Exploring the role of oil shocks on the financial stability of Gulf Cooperation Council countries

Abstract

This study explores the relationship and connectedness between oil returns and financial stresses in six Gulf Cooperation Council (GCC) countries using daily data from September 21, 2006 to May 31, 2019. The Bayesian Graph-based Structural Vector Autoregression (BGSVAR) model is utilised to estimate and analyse the direction of causality. In addition, the spillover approach is utilised to examine connectedness and risk transmission patterns between oil returns and financial stresses in the GCC economies in both time and frequency domains. The empirical analysis of the BGSVAR model shows that oil returns and financial stresses have both a contemporary and temporal relationship, whilst findings from the spillovers analysis show that oil returns tend to act as a net transmitter of spillovers to GCC financial markets in both medium and long-run horizons but a net receiver of spillovers in the short-run.

1 INTRODUCTION

The critical role played by oil in the global economy has been well-recognised for some time (e.g., Cunado & de Gracia, 2003, 2005; Hamilton, 2011), even more so for those in the Gulf region, many of whom depend on oil as their main export and source of government revenues. This has led to the development of a vast literature on the nexus between oil returns and many macroeconomic and financial fundamentals. In particular, there is significant literature on the link between oil returns and stock markets (e.g., Aloui et al., 2012; Broadstock et al., 2016; Gomez-Gonzalez et al., 2020; Park & Ratti, 2008; Zhang, 2017), the link between oil returns and foreign exchange markets (e.g., Basher et al., 2016; Reboredo, 2012), and between oil returns and the banking system (e.g., Alodayni, 2016; Khandelwal et al., 2016; Poghosyan & Hesse, 2009).

Despite ample studies on this topic, most of the previous studies have mainly concentrated on financial connectedness and risk transmission between oil and one aspect of the financial system (e.g., stock markets). No previous study has examined the impact of oil price shocks on the aggregate financial sectors of the Gulf Cooperation economies using a more comprehensive proxy that considers the combined effects of changes in different aspects of the financial markets, such as foreign exchange markets, stock markets and banking sectors, on the stability of the whole financial system of the country. Composite Financial Stress Indexes, therefore, offer more informative and accurate measurements of the conditions and soundness of the financial system in an economy than measurements that simply focus on one segment of the financial sector such as stock markets (see e.g., Apostolakis & Papadopoulos, 2015; Balakrishnan et al., 2011; Elsayed & Yarovaya, 2019; MacDonald et al., 2018; among others).

Therefore, our paper contributes to the existing literature in several ways. First, to the best of the authors' knowledge, this study is the first attempt to explore the nexus and interconnectedness pattern between oil shocks and the Financial Stress Indexes of Gulf Cooperation Council (GCC) economies. To this end, the Composite Financial Stress Indexes have been constructed to monitor financial system soundness in the GCC economies. Finally, a battery of economic techniques is applied. The Bayesian Graph-based Structural VAR approach developed by Ahelegbey et al. (2016) is used to analyse the direction of causality. Further, the spillover approaches introduced by Baruník and Křehlík (2018) and Diebold and Yılmaz (2014) are utilised to scrutinize connectedness and risk transmission patterns between oil returns and aggregate financial stress indexes of the GCC economies in both time and frequency domains.

The linkage between oil returns and financial stresses can potentially operate in both directions. In terms of whether oil prices can affect financial stress, it much depends on to what extent the country depends on oil revenues and natural resources in general (e.g., oil importers or oil exporters). For oil-importer countries, higher oil prices hinder economic activity, which can then feed into higher financial stress. In this regard, previous literature highlighted a positive comovement between oil price changes and financial stress. For oil exporters, such as the GCC economies, problems may arise due to a decrease in oil prices leading to a balance of payments and/or government budget problems, which can then feed into financial stress. So here we expect a negative relationship between oil price changes and financial stress.

It is also possible that financial stress can affect oil prices. For instance, periods of high global financial stress may be associated with weaker economies and thus lower energy demand, causing oil prices to fall. Such movements may happen more quickly in faster-moving (and more forward-looking) financial markets than in oil markets, suggesting any relationship may occur with a lag. However, the financialization of oil and other commodity markets in recent years means that financial stress might be more readily transmitted to oil markets.

Against this backdrop, this paper aims at exploring the relationship between oil returns and financial stress indexes in the GCC economies using data over the period from September 21, 2006 to May 31, 2019. The GCC was founded in 1981 and includes six countries, namely Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates (note there are seven financial centres since the UAE includes both Dubai and Abu Dhabi). In doing so, the focus on the GCC economies provides new insights into this important relationship for several reasons. First, to the best of the authors' knowledge, this study is the first attempt to explore the relationship and interconnectedness between oil price shocks and Financial Stress Indexes. Compared to previous literature, this research does not restrain analysis to one single dimension of the financial system. Instead, we adopted a comprehensive approach, which considers several aspects and dimensions of the financial system, including foreign exchange markets, stock markets, and banking systems. Second, GCC economies remain hugely dependent on oil for exports and government revenues, which in turn fuel investment and aggregate demand (Arouri, 2011). This leaves them especially vulnerable to movements in oil prices. Furthermore, these countries have made significant efforts to develop their financial systems, diversify their economies, and promote inward investment in recent years.1 Whilst it can be argued this is necessary to promote long-run development, it can also leave them more vulnerable to financial contagion. Finally, being located in the Middle East leaves GCC countries exposed to developments such as the Arab Spring2 and other sources of instability in this ‘politically sensitive’ area of the world. The period in question is also of particular interest since it includes a big rise followed by a sudden fall in oil prices, as well as several financial and political events such as the Global Crisis in 2007/2008, European Sovereign Debt Crisis between 2010 and 2012, Dubai credit crunch in 2009 and the Arab Spring started in 2011.

The rest of this study is organised as follows. First, related literature is reviewed and critically analysed in Section 2. Next, data and methodology are discussed in Section 3 whereas empirical results are presented and scrutinised in Section 4. Finally, Section 5 concludes and provides some policy implications.

2 LITERATURE REVIEW

This section includes two sub-sections. First, we present a review of the relevant literature on the relationships and the transmission mechanism between oil and stock market returns. Second, we discuss the interconnectedness and volatility spillover effects among oil shocks and financial stress.

2.1 Oil & Stock Markets

There have been a vast number of studies on the linkage between oil shocks and stock markets, going back to Jones and Kaul (1996), Hamilton (1996), and Sadorsky (1999) who investigate the relationship between oil prices and stock market returns. Since then a vast literature has emerged to assess the oil and stock markets linkages in both developed and developing economies (see e.g., Broadstock et al., 2016 for a survey). Analysis of developed economies includes Abhyankar et al. (2013), El-Sharif et al. (2005), Cunado and de Gracia (2003, 2014), Kang et al. (2016) and Kilian and Park (2009). Analysis of emerging markets includes Asteriou and Bashmakova (2013), Arouri and Rault (2012), Basher and Sadorsky (2006), Cong et al., 2008, Ghosh (2016), Fang and You (2014), Gupta and Modise (2013), and Zhu et al. (2015; 2016). Most literature finds that rising oil prices exert negative impacts on stock markets, whilst Wang et al. (2013) and Filis and Chatziantoniou (2014) find evidence that oil price shocks exert different impacts on oil importers compared to oil exporters. Similarly, Aloui et al. (2012) and Park and Ratti (2008) identify an asymmetric effect of oil price shocks on stock market returns, with the increases in oil prices exerting a larger effect than the decreases.

Over the years, the literature on the oil and stock markets relationships has evolved rapidly in order to incorporate the latest empirical techniques. For instance, non-linearity was accounted for by Ciner (2001) and Hamilton (2003), whilst regime-switching was included by Aloui and Jammazi (2009). Later literature then incorporated the potential for a dynamic relationship including Antonakakis and Filis (2013), Filis et al. (2011), Broadstock et al. (2012), Nguyen and Bhatti (2012), and Wen et al. (2012), with the latter two employing the copular approach.

Whilst these studies provide valuable insight into the oil-stock market nexus, they often assume oil shocks are exogenous and fail to account for the increasing connectedness of financial markets over the years or the increasing financialization of oil markets (Creti & Nguyen, 2015). This paper investigates the linkage between oil price changes and financial stress in six Gulf Cooperation Council (GCC) countries using daily data from 2006 to 2019. The Bayesian Graph-based Structural VAR (BGSVAR) model is utilised to estimate and analyse the direction of causality. In addition, the spillover approach is utilised to examine connectedness and risk transmission patterns between oil returns and financial stresses in the GCC economies in both time and frequency domains. The empirical analysis of BGSVAR model shows that oil returns and financial stresses have both a contemporary and temporal relationship, whilst findings from the spillovers analysis show that oil returns tend to act as a net transmitter of spillovers to GCC financial markets in both medium and long-run horizons, but a net receiver of spillovers in the short-run. Recent studies have attempted to account for these issues. Zhang (2017) employs the multivariate time series approach devised by Diebold and Yilmaz (2009, 2012, 2014) to analyse the linkage between oil price shocks and six international stock markets. It is found that the effect of oil price shocks on these stock markets is fairly limited (unless the shocks are large), but the transmission from stock markets to oil prices is more pronounced. In a similar vein, Yin and Ma (2020) analyse the effects of oil price shocks on volatility in the stock markets of the G20 countries for the period 1994 to 2019. They employ the graphical Bayesian (BGVAR) model to estimate interconnectedness for both the full and segmented samples. They find that in normal times causality runs from stock volatility to oil shocks, but in some cases, the reverse occurs. Finally, Gomez-Gonzalez et al. (2020) examine volatility spillovers and the direction of causality between oil and stock market indexes of 17 oil-dependent countries over the period from August 1999 to March 2018. In doing so, they applied the dynamic Granger-type causality tests and the total spillover index approach of Diebold and Yilmaz (2009, 2012, 2014) with LASSO methods. Empirical results from the spillover analysis show that the connectedness between the oil market and stock markets is time-varying. Further, volatility spillovers are mainly transmitted from stock markets to oil with the oil market being the largest net receiver of shocks over the sample period. On the other hand, findings from dynamic predictive causality tests indicate time-varying bidirectional causalities between the oil market and stock markets with oil granger-cause stock markets over the last few years of the sample.

In the context of GCC countries, the relationship between oil returns and stock returns has been investigated by several authors, with mixed results. Hammoudeh and Choi (2006) find that the changes in oil prices have no effect on the movements of stock indexes. Malik and Hammoudeh (2007) report strong evidence of volatility spillovers from the oil to the stock markets (with an exception for the Saudi Arabian stock market), where the reverse occurred. Arouri and Rault (2010) find evidence of negative Granger causality from oil returns to equities, whilst Arouri et al. (2011) found significant return and volatility transmissions between oil prices and stock returns. Maghyereh and Al-Kandari (2007), Zarour (2006), and Arouri and Fouquau (2009) all show evidence of some nonlinear relationships between oil prices and stocks. Fayyad and Daly (2011) compare the response of GCC stock markets to oil shocks with stock markets in the US and UK, finding that the UAE, UK, and Qatar are the most responsive. Finally, Maghyereh and Awartani (2012) employ the Diebold and Yilmaz (2009, 2012) method to analyse the return and volatility spillover effects between oil prices and stock indexes from 2004 to 2006. They find that return and volatility spillover effects are transmitted in both directions, but that the oil market gives more than it takes in both cases, and that these effects increase after the GFC.

2.2 Financial stress and oil shocks

Financial contagion has become the subject of much research in recent years, particularly following the 2008 Global Financial Crisis (GFC). The studies on financial transmission and contagion can be traced back to the seminal paper of Engle et al. (1990) who proposed the ‘heat-wave’ (where volatility is country-specific) and ‘meteor shower’ (where volatility is transmitted across countries) hypotheses.

It is now widely accepted in the literature that financial volatility is transmitted from country to country via both trade (Forbes, 2002; Glick & Rose, 1999) and financial (Caramazza et al., 2004; Kaminsky & Reinhart, 2000) linkages. Furthermore, as Balakrishnan et al. (2011) point out, financial stresses caused by global or regional events can be transmitted across multiple countries. This has led to a growing literature on financial spillovers (e.g., Apostolakis & Papadopoulos, 2015; Beirne et al., 2013; Caramazza et al., 2004; Cardarelli et al., 2011; Chau & Deesomsak, 2014; Diebold & Yilmaz, 2009; Yarovaya et al., 2016a, 2016b).

This vast literature includes some studies that focus on the MENA region (which incorporates the GCC), including Lagoarde-Segot and Lucey (2009) who found that MENA stock markets were more connected with developed countries than with themselves, and Neaime (2012, 2016) who also found weak integration between MENA stock markets. Other research has looked into volatility transmission in MENA stock markets (Chau et al., 2014; Lagoarde-Segot & Lucey, 2009; Neaime, 2005, 2016), whilst others have focused on the linkages between stock markets in MENA economies with those in the advanced economies (Darrat et al. 2000; Graham et al., 2013; Maghyereh et al., 2015; Neaime, 2012). The literature so far has mainly focused on contagion between one aspect of the financial system (e.g., stock markets). However, it is becoming increasingly popular to use some form of Financial Stress Index (FSI). These are constructed from a set of variables covering a broad range of financial indicators, providing a more comprehensive measure of financial conditions than any single variable alone.

Various studies have looked at the relationships between FSI and some measures of economic activity (e.g., Cardarelli et al., 2011; Cevik et al., 2013; Chau & Deesomsak, 2014; Mallick & Sousa, 2013), whilst others consider the transmission of financial stress between countries (e.g., Balakrishnan et al., 2009; Park & Mercado Jr, 2014). Yet there has been relatively little research employing FSI to assess financial spillovers. One such paper to do so is Elsayed and Yarovaya (2019) who analyse volatility spillover effects of Financial Stress Indexes in the MENA countries. They employ a dynamic frequency approach to show that the transmissions of financial stress between these markets are higher at the low frequencies than at the high frequencies, suggesting the domestic markets in MENA countries are slow in responding to the information from other markets. They also find that the GFC produced stronger spillovers across MENA financial markets in the Arab Spring.

The idea that financial stress and oil shocks are related is not new, however, there is relatively empirical literature on this issue. Chen et al. (2014), using data from 1993–2012, find that Kansan city FSI shocks cause statistically significant and negative impacts on oil prices. However, they do not explicitly assess the volatility spillover effects between FSI and oil prices. Nazlioglu et al. (2015) investigate the linkage between oil prices and financial stress at the global level, using the FSI for the US as a measure of global financial stress. They employ the volatility spillover test of Hafner and Herwartz (2006a, 2006b) and the mean causality test of Toda and Yamamoto (1995) on data from 1991 to 2014 to assess this relationship before, during and after the GFC. They present several key findings. First, the financial stress index and oil prices are both dominated by long-term volatility. Second, volatility transferred from oil prices to financial stress before the GFC and it reversed after the GFC. Finally, there is a causal link between financial stress and oil prices during the GFC.

Whilst this literature provides valuable insights into the oil-financial stress nexus, many questions remain unanswered. First, the existing literature mainly focuses on finical stress at the global (or US) level and does not account for regional differences. This is particularly important when analysing regions such as the GGC countries, who's dependence on oil exports leaves them vulnerable and potentially more exposed to oil shocks. Second, much of the existing literature does not account for financial spillovers. Due to the growing financialization of oil markets, and the growing interconnectedness in financial markets, it is possible that oil shocks and financial stress interact with each other in a more complex pattern. Thus, it is important to further investigate this relationship using methods that can account for financial spillovers.

3 METHODS

3.1 Data

For example, when calculating the FSI for Bahrain, equal weight has been assigned to the Bahrain Foreign Exchange Market Index (BHEI), the Bahrain Stock Market Index (BHSI), and the Bahrain Bank Index (BHBI). Each market stress index is itself computed using a variance-equal weighting of n standardised5 financial variables (see Equation (2)). The Banking Stress Index is composed of three variables: negative bank equity returns, bank equities volatility,6 and beta for the banking sector.7 The Stock Market Index is composed of two variables: negative stock returns8 and stock volatility.9 The Foreign Exchange Market Index is computed using the same approach as the stock market index.

Table 1 below provides a summary of descriptive statistics for oil returns and the FSIs for each of the six countries. Panel A reports the first four statistical moments along with test statistics for normality, autocorrelation, heteroskedasticity and stationarity. Results are in line with the standard stylised facts of financial time series, for example, the distributions are asymmetric and fat-tailed and volatility is clustering. In particular, the mean of each time series is close to zero, whilst the standard deviations are relatively large (with oil slightly less so). The kurtosis statistic for each variable suggests a leptokurtic10 distribution, whilst the skewness statistic suggests each of the series is skewed positively. The results from the J-B test confirm all series are non-normal. Furthermore, the ERS11 statistic suggests all series are I(0), whilst both Ljung-Box () statistics provide strong evidence of serial correlations and non-linear dependence for all the time series. The LM test calculated based on 20 lags shows significant evidence of the ARCH effects existing in all time-series variables, suggesting conditional heteroskedasticity is present. Panel B reports the correlation matrix between oil returns and the six FSI's. It can be seen that oil is negatively correlated with each of the FSI's, whilst the FSI's are positively correlated with each other.

| Variables | R | BH | KW | OM | QA | SA | UAE |

|---|---|---|---|---|---|---|---|

| Panel A: Summary Statistics | |||||||

| Mean | 0.0000 | 0.0000 | 0.0002 | 0.0000 | 0.0000 | 0.0000 | 0.0003 |

| Std. Deviation | 0.023 | 0.341 | 0.313 | 0.403 | 0.314 | 0.396 | 0.398 |

| Maximum | 0.212 | 6.426 | 4.595 | 4.314 | 5.382 | 3.171 | 3.978 |

| Minimum | −0.130 | −2.921 | −2.903 | −1.295 | −3.625 | −1.144 | −1.205 |

| Kurtosis | 5.735** | 52.821** | 33.876** | 23.985** | 54.456** | 13.507** | 16.458** |

| Skewness | 0.220** | 3.473** | 3.229** | 3.729** | 3.299** | 2.720** | 2.950** |

| J-B Test | 4565** | 3915** | 1641** | 8704** | 4151** | 2925** | 4217** |

| ERS | −7.048** | −6.912** | −5.923** | −5.611** | −8.766** | −3.475** | −7.994** |

| Q(20) | 33** | 3603** | 3700** | 9628** | 2593** | 8467** | 7220** |

| Q2(20) | 176** | 144** | 745** | 2964** | 592** | 3181** | 1934** |

| ARCH (20) | 511** | 217** | 788** | 548** | 517** | 647** | 361** |

| Panel B: Correlation Matrix | |||||||

| R | 1.000 | ||||||

| BH | −0.034* | 1.000 | |||||

| KW | −0.030* | 0.225** | 1.000 | ||||

| OM | −0.095** | 0.360** | 0.323** | 1.000 | |||

| QA | −0.094** | 0.257** | 0.515** | 0.424** | 1.000 | ||

| SA | −0.113** | 0.258** | 0.191** | 0.463** | 0.295** | 1.000 | |

| UAE | −0.097** | 0.292** | 0.294** | 0.531** | 0.382** | 0.465** | |

- Note: This table reports descriptive statistics for oil returns and financial stress indexes data used in the empirical analysis over the full sample starting from 21 September 2006 to 31 May 2019. J-B is the Jarque–Bera test for the null hypothesis of normality whereas ERS is the ADF-GLS unit root test proposed by Elliott et al. (1996). Q(20) and Q2(20) is the Ljung–Box test for serial correlation in raw series and squared residuals up to 20 lag. Similarly, ARCH (20) testing Engle's ARCH effects. **, * indicate significant at 1% and 5% level.

3.2 Empirical method

This paper employs two approaches to investigate the linkage between oil shocks and FSIs – the total spillover index methodology of Baruník and Křehlík (2018) and Diebold and Yilmaz (2009, 2012) and the Bayesian Graph-based structural VAR model (BGVAR) of Ahelegbey et al. (2016).

The total spillover index method employs a multivariate time-series model to generate measures of interdependence in a system of variables over time. This measure can be used to analyse spillover effects via the construction of the forecast error variance decomposition matrix displaying the interconnectedness of these variables, as well as measures of net directional connectedness. The method can also be modified by utilising a rolling window approach to allow for the time-varying spillover effects. This method enables us to estimate both the size and the direction of the spillovers between GCC financial stress and oil markets. Thus, we can examine the contributions of the oil market innovations to a system of variables in the oil market and financial markets in the GCC. This approach has three key advantages over other commonly used methods such as the vector-error correction (VEC) model or the multivariate generalised autoregressive conditional heteroskedasticity (GARCH) models. First, it is relatively straightforward to compute and interpret. Second, it allows us to study spillovers from one market to the other markets over time as well as the net effects when spillovers operate in both directions. Third, we can use it to analyse the effects of financial and political events such as the GFC and the Arab Spring on the interlinkages among variables under consideration. The method has been used to analyse many aspects of the financial system, such as foreign exchange (Green-Nimmo et al., 2016) and sovereign bond markets (Fernandez-Rodrigueza et al., 2016). However, the only previous studies to employ this approach to analyse financial stress are Apostolakis and Papadopoulos (2014), who employ the FSI to analyse financial stress comovements among the G7 countries, and Elsayed and Yarovaya (2019) who adopt this approach to analyse the effect of political instability caused by the Arab Spring on financial stress in the MENA countries. As far as we are aware, it has not been used to assess the relationship between oil price shocks and financial stress in GCC countries.

Further, the Bayesian Graphical Structural Vector Autoregression (BGSVAR) model has been used to estimate the direction of causality between oil returns and FSIs. The BGVAR model provides an accessible measure of the two-way causal relationship between variables by expressing the conditional independence structure with a set of vertices and undirected edges. A key strength of this model is that it helps minimise the over-parametrisation problem by using the data to identify the structural relationship between the variables, without resorting to economic theory. This is particularly useful in an issue such as this, where there are many possible ways in which the variables could interact, with no clear theoretical relationship, and where previous empirical research has led to mixed results.

4 RESULTS AND ANALYSES

In Tables 2 and 3, we present the edge probabilities calculated based on the Bayesian graph-based VAR model (BGVAR) for the contemporaneous and dynamic relationships between oil returns and stress indexes. The results highlighted in bold indicate strong evidence of dependence for edges whose posterior probabilities are above 0.50. We find evidence of both contemporary and temporal causal relationships from the estimation results of the BGVAR model under the MIN and MAR structures. Table 2 shows the MIN results that the highest posterior probabilities for oil returns originated from the Saudi Arabia financial market (SA index), followed by the Qatar financial market (QA index). The current values of SA and QA indexes tend to explain the current values of oil returns (i.e., [SA t & QA t) → Oil Returns t]). By contrast, results from the MAR structure in Table 3 show strong evidence of the dependence of current values of the Kuwait and Saudi Arabia financial market on lagged values of oil returns (i.e., (Oil Returns t−1 → KWt & SAt,). The results suggest that lagged values of oil returns have strong power in explaining the current conditions of the Kuwait and Saudi Arabia financial markets. These results are in line with the findings from the existing literature (see, e.g., Nazlioglu et al., 2015), providing more empirical evidence for linkages between oil returns and financial stress indexes.

| Variable | R | BH | KW | OM' | QA | SA | UAE |

|---|---|---|---|---|---|---|---|

| R | 0.00 | 0.03 | 0.05 | 0.25 | 0.50 | 0.68 | 0.18 |

| BH | 0.03 | 0.00 | 0.52 | 0.52 | 0.51 | 0.60 | 0.52 |

| KW | 0.07 | 0.48 | 0.00 | 0.53 | 0.52 | 0.09 | 0.49 |

| OM | 0.15 | 0.48 | 0.47 | 0.00 | 0.50 | 0.58 | 0.48 |

| QA | 0.39 | 0.43 | 0.48 | 0.50 | 0.00 | 0.57 | 0.47 |

| SA | 0.32 | 0.40 | 0.04 | 0.42 | 0.42 | 0.00 | 0.39 |

| UAE | 0.10 | 0.46 | 0.50 | 0.52 | 0.53 | 0.61 | 0.00 |

- Note: Bold entries represent the selected edges for the MIN structures based on posterior probabilities greater than 0.50.

| Variable | R | BH | KW | OM' | QA | SA | UAE |

|---|---|---|---|---|---|---|---|

| R | 0.98 | 0.04 | 0.05 | 0.07 | 0.33 | 0.21 | 0.29 |

| BH | 0.04 | 1.00 | 0.93 | 1.00 | 0.24 | 1.00 | 0.09 |

| KW | 0.53 | 0.27 | 1.00 | 1.00 | 0.08 | 1.00 | 0.06 |

| OM | 0.15 | 0.86 | 0.82 | 1.00 | 0.10 | 1.00 | 0.79 |

| QA | 0.28 | 0.71 | 1.00 | 0.97 | 1.00 | 1.00 | 0.10 |

| SA | 0.99 | 0.79 | 0.02 | 1.00 | 0.03 | 1.00 | 1.00 |

| UAE | 0.48 | 0.09 | 0.42 | 0.36 | 0.23 | 1.00 | 1.00 |

- Note: Bold entries represent the selected edges for the MAR structures based on posterior probabilities greater than 0.50.

In Tables 4, 5, 6 and 7, we report the estimation results of returns spillovers following the methods of Baruník and Křehlík (2018) and Diebold and Yilmaz (2012). The off-diagonal element (for ) in the tables is the estimated contribution to the forecast error variance of variable i (reported in the first column) coming from variable j (reported in the first row). The total spillover index is reported in the lower right corner of each table. The directional spillovers transmitted by variable i to all other variables j (labelled contributions to others) and the directional spillovers received by variable i from all other variables j (labelled contributions from others) are reported in the last row and column, respectively.

| Variable | R | BH | KW | OM | QA | SA | UAE | From others |

|---|---|---|---|---|---|---|---|---|

| R | 94.47 | 0.09 | 0.17 | 1.36| | 0.99 | 1.63 | 1.29 | 0.79 |

| BH | 0.61 | 72.76 | 2.98 | 8.66 | 3.86 | 6.16 | 4.98 | 3.89 |

| KW | 0.64 | 1.55 | 70.92 | 5.77 | 14.08 | 2.81 | 4.22 | 4.15 |

| OM | 1.80 | 3.92 | 4.25 | 55.56 | 6.86 | 13.40 | 14.21 | 6.35 |

| QA | 1.39 | 2.15 | 15.09 | 7.98 | 63.36 | 5.97 | 7.06 | 5.66 |

| SA | 2.26 | 1.71 | 0.92 | 7.58 | 2.70 | 74.23 | 10.58 | 3.68 |

| UAE | 1.84 | 2.10 | 3.87 | 11.45 | 5.74 | 12.67 | 62.33 | 5.38 |

| Contribution to others | 1.22 | 1.65 | 3.90 | 6.11 | 4.89 | 6.09 | 6.05 | 29.91% |

- Note: *From Others - directional spillover indexes measure spillovers from all markets j to market i; **Contribution to others - directional spillover indexes measure spillovers from market i to all markets j;

| Variable | R | BH | KW | OM | QA | SA | UAE | From others |

|---|---|---|---|---|---|---|---|---|

| R | 78.62 | 0.07 | 0.16 | 1.05 | 0.64 | 1.03 | 0.90 | 1.24 |

| BH | 0.06 | 39.10 | 0.37 | 0.99 | 0.44 | 0.33 | 0.81 | 0.97 |

| KW | 0.19 | 0.31 | 38.63 | 0.78 | 6.40 | 0.48 | 0.97 | 2.94 |

| OM | 0.37 | 0.52 | 0.46 | 21.22 | 1.42 | 1.88 | 2.50 | 2.31 |

| QA | 0.39 | 0.34 | 6.02 | 2.15 | 35.89 | 0.94 | 2.95 | 4.12 |

| SA | 0.75 | 0.13 | 0.08 | 1.26 | 0.40 | 26.41 | 1.95 | 1.47 |

| UAE | 0.36 | 0.45 | 0.59 | 2.56 | 1.98 | 2.10 | 21.92 | 2.59 |

| Contribution to others | 0.68 | 0.59 | 2.48 | 2.83 | 3.63 | 2.18 | 3.25 | 15.64% |

- Note: *From Others - directional spillover indexes measure spillovers from all markets j to market i within the frequency band; **Contribution to others - directional spillover indexes measure spillovers from market i to all markets j within the frequency band.

| Variable | R | BH | KW | OM | QA | SA | UAE | From others |

|---|---|---|---|---|---|---|---|---|

| R | 14.99 | 0.01 | 0.01 | 0.28 | 0.32 | 0.54 | 0.35 | 0.44 |

| BH | 0.47 | 30.71 | 2.24 | 6.55 | 2.95 | 4.89 | 3.50 | 6.01 |

| KW | 0.39 | 1.07 | 29.57 | 4.29 | 6.88 | 1.95 | 2.78 | 5.06 |

| OM | 1.22 | 2.89 | 3.23 | 30.19 | 4.67 | 9.70 | 9.98 | 9.25 |

| QA | 0.88 | 1.56 | 8.17 | 5.01 | 22.33 | 4.27 | 3.54 | 6.83 |

| SA | 1.30 | 1.31 | 0.67 | 5.23 | 1.91 | 41.82 | 7.25 | 5.16 |

| UAE | 1.28 | 1.38 | 2.78 | 7.53 | 3.22 | 8.95 | 35.61 | 7.34 |

| Contribution to others | 1.62 | 2.40 | 4.99 | 8.43 | 5.82 | 8.84 | 8.00 | 40.10% |

- Note: *From Others - directional spillover indexes measure spillovers from all markets j to market i within the frequency band; **Contribution to others - directional spillover indexes measure spillovers from market i to all markets j within the frequency band.

| Variable | R | BH | KW | OM | QA | SA | UAE | From others |

|---|---|---|---|---|---|---|---|---|

| R | 0.86 | 0.00 | 0.00 | 0.03 | 0.03 | 0.06 | 0.03 | 0.32 |

| BH | 0.08 | 2.95 | 0.37 | 1.12 | 0.47 | 0.94 | 0.66 | 7.73 |

| KW | 0.06 | 0.18 | 2.73 | 0.70 | 0.81 | 0.39 | 0.48 | 5.55 |

| OM | 0.20 | 0.50 | 0.56 | 4.15 | 0.77 | 1.81 | 1.74 | 11.88 |

| QA | 0.12 | 0.25 | 0.91 | 0.82 | 2.13 | 0.76 | 0.57 | 7.28 |

| SA | 0.21 | 0.27 | 0.17 | 1.09 | 0.39 | 6.00 | 1.38 | 7.47 |

| UAE | 0.20 | 0.27 | 0.49 | 1.36 | 0.54 | 1.62 | 4.80 | 9.54 |

| Contribution to others | 1.86 | 3.12 | 5.32 | 10.88 | 6.40 | 11.87 | 10.34 | 49.78% |

- Note: *From Others - directional spillover indexes measure spillovers from all markets j to market i within the frequency band; **Contribution to others - directional spillover indexes measure spillovers from market i to all markets j within the frequency band.

In Table 4, the Diebold and Yilmaz (2012) results show that oil returns deliver most spillovers to the SA stress index, followed by the UAE index. For example, shocks from oil returns are responsible for 2.26% (1.84%) of the error variance in forecasting the SA (UAE) index. However, it is noteworthy that the estimated contributions to the forecast error variance of various stress indexes in Gulf countries from oil returns are considerably small, and is ranged from 0.61% (i.e., from BH) to 2.26% (i.e., from SA). Only 0.61% of forecasting error variance in the BH index comes from shocks to oil returns. The contributions to forecast error variances of stress indexes are mainly from their own innovations. On average, the spillover index for the whole system is 29.91%, indicating that more than a quarter of forecast error variance comes from the spillovers over the full sample period.

Table 5 reports the Baruník and Křehlík (2018) results in the short run (1–5 days). We find that the results are consistent with the DY results (as shown in Table 4), however, the size of these spillovers in the short run is much smaller than the results generated using the Diebold and Yilmaz (2012) method. The total spillover index at short-term frequencies is 15.64%, which is also smaller than that of the Diebold and Yilmaz (2012) method. Table 6 reports the Baruník and Křehlík (2018) spillover results in the medium term (5 to 200 days). The general findings are also similar to the previous ones. However, the total spillover index is 40.10% in the medium term, and it is higher than that of the Diebold and Yilmaz (2012) method and the short-term total spillover index. In the long term of more than 200 days, our results (reported in Table 7) indicate that the total spillover index is 49.78%, showing that nearly 50% of forecast error variance comes from spillovers at long-term frequencies. Moreover, we find that the contributions to the forecast error variance of various stress indexes from oil returns become larger over medium and long terms (i.e., lower frequencies) and they become larger than the contributions from the forecast error variance of various stress indexes to oil returns. Findings from the spillovers analysis suggest that oil returns tend to act as a net transmitter of spillovers to GCC financial markets in both medium and long-run horizons but as a net receiver of spillovers in the short run.14 However, it's noteworthy that the spillover effects among oil returns and financial stress indexes are relatively small. Our results are consistent with the work of Balcilar et al. (2020) who investigate spillover effects in the oil market, the oil-related credit default swaps (CDSs), and financial market risks in the US in and post subprime crises using the spillover index methods of Diebold and Yilmaz (2009, 2012). Their results show that, as for the net directional return spillovers, stock market risk as captured by the VIX is the largest net contributor. They report that the stock market is the net transmitter, whereas crude oil (and also oil-related market CDSs) are net receivers in terms of return spillovers. Our results are also in line with the work from Qin (2020) who studies the spillover effects between oil shocks and financial systemic stresses using the method by Diebold and Yilmaz (2009) and daily data for 20 countries. Qin (2020) reports international evidence that the spillovers effects are asymmetric and dependent on market conditions. They find that oil shocks are more likely to spill over from financial systems to the oil market during financial crises. Furthermore, our finding that total spillovers between underlying markets are larger at lower frequencies (than higher frequencies) could be evidence suggesting that the financial markets in the GCC countries are slow in adjusting to the stress information they received from the oil markets (and vice versa). This finding is consistent with Elsayed and Yarovaya (2019), who study the comovements and volatility spillovers of aggregated FSI for eight MENA countries and find stress transmissions between markets are higher at low frequencies.

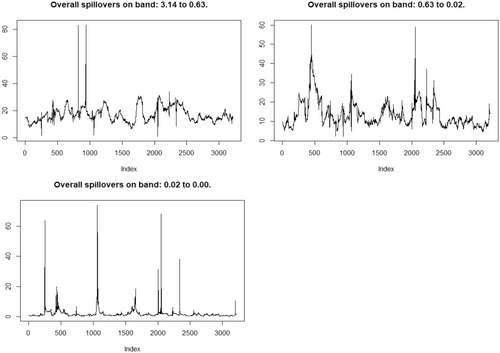

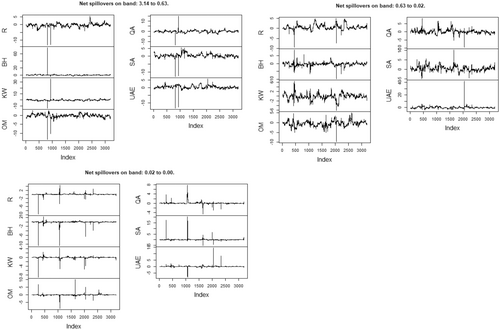

Following the Diebold and Yilmaz (2012) and Baruník and Křehlík (2018) static analysis, the study examines the dynamics of spillover effects using rolling samples of a hundred days. The initial sample period starts from 22/09/2006 to 28/02/2007. Figures 1 and 2 plot time-varying behaviours of the overall spillovers as well as the net spillovers across different frequencies over the period from 29/02/2007 to 31//05/2019.

We find that overall spillovers spike dramatically during periods of the 2007–2008 GFC, the 2010 European debt crisis, and the 2014 Russian financial crisis for the medium- and long-term frequencies. However, this pattern is less clear for the short-term frequency. In terms of the dynamics of net spillovers between oil returns and financial stress indexes across various frequency bands (i.e., over the short-, medium-, and long-term frequencies), we find that in most cases, the values of net spillovers change between negative and positive signs over time, suggesting that oil returns can act as either a net transmitter or receiver of spillovers from stress indexes in the system at given points of time and bands of frequency. But it is noteworthy that net spillovers for oil returns tend to become negative during the financial crisis periods, suggesting that oil returns tend to become a net receiver of spillovers from different stress indexes across different frequencies. The results could potentially be explained by the increased speculative activity in oil markets due to the increasing financialisation of oil markets (Fattouh et al., 2013; Morana, 2013), and are in line with Antonakakis et al. (2017), Awartani and Maghyereh (2013), and Nazlioglu et al. (2015), among others, indicating increasing interdependence and financial contagion across the oil and stock markets in a time-varying environment.

5 CONCLUSION

The critical role played by oil is well-recognised for the global economy in general and Gulf Cooperation Countries in particular. This is due to the fact that these economies are mainly relying on revenues from oil and other natural resources. Attaining a deeper understanding of the nature and connection between oil price changes and aggregate financial stress is timely given the recent oil crises and is of great interest to researchers and investors. To this end, this paper scrutinises the financial connectedness and relationship between oil returns and financial market tension in six Gulf Cooperation economies, that is Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates over the period from September 21, 2006 to May 31, 2019. To this end, The Bayesian Graphical Structural Vector Autoregression (BGSVAR) approach is utilised to estimate and analyse the direction of causality. Further, the connectedness approaches of Baruník and Křehlík (2018) and Diebold and Yılmaz (2014) are performed to scrutinise interconnectedness and risk transmission patterns between oil price changes and financial stress indexes of the GCC economies in both time and frequency domains.

In doing so, this paper contributes to the body of existing literature in several ways. First, this is the first attempt to scrutinise the relationship and interconnectedness between oil price shocks and Financial Stress Indexes. Second, the GCC economies are mainly dependent on oil revenues, which leaves them especially vulnerable to changes and abrupt movements in oil prices. Finally, the period in question is also of particular interest, since it includes a big rise followed by a sudden fall in oil prices, as well as several financial and political developments such as the Global Crisis in 2007/2008, European Sovereign Debt Crisis between 2010 and 2012, Dubai credit crunch in 2009, and the Arab Spring started in 2011.

Empirical results of the BGSVAR model show that oil returns and financial Stress Indexes in the GCC countries have both a contemporary and temporal relationship under both Multivariate Instantaneous (MIN) and Multivariate Autoregressive (MAR) structures. The MIN results indicate that the current values of financial market stress in Saudi Arabia and Qatar are able to interpret the current values of oil returns. On the contrary, results from the MAR structure suggest that lagged values of oil returns have strong power in explaining the current conditions of Kuwait and Saudi Arabia's financial markets. Findings from the spillovers analysis show that oil returns tend to act as a net transmitter of risk spillovers to the GCC financial sectors in both medium and long-run horizons but as a net receiver of spillovers in the short-run. However, it's noteworthy that the spillover effects among oil returns and financial stress indexes are relatively small.

These empirical results are very important and have some policy implications for several stakeholders such as investors and policymakers. In particular, shareholders, investors and fund managers who have opened positions in both the oil market and the financial market in the GCC economies should take into consideration the level of connectedness and risk transmission between these markets and hence adjust their holdings and portfolio allocations accordingly. Furthermore, our results have important policy implications at the country level, which should be considered by policymakers and regulators when designing financial and macroeconomic policies.

Endnotes

Open Research

DATA AVAILABILITY STATEMENT

The data that support the findings of this study are available from the Datastream database.