Connectedness Structure and Volatility Dynamics Between BRICS Markets and International Volatility Indices: An Investigation

ABSTRACT

This research aims to explore and understand the dynamic nature of volatility connectedness between BRICS stock markets and various asset price implied volatility indices through a TVP-VAR broadened connectedness approach. Results display nontrivial dynamic connectedness in the BRICS stock markets and uncertainties in different markets during the period 31 March 2019–31 August 2023. They also report heterogeneous patterns in the connectedness between stock indices and volatility indices. The time-varying spillover effect seems to be strong during the black-swan events. The variations of volatility connectedness among each volatility index and stock market increasingly depend on unusual stress caused by the outbreak of unexpected events. These finding provide significant guidance for investors seeking to enhance their risk management practices. By leveraging the insights into volatility transmission mechanisms and the roles of different volatility indices, investors can make informed decisions to protect and grow their investments in an increasingly volatile global market.

1 Introduction

In recent years, the phenomena of financial market uncertainty, cryptocurrency fluctuations, and commodity price volatility, along with successive crises, drew the attention of several researchers to understand the impact of such phenomena on traditional market fundamentals, for example, Bouri et al. (2021), Fang et al. (2022), Ghorbel, Loukil, and Bahloul (2022), Ren and Lucey (2022), Salisu and Ogbonna (2022), Mensi et al. (2023), Yousaf, Patel, and Yaroyaya (2022). In this regard, some studies focus on dynamic connectedness and the spillover effect between cryptocurrency volatility, oil and gold price variability, and stock market behaviour. They generally report that the spillover effect has intensified, and the risk transmission mechanisms have grown more intricate due to global financial interconnectedness and extreme market conditions, as indicated in studies by Mensi, Hammoudeh, and Kang (2017), Su (2020), Zhu et al. (2022), and Jin et al. (2023). By leafing through the literature on financial contagion, one might report the existence of two main types of spillover effects. Indeed, some studies investigate the spillover risk effect in different financial markets for a particular economy (e.g., Bhuiyan, Husain, and Zhang 2021; Jiang et al. 2022) while others focus on the spillover risk effect within specific financial markets across various economies and/or regions, as exemplified in the works of Alonso Gadi and Sicilia (2022) and Wang et al. (2023).

In this context, the occurrence of extraordinary events has interestingly rekindled interest in analysing the interdependence framework of various asset classes as portfolio managers and investors are concerned about the magnitude and the sense of net return spillover contributions by different asset types in their portfolios. The Russia-Ukraine conflict provokes a raise in the volatility risk of commodity markets, surges in uncertainty and risk aversion (Fang and Shao 2022), and currency depreciations in several emerging markets (Umar, Riaz, and Yousaf 2022). The health crisis has increased the instability in capital markets, as noted by Baker et al. (2020).

In such circumstances, commodities have appeared to be an interesting investment asset and constituent of asset allocations for portfolio managers and investors (Jain and Biswal 2016). That is why several researchers have sweepingly investigated the dynamic cross-linkages of oil and gold along with their diversification advantages (e.g., Kang et al. 2019; Mensi et al. 2021). In particular, some empirical findings have shown that gold seems to be a haven and hedge for many G7 stock indices (e.g., Gökgöz et al. 2024; Fakhfekh, Jeribi, and Ben Salem 2021; Shahzad et al. 2020). Nonetheless, studies analyzing the linkages across global commodities indices and emerging stock markets and global commodities indices remain under-explored (Singh et al. 2018). In this context, the BRICS region has undoubtedly experienced the spillover effect on the stock market, especially during the COVID-19 crisis period. The health crisis produced very high risks that exceeded the financial crisis level. The oil and gold market crash during such period has strongly affected the BRICS stock markets which reduced the Nikkei price to a very low level compared to 30 previous years. Various recent research indicates the amplifier influence of oil and gold volatilities on BRICS stock market volatility (e.g., Karim, Chowdhury, and Masih 2022; Khalfaoui, Hammoudeh, and Rehman 2023). Cryptocurrencies are also not hidden by the financial upheaval affected by the COVID-19 pandemic and the war between Russia and Ukraine. Major cryptocurrencies, especially Bitcoin, have dropped to their lowest level during the COVID-19 crisis, Fakhfekh, Jeribi, and Ben Salem 2021, Karagiannopoulou et al. 2023).

In this context, apprehending the connectedness network across financial market volatility and the flow of information transmission among markets seems to be a substantial source of information for investors and policymakers. That is why many researchers have investigated uncertainties and stock markets using different volatility indices. For instance, Lu et al. (2020) display that OVX (CBOE Crude Oil Volatility Index) is characterised by predictive information for oil realised volatility and that regime switching could provide valuable insights for addressing structural breaks in the oil market. Niu, Ma, and Zhang (2022) examine whether various measures of certainty contribute additional information for forecasting the OVX. They present uncertainty measures that are potentially useful in predicting oil volatility within a high-frequency analytical framework. Li (2022) investigate the cross-correlations between volatility indices and oil. Their findings highlight the anti-persistent nature of cross-correlations between these markets. They demonstrate that, in the short term, volatility indices and oil prices move in a positive (respectively reverse) direction. In contrast, in the long term, this relationship reverses. Li (2022) analyzes the relationships between the equity-oil volatility indices using OVX and VIX (CBOE Volatility Index). They find a long-term relationship between VIX and OVX. Long et al. (2022) investigate the connectedness among green bonds in China, Europe, and the United States and uncertainty. They report that the spillover effect during turbulent market periods is substantially greater than during normal ones. Bossman et al. (2023) explore the asymmetric interactions among EU stock markets (sectoral stocks) and market sentiment, WTI (crude oil), OVX, and GPR (Geopolitical Risk) during tremendous times of geopolitical unrest. They particularly use VIX, OVX, and GPR as three sentiment-driven indices. They show that stock markets are influenced asymmetrically by GPR, OVX, WTI, and VIX. They also display that VIX and OVX provide certain safe-haven and hedging features for EU stocks. Antonakakis et al. (2023) study the dynamic relationships across OVX and asset classes (stock markets, energy commodities, exchange rates, bond markets, and precious metals) They indicate that connectedness among oil price implied volatilities and different asset classes seems to change over time at very high levels. Al-Nassar et al. (2023) delve into the potential hedging and safe-haven characteristics of oil, Bitcoin, gold, and OVX against the risks associated with the Saudi stock market's sectors during the crisis periods. Their research reveals that OVX and gold act as effective hedging tools and can be considered limited safe-haven assets during the initial phase of the Coronavirus crisis.

The BRICS region is particularly central to global economic events such as COVID-19 and the war between Russia and Ukraine. The COVID-19 originated in China and extended worldwide. Russia is a direct party to the conflict. Additionally, BRICS countries, being emerging market economies, are more volatility to global shocks virsus to developed economies. Emerging markets are impacted by global risks originating in developed market economies (Gökgöz and Kandemir 2023, 14). Consequently, they are expected to be more impacted by global economic shocks. This necessitates that investors in BRICS countries construct more dynamic and highly diversified portfolios to mitigate risk. For these reasons, we focus on the BRICS countries for observation. Volatility indices present as crucial factors of market vulnerability, providing insights into market sensitivities to the global economy and aiding in optimal portfolio management (Gökgöz, Arifoğlu, and Kandemir 2024). Furthermore, global economic events like COVID-19 and the war between Russia and Ukraine have impacted commodities, cryptocurrencies, and other financial markets alongside stock indices. During these periods, the oil, cryptocurrency, and other commodity markets exhibited particularly high volatility levels. In this context, examining the relationships between the BRICS markets, both internally and with volatility indices, offers investors and portfolio managers significant insights. Additionally, using a dynamic model provides more consistent results in understanding the effect of global economic events and the subsequent changes. Therefore, we employ the TVP-VAR speeded joint connectedness model.

Based on this crux, this study investigates the TVP-VAR speeded joint connectedness framework to more effectively analyze volatility spillover effects and dynamic connectedness between uncertainties in the stock, oil, gold, exchange rates, and cryptocurrency markets and the stock markets in the BRICS region during the period from April 2019 to September 2023. In other words, we attempt to provide a thorough and all-encompassing analysis of the transmission mechanisms for cross-market volatility shocks and cross-country within the BRICS region. We also try to understand such issues during the outbreak of black-swan. Uncertainty surrounding the outbreak of unforeseen and significant events poses substantial challenges for investors and policymakers who are worried about the possibility of information transmission among different markets and could spill over into real economic sectors. So, a profound apprehending of the dynamic features of risk spillovers among different markets remains substantial for portfolio diversification and risk management.

Our paper makes different main contributions to the ongoing literature: First, this paper is the first to compare and analyze the dynamic spillover effect of gold price volatility, cryptocurrency volatility, and oil volatility on the fluctuation of BRICS stock markets. We analyze these three major indicators simultaneously, which complete the existing gaps in the recent literature. Second, we use a dynamic spillover model that allows us to take into account all future asymmetric and nonlinear features of BRICS stock markets and global financial volatility. It is necessary to understand in more detail the volatility in extreme market conditions. Third, we employ the spillover network to investigate the dynamic progression of risk spillover at the upper and lower extremes, as well as the connectedness among various volatility indices. Our empirical findings give helpful guidance for policymakers and investors in making informed investment decisions and establishing market regulations, respectively. Lastly, our study provides insightful information concerning the cross-market volatility transmission channels, identifying which market has the highest effect on the BRICS stock markets.

This study is organised as follows: Section 2 examines the latest research on the spillover impact on the BRICS stock markets and the volatility of gold, oil, stock markets, and currencies. Section 3 is dedicated to outlining the model specification, whereas Section 4 details the data's descriptive statistics. Estimation results are provided in Section 5. The paper concludes in the final section.

2 Literature Review

This literature review seeks to synthesize existing research on the connectivity dynamics and interconnectedness between the BRICS markets (Brazil, Russia, India, China and South Africa) and international volatility indices. By examining the transmission mechanisms of volatility, the role of major recent crises, and the methodological approaches employed in previous studies, this review aims to offer a thorough understanding of the current state of knowledge in this field.

Examining connectedness and volatility dynamics in financial markets has been a significant area of study in international finance, with particular interest in understanding how these dynamics manifest in developed and developing economies. Previous research has focused on the BRICS markets due to their substantial economic growth and increasing integration into the global financial system. Studies have shown that BRICS markets exhibit unique patterns of connectedness and volatility transmission. For instance, Diebold and Yilmaz (2009, 2012) developed measures of volatility spillovers and demonstrated that BRICS markets are highly interconnected, with significant volatility spillovers occurring between them. Expanding this analysis to include other developing economies could provide a richer understanding of whether these observed patterns are unique to BRICS markets or prevalent in other regions as well. Emerging markets in Latin America, Southeast Asia, and Africa, for example, could exhibit different or similar volatility and connectedness characteristics. Research by Dungey et al. (2005) and Beirne et al. (2013) highlights that while emerging markets share some common features with BRICS in terms of volatility transmission, regional factors and levels of market development can lead to distinctive patterns.

Several recent studies have concentrated on the connectedness between BRICS countries and the volatility indices. Some of them have particularly investigated the volatility spillover effect of BRICS stock markets (e.g., Panda and Thiripalraju 2018; Ji et al. 2020; Su 2020; Shi 2021; Nyakurukwa and Seetharam 2023) while others have analyzed interdependencies between energy commodities volatility, cryptocurrency volatility, and BRICS markets (e.g., Zhu et al. 2022; Khalfaoui, Hammoudeh, and Rehman 2023; Wang, Huang, and Zhang 2023). To explore the connection between the stock and oil market volatility during the COVID-19 pandemic, Jin et al. (2023) find the time-varying spillover effect between oil shocks and the BRICS stock market. They demonstrate that different market reactions function to shock types in the oil market. Particularly, the Russian stock market and oil show the most pronounced risk spillovers across all time scales, whereas Chinese stock markets and oil display the least intense risk spillovers. Using a quantile connectedness method, Chang et al. (2023) reveal that the spillover impact of oil price shock and BRICS economies is events-dependent, that is, it is stronger during crisis periods and weaker in the normal period.

Other researchers have rather concentrated on the role of cryptocurrency volatility in BRICS countries and how safe-haven assets can affect BRICS market volatility. For instance, Bouri et al. (2017) use a quantiles approach to decompose the Bitcoin returns in various horizons and thus analyze how Bitcoin can be a hedge asset during the crisis period. They found that Bitcoin reacts positively to shock at the lower and upper level of the quantiles bound, and thus, it is a hedge asset against shock. This result was explored by Alonso Gadi and Sicilia (2022). Using a daily return of 24 cryptocurrencies from January 2018 to September 2022, Alonso Gadi and Sicilia (2022) analyze the versifier properties, safe-haven, and hedge of all main financial assets index in BRICS and G7 economies before and after the COVID-19 crisis. They found that gold lost its property as a hedge asset and S&P 500 and DXY (US Dollar Index) are the most hedging assets in the coronavirus period. They also show China and Russia stopped depending on hedge financial assets and Bitcoin propriety largely changed after the health crisis.

BRICS are often more susceptible to global shocks due to their relatively less mature financial systems and greater exposure to external economic conditions. Several studies have shown that global factors, such as commodities prices and cryptocurrency volatilities, significantly impact BRICS economies, see for instance Kalsie, Dhamija, and Arora (2020), Rikhotso and Simo-Kengne (2022), Kocaarslan et al. (2019). Traditional econometric models, such as vector autoregressions (VAR) and cointegration techniques, have been extensively used to study the connectedness between global factors volatility and BRICS stock markets. However, these models often assume linear relationships and may not fully capture the complexities of financial markets. Using the wavelet approach, Bhuiyan, Husain, and Zhang (2021) show a neutral dependence between the volatility of Bitcoin, global commodity indices, and crude oil during the period July 2014–November 2019. They also show a significant bidirectional causality among DXY, Bitcoin, and gold. The superiority of Bitcoin compared to commodities and other financial assets proves Bitcoin could provide a diversification return to investors. In the same line, Moratis (2021) shows that Bitcoin is the largest contributed crypto to the spillover risk effect but its size is not the only determinant compared to other cryptocurrencies. Based on a dynamic Bayesian Vector Autoregressive model, they analyze the pairwise directional effect of the spillover risk and prove that investors should take into consideration the specific features and behaviour of cryptocurrency. For example, they found that Ripple is a net receiver of risks during the crisis period while Bitcoin is less risk-receiving. These results were also confirmed by Ji et al. (2019) and Bouri, Gupta, and Roubaud (2019). However, on the grounds of a daily database of various important cryptocurrencies and key stock indexes, Jiang et al. (2022) revisit this conclusion at different quantiles and frequencies. They show that cryptocurrencies, especially Bitcoin, do not constitute a solid safe hedge against the uncertainty of stock markets. Particularly, they find a positive and significant and positive interaction between Bitcoin and shocks. Using the QARDL model, Wang and You (2023) demonstrate that the impacts of gold returns and stock market vulnerability are more pronounced in the long run. Specifically, a decrease in global stock market volatility is associated with higher BRICS stock prices, highlighting the stabilising effect of reduced uncertainty on these markets. Additionally, gold returns show upward co-movement compared to BRICS stock markets, reflecting gold's role as a safe-haven equities.

Moreover, recent studies have explored the spillover effects among equity asset classes, commodities, and BRICS stock markets to understand the various transmission channels during normal and crisis periods. Qiang, Bouri, and Roubaud (2018) analyzed the dynamic spillover effect and information transmission between US equities, strategic commodities, and the BRICS stock market by integrating the graph theory approach and the dynamic conditional correlation model. They found that the structure of the information transmission network is unstable and evolves over different periods. The impact varies depending on the event period, with some events affecting only local markets and others having a global influence. A notable finding of this study is that while events can alter the degree of co-movement among markets, their impact on the overall integration structure of market volatilities is limited. Similarly, Iqbal et al. (2024) examined volatility spillovers across several equity markets and asset classes from March 16, 2011 to November 10, 2020, during both normal and crisis periods. This study encompassed 12 volatility indices, including global equities, strategic commodities, and the US Treasury bond market. It found that the identity of transmitters and receivers of spillover risks differs between normal and crisis period. During normal periods, the stock market of the US is the central transmitter of shocks, consistent with its prominent role in the global financial system. However, in the crisis period, the Chinese stock markets and some commodities emerge as significant transmitters, highlighting the shifting dynamics under stress conditions. These analyses highlight the dynamic interactions and volatility transmission mechanisms that operate under varying economic scenarios, offering a comprehensive view of how these markets are interconnected. To draw generalised conclusions, Bouri et al. (2024) examine the impact of three major global risk factors on the prices and volatility of stock indices, commodity markets, and the movement of green bond markets. They present three key findings: (i) Risk spillovers mainly occur in the centre of the distribution, with no evidence of down-to-down risk spillovers. (ii) The crude oil volatility crisis affects both the upside and downside risks of asset returns, while the other two crises have different effects on green bond and Islamic stock indices. (iii) Asset prices tend to transmit with global risk indices in the short period but disconnect over longer horizons.

In light of the increase in gold price fluctuation in the world economy, various studies analyze the asymmetric volatility spillovers of gold volatility in BRICS economies. For instance, Chen, Xu, and Hu (2022) examined the interaction between gold price volatility and BRICS stock market volatility during the period of August 2005 until March 2020. They find unstable and an asymmetry spillover effect between the BRICS financial market and Gold price volatility. Notably, the empirical results show that the gold market is a net receiver of shock in Brazil, India, and China. However, South Africa has a weak spillover effect with gold price fluctuations. Wang and You (2023), analyze the long and short-frequency impacts of gold price variation and global factor variation on the BRISC economies using the QARDL (Quantile Autoregressive Distributed Lags) model. They demonstrate an important impacts between gold price variation and BRICS financial market fluctuations. This effect is more important in the long term. Particularly, they demonstrate upward co-movement between gold price volatility and the BRICS stock market under extreme market conditions. They also indicate that irrational variables such as investor sentiment, macro-policy uncertainty, and financial tension, play an important role in BRICS market volatility.

Various econometric methodologies have been applied to analyze the BRICS financial market volatility and the spillover effects. The static and dynamic analysis was concentrated on multivariate GARCH models (e.g., Mensi, Hammoudeh, and Kang 2017; Mir and Bhutta 2014; Panda, Ahmad, and Thiripalraju 2023), VAR models (e.g., Agyei et al. 2022; Chatziantoniou, Gabauer, and Marfatia 2022), Copula Models (e.g., Jin et al. 2023; Jiang et al. 2022), and static quantile models (e.g., Kocaarslan et al. 2017; Miled et al. 2021; Jin et al. 2023; Jiang et al. 2022). Nevertheless, these models do not examine the dynamic spillover of financial indices volatility, which has strongly affected world markets since the subprime crisis. The research of Diebold and Yilmaz (2012, 2014) is the seminal one that introduced the dynamic connectedness index. More recently, various studies have endeavoured to enhance this research from diverse perspectives. A particular improvement is represented by introducing the time-varying approach into the spillover index. This approach allows a nuanced and detailed examination of spillover effects volatility in interconnected financial systems. It plays a crucial role in enhancing our comprehension of how transmission channels operate within the financial system (Nyakurukwa and Seetharam 2023). Table A1 reports some studies which analyze the connectedness between different asset classes.

3 Methodology

The framework of the connectedness model formulated by Diebold and Yilmaz (2009, 2012, 2014) has recently attained significant recognition, being widely utilised in academic research. Such an approach could help to elucidate the effects of a shock within a given variable within a network on the forecast error variances of other variables and their ensuing responses within the overarching network of connectedness (Balcilar, Gabauer, and Umar 2021). Thus, it effectively discerns the directionality and intensity of connections that prevail among variables constituting the network of connectedness.

Nevertheless, the connectedness approach has some issues such as suboptimal normalisation of connectedness and the rolling window size (Guo and Tanaka 2022). That is why the TVP-VAR model of Antonakakis, Chatziantoniou, and Gabauer (2020) addresses these concerns by extending Diebold and Yilmaz's (2014) connectivity model. Such an approach uses the Kalman filter estimated with forgetting factors developed by Koop and Korobilis (2014). As estimated by Koop and Korobilis (2014), the Kalman filter is designed to accommodate stochastic volatility in variances. Consequently, it mitigates the risk of information loss concerning irregular or smoothed parameters. This allows the TVP-VAR model to scrutinise dynamic spilover, even within datasets with lower temporal frequencies and constrained temporal extents (Antonakakis, Chatziantoniou, and Gabauer 2020; Arifoğlu, Gökgöz, and Kandemir 2023).

Moreover, the model can non-parametrically model time-varying relationships by permitting parameter changes in conditional variance and mean within a Bayesian model averaging (BMA) framework (Hauzenberger et al. 2022). Bayesian inference derives posterior probabilities for all regressors and models considered, averaging information obtained from the entire model space. Consequently, this method explicitly identifies robust regressors and addresses model uncertainty, reducing the risk of inference from potentially misspecified and subjectively selected models. In this context, BMA is a model selection method that enables isolating indices with a significant impact on market connectedness measures (Szafranek, Rubaszek, and Uddin 2023). This approach also contributes to high predictive performance for high-dimensional datasets (Chan 2023). With these advantages, the TVP-VAR model is an effective and widely used model for revealing the time-varying effects of relationships among financial assets (Baykut and Gökgöz 2024).

In our case, the suitability of the TVP-VAR model arises from the temporal scope of our dataset, spanning from April 2019 to September 2023. This window encompasses a tumultuous period punctuated by an array of global economic, health, and political shocks, such as the United States and China trade dispute, the unfolding of the COVID-19 pandemic alongside its various evolutions, such as new viral strains and vaccination drives, the Ukraine-Russia conflict, and the insolvency of Silicon Valley Bank. In light of these seismic events, the dynamic analysis approach becomes indispensable for discerning the reverberations of global shocks upon the interconnectedness between the BRICS country stock indices and volatility indices.

In the ensuing sections, we shall utilise the TVP-VAR broadened by the connectedness context to probe the interrelations between BRICS country stock indices and volatility indices. As recommended by Balcilar, Gabauer, and Umar (2021), this model amalgamates facets of the methodologies introduced by Diebold and Yilmaz (2014), Antonakakis, Chatziantoniou, and Gabauer (2020), and Lastrapes and Wiesen (2021). Notably, the TVP-VAR speeded with the connectivity enhances connectedness metrics by applying the ‘normalisation technique’ delineated developed by Lastrapes and Wiesen (2021) and additionally factoring in the inter-variable cross-correlations (Ha, Thanh, and Linh 2022; Cagli, Mandaci, and Taskin 2023).

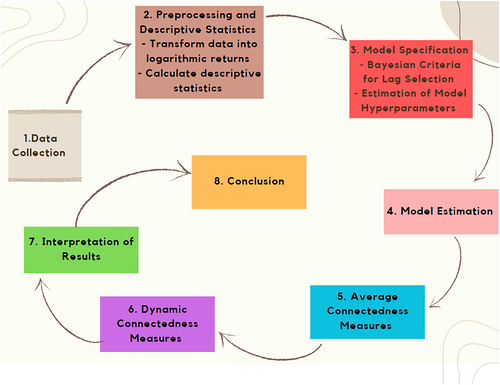

In Appendix A, we provide a flowchart (Figure 9) summarising the econometric procedure and visually representing the steps involved in the model estimation process. The first step in the econometric procedure outlined in our study is ‘data collection’ followed by ‘preprocessing and descriptive statistics’. The subsequent steps include ‘model specification’, ‘model estimation’, ‘average connectedness measures’, ‘dynamic connectedness measures’, ‘interpretation of results’, and finally, ‘conclusion’.

4 Data and Descriptive Statistics

In this study, we utilise daily data encompassing the stock market indices of BRICS markets in conjunction with various volatility indices, including the VIX, OVX, GVZ, EVX, and CVI. The dataset spans from 31 March 2019 2 to 31 August 2023. Data procurement was conducted via “investing.com,” a crucial preprocessing step involved converting the data into a daily return series. The comprehensive description and utilisation of the data used in this paper are concisely delineated in Table 1.

| Series | Definitions |

|---|---|

| SSEC | Shanghai Composite Index (China) |

| RTSI | Russian Trading System (Russia) |

| BVSP | Sao Paulo Stock Exchange (Brazil) |

| BSES | S&P BSE Sensex (India) |

| JTOPI | FTSE/JSE Top 40 Index (South Africa) |

| VIX | CBOE Volatility index |

| OVX | CBOE Oil Volatility Index |

| GVZ | CBOE Gold Volatility Index |

| EVZ | Euro Currency Volatility Index |

| CVI | Crypto Volatility Index |

Before examining the dynamic and mean volatility spillover relationship between the stock market indices of BRICS countries and volatility indices using a TVP-VAR extended joint connectedness model, it is crucial to analyze the distributional properties of the time-varying series data. Therefore, the descriptive statistics related to the return series are depicted in Table 2.

| Mean | Median | Maximum | Minimum | SD | Skewness | Kurtosis | JB | ADF | |

|---|---|---|---|---|---|---|---|---|---|

| SSEC | 4.06E-05 | 0.000121 | 0.057114 | −0.077244 | 0.010516 | −0.667328 | 8.399347 | 1385.597* | −32.3697* |

| RTSI | 0.000207 | 0.000753 | 0.261176 | −0.383021 | 0.024948 | −2.858961 | 67.79138 | 189496.4* | −35.9934* |

| BVSP | 0.000327 | 8.08E-05 | 0.139082 | −0.147797 | 0.017390 | −0.909363 | 20.62281 | 14058.82* | −39.3753* |

| BSES | 0.000560 | 0.000381 | 0.089749 | −0.131526 | 0.012930 | −1.043009 | 20.65616 | 14158.27* | −34.9143* |

| JTOPI | 0.000382 | 0.000000 | 0.094798 | −0.099229 | 0.013750 | −0.147702 | 11.55176 | 3279.638* | −11.927* |

| VIX | 0.003188 | −0.007277 | 0.616421 | −0.233735 | 0.083161 | 1.936128 | 11.69653 | 4059.197* | −37.1653* |

| OVX | 0.003074 | −0.004425 | 1.357731 | −0.463265 | 0.086122 | 5.647076 | 77.44275 | 253936.5* | −32.8797* |

| GVZ | 0.001531 | −0.00287 | 0.346731 | −0.233301 | 0.053723 | 1.222006 | 8.240049 | 1497.444* | −34.9318* |

| EVZ | 0.001900 | 0.000000 | 0.642857 | −0.326087 | 0.059700 | 1.887525 | 20.49800 | 14352.64* | −27.2266* |

| CVI | 0.001381 | −0.006927 | 0.440765 | −0.183039 | 0.059188 | 2.829177 | 18.18428 | 11761.37* | −29.4141* |

- Note: ‘*’ indicates significance at 5%.

From Table 2, the mean values of all the series are positive. Notably, the standard deviations of the volatility index return series significantly surpass those of the BRICS stock market index return series. Consequently, volatility indices manifest a more pronounced degree of volatility than BRICS indices. Moreover, VIX and OVX record the highest standard deviations among the series.

The VIX is generally considered as a gauge of volatility in the S&P 500 index and is widely recognised as an indicator of market uncertainty and risk perception. A heightened VIX value implies increased market uncertainty and volatility, whereas a diminished VIX value conveys a sense of predictability and stability within the market. Consequently, an elevated VIX level signifies substantial fluctuations in market stability. Recall that the analysis timeframe adopted in this study encompasses periods marked by notable global economic influences, including the Coronavirus crisis, the Ukraine-Russia conflict, and the SVB bankruptcy. The pronounced volatility in VIX, which essentially functions as a metric for global uncertainty, can be feasibly correlated with these global and political risk factors. Moreover, this period coincided with significant oil price fluctuations, resulting in OVX, designed to measure volatility in oil prices, displaying greater volatility compared to other series.

In parallel fashion, GVZ representing gold price volatility, EVZ, tracking Euro/USD exchange rate volatility, and CVI, gauging cryptocurrency market volatility, also exhibit greater volatility when juxtaposed with BRICS stock market indices. The notion that one series is less volatile than another suggests that the future prices of the former are more predictable than those of the latter. Therefore, it is reasonable to assert that future prices of BRICS stock market indices manifest higher predictability when contrasted with volatility indices.

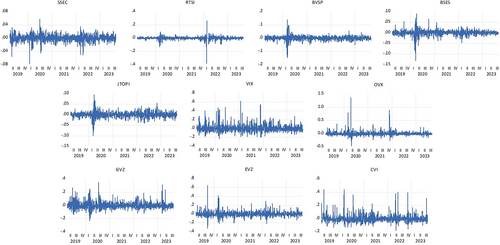

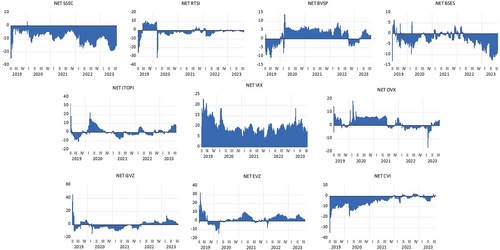

All series show asymmetric distributions, with skewness values deviating from zero and kurtosis values departing from the standard normal distribution value of three (skewness ≠ 0; kurtosis ≠ 3). The BRICS series skews leftward (skewness < 0), while the volatility index series skews rightward (skewness > 0). Furthermore, all series exhibit leptokurtic distributions, reflecting fatter tails compared to the normal distribution (kurtosis > 3). Based on Jarque-Bera (JB) values, one might affirm that none of the series conforms to a normal distribution. It is imperative to highlight that unit root tests establish the stationarity of all series at level (I0). Figure 1 shows the time series graphs of the return series.

Upon scrutinising Figure 1, it becomes evident that all series exhibit pronounced volatility. These findings indicate that all series were collectively impacted by the uncertainties arising from the COVID-19 pandemic and the Ukraine-Russia conflict. However, these global events did not affect the BRICS stock market indices to the same extent. The highest outlier in the RTSI series occurred during the onset of the Ukraine-Russia conflict in February 2022. Conversely, the highest outliers in the BVSP, BSES, and JTOPI series coincided with the COVID-19 pandemic in March 2020. Moreover, the volatility index series displays a more significant number of outliers than the BRICS series. These outliers in volatility indices can be attributed to regional events with global economic repercussions, such as the United States elections in November 2020 (notably in VIX) and the SVB bankruptcy in March 2023 (particularly in GVZ). As a result, these regional events contributed to increased variation in the volatility indices.

The varying periods of increased volatility across the series suggest that the interactions among the series may fluctuate over time. It underscores the possibility that different volatility dynamics may impact the series to varying degrees. Furthermore, it implies that the dynamics influencing the series' volatilities may evolve differently over time. Consequently, examining the common and dynamic transmission of volatility among the series through a shared model is crucial for obtaining fewer erratic findings and understanding how the interactions in volatility transmissions among the series change over time.

5 Estimation Results and Interpretation

This study employs the TVP-VAR extended joint connectedness approach to analyze the volatility spillover relationships and connectedness structure among the BRICS countries' stock market indices and volatility indices. We first report the mean connectedness among the series. We subsequently present the TCI, which illustrates the changing levels of total connectedness among the series. This allows us to consider global events' impact on the series' connectedness. Next, we dynamically examine each series' net connectedness to other series, its total volatility spillover received from other series, and the total volatility spillover it transmits to other series. This dynamic analysis enables us to ascertain how a series serves as either a net volatility receiver or transmitter over time, shedding light on how global events influence its role in the volatility transmission process.

Lastly, one might report the dynamic pairwise net connectedness among the series. This helps us to track the net volatility transmissions between the series. As a result, the dynamic analysis can consider which series acts as a net volatility receiver or transmitter concerning other series, allowing for an evaluation of the impact of global events. This comprehensive analysis offers insights into how global events impact the volatility transmission dynamics among the series and the evolving roles of each series in this process over time.

5.1 Average of Dynamic Connectedness Measures

The average of dynamic connectedness illustrates the average connectedness between series over the entire period. It quantifies the impact of changes in one series on itself and in the other series as a percentage. Table 3 shows the average explanatory power of changes in one series concerning changes in other series, as an average over the entire period. Table 3 also presents the total average volatility transmitted from one series to others (from), the total average volatility transmitted by one series to others (to), net average volatility (net), and the total average volatility (Inc. Own). This allows us to discern the influence of other series on an increase or decrease in one series and the states of being a net volatility receiver or transmitter for series in both pairwise and overall terms. The average connectedness among BRICS country stock and volatility index return series and the average volatility transmissions among these series is thereafter reported in Table 3.

| SSEC | RTSI | BVSP | BSES | JTOPI | VIX | OVX | GVZ | EVZ | CVI | FROM | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SSEC | 75.4 | 1.71 | 2.53 | 3.39 | 7.41 | 3.2 | 2.16 | 1.62 | 1.94 | 0.65 | 24.59 |

| RTSI | 1.4 | 67 | 5.13 | 5.33 | 8.88 | 4.6 | 2.88 | 1.55 | 2.24 | 0.95 | 32.97 |

| BVSP | 1.34 | 4.13 | 64.84 | 4.73 | 6.19 | 8.6 | 3.4 | 2.51 | 3.13 | 1.16 | 35.16 |

| BSES | 2.68 | 5.06 | 5.09 | 65.3 | 6.46 | 4.8 | 2.76 | 2.38 | 3.93 | 1.56 | 34.74 |

| JTOPI | 5.37 | 8.85 | 6.64 | 6.34 | 55.46 | 7.3 | 3.11 | 2.86 | 2.81 | 1.21 | 44.54 |

| VIX | 1.34 | 3.6 | 7.62 | 3.09 | 5.95 | 55 | 6.88 | 8.69 | 5.41 | 2.92 | 45.51 |

| OVX | 1.09 | 2.07 | 3.44 | 2.4 | 2.5 | 7.1 | 72.6 | 5.15 | 2.96 | 0.67 | 27.37 |

| GVZ | 0.94 | 1.22 | 2.56 | 1.9 | 2.89 | 9.6 | 5.49 | 63.2 | 8.91 | 3.29 | 36.82 |

| EVZ | 0.57 | 2.18 | 2.8 | 3.67 | 2.71 | 5.7 | 3.32 | 8.26 | 69 | 1.8 | 31 |

| CVI | 0.53 | 1.69 | 1.61 | 1.89 | 2.74 | 4 | 1.15 | 4.1 | 2.6 | 79.7 | 20.32 |

| TO | 15.3 | 30.5 | 37.44 | 32.7 | 45.73 | 55 | 31.2 | 37.1 | 33.9 | 14.2 | 333 |

| Inc. Own | 90.7 | 97.6 | 102.3 | 98 | 101.2 | 109 | 104 | 100 | 103 | 93.9 | TCI |

| NET | −9.3 | −2.5 | 2.27 | −2.01 | 1.19 | 9.4 | 3.78 | 0.3 | 2.94 | −6.1 | 33.3 |

- Note: The density of connectedness intensifies from yellow to dark orange.

On average, the findings indicate that the TCI among the series is approximately 33.3%. This implies that about 33% of changes in one series are explained by changes in other series, while the remaining changes (67%) are attributed to internal dynamics within each series. In this respect, a generally high degree of connectedness among the series is well-documented, signifying their susceptibility to common market shocks. The high connectivity between the global volatility indices and the BRICS stock market volatility could arise from the economic interconnectedness, trade links, contagion effects, and the crucial role of these groups in the world. Furthermore, BRICS countries are important producers of commodities like oil and natural gas. Therefore, any price fluctuations in these commodities have a direct impact on the BRICS stock markets, as they affect production costs and corporate profits.

Upon closer examination of the individual series, one might observe that the SSEC and CVI exhibit relatively lower connectedness with other series. These two series tend to rely more on their internal dynamics to explain changes. In other words, SSEC and CVI demonstrate a higher degree of divergence from the rest of the series, especially considering the overall average. Specifically, the SSEC index is less sensitive to global volatility indices due to several measures implemented by Chinese authorities aimed at stabilising the stock market, including capital controls and direct market interventions. These measures effectively isolate the SSEC from global market fluctuations, consequently reducing its connectedness with both volatility indices and other BRICS countries' stock indices. Similarly, the structure of the cryptocurrency market, represented by the CVI, significantly differs from traditional financial markets. It is less regulated, and the regulatory landscape varies considerably across regions, affecting its response to global indices. China, for example, banned ICOs (Initial Coin Offerings) and cryptocurrency exchanges on its territory, which had a significant impact on crypto volatility. Furthermore, participants in the cryptocurrency market tend to be technology-focused investors, inclined towards innovative investment vehicles, which differentiates their investment strategies from those in other financial markets. These factors mean that these assets may react differently to fluctuations in global indices. Conversely, the VIX exhibits the highest average connectedness with all the other series. OVX and EVZ closely followed VIX.

Moving next into the results of the net volatility transmitter-receiver analysis (net = to–from), we report interesting findings. On average, the volatility indices (except for CVI) act as net volatility transmitters about the BRICS equity indices. The VIX emerges as the primary net volatility transmitter whereas RTSI stands out as the primary net volatility receiver. As far as the BRICS equity indices are concerned, the BVSP is the highest average net volatility transmitter.

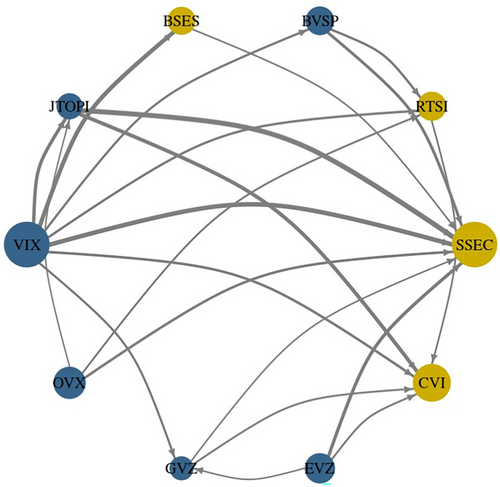

Figure 2 shows the pairwise average connectedness among the series. Recall that the pairwise average connectedness is derived by subtracting the volatility transmitted from another series (from) to a series from the volatility received by that series (to). In Figure 2, the flow of volatility transmission is depicted with arrows, showing the direction from the sender to the receiver. The arrow's thickness represents the magnitude of the average net volatility transmission.

As evidenced in Figure 3, the volatility indices (except CVI) act as net volatility transmitters. Indeed, cryptocurrencies form a enough small market in relative to other financial markets such as the stock market or the commodities market. Hence, their impact as a net transmitter of risk is limited. Furthermore, cryptocurrencies are often considered as decorrelated assets compared to traditional financial markets. This means that they tend to react differently to crises. The VIX functions as the overall volatility transmitter while the SSEC reacts as the overall volatility receiver for BRICS country stock indices. The pairwise dynamics of volatility transmission between volatility indices and BRICS country stock indices vary depending on the index.

To sum up, it is worth noting that the potential of financial assets to serve as effective diversifiers can be attributed to their weak relationships among these assets (Baur and Lucey 2010; Kandemir and Gökgöz 2022). According to the average connectedness findings, the lower connectedness of SSEC and CVI with other series indicates that SSEC and CVI differentiate from other series and are similarly unaffected by market shocks. Therefore, combining SSEC and CVI with BRICS indices in an investment portfolio would contribute to the diversification of the portfolio and its long-term investment horizon. This finding is essential regarding international portfolio diversification and its recommendations to investors. 3 It is also in line with Khalfeoui's (2023, 2023) study, suggesting that cryptocurrencies can be a good diversifier for BRICS stock markets.

The high overall connectedness of the VIX, which is again a measure of market uncertainty, indicates not only that it is the primary volatility transmitter but also the series is affected by common market shocks. Being net volatility transmitters about BRICS country stock indices, OVX, GVZ, and EVZ suggest that BRICS country stock indices are significantly affected by changes in the volatility of oil prices, gold, and the EU/USD exchange rate. However, these effects vary depending on the volatility index and BRICS countries. This finding implies that BRICS country stock indices do not react uniformly to common market shocks.

Despite the average connectedness findings providing an overview of the connections between the series throughout the entire period, they do not reveal the changing dynamics of connectedness between series over time or the impact of global events (such as health, economic, and political events). Therefore, It is worth interesting to examine the dynamic connectedness between series to better figure out and depict the dynamics of connections and common shock exposure during periods of global events.

5.2 Total Connectedness Index

Overwhelmingly, the TCI illustrates the series' changing levels of total connectedness. Higher TCI values indicate an important level of global connectivity in the series whereas lower TCI values suggest reduced connectedness during the respective periods. Figure 3 displays the short-term evolution of the total connectivity among the BRICS countries' stock market indices and volatility indices.

From Figure 3, the value of TCI fluctuates between 22% and 61% throughout the period from April 2019 to September 2023, with an average of 33.3%. It reaches its peak in June 2019 (43%), March 2020 (61%), February 2022 (37%), and March–June 2023 (28%–30%). When TCI reaches its peak, the connectedness among the series attains its highest values, indicating that a common shock influences the series. Therefore, it would be accurate to relate the dates when TCI reaches its peak to global economic, health, and political events with significant impacts. The series seems to be sensitive to international market turbulence and shocks resulting from such turbulence. Examining the dates when TCI peaked, it is observed that June 2019 corresponds to the period of the United States and China Trade crises (2018–2020) and the political tensions during that period. March 2020 aligns with the coronavirus crisis on March 11, 2020. February 2022 equivalent to the beginning of the Ukraine-Russia conflict. March and June 2023 coincide with the bankruptcy of SVCB (March 2023) and a period of increased global economic risks.

The connectedness between the BRICS country's stock market indices and volatility indices fluctuates over time and exhibits spikes during periods of global events. Therefore, the level of connectedness between BRICS and volatility indices is influenced by global events. This finding aligns with other studies that have shown an increase in connectedness between BRICS and volatility indices during periods of global events (Khalfaoui et al. 2023), a significant rise in the connectedness between energy commodities and BRICS during the coronavirus crisis (Billah et al. 2022; Zhang and Hamori 2022; Jin et al. 2023), and increased connectedness between energy markets, macroeconomic factors, volatility indices, and BRICS during the Ukraine-Russia War (Ha 2023; Nyakurukwa and Seetharam 2023).

It is essential to recognise that market responses to global turbulences can vary across different markets (Nyakurukwa and Seetharam 2023). In this context, analysing the connectedness of series individually and dynamically in pairs is effective in understanding changing connectedness structures over time and the effect of global shocks on the connectivity of series.

5.3 Dynamic Directional Connectedness

In this sub-section, we focus on the dynamic directional connectedness of each series, including its total volatility spillover to all other series (to), the total volatility spillover from all other series to it (from), and the series' net directional connectedness (net). This allows for a more detailed analysis of each series' total volatility transmission relationship with other series, their position within the connectedness network, and the impact of global events on each series' network position.

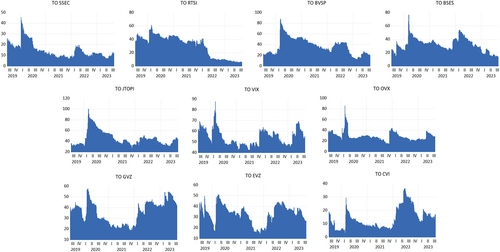

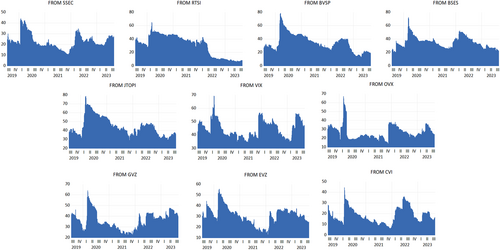

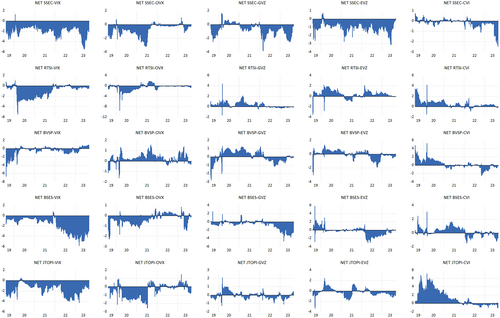

Figure 4 illustrates the time-varying total directional connectedness of each series to other series, while Figure 5 depicts the total directional connectedness from all other series to each series.

The directional connectedness graphs in Figures 4 and 5 show spikes during periods of global events, similar to the total connectedness index. The graphs depict each series's total directional connectedness to other series peaks during the period of the United States–United States–China trade War, the declaration of the COVID-19 pandemic, the onset of the Ukraine-Russia war, and the period near the SVB bankruptcy. However, the highest values in the directional connectedness graphs vary by series, indicating that the transmission of volatility dispersion in response to different global shocks differs among the series.

Except for CVI, all series show that the highest total directional connectedness to other series occurred when COVID-19 was declared a pandemic. The outbreak of the Ukraine-Russia War marks the highest value directional connectedness to other series for CVI. Unsurprisingly enough, this finding could be explained by two facts. First, during a war, investors search for safe haven assets such as gold, which can increase speculation on cryptocurrencies, as a ‘new’ financial safe haven. This will, in turn, increase cryptocurrency price volatility in geopolitical events. Second, wars often create important political and economic uncertainty that affects investors' confidence in traditional currencies and they therefore turn to cryptocurrencies as an alternative. This will increase not only demand but also volatility. The shock created by the fallout of SVB is more pronounced compared to BRICS. During SVB's bankruptcy period, global economic risks increased the volatility spillover from the volatility indices to other series. In particular, GVZ and EVZ transmitted more volatility to other series during the SVCB bankruptcy period than other volatility indices.

The total directional connectedness graphs from all series to each series exhibit similarity to the total directional connectedness graphs from each series to other series. During periods of high volatility spillover from one series to others, the volatility received from other series also tends to increase. However, the intensity of the volatility a series receives and transmits varies. Therefore, examining the positions of the series as net receivers or transmitters of volatility throughout the entire period would be particularly valuable, especially in investigating the impact of global events on network connectivity in series.

Figure 6 presents the time-varying net directional connectedness graphs for each series. Net directional connectedness is obtained by subtracting the volatility received from all other series (from) from the volatility transmitted to all other series (to) for each series. Therefore, a positive net directional connectedness for a series indicates that it was a net volatility transmitter during that period, while a negative net directional connectedness suggests that the series was a net volatility receiver.

When examining the net total directional connectedness graphs, it is evident that SSEC and CVI seem to consistently be net receivers of volatility throughout the entire period. Nevertheless, VIX exhibits a strong tendency to be a net transmitter of volatility. Among the BRICS series, RTSI, BSES, and JTOPI generally act as net receivers of volatility, whereas BVSP is predominantly a net transmitter of volatility. This suggests that RTSI, BSES, and JTOPI are more reactive to volatility shocks originating from other markets within the BRICS group or possibly from external sources. As net receivers, these indices experience heightened sensitivity to external market movements or shocks. In contrast, BVSP (Brazilian Bovespa Index) is characterised as a net transmitter of volatility among the BRICS series. This indicates that movements in BVSP tend to have a stronger influence on the volatility of other BRICS indices. BVSP's role as a net transmitter suggests that changes in BVSP can lead to volatility spillovers to other BRICS markets, potentially influencing their market dynamics. In the volatility series, OVX and EVZ typically act as transmitters of overall volatility, while GVZ generally serves as a receiver of volatility. The positions of series as either receivers or transmitters of volatility and the intensity of net volatility spillovers vary over time. Interestingly, series’ net directional spillovers have either changed direction or intensified during periods of global events. RTSI, GVZ, and EVZ were net transmitters of volatility before the declaration of the COVID-19 pandemic but shifted to net receivers (some during specific periods) after the pandemic was declared. The other series exhibits an increase in the intensity of net volatility spillovers following the declaration of the COVID-19 pandemic. It is also noteworthy that the influence of substantial global economic and political events, such as the Ukraine-Russia war and the bankruptcy of SVB, is perceptible in the patterns observed in the net directional spillover graphs. These events have played pivotal roles in shaping the dynamics of volatility transmission among these financial series.

5.4 Dynamic Net Total Pairwise Directional Connectedness

This sub-section delves into the Net Total Pairwise Directional Connectedness (NTPDC) among the series. NTPDC allows for the dynamic analysis of the connectedness between two series. Such an approach enables us to observe dynamically which of the two series is acting as a net receiver or transmitter of volatility, providing a more detailed insight into the impact of global events on pairwise connectedness.

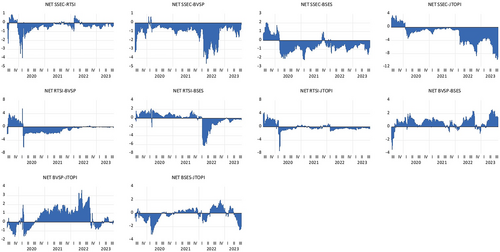

Figure 7 illustrates the NTPDC among the BRICS series, while Figure 8 shows the NTPDC between the BRICS and volatility series. A positive value in net pairwise connectedness indicates that the first series (mentioned in the graph) is a net transmitter of volatility, whereas a negative value signifies that the second series (mentioned in the graph) is a net transmitter of volatility.

The NTPDC graphs among the BRICS series exhibit time-varying patterns. The findings indicate that SSEC was a net volatility transmitter against RTSI, BSES, and JTOPI before the COVID-19 pandemic declaration (in March 2020). However, it transitions to a net volatility receiver position following the onset of the COVID-19 pandemic. Again, it thereafter became a net volatility transmitter against RTSI and BSES during the beginning of the Ukraine–Russia conflict (in February 2022) and maintained its net volatility receiver position afterward. The results clearly show an increase in the intensity of pairwise volatility transmission between the SSEC and BRICS series during the COVID-19 pandemic, the Ukraine-Russia conflict, and SVB bankruptcy in March 2023.

Regarding the connectedness of RTSI with BVSP and JTOPI, it functioned as a net transmitter of volatility before the COVID-19 pandemic. But, it transitions to a net volatility receiver position with the advent of the COVID-19 pandemic. With the onset of the Ukraine-Russia conflict, it shifts from being a net volatility transmitter to a net volatility receiver against BSES. Indeed, before the COVID-19 pandemic, RTSI functioned predominantly as a net transmitter of volatility. This suggests that movements in RTSI had a stronger impact on BVSP and JTOPI, indicating a leading role in volatility transmission among these indices. As the COVID-19 pandemic emerged, RTSI transitioned to a net volatility receiver position. This change implies that during this crisis period, RTSI became more reactive to volatility shocks originating from BVSP and JTOPI rather than transmitting volatility itself. With the onset of the Ukraine-Russia conflict, RTSI's role in volatility transmission further evolved. Specifically, RTSI shifted from being a net volatility transmitter to becoming a net volatility receiver concerning BSES. This indicates that developments related to the conflict affected RTSI's volatility dynamics more significantly than those of BSES during this period. These findings underscore the dynamic nature of market interconnectedness and volatility transmission across global indices. The shifts observed highlight the sensitivity of RTSI to major geopolitical events and crises, influencing its role as either a transmitter or receiver of volatility. Understanding these dynamics is crucial for investors and policymakers navigating global markets, particularly during times of heightened uncertainty and geopolitical tension.

The direction and intensity of connectedness among the other BRICS series also display variations due to global health, economic, and political events. BVSP, BSES, and JTOPI generally tend to be net volatility transmitters, but the direction and strength of volatility transmission change during global events. A similar pattern can be observed in the pairwise directional connectedness between BSES and JTOPI.

Figure 8 displays the NTPDC graphs between the stock index series of BRICS countries and their respective volatility index series.

In the NTPDC between VIX and the BRICS series, VIX generally tends to be a net volatility transmitter of risks. Recall, it is a measure of expected stock market volatility in the short term. Hence, if the VIX increases, investors expect an increase in stock prices which amplifies stock market uncertainty. It is a crucial indicator of investor confidence. When the VIX is high, investor confidence about market stability declines. Therefore, our empirical results are very interesting and reflect the transmission mechanisms between the BRICS stock market and volatility indices. On the other hand, OVX could be considered a net volatility receiver or transmitter that varies over time. However, it typically acts as a net volatility transmitter (resp. a net volatility receiver) against SSEC, RTSI, BSES, and JTOPI (resp. BVSP. GVZ and EVZ). CVI generally acts as a net volatility transmitter against SSEC. These results are highly significant for investors in the context of risk management, offering several insights and practical implications. Particularly, recognising that VIX generally acts as a net transmitter of volatility to the BRICS series underscores the importance of monitoring VIX as a leading indicator of market sentiment and future volatility. Investors can use VIX as a barometer to gauge expected market turbulence and adjust their portfolios accordingly to manage risk. Furthermore, With VIX being a crucial indicator of investor confidence and expected short-term market volatility, investors can use VIX derivatives (such as futures and options) to hedge against anticipated market downturns. This strategy becomes particularly relevant when VIX indicates heightened volatility. In addition, CVI generally acts as a net volatility transmitter against SSEC. Hence, OVX and CVI can act as both transmitters and receivers of volatility, and then investors need to be aware of their dynamic roles. This result helps in strategic asset allocation, as investors can diversify their portfolios by including assets that are less likely to be simultaneously impacted by the same volatility shocks, thus reducing overall risk. In this regard, understanding the varying roles of OVX and CVI against different BRICS indices is very important to help investors tailor their risk management approaches. For instance, if OVX is acting as a net transmitter against SSEC, RTSI, BSES, and JTOPI, but as a net receiver against BVSP, investors can develop specific strategies for each market, such as increased vigilance or hedging in markets where OVX is a transmitter. The findings provide a framework for enhanced monitoring of market stability. Investors can track changes in VIX, OVX, and CVI to anticipate periods of increased market uncertainty and take pre-emptive actions to safeguard their investments. Therefore, they can make dynamic portfolio adjustments based on the expected direction and intensity of volatility transmission.

Although their position in volatility transmission to other BRICS series varies throughout the period. One might also observe changes in the direction and intensity of pairwise connectedness among the BRICS series and volatility series, particularly during global events. Significant global events, such as the onset of COVID-19 in March 2020 and the Ukraine-Russia conflict starting in February 2022, have led to notable changes in the direction and intensity of these pairwise connections. The intensity of all pairwise connections increased or changed direction during these periods. Particularly during the Ukraine-Russia conflict, the bilateral connections of BRICS indices with OVX became more pronounced, especially between RTSI and OVX, where the net bilateral volatility transmission approached zero. This can largely be attributed to the uncertainties related to sanctions imposed on Russia and potential restrictions on Russian energy supplies. Additionally, the findings indicate that the collapse of SVCB in March 2023 also led to changes in the intensity of connections between BRICS indices and volatility indices, further illustrating the responsiveness of these markets to global financial disturbances.

6 Conclusion

Understanding the connectedness framework among different markets and establishing a comprehensive and complete picture of how uncertainty and flow of information transmission across different markets becomes an interesting research avenue given the outbreak of several black-swan events. In this respect, the current study attempts to examine the connectedness structure and volatility spillover impacts between BRICS stock markets and uncertainties in gold, crypto, exchange rates, oil, and stock markets during the period from April 2019 to September 2023. To this end, we use the TVP-VAR broadened by the connectedness approach to figure out the flow of information transmission and shock propagation among markets.

The empirical findings overwhelmingly shed light on the connectedness between the BRICS country stock indices and volatility indices and their responses to global events. Particularly, our analysis shows that volatility spillovers are significant among BRICS markets, indicating that a rise in volatility in one market can lead to increased volatility in others. This effect underscores the sensitivity of BRICS markets to global risk factors and the transmission of market uncertainty. These findings emphasise the importance of integrating the dynamic nature of connectivity and how it evolves during global shocks. Understanding the connectedness and responses to global events is crucial for risk management. Investors and policymakers can better anticipate and mitigate the impact of global shocks by recognising these patterns. This result is important for policymakers to formulate policies that enhance financial stability. By monitoring global risk factors and their potential impacts, policymakers can implement measures to cushion their economies from adverse effects. It is evident that series are highly sensitive to international market turbulence, and this sensitivity is further heightened during turbulent global events. In particular, the distinct connection patterns could characterise the connectedness among series. The empirical findings also show that the volatility spillover effects between volatility indices and BRICS stock markets change over time and increase during the distress period. The magnitude and the direction of the spillover effect between uncertainties in different markets and stock markets in the BRICS region as well as their role as a net volatility receiver/transmitter seem to differ according to uncertainty measure. In particular, the direction of volatility during the distress period.

These results confirmed the previous studies which investigated the interrelations among uncertainty using different volatility measures and stock/commodity markets. For instance, Al-Yahyaee et al. (2019) analyze the comovements between Bitcoin and VIX. They display that the Bitcoin-VIX nexus changes over time and through low and high frequencies. They also show negative (out-of-phase) comovements among two time series whereas positive (in-phase) comovements at low and high frequencies. Benedetto et al. (2020) analyze the direction of information between OVX and the spot variance of WTI and Brent returns. They observe an uptick in the information flow between OVX and the spot variance of Brent returns, associated with a reduction in the information flow with WTI. Additionally, they indicate that the information flow predominantly originates from OVX to the spot variances of WTI and Brent. This suggests that investor sentiment regarding the oil market's effectiveness significantly influences volatility in the spot market.

In the NTPDC between VIX and the BRICS series, We found that the VIX (stock market volatility in the short term) generally tends to be a net volatility transmitter of risks. This means that if the VIX increases, investors expect an increase in stock prices which amplifies stock market uncertainty. It is a crucial indicator of investor confidence. When the VIX is high, investor confidence about market stability declines. This result are highly significant for investors in the context of risk management, offering several insights and practical implications. Particularly, recognising that VIX generally acts as a net transmitter of volatility to the BRICS series underscores the importance of monitoring VIX as a leading indicator of market sentiment and future volatility. Investors can use VIX as a barometer to gauge expected market turbulence and adjust their portfolios accordingly to manage risk. Furthermore, With VIX being a crucial indicator of investor confidence and expected short-term market volatility, investors can use VIX derivatives (such as futures and options) to hedge against anticipated market downturns. This strategy becomes particularly relevant when VIX indicates heightened volatility. On the other hand, our system demonstrates that OVX could be considered a net volatility receiver or transmitter that varies over time. However, it typically acts as a net volatility transmitter (resp. a net volatility receiver) against SSEC, RTSI, BSES, and JTOPI (resp. BVSP. GVZ and EVZ). In addition, CVI generally acts as a net volatility transmitter against SSEC. Hence, OVX and CVI can act as both transmitters and receivers of volatility, and then investors need to be aware of their dynamic roles. This result helps in strategic asset allocation, as investors can diversify their portfolios by including assets that are less likely to be simultaneously impacted by the same volatility shocks, thus reducing overall risk. In this regard, understanding the varying roles of OVX and CVI against different BRICS indices is very important to help investors tailor their risk management approaches. For instance, if OVX is acting as a net transmitter against SSEC, RTSI, BSES, and JTOPI, but as a net receiver against BVSP, investors can develop specific strategies for each market, such as increased vigilance or hedging in markets where OVX is a transmitter. The findings provide a framework for enhanced monitoring of market stability. Investors can track changes in VIX, OVX and CVI to anticipate periods of increased market uncertainty and take pre-emptive actions to safeguard their investments. Therefore, they can make dynamic portfolio adjustments based on the expected direction and intensity of volatility transmission.

In sum, our empirical findings have practical implications for investment decisions and risk management strategies in the international financial markets, emphasising the need for a dynamic and adaptable approach to navigate the complexities of interconnected financial systems. Furthermore, they underscore the dynamic nature of market interconnectedness and volatility transmission across global indices. The shifts observed highlight the sensitivity of BRICS stock market indices to major geopolitical events and crises, influencing its role as either a transmitter or receiver of volatility. Understanding these dynamics is crucial for investors and policymakers navigating global markets, particularly during times of heightened uncertainty and geopolitical tension. For investors, there are several key takeaways from this research. First, they should consider including less connected series, such as SSEC and CVI, in their portfolios to enhance diversification. These series exhibit a degree of independence from common market shocks, potentially reducing overall portfolio risk. Conversely, high-connectedness series like VIX should be closely monitored in risk management strategies, as they are particularly sensitive to common market shocks. Notably, during significant global events, investors must be flexible and adapt their strategies to account for the changing connectedness structures among financial series. The evolving nature of these connections can profoundly impact investment outcomes. Investors can use these insights to devise more robust investment strategies, balancing their portfolios to manage risk more effectively during periods of market turbulence. For policymakers, this finding is also important in formulating policies that enhance financial stability. By monitoring global risk factors and their potential impacts, policymakers can implement measures to cushion their economies from adverse effects. In addition, Policymakers can use these insights to assess the impact of external shocks on domestic financial stability. Policies aimed at enhancing market resilience and mitigating volatility transmission can be tailored based on the identified roles of each index.

Acknowledgements

We would like to express our deepest gratitude to the editors and reviewers for their insightful comments and suggestions. Their detailed feedback has significantly contributed to the refinement of this manuscript. We deeply appreciate their time and expertise, which have been instrumental in enhancing the quality and accuracy of our work.

Conflicts of Interest

The authors declare no conflicts of interest.

Endnotes

Appendix A

| Authors | Variables | Period | Methods | Empirical findings |

|---|---|---|---|---|

| Jin et al. 2023 | BRICS stock market and oil index | 1 Jan 2019–31 Dec 2021 | VMD-Copula-ΔCoVaR model |

|

|

||||

| Chang et al. (2023) | Oil price and BRICS stock markets | 07 Mar 2003–25 Feb 2022 | Quantile connectedness approach |

|

| Li et al. (2021) | Global volatility indices and oil index | 02 Jan 2014–16 Sep 2021 | Multiscale multivariate multifractal detrended fluctuation analysis (MMV-MFDFA) |

|

|

||||

| Al-Nassar et al. (2023) | Oil, Bitcoin, gold, OVX and the Saudi stock market's sectors | 5 Jan 2016–22 Sep, 2021 | Bivariate dynamic conditional correlation-generalised autoregressive conditional heteroskedasticity |

|

| Li (2022) | OVX and VIX | May 2007–Nov 2019 | Markov-switching vector correction model (MRS-VECM) |

|

| Antonakakis et al. (2023) | OVX, stock markets, energy commodities, exchange rates, bond markets, and precious metals | Feb 1975–Jan 2019. | TVP-VAR |

|

| Wang and You (2023) | Global factors volatilities and BRICS stock markets. | Sep 1997–Dec 2018 | Quantile autoregressive distributed lags (QARDL) approach |

|

|

||||

|

||||

| Iqbal et al. (2024) | 12 volatility indices such as global equities, strategic commodities, and the US Treasury bond market. | 16 Mar 2011–10 Nov 2020 | Quantile approach |

|

|

||||

|

||||

| Khalfaoui, Hammoudeh, and Rehman (2023) | Conventional and Islamic BRICS stock markets, cryptos (Bitcoin, Ethereum, Litecoin) and various global uncertainties | 8 Oct 2016–28 May 2021 | Quantile vector autoregression |

|

| Bossman et al. (2023) | VIX, OVX, stock markets and GPR | Dec 2010–Aug 2022 | TVP-VAR |

|

|

||||

| Ji et al. (2019) | The BRICS stock market equities and commodities volatility indices | 16 Mar 2011–9 Dec 2016 | The graph theory approach and the dynamic conditional correlation model. |

|

|

||||

| Bhuiyan, Husain, and Zhang (2021). | Bitcoin and the volatility of global commodity indices. | Jul 2014–Nov 2019 | Bidirectional causality and TVP-VAR |

|

|

||||

|

||||

| Bouri et al. (2024) | Three global major risk factors (geopolitical risk, economic policy uncertainty, and crude oil volatility), stock indices, commodity, and green bond markets. | 1 Feb 2013–30 Jun 2023 | Granger causality tests in quantiles and distributions and the wavelet-based correlation and causality approaches |

|

|

||||

|

||||

| Chen, Xu, and Hu (2022) | Gold price volatility and BRICS stock market volatility | Aug 2005–Mar 2020. | Asymmetric VAR-BEKK(DCC)-GARCH model |

|

|

Open Research

Data Availability Statement

The data that support the findings of this study are openly available in investing at https://www.investing.com/.