Exploring ESG Indicators and the Sustainable Development Goals: A Fuzzy Multi-Criteria Approach to Cause-and-Effect Analysis

Funding: This work was supported by Coordenação de Aperfeiçoamento de Pessoal de Nível Superior, 88887.798248/2022-00.

ABSTRACT

Corporate sustainability, measured by Environmental, Social, and Governance (ESG) indicators, faces challenges in aligning with the global Sustainable Development Goals (SDGs). This study identifies ESG indicators in the literature and evaluates their cause-and-effect relationships with the SDGs using a hybrid approach combining fuzzy DEMATEL and fuzzy cognitive maps (FCM). Our findings reveal that environmental indicators exert significant influence on the system and demonstrate strong causal relationships with multiple SDGs. By integrating these methodologies, the study provides a novel perspective on mapping corporate contributions to sustainable development. This hybrid approach provides a clearer understanding of how ESG indicators and SDGs are interconnected, offering actionable insights to help companies prioritize initiatives that support global sustainability goals. Furthermore, this study emphasizes the practical advantages of combining fuzzy DEMATEL and FCM over standalone methods, particularly in visualizing complex relationships and hierarchical influences. Future research could explore additional applications of this methodology and investigate private sector motivations for aligning with specific SDGs.

1 Introduction

Management and business literature has increasingly explored the relationship between sustainability and corporate environment. In this sense, the relationship between sustainability practices and financial performance is widely discussed in the literature. Many investigations focus on the impact of sustainable disclosures, including the Sustainable Development Goals (SDGs), on corporate performance. Some studies report a positive relationship (Al Lawati and Hussainey 2022; Husnah and Fahlevi 2023). However, other studies find no significant correlation (Ramos et al. 2022).

In fact, since their launch in 2015 by the UN, the 17 Sustainable Development Goals have been increasingly addressed in the literature to emphasize the importance of the private sector in achieving sustainable development (Ikuta and Fujii 2022; MacNeil et al. 2021; Shayan et al. 2022), but addressing the SDGs in the business scenario is not always intuitive, given their macroeconomic characteristics. Thus, Dong et al. (2023) indicates the concept of Environmental, Social, and Governance (ESG) as a useful tool for implementing the SDGs at the business level, linking corporate sustainability to global challenges.

Over the years, ESG has also been used as an important source in assessing company corporate risk when seeking resources in the capital market. This comes from a need to finance investment projects to improve financial performance and has been shown in several studies (Alda 2019; Bassen and Kovács 2008; Bhattacharya and Sharma 2019; Cerciello et al. 2023). As such, social, environmental, and responsible management actions reframe a company's value vision, promoting business longevity while avoiding resource scarcity and enabling the company's economic and operational continuity (Minutolo et al. 2019).

ESG metrics stand out as an organization's non-financial capacity indicators because they cover many factors that capture nearly all aspects of a company's operation (Srivisal et al. 2021). This includes carbon footprint, pollution, energy consumption, diversity, labor practices, community relations, transparency, compensation, business ethics, corporate board structure, etc. (Kocmanová et al. 2020; Srivisal et al. 2021). Thus, ESG indicators portray the impact of a company's performance regarding the sustainability of the corporation.

However, despite the relationship between ESG and SDGs, some research points out challenges to full integration, such as the lack of standardization and transparency of ESG metrics, the difficulty in defining specific key performance indicators for each SDG, and the difficulty in aligning shareholder interests with global sustainability challenges (Al Lawati and Hussainey 2022; Dong et al. 2023). The ESG and SDG literature contemplate several methods for exploring these themes to overcome these gaps, including some multicriteria decision-making (MCDM) methods, such as the Delphi technique (Jiang et al. 2023), Fuzzy DEMATEL (Hacioglu et al. 2023; Jiang et al. 2023), Fuzzy Cognitive Maps (FCM) (Wibisono et al. 2023; Zioło et al. 2023) and TOPSIS (Hacioglu et al. 2023).

Therefore, the benefits of using MCDM techniques for identifying, ranking, and classifying variables, as well as for analyzing cause-and-effect relationships, are noted. In addition, the association of MCDM techniques has demonstrated potential benefits for scenario analysis, as is the case of the combination of the Fuzzy DEMATEL technique and FCM. There are some studies that combine Fuzzy DEMATEL and Fuzzy Cognitive Maps in areas such asIndustry 4.0 (Ardakani et al. 2024; Erkan et al. 2023); Construction (Bapat et al. 2021); Container terminal management (Khajeh and Shahbandarzadeh 2023); Healthcare sector (Dolatabad et al. 2022).

Previous studies discuss ESG and SDGs in the current literature, including their relationships (Betti et al. 2018; Moktadir et al. 2024; Ramos et al. 2022; Singh and Kumar 2024; Zioło et al. 2023). Some apply MCDM techniques (Hacioglu et al. 2023; Jiang et al. 2023; Moktadir et al. 2024), but none use hybrid methods like Fuzzy DEMATEL and FCM to analyze causal relationships between ESG indicators and SDGs. This gap limits the assessment of private sector contributions to global challenges.

In this context, this study questions: How can fuzzy multi-criteria decision-making techniques be utilized to explore and evaluate the cause-and-effect relationships between ESG indicators and the Sustainable Development Goals?

To answer this question, this study aims to identify in the literature, financial and non-financial, indicators related to the Environmental, Social, and Governance (ESG) pillars, and to evaluate the cause-and-effect relationships between these indicators and the Sustainable Development Goals. As a procedure, this study will explore the systematic literature review to identify the relevant indicators, will use the Fuzzy DEMATEL technique to evaluate the cause-and-effect relationships, in addition to exploring the use of FCM to model causal relationships between the most influential indicators and the most influenced SDGs. This hybrid approach identifies the most influential ESG indicators on SDGs and quantifies their causal relationships, enabling companies to prioritize actions that maximize their contributions to global sustainability goals. By doing so, it equips decision-makers with evidence-based tools to address critical sustainability challenges.

The remainder of the paper is organized as follows. In section 2 we review the literature corporate sustainable and MCDM, Section 3 presents the research methodology procedure. Section 4 presents the proposed approach results. Section 5 discusses the results. Finally, Section 6 describes the conclusion and limitations of this work.

2 Corporate Sustainable and MCDM

The concept of ESG performance refers to how a company manages environmental, social, and governance issues (Eccles et al. 2014), including aspects such as environmental responsibility, diversity and inclusion practices, business ethics, and its impact on the community, among others. Classified as an indicator of an organization's non-financial capacity (Srivisal et al. 2021), the ESG performance of an organization relates to its ability to integrate environmental, social, and governance considerations into its operations and business strategies, aiming for long-term sustainability and meeting the demands of all stakeholders (Bhattacharya and Sharma 2019; Hao et al. 2022).

Transparency in the disclosure of non-financial information generates benefits for the corporation's economic-financial performance (Brockett and Rezaee 2012). Governmental institutions have promoted efforts on a global scale to demonstrate to the business sector that the adoption of ESG practices generates benefits that go beyond the social and environmental sphere. This optimizes a company's overall performance and adds value to institutions and their businesses (Aouadi and Marsat 2018).

In this context, MCDM methods emerge, which, according to Behzadian et al. (2012), were developed with the aim of classifying and/or ranking alternatives, assigning preferences, and selecting alternatives based on a subjective order. Sousa et al. (2021) state that MCDM methods are widely used in various fields, including in relation to issues involving Sustainable Development.

Previous studies have indicated that the ESG and SDG literature already highlights MCDM methods in various contexts. Jiang et al. (2023) integrated Delphi and Fuzzy DEMATEL techniques to identify and rank important strategies in the integration of ESG practices and natural resource management in Chinese small and medium-sized enterprises, under the dual carbon goal. Zioło et al. (2023) analyzed ESG risk in different business sectors and identified a correlation between risk and the financial system model in Anglo-Saxon/German-Japanese companies. For this, Fuzzy Cognitive Maps (FCM) and multiple correspondence analysis were combined to assess the strength and direction of relationships between factors included in sustainable business models and identify relationships between selected variables.

However, it is important to highlight that the literature points out a difficulty for some methods to deal with the inherent subjectivity of judgments and linguistic assessments, as pointed out by Nguyen and Fayek (2022), who highlighted in the context of construction, engineering, and management (CEM) the use of fuzzy representations as a potentially valuable tool for dealing with the highlighted weaknesses.

Some researchers point out the combination between Fuzzy DEMATEL and Fuzzy Cognitive Maps as beneficial in the identification, selection, and prioritization of factors, as well as in the deepening of causal analyses, as shown in Table 1.

| References | Title | Context |

|---|---|---|

| Erkan et al. Erkan et al. (2023) | An integrated Fuzzy DEMATEL and Fuzzy Cognitive Maps approach for the assessing of the industry 4.0 Model | Industry 4.0 |

| Patel et al. Patel et al. (2021) | Identification of Critical Success Factors (CSFs) of BIM Software Selection: A Combined Approach of FCM and Fuzzy DEMATEL | Technology selection |

| Khajeh & Shahbandarzadeh Khajeh and Shahbandarzadeh (2023) | Modeling factors affecting the interests of the container terminal using fuzzy cognitive map and fuzzy DEMATEL | Logistic |

| Dolatabad et al. Dolatabad et al. (2022) | Analyzing the key performance indicators of circular supply chains by hybrid fuzzy cognitive mapping and Fuzzy DEMATEL: evidence from the healthcare sector | Healthcare |

| Bapat et al. Bapat et al. (2021) | Evaluation of Key Performance Indicators of Integrated Project Delivery and BIM Model for Infrastructure Transportation Project in Ahmedabad, India through Decision-Making Approach | Technology selection |

| Ardakani et al. Ardakani et al. (2024) | A Fuzzy DEMATEL—FCM approach for analyzing the enablers of the circular economy and Industry 4.0 in the supply chain | Industry 4.0 in the Supply Chain Management |

Erkan et al. (2023) implemented both methods in the evaluation of relevant concepts in the context of Industry 4.0, associating Fuzzy DEMATEL with Fuzzy AHP to analyze the importance of nine concepts in this area and using FCM to form a relationship map. Thus, the authors employed the results of the fuzzy DEMATEL as input for the FCM, as the former method addresses the challenge of achieving consensus among experts regarding the interaction weights required by the latter.

Ardakani et al. (2024) also explore the industry 4.0 context, but emphasize the Supply Chain Management application. The authors employed Fuzzy DEMATEL and FCM techniques, after identifying in the literature 15 enablers which explain the implementation of circular economy and Industry 4.0 principles within the Supply Chain of a glass factory from Iran. The hybrid approach enables the structuring of complex factors into cause-and-effect groups and additionally facilitates the illustration of the dynamics among these factors.

Patel et al. (2021) sought to identify the interrelationship of critical success factors in the selection of BIM (Building Information Modeling) software. In this analysis, Fuzzy Cognitive Mapping (FCM) was first employed to identify and prioritize the most influential factors. These selected factors were then analyzed using fuzzy DEMATEL to establish their causal relationships and determine the direction of influence between them.

Bapat et al. (2021), explored a similar context, trying to evaluate and prioritize indicators for the adoption of Integrated Project Delivery and Building Information Modeling in a metro-rail construction in India. Then, they also identified 24 indicators from literature, and applied FCM and FDEMATEL, to evaluate the interrelationships between the most critical indicators. In addition to employing the hybrid approach to validate the data and enhance the robustness of the analysis, the authors concluded that this combination is effective and applicable across various industry sectors that involve group decision-making or complex decision environments.

Khajeh and Shahbandarzadeh (2023) modeled factors that affect the interest of container terminals, using fuzzy DEMATEL to understand the relationships between the indicators raised in the literature and subsequently applied FCM to visualize the influence and dependence of each indicator. The combination of the techniques enabled the identification of self-loops, revealing that certain indicators influence both themselves and others, thereby demonstrating their internal and external potential. However, it was through the FCM that these dynamics became visually explicit.

Dolatabad et al. (2022) explored the performance of circular supply chains in the hospital context, using Fuzzy Delphi to extract KPIs from the literature and combining FCM and Fuzzy DEMATEL to illustrate the conceptual model. The implementation of the three techniques aimed to address the challenges commonly encountered in the application of hybrid MCDM methods, particularly the large number of KPIs that complicated expert decision-making due to the imprecision of intuitive judgments. Furthermore, the approach accounted for causal relationships by comparing the results of FDEMATEL and FCM to support a more logical and coherent analysis.

Although expert evaluations are inherently susceptible to bias, the hybrid approach combining FDEMATEL and FCM aims to mitigate these limitations. The application of fuzzy logic, through triangular fuzzy numbers (Ardakani et al. 2024), allows experts to express their judgments more realistically by addressing the uncertainty and vagueness typical of complex decision-making contexts. This methodological synergy contributes to a more robust analysis and a deeper understanding of complex systems, reducing—though not entirely eliminating—the bias inherent in qualitative assessments.

3 Methods

The methodological procedures relate ESG indicators to the SDGs, demonstrating the cause-and-effect relationship between the terms and revealing their causality. In this way, the fuzzy theory facilitates the process of analyzing the terms through the use of the Fuzzy DEMATEL and Fuzzy Cognitive Maps techniques.

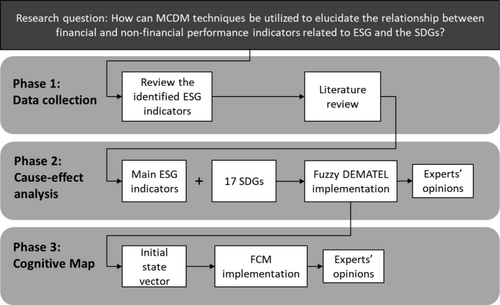

The steps of the proposed approach to answer the research question are illustrated in Figure 1. In the first phase, ESG indicators were identified through a literature review and content analysis. This qualitative approach helped highlight the most relevant indicators. Subsequently, the degree of their influence on SDGs was determined using a combination of Fuzzy DEMATEL and Fuzzy Cognitive Maps. We chose to begin our approach with a literature review to identify indicators relevant to this field of research, as well as previous studies, (e.g., Dolatabad et al. 2022; Khajeh and Shahbandarzadeh 2023; Patel et al. 2021). Furthermore, the combination of Fuzzy DEMATEl and Fuzzy Cognitive Maps enriches the analysis because, although both approaches help to identify central concepts, mapping causal relationships between elements of a system (Kosko 1986), the former facilitates the visualization of hierarchy in complex systems and enables analysis by quadrants, facilitating the reduction of nodes of the most relevant concepts (e.g., Alizadeh et al. 2008), while the latter (i.e., FCM), is based on neuro and evolutional computing, organizing information flexibly, trying to reproduce human reasoning (Kosko 1986; Mazzuto et al. 2018).

Source: Own authorship.

After the literature review, 48 ESG indicators were identified, classified according to the Refinitiv Eikon ESG scoring categories, and the percentage distribution of each indicator identified based on its occurrence in the selected articles is presented. In addition, corporate performance indicators were identified in the ESG literature. Reading the articles allowed the identification of classification categories to group these indicators. Thus, 25 indicators were identified and grouped and organized based on the distribution of articles containing corporate performance indicators. In both cases, ESG indicators and corporate performance indicators were filtered, considering an occurrence in at least five documents, resulting in a set of 33 main indicators (Table 2). The selected indicators were subsequently used in the Fuzzy DEMATEL and FCM evaluation stage. The complete set of 73 indicators is provided in the Supporting Information. This compilation is the result of a systematic review conducted by da Cunha et al. (2025), in which the methodological procedures and classification criteria are detailed.

| Dimension | ID | Indicator | Dimension | ID | Indicator |

|---|---|---|---|---|---|

| Environmental | E1 | Greenhouse gas emissions | Governance | G1 | Diversity on the board of directors |

| E2 | Waste Management | G2 | Structure of the board of directors | ||

| E3 | Pollution control | G3 | Remuneration policy | ||

| E4 | Hazardous waste control | G4 | Independence from the board of directors | ||

| E5 | Climate change | G5 | Transparency | ||

| E6 | Biodiversity | G6 | Anti-Corruption and Bribery Policies | ||

| E7 | Water consumption | Performance | P1 | Return on Assets-ROA | |

| E8 | Energy consumption | P2 | Return on Equity-ROE | ||

| Social | S1 | Diversity and Inclusion | P3 | Return over investment-ROI | |

| S2 | Employee Satisfaction | P4 | Market value | ||

| S3 | Accident Frequency | P5 | Profitability | ||

| S4 | Education and training | P6 | Crisis | ||

| S5 | Employee health and safety | P7 | Sustainability | ||

| S6 | Product safety | P8 | Relationship with stakeholders | ||

| S7 | Data protection | P9 | Competitive advantage | ||

| S8 | Relations to the local community | P10 | Reputation | ||

| S9 | Charitable actions |

- Source: da Cunha et al. (2025).

3.1 Fuzzy Set Theory and Fuzzy Decision Making

Tseng et al. (2018) state that uncertainties affect decision-making in supply chains and, therefore, appropriate techniques should be applied to deal with their influence. Among these approaches, the fuzzy set theory stands out for the number of successful applications in several different fields (Lima-Junior and Carpinetti 2017). A fuzzy set is an extension of a classical set. In the classical set theory, the membership of an element to a set is established by a binary relation: the element either belongs or does not belong to the set. In the fuzzy set theory, an element belongs to a fuzzy set with different membership degrees, usually from zero to one (Zadeh 1965), which are determined by a membership function.

Initially proposed by Zadeh (1996), the theories based on fuzzy sets stand out due to their ability to be combined with several multi-criteria techniques in the proposition of decision-making models that address data imprecision (Kahraman et al. 2015). Linguistic variables and fuzzy numbers are used to represent decision makers' subjective assessments of the alternatives' performance and criteria weights considered in a problem (Abdullah 2013). The linguistic variables are represented qualitatively using linguistic terms and quantitatively translated by fuzzy sets in a discourse universe using pertinence functions (Klir and Yuan 1995).

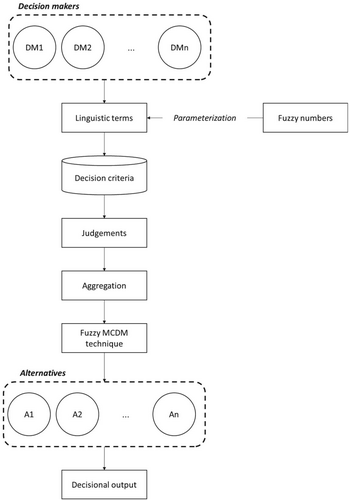

Thus, when the objective is to evaluate, judge or decide, firstly, a set of decision makers is considered. They can be managers, academic experts or any individual with knowledge regarding the modeled problem, so the results are not affected by inexperience or by lack of information. Fuzzy multicriteria decision-making (MCDM) is based on the computing with words approach (Zadeh 1996), hence, linguistic terms are defined, which will be used by the decision makers to conduct evaluations. These linguistic terms, in turn, are associated with fuzzy numbers.

Linguistic variables can be determined and associated with fuzzy numbers to capture a decision maker's subjective judgment in a quantitative way (Zadeh 1975). Thus, imprecision is considered by the possibility of the same element simultaneously belonging to more than one set, which is based on the parameterization of pertinence functions (Zadeh 1965). Fuzzy numbers are described by their respective pertinence functions, with the triangular and trapezoidal as the most commonly used function types (Lima-Junior et al. 2013).

For example, five linguistic terms can be employed for evaluating the alternatives' performance on the decision criteria: “very low”, “low”, “medium”, “high” and “very high”. The corresponding fuzzy sets for these linguistic terms are presented in Table 3 and their fuzzy membership functions illustrated on Figure 2.

| Linguistic terms | Corresponding fuzzy sets |

|---|---|

| Very Low | (0, 0, 2.5) |

| Low | (0, 2.5, 5) |

| Medium | (2.5, 5, 7.5) |

| High | (5, 7.5, 10) |

| Very High | (7.5, 10, 10) |

- Source: Own authorship.

Source: Own authorship.

These linguistic terms will be applied to the decision criteria, which are the factors that the decision makers use as reference for evaluating the alternatives. Usually, in supplier management, criteria are factors such as quality, price, speed of delivery, or financial health of the company. Hence, as illustrated in the diagram, the experts make their judgements using the linguistic terms associated with fuzzy numbers. These judgements are mathematically aggregated and then inputted into the fuzzy MCDM technique. The technique processes the information and returns a decisional output that can be, for instance, the ranking of alternatives or their classification. Figure 2 illustrates this process.

This methodological choice enhances the robustness of the results by minimizing potential biases and variability inherent in subjective evaluations (Cazeri et al. 2024). While individual biases in expert assessments may exist, they are mitigated through the application of fuzzy set theory, which mathematically processes subjectivity by converting qualitative judgments into fuzzy numbers and aggregating them. This approach ensures a more balanced and reliable assessment of adherence levels, reducing the influence of individual subjectivity and enhancing the consistency of the evaluation (Zadeh 1996).

3.2 Fuzzy DEMATEL

Decision Making Trial and Evaluation Laboratory, or simply DEMATEL, is a method considered to be widely effective for complex systems in identifying cause-and-effect relationships, which uses crisp values in its structural model (Si et al. 2018). In this context, due to the difficulty of estimating exact values for complex real-world problems, many researchers apply the concepts of fuzzy theory proposed by Zadeh (1965).

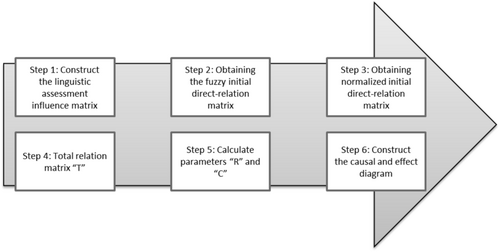

In Phase 2, fuzzy DEMATEL was used to identify the influence relationships between the most prominent ESG indicators in the literature and the 17 Sustainable Development Goals. The necessary evaluations were collected in a pilot application with only one expert. The implementation steps of Fuzzy DEMATEL are described by (Khan et al. 2019) and illustrated in Figure 3.

Source: Khan et al. (2019).

Steps 1 and 2 of Fuzzy DEMATEL comprise the process in which experts compare existing alternatives pair by pair, using linguistic terms within a scale (Table 4) with five levels (Erkan et al. 2023). For each expert, an evaluation matrix is created ij to measure and their corresponding triangular fuzzy numbers (lij, mij, uij), where factor i influences factor j (Chen-Yi et al. 2007; Khan et al. 2019).

| Linguistic scale | Triangular fuzzy numbers | |

|---|---|---|

| No influence | NI | (0, 0, 0.25) |

| Low influence | LI | (0, 0.25, 0.50) |

| Medium influence | MI | (0.25, 0.50, 0.75) |

| High influence | HI | (0.50, 0.75, 1) |

| Very high influence | VHI | (0.75, 1, 1) |

- Source: Own authorship.

3.3 Fuzzy Cognitive Maps

In Phase 3, we employ the Fuzzy cognitive maps, which were proposed by Kosko (1986) and use fuzzy graphs to represent causality. Fuzzy cognitive maps are graphical structures that demonstrate the relationships between factors using weights quantified by fuzzy numbers, and are generally illustrated by causal loops that illustrate the cause-and-effect relationship between the factors analyzed, represented by nodes (Kosko 1986; Zanon et al. 2024). Zioło et al. (2023) indicate that FCM is very useful for recognizing the direction and strength of relationships between some factors, including in analyses involving corporate sustainability.

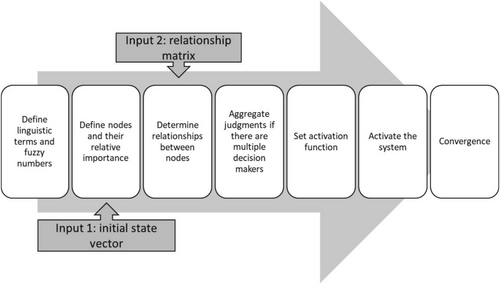

According to Papageorgiou (2011), the process of constructing an FCM is relatively simple and can be done manually by experts or generated by other computational sources. In this sense, the author indicates that the execution steps include: Identifying dominant factors or concepts, identifying the causal relationship between these concepts, and estimating the strength of the link between them.

Linguistic variables are used to represent the interrelationship between concepts (Table 5). Usually, all variables are mapped to the interval [−1, 1], and all linguistic values obtained in the experts' evaluation are transformed into fuzzy numbers, using the Area Center defuzzification method (Papageorgiou 2011).

| Linguistic scale | Triangular fuzzy number | |

|---|---|---|

| Null | N | (0, 0, 0) |

| No influence | NI | (0, 0, 0.25) |

| Low influence | LI | (0, 0.25, 0.50) |

| Medium influence | MI | (0.25, 0.50, 0.75) |

| High influence | HI | (0.50, 0.75, 1) |

| Very high influence | VHI | (0.75, 1, 1) |

Where, is the value of i at the end of iteration k, is the value of i at the beginning of iteration k, similarly, is the value of concept j, at the beginning of iteration k, n is the Number of concepts included in the model, is the weight of the causal relationship between the previous concept j and the subsequent concept i, and is a transfer function to compress values within the FCM value domain (Koasidis et al. 2023).

The second stage of the FCM would be the multiplication of the initial vector E defined by the experts, and the result updated using Equation (8). The result would be considered the initial vector of the next iteration; the loop would be repeated until the condition , where e is the residual value, considered as the smallest possible difference between the concepts (Papageorgiou 2011). Figure 4 illustrates the steps of the FCM process.

4 The Proposed Approach

A hypothetical corporate system is used to test the impact of environmental, social, and governance indicators on achieving the Sustainable Development Goals. An interview was conducted with an expert in fundamentalist analysis of the financial market, sustainability, and sustainable investments.

4.1 Fuzzy DEMATEL

Based on the indicators collected in the literature (Table 2) and bearing in mind the 17 SDGs (UN, 2015), an illustrative application of the proposed approach was conducted, based on the assessment of an expert in ESG and corporate sustainability.

The assessments were based on the defined criteria and linguistic terms presented in Table 4. With this information, the causal relationships between ESG and SDG indicators were qualitatively assessed. It was decided to omit the information regarding the relationship quadrants, ESGxESG, SDGxESG and SDGxSDG, due to the size of the matrix and the non-influence nature of these quadrants, favoring the assessments of the ESGxSDG quadrant.

From the evaluation matrix, the linguistic terms are translated into their corresponding fuzzy number, in each of the vertices of the fuzzy triangular (l, m, u), to obtain the aggregated judgment matrix, which allowed the execution of the defuzzification step using the area center method, which is illustrated in Table 6. With the defuzzified matrix, it is possible to continue with the DEMATEL steps. The matrix is normalized, and the new matrix allows the calculation of the T matrix.

| SDG1 | SDG2 | SDG3 | SDG4 | SDG5 | SDG6 | SDG7 | SDG8 | SDG9 | SDG10 | SDG11 | SDG12 | SDG13 | SDG14 | SDG15 | SDG16 | SDG17 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| E1 | 0.08 | 0.25 | 0.5 | 0.08 | 0.08 | 0.08 | 0.25 | 0.25 | 0.75 | 0.083 | 0.5 | 0.917 | 0.917 | 0.5 | 0.5 | 0.083 | 0.083 |

| E2 | 0.25 | 0.25 | 0.25 | 0.08 | 0.25 | 0.75 | 0.08 | 0.75 | 0.92 | 0.25 | 0.75 | 0.917 | 0.75 | 0.25 | 0.25 | 0.083 | 0.5 |

| E3 | 0.08 | 0.08 | 0.92 | 0.08 | 0.08 | 0.5 | 0.25 | 0.25 | 0.75 | 0.083 | 0.5 | 0.917 | 0.75 | 0.75 | 0.75 | 0.083 | 0.25 |

| E4 | 0.08 | 0.25 | 0.92 | 0.08 | 0.08 | 0.5 | 0.08 | 0.25 | 0.75 | 0.083 | 0.25 | 0.917 | 0.25 | 0.75 | 0.5 | 0.083 | 0.25 |

| E5 | 0.25 | 0.92 | 0.75 | 0.08 | 0.08 | 0.92 | 0.75 | 0.25 | 0.75 | 0.083 | 0.25 | 0.75 | 0.917 | 0.75 | 0.75 | 0.083 | 0.5 |

| E6 | 0.08 | 0.92 | 0.75 | 0.08 | 0.08 | 0.25 | 0.25 | 0.08 | 0.5 | 0.083 | 0.25 | 0.5 | 0.75 | 0.917 | 0.917 | 0.083 | 0.083 |

| E7 | 0.25 | 0.92 | 0.92 | 0.08 | 0.08 | 0.92 | 0.92 | 0.25 | 0.75 | 0.083 | 0.25 | 0.75 | 0.25 | 0.75 | 0.75 | 0.083 | 0.083 |

| E8 | 0.08 | 0.25 | 0.25 | 0.25 | 0.08 | 0.25 | 0.92 | 0.75 | 0.75 | 0.25 | 0.5 | 0.75 | 0.917 | 0.25 | 0.25 | 0.083 | 0.083 |

| S1 | 0.92 | 0.5 | 0.08 | 0.75 | 0.92 | 0.25 | 0.25 | 0.75 | 0.5 | 0.917 | 0.5 | 0.25 | 0.083 | 0.083 | 0.083 | 0.75 | 0.75 |

| S2 | 0.08 | 0.08 | 0.5 | 0.5 | 0.25 | 0.08 | 0.08 | 0.75 | 0.08 | 0.083 | 0.083 | 0.083 | 0.083 | 0.083 | 0.083 | 0.083 | 0.083 |

| S3 | 0.08 | 0.08 | 0.75 | 0.25 | 0.08 | 0.08 | 0.08 | 0.75 | 0.25 | 0.083 | 0.083 | 0.25 | 0.083 | 0.083 | 0.083 | 0.083 | 0.083 |

| S4 | 0.08 | 0.08 | 0.08 | 0.25 | 0.25 | 0.08 | 0.08 | 0.75 | 0.25 | 0.917 | 0.083 | 0.25 | 0.083 | 0.083 | 0.083 | 0.083 | 0.083 |

| S5 | 0.08 | 0.08 | 0.92 | 0.25 | 0.08 | 0.08 | 0.08 | 0.75 | 0.5 | 0.083 | 0.083 | 0.5 | 0.083 | 0.083 | 0.083 | 0.083 | 0.083 |

| S6 | 0.08 | 0.08 | 0.25 | 0.08 | 0.08 | 0.08 | 0.08 | 0.25 | 0.92 | 0.083 | 0.25 | 0.917 | 0.083 | 0.083 | 0.083 | 0.083 | 0.083 |

| S7 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.92 | 0.083 | 0.083 | 0.5 | 0.083 | 0.083 | 0.083 | 0.083 | 0.083 |

| S8 | 0.25 | 0.5 | 0.25 | 0.5 | 0.08 | 0.25 | 0.08 | 0.08 | 0.25 | 0.5 | 0.917 | 0.083 | 0.083 | 0.083 | 0.083 | 0.917 | 0.75 |

| S9 | 0.75 | 0.75 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.5 | 0.25 | 0.083 | 0.083 | 0.083 | 0.083 | 0.25 | 0.5 |

| G1 | 0.08 | 0.08 | 0.08 | 0.75 | 0.92 | 0.08 | 0.08 | 0.75 | 0.25 | 0.917 | 0.083 | 0.083 | 0.083 | 0.083 | 0.083 | 0.5 | 0.083 |

| G2 | 0.08 | 0.08 | 0.08 | 0.75 | 0.75 | 0.08 | 0.08 | 0.75 | 0.25 | 0.75 | 0.083 | 0.083 | 0.083 | 0.083 | 0.083 | 0.083 | 0.083 |

| G3 | 0.08 | 0.08 | 0.08 | 0.08 | 0.75 | 0.08 | 0.08 | 0.92 | 0.25 | 0.75 | 0.083 | 0.083 | 0.083 | 0.083 | 0.083 | 0.083 | 0.083 |

| G4 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.5 | 0.5 | 0.083 | 0.083 | 0.083 | 0.083 | 0.083 | 0.083 | 0.083 | 0.083 |

| G5 | 0.08 | 0.08 | 0.08 | 0.08 | 0.5 | 0.08 | 0.08 | 0.5 | 0.25 | 0.083 | 0.083 | 0.5 | 0.083 | 0.083 | 0.083 | 0.083 | 0.5 |

| G6 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.5 | 0.5 | 0.083 | 0.917 | 0.083 | 0.083 | 0.083 | 0.083 | 0.75 | 0.75 |

| P1 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.5 | 0.92 | 0.083 | 0.083 | 0.5 | 0.083 | 0.083 | 0.083 | 0.083 | 0.083 |

| P2 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.5 | 0.92 | 0.083 | 0.083 | 0.5 | 0.083 | 0.083 | 0.083 | 0.083 | 0.083 |

| P3 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.5 | 0.92 | 0.083 | 0.083 | 0.5 | 0.083 | 0.083 | 0.083 | 0.083 | 0.083 |

| P4 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.75 | 0.5 | 0.083 | 0.083 | 0.5 | 0.083 | 0.083 | 0.083 | 0.083 | 0.083 |

| P5 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.5 | 0.92 | 0.083 | 0.083 | 0.5 | 0.083 | 0.083 | 0.083 | 0.083 | 0.083 |

| P6 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.75 | 0.75 | 0.083 | 0.083 | 0.75 | 0.083 | 0.083 | 0.083 | 0.083 | 0.083 |

| P7 | 0.08 | 0.08 | 0.08 | 0.08 | 0.25 | 0.08 | 0.08 | 0.75 | 0.75 | 0.083 | 0.25 | 0.25 | 0.083 | 0.083 | 0.083 | 0.083 | 0.5 |

| P8 | 0.08 | 0.08 | 0.08 | 0.08 | 0.25 | 0.08 | 0.08 | 0.75 | 0.75 | 0.083 | 0.75 | 0.75 | 0.25 | 0.083 | 0.083 | 0.25 | 0.5 |

| P9 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.25 | 0.92 | 0.083 | 0.083 | 0.5 | 0.083 | 0.083 | 0.083 | 0.083 | 0.25 |

| P10 | 0.08 | 0.08 | 0.08 | 0.08 | 0.25 | 0.08 | 0.08 | 0.92 | 0.5 | 0.083 | 0.083 | 0.75 | 0.083 | 0.083 | 0.083 | 0.083 | 0.5 |

- Source: Own authorship.

With the defuzzified matrix, it is possible to continue with the DEMATEL steps. The matrix is normalized, and the new matrix allows the calculation of the T matrix, where it is possible to obtain R (sum of the values of the same row), which corresponds to influence rank, and C (sum of the values per column), which corresponds to being affected rank (Chien et al. 2014), and in this way, we obtain R + C, which represents the prominence of the factors and R − C which reveals the causative and impacted factors.

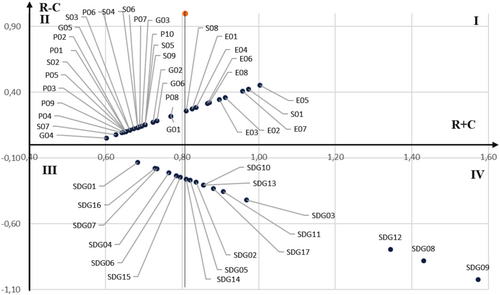

Quadrant I, shows the central factors of the system and how they affect the structure, but they also depend on each other a lot. In quadrant II, we have the so-called driving factors, which have an impact, but are less influenced, indicating an aptitude to direct behaviors. In quadrant 3, we have factors that are more impacted and highly dependent, while in quadrant IV we have the independent factors. Factors in quadrant IV are more impacted and highly dependent (Chien et al. 2014; Zanon et al. 2024).

In quadrant I, we have the cause factors of perceived benefits (Wu et al. 2013), identified as central; they are also those that exert the most influence and are the most prominent. In this quadrant, we have E5, S1, E7, E2, E3, E8, E6, E4, E1, S8 (Tables 7 and 8). Therefore, the actions measured by these indicators hold paramount importance for the system being analyzed and have the potential to impact the other variables situated primarily in quadrants II and IV.

| Environmental factors | Influence rank (R) | Affectedness rank (C) | R + C | R − C | Causal diagram quadrant |

|---|---|---|---|---|---|

| E01 | 0.55 | 0.28 | 0.83 | 0.27 | I |

| E02 | 0.64 | 0.28 | 0.91 | 0.36 | I |

| E03 | 0.62 | 0.28 | 0.90 | 0.35 | I |

| E04 | 0.56 | 0.28 | 0.84 | 0.28 | I |

| E05 | 0.73 | 0.28 | 1.00 | 0.45 | I |

| E06 | 0.59 | 0.28 | 0.87 | 0.32 | I |

| E07 | 0.68 | 0.28 | 0.96 | 0.41 | I |

| E08 | 0.60 | 0.28 | 0.87 | 0.32 | I |

- Source: Own authorship.

| Social factors | Influence rank (R) | Affectedness rank (C) | R + C | R − C | Causal diagram quadrant |

|---|---|---|---|---|---|

| S01 | 0.70 | 0.28 | 0.97 | 0.42 | I |

| S02 | 0.38 | 0.28 | 0.65 | 0.10 | II |

| S03 | 0.39 | 0.28 | 0.66 | 0.11 | II |

| S04 | 0.41 | 0.28 | 0.68 | 0.13 | II |

| S05 | 0.43 | 0.28 | 0.70 | 0.15 | II |

| S06 | 0.41 | 0.28 | 0.68 | 0.13 | II |

| S07 | 0.35 | 0.28 | 0.63 | 0.08 | II |

| S08 | 0.53 | 0.28 | 0.81 | 0.26 | I |

| S09 | 0.43 | 0.28 | 0.70 | 0.15 | II |

- Source: Own authorship.

| Governance factors | Influence rank (R) | Affectedness rank (C) | R + C | R − C | Causal diagram quadrant |

|---|---|---|---|---|---|

| G01 | 0.49 | 0.28 | 0.77 | 0.22 | II |

| G02 | 0.45 | 0.28 | 0.72 | 0.17 | II |

| G03 | 0.42 | 0.28 | 0.69 | 0.14 | II |

| G04 | 0.33 | 0.28 | 0.60 | 0.05 | II |

| G05 | 0.39 | 0.28 | 0.66 | 0.11 | II |

| G06 | 0.46 | 0.28 | 0.73 | 0.18 | II |

- Source: Own authorship.

In quadrant II, there are the so-called cause factors of perceived risks (Wu et al. 2013), those factors with a high relationship but low prominence, recognized as drivers. In this group, we have P8, G1, G6, G2, S5, P10, S9, G3, P7, S4, S6, P6, S3, G5, P1, P2, P3, P5, S2, P9, P4, S7, G4 (Tables 8–10). These indicators may be affected by changes in highly prominent indicators.

| Performance factors | Influence rank (R) | Affectedness rank (C) | R + C | R − C | Causal diagram quadrant |

|---|---|---|---|---|---|

| P01 | 0.38 | 0.28 | 0.65 | 0.10 | II |

| P02 | 0.38 | 0.28 | 0.65 | 0.10 | II |

| P03 | 0.38 | 0.28 | 0.65 | 0.10 | II |

| P04 | 0.37 | 0.28 | 0.64 | 0.09 | II |

| P05 | 0.38 | 0.28 | 0.65 | 0.10 | II |

| P06 | 0.40 | 0.28 | 0.67 | 0.12 | II |

| P07 | 0.41 | 0.28 | 0.69 | 0.14 | II |

| P08 | 0.49 | 0.28 | 0.77 | 0.22 | II |

| P09 | 0.37 | 0.28 | 0.65 | 0.10 | II |

| P10 | 0.43 | 0.28 | 0.70 | 0.15 | II |

- Source: Own authorship.

In quadrant III, we have effect factors of perceived risks (Wu et al. 2013), also called independent factors, characterized by low prominence and low relationship, can be considered relatively disconnected from the system. Here, we have, SDG 01, SDG 07, SDG 16, SDG 04, SDG 06, SDG 15 (Table 11). Given that these variables have limited influence and are little influenced by other factors, intervention strategies should be carefully considered. It may prove to be more efficacious to concentrate intervention efforts and resources in Quadrant I, which possess a greater impact on the system and exhibit greater interactivity.

| SDG factors | Influence rank (R) | Affectedness rank (C) | R + C | R − C | Causal diagram quadrant |

|---|---|---|---|---|---|

| SDG01 | 0.28 | 0.41 | 0.68 | −0.13 | III |

| SDG02 | 0.28 | 0.56 | 0.84 | −0.28 | IV |

| SDG03 | 0.28 | 0.69 | 0.97 | −0.42 | IV |

| SDG04 | 0.28 | 0.49 | 0.76 | −0.21 | III |

| SDG05 | 0.28 | 0.54 | 0.82 | −0.27 | IV |

| SDG06 | 0.28 | 0.51 | 0.79 | −0.23 | III |

| SDG07 | 0.28 | 0.46 | 0.73 | −0.18 | III |

| SDG08 | 0.28 | 1.15 | 1.43 | −0.88 | IV |

| SDG09 | 0.28 | 1.30 | 1.57 | −1.02 | IV |

| SDG10 | 0.28 | 0.58 | 0.86 | −0.30 | IV |

| SDG11 | 0.28 | 0.63 | 0.91 | −0.36 | IV |

| SDG12 | 0.28 | 1.07 | 1.34 | −0.79 | IV |

| SDG13 | 0.28 | 0.58 | 0.86 | −0.30 | IV |

| SDG14 | 0.28 | 0.53 | 0.81 | −0.26 | IV |

| SDG15 | 0.28 | 0.52 | 0.80 | −0.24 | III |

| SDG16 | 0.28 | 0.45 | 0.73 | −0.18 | III |

| SDG17 | 0.28 | 0.61 | 0.88 | −0.33 | IV |

- Source: Own authorship.

On the other hand, in quadrant IV, we have effect factors of perceived benefits (Wu et al. 2013), the impact factors which have high prominence and low relationship, of which the following stand out: SDG 14, SDG 05, SDG 02, SDG 13, SDG 10, SDG17, SDG 11, SDG 03, SDG 12, SDG 08, and SDG 09 (Table 11). These indicators are highly dependent and are not suitable for policy formulation, as they are sensitive to several other factors and can be changed. Therefore, managers in this set should pay attention to the factors that affect these indicators (Khajeh and Shahbandarzadeh 2023).

Finally, the cause-and-effect diagram was developed, as shown in Figure 5, based on the coordinates obtained by interrelating the R + C and R − C points. All criteria below the R + C line is impacted by those above the line. The intersection between R + C and R − C allows the creation of imaginary lines to visualize four quadrants, where it is possible to observe the degree of importance of the criteria in relation to their prominence (Wu et al. 2013).

Source: Own authorship.

The results are consistent with the proposal, given that no SDG was considered an influencer. A greater importance for environmental indicators is also observed, which is also consistent, given the global characteristics of the SDGs and especially the challenges related to climate change.

The analysis revealed a clear relationship between specific ESG indicators and their differentiated impact on the SDGs, highlighting how environmental, social, and governance dimensions contribute in distinct ways to the sustainable development agenda. Environmental indicators such as E05 (Climate Change), E01 (GHG Emissions), and E02 (Waste Management) demonstrated a strong influence on SDG 13 (Climate Action) and SDG 12 (Responsible Consumption and Production), reflecting the critical role of corporations in reducing ecological impacts. Social indicators such as S01 (Diversity) and S08 (Community Relations) showed a stronger connection with SDG 8 (Decent Work and Economic Growth) and SDG 10 (Reduced Inequalities), underscoring the importance of inclusive practices and local engagement for social development.

Furthermore, governance indicators such as G06 (Anti-Corruption) and G01 (Board Diversity) were linked to SDG 16 (Peace, Justice and Strong Institutions) and SDG 5 (Gender Equality), reinforcing the relevance of transparent and equitable governance structures. These findings suggest that companies can optimize their contribution to the SDGs by prioritizing strategic ESG indicators, thereby aligning operational performance with global sustainability goals.

4.2 Fuzzy Cognitive Maps

To implement the FCM, ESG indicators with R + C > 0.70 were considered (Table 6). This is because it was decided to highlight only those evaluated with linguistic terms HI and VHI. Thus, it can be said that the FDEMATEL results supported the definition of the initial state vector used in the FCM procedures.

Therefore, 14 ESG indicators versus the 17 SDGs were considered, making the necessary adjustments to the evaluation matrix based on the linguistic terms in Table 5. Thus, it was possible to regroup the data with the expert's evaluation, convert the linguistic terms to fuzzy numbers, and defuzzify and aggregate the results using the area center method (Table 12). It is worth noting that, as in FDEMATEL, this article only presents the relationship between ESGxSDG.

| E1 | E2 | E3 | E4 | E5 | E6 | E7 | E8 | S1 | S8 | G1 | G2 | G6 | P8 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| SDG1 | 0.06 | 0.25 | 0.06 | 0.06 | 0.25 | 0.06 | 0.25 | 0.06 | 0.94 | 0.25 | 0.06 | 0.06 | 0.06 | 0.06 |

| SDG2 | 0.25 | 0.25 | 0.06 | 0.25 | 0.94 | 0.94 | 0.94 | 0.25 | 0.5 | 0.5 | 0.06 | 0.06 | 0.06 | 0.06 |

| SDG3 | 0.5 | 0.25 | 0.94 | 0.94 | 0.75 | 0.75 | 0.94 | 0.25 | 0.06 | 0.25 | 0.06 | 0.06 | 0.06 | 0.06 |

| SDG4 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.25 | 0.75 | 0.5 | 0.75 | 0.75 | 0.06 | 0.06 |

| SDG5 | 0.06 | 0.25 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.94 | 0.06 | 0.94 | 0.75 | 0.06 | 0.25 |

| SDG6 | 0.06 | 0.75 | 0.5 | 0.5 | 0.94 | 0.25 | 0.94 | 0.25 | 0.25 | 0.25 | 0.06 | 0.06 | 0.06 | 0.06 |

| SDG7 | 0.25 | 0.06 | 0.25 | 0.06 | 0.75 | 0.25 | 0.94 | 0.94 | 0.25 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 |

| SDG8 | 0.25 | 0.75 | 0.25 | 0.25 | 0.25 | 0.06 | 0.25 | 0.75 | 0.75 | 0.06 | 0.75 | 0.75 | 0.5 | 0.75 |

| SDG9 | 0.75 | 0.94 | 0.75 | 0.75 | 0.75 | 0.5 | 0.75 | 0.75 | 0.5 | 0.25 | 0.25 | 0.25 | 0.5 | 0.75 |

| SDG10 | 0.06 | 0.25 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.25 | 0.94 | 0.5 | 0.94 | 0.75 | 0.06 | 0.06 |

| SDG11 | 0.5 | 0.75 | 0.5 | 0.25 | 0.25 | 0.25 | 0.25 | 0.5 | 0.5 | 0.94 | 0.06 | 0.06 | 0.94 | 0.75 |

| SDG12 | 0.94 | 0.94 | 0.94 | 0.94 | 0.75 | 0.5 | 0.75 | 0.75 | 0.25 | 0.06 | 0.06 | 0.06 | 0.06 | 0.75 |

| SDG13 | 0.94 | 0.75 | 0.75 | 0.25 | 0.94 | 0.75 | 0.25 | 0.94 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.25 |

| SDG14 | 0.5 | 0.25 | 0.75 | 0.75 | 0.75 | 0.94 | 0.75 | 0.25 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 |

| SDG15 | 0.5 | 0.25 | 0.75 | 0.5 | 0.75 | 0.94 | 0.75 | 0.25 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 |

| SDG16 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.75 | 0.94 | 0.5 | 0.06 | 0.75 | 0.25 |

| SDG17 | 0.06 | 0.5 | 0.25 | 0.25 | 0.5 | 0.06 | 0.06 | 0.06 | 0.75 | 0.75 | 0.06 | 0.06 | 0.75 | 0.5 |

- Source: Own authorship.

To activate the system, Equations (7) and (8) were applied. In Equation (8), the sigmoid lambda value used was 0.7, which according to Mago et al. (2014) is a value that guarantees good accuracy of the results. Applying the Python software, the system converged for 23 iterations, arriving at the final state vector shown in Table 13.

| ID | V0 | Initial state vector | Final state vector | ID | V0 | Initial state vector | Final state vector |

|---|---|---|---|---|---|---|---|

| E1 | IA | 0.125 | 0.604 | SDG 01 | N | 0.000 | 0.838 |

| E2 | IMA | 0.188 | 0.604 | SDG 02 | N | 0.000 | 0.944 |

| E3 | IA | 0.125 | 0.604 | SDG 03 | N | 0.000 | 0.959 |

| E4 | IA | 0.125 | 0.604 | SDG 04 | N | 0.000 | 0.894 |

| E5 | IMA | 0.188 | 0.604 | SDG 05 | N | 0.000 | 0.899 |

| E6 | IMA | 0.188 | 0.604 | SDG 06 | N | 0.000 | 0.94 |

| E7 | IMA | 0.188 | 0.604 | SDG 07 | N | 0.000 | 0.914 |

| E8 | IMA | 0.188 | 0.604 | SDG 08 | N | 0.000 | 0.967 |

| G1 | IA | 0.125 | 0.604 | SDG 09 | N | 0.000 | 0.986 |

| G2 | IA | 0.125 | 0.604 | SDG 10 | N | 0.000 | 0.916 |

| G6 | IA | 0.125 | 0.604 | SDG 11 | N | 0.000 | 0.969 |

| P8 | IA | 0.125 | 0.604 | SDG 12 | N | 0.000 | 0.981 |

| S1 | IMA | 0.188 | 0.604 | SDG 13 | N | 0.000 | 0.963 |

| S8 | IA | 0.125 | 0.604 | SDG 14 | N | 0.000 | 0.948 |

| SDG 15 | N | 0.000 | 0.943 | ||||

| SDG 16 | N | 0.000 | 0.902 | ||||

| SDG 17 | N | 0.000 | 0.931 |

- Source: Own authorship.

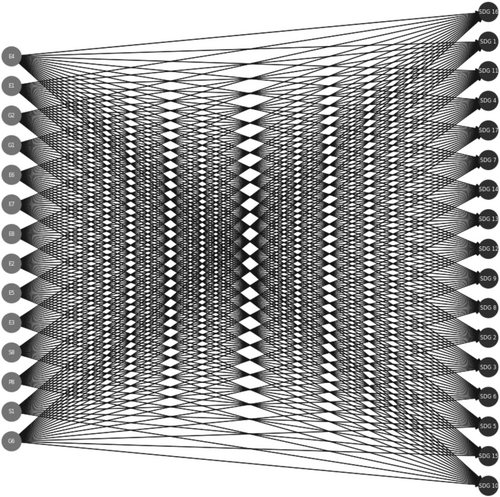

Zanon et al. (2024), demonstrate that the FCM is very useful for improving our comprehension of the dynamics between different factors. The final FCM visualized in Figure 6, where it is possible to observe the prominence of some components by the size of the circle, and how the main ESG indicators chosen from the literature and SDG are connected.

Source: Own authorship.

It is possible to observe that the largest circles refer to the SDGs most influenced by the selected indicators, and this difference, which on the visual map may seem subtle, is better observed in the relationship matrix in Table 13.

The FCM results indicate that the selected ESG indicators exert significant influence over multiple SDGs, particularly SDG 9 (0.986), SDG 12 (0.981), and SDG 13 (0.963), highlighting the central role of environmental metrics such as E5 (Climate Change), E1 (Emissions), and E2 (Waste Management) in promoting sustainable production systems. Social and governance indicators also showed relevance for goals like SDG 8 (Decent Work) and SDG 5 (Gender Equality), underscoring the broad contribution of corporate practices to the 2030 Agenda. However, the consistently high scores assigned to most SDGs in the FCM—including less intuitive cases such as SDG 1 (No Poverty; 0.838)—suggest a potential overestimation of some relationships, possibly due to the model's aggregative structure. This indicates a need for refinements, such as assigning differentiated weights to specific links and conducting sectoral validation to mitigate bias.

The combined use of Fuzzy Cognitive Maps (FCM) and F-DEMATEL offers a strategically complementary perspective: while FDEMATEL identifies direct and hierarchical causal relationships (e.g., E5 → SDG 13, G6 → SDG 16), FCM captures complex systemic effects and feedback loops that reveal less obvious pathways (e.g., S8 → SDG 11 → SDG 1). This distinction explains why SDG 1, which is less central in FDEMATEL, receives a high influence score in FCM—not due to direct ESG action, but through indirect mediation chains. Integrating both approaches enriches ESG-based decision-making by simultaneously identifying high-leverage interventions and potential cascading benefits, provided the methodological limitations are acknowledged and adjusted using context-specific evidence.

5 Discussion

Our findings reveal that all ESG indicators in the environmental category, as well as indicators (S1) diversity and inclusion and (S8) relations to the local community, are causal factors of perceived benefits and warrant attention, as they are drivers of change and capable of contributing to the improvement of initiatives represented in the other quadrants. This implies, for instance, that strategies directed towards indicators in quadrant I may have an impact on SDG 14, SDG05, SDG 02, SDG 13, SDG 10, SDG 17, SDG 11, SDG 03, SDG 12, SDG 08, and SDG 09, indicating their significant dependence on other indicators within the system.

Changes in specific indicators may not be easily attributable to changes in the SDGs, since they are long-term global goals. Hence, despite the significant prominence and impact of the ESG indicators, in quadrant I, on the SDG, in quadrant IV, achieving a direct and immediate impact may turn out to be more challenging owing to the low relation between variables in quadrant IV.

By incorporating the insights presented in Figure 6 and Table 13, it becomes clear that all the selected ESG indicators have considerable influence on the system. This is evident when observing that the most impacted SDGs are those with a stronger corporate appeal than from a social and sustainability perspective. And the findings obtained through the pilot application are in accordance with other literature that explores the connection between corporate sustainability and sustainable development goals (e.g., Diaz-Sarachaga 2021; MacNeil et al. 2021; Ramos et al. 2022).

Diaz-Sarachaga (2021) studied four Spanish companies from 2018 to 2019 to find the gaps between the disclosure of corporate contributions to the SDGs through the analysis of GRI standards and annual reports. The author discovered that his findings were consistent with a report from Scott and McGill (2018), which identified SDG 08, 12, 13, 03, and 09 as the most significant targets for numerous corporations worldwide. The results of this pilot application are in line with those cited above.

MacNeil et al. (2021) analyzed the influence of Sustainable Development Goals on firm performance using 21 firms from six industries present in the Corporate Knights index. The study centered on comparing financial parameters (such as Return on Assets and Return on Equity) with SDG disclosure. The results indicated that SDGs 13, 08, and 05 were the most commonly adopted by different types of industries, while SDGs 02, 06, and 14 received the least attention. Our results partially align with our results by highlighting SDGs 13 and 08 as among the most prominent and SDG 02 as one of the least prominent. Nevertheless, the pilot approach employed in this study highlighted SDGs 06 and 14 with a certain degree of significance, whereas SDG 05 was less prominent. This outcome may be attributed to the fact that the research compared environmental, social, and economic indicators to Sustainable Development Goals rather than financial performance.

The findings of this study are also supported by MacNeil et al. (2021), who propose a sustainability framework. They indicate that among the economic dimensions of the GRI that are linked to the SDGs, three-dimensional disclosure (economic, environmental, and social), which encompasses the effects on key stakeholders, primarily impacts SDGs 11 and 12. According to the authors, disclosures of indirect economic impacts, such as significant investments and services in infrastructure, can have positive or negative impacts on SDGs 09, 11, 12, 13, and 15.

Some authors explore the disclosure of Sustainable Development Goals by companies in some countries on a regional scale. Fonseca and Carvalho (2019) indicate, through the analysis of reports from 235 Portuguese companies, that the top five Sustainable Development Goals most reported by companies were SDGs 12, 13, 09, 08, and 17. Lodhia et al. (2023) analyzed the disclosure of the SDGs by the top 50 Australian companies and found that SDGs 13, 05, 08, 12 and 09 were the most emphasized, while SDGs 02, 14 and 01 were less contemplated.

In the case of Indonesia, Gutiérrez-Ponce and Wibowo (2023) analyzed sustainability reports from 25 companies listed on the Indonesia Selective Index from 2017 to 2021, and found that the companies were indeed committed to environmental and social areas covered in SDGs 06, 07, 08, 09, 13, and 15. However, the greatest disclosures were concentrated in SDGs 03 and 04, while SDG 14 was the least disclosed. Yu et al. (2020) found that, among 100 companies listed on the Shanghai Stock Exchange from 2016 to 2018, the priority SDGs were SDGs 09, 08, 07, and 16. Furthermore, it was found that the SDGs were 09, 08, 07, and 16. It can be observed that the literature on regional analyses of the SDGs most prominently disclosed by companies in each country is generally in accordance with the findings of the pilot approach when viewed globally for the five most prominent SDGs.

In Brazil, no studies have been identified that provide a comprehensive indication of the implementation of the Sustainable Development Goals in more than one industrial sector. Moreover, no studies were discovered in Brazilian enterprises that compared environmental, social, and corporate governance indicators with the attainment of the Sustainable Development Goals. This reinforces the suggestive contribution of this study and paves the way for future investigations that explore this context.

Our findings demonstrate that ESG indicators disproportionately influence specific SDGs due to their inherent focus. For example, SDG 13 (Climate Action) is closely linked to environmental indicators (E05, E01), since corporate emissions directly impact climate mitigation—a core target of this goal. Conversely, SDG 5 (Gender Equality) connects with governance metrics (G01) through board diversity policies, showing how structural changes can foster systemic progress. The integration of multi-criteria decision-making techniques—specifically FCM and Fuzzy DEMATEL—proved to be strategic. FDEMATEL identifies causal hierarchies and immediate priorities (e.g., anti-corruption for SDG 16), while FCM reveals long-term feedback loops (e.g., community engagement reinforcing SDG 11 and indirectly SDG 1).

This combination allows decision-makers to choose between direct interventions (e.g., reducing emissions for SDG 13) and more systemic actions with amplified ripple effects (e.g., enhancing diversity to impact SDG 5 and SDG 10). For corporations, the results can be translated into prioritization matrices (e.g., “ESG indicators with the greatest impact on the firm's target SDGs”). For policymakers, the causal structures identified by F-DEMATEL offer a foundation to design focused regulations to accelerate progress across multiple SDGs simultaneously.

6 Conclusions

Our approach made it possible to identify the most frequently cited ESG indicators in the literature and, through expert validation, establish their relationships with the SDGs. This successfully addressed the study's primary objective and research question. The complementary use of Fuzzy DEMATEL and Fuzzy Cognitive Maps proved effective for identifying and visualizing cause-and-effect relationships.

Furthermore, integrating these techniques with other methodologies could enhance analytical robustness, as demonstrated in supply chain, Industry 4.0, and healthcare applications. On the other hand, the study's reliance on a systematic literature review and expert opinions introduces limitations, including selection bias from inclusion/exclusion criteria and inherent subjectivity in expert judgments.

This research primarily contributes to the ESG-SDG literature by highlighting corporate commitments to global challenges like climate change. Specifically, our hybrid approach advances understanding by quantifying both indicator frequency and expert-validated causal relationships. For instance, while environmental indicators show strong SDG alignment, the private sector underestimates social indicators (e.g., diversity)—a gap underexplored in prior studies.

We observed strong convergence between environmental indicators and SDGs, with all analyzed metrics deemed highly influential. However, the findings also underscore the private sector's critical role in addressing social issues (e.g., diversity, community engagement). Notably, while global reports prioritize SDG 13 (Climate Action), our study reveals that governance indicators (e.g., transparency) are systematically undervalued in practice. This discrepancy may stem from sampling bias (expert demographics) or a corporate “say-do gap”. Future cross-sectional empirical studies could validate these insights.

We hope this study inspires further research into how external factors affect SDG achievement and whether companies prioritize the most impactful indicators. The practical implications are multifaceted: Corporate leaders might use these findings to rebalance ESG strategies, emphasizing neglected but high-impact social indicators. Investment analysts could incorporate the demonstrated cause-effect relationships into sustainability risk assessments. Policymakers may consider standardizing currently voluntary social metrics to accelerate SDG progress. In parallel, both policymakers and firms can leverage these tools to design targeted, evidence-based action plans. To maximize their effectiveness, however, it is essential to improve usability for non-technical stakeholders. Future applications should prioritize interactive dashboards and intuitive visualizations to enhance communication and foster broader engagement.

The conclusions of this study should be interpreted in light of certain limitations. First, the assignment of FCM weights based on expert judgment may introduce bias, and the additive structure of FCM can potentially overestimate some influences. Moreover, three broader concerns warrant consideration: (1) expert-derived results may reflect regional perspectives rather than global patterns; (2) the static nature of the analysis does not account for how economic shifts or crises might reshape ESG–SDG dynamics; and (3) the absence of broader empirical validation limits the generalizability of the findings across industries.

Future research should pursue several critical directions to refine the ESG–SDG relationships uncovered. First, expanding the number of experts and incorporating sector-specific models would improve the robustness and relevance of findings. Comparative analyses across industries and regions could help mitigate sampling biases and reveal contextual nuances. Additionally, integrating quantitative data would complement the current expert-driven approach, enhancing methodological balance. Investigating the root causes behind the under-prioritization of certain indicators may uncover structural barriers to SDG implementation. Finally, emerging technologies, such as AI-powered big data analytics and blockchain-enabled supply chain tracking, offer promising avenues to strengthen fuzzy method applications and validate insights at scale.

Acknowledgments

The authors would like to acknowledge the Coordenação de Aperfeiçoamento de Pessoal de Nível Superior—Brasil (CAPES) for supporting this research. The Article Processing Charge for the publication of this research was funded by the Coordenação de Aperfeiçoamento de Pessoal de Nível Superior - Brasil (CAPES) (ROR identifier: 00x0ma614).

Conflicts of Interest

The authors declare no conflicts of interest.