Implementing Supply Chain Management 4.0: Potential Driving Forces and Strategies From an Empirical Study of Pharmaceutical Industries

ABSTRACT

This study investigates the potential driving forces and strategies for implementing supply chain management 4.0 (SCM 4.0) in pharmaceutical manufacturing industries (PMIs). Pertinent data were collected from 111 related companies using a mixed-methods research approach. The study used IBM SPSS and AMOS version 21 for exploratory and confirmatory factor analysis, respectively. The driving forces include regulatory and compliance, market, technological, and economic drivers, while research, development, and innovation emerged as the first-ranked strategy. With the manufacturing landscape in Tanzania transitioning towards digital transformation, implementing SCM 4.0 is essential. Digital transformation in PMIs can improve supply chain performance by enabling predictive analytics, real-time tracking, and better resource optimisation. Incorporating digital technologies like the Internet of Things, artificial intelligence, blockchain technology, and big data analytics is crucial for PMIs to maintain competitiveness and resilience in a globalized market. The digital transformation can boost efficiency, precision, and regulatory compliance while mitigating SCM risks. The transformation in deploying advanced robotics and automating the production systems within the PMIs can assist in streamlining the manufacturing workflows, diminishing human errors, and ultimately increasing the PMI outputs. Likewise, collaboration between PMIs, academia, research institutions, and government agencies is essential for knowledge sharing and addressing common PMIs' challenges. PMIs should be customer-focused and use SCM 4.0 technologies to improve competitiveness and satisfy changing customer demands. Likewise, to develop new technology and business models, it is essential to support innovation and entrepreneurship through funding programs, incubators, and hubs.

1 Introduction

Supply chains (SCs) constitute the foundation of international trade and economic activity because they make it easier for commodities and services to move across borders and promote prosperity, particularly for developing countries and small enterprises [1]. Businesses depend on effective SCs to compete successfully in the global market economy, which has made their significance more apparent in recent years. Effective SCs should integrate financial factors; this is mostly referred to as supply chain finance (SCF) [2]. Competitive driving forces and strategies across the entire industry or company can influence the SCs. SCF is a crucial aspect of supply chain management (SCM), involving buyers, sellers, and financial institutions to help businesses reduce financing costs, enhance productivity, maximize capital flow, and manage supply chain risks through financial tools and tactics [2]. According to Larson [3], SCM is a group of strategies meant to streamline the manufacturing and distribution of goods by combining manufacturers, suppliers, warehouses, retail locations, and customers. SCM is essential for minimizing expenses and preserving service levels while satisfying customer demand in terms of quantity, quality, location, cost-effectiveness, product or service availability, transparent communication, streamlining returns and exchanges, and timing [4-6].

In the modern era of rapidly advancing technologies, the landscape of industries is undergoing a profound transformation [7]. Among the transformative forces, Industry 4.0 (I4.0) has emerged as a pivotal concept, ushering in a new era of interconnectedness, automation, and data-driven decision-making [8]. I4.0 has redefined traditional linear SCs into dynamic, interconnected, and responsive systems. It enables real-time data collection and analysis, allowing for predictive and prescriptive decision-making across the SC. This transformation reduces lead times, optimizes inventory levels, and enhances demand forecasting accuracy. Smart sensors and Internet of Things (IoT) devices embedded in products and assets enable end-to-end visibility, providing insights into every stage of the SC [9, 10].

To date, the world has witnessed four industrial revolutions (IRs). Such IRs—Industry 1.0 (1st IR), Industry 2.0 (2nd IR), Industry 3.0 (3rd IR), and I4.0 (4th IR) – characterize a progression of societal and technological changes [11]. As per Taifa [11], each IR advances upon the previous one, resulting in more innovative and cutting-edge interconnected systems. I4.0, or fourth IR or 4IR, is mainly defined as a neologism which states the ongoing technological advancements in the twenty-first century and involves the integration of technologies such as IoT, cyber-physical systems (CPS), cyber security, additive manufacturing (3D printing), building information modeling (BIM), dark manufacturing, virtual factory (VF), vertical and horizontal systems' synchronization (VHSS), machine learning (ML), artificial intelligence (AI), cloud computing (CC), automation and robotics, mixed reality (MR), advanced human-machine interfaces (HMIs), cognitive computing, quantum computing (QC), computer simulation (CS), smart sensors (SS), virtual reality (VR), augmented reality (AR), digital twins, big data analytics (BDA), and blockchain technology (BT) [12-15].

The emergence of I4.0, or the fourth industrial revolution (IR), has changed a number of industries, including those that deal with SC and SCM. According to Alkahtani and Abidi [16], SCM has undergone multiple stages of development. Manual operations and simple logistics typified SCM 1.0, whereas SCM 2.0 involved advanced information systems and enterprise resource planning (ERP) integration. SCM 3.0 was brought about by the internet and digital technology, which is distinguished by increased SC visibility, real-time data interchange, globalization, and advanced analytics. SCM 4.0 utilizes I4.0 technologies like the IoT, VHSS, AI, CC, MR, CS, VR, AR, digital twins, BDA, and BT. SCM 4.0 focuses on intelligent and networked systems that facilitate autonomous decision-making, predictive analytics, and end-to-end transparency, significantly increasing SCM practices' efficiency, agility, and resilience [17, 18]. I4.0 is restructuring how businesses innovate, improve, and distribute their products. Manufacturers are integrating new technologies into production processes and facilities, marking a significant shift in the business landscape. As network chains evolve, organizations must acknowledge and embrace this imminent change in their operations and broader supply contexts [19]. I4.0 seamlessly blends smart manufacturing, intelligent products, and IoT to provide real-time insights into production, machinery, and component flow [7]. This data integration empowers managers to make informed decisions, monitor performance, and track items instantaneously.

The presence of robust SC and SCM contributes massively to the economic development of all countries, especially those that foster industrialization. Industrialization, which is essential to reaching Tanzania's objective of becoming a middle-income country by 2025, has been the 5th Phase of the Government's key policy emphasis. The manufacturing sector, which contributes to 25% of Tanzania's export value and 5.6% of the country's gross domestic product (GDP), is the primary sector that propels industrialization in most developing countries and defines an economy's long-term survival [20]. Tanzania's overall industrial sector consists of manufacturing industries, accounting for 53% of the total processing industries, making up 43%, and assembling industries, representing 4% [21].

The manufacturing sector in Tanzania comprises various subsectors, including basic pharmaceutical products, textiles, beverages, wearing apparel, food products, leather products, wood and paper products, rubber and plastics, among others. With the manufacturing landscape in Tanzania transitioning towards digital transformation, exploring SCM 4.0 is essential. The evolution of the manufacturing sector into I4.0 represents a paradigm shift in optimizing SCs to meet the evolving demands of a dynamic world [22]. The rapid advancement of I4.0 technology has led to a transformative shift in SCM, known as SCM 4.0. However, sectors like pharmaceuticals in Tanzania face challenges in fully integrating I4.0 due to technology applicability, change management, and workforce skills [22].

Despite the global discourse on I4.0 and its potential benefits, its practical application within Tanzania's pharmaceutical manufacturing sector remains largely unexplored. There is a lack of empirical research on how these technologies can be practically integrated into the pharmaceutical SCs of developing countries, including Tanzania, where challenges such as limited technological infrastructure, workforce skills, and regulatory constraints are prevalent. Also, there is a crucial research gap focusing on the lack of actionable strategies for adopting and implementing SCM 4.0 in Tanzania's manufacturing pharmaceutical sector. While the potential benefits of I4.0 technologies in SCM are well documented globally, insufficient research addresses how these technologies can be strategically applied within the unique constraints and challenges developing economies like Tanzania face.

Although I4.0 and its potential advantages are being discussed globally, little is known about how it can be used by Tanzania's pharmaceutical manufacturing industries (PMIs). There is a dearth of empirical research on the practical integration of these technologies into pharmaceutical SCs in developing nations like Tanzania, where issues like workforce skills and knowledge, resource constraints, and limited technological infrastructure seem common. The absence of practical methods for embracing and executing SCM 4.0 in Tanzania's PMI is another significant research gap. Although the potential advantages of I4.0 technologies in SCM are widely known, little research has been done on how these technologies can be strategically implemented within the particular limitations and difficulties faced by developing nations like Tanzania. These disparities pose serious obstacles to industry stakeholders' and governments' ability to formulate well-informed strategies and make well-informed judgments on the digital transformation of the PMI. To close this gap, research is required to evaluate the suitability of SCM 4.0 in Tanzania PMIs. This study offers practical insights for managing the digital transformation process in the PMI by looking at motivating factors and suggesting application tactics. Thus, two research questions (RQs) must be addressed in this study:

RQ1.What are the driving forces or motivators underlying SCM 4.0's applicability in PMIs?

RQ2.Which strategies are crucial to implement SCM 4.0 in PMIs?

2 Theoretical Background

2.1 Industrial Revolutions (IRs)

According to Nzumile, Mahabi et al. [13], the four IRs represent important turning points in the history of industry and technology. In the late 18th century, the first IR brought steam power and mechanization [23]. The second, in the late 19th century, brought about mass production and electricity. In the mid-20th century, the third revolution saw the rise of computers and automation. The current fourth IRs, often called “Industry 4.0” or “I4.0”, is characterized by the fusion of digital, physical, and biological technologies, leading to advancements in AI, the IoT, automation, and BDA, transforming industries with smart, interconnected systems and innovative production methods [12, 24]. According to Javaid et al. [25], I4.0 technologies facilitate the digitisation and integration of information across value chains, improving the provision of products and services and fostering creative digital business models. They may augment revenue, expand consumer accessibility, and refine post-utilization collection procedures. Digitisation also provides instantaneous data and insights, facilitating sustainable industrial methods and minimizing environmental effects. The integration of the circular economy with Industry 4.0 and waste reduction facilitates value recovery from trash.

2.2 SCM, SCM 4.0 and Pharma 4.0

The definition of SCM developed and used by the members of the Global Supply Chain Forum (GSCF) [26] states: “SCM is the integration of key business processes from end user through original suppliers that provides products, services, and information that add value for customers and other stakeholders”. Due to its multidisciplinary nature, SCM lacks a universally agreed-upon definition [15]. Despite these differences, professionals and academics in the field share common concerns and objectives. While definitions vary, the essence remains consistent: optimizing the efficient flow of products or services from production to consumers [27]. The flexibility of SCM allows for diverse interpretations while maintaining a collective focus on enhancing SC processes.

The term supply chain 4.0 is used to emphasize the connections between I4.0 and SC [28]. I4.0 is restructuring how businesses innovate, improve, and distribute their products. Manufacturers are integrating new technologies into production processes and facilities, marking a significant shift in the business landscape. As network chains evolve, organizations must acknowledge and embrace this imminent change in their operations and broader supply contexts [19]. I4.0 seamlessly blends smart manufacturing, intelligent products, and IoT to provide real-time insights into production, machinery, and component flow. This data integration empowers managers to make informed decisions, monitor performance, and track items instantaneously [29]. I4.0 has instigated a paradigm change in the industrial SC and SCM [9], as industries use technologies such as IoT, CPS, BT, CC, and BDA to minimize lead time, cost efficiency, flexibility, labor, material, market responsiveness, and equipment resources [11, 30]. The 4th IR seeks to augment economic development and guarantee manufacturing sustainability [31]. Large to small and medium-sized enterprises (SMEs) are adapting their operations to align with I4.0 to enhance productivity and flexibility in manufacturing processes. Likewise, Javaid et al. [32] highlighted that the advanced I4.0 technologies, including IoT, BDA, and AI, have transformed traditional production systems into digitalized ones, enhancing various industrial systems and transforming traditional manufacturing processes.

While SCM 4.0 in the pharmaceutical industry primarily focuses on optimizing SC activities through integrating advanced digital technologies like AI, IoT, and blockchain technology, Pharma 4.0 extends beyond SCM to encompass a broader spectrum of areas within the pharmaceutical sector. Pharma 4.0 can be defined as the integration of advanced technologies linked with I4.0 to foster digital transformation for pharmaceutical manufacturing and industrial operations, thus targeting to emphasize decentralized decisions and improve efficiency, flexibility, compliance, and productivity. This includes drug discovery and development, manufacturing processes, distribution networks, regulatory compliance, patient engagement, and healthcare delivery. Pharma 4.0 emerging concepts leverage digital innovations across these domains to enhance efficiency, quality, and safety throughout the pharmaceutical value chain.

I4.0 technologies are crucial for various sectors and factories to efficiently manage their logistics systems, ensuring fast, reliable information and communication [10]. I4.0 technologies are essential for PMIs to achieve sustainable goals in manufacturing SC. Choosing the appropriate technologies is crucial for survival and competitiveness. However, most SCM partners or nodes face challenges in adopting new technologies due to significant investment needs and some business process reengineering where necessary [10]. A data-driven strategy can transform SCM services, increasing delivery speeds and accuracy by embracing hyper-automation and advanced technologies.

2.3 Tanzania Pharmaceutical Industry SCM

The pharmaceutical sector in Tanzania relies heavily on imports, comprising about 80% of the market [33]. Consequently, most pharmaceutical medicines and medical devices distributed within the country are imported. The pharmaceutical supply chain in Tanzania involves multiple stakeholders and regulatory bodies, ensuring the availability, accessibility, and quality of products. The Tanzania Medicines and Medical Devices Authority (TMDA) oversees the registration, licensing, and inspection of pharmaceutical products, manufacturers, and distributors to maintain quality and safety standards. The Medical Stores Department (MSD) is the central hub for the Government's procurement and distribution of pharmaceuticals and medical supplies, managing procurement negotiations, inventory, and logistics to meet healthcare needs.

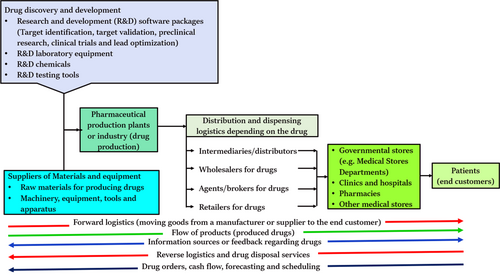

The general SC for a pharmaceutical company encompasses a series of vital components called nodes [34], including the management of raw materials, supplier interactions, the manufacturing process, warehousing, distribution, and the provision of storage facilities, such as wholesalers and pharmacies [35]. The journey of the pharmaceutical SC extends with the delivery of products to hospitals and, ultimately, the end-users. Furthermore, the SC ends its impact beyond this final destination by responsibly managing the recycling of used products, thus completing the full lifecycle of pharmaceuticals [36]. Figure 1 depicts a general SC for a pharmaceutical company or industry. It should be noted that Figure 1 is the typical SC, which means some processes do not necessarily need to be executed in all pharmaceutical industries. For example, not all industries conduct drug discovery and development.

Source: Authors' own work.

2.4 Driving Forces for SCM 4.0 Applicability

Driving forces are those elements or essentials that push, propel, or motivate a particular phenomenon, action, or change in a specific direction [37]. They are the influential components that actively contribute to a specific outcome or result. In research or analysis, driving forces are often used to explain why certain events occur or trends develop. The term driving forces differs from other related terms such as factors or indicators. Factors are general components encompassing various elements that can influence an outcome or situation [38]. They can include both driving and inhibiting forces, while driving forces refer to those factors that actively push or promote a particular change or development. In addition to comprehending the idea of I4.0, it is critical to discuss the driving forces that can motivate businesses such as PMIs to apply I4.0 in their operations, including SCs [39]. The main driving forces derived from the reviewed literature regarding companies are presented in Table 1.

| Category | Driving force | Sources |

|---|---|---|

| Regulatory and compliance driving forces | DF1. Government policies | Eltayeb et al. [40], Nagy et al. [41], Debnath et al. [42], Müller et al. [43], Lawson [44], Das [45] and Erol et al. [46] |

| DF2. Regulatory compliance and standards | ||

| DF3. Quality control | ||

| DF4. International trade requirement | ||

| Market and logistics driving forces | DF5. Supplier collaboration | Garay-Rondero et al. [47], Ghobakhloo et al. [48], Zhang et al. [49], Lawson [44]. |

| DF6. Demand fluctuations | Müller et al. [43], Stock and Seliger [50], Herceg et al. [51], Horváth and Szabó [39], Ibarra et al. [52], Ślusarczyk [53]. | |

| DF7. Competitive pressure | Herceg et al. [51], Müller et al. [43], Horváth and Szabó [39], Eltayeb et al. [40] | |

| DF8. Business model innovation | ||

| DF9. Security requirement | Yuan and Xue [22], Mullet et al. [54], Mahmood et al. [55], Herceg et al. [51], Stentoft et al. [56] | |

| DF10. Labor market change | Herceg et al. [51], Stentoft et al. [56], Horváth and Szabó [39], Garay-Rondero et al. [47], Yuan and Xue [22] and Ghobakhloo et al. [48]. | |

| DF11. Customer requirements | ||

| DF12. Logistics optimisation | ||

| Economic and financial driving forces | DF13. Energy and resource efficiency | Eltayeb et al. [40], Horváth and Szabó [39]. |

| DF14. Cost reduction | Herceg et al. [51], Müller et al. [43], Rogers et al. [57], Stock and Seliger [50], and Erol et al. [46] | |

| DF15. Performance improvement | ||

| DF16. Circular economy requirement | Rajput and Singh [58], Romero et al. [59] | |

| DF17. Financial resources | Horváth and Szabó [39], Kiel et al. [60]. | |

| Technological driving forces | DF18. Technological advancement | Ghobakhloo et al. [48], Paritala et al. [61], Debnath et al. [42]. |

| DF19. Real-time data availability | Bentaher and Rajaa [62], Tsaramirsis et al. [63], Sharifpour et al. [64]. | |

| DF20. Products customisation | Zhang et al. [49], Stentoft et al. [56], Horváth and Szabó [39]. | |

| DF21. Decentralized data architecture | Zhang et al. [49], Ghobakhloo et al. [48], Bentaher and Rajaa [62], Eltayeb et al. [40] | |

| DF22. Reliable infrastructure | Osakwe [65], Paritala et al. [61] |

2.5 Strategies for SCM 4.0 Applicability

The emergence of I4.0 has ushered in a wave of transformative initiatives in developed countries, with tangible benefits already being realized. However, this technological revolution remains largely uncharted territory for many developing and least-developed nations, particularly in Africa. Some are still entrenched in the early stages of industrialization, struggling to transition even to Industry 3.0. These nations face foundational challenges, including limited access to electricity and, where available, its unreliable nature [66].

Tanzania, as one of the developing countries, requires a strategy and clear roadmap outlining how it intends to facilitate the implementation of advanced technologies [65]. Bongomin et al. [67] identified key strategic approaches for fostering I4.0 applicability within the East African Community (EAC). These include investing in education and training for a skilled workforce, fostering public-private partnerships (PPP) and policy innovation, promoting open innovation initiatives, prioritizing research and development, encouraging collaboration and partnerships, and fostering international and regional cooperation. The proposed strategies align with findings from other scholars, including Mahdiraji et al. [68], who advocate for developing new business models and operations optimization, and Moosivand et al. [36], who emphasize the strategic investment in new technologies. These strategies pave the way for the applicability of I4.0 principles, which are relevant to enhancing SCM 4.0 practices, as shown in Table 2.

| Code | Strategy | Source |

|---|---|---|

| ST1 | Open innovation initiatives | Zeid and Syed [69] |

| ST2 | International and regional cooperation | Brenton and Hoffman [70] |

| ST3 | New business model development | Mahdiraji et al. [68], Mattsson et al. [71] |

| ST4 | Research, development and innovation | Machado et al. [72], Švarcová et al. [73] |

| ST5 | Collaboration and partnership | Santiago [74], Winberg and Ahrén [75] |

| ST6 | Education and training | Jujjavarapu et al. [76], Petrillo et al. [77] |

| ST7 | Public-Private Partnerships (PPP) and policy innovation | Zervoudi [78], MITC [79] |

| ST8 | Operations optimization | Gallego-García et al. [80], Mahdiraji et al. [68] |

| ST9 | Investment in new technologies | Debnath et al. [42], Ali and Aboelmaged [81] |

2.6 Conceptual Framework (CE)

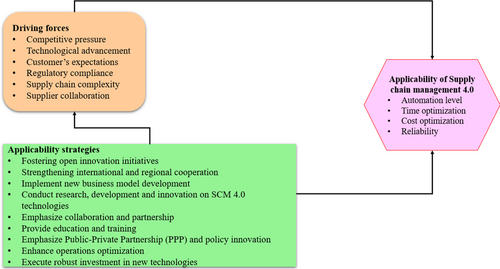

Figure 2 forms a relevant CE that guided the study in addressing critical research gaps and providing comprehensive insights into the applicability of SCM 4.0. The independent variables include driving forces influencing the applicability of SCM 4.0 in Tanzania pharmaceutical manufacturing industries (PMIs). Literature suggests these driving forces include competitive pressure, technological advancement, customer expectations, SC complexity, supplier collaboration, cost reduction, and performance improvement: such studies include Rajput and Singh [58], Horváth and Szabó [39], Kiel et al. [60], Ghobakhloo et al. [48], Paritala et al. [61], Tsaramirsis et al. [63], Sharifpour et al. [64], Zhang et al. [49], Stentoft et al. [56], and Horváth and Szabó [39]. The other independent variable is strategies for SCM 4.0 applicability within PMIs, focusing on SCM as the central theme. Conversely, the dependent variable centers on the applicability of SCM 4.0 for PMIs.

As illustrated in Figure 2, all these variables combined form a relevant conceptual framework that guided the study in addressing critical research gaps and providing comprehensive insights into the state of SCM 4.0 drivers and the strategies needed to propel Tanzania PMIs into the era of digitalized SCM.

3 Research Methodology

3.1 Research Design

The study employs a mixed-methods approach to comprehensively explore the driving forces and applicability strategies of SCM 4.0 in PMIs. The research design integrates quantitative and qualitative methods to gather data from the SC nodes operating within the pharmaceutical industry. This mixed-methods approach was chosen to allow for a comprehensive analysis integrating quantitative and qualitative data, offering a nuanced understanding of SCM 4.0 applicability in PMIs in Tanzania.

3.2 Sample Design and Characterization of Sample

Drawing on established methodologies from previous studies such as that of Ali and Aboelmaged [81], the study implemented a purposive sampling strategy coupled with a snowball sampling technique. The purposive sampling aspect enabled the deliberate selection of PMIs as primary participants. The snowball sampling approach facilitated the identification of additional participants through referrals from initial contacts, creating a chain network encompassing suppliers, distributors, retailers, and end customers.

Drawing from the unique features of the pharmaceutical SC, the study employed three pre-established criteria as outlined in prior research studies, such as those conducted by Tortorella et al. [82] and Marodin et al. [83]. Initially, the study selected respondents affiliated with the SC network of the selected PMIs, comprising suppliers who provide raw materials to these PMIs and distributors involved in distributing products from these PMIs. Second, all surveyed organizations were required to have ongoing digitalization initiatives, including retailers (pharmacies) with electronic Logistics Management Information Systems (eLMIS) and customers (hospitals) with Electronic Health Record Systems (EHRS). This criterion aimed to guarantee a basic familiarity with SCM 4.0 technologies among respondents. Last, respondents were specifically sought from the Dar es Salaam and Pwani regions in Tanzania.

3.3 Population and Sample Size Determination

The study targeted a diverse range of SC nodes within the pharmaceutical industry in Tanzania, including local PMIs, suppliers, wholesale distributors, retail pharmacies, and hospitals serving as customers. Population data on operating local PMIs and hospitals were obtained from the current reports by TMDA [33] and NBS [84]. However, the population of suppliers, wholesale distributors, and retail pharmacies was unknown, so a snowball technique had to be employed, facilitated by a chain referral process. The method involved leveraging the assistance of the selected PMIs to initiate the referral chain. Snowball sampling was used because it is a popular method in qualitative research, which is based on networking and referral dynamics [85]. PMIs were known; thus, they helped identify a few suppliers, wholesale distributors, and retail pharmacies who assisted researchers in starting with them. The earlier identified suppliers were requested to suggest more contacts who meet the criteria and may be willing participants, indicating further potential volunteers. The demographics and sampling characteristics of the study population are illustrated in Table 3. Likewise, the unit of analysis for the study was the individual company. Each company represents a distinct entity within the pharmaceutical SC, including Suppliers (SP), PMIs, Distributors (DS), Retailers (RS), and Customers (CS, hospitals).

| Region | |||||

|---|---|---|---|---|---|

| Category (SC nodes) | Nature of population (before data collection) | Sampling techniques | Sample size (n) | Dar es Salaam | Pwani |

| Suppliers | Unknown | Snowball | 23 | 23 | 0 |

| PMIs | Known (13) | Purposive | 10 | 9 | 1 |

| Wholesale distributors | Unknown | Snowball | 35 | 35 | 0 |

| Retail pharmacies | Unknown |

Snowball Purposive |

23 | 20 | 3 |

| Customers (hospitals) | Known (61) | Purposive | 20 | 17 | 3 |

| Total | 111 | 104 | 7 | ||

3.4 Data Collection Method and Techniques

Data were collected through closed-end questionnaires, document reviews, and focus groups. Document review included the process of looking through current SCM 4.0-related papers, reports, and records from online sources for Tanzania PMIs. At the same time, focus group discussions offered a valuable platform for engaging key stakeholders in collaborative discussions to refine and validate the proposed strategies. First, it was through the document review: a document review as a secondary type of data collection was adapted from a study conducted by Eltayeb et al. [40], which examined the existing documents, reports, company publications, academic literature, and records related to SCM 4.0. The process of searching and reporting the findings from documents was adapted from Athuman et al. [86] and Pamba and Taifa [87].

Second, data were collected using a questionnaire designed to align with the research objectives. The questionnaire included closed-ended questions with Likert scales to collect pertinent data about the driving forces and strategies. Various pharmaceutical supply chain (PSC) related companies, such as manufacturers, suppliers, distributors, retailers, and customers, were distributed the questionnaire in print to accommodate participants' accessibility. The closed-end questionnaire, which was used to collect pertinent driving forces and potential strategies for SCM 4.0, is shown in Appendix A. Out of the 152 questionnaires distributed to various PSC-related companies across different sample distribution points of the SC nodes, 111 valid questionnaires were collected. This figure was derived after receiving feedback from 125 questionnaires and conducting data cleaning, which involved the removal of 14 questionnaires due to invalid respondent responses.

3.4.1 Focus group discussion (FGD)

For the second research question, the research focused on proposing strategies for SCM 4.0 applicability in Tanzania PMIs using FGDs. The 12 industry experts engaged in robust discussions, providing valuable feedback on the strategies' relevance and effectiveness. The summary of the focus group discussion is in Section 4.3.1. Consensus points emerged regarding the effectiveness of some strategies, while areas of divergence highlighted the complexity of SCM 4.0 implementation. The FGDs were conducted after the ranking strategies were completed. In fact, as per Brown [88], FGDs are not intended to produce statistics that can be used broadly but rather to learn about participants' viewpoints on particular topics. They can serve as a groundbreaking pilot, a primary data collection tool, or a qualitative addition to a quantitative survey. Understanding group dynamics, procedures, and opinions is one of the data acquired. Verbatim content, paralinguistic characteristics, and nonverbal behavior can all be used as evidence. Although randomized sampling is not required, a methodical approach is employed.

There were two FGDs, and each session comprised 6 members. The two sessions considered all participants' experiences, opinions, values, knowledge, background, and demographics. The sessions were run for no more than an hour, as Brown [88] suggested. The first FGD had three PMIs and three suppliers, representing the upstream SC nodes. The second session comprised 6 members from the downstream SC nodes. Invited members were from the distributors, customers, and retailers categories, and each category was comprised of two experts. All sessions lasted for one hour, as per various studies, including Aziz [89] and Robert et al. [90].

3.5 Analysis Techniques

Analyzing the driving forces or motivators necessitates deploying exploratory factor analysis (EFA) and confirmatory factor analysis (CFA) using SPSS version 21.0 and AMOS version 21.0, respectively. The extraction approach was the principal component analysis, whereby the corresponding rotation approach was Varimax with Kaiser normalization. Thus, six iterations resulted in rotation convergence. EFA and CFA improved the study's overall insights and conclusions by offering a solid grasp of the underlying forces influencing SCM 4.0's application in the PMIs. Table 4 shows the model's assessment and measurement cut-off values.

| Analysis | Test | Cut–off values | Source |

|---|---|---|---|

| Internal consistency | Cronbach's Alpha (CA) |

Between 0.6 and 0.7 is Acceptable Between 0.7 and 0.9 Satisfactory |

[91] |

| Composite reliability (CR) |

≥ 0.6 Acceptable > 0.7 Satisfactory > 0.95 Redundancy |

[92] | |

| Indicator reliability | Factor loadings | ≥ 0.7 is Acceptable | [93] |

| Convergent Validity | Factor Outer loadings | ≥ 0.7 Acceptable | [93] |

| Average Variance Extracted | ≥ 0.5 Desired | [94] | |

| Discriminant Validity | Factor correlation | < 0.85 Distinct | [95] |

3.6 Relative Importance Index (RII)

3.7 Reliability, Validity, Replicability and Consistency Tests

A thorough statistical analysis of the consistency of the measuring scale guaranteed reliability. Cronbach's Alpha (CA) values for each factor were calculated to evaluate internal consistency, and results above the suggested cut-off of 0.70 confirmed the constructs' dependability. In order to confirm the dependability of latent variables across a variety of indices, composite reliability (CR) was also assessed during CFA. These steps taken together guaranteed the study's findings' dependability and robustness.

Validity was attained by using a two-step validation procedure. SPSS version 21.0 was used to conduct the EFA. Varimax rotation and the EFA with the greatest likelihood approach were used to investigate the underlying factor structure of the driving forces affecting the applicability of SCM 4.0. This guaranteed construct validity by successfully locating and classifying variables that measured the same construct. The identified factor structure was further validated through CFA using AMOS version 21.0. The analysis confirmed the appropriateness of the factor structure by assessing model fit indices such as root mean square residual (RMSR), goodness of fit index (GFI), root mean square error of approximation (RMSEA), and comparative fit index (CFI). The measurement cut-off values in Table 4 provided thresholds to ensure content validity and alignment with theoretical expectations. However, replicability was also ensured by maintaining transparency and rigor throughout the study. The methodology was thoroughly documented, including using SPSS version 21 and AMOS version 21 software and detailed descriptions of analytical methods, enabling other researchers to replicate the study. Measurement criteria and cut-off values (as presented in Table 4) were explicitly reported to provide clear reference points for reproducibility. Also, the standardized and well-documented questionnaire and data collection processes ensure that the instruments can be reused in similar research contexts.

4 Results

4.1 Respondents' Demographical Descriptions

The results, as shown in Table 5, depict the distribution of participants across various segments of the SC. Distributors represent the largest proportion of the surveyed participants, with 35 respondents constituting 32% of the total sample. Following closely are suppliers and retailers, each comprising 21% of the sample with 23 respondents each. On the other hand, customers represent 18% of the total sample, with 20 respondents. Manufacturers constitute the smallest segment, representing 9% of the sample with 10 respondents. The study involved 72 male and 39 female experts. Their age categories were as follows: 18–25 years were 10, 26–35 years (29), 36–45 years (40), 46–55 years (15) and above 55 years (17). The experts had varying working experience, with 17 having at most 5 years, 59 having 6–15 years, and 35 having 16–35 years. Among 111, experts with a diploma educational background were 4, bachelor's degree (82), master's degree (20) and Doctor of Philosophy (5). These findings suggest a diverse representation across different nodes of the SC.

| Category | Frequency | Per cent | |

|---|---|---|---|

| SC node | Suppliers | 23 | 21% |

| Manufacturers | 10 | 9% | |

| Distributors | 35 | 32% | |

| Retailers | 23 | 21% | |

| Customers | 20 | 18% | |

| Total | 111 | 100% | |

| PMIs size | Medium enterprises | 7 | 70% |

| Large enterprises | 3 | 30% | |

| Total | 10 | 100% |

As per FSDT [98], the Government of Tanzania categorizes business size based on the number of employees it has and capital investment. A company with 100 employees or more and a capital investment of more than 200 million (TZS) to 800 million (TZS) is categorized as a large enterprise. Then, seven (7) among the ten (10) selected PMIs are medium-sized enterprises, equivalent to 70% of the PMIs (Table 5). The remaining three (3) industries, equivalent to 30%, have employees between 100 and 249 and up to 200 million (TZS), which is a large enterprise, meaning they are more advanced in terms of their operations and even the dimensions of facilities. None of the industries have more than 250 employees or fewer than 50 employees.

As shown in Table 5, the distribution of participants reflects a diverse representation across various job titles and educational backgrounds. In the upstream SC node, logistic managers from suppliers constitute 21%, followed by production/operation managers and procurement managers from PMIs. Conversely, in the downstream supply chain node, the study engaged distribution managers from distributors (32%), retail operations managers from retailers (21%), and procurement officers representing customers (18%). This distribution ensures a comprehensive exploration of perspectives from different stages of the SC.

4.2 EFA For Driving Forces

4.2.1 EFA

The measurement of sampling adequacy (MSA) was computed by establishing the Kaiser-Meyer-Olkin (KMO) value, where its value was 0.862. Since the KMO > 0.50, it implied that the MSA criterion was satisfied [83]. Likewise, the degree of freedom was 190, while the approximated Chi-square value was 1608.846. Also, the Bartlett test of sphericity yields a statistically significant result (p < 0.05), indicating that our correlation matrix significantly differs from an identity matrix, aligning with our expectations.

The study analyzed the driving forces affecting the applicability of SCM 4.0 in Tanzania PMIs using a Likert scale. An EFA was conducted using principal component analysis and varimax rotation, providing a theoretical framework for understanding these factors [99]. Factor analysis results for driving forces are in Table 6 whereas the results for the convergent validity and reliability of the driving forces are presented in Table 7. The minimum loading factor cut-off value was 0.50, as per Jani et al. [100]. The extraction approach was the principal component analysis, whereby the corresponding rotation approach was Varimax with Kaiser normalization. Thus, six iterations resulted in rotation convergence.

| Component | ||||

|---|---|---|---|---|

| SC nodes | 1 | 2 | 3 | 4 |

| DF1 | 0.834 | |||

| DF2 | 0.791 | |||

| DF3 | 0.870 | |||

| DF4 | 0.871 | |||

| DF5 | 0.769 | |||

| DF6 | 0.672 | 0.430 | ||

| DF7 | 0.818 | |||

| DF8 | 0.850 | |||

| DF9 | 0.820 | |||

| DF10 | 0.734 | |||

| DF11 | 0.796 | |||

| DF12 | 0.508 | |||

| DF13 | 0.830 | |||

| DF14 | 0.879 | |||

| DF15 | 0.831 | |||

| DF16 | 0.807 | |||

| DF17 | 0.704 | |||

| DF18 | 0.781 | |||

| DF19 | 0.781 | |||

| DF20 | 0.824 | |||

| DF21 | 0.827 | |||

| DF22 | 0.868 | |||

- Note: DF1 to DF22 are depicted in Table 1.

| Dimension | Items | SFLs | CA | CR | AVE | Maximum shared variance |

|---|---|---|---|---|---|---|

| Regulatory and compliance driving forces | D1 | 0.807 | 0.901 | 0.901 | 0.697 | 0.144 |

| D2 | 0.730 | |||||

| D3 | 0.882 | |||||

| D4 | 0.908 | |||||

| Market and logistics driving forces | D5 | 0.798 | 0.901 | 0.939 | 0.687 | 0.316 |

| D7 | 0.876 | |||||

| DF9 | 0.888 | |||||

| DF10 | 0.789 | |||||

| DF11 | 0.731 | |||||

| DF12 | 0.807 | |||||

| Economic and financial driving forces | DF13 | 0.852 | 0.909 | 0.927 | 0.717 | 0.144 |

| DF14 | 0.900 | |||||

| DF15 | 0.786 | |||||

| DF16 | 0.820 | |||||

| DF17 | 0.722 | |||||

| Technological driving forces | DF18 | 0.827 | 0.926 | 0.910 | 0.669 | 0.316 |

| DF19 | 0.825 | |||||

| DF20 | 0.845 | |||||

| DF21 | 0.860 | |||||

| DF22 | 0.877 |

- Note: Model fitness: RMSEA = 0.074, X2 = 547.52, GFI = 0.850, df = 183, X2/df = 2.99, RMR = 0.027, CFI = 0.921.

The EFA yielded the expected outcome of a four-factor solution, as shown in Table 7, with all items loading onto their respective factors as anticipated. During the initial loading, item ‘DF6’ showed cross-loadings, prompting its removal from further analysis. Then, ‘DF8’ exhibited cross-loadings during the second loading after the exclusion of ‘DF6’. The four-factor solution accounted for 72.67% of the total variance, indicating a substantial proportion of variance explained by the identified factors. These results indicate good validity for the factors derived from the exploratory analysis. CFA was employed to validate these findings further.

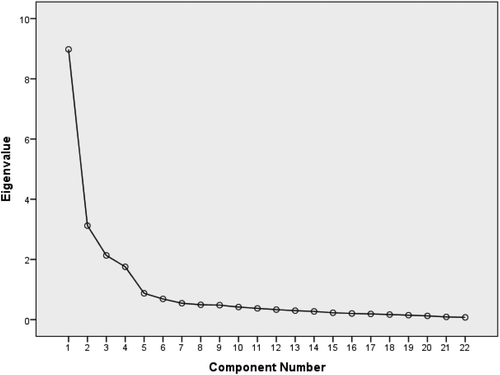

The scree plot, depicted in Figure 3, visually represents the number of components. It displays the eigenvalues corresponding to each extracted factor, with a threshold set at an eigenvalue of 1. Take note of the plot, which shows that four components (1–4) have eigenvalues greater than 1, suggesting that they are important in explaining the dataset's variance. This observation suggests that these retained factors are instrumental in elucidating the underlying structure of the data.

4.2.2 CFA

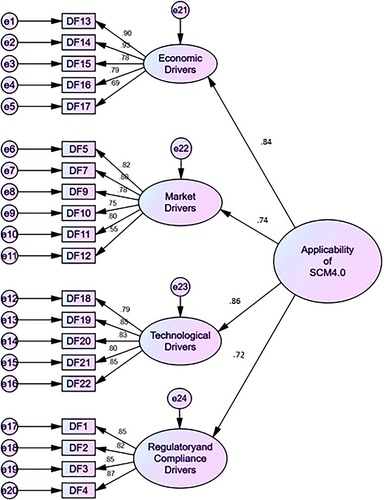

The model underwent evaluation to assess reliability, convergent validity, and discriminant validity. Initially, a graphical representation of the CFA was presented, illustrating the finalized calculated model. The reliability and convergent validity results are in Table 7. The structural equation model (SEM) path diagram in Figure 4 was employed to visually depict the relationships between observed indicators and two orders of latent variables within the model. The first-order latent variables: economic drivers (loading: 0.84), market drivers (loading: 0.74), technological drivers (loading: 0.86), and regulatory and compliance drivers (loading: 0.72), demonstrated significant factor loadings onto the higher-order latent variable, denoted as the applicability of SCM 4.0.

The analysis results shown in Table 7 reveal the standardized factor loadings (SFLs), CA, CR, AVE, and maximum shared variance for each dimension and its corresponding items. For the regulatory and compliance driving forces dimension, items DF1, DF2, DF3, and DF4 exhibit high SFLs ranging from 0.82 to 0.87, indicating strong associations with the underlying construct. The dimension demonstrates satisfactory internal consistency (CA = 0.901) and composite reliability (0.901), with an AVE of 0.697 and a maximum shared variance of 0.144. Similarly, for the market driving forces dimension, items DF5 to DF11 display robust factor loadings ranging from 0.75 to 0.89. Except for one item, DF12 shows a low standardized factor loading of 0.55. The overall dimension exhibits high internal consistency (CA = 0.901) and composite reliability (0.939), with an AVE of 0.687 and a maximum shared variance of 0.316. Moreover, the SFLs for the economic and financial forces and technological driving forces can be analyzed similarly. With regard to the model fitness, the CFA results show a good fit for the model, with a chi-square to degrees of freedom ratio of 2.99, RMSEA of 0.074, RMSR of 0.027, and CFI of 0.921, aligning with Hu and Bentler [101] recommended thresholds: RMSEA < 0.08, RMSR < 0.05, CFI > 0.90.

4.3 Strategies for SCM 4.0 Applicability in PMIs in Tanzania

The RII was used to assess the significance of SCM 4.0 strategies in SCM within PMIs in Tanzania, using questionnaires to rank and compare their perceived significance. The process incorporated calculating the weighted total and the RII for each strategy and then ranking each criterion (strategy) on a numerical scale.

Step 1: Calculating the weighted total (W) and the RII for each criterion (strategy).

The weighted total of each criterion was computed based on the data provided by respondents, and then the RII was calculated using Equation (1) and the results are shown in Table 8. In order to compute the total weighted score for RII, it is suggested that all RII scores be summed up by adding up the RII values for all SCM 4.0 strategies being evaluated. This should be followed by dividing by the total number of strategies (dividing the sum of the RII scores by the total number of factors).

| Code | Strategy | Mean | A = 5, N = 111 | Importance level | Rank |

|---|---|---|---|---|---|

| ST1 | Fostering open innovation initiatives | 3.96 | 0.74 | H | 8 |

| ST2 | Strengthening international and regional cooperation | 3.89 | 0.72 | H | 9 |

| ST3 | Implement new business model development | 4.01 | 0.78 | H | 6 |

| ST4 | Conduct research, development and innovation on SCM 4.0-related technologies | 4.58 | 0.94 | VH | 1 |

| ST5 | Emphasize collaboration and partnership | 4.19 | 0.82 | VH | 5 |

| ST6 | Provide education and training | 4.20 | 0.84 | VH | 4 |

| ST7 | Emphasize Public-Private Partnership (PPP) and policy innovation | 3.99 | 0.76 | H | 7 |

| ST8 | Enhance operations optimization | 4.41 | 0.86 | VH | 3 |

| ST9 | Execute robust investment in new technologies such as IoT, CPS, cyber security, additive manufacturing (3D printing), BIM, dark manufacturing, VF, VHSS, ML, AI, CC, robotics, MR, CS, cognitive computing, QC, SS, VR, AR, digital twins, BDA, and BT | 4.45 | 0.90 | VH | 2 |

Step 2: Ranking each criterion (strategy) on a numerical scale.

The calculated RII values were used to rank the strategies, as shown in Table 8. The higher the value, the higher priority it has and ranks. The RII decision criteria were modified from Ouansrimeang and Wisaeang [96] and Atilola et al. [97] as follows: 0.00 ≤ RII ≤ 0.20 (very low = VL), 0.20 ≤ RII ≤ 0.40 (low = L), 0.41 ≤ RII ≤ 0.60 (average = A), 0.61 ≤ RII ≤ 0.80 (high = H), and 0.81 ≤ RII ≤ 1.00 (very high = VH). The preference when implementing the strategies should be in ascending order as per the RII scores.

Enhancing research, development, and innovation is one of the most important strategies for driving technological advancement and leadership in a digitalized world, with a high RII of 0.94, ensuring competitiveness and sustainability. The second most important strategy is how the industry prioritizes optimizing operations and investment in new technologies to enhance efficiency and responsiveness to SCM 4.0 requirements, with an RII of 0.90, being proactive. In addition, the industry should respect education and training in attaining effective SCM 4.0 applicability and observing the nature of human capital. Enhancement of partnership, collaboration, and policy innovation was also among the core strategies, formulating conducive policies and environments for effective digital transformation. Likewise, Bongomin et al.'s [67] study highlights strategic measures towards promoting I4.0 use in the EAC and SCM 4.0 use in Tanzania's PMIs through innovation focus, enhancement of efficiency, technology investment, skills development, and collaboration. The validation procedure utilized FGDs to ensure the credibility of RII findings. Twelve experts from the industry participated in discussions and provided reflective comments on high-priority strategies for SCM 4.0 implementation in PMIs. Consensus points were achieved concerning the effectiveness and appropriateness of certain strategies, while divergence points highlighted the intricacy of SCM 4.0 implementation.

4.3.1 Summary of Focus Group Discussion

Vital results were obtained from two FGDs. Such results focused on SCM 4.0 strategies that PMIs can adopt. Training and education were emphasized as imperative, with experts citing investing in digital literacy training and SCM programs in order to develop the skills necessary in the workplace. Partnership and collaboration were also at the center, with experts forming partnerships with suppliers, customers, and technology providers in order to leverage pooled expertise and resources.

Investment in new technology in areas such as BT, IoT, and AI was also identified, as they can automate operations, improve inventory management, make products more trackable, and improve coordination with distributors and suppliers. Operations optimisation was also identified as a central strategy, in which PMIs are able to optimize productivity and be agile to changing market demands. Research, development, and innovation (RDI) were also prioritized, with experts fostering an innovation culture and investing in RDI programs to create new solutions and drive the markets.

New business models were also highlighted, with specialists citing the game-changing capability of digital platforms and data insights to shape new business models that will propel greater operating efficiency and competitiveness. Open innovation programs were also highlighted, with specialists collaborating with outside stakeholders to foster innovation and continuously improve SC activities.

International and regional cooperation was also emphasized, with experts valuing global best practices and standards through collaboration with international partners to enhance supply chain resilience and sustainability. Public-private partnerships (PPPs) and policy innovation were also emphasized to create an environment fostering innovation and growth within the pharmaceutical industry.

To improve the tactics, recommendations included encouraging a culture of innovation and continuous improvement within PMIs, improving cooperation with industry stakeholders and regulatory agencies, and integrating contextual factors into strategy creation. By addressing these recommendations, PMIs can better tailor their SCM 4.0 initiatives to address specific barriers and opportunities in PMIs, maximizing the likelihood of successful implementation and applicability.

Since the level of SCM 4.0 differs from industry to industry, the implementations should be supported by a structured approach that can balance industry-specific requirements with the general principles. This means the PMIs would need to compute the status quo SCM 4.0 maturity level, describe the clear industry's goals, and evaluate available and needed resources. Thus, the implementation will have to follow after such evaluation. It is also suggested that PMI should implement the strategies gradually for smaller and more manageable SCM projects, which consequently can be expanded depending on the success achieved over a while.

5 Discussion of the Results

Prior studies have continuously emphasized the importance of regulatory and compliance factors to SCM. Similar high dependability scores were noted in a study by Eltayeb et al. [40], highlighting compliance's significance in preserving sustainable SCs. However, regulatory pressures have a major impact on supply chain environmental practices, according to Nagy et al. [41], which supports the findings of high reliability and strong relationships. The study's shared variance and AVE metrics support the robustness of the regulatory and compliance aspects by matching those found in this research.

Market-driving dynamics are frequently associated with customer demand and competitive advantage in SC research. For instance, research by Horváth and Szabó [39] and Herceg et al. [51] highlighted the important influence of market dynamics on SC responsiveness and agility. The study's strong composite reliability and internal consistency are similar to those found in Müller et al.'s [43] study, which found that Cronbach Alpha values for market-related constructs were over 0.90.

Economic factors are crucial for strategic management (SC) performance, with technological advancements democratizing access to information and enabling innovative solutions. The same findings were reported by Horváth and Szabó [39] and Kiel et al. [60]. Global markets and evolving consumer preferences incentivize PMIs to embrace digital transformation to enhance operational efficiency, product quality, and market responsiveness. Tanzania PMIs need tailored strategies to enhance SCM 4.0 implementation, including investing in technology, training digital skills, fostering stakeholder collaboration, advocating for supportive policies, and knowledge sharing among PMIs, academia, and international partners. Proactive partnerships with developed and emerging economies can accelerate Tanzania's applicability, as seen in German entities transitioning to I4.0. This is consistent with research findings by Forkmann et al. [102], Maganga and Taifa [103] and [13, 14], highlighting organizations' proactive partnerships with counterparts in developed and emerging economies to facilitate a smooth transition to I4.0.

Research by Bader et al. [104], Schrecker et al. [105], and Zeid and Syed [69] supports open innovation's role in enhancing supply chain performance. Open innovation allows firms to adapt quickly to market changes, aligning with an RII of 0.74. Studies by Kutu and Ngalawa [106] and Brenton and Hoffman [70] highlight the benefits of international and regional cooperation for efficiency and reliability.

Additionally, the disruptive impact of new business models is highlighted by Erdogan et al. [107], Mahdiraji et al. [68], and Mattsson et al. [71]. The idea that creative business models are essential for preserving a competitive edge in SCs is supported by the study's RII of 0.78. The results of this investigation are consistent with those of Machado et al. [72] and Švarcová et al. [73], demonstrating the noteworthy influence of research, development, and innovation on manufacturing innovations and process efficiency. In fact, both innovation and eco-innovation are crucial for all manufacturing industries [87, 108]. The innovation may encompass the expert systems enabling the desirable transformation [109].

The study findings on the significance of collaboration are supported by Santiago [74] and Winberg and Ahrén [75], who emphasize the value of teamwork in attaining SC excellence and show how collaborative practices enhance information sharing, trust, and cooperative problem-solving in SCs. Studies like Jujjavarapu et al. [76], Petrillo et al. [77], and Santiago [74] also support the importance of education and training strategies, finding that continuous education and training programs are essential for keeping SC professionals abreast of the most recent practices and technological advancements.

The usefulness of PPPs in providing public infrastructure and services is examined by Mitra [110] and Zervoudi [78], who also highlight the opportunities for creative solutions and show how effective they are at doing so. Gallego-García et al. [80] and Mahdiraji et al. [68] emphasize the significance of the operations optimisation approach, offering insights into lean manufacturing concepts and stressing waste reduction and continuous process improvement in SCs. Finally, the transformative potential of emerging technologies like IoT, AI, and BDA in modernizing SC operations and decision-making, the influence of technological investments on SC performance was underlined by Ali and Aboelmaged [81], Ocicka et al. [8] and Debnath et al. [42]. Technology as a crucial driving force is also supported by UNCTAD [111]. UNCTAD [111] states that technology plays a crucial role in the resilience and variety of supply networks. It facilitates cost-effectiveness, manufacturing efficiency, and product customization, accelerates delivery, improves information flow, and increases supply chain integration. Digital platforms and services promote diversification across sectors and markets. Technological services like connectivity, electronic data interchange, logistics, digitisation, traceability software, and intelligent services also enhance supply chain sustainability and resilience [111].

5.1 Effect of Digital Transformation Influences SCM in PMIs

Digital transformation implies a shift in SCM that involves collecting, sharing, and analyzing supply chain data at various stages, including demand planning, transportation and logistics management, warehouse management, asset management, procurement, and order fulfillment [42]. Several industries have been transformed by integrating advanced technologies [14, 112]. Globally, all industries have at least witnessed the digital transformation effect in one of the processes, products, or services offered [31]. Pharmaceutical manufacturing industries, through their SCM, have the potential to be transformed digitally. Such transformation can improve SC performance by enabling predictive analytics, real-time tracking, and better resource optimization [44]. Incorporating digital technologies, including AI, IoT, BT, and BDA, is crucial for PMIs to uphold competitiveness and resilience in a globalized market. The transformation of PMIs can potentially boost efficiency, precision, and regulatory compliance. There is a high chance that the transformation can accelerate performance, resilience, and agility while mitigating encountered SCM risks. Likewise, the transformation in terms of deploying advanced robotics and automating the production systems within the PMIs can assist in streamlining the manufacturing workflows, diminishing human errors, and ultimately increasing the PMI outputs.

6 Conclusions and Recommendations

6.1 Conclusion

The study offers insights into the driving forces influencing SCM 4.0 applicability in Tanzania's PMIs, identifying four key dimensions: regulatory and compliance, market, economic, and technological driving forces. Technological advancements emerged as particularly significant. The study also proposed strategies to facilitate SCM 4.0 implementation. All respondents initially ranked the strategies, which were later validated through a focus group discussion. FGDs comprised 12 industry experts engaged in discussions, providing feedback on the strategies' relevance and effectiveness. Consensus points emerged on some strategies' effectiveness, while areas of divergence highlighted the complexity of SCM 4.0 implementation. FGDs were conducted to exploregroup dynamics, procedures, and opinions. The study employed a methodical approach, considering all participants' experiences, opinions, values, feelings, knowledge, background, and demographics. The confirmed strategies include technological investment, regulatory compliance, customer-centric approaches, collaborative partnerships, open innovation initiatives, international cooperation, new business models, and PPP and policy innovation. These strategies aim to guide stakeholders in navigating digital transformation. By analyzing SCM 4.0 driving forces and applicability strategies, the research equips policymakers, regulatory bodies, and industry professionals with actionable insights to foster innovation, investment, and regulatory alignment, enhancing SCM 4.0 applicability and driving sustainable growth in Tanzania's pharmaceutical sector.

6.2 Recommendations

To advance digital transformation within Tanzania's PMIs, stakeholders should prioritize improving technological infrastructure and digital capabilities, such as AI, IoT, and BDA, while fostering a culture of innovation and digital literacy through continuous training. Collaboration between PMIs, academia, research institutions, and government agencies is essential for knowledge sharing and addressing common challenges. It is recommended that policymakers create policies that encourage innovation and investment and enhance digital infrastructure. PMIs should be customer-focused and use SCM 4.0 technology to improve competitiveness and satisfy changing customer demands. Likewise, to develop new technology and business models, it is essential to support innovation and entrepreneurship through funding programs, incubators, and hubs.

7 Implications of the Study

7.1 Theoretical Implications

The work is significant because it has the potential to advance academic understanding and real-world applications in the context of SCM 4.0, especially in developing nations like Tanzania. From an academic perspective, this study adds to the limited body of literature on the applicability of I4.0 technologies in resource-constrained environments, particularly in the pharmaceutical sector. It addresses the gap in understanding how advanced technologies such as IoT, AI, BDA, and blockchain technology can be integrated into SCs in developing economies, offering a unique perspective often overlooked in the global discourse on SCM 4.0.

Through an analysis of their implementation in Tanzania's resource-constrained pharmaceutical sector, the study contributes to the theoretical knowledge of I4.0 and SCM 4.0 by showing how pre-existing SCM 4.0 frameworks can be modified to meet particular regulatory, financial, and infrastructure problems. The study highlights the necessity for SCM 4.0 theories to consider adaptable regulatory frameworks and customized ways to meet the unique problems of developing economies by concentrating on particular factors, such as regulatory support, technical preparedness, and economic motivators. This viewpoint emphasizes how regulatory considerations can operate as enablers rather than just supporters, with incentives and rules essential to implementing SCM 4.0 in these situations.

As underlined in other parts of the findings, readiness is a complex and difficult concept where SCM 4.0 modifications are done to weak infrastructure environments. In this case, technological readiness includes both the availability of the technology and the adequate supporting regulations of a useful workforce. This fact leads to the assumption that technology-deprived environments are far more complex and need step-by-step systemic approaches instead of singular multi-factored methods to achieve readiness for SCM 4.0 models. That is why diversity in economic circumstances requires diversified approaches.

Moreover, the study identifies effective local and partner collaboration as pivotal areas of workforce strategies alongside other SCM 4.0 implementation scheme components. These strategies seem to advocate for the aggressive approach of enlisting local personnel training and skilled labour retention programs targeting overseas tech specialists for a more gradual approach to skill acquisition. This evidence demonstrates the extreme necessity of developing market demand—balancing local investment and nurturing home-grown talent with international assistance. On the other hand, SCM 4.0 can address the gaps in social services by improving the accessibility, quality, economic, and operational efficiency of healthcare. Altogether, our results justify.

7.2 Practical Implications

Having analyzed the collected data for driving forces and strategies, it is vital to point out that the study provided important results which can assist PMIs regarding SCM 4.0. Implementing the SCM 4.0-related technologies, driving forces, and strategies can potentially advance PMIs' SCM in Tanzania. It is expected that implementing strategies can assist in fostering digital transformation across the entire sector. Digital transformation in PMIs can improve SC performance by enabling predictive analytics, real-time tracking, and better resource optimization. Incorporating digital technologies like the IoT, AI, BT, and BDA is crucial for PMIs to maintain competitiveness and resilience in a globalized market. The transformation can boost efficiency, precision, and regulatory compliance while mitigating SCM risks. The transformation in deploying advanced robotics and automating the production systems within the PMIs can assist in streamlining the manufacturing workflows, diminishing human errors and ultimately increasing the PMI outputs.

8 Limitations of the Study

The findings align with driving forces and potential strategies for implementing SCM 4.0 in the PMIs. Some limitations can be explored for future studies. First, establishing the maturity level for SCM 4.0 in PMIs within the country is important. This will create awareness of the nature of technologies, which may be appropriate based on the current maturity level the PMIs possess. Second, the implementations of SCM 4.0 may necessarily require the transition frameworks should the current IR be at Industry 3.0. If PMIs have implemented some technologies associated with SCM 4.0, it is recommended to gradually expand to the emerging fifth IR, i.e., Industry 5.0. Therefore, future research can assess the preparedness for embracing SCM 5.0 together with the corresponding frameworks. Such transition frameworks can detail the constructs or factors aligning with people, technology, data, and processes, which are adequate to cause digital transformation within the SC of PMIs. Third, the study did not categorize the size of the PMIs involved. Some studies can separate the results based on the enterprise size, e.g., micro, small, medium, and large. For the current study, only PMIs were assessed to check whether the involved industries were medium or large; however, other results were not categorized as all were analyzed collaboratively. Lastly, the study has pointed out important I4.0 technologies within the SCM, such as IoT, CPS, cyber security, additive manufacturing (3D printing), BIM, dark manufacturing, VF, VHSS, ML, AI, CC, robotics, MR, CS, cognitive computing, QC, SS, VR, AR, digital twins, BDA, and BT. However, no detailed analysis was conducted to scrutinize the functionality of each technology with respect to the SC channels or nodes. Therefore, all these limitations can be explored in the future. Despite these limitations, the study has generated important results on the driving forces and strategies that are crucial for the applicability of SCM 4.0 in PMIs.

Author Contributions

Ismail W. R. Taifa: conceptualization, methodology, validation, visualization, writing – review and editing, project administration, resources, investigation, formal analysis. Johnson Subby Nzowa: conceptualization, investigation, funding acquisition, writing – original draft, methodology, validation, visualization, software, formal analysis, data curation.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A: Structured Questionnaire to Collect Data

Demographic Information

- Supply chain category or channel: Suppliers □, PMIs □, Wholesale distributors □, Retail pharmacies □, Customers (hospitals) □

- Gender: Male □ or Female □

- Years of the respondent: 18 to 25 years □, 26 to 35 years □, 36 to 45 years □, 46 to 55 years □ and above 55 years □.

- Working experience in the PMIs or SCM for PMIs: 0 to 5 years □, 6 to 15 years □, 16 to 35 years □, and above 35 years □

-

If you are from any PMIs, answer the following to identify the size of the PMI:

- Number of employees: 1 to 4 □, 5 to 49 □, 50 to 99 □, at least □

- Capital investment in machinery (Tsh): < 5 million □, 5 ≤million ≥200 □, 200 ≤million ≥800 □, >800 million □

- Educational background: No formal education □, Primary education, Secondary education □, Diploma □, Bachelor's or undergraduate degree □, Master's degree □, PhD □

- Position at the company: Logistics manager □, Production or operation manager □, Procurement manager □, Distribution manager □, Retail operations manager □, Procurement officers □

Driving Forces

Qn 1. How would you rate your application on the following SCM 4.0 technologies in your company? Use the five-point Likert scale: 1 = No application, 2 = Moderate application, 3 = Good application, 4 = Advanced application, 5 = Expert application.

Driving forces for SCM 4.0 applicability as derived from the reviewed literature.

| Category | Driving force | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|---|

| Regulatory and compliance driving forces | DF1. Government policies | |||||

| DF2. Regulatory compliance and standards | ||||||

| DF3. Quality control | ||||||

| DF4. International trade requirement | ||||||

| Market and logistics driving forces | DF5. Supplier collaboration | |||||

| DF6. Demand fluctuations | ||||||

| DF7. Competitive pressure | ||||||

| DF8. Business model innovation | ||||||

| DF9. Security requirement | ||||||

| DF10. Labor market change | ||||||

| DF11. Customer requirements | ||||||

| DF12. Logistics optimization | ||||||

| Economic and financial driving forces | DF13. Energy and resource efficiency | |||||

| DF14. Cost reduction | ||||||

| DF15. Performance improvement | ||||||

| DF16. Circular economy requirement | ||||||

| DF17. Financial resources | ||||||

| Technological driving forces | DF18. Technological advancement | |||||

| DF19. Real-time data availability | ||||||

| DF20. Products customization | ||||||

| DF21. Decentralized data architecture | ||||||

| DF22. Reliable infrastructure |

Strategies for SCM 4.0 Applicability in Pharmaceutical Manufacturing Industries

Rank the strategies for SCM4.0 applicability in the pharmaceutical using the following five-point Likert scale: 1= Strongly agree, 2= Agree, 3= Neutral, 4= Disagree, 5= Strongly disagree.

| Level of agreement | ||||||

|---|---|---|---|---|---|---|

| Code | Strategy | 1 | 2 | 3 | 4 | 5 |

| ST1 | Fostering open innovation initiatives | |||||

| ST2 | Strengthening international and regional cooperation | |||||

| ST3 | Implement new business model development | |||||

| ST4 | Conduct research, development and innovation on SCM 4.0-related technologies | |||||

| ST5 | Emphasise collaboration and partnership | |||||

| ST6 | Provide education and training | |||||

| ST7 | Emphasise Public-Private Partnership (PPP) and policy innovation | |||||

| ST8 | Enhance operations optimization | |||||

| ST9 | Execute robust investment in new technologies such as IoT, CPS, cyber security, additive manufacturing (3D printing), BIM, dark manufacturing, VF, VHSS, ML, AI, CC, robotics, MR, CS, cognitive computing, QC, SS, VR, AR, digital twins, BDA, and BT | |||||

Open Research

Data Availability Statement

The data that support the findings of this study are available from the corresponding author upon reasonable request.