Common and Distinct Neural Mechanisms Underlying Risk Seeking and Risk Aversion: Evidence From the Neuroimaging Meta-Analysis

Funding: This work was supported by the National Natural Science Foundation of China (32371122), the Natural Science Basic Research Plan in Shaanxi Province of China (2025JC-JCQN-060), the Social Science Foundation of Shaanxi Province (2023P015), the Fundamental Research Funds for the Central Universities (GK202301004), and the Special Funding for Teacher Education of Shaanxi Normal University and Funding of the New Think Tank for Basic Education in Western China (JSJY2025009).

Tao Ding and Peihua Xian contributed equally to this study.

ABSTRACT

Risky decision-making, a ubiquitous aspect of human behavior, primarily encompasses two behavioral tendencies: risk seeking and risk aversion. Despite extensive exploration of the neural mechanisms involved in risk decision-making, the specific neural activity patterns underlying risk seeking and risk aversion, along with their dynamic regulatory mechanisms, remain unclear. This study employed a comprehensive meta-analysis approach that includes 43 risk seeking and 22 risk aversion whole-brain experiments to explore the neural basis and functional networks of risk seeking and risk aversion. The results indicated that risk seeking was associated with activations in the right insula and left caudate, whereas risk aversion was related to activations in the left middle temporal gyrus (MTG) and left anterior cingulate cortex (ACC). Further analyses showed that risk seeking primarily was linked to the reward network, salience network, and cognitive control network, while risk aversion primarily was involved in the cognitive control network and valuation network. These findings lend support to the dual-system theory, wherein risk seeking is predominantly influenced by the emotional system, whereas risk aversion is primarily driven by the cognitive system. Our study offers a novel perspective on the neural mechanisms underpinning risky decision-making and provides a theoretical foundation for interventions aimed at individuals with decision-making impairments.

1 Introduction

Humans frequently engage in risk decision-making, whether in routine choices (e.g., investing in stocks) or in major life events (e.g., marriage). Risk decision-making encompasses two behavioral tendencies: risk seeking and risk aversion. Risk seeking involves the voluntary exposure to potential loss or harm in pursuit of a more favorable outcome or a higher reward (Nigg 2017; Wang et al. 2024). Conversely, risk aversion emphasizes the avoidance of risks and the pursuit of secure, albeit potentially less lucrative, solutions (Cuevas Rivera et al. 2018). The behavioral and neural mechanisms that underpin these different approaches to risk decision-making have garnered extensive attention from researchers across psychology, economics, management, and artificial intelligence.

Previous research has demonstrated that risk seeking is intricately linked to two processes of information processing: the evaluation of risk information and the processing of reward information (Platt and Huettel 2008; Blankenstein et al. 2017; Zhu et al. 2023). Key neural regions implicated in the evaluation of risk information include the insula, the posterior parietal cortex (PPC), and the dorsolateral prefrontal cortex (DLPFC) (Blankenstein et al. 2017; Bartra et al. 2013; Levy and Glimcher 2012; Zhu et al. 2023). For example, the insula plays a pivotal role in integrating risk-related information, encoding risk predictions and prediction errors, and facilitating communication between diverse functional systems by synthesizing their information (Chang et al. 2013; Kurth et al. 2010; Cui et al. 2022). Additionally, the PPC is involved in probabilistic assessments, while the DLPFC is crucial for value assessment and decision execution (Platt and Huettel 2008; Mohr et al. 2010; Levy 2017). On the other hand, neural systems that process reward-related information are interconnected with the basal ganglia, including regions such as the nucleus accumbens, caudate, ventral striatum (VS), and putamen, as well as the medial frontal cortex, specifically the ventral medial prefrontal cortex (vmPFC) and the orbitofrontal cortex (OFC) (Liu et al. 2011; Diekhof et al. 2012; Kohls et al. 2013; Silverman et al. 2015; Ferry et al. 2024). These regions are fundamental for reward processing, generating learning signals, and evaluating expected values in the context of risky decision-making (Blankenstein et al. 2017; Levy 2017; Mohr et al. 2010). For instance, the caudate has been observed to exhibit heightened activation in individuals who actively pursue rewards and make risk-seeking decisions (Pletzer and Ortner 2016).

Multiple meta-analyses have explored the neural correlates of risk seeking, yielding varied results. Cui et al. (2022) linked risk seeking to activations in the insula and ventral striatum (VS), while Feng et al. (2022) observed increased activations in the claustrum and caudate. In contrast, Poudel et al. (2020) reported significant activations in the cingulate gyrus and inferior parietal lobe (IPL). Despite discrepancies, these findings collectively suggest that risk seeking involves both risk and reward processing. Notably, the involvement of the cingulate gyrus and IPL, integral to the cognitive control network, implies a potential role for cognitive control in this behavior. However, these studies predominantly rely on previous research contrasting high-risk with low-risk or risk-absent scenarios (Wu et al. 2021), potentially broadening the scope and diluting the specificity of meta-analytic findings on risk seeking neural mechanisms. Furthermore, most meta-analyses have focused on comparing risky decisions with other types, such as intertemporal decisions, neglecting the unique neural correlates of risk seeking.

In contrast to the wealth of research on risk seeking, fewer studies have examined the neural basis of risk aversion. Existing evidence suggests that risk aversion is associated with regions of the anterior cingulate cortex (ACC), inferior frontal gyrus (IFG), DLPFC, superior temporal gyrus (STG), and middle temporal gyrus (MTG) (Barkley-Levenson et al. 2013; Purcell et al. 2023; Zhu et al. 2023). While risk aversion shares common neural mechanisms with risk seeking, such as the DLPFC, it also has its own unique neural mechanisms. For example, the ACC, a core region of the cognitive control network, shows increased activation in the presence of risk aversion (Fukunaga et al. 2018). Since risk aversion is considered to be a sign of high self-control (Bridge et al. 2015; Spurrier and Blaszczynski 2014; Lin and Feng 2024), the cognitive control network (including MTG and STG) may be involved in risk aversion. For example, MTG shows inactivation during risk seeking and activation during risk aversion (Dong and Potenza 2016; Zhu et al. 2023).

Preferring non-impulsive, non-risky decisions is indicative of self-control (Bridge et al. 2015; Spurrier and Blaszczynski 2014; Lin and Feng 2024), yet risk aversion may entail adverse effects, such as unfavorable financial outcomes (Cuevas Rivera et al. 2018; Weissberger et al. 2022). Excessive risk aversion may deprive individuals of crucial development opportunities and potentially impede broader social progress. Notably, individuals with affective disorders (e.g., anxiety and obsessive-compulsive disorders) often exhibit a tendency toward overconservatism (Buelow 2020; Lu et al. 2024; Luigjes et al. 2016). Therefore, it is beneficial to provide a panoramic view of the neural mechanisms of risk aversion through systematic meta-analyses.

As outlined above, human decision-making under risk requires coordinated activity across multiple brain regions. Imbalances within these circuits, however, would drive significant maladaptive behaviors: striatal hyperactivation underlies excessive risk-taking in ADHD and addiction disorders (Wang et al. 2016; Adisetiyo and Gray 2017; Liu, Huang, et al. 2022), while relative developmental lag in the posterior mesofrontal cortex (PMC) is thought to contribute to heightened impulsive risk-taking and criminality in adolescents (Bjork et al. 2007; Marquez-Ramos et al. 2023; Jiang et al. 2024). Enhanced striato-prefrontal interactions are proposed to bolster underdeveloped adolescent cognitive control, improving decision-making (Somerville and Casey 2010). A systematic meta-analysis is thus critically needed to elucidate the neural mechanisms of risk seeking/aversion and regional interplay, with profound implications for understanding human development and mental health.

The dual-system theory of decision-making posits that both the hot (emotional) and cold (cognitive) systems contribute to decision-making processes (Steinberg 2008; Cui et al. 2022; Fryt et al. 2023). The hot system is automatic, intuitive, and impulsive, relying on classical conditioning, whereas the cold system is contemplative, flexible, and strategic, emphasizing self-regulation (Jahedi et al. 2017; Steinberg 2008; Zendehrouh 2015). The dual-system theory of decision-making aids in understanding intertemporal decision-making, where choosing a larger delayed reward involves the cognitive system (Cui et al. 2022), whereas opting for a smaller immediate reward reflects the emotional system (Varma et al. 2023). During the decision-making process, antagonism arises between the hot and cold systems, wherein the hot system inclines individuals toward impulsive decisions, whereas the cold system encourages rational decision-making (McClure et al. 2004; Miedl et al. 2015; Grant et al. 2010; Varma et al. 2023). Although dual-system regulation in risk decision-making is established (Marquez-Ramos et al. 2023; Zuo et al. 2025), the mechanisms governing risk seeking versus risk aversion remain unclear.

Neuroscience research has explored these systems' neural substrates. One perspective attributes them to relatively independent networks: the hot system linked to reward-processing regions (insula, striatum), and the cold system to the cognitive control networks (dmPFC, ACC) (Mohr et al. 2010; Miedl et al. 2015; Wu et al. 2021). Adolescent research shows slower maturation of control networks versus reward networks (Bjork et al. 2007; Jiang et al. 2024), while a recent meta-analysis reveals distinct neural signatures for impulsive and deliberate choices in intertemporal decisions (Varma et al. 2023), supporting independent networks.

An alternative perspective posits that hot and cold decision modes do not constitute qualitatively distinct systems but rather reflect rule-based selections within a unitary system (Kruglanski and Gigerenzer 2011). Mega et al. (2015) provided neuroscientific evidence for this, finding substantial neural activation overlap between modes, suggesting regulation by a unified network. Shared neural activity during both risk-seeking and risk-aversion behaviors also implies potential unified control. For instance, Mao et al. (2024) observed overlapping activation in the ACC, MFC, and insula during both types of choices. Furthermore, Somerville and Casey (2010) demonstrated interactions between the cognitive control (prefrontal) and reward (striatal) networks in adolescent risk-taking. A unified network might modulate behavior via relative changes in activation strength across its nodes.

Crucially, whether risk seeking and risk aversion are governed by distinct interacting networks or a single unified network requires resolution via meta-analysis. Widespread shared activation would support a unified network model. Minimal overlap, conversely, would favor distinct, interacting networks shaping human risk decision behavior.

In summary, despite previous studies with the ALE (Activation Likelihood Estimation) approach exploring neural mechanisms of risky decision-making, the common and unique neural activations in risk seeking versus risk aversion remain unresolved. Furthermore, whether distinct or unified neural networks regulate these processes remains unclear. To bridge these gaps, this study synthesized neuroimaging findings via quantitative meta-analysis. Separate datasets for risk seeking and risk aversion were analyzed using ALE, revealing respective brain activations. These results were then applied to conjunction and contrast analyses to ascertain shared or distinct neural mechanisms. Additionally, meta-analytic connectivity modeling (MACM) was employed, based on individual and contrast/conjunction analyses, to clarify the roles of emotional and cognitive systems in risky decision-making (Robinson et al. 2010; Bellucci et al. 2018; Wang et al. 2022).

2 Methods

2.1 Literature Search and Selection

In January 2025, a comprehensive online database search was conducted utilizing PubMed and Web of Science. The search employed a series of keywords, including (“risk taking” OR “risk preferences” OR “risk seeking” OR “risk avoidance” OR “loss aversion” OR “risk aversion” OR “ambiguity aversion”) AND (“fMRI” OR “functional magnetic resonance imaging”). Furthermore, we delved into additional resources, specifically (i) the bibliographies of published meta-analysis reviews and (ii) targeted searches based on the names of prominent authors within the field.

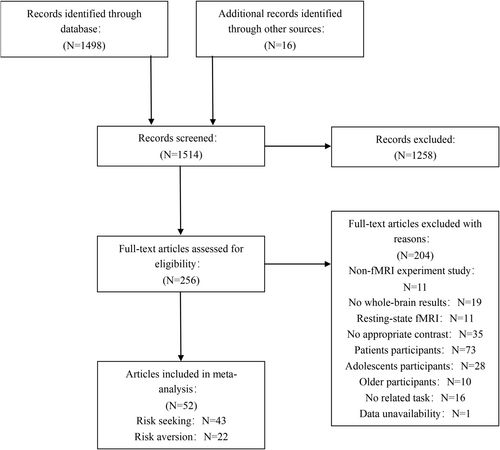

The initial assessment of the retrieved literature involved screening titles and abstracts, followed by a more rigorous full-text evaluation using the criteria outlined in Figure 1. These criteria encompassed: (i) the utilization of fMRI as the imaging technique; (ii) a focus on whole-brain analysis, rather than region of interest (ROI) analysis; (iii) the inclusion of participants without psychiatric or neurological diagnoses, excluding minors and the elderly (i.e., healthy adult participants); (iv) the presentation of activations in a standardized stereotaxic space, such as Talairach or Montreal Neurological Institute (MNI) coordinates, with a conversion to MNI coordinates conducted for studies reporting Talairach coordinates using the icbm2tal algorithm (accessible at http://brainmap.org/icbm2tal/); and (v) the reporting of a binary contrast (e.g., high-risk choice compared to low-risk choice or baseline, or vice versa) or parametric modulation analysis for high- and low-risk choices. Adhering to these rigorous criteria, our final meta-analysis encompassed 43 experiments (with 422 foci) related to risk seeking (Table 1) and 22 experiments (with 305 foci) related to risk aversion (Table 2).

| Article, year | N | Mean age (SD)/age range | Paradigm | Behavior type | Foci | Software | MNI/Talairach |

|---|---|---|---|---|---|---|---|

| Arioli et al. (2023) | 28 | 25.4 (3.64) | Mixed gamble | Accept gambling | 7 | SPM | MNI |

| Blankenstein et al. (2017) | 50 | 23.71 (2.56) | Wheel of fortune task | Risky decision | 13 | SPM | MNI |

| Brevers et al. (2015) | 10 | 36.2 (12.95) | Card-Deck paradigm | Risky decision | 5 | Brain Voyager | MNI |

| Brevers et al. (2016) | 15 | 24.67 (5.32) | Iowa gambling task | Risky decision | 4 | FEAT | MNI |

| Brunnlieb et al. (2016) | 34 | 25.6 (4.2) | Stag hunt task | Risky decision | 5 | SPM | MNI |

| Canessa et al. (2011) | 24 | 21.62 (2.75) | Wheels of fortune”task | Risky decision | 13 | SPM | Talairach |

| Cohen et al. (2005) | 60 | N.A./20–27 | Gambling task | Gamble | 5 | SPM | MNI |

| Dong et al. (2015) | 22 | 22.2 (1.8) | Three stages decision | Risky decision | 2 | SPM | MNI |

| Engelmann and Tamir (2009) | 10 | N.A./18–32 | Two-options gambling task | Gamble | 16 | AFNI | Talairach |

| Fukunaga et al. (2018) | 25 | 24.24 (3) | Gambling task | Gamble | 3 | SPM | MNI |

| Han et al. (2024) | 50 | 22.64 (4.5) | BART | Pump | 13 | DPABI | MNI |

| Häusler et al. (2018) | 157 | 39 (6.4) | Two-options investing paradigm | Risky decision | 2 | SPM | MNI |

| Helfinstein et al. (2014) | 108 | N.A./21–50 | BART | Pump | 7 | NeuroSynth | MNI |

| Hsu et al. (2005) | 16 | 23.5 (6.2) | Ellsberg paradox task | Risky decision | 12 | SPM | MNI |

| Huang et al. (2014) | 14 | 26.2/20–34 | Gambling task | Gamble | 5 | FreeSurfer | MNI |

| Hytönen et al. (2014) | 19 | 22.1 (2.2) | Sequential choice paradigm | Risky decision | 9 | SPM | MNI |

| Kruschwitz et al. (2012) | 188 | 20.73 (1.6) | Risky-gains task | High risk | 12 | AFNI | Talairach |

| Kuhn et al. (2024) | 46 | 34.3/19–58 | BART | Pump | 27 | SPM | MNI |

| Lei et al. (2017) | 37 | 23.1 (1.9) | BART | Pump | 1 | AFNI | MNI |

| Liu et al. (2007) | 17 | 26 (8) | Gambling task | Bet | 5 | FSL | MNI |

| Macoveanu et al. (2013) | 20 | 32.1 (5.9) | Card gambling task | Risky decision | 6 | SPM | MNI |

| Mao et al. (2024) | 56 | 32.59 (7.91) | BART | Pump | 12 | SPM | MNI |

| Matthews et al. (2004) | 12 | 34/20–56 | Lane risk task | Risky decision | 4 | AFNI | Talairach |

| Morawetz et al. (2020) | 29 | 24.52 (4.25) | Risky decision-making task | Risky decision | 3 | SPM | MNI |

| Nagel et al. (2018) | 18 | 26 (6.28) | Two-options | Risky decision | 4 | SPM | MNI |

| Paulus et al. (2003) | 17 | 38.3 (1.4) | Risky-gains task | High risk | 5 | AFNI | Talairach |

| Qu et al. (2019) | 46 | 19.4 | BART | Pump | 11 | FSL | MNI |

| Rigoli et al. (2019) | 23 | 37 (5) | Two-choice risk task | Risky decision | 14 | SPM | MNI |

| Rigoli et al. (2016) | 21 | 27/20–40 | Two-choice risk task | Gamble | 1 | SPM | MNI |

| Schmidt et al. (2024) | 29 | 23.14 (2.94) | BART | Pump | 23 | SPM | MNI |

| Suzuki et al. (2016) | 26 | 29.35 (4.71) | Gambling task | Gamble | 2 | AFNI | MNI |

| Tisdall et al. (2020) | 116 | 25.34 (2.64) | Monetary gambles | Accept gambling | 25 | SPM | MNI |

| van Leijenhorst et al. (2006) | 14 | 21.5 (2.2) | Cake task | Risky decision | 16 | SPM | Talairach |

| van Leijenhorst et al. (2010) | 15 | 21.6 (2.08) | Cake task | Risky decision | 6 | SPM | MNI |

| Losecaat Vermeer et al. (2014) | 26 | 22 (2.68) | Mixed gamble | Play | 10 | SPM | MNI |

| Wagels et al. (2017) | 92 | 24.11 | BART | Pump | 18 | SPM | MNI |

| Van Well et al. (2019) | 30 | 23.3 (4.2) | Two-options | Risky decision | 5 | FSL | MNI |

| Wright et al. (2012) | 22 | 22/18–32 | Accept/reject task | Accept gambling | 18 | SPM | Talairach |

| Wright, Symmonds, and Dolan (2013) | 24 | 24/19–36 | Selection task | Gamble | 18 | SPM | Talairach |

| Wright, Symmonds, Morris, and Dolan (2013) | 26 | 24/18–33 | Accept/reject task | Accept gambling | 23 | SPM | Talairach |

| Xu et al. (2020) | 56 | 21.18 (2.27) | Mixed gamble | Accept gambling | 11 | SPM | MNI |

| Zhang et al. (2019) | 25 | 20.64 (2.06) | Cup task | Risky decision | 13 | SPM | MNI |

| Zhu et al. (2023) | 27 | 27 (2.61) | BART | Pump | 8 | SPM | MNI |

- Abbreviations: BART, balloon analog risk-taking task; N.A., not available.

| Article, year | N | Mean age (SD)/age range | Paradigm | Behavior type | Foci | Software | MNI/Talairach |

|---|---|---|---|---|---|---|---|

| Bhanji et al. (2010) | 15 | 21.9 (3.09) | Binary choice task | High cetainty choice | 27 | SPM | MNI |

| Canessa et al. (2011) | 24 | 21.62 (2.75) | Wheels of fortune task | Conservative decision | 21 | SPM | Talairach |

| Currie et al. (2022) | 16 | 47 (8.5) | Loss aversion task | Low risk choice | 30 | SPM | MNI |

| Dreher et al. (2006) | 31 | 27.6 (5.7) | Slot-machine task | Low risk choice | 15 | SPM | MNI |

| Galván et al. (2013) | 43 | 19.28/17–21 | BART | Cash-out | 9 | FSL | MNI |

| Häusler et al. (2018) | 157 | 39 (6.4) | Two-options investing paradigm | Low risk choice | 18 | SPM | MNI |

| Liu et al. (2007) | 17 | 26 (8) | Gambling task | Bank | 8 | FSL | MNI |

| Liu et al. (2018) | 30 | 22.93 (2.13) | Devil task | Cash-out | 10 | SPM | MNI |

| Macoveanu et al. (2016) | 62 | 48 | Card gambling task | Low risk choice | 7 | SPM | MNI |

| Mao et al. (2024) | 56 | 32.59 (7.91) | BART | Cash-out | 6 | SPM | MNI |

| Matthews et al. (2004) | 12 | 34/20–56 | Lane risk task | Safe decision | 4 | AFNI | Talairach |

| Purcell et al. (2021) | 30 | 32.63 (8.52) | BART | Cash-out | 14 | SPM | MNI |

| Qu et al. (2019) | 46 | 19.4 | BART | Cash-out | 8 | FSL | MNI |

| Rigoli et al. (2016) | 21 | 27/20–40 | Two-choice risk task | Celect certain option | 1 | SPM | MNI |

| Roy et al. (2011) | 23 | 27.6 (7.9) | Wheel of fortune | Pass | 36 | FSL | MNI |

| Schonberg et al. (2012) | 16 | 23.6 (2.9) | BART | Cash-out | 4 | FSL | MNI |

| Tisdall et al. (2020) | 116 | 25.34 (2.64) | Monetary gambles | Reject gambling | 13 | SPM | MNI |

| van Leijenhorst et al. (2010) | 15 | 21.6 (2.08) | Cake task | Low risk choice | 6 | SPM | MNI |

| van Leijenhorst et al. (2006) | 14 | 21.5 (2.2) | Cake task | Low risk choice | 16 | SPM | Talairach |

| Wagels et al. (2017) | 92 | 24.11 | BART | Cash-out | 29 | SPM | MNI |

| Xu et al. (2020) | 56 | 21.18 (2.27) | Mixed gamble | Reject gambling | 24 | SPM | MNI |

| Zhang et al. (2019) | 25 | 20.64 (2.06) | Cup task | Certain decision | 6 | SPM | MNI |

- Abbreviation: BART, balloon analog risk-taking task.

During activation coordinate extraction, we classified reported activations as follows: Risk seeking: Activations associated with (a) higher-risk choices (e.g., selecting riskier options/balloon pumping; 41 studies), (b) individuals with higher risk preference (1 study: Kruschwitz et al. 2012), or (c) higher-risk trials (two studies: van Leijenhorst et al. 2006; Arioli et al. 2023). Risk aversion: Activations associated with (a) lower-risk choices (e.g., selecting safer/certain options/cashing out; 21 studies), or (b) lower-risk trials (1 study: van Leijenhorst et al. 2006).

2.2 ALE Meta-Analysis

ALE is a quantitative meta-analytic approach that allows for the integration of fMRI results across studies (Eickhoff et al. 2009, 2012; Zhang et al. 2022). This study employed the ALE algorithm to explore the neural correlates of risk seeking and risk aversion in risk decision-making. BrainMap GingerALE version 3.0.2 software (Eickhoff et al. 2012; Turkeltaub et al. 2012) was used for the data analysis. The algorithm is grounded in probability distributions, which evaluate both the spatial probability distributions and the activation statistics of each voxel within the brain (Laird et al. 2005; Turkeltaub et al. 2002). First, all reported foci for each contrast in the different studies were modeled as Gaussian 3D distributions, centered on the reported coordinates. These modeled activation maps (MA maps) were then constructed by combining the maximum probability distributions of voxel-associated foci for each experiment. Next, the MA maps were combined to calculate the overall ALE maps for all experiments (Turkeltaub et al. 2012). Finally, ALE scores from the convergent MA maps were calculated voxel-by-voxel to test for convergent (random-effects) foci, rather than study-specific foci (fixed-effects) (Eickhoff et al. 2009, 2012).

This study conducted two separate ALE analyses for the risk seeking and risk aversion datasets. A cluster-level family-wise error (cFWE) correction at p < 0.05 was applied, with a cluster-defining threshold of p < 0.001 and 10 000 permutations to assess the significant p map (Eickhoff et al. 2017).

2.3 Conjunction and Contrast Analysis

Conjunction and contrast analyses were performed to test the common and distinct neural activations between risk seeking and risk aversion. In the contrast analysis, initial individual ALE analyses were conducted on the datasets pertaining to risk seeking and risk aversion, with subsequent calculation of the differences in their respective ALE values. Subsequently, all experiments were pooled and randomly partitioned into two groups, each matching the size of the original experiment set. The ALE values for these newly formed datasets were then recalculated, and the discrepancy between their ALE values was determined. This entire process was iterated 25 000 times to establish the null distribution of the ALE value differences between risk seeking and risk aversion (Eickhoff et al. 2011; Langner et al. 2018). The ALE maps were then thresholded at a posterior probability threshold of p > 0.95 (Wu et al. 2021; Wang et al. 2022). In the conjunction analyses, the overlapping regions between the two corrected ALE results were identified (Eickhoff et al. 2011).

2.4 Meta-Analytic Connectivity Modeling (MACM) Analyses

MACM analyses were conducted to examine the co-activation patterns associated with risk seeking and risk aversion, providing a more comprehensive analysis of their underlying neural mechanisms. MACM analyses estimate the functional connectivity of regions of interest (ROIs) (Robinson et al. 2010). We selected the clusters that emerged significant from the contrast analyses and utilized these cluster-based ROIs as separate seeds within the BrainMap database (http://www.brainmap.org/) to search for studies reporting activations within each respective cluster (Wu et al. 2021), facilitating the construction of data-driven functional connectivity maps of these ROIs (Laird et al. 2005). ROI was defined as a sphere centered on the peak activation coordinates within a 10 mm radius (Wang et al. 2022; Bellucci et al. 2018). For inclusion in our analysis, we only considered whole-brain neuroimaging studies that reported activations in standard stereotaxic space for healthy participants. Using BrainMap, we screened for experiments featuring at least one activation focus within a specified seed region. Subsequently, we downloaded the activation coordinates and performed ALE analysis, applying FWE correction at p < 0.05 and a cluster-defining threshold of p < 0.001, to evaluate the convergence of co-activations across seeds.

3 Results

3.1 Results of Single ALE Analyses

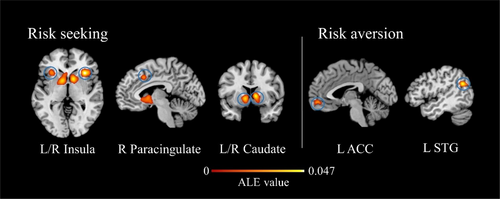

ALE meta-analysis of risk seeking revealed significant activations in the bilateral caudate, bilateral paracingulate gyrus, and bilateral insula (Figure 2, Table 3). The insula integrates risk-related information, encodes risk predictions and prediction errors, while the caudate, part of the basal ganglia, plays a key role in reward processing. Additionally, the paracingulate gyrus has important cognitive and emotional functions, mediating bottom-up information processing from limbic inputs to executive control areas. Regarding risk aversion, significant activations were located in the left STG, right middle frontal gyrus (MFG), and left ACC (Figure 2, Table 3). These regions are crucial parts of the cognitive control network. The results suggest that risk seeking mainly engages risk and reward information processing systems, reflecting the predominance of the emotional system in risk seeking. Risk aversion is primarily associated with cognitive control processes, reflecting the predominance of the cognitive system in risk aversion.

| Cluster # | Cluster size (mm3) | Brain areas | Side | BA | MNI coordinates | Peak Z score | ALE value | ||

|---|---|---|---|---|---|---|---|---|---|

| x | y | z | |||||||

| Risk seeking | |||||||||

| 1 | 7528 | Caudate | Right | 10 | 8 | 2 | 7.55 | 0.051340 | |

| Caudate | Left | −10 | 6 | −2 | 6.39 | 0.039990 | |||

| 2 | 3448 | Insula | Right | 34 | 22 | −2 | 7.68 | 0.052642 | |

| 3 | 1696 | Insula | Left | −32 | 22 | −4 | 5.34 | 0.030722 | |

| 4 | 2624 | Paracingulate Gyrus | Right | 32 | −6 | 16 | 40 | 5.12 | 0.028876 |

| Paracingulate Gyrus | Left | 32 | 4 | 26 | 38 | 5.10 | 0.028726 | ||

| Risk aversion | |||||||||

| 1 | 952 | Superior temporal gyrus | Left | 39 | −48 | −62 | 26 | 5.67 | 0.030250 |

| 2 | 736 | Medial frontal gyrus | Right | 0 | 56 | −10 | 4.10 | 0.018539 | |

| Anterior cingulate | Left | 32 | −6 | 48 | −12 | 3.59 | 0.015367 | ||

| Risk seeking ∩ Risk aversion | |||||||||

| None | |||||||||

| Risk seeking > Risk aversion | |||||||||

| 1 | 2680 | Insula | Right | 13 | 40 | 26 | −6 | 2.57 | |

| 2 | 1776 | Caudate | Left | −16 | 2 | −6 | 2.84 | ||

| Risk aversion > Risk seeking | |||||||||

| 1 | 928 | Middle temporal gyrus | Left | 39 | −49 | −67 | 26 | 3.67 | |

| 2 | 712 | Anterior cingulate | Left | 32 | −4 | 50 | −12 | 3.16 | |

- Note: All results have a threshold at P (cluster-FWE) = 0.05 with a cluster-forming threshold of p < 0.001 using 10 000 permutations.

- Abbreviation: BA, Brodmann area.

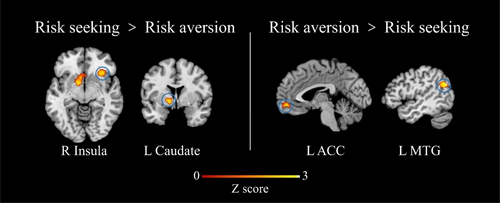

3.2 Results of Conjunction and Contrast Analyses

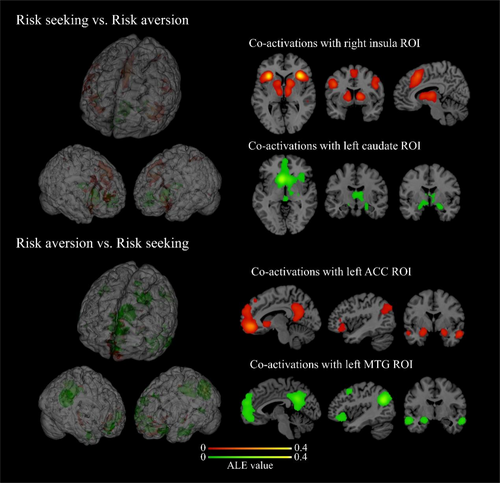

The contrast analysis revealed that compared to risk aversion, significant activations converged in the right insula and left caudate during risk seeking (Figure 3, Table 3). Conversely, the left MTG and left ACC were more activated in risk aversion than in risk seeking (Figure 3, Table 3). However, no significant activations were found in the conjunction analysis. The results of the contrast analysis were consistent with those of the individual analyses. Moreover, our analysis did not identify common activations between risk seeking and risk aversion, indicating that these two behaviors exhibit distinct neural activity patterns.

3.3 Results of MACM Analyses

We selected the distinct activations identified in the contrast analysis for risk seeking and risk aversion as seeds to investigate the brain connectivity networks. Specifically, for risk seeking, the right insula (427 experiments, 6351 subjects, 6838 foci) and left caudate (165 experiments, 2476 subjects, 2293 foci) were used as seeds. For risk aversion, the left MTG (251 experiments, 3613 subjects, 2858 foci) and left ACC (242 experiments, 3591 subjects, 3057 foci) were used as seeds.

For risk seeking, the analysis using the right insula as the seed showed significant activations in the bilateral right insula, bilateral caudate, bilateral thalamus, left superior frontal gyrus (SFG), and bilateral IPL. When using the left caudate as the seed, significant activations were observed in the right insula, vmPFC, dorsal anterior cingulate cortex (dACC), left caudate, bilateral thalamus, and bilateral parahippocampal gyrus (see Table S1 and Figure 4). Among these regions, the caudate and thalamus are important parts of the reward network. The insula is a core region of the salience network. The dACC, SFG, and IPL are involved in the cognitive control network. These findings suggest that ROIs associated with risk seeking are predominantly linked to the reward network, salience network, and cognitive control network.

For risk aversion, the analysis using the left ACC as the seed revealed that significant activations were located in the LPFC, vmPFC, OFC, ACC, posterior cingulate cortex (PCC), parahippocampal gyrus, and left MTG. When using the left MTG as the seed, significant activations were observed in the vmPFC, LPFC, ACC, PCC, left MTG, and left parahippocampal gyrus (see Table S1 and Figure 4). Among these regions, the ACC, PCC, LPFC, and left MTG engage the cognitive control network. The vmPFC and OFC are components of the valuation network. These findings indicate that risk aversion ROIs are primarily linked to the cognitive control network and valuation network.

The results of MACM analyses show that both risk seeking and risk aversion involve a combination of brain networks. The cognitive control network is prominently involved in both risk seeking and risk aversion, while risk seeking is more strongly related to the reward network compared to risk aversion.

4 Discussion

Firstly, the present study employed an ALE meta-analysis to investigate the neural mechanisms underpinning both shared and distinct aspects between risk seeking and risk aversion. The results indicate that regions implicated in risk seeking include the bilateral caudate, bilateral paracingulate gyrus, and bilateral insula, whereas risk aversion involves the left STG, right MFG, and left ACC. The contrast analysis reveals that the right insula and left caudate are more activated during risk seeking, contrasting with heightened activity in the left MTG and left ACC during risk aversion. Secondly, MACM analyses indicate that both behaviors engage a combination of brain networks, with risk seeking particularly involving the reward, salience, and cognitive control networks, and risk aversion primarily the cognitive control and valuation networks. Notably, while the cognitive control network is implicated in both, its influence is relatively minor in risk seeking and does not dominate decision-making (McClure et al. 2004; Miedl et al. 2015; Grant et al. 2010; Varma et al. 2023). Overall, our results underscore distinct neural activity patterns between risk seeking and risk aversion, suggesting that the relative changes in the influence of emotional and cognitive systems may shape individuals' behavioral patterns in risk decision-making.

4.1 Distinct Neural Activity of Risk Seeking

The current study revealed that risk seeking involves neural activations in the right insula and left caudate. The insula plays a pivotal role in processing risk information, integrating risk-related signals and encoding predictions and prediction errors (Baek et al. 2017; Sun et al. 2017; Wu et al. 2021; Picard et al. 2021; Cui et al. 2022). Prior studies have confirmed the insula as a core neural substrate for uncertain information processing, spanning networks involved in risky, ambiguous, and anticipatory threat decision-making (Feng et al. 2022; Wang et al. 2024). During risk seeking, individuals remain uncertain until the outcome is realized, prompting the insula to evaluate risk and signal uncertainty to other brain regions, especially the basal ganglia (Liu et al. 2017; Wu et al. 2021). Additionally, the left caudate, crucial for reward evaluation, computes subjective values across tasks, reward types, and decision stages, influencing preference formation and choice execution (Clithero and Rangel 2014; Verdejo-Garcia et al. 2018). Notably, its activation induces risk seeking, especially in typical risky decision-making paradigms where higher risks are associated with greater rewards, suggesting that reward incentives drive risk preference (Venkatraman et al. 2007; Gujar et al. 2011; Pletzer and Ortner 2016; Huo et al. 2023). In summary, our findings suggest that processing risk- and reward-related information is a fundamental neural activity in risk seeking, with rewards potentially driving risk seeking despite perceived risks.

4.2 Distinct Neural Activity of Risk Aversion

The current study revealed that risk aversion elicits distinct neural activations in the left MTG and left ACC, contrasting with risk seeking. These regions are integral to the cognitive control network (Dong and Potenza 2016; Khaleghi et al. 2020; Lin and Feng 2024). The ACC plays a role in modulating and inhibiting risk seeking (Fukunaga et al. 2013; Knutson and Huettel 2015; Dong and Potenza 2016), encompassing functions such as error, conflict, and performance monitoring (Holroyd and Coles 2002; Platt and Huettel 2008; Purcell et al. 2021; Román et al. 2019). Elevated ACC activation may signify heightened risk awareness, prompting individuals to prefer risk aversion (Rudorf et al. 2012). For example, reduced ACC, extending to the MTG, activity in nicotine-dependent individuals is linked to impaired impulse control (Luijten et al. 2014; Nestor et al. 2011; Palombo et al. 2015). Consistent with prior research, significant left MTG activation was observed during risk aversion (Zhu et al. 2023). The MTG is not only involved in planning and judgment, but is also associated with social cognitive processing (van der Meer et al. 2010; Van Hoeck et al. 2015; Dong and Potenza 2016). During risky decision-making, self-related decision-making beliefs influence behavioral patterns, a process associated with MTG activation (Rodrigo et al. 2014, 2018). Humans, akin to other animals, strive for benefits, avoid harm, and pursue risk-free or certain solutions (Cuevas Rivera et al. 2018). Thus, the pursuit of certainty may more align with individual decision-making beliefs. In summary, our findings suggest that impulse control constitutes a crucial foundation for risk aversion, with cognitive control processing being a unique and fundamental neural activity underlying it.

4.3 Brain Networks in Risk Seeking and Risk Aversion

Surprisingly, we found no overlap between risk seeking and risk aversion. This suggests that these two behavioral patterns may be regulated by distinct neural networks. Dual systems theory proposes that both emotional and cognitive systems influence decision-making (Steinberg 2008; Cui et al. 2022; Fryt et al. 2023), and they include different brain networks (Bjork et al. 2007; Jiang et al. 2024). Our study may support this view by showing distinct effects of these systems on risk seeking and aversion. The emotional system, involving the caudate and right insula, drives risk seeking, while the cognitive system, including the MTG and ACC, promotes risk aversion. MACM analyses revealed that risk seeking regions co-activate with the reward, salience, and cognitive control networks, whereas risk aversion regions involve the cognitive control and valuation networks. These findings align with previous research identifying the reward, default, salience, and cognitive control networks in risky decision-making (Krain et al. 2006; Mohr et al. 2010; Poudel et al. 2020; Wu et al. 2021; Wang et al. 2022) and a recent meta-analysis linking risk-taking to cognitive control, reward, and salience networks (Wang et al. 2024). These activation patterns overlap with resting-state networks, where reward, salience, and cognitive control connectivity predict risk decision-making (Ren et al. 2023; Ji et al. 2025). Previous research has shown that functional networks exhibit dynamic activity during risky decision-making, with increased activation of the reward network and decreased activation of the cognitive control network during risk seeking (Jiang et al. 2024). While cognitive control networks are crucial for impulse control, risk aversion, and preferences for safe choices (Rudorf et al. 2012; Dong and Potenza 2016), significant activation of the reward network by large rewards can override the cognitive system, leading to a preference for risk seeking and altering behavioral patterns (Liu et al. 2017; Nagel et al. 2018). The asynchronous development of these two networks during adolescence also positions the neural substrates of risk seeking and risk aversion within distinct yet interacting neural networks (Bjork et al. 2007; Marquez-Ramos et al. 2023; Jiang et al. 2024). In summary, our findings suggest that risk seeking is primarily governed by the emotional system, while risk aversion is primarily regulated by the cognitive system, both residing within two relatively distinct yet interconnected neural networks, and the imbalance between these two determines an individual's decision-making pattern.

However, the results of the MACM analyses may also reveal an alternative possibility. Both risk seeking and risk aversion seeds showed co-activation in the cognitive control network, suggesting potential unified network governance. Many studies emphasize the interaction between these two networks—specifically, the reward network's potential to promote cognitive control (Somerville and Casey 2010), and the cognitive control network's role in restricting the reward system (Liu et al. 2017; Nagel et al. 2018). Furthermore, during risk decision-making, individuals making rule-based choices, whether impulsive or deliberate, are likely to undergo a process of value computation (Van Duijvenvoorde et al. 2015; Wang et al. 2024). Thus, their distinct brain regions may function as integrated nodes modulating behavioral patterns. However, our primary analyses revealed no significant overlap, likely due to overlapping literature inclusion. Contrasting conditions within studies may suppress shared activation. This methodological approach, while limiting overlap detection, enhances differentiation between risk seeking and aversion mechanisms. Therefore, future research should probe whether these structures form unified networks and elucidate their organizational and modulatory dynamics.

4.4 Limitations

The present study is subject to several limitations. Primarily, there is an insufficiency of neuroimaging studies with a focus on risk aversion, and different experimental paradigms, definitions of risk aversion and risk seeking, as well as experimental manipulation, are utilized in different experiments. The results obtained may be considered inadequate due to these factors. Therefore, it is recommended that future studies conduct further analyses across different paradigms and designs. Secondly, in different decision-making contexts (e.g., loss vs. gain), risk aversion and risk seeking may involve distinct neural activity patterns. However, this study does not aim to differentiate between these factors. Future research should more comprehensively focus on this difference. Thirdly, risk decision-making is generally divided into two stages: valuation and response selection (Liu, Liu, et al. 2022). The present study has not classified different neural networks recruited for these stages. The analysis and comparison of the different stages of decision-making is a research avenue that could be pursued in future studies, which would help to better understand the reasons for the occurrence and shift of different behavioral modes. Finally, while our findings more strongly support the modulation of risk seeking and risk aversion by two interacting neural networks, this interpretation is not exclusive. Whether the implicated brain structures constitute distinct networks or an integrated network requires further analytical validation.

5 Conclusion

In conclusion, the current study indicates that risk seeking and risk aversion involve distinct neural activity patterns. The insula and caudate, regions associated with the emotional system, are primarily involved in risk seeking processing, while the MTG and ACC, regions related to the cognitive system, play more significant roles in risk aversion processing. The dynamic regulation of the emotional and cognitive systems shapes the behavioral modes observed in individuals during risk decision-making.

Author Contributions

Tao Ding: investigation, data curation, conceptualization, project administration, formal analysis, software, visualization, methodology, writing – original draft. Peihua Xian: conceptualization, data curation, methodology, project administration, resources, software, writing – original draft. Shuai Jin: conceptualization, data curation, methodology, formal analysis, software, validation. Zhiyuan Liu: conceptualization, methodology, project administration, resources, supervision, funding acquisition, writing – review and editing. Xuqun You: resources, supervision, writing – review and editing.

Acknowledgments

This research was supported by the National Natural Science Foundation of China (32371122), Natural Science Basic Research Plan in Shaanxi Province of China (2025JC-JCQN-060), the Social Science Foundation of Shaanxi Province (2023P015), the Fundamental Research Funds for the Central Universities (GK202301004), and Special Funding for Teacher Education of Shaanxi Normal University and Funding of the New Think Tank for Basic Education in Western China (JSJY2025009).

Conflicts of Interest

The authors declare no conflicts of interest.

Open Research

Data Availability Statement

The data that support the findings of this study are available from the corresponding author upon reasonable request.