How Green Credit Policies and Climate Change Practices Drive Banking Financial Performance

Funding: The authors received no specific funding for this work.

ABSTRACT

This study examines the influence of green credit policies (GCP) on banking financial performance (FP), emphasizing the moderating role of climate change practices (CCP). Using a stakeholder theory and legitimacy theory framework, we explore how green credit initiatives impact key financial metrics such as return on equity (ROE), earnings per share (EPS), and Tobin's Q. The study utilizes a dataset covering 14 Jordanian banks from 2016 to 2023, applying regression models to test the proposed relationships. Our findings reveal a positive and significant relationship between GCP and FP, indicating that banks with stronger GCP tend to experience enhanced financial outcomes. Additionally, CCP reinforces this positive effect, demonstrating that environmental transparency fosters financial resilience and long-term sustainability. Robustness checks confirm the validity of our results, mitigating concerns regarding reverse causality and endogeneity bias. This study contributes to the green finance literature by providing empirical evidence on the financial benefits of GCP, particularly in the context of developing economies. The research underscores the strategic importance of integrating sustainability-driven policies into banking operations to achieve both financial and environmental objectives. Our findings hold substantial policy implications, advocating for regulatory frameworks that promote green finance transparency. For banking institutions, this study highlights the competitive advantage of embedding sustainability into corporate strategies, ultimately enhancing market valuation and profitability.

1 Introduction

The increasing global focus on sustainability, climate change, and environmental preservation has propelled green finance to the forefront of policy discussions and academic research (Akomea-Frimpong et al. 2022; Dmuchowski et al. 2023; Ibrahim et al. 2021; Marie et al. 2024). Climate change has emerged as one of the most pressing global challenges, with the potential to significantly disrupt ecosystems, economies, and societies (Hong et al. 2024). Despite global consensus on the need to mitigate climate change, financing the necessary measures remains a substantial challenge, particularly for developing and emerging economies (Nguyen et al. 2021; Zhang et al. 2019). Thus, green finance, as a financial innovation, has become a critical tool for promoting environmentally sustainable projects and supporting the transition to a low-carbon economy (Sarker et al. 2020; Stephens and Skinner 2013). It emerged in response to the growing recognition that significant, targeted investment is necessary to enable the shift toward a green economy, where environmental, social, and economic dimensions are harmonized to achieve sustainability (Sharma and Kautish 2022). Given the urgency of tackling climate change and its disastrous effects, green financing must be focused on as an essential weapon against environmental harm (Fu et al. 2023). Therefore, the main objective of this study is to highlight the importance of the GCP strategy and how it can enhance banks' financial performance (FP) through the moderating role of climate change practices (CCP).

Currently, financial institutions carefully consider environmental performance as a crucial metric for allocating financial resources and evaluating investments (Desai and Siddharth 2025). Green credit policies (GCP) have garnered significant attention for their potential to align banking practices with sustainability goals. By allocating loans to environmentally sustainable projects, green credit can enhance banks' portfolio diversification, reduce exposure to climate-related risks, and ultimately improve financial system stability, fostering economic growth (Goodhart 2005; Cui et al. 2020; Zhou et al. 2022; Mirza et al. 2023). Also, the release of environmental information reduces market uncertainty and enhances the value proposition for investors (Moser and Martin 2012). Thus, green banking may play a significant role in managing “environmental sustainability, SD, and climate change, which are essential components of overall socio-economic development” in underdeveloped countries (Alam et al. 2018).

The global economy has become under serious risk from climate change, and businesses are becoming more vulnerable to financial hazards associated with it (Al Frijat and Elamer 2024; Al Frijat et al. 2024; Guesmi et al. 2025). These dangers show how urgently comprehensive plans are needed to lessen the effects of climate change and make the shift to sustainable economic simulations. Understanding firm-level climate risk exposure is therefore becoming increasingly important to regulators and investors (Guesmi et al. 2025). Also, promoting sustainable growth in underdeveloped nations is difficult for a number of causes, chief among them being financial constraints (Nguyen and Khominich 2024). On the other side, global businesses and other stakeholders now face the inevitable challenges of implementing low-carbon transformation successfully and proactively managing climate risk (He et al. 2025). As the environmental and economic consequences of climate change become increasingly apparent, governments, investors, and financial institutions are grappling with the complexities of financing adaptation and mitigation strategies (Megeid 2024). Green finance has emerged as a key mechanism to support the global transition toward sustainability and environmental initiatives and projects.

Although the literature has extensively discussed the potential benefits of GCP, the moderating role of CCP on the relationship between GCP and FP has received limited attention (Bhattacharyay 2021). So, understanding how GCP influences the FP of Jordanian banks is crucial. To facilitate sustainable development and meet climate goals, it is essential that financial institutions prioritize financing for green projects while gradually reducing support for industries that are energy-intensive and heavily polluting (Octavio and Setiawan 2024; Sdiri and Ammar 2024; Sideri 2023; Siregar et al. 2024; Srouji et al. 2023; Volz 2017). Fu et al. (2023) underscore the critical connection between green finance and sustainable development, emphasizing the need for significant investments in low-carbon projects to effectively combat climate change and promote economic growth. Such investments are vital for accelerating the transition to carbon neutrality and ensuring the financial system's role in addressing environmental challenges (Fu et al. 2023).

Theoretically, the speed at which GCP are implemented could affect nations differently. Economies with high incomes, such as those in developed nations, are less impacted by environmental issues. On the other hand, growing economies seem to be the most harmful to climate issues. Therefore, in order to address these risks and challenges in emerging settings, it is vital to focus on improving GCP, which are one of the primary policies for managing these risks. Despite this, emerging markets, including those in the Middle East and North Africa (MENA), present unique challenges and opportunities for green finance. Jordan, in particular, has taken proactive steps to integrate green finance into its financial system. That represents the country's Green Finance Strategy (2023–2028), unveiled by the Central Bank of Jordan (CBJ), which represents a critical step toward reducing climate risks and promoting sustainability in the financial sector (CBJ 2024). Despite this, Banks are uniquely positioned to drive the transition toward a low-carbon economy by leveraging their role as intermediaries between capital providers and environmentally sustainable projects (Simsek et al. 2024). According to Al-Mahrouq (2025), banks have played a significant role in the Jordanian market, with their portfolio of government securities accounting for roughly 51% of the overall balance of bonds and treasury bills. Also, since over 84% of its entire production and operating activities are related to this sector, it is one of the most productive economic sectors in terms of adding value. Additionally, because of its high levels of capital and liquidity and its classification as sound, safe, and solid, it enjoys a prestigious international standing (Al-Mahrouq 2025). This also indicates that there is diversity in the nationalities of investors within the Jordanian markets at the Amman Stock Exchange (ASE), including Saudi, Qatari, Chinese, Indian, Emirati, American, British, and other nationalities, which gives interest to this study on the Jordanian market surrounded by investors of different nationalities.

Many developing countries have accelerated industrialization processes at the expense of environmental sustainability in their pursuit of economic growth, leading to significant environmental degradation (Nguyen et al. 2025; Huo and Peng 2023; Liu et al. 2022), which is made worse by the climate-related disasters of climate change (Vestrelli et al. 2024). Locally, Jordan's banking sector faces significant barriers to fully implementing green finance initiatives, as demonstrated by a 2021 survey in which only 12% of banks reported using green financing in their investment policies, and 76% had not incorporated green financing into their governance frameworks. The gap in this study is that these policies have not been addressed at the Jordanian market level as an emerging market. So, this gap poses significant queries regarding how might GCP encourage more businesses and individuals to join the green financial market. What are the GCP? What is the role of GCP in addressing climate change challenges in emerging countries? How do GCP contribute to an improved bank's FP? To address Question 1, Question 2, and Question 3, we measured GCP using nine dimensions and CCP using 10 dimensions, concentrating on the target parameters identified by stakeholder theory and legitimacy theory. Also, we considered a return on investment as ROE, EPS, and Tobin's Q to measure FP. This thorough approach enables a more thorough evaluation of the CCP and green finance regulations that Jordan and other emerging countries must contend with in their pursuit of sustainability.

Therefore, by integrating stakeholder theory and legitimacy theory, this study provides a robust and multidimensional framework to understand how GCP and CCP jointly influence FP in the banking sector. First, the study highlights the role of GCP in mitigating information asymmetry between shareholders and managers by embedding sustainability into financial decision-making, which ultimately aligns managerial actions with long-term environmental and financial goals. Second, stakeholder theory emphasizes the external pressures from regulators, investors, and the public, which compel banks to adopt environmentally responsible practices as part of their strategic imperatives. This theory underscores that the integration of CCP strengthens banks' responsiveness to the demands of diverse constituencies, which in turn enhances their legitimacy and market standing. Third, legitimacy theory positions GCP and CCP as critical instruments through which banks can gain and maintain their social license to operate, particularly as environmental sustainability becomes a societal expectation. Together, these theoretical perspectives provide a comprehensive lens through which the interaction between green finance strategies and FP can be understood. The findings are expected to significantly contribute to the academic literature on sustainable finance by addressing key gaps, particularly within the context of emerging markets where the intersection of green credit and financial outcomes remains underexplored. Moreover, this research offers practical implications for policymakers and regulators, suggesting the need for more robust frameworks that incentivize green finance mechanisms. For financial institutions, the study highlights how integrating GCP and CCP not only bolsters financial resilience but also ensures alignment with broader sustainability goals, providing a clear pathway to achieving long-term economic and environmental performance.

The remainder of the paper is structured as follows. The next section discusses the theoretical framework, reviews relevant empirical literature, and develops the research hypotheses. This is followed by the research design, where data collection and analysis methods are outlined. The results are then reported, and the paper concludes with a discussion of the findings, their theoretical and practical implications, and suggestions for future research.

2 Theoretical Background

As concerns over climate change intensify, organizations and policymakers have developed frameworks and standards to promote transparency in disclosing climate-related risks and impacts. The increasing severity of climate-related disasters exposes businesses to heightened financial risks, prompting greater regulatory focus on corporate climate disclosures (Vestrelli et al. 2024; Chen et al. 2023). To facilitate this, the Climate Disclosure Standards Board has established sustainability standards that integrate nonfinancial information, including strategic, governance, and risk management aspects, which are critical to both corporate performance and the global economy (Vestrelli et al. 2024). These standards are becoming particularly relevant in developing nations, where the urgency of climate change adaptation is rising (Elamer and Boulhaga 2024; Roberts et al. 2021).

On the other hand, as climate change becomes a more prominent issue for businesses, particularly in emerging economies, stakeholder expectations regarding environmental responsibility continue to grow. Banks play a substantial role in funding sustainability issues, starting when companies must get external finance because creating sustained value necessitates financial expenditures that frequently exceed their capacities (Zioło et al. 2023). This funding comes from banks, which raise their customers' awareness of environmental issues or motivate them to conduct environmentally friendly acts (Zioło et al. 2023). That is, banks play a role in meeting the desires of their clients (stakeholders), pushing them to preserve the environment and reduce climate-related risks.

Moreover, the concept of green credit, while relatively new in global financial markets, has been gaining traction in emerging economies where the shift toward sustainability is imperative yet underfunded (Gulzhan et al. 2023). GCP encourage financial institutions to limit loans to high-pollution and high-emission industries while providing favorable terms for projects that prioritize environmental protection, emissions reduction, and energy conservation (Cui et al. 2018). These policies are rooted in the broader framework of the green economy, which seeks to advance economic growth in an environmentally sustainable manner (Li et al. 2022; Zhao et al. 2024). The pillars of green finance include developing a low-carbon economy, closing the green investment gap by financing environmentally sustainable projects, and creating innovative green financial products such as green bonds and loans (Zhao et al. 2024). By reducing capital flows to environmentally harmful industries, GCP contribute to broader environmental goals while enhancing banks' financial security by lowering climate-related risks (Beck and Demirguc-Kunt 2006; Tian et al. 2023).

In light of the theories surrounding the topic of the study, we discover that the legitimacy theory in this area specifically enhances the interpretation and significance of the stakeholder theory. Thus, alternating between theoretical interpretations and connecting them together investigates the integration of stakeholder theory and legality and connects them to the study's findings. For banks, this means adopting sustainability practices such as corporate social responsibility (CSR) and sustainable development goals (SDGs) to meet the increasing demands of stakeholders (Debrah et al. 2024). On the other side, Legitimacy theory, a widely accepted framework for understanding corporate environmental disclosure, asserts that organizations must align their activities with societal norms and expectations to maintain their legitimacy (Campbell 2003; Hahn et al. 2015; Suchman 1995). In the context of climate change, legitimacy theory suggests that businesses, particularly those in sectors with high environmental impacts, face greater scrutiny from the stakeholders and must demonstrate their social responsibility through transparent and responsible practices (Fernandez-Feijoo et al. 2015). This is particularly relevant for financial institutions, which are increasingly expected to play a key role in promoting environmental sustainability through their lending and investment decisions (Han et al. 2024).

Moreover, Stakeholder theory posits that organizations are responsible not only to shareholders but also to a broader set of stakeholders, including regulators, customers, employees, and society at large (Freeman 2015). This is especially relevant in today's environment, where stakeholders are becoming increasingly concerned about the environmental and social impact of corporate activities (Brou et al. 2021; Debrah et al. 2024). On the other side, by adhering to GCP, banks can enhance their legitimacy by demonstrating their commitment to addressing climate change. Green lending serves as a mechanism for engaging with stakeholders—such as governments, borrowers, and communities—in a manner that addresses environmental externalities and mitigates regulatory risks (Zhou et al. 2022). Furthermore, the disclosure of green initiatives, including climate change mitigation strategies, can significantly improve a bank's reputation and FP by signaling its commitment to sustainability (Adu and Roni 2024).

Additionally, organizations are under pressure to integrate sustainability into their operational strategies and communicate these efforts through comprehensive ESG disclosures (Dkhili 2024; Helfaya et al. 2023). Such transparency not only helps businesses maintain a positive reputation but also enhances FP by aligning with stakeholder values (Esteban-Sánchez et al. 2017). Previous research shows that stakeholders, including investors, exert significant influence on the adoption of green finance practices, which are crucial for promoting green growth and mitigating environmental risks (Christensen et al. 2021; Kawabata 2019). Additionally, stakeholder theory suggests that businesses must balance their FP with their environmental and social responsibilities to remain competitive in the market (Clarkson et al. 2011).

3 Literature Review and Hypothesis Development

3.1 GCP and Banks' FP

Green finance has emerged as a key financial innovation aimed at promoting environmental responsibility and providing financial support to companies that pursue green initiatives (Cui et al. 2020). As the banking sector plays a central role in the allocation of financial resources, it has a unique responsibility to support projects that align with environmental goals. Maltais and Nykvist (2021) argue that green finance is essential not only for achieving environmental sustainability but also for the long-term sustainability of the broader economy. The role of green credit, in particular, has been highlighted in numerous studies for its potential to enhance the FP of banks by reducing environmental risks and fostering positive market perceptions (Yin et al. 2021). In the opposite direction, Hu and Zheng (2022) argue that promoting green credit may have adverse impacts on economic growth.

Empirical studies demonstrate that GCP can positively impact banks' FP, particularly in terms of profitability. Yin et al. (2021), for example, found that green lending practices contributed to improved bank performance, with return on equity (ROE) serving as a key financial metric. Similarly, Zhang et al. (2019) showed that green finance plays a critical role in enhancing corporate FP by encouraging investments in renewable energy and environmentally friendly technologies. Through green finance instruments, firms gain access to lower-cost environmental loans, which promote investments in renewable energy, energy-efficient technologies, and environmental protection projects, all of which contribute to sustainable economic returns (Han 2024).

Moreover, Cui et al. (2020) argue that the development of green finance is an irreversible trend, as it drives economic transformation and promotes the efficient use of resources while addressing climate change. By providing financial support for environmentally responsible projects, banks can enhance both their market valuation and their role in sustainable development (Cui et al. 2023). Tian et al. (2023) also found that banks with stronger green credit performance tend to achieve higher market valuations upon the announcement of loans, reflecting positive investor sentiment toward green lending initiatives.

However, the relationship between green credit and bank profitability is not universally positive. Song et al. (2019) observed that while GCP are associated with greater market stability, they may also impose financial constraints on banks, potentially limiting their ability to generate higher profits. Green finance regulations often require banks to implement environmentally responsible strategies, which can lead to increased operational costs and changes in their loan portfolios, ultimately affecting profitability (Yu et al. 2023). Despite this, banks that prioritize green credit can attract environmentally conscious investors and benefit from higher stock prices at the time of issuing green loans (Yu et al. 2023).

Recent research further explores the complex relationship between green lending, risk, and profitability. Del Gaudio et al. (2022) examined the impact of banks' commitment to green lending on FP, finding that while green credit reduces credit risk, it can also constrain profitability. Similarly, Galán and Tan (2023) argue that green finance may have a negative impact on bank efficiency due to the costs associated with transitioning toward environmentally responsible lending practices. In contrast, Lian et al. (2022) found that GCP contribute positively to bank performance by enhancing ROE and net interest margin (NIM), demonstrating the potential financial benefits of prioritizing environmental sustainability.

Climate change poses an increasing risk to banks, particularly those that finance high-emission industries, which are more vulnerable to transitional and physical risks (Berry and Rondinelli 1998; Li, Liu, et al. 2024; Li, Udemba, et al. 2024). These risks highlight the importance of public support for banks to facilitate their role in promoting the ecological transition. As a result of the insights gained from the literature, the following hypotheses are proposed:

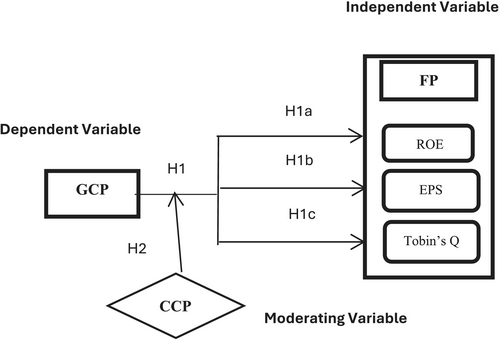

H1.A positive relationship exists between GCP and banks' FP.

H1a.A positive relationship exists between GCP and ROE.

H1b.A positive relationship exists between GCP and earnings per share (EPS).

H1c.A positive relationship exists between GCP and Tobin's Q.

3.2 The Moderating Role of CCP

In recent years, financial institutions worldwide have increasingly prioritized green credit as a key strategy for promoting environmental sustainability and reducing climate-related risks (Geng et al. 2023). GCP have emerged as an essential indicator of banks' environmental responsibility, as they not only improve banks' financial stability but also reinforce their commitment to addressing climate change (Gao and Guo 2022). Research by Gao and Guo (2022) demonstrates that GCP contribute to profitability by increasing noninterest income and reducing nonperforming credit ratios. Moreover, Bhattacharyay (2021) emphasizes that the financial sector must align capital flows with low-emission, climate-resilient growth, which highlights the need for financial institutions to adopt climate-friendly financing strategies and ensure the effective allocation of resources toward low-carbon projects.

As public awareness of climate change grows, so does the demand for greater transparency regarding banks' environmental impacts. CCP, which include disclosure of climate risks and the implementation of environmentally sustainable strategies, are increasingly seen as crucial components of banks' legitimacy. According to legitimacy theory, firms that actively disclose their climate-related initiatives are better positioned to gain social legitimacy and meet stakeholder expectations (Friedrich et al. 2023). Banks, therefore, face mounting pressure to align their green financing efforts with climate reporting and demonstrate a strong commitment to sustainable environmental development (Li, Liu, et al. 2024; Li, Udemba, et al. 2024). Research by Li, Liu, et al. (2024) and Li, Udemba, et al. (2024) further highlights the importance of green financing policies in driving the transition toward low-carbon economies, indicating that green credit can significantly reduce carbon emissions when effectively regulated.

The relationship between GCP and FP is increasingly mediated by the extent to which banks engage in CCP. Climate reporting, a key aspect of CCP, enhances transparency and provides stakeholders with valuable information about a bank's environmental impact. Nguyen et al. (2025) came to the conclusion that, especially in uncertain times, green credit plays a critical role in promoting “sustainable economic growth, controlling climatic risks, and reducing environmental pollution.” So, disclosing climate-related risks and adopting proactive environmental strategies not only strengthens banks' reputations but also positively influences their market valuations (Tian et al. 2023; Song et al. 2019). In this context, green finance, which aims to allocate resources toward sustainable projects, becomes more effective when banks actively communicate their environmental initiatives, fostering stronger investor confidence and enhancing financial resilience (Ahmed et al. 2024). Additionally, studies show that climate risk disclosure positively correlates with firm value, further underscoring the financial benefits of CCP (Vestrelli et al. 2024).

From an investor's perspective, climate-related disclosures are critical for assessing a company's long-term sustainability. Investors with a focus on climate issues increasingly favor companies that provide structured and transparent climate reports (Fu et al. 2023). Research indicates that GCP, when coupled with comprehensive CCP, enhance banks' FP by improving stock market returns and reducing credit risk (Gao and Guo 2022). Moreover, green credit encourages sustainable economic growth by investing in initiatives that lower greenhouse gas emissions, use renewable energy, and improve resource efficiency (Li et al. 2022; Xiao et al. 2022). Thus, it contributes to FP associated with climate change disclosure, highlighting the importance of integrating CCP into corporate sustainability strategies (Megeid 2024).

Incorporating CCP into GCP not only improves a bank's legitimacy but also mitigates risks related to climate change, such as credit and default risks, which pose significant challenges to financial institutions (Colas et al. 2020). By operationalizing green credit disclosures and aligning them with CCP, banks are better positioned to enhance their FP while contributing to global sustainability goals. Also, institutional investors are highly motivated to monitor banks' climate disclosures, which further strengthens the positive relationship between GCP and FP (El-Dyasty and Elamer 2020; Owusu et al. 2020). By providing investors with detailed information on their climate initiatives, banks can attract climate-conscious capital, improve market valuations, and secure long-term profitability (Chen et al. 2023; Matsumura et al. 2014).

Finally, institutional theory suggests that green credit regulations, such as those implemented in China, may significantly affect banks' FP by promoting sustainability and reducing environmental risks (Phan and Baird 2015). For banks operating in regions with high levels of climate risk, such as Jordan, the combination of GCP and CCP is likely to create synergies that enhance both financial and environmental outcomes. As the literature suggests, banks that integrate CCP into their green credit strategies are better positioned to improve their FP while addressing the challenges posed by climate change (Han et al. 2024).

Given these insights, this study proposes the following hypotheses:

H2.CCP moderate the relationship between GCP and banks' FP.

H2a.CCP moderates the relationship between GCP and ROE.

H2b.CCP moderates the relationship between GCP and EPS.

H2c.CCP moderates the relationship between GCP and Tobin's Q.

In summary, the rapidly changing climate and environment are now major concerns for all nations, developed or developing, and the attendant effects of these changes on both financial and nonFP. Prior research indicates that GCP are becoming more important and beneficial in enhancing banks' FP through climate change-related sustainable practices. It is significant to remember that while most researchers concur that green credit enhances bank performance, there are nonetheless a lot of variations, particularly in nations without such laws and procedures, especially in emerging countries. These findings highlight the need to implement and apply GCP in line with sustainable environmental goals, which are believed to have a prominent role in enhancing the performance of banks through the disclosure of climate practices as a moderating variable, especially in emerging countries. This study investigates the impact of GCP strategies on the FP of Jordanian banks, with a focus on the moderating role of CCP during the 2016–2023 period. To have a deeper comprehension of this relationship. Consequently, Figure 1 represents the study's conceptual model.

4 Methodology

4.1 Sample and Data Collections

This study investigates the impact of GCP strategies on the FP of Jordanian banks, with a focus on the moderating role of CCP during the 2016–2023 period. The study posits that increased disclosures on climate change in sustainability reports reflect a growing interest in green finance among Jordanian banks to support bank FP.

The sectors listed in ASE include banking, insurance, services, and industry sectors. There are 225 companies listed on the ASE. The number of banks in the banking sector is 14. This study focuses on all 14 Jordanian banks listed on the ASE as a study sample during the 2016–2023 period. As a critical sector, in 2015, Jordan established a Higher Council for a Green Economy to coordinate efforts between the public and private sectors in promoting green growth. The banking sector plays a pivotal role in addressing environmental degradation and responding to climate-related issues (Simsek et al. 2024). The banking sector in Jordan is notable for its size, influence, and strong internal control mechanisms compared to other industries (Srouji et al. 2023). Also, the financial sector is particularly significant, representing over 180% of the gross domestic product (GDP), highlighting its potential to both contribute to and mitigate climate-related impacts. As such, the promotion of green financing within this sector is essential to effectively addressing climate-related challenges (CBJ 2024). In 2022, the Jordanian banking sector's market value reached JD8 billion, accounting for 41% of the total market value across all sectors and 90% of the financial sector's market value (Mansur 2023, cited in Srouji et al. 2023).

Data on CCP, which serve as the moderating variable, and GCP, the independent variable, were collected from annual reports and sustainability disclosures. These reports provide detailed insights into how banks engage with sustainability initiatives (Elalfy and Weber 2019). FP data, the dependent variable, were obtained from annual financial reports, also accessible via the banks' websites. The study spans the critical period of 2016 to 2023, a timeframe marked by heightened global emphasis on climate agreements and environmental awareness, as well as notable developments in sustainability and environmental technology (Albitar et al. 2024).

4.2 Tolls Used for Variable Measurement

The analysis, which is based on secondary data spanning 8 years (2016–2023), uses a sample of 14 Jordanian banks. This article uses regression models to examine how the level of information banks report on GCP and CCP activities across all of their pillars and how they affect the FP. The secondary data was collected from sustainability reports and financial statements. The measurement of study variables is as follows:

4.2.1 Main Explanatory Variable (GCP)

GCP strategy refers to the extent to which banks adhere to environmentally friendly policies. The independent variable, GCP, is measured using the extent to which the bank adopts and adheres to GCP, from the sustainability reports of Jordanian banks from 2016 to 2023. A 9-item policy scale was adopted, where each item received a score of 1 if adopted and 0 if not adopted (see Appendix 1 for details).

4.2.2 Moderating Variable (CCP)

The moderate variable, CCP, refers to the extent to which banks are committed to disclosing all projects and initiatives related to environmental sustainability. It focuses on climate change-related disclosures such as greenhouse gas emissions, use of renewable energy, and environmental initiatives. The variable is measured by the extent to which the bank is committed to disclosing practices from the sustainability reports of Jordanian banks from 2016 to 2023. A 10-item scale was adopted, where each item received a score of 1 if disclosed and 0 if not disclosed (see Appendix 1 for more details).

4.2.3 Dependent Variable (FP)

The dependent variable, FP, is measured using three key financial indicators: Tobin's Q, ROE, and EPS. These metrics are commonly used in banking research to assess profitability and market performance. In line with previous studies, Tobin's Q is calculated as the firm's market value of outstanding stocks plus the book value of liabilities, scaled by its book value of total assets (Sari et al. 2022). ROE is measured as net income divided by its book value of total equity (Keter et al. 2023), while EPS is measured as net income scaled by total shares outstanding (Sari et al. 2022).

4.2.4 Control Variables

Several control variables are included to account for bank-specific characteristics (Dmuchowski et al. 2023; Tsang et al. 2023). These include: FSIZE is the natural logarithm of the total assets. DR is calculated as the ratio of total debt to total assets. Also, FAGE is the natural logarithm of the years a company has been listed on the ASE. Asset growth is measured as the total assets for the current year minus the previous year's assets divided by the previous year's assets.

4.3 Analytical Procedure

5 Results

5.1 Descriptive Analysis

Table 1 presents the descriptive statistics for the variables included in this study. The average firm performance, measured by ROE, EPS, and Tobin's Q, is 0.074, 0.197, and 0.110, respectively. The mean score for GCP disclosure is 0.365, indicating that, on average, banks disclose 36.5% of the items listed in the GCP index. Similarly, the CCPdisclosure mean is 0.360, showing a similar level of disclosure across the sample. The average firm size (FSIZE), calculated as the natural logarithm of total assets, is 21.866, and the average firm age (FAGE) is 3.562. The debt ratio (DR) averages 0.874, indicating a relatively high level of debt among the banks.

| Tables | Mean | Max | Min | S.D. | Obs. |

|---|---|---|---|---|---|

| ROE | 0.074 | 0.680 | −0.988 | 0.120 | 112 |

| EPS | 0.197 | 0.677 | −0.030 | 0.139 | 112 |

| Tobin's Q | 0.110 | 0.324 | 0.045 | 0.052 | 112 |

| GCP | 0.365 | 0.778 | 0.0 | 0.190 | 112 |

| CCP | 0.360 | 0.900 | 0.0 | 0.184 | 112 |

| FSIZE | 21.866 | 24.083 | 20.639 | 0.833 | 112 |

| FAGE | 3.562 | 3.807 | 2.890 | 0.249 | 112 |

| DR | 0.874 | 0.935 | 0.822 | 0.028 | 112 |

| AssetG | 0.073 | 0.614 | −0.149 | 0.116 | 112 |

5.2 Correlation Matrix

Table 2 presents the correlation matrix for the independent variables. The results indicate that no correlation coefficient exceeds 0.80, which suggests that multicollinearity is not a concern (Gujarati and Porter 2009). The highest correlation observed is between GCP and FSIZE at 0.538. Furthermore, a variance inflation factor (VIF) analysis was performed to confirm the absence of multicollinearity, with all VIF values below the critical threshold of 10 (Gujarati and Porter 2009). The highest VIF is 1.537, and the lowest is 1.082, indicating no multicollinearity issues in the regression models.

| Variables | GCP | FSIZE | AGE | DR | AssetG | VIF |

|---|---|---|---|---|---|---|

| GCP | 1.000 | 1.432 | ||||

| FSIZE | 0.538 | 1.000 | 1.537 | |||

| AGE | 0.216 | 0.354 | 1.000 | 1.145 | ||

| DR | 0.124 | 0.028 | 0.002 | 1.000 | 1.100 | |

| AssetG | 0.030 | −0.005 | 0.013 | 0.275 | 1.000 | 1.082 |

5.3 Data Stability Test

To ensure data stability, the Levin-Lin-Chu (LLC) test was conducted to verify the stationarity of the time series data. The LLC test is used to detect the presence of unit roots, which could indicate instability in the data over time. As shown in Table 3, all variables except GCP, CCP, and FSIZE are stationary at their levels, with p values below 0.05. For variables with nonstationary data (GCP, CCP, and FSIZE), the first difference was applied, and the data became stationary. Therefore, the data are deemed valid for further analysis.

| Variables | LLC-statistic | Prob. | Results |

|---|---|---|---|

| ROE | −4.970 | 0.000 | Stationary at level |

| EPS (taking the first difference) | −5.536 | 0.000 | Stationary at level |

| Tobin's Q | −4.989 | 0.001 | Stationary at level |

| GCP | −3.831 | 0.004 | Stationary at level |

| CCP (taking the first difference) | −3.819 | 0.004 | Stationary at level |

| Firm size (taking the first difference) | −10.629 | 0.000 | Stationary at level |

| Firm age | −3.361 | 0.015 | Stationary at level |

| Dept ratio | −4.467 | 0.000 | Stationary at level |

| Asset growth (taking the first difference) | −7.264 | 0.000 | Stationary at level |

5.4 Robustness Check

A robustness check was performed using the panel data method to account for individual differences across banks and to ensure the accuracy of the model estimation. Panel data have the advantage of providing more diverse data, less correlation among variables, and greater efficiency in estimation. Three models were considered: Pooled regression model (PRM), fixed effect model (FEM), and random effect model (REM). The Lagrange multiplier test was applied to choose between PRM and REM, while the Hausman test was used to select between FEM and REM.

In contrast, the Hausman test was conducted to determine whether the REM or FEM is more appropriate (Abdelkader et al. 2024; AlHares et al. 2020; Elamer and Boulhaga 2024). Based on Table 4, the outcome was nonsignificant results of the Hausman test (p > 0.05), and hence the study could reject the null hypothesis (FEM) in favor of using the REM. In this study, the REM is considered the most appropriate because it provides higher efficiency compared to the FEM, as it gives more accurate estimates with smaller standard errors. The REM is considered more efficient when the individual effects are not correlated with the independent variables. Therefore, The REM was selected for the final analysis of all hypotheses as it provided the most accurate estimates based on the tests conducted, proposing that it is reasonable to employ ordinary least square (OLS) regression to investigate the study's models. Therefore, Table 4 shows that the REM was the most appropriate model for all hypotheses, as indicated by the significant results of the Lagrange multiplier test (p < 0.05) and the nonsignificant results of the Hausman test (p > 0.05).

| Hypothesis | Lagrange multiplier | Hausman | Appropriate model | ||

|---|---|---|---|---|---|

| Chi2 | Sig. | Chi2 | Sig. | ||

| H1 | |||||

| H1a | 204.487 | 0.000 | 3.980 | 0.552 | REM |

| H1b | 153.410 | 0.000 | 8.481 | 0.132 | REM |

| H1c | 246.463 | 0.000 | 8.229 | 0.144 | REM |

| H2 | |||||

| H2a | 161.587 | 0.000 | 6.686 | 0.462 | REM |

| H2b | 141.447 | 0.001 | 9.532 | 0.217 | REM |

| H2c | 245.146 | 0.000 | 8.427 | 0.296 | REM |

|

Lagrange multiplier test to select an appropriate model (PRM) and (REM). H0: PRM is more consistent than REM. Hausman test to select an appropriate model (FEM) and (REM). H0: REM is more consistent than FEM. |

|||||

The random effects model (REM) was selected for the final analysis of all hypotheses, as it provided the most accurate estimates based on the tests conducted.

5.5 Hypotheses Testing

The regression analysis was conducted to examine the impact of GCP on FP, with CCP as a moderating variable. The analysis tested the relationship between GCP and three measures of FP—ROE, EPS, and Tobin's Q—while assessing the moderating role of CCP. Tables 5 and 6 present the results, which reveal a significant positive relationship between GCP and all three-performance measures, as well as a moderating effect of CCP on this relationship.

| Model | ROE | EPS | Tobin's Q |

|---|---|---|---|

| GCP | 0.028** (2.59) | 0.037*** (3.782) | 0.0082*** (3.118) |

| FSIZE | 0.011 (1.726) | 0.116*** (14.396) | 0.019*** (3.101) |

| FAGE | −0.021 (−0.958) | 0.001 (0.032) | 0.034* (1.862) |

| DR | 0.547*** (5.807) | −0.778*** (−8.814) | −0.624*** (−4.011) |

| AssetsG | −0.013 (−1.143) | 0.124** (2.527) | −0.05 (−1.332) |

| Intercept | −0.566*** (−4.620) | −1.817*** (−10.122) | 0.146 (0.770) |

| R 2 | 0.504 | 0.693 | 0.30 |

| Adj. R-squared | 0.481 | 0.678 | 0.267 |

| F-statistics | 21.544 | 47.765 | 9.102 |

| Probability | 0.002 | 0.000 | 0.000 |

| Observations | 112 | 112 | 112 |

- Note: the t-statistics asterisks refer to significance at p < 0.01 (***), p < 0.05 (**), and p < 0.10 (*) levels, respectively.

| Model | ROE | EPS | Tobin's Q |

|---|---|---|---|

| GCP | 0.080*** (2.874) | 0.116*** (10.719) | 0.036*** (4.605) |

| FSIZE | 0.008 (1.058) | 0.043** (2.000) | 0.008*** (3.819) |

| FAGE | 0.027 (1.114) | 0.140 (0.190) | 0.028 (1.407) |

| DR | 0.603*** (5.781) | −0.087 (−1.120) | −0.626*** (−11.880) |

| AssetsG | −0.030 (−0.950) | 0.098 (0.603) | −0.001 (−0.042) |

| CCP | 0.022** (2.101) | 0.829*** (5.027) | 0.103** (2.387) |

| GCP*CCP | 0.144*** (2.939) | 0.134*** (3.027) | 0.085** (2.299) |

| Intercept | −0.507*** (−3.472) | −1.779*** (−7.229) | 0.390*** (11.173) |

| R 2 | 0.471 | 0.690 | 0.574 |

| Adj. R-squared | 0.436 | 0.669 | 0.545 |

| F-statistics | 13.248 | 33.007 | 20.009 |

| Probability | 0.000 | 0.000 | 0.000 |

| Observations | 112 | 112 | 112 |

- Note: the t-statistics asterisks refer to significance at p < 0.01 (***), p < 0.05 (**), and p < 0.10 (*) levels, respectively.

Table 5 summarizes the regression analysis results for GCP and its relationship with FP. GCP is positively and significantly associated with ROE, EPS, and Tobin's Q. The results showed that the GCP strategy is critical to improving the Bank's FP, as it plays a pivotal role in enhancing the ROE, EPS, and Tobin's Q, which means that banks' interest in adopting GCP supports and enhances their FP, supporting hypothesis H1. GCP and ROE have a positive coefficient of 0.028 (p < 0.05), indicating a moderate effect on profitability. For GCP and EPS the positive coefficient is 0.037 (p < 0.01), showing a strong impact on earnings performance. For GCP and Tobin's Q, it also shows a significant positive relationship, with a coefficient of 0.0082 (p < 0.01), implying an increase in market valuation.

In terms of control variables, FSIZE has a significant positive impact on EPS and Tobin's Q, indicating that larger firms tend to have higher performance in these measures. FAGE shows a weak positive effect on Tobin's Q, suggesting that older firms may have a slight advantage in market valuation. On the other hand, DR has a positive effect on ROE but a negative impact on EPS and Tobin's Q, indicating that higher leverage may benefit profitability but harm market valuation and earnings.

Table 6 displays the regression results examining how the CCP index impacts the link between the GCP index and FP. From the regression coefficients, it is revealed that the interaction variable (GCP*CCP) has strengthened the significant positive correlation with ROE, EPS, and Tobin's Q, with a t-value of 2.939 at the 1% level, a t-value of 3.027 at the 1% level, and a t-value of 2.299 at the 2.4% level, respectively.

The initial findings indicate that banks that implement GCP perceive a notable improvement in their FP as a result of CCP disclosures in their sustainability reports. This means that it will be more strategic in response to growing stakeholder pressure on CCP disclosure, which moderates the relationship between the adoption of GCP and improved bank FP by higher ROE, EPS, and Tobin's Q ratio.

This finding is consistent with the predictions of the study hypothesis. Indeed, according to legitimacy theory, banks that disclose more information about their climate change initiatives through green bank loans are also likely to be environmentally sustainable, which implies that bank sustainability improves FP. Adu and Roni (2024) indicate that embedding the SDGs, for instance, can improve the bank's legitimacy by enhancing its reputation and financial efficiency by giving it access to important targets and fostering enduring relationships with vital stakeholders.

6 Discussion

As presented in the banks' sustainability and financial reports, the study analyses financial and nonfinancial data for the relationship between GCP and FP through CCP as a moderating variable. The results showed that the GCP strategy is critical to improving the Bank's FP, as it plays a pivotal role in enhancing the ROE, EPS, and Tobin's Q. Consequently, H1 is accepted. This indicates a positive relationship between GCP and FP, which means that banks' interest in adopting GCP supports and enhances their FP. Tian et al. (2023) state that when banks grant loans, their market valuations rise dramatically due to their green credit performance. Yin et al. (2021) conclude that while green lending raises risk, it also boosts bank profitability. Moreover, issuing corporate green finance is associated with favorable stock market responses and draws investors who value the environment (Tang and Zhang 2020; Flammer 2021).

Enhancement of FP comes through adopting policies related to concerns and awareness on preserving the natural environment and climate change, forming green credit or sustainability committees, setting guidance and instructions on how to use green loans, and monitoring clients' environmental initiatives. According to Birindelli et al. (2022), when banks give climate issues a medium-high degree of attention, their commitment reduces the risk level of bank loans. Moreover, a two-way causal relationship exists between Chinese banks' sustainability and FP. Institutional theory suggests the Chinese GCP might impact this relationship (Weber 2017).

Additionally, FP improvement comes through controlling policies of the risks of green credits, bank initiatives, and engagement in building networks on environmental issues, for example, memberships or relationships with B green groups, including government bodies and NGOs. According to Alsaifi et al. (2020), there is strong evidence that a firm's FP is favorably connected with its carbon emissions disclosure. Green finance also enhances the core efficiency of banks that carry greater risk (Galán and Tan 2023). GCP had impacted significant CCP and FP for Jordanian banks. Green disclosure is crucial for the banking sector to have sustainable growth (Firmansyah and Kartiko 2024). Also, enhancing FP comes with the bank's disclosure of establishing a green loan fund or climate change fund, information on the amount of loans allocated annually for green projects, and separate pages for green banking reporting that should be used in the annual report. Consequently, some earlier research, consistent with this study's findings, showed that According to Luo et al. (2021), introducing green credit substantially impacts the banking business's core competencies. Gulzhan et al. (2023) also suggested that a “green” finance approach may boost profitability. Also, by providing financial support for environmentally responsible projects, banks can enhance both their market valuation and their role in sustainable development (Cui et al. 2023).

To test hypothesis (H2), the main findings reveal that banks that adopt GCP experience a significant improvement in FP through the climate change-related disclosures that banks make in sustainability reports. This implies that banks' responses to increasing stakeholder pressures regarding climate change-related disclosures will be more strategic, extending beyond simply improving ROE, EPS, and Tobin's Q, as banks' interest in adopting GCP increases. According to Subramaniam and Loganathan (2024), Green finance has been found to support Singapore's development of renewable energy, with there is strong evidence that a firm's FP is favorably connected with its carbon emissions disclosure (Alsaifi et al. 2020). Also, Mirza et al. (2023) found that net interest margin and green lending positively correlate and can be very important in reaching net zero emissions. In the same context, the green credit strategy dramatically lowers “corporate sulfur dioxide emissions,” according to Xiao et al. (2022).

As banks become more interested in the disclosure of low-carbon economy initiatives, energy-efficient buildings, renewable energy infrastructure, solar energy projects, renewable energy projects, sewage use projects, and transportation projects that contribute to a clean environment to create environmental sustainability, the results also demonstrated that banks policies on financing customer projects are based on financial standards and environmental issues that contribute to improving FP. Some prior studies support the findings of this study to the degree to which banks use their disclosure of climate change as a weapon to counteract societal and regulatory pressure from various stakeholders (Cho et al. 2012), aiming to create a new corporate image for society by making climate actions visible (Hopwood 2009). Since greater bank involvement in climate-related issues can have many beneficial effects, including improved FP (Friedrich et al. 2023).

The findings also showed that banks that offer green loans—which are designed to fund environmental sustainability projects like wastewater treatment plants, recycling centers, or smoke and gas capture units—help boost their bottom lines. In other words, disclosures about funding climate change projects were what supported the link between banks' GCP and FP. Sharmeen et al. (2019) found that green banking policies improve banks profitability. Also, Kouloukoui et al. (2019) find a noteworthy positive correlation between corporate climate risk disclosures and FP. Shakil et al. (2019) have indicated a positive correlation between the environmental performance of banks in emerging markets and their FP. Tian et al. (2023) find that when banks disclose environmental information for industries that are not polluting, their market valuation rises. Also, Gutiérrez-Ponce and Wibowo (2024) confirmed that increased environmental disclosure would raise the profitability of financial banks. Buallay (2019) observed that environmental activity disclosure positively impacted ROA and TQ.

Finally, earlier studies such as (Ararat et al. 2015; Ducassy and Guyot 2017) used FSIZE as a control variable. It is argued that FSIZE may affect FP as large companies have a higher capacity to create internal funds. On the other hand, large companies have a larger variety of capabilities. However, large companies may have problems, especially coordination matters, which may negatively affect their FP. Therefore, FSIZE is the natural logarithm of the total assets. It is confirmed that the choice of debt plays a vital role in disciplining the company (Rashid 2018). In addition, DR is determined in this study by dividing total debt by total assets. Age may have an impact on a company's performance; it may be argued that older companies are probably more productive than younger ones (Ang et al. 2000). According to this argument, the natural logarithm of the number of years a firm has been listed on the ASE is FAGE. Also, one significant factor that could affect financial success is asset expansion. It measures a company's ability to enhance its asset holdings by referring to changes in the amounts of its assets over a given time period (Karimah et al. 2024). According to Larasati and Betharia (2024), businesses with significant asset expansion perform better when it comes to generating revenue. Consequently, the ratio is used to compute AssetG. Therefore, AssetG is calculated as the ratio of the ((total asset − total asset-1)/total asset-1) (Santioso and Daryatno 2024).

A few policies and practices that banks adopted also supported the study's results, whether related to climate change or green credit. One such bank is Ahli Bank “2017; Renewable Energy Loan Financing: p. 43”, Arab Bank “2016; Hybrid Car Loans and Solar Energy Systems: p. 29”, Jordan Islamic Bank “2018; Effective Contribution to Creating a Green and Pollution-Free Environment through Electric Cars: p. 31”, Housing Bank “2019; Their Commitment not to finance any activities that may have negative social or economic impacts on society or the environment. Green loans witnessed a significant increase compared to previous years, reaching 8,980,734 JD: p. 34 and 35”, and Cairo Amman Bank “2020; the bank adopted social initiatives aimed at protecting the environment and taking into account providing financing to companies: p. 211”. Also, Jordan Kuwait Bank “2021; to avoid environmental risks, loans were provided to a group of customers worth 3.28 JD for 204 customers: p. 16”, Bank of Jordan “2022; At Bank of Jordan, we seek to encourage our customers to move forward in their journey towards sustainability to finance environmentally friendly projects. As a result, environmentally friendly car loans witnessed a significant increase of 550% in 2022 compared with the previous year, with a total of 5.4 million JD: p.15”, and Union Bank “2023.”

7 Conclusion

The increasing focus on climate change and environmental sustainability has brought green finance to the forefront of global financial discussions, particularly in the banking sector. This study offers fresh perspectives into the moderating role of CCP in the sustainability field by exploring how they moderate the association between GCP and the FP of Jordanian banks in the 2016–2023 period. Past research has examined the direct effects of green finance on bank performance in developed and developing countries.

The study presents three key findings. First, the results indicate a significant positive relationship between GCP and FP across various financial metrics, including ROE, EPS, and Tobin's Q. This suggests that banks that prioritize green credit initiatives not only enhance their FP but also build stronger reputations for environmental responsibility. Second, the moderating role of CCP strengthens the positive impact of GCP on FP, underscoring the importance of climate-related disclosures. Banks that are more transparent in their environmental initiatives tend to benefit from improved financial outcomes, reflecting their commitment to sustainability. Finally, the findings highlight the critical role that bank size and DR play in moderating FP, indicating that larger banks with effective green credit strategies can further enhance their market valuation and profitability.

The theoretical contributions of this study are noteworthy. By integrating legitimacy theory and stakeholder theory, the research provides a comprehensive framework for understanding the strategic importance of green finance in the banking sector. It extends these theories by demonstrating how GCP and CCP not only improve FP but also enhance banks' legitimacy in the eyes of stakeholders. The study contributes to the growing literature on green finance by exploring the role of CCP as a moderator, highlighting how environmental disclosure practices enhance transparency and improve financial outcomes. This is particularly relevant for developing economies, where green finance is increasingly seen as a tool for achieving both environmental and financial goals.

This study also bridges a significant gap in the literature by examining green finance in the context of Jordan, a developing country facing numerous environmental and financial challenges. While previous studies have primarily focused on green finance in developed economies, this research offers novel insights into how green credit strategies can be applied to improve FP in emerging markets. By doing so, it enriches the understanding of the relationship between environmental sustainability and FP, providing a foundation for future research on green finance in similar contexts.

The implications of this study are far-reaching. For policymakers, the findings suggest that encouraging banks to adopt GCP can lead to both environmental and economic benefits. Regulatory frameworks that incentivize green finance and climate-related disclosures are essential to promote transparency and accountability in the financial sector. For bank managers and practitioners, the study highlights the competitive advantage that comes from integrating sustainability into corporate strategies. By enhancing green credit disclosures and adopting robust CCP, banks can not only improve their financial outcomes but also strengthen their market position in an increasingly sustainability-conscious world.

Although this study offers a valuable view of the literature on GCP, CCP, and FP, there are several limitations that should be noted. First, the research focuses exclusively on the banking sector in Jordan as an emerging country. This sectoral limitation limits the generalizability of the results, as the results may not be fully representative of banks operating in emerging markets. Therefore, future research should expand its scope to include banking sectors in other emerging countries. Second, this study used nine Pillars to measure GCP as an independent variable. While these Pillars offer useful insights, they may not cover the full range of sustainability concepts that influence banks' FP. Future research should expand the scope by adding a more comprehensive set of sustainability Pillars and adopting them as legitimacy for their conduct. This can be achieved by adopting new green policies that enrich markets with green products and services for their customers as market stakeholders. Third, as a moderator variable, CCP were measured using 10 dimensions in this study. The entire spectrum of environmental sustainability principles that affect banks' FP may not be fully captured by these dimensions, despite the fact that they offer valuable insights. This work should be expanded in future studies by including a wider range of environmental factors connected to climate change. Fourth, there is an absence or dearth of current, comprehensive studies on Jordanian banks' performance and green financial policy ideas. This emphasizes the need for more research on how to persuade banks to implement fresh green credit practices and regulations in order to satisfy the expanding demands of the global economy.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix 1

| Variable | Indicator | |

|---|---|---|

|

Green credit policies Bose et al. (2018) and Central Bank of Jordan (2024) |

GCP-1 | Information reveals the bank's policies, concerns, and awareness regarding preserving the natural environment and/or policies addressing climate change. |

| GCP-2 | Information related to forming green credit or sustainability committees at the Bank level. | |

| GCP-3 | Information about the Guidance and instructions on how to use green loans. | |

| GCP-4 | Information relating to monitoring clients' environmental initiatives includes an effluent treatment plant, recycling facilities, and smoke and gas arresting units. | |

| GCP-5 | Information about the risks of green loans or credits. | |

| GCP-6 | Reporting of information on the bank's initiatives and engagement in building networks on environmental issues, for example, memberships or relationships with B green groups, including government bodies, NGOs, and so forth. | |

| GCP-7 | Information about the establishment of a green loan fund or climate change fund. | |

| GCP-8 | Information on the amount of loans allocated annually for green projects. | |

| GCP-9 | Separate pages for green banking reporting should be used in the annual report. | |

| Climate change practices | CCP-1 | Disclosures related to the level of greenhouse gas emissions |

| CCP-2 | Disclosures related to the level of carbon emissions. | |

| CCP-3 | Disclosures related to the level of renewable energy. | |

| CCP-4 | Disclosures related to the level of energy savings and improvements. | |

| CCP-5 | Disclosures related to Water, effluents, and air pollution. | |

| CCP-6 | Disclosures related to Wastewater transportation and treatment projects | |

| CCP-7 | Disclosures related to Hybrid and electric car projects | |

| CCP-8 | Disclosures related to Green building projects | |

| CCP-9 | Disclosures related to Public transportation projects | |

| CCP-10 | Disclosures related to Manufacturing industries projects | |

| Financial performance | FP-1 | Return on equity |

| FP-2 | Earnings per share | |

| FP-3 | Toobin's | |

| Control variables | CV-1 | Firm size |

| CV-2 | Firm age | |

| CV-3 | Debit ratio | |

| CV-4 | Asset growth |