by Ginsburgh et al. (2017) and Ginsburgh and Weber (2020).

Another endogenous problem may raise due to the omitted variables that may potentially affect the bilateral trade and English proficiencies. We address this issue by adding multi-way fixed effects, including exporter-year fixed effects, importer-year fixed effects, and year fixed effects, as in Demir and Im (2020) and Chen and Novy (2022). In this way, all country-year specific and year specific factors are controlled for and exclude potential omitted variable bias.

4 EMPIRICAL RESULTS

We collect the bilateral trade data from the UN Comtrade Database for the period of 2011-2019, which covers 70 countries. Gravity data of IS, Contiguity, and FTA are retrieved from the CEPII database.

Table 1 presents summary statistics for the variables used in our empirical analysis. It shows that over the sample period, on average, goods trade flows are slightly larger than services trade flows for the sample countries. The average ease of communication is around 4 and the average institutional similarity index is 0.564, respectively. Gravity variables for distance and geographical proximity show that their mean and median values are close together while the observations for regional trade agreements are spread out over a wide range.

| Obs. | Mean | SD | Min | Max | |

|---|---|---|---|---|---|

| Log Trade Volumeg | 160,831 | 9.601 | 3.612 | 0.002 | 19.576 |

| Log Exportg | 160,831 | 8.559 | 3.793 | 0.000 | 18.910 |

| Log Importg | 160,831 | 7.830 | 4.544 | 0.000 | 18.910 |

| Log Trade Volumes | 13,065 | 17.548 | 2.912 | 3.584 | 24.598 |

| Log Exports | 8000 | 17.635 | 3.095 | 0 | 24.072 |

| Log Imports | 7813 | 17.212 | 3.714 | 0 | 23.958 |

| EoC | 160,831 | 4.007 | 0.152 | 3.458 | 4.401 |

| IS | 160,831 | 0.564 | 0.612 | 0.000 | 2.987 |

| Log Distance | 160,831 | 8.720 | 0.780 | 4.088 | 9.894 |

| Contiguity | 160,831 | 0.019 | 0.137 | 0.000 | 1.000 |

| FTA | 160,831 | 0.231 | 0.421 | 0.000 | 1.000 |

- Note: “g” and “s” subscripts refer to goods and services, respectively.

Table 2 displays our estimation results for trading in merchandize goods exports and imports, using the PPML approach, including exporter-year, importer-year, and year fixed effects. EoC has positive effects on trade volumes as well as exports and imports at 1% significance level. This finding confirms that language proficiency is a crucial determinant of bilateral trade. Higher English proficiency lowers communication costs between two trading partners. In comparison, while its economic effects on goods exports appear to be relatively lower than on goods imports (i.e., 1.096 vs. 1.675), the effects across total trade volumes and goods exports turn out to be quite close. Consistent with De Groot et al. (2004), the institutional similarity (IS) variable has a significantly positive effect across any regression specifications. Having a similar institutional framework implies similar rules, regulations, and standards as well as cultural and societal affinity between countries, which can promote bilateral trade. Thus, our baseline results for the goods trade are close to the previous studies using common language dummies, for example, Melitz and Toubal (2014), Demir and Im (2020), and so forth.

| Total | Total | Export | Export | Import | Import | |

|---|---|---|---|---|---|---|

| EoC | 0.316*** | 1.155*** | 0.268*** | 1.096*** | 0.404*** | 1.675*** |

| (0.020) | (0.049) | (0.023) | (0.057) | (0.034) | (0.081) | |

| IS | 0.033*** | 2.058*** | 0.036*** | 2.037*** | 0.042*** | 3.100*** |

| (0.003) | (0.119) | (0.003) | (0.140) | (0.005) | (0.196) | |

| EoC × IS | −0.500*** | −0.494*** | −0.755*** | |||

| (0.030) | (0.035) | (0.049) | ||||

| log Distance | −0.129*** | −0.125*** | −0.137*** | −0.133*** | −0.163*** | −0.158*** |

| (0.003) | (0.003) | (0.003) | (0.003) | (0.005) | (0.005) | |

| Contiguity | 0.023* | 0.044*** | 0.028* | 0.049*** | 0.020 | 0.054*** |

| (0.013) | (0.013) | (0.015) | (0.014) | (0.021) | (0.020) | |

| FTA | 0.007* | −0.023*** | 0.026*** | −0.004 | 0.018*** | −0.029*** |

| (0.004) | (0.004) | (0.005) | (0.005) | (0.007) | (0.007) | |

| F-stat. of 1st Stage Est. | 101.48*** | 101.48*** | 101.37*** | 101.37 | 93.26*** | 93.26*** |

| Exporter-Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Importer-Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 135,470 | 135,470 | 135,470 | 135,470 | 135,470 | 135,470 |

- Note: The dependent variable is bilateral trade volume. All results are based on PPML estimation using the 1-year lagged value of log trade volume as the instrument variable for EoC. F-stat. of 1st Stage Est. are the F-statistics of the first stage estimation. Robust standard errors clustered at exporter-importer country pairs are in parenthesis. *** and * denote significance level at the 1% and 10%, respectively. Exporter-Year FE, Importer-Year FE are country year fixed effects for both exporter and importer countries; Year FE is the year fixed effects. N is the number of observations.

Columns (2), (4), and (6) in Table 2 show the effects of the interaction term (EoC × IS) on bilateral trade and reveal a significant negative effect at 1% significance level. This evidence suggests that institutional similarity could substitute for the ease of communication, at least to some extent, in international trade. Countries with a high degree of institutional similarity can actively trade as much as they possess a high level of communication. That is, institutional similarity plays a role similar to the ease of communication due to lowering communication costs. log Distance has a significantly negative effect, which is consistent with previous research. This finding offers support to the view that increasing distance discourages bilateral trade because of high transportation costs. According to the estimates in column (2), other things being equal, an increase in geographic distance between countries by 1% inhibits trade volumes by about 0.072%. Looking at the other gravity variables, the coefficient estimates on Contiguity reveal significantly negative effects on merchandize goods exports. However, FTA appears to affect trade volumes while we do not find any significant effect on goods exports or imports.

We further study the heterogeneous effects of common language on exports and imports of services by using the same specifications as in Table 2. Table 3 reports the estimation results. While the effect of the language variable becomes substantially smaller, the coefficient estimates on EoC are quite similar in significance levels to those for merchandize goods. Columns (1) and (2) imply that a 1% increase in the EoC index is associated with about a 0.251% to 1.428% increase in service trade volumes on average. Besides, IS has a positive effect on bilateral international trade by lowering nontariff trade barriers. EoC × IS is another main variable of our interest. As discussed before, institutional similarity plays as major of a role as language proficiency does by lowering transaction costs. Column (2) shows that having a common institutional system substitutes for language proficiency more in service trade volumes than in goods trade volumes. Distance and FTA are consistent with those reported in Table 2. Unlike before, however, Contiguity appears with expected signs with a significance level of 0.01. We find that geographical proximity and sharing a common border have a positive and significant effect on bilateral trade across model specifications.

| Total | Total | Export | Export | Import | Import | |

|---|---|---|---|---|---|---|

| EoC | 0.251*** | 1.428*** | 0.487*** | 1.860*** | 0.237*** | 1.193*** |

| (0.050) | (0.229) | (0.119) | (0.430) | (0.063) | (0.249) | |

| IS | 0.023*** | 3.022*** | 0.014*** | 3.407*** | 0.022*** | 2.377*** |

| (0.004) | (0.546) | (0.005) | (0.889) | (0.006) | (0.573) | |

| EoC × IS | −0.732*** | −0.826*** | −0.573*** | |||

| (0.133) | (0.217) | (0.140) | ||||

| log Distance | −0.050*** | −0.043*** | −0.040*** | −0.030*** | −0.043*** | −0.037*** |

| (0.004) | (0.005) | (0.006) | (0.006) | (0.009) | (0.009) | |

| Contiguity | 0.039*** | 0.076*** | 0.070*** | 0.108*** | 0.090*** | 0.115*** |

| (0.014) | (0.017) | (0.017) | (0.023) | (0.027) | (0.028) | |

| FTA | 0.036*** | 0.019** | 0.003 | −0.018 | 0.014 | −0.001 |

| (0.007) | (0.008) | (0.011) | (0.014) | (0.012) | (0.012) | |

| F-stat. of 1st Stage Est. | 32.89*** | 32.89*** | 17.03*** | 17.03*** | 13.69*** | 13.69*** |

| Exporter-Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Importer-Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 8882 | 8882 | 5465 | 5465 | 5382 | 5382 |

- Note: The dependent variable is bilateral trade volume. All results are based on PPML estimation using the 1-year lagged value of log trade volume as the instrument variable for EoC. F-stat. of 1st Stage Est. are the F-statistics of the first stage estimation. Robust standard errors clustered at exporter-importer country pairs are in parenthesis. *** and ** denote significance level at the 1% and 5%, respectively. Exporter-Year FE, Importer-Year FE are country year fixed effects for both exporter and importer countries; Year FE is the year fixed effects. N is the number of observations.

As anecdotes, let's consider two countries in our sample: Indonesia and Singapore. They share many similar factors that affect trade volume, including geographic aspects, political environment, and climate. According to the standard gravity model, one would expect that the larger trade flows occur between close nations (the United States and Indonesia) and that the smaller trade flow occurs between distant nations (the United States and Singapore). The official language of Indonesia is Indonesian and its EPI is 52.94 in 2016, which is at a medium-level in the global records. Singaporeans use English, Malay, Chinese, and Tamil as official languages and the country's EPI is 63.52, which is ranked in the highest group. Our empirical result of the English proficiency effect on trade suggests that there is a larger volume of trade between the United States and Singapore than the trade volume between the United States and Indonesia. The exports (imports) to the United States account for 6.76% (9.20%) and 2.82% (0.80%) of Singapore and Indonesia's GDP, respectively. The use of the same language could allow trading partners to share similar social and cultural environments. As a communication tool, language increases social connectedness and affinities across countries, which can reduce trade barriers and promote international trade (see Badarinza et al., 2022; Bailey et al., 2021).

5 ROBUSTNESS CHECKS

In robustness tests, we analyze the differential effects of the ease of communication at a more disaggregated level due to practical concerns. The language effect in international trade could be sensitive across different sectors of goods and services. Note that as an additional test of robustness, we continue to adopt the same model specifications as in the previous subsection. First, we categorize products based on technological activity in manufacturing as described in Lall (2000). Lall (2000) provides the detailed classification by technology and the list of products. Resource-based products are manufactured in the labor-intensive industry, and primary products can be obtained by natural resource endowments, such as rice, meat, and crude petroleum. Low technology products require low end of skills while medium technology products can be produced by advanced skills and scale-intensive technologies. High technology products tend to require specialized technical skills and fast-changing technologies.

The estimation results in Table 4 strongly support that language proficiency plays a significant role even at the disaggregated level. In particular, its effects are larger for trade in high-technology products than trade in low technology products. Trade in highly complex and sophisticated goods is likely to require clear descriptions of various dimensions of the product, such as its specific features, materials, functions, and uses. We also find that language familiarity has a larger effect than physical distance on goods trade across model specifications. Regarding the bilateral preferential trade agreements, we continue to find the positive impact of language proficiency on goods trade flows, except for low tech products.

| Primary | Resource | Low Tech | Mid Tech | High Tech | |

|---|---|---|---|---|---|

| EoC | 0.281*** | 0.800*** | 0.676*** | 1.014*** | 1.492*** |

| (0.054) | (0.055) | (0.061) | (0.056) | (0.070) | |

| IS | 0.299** | 1.450*** | 1.405*** | 1.876*** | 2.783*** |

| (0.123) | (0.129) | (0.150) | (0.136) | (0.174) | |

| EoC × IS | −0.065** | −0.347*** | −0.334*** | −0.453*** | −0.674*** |

| (0.030) | (0.032) | (0.037) | (0.034) | (0.043) | |

| log Distance | −0.137*** | −0.161*** | −0.155*** | −0.126*** | −0.118*** |

| (0.003) | (0.003) | (0.004) | (0.003) | (0.004) | |

| Contiguity | 0.030** | 0.019 | 0.048*** | 0.051*** | 0.064*** |

| (0.013) | (0.014) | (0.016) | (0.013) | (0.015) | |

| FTA | 0.036*** | 0.007 | −0.006 | 0.004 | −0.007 |

| (0.005) | (0.005) | (0.006) | (0.005) | (0.005) | |

| F-stat. of 1st Stage Est. | 233.77*** | 240.96*** | 243.42*** | 253.14*** | 236.90*** |

| Exporter-Year FE | Yes | Yes | Yes | Yes | Yes |

| Importer-Year FE | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes |

| N | 99,196 | 110,102 | 113,311 | 112,299 | 101,251 |

- Note: The dependent variable is bilateral trade volume. All results are based on PPML estimation using the 1-year lagged value of log trade volume as the instrument variable for EoC. F-stat. of 1st Stage Est. are the F-statistics of the first stage estimation. Robust standard errors clustered at exporter-importer country pairs are in parenthesis. *** and ** denote significance level at the 1% and 5%, respectively. Exporter-Year FE, Importer-Year FE are country year fixed effects for both exporter and importer countries; Year FE is the year fixed effects. N is the number of observations.

Secondly, instead of the aggregate trade level, we consider subcategories of service sectors, such as transportation, travel, communication, construction, financial services, information services, and cultural services (see Table 5). Our results consistently confirm that language proficiency matters for service trade even at the disaggregated level, except for transport services, which could be considered as a part of trade activities. The possible explanation for the lack of significance is that transporting goods usually requires less face to face communication. Regarding institutional similarity, its marginal effect is inconclusive because many kinds of service trade appear as the north-south trade, that is, developed countries with various well-functioning services sectors tend to trade more to developing countries even though there exist large institutional gaps between north and south.

| Transportation | Information | Financial | Communications | Cultural | Construction | |

|---|---|---|---|---|---|---|

| EoC | 0.877*** | 1.852*** | 0.375* | 0.658*** | 0.564*** | 0.590** |

| (0.159) | (0.210) | (0.202) | (0.190) | (0.147) | (0.246) | |

| IS | 1.661*** | 2.907*** | 0.241 | 0.572 | 0.936*** | 1.371*** |

| (0.399) | (0.675) | (0.586) | (0.530) | (0.348) | (0.497) | |

| EoC × IS | −0.401*** | −0.702*** | −0.050 | −0.134 | −0.222*** | −0.326*** |

| (0.097) | (0.164) | (0.141) | (0.129) | (0.084) | (0.121) | |

| log Distance | −0.060*** | −0.029*** | −0.064*** | −0.052*** | −0.061*** | −0.070*** |

| (0.005) | (0.005) | (0.007) | (0.006) | (0.006) | (0.008) | |

| Contiguity | 0.033*** | 0.075*** | 0.006 | 0.044*** | 0.048*** | 0.042*** |

| (0.012) | (0.012) | (0.014) | (0.012) | (0.010) | (0.015) | |

| FTA | 0.006 | −0.043** | 0.014 | 0.017 | 0.022* | −0.038* |

| (0.011) | (0.018) | (0.019) | (0.017) | (0.012) | (0.020) | |

| F-stat. of 1st Stage Est. | 25.11*** | 23.69*** | 9.13*** | 16.95*** | 11.22*** | 7.37*** |

| Exporter-Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Importer-Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 6,091 | 4,130 | 2,324 | 3,611 | 2,871 | 2,225 |

- Note: The dependent variable is bilateral trade volume. All results are based on PPML estimation using the 1-year lagged value of log trade volume as the instrument variable for EoC. F-stat. of 1st Stage Est. are the F-statistics of the first stage estimation. Robust standard errors clustered at exporter-importer country pairs are in parenthesis. ***, **, and * denote significance level at the 1%, 5%, and 10%, respectively. Exporter-Year FE, Importer-Year FE are country year fixed effects for both exporter and importer countries; Year FE is the year fixed effects. N is the number of observations.

Finally, we focus our analysis on bilateral trade flows between non-English speaking countries (e.g., China, Russia, etc.) and English speaking countries (e.g., USA, UK, etc.), which would further explore the English Lingua Franca. The language distribution across countries/regions are in Table A1. Since the EPI scores are not applicable to English speaking countries, we only use the EPI of non-English countries as a proxy of our  variable. Estimation results for goods trade are shown in Table 6.

variable. Estimation results for goods trade are shown in Table 6.

| Total | Primary | Resource | Low Tech | Mid Tech | High Tech | |

|---|---|---|---|---|---|---|

| EoC | 1.308*** | 0.278** | 0.459*** | 0.372*** | 0.826*** | 0.874*** |

| (0.096) | (0.121) | (0.098) | (0.113) | (0.095) | (0.112) | |

| IS | 2.986*** | 0.528 | 0.882*** | 0.778** | 1.649*** | 1.486*** |

| (0.259) | (0.342) | (0.251) | (0.306) | (0.245) | (0.302) | |

| EoC × IS | −0.735*** | −0.124 | −0.214*** | −0.186** | −0.403*** | −0.363*** |

| (0.064) | (0.084) | (0.062) | (0.075) | (0.060) | (0.074) | |

| log Distance | −0.155*** | −0.148*** | −0.168*** | −0.164*** | −0.130*** | −0.108*** |

| (0.006) | (0.007) | (0.006) | (0.007) | (0.006) | (0.007) | |

| Contiguity | 0.062 | 0.055 | −0.015 | 0.039 | 0.107** | 0.127** |

| (0.051) | (0.050) | (0.056) | (0.068) | (0.052) | (0.059) | |

| FTA | −0.097*** | −0.010 | −0.031*** | −0.050*** | −0.054*** | −0.044*** |

| (0.009) | (0.010) | (0.009) | (0.011) | (0.009) | (0.010) | |

| F-stat. of 1st Stage Est. | 51.49*** | 46.77*** | 51.68*** | 51.13*** | 49.88*** | 48.69*** |

| Exporter-Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Importer-Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 50,259 | 33,843 | 39,783 | 40,546 | 40,856 | 36,409 |

- Note: The dependent variable is bilateral trade volume. All results are based on PPML estimation using the 1-year lagged value of log trade volume as the instrument variable for EoC. F-stat. of 1st Stage Est. are the F-statistics of the first stage estimation. Robust standard errors clustered at exporter-importer country pairs are in parenthesis. *** and ** denote significance level at the 1% and 5%, respectively. Exporter-Year FE, Importer-Year FE are country year fixed effects for both exporter and importer countries; Year FE is the year fixed effects. N is the number of observations.

We can see that the ease of communication generally plays a similar role in our baseline results, while the effects of  on exports become relatively weaker. Also, results for categorical analysis show less effects of

on exports become relatively weaker. Also, results for categorical analysis show less effects of  on trade volume. A potential reason is that one of the trade partners is a native speaking country/region, so the English proficiency of the other country/region becomes less important.

on trade volume. A potential reason is that one of the trade partners is a native speaking country/region, so the English proficiency of the other country/region becomes less important.

Similar results can be found for the services trade (see Table 7). There are few bilateral trade in services between neighboring countries that are also between English speaking countries and non-English speaking countries, we drop the  variable in Table 7.

variable in Table 7.

| Total | Transportation | Information | Financial | Communications | Cultural | Construction | |

|---|---|---|---|---|---|---|---|

| EoC | 0.920*** | −0.391 | 2.459*** | 1.761*** | 1.499*** | 0.457 | 1.052** |

| (0.246) | (0.368) | (0.249) | (0.594) | (0.309) | (0.512) | (0.434) | |

| IS | 1.978*** | −0.648 | 6.330*** | 5.060** | 4.110*** | 1.103 | 4.975*** |

| (0.569) | (0.880) | (0.952) | (2.550) | (1.003) | (2.003) | (1.793) | |

| EoC × IS | −0.491*** | 0.155 | −1.573*** | −1.238** | −1.008*** | −0.279 | −1.231*** |

| (0.141) | (0.216) | (0.234) | (0.622) | (0.248) | (0.500) | (0.444) | |

| log Distance | −0.034*** | −0.029*** | −0.045*** | 0.062*** | 0.004 | 0.042*** | 0.017 |

| (0.009) | (0.010) | (0.011) | (0.015) | (0.014) | (0.012) | (0.013) | |

| FTA | 0.042*** | 0.056*** | −0.109*** | −0.115* | −0.006 | 0.075*** | 0.024 |

| (0.011) | (0.017) | (0.022) | (0.064) | (0.027) | (0.020) | (0.027) | |

| F-stat. of 1st Stage Est. | 458.08*** | 299.30*** | 178.25*** | 45.62*** | 171.18*** | 132.63*** | 35.66*** |

| Exporter-Year FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Importer-Year FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 2367 | 1638 | 927 | 447 | 681 | 606 | 336 |

- Note: The dependent variable is bilateral trade volume. All results are based on PPML estimation using the 1-year lagged value of log trade volume as the instrument variable for EoC. F-stat. of 1st Stage Est. are the F-statistics of the first stage estimation. Robust standard errors clustered at exporter-importer country pairs are in parenthesis. ***, **, and * denote significance level at the 1%, 5%, and 10%, respectively. Exporter-Year FE, Importer-Year FE are country year fixed effects for both exporter and importer countries; Year FE is the year fixed effects. N is the number of observations.

6 CONCLUSION

This article examines the impact of language proficiency on bilateral international trade by using cross-country panel data. Unlike the previous study employing dummy variables for a common language, we incorporate the EPI, which is time-variant in the standard gravity model for trade. We find empirical evidence that the easier the direct communication, the larger the trade volume between trading partners. This finding is robust even when we separately estimate its impact on trade flows in disaggregated goods and services sectors. A common language could reduce communication costs and enable countries to experience similar cultural backgrounds. Thus, there exists a close trade distance and more imports and exports among countries whose languages are similar. Our results also highlight the importance of institutional affinity between potential trading partners. As it turns out, institutional similarity substitutes for communication easiness, at least to some extent, in bilateral trade.

Our study also provides a policy implication that governments should invest more in second language acquisition to promote bilateral international trade. The benefits of foreign language acquisition are not limited to international trade. The benefits extend to labor markets, international financial trade, and portfolio investment. In our study, English proficiency is used as a proxy for common language. Although English is among the most frequently used vehicle languages for trade, Chinese and Spanish have more speakers who use them as vehicle languages in their language communities (in more than 30 countries in both cases). Even Ethnologue estimates a similar number of first and second language speakers for English and Chinese languages. To account for this issue, one can consider different vehicle languages for each trade pair. We leave this suggestion to future research.

AUTHOR CONTRIBUTIONS

Li Su: conceptualization; data curation; formal analysis; investigation; methodology; writing – original draft; writing – review & editing. Hojin Jung: conceptualization; funding acquisition; project administration; supervision; writing – original draft; writing – review & editing. Mingzhuo Yang: data curation; formal analysis; investigation; methodology; writing – original draft; writing – review & editing.

ACKNOWLEDGMENTS

We would like to appreciate the constructive suggestions by the Editor and two anonymous referees. Yongbiao Fang and Zhangyan Cao provided very helpful research assistance. All the remaining errors are our own. This research was supported by National University Development Project at Jeonbuk National University in 2021.

CONFLICT OF INTEREST

The authors declare no conflict of interest.

ETHICS STATEMENT

None declared.

APPENDIX A

See Table A1

| Country/Region | First language | Second language | Country/Region | First language | Second language |

|---|---|---|---|---|---|

| Algeria | Arabic | French | Laos | Lao | French |

| Angola | Portuguese | Umbundu | Latvia | Latvian | English |

| Argentina | Spanish | Italian | Lithuania | Lithuanian Russian | |

| Austria | German | Turkish | Luxembourg | Luxembourgish | French |

| Azerbaijan | Azerbaijani | Russian | Malaysia | Malay | English |

| Bangladesh | Bengali | Mexico | Spanish | Nahuatl | |

| Belgium | Dutch | French | Mongolia | Mongolian | Russian |

| Bosnia Herzegovina | Bosnian | Derbian | Morocco | Arabic | Tamazight |

| Brazil | Portuguese | Spanish | Netherlands | Dutch | English |

| Bulgaria | Bulgarian | Turkish | Nigeria | English | Hausa |

| Cambodia | Khmer | Vietnamese | Norway | Norwegian | Sami |

| Cameroon | French | English | Oman | Arabic | English |

| Chile | Spanish | English | Pakistan | Urdu | English |

| China | Mandarin | Cantonese | Panama | Spanish | English |

| China, Macao SAR | Cantonese | Portuguese | Peru | Spanish | Quechua |

| China, Hong Kong SAR | Cantonese | English | Philippines | Filipino | English |

| Columbia | Spanish | Poland | Polish | English | |

| Costa Rica | Spanish | English | Portugal | Portuguese | Mirandese |

| Czechia | Czech | Slovak | Qatar | Arabic | English |

| Denmark | Danish | English | Rep. of Korea | Korean | |

| Dominican Rep. | Spanish | Russia | Russian | English | |

| Ecuador | Spanish | Quechua | Saudi Arabia | Arabic | English |

| Egypt | Arabic | English | Singapore | English | Mandarin |

| Estonia | Estonian | Russian | Slovakia | Slovak | Hungarian |

| Finland | Finnish | Swedish | Slovenia | Slovene | Croatian |

| France | French | English | South Africa | Zulu | Xhosa |

| Germany | German | Turkish | Spain | Spanish | Catalan |

| Greece | Greek | Sri Lanka | Sinhala | Tamil | |

| Guatemala | Spanish | Sweden | Swedish | English | |

| Hungary | Hungarian | English | Switzerland | German | French |

| India | Hindi | English | Thailand | Central Thai | English |

| Indonesia | Indonesian | Javanese | Tunisia | Arabic | |

| Iran | Persian | Azeri | Turkey | Turkish | Kurmanji |

| Iraq | Arabic | Kurdish | Ukraine | Ukrainian | Russian |

| Italy | Italian | English | United Arab Emirates | Arabic | English |

| Japan | Japanese | Uruguay | Spanish | ||

| Jordan | Arabic | English | Venezuela | Castillan | Spanish |

| Kazakhstan | Kazakh | Russian | Viet Nam | Vietnamese | |

| Kuwait | Arabic | English | Yemen | Arabic | English |

- Note: Second language information on some countries is not reported if the use of their first language is dominant. For example, approximately 98.8% of the Bangladeshi population use Bangla, and only 1.2% of the population use other languages.

REFERENCES

- 1 On the contrary, Ginsburgh et al. (2017) find that international trade promotes language learning and linguistic distances negatively affect language learning.

- 2 Similarly, Demir and Im (2020) find empirical evidence that cultural institutes have significantly positive impacts on bilateral trade and FDI flows.

- 3 Anderson and Van Wincoop (2004) also state that other information-related costs are equivalent to a 6% tax level, which is similar in magnitude to tariff and nontariff barriers.

- 4 For the details of EF EPI construction, readers can refer to the report by EF SET Academic Report via https://www.efset.org/