Achieving economy-wide gains from residential energy efficiency improvements: The importance of timing and funding approach in driving the transition

Abstract

Residential energy efficiency improvements are generally considered integral to achieving climate change targets. Alongside the primary benefits of reducing energy use and consumer bills, there is increasing policy interest in the potential for energy efficiency programmes to deliver economy-wide gains, measured by gross domestic product, employment, household real incomes and spending power etc. Our previous research shows that such sustained gains are likely over time. Here, we consider how transitory outcomes are likely to be heavily influenced by the timing of actions and who pays, how and when. Insight in this regard is crucial for policy makers considering the mix and timing of measures to reach net zero outcomes that are economically as well as technically feasible. We consider alternative funding, distributions and timeframes for residential retrofitting costs and projects using a UK economy-wide scenario simulation model. The key insight is that while government support for the provision of low-cost finance options is strategically important in alleviating budget constraints and mitigating potential short-term negative impacts on household spending, producer responses to the wind down of retrofitting spending can disrupt the adjustment of the economy. Here we identify pros and cons of different trajectories of action towards high-level energy efficiency policy targets.

1 INTRODUCTION

Residential energy efficiency improvements are widely accepted as having a key role in the transition to net zero across different levels of governance. Energy efficiency improvement policies have been part of the broader energy policy landscape even before the inaugural United Nation's Framework Convention on Climate Change, featuring measures ranging from voluntary certification and labelling programmes to regulations such as building codes and minimum energy performance standards (see Economidou et al., 2020 for a review).

As new policy documents are published, the role of energy efficiency is re-affirmed and new provisions are made to ensure that energy efficiency targets are achieved or become even more ambitious. For instance, at the EU level, a July 2021 proposal for a European Commission directive (EC, 2021) proposes that member states raise the ambition related to EU energy efficiency targets set in 2018. In the UK (the case example considered here) the HM Treasury (HMT, 2021a) Net Zero Review published alongside the UK Government's Net Zero Strategy (BEIS, 2021) recognises the importance of residential energy efficiency improvements, especially in relation to alleviating the exposure of UK households to the costs of transitioning to net zero. More recently, the UK Government announced that additional funds would be allocated between 2025 and 2028 to support the energy efficiency improvement of residential properties (HM Government, 2022).

Previously, the UK ‘Clean Growth Strategy’ (HM Government, 2019) had set a clear goal to bring as many UK residential properties as possible to an Energy Performance Certificate (EPC) Band C by 2035. Given the magnitude of this target, and the need to ensure supply chains build to deliver retrofitting projects, one challenge is whether the current UK approach of supporting rounds of short-term (no more than 4 years long) activity through what is known as the Energy Company Obligation (ECO) is the most effective approach, or whether commitment to a longer term and larger scale programme over the 15-year timeframe to 2035 is necessary.1

This provides a useful context to use a UK example to consider how the timing of action and funding approach adopted may impact the transition of the wider economy and particular metrics of policy interest to the type of longer term sustainable ‘green growth’ outcomes identified in the wider literature and by bodies such as the International Energy Agency (IEA, 2014). We use the type of economy-wide computable general equilibrium (CGE) model commonly adopted in this type of research, and employed by organisations at different levels of governance (e.g. Scottish Government, HM Treasury, European Commission), to conduct an analysis of the potential outcomes of an illustrative 15-year £68.5billion programme sufficient to meet the broad UK target of bringing most UK residential properties to EPC C by 2035.

Specifically, in the work discussed in this paper we focus on how the transition towards long-run outcomes is impacted by questions of ‘who pays, how and when’. This involves considering scenarios for early, late, or steady action, where households pay their own retrofitting costs at the time of delivery under a regulatory approach set against alternative approaches involving government grants or loans (over different timeframes) that enable the relaxation of budget constraints. This is important not only in terms of outcomes for households themselves, but also in avoiding consequent negative wider economy impacts if reduced household spending on other goods and services triggers contractionary processes. We set this analysis in terms of a prevailing wider economy landscape where the presence of a sustained labour supply constraint brings additional price pressures impacting the transition process and outcomes.

The key finding of our analysis is that, although not affecting long-run outcomes, the funding mechanism used to cover the retrofitting cost plays a significant role in both the nature and the magnitude of the potential impacts as the economy adjusts through an extended transitory timeframe. The funding mechanism influences whether negative pressures emerge on prices, incomes, activity levels and employment across the wider economy, how long those pressures may last, and the extent to which they are driven by reduced household consumption and/or other forces that lead to some ‘crowding out’ of other activities. By extension, the choice of funding mechanism impacts the emergence of gains or losses accruing to the government budget over the transition timeframe. The distribution of activity to enable energy efficiency gains over the duration of an extended (here, 15-year) programme also has notable implications. This can influence the timing and magnitude of potential negative pressures to the economy, while introducing requirements, for example in skilled labour that may be challenging to meet within more limited timeframes. Generally, we find that key policy considerations in supporting the rollout of programmes to enable residential energy efficiency include determining how the spending is distributed across not only different household income groups (one focus of our core research) but timeframes to policy targets, and, crucially, exactly how and by whom costs will be met therein.

The remainder of the paper is structured as follows: Section 2 provides a brief overview of the residential energy efficiency literature to date and sets out how our contribution addresses a crucial policy-relevant gap in terms of the impacts of timing and funding decisions in determining extended transitory outcomes. Section 3 sets of the key features of our methodology. Section 4 presents the main results of our work and discusses their implications. Section 5 concludes with a wider overview of the policy implications.

2 CONTRIBUTING TO LITERATURE ON WIDER ECONOMY IMPACTS OF ENERGY EFFICIENCY ACTIONS

Literature focussing broadly on the impacts of increasing energy efficiency, including but not limited to focus on residential properties, spans multiple years and publications. In a review of the last 40 years of research on energy efficiency, Saunders et al. (2021) identify some key topics studied as: assessment of the ‘energy efficiency gap’ and how it may be closed; different types of policy actions used to promote and support energy efficiency; the potential multiple benefits of energy efficiency improvements and the potential for ‘rebound’ effects in energy use as energy savings trigger a range of expansionary effects across sectors and economies.

The literature on the multiple benefits of energy efficiency includes numerous publications that consider the topic more broadly (e.g., IEA, 2014; Ryan & Campbell, 2012) or focus specifically on the differing nature and causality of impacts triggered by energy efficiency gains occurring in the production or consumption sides of the economy, and/or the performance of different types of energy efficiency policies (see Gillingham et al., 2006 and Turner, 2013, respectively for reviews).

There has been less integrated attention to how the wider economy impacts of energy efficiency actions are impacted by how costs are met. Consideration of, for example, retrofitting costs are often reflected in adjusting modelling parameters (e.g., Mizobuchi, 2008) or are treated as barriers to the adoption of energy efficiency measures by households and therefore reflected in changes in the adoption rates of such measures (e.g., Sorrell & Dimitropoulos, 2007). On a different approach, Figus et al. (2017) consider the case where energy efficiency costs are met by the government and then identify the implications of how the government budget deficit is covered. More recently, attention to the question of meeting the costs of enabling energy efficiency improvements has been focussed particularly in the context of carbon taxes, for example, with consideration of whether it would be beneficial to recycle revenues thereof through the funding of energy efficiency improvements (see, e.g., Bourgeois et al., 2021; Liu et al., 2021).

However, there has been a lack of attention to how the choice of funding mechanism will interact with specific energy efficiency actions (e.g., home insulation retrofitting programmes) to impact the wider economy outcomes of households actually realising energy efficiency gains and reducing their energy use and bills. Katris and Turner (2021) highlight that the characteristics of some funding mechanisms (e.g., administrative costs involved in centralised programmes such as the UK's Energy Company Obligation, ECO) can affect both the extent of energy efficiency gains realised and both the transition and sustained long-run outcomes of policy action by impacting the level of funds actually directed to retrofitting properties. Moreover, this study demonstrates that the retrofitting activity itself delivers limited and transitory gains, mainly observed in some production sectors, which, depending on how the retrofitting cost is covered, could be eroded or even entirely offset until such time as cost recovery is completed. Such transitory outcomes—both short term and extended—merit additional research focus given the political economy implications that must be considered by policy makers, particularly in a wider net zero context, where multiple required decarbonisation actions will introduce a range of wider economy and public budget pressures in different timeframes.

It is in this regard that we focus our policy perspective. Can residential energy efficiency actions constitute a clear source of wider economy gains in both long term and transitory timeframes in a manner that makes support of large-scale retrofitting programmes a clear ‘low hanging fruit’ that policy makers can focus on with minimal risk and potential gains to the performance of key indicators such as gross domestic product (GDP) and employment? To what extent might the answer to this question depend on how retrofitting cost is covered? Here we consider three broad funding approaches. The first involves the full cost being borne by the households retrofitting their properties reflecting the effect that a regulation would have, forcing households to reach a certain standard without any financial support. The second involves the cost being covered by government, involving purpose-specific grants to households, removing the burden from households and placing it on the public budget. The third involves support of interest free loans, over different repayment periods, so that the cost reverts to households but is deferred into the future.

We also focus attention on how outcomes (in each of these cases) may be impacted by how the retrofitting activity is distributed over the duration of an energy efficiency improvement programme. Here we consider three different approaches: an early action where 50% of the activity takes place in the first 3 years of the programme, a late action where 50% of the activity is concentrated in the last 3 years, and a steady action where the activity is evenly spread across the duration of the programme.

Finally, we set the analysis in the context of prevailing labour market and wider economic constraints. Of particular relevance in the UK context is the presence of a lasting labour supply constraint, where any expansionary process involving increased labour demand is likely to put upward pressures on the labour cost faced by all firms, thereby impacting prices across the wider economy and the cost of living. This is a particularly policy-relevant consideration in the context of concern for low income households, who Figus et al. (2017) have shown gain less from wider economy expansion from the outset, due to reduced reliance on, and return from, growing employment and wage rates, but will be impacted by increases in consumer prices.

3 METHODOLOGY

3.1 The UKENVI CGE model

In this work we employ the UKENVI computable CGE model of the UK. We calibrate on using a social accounting matrix (SAM) that incorporates the 2016 industry by industry tables, the most recently available at the time of the study, published by the UK Office for National Statistics (ONS).2 For our analysis, we simulate the long-run adjustment of the UK economy to a new equilibrium, triggered by the increased energy efficiency of UK households as described in Section 3.2. In order to be able to isolate the impacts driven by the retrofitting activity on and the efficiency improvement of UK households, we do not consider any other changes in the UK economy and therefore report the changes in relation to the values included in the SAM. Here, we present some key characteristics of our model to facilitate the readers' understanding of the results discussed in Section 4.

3.1.1 Production

In our model we identify 34 production sectors, as reported in Table A1. Each sector produces at minimum costs, using a nested constant elasticity of substitution function. Capital and labour are combined in the value-added nest, where the elasticity of substitution between the two factors is set at an inelastic value of 0.3. In the other main nest, energy and non-energy intermediates are combined. Note that UK sectors use a combination of domestically produced and imported intermediates, but they are considered imperfect substitutes with an elasticity of 2.0 (Armington, 1969). We note that in the absence of appropriate econometric analyses, we rely on elasticities that have been used in previous applications of UKENVI. By doing so, we also benefit from the sensitivity analyses, such as the one conducted by Turner (2009), that allow us to understand how changes in different elasticities within the model may affect the results of our analyses.

As mentioned above, to isolate the impacts of the broader energy efficiency improvement, and the retrofitting activity required to enable it, we do not model any technological advancements in any sector, so any changes in the production structure of the sectors are purely driven by differences in the relative prices of the different production factors.

3.1.2 Investment

For this work, we employ a forward-looking specification for the producers, with investment depending on exogenously determined depreciation and interest rates and with quadratic adjustment costs. Under this specification, producers anticipate all the demand and price levels in all timeframes and optimise their investment pattern to maximise the value of firms (Hayashi, 1982). Effectively, the actual capital stock gradually adjusts to its desired level, which is a function of sectoral output and relative input prices, until a new long-run equilibrium is reached, where the actual matches the desired capital stock. At that point the investment level is sufficiently large to cover the depreciation of capital but no further expansion of the capital stock.

3.1.3 Labour market

In (1), φ is a parameter calibrated to the steady state, ε is the elasticity of the wage rate relative to changes in the rate of unemployment, set to 0.113 (Layard et al., 1991), while our starting unemployment rate is 5%. Note that we do not model any worker skills or sector specific skill requirements; hence we assume perfect mobility between the different sectors.

In order to capture and demonstrate the importance of labour costs in determining the potential economy-wide outcomes, we also employ an alternative fixed nominal wage labour market closure. Regardless of the specific labour market closure, our long-run equilibrium conditions do not require full employment and, therefore, there can be long-run overall employment gains or losses.

3.1.4 Household consumption

The household expenditure is determined after we deduct from the household income all taxes and savings, which is a fixed share of the household income determined through the SAM data. For households we employ a myopic specification, meaning they make their consumption decisions based on their disposable income in each year. We believe this is more representative of how households make their consumption decisions compared to the alternative, perfect foresight specification, where the consumption pattern is determined by the future discounted utility (Lecca et al., 2014). A key point in relation to the retrofitting of residential properties is that when households are required to pay to retrofit their properties, either outright or in instalments, this precedes any other consumption. Therefore, covering the retrofitting cost restricts the households' disposable income and, by extension their consumption (see Section 3.2 for more details).

We identify five household quintiles, based on their gross annual income, each with their own initial income composition and consumption choices, determined by the SAM data. Households consume goods and services from all 34 sectors in our model; including the consumption of residential energy in the form of coal, electricity and gas. It is the efficiency with which these fuels are used that we change in our simulations (see Section 3.2).

3.1.5 Government and trade

In our model, government revenue includes various forms of taxation, with income tax being the largest income source for the government, as well as capital revenue and foreign remittances at a fixed exchange rate. Government spending is fixed in real terms, meaning that the nominal spending on goods and services will change in line with the specific government price index, while the nominal transfers to other parts of the economy (e.g. to households) adjust in line with changes to the CPI. In this work we do not require a balanced government budget, even when exploring grants as a funding option, therefore any changes in government revenue and expenditure are reflected on the accrued annual budget savings or deficit (we detail our motivation in Section 3.2).

Our model also includes a single external region with which the UK trades. Imports and exports are sensitive to the relative domestic and, fixed, external prices. Exports are modelled via a constant elasticity of transformation (CET) function, with a default elasticity of 2.0 for all sectors, and are inversely related to changes in domestic prices. As indicated in the ‘Production’ sub-section, UK and imported goods and services are considered imperfect substitutes, with the default Armington elasticity set at 2.0 for all sectors (Armington, 1969).

3.2 Simulation strategy

Our scenarios involve some central assumptions. The first is that ‘Construction’ is the main sector that delivers the retrofitting of properties, conducting 87.22% of the total value of retrofitting activity. The remaining 12.78% is directed to ‘Manufacture of fabricated metal products, excluding weapons & ammunition’ sector, which we use as a proxy for a number of non-insulation measures and for simplicity we refer to as ‘Heating Systems Manufacturing’. Across all scenarios, access to retrofitting funds is distributed among the different household quintiles in the same, almost equal, way; the lowest income households (HG1) have access to 20% of the funds, HG3 have access to the least amount (18%) and HG5 has access to the highest amount (22%).3 Furthermore, we assume a £4100 retrofitting cost per property, while each retrofitted property requires 17.2% less physical energy.4

Second, the energy efficiency improvements are funded through three broad types of funding mechanisms. We note that this is not an exhaustive list of the mechanisms that have been used across different countries to support energy efficiency improvements (see Bertoldi et al., 2020 for a review of the mechanisms that have been used at the EU level). However, we opt to focus on the types of mechanisms that, to date, have been more relevant in a UK context.

One mechanism involves a regulation obliging households to fund the retrofitting of their own properties in a single payment made in the year that the property is retrofitted. This limits the disposable income and the consumption of households throughout the enabling stage of the retrofitting programme but there are no payment requirements thereafter. Grant and loan options remove or defer this household budget constraint. In the case of grants, we simplify by not exploring options that the government may use to raise the required funds.5 In the case of loans, we simplify by abstracting from potential interest charged, focussing on interest free loans as an option whereby households can defer the retrofitting cost into the future, with two repayment periods (5-years or 25-years) considered.

We also assume that households use the entire amount available to them for retrofitting purposes. We do not explore the potential that for whatever reason some property owners may opt not to use the financial support available. Finally, we do not consider any administrative costs or the potential for the presence of economic rent; the full amount available is directed to the retrofitting of properties.

3.2.1 The 15-year programme

The focus of our analyses is on a longer-term, 15-year £68.5billion, programme that will allow the UK Government to achieve its goal of raising most UK households to EPC C by 2035. Our scenario involves UK producers being aware of ambitions, timescale and spending involved in the programme from the outset, and that—assuming it meets its targets—there will not be another (at least of this scale). Thus, producer responses are reflected in the use of the mixed model dynamic specification with forward-looking producers and myopic consumers discussed in Section 3.1.

We explore three different allocations of the retrofitting activity over the duration of the programme. We consider an early and a late action approach where 50% of the retrofitting activity is taking place in the first and last 3 years of the programme respectively, and a steady action approach where the activity is spread more evenly across the 15 years of the enabling stage. We assume that policy support, and therefore funding, remains in place throughout the duration of the programme, although we consider the implications of this changing under each of the three activity distribution approaches. Finally, note that we assume the 2016-year SAM database to reflect the economy in real terms where no changes other than the impacts of enabling and realising residential energy efficiency gains occur.

4 RESULTS

4.1 Overview of long-run outcomes and their drivers

Our long-run results (Table 1) concur with the consensus in the literature that, if efficiency gains do materialise, this will trigger a sustained wider economic expansion. Here, if the 15-year £68.5 billion programme results in a 10.41% efficiency improvement in the UK's total household stock (for the specific distribution of retrofitting activity across household income quintiles) the results suggest an expansion of the UK economy reflected in sustained GDP gains of £1285 million (0.073%) per annum. This is associated with increased employment opportunities across multiple sectors equating to 22,546 FTE jobs, a sustained 0.077% gain and additional government revenues that ultimately exceed any additional nominal government spending within the time period, with sustained annual government budget savings of £195.37 million.

| Base year values (2016 values) | Wage bargaining (central scenario) | Nominal wages fixed (sensitivity analysis) | |

|---|---|---|---|

| GDP (£million) | 1,751,690 | 1285.34 | 4416.10 |

| Employment (FTE) | 29,300,731 | 22,546 | 78,583 |

| Labour productivity (£/FTE) | 59,783 | −2.13 | −9.59 |

| Investment (£million) | 310,036 | 330.68 | 819.96 |

| Exports (£million) | 477,563 | −1496.49 | 0.00 |

| Imports (£million) | 515,335 | 1946.31 | 1580.86 |

| Household Consumption (£million) | 1,185,745 | 4867.97 | 5351.66 |

| Government budget (£million) | −517 | 195.37 | 1078.64 |

| CPI (% change) | 1 | 0.164 | 0.000 |

| Nominal wage (% change) | 1 | 0.331 | 0.000 |

| Real wage (% change) | 1 | 0.167 | 0.000 |

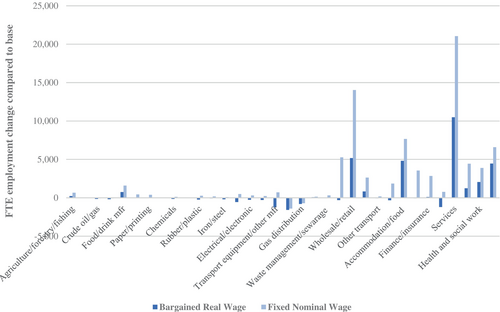

The key driver behind the wider economic expansion is the fact that the increased energy efficiency in residential properties helps reduce the energy bills of beneficiary households. In turn, those households spend their freed-up income on goods and services, triggering what is essentially a demand-driven expansion of the UK economy. We can see from Table 1 total household consumption is £4868 million (0.411%) higher than it would otherwise be once the expected efficiency gains are fully achieved and the economy has adjusted. However, this drives a change in the composition of the UK economy. As reflected in Figure 1, sectors that tend to service the needs of households, experience gains in demand, and therefore output, employment and value-added generated, while certain manufacturing industries and the ‘Electricity’ and ‘Gas distribution’ sectors are losing demand.6 This change in the composition of the UK economy favours sectors that are more labour intensive, associated with a marginal reduction of £2 in GDP per worker equating to a 0.004% fall in the productivity of the UK labour force.

This is a demand-driven expansion in the context of a sustained labour supply constraint, where wage bargaining processes drive increased output prices in all sectors, even the ‘Electricity’ and ‘Gas distribution’ industries that experience demand losses as energy efficiency increases. This results in a sustained 0.164% increase in the CPI, which erodes real income and spending gains to households, underpinned by a 0.331% increase in the nominal wage rate faced by producers. Thus, price effects constrain the wider economy expansion and associated job creation, with the greatest gross negative impacts falling on sectors that are more labour-intensive and/or more export-intensive, or which otherwise do not directly benefit from the net increase in household spending.

The importance of the labour costs in determining the long-run results is clearly demonstrated when we remove the impacts of variable labour costs by re-running the simulation with the nominal wage fixed. As shown in the last column of Table 1, in the absence of labour cost increases, the GDP gains are greater, £4416 million (0.252%), along with more net employment gains (over 78,580 FTE jobs) and government budget savings (approximately £1078 million). Figure 1 shows that greater gains in employment are realised in those sectors dominated by household demand, but with this leading to a greater loss in labour productivity in Table 1, though, in the absence of rising labour costs, there is no competitiveness loss in export production.

4.2 The role of the funding mechanism determining the transition path (steady action case)

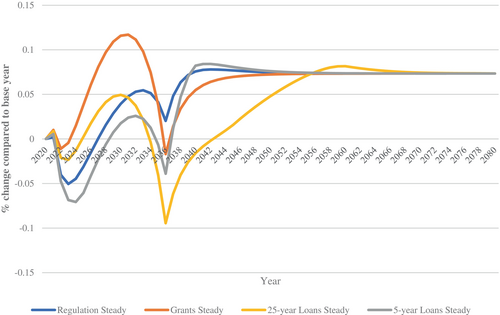

However, these long-run outcomes occur in a timeframe where the only sustained change is the reduced energy requirements and bills faced by households. On the one hand, this implies that, so long as the funding mechanism used to cover retrofitting cost does not impact the extent of efficiency gains realised,7 all approaches will deliver the same long-run outcome. However, Figure 2 shows that the choice of funding mechanism does affect the transition path (as represented by the evolution of UK GDP), first considering the ‘steady action’ case, where the £68.5billion spending is spread evenly over the 15-year timeframe.

A key observation is that regardless of the funding mechanism, some negative impacts are likely to manifest in some timeframes. Three main factors drive this result. First, the increased activity in labour intensive sectors—such as ‘Construction’, which directly delivers retrofitting projects, and subsequently in sectors where households tend to spend their income—drives higher labour costs across the economy, particularly negatively affecting sectors with limited or no supply chain involvement in the retrofitting activity.

Second, where the funding mechanism introduces restrictions to the households' disposable income, this will depress household consumption as a key driver of expansion. Third, as UK producers anticipate the end of the retrofitting programme, they adjust their investment activity to minimise the impact of higher labour costs as that source of additional demand comes to an end.

Of these three factors, the one that can be affected through the funding decision is the impact of household budget constraints. Figure 2 shows that when the retrofitting cost is covered by the government, through the provision of grants, then the negative impacts are limited both in magnitude and duration. On the other hand, deferral through loan finance does not produce such clear-cut outcomes so that in all cases where the cost is passed to the households at some point, we find greater and longer-lasting negative economy-wide impacts. However, the timing of the households incurring costs does play a key role in determining the extent of losses and gains in UK GDP in different timeframes.

For example, requiring that households pay the cost immediately (the ‘regulation’ case) leads to significant GDP losses at the early stages of the enabling stage but as efficiency gains are achieved the economy recovers and expands throughout the rest of the transition timeframe. This contrasts with the transition pathway under the other extreme of government providing grants so that households do not directly bear costs of retrofitting in any timeframe. Figure 2 shows that the provision grants does allow a greater economic expansion during the enabling stage of the programme, but this triggers a greater increase in labour costs compared to the regulation case so that the transitory contraction at the end of the retrofitting period is deeper.

Under loan financing, the impact of deferring the costs into the future is closely linked to the duration of the repayment period. Figure 2 shows that a shorter-term loan introduces significant restrictions to the household income, albeit smaller than the regulation case, for a period that exceeds the duration of the retrofitting programme. While this introduces less pressure on labour costs, the more constrained expansion in household demand is anticipated by UK producers in adjusting resources as the retrofitting programme comes to an end. Figure 2 shows that this leads to greater and longer negative GDP impacts compared to the regulation case. However, the economy swiftly recovers once the retrofitting has ended and before the end of the repayments, and in fact temporarily exceeds the economic expansion observed under the grants or the regulation option.

One policy response to such outcomes may be to promote/support the extension of loan repayment period with the aim of reducing the burden on household incomes in early years. However, Figure 2 also shows that extending loan repayment periods can lead to greater losses at the end of the retrofitting programme, where producers will anticipate the compounding of household budget constraints in later timeframes. Here, under our 25-year loan case we observe the most significant transitory wider economy contraction when retrofitting ends and a delay of approximately 6 years before the sustained economic expansion is achieved.

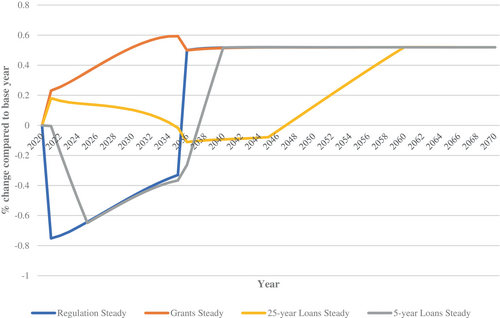

Of course, policy makers are also concerned about how impacts on total real UK household income and spending are distributed across different income groups over time, with particular concern for those lower income households affected by ‘energy poverty’ challenges.8 Here we find that the approach to funding has important implications at the household level. In our scenarios, where there is an almost equal distribution of the retrofitting activity across household income quintiles, any requirement for households to pay at the time of retrofit (regulation) or on a deferred basis (loans) triggers comparable disposable income reductions, in absolute terms. However, the impact in terms of the share of disposable income will clearly be greater for those in lower income quintiles, particularly the lowest 20% (HG1). Given policy concerns around absolute and fuel poverty that energy efficiency policies often seek to alleviate, policy concern may lie in how the choice of funding mechanism affects outcomes for low income households, both directly for beneficiary households and how lower income groups are impacted more generally by the economy-wide adjustment process. We find that the lowest household income quintile receives only modest gains when the economy expands (due to limited reliance on/access to labour or capital incomes). However, Figure 3 shows that the choice of funding mechanism for retrofitting has a substantial impact.

The scenario involves households in different income groups gradually receiving retrofits across the 15-year timeframe. Thus, while individual households will make payments at different points in time, Figure 3 reflects outcomes across the whole of the lowest income quintile. Here we observe that a substantial upfront cost in the ‘regulation’ case or the introduction of larger repayment requirements under a (limited deferral) 5-year loan option will reduce the disposable income, and therefore the consumption, of households in the lowest income quintile for a period of up to 18 years that is, for the entire duration of the retrofitting programme or until all low income households receiving 5-year loans throughout the period have completed repaying their project costs. Crucially, extending the repayment period and the instalments not only reduces the magnitude of the negative pressures to the household income but also shortens their duration to 13 years. The only way to avoid any negative impacts on the disposable income, and therefore the consumption, of the lowest income households is if the retrofitting cost is covered via grants.

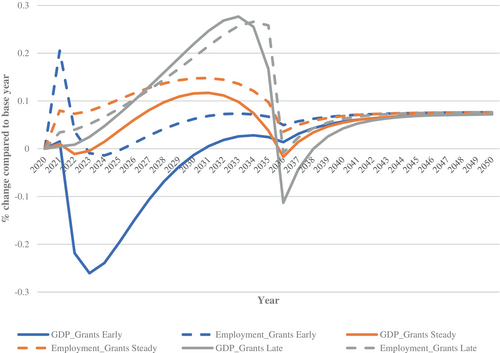

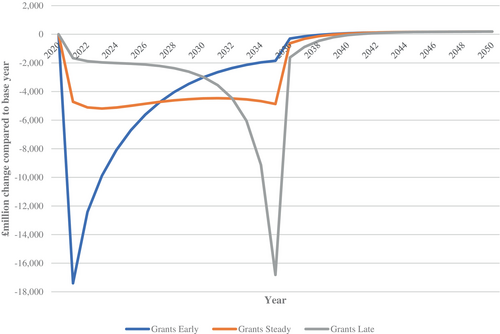

4.3 The importance of how retrofitting activity is distributed over time

Beyond the importance of how the retrofitting cost is covered and by whom, for a programme of that length there are multiple options regarding how to distribute the activity over its duration. In the presence of economic constraints, the distribution of activity can have implications of its own, as shown in Figure 4 for the GDP and employment under the grants option. Acting early allows more than half of the retrofitting activity to take place at the early stages of the programme, but, for example, compacting 50% of the retrofitting activity in 3 years introduces substantial cost and price pressures across the economy given the presence of lasting labour supply and temporary capital adjustment constraints. The outcome is net negative GDP (and associated employment and other macroeconomic) impacts over multiple years, where the additional value-added generated by the retrofitting activity and the emerging gains associated with realising residential energy efficiency gains are not sufficient to offset the labour cost driven negative pressures.

Meeting the demand for labour itself can be an issue that requires policy attention. Our results suggest that, even where labour supply is constrained, if such early action is taken the additional UK ‘Construction’ sector activity in delivering the retrofitting programme would require up to 120,861 additional FTE workers even in the first year and no less than 55,000 additional FTE workers by the third. If the appropriate skillsets do not exist in the UK labour market, even the constrained outcomes here may not be realised in practice.

Our ‘late action’ scenario (where 50% of the activity is reserved for the last 3 years of the programme) brings similarly condensed labour requirements but at a later stage. Here our simulation suggests that the UK ‘Construction’ sector would need at least 64,000 additional FTE workers by 2033 and up to 121,958 additional FTE workers by 2035. However, acting late would allow additional time for supply chains to develop and for the necessary labour force to be trained. Moreover, the efficiency gains achieved by the end of the programme help mitigate the negative impacts that manifest following the end of the retrofitting activity and maintain the economic contraction to a smaller scale, compared to the one observed under early action, and over a shorter period. On the other hand, if it is preferable to smooth both the evolution of the economy and the demand for labour over time, then the steady action approach would spread both the activity and impacts more evenly over the duration of the programme.

Consideration of the impacts of the expansion under different scenarios on the public budget will also be important particularly in the case of grant funding (see Figure 5). That is, the extent to which such additional revenues could ultimately contribute to the cost of funding the programme. Here we find that the steady per annum public budget savings reported in Table 1 only accrue once the economy is fully adjusted. As seen in Figure 5, through the transition, and particularly during the retrofitting period where spending has to be made to provide grants, there are net deficits for all timing options. However, early action approach introduces both large spending requirements and additional budget deficits associated with GDP contraction at the beginning of the programme, while late action allows GDP and revenue gains to build ahead of the bulk of the spending, somewhat mitigating the maximum budget deficit by the end of the programme. It is evident, therefore, that the timing of the retrofitting activity not only influences the evolution of the wider economy, but crucially determines the nature, timing and magnitude of impacts on the government budget.

The challenge not only for a public funding approach (which may in practice not apply to all households, potentially with a mix of all four funding approaches applying for different types of households in practice) but more generally around the timing of action is of course that a 15-year programme in the UK context will span over at least three parliamentary terms. Thus, for steady and late action approaches in particular to be successful, commitment to the programme and the necessary funding will need to be in place from the outset. In the event that policy makers remove their support for the programme, then only part of it will be delivered and producer expectations may not play out as in our scenario simulation analysis.

5 POLICY IMPLICATIONS AND CONCLUSIONS

Our analysis reflects the general consensus in the literature that the successful implementation of an energy efficiency improvement programme for residential properties has the ability to deliver sustained wider economy gains as reflected in a number of key macroeconomic indicators such as GDP, employment and government budget savings. In the UK case, we show that the extent of sustained economic expansion is impacted by the cost and price impacts of a lasting labour supply constraint but not by the funding mechanism employed.

However, our analysis shows that the funding approach adopted will impact the evolution and transition pathway of the economy, as will the timing of actions. Perhaps our central insight is that public funding of retrofitting projects can limit the magnitude and duration of any negative pressures both on household spending and how the economy adjusts. However, this will present challenges in terms of raising the necessary funds through alternative public funding approaches, particularly where sustained gains associated with the expansion delivered by realising residential energy efficiency gains will take time to accrue with their evolution depending on the timing of action. On the other hand, if households are required to cover the cost, either immediately or over multiple years, while this restricts direct government budget demands, it comes at the expense of greater and longer negative pressures to the economy over some timeframes, which will have public budget impacts of their own.

Also of likely policy concern, we have shown that the choice of a funding mechanism can have significant implications for the spending power of lower income households in particular, which could add to energy poverty challenges within a wider ‘just transition’ context where affordable heat in particular is likely to becoming a growing concern in the UK (BEIS, 2021).9 This may motivate any grant financing being focussed in supporting retrofitting in lower income households, traded off against the fact that wider economy gains delivered by freeing up spending power in these households will be limited.

More generally, the overall insight emerging from our work is that careful consideration is necessary before introducing an energy efficiency improvement policy, not least where labour supply constraints and conditions, for example in terms of the availability of appropriately skilled workers to deliver retrofitting projects will impact not only the successful delivery of programmes but what the ripple effects across the wider economy may be.

However, we acknowledge that our work has certain limitations that need to be addressed via further research. Some limitations emerge from the fact that the policy landscape regarding energy efficiency, and energy use more generally, is shifting over the years, meaning that certain considerations that were relevant at the time this study was conducted, may have significantly changed. For instance, we only consider a one-off improvement of residential buildings, which seems to align with the current policy consideration, but it is likely that on-going interventions may be necessary. It is useful then to explore how considering energy efficiency actions as a recurring intervention may affect the wider economy. Furthermore, the composition and the characteristics of the UK households are shifting over time, so future research needs to initially identify the effect of the UK households' social characteristics on the potential economy-wide outcomes of energy efficiency improvement policies and subsequently explore how changes in said characteristics may alter the observed outcomes.

ACKNOWLEDGEMENTS

The authors would like to thank Calum Knox, Cameron Murdoch, Michael Twist, Chris Nicholls and John Chawner of the UK Department for Business, Energy, and Industrial Strategy (BEIS) for their collaboration in informing and considering the development of the research discussed in this paper. Their input on the scenarios examined and their overall feedback on the work has been key to the completion of this work. We would also like to thank Jamie Stewart for his contribution in developing outputs linked to this paper and Kusum Vishwakarma for research assistance.

FUNDING INFORMATION

Our initial research reported was supported by funding from the UK Engineering and Physical Sciences Research Council (EPSRC) (grant ref. EP/M00760X/1). The additional policy-facing work reported here has been supported by linked EPSRC Impact Accelerator funding awarded at institutional level with match funding from the UK Department for Business, Energy and Industrial Strategy (BEIS). The authors acknowledge funding from the Children's Investment Fund Foundation and Bellona Foundation preparing this paper. For the purpose of Open Access, the authors have applied a CC licence to any Author Accepted Manuscript (AAM) version arising from this submission.

CONFLICT OF INTEREST STATEMENT

The authors declare no conflict of interest.

APPENDIX A

A.1 The sectors in our CGE model

| Sector number | Sector name | SIC code |

|---|---|---|

| S1 | Agriculture, Forestry and Fishing | 01–03 |

| S2 | Coal and Lignite | 05 |

| S3 | Crude Oil and Gas | 06–07 |

| S4 | Other Mining and Mining Support | 08–09 |

| S5 | Food, Drinks and Tobacco | 10–12 |

| S6 | Textile, Leather and Wood | 13–16 |

| S7 | Paper and Printing | 17–18 |

| S8 | Coke and Refined Petroleum Products | 19 |

| S9 | Chemicals | 20 |

| S10 | Pharmaceuticals | 21 |

| S11 | Rubber and Plastic | 22 |

| S12 | Cement, Lime and Glass | 23 |

| S13 | Iron, Steel and Metal | 24&25.4 |

| S14 | Manufacture of Fabricated Metal Products, excluding weapons & ammunition | 25.1–3&25.5–9 |

| S15 | Electrical Manufacturing | 26–28 |

| S16 | Manufacture of Motor Vehicles, Trailers and Semi-Trailers | 29 |

| S17 | Transport Equipment and Other Manufacturing (incl. Repair) | 30–33 |

| S18 | Electricity | 35.1 |

| S19 | Gas Distribution | 35.2–3 |

| S20 | Natural Water Treatment and Supply Services | 36 |

| S21 | Waste Management and Remediation | 37–39 |

| S22 | Construction – Buildings | 41–43 |

| S23 | Wholesale and Retail Trade | 45–47 |

| S24 | Land Transport | 49 |

| S25 | Other Transport | 50–51 |

| S26 | Transport Support | 52–53 |

| S27 | Accommodation and Food Service Activities | 55–56 |

| S28 | Communication | 58–63 |

| S29 | Financial and Insurance Services | 64–66 |

| S30 | Architectural Services | 71 |

| S31 | Services | 68–70 and 72–82 |

| S32 | Public Administration, Education and Defence | 84–85 |

| S33 | Health and Social work | 86–88 |

| S34 | Recreational and Other Private Services | 86–94 |

REFERENCES

- 1 ECO is managed by Great Britain's energy market regulator Ofgem, thereby excluding Northern Ireland, with costs socialised through the energy bills of all consumers. The latest round of ECO funding, ECO+, is scheduled to begin in Spring 2023 and run for 3 years.

- 2 The SAM is publicly available at https://doi.org/10.15129/77a8fbd3-15b6-424b-a88d-c920f2b812c0.

- 3 This breakdown is the outcome of internal analyses provided to us by the BEIS officials we focussed our engagement with.

- 4 We focus exclusively on cavity wall and loft insulation, as well as replacement of existing gas boilers with new ones, but not installing an entirely new heating system. We deliberately abstract from considering solid wall insulations or heat pump installations as it was unclear at the time that this study was conducted whether there would be policy support for such efficiency improvement measures.

- 5 This decision is motivated by the fact that potential approaches are not yet clear, with policy interest in this type of modelling work encompassing the gross revenue impacts of actions, in advance of decisions that could have further wider economy impacts (e.g., see Katris & Turner, 2021, on the potential distortions of taxpayer funding approaches). We also note that some extent of deficit funding may be made possible by the UK now issuing green gilts for a range of potential purposes including enabling energy efficiency (see HMT, 2021b).

- 6 There are different reasons behind the losses. ‘Electricity’ and ‘Gas distribution’ are negatively affected primarily due to the efficiency improvements. On the other hand, sectors like ‘Chemicals’ are negatively affected by the increased labour costs and associated competitiveness losses that lead to reduced export demand.

- 7 Katris and Turner (2021) explore how the presence of economic rent could affect the efficiency gains achieved via retrofitting residential properties. In that case, the long-run outcomes may be affected by the funding mechanism.

- 8 In the UK, the most explicit policy concern around energy/fuel poverty is often expressed at devolved regional level, for example, with the aims of the Energy Efficient Scotland including the alleviation of fuel poverty by removing poor energy efficiency as a contributory factor (see Scottish Government, 2018).

- 9 Specific attention is given in the 2021 UK Heat Strategy (BEIS, 2021b) to the need for improved energy efficiency in residential properties with a view to reducing the household energy bills (along with emissions) and, more generally, the cost of transitioning to net zero.