The impact of cryptocurrency heists on Bitcoin's market efficiency

Abstract

Within the adaptive market hypothesis (AMH) framework, this study explores the dynamic impact of cryptocurrency heists on Bitcoin's market efficiency. By analysing Bitcoin's one-minute price data, we calculate permutation entropy to assess market disorder and employ the complexity-entropy causality plane to quantify structural changes in the market. The analysis focuses on the market efficiency changes the day before, the day of, and the day after a heist, revealing that heists significantly disrupt market efficiency. Specifically, on the day of and following a heist, we observe a marked decrease in permutation entropy alongside a significant increase in complexity, indicating a notable decline in market efficiency. Further analysis shows that when a heist targets a specific token, this token draws investor attention, causing a less severe drop in Bitcoin's market efficiency, while the affected token's market efficiency drops more dramatically. These findings suggest that different token markets react differently to heists, and investors should consider adjusting their strategies to respond to these changes. For policymakers, the results highlight the critical need to enhance market stability and security through informed policy measures to mitigate the impact of such disruptive events.

1 INTRODUCTION

Do cryptocurrency heists affect the market efficiency of the Bitcoin market? This study examines this substantial risk posed to Bitcoin markets (Corbet et al., 2020; Krückeberg & Scholz, 2020; Lyócsa et al., 2020) by the presence of heists or the theft of cryptocurrency from the platforms where these assets are traded. Cryptocurrency heists have led to more than $10 billion in stolen funds. When we account for increasing cryptocurrency prices, if hackers were to liquidate all stolen cryptocurrencies today, their total wealth would surpass $49 billion (Tsihitas, 2024). These cryptocurrency heists, which have been increasing in both frequency and magnitude, have significantly impacted the cryptocurrency community, directly affecting investor trust, shaking market confidence and may cause investors to exit the market, reducing liquidity and price discovery efficiency (Ibikunle et al., 2016; Manahov et al., 2014).

Bitcoin is the most popular cryptocurrency, but its price has experienced extreme price volatility since its inception, soaring from one cent to approximately $66,000 in 2021 before dropping to $16,000 in 2022 and substantially increasing to around $71,000 in 2024 (CoinGecko.com, 2024). This extreme volatility has altered how people view the function and role of Bitcoin, from being a cryptocurrency to being increasingly perceived as a financial asset (Baek & Elbeck, 2015; Baur et al., 2018; Yermack, 2013). While Bitcoin and other cryptocurrencies have emerged as a new investment sector, their high volatility challenges monetary authorities and impacts the financial system. The unique market environment of cryptocurrencies results in market efficiency dynamics that differ from traditional financial assets. For example, the relative immaturity of the cryptocurrency market, with a large proportion of retail investors, often leads to decisions driven more by sentiment and speculation than by rational analysis (Brini & Lenz, 2024; Rudkin et al., 2023). This market immaturity often leads to heightened price volatility. Additionally, because the regulatory environment for cryptocurrencies is still developing, the market is particularly vulnerable to manipulation and fraud (Eigelshoven et al., 2021). Manipulative practices (e. g., pump-and-dump schemes) are common in the cryptocurrency market. These activities disrupt normal market operations, preventing prices from accurately reflecting true information. Lastly, the rapid development of blockchain technology, while enhancing transparency and information dissemination, also introduces instability due to smart contract vulnerabilities and scalability challenges (Ghosh et al., 2020; Singh et al., 2021). Therefore, scholars believe examining cryptocurrency market efficiency across different contexts is crucial for understanding its pricing mechanisms and stability (Aslam et al., 2023; Naeem et al., 2021). As the frequency of cryptocurrency heists increases, understanding their impact on market efficiency is essential for investors to adjust strategies and for policymakers to implement effective regulations.

We employ the adaptive market hypothesis (AMH) framework to examine Bitcoin's market efficiency changes during the 12 largest cryptocurrency heists. As cryptocurrency heists mainly involve multiple tokens, we also consider if the token(s) predominantly stolen within the heist are explanatory. Adopting an Econophysics approach, we use permutation and complexity-entropy causality planes to measure Bitcoin's dynamic market efficiency during multiple heists. Our results show that Bitcoin's market efficiency fluctuates over time, with significant drops in permutation entropy during many heists, indicating a decline in efficiency. Furthermore, we also find different tokens react differently to cryptocurrency heists, with variable market efficiency and volatility. Specifically, investors tend to focus more on the token(s) most affected by the heist, resulting in greater volatility and more pronounced declines in those tokens' market efficiency. According to AMH, external changes lead to dynamic fluctuations in market efficiency. If investors fail to adapt, efficiency declines due to maladaptive behaviour. The uncertainty and chaos from a cryptocurrency heist make it hard for investors to quickly process and analyse new information, delaying rational decision-making and triggering emotional reactions like panic selling or buying. This causes prices to deviate from their true price, reducing market efficiency. However, market efficiency may recover as new information is gradually absorbed and investors adjust.

This study is essential for many reasons, including the safety and stability of cryptocurrency markets, the protection of investors and perhaps most of all, the scale, growing frequency and increasing magnitude of these heist events. The Bitcoin market relies on trust and transparency among participants, and cryptocurrency heists can trigger investor concerns about the security of cryptocurrency platforms, prompting investors to sell off their holdings to avoid losses. This fear may lead to a herd effect in the market, amplifying volatility and generating further market inefficiency (Bouri et al., 2019; Gurdgiev & O'Loughlin, 2020; Raimundo Júnior et al., 2022). Further, some cryptocurrency platforms lack adequate security measures to protect customer assets, and the anonymity and irreversibility of cryptocurrency transactions make these thefts challenging to trace. This allows cryptocurrency thieves to exploit vulnerabilities and steal assets. After a platform suffers an attack, investors often struggle to obtain comprehensive details or accurately assess future risks. This uncertainty exacerbates information asymmetry, further affecting market efficiency (Barron & Qu, 2014; Hu & Prigent, 2019).

Our findings offer important insights for both investors and policymakers. Investors should adapt strategies in response to changing external conditions. When the market is disrupted, efficiency may temporarily decline, so investors should avoid rigid strategies and instead continuously assess market signals and adapt to new environments. During events such as cryptocurrency heists, investors can use high-frequency data and automated tools to respond swiftly, minimizing losses caused by delayed market reactions. Additionally, diversifying holdings can reduce individual token volatility's impact, mitigating risks in periods of inefficiency. For policymakers, these fluctuations highlight the need for stronger regulatory frameworks. Enhancing oversight of cryptocurrency exchanges through higher security standards and regular audits can help reduce the risk of cryptocurrency heist. Requiring timely disclosure of security breaches will also enable the market to react more quickly, minimizing the impact of information asymmetry on market efficiency.

Our contribution to the literature is examining cryptocurrency heists and their influence on market efficiency. While numerous scholars have explored multiple financial issues within the Bitcoin market (Corbet et al., 2019a) and have repeatedly examined Bitcoin and its market efficiency, the impact of cryptocurrency heists remains an overlooked area. Recent literature on Bitcoin's market efficiency has focused on specific timeframes (Bariviera, 2017; Jiang et al., 2018; Urquhart, 2016; Yi et al., 2022) or global crises like the COVID-19 pandemic (El Montasser et al., 2022; Kakinaka & Umeno, 2022; Wu et al., 2022). Similarly, the impact of launching Bitcoin derivatives (Köchling et al., 2019; Ruan et al., 2021; Shynkevich, 2021; Strych, 2022) and altering regulatory frameworks (Alexander & Heck, 2020; Shanaev et al., 2020) have also been examined. We contribute to this contemporary literature on the market conditions influencing Bitcoin's market efficiency by examining the impact of cryptocurrency heists.

This paper is structured as follows. The Section 2 reviews the literature review, and the Section 3 discusses the data and methodology. The Section 4 reports empirical results, and the Section 5 provides conclusions and implications for investors and policymakers and explores future research directions.

2 LITERATURE REVIEW

A voluminous literature has examined Bitcoin's market efficiency. This work can be divided into efficiency testing and identifying factors affecting market efficiency. Most efficiency tests indicate that Bitcoin's market is inefficient. However, as the market matures and improves in areas like liquidity, derivatives adoption and government regulation, Bitcoin markets may become efficient.

A starting point for testing market efficiency is randomness tests. Urquhart (2016) used daily Bitcoin returns as samples and conducted the Ljung-Box, Runs, Bartels, AVR, BDS and R/S Hurst tests. His findings indicated that the Bitcoin market was inefficient between August 1, 2010, and July 31, 2016. Nadarajah and Chu (Nadarajah & Chu, 2017) conducted the same tests on the odd integer powers of Bitcoin returns, providing conflicting results. Tiwari et al (Tiwari et al., 2018). used seven robust long-term dependency estimators to evaluate market efficiency, reporting that the Bitcoin market was generally efficient between 2010 and 2017, with some exceptions occurring from April to August 2013 and August to November 2016.

These methods have also examined the causes of Bitcoin market inefficiency. Kang et al (Kang et al., 2022). assessed Bitcoin's market efficiency using the Runs, Durbin–Watson, and variance ratio tests after the 2017 price surge and concluded that speculative investment led to market inefficiency. Zargar and Kumar (Zargar & Kumar, 2019) used a series of variance ratio tests and found that low-frequency Bitcoin returns followed a memoryless stochastic process from 2013 to 2018, indicating market efficiency. This result may have been misleading as high-frequency traders can gain additional returns over time through speculation.

The second way to test market efficiency is to examine the multifractal properties of time series. For example, Bariviera (Bariviera, 2017), Alvarez-Ramirez et al (Alvarez-Ramirez et al., 2018). and Al-Yahyaee et al (Al-Yahyaee et al., 2018). used the Hurst exponent, reporting that between 2011 and 2014, the Hurst exponent was generally above 0.5, indicating a long-term dependence on daily returns and inefficiency in the Bitcoin market. Jiang et al (Jiang et al., 2018), Yi et al (Yi et al., 2022). and Takaishi (Takaishi, 2018) used the generalized Hurst exponent and found that from 2010 to 2018, the Bitcoin market exhibited long-term dependence, indicating inefficiency. Kakinaka and Umeno (Kakinaka & Umeno, 2022) applied the A-MFDFA method and the generalized Hurst exponent to examine changes in cryptocurrency market efficiency over different investment periods. Using hourly data, their findings showed that following the COVID-19 pandemic, market efficiency was strong in the long term but weak in the short term. This suggests that a herd effect operates in the cryptocurrency market during black swan events like pandemics, leading to market inefficiency.

These multifractal methods have also been employed to identify factors affecting Bitcoin's market efficiency. Commonly discussed factors include (i) liquidity, referring to how easily Bitcoin can be bought and sold; (ii) the impact of derivatives, which could improve market efficiency by enhancing liquidity, providing hedging opportunities and improving price discovery; and (iii) regulatory policies, which can offer a stable, transparent environment for investors and potentially improve market efficiency.

Brauneis and Mestel (Brauneis & Mestel, 2018) used the Corwin–Schultz spread estimator, log-market capitalisation, turnover ratio and Amihud's illiquidity ratio to examine liquidity. They found that as liquidity increased, Bitcoin's market efficiency improved. Wei (Wei, 2018) and Takaishi and Adachi (Takaishi & Adachi, 2020) also used Amihud's illiquidity ratio and found that Bitcoin's market efficiency improved after 2017. These authors proposed that lower liquidity resulted in fewer active traders and slower responses to new information, reducing market efficiency. Conversely, more liquid markets attract active traders who can act on new information, improving efficiency. Al-Yahyaee et al (Al-Yahyaee et al., 2020). examined the relationships between the market transaction value and Bitcoin market value to quantify liquidity, discovering that improved liquidity enhanced market efficiency while greater volatility reduced market efficiency.

Multiple studies have also examined the introduction of cryptocurrency derivatives, producing some conflicting findings. Köchling et al (Köchling et al., 2019). argued that the introduction of Bitcoin futures reduced barriers for institutional investors and provided a way to short Bitcoin. Their study applied Urquhart's (Urquhart, 2016) methodology to discover that Bitcoin's market efficiency improved after the futures launch. This is important as previous studies have displayed that the participation of institutional investors and short-selling can improve market efficiency (Boehmer & Kelley, 2009; Saffi & Sigurdsson, 2011). Shynkevich (Shynkevich, 2021) employed technical analysis and revealed that before the introduction of Bitcoin futures, returns were significantly predictable, but technical trading rules became less effective after these derivatives were introduced. Distinctly, Ruan et al (Ruan et al., 2021). used multifractal detrending moving-average cross-correlation analysis and non-linear Granger causality tests, demonstrating a strong positive correlation between Bitcoin spot and futures returns, indicating that futures improved the spot market's efficiency. Last, Strych (Strych, 2022) examined the effects of margin trading and short selling on Bitcoin's market efficiency, finding that efficiency declined when both were introduced. High levels of market efficiency were also recorded when only short selling was allowed, suggesting margin trading was the main reason for the decline in efficiency.

The findings in the literature suggest that market efficiency may vary over time, with external changes potentially driving shifts in efficiency. This indicates that market efficiency is not static but dynamically evolves with the environment. When market participants fail to adapt to market changes and exhibit maladaptive behaviour, the market becomes inefficient. However, when market participants adjust to new market conditions through feedback, their behaviour aligns with the current market environment and efficiency returns (Lo, 2004). The adaptive behaviour of market participants does not occur independently of market forces but is driven by competition. The current market environment is the result of interactions among different participants. Self-interested individuals, competition, adaptation, natural selection and environmental conditions form efficient markets (Lo, 2005).

Lo (Lo, 2005) named the above theory the AMH, and this theory has been examined in multiple studies. Khuntia and Pattanayak (Khuntia & Pattanayak, 2018) used the Dominguez–Lobato conformance and the generalized spectral test in a rolling window to account for linear and non-linear correlations in Bitcoin returns from 2010 to 2017. Their results showed that market efficiency varied over time, with inefficient markets recorded from 2010 to 2012 to 2013–2014 and efficient markets observed between 2012–2013 and 2015–2017. These inconsistencies were associated with changes in the external financial environment, supporting the AMH. Similarly, Stosic et al (Stosic et al., 2019). used the complexity-entropy causality plane to find that Bitcoin and other major cryptocurrency markets moved between efficient and inefficient states over time. Khursheed et al (Khursheed et al., 2020). reached similar conclusions, adding an automatic portmanteau test to assess Bitcoin's AMH. These findings showed that price movements with linear and non-linear dependencies change over time, resulting in market efficiency falling during unstable conditions and market efficiency improving when conditions stabilize. Mokni et al (Mokni et al., 2024). used the adjusted market inefficiency magnitude (AMIM) metric and a quantile regression model to show that Bitcoin's market efficiency fluctuates over time. They also identified how various factors influence market efficiency. Specifically, rising global financial stress tends to decrease market efficiency, while increased liquidity enhances it. Among the factors considered, liquidity appears to be the primary driver of changes in market efficiency.

In summary, previous research has primarily tested for weak efficiency within the Bitcoin market. These studies have produced divergent research findings, indicating that Bitcoin's market efficiency varies over time (Khursheed et al., 2020). Subsequently, the AMH has been applied to explain the dynamic nature of market efficiency, whereby environmental factors influence market efficiency. AMH is not a replacement for the efficient market hypothesis (EMH) but helps to explain its empirical variations, offering a better understanding of time-varying efficiency (Khursheed et al., 2020; Patil & Rastogi, 2019), with current studies supporting the detection of Bitcoin's market efficiency using this AMH framework (Khuntia & Pattanayak, 2018; Khursheed et al., 2020; Chu et al., 2019; López-Martín, 2023; Noda, 2021). However, most studies have focused on changes in Bitcoin's market efficiency within a specific timeframe or in the context of global events like the COVID-19 pandemic while neglecting specific events within the cryptocurrency market, such as cryptocurrency heists. This oversight may hinder a full understanding of the impact of internal market events on Bitcoin's market efficiency and the vulnerabilities of the cryptocurrency ecosystem.

Chawki (Chawki, 2022) discussed how cryptocurrencies have become targets for hacking, phishing, malware, extortion and ransomware. The study highlights the need for market participants to consider cryptocurrency security and the importance of developing appropriate regulatory measures. Current research on the effects of cryptocurrency heists primarily centres on cryptocurrency market stability (Corbet et al., 2020; Caporale et al., 2020), with less attention given to market efficiency, and the results are mixed. For instance, Krückeberg and Scholz (Krückeberg & Scholz, 2020), using high-frequency Bitcoin data, identified significant arbitrage opportunities following heists, indicating market inefficiency. In contrast, using daily data, Yousaf et al (Yousaf et al., 2021). found no evidence of herding behaviour during cyberattacks, suggesting high market efficiency. These differences may stem from variations in data scope and frequency, with high-frequency data potentially offering better insights into the short-term impacts of heists on the market. Moreover, the existing studies have focused only on post-heist market efficiency, neglecting to compare efficiency before and after the event. This gap may lead to an incomplete understanding of the heist's impact. By comparing market efficiency before and after a heist, we can better assess the event's impact and the speed of market recovery. Therefore, we aim to address this gap by examining the issue within the AMH framework, contributing to the literature on the impact of cryptocurrency heists on market efficiency.

3 DATA AND METHODOLOGY

3.1 Data selection and variable description

Scholars face two challenges when selecting Bitcoin data: (i) determining daily prices and (ii) the data source. Vidal-Tomás (Vidal-Tomás, 2021) found differences in the scaling features of Bitcoin returns calculated using closing prices, following a Brownian motion, versus weighted prices, which deviates from this random process. This study noted that researchers using closing prices perceive the market as exhibiting weak efficiency, whereas those using weighted prices report inefficient market conditions. Therefore, using differently calculated daily prices can lead to varying research outcomes. Additionally, Vidal-Tomás (Vidal-Tomás, 2022) used the generalized Hurst exponent to analyse main cryptocurrency databases' scaling properties and underlying processes, including USD trading platforms (e. g., Coinbase), USD databases, which limit cryptocurrency price calculations to USD (e. g., Cryptocompare), and USD (cross-rate) databases, which are calculated by converting any non-US dollar cross rate into US dollars using the foreign exchange rate (e. g., Coinmarketcap). All sources reported time series with the same underlying characteristics, suggesting that using different sources to calculate a unified Bitcoin price does not distort its underlying process. Therefore, the data source had minimal impact on Bitcoin's market efficiency studies.

We choose Cryptocompare as our data source and use the closing price as our price proxy. Unlike weighted methods, the closing price more accurately reflects actual trading prices. Since cryptocurrency heists often happen quickly, typically within minutes or hours, low-frequency data might miss these fluctuations. Therefore, we use Bitcoin's 1-min closing price in USD as our variable.

Based on the stolen dollar amount, Tsihitas (Tsihitas, 2024) recorded the 12 largest cryptocurrency heists. To investigate the impact of these heists on Bitcoin's market efficiency, we examine the changes in market efficiency the day before, the day of, and the day after each heist. The data range for each heist is shown in Table 1. Table 2 presents the descriptive statistics of the price data for each cryptocurrency heist. Among these 12 cryptocurrency heists, the standard deviation and range of Bitcoin prices are substantial, indicating that Bitcoin's price fluctuates significantly due to these incidents. Notably, during the heists on the Bitmart exchange and the PancakeBunny platform, the price range reached as high as $13,757.79 and $10,964.63, respectively. The Jarque–Bera test reveals that Bitcoin's price distribution is abnormal and negatively skewed with platykurtic kurtosis in most cryptocurrency heists. In most cases, we observe more extreme values on the left, suggesting a greater likelihood of Bitcoin's price falling during these incidents. These descriptive statistics highlight how these incidents have amplified Bitcoin's price volatility and increased market risks.

| Heist platform | Data range |

|---|---|

| Mt Gox | February 23, 2014, to February 25, 2014 |

| Coincheck | January 25, 2018, to January 27, 2018 |

| KuCoin | September 24, 2020, to September 26, 2020 |

| PancakeBunny | May 19, 2021, to May 21, 2021 |

| Poly Network | August 9, 2021, to August 11, 2021 |

| Bitmart | December 3, 2021, to December 5, 2021 |

| Wormhole | February 2, 2022, to February 4, 2022 |

| Ronin Network | March 28, 2022, to March 30, 2022 |

| Beanstalk | April 15, 2022, to April 17, 2022 |

| Nomad | August 1, 2022, to August 3, 2022 |

| Binance | October 6, 2022, to October 8, 2022 |

| FTX | November 10, 2022, to November 12, 2022 |

| Heist platform | Obs | Mean | S.Dev. | Min | Max | Skew | Kurt | JB | ADF |

|---|---|---|---|---|---|---|---|---|---|

| Mt Gox | 4320 | 573.76 | 45.12 | 450.00 | 645.64 | −0.45 | −0.86 | 280.90 a | −2.65 |

| Coincheck | 4320 | 11186.00 | 274.12 | 10334.25 | 11723.02 | −0.73 | 0.22 | 394.57 a | −2.07 |

| KuCoin | 4320 | 10617.59 | 151.40 | 10223.14 | 10802.32 | −1.22 | −0.14 | 1072.30 a | −1.85 |

| PancakeBunny | 4320 | 39379.49 | 1786.70 | 32600.00 | 43564.63 | −0.77 | 0.49 | 467.58 a | −2.98 |

| Poly Network | 4320 | 45524.68 | 878.73 | 42844.25 | 46746.73 | −1.50 | 1.32 | 1923.50 a | −2.02 |

| Bitmart | 4320 | 51350.70 | 3502.54 | 43781.92 | 57539.71 | 0.52 | −1.35 | 521.40 a | −0.94 |

| Wormhole | 4320 | 37852.60 | 1163.26 | 36277.29 | 41702.14 | 1.15 | 0.59 | 1019.70 a | 0.093 |

| Ronin Network | 4320 | 47372.66 | 288.08 | 46674.65 | 48184.74 | 0.15 | −0.45 | 52.91 a | −3.49 b |

| Beanstalk | 4320 | 40314.85 | 171.33 | 39580.56 | 40704.14 | −0.83 | 0.72 | 593.05 a | −2.26 |

| Nomad | 4320 | 23124.10 | 227.39 | 22673.61 | 23605.82 | −0.04 | −1.35 | 327.02 a | −2.40 |

| Binance | 4320 | 19803.66 | 312.85 | 19276.37 | 20437.75 | 0.21 | −1.43 | 399.50 a | −3.21 c |

| FTX | 4320 | 16941.34 | 399.65 | 15678.51 | 18105.93 | 0.18 | 0.09 | 25.99 a | −2.96 |

- Abbreviations: ADF, augmented Dickey–Fuller test; JB, Jarque–Bera test; Kurt, Kurtosis, it is a measure of whether the data are heavy-tailed or light-tailed relative to a normal distribution; Skew, Skewness, it is a measure of symmetry.

- a At the 1% significance level.

- b At the 5% significance level.

- c At the 10% significance level.

3.2 Permutation entropy model

The permutation entropy model can capture the disorder and complexity within a time series, thereby revealing the dynamic changes in the market when it experiences external shocks. The underlying idea is that if asset prices follow a random walk hypothesis, converting them into a numerical sequence according to specific rules will result in disorder, with entropy reaching its maximum value. Conversely, if a relationship exists between past and future prices, the numerical sequence will display specific patterns, and entropy will not reach its maximum. Thus, calculating the price change entropy relative to the maximum entropy can reflect the predictability of the asset and quantify the current market efficiency (Zunino et al., 2010).

The permutation entropy model is well-suited for analysing the impact of cryptocurrency heists on Bitcoin's market efficiency. Its advantage is its high sensitivity to small changes within a time series (Zanin et al., 2012). Cryptocurrency markets often exhibit rapid price fluctuations and behavioural changes when subjected to external shocks, such as cryptocurrency heists (Bhatnagar et al., 2023; Corbet et al., 2019b). Permutation entropy can capture these short-term fluctuations and disorders, reflecting the immediate market efficiency changes. If the Bitcoin market quickly absorbs the information and stabilizes after a heist, permutation entropy should be high, indicating that the market remains efficient. Conversely, if permutation entropy remains low for an extended period—meaning that market price changes are highly predictable—it suggests that market efficiency has been negatively impacted. Therefore, the permutation entropy model directly quantifies the changes in market efficiency before and after such events.

Furthermore, the permutation entropy model does not rely on any specific probability distribution of the time series (Darbellay & Wuertz, 2000). Cryptocurrency markets often exhibit complex and nonlinear behaviours, where price movements may not follow standard statistical distributions. The permutation entropy model provides the flexibility to measure market disorder and efficiency changes without assuming any particular distribution.

Finally, since we use Bitcoin 1-min price data as the variable, and the permutation entropy model is more effective at distinguishing time series when using prices rather than returns, it can be applied to non-stationary processes without the need to assess time series stationarity (Stosic et al., 2019). This means that when analysing cryptocurrency markets, there is no need for stationarity preprocessing (e. g., differencing or detrending). We can directly apply permutation entropy to evaluate market disorder. This is particularly important for the rapidly changing cryptocurrency market, as it allows us to capture the true dynamics of the market without being constrained by data preprocessing steps.

3.3 Complexity-entropy causality plane

The complexity-entropy causality plane offers a visual representation of market conditions, enabling an intuitive assessment of the market's current state and its response to external shocks based on positioning points on the plane. Positions in the bottom right denote an efficient market characterized by high entropy and low complexity, indicating high market efficiency. Conversely, positions in the top left signify an inefficient market with low entropy and high complexity, suggesting the presence of predictable patterns and reduced efficiency. By observing how points on the plane shift over time, especially before and after cryptocurrency heists, we can visually track changes in market efficiency.

4 EMPIRICAL RESULTS

4.1 Detection of Bitcoin's market efficiency

We group the 1-min Bitcoin price data by hour to calculate hourly permutation entropy and complexity. Figure 2 presents the complexity-entropy causality plane (left) and permutation entropy changes (right) for 12 cryptocurrency heists. The results show that Bitcoin's market efficiency fluctuated before, during, and after these heists, aligning with the AMH, which suggests market efficiency changes in response to external events.

In most heists, complexity-entropy points are in the upper left corner, indicating high complexity and low permutation entropy, signalling low market efficiency. This supports AMH: investor sentiment and behavioural inadaptability can temporarily weaken price discovery and lower market efficiency during shocks like heists. In nine heists, including Coincheck exchange (Figure 2b2), KuCoin exchange (Figure 2c2), Poly Network (Figure 2e2), Bitmart exchange (Figure 2f2), Wormhole platform (Figure 2g2), Beanstalk platform (Figure 2i2), Nomad protocol (Figure 2j2), Binance exchange (Figure 2k2), and FTX exchange (Figure 2l2), Bitcoin's permutation entropy dropped significantly during or after the heists, showing a sharp decline in efficiency. In six heists (Coincheck exchange, Poly Network, Bitmart exchange, Wormhole platform, Nomad protocol and Binance exchange), this drop was particularly evident during the heist, reflecting the maladaptive behaviours of investors when faced with significant uncertainties and the asymmetry of market information.

According to AMH, market efficiency fluctuates in response to shocks as investors fail to adapt to changing environments. When a cryptocurrency heist occurs, the sudden uncertainty and chaos make it difficult for investors to quickly process, understand and analyse the new information related to the event. This delay in information processing hinders investors from making rational decisions, often leading to emotional reactions like panic selling or buying, causing prices to deviate from their true price and further declining market efficiency. As the market gradually absorbs the information and investors adapt to the new environment, efficiency may recover. Our findings highlight the dynamic nature of market adaptation and the significant impact that heists have on investor behaviour and market mechanisms.

Notably, the complexity-entropy causality plane for the Mt. Gox exchange heist (Figure 2a1) differs from other events. After the heist, most complexity-entropy points shifted to the lower left corner, and permutation entropy (Figure 2a2) dropped to zero for 19 hours over 3 days, indicating a severe decline in market efficiency. As the world's largest Bitcoin exchange at the time, the Mt. Gox heist resulted in the loss of approximately $450 million in Bitcoin, around 7% of the global Bitcoin supply. This event triggered market panic, leading to mass sell-offs and significant price volatility. AMH highlights that market efficiency fluctuates as participants adapt to shocks. The Mt. Gox exchange heist, being the first large-scale hacking incident, disrupted the usual information-processing mechanisms. Investor panic and emotional reactions caused information transmission and price discovery to fail, leading to a sharp decline in market efficiency. Over time, the market may readjust and recover, but the initial drop in efficiency aligns with the dynamic efficiency characteristics outlined in AMH.

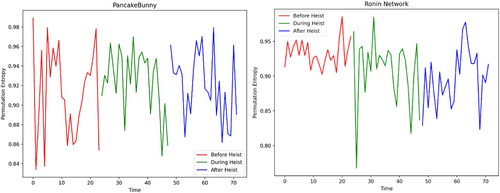

Moreover, Bitcoin's market efficiency did not significantly decrease during and after the PancakeBunny platform and Ronin Network heists. This may be because investors focus more on other affected tokens during these heists. In the PancakeBunny platform heist, hackers manipulated Binance Coin to steal approximately $200 million, while in the Ronin Network heist, they stole 173,600 Ethereum, totalling $620 million (Tsihitas, 2024). Subsequently, we examine whether investors will pay more attention to Binance Coin and Ethereum than Bitcoin during these two heists. We collect 1-minute price data for Binance Coin and Ethereum and calculate their hourly permutation entropy. Figure 3 shows that the permutation entropy values of Binance Coin and Ethereum fluctuated and dropped significantly during and after the heists.

While such heists can affect the market efficiency of cryptocurrency markets, this impact varies across different tokens. For example, Ethereum is the most affected token in the Ronin Network heist. Hence, Ethereum's market efficiency changes significantly as investors focus more on the most affected tokens and adjust their holdings accordingly. In contrast, although Bitcoin's market efficiency fluctuates during the heist, its volatility is much lower than that observed in the Ethereum market.

In summary, Bitcoin's market efficiency in the context of cryptocurrency heists is not static but fluctuates over time, consistent with previous research findings (Stosic et al., 2019; Fernandes et al., 2022; Lahmiri et al., 2018; Sensoy, 2019). During or after most heists, permutation entropy significantly declines, signalling a drop in market efficiency. However, in some cases, Bitcoin is less impacted as investors focus on the most affected tokens rather than Bitcoin, leading to a smaller decline in efficiency. Investors should adapt their strategies flexibly, avoid rigid approaches, and respond swiftly to external shocks based on market signals. Using high-frequency data and automated tools can help mitigate losses during periods of large market fluctuations. Diversifying token holdings can also reduce the risks associated with the volatility of individual tokens, and by closely monitoring the most affected tokens, investors can better navigate fluctuations in market efficiency. For policymakers, these fluctuations in market efficiency underscore the need for targeted regulatory frameworks. Increasing oversight of cryptocurrency exchanges, enforcing stricter security standards, and conducting regular audits can help reduce the risk of heists. Additionally, requiring exchanges to promptly disclose security breaches and heist incidents would allow the market to respond more quickly, minimizing the impact of information asymmetry on market efficiency. Maintaining efficient market conditions is essential for preserving investor confidence, liquidity and stable price discovery in the cryptocurrency market.

4.2 Robustness checks

For robustness, we use six randomness tests to evaluate Bitcoin's market efficiency on the date of a heist. These tests include the Hurst exponent (Hurst, 1951), the Ljung-Box test (Ljung & Box, 1978), the Runs test (Wald & Wolfowitz, 1940), the Bartels test (Bartels, 1982), the VR test (Lo & MacKinlay, 1988) and the BDS test (Broock et al., 1996).

The Hurst exponent measures the long-term memory of a time series, ranging from 0 to 1. A value above 0.5 suggests a positive long-term memory, below 0.5 indicates a negative long-term memory, and precisely 0.5 implies a random walk. The Ljung-Box test checks for serial correlation in the data, with the null hypothesis being no autocorrelation. The Runs test is a non-parametric test method for detecting the independence or randomness of a time series, and its null hypothesis is that the samples in the data set are random. The Bartels and VR tests detect whether the time series is a random walk. Their null hypothesis is that the time series is a random walk. The BDS test is a non-parametric statistical method that evaluates whether a time series exhibits autocorrelation or nonlinear correlation, assuming the null hypothesis that the series is independently and identically distributed.

Table 3 presents the p-value results of six randomness tests. Except for the VR test, which shows that the Bitcoin market is efficient during some cryptocurrency heists, the other five tests all indicate that it is inefficient during these heists. These robustness test results align with the previous findings from the complexity-entropy causality plane and permutation entropy model.

| Heist platform | Hurst exponent | Ljung–Box test | Runs test | Bartels test | VR test | BDS test |

|---|---|---|---|---|---|---|

| Mt Gox | 0.54 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Coincheck | 0.59 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| KuCoin | 0.49 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| PancakeBunny | 0.59 | 0.00 | 0.00 | 0.00 | 0.19 | 0.00 |

| Poly Network | 0.52 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Bitmart | 0.61 | 0.00 | 0.00 | 0.00 | 0.82 | 0.00 |

| Wormhole | 0.44 | 0.00 | 0.00 | 0.00 | 0.05 | 0.00 |

| Ronin Network | 0.47 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Beanstalk | 0.60 | 0.00 | 0.00 | 0.00 | 0.22 | 0.00 |

| Nomad | 0.49 | 0.00 | 0.00 | 0.00 | 0.39 | 0.00 |

| Binance | 0.56 | 0.00 | 0.00 | 0.00 | 0.20 | 0.00 |

| FTX | 0.53 | 0.00 | 0.00 | 0.00 | 0.01 | 0.00 |

- Note: A Hurst exponent different from 0.5 indicates that the time series statistically deviates from a random walk, implying an inefficient market. The rejection of the null hypothesis by the Ljung-Box test indicates that the time series is statistically autocorrelated and the market is inefficient. A rejection of the null hypothesis in the Runs test shows that the samples in the dataset are statistically nonrandom, implying market inefficiency. The rejection of the null hypothesis by the Bartels and VR tests indicates that the time series is not a random walk statistically and the market is inefficient. Finally, the BDS test rejecting the null hypothesis suggests the presence of statistical autocorrelation or non-linear correlations in the series, indicating an inefficient market.

5 CONCLUSION

Our study, the first of its kind, delves into the impact of cryptocurrency heists on the efficiency of the Bitcoin market. The analysis of permutation entropy and the complexity-entropy causality plane reveals a significant reduction in market efficiency during such heists. According to AMH, market efficiency fluctuates in response to shocks, as investors struggle to adapt to changing environments. The sudden uncertainty and chaos following a cryptocurrency heist make it challenging for investors to process, understand, and analyse the new information related to the event. This delay in information processing impedes investors from making rational decisions, often leading to emotional reactions like panic selling or buying, causing prices to deviate from their true price and further declining market efficiency. We also report instances of cryptocurrency heists where Bitcoin's market efficiency does not decrease significantly. This suggests that investors may concentrate on the most impacted tokens when analysing specific incidents. Different tokens may respond differently to cryptocurrency heists, so investors must recognize that market efficiency and volatility vary among tokens.

Our findings provide valuable insights for investors to refine their investment and risk management strategies. For instance, they should adapt their strategies flexibly and respond quickly to external shocks based on market signals. By using high-frequency data and automated tools, investors can mitigate losses during periods of significant market volatility. Our results also underscore the importance of distinguishing between different tokens, as they may react differently to heists. Investors need to recognize that the volatility and efficiency of each token vary, and their investment strategies should be adjusted accordingly. Diversifying token holdings can help reduce the risks associated with the fluctuations of individual tokens, and by closely monitoring the most affected tokens, investors can better navigate changes in market efficiency.

As cryptocurrency heists can affect Bitcoin's market efficiency, policymakers should work to enhance exchange and platform security standards and transparency to respond quickly to such incidents, reduce uncertainty, and maintain market stability. Policymakers also need to devise more effective regulatory measures that embrace a dynamic approach to mitigate market risks and minimize the influence of malicious activities. It is essential to maintain Bitcoin's market efficiency by implementing stricter security protocols on the platform and establishing transaction limits to prevent hackers' exploitation of vulnerabilities. For example, the Japanese Financial Services Agency (Japanese Financial Services Agency, 2022) has formulated relevant regulations for supervising domestic cryptocurrency transactions, including measures to protect investors and attempts to reshape the exchange's internal management system. Such measures can be productively replicated internationally.

One important area for future research is examining the impact of returning stolen cryptocurrencies or funds on market efficiency. Restoring stolen assets may have significant implications for market recovery, investor confidence and liquidity, affecting market efficiency dynamics. Future research needs to reexamine these findings with additional data and advanced analytical models. There is a broader need to develop more robust predictive indicators of market efficiency and examine the impact of other external environment changes on the efficiency and stability of the Bitcoin market. These are useful in reviewing investors' responses to market risks and uncertainties to infer their behavioural patterns.

In conclusion, our study offers valuable insights for investors, enhancing their understanding of the impact of extreme events on the Bitcoin market and aiding in improving their risk management practices. Investors must recognize that the Bitcoin market is susceptible to cryptocurrency heists, especially major heists that significantly impact the entire cryptocurrency community. Therefore, investors should stay vigilant regarding market volatility and uncertainty and develop corresponding investment strategies to manage risks.

ACKNOWLEDGEMENTS

We are very grateful to Lewis Ramsden, three anonymous reviewers and the editor for their suggestions, which greatly improved the quality of the paper.

CONFLICT OF INTEREST STATEMENT

The authors declare no conflicts of interest.

Open Research

DATA AVAILABILITY STATEMENT

The data that support the findings of this study are openly available in Github at https://github.com/MingnanLi/Cryptocurrency-heists-impact-market-efficiency-data.git.