Green banks versus non-green banks: A financial stability comparative analysis in terms of CAMEL ratios

Abstract

This study examines green and non-green-banks from a financial stability point of view and specifically whether there are any discernible performance differences between the two groups. Using the supervisory ratios namely CAMEL variables, and employing panel data techniques (random effects model) and a global panel data set of 165 banks from 38 countries for the period 1999 to 2021, we adopt the Differences-In-Differences approach to examine whether green (“treatment” group) and non-green (“control” group) banks exhibit differential behaviour, using the outbreak of the financial crisis (2008) as the time of intervention. Our results mainly show that green banks differ (and specifically perform better than their non-green counterparts) only in terms of Total Capital, Tier 1 Capital, and NPLs/Reserve for Loan Losses ratios during and after the financial crisis. As for the rest of the CAMEL factors, it seems that both groups exhibit the same behaviour, especially in the post-crisis period. Thus, green banks are not stronger in total than their non-green counterparts in terms of financial stability. We also find that the financial crisis had either a positive or a negative effect on most of the CAMEL factors of both bank types, except for the Leverage Ratio (a capital adequacy proxy) and Operational Expenses/Operational Income ratios (a management quality proxy), which proved crisis-insensitive.

1 INTRODUCTION

Global warming is the main element of climate change and is mainly attributed to the extended use of fossil fuels and Greenhouse Gas emissions (GHG). The IPCC (2021), p. 18) mentions that an increase in the average global temperature by 2°C is quite possible between 2041 and 2060 in the intermediate scenario. The severity of climate change is reflected in climate-driven natural disasters affecting humans and the economy. Eckstein et al. (2020) mention that, between 1999 and 2018, more than 495,000 people died as a direct result of more than 12,000 extreme weather events, while the economic losses were approximately 3.54 trillion USD (in Purchasing Power Parities). So, it becomes obvious that limiting the risk of an environmental disaster is rather impossible without a green transition, that is, a substantial transformation of production and consumption patterns, which implies a radical change in firms' production characteristics and households' consumption habits (Besley & Persson, 2023).

Although banks are firms that are not directly engaged in environmental degradation, they lend to other firms (which are either goods producers or services providers) and to households. To this extent, the banking sector can have a significant indirect contribution to reducing the risk of an environmental disaster by lending enterprises with increased environmental conscience and households with increased perception of “green values”.

In addition, climate change affects both countries' economies and financial sectors. Natural disasters, as a result of climate change, amplify the fragility of banking systems as they increase banks' probability of default (Danmarks Nationalbank, 2019; Klomp, 2014) and the probability of banking crises (from 26% to 248% by 2100 under the extreme scenario according to Lamperti et al. (2019)). The need for the protection of the environment and of the financial system from the negative effects of climate change has led to the creation and launch of “green banking” (i.e., credit facilities to low-carbon investments, renewables, etc.) and of the so-called “green banks” (fully public and quasi-public). Additionally, many small, medium, and large-sized—financial institutions around the world have introduced “green credit lines,” aiming to achieve the above-mentioned climate goal, and also to mitigate the negative impacts on the banking sector stemming from climate change.

As pure green banks are very few worldwide, for the purposes of our analysis we employ data on commercial banks (i.e., the typical banks that accept deposits, grant loans, etc.) and we characterize them as green or not by developing certain criteria, the basic criterion being whether a bank is a member of certain international organizations focusing on sustainability and environmental protection (see Subsection 3.3). During the last twenty years, the number of environmentally friendly banks exhibited a significant increase, showing that the banking sector takes seriously the issue of climate change and its adverse effects on humans and economies. For instance, membership of the Equator Principles rose from 13 in 2003 to 123 in 2021, while, according to Weber (2012), out of 61 banks examined (from 17 countries) 28 conducted systematic environmental evaluations since 2006.

In this study, we compare green and conventional (non-green hereafter) banks in terms of financial strength and soundness indicators known as CAMEL/CAMELS ratios (solvency, asset quality, management quality, profitability, and liquidity) which are employed as proxies of financial stability. For the purposes of our analysis, we use an unbalanced panel data set of 165 green and non-green banks (either global or non-global) from 38 countries worldwide covering the period 1999 to 2021, and we apply a random effects model and Differences-In-Differences (DID) method to examine if there are discernible performance differences between the two groups. Moreover, we compare green and non-green banks by considering that the implementation of a new “green” lending logic has to be a gradual process for the banking sector from a financial stability perspective, as a sudden transition could pose a threat to the stability of the financial system, taking into account that the adoption of lower risk weights for green assets could reduce the financial sector's capital adequacy without reducing its actual risks (Manninen & Tiililä, 2020; Nieto, 2017).

To the best of our knowledge, this is the first study examining the differences between green and non-green banks from a financial stability perspective in terms of CAMEL variables, both in the pre- and post-financial crisis periods and across countries, using a panel data set for a 23-year period.

Our analysis provides the following key results. First, the global financial crisis significantly impacts most CAMEL factors, except the leverage ratio and operational expenses to operational income ratio, proving crisis-insensitive across all bank types. Second, green banks demonstrate consistent behaviour across various fundamental aspects, except for risk-weighted capital ratios, indicating that they do not outperform non-green banks in terms of risk-adjusted capital adequacy ratios, especially before the crisis. Last, the crisis benefits green banks only in terms of two risk-adjusted capital ratios and partially in NPLs coverage ratio, with other CAMEL factors (leverage ratio, NPLs and provision ratios, management quality, earning ability and liquidity ratios) remaining unaffected, providing empirical evidence that green banks do not substantially differ from non-green banks in terms of financial stability.

The remainder of the paper is organized as follows. Section 2 presents related literature. Section 3 describes data, variables, and methodology. Section 4 contains results (including descriptive statistics and statistical tests) and discusses empirical findings. Finally, Section 5 concludes and presents policy implications.

2 A BRIEF LITERATURE REVIEW

2.1 CAMEL/CAMELS rating system and financial sector stability

The CAMEL/CAMELS rating system comprises financial criteria used by regulators to gauge banks' financial health, serving as a metric for banking sector stability, soundness, and risk, thereby measuring financial stability (Hirtle et al., 2020; Restoy, 2017). These ratings and factors are also utilized in predictive models for analysing and forecasting financial crises and bank failures (Demyanyk & Hasan, 2010). CAMEL/CAMELS ratings, combine ratio values and specific questionnaire outcomes (not publicly available), ranging from 1 (strongest performance and risk management) to 5 (weakest performance and highest supervisory concern) (FDIC, 2018–2023).

CAMEL/CAMELS proxies cover six main segments: capital adequacy (C), asset quality (A), management quality (M), earning ability (E), liquidity (L), and sensitivity to market risk (S) 1 (Board of Governors of the Federal Reserve System, 2018, 2023, p. 9). Each segment includes specific variables such as Total Capital and Leverage Ratio (C), Non-performing Loans to Total Loans (A), Operational Expenses to Operational Income (M), Return on Assets (E), Loan-to-Deposit and Liquidity Coverage Ratio (L), and Regulatory Capital for market risk/Regulatory Capital (S). These variables are well-documented in numerous banking sector studies (Cole & White, 2017; Papanikolaou, 2018). An analytical bibliographic review of CAMEL/CAMELS variables is available in Online Appendix A.

CAMEL/CAMELS ratings and factors also measure banks' risk and financial health (Chernykh & Kotomin, 2022; Martinez-Peria & Schmuckler, 2001), banks' performance from a supervisory view, and financial stability perspective (Gropp et al., 2022; Hirtle et al., 2020). They are used in studies of various countries' banking systems (see e.g., Afroj, 2022; Nguyen et al., 2020) and in creating new indexes for assessing banks' financial strength (see e.g., Doumpos et al., 2017).

2.2 Green banking and green banks

Green banking encompasses: (a) banking commitments (implementation of green finance principles), (b) financial flows (volume and distribution of loans to green investments), (c) financial risk (impact on NPLs and ROE), and (d) environmental and social outcomes (avoidance of negative E&S impacts, GHG emissions reduction, economic growth, job creation, etc.) (IFC & SBN, 2017; Park & Kim, 2020). Related concepts include green and sustainable finance (see Online Appendix B).

- “Pure Green Banks”: Dedicated public or non-profit entities focused on increasing and accelerating investments in clean energy and services using financial tools to mitigate climate change (CGC, 2019).

- “Green Investment Banks (GIBs)”: Public or quasi-public institutions financing renewable energy, energy efficiency, and other clean energy projects in partnership with private lenders to advance public objectives (CGC, 2017; OECD, 2015).

- “Social Banks”: Institutions that consider profit, environment, and people; in some cases, green and social banks coincide (Benedikter, 2011).

Pure green banks and GIBs are limited in number, with no more than 12 by the end of 2021, and currently only 9 (Green Bank Network, 2018, 2023).

3 DATA, VARIABLES, AND METHODOLOGIES

3.1 Data

We use data from Thomson Reuters Eikon for the CAMEL factors, and from: (a) supranational organizations (Federal Stability Board, Basel Committee on Banking Supervision) and the “Banks around the World” website, and (b) non-governmental organizations and institutions (BEI, EP, GABV, and UNEP FI) for classifying banks as global and green, respectively (see Subsection 3.3 and Online Appendix C).

From our initial sample, observations for the CAMEL variables NPLs/Reserve for Loan Losses % (asset quality proxy) and Operating Expenses/Operating Income % (management quality proxy) with extreme values (above 1.5 times the 99.5th percentile or below 0.5 times the 0.5th percentile) are characterized as outliers and excluded from the analysis. Our final unbalanced panel dataset comprises a maximum of 3795 observations from 1999 to 2021 on an annual basis, 2 including specific CAMEL variables for 165 banks from 38 countries worldwide.

3.2 Variables

Following studies on banks' financial strength and sector stability, we use CAMEL proxies for the first five segments (excluding the S segment due to data unavailability). All CAMEL variables employed are included in both the FDIC (2018–2023) and the Board of Governors of the Federal Reserve System (2018, 2023) examination manuals.

Specifically, we use 13 quantitative bank-specific variables (12 CAMEL factors plus bank size) and 4 dummy variables (global bank, green bank, financial crisis period, and the interaction between crisis and green banks) (see Table 1). Country dummies are also included. The global bank, crisis, and green bank variables are primary (or main) variables, with the interaction variable being the key variable of interest.

| CAMEL segment | Abbreviation/acronym | Variable definition and calculation | Data source |

|---|---|---|---|

| Panel A: Explanatory—control—variables | |||

| Capital adequacy | TCR | Total Capital Ratio (%) (=Total Capital to total risk-weighted assets *100) | Thomson Reuters Eikon |

| CRTIER1 | Tier 1 Capital Ratio (%) (=Tier 1 Capital to total risk-weighted assets *100) | Thomson Reuters Eikon | |

| LR | Leverage Ratio (%) (=Total Capital/(Total Assets − Customer Liabilities on Acceptances) * 100) | Thomson Reuters Eikon | |

| Asset quality | NPLS | Non-Performing Loans/Total Loans (%) (NPLs) | Thomson Reuters Eikon |

| PROVLLLOANS | Provision for Loan Losses/Total Loans (%) (=Provision for Loan Losses/(Total Loans−Interbank Loans) * 100) | Thomson Reuters Eikon | |

| NPLSRESERLL | Non-Performing Loans/Reserve for Loan Losses (%) | Thomson Reuters Eikon | |

| RESERLLLOANS | Reserve For Loan Losses/Total Loans (%) (=Reserve for Loan Losses/(Total Loans−Interbank Loans) * 100 | Thomson Reuters Eikon | |

| Management quality | OPEXPENSOPINCOME | Operating Expenses/Operating Income (%) (Operating Expenses = sum of all expenses related to operations; Operating Income = sales−total operating expenses) | Thomson Reuters Eikon; authors' calculation |

| OPEXPENSTA | Operating Expenses/Total Assets (%) | Thomson Reuters Eikon; authors' calculation | |

| Earning ability | ROA | Return on Assets (%) (ROA) (=Net Income before Preferred Dividends + ((Interest Expense on Debt-Interest Capitalized) * (1-Tax Rate)))/Average of Last Year's (Total Assets−Customer Liabilities on Acceptances) and Current Year's (Total Assets−Customer Liabilities on Acceptances) * 100 | Thomson Reuters Eikon |

| ROE | Return on Equity (%) (ROE) (=Net Income before Preferred Dividends−Preferred Dividend Requirement)/Average of Last Year's and Current Year's Common Equity * 100. | Thomson Reuters Eikon | |

| Liquidity | LTD | Total Loans/Total Deposits (%) | Thomson Reuters Eikon |

| – | SIZE | Bank size = log of Total Assets | Thomson Reuters Eikon; authors' calculation |

| Panel B: key or main explanatory variables (dummy variables and interaction term) | |||

| – | GLOBAL (= global) | 0 if non-global and 1 if global | FSB, BCBS, “Banks around the World” (http://www.relbanks.com), own research; authors' construction |

| – | NEWGREEN (= green) | 0 if non-green and 1 if green | ΒΕΙ, EP, GABV, UNEP FI, own research; authors' construction |

| – | CRISIS (= crisis) | 0 if time ≤ 2007Q4 and 1 if time ≥ 2008Q1 | Authors' construction |

| – | INTERACTION | Crisis × green | Authors' construction |

- Note: (a) The term “calculation” in the third column header refers to the Thomson Reuters Eikon (formerly Data Stream) calculation methodology described in Thomson Reuters Financial (2007). (b) The OPEXPENSOPINCOME, OPEXPENSTA, and SIZE variables are our own calculations based on Thomson Reuters Eikon relevant data. (c) Operating Expenses, Operating Income, and Total Assets amounts are all in 000's USD. (d) Total Loans = Loans−Interbank Loans. (e) “Customer Liabilities on Acceptances” are only subtracted when included in Total Assets (Thomson Reuters Financial, 2007). (f) Total Assets = the sum of cash and due from banks, total investments, net loans, customer liability on acceptances (if included in total assets), investment in unconsolidated subsidiaries, real estate assets, net property, plant and equipment, and other assets (Thomson Reuters Financial, 2007). (g) The characterization of a bank as global and green, respectively, is in accordance with the developed classification criteria (see Subsection 3.3). (h) Cut-off dates for the financial crisis period (pre- and post-crisis) were set according to the BIS (2009) timelines.

- Abbreviations: BCBS, Basel Committee on Banking Supervision; BEI, Banking Environment Initiative; EP, Equator Principles; FSB, Financial Stability Board; GABV, Global Alliance for Banking on Values; UNEP FI, United Nations Environment Programme- Finance Initiative.

The financial crisis variable is defined with the crisis starting in the last quarter of 2007. The pre-crisis and post-crisis periods are before and after 2007Q4, respectively, based on BIS (2009) and Reinhart and Rogoff (2014). 3 The dataset is not split into more sub-periods due to the varying duration and effects of the crisis across regions (Baur, 2012; De Bondt & Vermeulen, 2021; Laeven & Valencia, 2012; Reinhart & Rogoff, 2014). “During and after crisis” refers to 2008–2009, the peak of the global financial crisis (Reinhart & Rogoff, 2011), used as the interaction point for green banks with the crisis.

3.3 Classification criteria

We classify a bank as “green” if it was a member, by the end of 2021, of at least one of the following organizations: Banking Environment Initiative (BEI), Equator Principles (EP), United Nations Environment Programme—Finance Initiative (UNEP FI), and Global Alliance on Banking on Values (GABV) (see Online Appendix C for details). This aligns with Benedikter (2011), pp. 43–45) analysis for social and green banks. Additional criteria (e.g., sustainability policy soundness, green loan types, amounts, and share in total loan portfolio) were not employed due to data unavailability. Confirmation of green bank status involved reviewing annual and sustainability reports (covering the vast majority of banks characterized as green).

A bank is classified as “global” if it: (a) operates in more than one region via subsidiaries or branches, including significant representative offices worldwide, and (b) has an average asset size of $100 billion USD or more during the entire sample period. The first criterion is necessary, the second is not. These criteria follow BCBS (2017), De Haas and Van Lelyveld (2014), and Jeucken (2001), p. 186). Most global banks are included in the FSB (2022) list of Global Systemically Important Banks (G-SIBs) and the “Banks around the World” website. 4 Confirmation of global status was done through banks' official websites and reports.

All banks that are characterized as green and non-green (either global or not) are presented in Appendix Table A1.

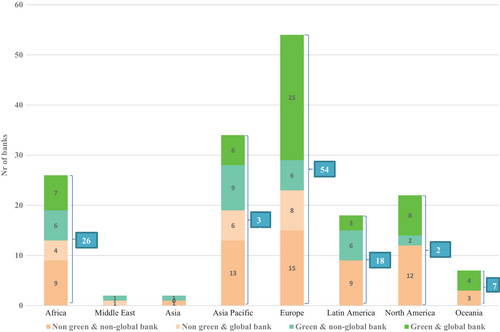

According to our criteria, from 165 banks, 84 are identified as green (53 global, 31 non-global) and 81 as non-green (19 global, 62 non-global) as of December 31, 2021. Care was taken to ensure a balanced number of green and non-green banks per region and country. Figure 1 and Table 2 summarize green and non-green banks per region and country.

| Region | Country | Banks number (total) | Of which: Green banks | % | Of which: Global banks | % |

|---|---|---|---|---|---|---|

| Africa | Kenya | 2 | 1 | 50% | 0 | 0% |

| Mauritius | 2 | 1 | 50% | 0 | 0% | |

| Morocco | 2 | 1 | 50% | 0 | 0% | |

| Nigeria | 12 | 6 | 50% | 3 | 50% | |

| South Africa | 8 | 4 | 50% | 4 | 100% | |

| Total | 26 | 13 | 50% | 7 | 54% | |

| Asia | India | 2 | 1 | 50% | 0 | 0% |

| Total | 2 | 1 | 50% | 0 | 0% | |

| Asia Pacific | Bangladesh | 2 | 1 | 50% | 0 | 0% |

| China | 8 | 4 | 50% | 2 | 50% | |

| Indonesia | 2 | 1 | 50% | 0 | 0% | |

| Japan | 10 | 4 | 40% | 3 | 75% | |

| Malaysia | 2 | 0 | 0% | 0 | – | |

| South Korea | 6 | 3 | 50% | 1 | 33% | |

| Taiwan R.O.C. | 2 | 1 | 50% | 0 | 0% | |

| Thailand | 2 | 1 | 50% | 0 | 0% | |

| Total | 34 | 15 | 44% | 6 | 40% | |

| Europe | Belgium | 2 | 1 | 50% | 0 | 0% |

| Denmark | 2 | 1 | 50% | 0 | 0% | |

| France | 6 | 4 | 67% | 4 | 100% | |

| Germany | 4 | 1 | 25% | 0 | 0% | |

| Greece | 2 | 0 | 0% | 0 | – | |

| Italy | 4 | 2 | 50% | 2 | 100% | |

| Netherland | 3 | 2 | 67% | 2 | 100% | |

| Norway | 2 | 1 | 50% | 1 | 100% | |

| Spain | 8 | 5 | 63% | 5 | 100% | |

| Sweden | 4 | 4 | 100% | 4 | 100% | |

| Switzerland | 6 | 2 | 33% | 2 | 100% | |

| Turkey | 6 | 3 | 50% | 0 | 0% | |

| UK | 5 | 5 | 100% | 5 | 100% | |

| Total | 54 | 31 | 57% | 25 | 81% | |

| Latin America | Argentina | 2 | 1 | 50% | 0 | 0% |

| Brazil | 6 | 3 | 50% | 3 | 100% | |

| Chile | 2 | 1 | 50% | 0 | 0% | |

| Colombia | 2 | 1 | 50% | 0 | 0% | |

| Ecuador | 2 | 1 | 50% | 0 | 0% | |

| Mexico | 2 | 1 | 50% | 0 | 0% | |

| Peru | 2 | 1 | 50% | 0 | 0% | |

| Total | 18 | 9 | 50% | 3 | 33% | |

| Middle East | Oman | 2 | 1 | 50% | 0 | 0% |

| Total | 2 | 1 | 50% | 0 | 0% | |

| North America | Canada | 10 | 5 | 50% | 5 | 100% |

| USA | 12 | 5 | 42% | 3 | 60% | |

| Total | 22 | 10 | 45% | 8 | 80% | |

| Oceania | Australia | 7 | 4 | 57% | 4 | 100% |

| Total | 7 | 4 | 57% | 4 | 100% | |

| Grand total | 165 | 84 | 51% | 53 | 63% |

- Note: (a) Banks are classified as green and global according to the developed classification criteria (see Subsection 3.3). (b) Data sources: for green banks: BEI, EP, UNEP FI, GABV, and our own research; for global banks: Financial Stability Board (FSB), “Banks around the World” (http://www.relbanks.com), and our own research.

3.4 Methodology

Our analysis (apart from descriptive statistics and the necessary statistical tests) involves: (a) hypothesis testing (using a t-test) to examine whether there are statistically significant differences in the mean values of CAMEL factors between green and non-green banks, and (b) the use of panel data regression techniques to investigate whether there are statistically significant differences between the two basic groups, allowing for the appropriate dynamics to capture potential persistence.

We estimate a series of models using random effects, ending with a Difference-in-Differences (DID) approach to assess differential behaviour between green and non-green banks. Following Imbens and Wooldridge (2007) and Berger and Raluca (2020), we define green banks as the “treatment” group and non-green banks as the “control” group, using the financial crisis outbreak as the time of “intervention” (see Subsections 3.2 and 3.4.1).

3.4.1 Panel data regression models & estimation methodology

The model (Equation (2)) assumes that each bank's intercept a varies over time (i.e., is random) and the slope coefficients β are constant across banks (RE model) (Gujarati, 2004; p.642, p.647). Here, u it is where μ i denotes the unobservable individual-specific effect and ν it denotes the remainder disturbance. μ i is time-invariant (e.g., country) and accounts for any individual-specific effect not included in the regression. ν it varies with individuals (e.g., banks) and time and can be thought of as the usual disturbance in the regression.

We choose to cluster on the bank level rather than country level since some countries in our sample have significantly more banks than others (see Figure 1 and Table 2).

By adding CR t × GR ijt we test for significant differences between green and non-green banks during and after the global financial crisis. Equation (3), the fully expanded version of our RE model, represents the DID approach applied to assess differences between green and non-green banks concerning CAMEL factors, where non-green bank is the control group, green bank is the treatment group, and the financial crisis outbreak (after 2007 Q4) is the time of intervention.

We consider the RE model most appropriate since it allows for time invariant variables (Wooldridge, 2002, p. 288) like country of origin and bank type (see e.g., Doumpos et al., 2017), while in the FE model, such variables' effects are absorbed by the constant term. Moreover, if differences across entities (i.e. banks) may affect the dependent variable(s), then the RE model is presumably most suitable (Clark & Linzer, 2015).

The final number of variables employed (after correlation analysis—see Subsection 4.4) is 15: (a) 11 control variables (10 CAMEL variables and bank size), (b) two main variables (dummy variables for crisis (CR) and global bank (GL)) and one key variable (dummy variable for green bank (GR)), and (c) the effect of the crisis on green banks (CR×GR), the main variable of interest. This interaction term captures the effect of the financial crisis on green banks. Specifically, we focus on this interaction term, where being a green bank during the crisis can become critical. In this case γ 5 , the coefficient of the interaction variable (see Equation 3), captures the impact of the financial crisis (CR) on the dependent variable Y i when GR equals one (and vice versa). Moreover, we have a two-way interaction describing the effect of a joint increase of CR and GR on Y i (Brambor et al., 2006; Braumoeller, 2004).

3.4.2 Main hypotheses

We test three main hypotheses:

Hypothesis a. (CAMEL variables and financial crisis): H0: γ 3 = 0, that is, the crisis has not affected CAMEL factors, against the alternative Ha: γ 3 ≠ 0, that is, the crisis has affected CAMEL factors, concerning both bank types. If the crisis (CR) estimate is not statistically significant, we accept H0 and reject Ha.

Hypothesis b. (CAMEL variables and green banks): H0: γ 4 = 0, that is, bank type does not affect CAMEL factors, against the alternative Ha: γ 4 ≠ 0, i.e., bank type affects CAMEL factors. If the green bank (GR) estimate is not statistically significant, we accept H0 and we reject Ha.

Hypothesis c. (Green banks and financial crisis): H0: γ 5 = 0, that is, the crisis has not affected green banks with respect to CAMEL factors, against the alternative Ha: γ 5 ≠ 0, i.e., the crisis has affected green banks with respect to CAMEL factors; if the interaction term (CR×GR) estimate is not statistically significant, we accept H0 and reject Ha.

The documentation for these hypotheses is presented in Online Appendix D.

4 RESULTS AND DISCUSSION

4.1 Descriptive statistics

Table 3 presents descriptive statistics for bank-specific CAMEL factors and bank size.

| Panel 1. All banks (green & non-green) | Panel 2: All banks (green & non-green): Pre- vs post-crisis period | Panel 3. Green vs non-green banks: Whole period | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Whole period | Pre-crisis period only | Post-crisis period only | Green banks only | Non-green banks only | |||||||||||

| Variables | Obs. | Mean | SD | Obs. | Mean | SD | Obs. | Mean | SD | Obs. | Mean | SD | Obs. | Mean | SD |

| TCR | 2435 | 15.42 | 6.28 | 567 | 13.38 | 9.84 | 1868 | 16.03 | 4.53 | 1140 | 15.52 | 3.95 | 1295 | 15.32 | 7.78 |

| CRTIER1 | 2414 | 12.54 | 4.81 | 592 | 9.98 | 5.49 | 1822 | 13.38 | 4.24 | 1154 | 12.55 | 3.83 | 1260 | 12.54 | 5.55 |

| LR | 3043 | 19.19 | 12.99 | 1050 | 18.52 | 14.46 | 1993 | 19.54 | 15.13 | 1220 | 18.52 | 10.07 | 1823 | 19.64 | 14.60 |

| NPLS | 2762 | 3.51 | 5.35 | 893 | 2.72 | 4.16 | 1869 | 3.88 | 5.79 | 1166 | 2.97 | 3.15 | 1596 | 3.90 | 6.47 |

| PROVLLLOANS | 3153 | 1.17 | 2.25 | 1093 | 1.14 | 2.30 | 2060 | 1.18 | 2.22 | 1287 | 0.93 | 1.29 | 1866 | 1.33 | 2.71 |

| NPLSRESERLL | 2356 | 129.69 | 75.58 | 762 | 105.36 | 68.29 | 1594 | 141.32 | 76.15 | 1012 | 134.90 | 70.99 | 1344 | 125.77 | 78.66 |

| RESERLLLOANS | 3006 | 3.04 | 4.52 | 1047 | 3.37 | 4.09 | 1959 | 2.86 | 4.73 | 1224 | 2.50 | 2.15 | 1782 | 3.41 | 5.57 |

| OPEXPENSOPINCOME | 2872 | 510.35 | 369.80 | 1006 | 552.31 | 378.54 | 1866 | 487.72 | 363.10 | 1195 | 515.83 | 2.15 | 1677 | 506.44 | 378.65 |

| OPEXPENSTA | 3191 | 6.20 | 6.24 | 1099 | 7.68 | 8.88 | 2092 | 5.42 | 4.03 | 1301 | 5.27 | 3.40 | 1890 | 6.84 | 7.54 |

| ROA | 2888 | 1.72 | 4.62 | 972 | 1.80 | 2.51 | 1916 | 1.67 | 5.39 | 1171 | 1.32 | 1.11 | 1717 | 1.98 | 5.91 |

| ROE | 3241 | 9.51 | 80.78 | 1087 | 14.36 | 30.19 | 2154 | 7.07 | 96.66 | 1333 | 11.65 | 21.21 | 1908 | 8.03 | 103.77 |

| LTD | 3161 | 128.06 | 366.97 | 1089 | 147.71 | 560.21 | 2072 | 117.73 | 200.75 | 1286 | 124.69 | 202.93 | 1875 | 130.37 | 445.91 |

| SIZE | 3355 | 18.05 | 2.16 | 1156 | 17.55 | 2.18 | 2199 | 18.31 | 2.10 | 1342 | 19.17 | 1.97 | 2013 | 17.30 | 1.95 |

| Panel 4: Green banks pre- vs post-crisis (green banks only) | Panel 5: Non-green banks pre- vs post-crisis (non-green banks only) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Pre-crisis period (green banks only) | Post-crisis period (green banks only) | Pre-crisis period (non-green banks only) | Post-crisis period (non-green banks only) | |||||||||

| Variables | Obs. | Mean | SD | Obs. | Mean | SD | Obs. | Mean | SD | Obs. | Mean | SD |

| TCR | 208 | 12.08 | 2.22 | 932 | 16.29 | 3.85 | 359 | 14.14 | 12.20 | 936 | 15.77 | 5.10 |

| CRTIER1 | 231 | 8.91 | 2.40 | 923 | 13.46 | 3.57 | 361 | 10.66 | 6.68 | 899 | 13.29 | 4.83 |

| LR | 276 | 16.46 | 7.69 | 944 | 19.13 | 10.60 | 774 | 19.26 | 16.14 | 1049 | 19.92 | 13.35 |

| NPLS | 259 | 1.52 | 1.58 | 907 | 3.38 | 3.36 | 634 | 3.21 | 4.75 | 962 | 4.36 | 7.35 |

| PROVLLLOANS | 291 | 0.67 | 1.35 | 996 | 1.01 | 1.27 | 802 | 1.31 | 2.54 | 1064 | 1.34 | 2.83 |

| NPLSRESERLL | 224 | 97.40 | 64.36 | 788 | 145.52 | 69.18 | 538 | 108.68 | 69.64 | 806 | 137.18 | 88.23 |

| RESERLLLOANS | 277 | 2.13 | 1.82 | 947 | 2.60 | 2.23 | 770 | 3.81 | 4.57 | 1012 | 3.12 | 6.21 |

| OPEXPENSOPINCOME | 281 | 547.96 | 311.91 | 914 | 505.95 | 369.48 | 725 | 554.00 | 401.58 | 952 | 470.22 | 356.19 |

| OPEXPENSTA | 293 | 5.81 | 2.97 | 1008 | 5.11 | 3.50 | 806 | 8.36 | 10.13 | 1084 | 5.71 | 4.46 |

| ROA | 266 | 1.38 | 0.94 | 905 | 1.31 | 1.16 | 706 | 1.96 | 2.87 | 1011 | 2.00 | 7.32 |

| ROE | 299 | 15.19 | 39.88 | 1034 | 10.62 | 10.80 | 788 | 14.04 | 25.59 | 1120 | 3.79 | 133.59 |

| LTD | 292 | 167.20 | 414.70 | 994 | 112.21 | 46.96 | 797 | 140.57 | 604.90 | 1078 | 122.83 | 274.60 |

| SIZE | 302 | 19.11 | 1.86 | 1040 | 19.18 | 2.00 | 854 | 17.00 | 2.02 | 1159 | 17.53 | 1.86 |

- Note: All variables listed in this table are defined in Table 1. The sample data period is between December 1999 and December 2021 (yearly observations).

An analysis of these statistics, including relevant graphs comparing average CAMEL variable values for both bank types in the pre- and post-crisis periods, is in Online Appendix E.

4.2 Unit root test

We examine our variables for unit roots using the Phillips-Peron (PP) and Augmented Dickey-Fuller (ADF) tests (Choi, 2001). The null hypothesis for both tests is that the panel contains a unit root. The results are reported in Table 4.

| Variable | Fisher-type test: PP | Fisher-type test: ADF | |||

|---|---|---|---|---|---|

| Inverse χ 2 P | Inverse χ 2 P | ||||

| Statistic | p-Value | Statistic | p-Value | ||

| TCR | 576.3223 | 0.0000 | 432.7961 | 0.0000 | |

| CRTIER1 | 456.2322 | 0.0000 | 421.1506 | 0.0000 | |

| LR | 842.8484 | 0.0000 | 491.0263 | 0.0000 | |

| NPLS | 1032.3208 | 0.0000 | 829.3101 | 0.0000 | |

| PROVLLLOANS | 1655.8885 | 0.0000 | 1044.3339 | 0.0000 | |

| NPLSRESERLL | 580.8081 | 0.0000 | 349.0031 | 0.0123 | |

| RESERLLLOANS | 1121.9818 | 0.0000 | 922.4793 | 0.0000 | |

| OPEXPENSOPINCOME | 1747.6865 | 0.0000 | 799.2404 | 0.0000 | |

| OPEXPENSTA | 1131.2831 | 0.0000 | 721.6166 | 0.0000 | |

| ROA | 1395.8630 | 0.0000 | 953.2277 | 0.0000 | |

| ROE | 1533.9488 | 0.0000 | 963.4409 | 0.0000 | |

| LTD | 802.2495 | 0.0000 | 674.4124 | 0.0000 | |

| SIZE | 886.6411 | 0.0000 | 571.8224 | 0.0000 | |

- Νote: (a) The Fisher-type unit root test refers to the Phillips-Perron (PP) and Augmented Dickey-Fuller (ADF) tests, respectively; the PP test was performed with a constant term, lag (1), and no trend, and the ADF test with a constant term, lag (1), and no trend. (b) For these tests, the null hypothesis of a unit root is tested against the alternative of stationarity.

The results reject the null hypothesis, indicating that all series-variables are stationary.

4.3 t-Test

t-Test results are shown in Table 5. We form six baseline hypotheses, each decomposed into 13 null hypotheses (the number of variables under investigation), to examine if the mean value of the i th CAMEL variable equals the mean value of the ith CAMEL variable of the hypothesis (H0) under investigation. The hypotheses tested are depicted in Table 5.

| Variable | 1. Ho: Green vs. non-green banks: Whole period | 2. All banks: Pre- vs. post-crisis period | 3. Pre vs. post-crisis: Green banks only | 4. Pre vs. post-crisis: Non-green banks only | 5. Green vs. non-green banks: Only pre-crisis period | 6. Green vs. non-green banks: Only post-crisis period | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Obs. (combined) | Unequal Variances | Obs. (combined) | Unequal variances | Obs. (combined) | Unequal variances | Obs. (combined) | Unequal variances | Obs. (combined) | Unequal variances | Obs. (combined) | Unequal Variances | |

| TCR | 2435 |

−0.204 (0.83; 0.407) |

2435 |

−2.649*** (6.212; 0.000) |

1140 |

−4.211*** (21.194; 0.000) |

1295 |

−1.635** (2.459; 0.014) |

567 |

2.052*** (3.108; 0.002) |

1868 |

−0.519** (2.484; 0.013) |

| CRTIER1 | 2414 |

−0.010 (0.05; 0.957) |

2414 |

−3.398*** (13.775; 0.000) |

1154 |

−4.552*** (23.099; 0.000) |

1260 |

2.626*** (6.799; 0.000) |

592 |

1.757*** (4.557; 0.000) |

1822 |

−0.169 (0.848; 0.397) |

| LR | 3043 |

1.118** (2.50; 0.01) |

3043 |

−1.026* (1.964; 0.049) |

1220 |

−2.669*** (4.626; 0.000) |

1283 |

−0.668 (0.939; 0.348) |

1050 |

2.799*** (3.772; 0.000) |

1993 |

0.798 (1.485; 0.138) |

| NPLS | 2762 |

0.931*** (4.99; 0.000) |

2762 |

−1.166*** (6.034; 0.000) |

1166 |

−1.863*** (12.537; 0.000) |

1596 |

−1.148*** (3.790; 0.000) |

893 |

1.688*** (7.941; 0.000) |

1869 |

0.973*** (3.714; 0.000) |

| PROVLLLOANS | 3153 |

0.396*** (5.47; 0.000) |

3153 |

−0.043 (0.503; 0.615) |

1287 |

−0.346*** (3.893; 0.000) |

1866 |

−0.031 (0.249; 0.804) |

1093 |

0.646*** (5.394; 0.000) |

2060 |

0.331*** (3.467; 0.000) |

| NPLSRESERLL | 2536 |

−9.129*** (2.95; 0.003) |

2536 |

−35.960*** (11.512; 0.000) |

1012 |

−48.163*** (9.717; 0.000) |

1344 |

−28.499*** (6.832; 0.000) |

762 |

11.283** (2.151; 0.032) |

1594 |

−8.381** (2.204; 0.028) |

| RESERLLLOANS | 3006 |

0.917*** (6.30; 0.000) |

3006 |

0.505*** (3.048; 0.002) |

1224 |

−0.471*** (−3.595; 0.000) |

1782 |

0.705*** (2.762; 0.006) |

1047 |

1.682*** (8.513; 0.000) |

1959 |

0.506** (2.429; 0.015) |

| OPEXPENSOPINCOME | 2872 |

−9.385 (0.68; 0.499) |

2872 |

64.589*** (4.425; 0.000) |

1195 |

42.013* (1.887; 0.059) |

1677 |

83.774*** (4.442; 0.000) |

1006 |

6.038 (0.253; 0.800) |

1866 |

−35.723** (2.751; 0.034) |

| OPEXPENSTA | 3191 |

1.570*** (7.96; 0.000) |

3191 |

6.197*** (8.019; 0.000) |

1301 |

0.697*** (3.389; 0.000) |

1890 |

2.655*** (6.958; 0.000) |

1099 |

2.553*** (6.433; 0.000) |

2092 |

0.595*** (3.409; 0.000) |

| ROA | 2888 |

0.661*** (4.519; 0.000) |

2888 |

0.126 (0.858; 0.391) |

1171 |

0.075 (1.077; 0.282) |

1717 |

−0.045 (0.178; 0.859) |

972 |

0.577*** (4.710; 0.000) |

1916 |

0.697*** (2.984; 0.003) |

| ROE | 3241 |

−3.619 (1.480; 0.139) |

3241 |

7.288*** (3.203; 0.001) |

1333 |

4.570* (1.961; 0.051) |

1908 |

10.249** (2.503; 0.012) |

1087 |

- 1.148 (0.463; 0.644) |

2154 |

−6.827* (1.704; 0.089) |

| LTD | 3161 |

5.674 (0.483; 0.629) |

3161 |

29.977* (1.709; 0.088) |

1286 |

54.989** (2.262; 0.025) |

1875 |

17.743 (0.771; 0.441) |

1089 |

−26.628 (0.823; 0.411) |

2072 |

10.618 (1.250; 0.212) |

| SIZE | 3355 |

−1.861*** (26.919; 0.000) |

3355 |

−0.763*** (9.752; 0.000) |

1342 |

−0.077 (0.621; 0.535) |

2013 |

−0.533*** (6.045; 0.000) |

1156 |

−2.109*** (16.547; 0.000) |

2199 |

−1.653*** (19.963; 0.000) |

- Note: (a) Testable hypotheses: 1. H0: The mean value of the i th CAMEL variable of green banks equals the mean value of the i th CAMEL variable of non-green banks. 2. H0: The mean value of the i th CAMEL variable of both bank types in the pre-crisis period equals the mean value of the i th CAMEL variable of both bank types in the post-crisis period. 3. H0: The mean value of the i th CAMEL variable of green banks in the pre-crisis period equals the mean value of the i th CAMEL variable of green banks in the post-crisis period. 4. H0: The mean value of the i th CAMEL variable of non-green banks in the pre-crisis period equals the mean value of the i th CAMEL variable of non-green banks in the post-crisis period. 5. H0: The mean value of the i th CAMEL variable of green banks in the pre-crisis period equals the mean value of the i th CAMEL variable of non-green banks in the pre-crisis period. 6. H0: The mean value of the i th CAMEL variable of green banks in the post-crisis period equals the mean value of the i th CAMEL variable of non-green banks in the post-crisis period. (b) First value denotes difference in means; absolute values in parentheses denote t and p values, respectively. (c) t-test critical values: t = 1.96, p = 0.05: if t > 1.96 and p < 0.05, there is a statistically significant difference at the 5% level; otherwise, there is no statistically significant difference (see: Verbeek, 2000; p. 23). (d) Number of asterisks denotes significance level: *** at the 1% level (p-value <0.01), ** at the 5% level (0.01 < p-value <0.05), * at the 10% level (0.05 < p-value <0.1). (e) Statistically significant cases are indicated by bold characters.

The t-test results show statistically significant differences in the mean values of CAMEL variables in 59 out of 78 cases examined. This indicates that the majority of the CAMEL variables are good candidates for distinguishing between pre- and post-crisis periods as well as between green and non-green banks in both time periods. However, these differences might be driven by other bank characteristics or factors. Additionally, the results do not necessarily imply that green banks outperform non-green banks or vice versa. This necessitates further analysis to investigate if green (“treatment” group) and non-green banks (“control” group) exhibit differential behaviour.

4.4 Correlation analysis

We employ Pearson pairwise correlation (r) to check for potential multicollinearity among variables. We performed two separate correlation analyses: (a) one with all CAMEL variables and bank size, and (b) one with the remaining variables after examining the size of the correlation coefficients. Correlation matrices can be found in Tables 6 and 7. Specifically, to avoid multicollinearity problems, we excluded all variables with a correlation coefficient r ≥ 0.50, which can be considered a threshold between comparatively low and moderate correlations (Gujarati, 2004, p. 359).

| Variables | TCR | CRTIER1 | LR | NPLS | PROVLL LOANS | NPLS RESERLL | RESERL LLOANS | OPEXPENS OPINCOME | OPEXP ENSTA | ROA | ROE | LTD | SIZE |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| TCR | 1.000 | ||||||||||||

| CRTIER1 | 0.949 | 1.000 | |||||||||||

| LR | 0.292 | 0.281 | 1.000 | ||||||||||

| NPLS | 0.176 | 0.195 | 0.052 | 1.000 | |||||||||

| PROVLLLOANS | 0.425 | 0.378 | 0.169 | 0.365 | 1.000 | ||||||||

| NPLSRESERLL | 0.077 | 0.108 | −0.034 | 0.370 | −0.142 | 1.000 | |||||||

| RESERLLLOANS | 0.297 | 0.284 | 0.105 | 0.770 | 0.655 | −0.096 | 1.000 | ||||||

| OPEXPENSOPINCOME | −0.103 | −0.124 | −0.009 | 0.199 | 0.109 | 0.158 | 0.135 | 1.000 | |||||

| OPEXPENSTA | 0.381 | 0.340 | 0.203 | 0.272 | 0.803 | −0.193 | 0.560 | 0.169 | 1.000 | ||||

| ROA | 0.413 | 0.399 | 0.305 | 0.016 | 0.376 | −0.246 | 0.282 | −0.192 | 0.598 | 1.000 | |||

| ROE | 0.116 | 0.106 | 0.045 | −0.167 | −0.184 | −0.040 | −0.117 | 0.030 | −0.044 | 0.360 | 1.000 | ||

| LTD | −0.029 | −0.026 | 0.521 | −0.004 | −0.035 | 0.059 | −0.045 | 0.178 | 0.013 | 0.043 | −0.036 | 1.000 | |

| SIZE | −0.277 | −0.309 | −0.210 | −0.173 | −0.230 | 0.073 | −0.272 | 0.005 | −0.414 | −0.386 | 0.003 | −0.059 | 1.000 |

- Note: (a) All variables are defined in Table 1. (b) Data sources: Thomson Reuters Eikon (ex-DataStream) and own calculations. (c) Pairwise correlations above r = 0.50 are marked with red bold characters.

| Variables | TCR | CRTIER1 | LR | NPLS | PROVLL LOANS | NPLS RESERLL | OPEXPENS OPINCOME | ROA | ROE | LTD | SIZE |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TCR | 1.000 | ||||||||||

| CRTIER1 | 0.949 | 1.000 | |||||||||

| LR | 0.292 | 0.281 | 1.000 | ||||||||

| NPLS | 0.176 | 0.195 | 0.052 | 1.000 | |||||||

| PROVLLLOANS | 0.425 | 0.378 | 0.169 | 0.365 | 1.000 | ||||||

| NPLSRESERLL | 0.077 | 0.108 | −0.034 | 0.370 | −0.142 | 1.000 | |||||

| OPEXPENSOPINCOME | −0.103 | −0.124 | −0.009 | 0.199 | 0.109 | 0.158 | 1.0000 | ||||

| ROA | 0.413 | 0.399 | 0.305 | 0.016 | 0.376 | −0.246 | −0.192 | 1.000 | |||

| ROE | 0.116 | 0.106 | 0.045 | −0.167 | −0.184 | −0.040 | 0.030 | 0.360 | 1.000 | ||

| LTD | −0.029 | −0.026 | 0.521 | −0.004 | −0.035 | 0.059 | 0.178 | 0.043 | −0.036 | 1.000 | |

| SIZE | −0.277 | 0.309 | −0.211 | −0.173 | −0.230 | 0.073 | 0.005 | −0.386 | 0.003 | −0.059 | 1.0000 |

- Note: (a) All variables are defined in Table 1. (b) Data sources: Thomson Reuters Eikon (ex-DataStream) and own calculations. (c) Pairwise correlations above r = 0.50 are marked with red bold characters.

The correlation coefficients of the remaining variables are all below 0.50 (see Table 7), 5 suggesting no evidence of multicollinearity problems.

4.5 Main results: Regressions results and discussion

In Tables 8–17, we present the estimation results of the RE model.

| Depended variable: TCR | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Method of estimation: RE GLS | [1] | [2] | [3] | [4] | [5] | [6] | [7] | [8] | [9] |

| TCR (T-1) |

0.805*** (26.31) |

0.463*** (2.67) |

0.459*** (2.65) |

0.459*** (2.65) |

0.431** (2.57) |

0.391** (2.42) |

0.389** (2.40) |

0.383** (2.39) |

|

| CRTIER1(T-1) |

0.637*** (8.96) |

||||||||

| LR(T-1) |

0.553*** (4.25) |

0.096** (2.48) |

0.097** (2.51) |

0.098** (2.48) |

0.107*** (2.61) |

0.991*** (2.68) |

0.100*** (2.68) |

0.099*** (2.73) |

|

| NPLS(T-1) |

−0.007 (0.25) |

0.057 (1.50) |

0.060 (1.59) |

0.059 (1.57) |

0.080* (1.77) |

0.095** (2.05) |

0.094** (2.05) |

0.098** (2.16) |

|

| PROVLLLOANS(T-1) |

0.095 (1.33) |

0.130 (0.72) |

0.126 (0.70) |

0.132 (0.72) |

0.190 (0.82) |

0.152 (0.73) |

0.154 (0.74) |

0.156 (0.75) |

|

| NPLSRESERLL(T-1) |

0.001 (1.24) |

0.003* (1.92) |

0.003* (1.89) |

0.003* (1.90) |

−9.86e-06 (0.01) |

0.003* (1.65) |

−0.003* (1.66) |

−0.004* (1.92) |

|

| OPEXPENSOPINCOME(T-1) |

−0.0003 (1.19) |

−0.0005 (1.47) |

−0.0005 (1.46) |

−0.0006 (1.47) |

−0.0007* (1.84) |

−0.0008** (2.15) |

−0.0009** (2.17) |

−0.0009** (2.26) |

|

| ROA(T-1) |

−0.084 (0.64) |

0.029 (0.17) |

0.351 (0.21) |

0.023 (0.14) |

−0.174 (0.86) |

−0.080 (0.40) |

−0.084 (0.42) |

−0.096 (0.48) |

|

| ROE(T-1) |

−0.002*** (4.18) |

−0.001 (1.49) |

−0.001 (1.48) |

−0.001 (1.42) |

−0.0006 (0.55) |

−0.0005 (0.48) |

−0.0005 (0.45) |

−0.0004 (0.39) |

|

| LTD(T-1) |

−0.003 (0.98) |

−0.008 (1.53) |

−0.008 (1.54) |

−0.008 (1.54) |

−0.009 (1.47) |

−0.008 (1.44) |

−0.008 (1.44) |

−0.008 (1.36) |

|

| SIZE(T-1) |

0.034 (0.48) |

−0.006 (0.06) |

0.214* (1.92) |

−0.155 (1.40) |

−0.198 (1.57) |

−0.187 (1351) |

|||

| GLOBAL |

0.276 (0.61) |

−0.346 (0.84) |

0.422 (1.13) |

0.315 (0385) |

0.252 (0.67) |

||||

| COUNTRY | YES | YES | YES | YES | |||||

| CRISIS |

2.146*** (4.477) |

2.135*** (4.83) |

1.580*** (4.17) |

||||||

| NEWGREEN |

0.350 (1.18) |

−0.592** (2.05) |

|||||||

| INTERACTION (= CRISIS × NEWGREEN) |

1.219*** (3.01) |

||||||||

| CONSTANT |

3.176*** (7.10) |

6.646*** (7.92) |

7.071*** (3.30) |

6.492** (2.48) |

7.099** (2.31) |

3.387 (1.24) |

9.489*** (2.92) |

10.223*** (2.83) |

10.574*** (2.92) |

| Sigma u i | 0 | 0.766 | 1.022 | 1.038 | 1.026 | 0.715 | 0.710 | 0.717 | 0.735 |

| Sigma e i | 2.895 | 2.043 | 2.288 | 2.239 | 2.239 | 2.239 | 2.180 | 2.180 | 2.156 |

| Rho | 0 | 0.123 | 0.166 | 0.177 | 0.174 | 0.093 | 0.096 | 0.098 | 0.104 |

| Observations | 2252 | 1404 | 1461 | 1461 | 1461 | 1461 | 1461 | 1461 | 1461 |

| No. of countries | 38 | 38 | 38 | 38 | 38 | 33 | 33 | 33 | 33 |

| Diagnostics: | |||||||||

| R 2: within | 0.614 | 0.412 | 0.315 | 0.318 | 0.316 | 0.331 | 0.383 | 0.384 | 0.394 |

| R 2: between | 0.969 | 0.890 | 0.837 | 0.837 | 0.842 | 0.861 | 0.877 | 0.876 | 0.873 |

| R 2: overall | 0.755 | 0.714 | 0.626 | 0.624 | 0.627 | 0.686 | 0.712 | 0.713 | 0.714 |

| Wald chi2(1) test: p-value | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

- Note: Please refer footnote of Table 17.

| Depended variable: CRTIER1 | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Method of estimation: RE GLS | [1] | [2] | [3] | [4] | [5] | [6] | [7] | [8] | [9] |

| TCR (T-1) |

0.367** (2.15) |

||||||||

| CRTIER1(T-1) |

0.869*** (47.11) |

0.828*** (14.95) |

0.829*** (14.28) |

0.828*** (14.26) |

0.762*** (10.43) |

0.705*** (8.83) |

0.704*** (8.83) |

0.700*** (8.80) |

|

| LR(T-1) |

0.124*** (3.09) |

0.023*** (3.12) |

0.024*** (3.13) |

0.024*** (3.18) |

0.038*** (3.04) |

0.033*** (2.75) |

0.034*** (2.76) |

0.034*** (2.84) |

|

| NPLS(T-1) |

0.085** (2.23) |

0.005 (0.18) |

0.006 (0.21) |

0.005 (0.19) |

0.036 (0.95) |

0.052 (1.44) |

0.052 (1.44) |

0.053 (1.47) |

|

| PROVLLLOANS(T-1) |

0.014 (0.08) |

−0.064 (1.33) |

−0.066 (1.41) |

0.061 (1.25) |

−0.029 (0.51) |

−0.028 (0.49) |

−0.027 (0.48) |

−0.014 (0.25) |

|

| NPLSRESERLL(T-1) |

0.008*** (4.08) |

0002*** (2.83) |

0.003*** (2.72) |

0.002*** (2.73) |

0.002 (1.53) |

−0.0007 (0.58) |

−0.0007 (0.59) |

−0.0009 (0.73) |

|

| OPEXPENSOPINCOME(T-1) |

−0.001*** (2.62) |

−0.0003* (1.79) |

−0.0003* (1.69) |

−0.0003* (1.74) |

−0.0005* (1.86) |

−0.0006** (2.20) |

−0.0006** (2.25) |

−0.0006** (2.36) |

|

| ROA(T-1) |

−0.007 (0.03) |

−0.051 (0.41) |

−0.046 (0.41) |

−0.058 (0.50) |

−0.151 (1.23) |

−0.033 (0.25) |

−0.036 (0.26) |

−0.034 (0.25) |

|

| ROE(T-1) |

−0.002 (1.53) |

−0.003*** (9.11) |

−0.003*** (8.74) |

−0.003*** (8.51) |

−0.003*** (6.65) |

−0.003*** (6.67) |

−0.003*** (6.70) |

−0.003*** (6.79) |

|

| LTD(T-1) |

−0.013** (2.09) |

−0.0004 (0.34) |

−0.0004 (0.34) |

−0.0005 (0.40) |

−0.003 (1.07) |

−0.003 (1.17) |

−0.003 (1.17) |

−0.003 (1.10) |

|

| SIZE(T-1) |

0.008 (0.17) |

−0.014 (0.25) |

0.056 (0.80) |

−0.122 (1.63) |

−0.132* (1.67) |

−0.127 (1.61) |

|||

| GLOBAL |

0.126 (0.74) |

0.467 (0.21) |

0.403** (2.19) |

0.378** (2.05) |

0.364** (1.96) |

||||

| COUNTRY | YES | YES | YES | YES | |||||

| CRISIS |

1.597*** (4.56) |

1.594*** (4.55) |

1.288*** (3.73) |

||||||

| NEWGREEN |

0.081 (0.59) |

−0.465** (2.29) |

|||||||

| INTERACTION (= CRISIS × NEWGREEN) |

0.693*** (3.23) |

||||||||

| CONSTANT |

1.862*** (7.96) |

5.690*** (2.61) |

1.953*** (3.29) |

1.796 (1.29) |

2.162 (1.42) |

1.638 (0.95) |

4.662** (2.39) |

4.846** (2.42) |

5.034** (2.50) |

| Sigma u i | 0 | 1.688 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Sigma e i | 2.152 | 2.317 | 1.879 | 1.837 | 1.837 | 1.837 | 1.802 | 1.800 | 1.789 |

| Rho | 0 | 0.347 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Observations | 2233 | 1398 | 1438 | 1438 | 1438 | 1438 | 1438 | 1438 | 1438 |

| No. of countries | 38 | 38 | 38 | 38 | 38 | 34 | 34 | 34 | 34 |

| Diagnostics: | |||||||||

| R 2: within | 0.580 | 0.341 | 0.565 | 0.565 | 0.564 | 0.573 | 0.603 | 0.603 | 0.607 |

| R 2: between | 0.982 | 0.627 | 0.972 | 0.973 | 0.973 | 0.969 | 0.971 | 0.972 | 0.971 |

| R 2: overall | 0.789 | 0.538 | 0.813 | 0.813 | 0.813 | 0.82 | 0.838 | 0.838 | 0.839 |

| Wald chi2(1) test: p-value | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

- Note: Please refer footnote of Table 17.

| Depended variable: LR | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Method of estimation: RE GLS | [1] | [2] | [3] | [4] | [5] | [6] | [7] | [8] | [9] |

| TCR (T-1) |

0.298** (2.39) |

0.001 (0.05) |

−0.002 (0.07) |

0.0006 (0.02) |

0.036 (1.39) |

0.036 (1.41) |

0.038 (1.47) |

0.037 (1.45) |

|

| CRTIER1(T-1) | |||||||||

| LR(T-1) |

0.921*** (34.25) |

0.890*** (32.39) |

0.889*** (33.10) |

0.887*** (32.55) |

0.799*** (25.86) |

0.799*** (25.60) |

0.799*** (25.68) |

0.799*** (25.61) |

|

| NPLS(T-1) |

−0.071 (0.57) |

0.032 (0.97) |

0. 028 (0.83) |

0.030 (0.90) |

0.007 (0.14) |

0.007 (0.13) |

0.006 (0.13) |

0.007 (0.13) |

|

| PROVLLLOANS(T-1) |

0 0.059 (0.98) |

−0.299* (1.87) |

−0.290* (1.76) |

−0.303* (1.83) |

−0.260 (1.29) |

−0.259 (1.28) |

−0.262 (1.30) |

−0.260 (1.28) |

|

| NPLSRESERLL(T-1) |

0.004 (0.98) |

−0.002* (1.80) |

−0.002* (1.80) |

−0.002* (1.83) |

−0.002 (1.11) |

−0.002 (1.08) |

−0.002 (1.06) |

−0.002 (1.09) |

|

| OPEXPENSOPINCOME(T-1) |

−0.0009 (1.10) |

0.0002 (0.36) |

0.0001 (0.27) |

0.0002 (0.37) |

0.0004 (0.72) |

0.0004 (0.72) |

0.0004 (0.77) |

0.0004 (0.76) |

|

| ROA(T-1) |

1.055** (2.39) |

0.210 (0.99) |

0.166 (0.68) |

0.200 (0.80) |

0.353 (1.23) |

0.353 (1.21) |

0.353 (1.22) |

0.354 (1.22) |

|

| ROE(T-1) |

−0.0012 (0.60) |

0.00003 (0.04) |

0.0002 (0.23) |

0.0001 (0.12) |

−0.0004 (0.35) |

−0.0004 (0.35) |

−0.0005 (0.37) |

−0.0005 (0.37) |

|

| LTD(T-1) |

0.071*** (3.06) |

0.008* (1.73) |

0.008* (1.74) |

0.009* (1.76) |

0. 008 (1.23) |

0. 008 (1.23) |

0.007 (1.24) |

0.008 (1.25) |

|

| SIZE(T-1) |

−0.060 (1.01) |

−0.005 (0.07) |

0.085 (1.27) |

0.087 (1.34) |

0.112 (1.59) |

0.114 (1.60) |

|||

| GLOBAL |

−0.314 (1.63) |

−0.492** (2.03) |

−0.495** (2.13) |

−0.429* (1.93) |

−0.436* (1.95) |

||||

| COUNTRY | YES | YES | YES | YES | |||||

| CRISIS |

−0.017 (0.06) |

−0.010 (0.04) |

−0.118 (0.36) |

||||||

| NEWGREEN |

−0.209 (1.10) |

−0.404 (0.87) |

|||||||

| INTERACTION (= CRISIS × NEWGREEN) |

0.244 (0.49) |

||||||||

| CONSTANT |

1.588*** (3.49) |

3.847 (1.20) |

1.173** (2.19) |

2.411 (1.63) |

1.470 (0.86) |

1.031 (0.64) |

1.004 (0.66) |

0.554 (0.35) |

0.614 (0.39) |

| Sigma u i | 0 | 5.285 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Sigma e i | 4.460 | 4.627 | 3.472 | 3.467 | 3.467 | 3.467 | 3.465 | 3.467 | 3.468 |

| Rho | 0 | 0.566 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Observations | 2808 | 1447 | 1447 | 1447 | 1447 | 1447 | 1447 | 1447 | 1447 |

| No. of countries | 38 | 38 | 38 | 38 | 38 | 33 | 33 | 33 | 33 |

| Diagnostics: | |||||||||

| R 2 : within | 0.552 | 0.196 | 0.543 | 0.543 | 0.543 | 0.544 | 0.544 | 0.544 | 0.545 |

| R 2 : between | 0.995 | 0.376 | 0.980 | 0.980 | 0.980 | 0.980 | 0.980 | 0.980 | 0.980 |

| R 2: overall | 0.869 | 0.350 | 0.841 | 0.841 | 0.841 | 0.850 | 0.850 | 0.850 | 0.850 |

| Wald chi2(1) test: p-value | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

- Note: Please refer footnote of Table 17.

| Depended variable: NPLS | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Method of estimation: RE GLS | [1] | [2] | [3] | [4] | [5] | [6] | [7] | [8] | [9] |

| TCR (T-1) |

−0.008 (0.50) |

−0.317** (2.16) |

−0.030** (2.09) |

−0.030** (2.09) |

−0.025* (1.82) |

−0.037** (2.12) |

−0.037** (2.13) |

−0.036** (2.13) |

|

| CRTIER1(T-1) | |||||||||

| LR(T-1) |

−0.002 (0.12) |

0.007 (1.10) |

0.007 (1.20) |

0.007 (1.20) |

0.005 (0.61) |

0.0007 (0.09) |

0.0006 (0.07) |

0.0006 (0.07) |

|

| NPLS(T-1) |

0.819*** (12.26) |

0.848*** (13.15) |

0.851*** (13.15) |

0.851*** (13.24) |

0.777*** (9.35) |

0.781*** (9.40) |

0.781*** (9.39) |

0.781*** (9.39) |

|

| PROVLLLOANS(T-1) |

0.722*** (2.84) |

0.116** (2.35) |

0.109** (2.19) |

0.110** (2.22) |

0.163*** (2.67) |

0.160** (2.56) |

0.158** (2.55) |

0.159** (2.57) |

|

| NPLSRESERLL(T-1) |

0.016*** (8.64) |

0.0008 (0.65) |

0.0008 (0.62) |

0.0008 (0.63) |

0.001 (0.87) |

0.0005 (0.28) |

0.0005 (0.30) |

0.0005 (0.29) |

|

| OPEXPENSOPINCOME(T-1) |

0.0009 (1.11) |

0.0003 (0.98) |

0.0003 (1.06) |

0.0003 (1.02) |

0.0003 (0.76) |

0.0002 (0.71) |

0.0003 (0.75) |

0.0005 (0.75) |

|

| ROA(T-1) |

−0.100 (0.32) |

0.171* (1.69) |

0.202** (1.98) |

0.199* (1.85) |

0.121 (1.08) |

0.151 (1.44) |

0.152 (1.44) |

0.152 (1.44) |

|

| ROE(T-1) |

−0.004** (2.52) |

−0.003*** (4.63) |

−0.003*** (4.79) |

−0.003*** (4.66) |

−0.003*** (3.86) |

−0.003*** (3.88) |

−0.003*** (3.89) |

−0.003*** (3.89) |

|

| LTD(T-1) |

0.004 (0.73) |

0.002 (1.05) |

0.001 (1.01) |

0.001 (1.02) |

0.002 (1.06) |

0.002 (1.07) |

0.002 (1.09) |

0.003 (1.11) |

|

| SIZE(T-1) |

0.042* (1.91) |

0.038 (1.29) |

0.107*** (3.30) |

0.050 (1.42) |

0.062* (1.65) |

0.062* (1.66) |

|||

| GLOBAL |

0.023 (0.21) |

−0.061 (0.52) |

0.059 (0.47) |

0.089 (0.70) |

0.088 (0.69) |

||||

| COUNTRY | YES | YES | YES | YES | |||||

| CRISIS |

0.584*** (4.16) |

0.587*** (4.16) |

0.587*** (2.94) |

||||||

| NEWGREEN |

−0.096 (1.21) |

−0.129 (0.98) |

|||||||

| INTERACTION (= CRISIS × NEWGREEN) |

0.042 (0.24) |

||||||||

| CONSTANT |

0.588*** (3.06) |

−0.398 (0.67) |

0.065 (0.27) |

−0.810 (1.60) |

−0.742 (1.14) |

−2.025*** (2.67) |

−1.108 (1.37) |

−1.323 (1.57) |

−1.312 (1.56) |

| Sigma u i | 0 | 1.753 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Sigma e i | 2.683 | 2.152 | 1.463 | 1.448 | 1.448 | 1.448 | 1.443 | 1.444 | 1.444 |

| Rho | 0 | 0.399 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Observations | 2562 | 1456 | 1456 | 1456 | 1456 | 1456 | 1456 | 1456 | 1456 |

| No. of countries | 38 | 38 | 38 | 38 | 38 | 33 | 33 | 33 | 33 |

| Diagnostics: | |||||||||

| R 2: within | 0.472 | 0.255 | 0.655 | 0.656 | 0.656 | 0.660 | 0.666 | 0.666 | 0.666 |

| R 2: between | 0.982 | 0.380 | 0.954 | 0.955 | 0.955 | 0.959 | 0.960 | 0.960 | 0.961 |

| R 2: overall | 0.706 | 0.302 | 0.803 | 0.803 | 0.803 | 0.816 | 0.820 | 0.820 | 0.820 |

| Wald chi2(1) test: p-value | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

- Note: Please refer footnote of Table 17.

| Depended variable: PROVLLLOANS | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Method of estimation: RE GLS | [1] | [2] | [3] | [4] | [5] | [6] | [7] | [8] | [9] |

| TCR (T-1) |

0.002 (0.39) |

−0.011** (1.98) |

−0.010* (1.78) |

−0.008 (1.57) |

−0.002 (0.41) |

−0.005 (0.80) |

−0.004 (0.77) |

−0.004 (0.75) |

|

| CRTIER1(T-1) | |||||||||

| LR(T-1) |

0.004 (0.47) |

−0.004 (1.34) |

−0.003 (1.23) |

−0.005* (1.67) |

0.0002 (0.04) |

−0.0005 (0.11) |

−0.0005 (0.12) |

−0.0005 (0.12) |

|

| NPLS(T-1) |

0.050** (2.15) |

0.017 (1.38) |

0.019 (1.54) |

0.020 (1.63) |

0.210 (1.29) |

0.022 (1.38) |

0.022 (1.38) |

0.022 (1.38) |

|

| PROVLLLOANS(T-1) |

0.277** (2.57) |

0.737*** (12.97) |

0.734*** (12.72) |

0.724*** (12.53) |

0.622*** (9.37) |

0.621*** (9.43) |

0.621*** (9.39) |

0.620*** (9.35) |

|

| NPLSRESERLL(T-1) |

−0.0004 (0.60) |

0.00004 (0.12) |

0.00002 (0.06) |

0.000 (0.03) |

0.00002 (0.06) |

−0.0002 (0.37) |

−0.0002 (0.36) |

−0.0001 (0.32) |

|

| OPEXPENSOPINCOME(T-1) |

0.0006*** (3.16) |

0.0003 (1.56) |

0.0003 (1.59) |

0.0003* (1.71) |

0.0003* (1.65) |

0.0003 (1.64) |

0.0003 (1.63) |

0.0003 (1.63) |

|

| ROA(T-1) |

0.310*** (3.00) |

0.278*** (3.54) |

0.295*** (3.50) |

0.321*** (3.66) |

0.350*** (3.30) |

0.357*** (3.35) |

0.358*** (3.35) |

0.358*** (3.35) |

|

| ROE(T-1) |

−0.002*** (4.06) |

0.0002 (0.71) |

0.0002 (0.46) |

0.00007 (0.22) |

−0.0003 (0.69) |

−0.0003 (0.67) |

−0.0003 (0.67) |

−0.0003 (0.67) |

|

| LTD(T-1) |

0.003 (1.48) |

0.0009 (1.29) |

0.0009 (1.23) |

0.001 (1.53) |

0.002* (1.67) |

0.002* (1.66) |

0.002* (1.67) |

0.002 (1.64) |

|

| SIZE(T-1) |

0.022* (1.73) |

0.064*** (2.72) |

0.039** (1.96) |

0.026 (1.22) |

0.028 (1.17) |

0.028 (1.15) |

|||

| GLOBAL |

−0.237*** (2.99) |

−0.223** (2.48) |

−0.196** (2.24) |

−0.190** (2.38) |

−0.188** (2.38) |

||||

| COUNTRY | YES | YES | YES | YES | |||||

| CRISIS |

0.130** (2.28) |

0.131** (2.29) |

0.159** (2.14) |

||||||

| NEWGREEN |

−0.019 (0.40) |

0.033 (0.57) |

|||||||

| INTERACTION (= CRISIS × NEWGREEN) |

−0.065 (0.91) |

||||||||

| CONSTANT |

0.860*** (6.16) |

−0.257 (0.95) |

−0.208 (1.34) |

−0.668* (1.78) |

−1.384** (2.53) |

−1.200** (2.41) |

−0.998** (1.94) |

−1.039* (1.83) |

−1.056* (1.85) |

| Sigma u i | 0.625 | 0.832 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Sigma e i | 1.564 | 0.710 | 0.690 | 0.688 | 0.688 | 0.688 | 0.688 | 0.688 | 0.688 |

| Rho | 0.138 | 0.578 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Observations | 2978 | 1477 | 1474 | 1474 | 1474 | 1474 | 1474 | 1474 | 1474 |

| No. of countries | 38 | 38 | 38 | 38 | 38 | 33 | 33 | 33 | 33 |

| Diagnostics: | |||||||||

| R 2 : within | 0.025 | 0.078 | 0.099 | 0.102 | 0.105 | 0.113 | 0.116 | 0.116 | 0.116 |

| R 2 : between | 0.834 | 0.440 | 0.950 | 0.949 | 0.952 | 0.955 | 0.955 | 0.956 | 0.956 |

| R 2: overall | 0.273 | 0.335 | 0.722 | 0.723 | 0.727 | 0.745 | 0.745 | 0.746 | 0.746 |

| Wald chi2(1) test: p-value | 0.010 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

- Note: Please refer footnote of Table 17.

| Depended variable: NPLSRESERLL | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Method of estimation: RE GLS | [1] | [2] | [3] | [4] | [5] | [6] | [7] | [8] | [9] |

| TCR (T-1) |

1.232** (2.24) |

−0.108 (0.40) |

−0.050 (0.19) |

−0.028 (0.10) |

−0.180 (0.73) |

−0.494** (2.02) |

−0.513** (2.11) |

−0.531** (2.20) |

|

| CRTIER1(T-1) | |||||||||

| LR(T-1) |

0.687 (1.54) |

−0.065 (0.42) |

−0.055 (0.36) |

−0.077 (0.48) |

−0.218 (1.08) |

−0.310 (1.51) |

−0.307 (1.49) |

−0.304 (1.46) |

|

| NPLS(T-1) |

7.371*** (4.15) |

−0.034 (0.08) |

0.061 (0.14) |

0.076 (0.17) |

0.092 (0.21) |

0.281 (0.65) |

0.286 (0.66) |

0.304 (0.70) |

|

| PROVLLLOANS(T-1) |

−10.778*** (3.15) |

−2.847*** (3.00) |

−3.122*** (3.26) |

−3.266*** (3.43) |

−3.071*** (2.83) |

−2.962*** (2.75) |

−2.930*** (2.72) |

−2.854*** (2.64) |

|

| NPLSRESERLL(T-1) |

0.840*** (49.71) |

0.840*** (37.23) |

0.839*** (36.30) |

0.838*** (37.19) |

0.786*** (33.08) |

0.761*** (29.27) |

0.761*** (29.37) |

0.758*** (29.20) |

|

| OPEXPENSOPINCOME(T-1) |

0.011 (1.22) |

0.006 (1.46) |

0.006* (1.66) |

0.007* (1.82) |

0.006 (1.40) |

0.006 (1.21) |

0.005 (1.13) |

0.005 (1.11) |

|

| ROA(T-1) |

−3.847 (0.96) |

3.177** (2.24) |

4.295*** (2.84) |

4.706*** (3.09) |

5.760*** (3.42) |

6.143*** (3.68) |

6.124*** (3.68) |

6.131*** (3.70) |

|

| ROE(T-1) |

−0.215* (1.76) |

−0.156*** (3.39) |

−0.176*** (3.66) |

−0.176*** (3.85) |

−0.182*** (3.64) |

−0.154*** (3.87) |

−0.154*** (3.87) |

−0.154*** (3.85) |

|

| LTD(T-1) |

0.110* (1.73) |

0.071** (2.58) |

0.069*** (2.24) |

0.073*** (2.69) |

0.071** (2.45) |

0.074** (2.31) |

0.073** (2.26) |

0.077** (2.33) |

|

| SIZE(T-1) |

1.286* (1.96) |

1.921** (2.67) |

2.408** (2.46) |

0.932 (0.86) |

0.574 (0.54) |

0.626 (0.58) |

|||

| GLOBAL |

−3.674 (1.38) |

−9.325*** (2.85) |

−6.212* (1.88) |

−7.115** (2.11) |

−7.308** (2.15) |

||||

| COUNTRY | YES | YES | YES | YES | |||||

| CRISIS |

15.263*** (4.65) |

15.156*** (4.64) |

11.570*** (2.76) |

||||||

| NEWGREEN |

2.881 (1.33) |

−3.684 (0.81) |

|||||||

| INTERACTION (= CRISIS × NEWGREEN) |

8.148* (1.67) |

||||||||

| CONSTANT |

20.733*** (9.48) |

81.834*** (5.13) |

13.434*** (2.61) |

−13.165 (0.89) |

−24.248 (1.64) |

−20.827 (1.02) |

3.188 (0.14) |

9.644 (0.43) |

11.592 (0.52) |

| Sigma u i | 0 | 45.474 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Sigma e i | 38.515 | 51.654 | 37.349 | 37.150 | 37.150 | 37.151 | 36.749 | 36.748 | 36.672 |

| Rho | 0 | 0.437 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Observations | 2087 | 1469 | 1398 | 1398 | 1398 | 1398 | 1398 | 1398 | 1398 |

| No. of countries | 38 | 38 | 38 | 38 | 38 | 33 | 33 | 33 | 33 |

| Diagnostics: | |||||||||

| R 2: within | 0.513 | 0.143 | 0.506 | 0.508 | 0.508 | 0.508 | 0.520 | 0.520 | 0.522 |

| R 2: between | 0.965 | 0.241 | 0.950 | 0.949 | 0.950 | 0.947 | 0.950 | 0.950 | 0.949 |

| R 2: overall | 0.713 | 0.185 | 0.729 | 0.730 | 0.731 | 0.743 | 0.748 | 0.748 | 0.749 |

| Wald chi2(1) test: p-value | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

- Note: Please refer footnote of Table 17.

| Depended variable: OPEXPENSOPINCOME | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Method of estimation: RE GLS | [1] | [2] | [3] | [4] | [5] | [6] | [7] | [8] | [9] |

| TCR (T-1) |

−3.791 (0.71) |

0.211 (0.06) |

0.263 (0.07) |

0.255 (0.07) |

0.528 (0.11) |

0.261 (0.05) |

0.238 (0.05) |

0.185 (0.04) |

|

| CRTIER1(T-1) | |||||||||

| LR(T-1) |

−5.511** (2.18) |

−2.444* (1.69) |

−2.439* (1.69) |

−2.434* (1.68) |

−2.085 (1.10) |

−2.152 (1.14) |

−2.147 (1.14) |

−2.154 (1.14) |

|

| NPLS(T-1) |

−3.701 (0.53) |

−0 0.627 (0.14) |

−0.533 (0.12) |

−0.539 (0.12) |

−5.381 (1.19) |

−5.146 (1.11) |

−5.139 (1.10) |

−5.121 (1.11) |

|

| PROVLLLOANS(T-1) |

45.690*** (3.57) |

7.582 (0.80) |

7.301 (0.76) |

7.345 (0.74) |

−3.804 (0.34) |

−4.011 (0.36) |

−3.963 (0.35) |

−3.682 (0.33) |

|

| NPLSRESERLL(T-1) |

−0.019 0.10) |

−0.049 (0.42) |

−0.051 (0.43) |

−0.051 (0.43) |

−0.027 (0.20) |

−0.051 (0.36) |

−0.051 (0.35) |

−0.058 (0.41) |

|

| OPEXPENSOPINCOME(T-1) |

0.561*** (20.38) |

0.577*** (13.14) |

0.578*** (12.95) |

0.578*** (12.57) |

0.497*** (8.70) |

0.498*** (8.76) |

0.498*** (8.68) |

0.497*** (8.68) |

|

| ROA(T-1) |

−5.091 (0.31) |

2.632 (0.25) |

3.889 (0.37) |

3.805 (0.36) |

3.572 (0.25) |

3.683 (0.26) |

3.620 (0.25) |

3.626 (0.25) |

|

| ROE(T-1) |

−6.231*** (3.33) |

−0.558 (0.55) |

−0.604 (0.62) |

−0.610 (0.60) |

−0.857 (0.90) |

−0.591 (0.65) |

−0.584 (0.64) |

0.603 (0.66) |

|

| LTD(T-1) |

1.644*** (3.99) |

0.672*** (2.75) |

0.671*** (2.76) |

0.670*** (2.75) |

0.343 (1.31) |

0.348 (1.33) |

0.347 (1.33) |

0.355 (1.38) |

|

| SIZE(T-1) |

1.336 (0.25) |

1.170 (0.18) |

−6.956 (0.93) |

−8.712 (1.12) |

−9.195 (1.13) |

−9.072 (1.12) |

|||

| GLOBAL |

0.954 (0.05) |

−10.175 (0.41) |

−6.904 (0.27) |

−8.000 (0.30) |

−8.490 (0.32) |

||||

| COUNTRY | YES | YES | YES | YES | |||||

| CRISIS |

17.429 (0.78) |

17.388 (0.78) |

7.909 (0.30) |

||||||

| NEWGREEN |

3.737 (0.21) |

−13.283 (0.53) |

|||||||

| INTERACTION (= CRISIS × NEWGREEN) |

21.388 (0.74) |

||||||||

| CONSTANT |

204.821*** (13.81) |

536.212*** (5.70) |

159.360*** (2.62) |

132.253 (1.01) |

135.267 (0.87) |

313.802* (1.79) |

336.889* (1.84) |

345.438* (1.81) |

351.828* (1.83) |

| Sigma u i | 30.163 | 166.020 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Sigma e i | 239.126 | 267.778 | 233.734 | 233.802 | 233.802 | 233.802 | 233.754 | 233.843 | 233.710 |

| Rho | 0.016 | 0.278 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Observations | 2558 | 1488 | 1404 | 1404 | 1404 | 1404 | 1404 | 1404 | |

| No. of countries | 38 | 38 | 38 | 38 | 38 | 33 | 33 | 33 | |

| Diagnostics: | |||||||||

| R 2: within | 0.138 | 0.053 | 0.100 | 0.100 | 0.100 | 0.102 | 0.103 | 0.103 | 0.104 |

| R 2: between | 0.900 | 0.331 | 0.879 | 0.879 | 0.879 | 0.840 | 0.841 | 0.840 | 0.839 |

| R 2: overall | 0.381 | 0161 | 0.397 | 0.397 | 0.397 | 0.435 | 0.435 | 0.435 | 0.435 |

| Wald chi2(1) test: p-value | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

- Note: Please refer footnote of Table 17.

| Depended variable: ROA | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Method of estimation: RE GLS | [1] | [2] | [3] | [4] | [5] | [6] | [7] | [8] | [9] |

| TCR (T-1) |

0.003 (0.40) |

0.002 (0.74) |

0.0006 (0.22) |

−0.0003 (0.10) |

−0.003 (1.07) |

0.003 (0.81) |

0.002 (0.78) |

0.002 (0.77) |

|

| CRTIER1(T-1) | |||||||||

| LR(T-1) |

0.013* (1.96) |

0.004* (1.84) |

0.003 (1.43) |

0.004* (1.82) |

0.004* (1.71) |

0.006** (2.33) |

0.006** (2.33) |

0.006** (2.32) |

|

| NPLS(T-1) |

−0.029** (1.97) |

−0.004 (0.48) |

−0.007 (0.80) |

−0.008 (0.87) |

−0.008 (0.69) |

−0.010 (0.85) |

−0.010 (0.85) |

−0.010 (0.85) |

|

| PROVLLLOANS(T-1) |

0.110 (1.48) |

0.078*** (2.67) |

0. 084*** (2.92) |

0.090*** (3.12) |

0.098*** (3.10) |

0.101*** (3.25) |

0.101*** (3.25) |

0.101*** (3.27) |

|

| NPLSRESERLL(T-1) |

−0.002*** (5.05) |

−0.0008*** (4.10) |

−0.0008*** (3.94) |

−0.001*** (3.72) |

−0.001*** (2.86) |

−0.001* (1.70) |

−0.001* (1.70) |

−0.001* (1.66) |

|

| OPEXPENSOPINCOME(T-1) |

−0.0004*** (4.64) |

−0.0001 (1.39) |

−0.0002 (1.62) |

−0.0002* (1.77) |

−0.0002** (2.08) |

−0.0002** (2.09) |

−0.0002** (2.09) |

−0.0002** (2.05) |

|

| ROA(T-1) |

0.746*** (3.20) |

0.802*** (18.56) |

0.773*** (17.03) |

0.759*** (16.16) |

0.655*** (13.33) |

0.640*** (13.14) |

0.640*** (13.14) |

0.640*** (13.14) |

|

| ROE(T-1) |

0.0007*** (3.13) |

−0.002*** (10.04) |

−0.002*** (9.31) |

−0.002*** (8.96) |

−0.002*** (7.33) |

−0.002*** (7.38) |

−0.002*** (7.37) |

−0.002*** (7.38) |

|

| LTD(T-1) |

0.003* (1.71) |

0.002 (0.60) |

0.003 (0.74) |

0.0002 (0.43) |

0.001 (1.34) |

0.001 (1.35) |

0.001 (1.34) |

0.001 (1.36) |

|

| SIZE(T-1) |

−0.038*** (3.96) |

−0.062*** (3.71) |

−0.027 (1.61) |

−0.001 (0.06) |

−0.003 (0.14) |

−0.003 (0.14) |

|||

| GLOBAL |

0.138** (2.38) |

0.083 (1.47) |

0.028 (0.49) |

0.023 (0.45) |

0.023 (0.45) |

||||

| COUNTRY | YES | YES | YES | YES | |||||

| CRISIS |

−0.264*** (5.74) |

−0.264*** (5.73) |

−0.265*** (3.93) |

||||||

| NEWGREEN |

0.014 (0.37) |

0.011 (0.19) |

|||||||

| INTERACTION (= CRISIS × NEWGREEN) |

0.003 (0.04) |

||||||||

| CONSTANT |

0.419 (1.05) |

1.254*** (4.24) |

0.263*** (3.25) |

1.052*** (4.43) |

1.466*** (4.14) |

0.949** (2.50) |

0.542 (1.55) |

0.571 (1.47) |

0.572 (1.44) |

| Sigma u i | 0 | 0.636 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Sigma e i | 2.301 | 0.609 | 0.562 | 0.556 | 0.556 | 0.556 | 0.552 | 0.552 | 0.552 |

| Rho | 0 | 0.522 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Observations | 2655 | 1479 | 1441 | 1441 | 1441 | 1441 | 1441 | 1441 | 1441 |

| No. of countries | 38 | 38 | 38 | 38 | 38 | 33 | 33 | 33 | 33 |

| Diagnostics: | |||||||||

| R 2: within | 0.004 | 0.101 | 0.212 | 0.219 | 0.222 | 0.224 | 0.247 | 0.247 | 0.247 |

| R 2: between | 0.997 | 0.384 | 0.952 | 0.947 | 0.947 | 0.963 | 0.962 | 0.962 | 0.962 |

| R 2: overall | 0.505 | 0.275 | 0.739 | 0.742 | 0.745 | 0.763 | 0.769 | 0.769 | 0.769 |

| Wald chi2(1) test: p-value | 0.001 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

- Note: Please refer footnote of Table 17.

| Depended variable: ROE | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Method of estimation: RE GLS | [1] | [2] | [3] | [4] | [5] | [6] | [7] | [8] | [9] |

| TCR (T-1) |

−0.036 (0.34) |

−0.037 (0.37) |

−0.048 (0.51) |

−0.083 (0.98) |

−0.133* (1.76) |

−0.026 (0.45) |

−0.026 (0.45) |

−0.030 (0.51) |

|

| CRTIER1(T-1) | |||||||||

| LR(T-1) |

−0.254** (2.37) |

−0.238* (1.91) |

−0.240* (1.90) |

−0.209* (1.84) |

−0.192* (1.65) |

−0.160 (1.39) |

−0.160 (1.39) |

−0.160 (1.39) |

|

| NPLS(T-1) |

−0.424** (2.26) |

−0.410** (2.05) |

−0.427** (2.07) |

−0.458** (2.17) |

−0.286 (0.93) |

−0.334 (1.07) |

−0.334 (1.07) |

−0.332 (1.06) |

|

| PROVLLLOANS(T-1) |

0.644 (1.12) |

0.817 (1.61) |

0.867 (1.62) |

1.076* (1.92) |

0.808 (1.18) |

0.832 (1.20) |

0.832 (1.20) |

0.852 (1.23) |

|

| NPLSRESERLL(T-1) |

−0.021*** (3.35) |

−0.021*** (3.26) |

−0.021*** (3.25) |

−0.020*** (3.16) |

−0.020** (2.33) |

−0.012 (1.41) |

−0.012 (1.41) |

−0.013 (1.39) |

|

| OPEXPENSOPINCOME(T-1) |

−0.009** (2.20) |

−0.009** (2.24) |

−0.009** (2.21) |

−0.010** (2.24) |

−0.011** (1.98) |

−0.011* (1.95) |

−0.011* (1.95) |

−0.011* (1.94) |

|

| ROA(T-1) |

2.828*** (4.86) |

2.460*** (4.69) |

2.258*** (3.95) |

1.708*** (2.60) |

0.921 (1.11) |

0.669 (0.79) |

0.669 (0.79) |

0.661 (0.78)) |

|

| ROE(T-1) |

0.289*** (2.92) |

0.034 (0.58) |

0.038 (0.66) |

0.038 (0.74) |

0.036 (0.68) |

0.026 (0.62) |

0.026 (0.62) |

0.027 (0.63) |

|

| LTD(T-1) |

0.014 (1.24) |

0.014 (1.22) |

0.014 (1.22) |

0.010 (0.91) |

0.001 (0.07) |

−0.001 (0.07) |

−0.001 (0.09) |

−0.001 (0.05) |

|

| SIZE(T-1) |

−0.236 (0.97) |

−1.133* (1.87) |

−0.947 (1.10) |

−0.347 (0.41) |

−0.572 (0.56) |

−0.562 (0.56) |

|||

| GLOBAL |

5.169** (2.19) |

4.346 (1.29) |

3.079 (0.92) |

2.514 (0.86) |

2.475 (0.85) |

||||

| COUNTRY | YES | YES | YES | YES | |||||

| CRISIS |

−6.030*** (6.14) |

−6.088*** (6.24) |

−6.720*** (4.21) |

||||||

| NEWGREEN |

1.813 (1.19) |

0.661 (0.44) |

|||||||

| INTERACTION (= CRISIS × NEWGREEN) |

1.434 (0.69) |

||||||||

| CONSTANT |

6.183*** (2.89) |

19.021*** (8.43) |

18.672*** (6.47) |

23.523*** (3.24) |

39.106*** (2.87) |

37.501* (1.87) |

28.196 (1.44) |

32.219 (1.43) |

32.582 (1.43) |

| Sigma u i | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Sigma e i | 81.125 | 19.082 | 19.065 | 18.934 | 19.934 | 18.934 | 18.894 | 18.901 | 18.908 |

| Rho | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Observations | 3067 | 1491 | 1489 | 1489 | 1489 | 1489 | 1489 | 1489 | 1489 |

| No. of countries | 38 | 38 | 38 | 38 | 38 | 33 | 33 | 33 | 33 |

| Diagnostics: | |||||||||

| R 2: within | 0.003 | 0.032 | 0.029 | 0.031 | 0.038 | 0.044 | 0.056 | 0.056 | 0.056 |

| R 2: between | 0.204 | 0.322 | 0.349 | 0.343 | 0.374 | 0.458 | 0.450 | 0.453 | 0.453 |

| R 2: overall | 0.008 | 0.088 | 0.088 | 0.089 | 0.099 | 0.122 | 0.132 | 0.133 | 0.133 |

| Wald chi2(1) test: p-value | 0.004 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

- Note: Please refer footnote of Table 17.

| Depended variable: LTD | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Method of estimation: RE GLS | [1] | [2] | [3] | [4] | [5] | [6] | [7] | [8] | [9] |

| TCR (T-1) |

−0.972* (1.91) |

0.114 (0.47) |

0.035 (0.15) |

0.030 (0.12) |

0.091 (0.27) |

0.410 (0.89) |

0.401 (0.89) |

0.414 0.93 |

|

| CRTIER1(T-1) | |||||||||

| LR(T-1) |

3.840*** (2.40) |

0.611* (1.95) |

0.589* (1.89) |

0.593* (1.90) |

1.255* (1.77) |

1.345* (1.83) |

1.347* (1.83) |

1.348* (1.83) |

|

| NPLS(T-1) |

0.293 (0.21) |

0.513 (0.53) |

0. 382 (0.43) |

0.378 (0.44) |

0.429 (0.38) |

0.291 (0.28) |

0.293 (0.28) |

0.284 (0.27) |

|

| PROVLLLOANS(T-1) |

−6.498 (1.61) |

−2.656 (1.30) |

−2.381 (1.19) |

−2.352 (1.16) |

−3.504 (1.29) |

−3.352 (1.33) |

−3.333 (1.33) |

−3.403 (1.37) |

|

| NPLSRESERLL(T-1) |

0.041 (0.57) |

0.011 (0.26) |

0.012 (0.29) |

0.013 (0.30) |

0.028 (0.63) |

0.052 (1.04) |

0.052 (1.04) |

0.053 (1.11) |

|

| OPEXPENSOPINCOME(T-1) |

0.018** (2.50) |

−0.003 (0.69) |

−0.004 (0.89) |

−0.004 (0.86) |

0.0001 (0.03) |