ESG Meets DeFi: Exploring Time-Varying Linkages and Portfolio Implications

ABSTRACT

This study delves into the connection between Environmental, Social and Governance (ESG) indices and emerging Decentralised Finance (DeFi) assets. Specifically, it explores the ever-changing, frequency-based linkage between these ESG indices and innovative DeFi assets. Employing the wavelet coherence technique, we analyse a broad range of ESG indices, spanning emerging, developed and US indices, alongside various DeFi assets. This examination covers a period encompassing the COVID-19 pandemic and the Russian-Ukrainian conflict to assess market linkages during extreme events. We then calculate optimal weights and hedge ratios for ESG-DeFi asset pairs to evaluate portfolio implications. Wavelet analysis results frequently show no connection between ESG indices and DeFi assets, underscoring the diversification benefits of adding DeFi to an ESG portfolio. However, this relationship notably strengthens at the pandemic crisis's onset, indicating DeFi assets lose diversification potential during turbulent times. Portfolio allocation should mainly favour ESG indices during normal periods, with minimal variations in optimal weights pre- and post-COVID. Meanwhile, hedge ratio analysis suggests DeFi assets make sound investments during crises, although hedging costs increase during turbulent periods. These findings hold relevance for investors, portfolio managers and policymakers.

1 Introduction

Climate change has become a prominent topic of concern in recent times, with global temperatures rising at an unprecedented rate. Substantial efforts are being made to combat this temperature increase through the implementation of decarbonisation policies. The 2016 Paris summit agreement marks a significant milestone in the journey to achieve net-zero emissions by 2050 (Mirza et al. 2023; Naeem and Arfaoui 2023; Naeem et al. 2021; Nguyen et al. 2021). Corporations and investors are increasingly prioritising environmental concerns. Some investors are committed to supporting projects that have a positive impact on the climate (Adhikari and Safaee Chalkasra 2023; Clapp 2018). Social responsibility has also gained prominence among governments, organisations, policymakers and investors in recent years. Certain investors consider social issues when making investment decisions, highlighting the ongoing importance of these concerns (Li et al. 2019). In the realm of investment decisions, corporate governance—agency theory plays a central role in addressing governance issues (Hsu and Liao 2022; Hu et al. 2020). Therefore, the three facets of environmental, social and governance factors carry significant weight. Investors base their decisions to buy or abstain from purchasing stocks on these criteria (Chen et al. 2023; Perote, Vicente-Lorente, and Zuñiga-Vicente 2023; Wen et al. 2022; Zhang, Zhao, and Lau 2022). Given the critical importance of environmental, social and governance (ESG) matters, various indices have been developed and regularly updated by different entities. These indices provide insights into companies' overall performance in these areas.

Stocks are one of the most primitive forms of investment securities and innovation in the forms of securities is constant. Along with stocks, investors have historically invested in bonds as well. Derivative securities including forwards, futures and options are also sink of investment. Cryptocurrencies are the latest addition to the list of possible investment choice (Almeida and Gonçalves 2023; Jalan et al. 2023). Investors now invest in these newly established assets. These cryptocurrencies can be divided into many different types of especially non-fungible tokens, Decentralised Finance, Meme tokens, stable coins, Islamic cryptos, gold-based cryptos and so forth although the investors maximise their utility by investing in the stocks of the companies that take best care of ESG issues. However, in turbulent times like financial crisis, pandemics and current period of high inflation, investors would like to diversify their investment portfolios in such a way that they do not lose money on their investments. The most obvious solution to the above-mentioned problem is the diversification for which the recent category of assets is most suitable as many studies have concluded that there is no strong correlation between stocks and cryptocurrencies (Hassan et al. 2022; Yousaf, Riaz, and Goodell 2023).

During the recent COVID-19 pandemic crisis, financial markets worldwide have witnessed unprecedented loses due to the economic activity slow-down and heightened uncertainty, which pose new challenges on asset allocations, risk management and financial stability (Arif et al. 2021, 2022). Moreover, the recent pandemic crisis has more than shed light on sustainability concerns, and thus provided an exceptional opportunity to examine the potential persistence of eco-friendly assets when facing extreme crises and market downturns. Green finance investment has emerged as an alternative financial instrument providing new investment opportunities to immunise investors portfolios during periods of market distress. In this context, investors and policy makers focused on the ability of green finance instruments to persist against unexpected shocks and recent studies have shown that sustainable financial markets have performed well during the recent pandemic and suggest that portfolio including ESG stocks performed better than conventional assets (Broadstock et al. 2021).

Given the popularity and performance superiority of sustainable finance instruments, a strand of research papers examined the linkage between these assets and other conventional assets including stocks, bonds, equities, commodities and cryptocurrencies. These studies aim to investigate the connections, spillovers effects, diversification and hedging properties of green-finance assets against conventional assets. Umar et al. (2021) have analysed the safe haven properties of ESG investment. They documented the intervals of low medium and high consistency between COVID-19 panic index and ESG leaders' indices where low coherence indices reveal diversification potential of ESG investment during turbulent times like pandemic. In another study, Rubbaniy, Khalid, Rizwan, et al. (2022) found the co-movements between COVID-19 fear index and ESG stock indices on frequency band of 32–64 days. Piserà and Chiappini (2022) provide the empirical evidence for the risk hedging properties of ESG indices and ESG thematic indices during COVID-19 pandemic. The results also confirmed the superior hedging properties of ESG indices over cryptocurrency assets.

There are some existing studies that analysed the connectedness between ESG stocks and cryptos and concluded that cryptos are best hedge for ESG investors, which confirm the hedging and safe-haven properties of ESG stocks. Qiao et al. (2023) found that yield farming tokens aggravate DeFi's depreciation risk but hedge in medium term. Furthermore, traditional investments affect depreciation risk, but emerging concepts affect depreciation risk. These findings have implications for investors to diversify their portfolios. Using the data from 13 Defi's and many popular indices, Piñeiro-Chousa et al. (2022) found Defi's to be safe heavens like other cryptocurrency assets that is, the investors may obtain diversification benefits by investing in these assets. Yousaf and Yarovaya (2022) uses TVP-VAR model to study the connectedness between NFTs, Defi's and traditional assets like oil, gold, Bitcoin and S&P 500. The results revealed that digital assets are relatively decoupled from traditional asset classes hence the investors may invest in these new assets to effectively diversify their portfolios. In another related study, Yousaf, Nekhili, and Gubareva (2022) studied the connectedness between famous DeFi assets and four major currencies other than US dollar and found low connectedness between these two asset types. The study also found that the connectedness between new digital assets and traditional currencies increased during the incidence of pandemic. The above-mentioned studies suggest that these studies analysed the connections between different types of assets to conclude whether they can help the investors to diversify or not. So, diversification theory is the base for most of these studies and we also follow diversification theory while studying the connectedness between different types of assets.

As these new Fintech-based assets are part of the financial system so they affect and get affected by other types of assets in the financial system (Diebold and Yilmaz 2012; Schweitzer et al. 2009). Schweitzer et al. (2009) specifically mention that in a complex system, the links are not binary rather they are weighted according to economic interactions. It is obvious from the above-mentioned studies that literature is available for the connectedness among cryptos, NFTs and DeFi assets however, to the best of our knowledge, none of the existing studies explore the connection between ESG and DeFi assets, despite their extreme importance in these times. DeFi's could be a very good diversification option for investors who keep an eye on not only the financial performance but also environmental, social and governance aspects of the organisations. According to Maouchi, Charfeddine, and El Montasser (2022), the market capitalisation of top Defi's has increased from USD 677 million in 2020 to USD 87.05 billion in May 2021, an unprecedented increase of 12,763% over the above-mentioned period. The huge increase in the market capitalisation of Defi's highlights their importance as a separate type of cryptocurrency and the growth potential they have. Therefore, to bridge this gap in literature and to provide timely guidance to the investors for better diversification opportunities, this study analyses the connection between ESG indices and DeFi assets. By applying a wavelet coherence approach, we aim to show that the time-frequency connectedness between sustainable finance and cryptos markets a more exact description when considering simultaneously cross-market linkage and various investment horizons. In fact, understanding the frequency connections between sustainable instruments and cryptos markets is of great importance for policy makers and investors. Moreover, investors are continually seeking for new alternative assets to diversify their portfolio, therefore, it is crucial to evaluate the diversification, hedging and safe-haven ability of sustainable finance instruments, especially during periods of crisis and turmoil when investors are in urgent need for safe-haven refugees. For policy makers, understanding the connection between eco-friendly instruments and conventional assets provides helpful insights to develop a durable financial system that permits increasing the amounts of funds invested in eco-friendly and sustainable investments to protect and re-establish financial stability.

Results from this study reveal that during calm periods and for most investment horizons ESG indices and DeFi assets are not related, which implies that DeFi assets may be considered as suitable diversifiers for ESG stock portfolios during normal periods. Whereas, during the outbreak of the COVID-19 pandemic, the connection between these asset classes strengthened significantly, especially in the medium-term and at early-stage of the pandemic onset. These results highlight that during the crisis period DeFi assets lost their diversifying potential. Results from the portfolio implication analysis show that, for the whole sample periods, the most part of the investment capital should go to the ESG indices and a little part for the DeFi assets, with a little variation in the optimal weights for the post-COVID period compared to the pre-COVID and during the COVID-periods. Finally, results from the hedging ratios calculations reveal that, for the post-COVID periods, ESG stocks act as better hedgers, so investors should go to ESG assets rather than DeFi. Further, investing in the DeFi assets at the COVID period and its following waves is the best choice, during other periods ESG indices are more profitable. Finding from this study have several implications for investors, portfolio managers and risk managers concerning capital asset-allocation, diversification opportunities and effective hedging strategies building.

Our study contributes to the existing literature in several ways. First and foremost, it is the pioneering work that comprehensively analyses the critical connection between ESG indices and DeFi assets. Previous studies have linked the ESG with different other assets, like conventional stocks (Barson et al. 2024; Ghaemi Asl et al. 2023), commodities (Cagli, Mandaci, and Taşkın 2023; Rehman, Ahmad, and Vo 2022), bonds (Reboredo, Ugolini, and Aiube 2020) and cryptocurrencies (Duan et al. 2023). On the other hand, DeFi—a specific type of cryptocurrencies has been linked with similar assets like stocks (Yousaf, Jareño, and Tolentino 2023; Yousaf and Yarovaya 2022), commodities (Ali, Ijaz, and Yousaf 2023; Yousaf and Yarovaya 2022), cryptocurrencies (Corbet et al. 2023; Karim et al. 2022), bonds (Umar, Polat, Choi, and Teplova, 2022), among others.

Further, in a recent study, Hassan et al. (2022) have analysed the dynamic spillover between cryptocurrency environmental attention index (ICEA) and three asset classes including: commodities, green bonds and environment-related stocks. In another study, Kamal and Hassan (2022) examined the connectedness between cryptocurrency environment attention index (ICEA) and clean energy stocks and green bonds. More recently, Anwer et al. (2023) examine dynamic movement between digital assets and environmentally sustainable assets to assess the hedging ability of these new assets class among each other. The novelty of our study compared to the above-mentioned studies consists of considering the new DeFi assets instead of traditional cryptocurrency index. As the use of novel technologies and crypto assets gains momentum, it is becoming clear that ESG considerations cannot be ignored. In fact, ESG factors are becoming an essential aspect for evaluating investment in cryptocurrency markets. Moreover, our choice to link ESG and DeFi is motivated by modern portfolio theory which motivates diversification across assets, the efficient market hypothesis related to how new information gets incorporated into asset prices, and theories around safe haven assets during crises. Thus, investors in the cryptocurrency markets should consider the environmental impact of mining, the social implication of new financial technologies and the governance of decentralised systems to make informed investment decisions.

Second, the existing studies has utilised several models to investigate the linkage between different assets classes. For instance, DCC-GARCH (Gabauer 2020; Yousaf, Ali, and Wong 2022), TVP-VAR (Aharon and Demir 2022; Ali et al. 2023; Cao and Xie 2022; Yousaf, Ali, et al. 2024), QVAR (Abdullah et al. 2023; Ali, Umar, et al. 2024; Naeem et al. 2023; Yousaf, Zeitun, et al. 2024). However, this study uses novel connectedness approach including, the continuous wavelet transforms (CWT), the cross wavelet transform (XWT), wavelet transform coherence (WTC). The wavelet transformation approach provides accurate results in the form of time-frequency heat-maps including the information in both, coherence and time difference for the considered pairs of assets. In particular, the coherence wavelet analysis is able to provide information on the joint behaviour indices, not only along the unique dimension time, but also over different investment horizons or as called frequency periods, such analysis enables us to examine various patterns of ESG indices and their co-movement with DeFi assets.

Third, this study also extends the existing literature on Defi's—an emerging class of assets by exploring their relationship with ESG-based stocks rather than traditional assets. In addition, we contribute to the ongoing literature examining the response of financial markets to extreme events. In fact, the sample period considered in this study includes different crisis period such as, the onset of the COVID-19 pandemic and the recent Russian-Ukrainian conflict, which permits to examine the response of the pairs of ESG-DeFi assets connection to crisis events. The finding of this study that connectedness between ESG and DeFi increases during turbulent times support the findings of many existing studies which implies that Defi's lose their diversification benefit in turbulent times (Qiao et al. 2023; Yousaf, Nekhili, and Gubareva 2022; Yousaf and Yarovaya 2022). Finally, we add to the existing studies dealing with portfolio management and hedging and diversification strategies by introducing the portfolio implication analysis. This analysis provides useful information for investors interested to sustainability-related financial products and help investors in term of portfolio rebalancing and building effective hedging strategies to avoid extreme loses during crisis period and to reduce exposure to market risks.

The rest of the manuscript is organised as follows. Section 1 sums up the existing literature, Section 2 discusses the data and methodology, Section 3 explains the empirical results and Section 4 concludes the paper.

2 Data and Methodology

2.1 Data

To investigate the comovement between ESG and DeFi assets, following (Alessandrini and Jondeau 2020; Rubbaniy, Khalid, Rizwan, et al. 2022) we uses the data of 4 ESG stock indices (MSCI Developed market index excluding US-Developed, MSCI Developing markets index-Emerging, MSCI US ESG leader index-USA and MSCI KLD 400 index-KLD400). 1 Additionally, that data of 8 DeFi (Wrapped Bitcoin-WBTC, Chainlink-LINK, Theta Network-THETA, Tezos-XTZ, Fantom-FTM, Maker-MKR, Synthetics-SNX, Basic Attention Token-BAT) is used in analysis. Our sample data runs from 30 January 2019 to 21 December 2022. The data for ESG indices and DeFi assets are extracted from Thomson Reuters Datastream and coinmarketcap.com, respectively. Moreover, similar to (Ali, Naveed, et al. 2024; Ali, Yousaf, and Umar 2023; Chkili, Rejeb, and Arfaoui 2021; Zaremba, Kizys, and Aharon 2021) COVID-19 period start from 1 January 2020. Since, WHO made the announcement of setting up the Incident management support team to deal with COVID-19 on war footing on the same day. 2 Furthermore, more than 18 countries report their COVID-19 related cases in January 2020 along with China.

2.2 Methodology

Prior research has employed many models for examining the relationship between two variables. For example, bivariate cross-quantilogram approach (Corbet, Katsiampa, and Lau 2020; Uddin et al. 2019), DCC-GARCH (Gabauer 2020; Shaik and Rehman 2023), TVP-VAR-a rolling window-based approach (Aharon and Ali 2024; Ali, Moussa, and Youssef 2023), and rolling window models, but these models ignores the frequency dependence structure of the time series. Consequently, many studies use quantile cross-spectral coherence approach (Baumöhl 2019; Maghyereh and Abdoh 2020) built on frequency model proposed by (Baruník and Kley 2019) to investigate the dependencies in tails of joint distribution of assets by capturing the frequency domain. Nevertheless, the approach is unable to jointly capture both the time and frequency characteristics.

The challenges associated with capturing both time and frequency dimensions simultaneously are resolved by the implementation of the wavelet coherence technique, which allows the adjustment of the window size of time series according to extended functions at low and high frequencies. Several studies have used wavelet analysis for empirical analysis (Ali, Yousaf, and Umar 2023; Ali, Yousaf, and Vo 2023; Patel, Goodell, and Chishti 2023; Rubbaniy, Khalid, Rizwan, et al. 2022; Shahzad, Aloui, and Jammazi 2020; Tiwari et al. 2015; Umar, Gubareva, Teplova, and Tran, 2022), however, our choice is motivated by numerous reasons. First, capturing latent process with dynamic cycles, lead–lag relationship and patterns in underlying time series is a fundamental property of the wavelet approach (Fakhfekh, Jeribi, and Ben Salem 2023; Rubbaniy, Khalid, Syriopoulos, et al. 2022). Second, wavelet coherence analysis doesn't require variable to be stationary, which is very common in financial time series data (Jiang and Yoon 2020; León and Soto 1997). In addition, this approach is equally useful when the data undergo frequent structural change like our study period encompassed COVID-19, Russian Ukraine conflict and FTX crash among others. Third, wavelet analysis also accounts for the nonlinear lead lag relationship between variables. Finally, when it comes to deriving statistical inference on the relationship among our study variables, it might be beneficial to consider longer spans of the data. However, it is noteworthy that the wavelet coherence framework remains unaffected by the length of the time series variables.

Given the advantages of the wavelet coherence approach over other methods, particularly its ability to examine the time and frequency domains simultaneously when exploring the relationship between two time series, we used this framework to investigate the co-movements Between ESG and DeFi assets. Following section offers an intricate account of our the methodology.

2.2.1 Wavelet Coherence Analysis

Here, denotes the wavelet transform between two time series and , and is the complex conjugate of the . The cross-wavelet power and the local variance of a time series are both represented by the wavelet power spectrum, which is denoted by the . Following Qin, Cai, and Dong (2014), the local covariance between two time series is defined by .

Here, is the smoothing operator for both time and frequency domain. is the wavelet correlation with value range between 0 and 1, a higher value indicates stronger correlation between the series.

In Equation (4), the imaginary and real part is represented by and , respectively. The arrow pointing towards right (left) indicates 0(180) phase difference suggesting both series have positive (negative) correlation at the given time frequency domain, thus have a in(out) phase relationship. Similarly, up(down)ward directed arrows suggest that second(first) series leads the first (second) series.

2.2.2 Optimal Portfolio Analysis

3 Results

3.1 Preliminary Analysis

Table 1 provides the descriptive statistics for the full sample, and then separately for pre and during the COVID-19 period. The details of summary statistics for the overall sample are given below. The average value of ESG index for developed countries excluding US over the selected period is 0.009 with a standard deviation of 1.081, which is quite a lot of variation. The series is negatively skewed, which means that only a few companies have very high values for ESG index but most of them have values lying to the left of average value. The average value for ESG index of emerging countries is a negative number. The standard deviation values for ESG index of developing countries are even higher than that of the ESG index for developed countries, which implies that the variation in the ESG factor adoption is higher among companies in the case of developing countries. Interestingly, the skewness of ESG for developing countries is less than that of ESG for developed countries.

| Developed | Emerging | KLD400 | USA | WBTC | LINK | THETA | XTZ | FTM | MKR | SNX | BAT | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Panel A: Full sample | ||||||||||||

| Mean | 0.009 | −0.007 | 0.037 | 0.037 | 0.155 | 0.26 | 0.262 | 0.074 | 0.395 | 0.037 | 0.353 | 0.048 |

| Variance | 1.17 | 1.312 | 2.176 | 2.096 | 22.685 | 55.641 | 59.438 | 54.536 | 108.993 | 49.99 | 84.007 | 45.564 |

| Skewness | −1.06* | −0.55* | −0.777* | −0.797* | −0.838* | −0.601* | −0.757* | −0.719* | 0.391* | −1.021* | 0.394* | −0.411* |

| Ex. kurtosis | 14.596* | 5.678* | 12.871* | 13.525* | 13.886* | 8.528* | 6.792* | 7.752* | 7.604* | 20.407* | 5.357* | 6.036* |

| JB | 9201.9* | 1414.7* | 7108.8* | 7844.1* | 8273.5* | 3136.8* | 2047.9* | 2628.8* | 2471.4* | 17789.1* | 1239.9* | 1569.2* |

| ERS | −8.363 | −5.035 | −6.658 | −8.656 | −12.882 | −4.458 | −10.656 | −14.957 | −6.653 | −10.468 | −8.294 | −11.972 |

| Q(20) | 40.133* | 22.548* | 182.749* | 189.45* | 31.288* | 15.648* | 14.049 | 28.669* | 27.260* | 28.602* | 21.026* | 17.276* |

| Q2(20) | 246.6* | 707.4* | 1083.1* | 1150.7* | 38.9* | 49.5* | 19.829* | 57.548* | 39.167* | 20.890* | 22.975* | 30.451* |

| Panel B: Pre COVID-19 | ||||||||||||

| Mean | 0.053 | 0.033 | 0.079 | 0.080* | 0.303 | 0.595 | 0.2 | 0.531 | 0.452 | 0.053 | 1.403* | 0.189 |

| Variance | 0.281 | 0.491 | 0.578 | 0.53 | 26.422 | 52.942 | 37.986 | 42.467 | 77.12 | 27.412 | 87.491 | 31.456 |

| Skewness | −0.323* | −0.436* | −0.898* | −0.898* | 1.334* | 1.669* | −0.263* | 0.629* | 0.793* | 0.122 | 1.023* | 0.108 |

| Ex. kurtosis | 0.594* | 1.425* | 2.688* | 2.769* | 6.865* | 8.192* | 2.374* | 1.405* | 4.493* | 0.985* | 3.737* | 2.178* |

| JB | 7.673* | 27.802* | 104.128* | 108.48* | 540.273* | 779.169* | 58.878* | 35.430* | 226.125* | 10.245* | 180.766* | 47.723* |

| ERS | −3.142 | −2.043 | −2.489 | −3.48 | −5.82 | −2.206 | −5.544 | −7.735 | −3.159 | −4.975 | −3.642 | −5.359 |

| Q(20) | 13.155 | 24.759* | 13.925 | 13.984 | 27.721* | 9.392 | 10.918 | 16.257* | 11.707 | 6.108 | 15.369 | 11.404 |

| Q 2(20) | 14.977 | 13.992 | 52.087* | 53.244* | 93.097* | 19.252* | 4.124 | 21.968* | 4.479 | 13.878 | 19.880* | 14.364 |

| Panel C: During COVID-19 | ||||||||||||

| Mean | −0.004 | −0.019 | 0.024 | 0.024 | 0.109 | 0.157 | 0.281 | −0.067 | 0.377 | 0.032 | 0.03 | 0.004 |

| Variance | 1.443 | 1.565 | 2.669 | 2.579 | 21.558 | 56.497 | 66.101 | 58.228 | 118.921 | 56.988 | 82.601 | 49.948 |

| Skewness | −0.980* | −0.509* | −0.702* | −0.719* | −1.746* | −1.230* | −0.812* | −0.958* | 0.323* | −1.109* | 0.180* | −0.478* |

| Ex. kurtosis | 12.042* | 4.828* | 10.706* | 11.191* | 16.791* | 8.470* | 6.825* | 8.520* | 7.693* | 20.288* | 5.832* | 6.199* |

| JB | 4812.9* | 787.364* | 3769.7* | 4116.5* | 9510.6* | 2515.4* | 1591.6* | 2465.7* | 1927.1* | 13467.4* | 1104.1* | 1271.9* |

| ERS | −11.149 | −11.129 | −12.086 | −12.069 | −12.978 | −11.147 | −11.765 | −11.655 | −10.784 | −11.127 | −13.315 | −4.482 |

| Q(20) | 31.595* | 17.480* | 154.134* | 158.63* | 25.563* | 17.072* | 12.583 | 29.907* | 27.844* | 31.818* | 21.030* | 19.850* |

| Q 2(20) | 170.608* | 512.735* | 798.765* | 849.91* | 9.792 | 50.403* | 14.117 | 43.080* | 33.154* | 14.893 | 18.890* | 23.321* |

- Note: This table reports the descriptive statistics for full sample (30 January 2019 to 21 December 2022), pre-COVID-19 (30 January 2019 to 31 December 2019) and COVID-19 (1 January 2020 to 21 December 2022). MSCI Developed market index excluding US-Developed, MSCI Developing markets index-Emerging, MSCI US ESG leader index-USA and MSCI KLD 400 index-KLD400, Wrapped Bitcoin-WBTC, Chainlink-LINK, Theta Network-THETA, Tezos-XTZ, Fantom-FTM, Maker-MKR, Synthetics-SNX, Basic Attention Token-BAT.

- * Represents significance at 5%.

The average value of the MSCI KLD 400 companies is 0.037, which is very high compared with the above-mentioned series. The reason for this high number is that this index only captures the ESG score for the top 400 companies based on their ESG performance. The standard deviation value for this series is even higher, compared with the previous two, which suggests that the variation in the adoption of ESG is higher even in the top performing companies. Like the previous two series, this series is also negatively skewed and has fat tails. The summary statistics for the ESG index of US companies only are by and large the same as KLD400. Like all the above-mentioned series, the ESG index values for US companies are also negatively skewed and have fat tails it implies that some extreme values are possible.

The study uses the data from eight DeFi tokens for the sake of analysis. The descriptive statistics for all the DeFi tokens are mentioned below. The average value of return for WBTC is 15.5% with a very high standard deviation of 476.3%. This series is also negatively skewed and have fat tails. LINK has also recorded a very high average return of 26% with even higher standard deviation of 745.9%. The average return for the THETA, XTZ, FTM, MKR, SNX and BAT is 26.2%, 7.4%, 39.5%, 3.7%, 35.3% and 4.8%, respectively. FTM records the highest standard deviation of 1044% among all of them. All the series are negatively skewed except FTM and SNX. The values for kurtosis also show that all these series have fat tails and elevated tops. The descriptive statistics for the sub samples of pre and post COVID are mentioned in Panel B and Panel C.

Table 2 provides the unconditional correlation coefficients of overall sample for all the series used in this study. The most noteworthy and highest correlation is between the US ESG index and KLD400, which stands at 99.8%. The table reveals another fact that the correlation between all the pairs is positive. The correlation among all the ESG indices is positive and the correlation between ESG of emerging countries and ESG of developed countries is 69.7%, which is second largest. The correlation among the returns of all the Defi's is also positive. It suggests that return and ESG score move hand in hand.

| Developed | Emerging | KLD400 | USA | WBTC | LINK | THETA | XTZ | FTM | MKR | SNX | BAT | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Panel A: Full sample period | ||||||||||||

| Developed | 1 | |||||||||||

| Emerging | 0.697* | 1 | ||||||||||

| KLD400 | 0.620* | 0.433* | 1 | |||||||||

| USA | 0.625* | 0.433* | 0.998* | 1 | ||||||||

| WBTC | 0.293* | 0.156* | 0.332* | 0.326* | 1 | |||||||

| LINK | 0.269* | 0.139* | 0.322* | 0.319* | 0.604* | 1 | ||||||

| THETA | 0.287* | 0.178* | 0.289* | 0.287* | 0.543* | 0.562* | 1 | |||||

| XTZ | 0.287* | 0.178* | 0.355* | 0.352* | 0.596* | 0.662* | 0.572* | 1 | ||||

| FTM | 0.230* | 0.152* | 0.262* | 0.262* | 0.467* | 0.512* | 0.480* | 0.479* | 1 | |||

| MKR | 0.278* | 0.148* | 0.346* | 0.344* | 0.596* | 0.588* | 0.503* | 0.587* | 0.438* | 1 | ||

| SNX | 0.218* | 0.130* | 0.260* | 0.258* | 0.487* | 0.535* | 0.452* | 0.510* | 0.457* | 0.542* | 1 | |

| BAT | 0.282* | 0.172* | 0.348* | 0.346* | 0.606* | 0.627* | 0.587* | 0.664* | 0.522* | 0.567* | 0.495* | 1 |

| Panel B: Pre COVID-19 | ||||||||||||

| Developed | 1 | |||||||||||

| Emerging | 0.658* | 1 | ||||||||||

| KLD400 | 0.616* | 0.449* | 1 | |||||||||

| USA | 0.617* | 0.441* | 0.995* | 1 | ||||||||

| WBTC | −0.063 | −0.121 | −0.094 | −0.104 | 1 | |||||||

| LINK | −0.037 | −0.197* | 0.002 | −0.003 | 0.272* | 1 | ||||||

| THETA | 0.083 | 0.087 | 0.025 | 0.026 | 0.245* | 0.205* | 1 | |||||

| XTZ | −0.006 | 0.012 | 0.082 | 0.08 | 0.375* | 0.180* | 0.319* | 1 | ||||

| FTM | 0.091 | 0.119 | 0.032 | 0.028 | 0.303* | 0.303* | 0.355* | 0.278* | 1 | |||

| MKR | −0.037 | −0.057 | −0.009 | −0.018 | 0.481* | 0.280* | 0.367* | 0.487* | 0.342* | 1 | ||

| SNX | 0.042 | −0.004 | −0.017 | −0.021 | 0.316* | 0.157* | 0.157* | 0.187* | 0.273* | 0.402* | 1 | |

| BAT | 0.029 | 0.062 | 0.041 | 0.042 | 0.278* | 0.282* | 0.361* | 0.321* | 0.382* | 0.436* | 0.190* | 1 |

| Panel C: During COVID-19 | ||||||||||||

| Developed | 1 | |||||||||||

| Emerging | 0.702* | 1 | ||||||||||

| KLD400 | 0.621* | 0.432* | 1 | |||||||||

| USA | 0.625* | 0.433* | 0.998* | 1 | ||||||||

| WBTC | 0.363* | 0.214* | 0.417* | 0.411* | 1 | |||||||

| LINK | 0.319* | 0.197* | 0.376* | 0.373* | 0.714* | 1 | ||||||

| THETA | 0.312* | 0.191* | 0.321* | 0.319* | 0.627* | 0.646* | 1 | |||||

| XTZ | 0.327* | 0.203* | 0.395* | 0.392* | 0.664* | 0.785* | 0.624* | 1 | ||||

| FTM | 0.249* | 0.158* | 0.293* | 0.292* | 0.517* | 0.564* | 0.504* | 0.522* | 1 | |||

| MKR | 0.310* | 0.173* | 0.384* | 0.382* | 0.635* | 0.657* | 0.525* | 0.608* | 0.456* | 1 | ||

| SNX | 0.251* | 0.157* | 0.311* | 0.308* | 0.547* | 0.650* | 0.528* | 0.598* | 0.507* | 0.581* | 1 | |

| BAT | 0.313* | 0.189* | 0.387* | 0.385* | 0.702* | 0.711* | 0.629* | 0.736* | 0.550* | 0.589* | 0.575* | 1 |

- Note: This table reports the correlation between ESG and DeFi assets. MSCI Developed market index excluding US-Developed, MSCI Developing markets index-Emerging, MSCI US ESG leader index-USA and MSCI KLD 400 index-KLD400, Wrapped Bitcoin-WBTC, Chainlink-LINK, Theta Network-THETA, Tezos-XTZ, Fantom-FTM, Maker-MKR, Synthetics-SNX, Basic Attention Token-BAT.

- * Represents significance at 5%.

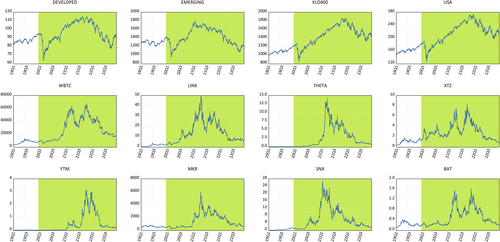

Figure 1 shows the movement of ESG indices and selected DeFi assets, where we have time on x-axis and values on y-axis. The white part of the diagrams is pre-COVID period, and the highlighted period shows the COVID-19 period. All the ESG indices shows sharp decline in the values of all the indices is observed at the beginning of pandemic period. It implies that the incidence of COVID-19 adversely impacted all the ESG indices as a whole. However, the values of all the indices increased from the second quarter of 2020 and a decline is observed in the year 2022. It means that the impact of pandemic on these indices was temporary until the start of Russia-Ukraine conflict. As far as the prices of eight Defi's are concerned, they did not show any abrupt response to the incidence of COVID-19, unlike the ESG indices. It implies that the digital assets markets reacted slowly to the global pandemic. The figures also show an exponential growth in the prices of Defi's token in the year 2021 before declining in the coming year. It shows a flight to these assets in response to COVID-19 and policy uncertainty. The investors believed these assets to be safe heavens in the pandemic. The figures also show that the prices of Defi's at the end of 2022 are almost at the same level at which they were before the incidence of global COVID-19 pandemic. It implies that these Defi's reacted to the pandemic and reverted back to their mean. The price variation in WBTC, LINK, XTZ, FTM and BAT shows collars, but the others do not.

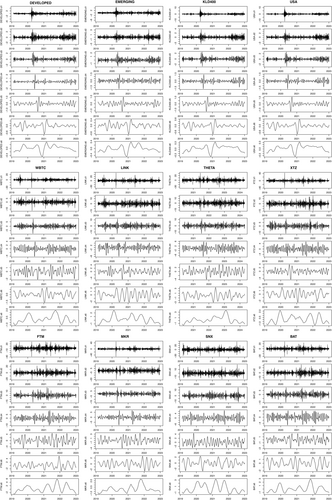

Figure 2 showcases the percentage change for all the above series. The white area of the graph shows the pre-COVID period while the highlighted area shows the COVID-19 period. We observe a large variation in returns during the initial phase of the COVID-19 pandemic. The values show a quiet period afterwards and the values seem to show greater variation, which coincides with Russia-Ukraine war period. Similarly, the return of Defi's also shows lot of variation and the noise of these series is higher than those of ESG indices. It verifies that fact that Defi's are more volatile compared to regular assets. Like the indices' series, the return of these Defi's also shows abrupt change, which coincides with the incidence of COVID-19 pandemic. The later variation in returns also seems to coincide with the second and third global wave of COVID-19. So, the Defi's reaction to the second and third waves of COVID-19 is more pronounced compared with the ESG indices. The newness of this asset class may be a reason for these abrupt changes.

3.2 Wavelet Coherence

Figure 3 shows the wavelet decomposition of all the ESG indices and Defi's. The x-axis of figures shows time and y-axis shows decomposition values. d1-d2 shows the short-term movement in the values of the concerned series, d3-d4 depicts the medium-term movements and d5-d6 shows long-term movements. The ‘s6’ shows the movements in very long-term. It is evident from Figure 3 that the variation in the values of ESG indices is highest in the short-run and it declines in the long run. There is more noise in the short run while the long run is relatively stable. The values for s6 show that all the ESG indices had a dip towards the end of 2020, showing the impact of COVID-19 on all the series. Moreover, it shows that the Defi's had lot of variation in short term, but the series are relatively calm in the long run. A careful analysis of the figures reveals that all the series show an increase in the very long term at the incidence of COVID-19. It implies that the prices of Defi's had a positive response to the incidence of the pandemic. Most of the Defi's also show that the prices of Defi's declined to their lowest at the end of the year 2021. After looking at the variation in price, it is also observable that the prices dropped suddenly from a peak towards to the end of the year 2022. Only looking at the long-term variation in prices once may conclude that Defi's have higher volatility compared with the ESG indices. It is once again obvious from the Figure 3 that Defi's are more responsive to the later waves of COVID-19 and Ukraine-Russia war.

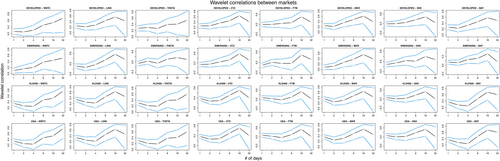

Next, we examine the correlations between the ESG and DeFi using the wavelet correlations, which enable us to investigate the correlation pattern across time. In Figure 4, we have time period in number of days on x-axis, and correlation on y-axis. We document that ESG indices exhibit weak positive correlation with DeFi in the short run. However, in the longer time horizon, correlation increases and on average it remains between 0.20 and 0.60. Thus, we confirm positive co-movement between ESG and DeFi, which is neither too low nor too high.

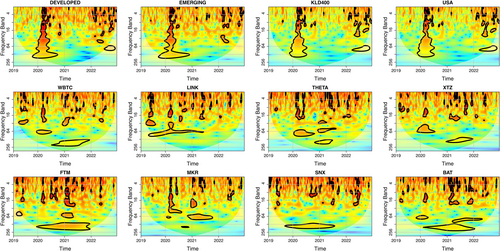

Subsequently, we display the wavelet spectrum in Figure 5. The primary objective of the wavelet spectrum is to emphasise the time and frequency range in which an asset experiences substantial alterations, as indicated by the black outlines. Our results highlight the during 200–400 all ESG indices suffer from significant volatility change, which corresponds to the start of COVID-19. Moreover, its pertinent to mention here is that this volatility change happens at all frequency bands suggesting COVID-19 has both short- and long-term impact on the market similar to Ali, Yousaf, and Umar (2023), Ali, Yousaf, and Vo (2023) and Rubbaniy, Khalid, Rizwan, et al. (2022). However, the main limitation of the wavelet spectrum is that it is univariate and does not provide any information about the relationship between the variables. Therefore, we have employed the wavelet coherence analysis to investigate the ESG-DeFi nexus.

Figure 6 displays the wavelet coherence results for the relationship between ESG index of developed and emerging countries with the selected Defi's. The x-axis shows time while the y-axis depicts frequency. The black contours and the red colour show the significant relationship between the two series. A look at the figure shows that ESG indices of developed countries do not have significant relationship with the selected Defi's in the short-run. However, most of the Defi's seem to have a relationship with ESG indices in the medium to long run. Strong in-phase movements are visible at the beginning of the year 2020 except for SNX, showing that the connectedness between Defi's and ESG index based on data from developed countries increased with the incidence of COVID-19. The direction of arrows from left to right in red areas surrounded by black contours shows the significant positive co-movements between the series. It implies that the increase in ESG is associated with higher price of Defi's. The figures show that for most of the time, there is no relationship between the selected series implying that addition of Defi's to the portfolios may enhance diversification.

The lower section of Figure 6 shows the time frequency-based co-movement between ESG index of emerging economies and the selected Defi's. All the figures show that there exists no relationship between the two series in the very short run. Red areas encircled by the black lines are visible at the medium ranges only, that is, the series only co-move in the medium term. SNX is once again an exception. It does not seem to have any correlation with the ESG index of emerging economies. The in-phase movement is more prominent at the incidence of COVID-19 but for the rest of the time, there seems to be no correlation between the above said series. Therefore, Defi's can be used as a diversifier for the portfolios formulated on the basis of ESG performance of shares.

Figure 6 also presents the relationship between KLD400 and US ESG indices with the eight Defi's tokens. The figure shows the time frequency relationship between above-mentioned series. The results once again show that significant positive relationships existed between the series in the medium to longer term. However, the correlation between the series in the short run is non-existent. Contours in the two areas of the graphs are more visible and they are the times immediately after the incidence of COVID-19 and the Russia-Ukraine war. More noteworthy feature here is that KLD400 and US ESG indices did not only co-move at the incidence of pandemic, rather they also show positive correlation in the Russia-Ukraine ware as well. It implies that extreme events lower the ability of the investors to diversify as the co-movements increase. Another interesting fact is that the SNX also shows significant relationship with the KLD and ESG indices, but it did not show any significant relationship with ESG indices measured for developed and emerging countries. The results of the US ESG index and with Defi's are same as the relationship between KLD400 and Defi's. The reason is that the KLD400 is composed based on top 400 US companies and the US index is based on 1200 companies.

For investors seeking to optimise their portfolio strategies by incorporating Defi's, our findings carry valuable policy implications. The wavelet coherence analysis reveals that Defi's exhibit a significant connection with ESG indices of developed countries in the medium to long term, particularly during the COVID-19 period. This suggests that investors with exposure to ESG-focused portfolios may consider integrating Defi's for potential diversification benefits and risk mitigation. On the other hand, in the short run, ESG indices of both developed and emerging countries appear to have limited correlation with the selected Defi's. Therefore, for investors looking for short-term diversification, Defi's may not be as effective. These results contradict the findings from Anwer et al. (2023) who find that except the contagion during crisis period, environmentally sustainable assets remain detached from cryptocurrency indices. This underscores the importance of understanding the time-frame and specific objectives when incorporating Defi's into ESG-based portfolios. Overall, our study suggests that Defi's can serve as a diversifier in portfolios rooted in ESG indices, providing investors with potential risk management benefits and enhancing portfolio performance, particularly in the medium to long term. This result aligns with Patel, Gubareva, and Chishti (2024) who argue that investors can consider cryptocurrency environment attention index (ICEA) to their investment portfolio consisting of green crypto, energy crypto and green financial assets for diversification and hedging purposes. Moreover, our findings align with previous empirical findings including and Kamal and Hassan (2022) who find that ICEA have positive connectedness with green assets and Hassan et al. (2022) who reveal that environment related-stocks are weakly linked to ICEA and also influenced by market conditions on time-to-time Additionally, the observation that during the COVID-19 pandemic, there was a notable increase in the connectedness between Defi's and ESG indices of developed countries, implies that these financial instruments could potentially act as effective hedging tools during periods of market uncertainty, offering investors an avenue for risk reduction within their portfolios which support previous finding from Anwer et al. (2023) who argue that environmentally sustainable assets significantly comove with cryptocurrency indices during the pandemic, underscoring that both the asset classes may serve as effective hedge against each other. Further, our finding adds to Naeem and Karim (2021), who reveal that green assets are valuable hedge to Bitcoin. Our results also align with Ren and Lucey (2022) who argue that clean energy may serve as good save haven for dirty cryptocurrencies as compared with clean cryptocurrencies during periods of increased uncertainty.

3.3 Robustness Analysis

For robustness purpose, we estimated the baseline model by changing the significance level to 10% and further divide the sample into pre COVID-19 and COVID-19 period, reported in Figures 7 and 8. Figure 7 shows the wavelet coherence analysis results for ESG indices and Defi's in the pre-COVID period. Figure shows that there was no correlation between the ESG indices and Defi's because most of the area in the cones is either blue or do not have black contours. One can hardly see regions of significant relationship in the cone, which suggests that Defi's has the diversification benefit for the portfolio of ESG focused stocks. Figure 8 describes the wavelet coherence results for the COVID-19 period. In most of the figures, there exists a strong relationship between ESG indices and Defi's in the medium term and at the very beginning of the COVID-19 period. Most of the figures also show black contours which coincide with Russia-Ukraine war. Other than these regions, Defi's seems to be an excellent opportunity for investors to diversify in the medium to long term.

3.4 Portfolio Analysis

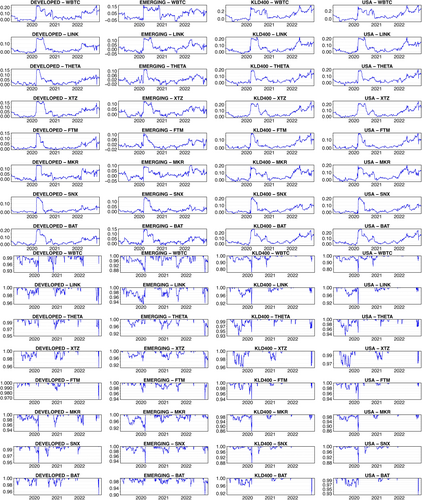

As far as the portfolio optimal weights and hedge ratios are concerned, they are provided in Table 3. Portfolio weights are given for complete sample and for pre COVID-19 and during COVID-19 period. The optimal weight of the full sample for ESG index of developed markets and Defi's is 0.999, which suggests that 99.9% of the investment should be done in stocks from developed markets and 0.01% of the investment should go for Defi's. Moreover, the weight during COVID-19 is higher than that of pre COVID-19, signifying that investors should lower their investment in DeFi during period of high uncertainty. This pattern is similar across other ESG markets as well.

| Optimal weight | Optimal hedge ratio | |||||

|---|---|---|---|---|---|---|

| Full sample | Pre COVID-19 | COVID-19 | Full sample | Pre COVID-19 | COVID-19 | |

| Developed/WBTC | 0.992 | 0.984 | 0.995 | 0.065 | −0.003 | 0.087 |

| Developed/LINK | 0.997 | 0.992 | 0.998 | 0.038 | −0.001 | 0.051 |

| Developed/THETA | 0.997 | 0.995 | 0.998 | 0.034 | 0.008 | 0.043 |

| Developed/XTZ | 0.997 | 0.992 | 0.999 | 0.041 | 0.001 | 0.054 |

| Developed/FTM | 0.999 | 0.999 | 0.999 | 0.028 | 0.007 | 0.035 |

| Developed/MKR | 0.995 | 0.989 | 0.997 | 0.032 | −0.001 | 0.044 |

| Developed/SNX | 0.998 | 0.998 | 0.998 | 0.028 | 0.003 | 0.035 |

| Developed/BAT | 0.997 | 0.993 | 0.998 | 0.045 | 0.006 | 0.057 |

| Emerging/WBTC | 0.976 | 0.971 | 0.980 | 0.041 | −0.007 | 0.058 |

| Emerging/LINK | 0.988 | 0.975 | 0.993 | 0.023 | −0.015 | 0.035 |

| Emerging/THETA | 0.991 | 0.990 | 0.992 | 0.020 | 0.008 | 0.026 |

| Emerging/XTZ | 0.989 | 0.987 | 0.992 | 0.026 | 0.003 | 0.035 |

| Emerging/FTM | 0.996 | 0.999 | 0.996 | 0.020 | 0.012 | 0.024 |

| Emerging/MKR | 0.987 | 0.978 | 0.991 | 0.020 | −0.004 | 0.029 |

| Emerging/SNX | 0.995 | 0.992 | 0.996 | 0.019 | −0.001 | 0.025 |

| Emerging/BAT | 0.991 | 0.989 | 0.993 | 0.030 | 0.010 | 0.037 |

| KLD400/WBTC | 0.982 | 0.962 | 0.989 | 0.105 | −0.011 | 0.142 |

| KLD400/LINK | 0.995 | 0.985 | 0.998 | 0.061 | 0.000 | 0.080 |

| KLD400/THETA | 0.994 | 0.982 | 0.998 | 0.048 | 0.000 | 0.065 |

| KLD400/XTZ | 0.996 | 0.988 | 0.999 | 0.068 | 0.009 | 0.087 |

| KLD400/FTM | 0.998 | 0.995 | 0.999 | 0.044 | 0.007 | 0.056 |

| KLD400/MKR | 0.992 | 0.978 | 0.997 | 0.059 | 0.001 | 0.078 |

| KLD400/SNX | 0.996 | 0.994 | 0.997 | 0.042 | 0.002 | 0.055 |

| KLD400/BAT | 0.996 | 0.984 | 0.999 | 0.072 | 0.007 | 0.093 |

| USA/WBTC | 0.982 | 0.962 | 0.989 | 0.100 | −0.013 | 0.136 |

| USA/LINK | 0.995 | 0.985 | 0.998 | 0.059 | −0.001 | 0.078 |

| USA/THETA | 0.994 | 0.982 | 0.999 | 0.047 | 0.000 | 0.063 |

| USA/XTZ | 0.996 | 0.988 | 0.999 | 0.066 | 0.008 | 0.084 |

| USA/FTM | 0.998 | 0.995 | 0.999 | 0.042 | 0.006 | 0.055 |

| USA/MKR | 0.993 | 0.978 | 0.998 | 0.057 | 0.000 | 0.076 |

| USA/SNX | 0.996 | 0.994 | 0.998 | 0.041 | 0.002 | 0.053 |

| USA/BAT | 0.996 | 0.985 | 0.999 | 0.070 | 0.006 | 0.091 |

- Note: This table reports the optimal weight and hedge ratio for the pair of ESG and DeFi asset for full sample (30 January 2019 to 21 December 2022), Pre COVID-19 (30 January 2019 to 31 December 2019) and COVID-19 (1 January 2020 to 21 December 2022). MSCI Developed market index excluding US-Developed, MSCI Developing markets index-Emerging, MSCI US ESG leader index-USA and MSCI KLD 400 index-KLD400, Wrapped Bitcoin-WBTC, Chainlink-LINK, Theta Network-THETA, Tezos-XTZ, Fantom-FTM, Maker-MKR, Synthetics-SNX, Basic Attention Token-BAT.

The average optimal hedge ratio for ESG indices based on developed markets and Defi's is 0.0425, which indicates that the $1 long position in ESG indices based on developed markets can be hedged with the 4.25% short position in Defi's. Comparison of the hedge ratio for the above pairs in pre COVID-19 and during COVID-19 period highlight that the hedge ratio is higher during COVID-19, suggesting hedging through DeFi is expensive.

Moreover, the results of dynamic analysis of portfolio weights are presented in Figure 9, which suggests that investors should continuously balance their portfolio to get higher risk adjusted returns. Time varying hedge ratios are given in Figure 9. All the pairs of ESG-based indices and Defi's show an abrupt increase in hedge ratios at the first quarter of 2020. It implies that hedging ESG-based investment with Defi's was expensive at the occurrence of COVID-19. Overall, the time-varying hedge ratios are higher during the COVID crisis, showing the higher hedging cost during a crisis.

4 Conclusion

Given the ongoing development and progress of the green monetary framework around the world, investors and stockholders are becoming more interested in the ESG indices markets. Few research has examined the interconnection of ESG indices with other financial assets but none of the previous studies have examined the linkage between ESG stocks and new digital asset classes. The rapid emergence and growth of the DeFi assets market has lead researchers and academic to examine the utility of such assets and the profits they can bring when add to investors' portfolios. In this context, the main objective of this study is to investigate the connection between the ESG indices and a large set of DeFi assets and to test the impact the COVID-19 outbreak in the linkages between these assets. Then, we try to examine the portfolio implications by computing the static and time varying optimal weights and hedge ratio for the pre- and post-crisis periods. Such analysis permits us to test the hedging and diversifying proprieties of these new digital assets during normal and crisis periods and help investors to build more efficient asset-allocation and hedging strategies. For this purpose, we apply the wavelet coherence analysis to examine how connection between ESG indices and DeFi assets varies over time and across scales. In addition, we use the TVP-VAR models to compute the optimal weights and hedging ratios.

Results from the continuous wavelet transformation and the wavelet coherence transformation can be summarised as follow: first, we did not find any significant connections between ESG indices and different DeFi assets considered at short term, while moving to medium and long term horizons we can register significant relationship between these assets which implies that investors my gain diversification profits when adding DeFi assets to their ESG indices portfolios only for short-term horizon investment. Second, with the onset of the COVID-19 we register a significant positive relationship between ESG indices and DeFi assets for medium to long-term horizons. Moreover, we find that during the pre-COVID period ESG indices and DeFi assets are not connected, while during the COVID-19 period linkage between these assets strengthened remarkably at medium-term horizon and at early-stage of the pandemic. These findings underscore that DeFi assets may act as accurate diversifiers when add to ESG indices portfolio during calm period, but at extreme events such as COVID-19 and the Russia-Ukraine war the diversifications potential of DeFi assets reduces significantly.

Results from portfolio implication analysis show that investors should allocate most of their investment in ESG indices and a little part in DeFi assets. Specifically, results for the pre- and post-COVID period show that weights increased slightly during the post-COVID-19 period suggesting that ESG stocks offer better hedging during this period. From the time-varying optimal weights analysis, we find that investment in DeFi assets at the COVID-period and its following waves is more profitable. Otherwise, during a tranquil period (the pre- and post-COVID periods) profits from investment in ESG stocks are greater. Finally, the results from static and dynamic hedging ratios analysis reveal that hedging cost of ESG stocks-based investment with DeFi assets increased significantly during the onset at the COVID-19 pandemic.

Findings from this study have several implications for investors, risk managers and decision makers. The findings suggest that investments in ESG indices and DeFi assets can provide diversification benefits, which could incentivise more investments in environmentally sustainable companies and projects. As investors allocate more capital towards ESG-compliant assets, companies may be motivated to adopt greener practices to attract investment, contributing to mitigating climate change. Moreover, Adding DeFi assets to ESG portfolios can boost profits during normal periods and short-term investments, while during market distress, it can hedge investments and reduce market risk exposure. Further, the superiority of ESG assets in term of profits during normal periods and for different investment horizons will probably attract investors, regulators and market regulators to increase their investment in such assets which well in turn strengthen social and environmental profits for society and generate new avenues to mitigate losses and generate profits during period of market distress. Thus, information about ESG assets may be useful for government and policymakers to efficiently monitor markets anticipations. Policymakers could leverage these insights to promote sustainable finance and facilitate the transition towards a low-carbon economy. Finally, recently green finance and sustainable development are becoming key challenges for companies and government. In this context, companies need to identify, assess and convey ESG practices to reinforce stockholders' relationship. Overall, finding from our study provide new insights for companies, investors, risk managers and policymakers regarding portfolio diversification, hedging and assets-allocation during normal and crisis period and considering different investment horizons.

Conflicts of Interest

The authors declare no conflicts of interest.

Endnotes

Open Research

Data Availability Statement

The data that support the findings of this study are available on request from the corresponding author. The data are not publicly available due to privacy or ethical restrictions.