Non-Tariff Measures and U.S. Agricultural Exports

Editor in charge: Gopinath Munisamy and Zhengfei Guan

Abstract

How much do non-tariff measures (NTMs) affect U.S. agricultural exports? While countries maintain a large and diverse set of NTMs to safeguard the health of plants, animals, and humans, policymakers and regulatory bodies may neglect the impact these measures have on international trade. This paper evaluates the impact of two broad types of NTMs important to U.S. food and agricultural exports: sanitary and phytosanitary (SPS) measures and technical barriers to trade (TBTs). We construct a new database detailing the more prominent SPS and TBT measures impacting U.S. exports as highlighted in the Office of the United States Trade Representative's (USTR) National Trade Estimate (NTE) report from 2007 to 2021. Using a theoretically consistent gravity equation, we find that SPS and TBT measures reduce U.S. agricultural exports by 34.5%, on average, equivalent to a 16.4% ad valorem tariff. However, we find little evidence that these NTMs significantly affect the probability of U.S. exports or export survival in destination markets (i.e., the probability of export failure) suggesting that these measures primarily impact variable trade costs and the intensive margin of trade.

The World Trade Organization (WTO) permits members to implement non-tariff measures (NTMs) under the Agreement on the Application of Sanitary and Phytosanitary (SPS) measures and Technical Barriers to Trade (TBT) to safeguard human health, animal and plant welfare, and the environment, provided that these measures are based on scientific evidence and non-discriminatory (Disdier & Fugazza, 2020; DITC, United Nations Conference on Trade and Development [UNCTAD], Trade Analysis Branch, 2010; Xiong & Beghin, 2012). Although NTMs have been present in trade for some time, their significance in global agricultural trade has grown (Beghin & Schweizer, 2021). This is partly due to declining average tariff rates and market liberalization facilitated through free trade agreements, making agricultural market access increasingly dependent on compliance with foreign regulations and product standards (Bureau et al., 2019; Grant & Arita, 2017; Kuenzel, 2023; Rau & Vogt, 2019; United States Trade Representative [USTR], 2021).

Unlike other trade policies, such as quotas and tariffs, the effect of NTMs on trade is not uniform and varies depending on the specific circumstances (Ghodsi et al., 2017; Li & Beghin, 2014). In the literature, while some studies report that NTMs impede trade, others report that they enhance trade or have mixed results (Beckman & Arita, 2017; Disdier et al., 2008; Peterson et al., 2018; Xiong & Beghin, 2012). Indeed, as the fundamental purpose of NTMs is to address market failures related to consumer information, health, and environmental protection (Grant & Arita, 2017), NTMs may mitigate information asymmetry and increase demand by providing more information to consumers. On the other hand, NTMs can also impede trade by increasing compliance costs, such as those associated with additional SPS treatment requirements, non-automatic licensing, facility registration requirements, biotechnology approvals, and more stringent maximum residue limits (MRLs). They can also be used for protectionist purposes and distort foreign trade (Disdier & Fugazza, 2020; Disdier & Marette, 2010; Nicita et al., 2013). As Santeramo and Lamonaca (2019) argue, the trade effects of NTMs are mostly case-specific and depend on factors such as the countries involved, the type of measures implemented, and the products traded.

A substantial empirical literature has examined the trade effects of SPS and TBT measures. However, their impact on exports from a large economy such as the U.S., whose exporting firms may be able to adapt to changing regulations globally, remains underexplored. This paper aims to provide new evidence on the impacts of NTMs on U.S. agricultural exports using a unique dataset derived from the annual National Trade Estimate Report on Foreign Trade Barriers (NTE) published by the Office of the USTR. The NTE report compiles information from various sources, including USTR, the Departments of Commerce and Agriculture, other U.S. Government agencies, U.S. Embassies, attachés stationed in foreign countries, and input from the public in response to notices published in the Federal Register. The goal of the NTE report is to define and publicize “significant foreign trade barriers” impacting U.S. agricultural exports that could benefit from further negotiations based on U.S. trade law and the rules-based multilateral system (USTR, 2021).1 It therefore provides a detailed inventory of the types of measures that may represent important impediments to U.S. agricultural exporters, a description of the product sectors impacted, foreign countries maintaining the measures, and, in most cases, the timeframe under which these measures have been active. In short, this article addresses two important policy questions. First, to what extent do foreign SPS and TBT barriers identified in the USTR's NTE reports impact U.S. agricultural exports? Second, which types of these regulations, and in which regions, are most restrictive to U.S. agricultural trade? Empirical evidence on these questions will help guide policymakers in identifying priority foreign trade barriers and allocating resources to negotiate reforms, thereby enhancing U.S. agricultural export competitiveness.

As the NTE report likely publicizes and focuses on the more “significant” foreign trade barriers, some of our analysis naturally results in significant trade impacts for U.S. agricultural exports. However, our contribution lies in understanding how much these measures impact trade as predicted by the model, and in the detailed analysis across different types of SPS and TBT measures maintained by foreign trading partners. Constructing a database of NTMs from the USTR NTE report and mapping these measures to product-line U.S. export flows from BACI (Gaulier & Zignago, 2010) at the 6-digit level of the Harmonized System (HS) over the period 2007–2021 allows us to study the impact of foreign countries' SPS and TBT measures over time at a very fine level of product classification. We also map each measure to its corresponding international classification of NTMs developed by the Multi-Agency Support Team (MAST) group (UNCTAD, 2019) and create a more specific categorization of NTMs based on the underlying objective of each measure (i.e., alcoholic beverage (AB) standards, animal disease regulations, certification requirements, clearance restrictions, food safety, food standards, GE biotech, halal certifications & standards, labeling requirements, microbes, pesticide MRLs, plant disease & pests, product registration, production requirements, shelf life requirements, and veterinary drugs).

We find that the prevalence of SPS and TBT measures has been increasing over time for U.S. agricultural exports. The estimation of a theory-consistent, product-line gravity model confirms that NTMs identified by the USTR pose significant barriers to U.S. agricultural exports. On average, the presence of NTMs leads to a 34.46% decrease in U.S. agricultural exports, which is equivalent to a 16.4% ad valorem equivalent (AVE) tariff. However, we find no significant change in the overall probability of export failures and economically small impacts on the probability of U.S. exports. The results suggest that NTMs publicized by USTR significantly affect the intensive margin of U.S. agricultural exports but have a limited effect on export failure, although more research and a longer sample period may be necessary to draw definitive conclusions about the extensive margin. Overall, the results suggest SPS and TBT regulations impact U.S. exporting firms through variable instead of fixed trade costs.

These results should be treated with some degree of caution. Our analysis draws from the USTR's NTE report, which provides a detailed description of SPS and TBT measures impacting U.S. agricultural exports and reflects a more singular viewpoint. Not all measures flagged in the NTE reports may ultimately diverge from WTO principles upon evaluation in formal dispute settlements, or qualify as' unnecessary' tradebarriers. However, the reasons behind these measures, as perceived by the countries implementing them, remain less transparent and beyond the scope of this paper.

Furthermore, among the broad range of NTMs, this paper focuses only on those that are of concern to U.S. exporters and the USTR, and that are not necessarily notified to the WTO by importing countries, nor have they consistently been the subject of specific trade concerns or formal disputes. Given this unique dataset, our theoretically consistent model accounts for other trade frictions, captured through multilateral resistance terms, that are not reported in the USTR dataset but may be implemented by importing countries on a non-discriminatory basis.

The remainder of the paper is organized as follows. Section 1 provides a literature review on the impact of NTMs on trade and highlights how our dataset differs from those used in other studies. The current literature is often based on either countries' notifications reported to the WTO, specific trade concerns, or surveys conducted by UNCTAD. Section 2 describes the construction of the NTM dataset along with a descriptive analysis. Section 3 develops the empirical specification used to assess the impact of NTMs on U.S. agricultural exports. Section 4 presents the results, and the final section concludes the paper.

LITERATURE

Since 1995 and the creation of the WTO's Agreement on the Application of SPS Measures and TBT, SPS and TBT measures impacting trade in food and agricultural products have gained significance and have become an important component of multilateral and regional trade negotiations. Under the SPS and TBT agreements, WTO members are required to notify their SPS and TBT measures. While there are often delays in WTO member notification and some measures do not get notified, the general notification process has enhanced economists' understanding of the sheer number of measures operating in world trade. Due to their complexity, the analysis of NTMs raises several challenges for researchers and policymakers.

The first challenge concerns the measurement of SPS and TBT measures. Unlike other trade policies, such as tariffs, tariff rate quotas (TRQs), and anti-dumping or countervailing duties, SPS and TBT measures are not directly quantifiable and comparable (Grant & Arita, 2017). SPS and TBT notifications rarely provide any direct information regarding the costs associated with regulatory compliance. Thus, economists have largely inferred the costs of SPS and TBT measures from price comparisons (Cadot et al., 2018) or an indirect approach based on a model of bilateral trade flows in the presence of SPS and TBT measures compared to trade flows not subject to such measures, as predicted by the model.

A second challenge in the empirical literature evaluating the impacts of NTMs is that previous analyses are based on different information and sources. Each of these data sources offers its own advantages and limitations. The WTO's Integrated Trade Intelligence (I-TIP) database is widely used in the literature (Fontagné et al., 2015; Ghodsi et al., 2017; Ning & Grant, 2019). The WTO data provides a comprehensive collection of NTMs based on notifications made by WTO members and specific trade concerns (STCs) raised during the WTO's SPS and TBT committee meetings. This dataset offers valuable insights into notified NTMs and those perceived as barriers in the WTO discussions (Fontagné et al., 2015; Grant & Arita, 2017).

However, it is important to note that member countries are only required to notify new measures, which may result in the omission of preexisting NTMs and delays in the compilation of regulations (De Melo & Nicita, 2018; Grant & Arita, 2017). The Trade Analysis and Information System (TRAINS) database, provided by UNCTAD, is another widely used resource (Beghin et al., 2015; Looi Kee et al., 2009; Nicita et al., 2013). TRAINS provides information on NTMs and includes tariff data at the HS 6-digit level of product classification. Similar to the I-TIP dataset, TRAINS relies on information reported by NTM-implementing countries, and self-reported NTMs may encompass multiple measures reported simultaneously, making it challenging to isolate specific standards and exporter concerns (Grant & Arita, 2017). Furthermore, both datasets provide NTM information at the importer level, assuming that these measures apply uniformly to all exporters.

Lastly, in addition to these, there are various datasets specifically tailored for certain groups of measures or countries (Li & Beghin, 2014; Peterson et al., 2013; Xiong & Beghin, 2012). In our analysis, we opt for a different approach by focusing on the U.S. perception of NTMs faced by exporters, as defined in USTR's NTE. This provides a list of NTMs of concern for U.S. exporters, some of which have not been notified to the WTO by importing countries or have not been the subject of specific trade concerns or lodged as a formal trade dispute.

The choice of proxies to assess the impact of NTMs is a third major challenge. The majority of studies use a binary dummy variable to indicate the presence of an NTM measure (Fontagné et al., 2015; Ghodsi et al., 2017; Looi Kee et al., 2009; Peterson et al., 2013). The disadvantage of binary proxy variables is that they do not imply the stringency of the measures (De Melo & Nicita, 2018). However, they are easy to work with. Other studies use inventory measures like frequency and coverage indices (Nicita et al., 2013), or focus on specific measures such as MRLs using international standards developed by the Codex Alimentarius Commission (Li & Beghin, 2014). Lastly, some studies use a count variable that represents the number of NTMs applied (Czubala et al., 2009; Ghodsi & Stehrer, 2022; Kuenzel, 2023; Moenius, 2004; Portugal-Perez et al., 2010; Sun et al., 2021). However, it is important to consider the potential limitations of using a count variable as a proxy for NTM stringency, as NTMs can vary in their levels of stringency, and counting measures assigns equal weight to all measures (De Melo & Nicita, 2018). Disdier et al. (2008) utilize three different proxies to measure the effect of NTMs and find that the choice of proxy significantly impacts the results. However, Li (2013) emphasizes that there is not enough evidence that different proxies would lead to systematically different trade effects in a theoretically robust regression framework. Additionally, Santeramo and Lamonaca (2019) argue that when inventory measures or AVE proxies are used, the trade effects tend to be negative; however, when count or dummy variable proxies are employed, the trade effects could be either negative or positive.

Apart from data and proxy issues, various quantification methods exist to measure NTM effects in the literature. Direct methods compare domestic and international counterfactual prices to estimate the AVE effects of NTMs (Cadot & Gourdon, 2014). However, obtaining price data for this approach can be challenging. The other limitation of this approach is that it does not provide insights into negative ad valorem equivalent price effects when NTMs enhance trade through increased domestic demand (Disdier & Fugazza, 2020).

The indirect methods, on the other hand, are based on theoretically consistent trade models and are frequently used in the literature to quantify NTM effects. Several studies have utilized indirect methods in their studies (Beghin et al., 2015; Fontagné et al., 2015; Ghodsi et al., 2016, 2017; Grant et al., 2015; Looi Kee et al., 2009; Peterson et al., 2013; Raimondi et al., 2023). For instance, Looi Kee et al. (2009) conducted a comprehensive study using the TRAINS dataset, encompassing data from 78 countries, 4575 products, and 30 different types of NTMs. They find a significant negative impact of NTMs on international trade. Nicita et al. (2013) find that SPS measures impact only 15% of overall trade but affect 60% of agricultural trade. They also found a positive relationship between most-favored-nation (MFN) tariffs and NTM indices, suggesting that NTMs could be substitutes for tariffs in protectionist policies.

While the literature on NTMs is abundant, it is not yet clear whether NTMs act as barriers or catalysts for trade. Ghodsi et al. (2017) used a gravity framework to measure the trade effects of SPS and TBT measures. Their findings revealed that 6% of all trade effects were trade-impeding, most of which stemmed from quantitative trade restrictions and TBTs. Ning and Grant (2019) employed a gravity equation at the product level, using WTO's SPS specific trade concerns data to examine the effects of SPS measures on member countries' trade. They found that active SPS concerns imply an average 68% decrease in agricultural trade. On the other hand, some studies suggest that NTMs can increase trade (Bao & Qiu, 2012; Beghin et al., 2015; Crivelli & Gröschl, 2012; Gourdon et al., 2020; Santeramo & Lamonaca, 2022). For example, Beghin et al. (2015) extended (Looi Kee et al., 2009)'s framework by incorporating measures that aimed to address market failures. They found that 12% of the product lines were affected by NTMs, and among those, 39% exhibited trade-enhancing effects. Moreover, Crivelli and Gröschl (2012) used a Heckman selection model and SPS specific trade concern measures. They found that even though SPS measures decrease the probability of firms' export, conditional on market entry, they have a trade-enhancing effect on markets with SPS measures in place. Santeramo and Lamonaca (2019) conducted a meta-analysis to examine the trade effects of NTMs based on 62 papers. Their analysis reveals that the results are likely to vary depending on the level of data aggregation, sector, country profile, and estimation method used. Furthermore, they emphasize that the trade effects of NTMs are often specific to each case, highlighting the importance of considering the unique characteristics and circumstances involved. In this study, we also find that certain types of NTMs, which aim to enhance product quality and address market failures, act as catalysts for U.S. agricultural exports, despite their initial perception as trade barriers.

DATA

In this section, we describe the construction of a unique dataset that maps foreign country SPS and TBT measures publicized in USTR's NTE report to U.S. product-line bilateral exports. The construction of this database proceeds in two steps: (i) constructing the NTM data which maps SPS and TBT measures to products and countries through time, and (ii) combining the NTM data with U.S. bilateral exports at the HS6-digit level from 2007 to 2021 to evaluate country and product sector coverage and frequency incidences.

Constructing NTM data

We build a unique dataset that maps foreign country SPS and TBT measures publicized in USTR's NTE report to product-line bilateral trade volumes. The NTE report classifies reported foreign trade barriers into 11 categories. First, we carefully reviewed each measure and country-specific profile in the NTE 2021 report to create a unique dataset of reported SPS and TBT measures. Second, we reconciled each measure with country-product measures reported in previous reports to define the time period under which each measure, or set of measures, was active. Third, we developed a more specific classification of NTMs based on the underlying objective for each measure summarized in the NTE report. Fourth, we then mapped each measure with its corresponding international classification of NTMs using the MAST categories for SPS and TBT measures and their detailed chapter classifications (UNCTAD, 2019). Finally, we combined this inventory of SPS and TBT measures with product-line U.S. bilateral export flows from BACI (Gaulier & Zignago, 2010) at the 6-digit level of the HS over the 2007–2021 period.

The NTE report provides several details on the objective of the NTM measure, the first introduction date of the measure, affected products or sectors, and the outcomes of any successful resolutions. However, in the event of missing information, we conducted further research using resources such as USDA Global Agricultural Information Network (GAIN) reports, regulatory documents from the implementing country, and other online sources. The report often describes the affected products with various classifications and aggregation levels. Select examples of products and sectors mentioned are beef, beef products, blueberries, cotton, eggs, dairy, genetically engineered (GE) products, oil seeds, processed foods, and wheat. Some of these product categories directly refer to the HS6 level product category (i.e., blueberries or cotton), while others imply broader chapter or section headings at the HS4 or HS2 level category. To benefit from more disaggregated information in the dataset, we coded all NTM information at the HS6 level. However, as measures are described at higher levels of product aggregations, such as HS2 and HS4, we coded these measures by assuming they impact all HS6 products within an HS4 or HS2 chapter heading. For example, in 2015 China restricted U.S. poultry meat exports due to highly pathogenic avian influenza. The main objective coded for this measure is related to animal disease, which coincides with MAST classification A1, prohibitions & restrictions of imports for SPS reasons. Therefore, all HS6 products classified under HS4-0207 (poultry meat and edible offal) are coded as animal disease restrictions and A1 prohibitions & restrictions NTM under the MAST classification. This measure has a start date of 2015 and a resolution date of 2019, as described in USTR's NTE reports.

The SPS and TBT measures were then merged with U.S. bilateral exports from the BACI database at the HS6-digit level of products. The BACI dataset is derived from the United Nations COMTRADE database. In order to ensure accuracy, the BACI dataset cross-checks trade flows reported by both exporter and importer and reconciles and corrects any discrepancies in bilateral trade flows (Gaulier & Zignago, 2010). In total, over 220 NTMs are matched to U.S. bilateral exports. The trade flow data covers U.S. food and agricultural exports to 155 destination markets from 2007 to 2021 and contains around 780,000 observations. Over half, or 53%, of U.S. bilateral flows at the HS6 level are zero trade flows. Nearly 20% (18.67%) or 146,000 observations on U.S. food and agricultural exports are impacted by SPS and TBT measures publicized in the NTE reports. SPS measures account for nearly 10.98% of these observations; TBT measures account for 6.79%, and a smaller fraction of observations (0.08%) are impacted by SPS and TBT measures contemporaneously.

Descriptive statistics

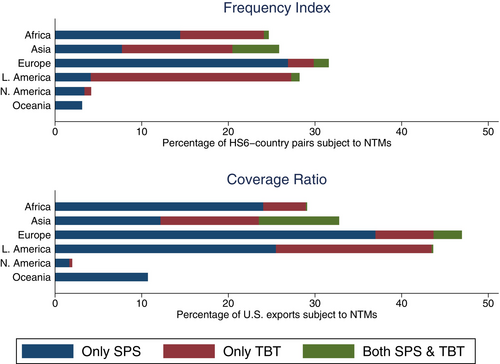

As shown in Figure 1, SPS measures are the most common type of NTM facing U.S. agricultural exports to Africa, Europe, North America, and Oceania. These measures affect nearly 30% of U.S. products exported to Europe and 15% of those exported to Africa, while their share remains below 10% for U.S. exports to other destinations. On the other hand, TBT measures have a greater impact on product shares than SPS measures in Asia and Latin America, affecting approximately 12% and 22% of products, respectively. Additionally, Asia and Europe show a higher share of products impacted by both SPS and TBT measures, affecting about 5% and nearly 2% of products, respectively.

Figure 1 also shows that the share of U.S. exports subject to NTMs (coverage ratio) is higher than the share of HS6-country pairs with NTMs (frequency index) in all regions. This could be due to the U.S. exporting higher volumes of products that face NTMs (composition effect) or because NTMs affect the intensive margin of trade (mostly traded goods) (Disdier & Fugazza, 2020). As shown in the coverage ratio portion of the figure, the share of SPS measures in U.S. export volume is higher than that of TBT measures, meaning that the share of U.S. agricultural exports facing SPS measures is greater than the share facing TBT measures. For instance, SPS measures impact approximately 12% of U.S. exports to Asia, 24% of exports to Africa, 37% of exports to Europe, and 25% of exports to Latin America. On the other hand, TBT measures affect nearly 11% of U.S. exports to Asia, 5% of exports to Africa, 7% of exports to Europe, and 7% of exports to Latin America. However, the presence of both SPS and TBT measures has an impact on 5% of exports to Asia, 3% of exports to Europe, and less than 1% of exports to Latin America.

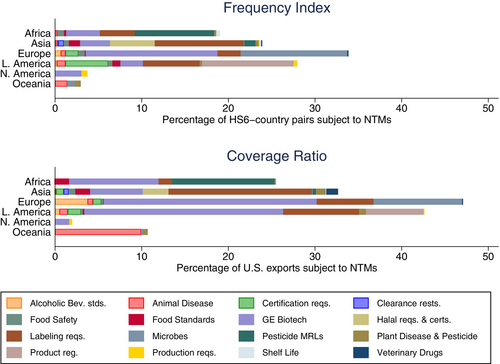

Figure 2 displays the frequency and coverage ratios using a more detailed NTM classification based on the underlying objective of each measure as described in the USTR NTE reports (i.e., restrictions for animal disease related events). GE biotech products affect nearly 25% of U.S. exports to Europe, 23% of exports to Latin America, and 10% of exports to Africa. Additionally, even though the share of GE biotech products in exports is smaller in other regions, they still account for more than 5% of exports to all regions except Oceania. Some of the NTM objectives that affect small shares of products (frequency index) affect high shares of export values (coverage ratio). For instance, alcoholic beverage standards affect less than 1% of U.S. products exported to Europe. However, as a share of the value exported, they affect nearly 4% of U.S. exports to Europe. It is worth mentioning that product registration and certification requirements affect lower shares of U.S. agricultural exports to Latin America than the share of products affected. When the coverage ratio is smaller than the frequency index, this suggests that the presence of these measures may restrict trade and result in a downward bias in the coverage ratio, or that NTMs affect a lower share of trade (Disdier & Fugazza, 2020).

The aforementioned differences in NTM objectives and regulations may result in high compliance costs for U.S. exporters. For instance, Mexico's labeling requirement for processed food mandates that the front-of-panel product labels display up to five black stop-sign-shaped symbols for products that exceed specified threshold levels of calories, sugars, saturated fats, trans fats, and sodium (USTR, 2021). In contrast, India's label requirement for packaged food and alcoholic beverages mandates front-of-pack nutrition labeling of added sugar and saturated fat and requires red-colored nutrient labels stating “High in Fat, Sugar and Salt” based on thresholds established by the Indian government (USTR, 2021). While these measures may indicate higher product quality, they could also induce higher costs for U.S. exporters. These costs could arise from the adjustment of labeling systems, packaging, and reformulation of products to comply with the specified thresholds provided in the regulations. Considering that these measures often vary by destination market, compliance costs for firms could be significant.

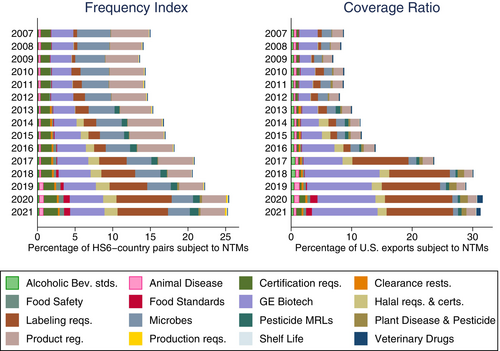

As shown in Figure 3, both the frequency and coverage ratios increase each year, which aligns with the increasing global use of NTMs.4 However, these indices have not increased for all NTM objectives. For example, the frequency index for microbes decreased from 4% of U.S. products in 2007 to around 3% in 2021, and the coverage ratio decreased from 1.5% to less than 1% in 2021. The overall frequency index increases from nearly 17% in 2007 to more than 25% in 2021, implying that almost one-fourth of U.S. agricultural products face non-tariff SPS and/or TBT measures that have been flagged as foreign trade barriers in the NTE reports.

The coverage ratio, on the other hand, increases from 11% to almost 33% in the same year, indicating that almost one-third of the U.S. agriculture exports are affected by NTMs. The graph depicts that the changes in both indexes are mainly driven by the introduction of new GE biotech and labeling requirements, and changes in trade volumes. Moreover, even though the share of products with GE biotech and labeling requirements increases after 2018, U.S. exports faced by these NTMs decrease or remain stable in this period. This might be due to the fact that some firms exit the export market as the compliance procedures are costly or because of a decline in U.S. agricultural exports.

ECONOMETRIC MODEL

represents international trade flows.7 Equation (10) incorporates tariff rates at the product, period, and country-specific levels, along with covariates that explain trade flows based on the latest gravity model literature.8 These covariates include distance, shared colonizer history, common language, and contiguity.9 Exporter-product-time and importer-product-time fixed effects control for demand and supply conditions. The trade elasticity is calculated as (Fontagné et al., 2020). Higher values of indicate stronger substitutability of products from different countries to changes in trade costs, while lower substitution values suggest weaker product substitution across countries (Rubínová & Sebti, 2021).

In addition to the impact on trade volumes, NTMs can also restrict market access for exporters by imposing high fixed costs associated with compliance procedures (Arkolakis et al., 2021; Chaney, 2008). These fixed costs can limit a country's ability to export a specific products (Arkolakis et al., 2021; Chaney, 2008). Moreover, NTMs may hinder the formation of new bilateral trade relationships or even lead to the discontinuation of existing ones (Crivelli & Groeschl, 2016; Shi et al., 2025). Despite their relevance, the gravity model estimated using PPML primarily captures the intensive margin effects, which refer to the impact of NTMs on the volume of existing trade, while overlooking the extensive margin, which reflects the probability of trade. To address this limitation, we adopt an extensive margin framework that allows us to assess how NTMs influence a country's ability to export. Specifically, we use this approach to evaluate the probability of U.S. exports being affected by NTMs through costly compliance procedures.

To measure this, we use equation (11), where the dependent variable indicates the presence of U.S. exports. The dependent variable equals one if there is a positive trade flow at time t () and zero otherwise. We refer to this framework as extensive margins, probability of trade (export). The extensive margin framework examines whether U.S. exports to specific destinations are influenced by the NTMs in place (Egger et al., 2011; Grant & Boys, 2012; Helpman et al., 2008; Yotov et al., 2016).

Additionally, we evaluate trade failure (i.e., the probability that U.S. exports cease) as an alternative robustness check since NTMs can also lead to discontinuation of existing trade flows. To measure this, we again use equation (11), but here the dependent variable indicates the presence of trade stoppages. In this case, takes a different form: it equals one if there is a positive trade flow at time t-1 () but no trade at time t () and zero otherwise. We refer to this framework as the probability of trade (export) failure.

RESULTS

The results are organized in several subsections. In the first subsection, we begin with a discussion of the impacts of NTMs and SPS and TBT measures on U.S. agricultural exports overall and by destination region. In subsection two, we present the results after estimating a more flexible model in which SPS and TBT measures are categorized by their different objectives. Subsection three presents the results organized by sectors, allowing for a sector-specific examination of the trade impacts. Finally, in the last subsection, we discuss the limits of the analysis, providing insights and interpretations to further enhance our understanding and implications of the findings.

Overall trade estimates

Panel A in Table 1 presents the overall results for all NTMs (i.e., all SPS and TBT measures identified in USTR's NTE reports). The results in column 1 show that the presence of NTMs leads to a statistically significant reduction in U.S. agricultural exports. To facilitate interpretation, we transform the NTM coefficients into percentage trade effects using the exponential transformation. On average, SPS and/or TBT measures reduce U.S. agricultural exports by 34.5%. This result is significant economically and statistically. Additionally, on an ad valorem tariff equivalent basis, as outlined in equation (9), foreign SPS and/or TBT measures facing U.S. exports are equivalent to a 16.4% tariff.

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Agricultural exports | Positive exports | Animal products | Foodstuffs | Vegetables | |

| Panel A | |||||

| NTM | −0.42*** | −0.40*** | −0.30*** | 0.43*** | −0.57*** |

| (0.05) | (0.05) | (0.08) | (0.06) | (0.07) | |

| Log(1 + tariffjkt) | −0.73*** | −0.63*** | −0.93*** | −0.55*** | −0.93*** |

| (0.11) | (0.10) | (0.10) | (0.08) | (0.18) | |

| Constant | 11.09*** | 11.21*** | 10.57*** | 10.36*** | 11.90*** |

| (0.03) | (0.03) | (0.03) | (0.02) | (0.05) | |

| Trade Effects% | |||||

| NTM | −34.46*** | −33.30*** | −26.15*** | 53.99*** | −43.70*** |

| AVE Effects% | |||||

| NTM | 16.42*** | 15.68*** | 6.15*** | −17.39*** | 31.29*** |

| Observations | 780,080 | 367,871 | 176,568 | 235,304 | 291,501 |

| Pseudo R2 | 0.76 | 0.74 | 0.73 | 0.78 | 0.80 |

| Panel B | |||||

| Only SPS | −0.47*** | −0.44*** | −0.39*** | 0.26*** | −0.59*** |

| (0.06) | (0.06) | (0.09) | (0.06) | (0.08) | |

| Only TBT | −0.24** | −0.25** | 0.04 | 0.57*** | 0.43 |

| (0.08) | (0.08) | (0.10) | (0.10) | (0.30) | |

| Both SPS & TBT | −0.45*** | −0.47*** | −1.34*** | 1.05** | 0.45 |

| (0.12) | (0.13) | (0.15) | (0.37) | (0.30) | |

| Log(1 + tariffjkt) | −0.73*** | −0.64*** | −0.90*** | −0.55*** | −0.93*** |

| (0.11) | (0.10) | (0.10) | (0.08) | (0.18) | |

| Constant | 11.08*** | 11.20*** | 10.56*** | 10.35*** | 11.82*** |

| (0.03) | (0.03) | (0.03) | (0.02) | (0.05) | |

| Trade Effects% | |||||

| Only SPS | −37.42*** | −35.80*** | −32.03*** | 29.27*** | −44.62*** |

| Only TBT | −21.59** | −22.21** | 4.45 | 76.44*** | 53.36 |

| Both SPS & TBT | −36.28*** | −37.69*** | −73.77*** | 184.41 | 56.27 |

| AVE Effects% | |||||

| Only SPS | 18.36*** | 17.28*** | 7.90*** | −10.74*** | 32.32*** |

| Only TBT | 9.14** | 9.45** | −1.55 | −18.47*** | −14.26 |

| Both SPS & TBT | 17.60*** | 18.55*** | 61.83*** | −31.34*** | −14.84 |

| Observations | 780,080 | 367,871 | 176,568 | 235,304 | 291,501 |

| Pseudo R2 | 0.75 | 0.73 | 0.73 | 0.78 | 0.79 |

- Note: The dependent variable is the value of exports of HS6-product k to importing country j from the United States in year t, inclusive of zero trade flows (except for column 2, which includes only positive trade flows). Columns 3–5 are estimated for subsets of data in column 1, based on the HS6 classification spanning sections 1 (Animal & Animal Products), 2 (Foodstuffs), and 3 (Vegetable-based Products). See sectoral mapping in Table A8. NTM, SPS, and TBT refers to non-tariff measures, Sanitary and Phytosanitary, and Technical Barriers to Trade, respectively. For the AVE transformation, the estimated elasticities are for columns 1 and 2, and , , for columns 3–5, respectively. See Table A9 for the elasticity estimates. Standard errors are in parentheses and computed using the delta method for transformed coefficients.

- * p < 0.05.

- ** p < 0.01.

- *** p < 0.001.

In column 2, we estimate the same specification but restrict the sample to positive trade flows. If the presence of SPS and TBT measures on U.S. agricultural exports is highly correlated with zero export realizations, then this may explain some of the larger negative impacts of these measures (Grant & Boys, 2012). Interestingly, however, after sub-setting the sample on positive trade flows, the estimated coefficients and associated NTM trade effects closely mirror the results presented in column 1. This suggests that the extensive margin effects associated with non-tariff regulations against U.S. agricultural exports may be somewhat limited. The results in column 1 (Table 1) are also supported by results in Tables A2, A3, A5 and A6. The limited effect on the extensive margins implies that NTMs flagged by the USTR mainly impact variable trade costs rather than fixed costs. Since some U.S. firms may already comply with similar NTMs, these fixed costs may not be large enough to push U.S. firms out of the market (Chaney, 2008; Hejazi et al., 2017). Given the similarity in results across positive and positive plus zero trade flow samples, in what follows, we present U.S. export results using the full sample (Table A4).

Columns 3 to 6 provide a breakdown of results based on HS6 classification spanning from sections 1 (Animal & Animal Products), 2 (Foodstuffs), and 3 (Vegetable-based products).10 For animal & animal products, the results in column 3 suggest the presence of NTMs reduces U.S. agricultural exports by 26%. Notably, this trade-reducing influence is more pronounced within the vegetable sector, encompassing vegetables, fruits, cereals, and their derivative products. Here, the presence of such measures leads to a substantially higher 44% reduction in U.S. exports on average. Conversely, as shown in column 4, SPS and/or TBT measures lead to a 54% increase in U.S. exports of products in the foodstuffs category. Foodstuffs consist of prepared and preserved products, often encompassing packaged goods, beverages, vinegar, and tobacco products. The positive trade effect within this sector is frequently attributed to measures associated with greater consumer information such as packaging information, labeling, nutritional composition, and the implementation of quality improvement standards11 These factors could explain the positive NTM effects and will be explored in greater detail in the subsequent sections.

While the overall NTM effects on U.S. agricultural exports provide new quantitative insights on the trade-restrictive or enhancing nature of these measures, they do not tell us whether there are systematic differences between the application of SPS versus TBT measures. To gain further insight, Panel B in Table 1 decomposes the aggregate NTM trade effect into SPS, TBT, and a combined, but mutually exclusive category labeled Both SPS & TBT. This latter category is for products and destination markets in which SPS and TBT measures are jointly operating.

Several interesting findings emerge from this delineation of NTM measures. First, the results in columns 1 and 2 reveal that a significant share of the overall NTM trade effect on U.S. exports is driven by SPS measures. Specifically, SPS measures result in a 37% reduction in U.S. agricultural exports, while TBT and both SPS and TBT measures decrease U.S. agricultural exports by 22% and 36%, respectively. This result is large but lower than the findings of Ning and Grant (2019), which reported a 68% trade-reducing effect related to SPS measures based on specific trade concerns raised in the WTO's SPS Committee. Second, in terms of the ad valorem tariff equivalent, the trade-reducing effects are equivalent to 18% for SPS measures, 9% for TBT measures, and around 18% when both SPS and TBT measures are concurrently in effect.

Third, taking a closer look at the broad product categories reveals that the large and statistically significant negative impact of SPS measures on trade occurs primarily in vegetable products, which include cereals, fruits, vegetables, and other related products. On average, SPS measures reduce U.S. vegetable product exports by 45% and are equivalent to a 32% ad valorem tariff. Comparatively, SPS measures resulted in a smaller 32% reduction in U.S. exports of animals and animal products. Interestingly, TBT measures alone did not yield a significant trade impact for the animal-related products category. However, when both SPS and TBT measures were simultaneously in effect, the trade-hindering effects more than doubled, reducing U.S. exports by 74%, likely due to the combined stringency imposed on exporters by these measures.

Lastly, the trade effects of these measures vary significantly for foodstuff products. The presence of only SPS measures results in a trade-enhancing effect of 29%, while for only TBT measures, the effect is even more pronounced at 76%. The coexistence of both SPS and TBT measures does not yield a significant trade effect; however, it is worth noting that having both SPS and TBT together has a significant positive coefficient in the initial estimation before transforming them into trade effects. Consequently, these measures for foodstuff products have a positive trade flow effect that translates into a negative ad valorem equivalent tariff ranging from 11% to 31%, depending on the measure.

Table 2 reveals that the overall trade reduction effect of NTMs for different destination regions ranges from 15% to 42%. The results are statistically insignificant for Africa. The results across most regions are robust—the negative trade effects of non-tariff regulations are primarily driven by SPS measures. As the decomposition, requirements, and stringency of NTMs vary significantly depending on policy objectives, culture, and tastes, as shown in the data section, the SPS and TBT effects are quite heterogeneous among regions, just as they are in product categories. For example, U.S. agricultural products face both SPS and TBT measures more frequently when exported to Asia and Europe. Consequently, the coexistence of both measures significantly affects U.S. exports to Asia and Europe, with ad valorem equivalent tariff effects of 22% and 138%, respectively. These effects are driven by SPS measures, as the effects of TBT measures are comparatively lower in these regions.

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Agricultural exports | Africa | Asia | Europe | Latin America | Oceania | |

| Panel A | ||||||

| NTM | −0.42*** | −0.16 | −0.54*** | −0.41*** | −0.47*** | −0.48*** |

| (0.05) | (0.13) | (0.08) | (0.08) | (0.08) | (0.11) | |

| Log(1 + tariffjkt) | −0.73*** | −5.91*** | −0.71*** | −1.10*** | −1.52*** | −5.15** |

| (0.11) | (0.43) | (0.11) | (0.20) | (0.18) | (1.58) | |

| Constant | 11.09*** | 10.54*** | 12.03*** | 9.92*** | 11.21*** | 9.79*** |

| (0.03) | (0.06) | (0.04) | (0.04) | (0.02) | (0.02) | |

| Trade Effects% | ||||||

| NTM | −34.46*** | −14.78 | −41.92*** | −33.72*** | −37.47*** | −38.01*** |

| AVE Effects% | ||||||

| NTM | 16.42*** | 5.92 | 21.59*** | 15.95*** | 18.40*** | 18.77*** |

| Observations | 780,080 | 86,241 | 253,631 | 184,424 | 188,223 | 15,127 |

| Pseudo R2 | 0.75 | 0.77 | 0.82 | 0.77 | 0.86 | 0.93 |

| Panel B | ||||||

| Only SPS | −0.47*** | −0.62*** | −0.59*** | −0.29*** | −0.04 | −0.48*** |

| (0.06) | (0.15) | (0.08) | (0.08) | (0.08) | (0.11) | |

| Only TBT | −0.24** | 1.44*** | −0.32* | 0.05 | −1.00*** | |

| (0.08) | (0.12) | (0.16) | (0.13) | (0.09) | ||

| Both SPS & TBT | −0.45*** | 0.09 | −0.61** | −2.41*** | −0.90*** | |

| (0.12) | (0.67) | (0.23) | (0.20) | (0.16) | ||

| Log(1 + tariffjkt) | −0.73*** | −5.56*** | −0.72*** | −0.99*** | −1.54*** | −5.15** |

| (0.11) | (0.39) | (0.12) | (0.11) | (0.17) | (1.58) | |

| Constant | 11.08*** | 10.52*** | 12.03*** | 9.89*** | 11.23*** | 9.79*** |

| (0.03) | (0.05) | (0.04) | (0.03) | (0.02) | (0.02) | |

| Trade Effects% | ||||||

| Only SPS | −37.42*** | −46.30*** | −44.57*** | −25.42*** | −3.74 | −38.01*** |

| Only TBT | −21.59** | 320.46*** | −27.08* | 5.53 | −63.18*** | |

| Both SPS & TBT | −36.28*** | 9.37 | −45.42*** | −90.98*** | −59.24*** | |

| AVE Effects% | ||||||

| Only SPS | 18.36*** | 25.06*** | 23.64*** | 11.13*** | 1.38 | 18.77*** |

| Only TBT | 9.14** | −40.35*** | 12.03 | −1.92 | 43.25*** | |

| Both SPS & TBT | 17.60*** | −3.17 | 24.33* | 137.61*** | 38.11*** | |

| Observations | 780,080 | 86,241 | 253,631 | 184,424 | 188,223 | 15,127 |

| Pseudo R2 | 0.75 | 0.78 | 0.82 | 0.77 | 0.86 | 0.93 |

- Note: The dependent variable is the value of exports of HS6-product k to importing country j from the United States in year t, inclusive of zero trade flows. Columns 2 to 6 are estimated for subsets of data in column 1, based on the Food and Agriculture Organization's (FAO) country-group definitions: https://www.fao.org/faostat/en/#definitionshttps://www.fao.org/faostat/en/#definitions. NTM, SPS, and TBT refer to non-tariff measures, Sanitary and Phytosanitary, and Technical Barriers to Trade, respectively. For the AVE transformation, the estimated elasticity is for columns 1 to 5. See Table A9 for the elasticity estimates. Standard errors are in parentheses and computed using the delta method for transformed coefficients.

- * p < 0.05.

- ** p < 0.01.

- *** p < 0.001.

In contrast, the AVE effect for Latin America is around 38%. Interestingly, however, SPS measures do not exhibit a significant effect on U.S. exports to Latin America. Instead, TBT measures emerge as the primary driver of trade-hindering effects in this region. This observation is further supported by Figure 1, which shows that TBT measures affect a lower share of exports to Latin America (coverage) compared to the share of products affected (frequency). This discrepancy suggests that the presence of TBT measures may be more trade-restrictive, resulting in a downward bias in the coverage ratio.

Table 3 provides the extensive margin probability of trade and the probability of trade failure estimations for different NTM categories as described above. Panel A shows that the presence of NTMs does not have a significant impact on the extensive margin, the probability of trade, and the probability of U.S. export failure. However, at the broad sectoral level, the presence of NTMs implies a lower probability of U.S. exports of animal & animal products, whereas it indicates a higher probability of exports for foodstuffs and vegetables. Furthermore, the impact of NTMs on the probability of export failure for the foodstuffs sector is positive, consistent with the fact that some NTM trade impacts are positive for this sector. Even though the NTM coefficients for some broad sectors are statistically significant, they are economically very small.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Agricultural exports | Animal products | Foodstuffs | Vegetables | |

| Panel A | ||||

| EM, probability of trade | ||||

| NTM | 0.00 | −0.03*** | 0.01** | 0.03*** |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Log(1 + tariffjkt) | −0.18*** | −0.21*** | −0.17*** | −0.15*** |

| (0.00) | (0.01) | (0.01) | (0.01) | |

| Constant | 0.49*** | 0.45*** | 0.57*** | 0.49*** |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| p-value | 0.00 | 0.00 | 0.00 | 0.00 |

| Probability of trade failure | ||||

| NTM | −0.00 | 0.01 | −0.01*** | 0.00 |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Log(1 + tariffjkt) | 0.01** | 0.01 | 0.01** | 0.00 |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Constant | 0.09*** | 0.09*** | 0.08*** | 0.09*** |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| p-value | 0.01 | 0.10 | 0.00 | 0.63 |

| Panel B | ||||

| EM, probability of trade | ||||

| Only SPS | 0.00 | −0.04*** | −0.01* | 0.03*** |

| (0.00) | (0.01) | (0.01) | (0.00) | |

| Only TBT | 0.00 | 0.03*** | 0.06*** | 0.04*** |

| (0.00) | (0.01) | (0.01) | (0.01) | |

| Both SPS & TBT | −0.05*** | −0.12*** | 0.16*** | 0.07*** |

| (0.01) | (0.01) | (0.04) | (0.02) | |

| Log(1 + tariffjkt) | −0.17*** | −0.20*** | −0.17*** | −0.15*** |

| (0.00) | (0.01) | (0.01) | (0.01) | |

| Constant | 0.49*** | 0.45*** | 0.57*** | 0.49*** |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| p-value | 0.00 | 0.00 | 0.00 | 0.00 |

| Probability of trade failure | ||||

| Only SPS | 0.00 | 0.01 | −0.00 | 0.00 |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Only TBT | −0.01* | 0.01 | −0.02*** | 0.01 |

| (0.00) | (0.01) | (0.00) | (0.01) | |

| Both SPS & TBT | 0.01 | 0.01* | −0.02 | 0.01 |

| (0.00) | (0.01) | (0.02) | (0.01) | |

| Log(1 + tariffjkt) | 0.01*** | 0.01 | 0.01** | 0.00 |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Constant | 0.09*** | 0.09*** | 0.08*** | 0.09*** |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| p-value | 0.00 | 0.14 | 0.00 | 0.58 |

| Observations | 783,903 | 179,100 | 235,821 | 293,127 |

| Method | LPM | LPM | LPM | LPM |

- Note: EM refers to extensive margins. The dependent variable for EM, the probability of trade, is a dummy variable: it equals one if there is a positive trade flow at time t () and zero otherwise. The dependent variable for the probability of trade failure is also a dummy variable but takes a different form: it equals one if there is a positive trade flow at time t−1 () but no trade at time t () and zero otherwise. Columns 3 to 5 are subsets of data based on the HS6 classification spanning sections 1 (Animal & Animal Products), 2 (Foodstuffs), and 3 (Vegetable-based Products). See sectoral mapping in Table A8. NTM, SPS, and TBT refer to non-tariff measures, Sanitary and Phytosanitary, and Technical Barriers to Trade, respectively. Standard errors are in parentheses.

- * p < 0.05.

- ** p < 0.01.

- *** p < 0.001.

Panel B of Table 3 further details the analysis for only SPS, only TBT, and combined but mutually exclusive SPS and TBT categories. Similar to the aggregate NTM impact, we observe that the existence of both SPS and TBT measures reduces the probability of trade, while the presence of these measures together does not cause U.S. exports to stop. Furthermore, only TBT measures have a negative coefficient for the probability of trade failure, implying that TBT measures actually decrease the probability of trade failure. These results confirm that extensive margin effects are very limited, as the statistically significant coefficients are economically very small. The results suggest that NTMs significantly affect trade volumes and intensive margins, while their impact on extensive margins is minimal, indicating that these NTMs mainly influence U.S. firms by increasing variable costs rather than fixed costs.

SPS and TBT objectives

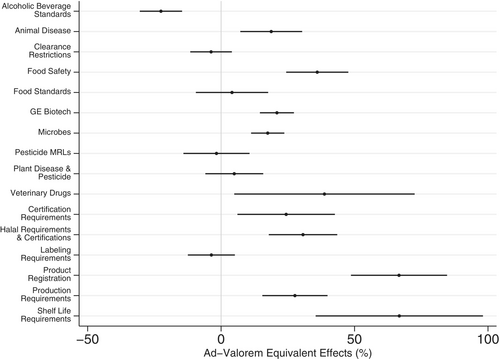

It is important to note that while NTMs hinder U.S. agricultural exports at the aggregate level, this does not imply that all NTMs are trade-restrictive. Figure 4 plots the AVE based on a model estimation of the aggregate SPS and TBT trade effect (i.e., the aggregate NTM effect) across categories of NTM types. The solid dots represent the AVE computation of the coefficient results, while the width of the line represents the 95% confidence interval of the AVE estimates.12 Among various NTM objectives, animal disease, certification requirements, food safety, GE biotech, halal requirements & certifications, microbes, product registration, production requirements, and shelf life requirements tend to reduce U.S. agricultural exports. While the smallest trade-reducing effect is 17% for microbes and 19% for animal disease, most NTM categories result in AVE exceeding 10%. The stronger AVE effects range from 21% to 67% for GE biotech, food safety, veterinary drugs, certification requirements, halal requirements & certifications, production requirements, shelf life requirements, and product registration. One possible explanation for these negative effects is that it is costly for exporting firms to comply with foreign procedures, which may vary by destination markets maintaining these measures. Among these categories, GE biotech objectives hold a unique position for U.S. agricultural exports. Over 90% of U.S. corn, soybean, and upland cotton are produced with GE biotechnology (Hellerstein & Vilorio, 2019). Additionally, new announcements of measures, such as Mexico's new GE biotech regulations on certain biotechnology products announced in several decrees in 2021 and 2023 (USTR, 2023) suggest that this type of measure is likely to remain a significant challenge for U.S. agricultural exporters.

Conversely, note the negative AVE result for alcoholic beverage standards. This result is possible if higher quality attributes can be signaled to consumers, thereby increasing demand for U.S. exports. Consequently, U.S. exporting firms can be comparatively more advantaged in destination markets where product standards help shape consumer preferences. Lastly, certification requirements, food standards, labeling requirements, and plant disease & pesticide objectives are not significant at the aggregate level specification.

Sector-specific analysis

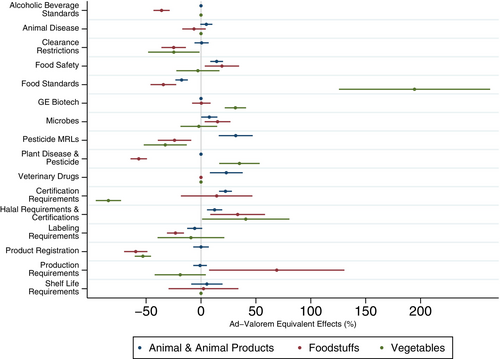

It is important to note that some of these NTM objectives are concentrated in specific industries. For instance, alcoholic beverage standards, animal disease, and veterinary drug objectives are related to foodstuffs and animal products related sectors, respectively, due to their sector-specific nature. To distinguish the effects of these objectives, we conducted a more detailed analysis at the sectoral level shown in Figure 5, which plots the AVEs trade effects for previously discussed broad sector categories of the HS system.13

The impact of NTM measures on U.S. exports of animal and animal products ranges from 8% to 32% in AVE tariff terms. The stronger trade-reducing effects are observed for halal requirements & standards, food safety measures, certification requirements, veterinary drugs, and pesticide maximum residue levels (MRLs). Interestingly, food standards, in contrast, have a trade-enhancing effect equivalent to a −18% AVE tariff for the animal and animal products category and foodstuff category.

Trade-enhancing effects are more frequently observed in foodstuffs compared to other products. For instance, alcoholic beverages, food standards, labeling requirements, and product registration have trade-enhancing effects on foodstuffs. On the other hand, trade-reducing effects are limited to food safety, production requirements, halal requirements & standards, and microbes. Consequently, measures related to product quality and consumer information are often found to be the least trade-restrictive or trade-enhancing among measures.

Similarly, for vegetable products, certification requirements and product registration measures have a notable trade-enhancing effect. On the other hand, the negative trade flow effects (and positive AVEs) associated with measures such as GE biotech, plant disease & pesticide, halal requirements, and food standards are equivalent to 31%, 35%, 41%, and 194% AVE tariffs, respectively.

Tables A3 and A6 provide extensive margin estimations for different NTM category specifications. The main finding is that the majority of SPS and TBT measures do not produce statistically significant impacts on the likelihood of U.S. export failures. Although most NTMs exhibit trade-hindering effects on existing trade relationships (i.e., the intensive margin of exports), evidence suggests that these measures do not significantly affect the ability of U.S. exporting firms to maintain some market presence. As shown in Tables A2 and A5, while most NTM objectives have statistically significant effects on the probability of U.S. exports, their economic impacts are very small—often less than 0.1%.

Limits of the analysis

Readers need to interpret our results with some caution. The main source of our data on SPS and TBT measures maintained by foreign trading partners against U.S. agricultural exports is USTR's NTE reports. While some of these measures represent long-standing non-tariff trade issues that have been raised as specific trade concerns within the WTO's SPS and TBT committees (e.g., Specific trade concerns for India's restrictions on poultry due to avian influenza raised 17 times between 2004 and 2011), and others have been contested in formal dispute settlement proceedings (e.g., the U.S. initiated a formal dispute in 1996 concerning the E.U.'s ban on growth-promoting hormones in beef, which was partially resolved in 2019) (United States Trade Representative, 2021), the measures flagged as concern by USTR represent one side of the trade relationship. We know fewer details about the justification of measures from the point of view of importing countries maintaining these measures. Moreover, not all of these measures may prove to violate WTO principles when adjudicated in formal dispute settlement or be identified as “unnecessary” barriers to trade. Notwithstanding these caveats, our results highlight that SPS and TBT measures identified in USTR's report pose significant challenges for food and agricultural exporters in the U.S.

The positive trade effects of NTMs on are mostly observed in foodstuffs category. However, this positive effect may not hold for each HS6 commodities in the foodstuffs group. Furthermore, as discussed in Cadot et al. (2018), our analysis does not distinguish between the trade costs associated with NTMs and the potential demand-enhancing effects that may arise from reducing asymmetric information or signaling higher product quality to consumers in importing countries. A detailed exploration of this distinction offers a promising direction for future research.

CONCLUSION

This paper contributes to the existing literature estimating the impacts of NTMs by constructing a new dataset of NTMs facing U.S. agricultural exports from the NTE Report on Foreign Trade Barriers. Using a theoretically consistent gravity equation, we find that the presence of NTMs reduces U.S. agricultural exports by 34.5%, equivalent to 16.4% AVE tariff. The trade impacts are larger for SPS measures, which reduce U.S. agricultural exports by 37%, on average, and are equivalent to an ad valorem tariff of nearly 20%. However, our analysis reveals limited evidence that NTMs affect the extensive margin of trade or the probability of U.S. export failure. Moreover, through a novel classification based on the specific objectives of NTMs, we find that 10 out of 16 categories reduced U.S. agricultural exports. It is worth noting, however, that not all NTM objectives resulted in negative trade flow effects for U.S. agricultural exports. NTMs aimed at improving quality and safety and reducing information asymmetry increased U.S. agricultural exports across most sectors. NTM effects vary significantly depending on the specific type of NTM, sector, and the coexistence of different measures. These results shed considerable light on the complex dynamics underlying NTMs and offer valuable insights for policymakers and stakeholders involved in exporting U.S. food and agricultural products.

The implications are as follows. First, although NTMs are implemented to correct market failures, they impact trade regardless of their intended purpose. The trade impacts of NTMs flagged by the USTR are particularly significant for the intensive margin (traded goods) rather than the extensive margin. This implies that these NTMs primarily affect variable trade costs rather than fixed costs for U.S. exporters. Second, the reasoning behind NTMs and their implications varies significantly across countries, making it challenging to find common ground for harmonizing standards and regulations. Annually, U.S. agricultural exports have exceeded $170 billion since 2021. However, more than 33% of U.S. exports are subject to NTMs. Thus, resolving non-tariff regulations or achieving mutual recognition of production processes and standards, particularly for SPS measures, will be critical for the future competitiveness of U.S. agricultural exports. By addressing these measures maintained by foreign trading partners, U.S. policymakers and trade negotiators can ensure a more level playing field for U.S. farmers and exporters and a trade balance that is more indicative of the competitiveness of this sector.

As suggested by an anonymous reviewer, future research should consider whether SPS and TBT measures publicized in the NTE report are implemented by a single destination market or by multiple markets maintaining a common measure. It may be the case that U.S. exporters are better able to adapt to measures that are consistently applied across multiple importing countries than to those maintained solely by a single country. The USTR NTE report on foreign trade barriers compiles a list of such measures on a country-by-country basis but does not indicate whether they are also enforced in other markets. We view this as a promising direction for future research.

ACKNOWLEDGMENTS

The authors wish to thank the U.S. Department of Agriculture's Office of the Chief Economist (USDA/OCE) for funding under Cooperative Agreement No. 58-0111-24-021 to support trade research and the competitive position of U.S. agriculture in international markets and the Foreign Agricultural Service (USDA/FAS) under project number FX21TA-10960R017 to support non-tariff data collection and assembly. Jinyang Yang provided excellent research assistance. We also thank John Beghin, Keithly Jones, Shawn Arita, Sharon Sydow, and Seth Meyer for many helpful comments, and participants at the 2022 annual meeting of the American Agricultural and Applied Economics Association and 2024 International Agricultural Trade Research Consortium. All remaining errors are our own.

Endnotes

APPENDIX A

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| All | Animal | Foodstuffs | Vegetable | |

| Alcoholic beverage standards | −22.53*** | −35.92*** | ||

| (4.04) | (3.76) | |||

| Animal disease | 18.79** | 4.86 | −6.37 | |

| (5.91) | (2.80) | (5.44) | ||

| Clearance restrictions | −3.75 | 0.54 | −24.90*** | −24.77* |

| (3.98) | (3.30) | (5.68) | (11.95) | |

| Food safety | 36.02*** | 14.25*** | 19.07* | −2.84 |

| (5.93) | (2.95) | (7.96) | (10.01) | |

| Food standards | 4.09 | −17.66*** | −34.28*** | 194.49*** |

| (6.90) | (2.89) | (5.97) | (35.13) | |

| GE biotech | 20.92*** | 0.30 | 31.33*** | |

| (3.25) | (4.29) | (4.95) | ||

| Microbes | 17.47*** | 7.57* | 15.08* | −1.98 |

| (3.17) | (3.75) | (5.99) | (8.52) | |

| Pesticide MRLs | −1.73 | 31.63* | −24.11** | −32.55** |

| (6.32) | (7.89) | (7.78) | (10.01) | |

| Plant disease & pesticide | 4.94 | −56.70*** | 35.01*** | |

| (5.53) | (3.82) | (9.39) | ||

| Veterinary drugs | 38.73* | 23.04** | ||

| (17.24) | (7.62) | |||

| Certification requirements | 24.38** | 22.29*** | 14.27 | −84.33*** |

| (9.32) | (2.99) | (16.60) | (5.88) | |

| Halal requirements & certifications | 30.70*** | 12.38*** | 33.38** | 40.77* |

| (6.54) | (3.54) | (12.72) | (20.30) | |

| Labeling requirements | −3.64 | −5.75 | −23.26*** | −9.16 |

| (4.49) | (3.50) | (3.95) | (15.51) | |

| Product registration | 66.66*** | 0.02 | −59.45*** | −52.94*** |

| (9.18) | (3.62) | (5.42) | (3.78) | |

| Production requirements | 27.67*** | −0.85 | 68.97* | −18.91 |

| (6.23) | (3.16) | (31.45) | (11.89) | |

| Shelf life requirements | 66.77*** | 5.35 | 2.27 | |

| (15.99) | (7.26) | (16.24) | ||

| Log(1 + tariffjkt) | −0.71*** | −0.90*** | −0.53*** | −0.92*** |

| (0.11) | (0.11) | (0.08) | (0.18) | |

| Constant | 11.09*** | 10.56*** | 10.33*** | 11.79*** |

| (0.03) | (0.03) | (0.02) | (0.05) | |

| Observations | 780,080 | 176,294 | 235,304 | 291,501 |

| Pseudo R2 | 0.76 | 0.73 | 0.79 | 0.81 |

| p-value | 0.00 | 0.00 | 0.00 | 0.00 |

| Fixed effects | jt, kt | jt, kt | jt, kt | jt, kt |

- Note: The dependent variable is the value of exports of HS6-product to importing country from the United States in year t, inclusive of zero trade flows. Columns 2 to 4 are estimated for subsets of data in column 1, based on the HS6 classification spanning sections 1 (Animal & Animal Products), 2 (Foodstuffs), and 3 (Vegetable-based Products). See the abbreviation list and sectoral mapping in Tables A7 and A8, respectively. NTMs refers to non-tariff measures. Coefficients are estimated using equation (6) and transformed into AVE effects using equation (9). For the AVE transformation, the estimated elasticities are for column 1 and , , and for columns 2 to 4, respectively. See Table A9 for the elasticity estimates. Standard errors are in parentheses and computed using the delta method for transformed coefficients.

- * p < 0.05.

- ** p < 0.01.

- *** p < 0.001.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| All | Animal | Foodstuffs | Vegetable | |

| Alcoholic beverage standards | 0.16*** | 0.15*** | ||

| (0.01) | (0.01) | |||

| Animal disease | −0.04*** | −0.07*** | −0.09*** | |

| (0.01) | (0.01) | (0.02) | ||

| Clearance restrictions | 0.08*** | 0.05 | 0.04 | 0.06 |

| (0.02) | (0.03) | (0.02) | (0.06) | |

| Food safety | −0.01 | −0.07*** | 0.13*** | 0.14*** |

| (0.01) | (0.01) | (0.02) | (0.02) | |

| Food standards | −0.09*** | −0.07** | 0.01 | −0.30*** |

| (0.01) | (0.02) | (0.02) | (0.02) | |

| GE Biotech | 0.02*** | −0.01 | 0.04*** | |

| (0.00) | (0.01) | (0.00) | ||

| Microbes | −0.00 | −0.05*** | −0.02** | −0.02 |

| (0.00) | (0.01) | (0.01) | (0.01) | |

| Pesticide MRLs | 0.02* | 0.06 | −0.14** | 0.02 |

| (0.01) | (0.03) | (0.05) | (0.02) | |

| Plant disease & pesticide | −0.03 | 0.24*** | −0.07*** | |

| (0.02) | (0.05) | (0.02) | ||

| Veterinary drugs | −0.22*** | −0.20*** | ||

| (0.01) | (0.01) | |||

| Certification requirements | −0.08*** | −0.06*** | −0.07*** | 0.21*** |

| (0.01) | (0.01) | (0.02) | (0.03) | |

| Halal requirements & certifications | −0.02* | −0.03* | −0.07** | 0.08** |

| (0.01) | (0.01) | (0.02) | (0.03) | |

| Labeling requirements | 0.02*** | −0.07*** | 0.06*** | −0.01 |

| (0.00) | (0.02) | (0.01) | (0.02) | |

| Product registration | 0.01 | 0.07*** | 0.35*** | 0.00 |

| (0.01) | (0.02) | (0.03) | (0.03) | |

| Production requirements | −0.09*** | −0.07*** | 0.09* | −0.01 |

| (0.02) | (0.02) | (0.04) | (0.03) | |

| Shelf life requirements | −0.14*** | 0.23*** | 0.04 | |

| (0.02) | (0.06) | (0.03) | ||

| Log(1 + tariffjkt) | −0.17*** | −0.20*** | −0.17*** | −0.15*** |

| (0.00) | (0.01) | (0.01) | (0.01) | |

| Constant | 0.49*** | 0.45*** | 0.56*** | 0.49*** |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Observations | 783,903 | 178,816 | 235,821 | 293,127 |

| p-value | 0.00 | 0.00 | 0.00 | 0.00 |

| Fixed effects | jt, kt | jt, kt | jt, kt | jt, kt |

- Note: The dependent variable for extensive margins, the probability of trade, is a dummy variable: it equals one if there is a positive trade flow at time t () and zero otherwise. Columns 2 to 4 are subsets of data based on the HS6 classification spanning sections 1 (Animal & Animal Products), 2 (Foodstuffs), and 3 (Vegetable-based Products). See the abbreviation list and sectoral mapping in Tables A7 and A8, respectively. NTMs refers to non-tariff measures. Standard errors are in parentheses.

- * p < 0.05.

- ** p < 0.01.

- *** p < 0.001.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| All | Animal | Foodstuffs | Vegetable | |

| Alcoholic beverage standards | −0.04** | −0.04*** | ||

| (0.01) | (0.01) | |||

| Animal disease | 0.01 | 0.01 | −0.02* | |

| (0.00) | (0.01) | (0.01) | ||

| Clearance restrictions | −0.00 | 0.01 | −0.01 | 0.00 |

| (0.01) | (0.02) | (0.01) | (0.04) | |

| Food safety | 0.01 | 0.00 | 0.03 | −0.00 |

| (0.01) | (0.01) | (0.02) | (0.01) | |

| Food standards | 0.00 | −0.01 | 0.01 | 0.02 |

| (0.01) | (0.01) | (0.02) | (0.02) | |

| GE Biotech | 0.00 | 0.00 | 0.00 | |

| (0.00) | (0.01) | (0.00) | ||

| Microbes | 0.00 | 0.01 | −0.01 | 0.01 |

| (0.00) | (0.01) | (0.00) | (0.01) | |

| Pesticide MRLs | 0.01 | 0.04 | −0.01 | 0.00 |

| (0.01) | (0.02) | (0.04) | (0.01) | |

| Plant disease & pesticide | 0.01 | −0.06* | 0.02 | |

| (0.01) | (0.03) | (0.01) | ||

| Veterinary drugs | 0.01 | 0.01 | ||

| (0.01) | (0.01) | |||

| Certification requirements | −0.00 | −0.00 | −0.02* | 0.01 |

| (0.00) | (0.01) | (0.01) | (0.02) | |

| Halal requirements & certifications | 0.01 | −0.00 | 0.01 | −0.01 |

| (0.01) | (0.01) | (0.02) | (0.02) | |

| Labeling requirements | −0.00 | 0.03* | −0.01** | 0.02 |

| (0.00) | (0.01) | (0.01) | (0.01) | |

| Product registration | −0.01** | 0.01 | −0.06*** | 0.02 |

| (0.00) | (0.01) | (0.02) | (0.02) | |

| Production requirements | 0.00 | 0.03 | −0.04 | −0.02 |

| (0.01) | (0.02) | (0.03) | (0.02) | |

| Shelf life requirements | 0.02 | −0.05 | 0.00 | |

| (0.01) | (0.04) | (0.02) | ||

| Log(1 + tariffjkt) | 0.01*** | 0.01 | 0.01** | 0.00 |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Constant | 0.09*** | 0.09*** | 0.08*** | 0.08*** |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Observations | 783,903 | 178,816 | 235,821 | 293,127 |

| p-value | 0.00 | 0.19 | 0.00 | 0.58 |

| Fixed effects | jt, kt | jt, kt | jt, kt | jt, kt |

- Note: The dependent variable for the probability of trade failure is a dummy variable: it equals one if there is a positive trade flow at time t−1 () but no trade at time t () and zero otherwise. Columns 2 to 4 are subsets of data based on the HS6 classification spanning sections 1 (Animal & Animal Products), 2 (Foodstuffs), and 3 (Vegetable-based Products). See the abbreviation list and sectoral mapping in Tables A7 and A8, respectively. NTMs refers to non-tariff measures. Standard errors are in parentheses.

- * p < 0.05.

- ** p < 0.01.

- *** p < 0.001.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| All | Animal | Foodstuffs | Vegetable | |

| A1 Prohibitions restrictions | 41.08*** | 11.39*** | 9.95* | 92.89*** |

| (3.59) | (2.99) | (4.76) | (7.77) | |

| A2 Tolerance limits | 7.83 | 26.67*** | −14.82* | −19.04 |

| (5.39) | (7.14) | (7.50) | (11.33) | |

| A3 Labeling packing | 29.18* | −73.18*** | 138.70* | |

| (12.10) | (2.99) | (56.91) | ||

| A4 Hygienic requirements | 28.09** | −1.58 | 69.15 | |

| (9.64) | (4.11) | (55.80) | ||

| A5 Treatment for disease | −31.91*** | 6.97 | −32.21*** | 14.77 |

| (5.79) | (8.18) | (6.83) | (25.70) | |

| A6 Production requirements | 136.75*** | 55.42*** | 386.77*** | |

| (20.02) | (9.61) | (80.78) | ||

| A8 Conformity assessment | 52.39*** | 13.47*** | −11.42*** | 126.92*** |

| (4.89) | (2.20) | (2.88) | (12.43) | |

| A9 Other | 4.59 | 6.53** | 576.60*** | −34.78*** |

| (3.18) | (2.41) | (111.89) | (7.88) | |

| B2 Tolerance limits | 28.72*** | −1.67 | 107.54** | |

| (7.09) | (3.32) | (35.49) | ||

| B3 Labeling packing | 49.48*** | 40.86*** | 6.31 | 29.55 |

| (9.25) | (10.44) | (6.68) | (15.62) | |

| B4 Production requirements | 179.23*** | 26.25*** | ||

| (25.13) | (6.65) | |||

| B7 Product quality & safety | −20.71*** | 6.00 | −35.73*** | |

| (4.36) | (7.33) | (4.18) | ||

| B8 Conformity assessment | 8.66* | 12.38*** | 12.01* | −62.36*** |

| (3.71) | (1.87) | (5.80) | (7.63) | |

| B9 Other | −43.56*** | −14.96 | −55.57*** | 0.25 |

| (2.43) | (7.76) | (1.96) | (28.11) | |

| Log(1 + tariffjkt) | −0.79*** | −0.90*** | −0.56*** | −1.00*** |

| (0.11) | (0.11) | (0.08) | (0.18) | |

| Constant | 11.18*** | 10.65*** | 10.39*** | 11.90*** |

| (0.03) | (0.03) | (0.02) | (0.05) | |

| Observations | 780,080 | 176,294 | 235,304 | 291,501 |

| Pseudo R2 | 0.76 | 0.73 | 0.79 | 0.80 |

| p-value | 0.00 | 0.00 | 0.00 | 0.00 |

| Fixed effects | jt, kt | jt, kt | jt, kt | jt, kt |

- Note: The dependent variable is the value of exports of HS6-product to importing country from the United States in year t, inclusive of zero trade flows. Columns 2 to 4 are estimated for subsets of data in column 1, based on the HS6 classification spanning sections 1 (Animal & Animal Products), 2 (Foodstuffs), and 3 (Vegetable-based Products). See the abbreviation list and sectoral mapping in Tables A7 and A8, respectively. MAST refers to Multi-Agency Support Team. Coefficients are estimated using equation (6) and transformed into AVE effects using equation (9). For the AVE transformation, the estimated elasticities are for column 1 and , , and for columns 2 to 4, respectively. See Table A9 for the elasticity estimates. Standard errors are in parentheses and computed using the delta method for transformed coefficients.

- * p < 0.05.

- ** p < 0.01.

- *** p < 0.001.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| All | Animal | Foodstuffs | Vegetable | |

| A1 Prohibitions restrictions | 0.01*** | −0.14*** | −0.07*** | 0.04*** |

| (0.00) | (0.01) | (0.01) | (0.00) | |

| A2 Tolerance limits | −0.06*** | −0.12*** | −0.06* | −0.02 |

| (0.01) | (0.01) | (0.03) | (0.02) | |

| A3 Labeling packing | 0.03 | 0.11*** | 0.05 | |

| (0.02) | (0.03) | (0.06) | ||

| A4 Hygienic requirements | 0.04* | 0.03 | 0.08* | |

| (0.02) | (0.02) | (0.04) | ||

| A5 Treatment for disease | 0.05 | −0.12 | 0.12*** | −0.06 |

| (0.03) | (0.15) | (0.02) | (0.06) | |

| A6 Production requirements | −0.21*** | −0.18*** | −0.29*** | |

| (0.01) | (0.01) | (0.03) | ||

| A8 Conformity assessment | −0.01** | −0.03*** | −0.01 | −0.01 |

| (0.00) | (0.01) | (0.01) | (0.01) | |

| A9 Other | 0.07*** | 0.04*** | 0.08 | 0.09*** |

| (0.01) | (0.01) | (0.13) | (0.02) | |

| B2 Tolerance limits | 0.04 | 0.05* | 0.08 | |

| (0.02) | (0.02) | (0.04) | ||

| B3 Labeling packing | −0.01* | −0.13*** | 0.04*** | −0.02 |

| (0.01) | (0.02) | (0.01) | (0.02) | |

| B4 Production requirements | −0.21*** | −0.13*** | ||

| (0.02) | (0.03) | |||

| B7 Product quality & safety | 0.14*** | 0.23*** | 0.15*** | |

| (0.01) | (0.06) | (0.01) | ||

| B8 Conformity assessment | −0.02*** | −0.03*** | −0.01 | 0.08*** |

| (0.00) | (0.01) | (0.01) | (0.01) | |

| B9 Other | 0.11*** | 0.04 | 0.12*** | 0.07 |

| (0.01) | (0.07) | (0.01) | (0.10) | |

| Log(1 + tariffjkt) | −0.17*** | −0.21*** | −0.16*** | −0.15*** |

| (0.00) | (0.01) | (0.01) | (0.01) | |

| Constant | 0.49*** | 0.45*** | 0.57*** | 0.48*** |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Observations | 783,903 | 178,816 | 235,821 | 293,127 |

| p-value | 0.00 | 0.00 | 0.00 | 0.00 |

| Fixed effects | jt, kt | jt, kt | jt, kt | jt, kt |

- Note: The dependent variable for extensive margins, the probability of trade, is a dummy variable: it equals one if there is a positive trade flow at time t () and zero otherwise. Columns 2 to 4 are subsets of data based on the HS6 classification spanning sections 1 (Animal & Animal Products), 2 (Foodstuffs), and 3 (Vegetable-based Products). See the abbreviation list and sectoral mapping in Tables A7 and A8, respectively. MAST refers to Multi-Agency Support Team. Standard errors are in parentheses.

- * p < 0.05.

- ** p < 0.01.

- *** p < 0.001.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| All | Animal | Foodstuffs | Vegetable | |

| A1 Prohibitions restrictions | 0.00 | 0.01 | 0.01 | 0.00 |

| (0.00) | (0.01) | (0.01) | (0.00) | |

| A2 Tolerance limits | 0.00 | 0.02* | 0.01 | −0.01 |

| (0.01) | (0.01) | (0.02) | (0.01) | |

| A3 Labeling packing | 0.03* | −0.00 | 0.05 | |

| (0.01) | (0.02) | (0.05) | ||

| A4 Hygienic requirements | −0.02 | −0.01 | −0.03 | |

| (0.01) | (0.02) | (0.02) | ||

| A5 Treatment for disease | −0.02 | −0.00 | −0.03 | 0.03 |

| (0.02) | (0.08) | (0.02) | (0.04) | |

| A6 Production requirements | 0.01 | −0.00 | 0.04 | |

| (0.01) | (0.01) | (0.02) | ||

| A8 Conformity assessment | 0.00* | 0.01 | −0.01 | −0.00 |

| (0.00) | (0.00) | (0.00) | (0.01) | |

| A9 Other | −0.00 | −0.00 | −0.00 | 0.02 |

| (0.00) | (0.01) | (0.08) | (0.01) | |

| B2 Tolerance limits | −0.03 | −0.02** | −0.04 | |

| (0.02) | (0.01) | (0.03) | ||

| B3 Labeling packing | 0.00 | 0.02 | −0.01 | −0.00 |

| (0.00) | (0.01) | (0.01) | (0.01) | |

| B4 Production requirements | 0.04* | 0.04* | ||

| (0.02) | (0.02) | |||

| B7 Product quality & safety | −0.04** | −0.05 | −0.04*** | |

| (0.01) | (0.04) | (0.01) | ||

| B8 Conformity assessment | −0.00 | 0.00 | −0.02* | 0.01 |

| (0.00) | (0.00) | (0.01) | (0.01) | |

| B9 Other | −0.01 | 0.05 | −0.02* | 0.11* |

| (0.01) | (0.04) | (0.01) | (0.04) | |

| Log(1 + tariffjkt) | 0.01*** | 0.01 | 0.01** | 0.00 |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Constant | 0.09*** | 0.09*** | 0.08*** | 0.09*** |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Observations | 783,903 | 178,816 | 235,821 | 293,127 |

| p-value | 0.00 | 0.01 | 0.00 | 0.10 |

| Fixed effects | jt, kt | jt, kt | jt, kt | jt, kt |

- Note: The dependent variable for the probability of trade failure is a dummy variable: it equals one if there is a positive trade flow at time t−1 () but no trade at time t () and zero otherwise. Columns 2 to 4 are subsets of data based on the HS6 classification spanning sections 1 (Animal & Animal Products), 2 (Foodstuffs), and 3 (Vegetable-based Products). See the abbreviation list and sectoral mapping in Tables A7 and A8, respectively. MAST refers to Multi-Agency Support Team. Standard errors are in parentheses.

- * p < 0.05.

- ** p < 0.01.

- *** p < 0.001.

| Abbreviation | Full form | Example |

|---|---|---|

| Certs | Certifications | Halal reqs. & certs. |

| MRLs | Maximum residue limits | Pesticide MRLs |

| Reg | Registration | Product reg. |

| Reqs | Requirements | Production reqs. |

| Rests | Restrictions | Clearance rests. |

| Stds | Standards | Alcoholic beverage stds. |

| HS 2-Digits | Broad sector |

|---|---|

| 01–05 | Animal & Animal products |

| 06–15 | Vegetable products |

| 16–24 | Foodstuffs |