The transmission mechanism analysis of the impact of economic policy uncertainty on household consumption

Abstract

Economic policy uncertainty is proven to have an important effect on household consumption. However, the literature on its transmission mechanism and on comparing the consumption response of urban and rural households, especially in China, is limited. In this paper, we propose two channels through which economic policy uncertainty affects household consumption, the precautionary saving channel and the investment-employment channel. Then, we use the household survey data (China Health and Nutrition Survey) to explore the heterogeneous effect among urban and rural households. We verify that an increase in economic policy uncertainty can significantly reduce household consumption through both channels. Further, the precautionary saving channel is more important in the urban household sample, while the investment-employment channel is more pronounced in the rural household sample. In addition, the heterogeneous effect also exists across households in different regions. Our results are robust with consideration of different estimation methods, the lagged effect of the uncertainty, and other characteristics of households.

1 INTRODUCTION

After the 2008 global financial crisis, to rescue their continuously sluggish economy, many countries strengthened the policy interventions and continuously increased the intensity and pace of policy regulation. Some countries, mostly developed economies, even implemented aggressive fiscal and unconventional monetary policies. However, the global economy does not return to its original growth path as quickly as expected, while the worldwide economic policy uncertainty (EPU) is elevated. International Monetary Fund (IMF) (2012), IMF (2013) mentioned that, during this crisis, the rise of policy uncertainties exacerbated the economic recession in developed economies, like Europe and the United States, and further delayed the subsequent recovery process.

As for China, over the past 40 years of reform and opening-up, it has gradually undergone comprehensive economic policy adjustments and institutional reforms in almost every economic sector. There is no doubt that many important reform policies can bring long-term and positive effects on China's economic development. However, in the short term, frequent policy adjustments can also increase EPU and produce a negative effect on the whole economy. Especially after 2012, faced with the sustained rise of EPU, China endured more and more serious household consumption decline (Chen et al., 2014). So, can the consumption decline be accounted for by the rise of EPU? What are the channels through which EPU affects consumption? Can it explain the consumption disparity in urban and rural households? This article conducts an in-depth analysis of the above issues, and proposes some suggestions on promoting consumption and the economy to reduce the adverse effect of EPU.

Recently, the effect of EPU on the macroeconomy has become a hot topic in the literature. Most studies have reached a consensus that the rise of EPU behaves like a negative demand shock (Leduc & Liu, 2016) and have a negative effect on the economy (Alexopoulos & Cohen, 2009; Bloom, 2009; Bloom et al., 2018). Further, empirical studies using firm-level data show that the rise of EPU will lead to the wait-and-see effect and reduce investment (Chen & Wang, 2016; Gulen & Ion, 2016; Rao et al., 2017; Tan & Zhang, 2017).

However, the question on how China's household consumption varies with EPU has not received much attention from the researchers. One relevant study, based on China's provincial data, verifies the negative impact of EPU on consumption and other macroeconomic variables of interest in China (Huang & Guo, 2015). Yet the impact mechanism is left to be studied. More importantly, there still remains a lack of systematic research on the impact of macroeconomic policy change on the household consumption decision in the microperspective. This article tries to fill this gap and explores the impact and mechanism of EPU on household consumption.

This paper proposes two channels through which EPU affects household consumption. One channel is the precautionary saving channel and the other is the investment-employment channel. The precautionary saving channel means that an increase in EPU has a negative effect on household consumption. Besides, durable consumption falls more compared with nondurable goods (e.g., food) consumption. The investment-employment channel means that an increase in EPU can depress corporate investment through the wait-and-see effect and this, in turn, suppresses labor demand, leading to a decrease in household income and thus consumption. To test the existence of both channels, our paper combines China's EPU index with both the macroeconomic data set and the household survey data (China Health and Nutrition Survey [CHNS]) to investigate the impact of EPU in both macro- and microperspectives. We first apply a new identification method, max share approach, to reveal the two channels through which EPU affects household consumption in a VAR framework. Then we use the household survey data (CHNS) to further explore the difference in the EPU's effect among urban and rural households. We verify that an increase in EPU can significantly reduce household consumption through the two channels mentioned above. Further, the precautionary saving channel is more important in the urban household sample, while the investment-employment channel is more pronounced in the rural household sample. In addition, the precautionary savings channel is more significant in the eastern region, while the investment-employment channel is more pronounced in the central and western regions. Our results are robust under different model settings.

This paper relates to three strands of literature. One strand refers to the literature on the impact of EPU from the macroeconomic perspective. The outbreak of the US subprime crisis in 2008 led to the global economic crash and also caused the over-adjustment of economic policies in many countries. More and more studies find that EPU is the main cause of the sudden decline in output, employment, investment, and consumption (Alexopoulos & Cohen, 2009; Bloom, 2009; Bloom et al., 2018; Fernández-Villaverde et al., 2015). Our study further verifies the negative impact of EPU on the economy in China.

The second strand of the literature studies the effect of EPU in a microperspective. Many research combine the macro-EPU index with firm-level data. Based on US corporate data, Baker et al. (2016) find that the rise of the macroEPU index impedes corporate investment and employment. Chen and Wang (2016), Rao et al. (2017), and Tan and Zhang (2017) follow Baker et al. (2016) and find that the rise of China's EPU index also has a negative effect on firm investment.

The third strand refers to the literature on the insufficient consumption problem in China. It is well known that the consumption to GDP ratio is much lower in China compared with other countries. The existing literature has provided several popular explanations on the consumption problem in China, such as the stronger household liquidity constraint (Hu & Liu, 2007; Wan et al., 2001) and higher precautionary saving behavior (Jia et al., 2011; Ling & Zhang, 2012; Sun, 2001; Tian, 2004). However, according to our knowledge, few studies have interpreted China's consumption problem through the lens of EPU. Our study attempts to extend the relevant literature.

Our study contributes to the literature in four important ways. First, to our best knowledge, this is the first paper that aligns the macroeconomic policy uncertainty index with the individual consumption data to investigate the impact of EPU on household consumption. Second, it further analyzes the heterogeneous response of consumption of both urban and rural households and explores their different mechanisms, which can in turn explain the rural–urban consumption disparity in certain degree. Third, it also discusses the regional differences through the lens of the heterogeneous impact of EPU. Finally, we use a new identification method, max share method, to investigate the impact of EPU in a macroperspective, which extends the use of this identification approach.

The structure of this paper is as follows. Section 2 introduces China's EPU index and the dynamic change over years. Section 3 analyzes the impact of EPU on household consumption and other economic variables of China in the macro view. Section 4 builds the econometric models to examine the impact and mechanism of EPU on consumption in the household (micro) view. Section 5 interprets the empirical results. The last section illustrates the conclusions and proposes some policy suggestions.

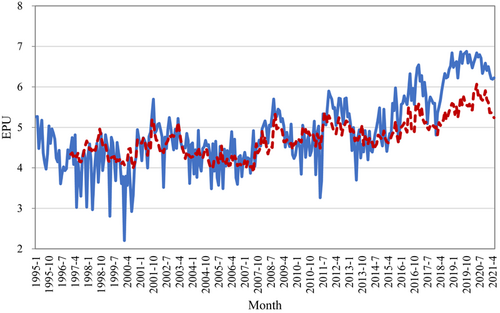

2 THE DYNAMIC OF EPU IN CHINA

First, it is necessary to give a broad view of the historical trend and characteristics of EPU in China. In this study, we use the EPU Index of China. The EPU index, constructed by Baker et al. (2016), is a group of indicators quantifying the uncertainty of economic policy for specific economy. It contains the global index, index of the United States, index of China, and that of other countries (Baker et al., 2016). More importantly, the EPU index is updated regularly on the website and is commonly used in existing studies.1

The main idea of the EPU index construction by Baker et al. (2016) is based on newspaper coverage frequency. They summarize several keywords that are related to EPU and identify articles containing these terms in the newspaper. The EPU index is then measured by the share of the frequency of articles containing those terms related to EPU, reflecting the public's attention to EPU. For example, if the share is higher in this month, it reflects that the public perceive higher EPU in this month.

Specifically, the construction of China's EPU index can be stated as follows. First, to avoid the political tendency of the mainland media, they choose the South China Morning Post (SCMP), a leading English-language newspaper in Hong Kong, as their information source. Second, they flag all articles that contain at least one term from each of the Chinese economic uncertainty term sets: {China, Chinese} and {economy, economic} and {uncertain, uncertainty}. Then, they further select articles that discuss policy matters from this subset. Third, they divide the resulting monthly frequency count by the number of all SCMP articles in the same month. Finally, they normalize the resulting series to a mean value of 100 from 1995m1 to 2011m12. Our study uses the recently updated EPU index from its official website, which ends at the year of 2021.

Figure 1 depicts both the global and China's EPU indices in the past two decades and more.2 It can be found that the trends of these two indices are basically consistent over the long term, but the EPU index of China is much more volatile than the global one. This implies that the fluctuations of EPU in China stem from not only the worldwide economic policy uncertainties but also the domestic implementation of more proactive and flexible macrocontrol policies in the process of China's institutional reform and economic structural transformation. Roughly speaking, during the observation period of the EPU index, the trend of economic policy adjustment in China has generally experienced three stages.

The first stage is from 1995 to 2000. Previous to that period, China carried out the reform and opening-up policy and gradually completed market-based reform, which accelerated the construction of industrialization and urbanization. Hence, during 1995–2000, the institutional frameworks of employment, education, medical care, and other social security were basically established, and the economy entered a stage of steady and rapid growth. Hence, the EPU index showed a gradual downward trend. The second stage is from 2001 to 2007. After joining the World Trade Organization, China made many bold policy reforms for the purpose of effectively connecting with the international market and increasing trade and foreign investment. Among them, some policies had some negative impact on the economy in the short term, or not achieved the desired results. Therefore, the domestic economic environment underwent tremendous changes with the policy adjustments and the EPU index showed a significant rise in the early stage, followed by a slow decline. The third stage is from 2008 to the present. The outbreak of the subprime crisis brought a huge impact on the global economy, which exacerbated the international market volatility and created much more global uncertainty. In this complex international environment, China implemented active fiscal and monetary policies and the EPU index fluctuated greatly. After 2011, with the end of fiscal stimulus program, the downward pressure on economic growth was amplified and both inflation and real estate bubble appeared to be more severe. This intensified the economic policy regulation and led to a round of big fluctuations of the EPU index.

It is worth noting that in 2015−2016, the EPU index of China begun to rise sharply again. This is closely related to several important events occurring during this period. For example, China's stock market crash and the delay of the implementation of the registration system from June to July of 2015, an unanticipated RMB depreciation and change in the fixed exchange rate regime in August 2015, an unsuccessful launch of the “circuit-breaker” mechanism in Chinese stock markets in January 2016, British exit in February 2016, China's housing policies tightening in April 2016, US interest rate hike in June 2016. These events are closely related to the rise of EPU over the period of 2015–2016. In January 2017, Donald Trump was elected as US president, which increased the tensions between China and the United States and caused EPU to reach a new high. Then the EPU index decreased, as China's economic performance beat market expectations (with real GDP growth rate reaching 6.9%, the first rise in the past 7 years) and deepened its institutional reform (see the report of the 19th National Congress of the Communist Party of China). However, in March 2018, the United States threatened to impose tariffs on $60 billion of goods imported from China, marking the beginning of the China–US trade war. In the following 2 years, the trade frictions persisted between China and the United States and were continuously beyond market expectations, leading to the rise of EPU index again.

3 THE IMPACT OF EPU: PRIMARY TEST

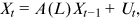

Based on the research of Uhlig (2003) and Kurmann and Otrok (2013), this section uses the max share approach to identify EPU shock and then examines the relationship between EPU and macroeconomic variables in a VAR framework.

The max share approach aims to extract the shock that explains the maximum share of the forecasted error variance (FEV) of a target variable over some horizon. The logic behind is as follows. In the real world, there are many orthogonal shocks that can affect the target variable (i.e., EPU in our paper), if there exists a certain shock that dominates the variations of the target variable in the sample period, then we can use this single shock to study the effect of the target variable on other variables without losing much efficiency. In this paper, we define the first shock that explains the maximum share of the FEV of the EPU index as the EPU shock. An advantage of this method is that it does not depend on the order of variables, which is indeed a limitation of the Choleski method.

()

() . Among them,

. Among them,  represents the quarterly arithmetic average value of EPU index of China.

represents the quarterly arithmetic average value of EPU index of China.  represents real GDP.

represents real GDP.  represents real household consumption.

represents real household consumption.  represents real private investment.

represents real private investment.  represents the aggregate price level and is measured by the GDP deflator.

represents the aggregate price level and is measured by the GDP deflator.  represents total employment. All variables are taken as natural logarithms. The samples for this model are quarterly macrolevel data, originated from Chang et al. (2016)3 and the sample interval is from 1996Q1 to 2017Q4.

represents total employment. All variables are taken as natural logarithms. The samples for this model are quarterly macrolevel data, originated from Chang et al. (2016)3 and the sample interval is from 1996Q1 to 2017Q4.  refers to the residual term.

refers to the residual term.  refer to orthogonalized structural shocks. B is a 6 × 6 matrix, which is identified by the max share approach.4 The results estimated by the max share approach are shown in Figures 2, 3.5

refer to orthogonalized structural shocks. B is a 6 × 6 matrix, which is identified by the max share approach.4 The results estimated by the max share approach are shown in Figures 2, 3.5

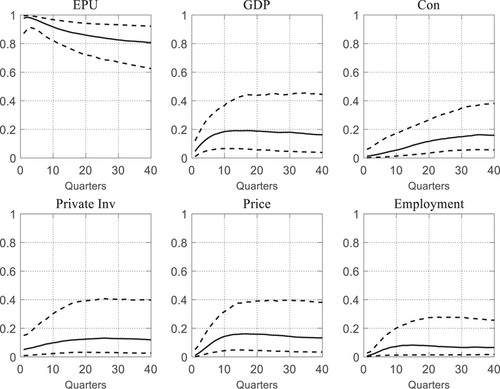

Figure 2 displays the fraction of FEV of relevant variables explained by the EPU shock. The EPU shock explains as much as 97.7% of FEV of the EPU index in the first quarter and this fraction keeps as high as 86% (81%) after 20 (40) quarters. This implies that the EPU shock dominates the variation of the EPU index in the sample period. Besides, the EPU shock has non-ignorable power in explaining the variation of other variables. For example, the EPU shock can explain as much as 19% of output FEV, 16% of consumption FEV, 13% of investment FEV, 16% of price FEV, and 8% of employment FEV, indicating that EPU plays an important role in economic fluctuations of China.

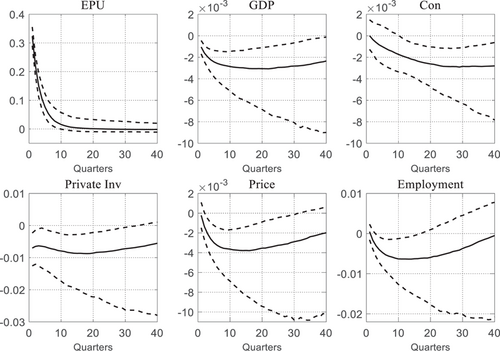

Figure 3 displays the impulse response functions of various variables to the EPU shock. It shows that GDP, household consumption, private investment, price, and employment all decrease significantly after a positive EPU shock. Specifically, output and price level fall quickly in the first 10–20 quarters, then slowly rebound, which indicates that the uncertainty shock behaves as a demand shock, consistent with Leduc and Liu (2016). Private investment falls much more than output, indicating that private investment is much more sensitive to EPU, which is consistent with the wait-and-see effect.6 Employment falls quickly in the first 10 quarters and rebounds slowly after then. In comparison, consumption falls nearly as much as output in the first 20 quarters and it rebounds more slowly than output after then. Since consumption still falls when employment starts to rebound 10 quarters after the EPU shock, this implies that the decline in consumption may well be not only caused by the decrease of employment, but also by other effects like precautionary saving.

Besides, the fact that the decline of household consumption is comparable to output vastly differs from developed countries (Bloom et al., 2018; Fernández-Villaverde et al., 2015). The uniqueness of high volatility of consumption in China has been identified by many studies, which try to explain this from the perspectives of the liquidity constraints as well as the crowding-out effect of government expenditure (Chen & Zhang, 2010; Hu & Liu, 2007; Huang, 2005). However, recent research pointed out that the problem of consumption fluctuation in China is much more complicated and the above factors may not be the major reasons for it (Ding & Hui, 2018).

Our research is consistent with Ding and He's view and shows that EPU can result in greater fluctuation in consumption. From these empirical results, we believe that EPU affects household consumption through two channels: one is precautionary saving. That is, the EPU may encourage more saving and reduce demand, thus leading to less household consumption. The other channel is investment-employment, which means that the uncertainty could affect the household through firm sectors. The increase in EPU can lead to a decrease in corporate investment through the wait-and-see effect, which can in turn suppress the labor demand (Chen & Wang, 2016; Julio & Yook, 2012; Rao et al., 2017; Tan & Zhang, 2017). Hence, through the investment-employment channel, the increase in the uncertainty can cause much more job-loss, reduce household's income and consumption in the longer term.

Of these two channels, the precautionary saving channel reflects household's decision of intertemporal substitutions, which means that they can actively respond to economic policy risks. Therefore, the impact of policy uncertainty in this channel is temporary. However, the investment-employment channel could impact employment and household future income, so the uncertainty may have a long-term effect on consumption. The following section will examine these two channels and compare the extent of impact through different channels.

4 ECONOMETRIC MODELS, DATA, AND VARIABLES

4.1 Model setting

In this section, we construct the econometric models to test the above two channels through which EPU affects household consumption. To be specific, we set different models for the precautionary saving channel and investment-employment channel.

4.1.1 Precautionary saving model

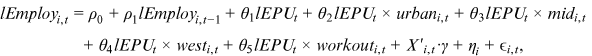

()

() represents real household consumption deflated by price index, and we use real durable goods consumption (

represents real household consumption deflated by price index, and we use real durable goods consumption ( ) and real food consumption (

) and real food consumption ( ) as the dependent variable, respectively.

) as the dependent variable, respectively.  represents the EPU index faced by households. Since it is annual data, households have enough time to adjust consumption decisions in response to the economic policy changes, we do not include lags of

represents the EPU index faced by households. Since it is annual data, households have enough time to adjust consumption decisions in response to the economic policy changes, we do not include lags of  in Equation (2).

in Equation (2).As mentioned above, under the precautionary savings framework, the rise of EPU can result in much more decline of durable goods consumption than food consumption. Therefore, the model predicts that the coefficient ( ) could be significantly negative in the regression of durable goods consumption, while the absolute value of

) could be significantly negative in the regression of durable goods consumption, while the absolute value of  could be smaller or even insignificant in the regression of food consumption.

could be smaller or even insignificant in the regression of food consumption.  is the indicator variable for urban residents and the coefficient (

is the indicator variable for urban residents and the coefficient ( ) of the interactive variable (

) of the interactive variable ( ) indicates the difference in the impact of EPU on urban and rural households consumption.

) indicates the difference in the impact of EPU on urban and rural households consumption.  and

and  are indicators for households living in central and western regions respectively, and the coefficients (

are indicators for households living in central and western regions respectively, and the coefficients ( ) of the cross terms (

) of the cross terms ( ) represent the regional difference in the impact of EPU relative to the eastern region. In addition, we introduce the lag of the dependent variable in the model,

) represent the regional difference in the impact of EPU relative to the eastern region. In addition, we introduce the lag of the dependent variable in the model,  or

or  , to control for household's consumption habit.

, to control for household's consumption habit.

is a set of the control variables, including family wealth (

is a set of the control variables, including family wealth ( ), family net income (

), family net income ( ), family size (

), family size ( ), gender of the head of the household (

), gender of the head of the household ( ), urban dummy variables (

), urban dummy variables ( ), age as well as age square of the head of the household (

), age as well as age square of the head of the household ( ), education level of the head of household (

), education level of the head of household ( ), marital status of the head of household (

), marital status of the head of household ( ) and real interest rate (

) and real interest rate ( ). In addition, we introduce

). In addition, we introduce  to control the fixed effect (FE) of each household. To control for the time span between observations at different time, we add the dummy variables

to control the fixed effect (FE) of each household. To control for the time span between observations at different time, we add the dummy variables  and

and  , which represents 3 or 4 years of time span between the two observation periods.

, which represents 3 or 4 years of time span between the two observation periods.

4.1.2 Investment-employment model

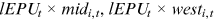

()

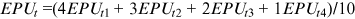

() represents the nonagricultural employment of household in logarithm, that is

represents the nonagricultural employment of household in logarithm, that is  .

.  is an indicator for household with at least one member who has gone out as a migrant worker. Beside this, the definitions of other variables in this model are consistent with ones in Equation (2). The coefficients of main interest are

is an indicator for household with at least one member who has gone out as a migrant worker. Beside this, the definitions of other variables in this model are consistent with ones in Equation (2). The coefficients of main interest are  and

and  , representing the uncertainty's average impact on household employment and its heterogeneous effect among urban and rural households, respectively. In addition, the coefficient (

, representing the uncertainty's average impact on household employment and its heterogeneous effect among urban and rural households, respectively. In addition, the coefficient ( ) is also of great importance, which represents the impact of EPU on the employment situation of migrant workers. The set of variables,

) is also of great importance, which represents the impact of EPU on the employment situation of migrant workers. The set of variables,  , include real GDP growth rate (

, include real GDP growth rate ( ), regional dummy variables (

), regional dummy variables ( ,

,  ), the number of retired persons in the family (

), the number of retired persons in the family ( ), family size (

), family size ( ) and several characteristics of the head of household, such as education (

) and several characteristics of the head of household, such as education ( ), gender (

), gender ( ), age and age square (

), age and age square ( ,

,  ), and marital status (

), and marital status ( ).

).4.2 Data and variable setting

Our study uses the CHNS data, which is household-level panel data set and widely used in existing literature. Based on data availability, we use six rounds of this survey data, and time spans from 1997 to 2011. The sample is distributed in nine provinces and covers the eastern, middle, and western part of China.7 After sample refining, we obtain 17341 valid household samples, including 11,309 rural and 6032 urban ones.

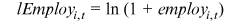

In addition, this article deals with the main variables as follows. First, consistent with the previous part, we continue to use the EPU index of China as the proxy variable for EPU. To align the quarterly EPU data with the yearly household observations, we create the annual weighted average of EPU, namely  , where

, where  represents original EPU index at the ith quarter of year t. This means the policy changes in early quarter, such as

represents original EPU index at the ith quarter of year t. This means the policy changes in early quarter, such as  , have much more impact than ones in latter quarter, such as

, have much more impact than ones in latter quarter, such as  . It is because that household can adjust their consumption more effectively and adequately for policies implemented in early time, while a sudden policy change at the end of year could not have much effect on the current consumption. Second, regarding household durable goods consumption, the CHNS data set offers household consumption value of 19 common electric appliances in the previous observation year, we obtain the real durable goods consumption by summing these 19 items and deflating the sum with the current price index. Then we get the logarithm of the real durable goods consumption, lcon_dura. For household's food consumption, we use the 3-day household food consumption as the proxy variable. The data processing of food consumption is consistent with the relative research of Jia et al. (2011) and Zhai and Hu (2017). Specifically, we collect household's 3-days food consumption expense, which contains 93 kinds of common food in 15 categories,8 and deflate the nominal consumption by the matched community-level free-market prices published.9 Hence, the real household food consumption,

. It is because that household can adjust their consumption more effectively and adequately for policies implemented in early time, while a sudden policy change at the end of year could not have much effect on the current consumption. Second, regarding household durable goods consumption, the CHNS data set offers household consumption value of 19 common electric appliances in the previous observation year, we obtain the real durable goods consumption by summing these 19 items and deflating the sum with the current price index. Then we get the logarithm of the real durable goods consumption, lcon_dura. For household's food consumption, we use the 3-day household food consumption as the proxy variable. The data processing of food consumption is consistent with the relative research of Jia et al. (2011) and Zhai and Hu (2017). Specifically, we collect household's 3-days food consumption expense, which contains 93 kinds of common food in 15 categories,8 and deflate the nominal consumption by the matched community-level free-market prices published.9 Hence, the real household food consumption,  , is derived from the 3-days consumption. In addition, the total household income variable, lincome, is the household's aggregate income deflated by the price and taking the logarithm. The household wealth variable, lwealth, is the sum of the household physical assets10 deflated by fixed asset price index and taking the logarithm. For macrovariables, this article uses the real interest rate variable to control the intertemporal substitution effect of household consumption decisions, and uses the difference between the 7-day reverse repo rate and the inflation rate (measured by the GDP deflator index) as the proxy of real interest rate. The statistical description of the main variables is shown in Tables 1 and 2.

, is derived from the 3-days consumption. In addition, the total household income variable, lincome, is the household's aggregate income deflated by the price and taking the logarithm. The household wealth variable, lwealth, is the sum of the household physical assets10 deflated by fixed asset price index and taking the logarithm. For macrovariables, this article uses the real interest rate variable to control the intertemporal substitution effect of household consumption decisions, and uses the difference between the 7-day reverse repo rate and the inflation rate (measured by the GDP deflator index) as the proxy of real interest rate. The statistical description of the main variables is shown in Tables 1 and 2.

| Variable | Description | Total | Urban HH | Rural HH | Dif. | |||

|---|---|---|---|---|---|---|---|---|

| Mean | Std. | Mean | Std. | Mean | Std. | |||

| lcon_dura | The household's real durable goods consumption in logarithm | 8.11 | 1.25 | 8.60 | 1.08 | 7.85 | 1.26 | 0.745*** |

| lcon_food | The household's real food consumption in logarithm | 2.86 | 0.74 | 2.74 | 0.74 | 2.91 | 0.73 | −0.172*** |

| lincome | The household's income in logarithm | 9.89 | 1.03 | 10.06 | 1.04 | 9.80 | 1.02 | 0.256*** |

| lwealth | The household's wealth in logarithm | 10.30 | 2.12 | 10.82 | 2.10 | 10.03 | 2.08 | 0.789*** |

| size | The household size | 3.45 | 1.44 | 3.03 | 1.23 | 3.67 | 1.49 | −0.638*** |

| lEmploy |  |

0.88 | 0.49 | 0.70 | 0.49 | 0.97 | 0.46 | −0.272*** |

| workout | Number of migrant workers | 0.29 | 0.68 | 0.11 | 0.39 | 0.38 | 0.77 | −0.269*** |

| retire | Number of retired | 0.29 | 0.62 | 0.62 | 0.79 | 0.12 | 0.41 | 0.492*** |

| gender | Gender of household head, 1 for male, 2 for female | 1.17 | 0.37 | 1.26 | 0.44 | 1.12 | 0.32 | 0.138*** |

| age | Age of household head | 52.36 | 13.18 | 54.71 | 13.96 | 51.16 | 12.59 | 3.557*** |

| edu | Education of household head | 1.79 | 1.38 | 2.41 | 1.59 | 1.47 | 1.12 | 0.934*** |

| N | Observations | 17,341a | 6032 | 11,309 | ||||

- Note: Dif. refers to the mean value difference between the urban and rural household subsample. *, **, and *** represent statistical significance at 10%, 5%, and 1% levels, respectively.

- Abbreviation: EPU, economic policy uncertainty.

- a Since food price data is missing after 2006, the observations of food consumption (10,696) is smaller than that of other variables. This is not a big problem because the precautionary saving channel is verified mainly by using durable goods consumption data.

| Variable | Description | Mean | Std. | Min. | Max. | Obs. |

|---|---|---|---|---|---|---|

| lEPU | EPU in logarithms | 4.54 | 0.33 | 4.20 | 5.12 | 6 |

| rate | Real interest rate | 0.005 | 0.038 | −0.047 | 0.046 | 6 |

| gdprate | Real GDP growth (%) | 9.88 | 1.13 | 7.7 | 11.4 | 6 |

- Abbreviation: EPU, economic policy uncertainty.

As is clearly depicted from Table 1, the durable goods consumption, income, and wealth of urban households are significantly higher than those of rural households. The average amount of food consumption of rural household is significantly higher, which can be partly explained by the relatively larger family size in rural areas since the per capita food consumption of rural households is significantly lower than that of urban households (see the appendix). In addition, it is said that a certain part of food consumption in rural area is self-supported, which tends to lead to an underestimation of food consumption. But in this paper, based on Jia et al. (2011), we have combined the used amounts of all food reported by each family with its community-level free-market prices to precisely calculate the value of food consumption, thereby increasing the total food consumption of rural households. In terms of the labor force, the number of employed and migrant workers in rural households is significantly higher than that in cities. The average educational background and the average income of rural households are relatively lower, reflecting the disadvantages of rural labor in the job market, which makes the rural household be badly hit under the economic uncertainty (Wu et al., 2015).

5 EMPIRICAL EVIDENCE

5.1 The effect of EPU through precautionary saving channel

Table 3 displays the empirical results of Equation (2), that is, the precautionary saving model. The dependent variables in the first and second columns are household's food consumption, and the dependent variables in the third and fourth columns are household's durable goods consumption. For each dependent variable, we display the results of both the basic form and the simplified form, that is, regression without EPU interaction terms. Since one lag of the dependent variable is included in each model, the system GMM model is more preferred to other models like FE model, so we use system GMM results as the baseline results.11

| lcon_food | lcon_dura | |||

|---|---|---|---|---|

| Variable | (1) | (2) | (3) | (4) |

| Yt-1 | −0.212 | −0.211 | 0.176*** | 0.182*** |

| (0.842) | (0.811) | (0.032) | (0.031) | |

| lEPUt | −0.021 | −0.266 | −0.336** | −0.496*** |

| (2.756) | (2.675) | (0.141) | (0.150) | |

| lEPUt× urban | 0.301*** | −0.126* | ||

| (0.095) | (0.073) | |||

| lEPUt× mid | 0.123 | 0.121* | ||

| (0.116) | (0.069) | |||

| lEPUt× west | 0.038 | 0.370*** | ||

| (0.160) | (0.094) | |||

| lincome | 0.029 | 0.028 | 0.084*** | 0.088*** |

| (0.018) | (0.019) | (0.019) | (0.019) | |

| lwealth | −0.001 | −0.001 | 0.086*** | 0.089*** |

| (0.008) | (0.008) | (0.008) | (0.009) | |

| size | 0.153*** | 0.153*** | 0.121*** | 0.123*** |

| (0.036) | (0.036) | (0.017) | (0.016) | |

| gender | −0.120 | −0.117 | −0.038 | −0.028 |

| (0.097) | (0.098) | (0.079) | (0.078) | |

| urban | 5.729 | 4.371 | 0.173 | 0.733 |

| (18.366) | (17.810) | (0.500) | (0.504) | |

| age | −0.046** | −0.047** | 0.017 | 0.018 |

| (0.019) | (0.019) | (0.016) | (0.016) | |

| age2 | 4.21E-04** | 4.32E-04** | −2.07E-04 | −2.11E-04 |

| (1.88E-04) | (1.78E-04) | (1.44E-04) | (1.42E-04) | |

| marriage | −0.002 | 0.004 | 0.067 | 0.071 |

| (0.080) | (0.081) | (0.097) | (0.097) | |

| edu | 0.023 | 0.028 | 0.017 | 0.013 |

| (0.029) | (0.028) | (0.025) | (0.025) | |

| rate | −14.502 | −14.086 | −3.314*** | −3.653*** |

| (24.831) | (23.840) | (0.989) | (0.992) | |

| mid | 6.336 | 5.699 | 0.844** | 0.307 |

| (20.307) | (19.198) | (0.370) | (0.417) | |

| west | 4.890 | 4.718 | 0.149 | −1.753*** |

| (12.785) | (12.788) | (0.459) | (0.545) | |

| Constant | −1.716 | −0.576 | 5.247*** | 5.816*** |

| (4.474) | (4.236) | (0.833) | (0.847) | |

| Obs | 5470 | 5470 | 9360 | 9360 |

- Note: The dependent variables are food consumption in columns (1) and (2) and durable goods consumption in columns (3) and (4). The estimation method is system GMM. *, **, and *** represent statistical significance at 10%, 5%, and 1% levels, respectively.

In columns (1) and (2), both coefficients of the variable  are negative but not significant (−0.021 vs. −0.266), indicating that the rise of EPU does not significantly reduce food expenditure. However, the regression results show that EPU could reduce the consumption of urban households more slightly, since the coefficient of the cross term

are negative but not significant (−0.021 vs. −0.266), indicating that the rise of EPU does not significantly reduce food expenditure. However, the regression results show that EPU could reduce the consumption of urban households more slightly, since the coefficient of the cross term  is significantly positive (0.301), which offsets the general consumption reduction effect. It should be noted that, we could not simply infer from the positive coefficient that the uncertainty might promote food consumption because the estimation result for the urban household sample shows that the coefficient of EPU is still negative and insignificant. Among all results in different settings, it is proved that the EPU does not have a significant impact on household food consumption. Moreover, the coefficients of the regional cross terms,

is significantly positive (0.301), which offsets the general consumption reduction effect. It should be noted that, we could not simply infer from the positive coefficient that the uncertainty might promote food consumption because the estimation result for the urban household sample shows that the coefficient of EPU is still negative and insignificant. Among all results in different settings, it is proved that the EPU does not have a significant impact on household food consumption. Moreover, the coefficients of the regional cross terms,  and

and  , are also not significant, indicating that the impact of EPU on the consumption of households living in different regions does not differ significantly. For other control variables, the coefficients of household wealth and household income are both insignificant, implying that the increase in income and wealth does not significantly increase household food consumption, which is consistent with the lower income elasticity of demand. The variable standing for family size significantly increases household consumption of food, reflecting the role of population increase in promoting food demand.

, are also not significant, indicating that the impact of EPU on the consumption of households living in different regions does not differ significantly. For other control variables, the coefficients of household wealth and household income are both insignificant, implying that the increase in income and wealth does not significantly increase household food consumption, which is consistent with the lower income elasticity of demand. The variable standing for family size significantly increases household consumption of food, reflecting the role of population increase in promoting food demand.

In columns (3) and (4) of Table 3, we can infer from these results that both coefficients of EPU,  , are significantly negative (−0.336 vs. −0.496) under different settings, indicating that the rise of EPU can significantly reduce household durable goods consumption, which is consistent with the previous VAR results. Combining the regression results of food consumption with those of durable goods consumption, we can conclude that the rise of EPU does impose a negative effect on durable goods consumption and does not lead to much change in food consumption. This reflects the fact that EPU could promote the intertemporal substitution of household consumption. Namely, household may reduce current consumption and increase savings for future consumption. Hence, this indeed verifies that the precautionary saving mechanism works.

, are significantly negative (−0.336 vs. −0.496) under different settings, indicating that the rise of EPU can significantly reduce household durable goods consumption, which is consistent with the previous VAR results. Combining the regression results of food consumption with those of durable goods consumption, we can conclude that the rise of EPU does impose a negative effect on durable goods consumption and does not lead to much change in food consumption. This reflects the fact that EPU could promote the intertemporal substitution of household consumption. Namely, household may reduce current consumption and increase savings for future consumption. Hence, this indeed verifies that the precautionary saving mechanism works.

More importantly, there exists distinct difference about the uncertainty's impact on urban and rural households' consumption. The coefficient of the cross term  is significantly negative (−0.126) in column (4) of Table 3, indicating that the rise of EPU could cause much severer decline in durable goods consumption and more savings of urban households than that of rural household. That means that the urban households' consumption is much more sensitive to the uncertainty and they are more likely to hedge risks by the way of precautionary saving (Ling & Zhang, 2012). This can be partly explained by the fact that urban residents have a higher saving motive than rural residents. Since urban population expansion exacerbates the scarcity of certain public resources, the costs of housing, education, medical care, and other living expenditures of urban residents become much higher. This forces households to try all methods they have to hedge risks and smooth consumption, and saving is apparently the most common way. Another interpretation for the heterogeneous impact of uncertainty is that urban dwellers have greater awareness and capacity for risk prevention. Since urban residents have much more access to financial instruments than rural residents, under higher policy uncertainty, they can easily substitute consumption intertemporally in more convenient ways. Therefore, rising policy uncertainty may bring greater restraint to urban households' consumption in the short term, which will rebound in the future, so the long-term (aggregate) impact on urban households' consumption is much weaker than rural households.

is significantly negative (−0.126) in column (4) of Table 3, indicating that the rise of EPU could cause much severer decline in durable goods consumption and more savings of urban households than that of rural household. That means that the urban households' consumption is much more sensitive to the uncertainty and they are more likely to hedge risks by the way of precautionary saving (Ling & Zhang, 2012). This can be partly explained by the fact that urban residents have a higher saving motive than rural residents. Since urban population expansion exacerbates the scarcity of certain public resources, the costs of housing, education, medical care, and other living expenditures of urban residents become much higher. This forces households to try all methods they have to hedge risks and smooth consumption, and saving is apparently the most common way. Another interpretation for the heterogeneous impact of uncertainty is that urban dwellers have greater awareness and capacity for risk prevention. Since urban residents have much more access to financial instruments than rural residents, under higher policy uncertainty, they can easily substitute consumption intertemporally in more convenient ways. Therefore, rising policy uncertainty may bring greater restraint to urban households' consumption in the short term, which will rebound in the future, so the long-term (aggregate) impact on urban households' consumption is much weaker than rural households.

In addition, there exists significant regional differences about the impact of EPU on households' durable goods consumption. The coefficients of the cross terms in column (4),  and

and  , are significantly positive (0.121 vs. 0.37). This shows that the durable goods consumption of households in the central and western regions responds less to the rise of EPU compared with the eastern one, which implies that households in the eastern region have greater incentives to hedge risk through precautionary saving. In fact, this result is logically consistent with the heterogeneous impact of uncertainty on urban and rural areas. Since, in the eastern region, the costs of living are much higher and the financial sector is much more developed, households are more inclined to smooth consumption and save for hedging risk under EPU. Additionally, the results of other control variables in the durable goods consumption regression are basically consistent with theoretical expectations.

, are significantly positive (0.121 vs. 0.37). This shows that the durable goods consumption of households in the central and western regions responds less to the rise of EPU compared with the eastern one, which implies that households in the eastern region have greater incentives to hedge risk through precautionary saving. In fact, this result is logically consistent with the heterogeneous impact of uncertainty on urban and rural areas. Since, in the eastern region, the costs of living are much higher and the financial sector is much more developed, households are more inclined to smooth consumption and save for hedging risk under EPU. Additionally, the results of other control variables in the durable goods consumption regression are basically consistent with theoretical expectations.

5.2 The effect of EPU through investment-employment channel

The regression results of Equation (3), the investment-employment model, are depicted in Table 4. The first and second columns of Table 4 are the estimation results with and without the cross terms of EPU and urban or other variables. Again, we report system GMM estimation results and put the results of FEs model in the appendix. Obviously, the coefficients of the variable  in both forms are all significantly negative (−0.132 vs. −0.084), indicating that the rise of EPU could cause a decrease in household employment. As mentioned in the previous part, the increase in EPU will inhibit the investment demand and labor demand of enterprises, which will in turn increase the unemployment risk or even much job loss in the household sector. Hence, through the investment-employment mechanism, the impact of EPU could be transferred from firm sector to household sector, which does harm to residents' employment status as well as future income and will eventually reduce household consumption.

in both forms are all significantly negative (−0.132 vs. −0.084), indicating that the rise of EPU could cause a decrease in household employment. As mentioned in the previous part, the increase in EPU will inhibit the investment demand and labor demand of enterprises, which will in turn increase the unemployment risk or even much job loss in the household sector. Hence, through the investment-employment mechanism, the impact of EPU could be transferred from firm sector to household sector, which does harm to residents' employment status as well as future income and will eventually reduce household consumption.

| Variable |  |

|

|---|---|---|

| (1) | (2) | |

| Yt−1 | 0.109*** | 0.101*** |

| (0.029) | (0.028) | |

| lEPUt | −0.132*** | −0.084*** |

| (0.015) | (0.020) | |

| lEPUt× workout | −0.034*** | |

| (0.002) | ||

| lEPUt× urban | 0.043* | |

| (0.022) | ||

| lEPUt× mid | −0.045* | |

| (0.023) | ||

| lEPUt× west | −0.086*** | |

| (0.033) | ||

| size | 0.103*** | 0.146*** |

| (0.008) | (0.008) | |

| retire | −0.254*** | −0.259*** |

| (0.021) | (0.021) | |

| gender | −0.084*** | −0.086*** |

| (0.030) | (0.028) | |

| age | 0.021** | 0.026*** |

| (0.008) | (0.007) | |

| age2 | −1.99E-4*** | −2.34E-4*** |

| (7.22E-05) | (6.60E-05) | |

| marriage | 0.027 | 0.038 |

| (0.040) | (0.040) | |

| edu | 0.009 | 0.006 |

| (0.010) | (0.010) | |

| gdprate | −0.067*** | −0.055*** |

| (0.005) | (0.005) | |

| mid | −0.196 | −0.201 |

| (0.401) | (0.534) | |

| west | −0.899** | −0.464 |

| (0.416) | (0.569) | |

| (0.345) | (0.404) | |

| Obs | 9340 | 9340 |

- Note: The dependent variable is ln (1 + number of employed). The estimation method is system GMM. *, **, and *** represent statistical significance at 10%, 5%, and 1% levels, respectively.

More importantly, the coefficient of the cross term  is significantly negative (−0.034), indicating that EPU has greater effect on families with migrant workers. It can be explained by the fact that migrant workers usually have less job opportunities and labor security due to labor market discrimination, so they are more likely to get fired under high EPU. Similarly, there exists heterogeneous impact of uncertainty on urban and rural households. The coefficient of the cross term

is significantly negative (−0.034), indicating that EPU has greater effect on families with migrant workers. It can be explained by the fact that migrant workers usually have less job opportunities and labor security due to labor market discrimination, so they are more likely to get fired under high EPU. Similarly, there exists heterogeneous impact of uncertainty on urban and rural households. The coefficient of the cross term  is also significantly positive (0.043), implying that the rise of EPU has much more adverse influence on the employment of rural households than urban households. This can also be explained by labor market discrimination. Due to China's unique HuKou system, there lacks complete labor security for rural workers, so they face higher chance of unemployment compared with urban workers under unstable economic policy circumstances. Hence, through investment-employment channel, EPU can have more adverse effect on rural households than urban ones, and this will in turn suppress their consumption more.

is also significantly positive (0.043), implying that the rise of EPU has much more adverse influence on the employment of rural households than urban households. This can also be explained by labor market discrimination. Due to China's unique HuKou system, there lacks complete labor security for rural workers, so they face higher chance of unemployment compared with urban workers under unstable economic policy circumstances. Hence, through investment-employment channel, EPU can have more adverse effect on rural households than urban ones, and this will in turn suppress their consumption more.

For the regional impacts, it is showed that the coefficients of the cross terms  and

and  are both significantly negative, and the coefficient of the latter is much larger in absolute value (−0.045 vs. −0.086). This means that EPU has a significantly greater adverse effect on the employment of residents in the central and western regions than in the eastern region, and the households in the western regions are most affected. This heterogeneous regional effect may be explained by the different industrial structure and economic development of each region in China. Compared with the eastern region, the economic development of the central and western regions is slower and the industrial structure is relatively single. For instance, resource-dependent industries, such as energy, chemical, and mineral industry, account for a relatively higher proportion in the less developed region (Song & Liu, 2013). This leads to a more fragile economic structure in response to policy uncertainty. Therefore, EPU has a stronger adverse effect on household consumption in the central and western regions through investment-employment channels.

are both significantly negative, and the coefficient of the latter is much larger in absolute value (−0.045 vs. −0.086). This means that EPU has a significantly greater adverse effect on the employment of residents in the central and western regions than in the eastern region, and the households in the western regions are most affected. This heterogeneous regional effect may be explained by the different industrial structure and economic development of each region in China. Compared with the eastern region, the economic development of the central and western regions is slower and the industrial structure is relatively single. For instance, resource-dependent industries, such as energy, chemical, and mineral industry, account for a relatively higher proportion in the less developed region (Song & Liu, 2013). This leads to a more fragile economic structure in response to policy uncertainty. Therefore, EPU has a stronger adverse effect on household consumption in the central and western regions through investment-employment channels.

For other control variables, the coefficient of family size ( ) is significantly positive. The number of retired in each family (

) is significantly positive. The number of retired in each family ( ) has a significant negative impact on family employment. The coefficient of the gender of the household head (

) has a significant negative impact on family employment. The coefficient of the gender of the household head ( ) is significantly negative. The coefficient of the primary term of age (

) is significantly negative. The coefficient of the primary term of age ( ) is significantly positive, and the coefficient of the square term (

) is significantly positive, and the coefficient of the square term ( ) is significantly negative, indicating the nonlinear relationship between labor age and employment. On the whole, the coefficients of the main control variables are basically consistent with the theoretical expectations.

) is significantly negative, indicating the nonlinear relationship between labor age and employment. On the whole, the coefficients of the main control variables are basically consistent with the theoretical expectations.

5.3 Robust test

5.3.1 Reconstructing the EPU index

In the baseline case, we assume that policy changes in early quarter, such as  , have much more impact than ones in latter quarter, such as

, have much more impact than ones in latter quarter, such as  , so we define EPU as

, so we define EPU as  . Here, we recalculate the average annual index with equal weight, that is,

. Here, we recalculate the average annual index with equal weight, that is,  , and apply the new EPU index to the regression models to check the robustness of our basic conclusion. The re-estimation results are shown in Table 5.

, and apply the new EPU index to the regression models to check the robustness of our basic conclusion. The re-estimation results are shown in Table 5.

| lcon_food | lcon_dur |  |

||||

|---|---|---|---|---|---|---|

| Variable | (1) | (2) | (3) | (4) | (5) | (6) |

| Yt−1 | −0.212 | −0.220 | 0.178*** | 0.180*** | 0.096*** | 0.088*** |

| (0.842) | (0.839) | (0.032) | (0.032) | (0.029) | (0.028) | |

| lEPU2t | −0.023 | −0.320 | −0.329** | −0.484*** | −0.117*** | −0.072*** |

| (2.978) | (2.990) | (0.146) | (0.154) | (0.014) | (0.019) | |

| lEPU2t× workout | −0.035*** | |||||

| (0.002) | ||||||

| lEPU2t× urban | 0.341*** | −0.120* | 0.037* | |||

| (0.104) | (0.068) | (0.021) | ||||

| lEPU2t× mid | 0.118 | 0.100 | −0.037* | |||

| (0.129) | (0.065) | (0.022) | ||||

| lEPU2t× west | 0.033 | 0.331*** | −0.081*** | |||

| (0.169) | (0.087) | (0.030) | ||||

| Other controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Obs | 5470 | 5470 | 9360 | 9360 | 9340 | 9340 |

- Note: The dependent variables are food consumption in columns (1) and (2), durable goods consumption in columns (3) and (4) and ln (1 + number of employed) in columns (5) and (6). The estimation method is system GMM. The other control variables of each equation are similar to those in Table 3 or 4. *, **, and *** represent statistical significance at 10%, 5%, and 1% levels, respectively.

As can be seen from Table 5 that, the coefficients of the variable  are small and insignificant in the food consumption equation, while they are significantly negative in the durable goods consumption equation, consistent with the basic results. Besides, the coefficients of the cross terms,

are small and insignificant in the food consumption equation, while they are significantly negative in the durable goods consumption equation, consistent with the basic results. Besides, the coefficients of the cross terms,  , are all very similar to the baseline case. These results verify that the precautionary saving mechanism works again.

, are all very similar to the baseline case. These results verify that the precautionary saving mechanism works again.

Table 5 also shows that, the coefficients of the variable  are significantly negative in the employment equation, consistent with the basic results. Besides, the coefficients of the cross terms,

are significantly negative in the employment equation, consistent with the basic results. Besides, the coefficients of the cross terms,  , are all similar to the baseline case. These results verify the existence of investment-employment channel again.

, are all similar to the baseline case. These results verify the existence of investment-employment channel again.

5.3.2 The impact of EPU with time lag

To see the lasting effect of EPU, we add one lag of  ,

,  , and the cross terms of

, and the cross terms of  and other dummy variables to the baseline equations. The results are shown in Table 6. It can be easily seen from columns (1) and (2) that the coefficients of

and other dummy variables to the baseline equations. The results are shown in Table 6. It can be easily seen from columns (1) and (2) that the coefficients of  and its cross terms in the equations of food and durable goods consumption are basically consistent with the baseline results, verifying again the existence of precautionary saving channel. Besides, the coefficients of

and its cross terms in the equations of food and durable goods consumption are basically consistent with the baseline results, verifying again the existence of precautionary saving channel. Besides, the coefficients of  and its cross terms are basically consistent with those of

and its cross terms are basically consistent with those of  , showing a lasting effect.

, showing a lasting effect.

| lcon_food | lcon_dur |  |

|

|---|---|---|---|

| Variable | (1) | (2) | (3) |

| Yt−1 | 0.081** | 0.173*** | 0.133*** |

| (0.033) | (0.028) | (0.023) | |

| lEPUt | 1.790 | −0.485*** | −0.084*** |

| (1.248) | (0.117) | (0.032) | |

| lEPUt-1 | 2.983 | −0.329*** | −3.0E-5 |

| (2.027) | (0.104) | (0.031) | |

| lEPUt× workout | −0.035*** | ||

| (0.002) | |||

| lEPUt× urban | −2.374 | −0.444*** | −0.000 |

| (2.819) | (0.116) | (0.002) | |

| lEPUt−1 × urban | −4.650 | −0.410*** | 0.080*** |

| (4.878) | (0.110) | (0.019) | |

| lEPUt× mid | 0.079 | 0.168 | 0.053*** |

| (0.364) | (0.123) | (0.019) | |

| lEPUt−1 × mid | −0.087 | 0.163 | −0.067 |

| (0.681) | (0.116) | (0.045) | |

| lEPUt × west | 0.161 | 0.329** | −0.049 |

| (0.372) | (0.150) | (0.044) | |

| lEPUt−1 × west | 0.164 | 0.045 | −0.096* |

| (0.709) | (0.140) | (0.054) | |

| Other controls | Yes | Yes | Yes |

| Obs | 5470 | 9360 | 9340 |

- Note: The dependent variables in columns (1) and (3) are food consumption, durable goods consumption and ln(1 + number of employed), respectively. The estimation method is system GMM. The other control variables of each equation are similar to those in Table 3 or 4. *, **, and *** represent statistical significance at 10%, 5%, and 1% levels, respectively.

Column (3) of Table 6 also shows that, when  is included, the coefficients of

is included, the coefficients of  and its cross terms are mostly insignificant, while the coefficients of

and its cross terms are mostly insignificant, while the coefficients of  and the cross terms change little in the employment equation, consistent with the baseline results.

and the cross terms change little in the employment equation, consistent with the baseline results.

5.3.3 Heterogeneous effect test

Existing literature points out that the household head has an important influence on household consumption decision. On the one hand, his or her risk appetite will influence household consumption and saving decisions under policy uncertainty. This will amplify or reduce the impact of the precautionary saving mechanism on household consumption expenditure. In China, the individual's risk preference can be influenced by his or her position. For instance, employees of government agencies, institutions, and state-owned enterprises have stable incomes and low unemployment risks, and have a low tolerance for risks. Workers employed in private firms, foreign companies, and other units are more adaptable to the highly competitive and volatile salary system, and usually have higher risk appetite. On the other hand, employers' capability to cope with policy uncertainty varies among different types, so does the adjustment of recruitment scale when facing shocks of uncertainty. Compared with other types of enterprises, the cost of labor adjustment in state-owned enterprises is higher, and state-owned enterprises will not lay off workers on a large scale under sudden shocks. Hence, there are fewer unemployment risks (Hu & Liu, 2007). Therefore, for families working in different units, EPU may have different effects on their consumption through investment-employment channels.

In view of this, based on the work unit type of the household head, our study divides the household sample into four groups: agricultural family, SOE family (working in government agencies, state-owned institutions, and research institutes or state-owned enterprises), collective firm family (working in large or small collectives) and other family (working in private, self-employed, foreign-funded enterprises or other units). We try to verify these two channels by further estimating the regression models of different mechanisms using each household group. The results are shown in Table 7.

| Agriculture family | SOE family | Collective firm family | Other family | |

|---|---|---|---|---|

| Variable | lcon_dura | |||

| Yt−1 | 0.150*** | 0.250** | 0.0717 | 0.170*** |

| (0.0455) | (0.101) | (0.206) | (0.0412) | |

| lEPUt | −0.253 | −1.231*** | −1.202 | −0.541*** |

| (0.284) | (0.424) | (0.903) | (0.202) | |

| lEPUt× urban | 0.894 | 0.151 | 0.251 | −0.100 |

| (0.724) | (0.141) | (0.432) | (0.0820) | |

| lEPUt× mid | −0.207 | −0.331* | 0.364 | 0.256*** |

| (0.145) | (0.172) | (0.380) | (0.0819) | |

| lEPUt× west | 0.129 | −0.0133 | 0.207 | 0.397*** |

| (0.150) | (0.235) | (0.566) | (0.110) | |

| Other controls | Yes | Yes | Yes | Yes |

| Obs | 2205 | 1336 | 1218 | 4594 |

| Variable | lEmploy | |||

| Yt−1 | −0.0221 | −0.100 | −0.122 | −0.0335 |

| (0.0732) | (0.188) | (0.177) | (0.103) | |

| lEPUt | −0.120*** | −0.111** | −0.0914* | −0.0908** |

| (0.0382) | (0.0537) | (0.0532) | (0.0381) | |

| lEPUt× urban | 0.0510 | 0.0384 | 0.163 | 0.114*** |

| (0.141) | (0.0496) | (0.119) | (0.0392) | |

| lEPUt× mid | −0.00580 | 0.0172 | 0.150 | −0.0621 |

| (0.0407) | (0.0514) | (0.0990) | (0.0510) | |

| lEPUt× west | −0.0194 | −0.0427 | −0.0667 | −0.0811 |

| (0.0535) | (0.0576) | (0.161) | (0.0497) | |

| Other controls | Yes | Yes | Yes | Yes |

| Obs | 2210 | 1335 | 1208 | 1556 |

- Note: The dependent variables are durable goods consumption in the upper part and ln (1 + number of employed) in the lower part, respectively. The estimation method is system GMM. The other control variables of each equation are similar to those in Table 3 or 4. *, **, and *** represent statistical significance at 10%, 5%, and 1% levels, respectively.

The upper part stands for the results of the precautionary saving channel. The regression coefficients of the variable  on durable goods consumption are all negative in the four types of households, among which the coefficient of the SOE family is larger in absolute value than other types of family. This implies that families with a lower tolerance for risks are more sensitive to EPU and could reduce much more durable goods consumption. Rural household consumption has much smaller and insignificant response to EPU.

on durable goods consumption are all negative in the four types of households, among which the coefficient of the SOE family is larger in absolute value than other types of family. This implies that families with a lower tolerance for risks are more sensitive to EPU and could reduce much more durable goods consumption. Rural household consumption has much smaller and insignificant response to EPU.

The second part of Table 7 depicts the results of the investment-employment channel. Among all regression for each household group, the coefficients of the variable  are all significantly negative, indicating that EPU generally inhibits the labor demand of different employers, which in turn leads to the decrease in employment of all types of households. And these will eventually curb household consumption.

are all significantly negative, indicating that EPU generally inhibits the labor demand of different employers, which in turn leads to the decrease in employment of all types of households. And these will eventually curb household consumption.

In addition, the coefficients of the cross term  are mostly insignificant in both regressions,12 which means that there does not exist heterogeneous impact between urban and rural households. This might be mainly because that, when controlling the job types of householders, the differences in household consumption and changes of employment between urban and rural areas are also controlled.13 The coefficients of the cross terms of regional dummy,

are mostly insignificant in both regressions,12 which means that there does not exist heterogeneous impact between urban and rural households. This might be mainly because that, when controlling the job types of householders, the differences in household consumption and changes of employment between urban and rural areas are also controlled.13 The coefficients of the cross terms of regional dummy,  and

and  , are mostly negative but at lower level of significance. In summary, the subsample regression results further verify the impact of EPU on household consumption through precautionary saving and investment-employment channels.

, are mostly negative but at lower level of significance. In summary, the subsample regression results further verify the impact of EPU on household consumption through precautionary saving and investment-employment channels.

6 CONCLUSIONS AND POLICY SUGGESTIONS

This article investigates the impact of China's EPU on household consumption and explores its transmission mechanism in both macro- and microperspectives. Innovatively, we combine the Chinese EPU index constructed by Baker et al. (2016) with macroeconomic data in China as well as the household survey data (CHNS), and comprehensively apply macro and micromodel to empirically verify the conclusions. We find that the rise of EPU can significantly reduce household consumption through precautionary saving and investment-employment channels. Among them, the precautionary saving channel has a stronger effect on urban household consumption, which is manifested in reducing current consumption of durable goods and increasing savings, and this may derive from the fact that urban households have a more convenient way to achieve intertemporal substitution of consumption to deal with the impact of uncertainty. Policy uncertainty has a stronger adverse effect on rural household consumption through the investment-employment channel. The major reason is that the increase in uncertainty affects employment by exerting impacts on corporate investment and recruitment scale, while rural household may face higher unemployment risks and lower future income, thus inhibiting consumption demand in the long run. From a regional perspective, households' precautionary savings in the eastern regions have a more significant response to EPU, while households in the relatively less developed central and western regions are more likely to be affected through investment-employment channel. The conclusions of this study expand the relevant literature.

Based on our findings, we come to the following policy suggestions: First, economic policies need to be consistent, so as to reduce the adverse effects of policy uncertainty on the economy. Especially, the local government policies should coordinate with the long-term strategic planning of the central government. Second, compared with urban households, this study shows that rural households are less capable of substituting consumption intertemporally. It is necessary to enrich goods market in rural areas and improve the access to financial resources and other risk aversion channels for rural household, for the purpose of improving their abilities of dealing with uncertainty. Thirdly, it can be seen that the uncertainty has a stronger inhibitory effect on rural residents' consumption through investment-employment channel. It is urgent that the government should eliminate rural discrimination and improve the security of the rural labor force. Finally, it is necessary to optimize the industrial structures in the central and western regions, promote balanced economic development in various regions, and reduce the impact of EPU on underdeveloped regions.

AUTHOR CONTRIBUTIONS

Yanwei Gu: Conceptualization; data curation; project administration; writing—original draft; writing—review and editing. Guancheng Jiang: Writing—original draft; writing—review and editing. Xiao Liang: Conceptualization; data curation; project administration; writing—original draft; writing—review and editing.

ACKNOWLEDGMENTS

We would like to thank the editor and the anonymous referees for their helpful comments. This study was supported by the Graduate Student Innovation Fund of the School of Economics of Shanghai University of Finance and Economics (Grant No. KYCX-2020-37). All remaining errors and omissions are ours.

CONFLICT OF INTEREST

The authors declare no conflict of interest.

ETHICS STATEMENT

None declared.

APPENDIX A

(Table A1)

| N | Mean | SD | Min. | Max. | Urban–rural | |

|---|---|---|---|---|---|---|

| Rural | 7244 | 1.665 | 0.747 | −4.043 | 7.757 | - |

| Urban | 3452 | 1.693 | 0.751 | −3.010 | 5.665 | - |

| Whole | 10,696 | 1.674 | 0.748 | −4.043 | 7.757 | 0.028* |

APPENDIX B

(Table B1)

| lcon_food | lcon_dur | lEmploy | ||||

|---|---|---|---|---|---|---|

| Variable | (1) | (2) | (3) | (4) | (5) | (6) |

| Yt−1 | −0.332*** | −0.333*** | −0.099*** | −0.099*** | ||

| (0.018) | (0.019) | (0.015) | (0.015) | |||

| lEPUt | 0.030 | −0.141** | −0.354*** | −0.374*** | −0.137*** | −0.086*** |

| (0.037) | (0.059) | (0.126) | (0.131) | (0.011) | (0.017) | |

| lEPUt× workout | −0.028*** | |||||

| (0.001) | ||||||

| lEPUt× urban | 0.096 | −0.092* | 0.033* | |||

| (0.082) | (0.054) | (0.020) | ||||

| lEPUt× mid | 0.273*** | −0.039 | −0.036* | |||

| (0.079) | (0.058) | (0.021) | ||||

| lEPUt× west | 0.127 | 0.175** | −0.092*** | |||

| (0.095) | (0.070) | (0.025) | ||||

| Other controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Obs | 5470 | 5470 | 9360 | 9360 | 9340 | 9340 |

- Note: The dependent variables are food consumption in columns (1) and (2), durable goods consumption in columns (3) and (4) and ln (1 + number of employed) in columns (5) and (6). The estimation method is fixed effect. The other control variables of each equation are similar to those in Table 3 or 4. *, **, and *** represent statistical significance at 10%, 5%, and 1% levels, respectively.

REFERENCES

- 1 Details of EPU index construction can be seen from the website, http://www.policyuncertainty.com.

- 2 The Global EPU Index is a GDP-weighted average of national EPU indices for 21 countries: Australia, Brazil, Canada, Chile, China, Colombia, France, Germany, Greece, India, Ireland, Italy, Japan, Mexico, the Netherlands, Russia, South Korea, Spain, Sweden, the United Kingdom, and the United States.

- 3 See: https://www.frbatlanta.org/cqer.aspx.

- 4 Details of identification can be found in Uhilg (2003) and Kurmann and Otrok (2013).

- 5 We set the prediction horizon to

to capture the short- and median-run movements in the EPU index.

to capture the short- and median-run movements in the EPU index. - 6 Xu and Wang (2018) also use the max share approach to identify the EPU shock, but the difference is that we add another variable, employment, in the VAR. Besides, investment in their paper refers to total investment, while we use private investment because private investment reacts to EPU more sensitively compared with state-owned firms. More importantly, private investment can express the investment-employment channel more accurately because private firms provide more than 80% of China's employment.

- 7 Among the nine provinces, Liaoning, Jiangsu, and Shandong represent the eastern part; Heilongjiang, Henan, Hubei, and Hunan represent the middle part; Guangxi and Guizhou represent the western part.

- 8 Since CHNS focuses on people's nutrition and health, it collects detailed nutrition data about every household in the data, including 93 kinds of food, but they only track 3 days. One of the main advantages of the CHNS data set is that, it precisely records the amount of each kind of food used in a day by each family, including food bought from the market and self-supported. The common food in our study contain cereals and products, potato and starch products, dried beans and products, vegetables, fruits, nuts and seeds, meat, poultry, dairy and products, eggs and products, fish, shrimps, crabs and shellfish, instant foods, confections, fats, condiments.

- 9 To find the accurate price index for each kind of food in household food consumption sample, it is necessary to match each kind of food with its corresponding food codes. We create the match between food name and food code from two publicly published books, Food Composition published in 1991 and China Food Composition published in 2002, which are widely used in existing literature. While the match for observation before year of 2004 is based on Food Composition, and the match for observation after 2004 is based on China Food Composition.

- 10 Household assets generally include financial assets and physical assets. Using microlevel data, Li and Chen (2014) have showed that household physical assets account for much more than financial assets in China, so we use the physical assets as the proxy of household assets. In particular, the aggregate household physical assets include real estate, transportation, electric appliances, agricultural machinery, and equipment.

- 11 In fact, the basic results are robust when we use FE models to estimate the equations, see the appendix.

- 12 One exception is that EPU has a much smaller effect on employment of urban households working in private, self-employed, foreign-funded enterprises, or other units.

- 13 The employment career of rural households is relatively simple and limited compared with urban ones. According to the sample data, the heads of rural household are more likely to be hired by the agricultural sector, collective firm, and other sector. The share of rural household in each subgroup is: 82% (other family), 89% (collective firm family), 36% (SOE family), and 97% (agriculture family).